公司金融理论Lecture 7 Estimating the firm's cost of capital, WACC(4)

高级公司金融大纲

《高级公司金融》教学大纲课程代码:Fin504课程名称:高级公司金融英文名称:Advanced Corporate Finance课程性质:金融专业必修课学分学时:2授课对象:硕士一年级课程简介:This advanced study of corporate financial analysis and planning includes capital budgeting, cost of capital, and capital structure and valuation. Selected topics that may be covered are mergers and acquisition, IPO, financial distress and reorganization, etc. A combination of lectures and case-study discussion is used to illustrate theories and techniques helpful in financial analysis先修课程:无选用教材:Stephen A.Ross, Randolph W. Westerfield and Jeffrey F.Jaffe, Corporate Finance, , 8th edition McGraw Hill Education, 2008.考核方式与成绩评定:(闭卷,出勤5%、平时35%、期末成绩60%所占比例)主讲教师:束景虹所属院系:经贸学院联系方式:64837832答疑时间及地点:预约,博学楼1205Lecture 1 Introduction to Corporate Finance教学目标和要求:Understand key concepts教学时数:2教学方式:lecture准备知识:教学内容:I. what is corporate financeII. business organization formsIII. the goal of financial managersIV. Agency conflict参考资料:Textbook, Chapter1Lecture 2 Financial Cash flow and Financial Statements教学目标和要求:Understand Balance Sheet and Income Statements教学时数:4教学方式:lecture准备知识:教学内容:I.How to read balance sheet and income statementII.How to compute financial cash flowIII.Understand financial ratiosIV.Estimate growth rateV.Make financial planning参考资料:Textbook, Chapter2&3,Readings: The history of ratio analysisLecture 3 Discounted Cash Flow Analysis教学目标和要求:Value financial securities教学时数:2教学方式:lecture准备知识:教学内容:I.The concept of NPVII.How to apply NPV to value annuity, insurance, mortgage loans, bond, equity.III.Limitations of NPV approach参考资料:Textbook, Chapter4, 5&6,Lecture 4 Capital Budgeting教学目标和要求:understanding a typical capital budgeting process教学时数:2教学方式:lecture准备知识:教学内容:I.How to estimate incremental cash flowII.Case study: a replacement decisionIII.Breakeven analysis and sensitive analysis参考资料:Textbook, Chapter 7Lecture 5 Alternative Decision Rules教学目标和要求:learn other decision rules教学方式:lecture准备知识:教学内容:I.IRR versus NPVII.Real optionIII.Other decision rules参考资料:Textbook, Chapter 6&8Readings: How do CFOs make investment decisionsLecture 6 Cost of Capital教学目标和要求:estimate cost of capital教学时数:2教学方式:lecture准备知识:教学内容:I.Market efficiency and the concept of cost of capital II.Cost of equityIII.Cost of debtIV.Weighted average cost of capital参考资料:Textbook, Chapter 10, 11& 12Readings: 12 ways to estimate cost of capitalLecture 7 Firm Valuation教学目标和要求:A case study to show how to value a firm教学时数:2教学方式:lecture准备知识:教学内容:I.Book value approachII.DCF approach (DDM, FCFEE, RI)III.Market ratiosIV.Real option approach参考资料:to be assignedLecture 8 Capital Structure--concept 教学目标和要求:understand static capital structure theory教学时数:2教学方式:lecture准备知识:I.Why capital structure mattersII.M&M propositions I and II without and with taxIII.Expected bankruptcy cost and agency cost参考资料:textbook, Chapter 13, 14 & 15.Lecture 9 Capital Structure--practice教学目标和要求:empirical studies on capital structures教学时数:2教学方式:lecture准备知识:教学内容:I.Perking order theoryII.The determinates of capital structureIII.Some empirical tests参考资料:textbook, Chapter 16&17Readings: to be assigned.Lecture 10 Dividend Policy教学目标和要求:understand the relation between dividend policy and shareholder value教学时数:2教学方式:lecture准备知识:教学内容:I.Traditional view of dividend policyII.Dividend policy and corporate governanceIII.The interaction among paying dividend, maintain capital structure and making investment budget.参考资料:textbook, Chapter 18Readings: to be assignedLecture 12 Raising Capital教学目标和要求:IPO教学时数:2教学方式:lecture准备知识:教学内容:I.Different forms of equity financingII.IPOsIII.Financial market and cost of IPO.参考资料:textbook, Chapter 19Readings: to be assignedLecture 13 Merge and Acquisition教学目标和要求:understand theory and practice of M&A教学时数:2教学方式:lecture准备知识:教学内容:I.Motivations for M&AII.How to evaluate synergy effectIII.Agency conflictsIV.How to finance M&AV. A cast study: Why did Lenovo take over IBM PC department. . 参考资料:textbook, Chapter 29Readings: to be assigned。

1公司金融概论-57页PPT资料

10

第二节 公司金融决策的环境

一、公司金融决策环境 概念:是指对企业金融活动产生影响的各种条件的总称。

企业融资、投资及利润分配等金融活动的运行均受制于 公司金融决策环境。

研究目的: 一方面,达到充分认识环境、适应环境; 另一方面,则为制定科学的金融决策、实现理财目标提供 充分、有价值的财务信息。

2019/12/18

8

三、公司金融学的发展 (一)传统公司金融理论的创建阶段——以筹资为中心

(1929年以前) 1897年托马斯·格林纳出版《公司金融》一书,公司金融学

才逐渐从微观经济学中分离出来,成为一门独立的学科。 ——利用普通股、债券和其他有价证券来融资。

(二) 传统公司金融理论的成熟阶段——以内部控制为中心 (1929—1950年)

侧重研究公司内部资金的有效利用和控制。1929年的世界 经济危机使财务管理者逐渐认识到,公司金融管理的问题 不仅仅在融资,更在于有效的内部控制,管好用好资金。

2019/12/18

9

(三)现代金融理论的形成阶段——以投资为中心(1950—1980年) 注重投资的管理,对资本预算、资本成本和资本结构等问题

2019/12/18

12

2.科技环境:2l世纪的经济,科学技术迅速发展,其核心是 以计算机技术、通信技术和网络技术为代表的信息革命。

知识经济的到来,将使无形资产成为企业最重要的投资对 象,投资决策重点。

3.法律环境:包括:企业组织法规、税收法规、财务法规。 1)企业组织法规。三类:公司制企业(国有企业)、私营

第一章 公司金融概论

Chapter 1 Overview of Corporate Finance

Lecture_7Options Trading Strategies(衍生金融工具-人民银行研究院,何佳)

What is the problem related to this privatization?

