根据合同审核信用证

根据外销(合同)审核信用证

根据外销合同审核信用证1. 引言外销合同审核信用证是国际贸易中常见的操作流程之一。

在国际贸易中,信用证的作用至关重要,它是国际贸易支付方式中最安全、最可靠的方式之一。

本文将介绍根据外销合同审核信用证的步骤和注意事项。

2. 外销合同审核信用证步骤2.1 确定信用证的类型在审核信用证之前,首先要确定信用证的类型。

常见的信用证类型有即期信用证和远期信用证。

即期信用证要求卖方在一定的时间内向开证行提交相关单据,而远期信用证给予卖方更长的时间来履行相关义务。

2.2 仔细阅读信用证文件在审核信用证之前,应仔细阅读信用证文件。

信用证文件通常包括信用证本身、外销合同、装运单据等。

务必确保信用证的内容与外销合同一致,并核对信用证中的细节是否与合同规定相符。

2.3 确认信用证的合规性审核信用证的一个重要步骤是确认信用证的合规性。

合规性主要包括几个方面:•确保信用证的开证行具备有效的信用力和可靠性。

•检查信用证是否违反国际贸易规则和相关法律法规。

•确认信用证开证日期是否在有效期内,以及单据提交期限是否合理。

2.4 核对信用证的单据要求信用证通常要求卖方提交一系列的单据,如提单、发票、装箱单等。

在审核信用证时,务必核对信用证中的单据要求,并确保能按时提供符合规定的单据。

2.5 合理订正信用证的不符点在审核信用证过程中,可能会发现信用证存在不符点。

在这种情况下,卖方需要与买方及信用证开证行进行沟通,并争取适当的订正。

这个步骤需要注意与买方的合作,并且要确保订正后的信用证符合合同要求。

3. 注意事项3.1 熟悉国际贸易规则和相关法律法规在审核信用证之前,务必熟悉国际贸易规则和相关法律法规。

对信用证的审核需要遵循国际贸易惯例,并遵守当地法律法规。

熟悉相关规则和法规,有助于提高审核的准确性和合规性。

3.2 与相关方保持良好沟通审核信用证是一个涉及多方的过程。

卖方需要与买方、信用证开证行以及装运和保险方保持良好的沟通。

及时解决问题,并确保所有相关方对信用证的规定和要求达成一致。

根据合同审核信用证(1)

