微观经济学英文版名词解释超详细

微观经济学-名词解释和中英文对照

【经济人】从事经济活动的人所采取的经济行为都是力图以自己的最小经济代价去获得自己的最大经济利益。

【需求】消费者在一定时期内在各种可能的价格水平愿意而且能够购买的该商品的数量.【供给】生产者在一定时期内在各种价格水平下愿意并且能够提供出售的该种商品的数量。

【均衡价格】.一种商品的均衡价格是指该种商品的市场需求量和市场供给量相等时的价格。

【供求定理】.其他条件不变的情况下,需求变动分别引起均衡价格和均衡数量的同方向的变动,供给变动引起均衡价格的反方向变动,引起均衡数量的同方向变动。

【经济模型】.经济模型是指用来描述所研究的经济事物的有关经济变量之间相关关系的理论结构。

【弹性】当一个经济变量发生1%的变动时,由它引起的另一个经济变量变动的百分比。

【弧弹性】表示某商品需求曲线上两点之间的需求量的变动对于价格的变动的反应程度。

【点弹性】表示需求曲线上某一点上的需求量变动对于价格变动的反应程度.【需求的价格弹性】表示在一定时期内一种商品的需求量变动对于该商品的价格变动的反应程度。

或者说,表示在一定时期内当一种商品的价格变化百分之一时所引起的该商品的需求量变化的百分比。

【需求的交叉价格弹性】。

表示在一定时期内一种商品的需求量的变动相对于它的相关商品的价格变动的反应程度。

或者说,表示在一定时期内当一种商品的价格变化百分之一时所引起的另一种商品的需求量变化百分比。

【替代品】如果两种商品之间能够相互替代以满足消费者的某一种欲望,则称这两种商品之间存在着替代关系,这两种商品互为替代品.【需求的收入弹性】需求的收入弹性表示在一定时期内消费者对某种商品的需求量变动对于消费者收入量变动的反应程度。

