国际会计准则框架翻译

(精选)国际会计准则框架翻译

1 目的和地位国际会计准则理事会框架是用于财务报表的编制及呈报,它描述了用于编制财务报表的基本概念。

该框架作为国际会计准则理事会制定会计准则的指南,同时也作为那些不由国际会计准则或国际财务报告准则或解释直接解决的会计问题的指南。

在没有标准或解释的情况下,特别是在处理交易的时候,管理层必须使用其判断力来建立和应用会计政策以此确保信息是相关可靠的。

在做出此种判断的时候,国际会计准则理事会要求管理层认真考虑框架中关于资产、负债、收入和费用的定义,确认标准和计量的概念。

2 国际会计准则理事会框架框架包括:>财务报告的目标>确定对财务报表有用的信息的质量特征>定义财务报表的基本要素,以及这些要素在财务报表中的确认和计量。

>提供资本保全的概念3 通用财务报表该框架涉及通用财务报表。

要求业务主体(无论是私营部门还是公共部门)至少每年编报一次通用财务报表,以满足众多外部使用者对信息的共同需要。

因此,该框架不必涉及专用财务报告,例如为税务机关编制的报告、为政府管理部门编制的报告、编制与证券发行有关的招股说明书以及编制与企业合并相关的报告。

3.1 使用者及其信息需求财务报表的主要使用者是现在和潜在的投资者、雇员、贷款人、供应商和其他商业债权人、顾客、政府及其机构与公众。

所有这些类别的使用者都是依靠财务报告来帮助他们作出决策。

该框架认为,因为投资者是企业风险资本的提供者,所以满足投资者需求的财务报告也会满足其他使用者的一般财务信息需求。

所有这些用户群体共同关注的是一个企业创造现金和现金等价物的能力以及产生这些未来现金流的时间性和确定性。

该框架提醒财务报告并不能提供使用者进行经济决策时可能需要的所有信息,一方面,财务报告反映的是过去事件的财务影响,而大多数财务报告使用者所做出的决策是与未来相关的。

另一方面,财务报告仅提供了其使用者有限的非财务信息。

虽然财务报告不能满足用户群的所有信息需求,但是通用财务报告致力于满足所有使用者共同的信息需求。

会计准则的共同框架【外文翻译】

外文翻译原文:A Common Framework for Accounting StandardsIn September 2010,the U.S.Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) completed the first phase of a project that will influence global standards setting for many years to come.Specifically,the Boards converged key portions of their conceptual frameworks.This month’s column will explain what the Boards have done and the significance of their accomplishment.What’s a Conceptual Framework?A conceptu al framework for a set of accounting standards is an explicit declaration of the fundamental concepts on which the set of standards is based.The concepts addressed by conceptual frameworks tend to be general in nature,broad in scope,and stable over time.For example,a conceptual framework typically will identify the kinds of financial statements that reporting entities should prepare (balance sheet,income statement,etc.) and define the basic elements of those financial statements (assets,liabilities,income, expenses,etc.). Having a conceptual framework eliminates the need for a standards setter,such as the FASB or the IASB,to reestablish core concepts each time it develops or updates a standard.Additionally,by consistently referring to a stable conceptual framework,a standards setter is more likely to promulgate standards that are consistent with each other as well as with significant assumptions and constraints. The conceptual framework of U.S.Generally Accepted Accounting Principles (GAAP) is documented in a series of Statements of Financial Accounting Concepts (SFACs) issued by the FASB.The IASB has documented the conceptual framework of International Financial Reporting Standards (IFRS) in its Framework for the Preparation and Presentation of Financial Statements.Though similar in some respects,the two frameworks have always been separate and distinct from each other—until recently.As part of theirefforts to converge the specific standards that comprise U.S.GAAP and IFRS,the Boards have begun to converge their conceptual frameworks as well.The FASB-IASB Conceptual Framework ProjectIn October 2004,the FASB and the IASB added a joint conceptual framework project to their agendas.The objective of the project is “to develop an improved common conceptual framework that provides a sound accounting standards.”In other words,the Boards have been working together to replace their separate frameworks with a single framework on which both future U.S.GAAP and future IFRS will be based.Each Board is committed to making the single framework better than either one’s existing framework. The joint conceptual framework project consists of eight phases,designated “A”through “H”:A. Objective and qualitative characteristicsB. Elements and recognitionC. MeasurementD. Reporting entityE. Presentation and disclosure, including financial reporting boundariesF. Framework purpose and status in GAAP hierarchyG. Applicability to the not-for-profit sectorH. Remaining issuesIn July 2006,the FASB and the IASB issued a Preliminary Views (PV) document for Phase A that described the Boards’tentative thoughts on the overall objective of financial reporting and on the necessary and desirable qualitative characteristics of reported financial information.After further deliberations,the Boards issued an Exposure Draft (ED) for Phase A in May 2008 that proposed the first two chapters of a common conceptual framework.Final versions of those two chapters were subsequently issued by the Boards on September 28,2010.The FASB issued the two chapte rs together as SFAC No.8,“Conceptual Framework for Financial Reporting—Chapter 1,The Objective of General Purpose Financial Reporting,and Chapter 3,Qualitative Characteristics of Useful Financial Information(a replacement of FASB Concepts Statements No.1 a nd No.2).”(SFACNo.1 was “Objectives of Financial Reporting by Business Enterprises,”and SFAC No.2 was “Qualitative Characteristics of Accounting Information.”)The Board had previously issued only seven SFACs in its 37-year history—none of them in the past 10 years.The infrequency of SFAC issuance reflects the high degree of stability in the FASB’s conceptual framework over time.But change happens,and the less frequently it happens,the more significant it is when it does happen.For its part,the IASB incorporated the two chapters into a revised version of its framework that it published as The Conceptual Framework for Financial Reporting 2010.Previously,the IASB hadn’t made a substantive revision to its framework since 2001. Again,that fact that conceptual frameworks don’t change frequently makes the recent changes by the FASB and the IASB all the more notable.The Objective of General Purpose Financial ReportingChapter 1 of the Boards’common conceptual framework focuses on the overall objective of financial reporting.As stated in SFAC No.8,“The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders,and other creditors in making decisions about providing resources to the entity.”This is broadly consistent with the FASB’s prior objective as stated in SFAC No.1:“Financial reporting should provide information that is useful to present and potential investors and creditors and other users in making rational investment,credit,and similar decisions.”The newly defined objective is also similar to the IASB’s prior objective of“provid[ing] information about the financial position,performance,and changes in financial position of an entity that is useful to a wide range of users in making economic decisions.”The aspect of the new converged objective that differs most from each Board’s previous objective is the emphasis on “general purpose”financial reporting.Both Boards currently view their standards-setting efforts as directed at the needs of financial-statement users who aren’t in a position to obtain specific information tailored to each user’s individual needs.Qualitative Characteristics of Useful Financial InformationThe FASB and the IASB decided that the second chapter they issued recently willactually be Chapter 3 of their common conceptual framework.The Boards have reserved Chapter 2 for the output of Phase D (the reporting entity phase) of the conceptual framework project.Most of us think of the information in financial statements as being primarily quantitative in nature.But the FASB and the IASB have long recognized that there are certain qualitative characteristics of financial information that affect its usefulness—specifically,how useful it is for making the kinds of economic decisions that users of financial statements make.Accordingly,the Boards have identified such qualitative characteristics in Chapter 3.As outlined above, there are in principle two distinct components to these payments, which are the transaction value at the point of purchase (which is the cost of the resource consumed) and the difference between this value and the actual settlement amount (which is a cost of finance). Yet, in practice, this distinction is rarely made, and the supplier's credit terms are typically rolled up into a single amount. While it would be possible for accounting standards to require the separate calculation of all financing expenses, the current absence of such a requirement means that an entity's operating profit includes suppliers' retum on finance. For the sake of consistency between the income statement and the balance sheet, accounts payable should therefore also be classified as operating. If they were not, measures of retum on capital employed would be artificially low. Conceptually, if financing activity is defined by nature, classifying accounts payable as operating would be the wrong answer, but practically it would at least be intemally consistent.It would not be the wrong answer, however, according to a fianctional perspective on financing activity. Indeed, the absence of a separately reported financing expense can be viewed as evidence that the underlying fiinction is not financing. The case for the functional perspective is stronger still if standard-setters also seek to achieve consistency with the cash flow statement. Consider, for example, an asset retirement obligation. The liability is by nature a source of finance, which results fi-om an operating expense and which increases as financing expenses (interest costs) are incurred. The cash settlement of the liability does not distinguish, however, between the operating andfinancing components of the liability: there is not an operating cash flow separate fi-om a financing cash flow.These concems over measurement reliability might suggest that the gain or loss from revised cash flow estimates should be reported as operating, yet the same would not be tme for a gain or loss from revisions to expected discount rates, which are the capitalised counterpart of the current period's interest costs and so are not candidates for inclusion in operating profit.The Boards have deemed relevance and faithful representation to be the fundamental qualitative characteristics of useful financial information.This reflects the Boards’belief that financial information must exhibit those characteristics in order to be useful for making decisions.Additionally,the Boards have identified comparability,verifiability,timeliness,and understandability as qualitative characteristics that enhance the usefulness of financial information.Such characteristics complement the fundamental characteristics and enhance decision-usefulness when they are present.In short,they are “nice to have”characteristics rather than “must have”ones.(As a matter of personal opinion,I find it somewhat disturbing that the Boards don’t consider understandability to be “fundamental.”)In addition to fundamental and enhancing qualitative characteristics,the Boards have also identified a pervasive constraint:cost. They clearly recognize that if the costs of applying a particular accounting standard would exceed the benefits of doing so,then it makes no sense to impose such a standard on reporting entities.The fundamental characteristics, enhancing characteristics,and pervasive constraint that the Boards have mutually identified represent a blending of concepts that were, for the most part,already present in their prior conceptual frameworks.The earlier frameworks of U.S.GAAP and IFRS,however,differed from each other with regard to relative priorities among the characteristics and the wording used to describe them.A less straightforward case arises if there is a loan of resource but the counterparty is not a bank or other financial institution. Would this change the initial observation regarding the nature of financing activity? A case that can be applied here is a pension obligation, for which the counterparty is employees rather than a bank. Adefined benefit pension plan involves the entity deferring settlement of an amount equal to the service cost, incurring interest costs thereon and then repaying the amount owed in the form of a pension. In principle, employees could accept immediate settlement of services rendered instead of entering a pension agreement, and an entity could achieve this immediate settlement by borrowing, with the net effect that the entity substitutes a bank loan for a pension obligation. Either way, the existence of the liability is associated with fiiture interest costs and repayment of capital, and there is a clear distinction between the expenses relating to operating activity (i.e. the service cost that gives rise to the liability) and the method by which these expenses are financed (either by employees or by the bank). A similar argument can also be made for cases other than pension obligations, such as provisions for deferred tax, where the counterparty providing finance (i.e. accepting deferred settlement) is the govemment. For some other provisions, such as those for asset retirement obligations, a clearly identifiable counterparty might be absent: an entity's current operating activity gives rise to a current obligation to incur future cash outflows, but payment will eventually be made to an entity that is not yet known. The absence of a current counterparty does not, however, change the conclusion that the entity's operating activity is being financed by means of deferred settlement. Interest costs are recognised purely as a consequence of this deferral, and not as a consequence of further operating activity, and the situation is no different in substance from a bank loan: the carrying amount of the provision equals the amount that the entity would need to borrow in order to settle its obligation, and the unwinding of the discount rate is equal to the interest costs that would be incurred on the amount borrowed.What Now?Because the conceptual framework of U.S.GAAP isn’t itself authoritative,the recent revisions to it don’t change authoritative U.S.GAAP as documented in the FASB Accounting Standards Codification(TM).The revisions do change authoritative IFRS,however,because the conceptual framework of IFRS is considered authoritative. Chapter 2 of the common conceptual framework is due to be released by the end of 2010.As noted previously,it will address the concept of the reporting entity (PhaseD).The Boards are also currently working on Phases B (Elements and Recognition) and C (Measurement).Although the conceptual framework project is currently being conducted in parallel with numerous standard-level projects,its successful completion will be essential to the ultimate success of all of the Boards’convergence efforts.As I say in the Convergence Guidebook for Corporate Financial Reporting (Wiley),“If different standard setters disagree on the basic concepts of financial reporting,then it is unlikely that those standard setters will ever agree on specific standards.”Now that the FASB and the IASB have agreed on some portions of a common conceptual framework,we see that the Boards are indeed capable of converging their standards at the conceptual level and are intent on achieving even more conceptual convergence in the years ahead.Source: Pounder, Bruce. A Common Framework for Accounting Standards [J]. Strategic Finance,2010,(11) : 61-64.译文:会计准则的共同框架2010年9月,美国财务会计准则委员会(FASB)和国际会计准则委员会(IASB)完成了一个项目的第一阶段,这个项目将在以后的多年里影响全球标准的制定。

国际会计英语术语

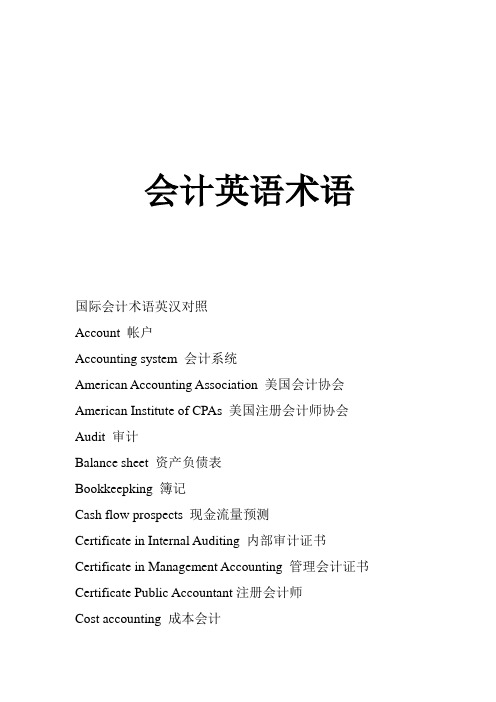

会计英语术语国际会计术语英汉对照Account 帐户Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Income statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会Statement of cash flow 现金流量表Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owners equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设Stockholders 股东Stockholders equity 股东权益Window dressing 门面粉饰原始分录错误error of original entry 原始分录簿book of original entry原则性错误error of principle流动资产current assets流动负债current liabilities流动比率current ratio流动抵押品floating charge租购hire purchase租购公司hirer个体entity差额承上balance brought down差额承前balance brought forward差额转下balance carried down帐户account透支overdraft透支额度facility extent名调乱错误error of commission现金日记簿cash book现金收支帐receipts and payments account现金折扣cash discount虚帐户nominal account净损失net loss累积基金accumulated fund停止经营quit concern动用资金capital employed专利税royalty专利权patent货物寄销帐goods sent on consignment account 票面值par value接纳accept净流动资产net current assets速动比率liquidity ratio寄销consignment寄销人consignor寄销帐consignment account票据拒付手续费noting charges票据贴现discounting bill of exchange 组织大纲memorandum of association 组织章程articles of association商誉goodwill贷方credit贷项通知单credit note贷项通知单(银行用) credit advice提用drawings提款帐drawings account费用expenses期未存货closing stock期初存货opening stock单式簿记single-entry bookkeeping备忘memorandum补助分类帐subsidiary account报表statement贴现discount发票invoice发票人drawer间接工资indirect wages贴现手续费discounting charge普通股ordinary shares普通日记簿general journal普通原始簿general book of original entry间接原料indirect material间接费用indirect expenses, overhead间接制造成本factory overhead开帐分录opening entries结帐分录closing entries短期合营joint venture短期合营帐joint venture account短期合营备忘帐memorandum joint venture account 结算票据honour the bill of exchange超额利润super profit资本capital资本主proprietor资本支出capital expenditure资本报酬率return on capital employed零用现金凭单petty cash voucher零用现金簿petty cash book债权人creditor债券debenture预计利息帐法interest suspense account method预付费用prepaid expenses预取收益receipt in advance会计等式accounting equation损益帐profit and loss account损益计算income determination过帐posting资产assets资产负债表balance sheet资产收回价值goods repossessed value试算表trial balance经常性项目recurrent item溢价premium溢价发行issued at premium催缴股款call银行往来调节表bank reconciliation statement 复式簿记double-entry bookkeeping说明account for实帐户real account对销contra制成品finished goods汇票bill of exchange, draft实际成本actual cost截线enter short其它资产 other assets递延资产 deferred assets债券发行成本 deferred bond issuance costs长期预付租金 long-term prepaid rent长期预付保险费 long-term prepaid insurance递延所得税资产 deferred income tax assets预付退休金 prepaid pension cost其它递延资产 other deferred assets闲置资产 idle assets闲置资产 idle assets长期应收票据及款项与催收帐款 long-term notes , accounts and overdue receivables长期应收票据 long-term notes receivable长期应收帐款 long-term accounts receivable催收帐款 overdue receivables长期应收票据及款项与催收帐款-关系人 long-term notes, accounts and overdue receivables- related parties 其它长期应收款项 other long-term receivables备抵呆帐-长期应收票据及款项与催收帐款 allowance for uncollectible accounts - long-term notes, accounts and overdue receivables出租资产 assets leased to others出租资产 assets leased to others出租资产 -重估增值 assets leased to others - incremental value from revaluation累积折旧 -出租资产 accumulated depreciation - assets leased to others存出保证金 refundable deposit资本公积- 库藏股票交易 additional paid-in capital - treasury stock trans-actions保留盈余(或累积亏损)如需转载,请注明来自FanE『翻译中国』http;// retained earnings (accumulated deficit)如需转载,请注明来自FanE『翻译中国』http;//法定盈余公积 legal reserve法定盈余公积 legal reserve特别盈余公积 special reserve意外损失准备 contingency reserve改良扩充准备 improvement and expansion reserve偿债准备 special reserve for redemption of liabilities 其它特别盈余公积 other special reserve未分配盈余(或累积亏损)如需转载,请注明来自FanE『翻译中国』http;// retained earnings-inappropriate (or accumulated deficit)如需转载,请注明来自FanE『翻译中国』http;//累积盈亏 accumulated profit or loss前期损益调整 prior period adjustments本期损益 net income or loss for current period杂项资产 miscellaneous assets受限制存款 certificate of deposit - restricted 杂项资产 -其它 miscellaneous assets - other负债 liabilities~ 流动负债 current liabilities短期借款 short-term borrowings(debt)如需转载,请注明来自FanE『翻译中国』http;//银行透支 bank overdraft银行借款 bank loan短期借款 -业主 short-term borrowings - owners短期借款 -员工 short-term borrowings - employees 短期借款 -关系人 short-term borrowings- related parties短期借款 -其它 short-term borrowings - other应付短期票券 short-term notes and bills payable应付商业本票 commercial paper payable银行承兑汇票 bank acceptance其它应付短期票券 other short-term notes and bills payable应付短期票券折价 discount on short-term notes and bills payable应付票据 notes payable应付票据 notes payable应付票据 -关系人 notes payable - related parties其它应付票据 other notes payable应付帐款 accounts pay able应付帐款 -关系人 accounts payable - related parties 应付所得税 income taxes payable应付所得税 income tax payable应付费用 accrued expenses应付薪工 accrued payroll应付租金 accrued rent payable应付利息 accrued interest payable应付营业税 accrued VAT payable应付税捐 -其它 accrued taxes payable- other其它应付费用 other accrued expenses payable~ 其它应付款 other payables应付购入远汇款 forward exchange contract payable应付远汇款 -外币 forward exchange contract payable - foreign currencies买卖远汇溢价 premium on forward exchange contract应付土地房屋款 payables on land and building purchased 应付设备款 Payables on equipment其它应付款 -关系人 other payables - related parties 应付股利 dividend payable应付红利 bonus payable应付董监事酬劳 compensation payable to directors and supervisors其它应付款 -其它 other payables - other预收款项advance receipts预收货款 sales revenue received in advance预收收入 revenue received in advance其它预收款 other advance receipts一年或一营业周期内到期长期负债 long-term liabilities -current portion一年或一营业周期内到期公司债 corporate bonds payable - current portion一年或一营业周期内到期长期借款 long-term loanspayable - current portion一年或一营业周期内到期长期应付票据及款项 long-term notes and accounts payable due within one year or one operating cycle一年或一营业周期内到期长期应付票据及款项-关系人long-term notes and accounts payables to related parties - current portion其它一年或一营业周期内到期长期负债 other long-termlia- bilities - current portion~ 其它流动负债 other current liabilities销项税额 VAT received(or output tax)如需转载,请注明来自FanE『翻译中国』http;//暂收款 temporary receipts代收款 receipts under custody估计售后服务/保固负债 estimated warranty liabilities 递延所得税负债 deferred income tax liabilities递延兑换利益 deferred foreign exchange gain业主(股东)如需转载,请注明来自FanE『翻译中国』http;//往来 owners current account同业往来 current account with others其它流动负债-其它 other current liabilities - others 长期负债 long-term liabilities应付公司债 corporate bonds payable应付公司债 corporate bonds payable应付公司债溢(折)如需转载,请注明来自FanE『翻译中国』http;//价 premium(discount)如需转载,请注明来自FanE『翻译中国』http;// on corporate bonds payable(本文已被浏览2355 次)一贯原则consistency人名帐户personal account工作底稿working paper已承兑汇票accepted draft/bill已发行股本issued capital己催缴股本called-up capital己缴股本paid-up capital已赎回票据retired bill欠付催缴股款calls in arrear毛存现金cash in hand毛利gross profit毛利率gross profit ratio/margin毛损gross loss日记簿journal月结单monthly statement少量余额minority balance分配allocation分类帐ledger公证文件noting分摊apportionment加成mark-up永久业权freehold主要成本prime cost未催缴股本uncalled capital申请及分配application and allotment 目标条款object clause平价发行issued at par出让人帐vendor account自平self-balancing自平分类帐self-balancing ledger自动转帐autopay成本会计cost accounting共同joint存货记录簿stock records存货周转率stock turnover rate存货帐stock account年终盘点存货year-end stock taking企业个体business entity合伙企业partnership在运品goods in transit在制品work-in-progress呆帐bad debts呆帐准备provision for bad debts没收forfeiture利息帐法interest account method重置replacement决算表final accounts折扣栏discount column折旧depreciation折旧帐法depreciation