《金融数学》(第二版)习题参考答案(修订版)

《金融学(第二版)》讲义大纲及课后习题答案详解 第15章

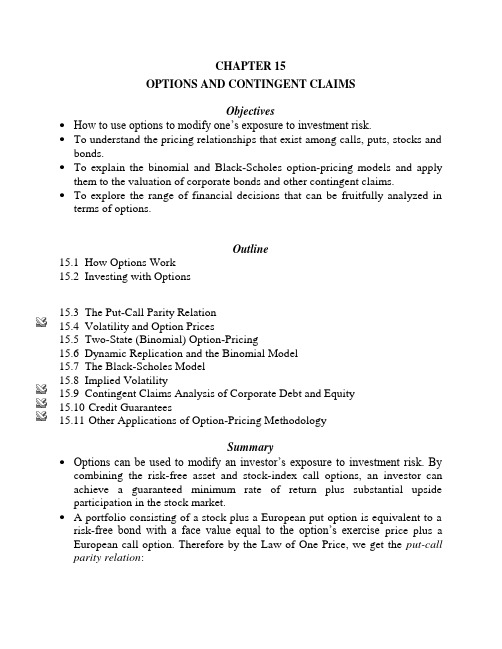

CHAPTER 15OPTIONS AND CONTINGENT CLAIMSObjectives•How to use options to modify one’s exposure to investment risk.•To understand the pricing relationships that exist among calls, puts, stocks and bonds.•To explain the binomial and Black-Scholes option-pricing models and apply them to the valuation of corporate bonds and other contingent claims.•To explore the range of financial decisions that can be fruitfully analyzed in terms of options.Outline15.1 How Options Work15.2 Investing with Options15.3 The Put-Call Parity Relation15.4 Volatility and Option Prices15.5 Two-State (Binomial) Option-Pricing15.6 Dynamic Replication and the Binomial Model15.7 The Black-Scholes Model15.8 Implied Volatility15.9 Contingent Claims Analysis of Corporate Debt and Equity15.10 Credit Guarantees15.11 Other Applications of Option-Pricing Methodologythe maturity of the option, and C the price of the call.•One can create a synthetic option from the underlying stock and the risk-free asset through a dynamic replication strategy that is self-financing after the initial investment. By the Law of One Price, the option’s price is given by the formula:where:C = price of the callS = price of the stockE = exercise pricer = risk-free interest rate (the annualized continuously compounded rate on a safe asset with the same maturity as the option)T = time to maturity of the option in yearsσ= standard deviation of the annualized continuously compounded rate of return on the stockd = continuous dividend yield on the stockln = natural logarithme = the base of the natural log function (approximately 2.71828)N(d1) = the probability that a random draw from a standard normal distribution will be less than d1.•The same methodology used to price options can be used to value many other contingent claims, including corporate stocks and bonds, loan guarantees, and the “real options” imbedded in investments in research and development and flexible manufacturing technology.Solutions to Problems at End of ChapterPayoff Diagrams1. Graph the payoff for a European put option with exercise price E, written on a stock with value S, when:a. You hold a long position (i.e., you buy the put)b. You hold a short position (i.e., you sell the put)SOLUTION: a.b.2.Graph the payoff to a portfolio holding one European call option and one European put option, each with the same expiration date and each with exercise price E, when both options are on a stock with value S.Investing with options3. The risk-free one –year rate of interest is 4%, and the Globalex stock index is at 100. The price of one-year European call options on the Globalex stock index with an exercise price of 104 is 8% of the current price of the index. Assume that the expected dividend yield on the stocks in the Globalex index is zero. You have $1million to invest for the next year. You plan to investenough of your money in one-year T-bills to insure that you will at least get back your original $1 million, and you will use the rest of your money to buy Globalex call options.a. Assuming that you can invest fractional amounts in Globalex options,show the payoff diagram for your investment. Measure the Globalex index on the horizontal axis and the portfolio rate of return on the vertical axis. What is the slope of the payoff line to the right of an index value of 104? b. If you think that there is a probability of .5 that the Globalex index a year from now will be up 12%, a probability of .25 that it will be up 40%, and a probability of .25 that it will be down 20%, what is the probability distribution of your portfolio rate of return?SOLUTION:a.To insure that you will at least get back your original $1 million, you need toinvestin T-bills.You can buy46.538,961$04.1000,000,1$1000,000,1$=+=+f r 69.4807854.461,38$10008.46.538,961$000,000,1$==⨯-options.The slope of the payoff line to the right of an index value of 104 is 4807.69, as seen from the graph:b.Put-Call Parity4.a.Show how one can replicate a one-year pure discount bond with a facevalue of $100 using a share of stock, a put and a call.b.Suppose that S=$100, P=$10, and C=$15. What must be the one-year interest rate?c.Show that if the one-year risk-free interest rate is lower than in youranswer to part b, there would be an arbitrage opportunity. (Hint: The price of the pure discount bond would be too high).SOLUTION:a.To replicate a one-year pure discount bond with a face value of $100, buy ashare of stock, and a European put with exercise price $100, and sell aEuropean call with an exercise price $100.b.S = $100, P = $10, and C = $15.E/(1+r) = S + P- C$100/(1+r) = $100 + $10 - $15 = $95r = 100/95 -1 = .053 or 5.3%c.If r = 4%, then one could make risk-free arbitrage profits by borrowing at 4%and investing in synthetic 1-year pure discount bonds consisting of a share of stock, a European put with exercise price $100, and a short position in aEuropean call with an exercise price $100. The synthetic bond would cost $95 and pay off $100 at maturity in 1 year. The principal and interest on the $95 it costs to buy this synthetic bond would be $95 x 1.04 = $98.8. Thus there would be a pure arbitrage profit of $1.20 per bond a year from now with zero initial outlay of funds.5. A 90-day European call option on a share of the stock of Toshiro Corporation is currently trading at 2,000 yen whereas the current price of the share itself is 2, 400 yen. 90-day zero-coupon securities issued by the government of Japan are selling for 9, 855 yen per 10, 000 yen face value. Infer the price of a 90-day European put option on this stock if both the call and put have a common exercise price of 500 yen.SOLUTION:Using the expression for put-call parity, P =-S + E/(1+r)T + CS is the share price, P is the price of the put, C is the price of the call and E is the common exercise price.Since government bonds are selling at . 9855 per 1 yen of face value, this is thediscount factor for computing the PV of the exercise price. There is no need to compute the riskless rate, r.Substituting in the parity equation we get:P = -2,400 + 500 x .9855 +2,000 = 92.75 yen6. Gordon Gekko has assembled a portfolio consisting of ten 90-day US Treasury bills, each having a face value of $1, 000 and a current price of $990.10, and 200 90-day European call options, each written on a share of Paramount stock and having an exercise price of $50.00. Gekko is offering to trade you this portfolio for 300 shares of Paramount stock, which is currently valued at $215.00 a share.If 90-day European put options on Paramount stock with a $50.00 exercise price are currently valued at $25.00,a.Infer the value of the calls in Gekko’s portfolio.b.Determine whether you should accept Gekko’s offer.SOLUTION:ing put-call parity, the current price of a call is found to be approximately$190.50 as follows:C =S - E/(1+r)T + P= $215 - $50 x .9901 + $25 = $190.495b.The v alue of Gekko’s portfolio is 10 x $990.10 + 200 x $190.495 = $48,000But the value of 300 shares is $64,500. We should reject Gekko’s offer.7. The stock of Kakkonen, Ltd., a hot tuna distributor, currently lists for $500.00 a share, whereas one-year European call options on this stock, with an exercise price of $200.00, sell for $400.00 and European put options with a similar expiration date and exercise price sell for $84.57.a.Infer the yield on a one-year, zero-coupon U.S. government bond soldtoday.b.If this yield is actually at 9%, construct a profitable trade to exploit thepotential for arbitrage.SOLUTION:ing put-call parity, we can infer the riskless yield to be approximately 8.36%as follows:A portfolio consisting of a share of the stock, a put, and a short position in acall is equivalent to a 1-year T-bill with a face value of E. Therefore the price of such a T-bill would have to be $184.57:E/(1+r)T = S + P- C = $500.00 +$84.57 -$400.00 = $184.571+r= 200/184.57 = 1.0836r= .0836 or 8.36%b.There are many ways to exploit the violation of the Law of One Price to makearbitrage profits. Since the risk-free interest rate is 9%, and the implied interest rate on the replicating portfolio is 8.36%, we could go short the replicating portfolio and invest the proceeds in T-bills. For example, at current prices,short-sell a “unit” portfolio, which consists of long positions in one put and one share and writing one call, to earn immediate revenue of $184.57. The portfolio you sold short requires payment of $200 one year from now. If you invest the $184.57 in one-year T-bills you will have 1.09x $184.57 = $201.18 a year from now. Thus you will earn a risk-free arbitrage profit of $1.18 with no outlay of your own money.Two-State Option Pricing8. Derive the formula for the price of a put option using the two-state model. SOLUTION:To price the put option, we create a synthetic option by selling short a fraction (denote the fraction “a”) and len d $b in risk-free asset. Denote the price of the stock S, the price of the put option P, the stock price when the next period is an “up” to be uS, the stock price when the next period is a “down” to be dS, the payoffs of the put option in each state Pu and Pd, and the risk-free interest r.We solve for (a, b) in 1) and 2) We find:andSo that the price of the put optionuP b r a S u =⨯++⨯⨯-)1(d P b r a S d =⨯++⨯⨯-)1(Sd u P P a d u ⨯---=)()1()(r d u P d P u b u d +⨯-⨯-⨯=⎥⎦⎤⎢⎣⎡⨯⎪⎭⎫ ⎝⎛---+⨯⎪⎭⎫ ⎝⎛--+⨯+=+⨯-=d u P d u r u P d u d r r b S a P 1)1)1(19. The share value of Drummond, Griffin and McNabb, a New Orleanspublishing house, is currently trading at $100.00 but is expected, 90 days from today, to rise to $150.00 or to decline to $50.00, depending on critical reviews of its new biography of Ezra Pound. Assuming the risk-free interest rate over the next 