Employees: To understand the needs of employees, it is useful to consider the failed January 1993 partial privatization. The poor participation is easily understood given employee's risk aversion and poor diversification. Based on a simple investment model, we numerically estimate the solutions for a variety of parameters. Assume a stock volatility is 30%, a two years holing period, a stock expected return of 20%, a risk free rate of 6%, and initial stock price of 150FFr.

0

Cost = c(X1)-c(X2)>0

Payoff from a bull spread using two put options (X1<X2)

Stock price Payoff from Payoff from Total payoff long put short put range

d.

Stock Price Range ST < X X < ST Payoff from long call (T*) c(ST,X,T,T*) c(ST,X,T,T*) Payoff from long call (T) 0 X-ST Total payoff c(ST,X,T,T*) c+X-ST

lecture-11-sectionB-Wrap up of Valuation

βA = βE

E E+D

(OK if the comp’s D not too high (+ can assume their D/V is stable))

3. Use the comps’ βA to estimate the project’s βA (e.g., as average). 4. Use estimated βA to calculate the all-equity cost of capital kA

How we get there:

Get D/V from comps, business plan, checklist, etc.

12

Cost of debt capital: kD

What we want: Expected return for creditors if project were a stand-alone with leverage ratio D/(D+E) estimated above. Imperfect approach to what we want: kD close the interest rate charged to project as stand-alone (unless debt is very risky). How we get there:

is reported as cash outflow but is not one Add (1-t)*Dep however, depreciation does imply a cash inflow of t*Dep. Altogether + Dep

