商业银行课后题1-10章

商业银行课后章节习题及参考答案

商业银行课后章节习题及参考答案第一章1.商业银行从传统业务发展到“金融百货公司”说明了什么问题?随着金融竞争的加剧,金融创新成为商业银行发展的关键和动力源。

这不仅表现在银行传统业务市场已被瓜分完毕,需要通过创新来挖掘新的市场和发展机会,而且对传统业务市场的竞争和重新分配也必须借助新的手段和方式。

各家商业银行纷纷利用新的科学技术、借鉴国外商业银行的先进经验,进行技术、制度和经营管理方式创新,全面拓展银行发展空间。

商业银行进行业务扩展可以分散经营风险,减少风险总量;多渠道获取利润;为社会提供全方位的金融服务;符合金融市场的运作要求内在统一性。

2.如何认识现代商业银行的作用?P5信用中介、支付中介、信用创造、金融服务3.银行组织形式有哪些?近年来,银行控股公司为什么发展迅速?P7银行的组织形式有:单一银行制、分行制和银行控股公司制(银行控股公司、非银行控股公司)金融控股公司的发展是随着全球金融自由化、市场竞争和现代信息技术在金融业广泛应用而日益兴隆的,它是现代经济发展的必然产物。

20世纪70年代中后期以来,全球范围内的放松市场监管、企业客户和个人客户的全球化发展,以及信息技术对金融业各个方面的战略性影响,使金融结构和客户结构发生了巨大变化。

各类金融机构开始向其他金融服务领域渗透,主要市场经济国家的金融业开始从分业经营体制向综合经营体制转型。

1.联合经营获得规模效应金融控股集团各子公司虽然是分业经营,但已经不是纯粹意义上的单一经营,而是互相联合起来,共同从事多种金融经营,保证集团整体效益的实现。

金融控股集团的基本作用是形成同一集团在品牌、经营战略、营销网络以及信息共享等方面的协同优势,降低集团整体的经营成本并从多元化经营中获取更多收益。

金融资产的强关联性和弱专用性,决定了其综合经营比其他行业更能形成规模经济和范围经济,而控股公司结构正是发挥这一优势的合适载体。

(产品创新、营销等)2.在当前监管体制下规避风险法人分业的作用是防止不同金融业务风险的相互传递,将风险控制在最小范围内,同时可对关联交易起到一定的遏制作用。

商业银行业务与经营综合练习题-附答案

《商业银行业务与经营》综合练习题第一章商业银行导论第一部分选择题1、最早进入中国的外国银行是()A、浙江兴业银行B、交通银行C、东方银行D、通商银行2、()是商业银行最基本,也是最能反映其经营活动特征的职能。

A、信用中介B、信用创造C、支付中介D、金融服务3、我国的商业银行实行的是(),而世界上大部分国家都实行此种组织形式。

A、单一银行制B、分行制C、银行控股公司制D、非银行控股公司制4、股份制商业银行的组织形式中,()是商业银行的最高权力机构。

A、董事会B、监事会C、总稽核D、股东大会5、现代股份制商业银行的内部组织结构可以分为()A、决策机构B、执行机构C、监管机构D、监督机构6、商业银行的管理系统由()方面组成。

A、全面管理B、财务管理C、人事管理D、经营管理E、市场营销管理7、世界各国在对银行业进行监管时,主要内容包括()A、银行业的准入B、银行资本的充足性C、银行的清偿能力D、银行业务活动的范围E、贷款的集中程度第二部分填空题1、在英国,早期的银行业是由发展而来的。

2、1694年,英国建立了历史上第一家资本主义股份制商业银行——,它的出现宣告了高利贷性质的银行业在社会信用领域垄断地位的结束。

3、商业银行的信用创造职能是在与职能的基础上产生的。

4、从全球商业银行来看,商业银行的外部组织形式主要有三种类型,即、和。

5、政府对银行监管的“CAMEL(骆驼)原则”具体指、、、和。

6、目前各国存款保险制度的组织形式主要有三种,即、和。

7、1894年我国的成立以后,开始正式行使对商业银行的监管职能。

而2003年12月27日,《中华人民共和国银行业监督管理法》,明确是银行业的监督管理机构。

第三部分名词解释1、信用创造2、银行控股公司制3、商业银行的外部组织形式4、商业银行的内部组织形式5、存款保险制度第四部分问答题1、商业银行在一国经济发展过程中发挥了什么样的作用?2、商业银行单一银行制有哪些优缺点?商业银行分行制有哪些优缺点?3、政府为什么要对银行业实施监管?我国政府如何对银行业实施监管?第二章商业银行的资本管理第一部分选择题1、一家银行在发展过程中,会遇到各种各样的风险,例如()A、信用风险B、利率风险C、汇率风险D、经营风险E、流动性风险2、(),国际清算银行通过了《关于统一国际银行资本衡量和资本标准的协议》(即《巴塞尔协议》),规定12个参加国应以国际可比性及一致性为基础制定各自银行资本标准。

金融学复习商业银行习题及答案

金融学复习商业银行习题及答案第一章货币习题一,单项选择1. 劣币驱逐良币是在实行()条件下的现象。

A.金单本位制B.银单本位制C.金币本位制D.金银复本位制2. 我们经常说某商品的价格是XX 元,这里发挥的是货币的哪项职能()A 流通手段B 价值尺度C 贮藏职能D 支付手段3. 劣币是指实际价值()的货币A 等于零B 等于名义价值C 高于名义价值D 低于名义价值4. 布雷顿森林体系的运行是以()为核心展开的A.国际货币基金组织B?世界银行C?美元 D.美元-黄金本位5. 在我国货币层次中,M 0通常指()A.其它存款B、个人储蓄存款C、居民储蓄存款D、流通中的现金6. 十六世纪至十八世纪较为典型的货币制度是()A银本位制 B.金银复本位制 C.金币本位制 D.金块本位制7. 下列不享有无限资格的是()A贵金属铸币B.纸币C.银行券D.存款支票8. 便于交换说提出的代表人物是()A司马迁B?马鲍鲁斯C?斯密D?西斯蒙第9. 关于货币起源正确的观点是()A.货币是先王创造的B.货币是由国家创造出来的C货币是为保存财富产生的D.货币是商品生产和商品交换发展的必然产物10. 关于货币本质正确的观点是()A金银天然是货币 B.货币是商品价值的符号C 货币是唯一的财富D .货币是固定充当一般等价物的商品11. 货币购买力是()A价值的倒数B.利率的倒数C.利息的倒数 D.价格的倒数12. 英国在16世纪就产生了代用货币,最初的代用货币是由()发行的A化币经营业B.金匠业 C.宗教机构 D.早期银行13. 在信用货币制度下金准备的作用是()A作为国内金属货币的准备金 B.作为支付存款的准备金C作为兑付银行券的准备金 D.作为国际支付的准备金14. 目前各国货币层次划分一般以()为标准。

