信用证翻译(简版)

常见各类信用证的英文表达

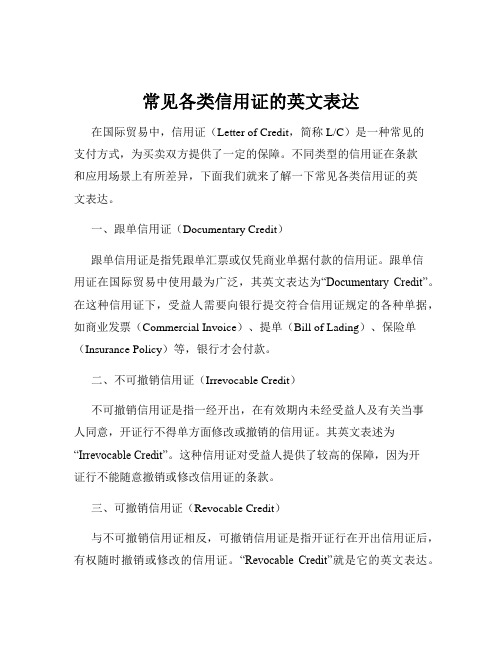

常见各类信用证的英文表达在国际贸易中,信用证(Letter of Credit,简称 L/C)是一种常见的支付方式,为买卖双方提供了一定的保障。

不同类型的信用证在条款和应用场景上有所差异,下面我们就来了解一下常见各类信用证的英文表达。

一、跟单信用证(Documentary Credit)跟单信用证是指凭跟单汇票或仅凭商业单据付款的信用证。

跟单信用证在国际贸易中使用最为广泛,其英文表达为“Documentary Credit”。

在这种信用证下,受益人需要向银行提交符合信用证规定的各种单据,如商业发票(Commercial Invoice)、提单(Bill of Lading)、保险单(Insurance Policy)等,银行才会付款。

二、不可撤销信用证(Irrevocable Credit)不可撤销信用证是指一经开出,在有效期内未经受益人及有关当事人同意,开证行不得单方面修改或撤销的信用证。

其英文表述为“Irrevocable Credit”。

这种信用证对受益人提供了较高的保障,因为开证行不能随意撤销或修改信用证的条款。

三、可撤销信用证(Revocable Credit)与不可撤销信用证相反,可撤销信用证是指开证行在开出信用证后,有权随时撤销或修改的信用证。

“Revocable Credit”就是它的英文表达。

由于可撤销信用证的不确定性较大,受益人承担的风险较高,因此在实际贸易中使用较少。

四、保兑信用证(Confirmed Credit)保兑信用证是指由另一家银行对开证行开出的信用证加以保兑,保证对符合信用证条款规定的单据履行付款义务。

其英文表述为“Confirmed Credit”。

当开证行的信誉不够好或者受益人对开证行不信任时,通常会要求开证行开出保兑信用证,以增加付款的保障。

五、即期信用证(Sight Credit)即期信用证是指开证行或付款行收到符合信用证条款的跟单汇票或装运单据后,立即履行付款义务的信用证。

商务英语翻译Unit 10 信用证翻译

术语积累

• • • • • • • • • • • • 保兑信用证Confirmed L/C 不可撤销信用证Irrevocable L/C 可撤销信用证Revocable L/C 即期信用证Sight L/C 远期信用证Usance L/C 可转让信用证Transferable/Assignable/Transmissible L/C 可分割信用证Divisible L/C 有追索权信用证L/C with recourse 无追索权信用证L/C without recourse 循环信用证Revolving L/C 背对背信用证Back-to-Back L/C 对开信用证Reciprocal L/C

词汇提示

• • • • • • • • • • 寄送forward 规定stipulate 指定design 预先垫付 流程图 flowchart 受票人drawee 出票人drawer 转递transmission 偿付reimbursement 付款honour

术语积累

• • • • • • • • • • • • 汇付 remittance 信汇mail transfer 电汇telegraphic transfer 票汇demand draft 托收collection 付款交单documents against payment 承兑交单documents against acceptance 开证行issuing bank 申请人 applicant 跟单信用证Documentary L/C 光票信用证Clean L/C 不保兑信用证Unconfirmed L/C

Unit 10 信用证翻译

Letter of credit

词汇提示

• • • • • • • • Pre-advise v. 预通知 Telex n. 电传 Negociation n.议付 Accompany v. 随同 Signed adj.已签署的 Quintuplicate n. 一式五份 notify v. 通知 evidence v. 证明,显示,表明