或者说,表示在一定时期内当消费者的收入变化百分之一时所引起的商品需求量变化的百分比.【恩格尔定律】。

在一个家庭或在一个国家中,食物支出在收入中所占的比例随着收入的增加而减少。

用弹性的概念来表述它则可以是:对于一个家庭或一个国家来说,富裕程度越高,则食物支出的收入弹性就越小;反之,则越大。

(完整版)微观经济学中英文术语及其解释

Scarcity the limited nature of society’s resourcesEconomics the study of how society manages its scarce resourcesEfficiency the property of society getting the most it can from its scarce resourcesEquity the property of distributing economic prosperity fairly among the members of society Opportunity cost whatever must be given up to obtain some itemMarginal changes small incremental adjustments to a plan of actionMarket economy an economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and servicesMarket failure a s/tuition in which a market left on its own fails to allocate resources efficiently Externality the impact of one person’s actions on the well-being of a bystanderMarket power the ability of a single economic actor (or small group of actors) to have a substantial influence on market pricesProductivity the quantity of goods and services produced from each hour of a worker’s time Inflation an increase in the overall level of prices in the economyPhilips curve a curve that shows the short-run tradeoff between inflation and unemployment Business cycle fluctuations in economic activity,such as employment and produaionCircular-flow diagram a visual model of the economy that shows how dollars flow through markets among households and firmsProduction possibilities frontier a graph that shows the combinations of output that the economy can possibly produce given the available factors of production and the available production technologyPositive statements claims that attempt to do describe the world as it isNormative statements claims that attempt to prescribe how the world should beAbsolute advantage the comparison among producers of a good according to their productivity Opportunity cost whatever must be given up to obtain some itemComparative advantage the comparison among producers of a good according to their opportunity costImports goods produced abroad and sold domesticallyExports goods produced domestically and sold abroadMarket a group of buyers and sellers of a particular good or serviceCompetitive market a market in which there are many buyers and many sellers so that each has a negligible impact on the market priceQuantity demanded the amount of a good that buyers are willing and able to-purchaseLaw of demand the claim that, other things equal, the quantity demanded of a good falls when the price of the good risesDemand schedule a table that shows the relationship between the price of a good and-the quantity demandedDemand curve a graph of the relationship between the price of a good and the quantity demanded Normal good a good for which, other things equal, an increase in income leads to an increase in demandInferior good a good for which, other things equal, an increase in income leads ‘to a decrease in demandSubstitutes two goods for which an increase in the price of one leads to an increase in the demand for the otherComplements two goods for which an increase in the price of one leads to a decrease in the demand for the otherQuantity supplied the amount of a good that sellers are willing and able to sellLaw of supply the claim that, other things equal, the quantity supplied of a good rises when the price of the good risesSupply schedule a table that shows the relationship between the price of a good and the quantity suppliedSupply curve a graph of the relationship between the price of a good and the quantity supplied Equilibrium a situation in which the price has reached the level where quantity supplied equals quantity demandedEquilibrium price the price that balances quantity supplied and quantity demandedEquilibrium quantity the quantity supplied and the quantity demanded at the equilibrium price Surplus a situation in which quantity supplied is greater than quantity demandedShortage a situation in which quantity demanded is greater than quantity suppliedLaws of supply and demand the claim that the price of any good adjusts to bring the quantity supplied and the quantity demanded for that good into balanceElasticity a measure of the responsiveness of quantity demanded or quantity supplied to one of its determinantsPrice elasticity of demand a measure of how much the quantity demanded of a good responds to a change in the price of that good, computed as the e percentage change in quantity demanded divided by the percentage change in priceIncome elasticity of demand a measure of how much the quantity demanded of a good responds to a change in consumers’ income, computed as the percentage change tn quantity demanded divided by the percentage change in incomeCross-price elasticity of demand a measure of how much the quantity demanded of one good respond to a change in the price of another good, computed as the percentage change m quantity demanded of the first good divided by the percentage change in the price of the second good Price elasticity of supply a measure of how much the quantity supplied of a good responds to a change in the price of that good, computed as the percentage change in quantity supplied divided by the percentage change in pricePrice ceiling a legal maximum on the price at which a good can be soldPrice floor a legal minimum on the price at which a good can be soldTax incidence the manner in which the burden of a tax is shared among participants in a market Welfare economics the study of how the allocation of resources affects economic well-being Willingness to pay the maximum amount that a buyer will pay for a goodConsumer surplus a buyer’s willingness to pay minus the amount the buyer actually paysCost the value of everything a seller must give up to produce a goodProducer surplus the amount a seller is paid for a good minus the seller’s costEfficiency the property of a resource allocation of maximizing the total surplus received by all members of societyEquity the fairness of the distribution of well-being among the members of societyDeadweight loss the fall in total surplus that results from a market distortion, such as a tax World price the price of a good that prevails in the world market for that goodTariff a tax on goods produced abroad and sold domesticallyImport quota a limit on the quantity of a good that can be produced abroad and sold domestically Externality the uncompensated impact of one person’s actions on the well-being of a bystander Internalizing an externality altering incentives so that people take account of the external effects of their actionsCoase theorem the proposition that if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their ownTransaction costs the costs that parties incur in the process of agreeing and following through on a bargainPigovian tax a tax enacted to correct the effects of a negative externalityExcludability the property of a good whereby a person can be prevented from using itRivalry the property of a good whereby one person’s use diminishes other people’s usePrivate goods goods that are both excludable and rivalPublic goods goods that are neither excludable nor rivalCommon resources goods that are rival but not excludableFree rider a person who receives the benefit of a good but avoids paying for itCost-benefit analysis a study that compares the costs and benefits to society of providing a public goodTragedy of the Commons a parable that illustrates why common resources get used more than is desirable from the standpoint of society as a wholeBudget surplus an excess of government receipts over government spendingBudget deficit an excess of government spending over government receiptsAverage tax rate total taxes paid divided by total incomeMarginal tax rate the extra taxes paid on an additional dollar of incomeLump-sum tax a tax that is the same amount for every personBenefits principle the idea that people should pay taxes based on the benefits they receive from government servicesAbility-to-pay principle the idea that taxes’ should be levied on a person according to how well that person can shoulder the burdenVertical equity the idea that taxpayers with a greater ability to pay taxes should pay larger amounts Horizontal equity the idea that taxpayers with similar abilities to pay taxes should pay the same amountProportional tax a tax for which high-income and low-income taxpayers pay the same fraction of incomeRegressive tax a tax for which high-income taxpayers pay a smaller fraction of their income than do low-income taxpayersProgressive tax a tax for which high-income taxpayers pay a larger fraction of their income than do low-income taxpayersTotal revenue the amount a firm receives for the sale of its outputTotal cost the market value of the inputs a firm uses in productionProfit total revenue minus total costExplicit costs input costs that require an outlay of money by the firmImplicit costs input costs that do not require an outlay of money by the firmEconomic profit total revenue minus total cost, including both explicit and implicit costs Accounting profit total revenue minus total explicit costProduction function the relationship between quantity of inputs used to make a good and the quantity of output of the goodMarginal product the increase in output that arises from an additional unit of inputDiminishing marginal product the property whereby the marginal product of an input declines as the quantity of the input increasesFixed costs costs that do not vary with the quantity of output producedVariable costs costs that do vary with the quantity of output producedAverage total cost total cost divided by the quantity of outputAverage fixed cost fixed costs divided by the quantity of outputAverage variable cost variable costs divided by the quantity of outputMarginal cost the increase in total cost that arises from an extra unit of productionEfficient scale the quantity of output that minimizes average total costEconomies of scale the property whereby long-run average total cost falls as the quantity of output increasesDiseconomies of scale the property whereby long-run average total cost rises as the quantity of output increasesConstant returns to scale the property whereby long-run average total cost stays the same as the quantity of output changesCompetitive market a market with many buyers and sellers trading identical products so that each buyer and setter is a price takerAverage revenue total revenue divided by the quantity soldMarginal revenue the change in total revenue from an additional unit soldSunk cost a cost that has already been committed and cannot be recoveredMonopoly a firm that is the sole seller of a product without close substitutesNatural monopoly a monopoly that arises because a single firm can supply a good or service to an entire market at a smaller cost than could two or more firmsPrice discrimination the business practice of selling the same good at different prices to different customersOligopoly a market structure in which only a few settlers offer similar or identical products Monopolistic competition a market structure in which many firms sell products that are similar but not identicalCollusion an agreement among firms in a market about quantities to produce or prices to charge Cartel a group of firms acting in unisonNash equilibrium a situation in which economic actors interacting with one another each choose their best strategy given the strategies that a/l the other actors have chosenGame theory the study of how people behave in strategic situationsPrisoners’ dilemma a particular “game’ between two captured prisoners that illustrates why cooperation is difficult to maintain even when it is mutually beneficialDominant strategy a strategy that is best for a player in a game regardless of the strategies chosen by the other playersMonopolistic competition a market structure in which many firms sell products that are similar but not identicalFactors of production the inputs used’ to produce goods and servicesProduction function the relationship between the quantity of inputs used to make a good and thequantity of output of that goodMarginal product of labor the increase in the amount of output from an additional unit of labor Diminishing marginal product the property whereby the marginal product of an input declines as the quantity of the input increasesValue of the marginal product the marginal product of an input times the price of the output Capital the equipment and structures used to produce goods and servicesCompensating differential a difference in wages that arises to offset the nonmonetary characteristics of different jobsHuman capital the accumulation of investments in people, such as education and on-the-job trainingUnion a worker association that bargains with employers over wages and working conditions Strike the organized withdrawal of labor from a firm by unionEfficiency wages above-equilibrium wages paid by firms in order to increase worker productivity Discrimination the offering of different opportunities to similar individuals who differ only by race, ethnic group, sex, age, or other personal characteristicsPoverty rate the percentage of the population whose family income falls below an absolute level called the poverty linePoverty line an absolute level of income set by the federal government for each family size below which a family is deemed to be in povertyIn-kind transfers transfers to the poor given in the form of goods and services-rather than cash Life cycle the regular pattern of income variation over a person’s lifePermanent income a person’s normal incomeUtilitarianism the political philosophy according to which the government should choose policies to maximize the total utility of everyone in societyUtility a measure of happiness or satisfactionLiberalism the political philosophy according to which the government should choose policies deemed to be just, as evaluated by an impartial observer behind a “veil of ignorance’’Maximin criterion the claim that the government should aim to maximize the well-being of the worst-off person in societyLibertarianism the political philosophy according to which the government should punish crimes and enforce voluntary agreements but not redistribute incomeWelfare government programs that supplement the incomes of the needyNegative income tax a tax system that collects revenue from high-income households and gives transfers to tow-income householdsBudget constraint the limit on the consumption bundles that a consumer can afford Indifference curve a curve that shows consumption bundles that give the consumer the same