根据合同审核信用证以下是受益人根据合同规定审核来证的实务操作,先看合同,然后根据合同内容审核信用证中与合同不相符的地方。

买卖合同进口国开来的信用证:ISSUING BANK: UNITED GREAT KINGDOM BANK LTD, LONDONCREDIT NUMBER: LOD88095DA TE OF ISSUE: 2008.09.01EXPIRYDATE AND PLACE: DATE 2008.10.20 PLACE U.K.APPLICANT:EASTERN TRADING COMPANY81 WORDFORD STREET,LONDONUNITED KINGDOMBENEFICIARY:SHANGHAI MAOLIN TRADE CORP.NO.97 MAOMING NAN ROADSHANGHAI P. R. OF CHINAAMOUNT: USD32040.00 (SAY U. S. DOLLARS THIRTY TWO THOUSAND AND FORTY ONL Y)THE CREDIT IS A V AILABLE WITH ANY BANK BY NEGOTIATION DRAFTS AT 30 DAYS AFTER SIGHT FOR FULL INVOICE V ALUE DRAWN ON USPARTIAL SHIPMENT: NOT ALLOWEDTRANSHIPMENT: ALLOWEDPORT OF LOADING: SHANGHAIPORT OF DISCHARGE: LONDONLATEST SHIPMENT DA TE: 2008.10.15DESCRIPTION OF GOODS: WOOLLEN BLANKETS, CIF LONDONART. NO. H666 600PCS @USD15.50/PC USD9300.00ART. NO.HX88 600PCS @USD16.30/PC USD9780.00ART. NO. HE21 720PCS @USD18.00/PC USD12960.00TOTAL: 1920PCS USD32040.00AS PER CONTRACT NO.SH2008X806DOCUMENTS REQUIRED:*SIGNED COMMERCIAL INVOICE IN TRIPLICATE*PACKING LIST IN TRIPLICATE*FULL SET OF CLEAN ON BOARD MARINE BILLS OF LADING MADE OUT TO ORDER MARKED FREIGHT PREPAID NOTIFY APPLICANT*GSP FORM A CERTIFYING THAT THE GOODS ARE OF CHINESE ORIGIN ISSUED BY COMPETENT AUTHORITIES*INSURANCE POLICY / CERTIFICATE COVERING ALL RISKS INCLUDING WAREHOUSE TO W AREHOUSE CLAUSE UP TO FINAL DESTINATION AT LONDON FOR AT LEAST 110 PCT OF CIF V ALUE AS PER INSTITUTE CARGO CLAUSE (A)*SHIPPING ADVICES MUST BE SENT TO APPLICANT WITHIN IMMEDIATEL Y AFTER SHIPMENT ADVISING THE INVOICE V ALUE, NUMBER OF PACKAGES, GROSS AND NET WEIGHT, VESSEL NAME, BILL OF LADING NO. AND DATE, CONTRACT NO. SHOWING SHIPPING MARK AS:EASTERN2008X826LONDONNO.1-80PRESENTATION PERIOD: 10 DAYS AFTER ISSUANCE DATE OF SHIPPING DOCUMENTS BUT WITHIN THE V ALIDITY OF THE CREDITCONFIRMATION: WITHOUTINSTRUCTIONS: THIS CREDIT IS SUBJECT TO UNIFORM CUSTOMS A PRACTICE FOR DOCUMENTARY CREDIT ICC NO.600.THE NEGOTIATION BANK MUST FORWARD THE DRAFTS AND ALL DOCUMENTS BY REGISTERED AIRMAIL DIRECT TO US IN TWO CONSECUTIVE LOTS. UPON RECEIPT OF THE DRAFTS AND DOCUMENTS IN ORDER, WE WILL REMIT THE PROCEEDS AS INSTRUCTED BY THE NEGOTIATING BANK.经审核,信用证存在以下问题:1.合同规定信用证有效期为装运日后15天,即2008年10月30日,而信用证为2008年10月20日;2.根据合同信用证的到期地点不应在英国,而应在中国。

根据合同审核信用证【范本模板】

习题二:信用证审核一、思考题:1。

何谓信用证?简述其一般流程。

2.信用证方式的基本当事人有哪些?在什么情况下,又可能有什么当事人?各当事人分别承担什么责任?3。

信用证方式的主要特点是什么?4。

何谓“议付”?“议付”与“付款”有什么区别?二、操作题:1.练习目的:学会阅读信用证2.练习要求:根据下面的信用证范例找出下列内容:(1)信用证的种类(2)信用证号码(3)开证日期(4)信用证的有效期(5)信用证的到期地点(6)开证申请人名称、地址(7)受益人名称、地址(8)开证行名称(9)信用证金额及货币单位(10)分批运输(11)转运(12)装运港(地)、目的港(地)(13)最迟装运期(14)货名及规格(15)价格术语(16)交单期限(17)信用证要求的单据(18)信用证特别条款信用证范例:JUNE 5,2003 14:35:46 LOGICAL TERMINAL HN03MT S700 ISSUE OF A DOCUMENTARY CREDIT PAGE 00001FUNC HNHQP786MSGACK DWS6789 AUTH OK,KEY B003060267DE43AF,ICBKCNBJ BFDC***RECORDBASIC HEADER F01 ICBKCNBJ A367 0675 780609 APPLICATION HEADER O700 2851 030605 BFDCIE2DAXXX 5439 447618 020605 1806N* BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)USER HEADER SERVICE CODE 103BANK PRIORITY 113MSG USER REF。

108INFO. FROM CI 115TO:INDUSTRIAL AND COMMERCIAL BANK OF CHINA ZHEJIANG,CHINA(ICBKCNZJYYY)SEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT *40A :IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 : AF/651909DATE OF ISSUE 31C : 20030605EXPIRY *31D :DATE 20030810 PLACE CHINAAPPLICANT *50 :A AND D SARUE DU CHEMIN VERTCENTRE DE GROS NO。

信用证审核_根据合同答案

*31 D :DATE 20000815 PLACE OSAKA

COVERING ALL RISKS WAR RISK FOR 140 PERCENT OF INVOICE VALUE SUBJECT TO C.I.C.DATED 1/1/1981 4. CERTIFICATE OF INSPECTION ISSUED BY THE APPLICANT 5. PACKING LISTS IN DUPLICATE.