account method折旧准备帐法depreciation provision account method 折价discount非人名帐户impersonal account抽取extract固定资产fixed assets长期负债long-term liabilities法人legal person股本share capital拒付票据dishonoured bill股份share或有负债contingent liability所有权ownership承兑acceptance承兑人acceptor法定股本authorised capital股东主权shareholders’equity股东资金shareholders’fund受票人drawee直线折旧法straight-line depreciation method 直接工资direct wages直接原料direct material直接费用direct expenses股票share certificate承销人consignee承销清单account sales抵销set-offs抵销性错误compensating error定额制度imprest system科目account负债liabilities信讬人trustee按比例分配pro rata背书endorsement持票人holder盈余surplus盈余分拨帐appropriation account重点钜数materiality重估折旧法revaluation depreciation method借方debit借项通知单debit note借项通知单(银行用) debit advice库存现金cash in hand配比match个别several纯利net profit纯利率net profit ratio记帐时借贷方互调complete reversal of entries 特别原始簿special book of original entry(本文已被浏览2562 次)认讲意图offer暂记帐户suspense account销货成本cost of goods sold销货折扣discounts allowed销货退回簿returns inwards book销货净额net sales销货发票sales invoice销货簿sales journal调整adjustment制造成本会计manufacturing account数量表达及稳定货币量度quantifiability and stable monetary measure随要随付payable on demand余绌surplus and deficit遗漏错误error of omission余额承上balance brought down余额承前balance brought forward余额递减折旧法reducing balance depreciation method余额转下balance carried down历史成本historical cost担保还款佣金del credere commission总分类帐general ledger应付帐款分类帐creditors ledger, purchases ledger应付帐款分类帐统制帐户creditors ledger control account, purchases ledger control account应收帐款分类帐debtors ledger, sales ledger应收帐款分类帐统制帐户debtors ledger control account, sales ledger control account应计收益accrued income亏绌deficit购货折扣discounts received购货退出簿returns outwards book购货帐purchases account购货净额net purchases购货簿purchases journal营业折扣trade discount购销帐trading account购销损益帐trading and profit and loss account优先股preference shares应付帐款赊帐期限credit period received form trade creditors 应付票据bill payable应收帐款赊帐期限credit period allowed to trade debtors应收票据bill receivable应计基础accrued basis购买权option偿债基金sinking fund营运资金比率working capital ratio转让transfer旧换新trade-in稳健保守conservatism, prudence簿记bookkeeping继续经营going concern变产帐realisation account赎回资本准备金capital redemption reserve fund英汉会计词汇accept 接纳acceptance 承兑accepted draft/bill 已承兑汇票acceptor 承兑人account 科目,帐户account for 说明account sales 承销清单accounting equation 会计等式accrued basis 应计基础accrued income 应计收益accumulated fund 累积基金actual cost 实际成本adjustment 调整allocation 分配application and allotment 申请及分配apportionment 分摊appropriation account 盈余分拨帐articles of association 组织章程assets 资产authorised capital 法定股本autopay 自动转帐bad debts 呆帐balance brought down 余额承上balance brought forward 余额承前balance carried down 余额转下balance sheet 资产负债表bank reconciliation statement 银行往来调节表bill of exchange, draft 汇票bill payable 应付票据bill receivable 应收票据book of original entry 原始分录簿bookkeeping 簿记business entity 企业个体call 催缴股款called-up capital 己催缴股本calls in arrear 欠付催缴股款capital 资本capital employed 动用资金capital expenditure 资本支出capital redemption reserve fund 赎回资本准备金cash book 现金日记簿cash discount 现金折扣cash in hand 手存现金closing stock 期未存货compensating error 抵销性错误complete reversal of entries 记帐时借贷方互调conservatism 稳健保守consignee 承销人consignment 寄销consignment account 寄销帐consignor 寄销人consistency 一贯原则contingent liability 或有负债contra 对销cost accounting 成本会计cost of goods sold 销货成本credit 贷方credit advice 贷项通知单(银行用)credit note 贷项通知单credit period allowed to trade debtors 应收帐款赊帐期限credit period received form trade creditors 应付帐款赊帐期限creditor 债权人creditors ledger 应付帐款分类帐creditors ledger control account 应付帐款分类帐统制帐户current assets 流动资产current liabilities 流动负债current ratio 流动比率debenture 债券debit 借方debit advice 借项通知单(银行用)debit note 借项通知单debtors ledger 应收帐款分类帐debtors ledger control account 应收帐款分类帐统制帐户del credere commission 担保还款佣金deficit 亏绌depreciation 折旧depreciation account method 折旧帐法depreciation provision account method 折旧准备帐法direct expenses 直接费用direct material 直接原料direct wages 直接工资discount 贴现,折价discounts allowed 销货折扣discount column 折扣栏discounts received 购货折扣discounting bill of exchange 票据贴现discounting charge 贴现手续费dishonoured bill 拒付票据double-entry bookkeeping 复式簿记draft 汇票drawee 受票人drawer 发票人drawings 提用drawings account 提款帐endorsement 背书enter short 截线entity 个体error of commission 帐名调乱错误error of omission 遗漏错误error of original entry 原始分录错误error of principle 原则性错误expenses 费用extract 抽取facility extent 透支额度factory overhead 间接制造成本final accounts 决算表finished goods 制成品fixed assets 固定资产floating charge 流动抵押品forfeiture 没收freehold 永久业权general book of original entry 普通原始簿general journal 日记簿general ledger 总分类帐going concern 继续经营goods in transit 在运品goods repossessed value 资产收回价值goods sent on consignment account 货物寄销帐goodwill 商誉gross loss 毛损gross profit 毛利gross profit ratio 毛利率hire purchase 租购hirer 租购公司historical cost 历史成本holder 持票人honour the bill of exchange 结算票据impersonal account 非人名帐户imprest system 定额制度income determination 损益计算indirect expenses 间接费用indirect material 间接原料indirect wages 间接工资interest account method 利息帐法interest suspense account method 预计利息帐法invoice 发票issued at par 平价发行issued at premium 溢价发行issued capital 已发行股本joint 共同joint venture 短期合营joint venture account 短期合营帐journal 日记簿ledger 分类帐legal person 法人liabilities 负债liquidity ratio 速动比率long-term liabilities 长期负债manufacturing account 制造成本会计margin 毛利率mark-up 加成match 配比materiality 重点钜数memorandum 备忘memorandum joint venture account 短期合营备忘帐memorandum of association 组织大纲minority balance 少量余额monthly statement 月结单net current assets 净流动资产net loss 净损失net profit 纯利net profit ratio 纯利率net purchases 购货净额net sales 销货净额nominal account 虚帐户noting 公证文件noting charges 票据拒付手续费object clause 目标条款offer 认讲意图opening stock 期初存货opening entries 开帐分录option 购买权ordinary shares 普通股overdraft 透支overhead 间接费用ownership 所有权paid-up capital 己缴股本par value 票面值partnership 合伙企业patent 专利权payable on demand 随要随付personal account 人名帐户petty cash book 零用现金簿petty cash voucher 零用现金凭单posting 过帐preference shares 优先股premium 溢价prepaid expenses 预付费用prime cost 主要成本pro rata 按比例分配profit and loss account 损益帐proprietor 资本主provision for bad debts 呆帐准备prudence 稳健保守purchases account 购货帐purchases journal 购货簿purchases ledger 应付帐款分类帐purchases ledger control account 应付帐款分类帐统制帐户quantifiability and stable monetary measure 数量表达及稳定货币量度quit concern 停止经营real account 实帐户realisation account 变产帐receipts and payments account 现金收支帐receipt in advance 预取收益recurrent item 经常性项目reducing balance depreciation method 余额递减折旧法replacement 重置retired bill 已赎回票据returns inwards book 销货退回簿return on capital employed 资本报酬率returns outwards book 购货退出簿revaluation depreciation method 重估折旧法royalty 专利税sales invoice 销货发票sales journal 销货簿sales ledger 应收帐款分类帐sales ledger control account 应收帐款分类帐统制帐户set-offs 抵销several 个别share 股份share capital 股本share certificate 股票shareholders’equity 股东主权shareholders’fund 股东资金self-balancing 自平self-balancing ledger 自平分类帐single-entry bookkeeping 单式簿记sinking fund 偿债基金special book of original entry 特别原始簿statement 报表stock account 存货帐stock records 存货记录簿stock turnover rate 存货周转率straight-line depreciation method 直线折旧法subsidiary account 补助分类帐super profit 超额利润surplus 盈余surplus and deficit 余绌suspense account 暂记帐户trade discount 营业折扣trade-in 旧换新trading account 购销帐trading and profit and loss account 购销损益帐transfer 转让trial balance 试算表trustee 信讬人uncalled capital 未催缴股本vendor account 出让人帐work-in-progress 在制品working capital ratio 营运资金比率working paper 工作底稿year-end stock taking 年终盘点存货(本文已被浏览2566 次)。