A偿还期B、流动性C、安全性D、收益性15. 金本位制下,()是决定两国货币汇率的基础A ?货币含金量B ?铸币平价C中心汇率D ?货币实际购买力16. 货币在衡量并表示商品价值大小时,执行()A 价值尺度职能B 流通手段职能C 贮藏手段职能D 支付手段职能17. 当商品卖后没有随之以购买,则货币会退出流通而处于静止状态,即发挥()A 价值尺度职能B 流通手段职能C 贮藏手段职能D 支付手段职能18. 流通中的货币一部分以现金形式存在,大部分的存在形式是()A 存款货币B 储蓄存款C 活期存款D 流通货币19. 货币购买力与物价水平的关系是(_)A 正相关B 负相关C 不相关D 不确定20. 货币的形态经历的阶段依次是()A 实物货币-金属货币-银行券-信用货币B 金属货币-实物货币-信用货币-银行券C 纸币-金属货币-信用货币-实物货币D 信用货币-金属货币-实物货币-银行券21. 布雷顿森林体系下的汇率制度是一种A自由浮动汇率制 B.完全固定汇率制 C.可调整的钉住汇率制 D.管理浮动汇率制22. 以金为货币金属,以金币为本位币,不铸造也不流通金币,银行券可兑换外币汇票属于()货币制度。

