国际金融英文版全.ppt

合集下载

国际金融英文版PPT CH4

The Classical Gold Standard (1876 – 1914)

The gold standard was a commitment by participating nations to fix the price of their domestic currencies in terms of a specified amount of gold. The government announces the gold par value which is the amount of its currency needed to buy one ounce of gold. Therefore, the gold was the international currency under the gold standard.

Exports rise Imports shrink

BOP surpluses Gold inflows

BOP deficits Gold outflows

Exports decline Imports increase

Money supply up Prices up

Performance of the gold standard

Gold Standard and Exchange Values

Pegging the value of each currency to gold established an exchange rate system. The gold par value determined the exchange rate between two currencies known as “mint par of exchange”

国际金融英文版PPT(共46页)

The exchange rate would fluctuate between (0.80 + 0.008) = 0.8008 and (0.80 – 0.008) = 0.792

0.8008 and 0.792 are called gold export and import points.

The BOP disequilibrium was corrected by “Price-specie-flow mechanism”.

Example of gold export and import

If the gold par value in New Zealand was NZ$125/ounce and A$100/ounce in Australia, so mint par of exchange: 100/125 = A$0.80/NZ$ Costs of gold transportation: A$0.008/NZ$

The Classical Gold Standard (1876 – 1914)

The gold standard was a commitment by participating nations to fix the price of their domestic currencies in terms of a specified amount of gold.

International monetary system is based on the exchange rate system adopted by individual nations. The exchange rate system is a set of rules governing the value of a currency relative to other currencies.

0.8008 and 0.792 are called gold export and import points.

The BOP disequilibrium was corrected by “Price-specie-flow mechanism”.

Example of gold export and import

If the gold par value in New Zealand was NZ$125/ounce and A$100/ounce in Australia, so mint par of exchange: 100/125 = A$0.80/NZ$ Costs of gold transportation: A$0.008/NZ$

The Classical Gold Standard (1876 – 1914)

The gold standard was a commitment by participating nations to fix the price of their domestic currencies in terms of a specified amount of gold.

International monetary system is based on the exchange rate system adopted by individual nations. The exchange rate system is a set of rules governing the value of a currency relative to other currencies.

国际金融英文版CH3

Convertibility means a currency can be freely exchanged for another currency. This is the most important characteristic of the foreign exchange.

Foreign exchange rate is the price of one currency in terms of another.

$0

1998

2001

2004

2007

2010

Spot Forwards Swaps

Top 10 geographic trading center in the foreign exchange market, 1992-2007 (daily averages in April, billions of $)

The foreign exchange market is an informal, over-the-counter and around-the-clock market.

It has no centralized meeting-place and no formal requirements for participation.

Direct quote is the amount of domestic currency per unit of foreign currency. In Japan ¥115 = €1 In Canada C$1.50 = ₤1

Indirect quote is the amount of foreign currency per unit of domestic currency. In England $1.60 = ₤1

Foreign exchange rate is the price of one currency in terms of another.

$0

1998

2001

2004

2007

2010

Spot Forwards Swaps

Top 10 geographic trading center in the foreign exchange market, 1992-2007 (daily averages in April, billions of $)

The foreign exchange market is an informal, over-the-counter and around-the-clock market.

It has no centralized meeting-place and no formal requirements for participation.

Direct quote is the amount of domestic currency per unit of foreign currency. In Japan ¥115 = €1 In Canada C$1.50 = ₤1

Indirect quote is the amount of foreign currency per unit of domestic currency. In England $1.60 = ₤1

国际金融英文版PPT CH8

The elasticity of export (or import) supply is the responsiveness of the quantity supplied to a change in price. If EX > 1, demand is elastic; the percent rise in quantity of exports is greater than the percent fall in price. If EX < 1, demand is inelastic; the percent rise in quantity of exports is smaller than the percen of demand for exports and imports of 15 industrial countries

The elasticity of demand for exports and imports for 9 developing countries (Con’t)

Chapter 8

The Balance-of-Payments Adjustment (I)

Elasticity Approach (Relative Price Effects)

Elasticity is the ratio between proportional change in one variable and proportional change in another. The elasticity of export (or import) demand is the responsiveness of the quantity demanded to a change in price. EX = △QX /△PX EM = △QM /△PM

国际金融双语PPT课件-总复习

14-10

买入价和卖出价的判定

• 从银行买卖外汇的角度,划分为买入汇率和 卖出汇率 • 买入汇率(Buying Rate)又称买入价,是指 报价银行从同业或客户那里买入外汇时所使 用的汇率。 • 卖出汇率(Selling Rate)又称卖出价,是指 报价银行向同业或客户卖出外汇时所使用的 汇率。 • USD1=CNY7.7764-7.7900 • 买价卖价? 判断原则?