ifrs准则中英文对照

ifrs准则中英文对照

IFRS准则(International Financial Reporting Standards)是国际

财务报告准则,又称国际会计准则(International Accounting Standards),是世界各国财务报告标准的国际统一标准。

其目的是为了促进全球财务信息的透明度和比较性,提高投资者和利益相关方对

企业财务状况的理解和信任度。

IFRS准则的起源可以追溯到20世纪70年代,当时国际航空运输协会建立了一个财务报告委员会,专门负责制定全球标准财务报告准则。

1989年,国际会计准则委员会(IASB)成立,被授权制定IFRS准则

并推进其全球范围内的推广和实施。

IFRS准则适用于所有上市公司和银行,以及一些非盈利性组织。

其主

要特点是强调财务报告的透明度、可比性和真实性。

其中,最重要的

标准包括IAS 1 (财务报告),IAS 2(存货),IAS 7(现金流量表)和IAS 8(会计政策、会计估计和会计错误)。

IFRS准则的全球推广和实施,旨在促进全球财务信息的透明度和比较性,增强投资者和利益相关方对企业财务状况的理解和信任度。

同时,IFRS准则为企业提供了更好的机会,通过全球化的财务报告标准,获

得更多的国际投资和融资。

当然,IFRS准则在全球范围内的推广和实施也面临诸多挑战,如地域差异、语言障碍、文化差异等。

因此,IFRS准则的设计和实施需要各国政府、监管部门、投资者、企业和专业人士的共同努力和支持,以确保IFRS准则能够真正发挥其充分作用,为全球金融市场的稳定和发展做出更大的贡献。

国际会计准则ias中文版

国际会计准则ias中文版国际会计准则2003年9月19日国际会计准则(IAS)目录Framework for the Preparation and Presentation of Financial Statements (3)Preface ...................................................................... ................................ .............................................. . (24)Procedure and Objective of IASB (27)IAS 1: Presentation of Financial Statements (33)IAS 2: Inventories................................................................... ..................................... ......................................... .55IAS 7: Cash Flow Statements (62)IAS 8: Net Profit or Loss for the Period, Fundamental Errors and Changes in Accounting Policies (73)IAS 10: Events After the Balance Sheet Date..........................................................................(82)IAS 11: Construction Contracts .................................................................... .. (93)IAS 12: Income T axes ........................................................................(101)IAS 14: Segment Reporting (134)IAS 15: Information Reflecting the Effects of Changing Prices (1)50IAS 16: Property, Plant and Equipment..................................................................... . (155)IAS 17: Leases (169)IAS 18: Revenue ...................................................................... . (18)IAS 19: Employee Benefits (188)IAS 20: Accounting for Government Grants and Disclosure of Government Assistance (227)IAS 21: The Effects of Changes in Foreign Exchange Rates ........................................................................ . (233)IAS 22: Business Combinations.................................................................. .. (244) IAS 23: Borrowing Costs (270)IAS 24: Related Party Disclosures .................................................................. . (275)IAS 26: Accounting and Reporting by Retirement Benefit Plans (280)IAS 27: Consolidated Financial Statements (288)IAS 28: Investments in Associates ................................................................... . (294)IAS 29: Financial Reporting in Hyperinflationary Economies .................................................................... . (301)IAS 30: Disclosures in the Financial Statements of Banks and Similar Financial Institutions (308)IAS 31: Financial Reporting of Interests in Joint Ventures (319)IAS 32: Financial Instruments: Disclosure and Presentation (328)IAS 33: Earnings per Share ........................................................................ .. (351)IAS 34: Interim Financial Reporting (365)IAS 35: Discontinuing Operations (376)IAS 36: Impairment of Assets........................................................................ .. (385)IAS 37: Provisions, Contingent Liabilities and Contingent Assets (410)IAS 38: Intangible Assets ....................................................................... . (426)IAS 39: Financial Instruments: Recognition and Measurement (452)IAS 40: InvestmentProperty...................................................................... .. (504)IAS 41: Agriculture (520)Framework for the Preparation and Presentation of Financial StatementsFramework for the Preparation and Presentation of Financial Statements架The IASB Framework is a conceptual accounting framework that sets out the concepts that underlie thepreparation and presentation of financial statements for external users. It was approved in 1989. The IASBFramework assists the IASB:.in the development of future International Accounting Standards and in its review of existingInternational Accounting Standards; and.in promoting the harmonisation of regulations, accounting standards and procedures relating to thepresentation of financial statements by providing a basis for reducing the number of alternativeaccounting treatments permitted by International Accounting Standards.In addition, the Framework may assist:.preparers of financial statements in applying International Accounting Standards and in dealing withtopics that have yet to form the subject of an International Accounting Standard;.auditors in forming an opinion as to whether financial statements conform with InternationalAccounting Standards;.users of financial statements in interpreting the information contained in financial statements preparedin conformity with International Accounting Standards; and .those who are interested in the work of IASB, providing themwith information about its approach to theformulation of accounting standards.The Framework is not an International Accounting Standard and does not define standards for any particularmeasurement or disclosure issue.In a limited number of cases there may be a conflict between the Framework and a requirement within anInternational Accounting Standard. In those cases where there is a conflict, the requirements of the International Accounting Standard prevail over those of the Framework.世界上许多企业都编制并且向外部使用者呈报财务报表。

