上海浦发银行个人担保借款合同--英文翻译版

个人担保书英文版

个人担保书英文版.docx个人担保书英文版the corporation. for this trading account ("account") the undersigned agrees to jointly a nd severally guaranteepersonally the immediate, full a nd complete performance of any a nd all of the duties a nd obligations of thisaccount a nd the payment of any a nd all damages, costs a nd expenses, which may become recoverable bygme from the corporation.this guarantee shall remain in full force a nd effect until the termination of this client services agreement,provided that the undersigned shall not be released from their obligations so long as the account a nd anyobligations the account has with gme lasts.personal guarantee acknowledgmentthis guarantee shall inure to the benefit of gme, its successors a nd assigns, a nd shall be binding on theundersigned a nd their heirs.this assigns:as guarantor, individually date signature____________________ _______________ ____________________as guarantor, individually date signature____________________ ________________ _____________________as guarantor, individually date signature____________________ ________________ _____________________借款合同担保书范本保证人:___________________________________________法定代表人:_______________________________________地址:_____________________________________________开户银行:_________________________________________帐户:______________________________________________________银行:一、本保证人保证“借款人”全面履行“合同”。

银行个人贷款合同中英文版6篇

银行个人贷款合同中英文版6篇全文共6篇示例,供读者参考篇1Personal Loan AgreementThis Personal Loan Agreement (the “Agreement”) is entered into on [Date] between [Lender Name], with a principal place of business at [Address] (the “Lender”), and [Borrower Name], with a residence address at [Address] (the “Borrower”).1. Loan Amount: The Lender agrees to lend the Borrower the principal amount of [Loan Amount] (the “Loan Amount”).2. Interest Rate: The Borrower agrees to pay interest on the outstanding principal amount of the loan at the rate of [Interest Rate] per annum.3. Term: The term of this loan shall be [Number] months from the date of this Agreement.4. Repayment: The Borrower agrees to repay the outstanding principal amount of the loan in [Number] equal installments of [Monthly Repayment Amount], payable on the [Day] day of each month.5. Prepayment: The Borrower may prepay the loan in full or in part at any time without penalty.6. Default: In the event of default, the Lender shall have the right to accelerate the loan and demand immediate repayment of the outstanding principal amount.7. Governing Law: This Agreement shall be governed by the laws of [Jurisdiction].8. Amendments: Any amendments to this Agreement must be made in writing and signed by both parties.IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.Lender: [Signature]Borrower: [Signature][Name][Date]篇2Personal Loan AgreementThis Personal Loan Agreement (the "Agreement") is entered into effective as of [Date] by and between [Lender’s Name],with a principal place of business at [Address] (the "Lender") and [Borrower’s Name], residing at [Address] (the "Borrower").1. Loan Amount and PurposeThe Lender agrees to loan the Borrower the principal amount of [Loan Amount] (the "Loan") for the purpose of [Loan Purpose]. The Borrower agrees to repay the Loan in accordance with the terms and conditions of this Agreement.2. Interest Rate and FeesThe Parties hereby agree that the interest rate on the Loan shall be [Interest Rate] per annum. In addition to the interest, the Borrower agrees to pay any applicable fees, including but not limited to, origination fees and late payment fees.3. Repayment TermsThe Loan shall be repaid in [Number of Installments] installments of [Monthly Repayment Amount] each, to be paid on the [Day of the Month] of each month, beginning on [First Repayment Date]. The Borrower shall make payments to the Lender at [Payment Address].4. PrepaymentThe Borrower may prepay all or part of the outstanding Loan balance at any time without penalty. Any prepayments made shall first be applied to any outstanding fees or charges and then to the outstanding principal balance.5. DefaultIf the Borrower fails to make any payment when due, the Loan shall be considered in default. Upon default, the Lender may declare the entire outstanding balance of the Loan immediately due and payable and take any appropriate legal action to collect the debt.6. Governing LawThis Agreement shall be governed by and construed in accordance with the laws of [State/Country]. Any dispute arising out of or relating to this Agreement shall be resolved through arbitration in [City], in accordance with the rules of the American Arbitration Association.IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the Effective Date first above written.[Lender’s Name] [Borrower’s Name]By:__________________ By:_______________Name:_______________ Name:______________Title:________________ Date:_______________Date:________________ [Witness's Name]WitnessThis Agreement represents the entire agreement between the Parties with respect to the Loan and supersedes any prior agreements or understandings, whether written or oral. This Agreement may not be modified except in writing signed by both Parties.篇3Personal Loan AgreementThis Personal Loan Agreement ("Agreement"), is made and entered into as of [Date] by and between [Lender], a bank organized and existing under the laws of [Country], and having its principal place of business at [Address], and [Borrower], an individual residing at [Address].Whereas, Borrower desires to borrow a sum of money from Lender, and Lender desires to lend Borrower such sum of money on the terms and conditions set forth herein.Now, therefore, in consideration of the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:1. Loan Amount. Lender agrees to lend Borrower the sum of [Amount in Words] ([Amount in Numbers]) dollars, to be disbursed in one lump sum payment.2. Interest Rate. The annual interest rate on the loan shall be [Interest Rate]%. Interest shall accrue from the date of disbursal of the loan until the loan is fully repaid.3. Repayment Terms. Borrower shall repay the loan in equal monthly installments of [Amount] dollars, beginning on [First Payment Date] and continuing on the same date of each month thereafter until the loan is fully repaid.4. Prepayment. Borrower may prepay the loan, in whole or in part, at any time without penalty. Any partial prepayments made by Borrower shall be applied first to accrued but unpaid interest and then to the outstanding principal amount of the loan.5. Default. In the event Borrower fails to make any payment when due, or otherwise defaults under the terms of this Agreement, Lender may declare the entire outstanding balanceof the loan immediately due and payable and pursue all available legal remedies to enforce its rights under this Agreement.6. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of [Country]. Any dispute arising under or in connection with this Agreement shall be resolved by arbitration in accordance with the rules of the [Arbitration Institution].7. Entire Agreement. This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral, relating to such subject matter.IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.[Lender] [Borrower]By: Name: Name:Title: Title:Date: Date:篇4Personal Loan AgreementThis Personal Loan Agreement (the "Agreement") is entered into on [Date] between [Lender], a financial institution located at [Address] ("Lender") and [Borrower], an individual located at [Address] ("Borrower").1. Loan Amount: The Lender agrees to loan the Borrower the principal amount of [Loan Amount] (the "Loan").2. Interest Rate: The Loan shall bear interest at the rate of [Interest Rate] per annum, calculated on the outstanding principal amount from time to time.3. Term: The term of the Loan shall be [Loan Term] months, beginning on the date of disbursement of the Loan.4. Repayment: The Borrower shall repay the Loan amount in [Number of Payments] equal monthly installments of [Installment Amount], with the first installment due on [First Due Date].5. Prepayment: The Borrower shall have the right to prepay the Loan in whole or in part at any time without penalty.6. Late Payment: In the event that any installment payment is not made when due, the Borrower shall pay a late payment fee of [Late Payment Fee].7. Default: The Loan shall be considered in default if the Borrower fails to make any installment payment within [Number of Days] days of its due date.8. Security: The Borrower hereby pledges, assigns, and transfers to the Lender all rights and interests in [Collateral], as security for the Loan.9. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of [Jurisdiction].IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.[Lender] [Borrower]Signature: __________________ Signature: __________________Print Name: _________________ Print Name: ________________Date: ___________________ Date: ____________________篇5Personal Loan ContractThis Personal Loan Contract ("Contract") is made and entered into on this ______ day of __________, 20__ between [Borrower’s Name], whose address is [Borrower’s Address]("Borrower") and [Lender’s Name], whose address is [Lender’s Address] ("Lender").Loan Amount:1. The Lender agrees to lend to the Borrower the sum of______________ dollars ($______) ("Loan Amount") for the purpose of [purpose of loan].Repayment Terms:2. The Borrower agrees to repay the Loan Amount to the Lender in accordance with the following terms:a. The Loan Amount shall be repaid in [number of installments] equal installments of ______________ dollars ($______) each.b. The Borrower shall make the first installment payment on the ______ day of __________, 20__ and subsequent installment payments on the same day of each month thereafter until the Loan Amount is fully repaid.c. The Borrower shall pay interest on the unpaid principal balance of the Loan Amount at the rate of ____________ percent per annum.Prepayment:3. The Borrower may prepay the Loan Amount in full or in part at any time without penalty.Default:4. If the Borrower fails to make any installment payment when due, the Loan Amount shall become immediately due and payable in full, and the Lender may pursue any available legal remedies to collect the outstanding amount.Governing Law:5. This Contract shall be governed by and construed in accordance with the laws of the State of [State].Entire Agreement:6. This Contract constitutes the entire agreement between the parties with respect to the Loan Amount, and supersedes all prior agreements and understandings, whether written or oral, relating to the Loan Amount.IN WITNESS WHEREOF, the parties hereto have executed this Contract as of the date first above written.[Borrower’s Signature][Lender’s Signature][Borrower’s Name][Lender’s Name]篇6Personal Loan AgreementThis Personal Loan Agreement (the "Agreement") is entered into on [Date], by and between [Lender Name], with its principal place of business located at [Address] (the "Lender") and [Borrower Name], with a mailing address of [Address] (the "Borrower").Loan Details:1. Loan Amount: The Lender agrees to lend the Borrower the principal amount of [Loan Amount] (the "Loan Amount").2. Interest Rate: The interest rate on the Loan Amount shall be [Interest Rate]% per annum.3. Repayment Term: The Borrower shall repay the Loan Amount in [Number] installments of [Amount] each on the [Monthly Due Date] of each month, starting on [First Repayment Date].4. Late Payment: In the event that the Borrower fails to make the repayment on time, a late fee of [Late Fee Amount] shall be charged.5. Prepayment: The Borrower shall have the right to prepay the Loan Amount in whole or in part at any time without penalty.Representations and Warranties:1. The Borrower represents and warrants that all information provided in connection with this Agreement is true, accurate, and complete.2. The Borrower agrees to use the Loan Amount for the purpose agreed upon between the parties.3. The Borrower shall promptly notify the Lender of any changes in the Borrower's financial condition that may affect the Borrower's ability to repay the Loan Amount.Miscellaneous:1. This Agreement constitutes the entire agreement between the parties concerning the Loan Amount and supersedes any prior agreements or understandings.2. This Agreement shall be governed by and construed in accordance with the laws of [Jurisdiction].3. Any disputes arising out of or in connection with this Agreement shall be resolved through mediation or arbitration.IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.Lender: [Lender Name]Borrower: [Borrower Name]。

个人借款合同英文范本

个人借款合同英文范本I understand that you are looking for a personal loan contract in English. 我明白你想要一份英文的个人借款合同范本。

A personal loan contract, also known as a personal loan agreement, is a legal document that outlines the terms and conditions of a loan between an individual borrower and a lender. 个人借款合同,也称个人借款协议,是一份法律文件,它概述了个人借款人和放贷人之间的贷款条款和条件。

This type of contract is important because it helps protect both the borrower and the lender by clearly outlining the rights and responsibilities of each party. 这种合同很重要,因为它通过清楚地概述每个参与方的权利和责任,帮助保护借款人和放贷人。