- CAPX

Working capital has an opportunity cost

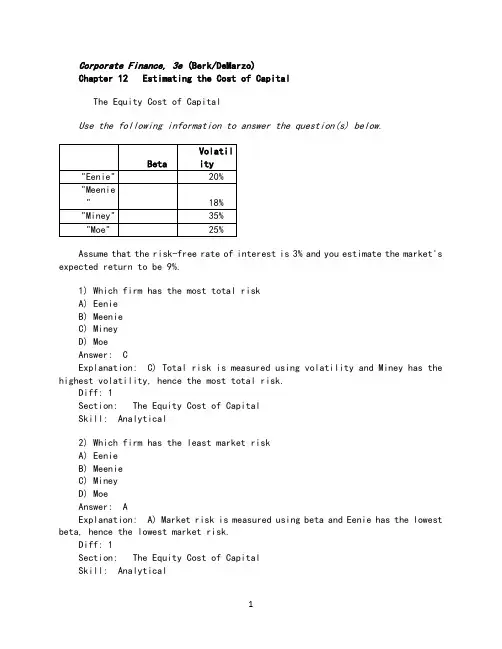

公司理财课后习题及答案chapter12estimatingthecostofcapital

Corporate Finance, 3e (Berk/DeMarzo)Chapter 12 Estimating the Cost of CapitalThe Equity Cost of CapitalUse the following information to answer the question(s) below.Assume that the risk-free rate of interest is 3% and you estimate the market's expected return to be 9%.1) Which firm has the most total riskA) EenieB) MeenieC) MineyD) MoeAnswer: CExplanation: C) Total risk is measured using volatility and Miney has the highest volatility, hence the most total risk.Diff: 1Section: The Equity Cost of CapitalSkill: Analytical2) Which firm has the least market riskA) EenieB) MeenieC) MineyD) MoeAnswer: AExplanation: A) Market risk is measured using beta and Eenie has the lowest beta, hence the lowest market risk.Diff: 1Section: The Equity Cost of CapitalSkill: Analytical3) Which firm has the highest cost of equity capitalA) EenieB) MeenieC) MineyD) MoeAnswer: DExplanation: D) Cost of capital is measured using the CAPM and is a linear function of beta. Therefore the firm with the highest beta (Moe) has the highest cost of equity capital.Diff: 1Section: The Equity Cost of CapitalSkill: Analytical4) The equity cost of capital for "Miney" is closest to:A) %B) %C) %D) %Answer: CExplanation: C) r Miney = 3% + (9% - 3%) = %Diff: 1Section: The Equity Cost of CapitalSkill: Analytical5) The equity cost of capital for "Meenie" is closest to:A) %B) %C) %D) %Answer: BExplanation: B) r Meenie = 3% + (9% - 3%) = %Diff: 1Section: The Equity Cost of CapitalSkill: Analytical6) The risk premium for "Meenie" is closest to:A) %B) %C) %D) %Answer: AExplanation: A) risk premium Meenie = (9% - 3%) = %Diff: 2Section: The Equity Cost of Capital Skill: AnalyticalThe Market PortfolioUse the following information to answer the question(s) below.Suppose all possible investment opportunities in the world are limited to the four stocks list in the table below:1) The weight on Taggart Transcontinental stock in the market portfolio is closest to:A) 15%B) 20%C) 25%D) 30%Answer: BSection: The Market PortfolioSkill: Analytical2) The weight on Wyatt Oil stock in the market portfolio is closest to:A) 15%B) 20%C) 25%D) 30%Answer: ASection: The Market PortfolioSkill: Analytical3) Suppose that you are holding a market portfolio and you have invested $9,000 in Rearden Metal. The amount that you have invested in Nielson Motors is closest to:A) $6,000B) $7,715C) $9,000D) $10,500Answer: DWyatt Oil$10$Nielson Motors$26$Total$Amount Nielson = × Amount Rearden = × $9,000 = $10,500Diff: 2Section: The Market PortfolioSkill: Analytical4) Suppose that you are holding a market portfolio and you have invested $9,000 in Rearden Metal. The amount that you have invested in Taggart Transcontinental is closest to:A) $4,500B) $6,000C) $7,715D) $9,000Answer: BCalculations B × C D/1950StockPriceperShareNumber ofSharesOutstanding(Millions)MarketCap WeightTaggartTranscontinental$25$Rearden Metal$45$Wyatt Oil$10$Nielson Motors$26$Total$Amount Nielson = × Amount Rearden = × $9,000 = $6,000Diff: 2Section: The Market PortfolioSkill: Analytical5) Suppose that you have invested $30,000 invested in the market portfolio. Then the amount that you have invested in Wyatt Oil is closest to:A) $4,500B) $6,000C) $7,715D) $9,000Answer: ACalculations B × C D/1950StockPriceperShareNumber ofSharesOutstandingMarketCap Weight(Millions)TaggartTranscontinental$25$Rearden Metal$45$Wyatt Oil$10$Nielson Motors$26$Total$Amount WO = Weight WO × Amount Market= .15 × $30,000 = $4,500Diff: 2Section: The Market PortfolioSkill: Analytical6) Suppose that you have invested $30,000 in the market portfolio. Then the number of shares of Rearden Metal that you hold is closest to:A) 450 sharesB) 700 sharesC) 1,400 sharesD) 2,300 sharesAnswer: BCalculations B × C D/1950StockPriceperShareNumber ofSharesOutstanding(Millions)MarketCap WeightTaggartTranscontinental$25$ Rearden Metal$45$ Wyatt Oil$10$ Nielson Motors$26$Total$ Shares RM = = = sharesDiff: 2Section: The Market PortfolioSkill: Analytical7) Suppose that you have invested $30,000 in the market portfolio. Then the number of shares of Wyatt Oil that you hold is closest to:A) 150 sharesB) 300 sharesC) 350 sharesD) 450 sharesAnswer: ACalculations B × C D/1950StockPriceperShareNumber ofSharesOutstanding(Millions)MarketCap WeightTaggartTranscontinental$25$ Rearden Metal$45$ Wyatt Oil$10$ Nielson Motors$26$Total$ Shares WO = = = sharesDiff: 2Section: The Market PortfolioSkill: Analytical8) Suppose that you are holding a market portfolio and you have invested $18,000 in Taggart Transcontinental. The number of shares of Wyatt Oil that you hold is closest to:A) 90 sharesB) 460 sharesC) 615 sharesD) 770 sharesAnswer: BCalculations B × C D/1950StockPriceperShareNumber ofSharesOutstanding(Millions)MarketCap WeightTaggartTranscontinental$25$ Rearden Metal$45$ Wyatt Oil$10$ Nielson Motors$26$Total$= = sharesDiff: 2Section: The Market PortfolioSkill: Analytical9) Suppose that you are holding a market portfolio and you have invested $18,000 in Taggart Transcontinental. The number of shares of Rearden Metal that you hold is closest to:A) 780 sharesB) 925 sharesC) 1,730 sharesD) 2,075 sharesAnswer: BCalculations B × C D/1950StockPriceperShareNumber ofSharesOutstanding(Millions)MarketCap WeightTaggartTranscontinental$25$Rearden Metal$45$Wyatt Oil$10$Nielson Motors$26$Total$= = 2, sharesDiff: 2Section: The Market PortfolioSkill: Analytical10) Suppose that you have invested $100,000 invested in the market portfolio and that the stock price of Taggart Transcontinental suddenly drops to $ per share. Which of the following trades would you need to make in order to maintain your investment in the market portfolio:1. Buy approximately 1,140 shares of Taggart Transcontinental2. Sell approximately 256 shares of Rearden Metal3. Sell approximately 57 shares of Wyatt Oil4. Sell approximately 148 shares of Nielson MotorsA) 1 onlyB) 2 onlyC) 2, 3, and 4 onlyD) 1, 2, 3, and 4E) None of the aboveAnswer: EExplanation: E) There is no need to rebalance your portfolio. As an investor, you still hold the market portfolio and therefore there are no trades needed.Diff: 3Section: The Market PortfolioSkill: AnalyticalUse the following information to answer the question(s) below.Suppose that Merck (MRK) stock is trading for $ per share with billion shares outstanding while Boeing (BA) has million shares outstanding and a market capitalization of $ billion. Assume that you hold the market portfolio.11) Boeing's stock price is closest to:A) $B) $C) $D) $Answer: CExplanation: C) Price BA = = = $Diff: 1Section: The Market PortfolioSkill: Analytical12) Merck's market capitalization is closest to:A) $ billionB) $ billionC) $ billionD) $ billionAnswer: BExplanation: B) Market Cap = Price × shares outstanding = $ × 2,110 = $77,437 millionDiff: 1Section: The Market PortfolioSkill: Analytical13) If you hold 1,000 shares of Merck, then the number of shares of Boeing that you hold is closest to:A) 240 sharesB) 330 sharesC) 510 sharesD) 780 sharesAnswer: BExplanation: B) Shares BA == = sharesDiff: 3Section: The Market PortfolioSkill: Analytical14) Which of the following statements is FALSEA) All investors should demand the same efficient portfolio of securities in the same proportions.B) The Capital Asset Pricing Model (CAPM) allows corporate executives to identify the efficient portfolio (of risky assets) by using knowledge of the expected return of each security.C) If investors hold the efficient portfolio, then the cost of capital for any investment project is equal to its required return calculated using its beta with the efficient portfolio.D) The CAPM identifies the market portfolio as the efficient portfolio.Answer: BDiff: 1Section: The Market PortfolioSkill: Conceptual15) Which of the following statements is FALSEA) If investors have homogeneous expectations, then each investor will identify the same portfolio as having the highest Sharpe ratio in the economy.B) Homogeneous expectations are when all investors have the same estimates concerning future investments and returns.C) There are many investors in