IAS国际会计准则英文版

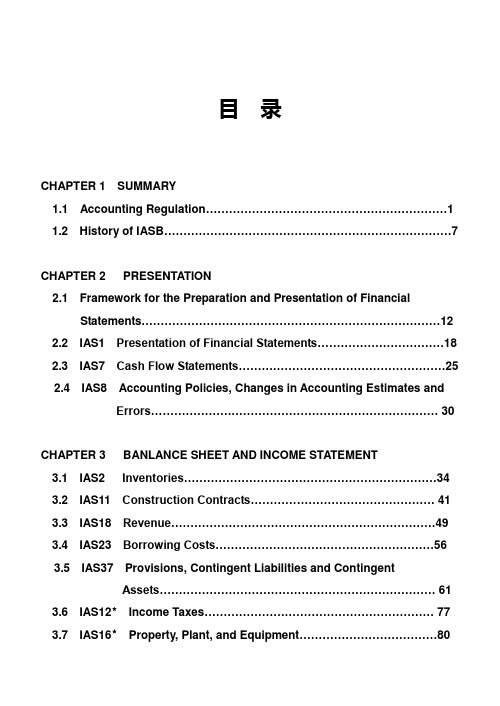

目录CHAPTER 1 SUMMARY1.1 Accounting Regulation (1)1.2 History of IASB (7)CHAPTER 2 PRESENTATION2.1 Framework for the Preparation and Presentation of FinancialStatements (12)2.2 IAS1 Presentation of Financial Statements (18)2.3 IAS7 Cash Flow Statements (25)2.4 IAS8 Accounting Policies, Changes in Accounting Estimates andErrors (30)CHAPTER 3 BANLANCE SHEET AND INCOME STATEMENT3.1 IAS2 Inventories (34)3.2 IAS11 Construction Contracts (41)3.3 IAS18 Revenue (49)3.4 IAS23 Borrowing Costs (56)3.5 IAS37 Provisions, Contingent Liabilities and ContingentAssets (61)3.6 IAS12*Income Taxes (77)3.7 IAS16*Property, Plant, and Equipment (80)3.8 IAS17*Leases (84)CHAPTER 4 DISCLOSURE4.1 IAS10 Events After the Balance Sh eet Date (88)4.2 IAS14 Segment Reporting (93)4.3 IAS24 Related Party Disclosures (108)4.4 IAS34 Interim Financial Reporting (113)CHARPTER 1 SUMMARY1.1 Accounting Regulation广义的会计规范所覆盖的范畴很广,其形成方式也各不相同。

ifrs准则中英文对照

IFRS准则中英文对照引言IFRS(国际财务报告准则,International Financial Reporting Standards)是由国际会计准则理事会(IASB,International Accounting Standards Board)颁布的一套国际财务报告准则。

IFRS准则的广泛应用对全球金融市场的稳定和信息透明度起到了重要作用。

IFRS准则的主要内容1. 会计准则的制定1.1 IFRS准则的目的和使用对象•IFRS准则的目的是为了提供用户对企业财务状况、经营绩效和现金流量的准确和公允的信息。

•IFRS准则适用于所有报告目标是全面提供信息的企业,包括上市公司、金融机构和非营利组织等。

1.2 IFRS准则的基本原则•公平表示原则:企业应按照公平表示原则编制财务报表,以反映其真实的财务状况和经营绩效。

•业务实质重于法律形式:企业应根据业务实质进行会计处理,而不仅仅依据法律形式。

•以预测结果为导向:企业应根据预计的经济利益和损益发生即时原则进行会计处理。

2. 财务报表要求2.1 资产负债表•资产负债表应按照资产、负债和股东权益的分类和顺序编制。

•资产负债表中的项目应根据其预计使用周期和流动性进行分类。

2.2 利润表•利润表中的项目应按照其性质和功能进行分类。

•利润表应明确列示企业期间内实现的收入、费用、损益和所得税等信息。

2.3 现金流量表•现金流量表应明确列示现金流入和流出的项目。

•现金流量表分为经营活动、投资活动和筹资活动三个部分。

IFRS准则与国内会计准则的差异IFRS准则与国内会计准则在以下方面存在差异: 1. 会计处理原则:IFRS准则更注重企业财务信息的公允价值,而国内会计准则更注重成本法计量。

2. 财务报告要求:IFRS准则对财务报表的格式和内容有更为详细的规定,包括分类和顺序等;而国内会计准则在这方面规定较为简略。

3. 对业务组合和资产处置的处理:IFRS 准则对业务组合和资产处置有更为详细的规定,而国内会计准则在这方面规定较为模糊。

国际会计准则框架

国际会计准则框架国际会计准则框架(International Financial Reporting Framework,以下简称IFRS)是国际会计准则委员会(International Accounting Standards Board,以下简称IASB)制定的一个重要准则。

它为制定和解释国际财务报告准则(IFRS)提供了指导,并确保各国会计准则之间的一致性。

IFRS是一套会计规则和原则的框架,旨在使财务报告具有可比性、透明度和可理解性。

它要求企业按照一定的原则编制财务报告,以确保这些报告可以与其它企业进行比较,并使投资者、债权人和其他利益相关者能够有效地评估企业的财务状况和业绩。

IFRS框架的核心原则是公允价值、谨慎性、实质经济事项和合理更新。

公允价值要求企业基于市场价格或估计市场价格来计量资产、负债和金融工具。

谨慎性原则要求企业对可能发生的亏损进行充分计提,并对可能收入的确认进行限制。

实质经济事项原则要求企业根据实质而非形式来处理交易和事件。

合理更新原则要求企业定期更新财务报告以反映最新的情况。

IFRS框架还详细说明了财务报告的基本要素,包括资产、负债、所有者权益、收入和费用。

资产是企业所拥有或控制的具有经济利益的资源,而负债是企业未来所需支付的经济利益。

所有者权益是企业在资产减去负债后所剩余的经济利益。

收入是企业在正常经营活动中获得的经济利益。

费用是企业为实现收入而发生的经济利益损失。

IFRS框架还详细说明了财务报告的基本假设,包括企业持续经营、会计实体、会计期间和货币计量。

持续经营假设认为企业将持续经营下去,除非有充分证据表明相反。

会计实体假设要求企业将企业与其所有者视为两个独立的经济实体。

会计期间假设要求企业将其经营活动分为特定的会计周期。

货币计量假设要求企业将财务信息以货币单位表示。

总体而言,IFRS框架确保了财务报告的透明度和一致性,并为投资者和其他利益相关者提供了判断企业财务状况和业绩的重要依据。

国际会计准则目录(中英文对照)

国际会计准则目录(中英文对照)1.IAS1:Presentation of Financial Statements《IAS1——财务报表的列报》2.IAS2:Inventories《IAS2——存货》3.IAS3:Consolidated Financial Statements《IAS3——合并财务报表》(已被IAS27和IAS28取代)4.IAS4:Depreciation Accounting《IAS4——折旧会计》(已被IAS16、IAS22和IAS38取代)5.IAS5:Information to Be Disclosed in Financial Statements《IAS5——财务报表中披露的信息》(已被IAS1取代)6.IAS6:Accounting Responses to Changing Prices《IAS6——物价变动会计》(已被IAS15取代)7.IAS7:Cash Flow Statements《IAS7——现金流量表》8.IAS8:Accounting Policies, Changes in Accounting Estimates and Errors 《IAS8——当期净损益、重大差错和会计政策变更》9.IAS9:Accounting for Research and Development Activities《IAS9——研发活动会计》(已被IAS38取代)10.IAS10:Events after the Balance Sheet Date《IAS10——资产负债表日后事项》11.IAS11:Construction Contracts《IAS11——建造合同》12.IAS12:Income Taxes《IAS12——所得税》13.IAS13:Presentation of Current Assets and Current Liabilities 《IAS13——流动资产和流动负债的列报》(已被IAS1取代)14.IAS14:Segment Reporting《IAS14——分部报告》15.IAS15:Information Reflecting the Effects of Changing Prices 《IAS15——反映物价变动影响的信息》(2003年已被撤销)16.IAS16:Property, Plant and Equipment《IAS16——不动产、厂场和设备》17.IAS17:Leases《IAS17——租赁》18.IAS18:Revenue《IAS18——收入》19.IAS19:Employee Benefits《IAS19——雇员福利》20.IAS20:Accounting for Government Grants and Disclosure of Government Assistance《IAS20——政府补助会计和政府援助的披露》21.IAS21:The Effects of Changes in Foreign Exchange Rates《IAS21——汇率变动的影响》22.IAS22:Business Combinations《IAS22——企业合并》(已被IFRS3取代)23.IAS23:Borrowing Costs《IAS23——借款费用》24.IAS24:Related Party Disclosures《IAS24——关联方披露》25.IAS25:Accounting for Investments《IAS25——投资会计》(已被IAS39 和IAS40取代)26.IAS26:Accounting and Reporting by Retirement Benefit Plans 《IAS26——退休福利计划的会计和报告》27.IAS27:Consolidated and Separate Financial Statements《IAS27——合并财务报表及对子公司投资会计》28.IAS28:Investments in Associates《IAS28——对联合企业投资会计》29.IAS29:Financial Reporting in Hyperinflationary Economies《IAS29——恶性通货膨胀经济中的财务报告》30.IAS30:Disclosures in the Financial Statements of Banks and Similar Financial Institutions《IAS30——银行和类似金融机构财务报表中的披露》31.IAS31:Interests in Joint Ventures《IAS31——合营中权益的财务报告》32.IAS32:Financial Instruments: Disclosure and Presentation 《IAS32——金融工具:披露和列报》33.IAS33:Earnings per Share《IAS33——每股收益》34.IAS34:Interim Financial Reporting《IAS34——中期财务报告》35.IAS35:Discontinuing Operations《IAS35——终止经营》(已被IFRS5取代)36.IAS36:Impairment of Assets《IAS36——资产减值》37.IAS37:Provisions, Contingent Liabilities and Contingent Assets 《IAS37——准备、或有负债和或有资产》38.IAS38:Intangible Assets《IAS38——无形资产》39.IAS39:Financial Instruments: Recognition and Measurement 《IAS39——金融工具:确认和计量》40.IAS40:Investment Property《IAS40——投资性房地产》41.IAS41:Agriculture《IAS41——农业》。

