罗斯公司理财第二章财务报表和现金流量

公司理财精要版(罗斯第9版)2财务报表、税和现金流量.pptx

2-18

2.3 税

➢ 关于税,我们唯一可以肯定的是,税法总是在 变动的。

➢ 边际税率与平均税率 ➢ 边际税率——多赚的下一美元中,将以税支 付出去的百分比; ➢ 平均税率——应纳税额 / 应税所得。

➢ 其他税

36

-71 238

6

42 2-24

美国联合公司财务现金流量

企业现金流量 经营性现金流量

(息税前利润 加折旧减税) 资本性支出 (取得的固定资产 减出售的资产资产) 净营运资本的增加

合计

企业流向投资者的现金流量 负债

(利息加到期本金 减长期债务融资) 权益 (股利加股票回购 减新增权益融资)

合计

238

2-19

边际税率与平均税率

➢ 假定你公司的应税所得为400万美元

➢ 公司的应付税额为多少? ➢ 平均税率是多少? ➢ 边际税率是多少?

➢ 假定你正在考虑某个能为公司增加应税所 得100万美元的项目,在分析中,你应当使 用哪个税率?

2-20

净营运资本(NWC)

➢ 净营运资本 = 流动资产 – 流动负债 ➢ 净营运资本通常随公司的增长而增长

(息税前利润 加折旧减税) 资本性支出 (取得的固定资产 减出售的资产资产) 净营运资本的增加

合计

企业流向投资者的现金流量 负债

(利息加到期本金 减长期债务融资) 权益 (股利加股票回购 减新增权益融资)

合计

238 -173

-23 42 36

6

对股东的现金流量 股利 股票回购

流向股东的现金 来自新股发行的现金 合计

2-15

公认会计准则(GAAP)

公司理财-罗斯(完整版)

$F

支付给债权人 $F 企业价值 (X)

如果企业的价值大于$F, 股东的索 偿权是: Max[0,$X – $F] = $X – $F 债权人的索偿权是: Min[$F,$X] = $F. 两者之和 = $X

承诺支付给债权人的金额$F。

1.2 企业的三种基本法律形式

• 个体业主制 • 合伙制

– 一般合伙制 – 有限合伙制

企业和金融市场

企业

投资于资产 (B) 流动资产 固定资产 企业发行证券 (A)

金融市场

现金流量留存 (E)

短期负债

企业创造 现金流量(C) 税收 (D) 支付股利和 偿付债务 (F) 长期负债 股东权益

最终,企业必须创造现金 流量。

政府

企业创造的现金流量必须 超过从金融市场筹集的现 金流量。

企业和金融市场

法律责任(Liability) 存续期(Continuity)

有限责任 无限存续期

税收(Taxation)

对股东双重征税(公司所得 税和个人所得税)

个人所得税

资金筹集

易于筹集资金

难于筹集资金

1.2 公司制企业

1.2.3 公司制

对于解决所面临的筹集大规模资金的问题来说,公司制是一种标准 的方式。

1.3 公司制企业的目标

1.1.3 财务经理的职责

财务经理通过资本预算、融资和资产流动性管理为公司创造价值。

公司必须通过购买资产创造超过其成本的现金(因此,公司创造的 现金流量必须大于它所使用的现金流量)。 公司必须通过发行债券、股票和其他金融工具产生超过其成本的现 金(因此,公司支付给债权人和股东的现金流量必须大于债权人和股东 投入公司的现金流量)。

用数学公式表示,债权人的索偿 权是:Min[$F,$X]

罗斯《公司理财》笔记整理

第一章导论1. 公司目标:为所有者创建价值,公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财能够看做对一下几个问题进行研究:1. 资本估量:公司应当投资什么样的长久财富。

2. 资本构造:公司怎样筹集所需要的资本。

3. 净营运资本管理:怎样管理短期经营活动产生的现金流。

4. 公司制度的长处:有限责任,易于转让所有权,永续经营。

弊端:公司税对股东的两重课税。

第二章会计报表与现金流量财富= 欠债+ 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润)= 净销售额-产品成本-折旧EBITDA = EBIT + 折旧及摊销现金流量总数CF(A) = 经营性现金流量-资天性支出-净营运资本增添额= CF(B) + CF(S)经营性现金流量OCF = 息税前利润+ 折旧-税资天性输出= 固定财富增添额+ 折旧净营运资本= 流动财富-流动欠债第三章财务报表剖析与财务模型1. 短期偿债能力指标(流动性指标)流动比率= 流动财富/流动欠债(一般状况大于一)速动比率= (流动财富-存货)/流动欠债(酸性实验比率)现金比率= 现金/流动欠债流动性比率是短期债权人关怀的,越高越好;但对公司而言,高流动性比率意味着流动性好,或许现金等短期财富运用效率低下。

关于一家拥有强盛借钱能力的公司,看似较低的流动性比率可能并不是坏的信号2. 长久偿债能力指标(财务杠杆指标)欠债比率= (总财富-总权益)/总财富or (长久欠债+ 流动欠债)/总财富权益乘数= 总财富/总权益= 1 + 欠债权益比利息倍数= EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 财富管理或资本周转指标存货周转率= 产品销售成本/存货存货周转天数= 365天/存货周转率应收账款周转率= (赊)销售额/应收账款总财富周转率= 销售额/总财富= 1/资本密集度4. 盈余性指标销售利润率= 净利润/销售额财富利润率ROA = 净利润/总财富权益利润率ROE = 净利润/总权益5. 市场价值胸怀指标市盈率= 每股价钱/每股利润EPS此中EPS = 净利润/刊行股票数市值面值比= 每股市场价值/每股账面价值公司价值EV = 公司市值+ 有息欠债市值-现金EV乘数= EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总财富周转率(财富运用效率)x权益乘数(财杠)ROA = 销售利润率x总财富周转率7. 销售百分比法假定项目随销售额改动而成比率改动,目的在于提出一个生成展望财务报表的迅速适用方法。