level of satisfactionMarginal rate of substitution the rate at which a consumer is willing to trade one good for another Perfect substitutes two goods with straight-line indifference curvesPerfect complements two goods with right-angle indifference curvesNormal good a good for which an increase in income raises the quantity demandedInferior good a good for which an increase in income reduces the quantity demandedIncome effect the change in consumption that results when a price change moves the consumer to a higher or lower indifference curveSubstitution effect the change in consumption that results when a price change moves indifference curve to a point with new marginal rate of substitutionGiffen good a good tor which an increase in the price raises the quantity demandedMoral hazard the tendency of a person who is imperfectly monitored to engage in dishonest or otherwise undesirable behaviorAgent a person who is performing an act for another person, called the principalPrincipal a person for whom another person, called the agent, is performing some actAdverse selection the tendency for the mix of unobserved attributes to become undesirable from the standpoint of an uninformed partySignaling an action taken by an informed party to reveal private information to an uninformed partyScreening an action taken by an uninformed party to induce an informed party to reveal informationCondorcet paradox the failure of majority rule to produce transitive preferences for society Arrow’s impossibility theorem a mathematical result showing that, under certain assumed conditions, there is no scheme for aggregating individual preferences into a valid set of social preferencesAbility-to-Pay principle (税收的)能力支付原则the idea that taxes should be levied on a person according to how well that person can shoulder the burdenAbsolute advantage绝对优势the comparison among producers of a good according to their productivityAccounting profit会计利润total revenue minus total explicit costAdverse selection逆向选择the tendency for the mix of unobserved attributes to become undesirable from the standpoint of an uninformed partyAgent代理人 a person who is performing an act for another person, called the principalArrow ’s impossibility theorem阿罗不可能定理a mathematical result showing that, under certain assumed conditions, there is no scheme for aggregating individual preferences into a valid set of social preferencesAverage fixed cost平均固定成本fixed costs divided by the quantity of outputAverage revenue平均收益total revenue divided by the quantity soldAverage tax rate平均税率total taxes paid divided by total incomeAverage total cost平均总成本total cost divided by the quantity of outputAverage variable cost平均可变成本variable costs divided by the quantity of outputBenefits principle受益原则the idea that people should pay taxes based on the benefits they receive from government servicesBudget constraint预算约束the limit on the consumption bundles that a consumer can afford Budget deficit预算赤字an excess of government spending over government receiptsBudget surplus预算盈余an excess of government receipts over government spending Business cycle经济周期fluctuations in economic activity, such as employment and production Capital资产the equipment and structures used to produce goods and servicesCartel卡特尔a group of firms acting in unisonCircular-flow diagram循环流向图 a visual model of the economy that shows how dollars flow through markets among households and firmsCoase theorem科斯定理the proposition that if private parties can bargain without cost overthe allocation of resources, they can solve the problem of externalities on their ownCollusion共谋an agreement among firms in a market about quantities to produce or prices to chargeCommon resources共源goods that are rival but not excludableComparative advantage比较优势the comparison among producers of a good according to their opportunity costCompensating differential补偿性工资差别 a difference in wages that arises to offset the nonmonetary characteristics of different jobsCompetitive market竞争性市场 a market with many buyers and sellers trading identical products so that each buyer and seller is a price takerComplements互补性商品two goods for which an increase in the price of one leads to a decrease in the demand for the otherCondorcet paradox孔多塞悖论(投票悖论)the failure of majority rule to produce transitive preferences for societyConstant returns to scale规模报酬不变the property whereby long-run average total cost stays the same as the quantity of output changesConsumer surplus消费者剩余 a buyer’s willingness to pay minus the amount the buyer actually paysCost成本the value of everything a seller must give up to produce a goodCost-benefit analysis成本收益分析 a study that compares the costs and benefits to society of providing a public goodCross-price elasticity of demand需求的交叉价格弹性 a measure of how much the quantity demanded of one good responds to a change in the price of another good, computed as the percentage change in quantity demanded of the first good divided by the percentage change in the price of the second goodDeadweight loss无谓损失the fall in total surplus that results from a market distortion, such as a taxDemand curve需求曲线 a graph of the relationship between the price of a good and the quantity demandedDemand schedule需求表 a table that shows the relationship between the price of a good and the quantity demandedDiminishing marginal product边际产品递减the property whereby the marginal product of an input declines.As the quantity of the input increasesDiscrimination歧视the offering of different opportunities to similar individuals who differ only by race, ethnic group, sex, age, or other personal characteristicsDiseconomies of scale规模不经济the property whereby long-run average total cost rises as the quantity of output increasesDominant strategy占优策略 a strategy that is best for a player in a game regardless of the strategies chosen by the other playersEconomic profit经济利润total revenue minus total cost, including both explicit and implicit costsEconomics经济学the study of how society manages its scarce resourcesEconomies of scale规模经济the property whereby long-run average total cost falls as the quantity of output increasesEfficiency效率the property of society getting the most it can from its scarce resources Efficiency wages效率工资above-equilibrium wages paid by firms in order to increase worker productivityEfficient scale有效规模the quantity of output that minimizes average total costElasticity弹性 a measure of the responsiveness of quantity demanded or quantity supplied to one of its determinantsEquilibrium均衡 a situation in which the price has reached the level where quantity supplied equals quantity demandedEquilibrium price均衡价格the price that balances quantity supplied and quantity demanded Equilibrium quantity均衡数量the quantity supplied and the quantity demanded at the equilibrium priceEquity平等the property of distributing economic prosperity fairly among the members of societyExcludability排他性the property of a good whereby a person can be prevented from using it Explicit costs显性成本input costs that require an outlay of money by the firmExports出口goods produced domestically and sold abroadExternality外部性the uncompensated impact of one person’s actions on the wellbeing of a bystanderFactors of production生产要素the inputs used to produce goods and servicesFixed casts固定成本costs that do not vary with the quantity of output producedFree rider免费搭车者 a person who receives the benefit of a good but avoids paying for it Game theory博弈论the study of how people behave in strategic situationsGiffen good吉芬商品 a good for which an increase in the price raises the quantity demanded Horizontal equity横向公平the idea that taxpayers with similar abilities to pay taxes should pay the same amountHuman capital人力资本the accumulation of investments in people, such as education andon-the-job trainingImplicit costs隐性成本input costs that do not require an outlay of money by the firmImport quota进口配额 a limit on the quantity of a good that can be produced abroad and sold domesticallyImports进口goods produced abroad and sold domesticallyIncome effect收入效应the change in consumption that results when a price change moves the consumer to a higher or lower indifference curveIncome elasticity of demand需求的收入弹性 a measure of how much the quantity demanded of a good responds to a change in consumers’ income, computed as the percentage change in quantity demanded divided by the percentage change in incomeIndifference curve无差异曲线 a curve that shows consumption bundles that give the consumer the same level of satisfactionInferior good低档物品 a good for which, other things equal, an increase in income leads to a decrease in demandInflation通货膨胀an increase in the overall level of prices in the economyIn-kind transfers实物转移支付transfers to the poor given in the form of goods and services rather than cashInternalizing an externality外部性的内在化altering incentives so that people take account ofthe external effects of their actionsLaw of demand需求定理the claim that, other things equal, the quantity demanded of a good falls when the price of the good risesLaw of supply and demand需求与供给定理the claim that the price of any good adjusts to bring the quantity supplied and the quantity demanded for that good into balanceLiberalism自由主义the political philosophy according to which the government should choose policies deemed to be just, as evaluated by an impartial observer behind a “veil of ignorance”Libertarianism自由至上主义the political philosophy according to which the government should punish crimes and enforce voluntary agreements but not redistribute incomeLife cycle生命周期the regular pattern of income variation over a person’s lifeLump-sum tax定额税 a tax that is the same amount for every personMacroeconomics宏观经济学the study of economy-wide phenomena, including inflation, unemployment, and economic growthMarginal changes边际变动small incremental adjustments to a plan of actionMarginal cost边际成本the increase in total cost that arises from an extra unit of production Marginal product边际产品the increase in output that arises from an additional unit of input Marginal product of labor劳动的边际产品the increase in the amount of output from an additional unit of laborMarginal rate of substitution边际替代率the rate at which a consumer is willing to trade one good for anotherMarginal revenue边际收益the change in total revenue from an additional unit soldMarginal tax rate边际税率the extra taxes paid on an additional dollar of incomeMarket市场 a group of buyers and sellers of a particular good or serviceMarket economy市场经济an economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and services Market failure市场失灵 a situation in which a market left on its own fails to allocate resources efficientlyMarket power市场势力the ability of a single economic actor (or small group of actors) to have a substantial influence on market pricesMaximin criterion极大极小准则the claim that the government should aim to maximize the well-being of the worst-off person in societyMedian voter theorem中位选举人定理 a mathematical result showing that if voters are choosing a point along a line and each voter wants the point closest to his most preferred point, then majority rule will pick the most preferred point of the median voterMicroeconomics微观经济学the study of how households and firms make decisions and how they interact in marketsMonopolistic competition垄断竞争 a market structure in which many firms sell products that are similar but not identicalMonopoly垄断 a firm that is the sole seller of a product without close substitutesMoral hazard道德风险the tendency of a person who is imperfectly monitored to engage in dishonest or otherwise undesirable behaviorNash equilibrium纳什均衡 a situation in which economic actors interacting with one another each choose their best strategy given the strategies that all the other actors have chosenNatural monopoly自然垄断 a monopoly that arises because a single firm can supply a good or service to an entire market at a smaller cost than could two or more firmsNegative income tax负所得税 a tax system that collects revenue from high-income households and gives transfers to low-income householdsNormal good正常商品 a good for which, other things equal, an increase in income leads to an increase in demandNormative statements规范性表述claims that attempt to prescribe how the world should be Oligopoly寡头 a market structure in which only a few sellers offer similar or identical productsOpportunity cost机会成本whatever must be given up to obtain some itemPerfect complements完全互补品two goods with right-angle indifference curvesPerfect substitutes完全替代品two goods with straight-line indifference curvesPermanent income持久性收入 a person’s normal incomePhillips curve菲利普斯曲线 a curve that shows the short-run tradeoff between inflation and unemploymentPigovian tax庇古税 a tax enacted to correct the effects of a negative externalityPositive statements实证表述claims that attempt to describe the world as it isPoverty line贫困线an absolute level of income set by the federal government for each family size below which a family is deemed to be in povertyPoverty rate贫困率the percentage of the population whose family income falls below an absolute level called the ‘poverty linePrice ceiling价格天花板(上限) a legal maximum on the price at which a good can be sold Price discrimination价格歧视the business practice of selling the same good at different prices to different customersPrice elasticity of demand需求的价格弹性 a measure of how much the quantity demanded of a good responds to a change in the price of that good, computed as the percentage change in quantity demanded divided by the percentage change in pricePrice elasticity supply供给的价格弹性 a measure of how much the quantity supplied of a good responds to a change in the price of that good, computed as the percentage change in quantity supplied divided by the percentage change in pricePrice floor价格地板I下限) a legal minimum on the price at which a good can be sold Principal委托人 a person for whom another person, called the agent, is performing some act Prisoners’ dilemma囚徒困境 a particular “game” between two captured prisoners that illustrates why cooperation is difficult to maintain even when it is mutually beneficialPrivate goods私人物品goods that are both excludable and rivalProducer surplus生产者剩余the amount a seller is paid for a good minus the seller’s cost Production function生产函数the relationship between quantity of inputs used to make a good and the quantity of output of that goodProduction possibilities frontier生产可能性曲线 a graph that shows the combinations of output that the economy can possibly produce given the available factors of production and the available production technologyProductivity生产率the quantity of goods and services produced from each hour of a worker’s timeProfit利润total revenue minus total cost。