OSAKA, JAPAN

CORPORATION.

BLANK

UE SUBJECT

TRAILER : ORDER IS <MAC:> <PAC:> <ENC:> <CHK:> <TNG:> <PDE:> MAC: 3CDFF74 5 6 7 8 9 10

信用证到期地点错误, 信用证到期地点错误 建议改为在受益人国内到期 开证申请人名称有误,应为 开证申请人名称有误,应为ITOCHU 付款期限错误, 付款期限错误,应为见票即付的汇票 转运应为允许 目的港错误,应为 目的港错误,应为OSAKA TWD003 单价有误 运费到付改为运费已付 保险加成率改为110% 保险加成率改为 客检条款删除 商品名称描述错误,应为TOY 商品名称描述错误, 应为

信用证审核情况一:根据正确的合同,审核信用证 习题二

请根据简式合同的条款(见合同2),审核下页的信用证,列举信用证存在的问题 并提出修改意见。(请将修改意见列明在信用证的下方)

KYOWA ASITAMA BANK, LTD.

FORM OF DOC, CREDIT DOC, CREDIT NUMBER DATE OF ISSUE EXIPRY APPLICANT BENEFICIARY *40 *20 *31 C *50 *59 : IRREVOCABLE : LC-410-392216 20000610 : ITOCHN CORPORATION, OSAKA SECTION 3-3-1, BUZENDA-CHO, SHIMONOSEKI, OSAKA, JAPAN : SHANGHAI TEXTILES IMP AND EXP CORPORATION. 27 ZHONGSHAN ROAD E, 1. SHANGHAI, CHINA AMOUNT AVAILABLE WITH/BY DRAFTS AT ... *32 B : CURRENCY USD AMOUNT 17040.00 *41 D : ANY BANK BY NEGOTIATION *42 C : DRAFTS AT 30 DAYS SIGHT FOR FULL INVOICE VALUE DRAWEE *42 A : OPENING BANK PARTIAL SHIPMENTS *43 P : PERMITTED TRANSSHIPMENT *43 T : PROHIBITED LOADING IN CHARGE *44 A : SHIPMENT FROM CHINESE PORT(S) FOR TRANSPORT TO ... *44 B : TO KOBE, JAPAN LATEST DATE OF SHIP. *44 C :20000730 DESCRIPT. OF GOODS *45 A : 1800 PIECES OF CHINESE YOY PRODUCTS ART NO. QUANTITY UNIT PRICE TWD001 1000 10.08 TWD003 800 8.90 PRICE TERMCIF OSAKA : DOCUMENTS REQUIRED *46 A : 1. COMMERCIAL INVOICE IN TRIPLICATE. 2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER MARKED FREIGHT TO BE COLLECTED AND NOTIFY APPLICANT 3. INSURANCE POLICY OR CERTIFICATE IN DUPLICATE ENDORSED IN BLANK

