国际金融英文课件5

合集下载

国际金融英文版PPT(共46页)

The exchange rate would fluctuate between (0.80 + 0.008) = 0.8008 and (0.80 – 0.008) = 0.792

0.8008 and 0.792 are called gold export and import points.

The BOP disequilibrium was corrected by “Price-specie-flow mechanism”.

Example of gold export and import

If the gold par value in New Zealand was NZ$125/ounce and A$100/ounce in Australia, so mint par of exchange: 100/125 = A$0.80/NZ$ Costs of gold transportation: A$0.008/NZ$

The Classical Gold Standard (1876 – 1914)

The gold standard was a commitment by participating nations to fix the price of their domestic currencies in terms of a specified amount of gold.

International monetary system is based on the exchange rate system adopted by individual nations. The exchange rate system is a set of rules governing the value of a currency relative to other currencies.

0.8008 and 0.792 are called gold export and import points.

The BOP disequilibrium was corrected by “Price-specie-flow mechanism”.

Example of gold export and import

If the gold par value in New Zealand was NZ$125/ounce and A$100/ounce in Australia, so mint par of exchange: 100/125 = A$0.80/NZ$ Costs of gold transportation: A$0.008/NZ$

The Classical Gold Standard (1876 – 1914)

The gold standard was a commitment by participating nations to fix the price of their domestic currencies in terms of a specified amount of gold.

International monetary system is based on the exchange rate system adopted by individual nations. The exchange rate system is a set of rules governing the value of a currency relative to other currencies.

国际金融英语International Finance 课件

Conversely, a budget surplus is present when the government’s revenues exceed its total expenditure. This surplus can be used by the government to reduce its outice Level

Price stability is desirable because a rising price level (inflation) creates uncertainty in the economy, and it may hamper economic growth. If there is a tendency of the rise of price level, the central bank will decrease money supply to slow down the economy to curb inflation.

B. Budget Deficits & surpluses(预算赤字和盈余)

A budget deficit is present when total government spending exceeds total government revenue from all sources. When a budget deficit is present, the government must borrow funds to finance the excess of its spending relative to revenue. It borrows by issuing interest-bearing bonds that become part of what we call national debt, the total amount of outstanding(未偿付的) government bonds.

Price stability is desirable because a rising price level (inflation) creates uncertainty in the economy, and it may hamper economic growth. If there is a tendency of the rise of price level, the central bank will decrease money supply to slow down the economy to curb inflation.

B. Budget Deficits & surpluses(预算赤字和盈余)

A budget deficit is present when total government spending exceeds total government revenue from all sources. When a budget deficit is present, the government must borrow funds to finance the excess of its spending relative to revenue. It borrows by issuing interest-bearing bonds that become part of what we call national debt, the total amount of outstanding(未偿付的) government bonds.

国际金融课件_5第五章 外汇市场与外汇交易

注意:为了节约交易时间,使用规范化的简语

1.一般只报点数 2. 交易额是100万的整倍数:如USD1表示100万美元 3.买入和卖出与数额同时报出:如“6 yours”表示我卖 给你600万美元,“3 mine”表示“我买入300万美元”。

4.但在确认环节,汇率则要报全价。

二、远期外汇业务

(一)远期外汇业务的概念与作用

远期外汇业务又称期汇交易,是指外汇买卖成交时, 双方将交割日预定在即期外汇买卖起息日后的一定 时间的外汇交易。 作用:保值和投机两方面的作用。

(二)远期汇率的标示方法

远期汇率就是买卖远期外汇时所使用的汇率, 它是在买卖成交时即确定下来的一个预定性的价格。 远期汇率以即期汇率为基础,但一般与即期汇率有 一定的差异,称为远期差价或称为远期汇水 (Forward margin)。 在直接标价法下:远期汇率=即期汇率+升水 远期汇率=即期汇率-贴水 在间接标价法下:远期汇率=即期汇率-升水 远期汇率=即期汇率+贴水

点数排列前大后小,汇率与汇水同边相减

口诀:前小后大用加法 前大后小用减法

练习:

1.即期汇率USD/CAD 三个月远期 十二个月远期 前大后小用减法 1.5369/79 300/290 590/580

则6个月远期汇率USD/CAD 1.5069/89

9个月远期汇率USD/CAD 1.4779/99

口诀:前小后大用加法 前大后小用减法

即期外汇业务按其银行间结付方式的不同分为 电汇(Telegraphic Transfer, T/T)、信汇(Mail Transfer, M/T)和票汇(Demand Draft, D/D)。

(二)即期外汇业务的报价与操作实例

例P64

小结:即期Байду номын сангаас汇买卖 步骤

国际金融课件internationalfinance

06

中国国际金融的实践与展望

中国国际金融业在规模和业务范围上不断扩大,成为全球金融市场的重要参与者。

中国国际金融业在推动经济增长、促进国际贸易和投资等方面发挥了重要作用。

改革开放以来,中国国际金融业经历了从无到有、从小到大的发展历程,逐步建立起较为完善的金融机构体系和金融市场体系。

中国国际金融的发展历程与现状

Global financial markets facilitate the flow of capital across borders, allowing for the efficient allocation of resources and the hedging of risks.