商业银行管理彼得S.罗斯第八版课后答案chapter_01

CHAPTER 1AN OVERVIEW OF BANKS AND THE FINANCIAL-SERVICES SECTORGoal of This Chapter: In this chapter you will learn about the many roles financial service providers play in the economy today. You will examine how and why the banking industry and the financial services marketplace as a whole is rapidly changing, becoming new and different as we move forward into the future. You will also learn about new and old services offered to the public.Key Topics in This Chapter•Powerful Forces Reshaping the Industry•What is a Bank?•The Financial System and Competing Financial-Service Institutions•Old and New Services Offered to the Public•Key Trends Affecting All Financial-Service Firms•Appendix: Career Opportunities in Financial ServicesChapter OutlineI. I ntroduction: P owerful Forces Reshaping the IndustryII. W hat Is a Bank?A. D efined by the Functions It Serves and the Roles It Play:B. B anks and their Principal CompetitorsC. Legal Basis of a BankD. D efined by the Government Agency That Insures Its DepositsIII.The Financial System and Competing Financial-Service InstitutionsA.Savings AssociationsB.Credit UnionsC.Money Market FundsD.Mutual FundsE.Hedge FundsF.Security Brokers and DealersG.Investment BankersH.Finance CompaniesI.Financial Holding CompaniesJ.Life and Property/Casualty Insurance CompaniesIV. T he Services Banks and Many of Their Closest Competitors Offer the PublicA. S ervices Banks Have Offered Throughout History1.Carrying Out Currency Exchanges2.Discounting Commercial Notes and Making Business Loans3.Offering Savings Deposits4.Safekeeping of Valuables and Certification of Value5.Supporting Government Activities with Credit6.Offering Checking Accounts (Demand Deposits)7.Offering Trust ServicesB. S ervices Banks and Many of Their Financial-Service Competitors HaveOffered More Recently1.Granting Consumer Loans2.Financial Advising3.Managing Cash4.Offering Equipment Leasing5.Making Venture Capital Loans6.Selling Insurance Policies7.Selling Retirement PlansC. Dealing in Securities: Offering Security Brokerage and Investment Banking Services1. Offering Security Underwriting2. Offering Mutual Funds and Annuities3. Offering Merchant Banking Services4. Offering Risk Management and Hedging ServicesV. Key Trends Affecting All Financial-Service FirmsA. S ervice ProliferationB. R ising CompetitionC. G overnment DeregulationD. A n Increasingly Interest-Sensitive Mix of FundsE. T echnological Change and AutomationF. C onsolidation and Geographic ExpansionG. C onvergenceH. G lobalizationVI. T he Plan of This BookVII. S ummaryConcept Checks1-1. What is a bank? How does a bank differ from most other financial-service providers?A bank should be defined by what it does; in this case, banks are generally those financial institutions offering the widest range of financial services. Other financial service providers offer some of the financial services offered by a bank, but not all of them within one institution.1-2. Under U.S. law what must a corporation do to qualify and be regulated as a commercial bank?Under U.S. law, commercial banks must offer two essential services to qualify as banks for purposes of regulation and taxation, demand (checkable) deposits and commercial loans. More recently, Congress defined a bank as any institution that could qualify for deposit insurance administered by the FDIC.1-3.Why are some banks reaching out to become one-stop financial service conglomerates? Is this a good idea in your opinion?There are two reasons that banks are increasingly becoming one-stop financial service conglomerates. The first reason is the increased competition from other types of financial institution s and the erosion of banks’ traditional service areas. The second reason is the Financial Services Modernization Act which has allowed banks to expand their role to be full service providers.1-4. Which businesses are banking’s closest and toughest com petitors? What services do they offer that compete directly with banks’ services?Among a bank’s closest competitors are savings associations, credit unions, money market funds, mutual funds, hedge funds, security brokers and dealers, investment banks, finance companies, financial holding companies, and life andproperty-casualty insurance companies. All of these financial service providers are converging and embracing each other’s innovations. The Financial Services Modernization Act has allowed many of these financial service providers to offer the public one-stop shopping for financial services.1-5. What is happening to banking’s share of the financial mark etplace and why? What kind of banking and financial system do you foresee for the future if present trends continue?The Financial Services Modernization Act of 1999 allowed many of the banks’ closest competitors to offer a wide array of financial services thereby taking away market share from “traditional” banks. Banks and their closest competitors are converging into one-stop shopping for financial services and this trend should continue in the future1-6. What different kinds of services do banks offer the public today? What services do their closest competitors offer?Banks offer the widest range of services of any financial institution. They offer thrift deposits to encourage saving and checkable (demand) deposits to provide a means of payment for purchases of goods and services. They also provide credit through direct loans, by discounting the notes that business customers hold, and by issuing credit guarantees. Additionally, they make loans to consumers for purchases of durable goods, such as automobiles, and for home improvements, etc. Banks also manage the property of customers under trust agreements and manage the cash positions of their business customers. They purchase and lease equipment to customers as an alternative to direct loans. Many banks also assist their customers with buying and selling securities through discount brokerage subsidiaries, the acquisition and sale of foreign currencies, the supplying of venture capital to start new businesses, and the purchase of annuities to supply future funding at retirement or for other long-term projects such as supporting a college education. All of these services are also offered by their closest competitors. Banks and their closest competitors are converging and becoming the financial department stores of the modern era.1-7. What is a financial department store? A universal bank? Why do you think these institutions have become so important in the modern financial system? Financial department store and universal bank refer to the same concept. A financial department store is an institution where banking, fiduciary, insurance, and security brokerage services are unified under one roof. A bank that offers all these services is normally referred to as a universal bank. These have become important because of convergence and changes in regulations that have allowed financial service providers to offer all services under one roof1-8. Why do banks and other financial intermediaries exist in modern society, according to the theory of finance?There are multiple approaches to answering this question. The traditional view of banks as financial intermediaries sees them as simultaneously fulfilling the financial-service needs of savers (surplus-spending units) and borrowers(deficit-spending units), providing both a supply of credit and a supply of liquid assets. A newer view sees banks as delegated monitors who assess and evaluate borrowers on behalf of their depositors and earn fees for supplying monitoring services. Banks also have been viewed in recent theory as suppliers of liquidity andtransactions services that reduce costs for their customers and, through diversification, reduce risk. Banks are also critical in the payment system for goods and services and have played an increasingly important role as a guarantor and a risk management role for customers.1-9. How have banking and the financial services market changed in recent years? What powerful forces are shaping financial markets and institutions today? Which of these forces do you think will continue into the future?Banking is becoming a more volatile industry due, in part, to deregulation which has opened up individual banks to the full force of the financial marketplace. At the same time the number and variety of banking services has increased greatly due to the pressure of intensifying competition from nonbank financial-service providers and changing public demand for more conveniently and reliably provided services. Adding to the intensity of competition, foreign banks have enjoyed success in their efforts to enter countries overseas and attract away profitable domestic business and household accounts.1-10. Can you explain why many of the forces you named in the answer to the previous question have led to significant problems for the management of banks and other financial firms and their stockholders?The net result of recent changes in banking and the financial services market has been to put greater pressure upon their earnings, resulting in more volatile returns to stockholders and an increased bank failure rates. Some experts see banks' role and market share shrinking due to restrictive government regulations and intensifying competition. Institutions have also become more innovative in their service offerings and in finding new sources of funding, such as off-balance-sheet transactions. The increased risk faced by institutions today, therefore, has forced managers to more aggressively utilize a wide array of tools and techniques to improve and stabilize their earnings streams and manage the various risks they face. 1-11. What do you think the financial services industry will look like 20 years from now? What are the implications of your projections for its management today? There appears to be a trend toward continuing consolidation and convergence. There are likely to be fewer financial service providers in the future and many of these will be very large and provide a broad range of financial services under one roof. In addition, global expansion will continue and will be critical to the survival of many financial service providers. Management of financial service providers willhave to be more technologically astute and be able to make a more diverse set of decisions including decisions about mergers, acquisitions and global expansion as well as new services to add to the firm.Problems and Projects1. You have just been hired as the marketing officer for the new First National Bank of Vincent, a suburban banking institution that will soon be serving a local community of 120,000 people. The town is adjacent to a major metropolitan area with a total population of well over 1 million. Opening day for the newly chartered bank is just two months away, and the president and the board of directors are concerned that the new bank may not be able to attract enough depositors and good-quality loan customers to meet its growth and profit projections. There are 18 other financial-service competitors in town, including two credit unions, three finance companies, four insurance agencies, and two security broker offices. Your task is to recommend the various services the bank should offer initially to build up an adequate customer base. You are asked to do the following:a.Make a list of all the services the new bank could offer, according to current regulations.b.List the type of information you will need about the local community tohelp you decide