2023根据外销标准合同审核信用证

根据外销合同审核信用证一、背景介绍外贸交易中,信用证是一种常用的支付方式。

出口商在与买家签订外销合同后,可以要求买家开立信用证作为支付保障。

然而,信用证的审核却是一个复杂而且关键的过程。

本文将介绍如何根据外销合同审核信用证,以确保交易的顺利进行。

二、外销合同审核信用证的重要性审核信用证是出口商在外贸交易过程中的重要一环。

通过审核信用证,出口商可以确保买方的支付能力,并从银行获得相应的付款保障。

同时,审核信用证也可以防止买方在支付过程中的不履约行为,保护出口商的权益。

因此,外销合同审核信用证是一个既需要注意细节又需要审慎处理的过程。

三、外销合同审核信用证的步骤1. 熟悉信用证的基本条款在审核信用证之前,出口商应该先熟悉信用证的基本条款。

这些条款包括信用证的有效期、付款方式、装运地点和文件要求等内容。

出口商需要确保信用证的条款与外销合同中的条款相符,以避免后续纠纷。

2. 检查信用证的合规性审核信用证的第一步是检查信用证的合规性。

出口商应该仔细审查信用证的文本,确保它符合国际贸易的规则和标准,如UCP600等。

出口商还需要检查信用证中的金额、货物描述等信息是否与外销合同一致。

3. 确认货物装运细节审核信用证的下一步是确认货物的装运细节。

出口商需要核实信用证中所要求的货物数量、质量要求以及装运日期等信息是否与外销合同一致。

如果有任何差异,出口商需要与买方进行协商,以确保双方达成一致。

4. 检查付款条件审核信用证的另一个重要方面是检查付款条件。

出口商应该确认信用证中规定的付款方式、付款期限以及付款金额等是否符合外销合同的约定。

如果有任何问题或疑虑,出口商可以与买方进行沟通并协商修改信用证的付款条件。

5. 确认文件要求外销合同通常规定了出口商需要向买方提供的文件,如发票、装箱单和提单等。

出口商在审核信用证时,需要核对信用证中所要求的文件清单,确保自己能够按时提供符合要求的文件。

如果有任何不清楚的地方,出口商可以与买方进行确认。

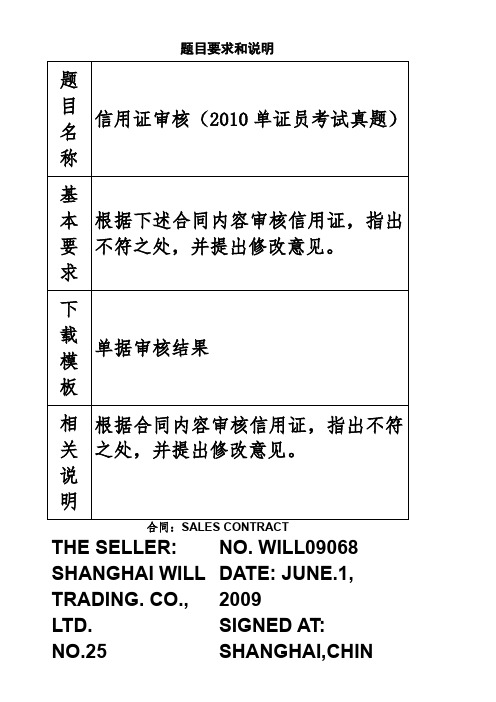

根据合同内容审核信用证(单证员考试国际商务单证缮制与操作试题)

题目要求和说明合同:SALES CONTRACTTHE SELLER:SHANGHAI WILL TRADING. CO., LTD. JIANGNING ROAD, SHANGHAI, CHINA NO. WILL09068DATE: , 2009SIGNED AT: SHANGHAI,CHINATHE BUYER:NU BONNETERIE DE GROOTE.AUTOSTRADEWEG 6 9090 MEUE BELGIUMThis Sales Contract is made by and between the Sellers and the Buyers, whereby the sellers agree to sell and the Buyers agree to buy the under-mentioned goods according to the terms and conditions stipulated below:Packing: IN CARTONS OF 50 PCS EACHTime of Shipment: DURING AUG. 2009 BY SEAShipping Mark: AT SELLER’S OPTIONLoaDing Port and Destination: FROM SHANGHAI, CHINA TO ANTWERP, BELGIUMPartial Shipment and Transshipment: ARE ALLOWEDInsurance: TO BE EFFECTED BY THE SELLER FOR 110 PCT OF INVOICE VALUE AGAINST ALL RISKS AND WAR RISK AS PER CIC OF THE PICC DATED01/01/1981.Terms of Payment: THE BUYER SHALL OPEN THROUGH A BANK ACCEPTABLE TO THE SELLER ANIRREVOCABLE SIGHT LETTER OF CREDIT TO REACH THE SELLER 30 DAYS BEFORETHE MONTH OF SHIPMENT AND TO REMAIN VALID FOR NEGOTIATION IN CHINA UNTILTHE 15th DAY AFTER THE FORESAID TIME OF SHIPMENT.SELLER BUYERSHANGHAI WILL TRADING CO., LTD NU BONNETERIE DE GROOTE张平LJSKOUT59: BENEFICIARY:SHANGHAI WILL IMPORT AND EXPORT CO., LTDJIANGNING ROAD, SHANGHAI, CHINA32B: AMOUNT:CURRENCY USD AMOUNT 1941A: AVAILABLE WITH…BY BY ANY BANK IN CHINA BY NEGOTIATION42C: DRAFTS AT30 DAYS AFTER SIGHT42A: DRAWEE :NU BONNETERIE DE GROOTE.43P: PARTIAL SHIPMTS:NOT ALLOWED43T: TRANSSHIPMENT:ALLOWED44E: PORT OF LOADING:ANY CHINESE PORT44F: PORT OF DISCHARGE :ANTWERP, BELGIUM44C: LATEST DATE OF SHIPMENT:09081545A: DESCRIPTION OF GOODS:+ 3000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT PCAS PER ORDER D0900326 AND SALES CONTRACT NUMBERWILL09068.+ 5000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT PCAS PER ORDER D0900327 AND SALES CONTRACT NUMBERWILL09069.SALES CONDITIONS: CFR ANTWERPPACKING: 50PCS/CTN46A:DOCUMENTS REQUIRED: 1. SIGNED COMMERCIAL INVOICES IN 4 ORGINAL AND 4 COPIES2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OFORDER, BLANK ENDORSED, MARKED FREIGHT COLLECT NOTIFY THEAPPLICANT3. CERTIFICATE OF ORIGIN.4. PACKING LIST IN QUADRUPLICATE STATING CONTENTS OF EACHSEPARARTELY.单据审核结果。