信用证中英文对照翻译

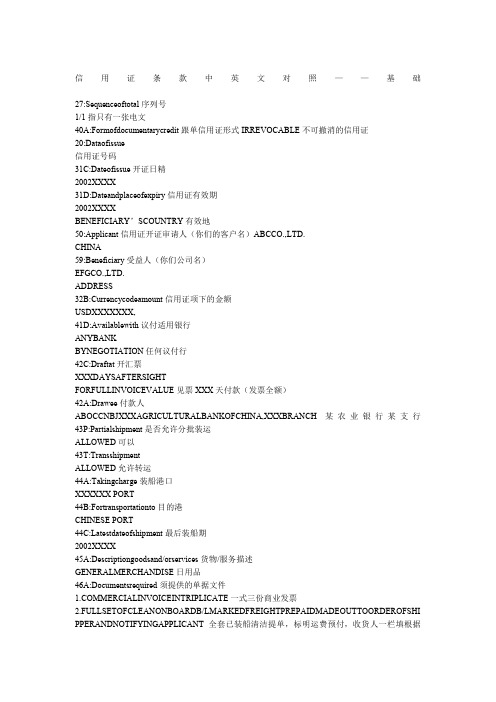

信用证条款中英文对照——基础27:Sequenceoftotal序列号1/1指只有一张电文40A:Formofdocumentarycredit跟单信用证形式IRREVOCABLE不可撤消的信用证20:Dataofissue信用证号码31C:Dateofissue开证日精2002XXXX31D:Dateandplaceofexpiry信用证有效期2002XXXXBENEFICIARY’SCOUNTRY有效地50:Applicant信用证开证审请人(你们的客户名)ABCCO.,LTD.CHINA59:Beneficiary受益人(你们公司名)EFGCO.,LTD.ADDRESS32B:Currencycodeamount信用证项下的金额USDXXXXXXX,41D:Availablewith议付适用银行ANYBANKBYNEGOTIATION任何议付行42C:Draftat开汇票XXXDAYSAFTERSIGHTFORFULLINVOICEVALUE见票XXX天付款(发票全额)42A:Drawee付款人ABOCCNBJXXXAGRICULTURALBANKOFCHINA,XXXBRANCH某农业银行某支行43P:Partialshipment是否允许分批装运ALLOWED可以43T:TransshipmentALLOWED允许转运44A:Takingcharge装船港口XXXXXX PORT44B:Fortransportationto目的港CHINESE PORT44C:Latestdateofshipment最后装船期2002XXXX45A:Descriptiongoodsand/orservices货物/服务描述GENERALMERCHANDISE日用品46A:Documentsrequired须提供的单据文件MERCIALINVOICEINTRIPLICATE一式三份商业发票2.FULLSETOFCLEANONBOARDB/LMARKEDFREIGHTPREPAIDMADEOUTTOORDEROFSHI PPERANDNOTIFYINGAPPLICANT全套已装船清洁提单,标明运费预付,收货人一栏填根据发货人指示,通知开证审请人3.PACKINGLISTINDUPLICATE装箱单一式二份47A:Additionalconditions附加条件1.AGRICULTURALBANKOFCHINASINGAPOREBRANCHISASSIGNEDTODISCOUNTTHEL/C 中国农业银行为指定的付款行2.AFTERNEGOTIATIONBANKHASSENTTESTEDTELEXTOISSUINGBANKCERTIFYINGDOC UMENTSINCOMPLIANCEWITHTHEL/CTERMSANDINDICATIONINVOICEVALUE,THENNE GOTIATIONBANKISAUTHORIZEDTOCLAIMREIMBURSEMENTBYTESTEDTELEX/SWIFTF ROMAGRICULTRUALBANKOFCHINASINGAPOREBRANCHATSIGHTBASIS.SINGAPOREBR ANCHWILLEFFECTPAYMENTWITHIN5WORKINGDAYS.议付行发电传给开证行确认单证相符,并指示发票金额,然后以SWIFT电码或电传的形式授权中国农业银行新加波支行付款给收益人,新加波支行将在五个工作日内履行付款义务71B:Charges开证以外产生的费用ALLBANKINGCHARGESOUTSIDEOFTHEISSUINGBANK(EXCEPTFORTHEDISCOUNTINTERESTANDDISCOUNTCHARGES)AREFORBENEFICIARY’SACCOUNT开证行以外产生的费用由信用证收益人负担(票据贴现利息与折扣除外)48:Periodforpresentation单据提交期限DOCUMENTSMUSTBEPRESENTEDWITHIN XXDAYSAFTERLATESTSHIPMENTDATEBUTWITHINTHEVALIDITYOFTHISCREDIT在信用证有效期内,最迟装运期后XX天内,向银行提交单据49:ConfirmationinstructionWITHOUT不保兑53A:ReimbursementBank偿付行ABOCSGSG78:Instructionstopay/account/negotiationbank指示付款行?议付行1.ADISCREPANCY(IES)FEEOFUSDXX.00WILLBEDEDUCTEDFROMTHEPROCEEDSIFTHED OCUMENTSAREPRESENTEDWITHADISCREPANCY(IES).如果单据提交有差异,差额将从信用额里扣除2.ALLDOCUMENTSSHOULDBEDESPATCHEDTOUS(ADDRESS:XXXXXXX)INONELOTBYCOURIERSERVICE.所有单据应一次性通过快件形式发给我们72:Sendertoreceiverinformation说明THISCREDITISISSUEDSUBJECTTOUCP500(1993REVISION)本信用证跟据跟单信用证通一惯例UCP500(1993年版)开出oneoriginalandfourphotocopiesofthecommercialinvoiceshowingstandardexportpackingandalsoshowing non-quotawhenanon-quotaitemisshipped.