which of the possible services are likely to have sufficientdemand to make them profitable.c.Divide the possible services into two groups--those you think are essentialto customers and should be offered beginning with opening day, and thosethat can be offered later as the bank grows.d. Briefly describe the kind of advertising campaign you would like to run tohelp the public see how your bank is different from all the other financialservice providers in the local area. Which services offered by the nonblankservice providers would be of most concern to the new bank’smanagement?Banks can offer, if they choose, a wide variety of financial services today. These services are listed below. However, unless they are affiliated with a larger bank holding company and can offer some of these services through that company, it may be more limited in what it can offer.Regular Checking Accounts Management Consulting Services NOW Accounts Letters of CreditPassbook Savings Deposits Business Inventory Loans Certificates of Deposit Asset-Based Commercial Loans Money Market Deposits Discounting of Commercial Paper Automobile Loans Plant and Equipment Loans Retirement Savings Plans Venture Capital LoansNonauto Installment Loans to IndividualsResidential Real Estate Loans Leasing Plans for Business Property and EquipmentHome Improvement Loans Security Dealing and Underwriting Personal Trust Management Services Discount Security BrokerageCommercial Trust Services Institutional Trust Services Foreign Currency Trading and ExchangePersonal Financial Advising Personal Cash-Management ServicesInsurance Policy Sales (Mainly Credit-Life)Insurance Today (Except in Some States)) Standby Credit Guarantees Acceptance FinancingTo help the new bank decide which services to offer it would be helpful to gather information about some of the following items in the local community:School Enrollments and Growth in School EnrollmentsEstimated Value of Residential and Commercial PropertyRetail SalesPercentage of Home Ownership Among Residents in the AreaNumber and Size (in Sales and Work Force) of Local Business Establishments Major Population Locations (i.e., Major Subdivisions, etc.) and Any Projected Growth AreasPopulation Demographics (i.e., Age Distribution of the Area)Projected Growth Areas of Industries in the AreaEssential services the bank would probably want to offer right from the beginning includes:Regular Checking Accounts Home Improvement Loans Automobile and other Consumer-type Money Market Deposit Accounts Installment Loans Retirement Savings PlansNOW Accounts Business Inventory LoansPassbook Savings Deposits Discounting of High-QualityCommercial NotesResidential Real Estate LoansCertificates of DepositAs the bank grows, opportunities for the profitable sale of additional services usually increase, especially for trust services for individuals and smaller businesses and personal financial advising as well as some commercial (plant and equipment) loans and leases. Further growth may result in the expansion of commercial trust services as well as a widening variety of commercial loans and credit guarantees.The bank would want to develop an advertising campaign that sends a message to potential customers that the new bank is, indeed, different from its competitors. Small banks often have the advantage of offering highly personalized services in which their customers are known and recognized and services are tailored to each individual customer's special financial needs. Quality and reliability of banking service are often more important to individual customers than is price. A new bank must try to sell prospective customers, most of who will come from other banks in the area, on personalized services, quality, and reliability - all three of which should be emphasized in its advertising program.2. Leading money center banks in the United States have accelerated their investment banking activities all over the globe in recent years, purchasing corporate debt securities and stock from their business customers and reselling those securities to investors in the open market. Is this a desirable move by these banking organizations from a profit standpoint? From a risk standpoint? From the public interest point of view? How would you research their question? If you were managing a corporation that had placed large deposits with a bank engaged in such activities, would you be concerned about the risk to your company's funds? What could you do to better safeguard those funds?In the 1970's and early 1980's investment banking was so profitable that commercial bankers were lured into the investment banking business largely because of its greater profit potential than possessed by more traditional commercial banking activities. Later foreign banks, particularly the British and Japanese banking firms, began to attract away large corporate customers from U.S. banks, who were restrained by regulation from offering many investment banking services. Thus, U.S. banks ran into severe difficulty in simply trying to hold onto their traditional corporate credit and deposit accounts because they could not compete service-wise in the investment banking field. Today, banks are allowed to underwrite securities through either a subsidiary or through a holding company structure. This change occurred as part of the Gramm-Leach-Bliley Act (Financial Services Modernization Act).Unfortunately, if investment banking is more profitable than traditional banking product lines, it is also more risky, consistent with the basic tenet of finance that risk and return are directly related. That is why the Federal Reserve Board has placed such strict limits on the type of organization that can offer these services. Currently, the underwriting of most corporate securities must be done through a subsidiary or as a separate part of the holding company so that, in theory at least, the bank is not responsible for any losses incurred. For this reason there may be little reason for depositors (including large corporate depositors) to be concerned about risk exposure from investment banking. Moreover, the ability to offer such services may make U.S. banks more viable in the long run which helps their corporate customers who depend upon them for credit.On the other hand, opponents of investment banking powers for bank operations inside the U.S. have some reasonable concerns that must be addressed. There are, for example, possible conflicts of interest. Information gathered in the investment banking division could be used to the detriment of customers purchasing other bank services. For example, a customer seeking a loan may be told that he or she must buy securities from the bank's investment banking division in order to receive a loan. Moreover, banks could gain effective control over some nonblank industrial corporations which might subject them to added risk exposure and place industrial firms not allied with banks at a competitive disadvantage. As a result theGramm-Leach-Bliley Act has built in some protections to prevent this from happening.3. The term bank has been applied broadly over the years to include a diverse set of financial-service institutions, which offer different financial service packages.Identify as many o f the different kinds of “banks” as you can. How do the “banks” you have identified compare to the largest banking group of all – the commercial banks? Why do you think so many different financial firms have been called banks? How might this terminological confusion affect financial-service customers?The general public tends to classify anything as a bank that offers some sort of financial service, especially deposit and loan services. Other institutions that are often referred to as a bank without being one are savings associations, credit unions, money market funds, mutual funds, hedge funds, security brokers and dealers, investment banks, finance companies, financial holding companies and life and property/casualty insurance companies. All of these institutions offer some of the services that a commercial bank offers, but generally not the entire scope of services. Since providers of financial services are normally called banks by the general public they are able to take away business from traditional banks and it is of utmost importance for commercial banks to clarify their unique position among financial services providers.4. What advantages can you see to banks affiliating with insurance companies? How might such an affiliation benefit a bank? An insurer? Can you identify any possible disadvantages to such an affiliation? Can you cite any real world examples of bank-insurer affiliations? How well do they appear to have worked out in practice?Before Glass-Steagall banks used to sell insurance services to their customers on a regular basis. in particular, banks would sell life insurance companies to loan customers to ensure repayment of the loan in case of death or disablement. These reasons still exist today and the right to sell insurances to customers again benefits banks in allowing them to offer their customers complete financial packages from financing the home or car to insure it, from giving investment advice to selling life insurance policies and annuities for retirement planning. Generally, a bank customer who is already purchasing a service from a bank might feel compelled to purchase an insurance product, as well. On the other hand, insurance companies sometimes have a negative image, which makes it more difficult to sell certain insurance products. Combining their products with the trust that people generally have in banks will make it easier for them to sell their products. The most prominent example of a bank-insurer affiliation is the merger of Citicorp and Traveler’s Insurance to Citigroup. However, given that Citigroup has sold Traveler’s Insurance indicates that the anticipated synergy effects did not materialize.5. Explain the difference between consolidation and convergence. Are these trends in banking and financial services related? Do they influence each other? How? Consolidation refers to increase in the size of financial institutions and the decline in the number of small independently owned banks and financial service providers. Convergence is the bringing together of firms from different industries to createconglomerate firms offering multiple services. Clearly, these two trends are related. In their effort to compete with each other, banks and their closest competitors have acquired other firms in their industry as well across industries to provide multiple financial services in multiple markets.6. What is a financial intermediary? What are their key characteristics? Is a bank a type of financial intermediary? Why? What other financial-services companies are financial intermediaries? What important role within the financial system do financial intermediaries play?A financial intermediary is a business that interacts with deficit spending individuals and institutions and surplus spending individuals and institutions. For that reason any financial service provider (including banks) is considered a financial intermediary. In their function as intermediaries they act as a bridge between the deficit and surplus spending units by offering financial services to the surplus spending individuals and then loaning those funds to the deficit spending individuals. Financial intermediaries accelerate economic growth by increasing the pool of available funds and lowering the risk of investments through diversification.。