《公司理财》考研罗斯版讲义考研复习笔记

《公司理财》考研罗斯版讲义考研复习笔记第一部分教材精讲第一篇价值本书第一篇介绍公司理财的基础知识,一共包括3章。

第1章“公司理财导论”主要介绍公司理财中的基本概念;第2章“会计报表与现金流量”主要介绍公司主要财务报表和现金流量,前者是公司财务行为的结果和进行财务分析的基础,现金流量则是公司理财的核心和企业价值所在;第3章“财务报表分析与财务模型”主要介绍各种财务报表分析的方法和财务规划中采用的主要模型。

这3章共同构成公司理财课程的基础,也向同学们传递了公司理财的基本理念,就是价值分析,而价值分析的基础则是公司的财务报表和现金流。

第1章公司理财导论1.1 本章要点本章介绍公司理财课程中涉及的基本概念,包括公司理财的主要内容、公司理财的目标以及对公司或企业的界定。

本章还会提出公司理财的一个重要观点:现金至上。

此外,为了实现两权分离状态下对股东利益的保护,有必要探讨公司的代理问题和控制权结构,以及解决代理问题的一些手段,比如法律等。

本章各部分要点如下:1.什么是公司理财所谓公司理财就是公司的投资和融资行为,这些行为的目的是为投资者创造价值。

公司的财务行为可以反映在财务报表中,事实上,从资产负债表就可以看到公司的资金运用(投资)和资金来源(融资)。

由于投融资的重要性,公司的财务经理具有重要作用。

2.企业组织要学习公司理财,首先要了解什么是公司或企业。

从法律角度,企业有三种组织形式,个人独资企业、合伙企业和公司制企业。

这三种企业在融资方面的情况各不相同。

3.现金流的重要性“现金至上”是公司理财的基本理念。

财务经理最重要的工作在于通过开展资本预算、融资和净营运资本活动为公司创造价值,也就是公司创造的现金流必须超过它所使用的现金流。

同学们需要理解公司财务活动与金融市场之间的现金流动。

4.公司理财的目标公司理财的目标是最大化现有所有者权益的市场价值。

但是由于现实中企业的复杂性,这一目标的实现还存在很多的约束。

5.代理问题与控制权现代企业很多采用股份公司的形式,这类公司的股东所有权和经营权之间存在两权分离,因此会导致股东和经理人之间的代理问题。

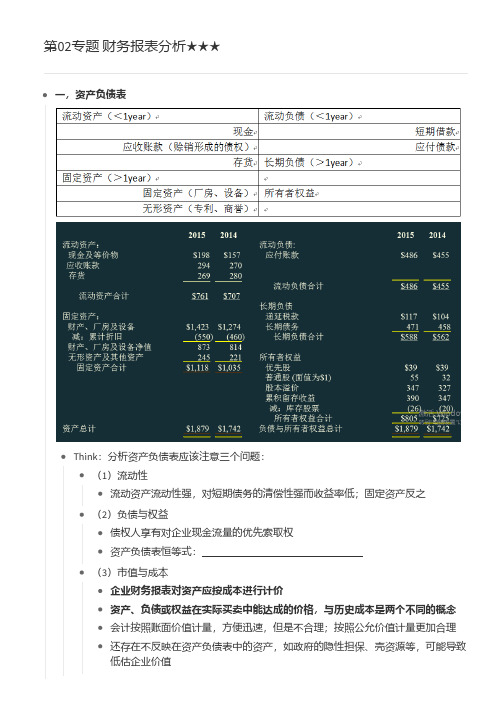

《公司理财》罗斯 第02专题 财务报表分析

Think:分析资产负债表应该注意三个问题:

(1)流动性

流动资产流动性强,对短期债务的清偿性强而收益率低;固定资产反之(2)负债与权益

债权人享有对企业现金流量的优先索取权

资产负债表恒等式:

(1)结构分析(以上结构需要背诵)

利润表的经营活动部分列示公司主要业务创造的收入和发生的费用

一般要求流动比率至少要达到1,流动比率>1时,NWC>0 2.长期偿债能力比率(财务杠杆比率)

(1)还本能力

(2)付息能力

营运能力指标(资产管理周转指标)

【补充】总资产周转率的倒数,被称为资本密集度4.盈利性指标

5.市场价值度量指标

市盈率P/E,市值面值比(市净率)P/B。

罗斯《公司理财》读书笔记

1.5 金融市场

1.5.1 一级市场:首次发行 1.5.2 二级市场:拍卖市场和经销商市场 1.5.3 上市公司股票的交易 1.5.4 挂牌交易

第二章 会计报表和现金流量

重点介绍现金流量的实务问题。

2.1 资产负债表

资产 ≡ 负债 + 股东权益 股东权益 ≡ 资产-负债

股东权益被定义为企业资产与负债之差,原则上,权益是指股东在企业清偿债务以后所拥有的剩余权 益。

1.3 公司制企业

1.3.1 个体业主制 1.3.2 合伙制 1.3.3 公司制

有限责任、产权易于转让和永续经营是其主要优点。

1.4 公司制企业的目标

系列契约理论:公司制企业力图通过采取行动提高现有公司股票的价值以使股东财富最大化。 1.4.1 代理成本和系列契约理论的观点 代理成本:股东的监督成本和实施控制的成本 1.4.2 管理者的目标