The personal loan contract should include important details such as the loan amount, interest rate, repayment terms, and any penalties for late payments. 个人借款合同应包括重要的细节,如贷款金额、利率、偿还条件以及逾期还款的任何处罚。

In addition, it should also cover other important aspects such as the loan disbursement process, conditions for early repayment, and what happens in the event of default. 另外,它也应涵盖其他重要方面,如贷款发放流程、提前偿还的条件以及在违约情况下的处理。

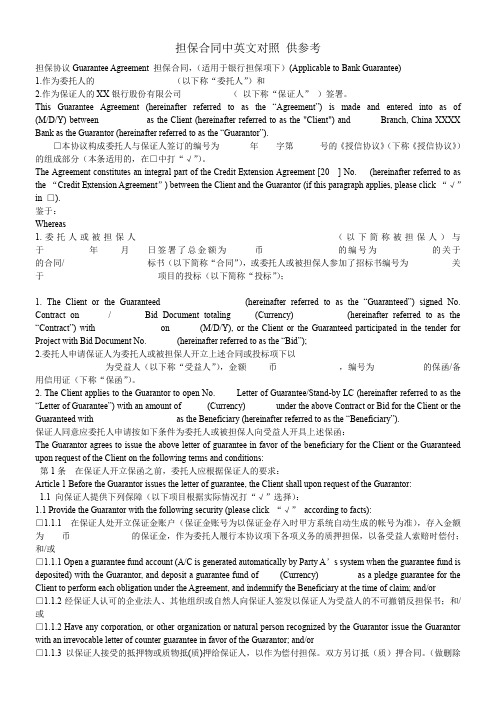

担保合同中英文对照

担保合同中英文对照供参考担保协议Guarantee Agreement 担保合同,(适用于银行担保项下)(Applicable to Bank Guarantee)1.作为委托人的(以下称“委托人”)和2.作为保证人的XX银行股份有限公司(以下称“保证人”)签署。

This Guarantee Agreement (hereinafter referred to as the “Agreement”) is made and entere d into as of (M/D/Y) between as the Client (hereinafter referred to as the "Client") and Branch, China XXXX Bank as the Guarantor (hereinafter referred to as the “Guarantor”).□本协议构成委托人与保证人签订的编号为年字第号的《授信协议》(下称《授信协议》)的组成部分(本条适用的,在□中打“√”)。

The Agreement constitutes an integral part of the Credit Extension Agreement [20 ] No. (hereinafter referred to as the “Credit Extension Agreement”) between the Client and the Guarantor (if this paragraph applies, please click “√”in □).鉴于:Whereas1.委托人或被担保人(以下简称被担保人)与于年月日签署了总金额为币的编号为的关于的合同/ 标书(以下简称“合同”),或委托人或被担保人参加了招标书编号为关于项目的投标(以下简称“投标”);1. The Client or the Guaranteed (hereinafter referred to as the “Guaranteed”) signed No. Contract on / Bid Document totaling (Currency) (hereinafter referred to as the “Contract”) with on (M/D/Y), or the Client or the Guaranteed participated in the tender for Project with Bid Document No. (hereinafter referred to as the “Bid”);2.委托人申请保证人为委托人或被担保人开立上述合同或投标项下以为受益人(以下称“受益人”),金额币,编号为的保函/备用信用证(下称“保函”)。

个人借款合同英文范本

个人借款合同英文范本(中英文实用版)**Personal Loan Agreement Template (English)**---**Loan Agreement**This Loan Agreement ("Agreement") is made and entered into as of [Date], by and between [Lender"s Name], with an address at [Lender"s Address] ("Lender"), and [Borrower"s Name], with an address at [Borrower"s Address] ("Borrower").**1.Loan Amount and Terms**(a) The Lender agrees to lend to the Borrower the sum of [Loan Amount], in lawful money of the United States of America.(b) The Borrower agrees to repay the Loan Amount, together with interest thereon, in accordance with the terms and conditions set forth herein.**2.Interest**The Borrower shall pay interest on the unpaid principal balance of the Loan at an annual rate of [Interest Rate] percent ([Interest Rate]%) calculated from the date of this Agreement until the Loan is fully repaid.**3.Repayment**(a) The Borrower agrees to make [number] equal payments of [Payment Amount] each, payable on the [Payment Due Date] of eachmonth, beginning on [First Payment Date], until the Loan, including all interest, is fully paid.(b) All payments shall be made in the form of a check, money order, or electronic transfer, and shall be sent to the Lender at the address specified above.**4.Prepayment**The Borrower may prepay the Loan in whole or in part at any time without penalty.**5.Default**If the Borrower fails to make any payment when due, or breaches any other term or condition of this Agreement, the Lender may declare the entire unpaid balance of the Loan immediately due and payable.**erning Law**This Agreement shall be governed by and construed in accordance with the laws of [Governing Jurisdiction].**7.Entire Agreement**This Agreement constitutes the entire understanding between the Lender and the Borrower with respect to the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral.IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.---**个人借款合同范本(中文)**---**借款合同**本借款合同(以下简称“合同”)由以下双方于[日期]签订,并生效:[出借人姓名],地址为[出借人地址](以下简称“出借人”)与[借款人姓名],地址为[借款人地址](以下简称“借款人”)。