商业银行课后习题及答案

一、名词解释表外业务(Off-BalanceSheetActivities,OB)是指商业银行所从事的、按照现行的会计准则不记入资产负债表内、不形成现实资产负债但能增加银行收益的业务。

表外业务是有风险的经营活动,形成银行的或有资产和或有负债,其中一部分还有可能转变为银行的实有资产和实有负债,故通常要求在会计报表的附注中予以揭示。

流动性风险:指银行无力为负债的减少或资产的增加提供融资而造成损失或破产的风险。

信用风险:指债务人或交易对手未能履行合同所规定的义务或信用质量发生变化,影响金融产品价值,从而给债权人或金融产品持有人造成经济损失的风险。

利率敏感性资产(RSL)是指那些在市场利率发生变化时,收益率或利率能随之发生变化的资产。

相应的利率非敏感性资产则是指对利率变化不敏感,或者说利息收益不随市场利率变化而变化的资产。

利率敏感性负债(RSL):是指那些在市场利率变化时,其利息支出会发生相应变化的负债核心资本又叫一级资本(Tier1capital)和产权资本,是指权益资本和公开储备,它是银行资本的构成部分附属资本、持续期缺口: 是银行资产持续期与负债持续期和负债资产现值比乘积的差额。

资本充足率:本充足率是一个银行的资产对其风险的比率可疑贷款是指借款人无法足额偿还贷款本息,即使执行担保,也肯定要造成较大损失大额可转让定期存单是由商业银行发行的、可以在市场上转让的存款凭证。

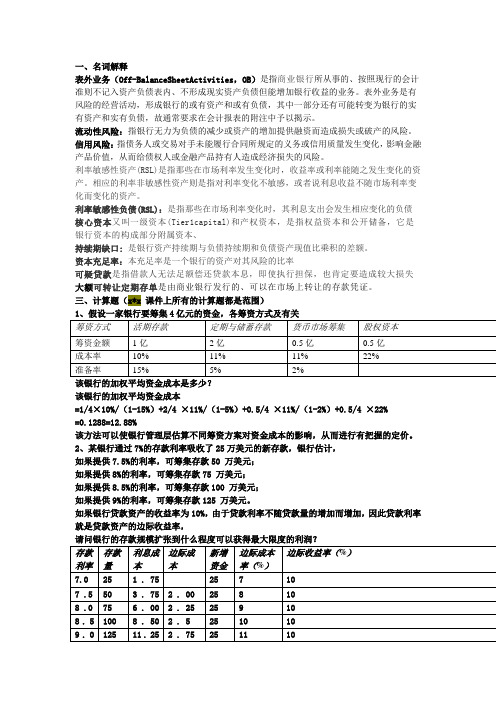

三、计算题(x*x 课件上所有的计算题都是范围)该银行的加权平均资金成本是多少?该银行的加权平均资金成本=1/4×10%/(1-15%)+2/4 ×11%/(1-5%)+0.5/4 ×11%/(1-2%)+0.5/4 ×22%=0.1288=12.88%该方法可以使银行管理层估算不同筹资方案对资金成本的影响,从而进行有把握的定价。

2、某银行通过7%的存款利率吸收了25万美元的新存款,银行估计,如果提供7.5%的利率,可筹集存款50 万美元;如果提供8%的利率,可筹集存款75 万美元;如果提供8.5%的利率,可筹集存款100 万美元;如果提供9%的利率,可筹集存款125 万美元。

商业银行业务与经营_庄毓敏主编_部分课后习题

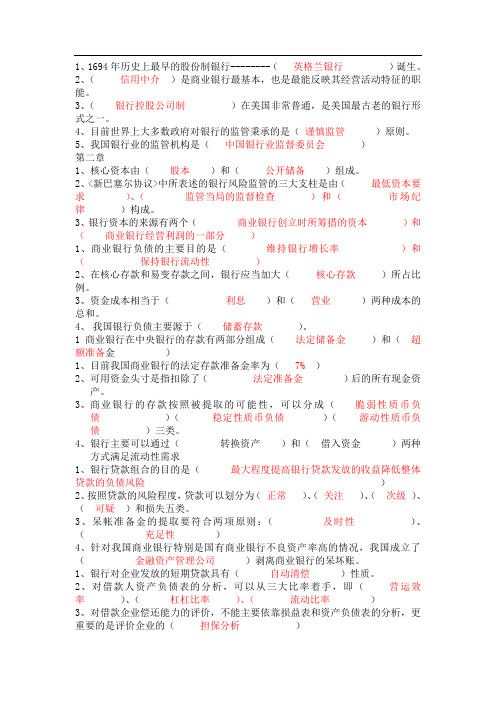

1、1694年历史上最早的股份制银行--------(英格兰银行)诞生。

2、(信用中介)是商业银行最基本,也是最能反映其经营活动特征的职能。

3、(银行控股公司制)在美国非常普通,是美国最古老的银行形式之一。

4、目前世界上大多数政府对银行的监管秉承的是(谨慎监管)原则。

5、我国银行业的监管机构是(中国银行业监督委员会)第二章1、核心资本由(股本)和(公开储备)组成。

2、<新巴塞尔协议>中所表述的银行风险监管的三大支柱是由(最低资本要求)、(监管当局的监督检查)和(市场纪律)构成。

3、银行资本的来源有两个(商业银行创立时所筹措的资本)和(商业银行经营利润的一部分)1、商业银行负债的主要目的是(维持银行增长率)和(保持银行流动性)2、在核心存款和易变存款之间,银行应当加大(核心存款)所占比例。

3、资金成本相当于(利息)和(营业)两种成本的总和。

4、我国银行负债主要源于(储蓄存款)。

1商业银行在中央银行的存款有两部分组成(法定储备金)和(超额准备金)1、目前我国商业银行的法定存款准备金率为( 7%)2、可用资金头寸是指扣除了(法定准备金)后的所有现金资产。

3、商业银行的存款按照被提取的可能性,可以分成(脆弱性质币负债)(稳定性质币负债)(游动性质币负债)三类。

4、银行主要可以通过(转换资产)和(借入资金)两种方式满足流动性需求1、银行贷款组合的目的是(最大程度提高银行贷款发放的收益降低整体贷款的负债风险)2、按照贷款的风险程度,贷款可以划分为(正常)、(关注)、(次级)、(可疑)和损失五类。

3、呆帐准备金的提取要符合两项原则:(及时性)、(充足性)4、针对我国商业银行特别是国有商业银行不良资产率高的情况,我国成立了(金融资产管理公司)剥离商业银行的呆坏账。

1、银行对企业发放的短期贷款具有(自动清偿)性质。

2、对借款人资产负债表的分析,可以从三大比率着手,即(营运效率)、(杠杠比率)、(流动比率)3、对借款企业偿还能力的评价,不能主要依靠损益表和资产负债表的分析,更重要的是评价企业的(担保分析)4、现金净流量包括企业的(经营活动)、(投资活动)、(融资活动)5、反映流动性的比率由(流动比率)和(速冻比率)两个指标构成。