90 days is 1%, can you value a European call option written on a share of DGM stock if the option carries an exercise price of $85.00?SOLUTION:Should the value of DBM stock rise to $150 in 90 days, the call will be worth $65.00 at that date, but if DBM stock falls to $50.00 the call will be worthless at expiration. Using the 2-state option pricing model, we find that the call is worth $32.82:To replicate the call using the stock and risk-free borrowing we buy x shares ofstock and borrow y. We findthe values for x and y by setting up two equations, one for each of the possible payoffs of the call at expiration:The solution to this set of two equations is x = .65 and y = $32.50/1.01 = $32.18 Thus, we can replicate the call option by buying .65 of a share of stock (at a cost of $65) and borrowing $32.18.The price of the call option is $32.82: C = .65 x $100 - $32.18 = $32.82The Black-Scholes Formula 10.a. Use the Black-Scholes formula to find the price of a 3-month European call option on a non-dividend- paying stock with a current price of $50.Assume the exercise price is $51, the continuously compounded risk-free interest rate is 8% per year, and σ is .4.b. What is the composition of the initial replicating portfolio for this call option?c. Use the put-call parity relation to find the Black-Scholes formula for the price of the corresponding put option.SOLUTION:a. The price of the call is $3.987. Since the present value of the exercise price is01.1506501.1150=⨯-⨯=⨯-⨯y x y x 4$5.504.4.4.=⨯⨯⨯=⨯⨯⨯=T S C σapproximately equal to the current stock price, we could use the linearapproximation to the Black-Scholes formula:b.The hedge ratio, which is the number of shares of stock you must buy, equalsN(d1), and the amount to borrow is N(d2) times the PV of the exercise price.To find N(d1) and N(d2) you must compute d1 and d2 and then apply the N( ) function (i.e., the standard normal cumulative density function). You can either use NORMDIST in Excel or use a statistical table to do this. The hedge ratio is .54, which means you would buy .54 of a share of stock for $27. The amount to borrow is $23.c. From put-call parity: P = -S + E e0.02 + C = -$50 + $51.01 + $4 = $5.0111. As a financial analyst at Yew and Associates, a Singaporean investment house, you are asked by a client if she should purchase European call options on Rattan, Ltd. stock, which are currently selling in U.S. dollars for $30.00. These options have an exercise price of $50.00. Rattan stock currently exhibits a share price of $55.00, and the estimated rate of return variance of the stock is .04.If these options expire in 25 days and the risk-free interest rate over that period is 5% per year, what do you advise your client to do?SOLUTION:We can apply the Black-Scholes formula, where S = $55, E = $50, σ = .2, T =25/365, r = .05. We find thatC = $5.20. This is a lot less than $30, so clearly the options are not worth buying.Valuation of Corporate Securities with the Two-State Model12. Lorre and Greenstreet, Inc., a purveyor of antique statues, currently has corporate assets valued at$100,000 and must repay $50, 000, the aggregate face value of zero-coupon bonds sold to private investors, in 90 days. An independent appraisal of a newly acquired antique falcon from Malta will be publicly released at that time, and the value of the firm’s assets is expected to increase to $170,000 if the falcon is certified as genuine, but to decline to a mere $45, 000 if the antique is found to be a fake. The firm will declare bankruptcy in this latter circumstance and shareholders will surrender the assets of the firm to its creditors.a.Can you express the current aggregate value of equity in Lorre andGreenstreet as a contingent expression of the value of the firm’s assets and the face value of its outstanding debt?b.Is there a relation between the expression you have derived for equity anda 90-day European call option written upon the aggregate value of thefirm’s assets?c.Can you express the current aggregate value of the bonds issued by Lorreand Greenstreet in terms of the value of the firm’s assets and the facevalue of its outstanding debt?d.Is there a relation among the current value of the bonds the firm hasissued, the current value of riskless bonds with the same term to maturity and face value, and a European put option written on the aggregate value of the firm’s assets? What would the implication of such a relationship be for expressing the value of risky debt in terms of risk-free debt andcollateral?SOLUTION:a.The aggregate value of the firm’s equity in 90 d ays is E1 = max (V1 -B, 0)where E1 and V1 are, respectively, the aggregate values in 90 days of thefirm’s equity and assets, and where B is the aggregate face value of the firm’s debt.The current value of the equity can be expressed as:E = xV - ywhere x is the fraction of the value of the firm that one must purchase toreplicate the payoffs from the equity, and y is the amount that must beborrowed. We find the values for x and y by setting up two equations, one for each of the possible payoffs of the equity 90 days from now:170000x - y(1+r) = 120,00045000x - y(1+r) = 0The solution to this set of two equations is x = 120/125 = .96 and y =$43,200/(1+r), where r is the risk-free 90-day interest rate. Thus, we canreplicate the equity by buying 96% of the firm’s assets (at a cost of $96,000) and borrowing the present value of $43,200. The current value of the equity is therefore:E = $96,000 -$43,200/(1+r)b.They are exactly analogous. The call value is analogous to the aggregate valueof equity, the share price is analogous to the aggregate value of the firm’sassets, and the exercise price is analogou s to the face value of the firm’s debt.In effect, the firm’s shareholders hold a call option on the firm’s assets, which they can exercise by repaying the face value of the debt.c.In the presence of limited corporate liability, the realized aggregate payoff tothe firm’s creditors in 90 days, D1, can be written as:D1 = min (V1,B).d.The difference in value between the firm’s bonds and the correspondingdefault-free bonds equals the value of a European put on the firm’s assets. This relation implies the limit ed liability that stockholders have to sell the firm’s assets at the debt’s face value, which also implies that the value of risk-free debt equals the sum of the value of the risky debt and the value of collateral.13. Gephardt, Army and Gore, a vaudeville booking agency, has issued zero-coupon corporate debt this week, consisting of 80 bonds, each with a face value of $1,000 and a term to maturity of one year. Industry analysts predict that the value of GAG assets will be $160,000 in one year if Rupert Murdoch succeeds in purchasing and converting the Washington Press Club into a comedy venue, $130,000 if Murdoch buys the club but retains its current scheduling, and $20,000 if Murdoch builds an alternative comedy venue in Washington. Industry analysts also predict that aggregate value of the assets of a second firm in the field of comedy entertainment, Yelstin Yuks, Ltd., will have the values of $100,000, $100,000, and $40,000 in these respective circumstances. Assuming that investors can purchase portfolios comprised of shares of the assets of GAG and YY Ltd., as well as buying or short –selling one-year, zero-coupon, government bonds at the risk-free annual rate of .10, thena.Infer the three alternative values for aggregate equity in GAG, one yearfrom today.b.Devise a portfolio that is a perfect substitute for the payoffs given by aportfolio composed only of equity in GAG.c.Determine the current market value of a share of equity in GAG, assuming10,000 shares of GAG stock are outstanding, the current market value of GAG assets is $120,000, and the current market value of YY Ltd., assets is $85,725.d.Determine the current market value of a bond issued by GAG, assuming80 bonds are issued, under these circumstances. What of the yield tomaturity on each such bond?SOLUTION:a.In the first circumstance, the value of aggregate equity in GAG is $160,000-$80,000=$80,000.In the second circumstance, the value of aggregate equity in GAG is $130,000-$80,000=$50,000.In the third circumstance, the value of aggregate equity in GAG is 0.b.Suppose that the replicating portfolio consists of buying x units of the GAGasset, y units of the YY asset, and z units of the government bond (with a face value of $100,000). The payoff of this portfolio will exactly match that of the GAG equity, that gives:160,000x + 100,000y + 100,000z = 80,000130,000x + 100,000y + 100,000z = 50,00020,000x + 40,000y +100,000z = 0solving the equations, we have x = 1, y = -1, z = 0.2c.We define three types of pure contingent claims: at the end of one year, AD1will pay off $1 if and only if Rupert Murdoch succeeds in purchasing andconverting the Washington Press Club into a comedy venue; AD2 will pay off $1 if and only if Murdoch buys the club but retains its current scheduling; AD3 will pay off $1 if and only if Murdoch builds an alternative comedy venue in Washington. Denote the prices as of today of the three pure contingent claims as p1, p2 and p3, respectively.From the value equation of the GAG asset, YY asset and the government bond, we have:GAG: 160,000p1 + 130,000p2 + 20,000p3 = 120,000YY: 100,000p1 + 100,000p2 + 40,000p3 = 85,725Government bond: 100,000p1 + 100,000p2 + 100,000p3 = 100,000/(1+10%) = 90,909Solve the equations, we have p1 = 0.3774, p2=0.4453, p3=0.0864The total value of GAG equity is80,000p1 + 50,000p2 = $52457The per share price of equity is $5.25.d.The value of the bond and the value of the equity add up to the value of theasset, so,V bond = V asset– V equity = 120,000 – 52547 = $67543The yield-to-maturity of bond is (80,000-67543)/67543 = 18.4%。