微观经济学名词解释

第四章:供给与需求的市场力量& 第五章:弹性及其应用名词解释:需求demand:买者愿意而且能购买的一种物品量供给supply:卖者愿意而且能够出售的一种物品量1需求定理law of demand:在其他条件相同时,(给定条件下,其他因素不变)一种物品价格上升,该物品需求量减少。

2供给定理:在其他条件相同时,一种物品价格上升,该物品供给量增加,当价格下降时,供给量减少。

3供求定理:任何一种物品价格的调整都会使该物品的供给与需求达到平衡。

4需求价格弹性price elasticity of demand:一种物品需求量对其价格变动反应程度的衡量,用需求量变动的百分比除以价格变动的百分比来计算。

5供给价格弹性:一种物品供给量对其价格变动反应程度的衡量,用供给量变动的百分比除以价格变动的百分比来计算。

6需求收入弹性:一种物品需求量对消费者收入变动反应程度的衡量,用需求量变动百分比除以收入变动百分比7交叉价格弹性:衡量一种物品需求量对另一种物品价格变动的反应程度,用第一种物品的需求量变动百分比除以第二种物品价格变动的百分比。

8均衡价格equilibrium price:使供给与需求平衡的价格。

9 替代商品substitute:一种物品价格上升引起另一种物品需求量增加的两种物品10 互补商品complement:一种物品价格上升引起另一种物品需求量减少的两种物品简答:1 需求的影响因素?1 收入2 相关物品的价格3 嗜好4 预期5 买者数量2 供给的影响因素?1 投入价格2 技术3 预期4 卖者数量1.为什么需求曲线向右下方倾斜?2.需求价格弹性的决定因素:1.相近替代品的可获得性 2. 必需品与奢侈品3. 市场的定义4. 时间的长短3.供给价格弹性的决定因素: 1. 卖者改变他们生产的物品量的伸缩性 2. 所考虑的时间长短4.供求曲线变化如何影响价格并如何影响配置?5.均衡价格在市场配置中有何意义?发出价格信号6. 当价格偏离均衡点时,如何自发的回到均衡价格?7. 需求价格弹性的类型?(5种)8. 供给价格弹性的类型?计算题:1 已知需求方程,求均衡价格?(二元一次方程)2 在均衡点上,球需求价格弹性?(注意P Q 的关系):供给、需求与政府政策2页空白没用的,请掠过阅读吧哈,这2页空白没用的,请掠过阅读吧哈,请掠过阅读吧,哈哈哈198941550160001994242500036197919912122149814921504空白没用的,请掠过阅读吧哈这1页空白没用的,请掠过阅读吧哈空白没用的,请掠过阅读吧,这1页空白没用的,请掠过阅读吧,111213303529285205 10空白没用的,请掠过阅读吧哈这1页空白没用的,请掠过阅读吧哈空白没用的,请掠过阅读吧,这1页空白没用的,请掠过阅读吧,50第六章名词解释:1 价格上限price ceiling:可以出售一种物品的法定最高价格2 价格下限price floor:可以出售一种物品的法定最低价格3 税收负担的原理:a 向买着征税:1税收影响需求,供给不受影响2 需求曲线向左移动3 比较新均衡,说明税收的影响 b 向卖者征税:1 直接影响供给2 供给曲线向左移动3 比较新均衡,说明税收影响关于税收的两个结论:1 税收抑制了市场活动。

微观经济学英文版名词解释超详细

微观经济学名词解释1经济周期,经济学;经济,国家的经济状况缺乏的,罕见的.功效; 效率,效能;实力,能力; [物]性能;.同等,平等; [数]相等,等式;[ɜː'nælɪtɪ]外部性’s a 旁观者; 局外人; 看热闹的人a[ɪn'ɪʃ(ə)n]增加的 a权力分散; 人口疏散; 密度分散a a 分配,分派; 把…拨给;英[ˈæləɪt]a ( ) a’s2a 家庭; 家庭,户[æəʊiːkə'nɒmɪ; ], , ,[ɪəʊiːkə'nɒmɪ['nɔːmətɪv]标定,规定; 指定,规定;美[ɪˈɪb]准的['ʌɪə) a3aa a美[də'ɪɪ】合乎国内的Array4完全竞a ['ə] 同一的,完全相同的美[aɪˈdɛɪkəl] a 争市场互补品a['kɑəmə]需求曲a a线需求表 a a[ɪ'lɪɪəm]a均衡均衡价格a , , a劣质品[ɪn'fɪərɪə], , a需求原理, , a供给原理a aa , ,普通商品需求量 a a aa a a a ['s ɜəs] a5需求交叉弹性是需求交叉价格弹性a a , [æ'ɪs ə] n . 弹性; 弹力; 灵活性; 伸缩性;a 需求的收入弹性a a a ’ , 需求价格弹性a a a ,供给的价格弹性 a a a , ( a )总收入; 总收益 a ,6['ːl ɪŋ] a ['mæɪm əm] a a a ['ɪɪd(ə)]a a7[k ən'ːm ə]['s ɜːəs]消费者剩余 a a ['ɪn əs] a a a a ’s美[ˌæləˈɪʃn]分配,配给受益者负担 a a8无谓损失又为社会净损失 过剩的; 多余的[ˈsɜəs] a 变形; 失真[d ɪˈɔr ʃən], a9n . 关税;关税表; 价格表aa10['θɪər əm] 科斯定理, 外在性矫正税 a a [ɜː'næl ɪt ɪ] n . 外形; 外在性; 外部事物;(经济学名词) 外部效应’s a内化 [ɪn's ɛɪv][æn'zæk ʃən]交易 a11可排他的; 包括在外的;–成本效益分析a a [ɪːd ə'b ɪl ətɪ]排他性a a[释义]坐享其成,无本获利; a a 消费竞争 a ’s ’s公共地悲剧 a 寓言; 格言; a12[释义]负担能力原则,付税能力原则; an.预算赤字; a 亏空; 缺空 预算结余 纳税横向均等;总量税 a 边际税率累进税 a a 分数; 一小部分 比例税率 a累退税 a a纵向公平 a13清楚的,明确的边际产量递减规律规模不经济,规模经济最小有效规模固定成本 隐性成本 边际成本a a ( )a[释义]变动成本;14a a沉没成本 a15[m ə'nɒp(ə)lɪ]a an.垄断; 专卖; 垄断者; 专利品; a a a a16垄断竞争市场 a求过于供的市场情况; a a17<经>卡特尔,企业联合 a ['ːnɪs(ə)n]a<经>卡特尔,企业联合 a a a['ə]缩减指数 a 100纳什均衡a[,ɑl ə'g ɑp ə] a a寡头’ [d ɪˈə囚徒困境”是1950年美国兰德公司提出的博弈论模型 a “” 18边际产量递减规律a边际价值19补偿微分 a [d ɪɪm ɪ'ɪʃ(ə)n] ; 歧视, , , , 效率工资 平衡,均势; 平静ˌ[əˈl ɪəm] *人力资本 , ,n . 攻击; 罢工[课,市]; 发现移开; 撤回 a aa , ,。