Regional financial markets serve specific geographical regions and are often associated with trade blocs or economic unions.

01

国际金融危机的定义

由于国际金融市场上的过度投机、金融监管缺失等原因,导致国际金融市场出现大规模动荡,影响各国经济的稳定。

02

国际金融危机的传染机制

通过贸易、金融和信息等渠道,将危机从一个国家传递到另一个国家。

国际金融危机及其传染机制

1

2

3

通过监测和分析国际金融市场的相关信息,及时发现潜在的风险点,采取应对措施。

02

03

04

05

Main International Financial Centers and Their Characteristics 主要国际金融中心及其特点

ห้องสมุดไป่ตู้

国际金融英文版PPT课件

3.Origin of the market A number of reasons have been given for the origin of the Eurocurrency market.Some analysts go so far as to say that the Soviets initiated the process of trading Eurocurrencies before the western Europeans used foreign deposits.

derivatives

3

Non-bank

❖ Public international financial institutions

public global financial institutions

regional public

national public

❖ Private international financial institutions

International finance

Foreign direct investment

Inventory of international

Financial resources

1.non-bank financial institution financial resources

2.international financial markets

5

International derivatives exchange-traded

❖ Users of derivatives/risks of derivatives ❖ Currency futures and options ❖ Interest rate futures and options

derivatives

3

Non-bank

❖ Public international financial institutions

public global financial institutions

regional public

national public

❖ Private international financial institutions

International finance

Foreign direct investment

Inventory of international

Financial resources

1.non-bank financial institution financial resources

2.international financial markets

5

International derivatives exchange-traded

❖ Users of derivatives/risks of derivatives ❖ Currency futures and options ❖ Interest rate futures and options

国际金融英文版PPT CH5

Big Mac in China costs ¥11.00, while the same Mac in U.S. costs $3.41. The actual exchange rate was ¥7.6/$ at the time. The implied exchange rate according to absolute PPP should be: ¥11/$3.41 = ¥3.23/$ The dollar was overvalued. An overvalued currency is a currency in which the actual value is higher than the value it is supposed to be. Otherwise, it is an undervalued currency.

%ΔS = πd – πf

πd, πf: domestic and foreign inflation rate

The equation shows if domestic inflation is high than foreign inflation, the foreign currency will appreciate against the domestic currency by the percent consistent with the inflation differencial.

Price index is an index number of the prices of goods of some given type. PC = (∑i PitWit)/(∑i Pi0Wi0)

国际金融学英文课件:ch06 International Banking

Consequently, very few nations’ investment projects are purely domestically financed. Most of the largest banking institutions, called megabanks, are located in Japan and Europe. Economies of scale can explain the existence of megabanks whose operations span the globe. Some economists believe that a particular form of economies of scale may explain the existence of megabanks: economies of scale in information processing.

Potential rivalry, or banking competition, measured by portion of total deposits/assets concentrated among a nation’s largest banks, is the main indicator of bank market structure.

12

Section 2: Banking Around the Globe

Business of banking varies from nation to nation. Each country has its own unique banking history,

and this fact alone accounts for distinctive features of national banking system. Banks’ role; bank market structure; legal environment;

国际金融英文PPT课件 (5)

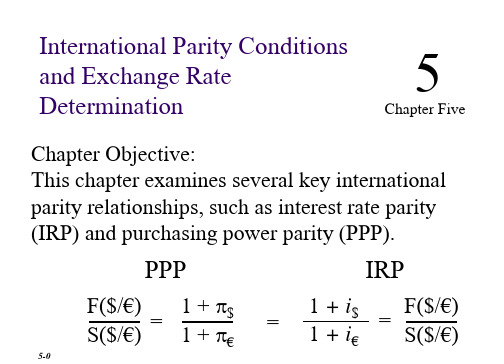

International Parity Conditions and Exchange Rate Determination

5

Chapter Five

Chapter Objective: This chapter examines several key international parity relationships, such as interest rate parity (IRP) and purchasing power parity (PPP).