公司的价值其实就是未来每期净现金流现值的加总。

净现值=现值-成本

第五章 债券和股票的定价

5.1 债券的定义和例子

债券是借款者承担某一确定金额债务的凭证。为了支付该笔款项,借款者同意在标明的日期支付利息和本 金。

5.2 如何对债券定价

债券的价格仅仅是债券现金流的现值。 5.2.1 纯贴现债券

最简单的一种债券,这种债券承诺在未来某一确定的日期作某一单笔支付。

销售净利润率

=

净利润 总销Βιβλιοθήκη 收入销售总利润率=

息前税前利润 总销售收入

资产净收益率= 净利润 平均总资产

资产总收益率

=

息前税前利润 平均总资产

资产收益率(ROA)=销售利润率 × 资产周转率

4

企业可以通过提高销售利润率或资产周转率来增大 ROA。然而,由于竞争的存在,企业很难同时做 到这两点,只能在二者中择一。

罗斯《公司理财》(第9版)配套题库【课后习题-会计报表与现金流量】

第2章会计报表与现金流量一、概念题1.资产负债表(balance sheet)答:资产负债表指反映企业某一特定日期财务状况的会计报表。

它是根据资产、负债和所有者权益之间的相互关系,按照一定的分类标准和一定的顺序,把企业一定日期的资产、负债和所有者权益各项目予以适当排列,并对日常会计核算工作中形成的大量数据进行高度浓缩整理后编制而成的。

资产负债表是企业最重要的对外报表之一,它能为投资者和企业管理当局提供有关企业的资源分布状况、债权人和股东对资产的要求权、企业的偿债能力和未来财务状况趋势等信息。

资产负债表的格式主要有账户式和垂直式两种,当前会计实务中采用较多的是账户式资产负债表。

账户式资产负债表分左右两方列示,左边列示企业的资产,右边列示负债和所有者权益,左右两方的合计数相等。

通常,资产负债表还提供期初数和期末数的比较资料。

2.损益表(income statement)答:损益表是指反映一个企业某一会计期间经营成果的会计报表,亦称“利润表”或“收益表”。

它把一定期间的收入与相关的费用进行配比,从而计算出企业一定期间的净利润(或净亏损)。

它反映企业生产经营的收入实现和成本耗费情况,表明企业的生产经营成果。

同时,通过该表提供不同时期的比较数字(如本月数、本年累计数、上年数),可以分析企业今后利润的发展趋势和获利能力。

损益表的结果可以分为多步式和单步式两种。

多步式损益表中的损益是通过多步配比而来的。

单步式损益表则是将本期所有的收入加在一起,然后将所有的费用加总在一起,通过一次配比求出本期损益。

3.现金流量(cash flow)答:现金流量是指某一段时期内企业现金流入和流出的数量。

如企业销售商品、提供劳务、出售固定资产、向银行借款等取得现金,形成企业的现金流入;购买原材料、接受劳务、购建固定资产、对外投资、偿还债务等而支付现金,形成企业的现金流出。