微观经济学英文版名词解释超详细

微观经济学英文版名词解释超详细微观经济学名词解释Chapter 1businesscycle 经济周期fluctuations in economic activity, such as employmentand productioneconomi cs 经济学; 经济,国家的经济状况the study of how society manages its scarce 缺乏的,罕见的 resourcesefficienc y n.功效; 效率,效能; 实力,能力; [物] 性能;the property of society getting the most it can from itsscarce resourcesequality n .同等,平等; [数]相等,等式;the property of distributing economic prosperityuniformly among the members of societyexternality[,ekst ɜː'næl ɪt ɪ]外部性the uncompensated impact of one person’s actions on the well-being of a bystander 旁观者; 局外人; 看热闹的人 incentive s omething that induces a person to actInflation [ɪn'fle ɪʃ(ə)n]an increase in the overall level of prices in the economy marginalchangessmall incremental 增加的 adjustments to a plan of actionmarket economyan economy that allocates resources through thedecentralized 权力分散; 人口疏散; 密度分散;decisions of many firms and households as they interact in markets for goods and servicesmarket failure a situation in which a market left on its own fails to allocate分配,分派; 把…拨给;英[ˈæləkeɪt] resources efficientlymarket power the ability of a single economic actor (or small group of actors) to have a substantial influence on market pricesopportunity costwhatever must be given up to obtain some itemproducti vity the quantity of goods and services produced from each unit of labor inputproperty rights the ability of an individual to own and exercise control over scarce resourcesrational people people who systematically and purposefully do the best they can to achieve their objectivesscarcity the limited nature of society’s resources Chapter 2circular-flow diagram a visual model of the economy that shows how dollars flow through markets among households 家庭; 家庭,户and firmsmacroeconomics [,mækr əʊiːkə'nɒmɪks; -ek-] the study of economy-wide phenomena, including inflation, unemployment, and economic growthmicroecono mics [,maɪkrəʊiːkə'nɒmɪks the study of how households and firms make decisions and how they interact in marketsnormative['nɔːmətɪv]标准的statements claims that attempt to prescribe定,规定; 指定,规定;美[prɪˈskraɪb] how the world should bepositivestatementsclaims that attempt to describe the world as it isproduction possibilities frontier['frʌntɪə)a graph that shows the combinations of output that the economy can possibly produce given the available factors of production and the available production technologyChapter 3advantag e the ability to produce a good using fewer inputs than another producercomparative advantag e the ability to produce a good at a lower opportunity cost than another producerexports goods produced domestically美[də'mestɪklɪ】合乎国内的and sold abroadimports goods produced abroad and sold domestically opportunity costwhatever must be given up to obtain some itemChapter 4competiti ve market 完全竞争市场a market with many buyers and sellers['selə] trading identical同一的,完全相同的美[aɪˈdɛntɪkəl] products so that each buyer and seller is a price takerComplements互补品['kɑmpləm ənt]two goods for which an increase in the price of one leads to a decrease in the demand for the otherdemand curve 需求曲线a graph of the relationship between the price of a good and the quantity demandeddemand schedule 需求表a table that shows the relationship between the price of a good and the quantity demandedEquilibriu m[,ikwɪ'lɪbrɪəm]均衡a situation in which the market price has reached the level at which quantity supplied equals quantity demandedequilibriu m price 均衡价格the price that balances quantity supplied and quantity demandedequilibriu m quantity the quantity supplied and the quantity demanded at the equilibrium pricegood劣质品[ɪn'fɪərɪə] a good for which, other things equal, an increase in income leads to a decrease in demandlaw of demand 需求原理the claim that, other things equal, the quantity demanded of a good falls when the price of the good riseslaw of supply 供给原理the claim that, other things equal, the quantity supplied of a good rises when the price of the good riseslaw of supply and demand the claim that the price of any good adjusts to bring the quantity supplied and the quantity demanded for that good into balancemarket a group of buyers and sellers of a particular good or servicenormal good普通商品a good for which, other things equal, an increase in income leads to an increase in demandquantity demande d 需求量the amount of a good that buyers are willing and able to purchasequantity supplied the amount of a good that sellers are willing and able to sellshortage a situation in which quantity demanded is greater than quantity suppliedsubstitute s two goods for which an increase in the price of one leads to an increase in the demand for the othersupply curve a graph of the relationship between the price of a good and the quantity suppliedsupply schedule a table that shows the relationship between the price of a good and the quantity suppliedsurplus ['sɜ:pləs] a situation in which quantity supplied is greater than quantity demandedChapter 5ceelasticity of demand 需求交叉弹性是需求交叉价格弹性a measure of how much the quantity demanded of one good responds to a change in the price of another good, computed as the percentage change in quantity demanded of the first good divided by the percentage change in the price of the second goodelasticity [,ilæ'stɪsəti]n .弹性; 弹力; 灵活性; 伸缩性;a measure of the responsiveness of quantity demanded orquantity supplied to one of its determinantsincomeelasticity of demand 需求的收入弹性a measure of how much the quantity demanded of a good responds to a change in consumers’ income, computed as the percentage change in quantity demanded divided by the percentage change in incomepriceelasticity of demand 需求价格弹性a measure of how much the quantity demanded of a good responds to a change in the price of that good, computed as the percentage change in quantity demanded divided by the percentage change in priceprice elasticity of supply 供给的价格弹性a measure of how much the quantity supplied of a good responds to a change in the price of that good, computed as the percentage change in quantity supplied divided by the percentage change in pricetotalrevenue (in a market)总收入; 总收益the amount paid by buyers and received by sellers of a good, computed as the price of the good times the quantity soldChapter 6price ceiling ['siːlɪŋ] a legal maximum['mæksɪməm] on the price at which a good can be soldpricefloora legal minimum on the price at which a good can be sold taxincidenc e['ɪnsɪd(ə)ns] the manner in which the burden of a tax is shared among participants in a marketChapter 7 consumer [kən'sjuːmə] surplus ['sɜːpləs]消费者剩余the amount a buyer is willing to pay for a good minus ['maɪnəs] the amount the buyer actually pays for itcost the value of everything a seller must give up to produce a goodefficiency the property of society getting the most it can from its scarce resourcesequality the property of distributing economic prosperity uniformly among the members of societyproducer surplus the amount a seller is paid for a good minus the seller’s cost of providing itwelfare economic s the study of how the allocation美[ˌæləˈkeɪʃn]分配,配给of resources affects economic well-beingwillingness to pay受益者负担the maximum amount that a buyer will pay for a goodChapter8Dead the fall in total surplus过剩的; 多余的[ˈsɜ:rpləs] thatweight loss 无谓损失又为社会净损失results from a market distortion变形; 失真[dɪˈstɔrʃən], such as a taxChapter 9tariffn .关税;关税表; 价格表a tax on goods produced abroad and solddomesticallyworld price the price of a good that prevails in the world market for that goodChapter 10Coase theorem['θɪərəm] 科斯定理the proposition that if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities外在性on their owncorrectiv e tax 矫正税a tax designed to induce private decision makers to take account of the social costs that arise from a negative externalityexternalit y [,ekstɜː'nælɪtɪ]n .外形; 外在性; 外部事物;(经济学名词)外部效应the uncompensated impact of one person’s actions on thewell-being of a bystanderinternalizing the externalit y 内化altering incentives[ɪn'sɛntɪv] so that people take account of the external effects of their actionstransacti the costs that parties incur in the process of agreeing toon[træn'zækʃən]交易costsand following through on a bargainChapter11clubgoodsgoods that are excludable but not rival in consumptioncommon resource s goods that are rival in consumption but not excludable可排他的; 包括在外的;•cost–benefitanalysis成本效益分析a study that compares the costs and benefits to society of providing a public goodexcludability [ɪks,kluːdə'bɪlətɪ]排他性the property of a good whereby a person can be prevented from using itfree rider [释义]坐a person who receives the benefit of a good but avoids paying for it享其成,无本获利;privategoodsgoods that are both excludable and rival in consumptionpublic goods goods that are neither excludable nor rival in consumptionrivalry inconsump tion消费竞争the property of a good whereby one person’s use diminishes other people’s useTragedyof the Common s公共地悲剧a parable寓言; 格言; that illustrates why common resources are used more than is desirable from the standpoint of society as a wholeChapter 12 ability-to-payprinciple [释义]负担能力原则,付税能力原则;the idea that taxes should be levied on a person according to how well that person can shoulder the burdenaveragetax ratetotal taxes paid divided by total incomebenefits principle the idea that people should pay taxes based on the benefits they receive from government servicesbudget deficit n.预算赤字;a shortfall亏空; 缺空of tax revenue from government spendingbudgetsurplus预算结余an excess of tax revenue over government spending horizontal equity 纳税横向均等;the idea that taxpayers with similar abilities to pay taxes should pay the same amountm tax 总量税a tax that is the same amount for every personmarginaltax rate边际税率the extra taxes paid on an additional dollar of incomeprogressi ve tax 累进税a tax for which high-income taxpayers pay a larger fraction分数; 一小部分of their income than do low-income taxpayersproportio nal tax 比例税率a tax for which high-income and low-income taxpayers pay the same fraction of incomeregressiv e tax 累退税a tax for which high-income taxpayers pay a smaller fraction of their income than do low-income taxpayersvertical equity 纵向公平the idea that taxpayers with a greater ability to pay taxes should pay larger amountsChapter13accounting profittotal revenue minus total explicit清楚的,明确的cost averagefixed costfixed cost divided by the quantity of outputaveragetotal costtotal cost divided by the quantity of outputaveragevariablecostvariable cost divided by the quantity of outputconstant returns to scale the property whereby long-run average total cost stays the same as the quantity of output changesdiminishin gmarginal product 边际产量递减规律the property whereby the marginal product of an input declines as the quantity of the input increasesmies of scale 规模不经济the property whereby long-run average total cost rises as the quantity of output increaseseconomic profit total revenue minus total cost, including both explicit and implicit costseconomie s of scale 规模经济the property whereby long-run average total cost falls as the quantity of output increasesefficientscale最小有效规模the quantity of output that minimizes average total costexplicitcostsinput costs that require an outlay of money by the firmfixed costs固定成本costs that do not vary with the quantity of output producedimplicit costs隐性成本input costs that do not require an outlay of money by the firmmarginal cost边际成本the increase in total cost that arises from an extra unit of productionmarginal product the increase in output that arises from an additional unit of inputproductio n function the relationship between the quantity of inputs used to make a good and the quantity of output of that goodprofit total revenue minus total costtotal cost the market value of the inputs a firm uses in production totalrevenue(for firm)the amount a firm receives for the sale of its outputvariablecosts[释义]变动成本;costs that vary with the quantity of output producedChapter14revenuetotal revenue divided by the quantity soldcompetiti ve market a market with many buyers and sellers trading identical products so that each buyer and seller is a price takermarginalrevenuethe change in total revenue from an additional unit soldsunk cost 沉没成本a cost that has already been committed and cannot be recoveredChapter 15monopoly[ mə'nɒp(ə)l ɪ] a firm that is the sole seller of a product without close substitutesnaturalmonopoly n.垄断; 专卖; 垄断者; 专利品;a monopoly that arises because a single firm can supply a good or service to an entire market at a smaller cost than could two or more firmsprice discrimina tion the business practice of selling the same good at different prices to different customersChapter 16 monopolistic competiti on垄断竞争市场a market structure in which many firms sell products that are similar but not identicaloligopoly求过于供的市场情况;a market structure in which only a few sellers offer similar or identical products17cartel <经>卡特尔,企业联合a group of firms acting in unison ['juːnɪs(ə)n]collusion an agreement among firms in a market about quantities to produce or prices to charge<经>卡特尔,企业联合a strategy that is best for a player in a game regardless of the strategies chosen by the other playersgametheorythe study of how people behave in strategic situations GDPdeflator[d i'fleitə]GDP缩减指数a measure of the price level calculated as the ratio of nominal GDP to real GDP times 100Nash equilibriu m 纳什均衡a situation in which economic actors interacting with one another each choose their best strategy given the strategies that all the other actors have chosenoligopoly[ ,ɑlə'gɑpəli] 寡头a market structure in which only a few sellers offer similar or identical productsprisoners’ dilemma [dɪˈlemə囚徒困境”是1950年美国兰德公司提出的博弈论模型a particular “game” between two captured prisoners that illustrates why cooperation is difficult to maintain even when it is mutually beneficialChapter18capital the equipment and structures used to produce goods and servicesdiminishi the property whereby the marginal product of an inputngmarginalproduct边际产量递减规律declines as the quantity of the input increasesfactors ofproductionthe inputs used to produce goods and servicesmarginal product of labor the increase in the amount of output from an additional unit of laborproducti on function the relationship between the quantity of inputs used to make a good and the quantity of output of that goodvalue ofthe marginal 边际价值product the marginal product of an input times the price of the outputChapter 19 compensating differential 补偿微分a difference in wages that arises to offset the non-monetary characteristics of different jobsdiscrimination[dɪ,skr ɪmɪ'neɪʃ(ə)n] ;歧视the offering of different opportunities to similar individuals who differ only by race, ethnic group, sex, age, or other personal characteristicsefficiency wages 效率工资above- equilibrium平衡,均势; 平静ˌ[ikwəˈlɪbriəm] wages paid by firms to increase worker productivityhuman capital*人力资本the knowledge and skills that workers acquire through education, training, and experiencestriken .攻击; 罢工[课,the organized withdrawal移开; 撤回of labor from a firmby a union市]; 发现union a worker association that bargains with employers over wages, benefits, and working conditions。