利息理论第三章课后答案

利息理论第三章课后答案《金融数学》课后习题参考答案第三章 收益率1、某现金流为:元,元,元,元,求该现金流的收益率。

解:由题意得:2、某投资者第一年末投资7000元,第二年末投资1000元,而在第一、三年末分别收回4000元和5500元,计算利率为0.09及0.1时的现金流现值,并计算该现金流的内部收益率。

解:由题意得:当时, 当时,令3、某项贷款1000元,每年计息4次的年名义利率为12%,若第一年后还款400元,第5年后还款800元,余下部分在第7年后还清,计算最后一次还款额。

解:由题意得:4、甲获得100000元保险金,若他用这笔保险金购买10年期期末付年金,每年可得15380元,若购买20年期期末付年金,则每年可得10720元,这两种年金基于相同的利率,计算。

3000o o =11000o =12000I =24000I =2001122()()()0O I O I v O I v -+-+-=23000100040000v v --=4133v i ⇒=⇒=23(0)[(47) 5.5]1000V v v v =--+⨯0.09i =(0)75.05V =0.1i =(0)57.85V =-(0)00.8350.198V v i =⇒=⇒=40.121(10.88854i v +=+⇒=571000400800657.86v pv p =++⇒=i i解:由题意得: 5、某投资基金按积累,,在时刻0基金中有10万元,在时刻1基金中有11万元,一年中只有2次现金流,第一次在时刻0.25时投入15000元,第二次在时刻0.75时收回2万元,计算k 。

解:由题意得:6、某投资业务中,直接投资的利率为8%,投资所得利息的再投资利率为4%,某人为在第10年末获得本息和1万元,采取每年末投资相等的一笔款项,共10年,求证每年投资的款项为:。

证明:7.某投资人每年初在银行存款1000元,共5年,存款利率为5%,存款所得利息的再投资利率为4%,证明:V (11)=1250(。

《金融学(第二版)》讲义大纲及课后习题答案详解 第四章

CHAPTER 4THE TIME VALUE OF MONEY AND DISCOUNTED CASH FLOW ANALYSISObjectives•To explain the concepts of compounding and discounting, future value and present value.•To show how these concepts are applied to making financial decisions.Outline4.1 Compounding4.2 The Frequency of Compounding4.3 Present Value and Discounting4.4 Alternative Discounted Cash Flow Decision Rules4.5 Multiple Cash Flows4.6 Annuities4.7 Perpetual Annuities4.8 Loan Amortization4.9 Exchange Rates and Time Value of Money4.10 Inflation and Discounted Cash Flow Analysis4.11 Taxes and Investment DecisionsSummary•Compounding is the process of going from present value (PV) to future value (FV). The future value of $1 earning interest at rate i per period for n periods is (1+i)n.•Discounting is finding the present value of some future amount. The present value of $1 discounted at rate i per period for n periods is 1/(1+i)n.•One can make financial decisions by comparing the present values of streams of expected future cash flows resulting from alternative courses of action. The present value of cash inflows less the present value of cash outflows is called net present value (NPV). If a course of action has a positive NPV, it is worth undertaking. •In any time value of money calculation, the cash flows and the interest rate must be denominated in the same currency.•Never use a nominal interest rate when discounting real cash flows or a real interest rate when discounting nominal cash flows.How to Do TVM Calculations in MS ExcelAssume you have the following cash flows set up in a spreadsheet:Move the cursor to cell B6 in the spreadsheet. Click the function wizard f x in the tool bar and when a menu appears, select financial and then NPV. Then follow the instructions for inputting the discount rate and cash flows. You can input the column of cash flows by selecting and moving it with your mouse. Ultimately cell B6should contain the following:=NPV(0.1,B3:B5)+B2The first variable in parenthesis is the discount rate. Make sure to input the discount rate as a decimal fraction (i.e., 10% is .1). Note that the NPV function in Excel treats the cash flows as occurring at the end of each period, and therefore the initial cash flow of 100 in cell B2 is added after the closing parenthesis. When you hit the ENTER key, the result should be $47.63.Now move the cursor to cell B7to compute IRR. This time select IRR from the list of financial functions appearing in the menu. Ultimately cell B7 should contain the following:=IRR(B2:B5)When you hit the ENTER key, the result should be 34%.Your spreadsheet should look like this when you have finished:Solutions to Problems at End of Chapter1. If you invest $1000 today at an interest rate of 10% per year, how much will you have 20 years from now,assuming no withdrawals in the interim?2. a. If you invest $100 every year for the next 20 years, starting one year from today and you earninterest of 10% per year, how much will you have at the end of the 20 years?b. How much must you invest each year if you want to have $50,000 at the end of the 20 years?3. What is the present value of the following cash flows at an interest rate of 10% per year?a. $100 received five years from now.b. $100 received 60 years from now.c. $100 received each year beginning one year from now and ending 10 years from now.d. $100 received each year for 10 years beginning now.e. $100 each year beginning one year from now and continuing forever.e. PV = $100 = $1,000.104. You want to establish a “wasting” fund which will provide you with $1000 per year for four years, at which time the fund will be exhausted. How much must you put in the fund now if you can earn 10% interest per year?SOLUTION:5. You take a one-year installment loan of $1000 at an interest rate of 12% per year (1% per month) to be repaid in 12 equal monthly payments.a. What is the monthly payment?b. What is the total amount of interest paid over the 12-month term of the loan?SOLUTION:b. 12 x $88.85 - $1,000 = $66.206. You are taking out a $100,000 mortgage loan to be repaid over 25 years in 300 monthly payments.a.If the interest rate is 16% per year what is the amount of the monthly payment?b.If you can only afford to pay $1000 per month, how large a loan could you take?c.If you can afford to pay $1500 per month and need to borrow $100,000, how many months would it taketo pay off the mortgage?d.If you can pay $1500 per month, need to borrow $100,000, and want a 25 year mortgage, what is thehighest interest rate you can pay?SOLUTION:a.Note: Do not round off the interest rate when computing the monthly rate or you will not get the same answerreported here. Divide 16 by 12 and then press the i key.b.Note: You must input PMT and PV with opposite signs.c.Note: You must input PMT and PV with opposite signs.7. In 1626 Peter Minuit purchased Manhattan Island from the Native Americans for about $24 worth of trinkets. If the tribe had taken cash instead and invested it to earn 6% per year compounded annually, how much would the Indians have had in 1986, 360 years later?SOLUTION:8. You win a $1 million lottery which pays you $50,000 per year for 20 years, beginning one year from now. How much is your prize really worth assuming an interest rate of 8% per year?SOLUTION:9. Your great-aunt left you $20,000 when she died. You can invest the money to earn 12% per year. If you spend $3,540 per year out of this inheritance, how long will the money last?SOLUTION:10. You borrow $100,000 from a bank for 30 years at an APR of 10.5%. What is the monthly payment? If you must pay two points up front, meaning that you only get $98,000 from the bank, what is the true APR on the mortgage loan?SOLUTION:If you must pay 2 points up front, the bank is in effect lending you only $98,000. Keying in 98000 as PV and computing i, we get:11. Suppose that the mortgage loan described in question 10 is a one-year adjustable rate mortgage (ARM), which means that the 10.5% interest applies for only the first year. If the interest rate goes up to 12% in the second year of the loan, what will your new monthly payment be?SOLUTION:Step 2 is to compute the new monthly payment at an interest rate of 1% per month:12. You just received a gift of $500 from your grandmother and you are thinking about saving this money for graduation which is four years away. You have your choice between Bank A which is paying 7% for one-year deposits and Bank B which is paying 6% on one-year deposits. Each bank compounds interest annually. What is the future value of your savings one year from today if you save your money in Bank A? Bank B? Which is the better decision? What savings decision will most individuals make? What likely reaction will Bank B have? SOLUTION:$500 x (1.07) = $535Formula:$500 x (1.06) = $530a.You will decide to save your money in Bank A because you will have more money at the end of the year. Youmade an extra $5 because of your savings decision. That is an increase in value of 1%. Because interestcompounded only once per year and your money was left in the account for only one year, the increase in value is strictly due to the 1% difference in interest rates.b.Most individuals will make the same decision and eventually Bank B will have to raise its rates. However, it isalso possible that Bank A is paying a high rate just to attract depositors even though this rate is not profitable for the bank. Eventually Bank A will have to lower its rate to Bank B’s rate in order to make money.13.Sue Consultant has just been given a bonus of $2,500 by her employer. She is thinking about using the money to start saving for the future. She can invest to earn an annual rate of interest of 10%.a.According to the Rule of 72, approximately how long will it take for Sue to increase her wealth to $5,000?b.Exactly how long does it actually take?SOLUTION:a.According to the Rule of 72: n = 72/10 = 7.2 yearsIt will take approximately 7.2 years for Sue’s $2,500 to double to $5,000 at 10% interest.b.At 10% interestn i PV FV PMTSolve10 - $2,500 $5,0007.27 YearsFormula:$2,500 x (1.10)n = $5,000Hence, (1.10)n = 2.0n log 1.10 = log 2.0n = .693147 = 7.27 Years.095310rry’s bank account has a “floating” interest rate on certa in deposits. Every year the interest rate is adjusted. Larry deposited $20,000 three years ago, when interest rates were 7% (annual compounding). Last year the rate was only 6%, and this year the rate fell again to 5%. How much will be in his account at the end of this year?SOLUTION:$20,000 x 1.07 x 1.06 x 1.05 = $23,818.2015.You have your choice between investing in a bank savings account which pays 8% compounded annually (BankAnnual) and one which pays 7.5% compounded daily (BankDaily).a.Based on effective annual rates, which bank would you prefer?b.Suppose BankAnnual is only offering one-year Certificates of Deposit and if you withdraw your moneyearly you lose all interest. How would you evaluate this additional piece of information when making your decision?SOLUTION:a.Effective Annual Rate: BankAnnual = 8%.Effective Annual Rate BankDaily = [1 + .075]365 - 1 = .07788 = 7.788%365Based on effective annual rates, you would prefer BankAnnual (you will earn more money.)b.If BankAnnual’s 8% annual return i s conditioned upon leaving the money in for one full year, I would need tobe sure that I did not need my money within the one year period. If I were unsure of when I might need the money, it might be safer to go for BankDaily. The option to withdraw my money whenever I might need it will cost me the potential difference in interest:FV (BankAnnual) = $1,000 x 1.08 = $1,080FV (BankDaily) = $1,000 x 1.07788 = $1,077.88Difference = $2.12.16.What are the effective annual rates of the following:a.12% APR compounded monthly?b.10% APR compounded annually?c.6% APR compounded daily?SOLUTION:Effective Annual Rate (EFF) = [1 + APR] m - 1ma.(1 + .12)12 - 1 = .1268 = 12.68%12b.(1 + .10)- 1 = .10 = 10%1c.(1 + .06)365 - 1 = .0618 = 6.18%36517.Harry promises that an investment in his firm will double in six years. Interest is assumed to be paid quarterly and reinvested. What effective annual yield does this represent?EAR=(1.029302)4-1=12.25%18.Suppose you know that you will need $2,500 two years from now in order to make a down payment on a car.a.BankOne is offering 4% interest (compounded annually) for two-year accounts, and BankTwo is offering4.5% (compounded annually) for two-year accounts. If you know you need $2,500 two years from today,how much will you need to invest in BankOne to reach your goal? Alternatively, how much will you need to invest in BankTwo? Which Bank account do you prefer?b.Now suppose you do not need the money for three years, how much will you need to deposit today inBankOne? BankTwo?SOLUTION:PV = $2,500 = $2,311.39(1.04)2PV = $2,500 = $2,289.32(1.045)2You would prefer BankTwo because you earn more; therefore, you can deposit fewer dollars today in order to reach your goal of $2,500 two years from today.b.PV = $2,500 = $2,222.49(1.04)3PV = $2,500 = $2,190.74(1.045)3Again, you would prefer BankTwo because you earn more; therefore, you can deposit fewer dollars today in order to reach your goal of $2,500 three years from today.19.Lucky Lynn has a choice between receiving $1,000 from her great-uncle one year from today or $900 from her great-aunt today. She believes she could invest the $900 at a one-year return of 12%.a.What is the future value of the gift from her great-uncle upon receipt? From her great-aunt?b.Which gift should she choose?c.How does your answer change if you believed she could invest the $900 from her great-aunt at only 10%?At what rate is she indifferent?SOLUTION:a. Future Value of gift from great-uncle is simply equal to what she will receive one year from today ($1000). Sheearns no interest as she doesn’t receive the money until next year.b. Future Value of gift from great-aunt: $900 x (1.12) = $1,008.c. She should choose the gift from her great-aunt because it has future value of $1008 one year from today. Thegift from her great-uncle has a future value of $1,000. This assumes that she will able to earn 12% interest on the $900 deposited at the bank today.d. If she could invest the money at only 10%, the future value of her investment from her great-aunt would only be$990: $900 x (1.10) = $990. Therefore she would choose the $1,000 one year from today. Lucky Lynn would be indifferent at an annual interest rate of 11.11%:$1000 = $900 or (1+i) = 1,000 = 1.1111(1+i) 900i = .1111 = 11.11%20.As manager of short-term projects, you are trying to decide whether or not to invest in a short-term project that pays one cash flow of $1,000 one year from today. The total cost of the project is $950. Your alternative investment is to deposit the money in a one-year bank Certificate of Deposit which will pay 4% compounded annually.a.Assuming the cash flow of $1,000 is guaranteed (there is no risk you will not receive it) what would be alogical discount rate to use to determine the present value of the cash flows of the project?b.What is the present value of the project if you discount the cash flow at 4% per year? What is the netpresent value of that investment? Should you invest in the project?c.What would you do if the bank increases its quoted rate on one-year CDs to 5.5%?d.At what bank one-year CD rate would you be indifferent between the two investments?SOLUTION:a.Because alternative investments are earning 4%, a logical choice would be to discount the project’s cash flowsat 4%. This is because 4% can be considered as your opportunity cost for taking the project; hence, it is your cost of funds.b.Present Value of Project Cash Flows:PV = $1,000 = $961.54(1.04)The net present value of the project = $961.54 - $950 (cost) = $11.54The net present value is positive so you should go ahead and invest in the project.c.If the bank increased its one-year CD rate to 5.5%, then the present value changes to:PV = $1,000 = $947.87(1.055)Now the net present value is negative: $947.87 - $950 = - $2.13. Therefore you would not want to invest in the project.d.You would be indifferent between the two investments when the bank is paying the following one-year interestrate:$1,000 = $950 hence i = 5.26%(1+i)21.Calculate the net present value of the following cash flows: you invest $2,000 today and receive $200 one year from now, $800 two years from now, and $1,000 a year for 10 years starting four years from now. Assume that the interest rate is 8%.SOLUTION:Since there are a number of different cash flows, it is easiest to do this problem using cash flow keys on the calculator:22.Your cousin has asked for your advice on whether or not to buy a bond for $995 which will make one payment of $1,200 five years from today or invest in a local bank account.a.What is the internal rate of return on the bond’s cash flows? What additional information do you need tomake a choice?b.What advice would you give her if you learned the bank is paying 3.5% per year for five years(compounded annually?)c.How would your advice change if the bank were paying 5% annually for five years? If the price of thebond were $900 and the bank pays 5% annually?SOLUTION:a.