现金流量信息能够表明企业经营状况是否良好、资金是否紧缺、企业偿付能力大小,从而为投资者、债权人、企业管理者提供非常有用的信息。

罗斯公司理财第二章:财务报表和现金流

CHAPTER 2ACCOUNTING STATEMENTS, TAXES AND CASH FLOWAnswers to Concepts Review and Critical Thinking Questions1.Liquidity measures how quickly and easily an asset can be converted to cash without significant lossin value. It’s desirable for firms to have high liquidity so that they have a large factor of safety in meeting short-term creditor demands. However, since liquidity also has an opportunity cost associated with it - namely that higher returns can generally be found by investing the cash into productive assets - low liquidity levels are also desirable to the firm. It’s up to the firm’s financial management staff to find a reasonable compromise between these opposing needs2.The recognition and matching principles in financial accounting call for revenues, and the costsassociated with producing those revenues, to be “booked” when the revenue process is essentially complete, not necessarily when the cash is collected or bills are paid. Note that this way is not necessarily correct; it’s the way accountants have chosen to do it.3.The bottom line number shows the change in the cash balance on the balance sheet. As such, it is nota useful number for analyzing a company.4. The major difference is the treatment of interest expense. The accounting statement of cash flowstreats interest as an operating cash flow, while the financial cash flows treat interest as a financing cash flow. The logic of the accounting statement of cash flows is that since interest appears on the income statement, which shows the operations for the period, it is an operating cash flow. In reality, interest is a financing expense, which results from the company’s choice of debt/equity. We will have more to say about this in a later chapter. When comparing the two cash flow statements, the financial statement of cash flows is a more appropriate measure of the company’s performance because of its treatment of interest.5.Market values can never be negative. Imagine a share of stock selling for –$20. This would meanthat if you placed an order for 100 shares, you would get the stock along with a check for $2,000.How many shares do you want to buy? More generally, because of corporate and individual bankruptcy laws, net worth for a person or a corporation cannot be negative, implying that liabilities cannot exceed assets in market value.6.For a successful company that is rapidly expanding, for example, capital outlays will be large,possibly leading to negative cash flow from assets. In general, what matters is whether the money is spent wisely, not whether cash flow from assets is positive or negative.7.It’s probably not a good sign for an established company, but it would be fairly ordinary for a start-up, so it depends.8.For example, if a company were to become more efficient in inventory management, the amount ofinventory needed would decline. The same might be true if it becomes better at collecting its receivables. In general, anything that leads to a decline in ending NWC relative to beginning would have this effect. Negative net capital spending would mean more long-lived assets were liquidated than purchased.9.If a company raises more money from selling stock than it pays in dividends in a particular period,its cash flow to stockholders will be negative. If a company borrows more than it pays in interest and principal, its cash flow to creditors will be negative.10.The adjustments discussed were purely accounting changes; they had no cash flow or market valueconsequences unless the new accounting information caused stockholders to revalue the derivatives. Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basic1.To find owner’s equity, we must construct a balance sheet as follows:Balance SheetCA $5,000 CL $4,500NFA 23,000 LTD 13,000OE ??TA $28,000 TL & OE $28,000We know that total liabilities and owner’s equity (TL & OE) must equal total assets of $28,000. We also know that TL & OE is equal to current liabilities plus long-term debt plus owner’s equity, so owner’s equity is:O E = $28,000 –13,000 – 4,500 = $10,500N WC = CA – CL = $5,000 – 4,500 = $5002. The income statement for the company is:Income StatementSales S/.527,000Costs 280,000Depreciation 38,000EBIT S/.209,000Interest 15,000EBT S/.194,000Taxes (35%) 67,900Net income S/.126,100One equation for net income is:Net income = Dividends + Addition to retained earningsRearranging, we get:Addition to retained earnings = Net income – DividendsAddition to retained earnings = S/.126,100 – 48,000Addition to retained earnings = S/.78,1003.To find the book value of current assets, we use: NWC = CA – CL. Rearranging to solve for currentassets, we get:CA = NWC + CL = $900K + 2.2M = $3.1MThe market value of current assets and fixed assets is given, so:Book value CA = $3.1M Market value CA = $2.8MBook value NFA = $4.0M Market value NFA = $3.2MBook value assets = $3.1M + 4.0M = $7.1M Market value assets = $2.8M + 3.2M = $6.0M 4.Taxes = 0.15(€50K) + 0.25(€25K) + 0.34(€25K) + 0.39(€273K – 100K)Taxes = €89,720The average tax rate is the total tax paid divided by net income, so:Average tax rate = €89,720 / €273,000Average tax rate = 32.86%.The marginal tax rate is the tax rate on the next €1 of earnings, so the marginal tax rate = 39%.5.To calculate OCF, we first need the income statement:Income StatementSales 元13,500Costs 5,400Depreciation 1,200EBIT 元6,900Interest 680Taxable income 元6,220Taxes (35%) 2,177Net income 元4,043OCF = EBIT + Depreciation – TaxesOCF = 元6,900 + 1,200 – 2,177OCF = 元5,923 capital spending = NFA end– NFA beg + DepreciationNet capital spending = £4,700,000 – 4,200,000 + 925,000Net capital spending = £1,425,0007.The long-term debt account will increase by $8 million, the amount of the new long-term debt issue.Since the company sold 10 million new