根据销售合同写信用证

致:[开证银行名称]日期:[信用证开证日期]编号:[信用证编号]以下为根据销售合同[销售合同编号]所申请的信用证详细内容,请予以审核并开立:一、信用证类型及条款1. 信用证类型:不可撤销、保兑信用证(Irrevocable and Confirmed Letter of Credit)2. 信用证有效期:[装运期限]后15天,在中国到期3. 信用证金额:[合同总价]美元4. 受益人:[卖方全称]- 地址:[卖方地址]- 国家:[卖方国家]5. 通知行:[通知行名称]- 地址:[通知行地址]- 国家:[通知行国家]6. 议付行:[议付行名称]- 地址:[议付行地址]- 国家:[议付行国家]7. 信用证性质:可转让、可分割信用证(Transferable and Divisible Letterof Credit)8. 分运及转运:允许分运及转运二、信用证条款1. 货物描述:[合同中详细货物描述,包括货号、品名及规格、数量、单价等]2. 装运期限:[合同中规定的装运期限]3. 装运口岸:[合同中规定的装运口岸]4. 目的口岸:[合同中规定的目的口岸]5. 保险:由卖方按发票全额110%投保至[目的口岸]为止的险种6. 单据要求:- 正本发票一份- 提单一份,注明“运费已付”或“运费预付”- 装箱单一份- 检验证书一份- 产地证明一份- 发货通知一份- 信用证项下其他单据7. 付款条件:即期付款8. 争议解决:任何争议应通过友好协商解决;如协商不成,提交[仲裁机构名称]仲裁三、其他特殊要求1. 信用证中必须注明允许分运及转运。

2. 信用证中必须注明受益人有权在信用证到期前要求提前议付。

3. 信用证中必须注明所有单据需加盖受益人公章。

四、申请理由本信用证是根据与[买方全称]签订的[销售合同编号]销售合同所申请。

为确保合同顺利履行,保障双方权益,特申请开立本信用证。

五、承诺我方承诺,在信用证有效期内,按照信用证条款要求,及时、准确地向贵行提交符合信用证要求的单据,并承担因单据不符合信用证条款而产生的所有责任。

根据合同内容审核信用证(2010年单证员考试国际商务单证缮制与操作试题)