the world, and each must have identical estimates of the volatilities, correlations, and expected returns of the available securities.D) The combined portfolio of risky securities of all investors must equal the efficient portfolio.Answer: CDiff: 1Section: The Market PortfolioSkill: Conceptual16) Which of the following statements is FALSEA) If some security were not part of the efficient portfolio, then every investor would want to own it, and demand for this security would increase causing its expected return to fall until it is no longer an attractive investment.B) The efficient portfolio, the portfolio that all investors should hold, must be the same portfolio as the market portfolio of all risky securities.C) Because every security is owned by someone, the sum of all investors' portfolios must equal the portfolio of all risky securities available in the market.D) If all investors demand the efficient portfolio, and since the supply of securities is the market portfolio, then two portfolios must coincide.Answer: ADiff: 2Section: The Market PortfolioSkill: Conceptual17) Which of the following statements is FALSEA) The market portfolio contains more of the smallest stocks and less of the larger stocks.B) For the market portfolio, the investment in each security is proportional to its market capitalization.C) Because the market portfolio is defined as the total supply of securities, the proportions should correspond exactly to the proportion of the total market that each security represents.D) Market capitalization is the total market value of the outstanding shares of a firm.Answer: ADiff: 1Section: The Market PortfolioSkill: Conceptual18) Which of the following statements is FALSEA) A value-weighted portfolio is an equal-ownership portfolio: We hold an equal fraction of the total number of shares outstanding of each security in the portfolio.B) When buying a value-weighted portfolio, we end up purchasing the same percentage of shares of each firm.C) To maintain a value-weighted portfolio, we do not need to trade securities and rebalance the portfolio unless the number of shares outstanding of some security changes.D) In a value weighted portfolio the fraction of money invested in any security corresponds to its share of the total number of shares outstanding of all securities in the portfolio.Answer: DDiff: 1Section: The Market PortfolioSkill: Conceptual19) Which of the following statements is FALSEA) The most familiar stock index in the United States is the Dow Jones Industrial Average (DJIA).B) A portfolio in which each security is held in proportion to its market capitalization is called a price-weighted portfolio.C) The Dow Jones Industrial Average (DJIA) consists of a portfolio of 30 large industrial stocks.D) The Dow Jones Industrial Average (DJIA) is a price-weighted portfolio.Answer: BExplanation: B) A portfolio in which each security is held in proportion toits market capitalization is called a value-weighted portfolio.Diff: 2Section: The Market PortfolioSkill: Conceptual20) Which of the following statements is FALSEA) Because very little trading is required to maintain it, an equal-weighted portfolio is called a passive portfolio.B) If the number of shares in a value weighted portfolio does not change, but only the prices change, the portfolio will remain value weighted.C) The CAPM says that individual investors should hold the market portfolio, a value-weighted portfolio of all risky securities in the market.D) A price weighted portfolio holds an equal number of shares of each stock, independent of their size.Answer: AExplanation: A) Because very little trading is required to maintain it, a value-weighted portfolio is called a passive portfolio.Diff: 3Section: The Market PortfolioSkill: Conceptual21) Which of the following statements is FALSEA) A market index reports the value of a particular portfolio of securities.B) The S&P 500 is the standard portfolio used to represent "the market" when using the CAPM in practice.C) Even though the S&P 500 includes only 500 of the more than 7,000 individual . Stocks in existence, it represents more than 70% of the . stock market in terms of market capitalization.D) The S&P 500 is an equal-weighted portfolio of 500 of the largest . stocks.Answer: DExplanation: D) The S&P 500 is a value-weighted portfolio of 500 of the largest . stocks.Diff: 2Section: The Market PortfolioSkill: Conceptual22) Which of the following statements is FALSEA) The S&P 500 and the Wilshire 5000 indexes are both well-diversified indexes that roughly correspond to the market of . stocks.B) Practitioners commonly use the S&P 500 as the market portfolio in the CAPM with the belief that this index is the market portfolio.C) Standard & Poor's Depository Receipts (SPDR, nicknamed "spider") trade on the American Stock Exchange and represent ownership in the S&P 500.D) The S&P 500 was the first widely publicized value weighted index and it has become a benchmark for professional investors.Answer: BDiff: 2Section: The Market Portfolio Skill: Conceptual23) In practice which market index is most widely used as a proxy for the market portfolio in the CAPMA) Dow Jones Industrial AverageB) Wilshire 5000C) S&P 500D) . Treasury BillAnswer: CDiff: 1Section: The Market PortfolioSkill: Conceptual24) In practice which market index would best be used as a proxy for the market portfolio in the CAPMA) S&P 500B) Dow Jones Industrial AverageC) . Treasury BillD) Wilshire 5000Answer: DDiff: 1Section: The Market PortfolioSkill: ConceptualUse the table for the question(s) below.Consider the following stock price and shares outstanding data:25) The market capitalization for Wal-Mart is closest to:A) $415 BillionB) $276 BillionC) $479 BillionD) $200 BillionAnswer: DSection: The Market PortfolioSkill: Analytical26) The total market capitalization for all four stocks is closest to:A) $479 BillionB) $415 BillionC) $2,100 BillionD) $200 BillionAnswer: BSection: The Market PortfolioSkill: Analytical27) If you are interested in creating a value-weighted portfolio of these four stocks, then the percentage amount that you would invest in Lowes is closest to:A) 25%B) 11%C) %D) 12%Answer: BSection: The Market PortfolioSkill: Analyticala value-weighted portfolio of these four stocks. The number of shares of Wal-Mart that you would hold in your portfolio is closest to:A) 710B) 1390C) 1000D) 870Answer: CStock NamePrice perShareSharesOutstanding(Billions)MarketCapitalization(Billions)PercentofTotalNumber ofSharesLowes$ $ %368 Wal-Mart$ $ %1,002 Intel$ $ %1,387 Boeing$ $ %190Total$Number of shares =Diff: 2Section: The Market PortfolioSkill: Analyticala value-weighted portfolio of these four stocks. The percentage of the shares outstanding of Boeing that you would hold in your portfolio is closest to:A) .000018%B) .000020%C) .000024%D) .000031%Answer: CStock NamePrice perShareSharesOutstanding(Billions)MarketCapitalization(Billions)PercentofTotalNumber ofSharesLowes$ $ %368Wal-Mart$ $ %1,002 Intel$ $ %1,387Boeing$ $ %190Total$Number of shares =percentage shares outstanding = 190/0 = .000024%Diff: 2Section: The Market PortfolioSkill: Analytical30) Assume that you have $250,000 to invest and you are interested in creatinga value-weighted portfolio of these four stocks. How many shares of each of the four stocks will you hold What percentage of the shares outstanding of each stock will you holdStock NamePriceper ShareSharesOutstanding(Billions)MarketCapitalization(Billions)PercentofTotalNumber ofSharesLowes$ $ %368 Wal-Mart$ $ %1,002 Intel$ $ %1,387 Boeing$ $ %190Total$% ofShares%Number of shares =In a value weighted portfolio, the percentage of shares of every stock will be the same.Diff: 3Section: The Market PortfolioSkill: AnalyticalBeta EstimationUse the following information to answer the question(s) below.Y ear Risk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn Beta2007%%%%% 2008%%%.40%% 2009%%%%%1) Wyatt Oil's average historical return is closest to:A) %B) %C) %D) %Answer: AExplanation: A) r average =YearRisk-freeReturnMarketReturnWyatt OilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%% 2008%%%%% 2009%%%%% Average%%%%%Section: Beta EstimationSkill: Analytical2) The Market's average historical return is closest to:A) %B) %C) %D) %Answer: BExplanation: B) r average =YearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%% 2008%%%%% 2009%%%%% Average%%%%%Section: Beta EstimationSkill: Analytical3) Wyatt Oil's average historical excess return is closest to:A) %B) %C) %D) %Answer: CExplanation: C) excess return average =YearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%% 2008%%%%% 2009%%%%%Section: Beta Estimation Skill: Analytical4) The Market's average historical excess return is closest to:A) %B) %C) %D) %Answer: DExplanation: D) excess return average=YearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyatt OilExcessReturn2007%%%%% 2008%%%%% 2009%%%%% Average%%%%%Section: Beta EstimationSkill: Analytical5) Wyatt Oil's excess return for 2009 is closest to:A) %B) %C) %D) %Answer: AExplanation: A) excess return e = (r WO - r rf)2009YearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyatt OilExcessReturn2007%%%%% 2008%%%%% 2009%%%%%Section: Beta Estimation Skill: Analytical6) The Market's excess return for 2008 is closest to:A) %B) %C) %D) %Answer: AExplanation: A) excess return e = (r WO - r rf)2009YearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%%2008%%%%%2009%%%%%Average%%%%%Section: Beta EstimationSkill: Analytical7) Using the average historical excess returns for both Wyatt Oil and the Market portfolio, your estimate of Wyatt Oil's Beta is closest to:A)B)C)D)Answer: BExplanation: B) excess return average =excess return average =YearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%% 2008%%%%%2009%%%%% Average%%%%%βWO= = = .8375Diff: 3Section: Beta EstimationSkill: Analytical8) Using the average historical excess returns for both Wyatt Oil and the Market portfolio estimate of Wyatt Oil's Beta. When using this beta, the alpha for Wyatt oil in 2007 is closest to:A) %B) %C) %D) +%Answer: CExplanation: C) excess return average =excess return average =YearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%% 2008%%%%% 2009%%%%% Average%%%%%βWO = = = .8375α = actual return - expected return for CAPM= % - [3% + .8375(6% - 3%)] = %Diff: 3Section: Beta EstimationSkill: Analytical9) Using just the return data for 2009, your estimate of Wyatt Oil's Beta is closest to:A)B)C)D)Answer: BYearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%%2008%%%%%2009%%%%%Average%%%%%βWO = = = .8651Diff: 2Section: Beta EstimationSkill: Analytical10) Using just the return data for 2008, your estimate of Wyatt Oil's Beta is closest to:A)B)C)D)Answer: AYearRisk-freeReturnMarketReturnWyattOilReturnMarketExcessReturnWyattOilExcessReturn2007%%%%% 2008%%%%%2009%%%%% Average%%%%%βWO = - = .8525Diff: 2Section: Beta EstimationSkill: Analytical11) Which of the following statements is FALSEA) Beta is the expected percent change in the excess return of the security for a 1% change in the excess return of the market portfolio.B) Beta represents the amount by which risks that affect the overall market are amplified for a given stock or investment.C) It is common practice to estimate beta based on the historical correlation and volatilities.D) Beta measures the diversifiable risk of a security, as opposed to its market risk, and is the appropriate measure of the risk of a security for an investor holding the market portfolio.Answer: DExplanation: D) Beta measures the nondiversifiable risk of a security.Diff: 1Section: Beta EstimationSkill: Conceptual12) Which of the following statements is FALSEA) One difficulty when trying to estimate beta for a security is that beta depends on the correlation and volatilities of the security's and market's returns in the future.B) It is common practice to estimate beta based on the expectations of future correlations and volatilities.C) One difficulty when trying to estimate beta for a security is that beta depends on investors expectations of the correlation and volatilities of the security's and market's returns.D) Securities that tend to move less than the market have betas below 1.Answer: BExplanation: B) Beta is measured using past information.Diff: 1Section: Beta EstimationSkill: Conceptual13) Which of the following statements is FALSEA) Securities that tend to move more than the market have betas higher than 0.B) Securities whose returns tend to move in tandem with the market on average have a beta of 1.C) Beta corresponds to the slope of the best fitting line in the plot of the securities excess returns versus the market excess return.D) The statistical technique that identifies the bets-fitting line through a set of points is called linear regression.Answer: ADiff: 2Section: Beta Estimation Skill: ConceptualUse the equation for the question(s) below.Consider the following linear regression model:(R i - r f) = a i + b i(R Mkt - r f) + e i14) The b i in the regressionA) measures the sensitivity of the security to market risk.B) measures the historical performance of the security relative to the expected return predicted by the SML.C) measures the deviation from the best fitting line and is zero on average.D) measures the diversifiable risk in returns.Answer: ADiff: 2Section: Beta EstimationSkill: Conceptual15) The a i in the regressionA) measures the sensitivity of the security to market risk.B) measures the deviation from the best fitting line and is zero on average.C) measures the diversifiable risk in returns.D) measures the historical performance of the security relative to the expected return predicted by the SML.Answer: DDiff: 2Section: Beta EstimationSkill: Conceptual16) The e i in the regressionA) measures the market risk in returns.B) measures the deviation from the best fitting line and is zero on average.C) measures the sensitivity of the security to market risk.D) measures the historical performance of the security relative to the expected return predicted by the SML.Answer: BDiff: 2Section: Beta EstimationSkill: ConceptualThe Debt Cost of CapitalUse the following information to answer the question(s) below.Consider the following information regarding corporate bonds:1) Wyatt Oil has a bond issue outstanding with seven years to maturity, a yield to maturity of %, and a BBB rating. The corresponding risk-free rate is 3% and the market risk premium is 5%. Assuming a normal economy, the expected return on Wyatt Oil's debt is closest to:A) %B) %C) %D) %Answer: BExplanation: B) r d = r rf + β(r m - r rf) = 3% + (5%) = %Diff: 1Section: The Debt Cost of CapitalSkill: Analytical2) Wyatt Oil has a bond issue outstanding with seven years to maturity, a yield to maturity of %, and a BBB rating. The bondholders' expected loss rate in the event of default is 70%. Assuming a normal economy the expected return on Wyatt Oil's debt is closest to:A) %B) %C) %D) %Answer: DExplanation: D) r d = ytm - prob(default) × loss rate = 7% - %(70%) = % Diff: 2Section: The Debt Cost of CapitalSkill: Analytical3) Wyatt Oil has a bond issue outstanding with seven years to maturity, a yield to maturity of %, and a BBB rating. The bondholders' expected loss rate in the event of default is 70%. Assuming the economy is in recession, then the expected return on Wyatt Oil's debt is closest to:A) %B) %C) %D) %Answer: BExplanation: B) r d = ytm - prob(default) × loss rate = 7% - %(70%) = % Diff: 2Section: The Debt Cost of CapitalSkill: Analytical4) Rearden Metal has a bond issue outstanding with ten years to maturity, a yield to maturity of %, and a B rating. The corresponding risk-free rate is 3% and the market risk premium is 6%. Assuming a normal economy, the expected return on Rearden Metal's debt is closest to:A) %B) %C) %D) %Answer: CExplanation: C) r d = r rf + β(r m - r rf) = 3% + (6%) = %Diff: 1Section: The Debt Cost of CapitalSkill: Analytical5) Rearden Metal has a bond issue outstanding with ten years to maturity, a yield to maturity of %, and a B rating. The bondholders expected loss rate in the event of default is 50%. Assuming a normal economy the expected return on Rearden Metal's debt is closest to:A) %B) %C) %D) %Answer: DExplanation: D) r d = ytm - prob(default) × loss rate = % - %(50%) = %Diff: 2Section: The Debt Cost of CapitalSkill: Analytical。