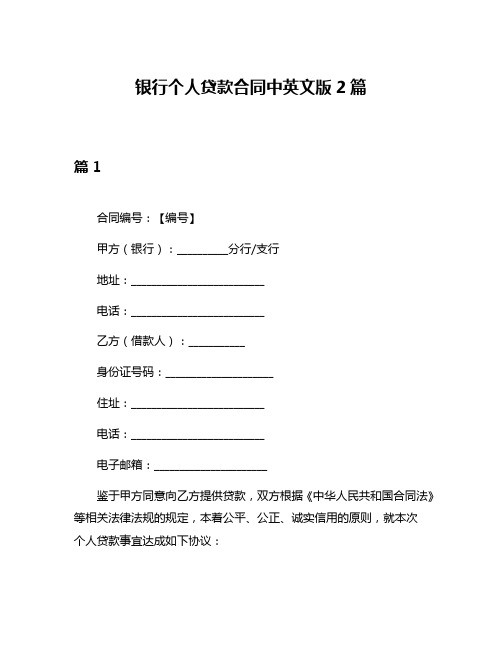

银行个人贷款合同中英文版2篇

银行个人贷款合同中英文版2篇篇1合同编号:【编号】甲方(银行):__________分行/支行地址:__________________________电话:__________________________乙方(借款人):___________身份证号码:_____________________住址:__________________________电话:__________________________电子邮箱:______________________鉴于甲方同意向乙方提供贷款,双方根据《中华人民共和国合同法》等相关法律法规的规定,本着公平、公正、诚实信用的原则,就本次个人贷款事宜达成如下协议:一、贷款事项1. 贷款金额:人民币______元整。

2. 贷款期限:自______年______月______日起至______年______月______日止。

共______期。

每月的______日为还款日。

3. 贷款利率:年利率为______,利息自贷款发放之日起计算。

4. 还款方式:等额本息还款法,每月还款额包括本金及利息,共计______元整。

若逾期未还,甲方有权加收逾期利息。

二、保证事项乙方保证贷款用途合法合规,并保证按时足额偿还贷款本息。

同时乙方提供必要材料配合甲方完成贷款审核、放款、抵押登记等事宜。

乙方未经甲方同意不得将贷款用于股票、期货等高风险投资行为。

三、抵押物事项为保证本合同的履行,乙方愿意以其所有的位于______的房产作为抵押物,作为偿还贷款的担保。

在贷款未全部清偿前,乙方不得擅自处置抵押物。

四、违约责任如乙方未按约定时间还款或存在其他违约行为,甲方有权采取以下措施:1. 计收罚息和复利;2. 宣布贷款提前到期并要求乙方立即偿还全部本息;3. 行使抵押权;4. 采取法律手段进行催收等。

同时乙方应承担因违约产生的律师费、诉讼费等相关费用。

五、合同的变更和解除本合同一经签订,未经双方同意不得随意变更或解除。

借款合同范本中英文对照版6篇

借款合同范本中英文对照版6篇篇1Loan Agreement借款人:Borrower: ______________贷款人:Lender: ________________日期:Date: _________________鉴于借款人向贷款人申请借款,双方经过友好协商,就借款事宜达成如下协议:借款人与贷款人经友好协商,就借款事宜达成以下协议条款:一、借款金额与用途借款金额:借款人向贷款人借款人民币__________元(大写__________元整)。

用于购买房屋及支付相关费用。

贷款人有权了解借款的使用情况,借款人应如实提供使用借款的有关情况。

Loan Amount: The Borrower shall borrow from the Lender the sum of RMB __________ only (in words: __________Yuan Only)for the purpose of purchasing a house and related expenses. The Lender has the right to inquire about the use of the loan, and the Borrower shall truthfully provide information about the use of the loan.二、借款期限借款期限自______年____月____日起至______年____月____日止,共______个月。

借款人应于到期日全额偿还本金和利息。

未经贷款人同意延期还款的,则视为违约。

借款人需承担由此产生的所有责任和费用。

Loan Term: The loan shall be repaid within a term from_________ (MM/DD/YYYY) to _________ (MM/DD/YYYY), for a total of _______ months. The Borrower shall repay the full principal and interest on the due date. Failur e to obtain the Lender’s consent for an extension of the repayment period shall be deemed a breach of contract. The Borrower shall bear all responsibilities and expenses arising from this default.三、利率与利息支付年利率为______%。

个人购房担保借款合同(上海浦发银行)

个人购房担保借款合同(上海浦发银行)个人购房担保借款合同(上海浦发银行)个人购房担保借款合同特别风险提示为维护您的利益,在您签署本合同前,请仔细阅读本提示,如有疑义可向业务人员咨询。

一、请仔细阅读您将要签署的合同文本,特别注意核对一下您的贷款金额、贷款期限、贷款利率(包括利率执行方式和浮动比例)、抵押物状况、以及您所选定的还款方式是否正确。

二、您授权银行在本合同签订后,将贷款款项以借贷给您的购房款名义划付给合同约定的收款人。

三、贷款的实际起始日期以贷款的实际发放日为准,贷款自发放日起计算利息,贷款执行利率按照贷款发放日银行公布利率及本合同约定的浮动比率执行。

详细计算方式参见本合同相应详细条款。

四、根据您对利率执行方式的选择,如在按照浮动利率计息期间,假设遇民银行调整贷款利率,那么自本合同约定的利率调整时间起,在新的贷款利率根底上,按照本合同约定的浮动比例浮动后执行。