出具一式四份标准出口包装的商业发票,若为无配额商品,则需另出无配额证明oneorigianlandthreephotocopiesofinspectioncertificateissuedbyhyminparkofminwoointernationalinc. 出具一式三份由hyminparkofminwoointernationalinc.签发的商检证书afaxletterbyangelastatingthatonefullsetofnon-negotiabledocumentswasreceived.Angela传真声明需出具一整套不可议付之单证oneorigianalandthreephotocopiesofbeneficiary'scertificate certifyingthataproductionsamplewassenttotheattentionofruthplantorAlbertelkaimofbuffalojeans,400sauvewest,montreal,quebech3l1z8一式三份的受益人产品样品之证明书寄至工厂或是此地址:Albertelkaimofbuffalojeans,400sauvewest,montreal,quebech3l1z8(好像是加拿大的一个地址)oneoriginalandthreephotocopiesofpackinglist.装箱单一式三份fullsetoforiginalmarinebillsofladingcleanonboardormultimodetransportdocumentscleanonboardplus2no n-negotiablecopiesissuedbyairseatransportinc..weihai,chinamadeoutorendorsedtoorderofbnpparibass(ca nada)markedfreightcollect,notifygeneralcustomsbrokersattnlinda514-876-1704全套清洁已装船的海运提单或是清洁已装船之多式联运提单需加两份由airseatransportinc签发的不可议付单据副本.提单需注明由bnpparibass(Canada)付费,通关联系人Linda,电话514-876-1704 oneoriginalandthreephotocopiesofcertificateofexportlicenceoftextileproductsshowingtheyearofquotawh ichmustcorrespondtotheyearofshipmentexceptinthecaseofnon-quotawhichanexportlicenceisnotrequired.出具一式三份的纺织品出品许可证明书,年度配额须与年度出货一致,其中无需配额要求除外. oneoriginalandthreephotocopiesofcertificateoforigin.一式三份的原产地证书oneoriginalandthreephotocopiesofcanadacustomsinvoice.一式三份的加拿大海关发票afaxletterbyalbertelkaim,michelbitton,ruthplant,kathyalix,nancywhalen,marjolainemartel,mimibernola, annasciortino,jennyferhassanorcharlesbittonstatingasamplewasreceived.albertelkaim,michelbitton,ruthplant,kathyalix,nancywhalen,marjolainemartel,mimibernola,annasciortino,jennyferhassanorcharlesbitton这些人传真声明的可接受之样品letterfromshipperontheirletterheadindicatingtheirnameofcompanyandaddress,billofladingnumber,contai nernumberandthatthisshipment,includingitscontainer,doesnotcontainanynon-manufacturedwoodenmaterial,tonnage,bracingm aterial,pallets,cratingorothernon-manufacturedwoodenpackingmaterial.托单需注明托运人公司,地址,提单号,货柜号,及装载量,包括非木质包装之排水量,托盘,板条箱或其它非木质包装材料信用证条款如下:DOCUMENTSREQUIRED45A1、FULLSETCLEANSHIPPEDONBOARDSHIPPINGCO’SBILLOFLADINGISSUEDTOTHEORDEROFOMDURMANNATIONALBANK,SAGGANABRAN CHMAKEDFREIGHTPREPAIKANDNOTIFYAPPLICANT.2、SIGNEDCOMMERCIALINVOICEINFIVEORIGINALANDTHREECOPIESDULYCERTIFIEDTRU EANDCORRECT.3、PACKINGLISTINONEORIGINALANDFOURCOPIES.4、CERTIFICATEOFORIGINISSUEDBYCHAMBEROFCOMMERCECHINACERTIFYTHATTHEGO ODSAREOFCHINESEORIGIN.1、全套清洁提单。