shares of stock with a $1 par value, the common stock account will increase by $10 million. The capital surplus account will increase by $16 million, the value of the new stock sold above its par value. Since the company had a net income of $7 million, and paid $4 million in dividends, the addition to retained earnings was $3 million, which will increase the accumulated retained earnings account. So, the new long-term debt and stockholders’ equity portion of the balance sheet will be:Long-term debt $ 68,000,000Total long-term debt $ 68,000,000Shareholders equityPreferred stock $ 18,000,000Common stock ($1 par value) 35,000,000Accumulated retained earnings 92,000,000Capital surplus 65,000,000Total equity $ 210,000,000Total Liabilities & Equity $ 278,000,0008.Cash flow to creditors = Interest paid – Net new borrowingCash flow to creditors = €340,000 – (LTD end– LTD beg)Cash flow to creditors = €340,000 – (€3,100,000 – 2,800,000)Cash flow to creditors = €340,000 – 300,000Cash flow to creditors = €40,0009. Cash flow to stockholders = Dividends paid – Net new equityCash flow to stockholders = €600,000 – [(Common end + APIS end) – (Common beg + APIS beg)]Cash flow to stockholders = €600,000 – [(€855,000 + 7,600,000) – (€820,000 + 6,800,000)]Cash flow to stockholders = €600,000 – (€7,620,000 – 8,455,000)Cash flow to stockholders = –€235,000Note, APIS is the additional paid-in surplus.10. Cash flow from assets = Cash flow to creditors + Cash flow to stockholders= €40,000 – 235,000= –€195,000Cash flow from assets = –€195,000 = OCF – Change in NWC – Net capital spending= OCF – (–€165,000) – 760,000= –€195,000Operating cash flow = –€195,000 – 165,000 + 760,000= €400,000Intermediate11. a.The accounting statement of cash flows explains the change in cash during the year. Theaccounting statement of cash flows will be:Statement of cash flowsOperationsNet income ZW$125Depreciation 75Changes in other current assets (25)Total cash flow from operations ZW$175Investing activitiesAcquisition of fixed assets ZW$(175)Total cash flow from investing activities ZW$(175)Financing activitiesProceeds of long-term debt ZW$90Current liabilities 10Dividends (65)Total cash flow from financing activities ZW$35Change in cash (on balance sheet) ZW$35b.Change in NWC = NWC end– NWC beg= (CA end– CL end) – (CA beg– CL beg)= [(ZW$45 + 145) – 70] – [(ZW$10 + 120) – 60)= ZW$120 – 70= ZW$50c.To find the cash flow generated by the firm’s assets, we need the operating cash flow, and thecapital spending. So, calculating each of these, we find:Operating cash flowNet income ZW$125Depreciation 75Operating cash flow ZW$200Note that we can calculate OCF in this manner since there are no taxes.Capital spendingEnding fixed assets ZW$250Beginning fixed assets (150)Depreciation 75Capital spending ZW$175Now we can calculate the cash flow generated by the firm’s assets, which is:Cash flow from assetsOperating cash flow ZW$200Capital spending (175)Change in NWC (50)Cash flow from assets ZW$(25)Notice that the accounting statement of cash flows shows a positive cash flow, but the financial cash flows show a negative cash flow. The cash flow generated by the firm’s assets is a better number for analyzing the firm’s performance.12.With the information provided, the cash flows from the firm are the capital spending and the changein net working capital, so:Cash flows from the firmCapital spending $(3,000)Additions to NWC (1,000)Cash flows from the firm $(4,000)And the cash flows to the investors of the firm are:Cash flows to investors of the firmSale of short-term debt $(7,000)Sale of long-term debt (18,000)Sale of common stock (2,000)Dividends paid 23,000Cash flows to investors of the firm $(4,000)13. a. The interest expense for the company is the amount of debt times the interest rate on the debt.So, the income statement for the company is:Income StatementSales £1,000,000Cost of goods sold 300,000Selling costs 200,000Depreciation 100,000EBIT £400,000Interest 100,000Taxable income £300,000Taxes (35%) 105,000Net income £195,000b. And the operating cash flow is:OCF = EBIT + Depreciation – TaxesOCF = £400,000 + 100,000 – 105,000OCF = £395,00014.To find the OCF, we first calculate net income.Income StatementSales Au$145,000Costs 86,000Depreciation 7,000Other expenses 4,900EBIT Au$47,100Interest 15,000Taxable income Au$32,100Taxes 12,840Net income Au$19,260Dividends Au$8,700Additions to RE Au$10,560a.OCF = EBIT + Depreciation – TaxesOCF = Au$47,100 + 7,000 – 12,840OCF = Au$41,260b.CFC = Interest – Net new LTDCFC = Au$15,000 – (–Au$6,500)CFC = Au$21,500Note that the net new long-term debt is negative because the company repaid part of its long-term debt.c.CFS = Dividends – Net new equityCFS = Au$8,700 – 6,450CFS = Au$2,250d.We know that CFA = CFC + CFS, so:CFA = Au$21,500 + 2,250 = Au$23,750CFA is also equal to OCF – Net capital spending – Change in NWC. We already know OCF.Net capital spending is equal to:Net capital spending = Increase in NFA + DepreciationNet capital spending = Au$5,000 + 7,000Net capital spending = Au$12,000Now we can use:CFA = OCF – Net capital spending – Change in NWCAu$23,750 = Au$41,260 – 12,000 – Change in NWC.Solving for the change in NWC gives Au$5,510, meaning the company increased its NWC by Au$5,510.15.The solution to this question works the income statement backwards. Starting at the bottom:Net income = Dividends + Addition to ret. earningsNet income = $900 + 4,500Net income = $5,400Now, looking at the income statement:EBT –EBT × Tax rate = Net incomeRecognize that EBT × tax rate is simply the calculation for taxes. Solving this for EBT yields: EBT = NI / (1– tax rate)EBT = $5,400 / 0.65EBT = $8,308Now we can calculate:EBIT = EBT + interestEBIT = $8,308 + 1,600EBIT = $9,908The last step is to use:EBIT = Sales – Costs – DepreciationEBIT = $29,000 – 13,000 – DepreciationEBIT = $9,908Solving