如在按照固定利率计息期间,假设遇民银行调整贷款利率或上海浦东开展银行调整购房贷款固定利率,本合同执行利率不作调整。

因此,民银行调整贷款利率或上海浦东开展银行调整购房贷款固定利率,由于您所选择的计息方式,您的贷款利率可能并不能向对您有利的方向变化或者保持对您有利的状况。

您已经对不同利率执行方式在利率波动情况下可能产生的不利风险有充分了解。

五、您已经确保您提交给银行的有关证件和资料是真实、合法、有效的。

您已经确认自己有权在本合同上签字,签字是真实有效的,是您真实意愿的表示,具有法律约束力。

六、如果您需要提前归还贷款,请提前三十(30)日向贷款银行提出书面申请,贷款银行同意后办理提前还款手续,并根据本合同约定收取违约金。

详情参见本合同相应条款。

七、您本着老实、信用的原那么,自愿签订并履行本合同。

您已仔细阅读本《特别风险提示》,对其内容和表述已完全准确理解。

如果您对本合同还有不理解之处,请暂缓签署本合同,您可以向上海浦东开展银行有关业务人员咨询。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

No.:SPD BankPersonal Guarantee Loan ContractContract version No.:SPDB201203SPD Bank Personal Guarantee Loan ContractPersonal Guarantee Loan ContractThe borrower:ID certificate type and No.:The lender (the Mortgagee / the pledgee): Shanghai Pudong Development Bank Co., Ltd. BranchThe mortgager (name / designation of natural person or legal person):ID certificate type and No.:The pledger (name / designation of natural person or legal person):ID certificate type and No.:The guarantor (name / designation of natural person or legal person):ID certificate type and No.:Whereas:The borrower applies to the lender for RMB personal loan, in accordance with the relevant laws, rules and regulations of the People's Republic of China, upon consensus through consultation among the parties, the present contract is hereby entered into for mutual observance. Meanwhile, the borrower, the guarantor and the lender hereby confirm that (check with a √ mark and uncheck with a × mark according to the conditions):□ Th e present contract serves as an ancillary business document of the Personal Comprehensive Credit Granting Contract under the number of signed by the borrower and the lender.□ The present contract is an independent business document signed by the borrower, the guarantor and the lender.Part 1 Contract Terms and ConditionsArticle 1 Loan Amount and Purpose1.1 The loan type of the present contract is S1.1A (personal car loan / personal consumption loan / personal business loan / personal credit loan / others: S1.1A), the loan amount is RMB S1.1B Yuan (in words: RMB S1.1C Yuan), and it is used for S1.1D only and shall not be appropriated. The lender has the right to monitor the use of loans.Article 2 Loan Term, Interest Rate and Method for Interest Calculation2.1 The loan term (and the debt performance period) under the present contract is S2.1A (“year(s) and month(s)”), and its start date is expected from the date S2.1B (from MM DD YY to MM DD YY). The actual loan start date is subject to the date recorded on the loan receipt.2.2 The value date of the loan under the present contract is the date of loan release. The method for interest calculation is as follows: the loan interest will be calculated on a daily, monthly and yearly basis. The calculation methods of full-year, full-month and full-day shall be adopted for loan interest. If full-year, full-month and full-day cannot be reached, the last day at the end of end is the full-day. If the loan period comes to the completion of year, the interest shall be calculated as per annual interest rate; if the loan period comes to the completion of month, the interest shall be calculated as per monthly interest rate; if the loan period covers full year (month) and remnant days, the interest of the part of full year (month) shall be calculated as per yearly (monthly) interest rate, and the interest of the remnant days shall be calculated according to the actual number of days. The formula of computation is as follows:For the full year and full month: Interest = principal × period (the number of year(s) or month(s)) × yearly or monthly interest rate;For the full year (month) and remnant day(s): Interest = principal × [period (the number of year(s) or month(s)) × yearly or monthly interest rate + the number of remnant day(s) × daily interest rate] 2.3 Except otherwise specified by the both parties, the date of settlement of the loan interest under the present contract is the repayment date for each period agreed in the present contract.2.4 The loan interest rate under the present contract can adopt the floating interest rate, fixed interest rate or quasi-fixed interest rate, and actually adopts the method: S2.4A;□ Floating interest rateIt shall be executed according to the benchmark loan interest rate and floating range published by the People's Bank of China in the corresponding period. The loan interest rate under the present contract is S2.4A – 1 – 1 (“□ above □ below %”) on the basis of the benchmark loan interest rate published by the People's Bank of China in the corresponding period. If the People's Bank of China adjusts the benchmark loan interest rate within the loan period, then, since the time that the contract loan interest agreed in the present contract is adjusted, the new contract loan interest rate will be executed after the floating according to the above said floating proportion on the basis of the new loan benchmark interest rate.The benchmark loan interest rate of the People's Bank of China in the corresponding period while signing the present contract is: S2.4A –1 –2 (“% (annual interest rate)”). The executed interest rate is determined according to the benchmark loan interest rate on the actual date of loan release regulated by the People's Bank of China in the corresponding period as well as the floating proportion under the present contract. Monthly interest rate = annual interest rate / 12, daily interest rate = annual interest rate / 360, and the interest rate per period = annual interest rate × the number of the month(s) of each period / 12.If the benchmark loan interest rate regulated by the People's Bank of China is adjusted within the loan period, then the contract interest rate shall be adjusted accordingly as per the S2.4A – 1 – 3 method:□ Adjustment by year, and interest accrual by stage. That is, the new interest rate will be executed according to the benchmark loan interest rate regulated by the People's Bank of China as well as the floating proportion stipulated under the present contract as of the first calendar day of the next calendar year after the interest rate adjustment.□ No interest rate adjustment, and no interest accrual by stage.□ Others: S2. 4A – 1 – 3□ Fixed interest rateIt shall be executed according to the fixed loan interest rate and floating range stipulated by Shanghai Pudong Development Bank in the corresponding period. The loan interest rate under the present contract is S2.4A – 2 – 1 (“□ above □ below %”) on the basis of the fixed loan interest rate published by Shanghai Pudong Development Bank in the corresponding period. If the People's Bank of China adjusts the benchmark loan interest rate or Shanghai Pudong Development Bank adjusts the fixed interest rate applicable to this business within the loan period, then the interest rate executed in the present contract will not be adjusted. The fixed interest rate of the corresponding period while signing the present contract is: S2.4A – 2 – 2 (“% (annual interest rate)”). The executed interest rate is determined according to the fixed loan inte rest rate on the actual date of loan release published by the People's Bank of China in the corresponding period as well as the floating proportion under the present contract. Monthly interest rate = annual interest rate / 12, daily interest rate = annual interest rate / 360, and the interest rate per period = annual interest rate × the number of the month(s) of each period / 12.