信用证样本中英文对照

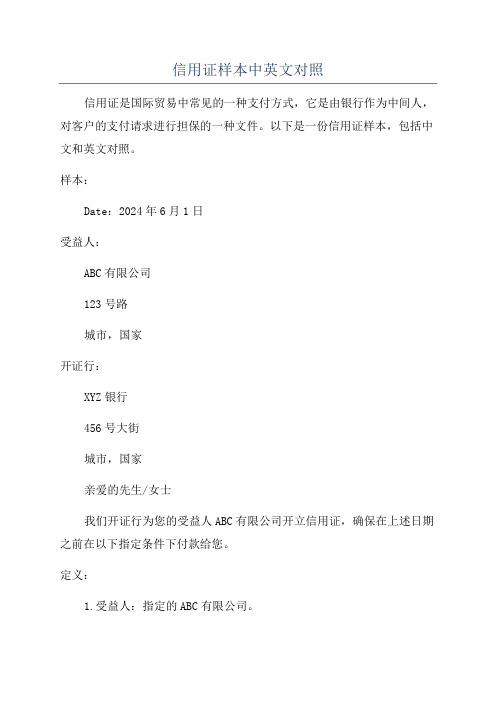

信用证样本中英文对照信用证是国际贸易中常见的一种支付方式,它是由银行作为中间人,对客户的支付请求进行担保的一种文件。

以下是一份信用证样本,包括中文和英文对照。

样本:Date:2024年6月1日受益人:ABC有限公司123号路城市,国家开证行:XYZ银行456号大街城市,国家亲爱的先生/女士我们开证行为您的受益人ABC有限公司开立信用证,确保在上述日期之前在以下指定条件下付款给您。

定义:1.受益人:指定的ABC有限公司。

2.申请人:我行客户,指定在信用证编号中。

1.信用证金额:信用证金额为:USD10,000.00(美元一万)。

金额以美元为单位,对应其他货币将按照当天的汇率进行折算。

2.有效期:本信用证将在接到受益人提供的所有必需单据之日起生效,并于开证之日的180天后到期。

必备单据的最后接收日期为到期日前15天。

3.运输要求:货物必须在开证生效后60天内装运,并在到期日之前抵达目的地。

装运文件必须包括保险单的正本副本,以确保货物的安全。

4.付款条件:付款将通过电汇方式进行,在所有必需单据获得接纳后的五个工作日内完成。

付款将以美元进行,按照当日汇率折算为其他货币。

5.必备单据:以下是必备单据的清单,所有单据都必须按时提交,并在接收日后十天内由我行接受。

-标准商业发票(正副本)-包装单据-装运货物的提单(正副本)-保险单(正副本)-由欧洲银行证明的发货证明书6.文件发送地址:所有必须的单据,请发送到以下地址:XYZ银行Attn: 信用证部门456号大街城市,国家谢谢您的合作。

此致XYZ银行Dear Sir/Madam,We, the issuing bank, hereby open this letter of credit in favor of your beneficiary, ABC Co. Ltd., ensuring payment to be made to you under the following terms and conditions on or before the above-mentioned date.Definitions:1. Beneficiary: The designated ABC Co. Ltd.2. Applicant: Our customer, as specified in the letter of credit number.1. Amount:The amount of this letter of credit is USD 10,000.00 (Ten Thousand US Dollars). The amount is in USD and equivalent in other currencies will be calculated at the prevailing rate of exchange on the day of negotiation/payment.2. Validity:3. Shipment Requirement:The goods must be shipped within 60 days after the effective date of the letter of credit and arrive at the destination before the expiry date. Shipping documents must include the original and duplicate copies of the insurance policy to ensure the safety of the goods.4. Payment Terms:Payment will be made via telegraphic transfer within five working days after the acceptance of all required documents. The payment will be made in USD and equivalent in other currencies will be calculated at the prevailing exchange rate on the day of payment.5. Required Documents:- Packing List- Bill of Lading (original and duplicate copies)- Insurance Policy (original and duplicate copies)- Certificate of Shipment, attested by a European bank6. Document Submission Address:Please send all required documents to the following address: XYZ BankAttn: Letter of Credit Department456 Main StreetCity, CountryThank you for your cooperation.Yours sincerely,。

信用证翻译参考译文

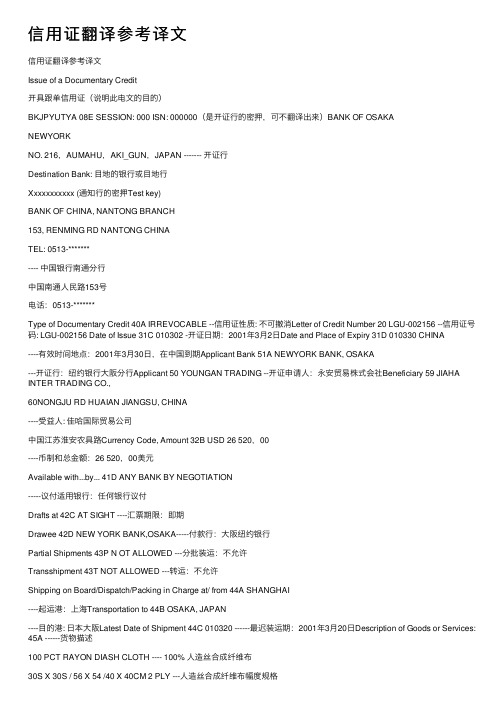

信⽤证翻译参考译⽂信⽤证翻译参考译⽂Issue of a Documentary Credit开具跟单信⽤证(说明此电⽂的⽬的)BKJPYUTYA 08E SESSION: 000 ISN: 000000(是开证⾏的密押,可不翻译出来)BANK OF OSAKANEWYORKNO. 216,AUMAHU,AKI_GUN,JAPAN ------- 开证⾏Destination Bank: ⽬地的银⾏或⽬地⾏Xxxxxxxxxxx (通知⾏的密押Test key)BANK OF CHINA, NANTONG BRANCH153, RENMING RD NANTONG CHINATEL: 0513-*******---- 中国银⾏南通分⾏中国南通⼈民路153号电话:0513-*******Type of Documentary Credit 40A IRREVOCABLE --信⽤证性质: 不可撤消Letter of Credit Number 20 LGU-002156 --信⽤证号码: LGU-002156 Date of Issue 31C 010302 -开证⽇期:2001年3⽉2⽇Date and Place of Expiry 31D 010330 CHINA----有效时间地点:2001年3⽉30⽇,在中国到期Applicant Bank 51A NEWYORK BANK, OSAKA---开证⾏:纽约银⾏⼤阪分⾏Applicant 50 YOUNGAN TRADING --开证申请⼈:永安贸易株式会社Beneficiary 59 JIAHA INTER TRADING CO.,60NONGJU RD HUAIAN JIANGSU, CHINA----受益⼈: 佳哈国际贸易公司中国江苏淮安农具路Currency Code, Amount 32B USD 26 520,00----币制和总⾦额:26 520,00美元Available with...by... 41D ANY BANK BY NEGOTIATION-----议付适⽤银⾏:任何银⾏议付Drafts at 42C AT SIGHT ----汇票期限:即期Drawee 42D NEW YORK BANK,OSAKA-----付款⾏:⼤阪纽约银⾏Partial Shipments 43P N OT ALLOWED ---分批装运:不允许Transshipment 43T NOT ALLOWED ---转运:不允许Shipping on Board/Dispatch/Packing in Charge at/ from 44A SHANGHAI----起运港:上海Transportation to 44B OSAKA, JAPAN----⽬的港: ⽇本⼤阪Latest Date of Shipment 44C 010320 ------最迟装运期:2001年3⽉20⽇Description of Goods or Services: 45A ------货物描述100 PCT RAYON DIASH CLOTH ---- 100% ⼈造丝合成纤维布30S X 30S / 56 X 54 /40 X 40CM 2 PLY ---⼈造丝合成纤维布幅度规格CIF OSAKA --- CIF⼤阪CHINA ORIGIN ---中国原产(不是“中国起源”)Documents Required: 46A ------议付单据(需要提交的跟单单据)1. SIGNED COMMERCIAL INVOICE IN 5 COPIES.------签字的商业发票⼀式五份2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED, MARKED "FREIGHT PREPAID" NOTIFYING ACCOUNT------全套清洁已装船提单, 抬头⼈/收货⼈为TOORDER(凭指⽰),空⽩背书,且注明运费已付(FREIGHT PREPAID),通知⼈是客户或开证申请⼈。

信用证的翻译

14.4信用证的翻译信用证是由银行发行的证书,授权持证者可从开证行,其支行或其他有关银行或机构提取所述款项。

它作为贸易上最重要的信用保证方法,代表买方的外汇银行,接手买方的委托,保证其货款的支付。

万一买方付不出货款,根据契约规定,银行必须履行向卖方付款的责任。

信用证是保证卖方收到汇票后即可收取货款的信用文件。

在卖方将货物装船后,外汇银行代替买方,开立汇票给卖方;卖方带着汇票和装船单据,到自己往来的外汇银行办理结算而取得货款。

信用证由开证行(Opening Bank)通过通知行(Informing Bank)交给卖方。

装船后,有议付行(Negotiating Bank)结算后转回开证行。

14.4.1格式化和规范化信用证的句式虽然句中缺少一定的成分,但却独立成句。

例如:Latest shipment Sep.10, 2005. 最近装船时间为2005年9月10 日。

Shipment from Dalian to Nagoya. 从大连运往名古屋的货物。

Each document to show B/L number and date and to be dated not earlier than 7 days from B/L date. 显示提单编号和日期的每张信用证,其开具日期不得早于提单日期7天。

All correspondence to be sent to City Bank import services department. 请将所有的信件送到花旗银行进口部。

Transshipment prohibited. 禁止转运。

14.4.2 专业术语的使用信用证因为具有国际通用性,意义精确严谨,文体特色鲜明,因此常使用专业术语。

为了描述进出口流程的各个环节和与此相关的各类单据,信用证使用大量表意清楚的专业术语。

翻译时必须熟悉该专业知识和专业表达法,否则会贻笑大方。

比如有关信用证类别的词汇:documentary L/C 跟单信用证clean L/C 光票信用证reciprocal L/C 对开信用证irrevocable L/C 不可撤销信用证又如有关当事人的词汇:party 当事人applicant/principal 开证申请人beneficiary 受益人issuing bank 开证行再如表示单据的词汇:draft 汇票invoice 发票packing list 装箱单bill of lading(B/L) 提单inspection certificate 检验证书fumigation certificate 熏舱证书下面再举例说明:back-to-back (letter of) credit 背对背信用证/转开信用证bona fida holder 善意持有人议付行向受益人垫付资金、买入跟单汇票后,即成为汇票持有人,也就是善意持有人。

【参考借鉴】信用证翻译完整版.doc

【参考借鉴】信用证翻译完整版.doc信用证类型1.ThisrevocablecreditmaRbecancelledbRtheIssuingBankatan Rmomentwithoutpriornotice这个可撤销的信用证可以被开证行在没有提前通知的任何时候撤销。

2.ThiscreditissubjecttocancellationoramendmentatanRtime withoutpriornoticetohebeneficiarR.这个信用证以没有提前通知收益人的任何时候的取消或修改为准。

3.Thisadvice,revocableatanRtimewithoutnotice,isforRourgui danceonlRinpreparingdraftsanddocumentsandconveRsnoengagementorobligationonourpartofo urabovementionedcorrespondent. 这个通知在任何时候都可能在没被通知的情况下被撤销,只是为了方便你准备票据和单据提供了一个指南,本通知书不构成我行对相关信用证之保兑和其他任何责任。

4.WeundertaketohonourRourdraftsdrawnandnegotiated inconformitRwith thetermsofthiscreditprovidedthatsuchnegotiationhasbeenmadepriortoreceiptbRt henoticeofcancellation.我们承担承兑和议付你方根据信用证开出的的相一致的汇票,该信用证在收到取消通知书之前都将被议付。

5.WeherebRissuethisirrevocabledocumentarRcreditinRourfa vour,whichisavailablebRpaRmentagainstpresentationofthefollowingdocuments.我方在此开具了以你方为收益人的不可撤销的跟单信用证,该信用证将根据以下单据的出示时议付。

信用证翻译

英语信用证的特点与翻译

一、格式统一、规范,用语简练 (一)省略be动词 例:Partial shipment allowed 允许分批。 (被动语态省略be动词)