$995 x (1+i)5 = $1,200.(1+i)5 = $1,200$995Take 5th root of both sides:(1+i) =1.0382i = .0382 = 3.82%In order to make a choice, you need to know what interest rate is being offered by the local bank.b.Upon learning that the bank is paying 3.5%, you would tell her to choose the bond because it is earning a higherrate of return of 3.82% .c.If the bank were paying 5% per year, you would tell her to deposit her money in the bank. She would earn ahigher rate of return.5.92% is higher than the rate the bank is paying (5%); hence, she should choose to buy the bond.23.You and your sister have just inherited $300 and a US savings bond from your great-grandfather who had left them in a safe deposit box. Because you are the oldest, you get to choose whether you want the cash or the bond. The bond has only four years left to maturity at which time it will pay the holder $500.a.If you took the $300 today and invested it at an interest rate 6% per year, how long (in years) would ittake for your $300 to grow to $500? (Hint: you want to solve for n or number of periods. Given these circumstances, which are you going to choose?b.Would your answer change if you could invest the $300 at 10% per year? At 15% per year? What otherDecision Rules could you use to analyze this decision?SOLUTION:a.$300 x (1.06)n = $500(1.06)n = 1.6667n log 1.06 = log 1.6667n = .510845 = 8.77 Years.0582689You would choose the bond because it will increase in value to $500 in 4 years. If you tookthe $300 today, it would take more than 8 years to grow to $500.b.You could also analyze this decision by computing the NPV of the bond investment at the different interest rates:In the calculations of the NPV, $300 can be considered your “cost” for acquiring the bond since you will give up $300 in cash by choosing the bond. Note that the first two interest rates give positive NPVs for the bond, i.e. you should go for the bond, while the last NPV is negative, hence choose the cash instead. These results confirm the previous method’s results.24.Suppose you have three personal loans outstanding to your friend Elizabeth. A payment of $1,000 is due today, a $500 payment is due one year from now and a $250 payment is due two years from now. You would like to consolidate the three loans into one, with 36 equal monthly payments, beginning one month from today. Assume the agreed interest rate is 8% (effective annual rate) per year.a.What is the annual percentage rate you will be paying?b.How large will the new monthly payment be?SOLUTION:a.To find the APR, you must first compute the monthly interest rate that corresponds to an effective annual rate of8% and then multiply it by 12:1.08 = (1+ i)12Take 12th root of both sides:1.006434 = 1+ ii = .006434 or .6434% per monthOr using the financial calculator:b.The method is to first compute the PV of the 3 loans and then compute a 36 month annuity payment with thesame PV. Most financial calculators have keys which allow you to enter several cash flows at once. This approach will give the user the PV of the 3 loans.Note: The APR used to discount the cash flows is the effective rate in this case, because this method is assuming annual compounding.25.As CEO of ToysRFun, you are offered the chance to participate, without initial charge, in a project that produces cash flows of $5,000 at the end of the first period, $4,000 at the end of the next period and a loss of $11,000 at the end of the third and final year.a.What is the net present value if the relevant discount rate (the company’s cost of capital) is 10%?b.Would you accept the offer?c.What is the internal rate of return? Can you explain why you would reject a project which has aninternal rate of return greater than its cost of capital?SOLUTION:At 10% discount rate:Net Present Value = - 0 + $5,000 + $4,000 - $11,000 = - 413.22(1.10) (1.10)2 (1.10)3c.This example is a project with cash flows that begin positive and then turn negative--it is like a loan. The 13.6% IRR is therefore like an interest rate on that loan. The opportunity to take a loan at 13.6% when the cost of capital is only 10% is not worthwhile.26.You must pay a creditor $6,000 one year from now, $5,000 two years from now, $4,000 three years from now, $2,000 four years from now, and a final $1,000 five years from now. You would like to restructure the loan into five equal annual payments due at the end of each year. If the agreed interest rate is 6% compounded annually, what is the payment?SOLUTION:Since there are a number of different cash flows, it is easiest to do the first step of this problem using cash flow keys on the calculator. To find the present value of the current loan payments:27.Find the future value of the following ordinary annuities (payments begin one year from today and all interest rates compound annually):a.$100 per year for 10 years at 9%.b.$500 per year for 8 years at 15%.c.$800 per year for 20 years at 7%.d.$1,000 per year for 5 years at 0%.e.Now find the present values of the annuities in a-d.f.What is the relationship between present values and future values?SOLUTION:Future Value of Annuity:e.f.The relationship between present value and future value is the following:nbeginning three years from today in an account that yields 11% compounded annually. How large should the annual deposit be?SOLUTION:You will be making 7 payments beginning 3 years from today. So, we need to find the value of an immediate annuity with 7 payments whose FV is $50,000:29.Suppose an investment offers $100 per year for five years at 5% beginning one year from today.a.What is the present value? How does the present value calculation change if one additional payment isadded today?b.What is the future value of this ordinary annuity? How does the future value change if one additionalpayment is added today?SOLUTION:$100 x [(1.05)5] - 1 = $552.56.05If you were to add one additional payment of $100 today, the future value would increase by:$100 x (1.05)5 = $127.63. Total future value = $552.56 + $127.63 = $680.19.Another way to do it would be to use the BGN mode for 5 payments of $100 at 5%, find the future value of that, and then add $100. The same $680.19 is obtained.30.You are buying a $20,000 car. The dealer offers you two alternatives: (1) pay the full $20,000 purchase price and finance it with a loan at 4.0% APR over 3 years or (2) receive $1,500 cash back and finance the rest at a bank rate of 9.5% APR. Both loans have monthly payments over three years. Which should you choose? SOLUTION:31.You are looking to buy a sports car costing $23,000. One dealer is offering a special reduced financing rate of 2.9% APR on new car purchases for three year loans, with monthly payments. A second dealer is offering a cash rebate. Any customer taking the cash rebate would of course be ineligible for the special loan rate and would have to borrow the balance of the purchase price from the local bank at the 9%annual rate. How large must the cash rebate be on this $23,000 car to entice a customer away from the dealer who is offering the special 2.9% financing?SOLUTION:of the 2.9% financing.32.Show proof that investing $475.48 today at 10% allows you to withdraw $150 at the end of each of the next 4 years and have nothing remaining.SOLUTION:You deposit $475.48 and earn 10% interest after one year. Then you withdraw $150. The table shows what happensAnother way to do it is simply to compute the PV of the $150 annual withdrawals at 10% : it turns out to be exactly $475.48, hence both amounts are equal.33.As a pension manager, you are considering investing in a preferred stock which pays $5,000,000 per year forever beginning one year from now. If your alternative investment choice is yielding 10% per year, what is the present value of this investment? What is the highest price you would be willing to pay for this investment? If you paid this price, what would be the dividend yield on this investment?SOLUTION:Present Value of Investment:PV = $5,000,000 = $50,000,000.10Highest price you would be willing to pay is $50,000,000.Dividend yield = $5,000,000 = 10%.$50,000,00034. A new lottery game offers a choice for the grand prize winner. You can receive either a lump sum of $1,000,000 immediately or a perpetuity of $100,000 per year forever, with the first payment today. (If you die, your estate will still continue to receive payments). If the relevant interest rate is 9.5% compounded annually, what is the difference in value between the two prizes?SOLUTION:The present value of the perpetuity assuming that payments begin at the end of the year is:$100,000/.095 = $1,052,631.58If the payments begin immediately, you need to add the first payment. $100,000 + 1,052,632 = $1,152,632.So the annuity has a PV which is greater than the lump sum by $152,632.35.Find the future value of a $1,000 lump sum investment under the following compounding assumptions:a.7% compounded annually for 10 yearsb.7% compounded semiannually for 10 yearsc.7% compounded monthly for 10 yearsd.7% compounded daily for 10 yearse.7% compounded continuously for 10 yearsa.$1,000 x (1.07)10 = $1,967.15b.$1,000 x (1.035)20 = $1,989.79c.$1,000 x (1.0058)120 = $2,009.66d.$1,000 x (1.0019178)3650 = $2,013.62e.$1,000 x e.07x10 = $2,013.7536.Sammy Jo charged $1,000 worth of merchandise one year ago on her MasterCard which has a stated interest rate of 18% APR compounded monthly. She made 12 regular monthly payments of $50, at the end of each month, and refrained from using the card for the past year. How much does she still owe? SOLUTION:Sammy Jo has taken a $1,000 loan at 1.5% per month and is paying it off in monthly installments of $50. We could work out the amortization schedule to find out how much she still owes after 12 payments, but a shortcut on the financial calculator is to solve for FV as follows:37.Suppose you are considering borrowing $120,000 to finance your dream house. The annual percentage rate is 9% and payments are made monthly,a.If the mortgage has a 30 year amortization schedule, what are the monthly payments?b.What effective annual rate would you be paying?c.How do your answers to parts a and b change if the loan amortizes over 15 years rather than 30?EFF = [1 + .09]1238.Suppose last year you took out the loan described in problem #37a. Now interest rates have declined to 8% per year. Assume there will be no refinancing fees.a.What is the remaining balance of your current mortgage after 12 payments?b.What would be your payment if you refinanced your mortgage at the lower rate for 29 years? SOLUTION:Exchange Rates and the Time Value of Money39.The exchange rate between the pound sterling and the dollar is currently $1.50 per pound, the dollar interest rate is 7% per year, and the pound interest rate is 9% per year. You have $100,000 in a one-year account that allows you to choose between either currency, and it pays the corresponding interest rate.a.If you expect the dollar/pound exchange rate to be $1.40 per pound a year from now and are indifferentto risk, which currency should you choose?b.What is the “break-even” value of the dollar/pound exchange rate one year from now?SOLUTION:a.You could invest $1 today in dollar-denominated bonds and have $1.07 one year from now. Or you couldconvert the dollar today into 2/3 (i.e., 1/1.5) of a pound and invest in pound-denominated bonds to have .726667(i.e., 2/3 x 1.09) pounds one year from now. At an exchange rate of $1.4 per pound, this would yield 0.726667(1.4) = $1.017 (this is lower than $1.07), so you would choose the dollar currency.b.For you to break-even the .726667 pounds would have to be worth $1.07 one year from now, so the break-evenexchange rate is $1.07/.726667 or $1.4725 per pound. So for exchange rates lower than $1.4725 per pound one year from now, the dollar currency will give a better return.。

《金融数学》(第二版)练习题(修订版)

1.21 投资者 A 今天在一项基金中存入 10,5 年后存入 30,已知此项基金按单利 11%计息;投资者 B 将进行同样数额的两笔存款,但是在 n 年后存入 10, 在 2n 年后存入 30,已知此项基金按复利 9.15%计息。在第 10 年末,两基金的累积值相等。求 n。

1.22

已知利息力为 δ t

批注: 第二版书稿中有错

2.16 一项年金从 2000 年 1 月 1 日开始,每月末支付 100 元,支付 60 次;这项年金的价值等价于在第 K 月末支付一笔 6000 元的款项。每月复利一次的 名义利率为 12%。求 k。

2.17 如果 a = x , a = y , 试将 d 表示为 x 和 y 的函数。

2.22 投资者在 t=0 和 t=10 时分别向一项基金投资 12,这项基金以年实际利率 i 计息。利息在年末支付,并以 0.75i 的年实际利率进行再投资。在 t=20 时,再投资利息的累积值为 64,求 i。

2.23 如果利息力为常数 δ = 1 ,求 a 的表达式。

1+ t

n

5

2.24 给定利息力 δ = 1 ,0≤ t ≤5,请计算 s 。

1+ 0.5t

5

∫ 2.25

已知

8

a

0t

dt

= 100 。请计算 a 10

。

2.26

如果 3a (2) n|

=

2a (2) 2n|

=

45s ( 2 ) 1|

,试计算

i

是多少?

2.27 当 t 为多少时,在时刻 t 支付 1 元相当于将这 1 元在时刻 0 与 1 之间连续支付?

2.28

已知 a = 4 , s =12 ,求利息力。

金融数学引论答案第二版

金融数学引论答案第二版【篇一:北大版金融数学引论第二章答案】>第二章习题答案1.某家庭从子女出生时开始累积大学教育费用5万元。

如果它们前十年每年底存款1000元,后十年每年底存款1000+x 元,年利率7%。

计算x 。

解:s = 1000s?7%+xs?7%20p10p20px = 50000 ? 1000s?7% = 651.72s?p7%102.价值10,000元的新车。

购买者计划分期付款方式:每月底还250元,期限4年。

月结算名利率18%。

计算首次付款金额。

解:设首次付款为x ,则有10000 = x + 250a?p1.5%48解得x = 1489.3613.设有n年期期末年金,其中年金金额为n,实利率i =n解:p v = na?npi= 1nn+2 =(n + 1)nn2n4.已知:a?pn= x,a?p2n= y 。

试用x和y 表示d 。

解: a?p2n= a?pn+ a?p (1 ? d)则nny ? xd = 1 ? ( x ) n5.已知:a?p7= 5.58238, a?= 7.88687, a?= 10.82760。

计算i。

11p18p解:a?p = a?p + a?p v718711解得=i = 6.0%10?p +a∞?p6.证明: 11?v10s。

s10?p北京大学数学科学学院金融数学系第 1 页版权所有,翻版必究证明:s?p + a∞?p=s?10p10+101 = 107.已知:半年结算名利率6%,计算下面10年期末年金的现值:开始4年每半年200元,然后减为每次100元。

解:p v = 100a?+ 100a20?8p3% p3% = 2189.7168.某人现年40岁,现在开始每年初在退休金帐号上存入1000元,共计25年。

然后,从65岁开始每年初领取一定的退休金,共计15年。

设前25年的年利率为8%,后15年的年利率7%。

计算每年的退休金。

解:设每年退休金为x,选择65岁年初为比较日=解得x = 8101.658。

金融学第二版课后习题答案

金融学第二版课后习题答案【篇一:王重润公司金融学第二版课后答案】业有几种组织方式?各有什么特点?( 1)有两种,有限责任公司和股份有限责任公司( 2)有限责任公司特点:有限责任公司是指股东以其出资额为限对公司承担责任,公司以其全部资产对公司的债务承担责任的企业法人;有限责任公司注册资本的最低限额为人民币3万元;其资本并不必分为等额股份,也不公开发行股票,股东持有的公司股票可以再公司内部股东之间自由转让,若向公司以外的人转让,须经过公司股东的同意;公司设立手续简便,而且公司无须向社会公开公司财务状况。

( 3)股份有限责任公司特点:1、有限责任2、永续存在3、股份有限责任公司的股东人数不得少于法律规定的数目,我国规定设立股份有限公司,应当有2人以上200人以下为发起人4、股份有限责任公司的全部资本划分为等额的股份,通过向社会公开发行的办法筹集资金,任何人在缴纳了股款之后,都可以成为公司股东,没有资格限制。

5、可转让性6、易于筹资2题:为什么我国《公司法》允许存在一人有限责任公司?一人有限责任公司与个人独资企业有何不同?答:1.就立法初衷而言,许可自然人投资设立一人有限责任公司的重要考虑是减少实质上的一人公司的设立,简化和明晰股权归属,减少纷争。

以往由于我国《公司法》禁止设立一人公司,使得投资人通过各种途径设立或形成的实质上的一人公司大量存在,挂名股东与真实股东之间的投资权益纠纷以及挂名股东与公司债权人之间的债务纠纷不断,令工商行政管理部门和司法机关无所适从。

在修订《公司法》的过程中,法律委员会、法制工作委员会会同国务院法制办、工商总局、国资委、人民银行和最高人民法院反复研究认为:从实际情况看,一个股东的出资额占公司资本的绝大多数而其他股东只占象征性的极少数,或者一个股东拉上自己的亲朋好友作挂名股东的有限责任公司,即实质上的一人公司,已是客观存在,也很难禁止。

根据我国的实际情况,并研究借鉴国外的通行做法,应当允许一个自然人投资设立有限责任公司。

(完整版)金融数学课后习题答案

(完整版)金融数学课后习题答案第一章习题答案1. 设总量函数为A(t) = t2 + 2t + 3 。

试计算累积函数a(t) 和第n 个时段的利息In 。

解: 把t = 0 代入得A(0) = 3 于是:a(t) =A(t)A(0)=t2 + 2t + 33In = A(n) ? A(n ?1)= (n2 + 2n + 3) ?((n ?1)2 + 2(n ?1) + 3))= 2n + 12. 对以下两种情况计算从t 时刻到n(t < n) 时刻的利息: (1)Ir(0 < r <n); (2)Ir = 2r(0 < r < n).解:(1)I = A(n) ? A(t)= In + In?1 + + It+1=n(n + 1)2t(t + 1)2(2)I = A(n) ? A(t)=Σnk=t+1Ik =Σnk=t+1Ik= 2n+1 ?2t+13. 已知累积函数的形式为: a(t) = at2 + b 。

若0 时刻投入的100 元累积到3 时刻为172 元,试计算:5 时刻投入的100 元在10 时刻的终值。

第1 页解: 由题意得a(0) = 1, a(3) =A(3)A(0)= 1.72a = 0.08,b = 1∴A(5) = 100A(10) = A(0) ? a(10) = A(5) ? a(10)a(5)= 100 × 3 = 300.4. 分别对以下两种总量函数计算i5 和i10 :(1) A(t) = 100 + 5t; (2) A(t) = 100(1 + 0.1)t. 解:(1)i5 =A(5) ? A(4)A(4)=5120≈4.17%i10 =A(10) ? A(9)A(9)=5145≈3.45%(2)i5 =A(5) ? A(4)A(4)=100(1 + 0.1)5 ?100(1 + 0.1)4100(1 + 0.1)4= 10%i10 =A(10) ? A(9)A(9)=100(1 + 0.1)10 ?100(1 + 0.1)9100(1 + 0.1)9= 10%第2 页5.设A(4) = 1000, in = 0.01n. 试计算A(7) 。

《_金融数学-课后习题答案》

金融数学-课后习题答案本文档为金融数学课后习题的参考答案。

在解答问题时,我会尽量给出详细的步骤和推导过程,帮助读者更好地理解金融数学的概念和方法。

1. 第一章:时间价值1.1 问题一题目:如果我现在存入1000元,年利率是5%,请问5年后我能得到多少钱?解答:首先需要计算每年的复利,即每年利息和本金的总和。

根据复利计算公式:年末总金额 = 本金 * (1 + 年利率)^时间年数代入数据进行计算:年末总金额 = 1000 * (1 + 0.05)^5 = 1000 * 1.2762815625 ≈ 1281.28元因此,5年后你能得到大约1281.28元。

1.2 问题二题目:如果我希望在5年后拥有2000元,年利率是5%,请问我需要存入多少钱?解答:首先需要计算本金与利息的比例,然后根据比例计算需要的本金。

根据复利计算公式:年末总金额 = 本金 * (1 + 年利率)^时间年数可以将该式转化为:本金 = 年末总金额 / (1 + 年利率)^时间年数代入数据进行计算:本金 = 2000 / (1 + 0.05)^5 = 2000 / 1.2762815625 ≈ 1567.45元因此,你需要存入大约1567.45元。

2. 第二章:贴现与现值2.1 问题一题目:如果一笔未来支付3000元的现金流在5年后,年利率是6%,请问它的现值是多少?解答:为了计算现值,我们需要使用贴现率(年利率)和时间年数。

根据贴现计算公式:现值 = 未来支付金额 / (1 + 年利率)^时间年数代入数据进行计算:现值= 3000 / (1 + 0.06)^5 = 3000 / 1.33822557689 ≈ 2241.53元所以,该未来支付的现金流的现值大约为2241.53元。

2.2 问题二题目:如果我希望在5年后得到3000元的现金流,年利率是6%,请问我愿意支付多少现值?解答:为了计算现值,我们使用贴现率(年利率)和时间年数。

利息理论第三章课后答案

《金融数学》课后习题参考答案第三章 收益率1、某现金流为:元,元,元,元,求该现金流的收益率。

解:由题意得:2、某投资者第一年末投资7000元,第二年末投资1000元,而在第一、三年末分别收回4000元和5500元,计算利率为及时的现金流现值,并计算该现金流的内部收益率。

解:由题意得:当时,当时,令3、某项贷款1000元,每年计息4次的年名义利率为12%,若第一年后还款400元,第5年后还款800元,余下部分在第7年后还清,计算最后一次还款额。

解:由题意得:4、甲获得100000元保险金,若他用这笔保险金购买10年期期末付年金,每年可得15380元,若购买20年期期末付年金,则每年可得10720元,这两种年金基于相同的利率,计算。

解:由题意得: 08688.010720153802010=⇒=i a a i i5、某投资基金按积累,,在时刻0基金中有10万元,在时刻1基金中有11万元,一年中只有2次现金流,第一次在时刻时投入15000元,第二次在时刻时收回2万元,计算k。

解:由题意得:6、某投资业务中,直接投资的利率为8%,投资所得利息的再投资利率为4%,某人为在第10年末获得本息和1万元,采取每年末投资相等的一笔款项,共10年,求证每年投资的款项为:。

证明:7.某投资人每年初在银行存款1000元,共5年,存款利率为5%,存款所得利息的再投资利率为4%,证明:V(11)=1250(。

V(11)=1000[5(1++(Is)8.甲年初投资2000元,年利率为 17%,每年末收回利息,各年收回的利息按某一利率又投资出去,至第10 年末,共得投资本息和元。