□ Quasi-fixed interest rateFixed interest rate will be executed for S2.4A – 3 – 1 (“month(s), estimated till MM DD YY) from the date of loan release. That is, it will be executed according to the fixed loan interest rate and floating range stipulated by Shanghai Pudong Development Bank in the corresponding period (the loan period is from the date of loan release till the date of expiry of the contract). The loan interest rate under the present contract is S2.4A – 3 – 2 (“□ above □ below %”) on the basis of the fixed loan interest rate published by Shanghai Pudong Development Bank in the corresponding period. If the People's Bank of China adjusts the benchmark loan interest rate or Shanghai Pudong Development Bank adjusts the fixed interest rate applicable to this business within the loan period, then the interest rate executed in the present contract will not be adjusted. The fixed interest rate of the corresponding period while signing the present contract is: S2.4A – 3 –3 (“% (annual interest rate)”). The executed interest rate is determined according to thefixed loan interest rate on the actual date of loan release published by the People's Bank of China in the corresponding period as well as the floating proportion under the present contract. Monthly interest rate = annual interest rate / 12, daily interest rate = annual interest rate / 360, and the interest rate per period = annual interest rate × the number of the month(s) of each period / 12. After the expiry of the fixed interest rate, i.e., S2.4A – 3 – 4 (from MM DD YY to MM DD YY), a floating interest rate will be executed. That is, it shall be executed according to the benchmark loan interest rate and floating range stipulated by the People's Bank of China in the corresponding period (the loan period is calculated from the date of the loan release). The loan interest rate under the present contract is S2.4A – 3 – 5 (“□ above □ below %”) on the basis of the benchmark loan interest rate published by the People's Bank of China in the corresponding period. If the People's Bank of China adjusts the benchmark loan interest rate during the period, then, since the time that the contract loan interest agreed in the present contract is adjusted, the new contract loan interest rate will be executed after the floating according to the above said floating proportion on the basis of the new loan benchmark interest rate. Therein, monthly interest rate = annual interest rate / 12, daily interest rate = annual interest rate / 360, and the interest rate per period = annual interest rate × the number of the month(s) of each period / 12. If the borrower needs to continue adopting the fixed interest rate to calculate the interest, then the borrower shall propose a separate application to the bank.If the benchmark loan interest rate regulated by the People's Bank of China is adjusted during the period of executing the floating interest rate, then the contract interest rate shall be adjusted accordingly as per the S2.4A – 3 – 6 method:□ Adjustment by year, and interest accrual by stage. That is, the new interest rate will be executed according to the benchmark loan interest rate regulated by the People's Bank of China as well as the floating proportion stipulated under the present contract as of the first calendar day of the next calendar year after the interest rate adjustment.□ No interest rate adjustment, and no interest accrual by stage.□ Others: S2.4A – 3 – 62.5 If the borrower fails to repay the loan principal and interest of the current period in full on schedule as required, it will be regarded as overdue, and the lender will have the right to charge penalty interest in accordance with the relevant provisions of the People's Bank of China (see also the relevant contents of Article 12 of the present contract).Article 3 Conditions on the borrower’s Money Withdrawal3.1 Unless agreed by the lender, the lender will have no obligation to release the loan under the contract to the borrower until the following conditions are fully met and satisfactory to the lender in terms of form and content:3.1.1 The borrower has submitted all the documents and data as required by the lender and obtained the approval of the lender.3.1.2 The present contract and its relevant annexes have been legally signed and entered into force.3.1.3 The guarantee rights or similar priority rights have been legally established and entered into force (if any): for the loan guaranteed by means of mortgage, its insurance and mortgage registration procedures have been completed, and the collateral registration voucher, ownership voucher, mortgage right voucher / other right voucher, and insurance policy original copy have been delivered to the lender for possession; for the loan guaranteed by means of pledge, the pledge object has been delivered to the lender for possession; for the pledge act requiring handling with registration procedures according to the law, the registration has been completed.3.1.4 A compulsory notarization has been processed by the notarization office approved by the lender for the present contract and the guarantee documents related with the present contract as well as other files (if the lender requires).3.1.5 The borrower has opened a bank account for money withdrawal, interest payment, expense payment, repayment and etc. as required by the lender.3.1.6 Other conditions proposed by the lender.3.2 Notwithstanding the provisions of the preceding paragraph, the establishment of the above conditions for money withdrawal does not represent that the lender necessarily has the obligation to release the loan when the above conditions are meet. The lender may suspend, and reduce or cancel the release of the loan and notice the borrower under the circumstances that the lender needs to adjust and increase the conditions for the loan release according to its own limits due to the changes of law, rules and regulations as well as policies or the restrictions of the government’s macro currency policies or financial regulatory policies or that other major incident change occurs; and moreover, if the lender release the loan when the above said conditions are not fully met, it will not constitute a defect of the lender’s performance of contract.Article 4 Loan Release and Payment4.1 The borrower agrees the lender to pay the loan money according to the payment method of S4.1A:□ 4.1.1 Method of payment by the lender upon authorizationIt means that the lender pays the loan money to th e borrower’s transaction objects which are compliant with the purpose agreed in the present contract according to the borrower's application for money withdrawal request and payment authorization. The specific loan payment provision is S4.1A – 1:□ The bo rrower has opened a special account for loan. The borrower authorizes the lender to transfer the loan money to the special account for loan opened by the borrower at the place of the lender when the conditions for