题目要求和说明THE SELLER: SHANGHAI WILL TRADING. CO., LTD.NO.25 NO. WILL09068 DATE: JUNE.1, 2009SIGNED AT: SHANGHAI,CHINAJIANGNINGROAD,SHANGHAI,CHINATHE BUYER:NU BONNETERIE DE GROOTE. AUTOSTRADEWEG 6 9090 MEUE BELGIUMThis Sales Contract is made by and between the Sellers and the Buyers, whereby the sellers agree to sell and the Buyers agree to buy theunder-mentioned goods according to the terms and conditionsPacking: IN CARTONS OF 50 PCS EACHTime of Shipment: DURING AUG. 2009 BY SEAShipping Mark: AT SELLER’S OPTIONLoaDing Port and Destination: FROM SHANGHAI, CHINA TO ANTWERP, BELGIUMPartial Shipment and Transshipment: ARE ALLOWED Insurance: TO BE EFFECTED BY THE SELLER FOR 110 PCT OF INVOICE VALUE AGAINST ALL RISKS AND WAR RISK AS PER CIC OF THE PICC DATED01/01/1981.Terms of Payment: THE BUYERSHALL OPENTHROUGH ABANKACCEPTABLETO THE SELLERANIRREVOCABLESIGHT LETTEROF CREDIT TOREACH THESELLER 30 DAYSBEFORE THEMONTH OFSHIPMENT ANDTO REMAINVALID FORNEGOTIATION INCHINA UNTILTHE 15th DAYAFTER THEFORESAID TIMEOF SHIPMENT.SELLER BUYER SHANGHAI WILL TRADING CO., LTD NU BONNETERIE DE GROOTE张平ISSUE:40E:APPLICABLERULES:UCP LATEST VERSION31D: DATE AND PLACE OF EXPIRY:DATE 090910 PLACE IN BELGIUM51D: APPLICANT BANK: ING BELGIUM NV/SV(FORMERLY BANKBRUSSELS LAMBERT SA), GENT50: APPLICANT:NU BONNETERIE DE GROOTE AUTOSTRADEWEG 69090 MELLE BELGIUM59: BENEFICIARY:SHANGHAI WILL IMPORT AND EXPORT CO., LTD NO.25 JIANGNING ROAD, SHANGHAI, CHINA32B: AMOUNT:CURRENCY USDAMOUNT 19 500.0041A: AVAILABLE BY ANY BANK IN CHINA BY NEGOTIATIONWITH…BY42C: DRAFTSAT30 DAYS AFTER SIGHT42A: DRAWEE :NU BONNETERIE DE GROOTE.43P: PARTIALSHIPMTS:NOT ALLOWED43T:TRANSSHIPMENT:ALLOWED44E: PORT OFLOADING:ANY CHINESE PORT44F: PORT OFDISCHARGE :ANTWERP, BELGIUM44C: LATESTDATE OFSHIPMENT:09081545A: DESCRIPTION OF GOODS:+ 3000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT EUR10.50/PC AS PER ORDER D0900326 AND SALES CONTRACT NUMBERWILL09068.+ 5000 PCS SHORT TROUSERS – 100PCT COTTON TWILL AT EUR12.00/PC AS PER ORDER D0900327 AND SALES CONTRACT NUMBER WILL09069.SALES CONDITIONS: CFR ANTWERP PACKING: 50PCS/CTN46A:DOCUMEN TS REQUIRED:1. SIGNED COMMERCIAL INVOICES IN 4 ORGINAL AND 4 COPIES2. FULL SET OF CLEANOF LADING, MADE OUT TO ORDER, BLANK ENDORSED, MARKED FREIGHT COLLECT NOTIFY THE APPLICANT 3. CERTIFICATE OF ORIGIN.4. PACKING LIST IN QUADRUPLICATE STATING CONTENTS OF EACH PACKAGE SEPARARTELY.5.INSURANCEPOLICY/CERTIFICATE ISSUED IN DUPLICATE IN NEGOTIABLE FORM, COVERING ALL RISKS, FROM WAREHOUSE TO WAREHOUSE FOR 120 PCT OF INVOICE VALUE. INSURANCEPOLICY/CERTIFICATE MUST CLEARLY STATE IN THE BODY CLAIMS, IF ANY, ARE PAYABLE IN BELGIUM IRRESPECTIVE OF PERCENTAGE47A:ADDITION AL CONDITIONS:1/ ALL DOCUMENTS PRESENTED UNDER THIS LC MUST BE ISSUED IN ENGLISH.单据审核结果。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