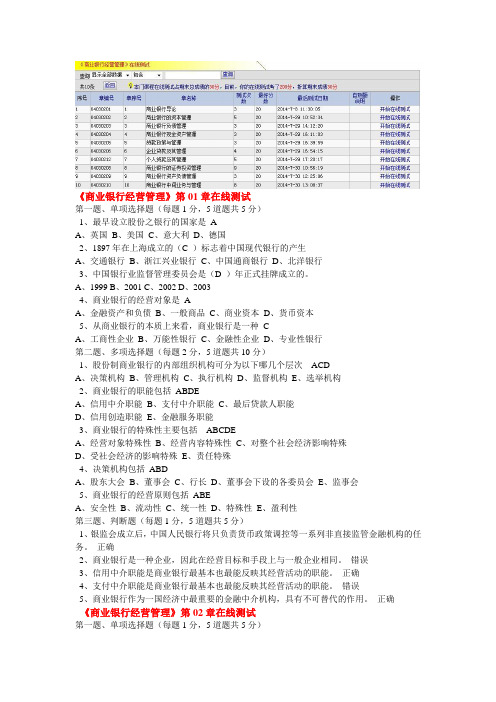

《商业银行经营管理》第01--10章在线测试

《商业银行经营管理》第01章在线测试第一题、单项选择题(每题1分,5道题共5分)1、最早设立股份之银行的国家是AA、英国B、美国C、意大利D、德国2、1897年在上海成立的(C )标志着中国现代银行的产生A、交通银行B、浙江兴业银行C、中国通商银行D、北洋银行3、中国银行业监督管理委员会是(D )年正式挂牌成立的。

A、1999B、2001C、2002D、20034、商业银行的经营对象是AA、金融资产和负债B、一般商品C、商业资本D、货币资本5、从商业银行的本质上来看,商业银行是一种CA、工商性企业B、万能性银行C、金融性企业D、专业性银行第二题、多项选择题(每题2分,5道题共10分)1、股份制商业银行的内部组织机构可分为以下哪几个层次ACDA、决策机构B、管理机构C、执行机构D、监督机构E、选举机构2、商业银行的职能包括ABDEA、信用中介职能B、支付中介职能C、最后贷款人职能D、信用创造职能E、金融服务职能3、商业银行的特殊性主要包括ABCDEA、经营对象特殊性B、经营内容特殊性C、对整个社会经济影响特殊D、受社会经济的影响特殊E、责任特殊4、决策机构包括ABDA、股东大会B、董事会C、行长D、董事会下设的各委员会E、监事会5、商业银行的经营原则包括ABEA、安全性B、流动性C、统一性D、特殊性E、盈利性第三题、判断题(每题1分,5道题共5分)1、银监会成立后,中国人民银行将只负责货币政策调控等一系列非直接监管金融机构的任务。

正确2、商业银行是一种企业,因此在经营目标和手段上与一般企业相同。

错误3、信用中介职能是商业银行最基本也最能反映其经营活动的职能。

正确4、支付中介职能是商业银行最基本也最能反映其经营活动的职能。

错误5、商业银行作为一国经济中最重要的金融中介机构,具有不可替代的作用。

正确《商业银行经营管理》第02章在线测试第一题、单项选择题(每题1分,5道题共5分)1、发行优先股对商业银行的不足之处不包括CA、股息税后支付,增加了资金成本B、总资本收益率下降时,会发生杠杆作用,影响普通股股东的权益C、不会稀释控制权D、可以在行情变动时对优先股进行有利于自己的转化,增大了经营的不确定性2、一旦银行破产倒闭时,对银行的资产的要求权排在最后的是BA、优先股股东B、普通股股东C、债权人D、存款人3、下列各项不属于发行资本债券特点的是 BA、不稀释控制权B、能大量发行,满足融资需要C、利息税前支付,可降低税后成本D、利息固定,会发生杠杆作用4、银行的附属资本不包括BA、未公开储备B、股本C、重估储备D、普通准备金5、内部资本融资的缺点在于其筹集资本的(D )在很大程度上收到银行本身的限制A、质量B、价格C、种类D、数量第二题、多项选择题(每题2分,5道题共10分)1、银行外部筹资的方法有ABCDEA、发行普通股B、发行优先股C、发行资本性工具D、出售资产与租赁设备E、股票于债券的互换2、所有者权益包括ACDEA、实收资本B、准备金C、资本公积D、盈余公积E、未分配利润3、附属资本包括ABCDEA、未公开储备B、重估储备C、普通准备金D、混合资本工具E、长期附属债务4、以下属于公开储备的有ACEA、未分配利润B、普通准备金C、营业盈余D、重估储备E、资本盈余5、(本题空白。

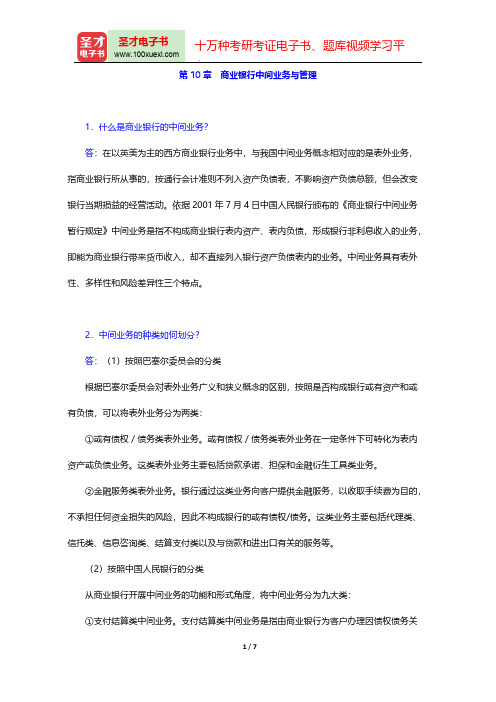

庄毓敏《商业银行业务与经营》(第2版)课后习题(商业银行中间业务与管理)【圣才出品】

第10章 商业银行中间业务与管理1.什么是商业银行的中间业务?答:在以英美为主的西方商业银行业务中,与我国中间业务概念相对应的是表外业务,指商业银行所从事的,按通行会计准则不列入资产负债表,不影响资产负债总额,但会改变银行当期损益的经营活动。

依据2001年7月4日中国人民银行颁布的《商业银行中间业务暂行规定》中间业务是指不构成商业银行表内资产、表内负债,形成银行非利息收入的业务,即能为商业银行带来货币收入,却不直接列入银行资产负债表内的业务。

中间业务具有表外性、多样性和风险差异性三个特点。

2.中间业务的种类如何划分?答:(1)按照巴塞尔委员会的分类根据巴塞尔委员会对表外业务广义和狭义概念的区别,按照是否构成银行或有资产和或有负债,可以将表外业务分为两类:①或有债权/债务类表外业务。