公司金融理论Lecture 6 The Cost of Capital of a Project(4)

Company cost of capital = rDD/V + rEE/V = 7.5 x .3 + 15 x .7 = 12.75%

Lecture 6

7

Company cost of capital

Is a useful starting point for setting discount rates for safer or riskier projects

capital as a benchmark discount rate for new investments

Lecture 6 5

Company cost of capital

Is the opportunity cost of capital for investment

in the firm as a whole Is defined as the expected return on a portfolio of the firm’s existing debt and equity securities Is usually calculated as a weighted average cost of capital:

40.00

30.00

20.00

10.00

R2 = .30 Beta = 2.22

Slope determined from plotting the line of best fit.

Intel return, %

0.00 -20.00 -10.00 0.00 10.00 20.00

-10.00

-20.00

Lecture 6

11

Estimating beta

公司金融理论Lecture 2 Estimating the cash flows of a project (shorten)

Lecture 2

2

What to discount

Wise investment decisions are based on the NPV rule NPV depends on future cash flows Cash flow is just the difference between cash received and cash paid out Cash flows are different to accounting profits which include income and expenses not yet received or paid as well as depreciation charges which are not cash flows at all

Lecture 2 7

Sunk costs, allocated overhead costs, inflation and salvage value

Ignore past and irreversible sunk costs Ignore the accountant’s allocation of existing overheads and include only the extra overhead expenses generated by a project Remember salvage value (net of any taxes) when the project comes to an end Treat inflation consistently by discounting nominal cash flows at a nominal rate of return and real cash flows at a real rate