loan release are met. The account No. of the special account is S4.1A – 1 – 1. The above said transfer act of the lender is the money withdrawal of the borrower. The borrower can only transfer the loan money under the present contract in the special account for loan, to the account of its transaction object that the borrower applies for to the lender under the present contract and supplementary change agreement and the lender approves and agrees to bind with the special account for loan payment.If the borrower has not yet determined the information on the binding paid transaction object when entering into the present contract, or needs to change the information on the binding paid transaction object after entering into the present contract, the borrower shall specify it by signing a supplemental agreement or alteration agreement with the lender. The amount that the borrowertransfers to any binding paid transaction object shall conform to the agreement between the both parties, and the entire total amount that the borrower transfers to all the binding paid transaction objects shall not exceed the total loan amount of the present contract. The borrower agrees that, according to the provisions and requirement of the lender, the borrower shall use the loan money which will not be used any more in the special account for loan to make early repayment of the loan under the contract. When the present contract is entered into, the information on the transaction object which is bound with the special account for loan payment is as follows:(1) The name of the transaction object is S4.1A – 1 – 2, and its account No. / passbook No. / card No. is S4.1A – 1 – 2, its account bank is S4.1A – 1 – 2, and its payment amount shall be not more than (currency & amount) S4.1A – 1 – 2;(2) The name of the transaction object is S4.1A – 1 – 2, and its account No. / passbook No. / card No. is S4.1A – 1 – 2, its account bank is S4.1A – 1 – 2, and its payment amount shall be not more than (currency & amount) S4.1A – 1 – 2;(3) The name of the transaction object is S4.1A – 1 – 2, and its account No. / passbook No. / card No. is S4.1A – 1 – 2, its account bank is S4.1A – 1 – 2, and its payment amount shall be not more than (currency & amount) S4.1A – 1 – 2;(4) S4.1A – 1 – 2 . □ The borrower has not opened a special account for loan. The borrower authorizes the lender to transfer the loan money to the accounts of the following transaction objects which confirm to the purpose agreed in the present contract when the conditions for loan release are met. The payment condition is that the borrower offers transaction contracts or other related transaction materials and certificates and the lender examines and approves them. The act that the borrower authorizes the lender to pay the loan money to the accounts of the following transaction objects means the borrower’s payment authorization. The above said payment act of the lender is the money withdrawal of the borrower:(1) The name of the transaction object is S4.1A – 1 – 2, and its account No. / passbook No. / card No. is S4.1A – 1 – 2, its account bank is S4.1A – 1 – 2, and its payment amount shall be not more than (currency & amount) S4.1A – 1 – 2;(2) The name of the transaction object is S4.1A – 1 – 2, and its account No. / passbook No. / card No. is S4.1A – 1 – 2, its account bank is S4.1A – 1 – 2, and its payment amount shall be not more than (currency & amount) S4.1A – 1 – 2;(3) The name of the transaction object is S4.1A – 1 – 2, and its account No. / passbook No. / card No. is S4.1A – 1 – 2, its account bank is S4.1A – 1 – 2, and its payment amount shall be not more than (currency & amount) S4.1A – 1 – 2;(4) S4.1A – 1 – 2 .If the borrower is not yet able to determine the specific transactions object information when signing the present contract, then the borrower shall file an Application Form for Payment by the Lender upon Authorization (see the annex for its format) to the lender 3 working days prior to the payment date after the conclusion of the present contract, and the lender will pay the loan money to the borrower’s transaction objects according to the amount applied for payment after the examination and approval of the lender. The payment condition is that the borrower offers transaction contracts or other related transaction materials and certificates and the lender examines and approves them. The act that the borrower authorizes the lender to pay the loan money to the accounts of the following transaction obj ects means the borrower’s payment authorization. Theabove said act of the lender’s payment to the borrower’s transaction objects according to the borrower’s application for payment is the money withdrawal of the borrower.□ 4.1.2 Method of payment by the borrower himselfIt means that the lender directly releases the loan money to the borrower's account according to the borrower’s application for money withdrawal and then the money will be paid by the borrower himself to the borrower's transaction objects which meet the purpose agreed in the present contract. That is, the borrower authorizes the lender to transfer the loan money to the account No. / passbook No. / card No. S4.1A –2 account opened by the borrower at the place of the lender when the conditions for loan release are met, and then, the money will be paid by the borrower himself to the borrower's transaction objects which meet the purpose agreed in the loan contract. The above said transfer act of the lender is the money withdrawal of the borrower. The borrower promises that, the borrower will regularly report to the lender or inform the lender of the information on the payment of the borrower’s loan money.4.2 If the lender still cannot release the loan under the present contract upon expiry of 90 days after the signature of this contract due to the reasons of the borrower, the lender will have the right to unilaterally terminate this loan contract.4.3 Any disputes with others, arising out of the borrower’s using the loan money after the release of the loan, will have nothing to do with the lender, and this loan contract shall be normally executed.Article 5 Repayment5.1 The repayment method is: S5.1A:For the loan period is less than one year (inclusive of one year), one of the following repayment methods can be selected (please select it by ticking the appropriate box):□ Repayment of the principal and interest in a lump sum upon its expiry, with the interest to be paid off together the principal (see Article 2 of the present contract for the method for interest calculation).□ Repayment of interest by installment, and repayment of the principal in a lump sum upon its expiry (interest per period = the remaining loan principal at the beginning of the period × interest rate per period).