微观经济学 名词解释

指在其他因素投入量不变时,额外增加1单位某种要素所获得的额外产量。

当某种固定要素(如土地)的供给量不受价格变化的影响,那么土地和其他要素获得的报酬(对其的支付)就叫做租金或经济租金。固定要素需求的增加只会影响它的价格。

10.Utility & The Law of Diminishing Marginal Utility(效用和边际效用递减规律)

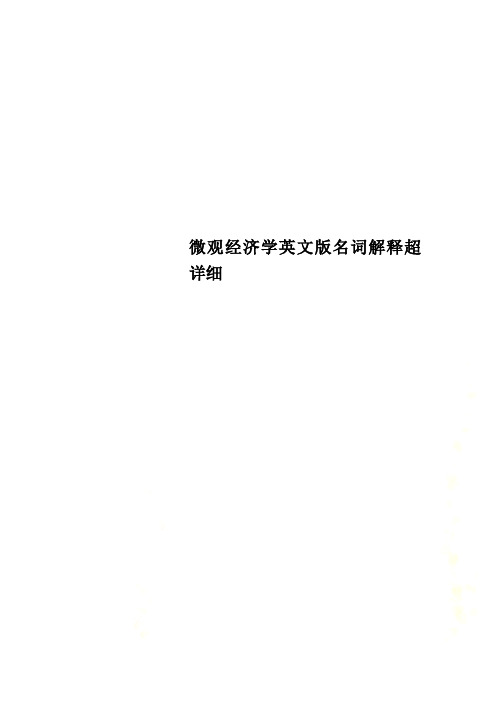

Utility denotes satifaction or how consumers rank different bundle of consumption goods, and it indicates consumer preference.

Budget Line

Assume the consumer’s income is I, the price of food is Pf and the clothing is Pc. MN is the consumer’s budget line. It sums up all the possible combinations of the two goods that would exhaust the consumer’s income.It’sabsolute slope equals the Pf/Pc ratio.

F(t`L,t`k)>t`f(L,k) , t>1

规模报酬递增是指所有的要素投入按照统一比例增加使得产出以一个更大的比例增加的现象。

西方经济学名词解释 英文版

西方经济学名词解释英文版第一章Macroeconomics 宏观经济学The study of the overall aspects and workings of a national economy, such as income, output, and the interrelationship among diverse economic sectors. 研究国民收入的各方面。

Microeconomics 微观经济学The study of the operations of the components of a national economy, such as individual firms, households, and consumers.研究经济中单个因素行为的分析。

GDP 国内生产总值 (Gross Domestic Product)The total market value of all final goods and services producedwithin the borders of a nation during a specified period.一国国民在各行业中一年内生产的最终产品和最终服务价值总和。