• (二)介词或介词词组代替句子 • 例:In the event of discrepant documents are presented to us and rejected, we may release the documents and effect settlement upon applicant’s waiver of such discrepancies. • 如果受益人提交了具有不符点的单据并被我行拒 付,在申请人放弃对上述不符点修改权力的条件 下,我行将放单结汇。 • 在例子中,分别使用介词词组in the event of 和介 词upon代替条件状语从句

• • • • • • • • • • • • • • • • •

3.drawee 付款人(或称受票人,指汇票) (1)to drawn on (or :upon) 以(某人)为付款人 (2)to value on 以(某人)为付款人 (3)to issued on 以(某人)为付款人 4.drawer 出票人 5.advising bank 通知行 (1)advising bank 通知行 (2)the notifying bank 通知行 (3)advised through…bank 通过……银行通知 6.opening bank 开证行 (1)opening bank 开证行 (2)issuing bank 开证行 (3)establishing bank 开证行 7.negotiating bank 议付行 8.paying bank 付款行 9.reimbursing bank 偿付行 10.confirming bank 保兑行

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

一、信用证翻译05AUG26, 09:05:27 LOGICAL TERMINALP05ISSUE OF A DOCUMENTARY CREDIT PAGE 00001FUNC SWPR3UMR00574MSGACK DWS7651 AUTH OK, KEY C394680346023HD38603, BKCHCNBJ LUMIFRPP RECORDBASIC HEADER F 01 BKCHCNBJA300 8306 B41602APPLICANTION HEADER 0 700 1737 970825 LUMIFRPPAXXX 1952 217075 050825 2337*BANQUE LEUMI FRANCE S.A.*PARISUSER HEADER SERVICE CODE 103:BANK PRIORITY 113:MSG USER REF. 108: ETRANGER/01296INFO. FORM CI 115SEQUENCE OF TOTAL *27: 1/1FORM OF DOC. CREDIT *40A: IRREVOCABLEDOC. CREDIT NUMBER *20: 55583DATE OF ISSUE *31C: 050826EXPIRY *31D: DA TE 051004 PLACE A T OUR COUNTERSAPPLICANT *50: BOUTONNERIE SAINT DENIS193 RUE SAINT DENIS 75002 PARISBENEFICIARY *59: CHEN HUA IMPORT/EXPORT CO.NO.869 GUANGZHOU ROAD,SHANGHAI,CHINAAMOUNT *32B: CURRENCY USD AMOUNT 52050.00PERCENTAGE CREDITAMOUNT TOLERANCE *39B: MAXIMUMA V AILABLE WITH/BY *41D: A T SIGHT OF DOCUMENTS IN ORDER AT OUR COUNTERS BY PAYMENT PARTIAL SHIPMENTS *43P: PROHIBITEDTRANSSHIPMENT *43T: PROHIBITEDLOADING IN CHARGE *44A: CHINESE PORTFOR TRANSPORT TO... 44B: MARSEILLESLATEST DA TE OF SHIP. 44C: 050919 BY SINOTRANSDESCRIPT. OF GOODS 45A: NYLON HOOK AND LOOP FASTENERSSALES BASIS: CIF MARSEILLESDOCUMENTS REQUIRED 46A:1/ORIGINALL Y MANUALLY SIGNED COMMERCIAL INVOICE IN 6 FOLD STA TING GOODS,DESTINATION, QUANTITIES AND UNIT PRICE STRICITY2/PACKING LIST IN 4 FOLD3/WEIGHT NOTE IN 4 FOLD4/FULL SET CLEAN ON BOARD OCCEAN BILL OF LADING MADE OUT TO THE ORDER OFBANQUE LEUMI FRANCE SA 100 RUE REAUMUR 75002 PARIS NOTIFYBOUTONNERIE SAINT DENTS 193 RUE SAINT DENIS 75002 PARIS MARKEDFREIGHT PREPAID SHOWING ‘SHIPPED ON BOARD’DUL Y DATED AND SIGNED BY THE CARRIER AND QUOTE BANQUE LEUMI FRANCE SADOCUMENTARY CREDIT NO.555835/ORIGINAL PLUS COPY OR PHOTOCOPY CERTIFICATE OF ORIGIN FORM A GSP6/ORIGINAL PLUS DUPLICATE INSURANCE POLICY COVERING ALL RISKS05AUG26 09:06:05 LOGICAL TERMINALP05ISSUE OF A DOCUMENTARY CREDIT PAGE 00002FUNC SWPR3UMR00574FOR 110 PCT INVOICED GOODS V ALUE. CLAIMS PAYABLE IN FRANCE BY USD7/BENEFICIARY’S STATEMENT IN 2 FOLD STATING NO MARK OF COUNTY/ORIGN INDICA TED ON SHIPPED GOODS OR ON CARTONSADDITIONAL COND. 47A:1/IN CASE OF PRESENTATION OF DISCREPANT DOCUMENTS EUR 55(OR COUNTER V ALUE)HANDLING CHARGES FOR EACH SET OF DISCREPANT DOCUMENTS AND EUR 22(ORCOUNTER V ALUE) FOR EACH TELEX OR SWIFT WILL BE ON BENEFICIARY’S ACCOUNTAND DEDUCTED FROM THE PROCEEDS.2/ANY OF OUR PAYMENT EFFECTED AGAINST DISCREPANT DOCUMENTS NOTCONSTITUTE AN AMENDMENT OF THIS L/C, NOR OUR AUTHORIZATION TONEGOTIATE/PAY WITH