习题二:信用证审核一、思考题:1.何谓信用证?简述其一般流程。

2.信用证方式的基本当事人有哪些?在什么情况下,又可能有什么当事人?各当事人分别承担什么责任?3.信用证方式的主要特点是什么?4.何谓“议付”?“议付”与“付款”有什么区别?二、操作题:1.练习目的:学会阅读信用证2.练习要求:根据下面的信用证范例找出下列内容:(1)信用证的种类(2)信用证号码(3)开证日期(4)信用证的有效期(5)信用证的到期地点(6)开证申请人名称、地址(7)受益人名称、地址(8)开证行名称(9)信用证金额及货币单位(10)分批运输(11)转运(12)装运港(地)、目的港(地)(13)最迟装运期(14)货名及规格(15)价格术语(16)交单期限(17)信用证要求的单据(18)信用证特别条款信用证范例:JUNE 5,2003 14:35:46 LOGICAL TERMINAL HN03MT S700 ISSUE OF A DOCUMENTARY CREDIT PAGE 00001FUNC HNHQP786MSGACK DWS6789 AUTH OK,KEY B003060267DE43AF,ICBKCNBJ BFDC***RECORDBASIC HEADER F01 ICBKCNBJ A367 0675 780609 APPLICATION HEADER O700 2851 030605 BFDCIE2DAXXX 5439 447618 020605 1806N* BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)USER HEADER SERVICE CODE 103BANK PRIORITY 113MSG USER REF. 108INFO. FROM CI 115TO:INDUSTRIAL AND COMMERCIAL BANK OF CHINA ZHEJIANG,CHINA(ICBKCNZJYYY)SEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT *40A : IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 : AF/651909DATE OF ISSUE 31C : 20030605EXPIRY *31D :DATE 20030810 PLACE CHINAAPPLICANT *50 : A AND D SARUE DU CHEMIN VERTCENTRE DE GROS NO.102AS0678 LESQUIN CEDEX FRANCEBENEFICIARY *59 : ZHEJIANGMACHINERY IMPORT& EXPORTCORPORATION,350 WENHUI ROAD,HANGZHOU,ZHEJIANG, CHINAAMOUNT *32B : CURRENCY USD AMOUNT 17600.00AVAILABLE WITH *41D : ANY BANKBY NEGOTIATION DRAFTS AT … 42C : SIGHTDRAWEE 42D : BFDCIE2DAXXX*BANQUE FRANCAISE DU COMMERCE EXTERIEUR* PARIS*(HEAD OFFICE)PARTIAL SHIPMENTS 43P : NOT ALLOWED TRANSHIPMENT 43T : ALLOWED:LOADING IN CHARGE 44A :SHANGHAI CHINAFOR TRANSPORTATION TO 44B :ANTWERPLATEST DATE OF SHIPMENT 44C : 20030725DESCRIPTION OF GOODS 45A :PARTS QTY. UNIT PRICELA1 500PCS @USD10.20 USD5100.00LA2 1000PCS @USD12.50 USD12500.00TOTAL USD 17600.00AS PER PROFORMA NR ZIEG/D003021 DATED 12/05/2003 AND ORDER NBER 03-758FREE ON BOARD SHANGHAIDOCUMENTS REQUIRED 46A :+COMMERCIAL INVOICE IN 03 ORIGINAL(S) AND 00 COPIES+PACKING LIST AND WEIGHT NOTE IN 03 ORIGINAL(S) AND 00 COPIES+3/3 ORIGINAL CLEAN ON BOARD OCEAN BILL OF LADING PLUS MORE 2 COPIES, ISSUED TO ORDER OF A AND D SA, RUE DU CHEMIN VERT,CENTRE DE GROS NO.102, AS0678 LESQUIN CEDEX FRANCE AND MARKED ” FREIGHT COLLECT ” AND NOTIFY DUBOIS SA ZONE INDUSTRIELLE DU PORT FLUVIAL 3749 TOURNAI BEIGIUM+CERTIFICATE GSP FORM A 1 ORIGINAL AND 1 COPY. ADDITIONAL CONDITIONS 47A:+ALL CHARGES OF BANKS OTHER THAN OUR OWN CHARGES ARE TO BE BORNE BY BENEFICIARY+QUANTITY AND VALUE MORE OR LESS 5 PERCENT ACCEPTABLE.+SHIPPING MARKS AS STATED ON THE RELEVANT SALES CONFIRMATION(S) OR PROFORMA INVOICE(S).