5-2

5.1.1 Interest Rate Parity Defined

IRP is an “no arbitrage” condition. If IRP did not hold, then it would be possible for

an astute trader to make unlimited amounts of money exploiting the arbitrage opportunity. Since we don’t typically observe persistent arbitrage conditions, we can safely assume that IRP holds.…almost all of the time!

Spot exchange rate 360-day forward rate U.S. discount rate British discount rate

S($/£) = $2.0000/£

F360($/£) = i$ = i£ =

$2.0100/£ 3.00% 2.49%

5-10

Covered Interest Arbitrage

5

Chapter Five

Chapter Objective: This chapter examines several key international parity relationships, such as interest rate parity (IRP) and purchasing power parity (PPP).

5-2

5.1.1 Interest Rate Parity Defined

IRP is an “no arbitrage” condition. If IRP did not hold, then it would be possible for

an astute trader to make unlimited amounts of money exploiting the arbitrage opportunity. Since we don’t typically observe persistent arbitrage conditions, we can safely assume that IRP holds.…almost all of the time!

Spot exchange rate 360-day forward rate U.S. discount rate British discount rate

S($/£) = $2.0000/£

F360($/£) = i$ = i£ =

$2.0100/£ 3.00% 2.49%

5-10

Covered Interest Arbitrage

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1.

பைடு நூலகம்

Demand and supply of currency

2.

Sterling is sold on foreign exchange markets when Goods and services are imported (domestic consumers and firms sell sterling to finance their purchase of imports or when they go overseas on holiday) Speculators sell pounds for another currency Investment capital flows out of the UK seeking a better rate of return Central banks go into the market and sell pounds to buy other foreign currencies. When the demand for sterling is high relative to supply, sterling goes up in value (an appreciation). The reverse is true when the market supply of pounds exceeds the demand (a depreciation).

The role of interest rate

International financial investors have an incentive to shift toward dollar-denominated assets, and this increases the demand for dollars in the foreign exchange market. The dollar tends to appreciate immediately. Furthermore, we can determine that the dollar should appreciate to about $0.4975 per SFr, assuming that the interest rates and the expected future exchange rate do not change. Once this new current spot exchange rate is posted in the market , the SFR then is expected to appreciate during the next 90 days at a faster rate, equal to about 6 percent. This re-established uncovered interest parity (5 percent interest plus about 6 percent expected appreciation matches the 11 percent American interest) and eliminates any further desire by international investors to reposition their portfolios.

The role of the expected future spot exchange rate

Example: with the US interest rate at 9 percent, the Swiss interest rate at 5 percent, and the current spot exchange rate at $0.50 per SFr, what happens if the spot exchange rate expected in 90 days increases from about $0.505 to about $0.515 per SFr? Relative to the initial current spot rate, investors now expect the franc to appreciate more in the next 90 days, at about a 12 percent annual rate rather than the previously expected 4 percent. This shifts the return differential in favour of Swiss currency assets and the demand for the franc increases in the foreign exchange market. The current spot exchange rate increases ( the franc appreciates and the dollar depreciates). In fact the spot exchange rate moves to about $0.51 per SFr. At the new spot rate, the franc then is expected to appreciate further by only about 4 percent (annual rate). Uncovered interest parity is re-established, and there is no further incentive for international investors to reposition their portfolios. As with a change in interest rates, the effect of a change in the expected future spot rate on the current spot exchange rate can happen very quickly (instantaneously or within a few minutes)

Demand and supply of currency

Short and long-term movements in the exchange rate, like any price, are caused by changes in market demand and supply conditions. Taking pound for example: The demand for pounds in the FOREX markets comes from four main sources: UK good and services are exported overseascreating an inflow of currency into to the UK which needs to be turned into sterling. Foreign investment flows into the UK economy Market speculators decide they want to purchase pounds in the expectation of making a profit Official buying of the currency by the central bank.

The role of interest rate

Foreign exchange markets seem sensitive to movements in interest rates. Jumps of exchange rates often follow changes in interest rates. If domestic interest rate (i) increases, while the foreign interest rate (if) and the spot exchange rate expected at some appropriate time in the future (eex) remain constant, the return shifts in favour of investments in assets denominated in domestic currency. Example: initially the American interest rate is 9%, the Swiss interest rate is 5% per year, the current spot rate is $0.50 per SFr, and the expected future spot rate in 90 days is $0.505 per SFr, implying that the franc is expected to appreciate at an annual rate of about 4%. What happens if the U.S. interest rate increases to 11%?

International Finance-2010

Chapter 5: What determines exchange rates Tutor: X. Zhang

Topics Covered

Introduction Exchange Rates in the Short Run The Long Run: Purchasing Power Parity (PPP) The Long Run: Monetary Approach How Well Can We Predict Exchange Rates?

The role of the expected future spot exchange rate