或有债权/债务类表外业务在一定条件下可转化为表内资产或负债业务。

这类表外业务主要包括贷款承诺、担保和金融衍生工具类业务。

②金融服务类表外业务。

银行通过这类业务向客户提供金融服务,以收取手续费为目的,不承担任何资金损失的风险,因此不构成银行的或有债权/债务。

这类业务主要包括代理类、信托类、信息咨询类、结算支付类以及与贷款和进出口有关的服务等。

(2)按照中国人民银行的分类从商业银行开展中间业务的功能和形式角度,将中间业务分为九大类:①支付结算类中间业务。

支付结算类中间业务是指由商业银行为客户办理因债权债务关②银行卡业务。

银行卡是由经授权的金融机构(主要指商业银行)向社会发行的具有消费信用、转账结算、存取现金等全部或部分功能的信用支付工具。

③代理类中间业务。

代理类中间业务指商业银行接受客户委托,代为办理客户指定的经济事务,提供金融服务并收取一定费用的业务。

④担保类中间业务。

担保类中间业务指商业银行为客户的债务清偿能力提供担保,承担客户违约风险的业务。

主要包括银行承兑汇票、备用信用证、各类保函等。

⑤承诺类中间业务。

承诺类中间业务是指商业银行在未来某一日期接照事前约定的条件向客户提供约定信用的业务,主要指借款承诺,包括可撤销承诺和不可撤销承诺两种。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

商业银行课后题1-10章第一章一.简答题1.商业银行的定义是什么?我国商业银行可以办理那些基本业务?2.商业银行的主要特征有那些表现?3.商业银行的职能是什么?4.商业银行在国民经济中占用怎样的地位?5.如何理解商业银行“三性原则”之间的关系?6.商业银行在经营中要坚持什么样的方针?7.商业银行经营的内外环境是指什么?二.多选题1.我国规定设立商业银行的注册资本,均为(BCD)A全部资本B部分资本C实缴资本D核心资本2.从商业银行的定义可以看出,商业银行的性质体现在(ACD)A商业银行是企业B商业银行是一种特殊的企业C商业银行是一种特殊的金融机关D商业银行是一种特殊的金融企业3.商业银行的信用中介职能有(ABC)A把社会闲置资金集中起来B把闲置的储蓄货币转化为职能资本C实现资本的续短为长D信息的生产与传递4.商业银行的二级准备金包括(ABCD)A超额准备金B短期国债C其他易于转让的短期证券D商业票据和银行承兑汇票5.商业银行转移风险的办法有(ABCD)A参加保险B订立抵押、担保条款C套期保值D及时转让相关债权债务第二章一.简答题1.商业银行从传统业务发展到“金融百货公司”说明了什么问题?2.什么是银行并购?银行并购的动机有哪些?3.怎样看待国际银行近年来发生的大规模并购行为?4.对我国未来银行业的并购趋势你有什么想法?5.现代商业银行面临哪些挑战?6.银行经营的发展趋势是什么?7.银行监管的发展趋势是什么?8.2022年的国际金融危机暴露了银行监管存在哪些漏洞?应怎样完善银行监管?二.单选题1.商业银行发展至今,已有(C)的历史。

A100年B200年C300年D500年2.银行业产生于(C)A英国B美国C意大利D德国3、最早设立股份制银行的国家是(A)A英国B美国C意大利D德国4.1694年英国政府为了同高利贷做斗争,以满足新生的资产阶级发展工业和商业的需要,决定成立的一家股份制银行是(A)A英格兰银行B曼切斯特银行C汇丰银行D利物浦银行5.北宋真宗时,由四川富商发行的(A),成为我国早期的纸币。

A交子B汇票C飞钱D当票6.1897年在上海成立的(C),标志着中国现代银行的产生。

A交通银行B浙江兴业银行C中国通商银行D北洋银行7.最早到中国来的外国银行是(A)A英商东方银行B伦敦银行C汇丰银行D英格兰银行8.我国商业银行的组织形式是()A单元制银行B分支形制银行C银行控股公司D连锁银行9.(A)是形成和维持适度竞争的市场结构的基本途径。

A并购B收购C兼并D扩张10.现代商业银行的发展方向是()A金融百货公司B贷款为主C吸收存款为主D表外业务为主一、简答题1.单一银行制、总分行制以及银行控股公司制各有什么优缺点?2.确立商业银行组织形式的原则是什么?3.简述商业银行的内部治理结构情况。

4.商业银行的治理结构有哪些特点?5.美国、英国、日本和德国的商业银行经营模式特征是什么?并比较其中的差异。

6.根据你对我国银行业的认识,简述我国商业银行经营模式的发展趋势。

7.商业银行的市场准入条件主要有哪些内容?8.商业银行监管的方法主要有哪些?并分析其中的差异。

二、选择题1.下列银行体制中,只存在于美国的是()A.分行制B.私人银行C.国有银行D.单元制2.股份制商业银行的最高权力机构是()B.股东大会C.监事会D.总经理3.下列商业银行中,属于股份制的有()A.中国银行B.招商银行C.中国工商银行D.中国农业银行4.目前,我国商业银行最主要的组织制度是()A.单一银行制度B.分支银行制度C.持股公司制度D.连锁银行制度5.商业银行的决策系统由什么组成?()A.股东大会B.董事会C.各种专门委员会D.监事会6.商业银行的经营模式有哪些?()A.单一银行制B.分业经营C.总分行制D.混业经营7.商业银行的监管原则有()A.依法监管B.公开监管C.公正监管D.效率监管8.混业经营模式有哪几种?()A.全能银行模式B.金融控股公司模式C.银行母公司模式D.松散合作模式9.巴塞尔委员会规定商业银行的最低资本充足率是()A.10%B.4%C.8%D.50%10.商业银行的内在治理结构分为()A.决策系统B.执行系统C.监督系统D.动态管理系统第四章一、简答题1.商业银行负债的作用是什么?2.商业银行负债业务经营目标有哪些?3.商业银行传统存款业务有哪些类型?4.商业银行创新的存款业务有哪些类型?5.影响商业银行存款的因素是什么?6.商业银行存款管理的目标是什么?7.请回答商业银行存款定价的主要方法。

8.商业银行借入负债有哪几类?9.简要说明存款保险制度的主要类型。

二、选择题1.影响商业银行存款的外部因素有()。

A.存款利率B.银行服务C.银行信誉D.同业竞争A.资本金B.金融债券C.同业拆借D.存款3.外国在中国发行的人民币债券称为()。

A.扬基债券B.武士债券C.熊猫债券D.袋鼠债券4.同业拆借资金的主要用途一半是()。

A.用于临时周转B.发放贷款C.购买国债D.弥补头寸5.下列哪些形式不属于商业银行非存款性负债?()A.同业借款B.回购协议借款C.再贴现借款D.再贷款E.金融债券F.财政存款6.下列属于欧洲货币的是()。