It isoften seen as an indicator of the standard of living ina country.Gross Domestic Product,consumption + investment goods + government purchases + net exportsEconomic Growth 经济增长steady growth in the productive capacity of the economy (and so a growth of national income)Real Economic Growth Rate 实际经济增长率A measure of economic growth from one period to another expressed as a percentage and adjusted for inflation (i.e. expressed inreal as opposed to nominal terms). The real economic growth rate isa measure of the rate of change that a nation's gross domestic product (GDP) experiences from one year to another. Gross national product (GNP) can also be used if a nation's economy is heavily dependent on foreign earnings. The real economic growth rate builds onto the economic growth rate by taking into account the effect that inflation has on the economy. The real economic growth rate is a "constant dollar" and therefore a more accurate look at the rate of economic growth because the real rate is not distorted by the effects of extreme inflation or deflation.GDP deflator GDP指数In economics the GDP deflator (implicit price deflator for GDP) is a measure of the change in prices of all new, domestically produced, final goods and services in an economy. GDP stands for gross domestic product the total value of all goods and services produced within that economy during a specified period.Nominal GDP 名义GDPA gross domestic product (GDP) figure that has not been adjusted for inflation.Real GDP 实际GDPThis inflation-adjusted measure that reflects the value of all goods and services produced in a given year, expressed in base-year prices. Often referred to as "constant-price", "inflation-corrected" GDP or "constant dollar GDP". Unlike nominal GDP, real GDP can accountfor changes in the price level, and provide a more accurate figure.Potential output 潜在产量/潜在GDPIn economics, potential output (also refered to as "natural real gross domestic product") refers to the highest level of real Gross Domestic Product output that can be sustained over the long term.GDP Gap GDP缺口The forfeited output of an country's economy resulting from the failure to create sufficient jobs for all those willing to work. A GDP gap denotes the amount of production that is irretrievably lost. The potential for higher production levels is wasted because therearen't enough jobs supplied.(与书异)Net Exports 净出口The value of a country's total exports minus the value of its total imports. It is used to calculate a country's aggregate expenditures, or GDP, in an open economy. In other words, net exports is the amount by which foreign spending on a home country's goods and services exceeds the home country's spending on foreign goods and services.Recession 经济衰退A significant decline in activity spread across the economy, lasting longer than a few months. It is visible in industrial production, employment, real income, and wholesale-retail trade. The technical indicator of a recession is two consecutive quarters of negative economic growth as measured by a country's GDP.Notes: Recession is a normal (albeit unpleasant) part of the business cycle. A recession generally lasts from six to eighteen months.Interest rates usually fall in recessionary times to stimulate the economy by offering cheap rates at which to borrow1money.Depression 经济萧条A severe and prolonged recession characterized by inefficient economic productivity, high unemployment, and falling price levels. In times of depression, consumer's confidence and investments decrease, causing the economy to shutdown. Value Added 附加值The enhancement a company gives its product or service beforeoffering the product to customers. This can either increase the products price or value.(与书异)Gross National Product – GNP 国民生产总值An economic statistic that includes GDP, plus any income earned by residents from overseas investments, minus income earned within the domestic economy by overseas residents. GNP is a measure of a country's economic performance, or what its citizens produced (i.e. goods and services) and whether they produced these items within its borders.Disposable Income 可支配收入The amount of after-tax income that is available to divide between spending and personal savings. This also known as your take home pay.Unemployment Rate 失业率The percentage of the total labor force that is unemployed but actively seeking employment and willing to work.Labor force 劳动力the group of people who have a potential for being employed.Frictional Unemployment 摩擦性事业Unemployment that is always present in the economy, resulting from temporary transitions made by workers and employers or from workers and employers having inconsistent or incomplete information.Structural Unemployment 结构性失业Unemployment resulting from changes in the basic composition of the economy. These changes simultaneously open new positions for trained workers.Cyclical Unemployment 周期性失业Unemployment resulting from changes in the business cycle.Natural Unemployment 自然失业率(与书异)The lowest rate of unemployment that an economy can sustain over the long run. Keynesians believe that a government can lower the rate of unemployment (i.e. employ more people) if it were willing to accept a higher level of inflation (the idea behindthe Phillips Curve). However, critics of this say that the effect is temporary and that unemployment would bounce back up but inflation would stay high. Thus, the natural, or equilibrium, rate is the lowest level of unemployment at which inflation remainsstable. Also known as the "non-accelerating inflation rate of unemployment" (NAIRU).Notes: When the economy is said to be at full employment, it is atits natural rate of unemployment. Economists debate how the natural rate might change. For example, some economists think that increasing labor-market flexibility will reduce the natural rate. Other economists dispute the existence of a natural rate altogether!Frictional unemployment — This reflects the fact that it takes time for people to find and settle into new jobs. If 12 individuals each take one month before they start a new job, the aggregate unemployment statistics will record this as a single unemployed worker. Technological change often reduces frictional unemployment, for example: the internet made job searches cheaper and more comprehensive.Structural unemployment — This reflects a mismatch between theskills and other attributes of the labour force and those demanded by employers. If 4 workers each take six months off to re-train before they start a new job, the aggregate unemployment statistics will record this as two unemployed workers. Technological change often increases structural unemployment, for example: technological change might require workers to re-train.Natural rate of unemployment — This is the summation of frictional and structural unemployment. It is the lowest rate of unemployment that a stable economy can expect to achieve, seeing as some frictional and structural unemployment is inevitable. Economists do not agree on the natural rate, with estimates ranging from 1% to 5%, or on its meaning —some associate it with"non-accelerating inflation.The estimated rate varies from countryto country and from time to time. Demand deficient unemployment — In Keynesian economics, any level of unemployment beyond the natural rateis most likely2due to insufficient demand in the overall economy. During a recession, aggregate expenditure is deficient causing theunderutilization of inputs (including labour). Aggregate expenditure (AE) can be increased, according to Keynes, by increasing consumption spending (C), increasing investment spending (I), increasing government spending (G), or increasing the net of exports minus imports (X?M).{AE = C + I + G + (X?M)}Okun's Law 奥昆法则A relationship between an economy's GDP gap and the actual unemployment rate. The relationship is represented by a ratio of 1 to2.5. Thus, for every 1% excess of the natural unemployment rate, a 2.5% GDP gap is predicted.Inflation 通货膨胀The rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.Deflation 通货紧缩 steadily falling pricesA general decline in prices, often caused by a reduction in thesupply of money or credit. Deflation can be caused also by a decrease in government, personal or investment spending. The opposite of inflation,deflation has the side effect of increased unemployment since there is a lower level of demand in the economy, which can lead to an economic depression. Hyperinflation 超级通货膨胀Extremely rapid or out of control inflation.Inflation rate 通货膨胀率In economics, the inflation rate is the rate of increase of the average price level (a measure of inflation). If one likes analogies, the size of a balloon is like the price level, while the inflation rate is how quickly it grows in size. Alternatively, the inflation rate is the rate of decrease in the purchasing power of money.Consumer Price Index (CPI) 消费价格指数The CPI, as it is called, measures the prices of consumer goods and services and is a measure of the pace of US inflation. The US Department of Labor publishes the CPI every month.Demand,pull inflation 需求拉动型通货膨胀inflation due to high demand for GDP and low unemployment, also known as Phillips Curve inflation. Cost,push inflation 成本推动型通货膨胀nowadays termed "supply shock inflation", due to an event such as a sudden increase in the price of oil. Built-in inflation - induced by adaptive expectations, often linked to the "price/wage spiral" because it involves workers tryingto keep their wages up with prices and then employers passing higher costs on to consumers as higher prices as part of a "vicious circle".Built-in inflation reflects events in the past, and so might be seen as hangover inflation. It is also known as"inertial" inflation, "inflationary momentum", and even "structural inflation".Indexing 指数化The adjustment of the weights of assets in an investment portfolio so that its performance matches that of an index. Linking movements of rates to the performance of an index.Notes:1. Indexing is a passive investment strategy. An investor can achieve the same risk and return of an index also by investing in an index fund.2. Types of rates that could be linked to the performance of an index are wage or tax rates.Phillips Curve 菲利普斯曲线An economic concept developed by A. W. Phillips stating thatinflation and unemployment have a stable and inverse relationship. The theory states that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment. The concept has been proven empirically and some government policies are directly influenced by it.第二章Aggregate Demand 总需求The total amount of goods and services demanded in the economy at a given overall price level and in a given time period. It is represented by the aggregate-demand curve, which describes the relationship between price levels and the quantity of output that firms are willing to provide. Normally there is a negative relationship between aggregate demand and the price level. Also3known as "total spending".Notes:Aggregate demand is the demand for the gross domestic product (GDP) of a country, and is represented by this formula: Aggregate Demand (AD) = C + I + G (X-M)C = Consumers' expenditures on goods and services.I = Investment spending by companies on capital goods.G = Government expenditures on publicly provided goods and services.X = Exports of goods and services.M = Imports of goods and services.Aggregate Supply 总供给The total supply of goods and services produced within an economy at a given overall price level in a given time period. It is represented by the aggregate-supply curve, which describes the relationship between price levels and the quantity of output thatfirms are willing to provide. Normally, there is a positive relationship between aggregate supply and the price level. Rising pricesare usually signals for businesses to expand production to meet a higher level of aggregate demand. Also known as "totaloutput".Notes:A shift in aggregate supply can be attributed to a number of variables. These include changes in the size and quality of labor, technological innovations, increase in wages, increase in production costs, changes in producer taxes and subsidies, and changes in inflation. In the short run, aggregate supply responds to higher demand (and prices) by bringing more inputs into the production process and increasing utilization of current inputs. In the long run, however, aggregate supply is not affected by theprice level and is driven only by improvements in productivity and efficiency.Exogenous Variable 外生变量A variable whose value is determined outside the model in which itis used.An economic variable that is related to other economic variables and determines their equilibrium levels. For example, rainfall is exogenous to the causal system constituting the process offarming and crop output. An exogenous variable by definition is one whose value is wholly causally independent from other variables in the system.Endogenous Variable 内生变量A value determined within the context of a model.An economic variable which is independent of the relationships determining the equilibrium levels, but nonetheless affects the equilibrium.Consumption 消费in economics, direct utilization of goods and services by consumers, not including the use of means of production, such as machinery and factories (see capital). Consumption can be divided into public and private sectors.Investment 投资An asset or item that is purchased with the hope that it will generate income or appreciate in the future. In an economic sense, an investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or appreciate and be soldat a higher price. In the financial sense investments include the purchase of bonds, stocks or real estate property. Government Purchases 政府购买Expenditures made in the private sector by all levels of government, such as when a government entity contracts a construction company to build office space or pave highways. A component of Keynesian expenditures, government purchases can be used as a tool for agovernment to influence the business cycle and provide economic stimulation when it is deemed necessary. Keynesian Economics 凯恩斯经济An economic theory stating that active government intervention inthe marketplace and monetary policy is the best method of ensuring economic growth and stability. A supporter of Keynesian economics believes it is the government's job to smooth out the bumps in business cycles. Intervention would come in the form of government spending and tax breaks in order to stimulate the economy, and government spending cuts and tax hikes in good times, in order to curb inflation.Classical Economics 古典经济学4Classical Economics refers to work done by a group of economists in the 18th and 19th centuries. They developed theories about the way markets and market economies work. The study was primarily concerned with the dynamics of economic growth. It stressed economic freedom and promoted ideas such as laissez-faire and free competition. Famous economists of this thinking include Adam Smith, David Ricardo, Thomas Malthus, and John Stuart Mill.Equilibrium of AD and AS 总供给和总需求的均衡supply and demand result in an equilibrium price (the interest rate) Stagflation 滞胀A condition of slow economic growth and relatively high unemployment - a time of stagnation - accompanied by a rise in prices, or inflation.第三章Fiscal Policy 财政政策Government spending policies that influence macroeconomic conditions. These policies affect tax rates, interest rates, and government spending, in an effort to control the economy.Government spending 政府支出consists of government purchases, including transfer payments, which can be financed by seigniorage (the creation of money for government funding), taxes, or government borrowing It is considered to be one of the major components of gross domestic product.Multiplier Effect 乘数效应The expansion of a country's money supply that results from banks being able to lend. The size of the multiplier effect depends on the percentage of deposits that banks are required to hold on reserves. In other words, it is money used to create more money and calculated by dividing total bank deposits by the reserve requirement.The multiplier effect depends on the set reserve requirement. The higher the reserve requirement, the tighter the money supply, which results in a lower multiplier effect for every dollar deposited. The lower the reserve requirement, the larger the money supply, which means more money is being created for every dollar deposited.Crowding Out Effect 挤出效应An economic theory explaining an increase in interest rates due to rising government borrowing in the money market. Notes: Governments often borrow money (by issuing bonds) to fund additional spending. The problem occurs when government debt 'crowds out' private companies and individuals from the lending market. Increased government borrowing tends to increase market interest rates. The problem is that the government can always pay the market interest rate, but there comes a point when corporations and individuals can no longer afford to borrow.Marginal propensity to consume (MPC) 边际消费倾向refers to the increase in personal consumer spending (consumption) that occurs with an increase in disposable income (income after taxes and transfers). For example, if a household earns one extra dollar of disposable income, and the marginal propensityto consume is 0.65, then of that dollar, the family will spend 65 cents and save 35 cents.Mathematically, the marginal propensity to consume (MPC) function is expressed as the derivative of the consumption (C) function with respect to disposable income (Y).In other words, the marginal propensity to consume is measured asthe ratio of the change in consumption to the change in income, thus giving us a figure between 0 and 1. One minus the MPC equals the marginal propensity to save. Marginal propensity to save (MPS) 边际储蓄倾向refers to the increase in saving (non-purchase of current goods and services) that results from an increase in income. For example, if a family earns one extra dollar, and the marginal propensity to save is 0.35, then of that dollar, the family will spend65 cents and save 35 cents. It can also go the other way, referring to the decrease in saving that results from a decrease in income. It is crucial to Keynesian economics and is the key variable determining the value of the multiplier. Mathematically, the marginal propensity to save (MPS) function is expressed as the derivative of the savings (S)function with respect to disposable income (Y).5In other words, the marginal propensity to save is measured as the ratio of the change in saving to the change in income, thus giving us a figure between 0 and 1. It is the opposite of the marginal propensity to consume (MPC). In the example above, the marginal propensity to consume would be 0.65. In general MPS = 1 - MPC.Money Supply 货币供给 (与书异)The entire quantity of bills, coins, loans, credit, and other liquid instruments in a country's economy. Money supply is divided into three categories--M1, M2, and M3--according to the type andsize of account in which the instrument is kept. The money supply is important to economists trying to understand how policies will affect interest rates and growth. M1The category of the money supply that includes all physical moneylike coins and currency. It also includes demand deposits, which are checking accounts and NOW accounts. M1 is the narrowest idea of "money." This is used as a measurement for economists trying to quantify the amount of money in circulation.M2A category within the money supply that includes M1 in addition toall time-related deposits, savings deposits, and non-institutionalmoney-market funds. M2 is a broader classification of money than M1. Economists use M2 when looking to quantify the amount of money in circulation and trying to explain different economic monetary conditions. M3The category of the money supply that includes M2 as well as alllarge time deposits, institutional money-market funds, short-term repurchase agreements, along with other larger liquid assets. This isthe broadest measure of money it is used by economists to estimate the entire supply of money within an economy. (书没有)Fiat Money 【美】(根据政府法令发行的)不兑现纸币Money that a government has declared to be legal tender, despite the fact that it has no intrinsic value and is not backed by reserves. Most of the world's paper money is fiat money.Legal tender 合法货币;偿付债务时债主必须接受的货币is payment that cannot be refused in settlement of a debt by virtueof law.Transactions demand 交易性需求is the demand or foreign currency. It is used for purposes of business transactions and personal consumption. transactions demand is one of the determinants of demand for money (and credit).Speculative demand 投机性需求is the demand for financial assets, such as securities, money or foreign currency, or financing. It is one of the determinants of demand for money (and credit).Liquidity Preference Theory 流动性偏好理论The hypothesis that forward rates offer a premium over expectedfuture spot rates. Proponents of this theory believe that, according to the term structure of interest rates, investors are risk-averse and will demand a premium for securities with longermaturities. A premium is offered by way of greater forward rates in order to attract investors to longer-term securities. The premium received normally increases at a decreasing rate due to downward pressure from the decreasing volatility of interest rates as the term to maturity increases. Also known as "liquidity preference hypothesis."Interest Rate 利率The monthly effective rate paid (or received if you are a creditor) on borrowed money. Expressed as a percentage of the sum borrowed.Nominal Interest Rate/the money interest rate名义利率The interest rate unadjusted for inflation. Not taking into account inflation gives a less realistic number. Real Interest Rate 实际利率6The amount by which the nominal interest rate is higher than the inflation rate. The real rate of interest is approximated by taking the nominal interest rate and subtracting inflation. The real interest rate is the growth rate of purchasing power derivedfrom an investment.Intermediate targets 中间目标An intermediate target is a variable (such as the money supply) that is not directly under the control of the central bank, but that does respond fairly quickly to policy actions, is observable frequently and bears a predictable relationship to the ultimate goals of policy.Open Market Operations 公开市场业务The buying and selling of government securities in the open marketin order to expand or contract the amount of money in the banking system. Purchases inject money into the banking system and stimulate growthwhile sales of securities do the opposite.Notes: Open market operations are the principal tools of monetary policy. (The discount rate and reserve requirements are also used.) The U.S. Federal Reserve's goal in using this technique is to adjust the federal funds rate--the rate at which banks borrowreserves from each other.Discount Rate 贴现率The interest rate that an eligible depository institution is charged to borrow short-term funds directly from a Federal Reserve Bank. This type of borrowing from the Fed is fairly limited. Institutions will often seek other means of meeting short-term liquidity needs. The Federal funds discount rate is one of two interest rates the Fed sets, the other being the overnight lendingrate, or the Fed funds rate.Lender of Last Resort 最后的贷款者/偿付者An institution, usually a country's central bank, that offers loansto banks or other eligible institutions that are experiencing financial difficulty or are considered highly risky or near collapse. In the U.S. the Federal Reserve acts as the lender of last resort to institutions that do not have any other means of borrowing and whose failure to obtain credit would dramatically affect the economy.Notes: The lender of last resort functions both to protectindividuals who have deposited funds, and to prevent panic withdrawing from banks who have temporary limited liquidity. Commercial banksusually try not to borrow from the lender of last resort because such action indicates that the bank is experiencing financial crisis. Critics of the lender-of-last-resort methodology suspect that the safety it provides inadvertently tempts qualifying institutions to acquire morerisk than necessary -since they are more likely to perceive the potential consequences of risky actions to be less severe.Reserve Requirements 法定准备金Requirements regarding the amount of funds that banks must hold in reserve against deposits made by their customers. This money must be in the bank's vaults or at the closest Federal Reserve Bank.Notes: Set by the Fed's Board of Governors, reserve requirements are one of the three main tools of monetary policy. The other two tools are open market operations and the discount rate. Also known as required reserves.第四章Supply-side economics 供给经济学A theory of economics that reductions in tax rates will stimulate investment and in turn will benefit the entire society.Laffer Curve 拉弗尔曲线Invented by Arthur Laffer, this curve shows the relationship between tax rates and tax revenue collected by governments. The chart below shows the Laffer Curve:7The curve suggests that, as taxes increase from low levels, tax revenue collected by the government also increases. It also shows that tax rates increasing after a certain point (T*) would cause people not to work as hard or not at all, thereby reducing tax revenue. Eventually, if tax rates reached 100% (the far right of the curve), then all people would choose not to work because everything they earned would go to the government.Notes: Governments would like to be at point T*, because it is the point at which the government collects maximum amount of tax revenue while people continue to work hard.Tax revenue税收is the income that is gained by governments because of taxation of the peopleBudget deficit 联邦预算赤字The amount by which government spending exceeds government revenues.Unemployment benefits 失业救济are sums of money given to the unemployed by the government or a compulsory para-governmental insurance system. Depending on the。

曼昆经济学原理微观名词解释(中英)

曼昆经济学原理(第七版)微观经济学分册名词解释中英文归纳CHAPTER 1Ten Principles of EconomicsScarcity: the limited nature of society’s resources稀缺性:社会资源的有限性Economics: the study of how society manages its scarce resources经济学:研究社会如何管理自己的稀缺资源。

Efficiency: the property of society getting the most it can from its scarce resources效率:社会能从其稀缺资源中得到最大利益的特性Equality: the property of distributing economic prosperity uniformly among the members of society平等:经济成果在社会成员中平均分配的特性Opportunity cost: whatever must be given up to obtain some item机会成本:为了得到某种东西所必须放弃的东西。

Rational people: people who systematically and purposefully do the best they can to achieve their objectives理性人:系统而有目的地尽最大努力实现其目标的人Marginal change: a small incremental adjustment to a plan of action边际变动:对行动计划的微小增量调整Incentive: something that induces a person to act激励:引起一个人做出某种行为的某种东西。

Market economy: an economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and services市场经济:当许多企业和家庭在物品与服务市场上相互交易时,通过它们的分散决策配置资源的经济。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。