for depreciation, we find that depreciation = $6,092.16.The balance sheet for the company looks like this:Balance SheetCash ¥175,000 Accounts payable ¥430,000 Accounts receivable 140,000 Notes payable 180,000 Inventory 265,000 Current liabilities ¥610,000 Current assets ¥580,000 Long-term debt 1,430,000Total liabilities ¥2,040,000 Tangible net fixed assets 2,900,000Intangible net fixed assets 720,000 Common stock ??Accumulated ret. earnings 1,240,000 Total assets ¥4,200,000 Total liab. & owners’ equity¥4,200,000Total liabilities and owners’ e quity is:TL & OE = CL + LTD + Common stockSolving for this equation for equity gives us:Common stock = ¥4,200,000 – 1,240,000 – 2,040,000Common stock = ¥920,00017.The market value of shareholders’ equity cannot be zero. A negative market val ue in this case wouldimply that the company would pay you to own the stock. The market value of shareholders’ equity can be stated as: Shareholders’ equity = Max [(TA – TL), 0]. So, if TA is 元4,000,000 equity is equal to 元1,000,000 and if TA is 元2,500,000 equity is equal to 元0. We should note here that the book value of shareholders’ equity can be negative.18. a. Taxes Growth = 0.15($50K) + 0.25($25K) + 0.34($10K) = $17,150Taxes Income = 0.15($50K) + 0.25($25K) + 0.34($25K) + 0.39($235K) + 0.34($8.165M)= $2,890,000b. Each firm has a marginal tax rate of 34% on the next $10,000 of taxable income, despite theirdifferent average tax rates, so both firms will pay an additional $3,400 in taxes.19.Income StatementSales ₦850,000COGS 630,000A&S expenses 120,000Depreciation 130,000EBIT (₦30,000)Interest 85,000Taxable income (₦115,000)Taxes (30%) 0 income (₦115,000)b.OCF = EBIT + Depreciation – TaxesOCF = (₦30,000) + 130,000 – 0OCF = ₦100,000 income was negative because of the tax deductibility of depreciation and interest expense.However, the actual cash flow from operations was positive because depreciation is a non-cash expense and interest is a financing expense, not an operating expense.20. A firm can still pay out dividends if net income is negative; it just has to be sure there is sufficientcash flow to make the dividend payments.Change in NWC = Net capital spending = Net new equity = 0. (Given)Cash flow from assets = OCF – Change in NWC – Net capital spendingCash flow from assets = ₦100,000 – 0 – 0 = ₦100,000Cash flow to stockholders = Dividends – Net new equityCash flow to stockholders = ₦30,000 – 0 = ₦30,000Cash flow to creditors = Cash flow from assets – Cash flow to stockholdersCash flow to creditors = ₦100,000 – 30,000Cash flow to creditors = ₦70,000Cash flow to creditors is also:Cash flow to creditors = Interest – Net new LTDSo:Net new LTD = Interest – Cash flow to creditorsNet new LTD = ₦85,000 – 70,000Net new LTD = ₦15,00021. a.The income statement is:Income StatementSales $12,800Cost of good sold 10,400Depreciation 1,900EBIT $ 500Interest 450Taxable income $ 50Taxes (34%) 17Net income $33b.OCF = EBIT + Depreciation – TaxesOCF = $500 + 1,900 – 17OCF = $2,383c.Change in NWC = NWC end– NWC beg= (CA end– CL end) – (CA beg– CL beg)= ($3,850 – 2,100) – ($3,200 – 1,800)= $1,750 – 1,400 = $350Net capital spending = NFA end– NFA beg + Depreciation= $9,700 – 9,100 + 1,900= $2,500CFA = OCF – Change in NWC – Net capital spending= $2,383 – 350 – 2,500= –$467The cash flow from assets can be positive or negative, since it represents whether the firm raised funds or distributed funds on a net basis. In this problem, even though net income and OCF are positive, the firm invested heavily in both fixed assets and net working capital; it had to raise a net $467 in funds from its stockholders and creditors to make these investments.d.Cash flow to creditors = Interest – Net new LTD= $450 – 0= $450Cash flow to stockholders = Cash flow from assets – Cash flow to creditors= –$467 – 450= –$917We can also calculate the cash flow to stockholders as:Cash flow to stockholders = Dividends – Net new equitySolving for net new equity, we get:Net new equity = $500 – (–917)= $1,417The firm had positive earnings in an accounting sense (NI > 0) and had positive cash flow from operations. The firm invested $350 in new net working capital and $2,500 in new fixed assets. The firm had to raise $467 from its stakeholders to support this new investment. It accomplished this by raising $1,417 in the form of new equity. After paying out $500 of this in the form of dividends to shareholders and $450 in the form of interest to creditors, $467 was left to meet the firm’s cash flow needs for investment.22. a.Total assets 2005 = ¥650,000 + 2,900,000 = ¥3,550,000Total liabilities 2005 = ¥265,000 + 1,500,000 = ¥1,765,000Owners’ equity 2005 = ¥3,550,000 – 1,765,000 = ¥1,785,000Total assets 2006 = ¥705,000 + 3,400,000 = ¥4,105,000Total liabilities 2006 = ¥290,000 + 1,720,000 = ¥2,010,000Owners’ equity 2006 = ¥4,105,000 – 2,010,000 = ¥2,095,000b.NWC 2005 = CA05 – CL05 = ¥650,000 – 265,000 = ¥385,000NWC 2006 = CA06 – CL06 = ¥705,000 – 290,000 = ¥415,000Change in NWC = NWC06 – NWC05 = ¥415,000 – 385,000 = ¥30,000c.We can calculate net capital spending as:Net capital spending = Net fixed assets 2006 – Net fixed assets 2005 + DepreciationNet capital spending = ¥3,400,000 – 2,900,000 + 800,000Net capital spending = ¥1,300,000So, the company had a net capital spending cash flow of ¥1,300,000. We also know that net capital spending is:Net capital spending = Fixed assets bought – Fixed assets sold¥1,300,000 = ¥1,500,000 – Fixed assets soldFixed assets sold = ¥1,500,000 – 1,300,000 = ¥200,000To calculate the cash flow from assets, we must first calculate the operating cash flow. The operating cash flow is calculated as follows (you can also prepare a traditional income statement):EBIT = Sales – Costs – DepreciationEBIT = ¥8,600,000 – 4,150,000 – 800,000EBIT = ¥3,650,000EBT = EBIT – InterestEBT = ¥3,650,000 – 216,000EBT = ¥3,434,000Taxes = EBT ⨯ .35Taxes = ¥3,434,000 ⨯ .35Taxes = ¥1,202,000OCF = EBIT + Depreciation – TaxesOCF = ¥3,650,000 + 800,000 – 1,202,000OCF = ¥3,248,000Cash flow from assets = OCF – Change in NWC – Net capital spending.Cash flow from assets = ¥3,248,000 – 30,000 – 1,300,000Cash flow from assets = ¥1,918,000 new borrowing = LTD06 – LTD05Net new borrowing = ¥1,720,000 – 1,500,000Net new borrowing = ¥220,000Cash flow to creditors = Interest – Net new LTDCash flow to creditors = ¥216,000 – 220,000Cash flow to creditors = –¥4,000Net new borrowing = ¥220,000 = Debt issued – Debt retiredDebt retired = ¥300,000 – 220,000 = ¥80,00023.Balance sheet as of Dec. 31, 2005Cash €2,107 Accounts payable €2,213Accounts receivable 2,789 Notes payable 407Inventory 4,959 Current liabilities €2,620Current assets €9,855Long-term debt €7,056 Net fixed assets €17,669 Owners' equity €17,848Total assets €27,524 Total liab. & equity €27,524Balance sheet as of Dec. 31, 2006Cash €2,155 Accounts payable €2,146Accounts receivable 3,142 Notes payable 382Inventory 5,096 Current liabilities €2,528Current assets €10,393Long-term debt €8,232 Net fixed assets €18,091 Owners' equity €17,724Total assets €28,484 Total liab. & equity €28,4842005 Income Statement 2006 Income Statement Sales €4,018.00 Sales €4,312.00 COGS 1,382.00 COGS 1,569.00 Other expenses 328.00 Other expenses 274.00 Depreciation 577.00 Depreciation 578.00 EBIT €1,731.00 EBIT €1,891.00 Interest 269.00 Interest 309.00 EBT €1,462.00 EBT €1,582.00 Taxes (34%) 497.08 Taxes (34%) 537.88 Net income € 964.92 Net income €1,044.12 Dividends €490.00 Dividends €539.00 Additions to RE €474.92 Additions to RE €505.12 24.OCF = EBIT + Depreciation – TaxesOCF = €1,891 + 578 – 537.88OCF = €1,931.12Change in NWC = NWC end– NWC beg = (CA – CL) end– (CA – CL) begChange in NWC = (€10,393 – 2,528) – (€9,855 – 2,620)Change in NWC = €7,865 – 7,235 = €630Net capital spending = NFA end– NFA beg+ DepreciationNet capital spending = €18,091 – 17,669 + 578Net capital spending = €1,000Cash flow from assets = OCF – Change in NWC – Net capital spendingCash flow from assets = €1,931.12 – 630 – 1,000Cash flow from assets = €301.12Cash flow to creditors = Interest – Net new LTDNet new LTD = LTD end– LTD begCash flow to creditors = €309 – (€8,232 – 7,056)Cash flow to creditors = –€867Net new equity = Common stock end– Common stock begCommon stock + Retained earnings = T otal owners’ equityNet new equity = (OE – RE) end– (OE – RE) begNet new equity = OE end– OE beg + RE beg– RE endRE end= RE beg+ Additions to RE04Net new equity = OE end– OE beg+ RE beg– (RE beg + Additions to RE06)= OE end– OE beg– Additions to RENet new equity = €17,724 – 17,848 – 505.12 = –€629.12Cash flow to stockholders = Dividends – Net new equityCash flow to stockholders = €539 – (–€629.12)Cash flow to stockholders = €1,168.12As a check, cash flow from assets is €301.12.Cash flow from assets = Cash flow from creditors + Cash flow to stockholdersCash flow from assets = –€867 + 1,168.12Cash flow from assets = €301.12Challenge25.We will begin by calculating the operating cash flow. First, we need the EBIT, which can becalculated as:EBIT = Net income + Current taxes + Deferred taxes + InterestEBIT = £192 + 110 + 21 + 57EBIT = £380Now we can calculate the operating cash flow as:Operating cash flowEarnings before interest and taxes £380Depreciation 105Current taxes (110)Operating cash flow £375The cash flow from assets is found in the investing activities portion of the accounting statement of cash flows, so:Cash flow from assetsAcquisition of fixed assets £198Sale of fixed assets (25)Capital spending £173The net working capital cash flows are all found in the operations cash flow section of the accounting statement of cash flows. However, instead of calculating the net working capital cash flows as the change in net working capital, we must calculate each item individually. Doing so, we find:Net working capital cash flowCash £140Accounts receivable 31Inventories (24)Accounts payable (19)Accrued expenses 10Notes payable (6)Other (2)NWC cash flow £130Except for the interest expense and notes payable, the cash flow to creditors is found in the financing activities of the accounting statement of cash flows. The interest expense from the income statement is given, so:Cash flow to creditorsInterest £57Retirement of debt 84Debt service £141Proceeds from sale of long-term debt (129)Total £12And we can find the cash flow to stockholders in the financing section of the accounting statement of cash flows. The cash flow to stockholders was:Cash flow to stockholdersDividends £94Repurchase of stock 15Cash to stockholders £109Proceeds from new stock issue (49)Total £60 capital spending = NFA end– NFA beg + Depreciation= (NFA end– NFA beg) + (Depreciation + AD beg) – AD beg= (NFA end– NFA beg)+ AD end– AD beg= (NFA end + AD end) – (NFA beg + AD beg) = FA end– FA beg27. a.The tax bubble causes average tax rates to catch up to marginal tax rates, thus eliminating thetax advantage of low marginal rates for high income corporations.b.Assuming a taxable income of $100,000, the taxes will be:Taxes = 0.15($50K) + 0.25($25K) + 0.34($25K) + 0.39($235K) = $113.9KAverage tax rate = $113.9K / $335K = 34%The marginal tax rate on the next dollar of income is 34 percent.For corporate taxable income levels of $335K to $10M, average tax rates are equal to marginal tax rates.Taxes = 0.34($10M) + 0.35($5M) + 0.38($3.333M) = $6,416,667Average tax rate = $6,416,667 / $18,333,334 = 35%The marginal tax rate on the next dollar of income is 35 percent. For corporate taxable income levels over $18,333,334, average tax rates are again equal to marginal tax rates.c.Taxes = 0.34($200K) = $68K = 0.15($50K) + 0.25($25K) + 0.34($25K) + X($100K);X($100K) = $68K – 22.25K = $45.75KX = $45.75K / $100KX = 45.75%。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