A.欧洲美元B.欧洲日元C.欧洲澳元D.欧洲加元7.下列属于创新存款业务的有()。

A.可转让支付命令账户B.货币市场存款账户C.大额可转让定期存单D.货币市场存单E.协定账户8.活期存款账户中,客户支付款项可以采取哪种形式?()A.支票B.本票C.汇票9.我国储蓄存款的原则为()。

A.存款自愿B.取款自由C.保护存款D.为储户保密E.存款有息10.商业银行负债风险有哪些类型?()A.系统性风险B.总量性负债风险C.结构性负债风险D.操作性负债风险第五章一、简答题1、商业银行现金资产由哪些方面构成?其主要作用是什么?2、法定存款准备金与超额存款准备金有什么不同?3、基础头寸、可用头寸及可贷头寸各由哪些内容构成?4、如何预测商业银行的资金头寸?5、商业银行资金调度的意义是什么?它有哪些渠道?6、如何预测商业银行库存现金需要量和最适运钞量?7、法定存款准备金如何计算?8、影响商业银行超额准备金需要量的因素有哪些?银行如何调节超额准备金数量?9、同业存款的目的是什么?如何进行预测?二、单选题1、商业银行保存在金库中的现钞和硬币是指()A.现金B.库存现金C.现金资产D.存款2、商业银行灵活调度头寸的最主要的渠道或方式是()A.贷款B.同业拆借C.存款D.证券回购A.现金B.从中央银行拆入现金C.短期证券D.证券回购协议A.从中央银行拆入现金B.从其他银行拆入现金C.各种商业票据D.大额定期存单5、按照法定比率向中央银行缴存的存款准备金是()A.法定存款准备金B.超额准备金C.备用金D.向中央银行借款6、以本期的存款余额为基础计算本期的准备金需要量的方法是()A.步准备金计算法B.滞后准备金计算法C.权益法D.汇总法三、多选题1、商业银行的现金资产一般包括()A.库存现金B.在中央银行存款C.存放同业存款D.托收中的现金2、商业银行在中央银行的存款由两部分构成,分别是()A.准备金B.法定存款准备金C.超额准备金D.备用金3、超额准备金的含义是()A.商业银行吸收的存款中扣除法定存款准备金以后的金额B.商业银行可用资金C.在存款准备金账户中,超过了法定存款准备金的那部分存款D.按照法定比率向中央银行缴存的存款准备金4、现金资产管理中应坚持的基本原则包括()A.效益性原则B.适度存量控制原则C.适时流量调节原则D.安全性原则5、商业银行头寸调度的渠道和方式主要有()B.短期证券回购及商业票据交易C.通过中央银行融资D.商业银行系统内的资金调度6、影响银行库存现金的因素比较复杂,其中主要有()A.现金收支规律B.营业网点的多少C.后勤保障的条D.与中央银行的距离、交通条件及发行库的确定7、匡算库存现金需要量主要应考虑两个因素,分别是()A.现金的用途B.库存现金周转时间C.库存现金支出水平的确定D.库存现金收入水平的确定8、商业银行头寸调度的重要渠道,也是商业银行的二级储备金的是()A.短期证券B.商业票据C.长期投资第六章一、简答题1、试述我国金融机构的贷款程序要点。

2、简述商业银行贷款的种类划分及贷款业务创新的集中主要类型。

3、试述银行信用分析的主要内容。

4、简述贷款定价的原则及影响贷款定价的因素。

5、试述贷款的几种主要定价方法。

6、简述财务比率分析的主要内容。

7、简述影响商业银行贷款业务的风险及其防治措施。

8、简述商业银行对问题贷款的处置方式。

二、单选题1、按担保合同规定,借款人贷款到期不能偿还银行贷款时,按约定由担保人承担偿还贷款时,此类贷款称为()A.信用贷款B.一般保证贷款C.连带责任担保贷款D.票据贴现贷款2、如银行贷款肯定要发生一定损失,但损失金额尚不确定,此类贷款应该归属于()A.关注类贷款B.次级类贷款C.可疑类贷款D.损失类贷款3、由于对环境条件等外部因素判断失误而给银行带来损失的风险,一般归纳于()A.信用风险B.市场风险C.操作风险D.国家风险4、产业分析落后导致银行不恰当的贷款支持属于()A.信用风险B.市场风险C.操作风险D.国家风险三、多选题1、下列措施中,属于风险补偿机制范畴的有()A.保险B.抵押和质押C.贷款组合D.提取呆账准备金2、下列项目中,属于银行贷款价格构成要素的有()A.利率B.承诺费C.补偿余额D.隐含条款3、下列风险状况,应该归属于操作风险范畴的有()A.对借款人财务状况分析失误导致不能按期还款B.不科学的操作流程或工作程序C.缺乏科学、成文的信贷政治D.银行资产、负债组合不匹配4、下列贷款项目中,应属于公司短期贷款的有()A.票据贴现B.证券交易商贷款C.循环信贷融资D.项目贷款5、商业银行在发放个人消费贷款前,需要对申请人进行信用评估。

建立科学、合理、规范的消费贷款信用评估体系,是推动商业银行开展消费贷款业务的有效保证。

那么构建科学、完整的消费贷款评价指标体系应遵循的原则包括()A.全面性B.合法性C.可操作性D.科学性6、个人住房抵押贷款的种类包括()A.标准的固定利率住房抵押贷款B.可调整利率的住房抵押贷款C.买下住房抵押贷款D.较短期限的住房抵押贷款7、个人住房抵押贷款的一级市场运作,其过程有()A.接受申请B.贷款买卖和交易C.向申请人提供有关贷款的信息D.贷款调查与评估8、个人住房抵押贷款的偿还及其方式是借款人最为关心的问题之一,一年期以上的贷款的还款方式有()A.等额本息还款法B.等额本金还款法C.等比例还款法D.比例还本法9、以下属于消费贷款的是()A.住房抵押贷款B.汽车消费贷款C.个人耐用品贷款D.个人助学贷款E.旅游消费贷款第七章一、简答题1、商业银行证券投资业务与放款业务的区别是什么?2、商业银行证券投资的目的与基本功能是什么?3、商业银行投资使用的金融工具有哪些?4、证券投资组合的一般原则是什么?5、证券投资策略有哪些?6、公司财务分析指标有哪些?二、单选题1、()是指银行将投资资金主要集中在短期证券和长期证券上的一种投资方法,它是期限分离组合策略中最主要的投资方法。