乙每年末投资150元,年利率14%,共20年,每年收回的利息按甲的再投资利率投资。

计算乙在第20年末的投资本息和。

9.某投资基金年初有投资2万元,年收益率为12%,3月末又投入资金5000元,9月末赎回资金8000元,假设1-t it=(1-t)i 计算年末基金的资金量。

《金融学(第二版)》讲义大纲及课后习题答案详解 第16章

CHAPTER 16CAPITAL STRUCTUREObjectives•To understand how a firm can create value through its financing decisions. •To show how to take account of a firm’s financing mix in evaluating investment decisions.Outline16.1 Internal versus External Financing16.2 Equity Financing16.3 Debt Financing16.4 The Irrelevance of Capital Structure in a Frictionless Environment16.5 Creating Value through Financing Decisions16.6 Reducing Costs16.7 Dealing with Conflicts of Interest16.8 Creating New Opportunities for Stakeholders16.9 Financing Decisions in Practice16.10 How to Evaluate Levered InvestmentsSummary•External financing subjects a corporation’s investment plans more directly to the discipline of the capital market than internal financing does.•Debt financing in its broadest sense includes loans and debt securities, such as bonds and mortgages, as well as other promises of future payment by the corporation, such as accounts payable, leases, and pensions.•In a frictionless financial environment, where there are no taxes or transaction costs, and contracts are costless to make and enforce, the wealth of shareholders is the same no matter what capital structure the firm adopts.•In the real world there are a number of frictions that can cause capital structure policy to have an effect on the wealth of shareholders. These include taxes, regulations, and conflicts of interest between the stakeholders of the firm. A firm’s management might therefore be able to create shareholder val ue through its capital structure decisions in one of three ways:•By reducing tax costs or the costs of burdensome regulations.•By reducing potential conflicts of interest among various stakeholders in the firm.•By providing stakeholders with financial assets not otherwise available tothem.•There are three alternative methods used in estimating the net present value of an investment project to take account of financial leverage: the adjusted present value method, the flows to equity method, and the weighted average cost of capital methodSolutions to Problems at End of ChapterDebt-Equity Mix1. Divido Corporation is an all-equity financed firm with a total market value of $100 million.The company holds $10 million in cash-equivalents and has $90 million in other assets.There are 1,000,000 shares of Divido common stock outstanding, each with a market price of $100.Divido Corporation has decided to issue $20 million of bonds and to repurchase $20 million worth of its stock.a.What will be the impact on the price of its shares and on the wealth of itsshareholders?Why?b.Assume that Divido’s EBIT has an equal probability of being $20 million,or $12 million, or $4million.Show the impact of the financial restructuring on the probability distribution of earnings per share in the absence oftaxes.Why does the fact that the equity becomes riskier not necessarily affect shareholder wealth?SOLUTION:a.In an M&M frictionless environment, where there are no taxes and contractsare costless to make and enforce, the wealth of shareholders is the same no matter what capital structure the firm adopts. In such an environment, neither the stock price nor shareholders’ wealth would be affected. In the real world Divido’s management might be ab le to create shareholder value by issuing debt and repurchasing shares in two ways:By reducing tax costsBy reducing the free cash flow available to management and exposing itself to greater market discipline.b.The formula for EPS without debt is:EPS all equity =EBIT1,000,000 sharesThe interest payments will be $1.2 million per year (.06 x $20 million)regardless of the realized value of EBIT. The number of shares outstanding after exchanging debt for equity will be 800,000. EPS with debt is therefore: EPS with debt = Net Earnings= EBIT – $1.2 million800,000 shares 800,000 sharesAlthough the shares of stock become riskier with debt financing, the expected earnings per share go up. In a frictionless financial environment, the net effect is to leave the price of the stock unaffected.Leasing2. Plentilease and Nolease are virtually identical corporations.The only difference between them is that Plentilease leases most of its plant and equipment whereas Nolease buys its plant and equipment and finances it by pare and contrast their market-value balance sheets.SOLUTION:Market-Value Balance Sheets of Nolease and Plentilease CorporationsThe main difference between the bonds and the lease as a form of debtfinancing is who bears the risk associated with the residual market value of the leased asset at the end of the term of the lease. Since Nolease Corporation has bought its equipment, it bears this risk. In Plentilease’s case, however, it is the lessor that bears this residual-value risk.Pension Liabilities3. Europens and Asiapens are virtually identical corporations.The only difference between them is that Europens has a completely unfunded pension plan, and Asiapens has a fully funded pension pare and contrast their market-value balance sheets.What difference does the funding status of the pension plan make to the stakeholders of these two corporations?SOLUTION:Balance Sheets of Asiapens and Europens CorporationsAsiapens has funded its pension plan by issuing bonds and investing the funds raised in a segregated pool of pension fund assets. These pension assets take the form of a diversified portfolio of stocks and bonds issued by othercompanies and serve as collateral for the pension benefits promised byAsiapens to its employees. In the case of Europens, there is no segregated poolof pension assets. The pension promises of Europens are backed by the assets of the company itself. Therefore, the employees of Asiapens are more secure about receiving their promised pension benefits, since the benefits arecollateralized by a more diversified portfolio of assets. In the case of bothcompanies, however, any unfunded pension liability reduces shareholdersequity.4. Comfort Shoe Company of England has decided to spin off its Tango Dance Shoe Division as a separate corporation in the United States.The assets of the Tango Dance Shoe Division have the same operating risk characteristics as those of Comfort.The capital structure of Comfort has been 40% debt and 60% equity in terms of marketing values, and is considered by management to be optimal.The required return on Comfort’s assets (if unlevered) is 16% per year, and the interest rate that the firm (and the division) must currently pay on their debt is 10% per year.Sales revenue for the Tango Shoe Division is expected to remain indefinitely at last year’s level of $10 million.Variable costs are 55% of sales.Annual depreciation is $1 million, which is exactly matched each year by new investments.The corporate tax rate is 40%.a.How much is the Tango Shoe Division worth in unlevered form?b.If the Tango Shoe Division is spun off with $5 million in debt, how muchwould it be worth?c.What rate of return will the shareholders of the Tango Shoe Divisionrequire?d.Show that the market value of the equity of the new firm would be justifiedby the earnings to the shareholders.SOLUTION:a.The unlevered free cash flow for the Tango Shoe Division would be (in$millions):Sales: $10.0Var. Cost: -5.5Depreciation - 1.0Taxable Income $ 3.5Taxes (@40%) -1.4After-Tax Income $2.1Depreciation 1.0Investment -1.0Free Cash Flow $2.1 millionUnlevered, Tango is worth: $2.1 million / 0.16 = $13.125 millionb.If Tango had $5 million of debt, its total value would be:Market Value with Debt = Market Value without Debt + PV of Interest Tax ShieldV L = V U + T x B= $13.125 + (.4 x 5) = $15.125 millionTango Equity = $15.125 - $5 = $10.125 millionc.Tango’s cost of equity capital would be .1778k e = k + (1-T)(k - r)D/E = .16 + (1-.4)(.16-.10)x 5/10.125 = .1778d.The value of the equity should be the present value of the expected net incomediscounted at the required rate of return on equity. The expected net income will be the unlevered cash flow less the after-tax cost of the interest of the debt: $2.1 - (.6) (.1 x $5) = $2.1 - $.3 = $1.8 million per yearS = $1.8 million / .1778 = $10.125 million5. Based on the above problem, Suppose that Foxtrot Dance Shoes makes custom designed dance shoes and is a competitor of Tango Dance Shoes. Foxtrot has similar risks and characteristics as Tango except that it is completely unlevered.Fearful that Tango Dance Shoes may try to take over Foxtrot in order to control their niche in the market, Foxtrot decides to lever the firm to buy back stock.a.If there are currently 500,000 shares outstanding, what is the value ofFoxtrot’s stock?b.How many shares can Foxtrot buy back and at what value if it is willing toborrow 30% of the value of the firm?c.What if it is willing to borrow 40% of the value of the firm?d.Should Foxtrot borrow more?SOLUTION:a.Current price per share: $13.125 million /.5 million shares = $26.25 per shareb.@30% debtAmount to borrow: 30% of 13.125 million = $3.9375 millionPV of Tax Shield = .4 x $3.9375 million = $1.575 millionValue of levered firm = $13.125 + $1.575 = $14.7 millionValue of equity in levered firm = $14.7 million $3.9375 million = $10.7625 millionTo compute the number of shares Foxtrot can repurchase, we need to know the price per share.If Foxtrot can repurchase shares at the existing price of $26.25 then the number of shares retired will be$3.9375 million/$26.25 per share = .15 million shares. This will leave .35million shares outstanding, and the price of each share will be $10.7625million/.35 million = $30.75.If the PV of the tax shield gets incorporated in the price of the shares before the repurchase, then the price of the shares will increase by $1.575 million/.5million = $3.15. So the price of the repurchased shares will be$26.25 + $3.15 = $29.40.Then the number of shares retired will be $3.9375 million/$29.40 per share = 133,929 shares. This will leave 366,071 shares outstanding each with a price of $29.40.c.@40% debtAmount to borrow: 40% of $13.125 million = $5.25 millionPV of Tax Shield = .4 x $5.25 million = $2.1 millionValue of levered firm = $13.125 + $2.1 = $15.225 millionValue of equity in levered firm = $15.225 million $5.25 million = $9.975 millionIf Foxtrot can repurchase shares at the existing price of $26.25 then the number of shares retired will be$5.25 million/$26.25 per share = .2 million shares. This will leave .3 million shares outstanding, and the price of each share will be $9.975 million/.3 million = $33.25.If the PV of the tax shield gets incorporated in the price of the shares before the repurchase, then the price of the shares will increase by $2.1 million/.5 million = $4.20. So the price of the repurchased shares will be$26.25 + $4.20 = $30.45.Then the number of shares retired will be $5.25million/$30.45 per share =172,414 shares. This will leave 327,586 shares outstanding each with a price of $30.45.d. Foxtrot’s management must trade off the tax savings due to additional debtfinancing against the costs of financial distress that rise with the degree of debt financing.6. Hanna-Charles Company needs to add a new fleet of vehicles for their sales force.The purchasing manager has been working with a local car dealership to get the best value for the company dollar.After some negotiations, a local dealer has offered Hanna-Charles two options:1) a three year lease on the fleet of cars or 2) 15% off the top to purchase outright. Option 2 would cost Hanna-Charles company about 5% less than the lease option in terms of present value.a.What are the advantages and disadvantages of leasing?b.Which option should the purchasing manager at Hanna-Charles pursueand why?SOLUTION:a.Advantages:The lessor bears all the residual-value riskTax BenefitsNo disposal concerns (or resale) when life of equipment is expended.Disadvantages:No ownership while maintaining maintenance responsibilityb.Lease or Buy:Hanna-Charles company should lease. Although they may spend more with the lease, they do not bear the residual-value risk.7. Havem and Needem companies are exactly the same differing only in their capital structures.Havem is an unlevered firm issuing only stocks whereas Needem issues stocks and bonds. Neither firm pays corporate taxes. Havem pays out all of its yearly earnings in the form of dividends and has 1 million shares outstanding.Its market capitalization rate is 11% and the firm is currently valued at$180 million.Needem is identical except that 40% of its value is in bonds and has 500,000 shares outstanding. Needem’s bonds are risk free and pay a coupon of 9% per year and are rolled over every year.a.What is the value of Needem’s shares?b.As an investor forecasting the upcoming year, you examine Havem andNeedem using three possible states of the economy that are all equallylikely: normal, bad, and exceptional.Assuming the earnings will be the same, one half, and one and a half respectively, produce a table that shows the earnings and the earnings per share for both Havem and Needem in all three scenarios.SOLUTION:a.Needem has $72 million in debt and $108 million in equity. Since there are500,000 shares, the value of each share is $216.b.Expected EBIT = $180 million x 11% = $19.8 million per yearInterest expense for Needem = $72 million x .09 = $6.48 million per yearb EBIT – Interest Expense8. Using the foregoing example, let us now assume that Havem and Needem must pay taxes at the rate of 40% annually.Given the same distribution of possible outcomes as previously:a.What are the possible after-tax cash flows for Havem and Needem?b.What are the values of the shares?c.If one was not risk averse, which company would that person invest in? SOLUTION:a.After-tax CF Havem = (1 -Tax Rate) EBIT = Net incomeNet income Needem = (1 -Tax Rate) (EBIT - Int. Pmt.)CF Needem = (1 -Tax Rate) (EBIT) + Tax Rate x Int. PmtCF Needem (bad) = (.60) $9.9 + (.40) x 6.48 = $8.532 millionCF Needem (normal) = (.60) $19.8 + (.40) x 6.48 = $14.472 millionCF Needem (except.) = (.60) $29.7 + (.40) x 6.48 = $20.412 millionb.The equity of Havem will be worth $11.88 million /.11 = $108 million or $108per shareThe total value of Needem’s debt + equity will be $108,000,000 + .4 x $72,000,000 = $136.8 million.Needem’s equity will be worth $136,800,000- $72,000,000 = $64.8 million.Since there are .5 million shares of Needem, each will be worth $129.60.c.Needem.9. The Griffey-Lang Food Company faces a difficult problem.In management’s effort to grow the business, they accrued a debt of $150 million while the value of the company is only $125 million.Management must come up with a plan to alleviate the situation in one year or face certain bankruptcy. Also upcoming are labor relations meetings with the union to discuss employee benefits and pension funds. Griffey-Lang at this time has three choices they can pursue: 1) Launch a new, relatively untested product that if successful (probability of .12) will allow G-L to increase the value of the company to $200 million, 2) Sell off two food production plants in an effort to reduce some of the debt and the value of the company thus making it even (.45 probability of success), or do nothing (probability of failure = 1.0).a.As a creditor, what would you like Griffey-Lang to do, and why?b.As an investor?c.As an employee?SOLUTION:a.As a Creditor:Option 2 best suits the creditor. Option 2 allows the creditor to regain some value through the sale of plant and equipment.b.As a shareholder:The shareholders have nothing to lose and everything to gain by taking a big chance with the new product.c.As an Employee:Selling off two production plants will eliminate jobs. Doing nothing means certain bankruptcy and may result in liquidation of the firm and the loss of all the jobs. For the employees, the best choice is option 1.。