国际会计准则40【外文翻译】

外文文献翻译一、外文原文原文:International Accounting Standard 40Investment Property Scope1 This Standard shall be applied in the recognition, measurement and disclosure of investment property.2 Investment property is held to earn rentals or for capital appreciation or both. Therefore, an investment property generates cash flows largely independently of the other assets held by an entity. This distinguishes investment property from owner-occupied property. The production or supply of goods or services (or the use of property for administrative purposes) generates cash flows that are attributable not only to property, but also to other assets used in the production or supply process. IAS3 Property, Plant and Equipment applies to owner-occupied property.Recognition15 Investment property shall be recognised as an asset when, and only when:(a) it is probable that the future economic benefits that are associated with the investment property will flow to the entity; and(b) the cost of the investment property can be measured reliably. Measurement at recognition4 An investment property shall be measured initially at its cost. Transaction costs shall be included in the initial measurement.5 The cost of a purchased investment property comprises its purchase price and any directly attributable expenditure. Directly attributable expenditure includes, for example, professional fees for legal services, property transfer taxes and other transaction costs.Measurement after recognition6 This Standard requires all entities to determine the fair value of investmentproperty, for the purpose of either measurement (if the entity uses the fair value model) or disclosure (if it uses the cost model). An entity is encouraged, but not required, to determine the fair value of investment property on the basis of a valuation by an independent valuer who holds a recognised and relevant professional qualification and has recent experience in the location and category of the investment property being valued.Fair value model7 After initial recognition, an entity that chooses the fair value model shall measure all of its investment property at fair value, except in the cases described in paragraph 47.8 A gain or loss arising from a change in the fair value of investment property shall be recognised in profit or loss for the period in which it arises.9 The fair value of investment property is the price at which the property could be exchanged between knowledgeable, willing parties in an arm’s length transaction (see paragraph 5). Fair value specifically excludes an estimated price inflated or deflated by special terms or circumstances such as atypical financing, sale and leaseback arrangements, special considerations or concessions granted by anyone associated with the sale.10 An entity determines fair value without any deduction for transaction costs it may incur on sale or other disposal.11 The fair value of investment property shall reflect market conditions at the end of the reporting period.EC staff consolidated version as of 16 September 2009, EN – EU IAS 40 FOR INFORMATION PURPOSES ONLY12 Fair value is time-specific as of a given date. Because market conditions may change, the amount reported as fair value may be incorrect or inappropriate if estimated as of another time. The definition of fair value also assumes simultaneous exchange and completion of the contract for sale without any variation in price that might be made in an arm’s length transaction between knowledgeable, willing parties if exchange and completion are not simultaneous.13 The fair value of investment property reflects, among other things, rentalincome from current leases and reasonable and supportable assumptions that represent what knowledgeable, willing parties would assume about rental income from future leases in the light of current conditions. It also reflects, on a similar basis,any cash outflows (including rental payments and other outflows) that could be expected in respect of the property. Some of those outflows are reflected in the liability whereas others relate to outflows that are not recognised in the financial statements until a later date (eg periodic payments such as contingent rents).14 The definition of fair value refers to ‘knowledgeable, willing parties’. In this context, ‘knowledgeable’ means th at both the willing buyer and the willing seller are reasonably informed about the nature and characteristics of the investment property, its actual and potential uses, and market conditions at the end of the reporting period.A willing buyer is motivated, but not compelled, to buy. This buyer is neither over-eager nor determined to buy at any price. The assumed buyer would not pay a higher price than a market comprising knowledgeable, willing buyers and sellers would require.to sell at any price, nor one prepared to hold out for a price not considered reasonable in current market conditions. The willing seller is motivated to sell the investment property at market terms for the best price obtainable. The factual circumstances of the actual investment property owner are not a part of this consideration because the willing seller is a hypothetical owner (eg a willing seller would not take into account the particular tax circumstances of the actual investment property owner).15 The definition of fair value ref ers to an arm’s length transaction. An arm’s length transaction is one between parties that do not have a particular or special relationship that makes prices of transactions uncharacteristic of market conditions. The transaction is presumed to be between unrelated parties, each acting independently.16 The best evidence of fair value is given by current prices in an active market for similar property in the same location and condition and subject to similar lease and other contracts. An entity takes care to identify any differences in the nature, location or condition of the property, or in the contractual terms of the leases and othercontracts relating to the property.17 In the absence of current prices in an active market of the kind described in paragraph 45, an entity considers information from a variety of sources, including:(a) current prices in an active market for properties of different nature, condition or location (or subject to different lease or other contracts), adjusted to reflect those differences;(b) recent prices of similar properties on less active markets, with adjustments to reflect any changes in economic conditions since the date of the transactions that occurred at those prices; and(c) discounted cash flow projections based on reliable estimates of future cash flows, supported by the terms of any existing lease and other contracts and (when possible) by external evidence such ascurrent market rents for similar properties in the same location and condition, and using discount rates that reflect current market assessments of the uncertainty in the amount and timing of the cashflows.18 In some cases, the various sources listed in the previous paragraph may suggest different conclusions about the fair value of an investment property. An entity considers the reasons for those differences, in order to arrive at the most reliable estimate of fair value within a range of reasonable fair value estimates.EC staff consolidated version as of 16 September 2009, EN –EU IAS 40 FOR INFORMATION PURPOSES ONLY19 In exceptional cases, there is clear evidence when an entity first acquires an investment property (or when an existing property first becomes investment property after a change in use) that the variability in the range of reasonable fair value estimates will be so great, and the probabilities of the various outcomes so difficult to assess, that the usefulness of a single estimate of fair value is negated. This may indicate that the fair value of the property will not be reliably determinable on a continuing basis (see paragraph 47).20 Fair value differs from value in use, as defined in IAS 36 Impairment ofAssets. Fair value reflects the knowledge and estimates of knowledgeable, willing buyers and sellers. In contrast, value in use reflects the entity’s estimates, including the effects of factors that may be specific to the entity and not applicable to entities in general. For example, fair value does not reflect any of the following factors to the extent that they would not be generally available to knowledgeable, willing buyers and sellers:(a) additional value derived from the creation of a portfolio of properties in different locations;(b) synergies between investment property and other assets;(c) legal rights or legal restrictions that are specific only to the current owner; and(d) tax benefits or tax burdens that are specific to the current owner.21 In determining the carrying amount of investment property under the fair value model, an entity does not double-count assets or liabilities that are recognised as separate assets or liabilities. For example:(a) equipment such as lifts or air-conditioning is often an integral part of a building and is generally included in the fair value of the investment property, rather than recognised separately as property,plant and equipment.(b) if an office is leased on a furnished basis, the fair value of the office generally includes the fair value of the furniture, because the rental income relates to the furnished office. When furniture is included in the fair value of investment property, an entity does not recognise that furniture as a separate asset.(c) the fair value of investment property excludes prepaid or accrued operating lease income, because the entity recognises it as a separate liability or asset.22 The fair value of investment property does not reflect future capital expenditure that will improve or enhance the property and does not reflect the related future benefits from this future expenditure.23 In some cases, an entity expects that the present value of its payments relating to an investment property(other than payments relating to recognised liabilities) will exceed the present value of the related cash receipts. An entity applies IAS 37Provisions, Contingent Liabilities and Contingent Assets to determine whether to recognise a liability and, if so, how to measure it.Inability to determine fair value reliably24 There is a rebuttable presumption that an entity can reliably determine the fair value of an investment property on a continuing basis. However, in exceptional cases, there is clear evidence when an entity first acquires an investment property (or when an existing property first becomes investment property after a change in use) that the fair value of the investment property is not reliably determinable on a continuing basis. This arises when, and only when, comparable market transactions are infrequent and alternative reliable estimates of fair value (for example, based on discounted cash flow projections) are not available. If an entity determines that the fair value of an investment property under construction is not reliably determinable but expects the fair value of the property to be reliably determinable when construction is complete, it shall measure that investment property under construction at cost until either its fair value becomes reliably determinable or construction is completed (whichever is earlier).If an entity determines that the fair value of an investment property (other than an investment property under construction) is not reliably determinable on a continuing basis, the entity shall EC staff consolidated version as of 16 September 2009, EN –EU IAS 40 FOR INFORMATION PURPOSES ONLY8 measure that investment property using the cost model in IAS 16. The residual value of the investment property shall be assumed to be zero. The entity shall apply IAS 16 until disposal of the investment property.25 In the exceptional cases when an entity is compelled, for the reason given in paragraph 53, to measure an investment property using the cost model in accordance with IAS 16, it measures at fair value all its other investment property, including investment property under construction. In these cases, although an entity may use the cost model for one investment property, the entity shall continue to account for each of the remaining properties using the fair value model.26 If an entity has previously measured an investment property at fair value, it shall continue to measure the property at fair value until disposal (or until the propertybecomes owner-occupied property or the entity begins to develop the property for subsequent sale in the ordinary course of business) even if comparable market transactions become less frequent or market prices become less readily available. Cost model27 After initial recognition, an entity that chooses the cost model shall measure all of its investment property in accordance with IAS 16’s requirements for that model, other than those that meet the criteria to be classified as held for sale (or are included in a disposal group that is classified as held for sale) in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. Investment properties that meet the criteria to be classified as held for sale (or are included in a disposal group that is classified as held for sale) shall be measured in accordance with IFRS 5. Transfers28 Transfers to, or from, investment property shall be made when, and only when, there is a change in use, evidenced by:(a) commencement of owner-occupation, for a transfer from investment property to owner-occupied property;(b) commencement of development with a view to sale, for a transfer from investment property to inventories;(c) end