+THIS CREDIT IS SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (1993 REVISION) INTERNATIONAL CHAMBER OF COMMERCE, PUBLICATION NUMBER 500.PRESENTATION PERIOD 48 : DOCUMENTS MUST BE PRESENTEDWITHIN 15 DAYS AFTER THE DATEOF SHIPMENT,BUT NOT LATERTHAN THE EXPIRY DATE OFCREDIT.CONFIRMATION * 49 : WITHOUTINSTRUCTIONS 78:+ WE WILL CREDIT NEGOCIATING BANK AT ITS BEST CONVENIENCE AFTER RECEIPT AT OUR COUNTERS OF DOCUMENTS ISSUED IN STRICT COMPLIANCE WITH TERMS OF ISSUED L/C. PLEASE FORWARD US DOCUMENTS VIA ANY COURRIER SERVICE. KINDLY ACKNOWLEDGE RECEIPT OF THIS L/C QUOTING YOUR REF.SEND TO RECO INFO. 72 : KINDLY ACKNOWLEDGE RECEIPTTHIS CREDIT BY RETURN SWIFT WILLBE MUCH APPRECIATEDTRAILER : MAC 6B32791ACHK:C7C590AF567A其他参考资料:发票号码: ZJIXM0135 发票日期: 2003年7月15日提单号码: WL-5307 提单日期: 2003年7月20日船名: KAMAN V.151 装运港: 上海集装箱号: GESU5637586(40’) 货物装箱情况: 25PCS/CTN毛重: @ 50KGS/CTN 净重: @48KGS/CTN 体积: @ 0.216CBM/CTN一、根据合同审核信用证(一)合同上海远大进出口公司SHANGHAI YUANDA IMPORT & EXPORT COMPANY上海市溧阳路1088号龙邸大厦16楼16TH FLOOR, DRAGON MANSION, 1088 LIYANG ROAD ,SHANGHAI200081 CHINASALES CONTRACTNO.: YD-MDSC9811 DA TE: 2007/11/8BUYERS: MAURICIO DEPORTS INTERNA TIONAL S.A. ADDRESS: RM 1008-1011 CONVENTION PLAZA,101 HARBOR ROAD, COLON, R.P.TEL.: FAX:THE UNDERSIGNED SELLERS AND BUYERS HA VE AGREED TO CLOSE THE FOLLOWING TRANSACTION ACCORDING TO THEQUANTITY AT THE SELLER’S OPTION.PACKING: 50KGS TO ONE GUNNY BAG. TOTAL 40000BAGS. SHIPMENT: TO BE EFFECTED DURING DEC.2007 FROM SHANGHAI, CHINA TO COLON,R.P. ALLOWING PARTIAL SHIPMENTS AND TRANSHIPMENT.INSURANCE: TO BE COVERED FOR 110% OF INVOICE V ALUE AGAINST ALL RISKS AS PER AND SUBJECT TO OCEAN MARINE CARGO CLAUSES OF PICC DA TED 1/1/1981.PAYMENT: THE BUYERS SHALL OPEN THROUGH A FIRST-CLASSBANK ACCEPTABLE TO THE SELLER AN IRREVOCABLE L/C AT 30DAYS AFTER B/L DATE TO REACH THE SELLER NOV .25,2007 ANDV ALID FOR NEGOTIATION IN CHINA UNTIL THE 15TH DAY AFTERTHE DATE OF SHIPMENT.SELLERS SHANGHAI YUANDA IMPORT &EXPORT COMPANY 赵国斌BUYER: MAURICIO DEPORTS INTERNATIONAL S.A. D.H.HONENEY请指出信用证中存在的问题:模拟练习:根据合同审核信用证(一)售货确认书售货确认书SALES CONFIRMATIONNO.LT07060DATE: AUG.10, 2005The sellers: AAA IMPORT AND EXPORT CO. The buyer: BBB TRADING CO.222 JIANGUO ROAD P.O.BOX 203DALIAN, CHINA GDANSK, POLAND下列签字双方同意按以下条款达成交易:The undersigned Sellers and Buyers have agreed to close the following总值TOTAL VALUE: U.S. DOLLARS FORTY FIVE THOUSAND ANDSIX HUNDRED ONL Y.装运口岸PORT OF LOADING: DALIAN目的地DESTINA TION: GDANSK转运TRANSSHIPMENT: ALLOWED分批装运PARTIAL SHIPMENTS: ALLOWED装运期限SHIPMENT: DECEMBER, 2005保险INSURANCE: BE EFFECTED BY THE SELLERS FOR 110%INVOICE V ALUE COVERING F.P.A. RISKS OFPICC CLAUSE付款方式PAYMENT: BY TRANSFERABLE CONFIRMED L/CPAY ABLE 60 DAYS AFTER B/L DA TE,REACHING THE SELLERS 45 DAYS BEFORETHE SHIPMENT一般条款GENERAL TERMS:1. 合理差异: 质地、重量、尺寸、花形、颜色均允许合理差异,对合理范围内查里提出的索赔,概不受理。