• 询价者不会透露交易意图,因此报价银 行必须报出买入价和卖出价。

McGraw-Hill/Irwin © 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

14-14

新型与传统国际金融市场的区别

国内金融市场

国内投资者 传统 国际 金融 市场

McGraw-Hill/Irwin © 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

14-4

货 物 服 务 经常项目 收 入

经常转移

资本项目 国际收支账户 资本和金融项目

金融项目

储备资产 错误与遗漏

McGraw-Hill/Irwin

McGraw-Hill/Irwin

© 2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

14-12

• ①地点在中国,是直接标价法,买价在前,卖 价在后; • ②地点在美国,是间接标价法,卖价在前,买 价在后; • • • • 判断原则: ①从银行自身角度出发,赚取买卖差价; ②银行持有本币,看其对外汇是买还是卖; ③如不属于直接、间接、美元标价法的一种, 则视银行目前持有币种为本币,判断买卖价。

国际金融英文版(全)

International financial markets

Eurocurrency markets International debts markets-long-term global bonds/foreign bonds/eurobonds/special types of bonds Short-and medium-term debt markets Euro-commercial paper and euro-medium-term notes/floating rate euro-notes International equities

Non-bank financial institutions in global finance International financial markets International derivatives exchange-traded International non-exchange traded derivatives

the balance of payment

3.the theories of foreign exchange rate determination 4.foreign exchange exposure

4.nonexchange traded derivatives

Inventory of international financial resources Yu feng yao

Foreign bonds-foreign bonds are issued in local market by a foreign borrower,with the assistance of a large investment bankers,and are denominated in a local currency. Eurobonds-eurobonds are financed by long-term funds in the Eurocurrency markets.They are underwritten by a multinational syndicate of banks and placed in countries other than the one in whose currency they are denominated.

国际金融英文版PPT CH5

Big Mac in China costs ¥11.00, while the same Mac in U.S. costs $3.41. The actual exchange rate was ¥7.6/$ at the time. The implied exchange rate according to absolute PPP should be: ¥11/$3.41 = ¥3.23/$ The dollar was overvalued. An overvalued currency is a currency in which the actual value is higher than the value it is supposed to be. Otherwise, it is an undervalued currency.

%ΔS = πd – πf

πd, πf: domestic and foreign inflation rate

The equation shows if domestic inflation is high than foreign inflation, the foreign currency will appreciate against the domestic currency by the percent consistent with the inflation differencial.

Price index is an index number of the prices of goods of some given type. PC = (∑i PitWit)/(∑i Pi0Wi0)

国际金融英文版PPT CH3

Spot Exchange Market and Exchange Rate Quotations

The spot exchange market is a market that deals in foreign exchange for immediate delivery. Immediate delivery in foreign currencies usually means within two business days.

A spot exchange rate is the current market price, the rate at which a foreign exchange dealer converts one currency into another currency on a particular day.

Small- to medium-size banks are not market makers in the interbank market. They buy from and sell to larger banks to offset retail transactions with their own customers.

American quote is the dollar per currency quote, i.e. the price of other currencies in terms of the dollar. Example: US$ 1.57 = £1 US$ 1.35 = €1

Hale Waihona Puke European quote is the currencies per dollar quote, i.e. the price of the dollar in terms of the other currencies. Example: A$ 1.02 = US$ 1 € 0.74 = US$ 1

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

After World WAR II,the Soviets used dollars instead of rubles for foreign trade and had maintained a large inventory of hard currencies,especially the dollar.In order to earn interest on these deposits,the soviets began to lend these deposits to Europeans or to American operating in Europe,thus creating Eurocurrencies.

❖ Eurocurrency markets

2.The cost of funds in this market is based on LIBOR,the London Inter-bank Offer Rate,the rate at which banks in the inter-bank system charge each other for funds of many different maturities

❖ Eurocurrency markets ❖ International Debt Markets-long-term ❖ Short-and Medium-term Debt Markets ❖ International Equities

❖ Eurocurrency markets

1.The Eurocurrency market has been referred to as a stateless vat of money,essentially owing to no allegiance to any nation.It is a huge ,global inter-bank money and capital market that facilitates loans with maturities range from 90 days to 10 years or more and that is almost totally outside all government regulations.

❖ Private international financial institutions global private regional private national private

International financial markets

❖ Eurocurrency markets ❖ International debts markets-long-term

3.Origin of the market A number of reasons have been given for the origin of the Eurocurrency market.Some analysts go so far as to say that the Soviets initiated the process of trading Eurocurrencies before the western Europeans used foreign deposits.

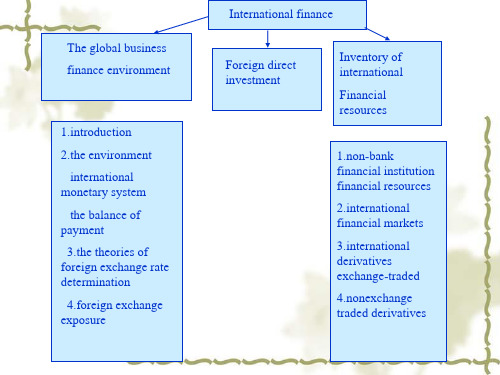

International finance

Foreign direct investment

Inventory of international

Financial resources

1.non-bank financial institution financial resources

2.international financial markets

International derivatives exchange-traded

❖ Users of derivatives/risks of derivatives ❖ Currency futures and options ❖ Interest rate futures and options

❖ International financial markets ❖ International derivatives exchange-traded ❖ International non-exchange traded

derivatives

Non-bank

❖ Public international financial institutions public global financial institutions regional public national public

The global business finance environment

1.introduternational monetary system

the balance of payment 3.the theories of foreign exchange rate determination 4.foreign exchange exposure

global bonds/foreign bonds/eurobonds/special types of bonds ❖ Short-and medium-term debt markets Euro-commercial paper and euro-medium-term notes/floating rate euro-notes ❖ International equities

3.international derivatives exchange-traded

4.nonexchange traded derivatives

Inventory of international financial resources

Yu feng yao

❖ Non-bank financial institutions in global finance

International non-exchange traded derivatives

❖ Currency and interest rate swaps ❖ Inter-bank currency futures and options ❖ Exotic derivatives

International financial markets