of owner-occupation, for a transfer from owner-occupied property to investment property; or(d) commencement of an operating lease to another party, for a transfer from inventories to investment property.29 Paragraph 51(2) requires an entity to transfer a property from investment property to inventories when, and only when, there is a change in use, evidenced by commencement of development with a view to sale. When an entity decides to dispose of an investment property without development, it continues to treat the property as an investment property until it is derecognised (eliminated from the statement of financial position) and does not treat it as inventory. Similarly, if an entity begins to redevelop an existing investment property for continued future use as investment property, the property remains an investment property and is notreclassified as owner-occupied property during the redevelopment.30 Paragraphs 54-59 apply to recognition and measurement issues that arise when an entity uses the fair value model for investment property. When an entity uses the cost model, transfers between investment property, owner-occupied property and inventories do not change the carrying amount of the property transferred and they do not change the cost of that property for measurement or disclosure purposes.31 For a transfer from investment property carried at fair value to owner-occupied property or inventories, the property’s deemed cost for subsequent accounting in accordance with IAS 16 or IAS 2 shall be its fair value at the date of change in use.61 If an owner-occupied property becomes an investment property that will be carried at fair value, an entity shall apply IAS 16 up to the date of change in use. The entity shall treat any difference at that date between the carrying amount of the property in accordance with IAS 16 and its fair value in the same way as a revaluation in accordance with IAS 16.32 Up to the date when an owner-occupied property becomes an investment property carried at fair value, an entity depreciates the property and recognises any impairment losses that have occurred. The entity treats any difference at that date between the carrying amount of the property in accordance with IAS 16 and its fair value in the same way as a revaluation in accordance with IAS 16. In other words:(a) any resulting decrease in the carrying amount of the property is recognised in profit or loss.However, to the extent that an amount is included in revaluation surplus for that property, thedecrease is recognised in other comprehensive income and reduces the revaluation surplus withinequity.(b) any resulting increase in the carrying amount is treated as follows:(i) to the extent that the increase reverses a previous impairment loss for that property, the increase is recognised in profit or loss. The amount recognised in profit or loss does not exceed the amount needed to restore the carrying amount to the carrying amount thatwould have been determined (net of depreciation) had no impairment loss been recognised.(ii) any remaining part of the increase is recognised in other comprehensive income and increases the revaluation surplus within equity. On subsequent disposal of the investment property, the revaluation surplus included in equity may be transferred to retained earnings. The transfer from revaluation surplus to retained earnings is not made through profit or loss.33 For a transfer from inventories to investment property that will be carried at fair value, any difference between the fair value of the property at that date and its previous carrying amount shall be recognised in profit or loss.34 The treatment of transfers from inventories to investment property that will be carried at fair value is consistent with the treatment of sales of inventories.35 When an entity completes the construction or development of a self-constructed investment property that will be carried at fair value, any difference between the fair value of the property at that date and its previous carrying amount shall be recognised in profit or loss.Disposals36 An investment property shall be derecognised (eliminated from the statement of financial position) on disposal or when the investment property is permanently withdrawn from use and no future economic benefits are expected from its disposal.37、The disposal of an investment property may be achieved by sale or by entering into a finance lease. In determining the date of disposal for investment property, an entity applies the criteria in IAS 18 for recognising revenue from the sale of goods and considers the related guidance in the Appendix to IAS 18.IAS 17 applies to a disposal effected by entering into a finance lease and to a sale and leaseback.38 Gains or losses arising from the retirement or disposal of investment property shall be determined as the difference between the net disposal proceeds and the carrying amount of the asset and shall be recognised in profit or loss (unless IAS 17 requires otherwise on a sale and leaseback) in the period of the retirement or disposal.39 The consideration receivable on disposal of an investment property isrecognised initially at fair value. In particular, if payment for an investment property is deferred, the consideration received is recognised initially at the cash price equivalent. The difference between the nominal amount of the consideration and the cash price equivalent is recognised as interest revenue in accordance with IAS 18 using the effective interest method.40 An entity applies IAS 37 or other Standards, as appropriate, to any liabilities that it retains after disposal of an investment property.DisclosureFair value model and cost model41 The disclosures below apply in addition to those in IAS 17. In accordance with IAS 17, the owner of an investment property provides lessors’ disclosures about leases into which it has entered. An entity that holds an investment property under a finance or operating lease provides lessees’ disclosures for finance leases and lessors’ disclosures for any operating leases into which it has entered.42 An entity shall disclose:(a) when classification is difficult (see paragraph 14), the criteria it uses to distinguish investment property from owner-occupied property and from property held for sale in the ordinary course of business.(b) the methods and significant assumptions applied in determining the fair value of investment property, including a statement whether the determination of fair value was supported by market evidence or was more heavily based on other factors (which the entity shall disclose) because of the nature of the property and lack of comparable market data.(c) the extent to which the fair value of investment property (as measured or disclosed in the financial statements) is based on a valuation by an independent valuer who holds a recognised and relevant professional qualification and has recent experience in the location and categoryof the investment property being valued. If there has been no such valuation, that fact shall be disclosed.(d) the amounts recognised in profit or loss for:(i) rental income from investment property;(ii) direct operating expenses (including repairs and maintenance) arising from investment property that generated rental income during the period; and (iii) direct operating expenses (including repairs and maintenance) arising from investment property that did not generate rental income during the period.(e) the existence and amounts of restrictions on the realisability of investment property or the remittance of income and proceeds of disposal.(f) contractual obligations to purchase, construct or develop investment property or for repairs,maintenance or enhancements.Fair value model43 In addition to the disclosures required by paragraph 66, an entity that applies the fair value model in paragraphs 27-49 shall disclose a reconciliation between the carrying amounts of investment property at the beginning and end of the period, showing the following:(a) additions, disclosing separately those additions resulting from acquisitions and those resultingfrom subsequent expenditure recognised in the carrying amount of an asset;(b) additions resulting from acquisitions through business combinations;(c) assets classified as held for sale or included in a disposal group classified as held for sale in accordance with IFRS 5 and other disposals;(d) net gains or losses from fair value adjustments;(e) the net exchange differences arising on the translation of the financial statements into a different presentation currency, and on translation of a foreign operation into the presentation currency of the reporting entity;(f) transfers to and from inventories and owner-occupied property; and(g) other changes.44 shall disclose amounts EC staff consolidated version as of 16 September 2009, EN –EU IAS 40 FOR INFORMATION PURPOSES ONLY 12 relating to that investment property separately from amounts relating to other investment property. In addition, an entity shall disclose:(a) a description of the investment property;(b) an explanation of why fair value cannot be determined reliably;(c) if possible, the range of estimates within which fair value is highly likely to lie; and(d) on disposal of investment property not carried at fair value:(i) the fact that the entity has disposed of investment property not carried at fair value;(ii) the carrying amount of that investment property at the time of sale; and(iii) the amount of gain or loss recognised.Cost model45 In addition to the disclosures required by paragraph 66, an entity that applies the cost model in paragraph 50 shall disclose:(a) the depreciation methods used;(b) the useful lives or the depreciation rates used;(c) the gross carrying amount and the accumulated depreciation (aggregated with accumulated impairment losses) at the beginning and end of the period;(d) a reconciliation of the carrying amount of investment property at the beginning and end of the period, showing the following:(i) additions, disclosing separately those additions resulting from acquisitions and those resulting from subsequent expenditure recognised as an asset;(ii) additions resulting from acquisitions through business combinations;(iii) assets classified as held for sale or included in a disposal group classified as held for sale in accordance with IFRS 5 and other disposals;(iv) depreciation;(v) the amount of impairment losses recognised, and the amount of impairment losses reversed, during the period in accordance with IAS 36;(vi) the net exchange differences arising on the translation of the financial statements into a different presentation currency, and on translation of a foreign operation into the presentation currency of the reporting entity;(vii) transfers to and from inventories and owner-occupied property; and(viii) other changes; and(e) the fair value of investment property. In the exceptional cases described in paragraph 47,when an entity cannot determine the fair value of the investment property reliably, it shalldisclose:(i) a description of the investment property;(ii) an explanation of why fair value cannot be determined reliably; and(iii) if possible, the range of estimates within which fair value is highly likely to lie.Transitional provisionsFair value model46 An entity that has previously applied IAS 40 (2000) and elects for the first time to classify and account for some or all eligible property interests held under operating leases as investment property shall recognise the effect of that election as an adjustment to the opening balance of retained earnings for the period in which the election is first made. In addition:(a) if the entity has previously disclosed publicly (in financial statements or otherwise) the fair value of those property interests in earlier periods (determined on a basis that satisfies the definition of fair value in paragraph 5 and the guidance in paragraphs 29-46), the entity is encouraged, but not required:(i) to adjust the opening balance of retained earnings for the earliest period presented for which such fair value was disclosed publicly; and(ii) to restate comparative information for those periods; and(b) if the entity has not previously disclosed publicly the information described in (a), it shall not restate comparative information and shall disclose that fact.47 This Standard requires a treatment different from that required by IAS 8. IAS 8 requires comparative information to be restated unless such restatement is impracticable.48 When an entity first applies this Standard, the adjustment to the opening balance of retained earnings includes the reclassification of any amount held inrevaluation surplus for investment property.Cost model49 IAS 8 applies to any change in accounting policies that is made when an entity first applies this Standard and chooses to use the cost model. The effect of the change in accounting policies includes the reclassification of any amount held in revaluation surplus for investment property.Effective date50 This international accounting standards on income from 1 January 2001 or after the date began annual financial statements and effective. Encourage early adoption. If the enterprise will these standards used in since 2001 start before January 1, the income, it shall disclose this fact51 This Standard supersedes IAS 40 Investment Property..Source: International accounting standards committee[M], International Accounting Standard40,2001二、翻译文章译文:国际会计准则40投资性房地产范围1、本准则适用于投资性房地产的确认、计量和披露。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1 目的和地位国际会计准则理事会框架是用于财务报表的编制及呈报,它描述了用于编制财务报表的基本概念。