公司金融课件Chap007

Chapter 7Net Present Value and Other Investment RulesMcGraw-Hill/IrwinCopyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.7.1 7.2 7.3 7.4 7.5 7.6 7.7 7.8Why Use Net Present Value? The Payback Period Method The Discounted Payback Period Method The Average Accounting Return Method The Internal Rate of Return Problems with the IRR Approach The Profitability Index The Practice of Capital Budgeting7-1Net Present Value (NPV) = Total PV of future project CF’s less the Initial Investment Estimating NPV:1. Estimate future cash flows: how much? and when? 2. Estimate discount rate 3. Estimate initial costsMinimum Acceptance Criteria: Accept if NPV > 0 Ranking Criteria: Choose the highest NPV7-2Suppose Big Deal Co. has an opportunity to make an investment of $100,000 that will return $33,000 in year 1, $38,000 in year 2, $43,000 in year 3, $48,000 in year 4, and $53,000 in year 5. If the company’s required return is 12% should they make the investment?Cash Flow (100,000) 33,000 38,000 43,000 48,000 53,000 PV of Cash Flow $ (100,000) $ 29,464 $ 30,293 $ 30,607 $ 30,505 $ 30,074 $ 50,943Year 0 1 2 3 4 5 $ $ $ $ $ $Net Present ValueAnswer: YES! The NPV is greater than $0. Therefore, the investment does return at least the required rate of return.7-3Accepting positive NPV projects benefits shareholders.NPV uses cash flows NPV uses all relevant cash flows of the project NPV discounts the cash flows properlyReinvestment assumption: the NPV rule assumes that all cash flows can be reinvested at the discount rate.7-4Spreadsheets are an excellent way to compute NPVs, especially when you have to compute the cash flows as well. Using the NPV function:◦ The first component is the required return entered as a decimal. ◦ The second component is the range of cash flowsbeginning with year 1.◦ Add the initial investment after computing the NPV.7-5How long does it take the project to “pay back” its initial investment? Payback Period = number of years to recover initial costs Minimum Acceptance Criteria:◦ Set by management; a predetermined time periodRanking Criteria:◦ Set by management; often the shortest payback period is preferred7-6Disadvantages:◦ ◦ ◦ ◦ ◦ Ignores the time value of money Ignores cash flows after the payback period Biased against long-term projects Requires an arbitrary acceptance criteria A project accepted based on the payback criteria may not have a positive NPVAdvantages:◦ Easy to understand ◦ Biased toward liquidity7-7Consider a project with an investment of $50,000 and cash inflows in years 1,2, & 3 of $30,000, $20,000, $10,000The timeline above clearly illustrates that payback in this situation is 2 years. The first two years of return = $50,000 which exactly “ pays back” the initial investment7-8How long does it take the project to “pay back” its initial investment, taking the time value of money into account? Decision rule: Accept the project if it pays back on a discounted basis within the specified time. By the time you have discounted the cash flows, you might as well calculate the NPV.7-9Suppose Big Deal Co. has an opportunity to make an investment of $100,000 that will return $33,000 in year 1, $38,000 in year 2, $43,000 in year 3, $48,000 in year 4, and $53,000 in year 5. If the company’s required return is 12% and predetermined payback period is 3 years should they make the investment?Year 0 1 2 3 4 5 $ $ $ $ $ $ Cash Flow (100,000) 33,000 38,000 43,000 48,000 53,000 PV of Cash Flow $ (100,000) $ 29,464 $ 30,293 $ 30,607 $ 30,505 $ 30,074 Cumulative PV of Cash Flows $ (100,000) $ (70,536) $ (40,242) $ (9,636) $ 20,869 $ 50,943Answer: NO! At the end of three years the project has still not broken even or “ paid back”. Therefore, it must be rejected.7-10Average Net Income AAR = Average Book Value of InvestmentAnother attractive, but fatally flawed, approach Ranking Criteria and Minimum Acceptance Criteria set by management7-117-12Disadvantages:◦ Ignores the time value of money ◦ Uses an arbitrary benchmark cutoff rate ◦ Based on book values, not cash flows and market valuesAdvantages:◦ The accounting information is usually available ◦ Easy to calculate7-13IRR: the discount rate that sets NPV to zero Minimum Acceptance Criteria: Ranking Criteria:◦ Accept if the IRR exceeds the required return ◦ Select alternative with the highest IRR ◦ All future cash flows assumed reinvested at the IRRReinvestment assumption:7-14Consider the following project:$50 $100 $1500 -$200123The internal rate of return for this project is 19.44%$50 $100 $150 NPV = 0 = −200 + + + 2 (1 + IRR) (1 + IRR) (1 + IRR) 37-15If we graph NPV versus the discount rate, we can see the IRR as the x-axis intercept.0% 4% 8% 12% 16% 20% 24% 28% 32% 36% 40% 44% $100.00 $73.88 $51.11 $31.13 $13.52 ($2.08) ($15.97) ($28.38) ($39.51) ($49.54) ($58.60) ($66.82)$120.00 $100.00 $80.00 $60.00 $40.00 $20.00 $0.00 ($20.00) -1% ($40.00) ($60.00) ($80.00)NPVIRR = 19.44%9% 19% 29% 39%Discount rate7-16You start with the cash flows the same as you did for the NPV. You use the IRR function:◦ You first enter your range of cash flows, beginning with the initial cash flow. ◦ You can enter a guess, but it is not necessary. ◦ The default format is a whole percent – you will normally want to increase the decimal places to at least two.7-17Disadvantages:◦ Does not distinguish between investing and borrowing ◦ IRR may not exist, or there may be multiple IRRs ◦ Problems with mutually exclusive investmentsAdvantages:◦ Easy to understand and communicate7-18Multiple IRRs Are We Borrowing or Lending The Scale Problem The Timing Problem7-19Mutually Exclusive Projects: only ONE of several potential projects can be chosen, e.g., acquiring an accounting system.◦ RANK all alternatives, and select the best one.Independent Projects: accepting or rejecting one project does not affect the decision of the other projects.◦ Must exceed a MINIMUM acceptance criteria7-20There are two IRRs for this project:$200 0 -$200NPV $100.00 $50.00 $0.00 -50% 0% ($50.00) ($100.00)7-21$800 2 3 - $8001Which one should we use?100% = IRR20% = IRR150%100%150% 200% Discount rateCalculate the net present value of all cash outflows using the borrowing rate. Calculate the net future value of all cash inflows using the investing rate. Find the rate of return that equates these values. Benefits: single answer and specific rates7-22Would you rather make 100% or 50% on your investments? What if the 100% return is on a $1 investment, while the 50% return is on a $1,000 investment?7-23$10,000 Project A 0 -$10,000 $1,000 Project B 0 -$10,000 1 1$1,000$1,00023$1,000$12,000237-24$5,000.00 $4,000.00 $3,000.00 $2,000.00Project A Project B10.55% = crossover rate10% 20% 30% 40%NPV$1,000.00 $0.00 ($1,000.00) 0% ($2,000.00) ($3,000.00) ($4,000.00) ($5,000.00)12.94% = IRRB16.04% = IRRADiscount rate7-25Compute the IRR for either project “A-B” or “B-A”Year Project A Project B Project A-B Project B-A 0 ($10,000) ($10,000) $0 $0 1 $10,000 $1,000 $9,000 ($9,000) 2 $1,000 $1,000 $0 $0 ($11,000) $11,000 3 $1,000 $12,000$3,000.00 $2,000.00 $1,000.00 $0.00 ($1,000.00) 0% ($2,000.00) ($3,000.00) Discount rate NPV10.55% =5% 10% 15% 20%A-B IRR B-A7-26NPV and IRR will generally give the same decision. Exceptions:◦ Non-conventional cash flows – cash flow signs change more than once ◦ Mutually exclusive projectsInitial investments are substantially different Timing of cash flows is substantially different7-27Total PV of Future Cash Flows PI = Initial InvestentMinimum Acceptance Criteria:◦ Accept if PI > 1Ranking Criteria:◦ Select alternative with highest PI7-28Disadvantages:◦ Problems with mutually exclusive investmentsAdvantages:◦ May be useful when available investment funds are limited ◦ Easy to understand and communicate ◦ Correct decision when evaluating independent projects7-29Varies by industry:◦ Some firms use payback, others use accounting rate of return.The most frequently used technique for large corporations is IRR or NPV.7-30。

公司金融,Lecture 04

11

• According to the first criterion, a physical asset is worth acquiring if it will increase the net profit of the owners of the firm.

But net profit will increase only if the expected rate of return, or yield, of the asset exceeds the rate of interest.

10

This proposition can be shown to follow from either of two criteria of rational decision-making which are equivalent under certainty, namely: (1) the maximization of profits, and (2) the maximization of market value. • Explanation below:

2

bankruptcy costs: Kraus, Alan, and Litzenberger, Robert H. "A state-Preference Model of Optimal Financial Leverage", The Journal of Finance, 1973,Vol. 28, No. 4, 911-922. Kim, E. H., 1978, A mean-variance theory of optimal capital structure and corporate debt capacity, Journal of Finance 33(1), 45-64. personal taxes: Miller, M., 1977, “Debt and Taxes”, Journal of Finance, 32(2), 261-276.

公司金融课程讲义第7章描述

第七章衍生工具在公司财务中的应用第一节期权概述一、期权与期权交易(一)期权概述1.期权的定义期权,英文为option,又可译为选择权。

期权是一种权利,它是给予其持有者在给定时间,或在此时间之前的任一时刻按规定的价格买入或卖出一定数量的某种资产的权利的一种法律合同。

期权分为买权(Call option,买入期权)和卖权(put option,卖出期权)。

买权又称看涨期权,其持有者可以在给定时间,或在此时间之前的任一时刻按规定的价格买入一定数量的某种资产。

卖权又称看跌期权,其持有者可以在给定时间,或在此时间之前的任一时刻按规定的价格卖出一定数量的某种资产。

2.期权的要素执行价格。

期权合同中规定的购入或售出某种资产的价格,称为期权的执行价格(exercise price或striking price)。

到期日。

期权合同规定的期权的最后有效日期(maturity date)。

标的资产。

期权合同中规定的双方买入或售出的资产为期权的标的资产。

期权费。

买卖双方购买或出售期权的价格称为期权费或期权的价格(option premium)。

比如,“IBM 11月份100买权”,就是指执行价格为100美元,到期日为11月份(具体到期日期是11月的第三个星期五后的那个星期六的美国中部时间下午10:59),标的资产为IBM公司普通股股票的买权。

3.欧式期权与美式期权根据期权对有效期性质规定的不同,期权又可分为欧式期权(European-style)和美式期权(American-style)。

欧式期权只有在到期日当天或在到期日以前某一非常有限的时间内可以行使权利,美式期权从它一开始购买一直到期日以前任何时刻都可以行使权利。

二者的差别如图8-1所示。

图8-1欧式期权与美式期权的执行期间4.期权购买者(buyer)和出售者(writer)的权利义务任何一个期权都有购买者(buyer)和出售者(writer)。

期权的购买者在购买期权时须付出一笔费用给出售者,以获得买卖某种资产的权利。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Step 3: Recalculate the WACC at the new financing weights

Lecture 7

12

3-Step adjustment example

Step 1: The firm’s current debt ratio is .4, so r = rDD/V + rEE/V = 0.06(.4) + 0.124(.6) =0.0984 Step 2: We will assume that the debt cost stays at 6% when the debt ratio is 20%, then rE = r + (r – rD)D/E = 0.0984 + (0.0984 -0.06)(.2/.8) =0.108 Cost of equity decreases because of lower financial risk Step 3: Recalculate WACC at the new debt ratio WACC = 0.06(1 - 0.35)(.2) + 0.108(.8) = 0.0942 WACC increases only because of the lower tax shields on reduced interest payments

Lecture 7

14

Valuing businesses

Do not deduct interest and calculate taxes as if the company were all-equity financed Usually forecast each year’s FCF out to an arbitrary medium-term valuation horizon (H) and add a terminal value to the cash flows in the horizon year

Lecture 7

2

Adjusted discount rate

As interest is a tax-deductible expense, the value of interest tax shield on debt supported by a project has to be incorporated into the

The terminal value (or horizon value) is the present value at the horizon of all subsequent cash flows (PVH)

valuation The adjustment is usually to calculate NPV by discounting after-tax cash flows at an adjusted discount rate, the after-tax weighted average cost of capital (WACC)

Lecture 7

3

WACC

D = market value of the firm’s debt E = market value of the firm’s equity V = D + E is the total market value of the firm rD = current cost of debt rE = current cost of equity TC = marginal corporate tax rate The after-tax cost of debt, rD(1 - TC), is used to

D E rE V V

Step 2: Estimate the cost of debt, rD, at the new debt ratio and calculate the new cost of equity: rE = r + (r – rD)D/E

This formula is MM’s proposition 2 in lecture 8

Lsinesses

You can use WACC to value an entire company or business as long as the debt ratio is to remain approximately constant

Treat the company as it were one big project and forecast the firm’s free cash flow (FCF) FCF = profit after tax + depreciation – investment in fixed assets – investment in working capital

Lecture 7

9

Review of assumptions

Users of WACC need not worry about small or temporary fluctuations in debt ratios that do not change the firm’s long-term financing policy Suppose that the firm borrows $12.5M but the project supports only $5M of debt capacity, then

expected equity income Expected equity return rE equity value $1.125 [(0.06)(1 0.35)($5)] 0.124 $7.5

Lecture 7

8

Review of assumptions

If a project has different business risk to the firm’s

Lecture 7

11

3 Steps to adjust WACC when debt ratios differ

Step 1: Calculate the opportunity cost of capital

This step is called unlevering the WACC:

Opportunity cost of capital = r rD

Lecture 7

6

Example:

A $12.5 million project, funded by $5M debt and $7.5M equity, is expected to generate a perpetual stream of cash flow of $1.731 million

Chapter 19

Learning objectives

Explain the after-tax weighted average cost of capital, WACC Use the WACC to value a project or business How to adjust WACC when business risk or capital structure changes Estimate the WACC in practice with helpful hints

ii. the project will be financed to maintain the firm’s

current, market-value debt ratio

Lecture 7

5

Example: BMA pp480-481

Cost of debt (rD)

0.06 Cost of equity (rE) 0.124 Marginal tax rate (TC) 0.35 Debt ratio (D/V) $500/$1250 = 0.4 Equity ratio (E/V) $750/$1250 = 0.6 WACC = rD(1 – TC)(D/V) + rE(E/V) = (0.06)(1 - 0.35)(0.4) + (0.124)(0.6) = 0.09 or 9.0%

per year pretax

The project is average risk, so we can use WACC to discount its after-tax cash flow of (1 - 0.35)($1.731)=$1.125 million NPV = -$12.5 + ($1.125/0.09) = 0

other assets, or if its acceptance would lead to a permanent, material change in the firm’s debt ratio, the firm can use WACC as a benchmark rate to be adjusted for differences in business risk or debt ratios Discounting cash flows by the WACC is only approximately correct if the firm does not adjust its borrowing (rebalance its capital structure) to maintain a constant debt ratio over time

D E WACC rD (1 TC ) rE V V

capture the value of interest tax shields