DISCREPANT DOCUMENTS APPL Y TO FUTURE DRAWINGS.3/5PCT MORE OR LESS IN SHIPPING QUANTITY IS ACCEPTABLEDETAILS OF CHARGES 71B:ABROAD/BENEF. AS WELL AS OUR AMENDMENT CHARGESPRESENTA TION PERIOD 48:WITHIN 15DAYS AFTER ON BOARD B/L DATECONFIRMATIONS *49:WITHOUTINSTRUCTIONS 78:ALL DOCUMENTS PRESENTED IN CONFORMITY WITH THE TERMS OF THE CREDIT IN ORDER AT OUR COUNTERS WE SHALL EFFECT PAYMENTSEND. TO REC. INFO. 72:SUBJECT TO UCP 1993 ICC PUB. 500PLS ACKNOWLEDGE RECEIPT OF THIS L/C QUOTING YOUR REFERENCE NUMBERBEST REGARDS DC DEPY SETRALER ORDER IS <MAC:><PAC:><ENC:><CHK:><TNG:><PDE:>MAC:A6B46FB1CHK:006094029B56二、试将下列信用证条款翻译成中文(1)Insurance Policy cover for 110% of total invoice value against All Risks and War Risk as per and subject to therelevant Ocean Marine Cargo Clauses of the People’s Insurance Company of China dated 1/1/1981.(2)Insurance Policy covered for 110% of total invoice value against Institute Cargo Clauses (A) and Institute War Clauses (Cargo).(3)Policy of Insurance in duplicate issued or endorsed to the order of endorsed to the order of ABC Co., Ltd. in the currency of the credit for the CIF value of the shipment plus 10 percent covering all risks and war risks of the People’s Insurance Company of China.(4)Insurance Policy/Certificate in 2 fold issued for 110% of the invoice value, covering Insurance Cargo Clauses A and war Clauses , staring claims payable in Holland by claims paying agent.(5)Full set 3/3 originals plus 3 non-negotiable copies clean on board ocean B/L , consigned to order and blank endorsed , marked ‘Freight Prepaid ’,showing shipping agent at destination , notifying applicant and evidencing the goods have been shipped by full container load.(6)Full set 3/3 of clean on board bill of lading established to order and blank endorsed , notifying buyer , mentioning ‘ Freight Prepaid ’and CIF Genoa in transit to Switzerland .(7)Shipment must be effected in three equal lots by separate steamers with an interval of at least 30 days between shipments .Documents must be separately negotiated.(8)Third party as consigner B/L is not acceptable.(9)Beneficiary’s original signed commercial invoices in quintuplicate with indication of the merchandise names , country of origin and other relevant information.(10)Signed commercial invoice u=in 6 copies , original of which must be certified by the Chamber of Commerce. (11)Commercial Invoice in 8 copies CFI Bangkok price and showing FOB value , freight charges and insurance premium separately.(12)The commercial invoice must show the accrual price of the goods described and certify that no other invoices have been or will be issued and that all particulars are true and correct.(13)Drafts in duplicate at sight bearing the clauses ‘Drawn under XYZ Bank Credit NO.34956 ’.(14)Drafts to be drawn at 30 day s’ sight on us for 100% of invoice values.(15)Bill of Exchange must be negotiated within 15 days from the date of Bill of Lading but not later than the L/C expiry date.(16)Drafts drawn under this credit must be negotiated in China on or before August 12 , 2005 after which date which dare this credit expires.(17)Documents to accompany drafts are listed below and must be presented for negotiation with 10 days of date of Bill of Lading or other document evidencing dispatch of goods.。