该框架作为国际会计准则理事会制定会计准则的指南,同时也作为那些不由国际会计准则或国际财务报告准则或解释直接解决的会计问题的指南。

在没有标准或解释的情况下,特别是在处理交易的时候,管理层必须使用其判断力来建立和应用会计政策以此确保信息是相关可靠的。

在做出此种判断的时候,国际会计准则理事会要求管理层认真考虑框架中关于资产、负债、收入和费用的定义,确认标准和计量的概念。

2 国际会计准则理事会框架框架包括:>财务报告的目标>确定对财务报表有用的信息的质量特征>定义财务报表的基本要素,以及这些要素在财务报表中的确认和计量。

>提供资本保全的概念3 通用财务报表该框架涉及通用财务报表。

要求业务主体(无论是私营部门还是公共部门)至少每年编报一次通用财务报表,以满足众多外部使用者对信息的共同需要。

因此,该框架不必涉及专用财务报告,例如为税务机关编制的报告、为政府管理部门编制的报告、编制与证券发行有关的招股说明书以及编制与企业合并相关的报告。

3.1 使用者及其信息需求财务报表的主要使用者是现在和潜在的投资者、雇员、贷款人、供应商和其他商业债权人、顾客、政府及其机构与公众。

所有这些类别的使用者都是依靠财务报告来帮助他们作出决策。

该框架认为,因为投资者是企业风险资本的提供者,所以满足投资者需求的财务报告也会满足其他使用者的一般财务信息需求。

所有这些用户群体共同关注的是一个企业创造现金和现金等价物的能力以及产生这些未来现金流的时间性和确定性。

该框架提醒财务报告并不能提供使用者进行经济决策时可能需要的所有信息,一方面,财务报告反映的是过去事件的财务影响,而大多数财务报告使用者所做出的决策是与未来相关的。

另一方面,财务报告仅提供了其使用者有限的非财务信息。

虽然财务报告不能满足用户群的所有信息需求,但是通用财务报告致力于满足所有使用者共同的信息需求。

3.2 财务报告的责任企业的管理层对企业财务报告的编制和呈报负有主要责任。

3.3 财务报告的目标财务报表的目标是提供关于企业财务状况、经营业绩和财务状况变动方面的信息,这种信息对于很大一批使用者进行经济决策是有用的。

财务状况:企业的财务状况受其所控制的经济资源、其财务结构、其资金流动性和偿债能力以及其适应所处经营环境变化的能力的影响。

财务状况表列示了此类信息。

经营业绩:经营业绩是一个企业在已投入的资源上赚取利润的能力。

关于利润数额变动的信息有助于预测企业在现有资源基础上产生现金流量的能力,同时还有助于预测企业利用可能投资的额外资源获取潜在额外现金流的能力。

该框架说明,关于经营业绩的信息主要在综合收益表中提供。

财务状况变动:财务报告的使用者获取企业在报告期从事投资、筹资和经营活动相关的信息。

这些信息有助于评估企业如何产生现金和现金等价物,以及企业如何使用这些现金流。

现金流量表提供了这类信息。

附注和附表:财务报告也包括附注和附表以及其他信息(a)对财务状况表和综合收益表有关项目的解释,(b)对影响企业的风险和不确定性的披露,(c)对没有在财务状况表中确认的所有资源和义务的解释。

4 潜在假设该框架列明了财务报告的潜在假设。

权责发生制:交易和其他事项的影响应当在它们发生时而不是当现金或现金等价物收到或支付时加以确认,以及在与它们相关期间的财务报表中予以报告。

持续经营:财务报告假设企业将会无限期地持续经营下去,或者如果这种假设无效,则披露和不同基础的报告是必需的。

5 财务报告的质量特征这些质量特征是使财务报告提供的信息对投资者、债权人及其他使用者有用的属性。

该框架确定了四种主要的质量特征:>可理解性>相关性>可靠性>可比性5.1 可理解性财务报告提供的信息应以使用者易于理解的方式列示,该使用者要对商业和经济活动以及会计有恰当的了解并且愿意话费适当的精力去研究信息。

5.2 相关性财务报告提供的信息要与影响使用者的经济决策相关。

它能够通过以下两点做到:(a)帮助使用者评价与企业相关的过去、现在和未来事项(2)确认或更改他们过去做出的评价。

重要性是相关性的一个组成部分。

如果信息的遗漏或误报能够影响使用者的经济决策,那么这种信息就是重要的。

及时性是相关性的另一组成部分。

为了使信息有用,信息必须在一定的时间内提供给使用者,在这段时间内使用者最有可能忍耐决策。

5.3 可靠性当财务报告中的信息没有重要错误或偏向,并且被使用者依靠用来忠实反映事件或交易时,信息就是可靠地。

有时在相关性与可靠性之间存在着一种权衡,通过判断提供适当的平衡是必需的。

可靠性受估计的影响,也受财务报告中项目确认和计量的不确定性影响。

这些不确定部分是由于披露造成的,部分是由编制财务报表时的审慎造成的。

谨慎性是指在不确定性条件下作出所需要的估计时,在实施必需的判断中加入一定程度的谨慎,例如不高估资产和收益,不低估负债或费用。

然而谨慎性只能在框架内其他质量特征的范围内实施,特别是在财务报告中交易相关性和忠实地呈报的范围内进行。

谨慎性没有理由故意高估负债或费用,也没有理由低估资产和收益,因为这样编制出来的财务报告不会是中立的,因此,也就不会具有可靠性。

5.4 可比性使用者必须能够比较企业在不同时期的财务报表,以便明确企业财务状况和经营业绩的变化趋势。

使用者还必须能够比较不同企业之间的财务报表。

会计政策的披露对于可比性来说是重要的。

6 财务报告的要素财务报表通过将交易和其他事项按照它们的经济特性分成大类,从而描绘交易和其他事项的财务影响。

这些大类被称为财务报告的要素。

与财务状况(财务状况表)直接相关的要素是>资产>负债>所有者权益与经营业绩(综合收益表)直接相关的要素是>收入>费用现金流量表反映了综合收益表中的收入要素和财务状况表中要素的一些变化。

6.1 要素的定义资产:资产是指企业控制的,由于过去事项而形成的、预期会导致未来经济利益流入企业的资源。

负债:是指企业由于过去事项而承担的现时义务,该义务的履行预期会导致含有经济利益的资源流出企业。

权益:是指企业的资产扣除全部负债以后的剩余利益。

收益:是指在会计期间内经济利益的增加,其表现形式为资产的流入或增值,或者是负债减少。

从而导致权益的增加,但不包括与权益所有者出资有关的那些事项。

收益的定义包含了收入和利得。

收入是在企业正常活动过程中产生的,并且有各种不同的名称,包括销售收入、服务费、利息、股利、使用费和租金等。

利得是指满足收益的定义但可能是也可能不是在企业正常活动过程中产生的其他项目。

利得代表了经济利益的增加,在这一点上与收入的性质没有差别。

因此,在本框架中没有将它列作一种单独的要素。

费用:是指在会计期间内经济利益的减少,其表现形式为资产的流出或折耗,或者是产生了负债,从而导致权益的减少,但不包括与权益所有者分配有关的那些事项。

费用的定义包含了损失以及在企业正常活动过程中发生的那些费用。

在企业正常活动过程中发生的那些费用包括,例如,销售成本、工资和折旧等。

它们通常表现为诸如现金和现金等价物、存货、不动产、厂房和设备等资产的流出或折耗。

损失是指满足费用的定义并且可能是也可能不是在企业正常活动过程中产生的其他项目。

损失代表了经济利益的减少,在这一点上它们与其他费用的性质没有差别。

因此,在本框架中不把它们列作单独的要素。

6.2 财务报告要素的确认确认是将满足要素定义和以下确认标准的项目列入财务状况表或损益表的过程:●与该项目有关的任何未来经济利益可能会流入或流出企业;●该项目具有能够可靠计量的成本或价值。

基于这些一般的标准:当未来经济利益可能流入企业并且资产具有能够可靠计量的成本或价值时,就应在财务状况表中确认该资产。

当一项现时义务的履行会导致含有经济利益的资源可能流出企业并且这一履行将要发生的金额可以可靠计量时,就应在财务状况表中确认该负债。

当与资产的增加或负债的减少有关的未来经济利益的增加已经发生并且能够可靠地计量时,应在综合收益表中确认收益。

这实际上意味着,确认收益的同时,也要确认资产的增加或负债的减少(例如,由于出售商品或劳务引起的资产的净增加,或由于免除应付债务而引起的负债的减少)。

当与资产的减少或负债的增加有关的未来经济利益的减少已经发生并且能够可靠地计量时,应在损益表中确认费用。

这实际上意味着,确认费用是与确认负债的增加或资产的减少同时发生的(例如,预提应付职工款项或计提设备折旧等)。

6.3 财务报告要素的计量计量涉及在财务报告中予以确认和报告的要素分配货币金额。

该框架认为,如今财务报表可以在不同程度上以不同的结合方式采用一系列不同的计量基础,包括:>历史成本>现行成本>可变现(结算)价值>现值历史成本是当今最常用的计量基础,但是历史成本通常也与其他计量基础结合起来使用。

该框架不包括以下概念和原则,即财务报告上特定的要素应该选择使用何种计量基础,在特定的环境中应该选择使用何种计量基础。

然而独立的标准和解释确实提供了这样的指导意见。

2435。