电子数据收集分析与检索系统 (EDGAR)

10K和10Q报告

2.1 资产负债表

会计师在某一特定时点对企业的会计价值 所拍摄的一张快照

资产负债表恒等式为: 资产 ≡ 负债 + 股东权益

美国 Composite公司(U.S.C.C.)资产负债表

流动资产: 现金和等价物 应收账款 存货 其它 流动资产合计

企业的税负是多少? 平均税率是多少? 边际税率是多少?

如果你正在考虑一个项目,它将增加企业1 百万美元的应税所得,在你的分析中适用 何种税率?

$2,262 1,655

327 90

$190 29

$219 49

$170 84

$86 $43 $43

U.S.C.C.损益表

常用一个单独的 部分报告针对利 润征收的所得税 额。

营业总收入 销货成本 销售、行政和管理费用 折旧 营业利润 其他收入 息前税前利润 利息费用 税前利润 所得税

当前:$71 递延:$13 净利润 留存收益增加 股利:

本章目录

2.1 资产负债表 2.2 损益表 2.3 所得税 2.4 净营运资本 2.5 财务现金流量 2.6 会计现金流量表

资料来源

年度报告

华尔街日报(Wall Street Journal)

互联网

纽约证券交易所 () 纳斯达克 () 教科书 ()

收入 – 费用 ≡ 利润

U.S.C.C.损益表

损益表的经营活 动部分报告企业 来自主营业务的 收入和费用。

营业总收入 销货成本 销售、行政和管理费用 折旧 营业利润 其他收入 息前税前利润 利息费用 税前利润 所得税

当前:$71 递延:$13 净利润 留存收益增加 股利:

$2,262 1,655

327 90

1. 会计流动性 2. 负债与权益 3. 市价与成本

会计流动性

指资产转变成现金的容易程度和速 度——在价值上不会有重大损失

流动资产的流动性最高。 某些固定资产是无形的。

一家企业资产的流动性越高,越不可能遭 受短期债务难题。

流动资产相比固定资产往往收益率更低。

负债与权益

债权人通常取得对企业现金流量的优先请 求权 。

财会人员对可变成本和固定成本不加区分。 取而代之以对会计成本进行产品成本或期 间费用的分类。

2.3 税

关于所得税,我们唯一可靠的一件事是, 它们总是在变。

边际与平均税率

边际 – 挣得的下一元钱的纳税百分比 平均 – 税单/应税所得

其它税项

边际税率与平均税率

假设你的企业挣到了4百万美元的应税收入。

非现金项目

折旧是最明显的,没有企业曾为“折旧” 写过一张支票”。

另一非现金项目是递延税款,它并不代表 一笔现金流量。

因此,净利润不是现金。

时间和成本

在短期,企业的某项设备、资源和投 资都是固定的,但企业能改变诸如劳 动力和原材料这样的投入 。

在长期,所有生产投入(由此还有成本) 都是可变的。

$2,262 1,655

327 90

$190 29

$219 49

$170 84

$86 $43 $43

损益表分析

当分析一张损益表时,有三件事须记住:

1. 公认会计准则 (GAAP) 2. 非现金项目 3. 时间和成本

GAAP

GAAP的配比原则规定,收入须与费用配 比。

从而,利润一产生就被报告,即使现金流 量未必发生。

第二章

财务报表和现金流量

McGraw-Hill/Irwin

Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved.

主要概念和方法

理解财务报表所提供的信息 区分账面和市场价值 辨别平均和边际税率 知道会计利润和现金流量的差别 计算一家企业的现金流量

$2,262 1,655

327 90

$190 29

$219 49

$170 84

$86 $43 $43

U.S.C.C.损益表

净利润就是所谓 的 “底线”。

营业总收入 销货成本 销售、行政和管理费用 折旧 营业利润 其他收入 息前税前利润 利息费用 税前利润 所得税

当前:$71 递延:$13 净利润 留存收益增加 股利:

股显东权然益,: 现金比地产、厂房和

ቤተ መጻሕፍቲ ባይዱ

设普优通先备股股 更(面值具$1)流动性。

$39 $39

55

32

股本溢价

347 327

累计留存收益

390 347

减库藏股票

(26) (20)

权益合计

$805 $725

负债和股东权益总计

$1,879 $1,742

资产负债表分析

当分析一张资产负债表时,财务经理应留 意三个要点:

股东权益是资产和负债之间的差额。

市价与成本

在公认会计准则 (GAAP)下,美国经审计的 企业财务报表在登记资产时依据的是成本。

市场价值是资产、负债和权益实际能被买 到或售出的价格,这是一个与历史成本完 全不同的概念。

2.2 损益表

衡量一个特定时期的财务业绩 利润的会计定义是:

固定资产: 地产、厂房和设备 减累计折旧 地产、厂房和设备净值 无形资产和其它资产 固定资产合计

资产总计

2006 2005

$140 294 269 58

$761

$107 270 280 50

$707

$1,423 $1,274 (550) (460) 873 814 245 221

$1,118 $1,035

$1,879 $1,742

资产的排列顺序,是2按006照一2005

流家应动付负持账债款续: 经营企业将其转$213换成$197

现应应计付金费票用据通e 常所需的时间长2253度0 。20553

流动负债合计

$486 $455

长期负债:

递延税款

$117 $104

长期债务

471 458

长期负债合计

$588 $562

$190 29

$219 49

$170 84

$86 $43 $43

U.S.C.C.损益表

损益表的非经营 活动部分包括了 所有财务成本, 如利息费用。

营业总收入 销货成本 销售、行政和管理费用 折旧 营业利润 其他收入 息前税前利润 利息费用 税前利润 所得税

当前:$71 递延:$13 净利润 留存收益增加 股利: