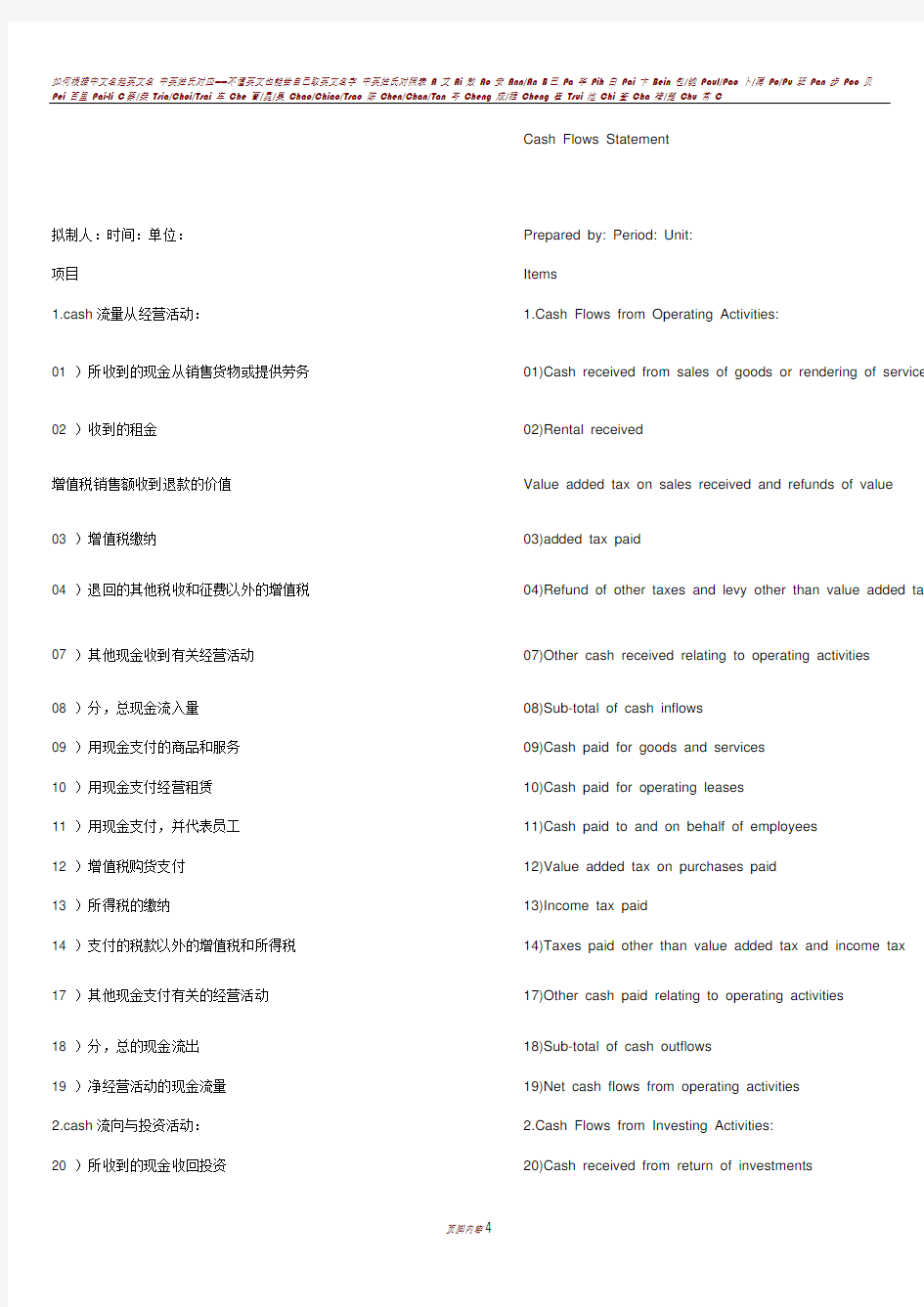

中英文对照--现金流量表

Cash Flows Statement

拟制人:时间:单位:Prepared by: Period: Unit:

项目Items

1.cash流量从经营活动: 1.Cash Flows from Operating Activities:

01 )所收到的现金从销售货物或提供劳务01)Cash received from sales of goods or rendering of services

02 )收到的租金02)Rental received

增值税销售额收到退款的价值Value added tax on sales received and refunds of value

03 )增值税缴纳03)added tax paid

04 )退回的其他税收和征费以外的增值税04)Refund of other taxes and levy other than value added tax

07 )其他现金收到有关经营活动07)Other cash received relating to operating activities

08 )分,总现金流入量08)Sub-total of cash inflows

09 )用现金支付的商品和服务09)Cash paid for goods and services

10 )用现金支付经营租赁10)Cash paid for operating leases

11 )用现金支付,并代表员工11)Cash paid to and on behalf of employees

12 )增值税购货支付12)Value added tax on purchases paid

13 )所得税的缴纳13)Income tax paid

14 )支付的税款以外的增值税和所得税14)Taxes paid other than value added tax and income tax

17 )其他现金支付有关的经营活动17)Other cash paid relating to operating activities

18 )分,总的现金流出18)Sub-total of cash outflows

19 )净经营活动的现金流量19)Net cash flows from operating activities

2.cash流向与投资活动: 2.Cash Flows from Investing Activities:

20 )所收到的现金收回投资20)Cash received from return of investments

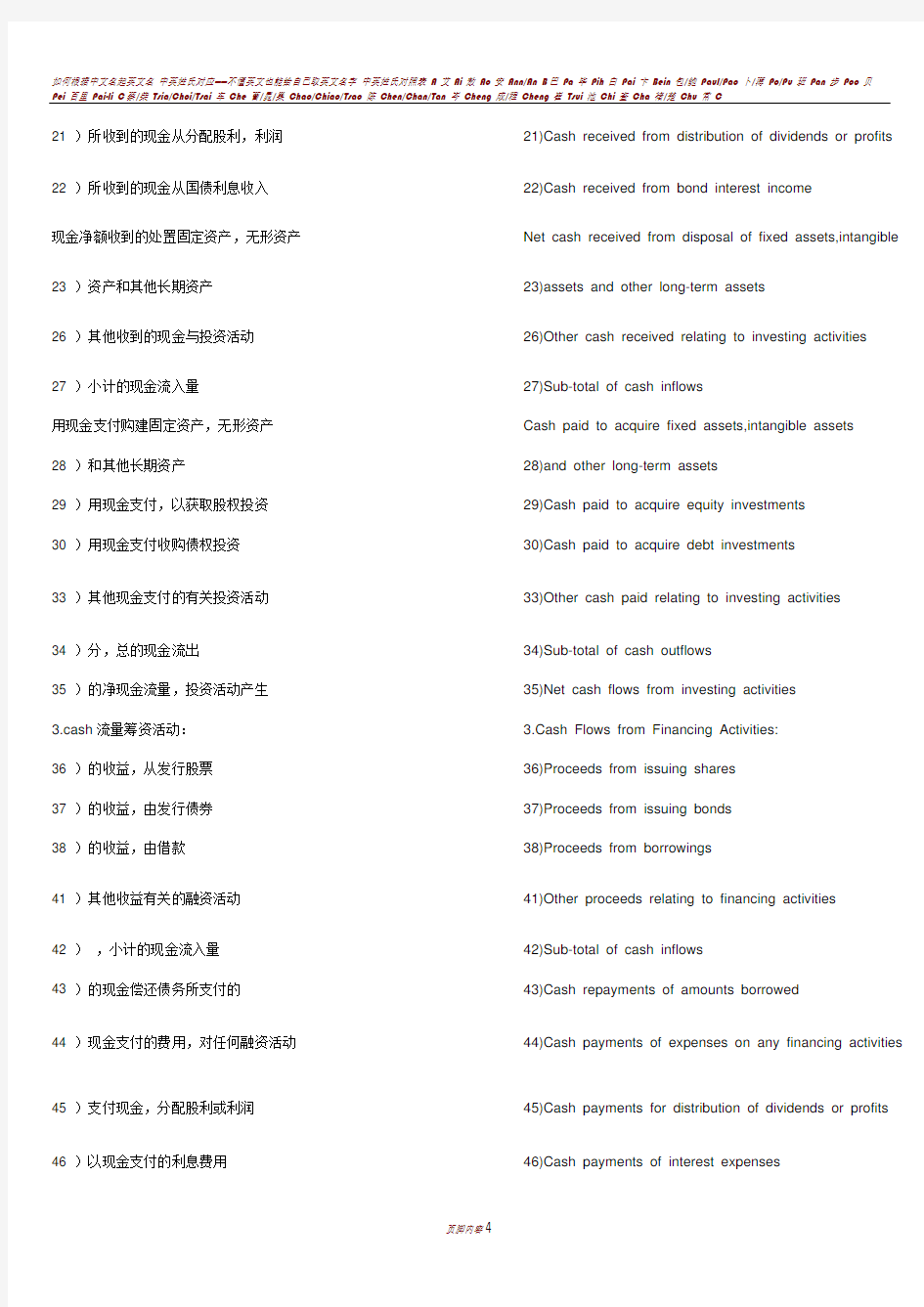

21 )所收到的现金从分配股利,利润21)Cash received from distribution of dividends or profits

22 )所收到的现金从国债利息收入22)Cash received from bond interest income

现金净额收到的处置固定资产,无形资产Net cash received from disposal of fixed assets,intangible 23 )资产和其他长期资产23)assets and other long-term assets

26 )其他收到的现金与投资活动26)Other cash received relating to investing activities

27 )小计的现金流入量27)Sub-total of cash inflows

用现金支付购建固定资产,无形资产Cash paid to acquire fixed assets,intangible assets

28 )和其他长期资产28)and other long-term assets

29 )用现金支付,以获取股权投资29)Cash paid to acquire equity investments

30 )用现金支付收购债权投资30)Cash paid to acquire debt investments

33 )其他现金支付的有关投资活动33)Other cash paid relating to investing activities

34 )分,总的现金流出34)Sub-total of cash outflows

35 )的净现金流量,投资活动产生35)Net cash flows from investing activities

3.cash流量筹资活动: 3.Cash Flows from Financing Activities:

36 )的收益,从发行股票36)Proceeds from issuing shares

37 )的收益,由发行债券37)Proceeds from issuing bonds

38 )的收益,由借款38)Proceeds from borrowings

41 )其他收益有关的融资活动41)Other proceeds relating to financing activities

42 ),小计的现金流入量42)Sub-total of cash inflows

43 )的现金偿还债务所支付的43)Cash repayments of amounts borrowed

44 )现金支付的费用,对任何融资活动44)Cash payments of expenses on any financing activities

45 )支付现金,分配股利或利润45)Cash payments for distribution of dividends or profits

46 )以现金支付的利息费用46)Cash payments of interest expenses

47 )以现金支付,融资租赁47)Cash payments for finance leases

48 )以现金支付,减少注册资本48)Cash payments for reduction of registered capital

51 )其他现金收支有关的融资活动51)Other cash payments relating to financing activities

52 )分,总的现金流出52)Sub-total of cash outflows

53 )的净现金流量从融资活动53)Net cash flows from financing activities

4.effect的外汇汇率变动对现金54.Effect of Foreign Exchange Rate Changes on Cash

https://www.360docs.net/doc/8b5531959.html,增加现金和现金等价物https://www.360docs.net/doc/8b5531959.html, Increase in Cash and Cash Equivalents

补充资料Supplemental Information

1.投资活动和筹资活动,不参与 1.Investing and Financing Activities that do not Involve in 现金收款和付款Cash Receipts and Payments

56 )偿还债务的转让固定资产56)Repayment of debts by the transfer of fixed assets

57 )偿还债务的转移投资57)Repayment of debts by the transfer of investments

58 )投资在形成固定资产58)Investments in the form of fixed assets

59 )偿还债务的转移库存量59)Repayments of debts by the transfer of investories

2.reconciliation净利润现金流量从经营 2.Reconciliation of Net Profit to Cash Flows from Operating 活动Activities

62 )净利润62)Net profit

63 )补充规定的坏帐或不良债务注销63)Add provision for bad debt or bad debt written off

64 )固定资产折旧64)Depreciation of fixed assets

65 )无形资产摊销65)Amortization of intangible assets

损失处置固定资产,无形资产Losses on disposal of fixed assets,intangible assets

66 )和其他长期资产(或减:收益)66)and other long-term assets (or deduct:gains)

67 )损失固定资产报废67)Losses on scrapping of fixed assets

68 )财务费用68)Financial expenses

69 )引起的损失由投资管理(或减:收益)69)Losses arising from investments (or deduct:gains)

70 )defered税收抵免(或减:借记卡)70)Defered tax credit (or deduct:debit)

71 )减少存货(或减:增加)71)Decrease in inventories (or deduct:increase)

72 )减少经营性应收(或减:增加)72)Decrease in operating receivables (or deduct:increase)

73 )增加的经营应付账款(或减:减少)73)Increase in operating payables (or deduct:decrease)

74 )净支付的增值税(或减:收益净额74)Net payment on value added tax (or deduct:net receipts

75 )净经营活动的现金流量75)Net cash flows from operating activities

https://www.360docs.net/doc/8b5531959.html,增加现金和现金等价物 https://www.360docs.net/doc/8b5531959.html, Increase in Cash and Cash Equivalents

76 )的现金,在此期限结束76)cash at the end of the period

77 )减:现金期开始77)Less:cash at the beginning of the period

78 )加:现金等价物在此期限结束78)Plus:cash equivalents at the end of the period

79 )减:现金等价物期开始79)Less:cash equivalents at the beginning of the period

80 ),净增加现金和现金等价物80)Net increase in cash and cash equivalents

现金流量表

《现金流量表的填制方法详解(新准则)》

现金流量表的填制方法详解 一、经营活动产生的现金流量的填列方法 (一)销售商品、提供劳务收到的现金=利润表中的“主营业务收入”+销项税额+应收帐款期初余额—应收帐款期末余额+应收票据期初余额—应收票据期末余额+预收帐款期末余额—预收帐款期初余额—当期计提的坏账准备—非收现的应收款项减少(如贴现利息) (二)收到的税费返还=企业交税交费后由税务等政府部门返还的(增值税,营业税,所得税,消费税,关税,教育费附加返还款)等各种税费。本项目可以根据“库存现金”、“银行存款”、“营业税金及附加”、“营业外收入”等账记的记录分析填列。 (三)收到其他与经营活动有关的现金=企业收到的罚款收入+经营租赁收入+加其他与经营活动有关的现金流入(若金额较大应单独列示) (四)购买商品、接受劳务支付的现金=利润表中“主营业务成本”+进项税+存货的期末余额—存货的期初余额+应付帐款的期初余额—应付帐款的期末余额+应付票据的期初余额—应付票据的期末余额+预付帐款的期末余额—预付帐款的期初余额—当期列入生产成本的(职工薪水,福利费,折旧费用)—当期列入制造费用的(职工薪水,福利费,折旧费用) (五)支付给职工以及为职工支付的现金=生产成本(薪酬)+制造费用(薪酬)+营业费用(薪酬)+管理费用(薪酬)+应付职工薪酬的期初余额—应付职工薪酬的期末余额(不包含在建工程人员工资如有为—应付职工薪在建工程(薪酬)期初余额—应付职工薪在建工程(薪酬)期末余额) PS:企业本期实际支付给职工的工资、奖金、各种津贴和补贴等职工薪酬(包括代扣代缴的个人所得税),但应由在建工程、无形资产负担的职工薪酬除外。支付的在建工程、无形资人员的职工薪酬除,在“购建固定资产、无形资产和其他长期资产所支付的现金“项目反映。 (六)支付的各项税费=所得税+主营业务税金及附加+应交增值税+消费费+营业税+关税+土地增值税+房产税+车船使用税+印花税+教育费附加+矿产资源 补偿费+个人所税税+社保费+堤围防护费等 PS:该项目反映企业当期实际上缴税务部门的各种税费(包括企业本期发生并支付的,本期支付以前各期发生的以及预交的教育费附加,矿产资源补偿费,印花税,房产税,土地增值税,车船使用税,预交的营业税等费用。本项目不包括计入固定资产价值,实际支付的耕地占用税,本期退回的增值税,所得税。(七)①支付其他与经营活有关的现金=经营活动产生的现金流入—经营活动产生的现金净流量—购买商品、接受劳务支付的现金—支付经职工以及为职工支付的现金—支付的各项税费 ②支付其他与经营活有关的现金=营业外支出(剔除固定资产处置损失)+管理费用(剔除工资、福利费、劳动保险金、待业保险金、住房公积金、养老保险、医疗保险、折旧、坏账准备或坏账损失、列入的各项税金等)+营业费用、成本及制造费用(剔除工资、福利费、劳动保险金、待业保险金、住房公积金、养老保险、医疗保险等)+其他应收款本期借方发生额+其他应付款本期借方发生额+银行手续费 PS:1、可根据补充资料推算出经营活的现金净流量,再以倒推的方式计算出此

现金流量表项目中英文对照

. 现金流量表中文项目現金流量表英文項目 合并现金流量表Consolidated Statements of Cash Flows 现金流量表Statements of Cash Flows 营业活动之现金流量:Cash flows from operating activities: 本期净利(净损) Net income (loss) 调整项目:Adjustments to reconcile net income (loss) to net cash provided by operating activities: 递延所得税Deferred income tax expense (benefit) 联属公司间未(已)实现利益净额Realized (unrealized) gain from inter-affiliate accounts 折旧费用Depreciation 各项摊提Amortization 备抵呆帐提列(回转) Allowance (reversal) for doubtful accounts 备抵销货退回折扣提列(回转) Allowance (reversal) for sales returns and discounts 存货跌价及呆滞损失Allowance for inventory valuation and obsolescence loss 权益法认列投资损失(利益)净额Equity in loss (gain) of affiliates, net 采权益法之现金股利Cash dividends from investee's company under equity method 应付利息补偿金Accrued premiums 汇率变动影响数Foreign exchange adjustments 已实现销货损失(利益) Realized gain (loss) from sale 未实现销货损失(利益) Unrealized gain (loss) from sale 短期投资跌价损失提列(回转) Provision for loss (reversal of provision for loss) on short-term investments 已实现投资损失(利益)净额Realized investment losses, net 出售短期投资损失(利益)净额Loss (gain) on disposal of short-term investments, net 出售长期投资损失(利益)净额Loss (gain) on disposal of long-term investments, net 出售固定资产损失(利益)净额Loss (gain) on disposal of property, plant and equipment, net 报废固定资产损失(利益)净额Loss (gain) on abandonment of property, plant and equipment, net 应收帐款减少(增加) Decrease (increase) in accounts receivable 应收票据减少(增加) Decrease (increase) in notes receivable 其它应收帐款、票据减少(增加) Decrease(increase) in other accounts 、notes receivable 催收款减少(增加) Decrease (increase) in uncollectible receivable 存货减少(增加) Decrease (increase) in inventories 预付款项减少(增加) Decrease (increase) in prepaid accounts 其它流动资产减少(增加) Decrease (increase) in other current assets 应付帐款增加(减少) Increase (decrease) in accounts payable 应付票据增加(减少) Increase (decrease) in notes payable 其它应付帐款、票据增加(减少) Increase(decrease) in other accounts、notes payable 应付所得税增加(减少) Increase (decrease) in income tax payable 应付费用增加(减少) Increase (decrease) in accrued expenses 递延退休金成本增加(减少) Increase (decrease) in deferred pension cost, net

财务报表中英文对照

财务报表中英文对照 1.资产负债表Balance Sheet 项目ITEM 货币资金Cash 短期投资Short term investments 应收票据Notes receivable 应收股利Dividend receivable 应收利息Interest receivable 应收帐款Accounts receivable 其他应收款Other receivables 预付帐款Accounts prepaid 期货保证金Future guarantee 应收补贴款Allowance receivable 应收出口退税Export drawback receivable 存货Inventories 其中:原材料Including:Raw materials 产成品(库存商品) Finished goods 待摊费用Prepaid and deferred expenses 待处理流动资产净损失Unsettled G/L on current assets 一年内到期的长期债权投资Long-term debenture investment falling due in a year 其他流动资产Other current assets 流动资产合计Total current assets 长期投资:Long-term investment: 其中:长期股权投资Including long term equity investment 长期债权投资Long term securities investment *合并价差Incorporating price difference 长期投资合计Total long-term investment 固定资产原价Fixed assets-cost 减:累计折旧Less:Accumulated Dpreciation 固定资产净值Fixed assets-net value 减:固定资产减值准备Less:Impairment of fixed assets 固定资产净额Net value of fixed assets 固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress 待处理固定资产净损失Unsettled G/L on fixed assets 固定资产合计Total tangible assets 无形资产Intangible assets

现金流量表中英文对照

现金流量表中英文对照 一、经营活动产生的现金流量 1. Cash Flow from Operating Activities 销售商品、提供劳务收到的现金 Cash from selling commodities or offering labor 收到的税费返还 Refund of tax and fee received 收到的其它与经营活动有关的现金 Other cash received related to operating activities 现金流入小计 Cash InflowSubtotal 购买商品、接受劳务支付的现金 Cash paid for commodities or labor 支付给职工以及为职工支付的现金 Cash paid to and for employees 支付的各项税费 Taxes and fees paid 支付的其它与经营活动有关的现金 Other cash paid related to operating activities 现金流出小计 Cash OutflowSubtotal 经营活动产生的现金流量净额 Cash flow generated from operating activitiesNet Amount 二、投资活动产生的现金流量 2. Cash Flow from Investing Activities 收回投资所收到的现金 Cash from investment withdrawal 取得投资收益所收到的现金 Cash from investment income 处置固定资产、无形资产和其他长期资产所收回的现金净额 Net cash from disposing fixed assets,intangible assets and other long-term ass 收到的其它与投资活动有关的现金 Other cash received related to investing activities 现金流入小计 Cash InflowSubtotal 购建固定资产、无形资产和其他长期资产所支付的现金 Cash paid for buying fixed assets,intangible assets and other long-term investm 投资所支付的现金 Cash paid for investment 支付的其他与投资活动有关的现金 Other cash paid related to investing activities 现金流出小计 Cash OutflowSubtotal

新企业会计准则下现金流量表的编制方法(完整版)

一)经营活动产生的现金流量的编制方法 按规定,企业应当采用直接法,列示经营活动产生的现金流量。 直接法是按现金流入和现金流出的主要类别列示企业经营活动产生的现金流量。在直接法下,一般是以利润表中的营业收入为起算点,调整与经营活动有关的项目的增减变动,然后计算出经营活动产生的现金流量。采用直接法具体编制现金流量表时,可以采用工作底稿法或T型账户法。业务简单的,也可以根据有关科目的记录分析填列。 1."销售商品、提供劳务收到的现金"项目 本项目可根据"主营业务收入"、"其他业务收入"、"应收账款"、"应收票据"、"预收账款"及"库存现金"、"银行存款"等账户分析填列。 本项目的现金流入可用下述公式计算求得: 销售商品、提供劳务收到的现金=本期营业收入净额+本期应收账款减少额 (-应收账款增加额)+本期应收票据减少额(-应收票据增加额)+本期预收账款增加额(-预收账款减少额) 注:上述公式中,如果本期有实际核销的坏帐损失,也应减去。(因核销坏账损失减少了应收帐款,但没有收回现金)。如果有收回前期已核销的坏帐金额, 应加上。(因收回已核销的坏帐,并没有增加或减少应收账款,但却收回了现金)。 2."收到的税费返还"项目 该项目反映企业收到返还的各种税费。本项目可以根据"库存现金"、"银行存款"、"应交税费"、"营业税金及附加"等账户的记录分析填列。 3."收到的其它与经营活动有关的现金"项目 本项目反映企业除了上述各项目以外收到的其它与经营活动有关的现金流入,如罚款收入、流动资产损失中由个人赔偿的现金收入等。本项目可根据"营业外收入"、"营业外支出"、"库存现金"、"银行存款"、"其他应收款"等账户的记录分析填列。 4?"购买商品、接受劳务支付的现金"项目 本项目可根据"应付账款"、"应付票据"、"预付账款"、"库存现金"、"银行存款"、"主营业务成本"、"其他业务成本""存货"等账户的记录分析填列。 本项目的现金流出可用以下公式计算求得: 购买商品、接受劳务支付的现金=营业成本+本期存货增加额(-本期存货减少额)+本期应付账款减少额(-本期应付账款增加额)+本期应付票据减少额(- 本期应付票据增加额)+本期预付账款增加额(-本期预付账款减少额) 5."支付给职工以及为职工支付的现金"项目 该项目反映企业实际支付给职工、以及为职工支付的工资、奖金、各种津贴和补贴等(含为职工支付的养老、失业等各种保险和其他福利费用)。但不含为离退休人员支付的各种费用和固定资产购建人员的工资。 本项目可根据"库存现金"、"银行存款"、"应付职工薪酬"、"生产成本"等账户的记录分析填列。 6."支付的各项税费"项目 本项目反映的是企业按规定支付的各项税费和有关费用。但不包括已计入固定资产原价而实际支付的耕地占用税和本期退回的所得税。 本项目应根据"应交税费"、"库存现金"、"银行存款"等账户的记录分析填列。

现金流量表项目中英文对照

现金流量表中文项目現金流量表英文項目 合并现金流量表Consolidated Statements of Cash Flows 现金流量表Statements of Cash Flows 营业活动之现金流量:Cash flows from operating activities: 本期净利(净损) Net income (loss) 调整项目:Adjustments to reconcile net income (loss) to net cash provided by operating activities: 递延所得税Deferred income tax expense (benefit) 联属公司间未(已)实现利益净额Realized (unrealized) gain from inter-affiliate accounts 折旧费用Depreciation 各项摊提Amortization 备抵呆帐提列(回转) Allowance (reversal) for doubtful accounts 备抵销货退回折扣提列(回转) Allowance (reversal) for sales returns and discounts 存货跌价及呆滞损失Allowance for inventory valuation and obsolescence loss 权益法认列投资损失(利益)净额Equity in loss (gain) of affiliates, net 采权益法之现金股利Cash dividends from investee's company under equity method 应付利息补偿金Accrued premiums 汇率变动影响数Foreign exchange adjustments 已实现销货损失(利益) Realized gain (loss) from sale 未实现销货损失(利益) Unrealized gain (loss) from sale 短期投资跌价损失提列(回转) Provision for loss (reversal of provision for loss) on short-term investments 已实现投资损失(利益)净额Realized investment losses, net 出售短期投资损失(利益)净额Loss (gain) on disposal of short-term investments, net 出售长期投资损失(利益)净额Loss (gain) on disposal of long-term investments, net 出售固定资产损失(利益)净额Loss (gain) on disposal of property, plant and equipment, net 报废固定资产损失(利益)净额Loss (gain) on abandonment of property, plant and equipment, net 应收帐款减少(增加) Decrease (increase) in accounts receivable 应收票据减少(增加) Decrease (increase) in notes receivable 其它应收帐款、票据减少(增加) Decrease(increase) in other accounts 、notes receivable 催收款减少(增加) Decrease (increase) in uncollectible receivable 存货减少(增加) Decrease (increase) in inventories 预付款项减少(增加) Decrease (increase) in prepaid accounts 其它流动资产减少(增加) Decrease (increase) in other current assets 应付帐款增加(减少) Increase (decrease) in accounts payable 应付票据增加(减少) Increase (decrease) in notes payable 其它应付帐款、票据增加(减少) Increase(decrease) in other accounts、notes payable 应付所得税增加(减少) Increase (decrease) in income tax payable 应付费用增加(减少) Increase (decrease) in accrued expenses 递延退休金成本增加(减少) Increase (decrease) in deferred pension cost, net

新准则下现金流量表的编制与分析

新准则下现金流量表的编制与分析 一)编制基础。编制基础是编制现金流量表的出发点,它明确了现金流量表所涉及会计要素的范围。我国现金流量表的编制基础是现金及现金等价物。 1.现金。现金流量表中的现金是指企业库存现金以及可以随时用于支付的存款,具体包括库存现金、银行存款、其他货币资金。 2.现金等价物。现金流量表准则将现金等价物定义为“企业持有的期限短、流动性强、易于转换为已知金额,价值变动风险小的投资”。现金等价物的核心是“支付能力大小,可否视为现金”,而不在于其是否是“投资”。例如,企业持有的3个月期的应收银行承兑汇票虽然不是投资,但它的支付能力不次于3个月到期的短期债券投资,并且由于银行承兑汇票能随时贴现和背书转让,其到期收回几乎无风险,所以,其应属于现金等价物。 (二)现金流量表项目分类及内容。除特殊项目(自然灾害损失、保险索赔等项目)外,对于企业一般活动项目应按照经营活动现金流量、投资活动现金流量、筹资活动现金流量分类别列示。 1.经营活动现金流量。经营活动产生的现金流量至少应当单独列示反映下列信息的项目:销售商品、提供劳务收到的现金;收到的税费返还;收到其他与经营活动有关的现金;购买商品、接受劳务支付的现金;支付给职工以及为职工支付的现金;支付的各项税费;支付其他与经营活动有关的现金。 2.投资活动现金流量。投资活动产生的现金流量至少应当单独列示反映下列信息的项目:收回投资收到的现金;取得投资收益收到的现金;处置固定资产、无形资产和其他长期资产收回的现金净额;处理子公司及其他营业单位收到的现金净额;收到其他与投资活动有关的现金;购建固定资产、无形资产和其他长期资产支付的现金;投资支付的现金;取得子公司及其他营业单位支付的现金净额;支付其他与投资活动有关的现金。 3.筹资活动的现金流量。筹资活动产生的现金流量至少应当单独列示反映下列信息的项目:吸收投资收到的现金;取得借款收到的现金;收到其他与筹资活动有关的现金;偿还债务支付的现金;分配股利、利润或偿付利息支付的现金;支付其他与筹资活动有关的现金。 经营活动产生的现金流量是一项重要的指标,它可以说明企业在不动用企业外部筹集资金的情况下,通过经营活动产生的现金流量是否足以偿还负债、支付股利和对外投资。经营活动产生的现金流量通常可以采用间接法和直接法两种方法计算。 间接法:即通过将企业非现金交易,过去或者未来经营活动产生的现金收入或支出的递延或应计项目,以及与投资或筹资现金流量相关的收益或费用项目对净收益的影响进行调整来反映企业经营活动所形成的现金流量。间接法以利润表上的净利润为起点,通过调整某些相关项目后得出经营产生的现金流量。 直接法:即通过现金收入和现金支出的总括分类反映来自企业经营活动的现金流量。采用直接法编制经营活动的现金流量时,有关企业现金收入和支出的信息可以从企业会计记录获得,也可以在利润表中营业收入、营业成本等数据的基础上,通过调整以下项目获得。 第一,本期存货及经营性应收和应付项目的变动; 第二,固定资产折旧,无形资产摊销等其他非现金项目; 第三,其现金影响属于投资或筹资活动现金流量的其他项目。

现金流量表编制自动生成报表很实用的

现金流量表编制

一、现金流量表主表项目 (一)经营活动产生的现金流量 ※1、销售商品、提供劳务收到的现金=主营业务收入+其他业务收入 +应交税金(应交增值税-销项税额)+(应收帐款期初数-应收帐款期末数)+(应收票据期初数应收票据期末数)

+(预收帐款期末数-预收帐款期初数) -当期计提的坏帐准备 -支付的应收票据贴现利息 -库存商品改变用途应支付的销项额 ±特殊调整事项 特殊调整事项的处理(不含三个账户部转帐业务),如果借:应收帐款、应收票据、预收帐款等,贷方不是“收入及销项税额”则加上,如果:贷应收帐款、应收票据、预收帐款等, 借方不是“现金类”科目,则减去。 ※①与收回坏帐无关 ②客户用商品抵债的进项税不在此反映。 2、收到的税费返还=返还的(增值税+消费费+营业税+关税+所得税+教育费附加)等 3、收到的其他与经营活动有关的现金 =除上述经营活动以外的其他经营活动有关的现金 ※4、购买商品、接受劳务支付的现金 =[主营业务成本(或其他支出支出) <即:存货本期贷方发生额-库存商品改变途减少数> +存货期末价值-存货期初价值)] +应交税金(应交增值税-进项税额) +(应付帐款期初数-应付帐款期末数)

+(应付票据期初数-应付票据期末数) +(预付帐款期末数-预付帐款期初数) +库存商品改变用途价值(如工程领用) +库存商品盘亏损失 -当期列入生产成本、制造费用的工资及福利费 -当期列入生产成本、制造费用的折旧费和摊销的大修理费 -库存商品增加额中包含的分配进入的制造费用、生产工人工资 ±特殊调整事项 特殊调整事项的处理,如果借:应付帐款、应付票据、预付帐款等(存贷类),贷方不是“现金类”科目,则减去,如果贷:应付帐款数、应付票据、预付帐款等,借方不是“销售成本 或进项税”科目,则加上。 5、支付给职工及为职工支付的现金 =生产成本、制造费用、管理费用的工资,福利费 +(应付工资期初数-期末数)+(应付福利费期初数-期末数) 附:当存在“在建工程”人员的工资、福利费时,注意期初、期末及计提数中是否包含“在建工程”的情况,按下式计算考虑计算关系。 本期支付给职工及为职工支付的工资 =(期初总额-包含的在建工程期初数) +(计提总额-包含的在建工程计提数)

最新现金流量表编制方法

最新现金流量表编制方法

最新现金流量表编制方法 新准则下现金流量表的编制方法: 一)经营活动产生的现金流量的编制方法 按规定,企业应当采用直接法,列示经营活动产生的现金流量。 直接法是按现金流入和现金流出的主要类别列示企业经营活动产生的现金流量。在直接法下,一般是以利润表中的营业收入为起算点,调整与经营活动有关的项目的增减变动,然后计算出经营活动产生的现金流量。采用直接法具体编制现金流量表时,可以采用工作底稿法或T型账户法。业务简单的,也可以根据有关科目的记录分析填列。 1."销售商品、提供劳务收到的现金"项目 本项目可根据"主营业务收入"、"其他业务收入"、"应收账款"、"应收票据"、"预收账款"及"库存现金"、"银行存款"等账户分析填列。 本项目的现金流入可用下述公式计算求得: 销售商品、提供劳务收到的现金=本期营业收入净额+本期应收账款减少额(-应收账款增加额)+本期应收票据减少额(-应收票据增加额)+本期预收账款增加额(-预收账款减少额) 注:上述公式中,如果本期有实际核销的坏帐损失,也应减去。(因核销坏账损失减少了应收帐款,但没有收回现金)。如果有收回前期已核销的坏帐金额,应加上。(因收回已核销的坏帐,并没有增加或减少应收账款,但却收回了现金)。 2."收到的税费返还"项目 该项目反映企业收到返还的各种税费。本项目可以根据"库存现金"、"银行存款"、"应交税费"、"营业税金及附加"等账户的记录分析填列。 3."收到的其它与经营活动有关的现金"项目 本项目反映企业除了上述各项目以外收到的其它与经营活动有关的现金流入,如罚款收入、流动资产损失中由个人赔偿的现金收入等。本项目可根据"营业外收入"、"营业外支出"、"库存现金"、"银行存款"、"其他应收款"等账户的记录分析填列。 4."购买商品、接受劳务支付的现金"项目 本项目可根据"应付账款"、"应付票据"、"预付账款"、"库存现金"、"银行存款"、"主营业务成本"、"其他业务成本""存货"等账户的记录分析填列。 本项目的现金流出可用以下公式计算求得: 购买商品、接受劳务支付的现金=营业成本+本期存货增加额(-本期存货减少额)+本期应付账款减少额(-本期应付账款增加额)+本期应付票据减少额(-本期应付票据增加额)+本期预付账款增加额(-本期预付账款减少额)5."支付给职工以及为职工支付的现金"项目 该项目反映企业实际支付给职工、以及为职工支付的工资、奖金、各种津贴和补贴等(含为职工支付的养老、失业等各种保险和其他福利费用)。但不含为离退休人员支付的各种费用和固定资产购建人员的工资。

现金流量表项目中英文对照讲解学习

现金流量表项目中英 文对照

精品文档 收集于网络,如有侵权请联系管理员删除 现金流量表中文项目 現金流量表英文項目 合并现金流量表 Consolidated Statements of Cash Flows 现金流量表 Statements of Cash Flows 营业活动之现金流量: Cash flows from operating activities: 本期净利(净损) Net income (loss) 调整项目: Adjustments to reconcile net income (loss) to net cash provided by operating activities: 递延所得税 Deferred income tax expense (benefit) 联属公司间未(已)实现利益净额 Realized (unrealized) gain from inter-affiliate accounts 折旧费用 Depreciation 各项摊提 Amortization 备抵呆帐提列(回转) Allowance (reversal) for doubtful accounts 备抵销货退回折扣提列(回转) Allowance (reversal) for sales returns and discounts 存货跌价及呆滞损失 Allowance for inventory valuation and obsolescence loss 权益法认列投资损失(利益)净额 Equity in loss (gain) of affiliates, net 采权益法之现金股利 Cash dividends from investee's company under equity method 应付利息补偿金 Accrued premiums 汇率变动影响数 Foreign exchange adjustments 已实现销货损失(利益) Realized gain (loss) from sale 未实现销货损失(利益) Unrealized gain (loss) from sale 短期投资跌价损失提列(回转) Provision for loss (reversal of provision for loss) on short-term investments 已实现投资损失(利益)净额 Realized investment losses, net 出售短期投资损失(利益)净额 Loss (gain) on disposal of short-term investments, net 出售长期投资损失(利益)净额 Loss (gain) on disposal of long-term investments, net 出售固定资产损失(利益)净额 Loss (gain) on disposal of property, plant and equipment, net 报废固定资产损失(利益)净额 Loss (gain) on abandonment of property, plant and equipment, net 应收帐款减少(增加) Decrease (increase) in accounts receivable 应收票据减少(增加) Decrease (increase) in notes receivable 其它应收帐款、票据减少(增加) Decrease(increase) in other accounts 、notes receivable 催收款减少(增加) Decrease (increase) in uncollectible receivable 存货减少(增加) Decrease (increase) in inventories 预付款项减少(增加) Decrease (increase) in prepaid accounts 其它流动资产减少(增加) Decrease (increase) in other current assets 应付帐款增加(减少) Increase (decrease) in accounts payable 应付票据增加(减少) Increase (decrease) in notes payable 其它应付帐款、票据增加(减少) Increase(decrease) in other accounts 、 notes payable 应付所得税增加(减少) Increase (decrease) in income tax payable 应付费用增加(减少) Increase (decrease) in accrued expenses 递延退休金成本增加(减少) Increase (decrease) in deferred pension cost, net

三大会计报表:资产负债表、损益表、现金流量表中英文对照

英文会计报表:FINANCIAL REPORT COVER 报表所属期间之期末时间点Period Ended 所属月份Reporting Period 报出日期Submit Date 记账本位币币种Local Reporting Currency 审核人Verifier 填表人Preparer 所属月份Reporting Period 报出日期Submit Date 资产负债表 Balance Sheet Assets Current Assets Bank and Cash Current Investment 一年内到期委托贷款Entrusted loan receivable due within one year 减:一年内到期 Less: Impairment for Entrusted loan receivable due within one year 减: Less: Impairment for current investment Net bal of current investment Notes receivable Dividend receivable 应收利息Interest receivable Account receivable 减:应收账款 Less: Bad debt provision for Account receivable Net bal of Account receivable Other receivable 减:其他应收款坏账准备Less: Bad debt provision for Other receivable 其他应收款净额Net bal of Other receivable Prepayment Subsidy receivable Inventory 减: Less: Provision for Inventory 存货净额Net bal of Inventory 已完工尚未结算款Amount due from customer for contract work Deferred Expense 一年内到期的 Long-term debt investment due within one year 一年内到期的应收融资租赁款Finance lease receivables due within one year Other current assets Total current assets 长期投资Long-term investment Long-term equity investment 委托贷款Entrusted loan receivable

现金流量表中英文版

现金流量表中英文版 现金流量表(非金融类) CASH FLOW STATEMENT(Travel enterprise) 会外年通03表 编制单位:Name of enterprise: 单位:元 项目ITEMS 行次金额 一、经营活动产生的现金流量:CASH FLOWS FROM OPERATING ACTIVITIES 1 销售商品、提供劳务收到的现金Cash received from sale of goods or rendering of services 2 收到的税费返还Refund of tax and levies 3 收到的其他与经营活动有关的现金Other cash received relating to operating activities 4 现金流入小计Sub-total of cash inflows 5 购买商品、接受劳务支付的现金Cash paid for goods and services 6 支付给职工以及为职工支付的现金Cash paid to and on behalf of employees 7 支付的各项税费Payments of all types of taxes 8 支付的其他与经营活动有关的现金Other cash paid relating to operating activities 9 现金流出小计Sub-total of cash outflows 10 经营活动产生的现金流量净额Net cash flows from operating activities 11 二、投资活动产生的现金流量:CASH FLOWS FROM INVESTING ACTIVITIES 12 收回投资所收到的现金Cash received from disposal of investments 13 取得投资收益所收到的现金Cash received from returns on investments 14 处置固定资产、无形资产和其他长期资产所收回的现金净额NetCashReceivedFromDisposalOfFixedAssets,IntangibleAssets&OtherLong-termAssets 15 收到的其他与投资活动有关的现金Other cash received relating to investing activities 16 现金流入小计Sub-total of cash inflows 17 购建固定资产、无形资产和其他长期资产所支付的现金Cash paid to acquire fixed assets,intangible assets & other long-term assets 18 投资所支付的现金Cash paid to acquire investments 19 支付的其他与投资活动有关的现金Other cash payments relating to investing activities 20 现金流出小计Sub-total of cash outflows 21 投资活动产生的现金流量净额Net cash flows from investing activities 22 三、筹资活动产生的现金流量:CASH FLOWS FROM FINANCING ACTIVITIES 23 吸收投资所收到的现金Cash received from capital contribution 24 借款所收到的现金Cash received from borrowings 25 收到的其他与筹资活动有关的现金Other cash received relating to financing activities 26 现金流入小计Sub-total of cash inflows 27 偿还债务所支付的现金Cash repayments of amounts borrowed 28 分配股利、利润和偿付利息所支付的现金Cash payments for interest expenses and distribution of dividends or profit 29 支付的其他与筹资活动有关的现金Other cash payments relating to financing activites 30 现金流出小计Sub-total of cash outflows 31 筹资活动产生的现金流量净额Net cash flows from financing activities 32 四、汇率变动对现金的影响EFFECT OF FOREIGN EXCHANGE RATE CHANGES ON CASH 33 五、现金及现金等价物净增加额NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS 34

财务报表各项目中英文对照

财务报表各项目中英文对照 一、损益表INCOME STATEMENT Aggregate income statement 合并损益表 Operating Results 经营业绩 FINANCIAL HIGHLIGHTS 财务摘要 Gross revenues 总收入/毛收入 Net revenues 销售收入/净收入 Sales 销售额 Turnover 营业额 Cost of revenues 销售成本 Gross profit 毛利润 Gross margin 毛利率 Other income and gain 其他收入及利得 EBITDA 息、税、折旧、摊销前利润(EBITDA) EBITDA margin EBITDA率 EBITA 息、税、摊销前利润 EBIT 息税前利润/营业利润 Operating income(loss)营业利润/(亏损) Operating profit 营业利润 Operating margin 营业利润率 EBIT margin EBIT率(营业利润率) Profit before disposal of investments 出售投资前利润 Operating expenses: 营业费用: Research and development costs (R&D)研发费用 marketing expensesSelling expenses 销售费用 Cost of revenues 营业成本 Selling Cost 销售成本 Sales and marketing expenses Selling and marketing expenses 销售费用、或销售及市场推广费用 Selling and distribution costs 营销费用/行销费用 General and administrative expenses 管理费用/一般及管理费用Administrative expenses 管理费用 Operating income(loss)营业利润/(亏损) Profit from operating activities 营业利润/经营活动之利润 Finance costs 财务费用/财务成本 Financial result 财务费用 Finance income 财务收益 Change in fair value of derivative liability associated with Series B convertible redeemable preference shares 可转换可赎回优先股B相关衍生负债公允值变动