□ Ot her repayment method: S5.1AThe "period" in the above formula refers to the S5.1A – 1 month(s) (for example: if the repayment is made on schedule on the basis of taking every 2 months as a period, then here shall be filled in with “2”, and the number filled in shall not be more than 12 months); the re payment date of each period is S5.1A – 2.For the loan period is more than one year (exclusive of one year), one of the following repayment methods can be selected (please select it by ticking the appropriate box):□ Adopt the method of matching the repaym ent of principal and interest.The amount of repayment of principal and interest for each period = loan principal × interest rate per period + loan principal ×interest rate per period ÷ [(1+ interest rate per period) total repayment periods– 1]□ Adopt t he method of matching the principal repaymentThe amount of repayment of principal and interest for each period = loan principal ÷total repayment periods + (loan principal – the accumulative repaid principal amount) × interest rate per period□ Other repa yment method: S5.1AThe "period" in the above formula refers to the S5.1A – 1 month(s) (for example: if the repayment is made on schedule on the basis of taking every 2 months as a period, then here shall be filled in with “2”, and the number filled in shall not be more than 12 months); the repayment date of each period is S5.1A – 2.5.2 The borrower who repays the loan by installment shall start repayment from the agreed repayment date of the next month (the Gregorian calendar) after the actual release of the loan. The specific calculation method for the initial loan repayment interest of the next month after the actual release of the loan is as follows: if the days of actual occupation of the loan during the period from the date of actual release of the loan to the agreed repayment date of the next month are less than one period, then the initial loan repayment interest will be determined by the days of actual occupation of the loan according to the method for interest calculation in Article 2.2 of the present contract; if the days of actual occupation of the loan during the period from the date of actual release of the loan to the agreed repayment date of the next month are more than one period, then the initial loan repayment interest will be calculated respectively according to the interest repayable for one period and the interest repayable for the part of those which are more than on period; therein: the interest repayable for one period shall be calculated in accordance with the agreed repayment method, and the interest repayable for the part of those which are more than on period shall be determined by the days of actual occupation of the loan according to the method for interest calculation in Article 2.2 of the present contract; if the days of actual occupation of the loan during the period from the date of actual release of the loan to the agreed repayment date of the next month are equal to one period, then the initial loan repayment interest will be determined by the interest repayable for the current period calculated according to the agreed repayment method.5.3 The borrower shall, before the zero clock of each date of repayment of principal and interest agreed in the present contract, deposit the loan principal and interest in full into the loan repayment account (settlement account) opened by the borrower at the place of the lender. The bank card No. or all-in-one current account No. of the loan repayment account is S5.3A. The borrower hereby irrevocably authorizes the lender to withhold the due loan principal and interest repayable from the said deposit account on its own initiative.5.4 If requiring to change the loan repayment account during the loan period, the borrower must file an application to the lender in advance and sign a new agreement on authorization for withholding after the consent of the lender and specify the start date of the new loan repayment account before its implementation.5.5 If the deposit account which the borrower authorizes the lender to withhold from is an overdraft account, then the borrower hereby irrevocably further authorizes that, when the deposit balance in the said account is insufficient to pay back the loan principal and interest of the current period, the lender may withhold the loan principal and interest of the current period by means ofoverdraft within the range of the allowable overdraft amount, and the borrower shall bear the overdraft principal, interest and the related costs arising therefrom.5.6 The borrower shall repay the loan principal and interest on schedule. If the borrower fails to repay the due loan principal and interest in full on schedule as required, the lender will have the right to withhold the outstanding and due principal, interest, default interest and the related costs (including attorney fee, litigation fee, auction fee, and other fees for realization of the creditor’s rights) from part or all of the accounts that the borrower opened at the place of the lender and the other business offices of the lender’s head office system.5.7 If the loan repayment is overdue, then overdue default interest of the outstanding loan principal and interest shall be paid together with the repayment of the overdue loan principal and interest, and the lender will have the right to charge a compound interest for the interest unpaid by the borrower.5.8 Except the circumstance of adopting a fixed interest rate, if the lender adjusts the amount of repayment of the principal and interest for each period due to by the interest rate adjustment factor of the People's Bank of China, the borrower shall unconditionally execute it.5.9 If repaying the loan in advance, the borrower shall obtain prior written consent of the lender. Without written consent of the lender, the borrower shall still repay the loan principal and interest in accordance with the period specified in the contract.5.10 If the borrower repays part of the loan principal and interest in advance, the loan interest will be still charged for the part of early repayment amount on and before the date of early repayment according to repayment according to the relevant regulations of the present contract, and the charged loan interest will not be calculated and refunded. If the borrower repays all the outstanding loan principal and interest in a lump sum in advance, the lender will have the right to charge the loan interest on and before the date of early repayment according to repayment according to the relevant regulations of the present contract, will not calculate and refund the charged loan interest, and also will not calculate and charge the loan interest after the date of early repayment.5.11 If the borrower repays the loan principal in advance, a default fine will be charged in accordance with the following stipulations:The borrower shall pay a default fine as per S5.11A (“%”) o f the early repayment amount of the loan principal; if the borrower proposes to make early repayment after over S5.11B year(s) of normal repayment, the default fine can be waived.Other provisions on early repayment: S5.11C□ Article 6 Mortgage Guarantee (S6 )6.1 In order to safeguard the realization of the creditor’s rights of the lender (hereinafter referred to as the Mortgagee), mortgage guarantee shall be provided to the lender for the loan principal, interest and relevant cost under the present contract by the mortgager with the property that the mortgager has the right to dispose.6.2 The information on the mortgage object under the present contract is: S6.26.2.1 Mortgage object。