瓦 轴B:2009年度独立董事述职报告 2010-04-27

国脉科技:2009年度独立董事述职报告(陈国龙) 2010-02-27

国脉科技股份有限公司2009年度独立董事述职报告各位股东及股东代表:国脉科技股份有限公司(以下简称“公司”)2008年第三次临时股东大会补选本人为第三届董事会独立董事,公司2009年第三次临时股东大会选举本人为第四届董事会独立董事。

作为公司的独立董事,2009年本人严格按照《公司法》、《关于在上市公司建立独立董事的指导意见》等法律、法规和《公司章程》、《独立董事工作制度》等规定,勤勉、忠实、尽责的履行职责,充分发挥独立董事的独立作用,维护公司整体利益以及全体股东尤其是中小股东的合法权益。

现本人就2009年度的履职情况述职如下:一、出席公司董事会和股东大会的情况及投票情况2009年度,本人准时亲自参加了公司召开的董事会和股东大会会议,忠实履行独立董事职责。

2009年公司董事会和股东大会的召集和召开程序符合法定要求,各重大经营决策事项的履行程序合法有效,本人对公司历次董事会审议的相关议案及公司其它事项均无异议并投了赞成票。

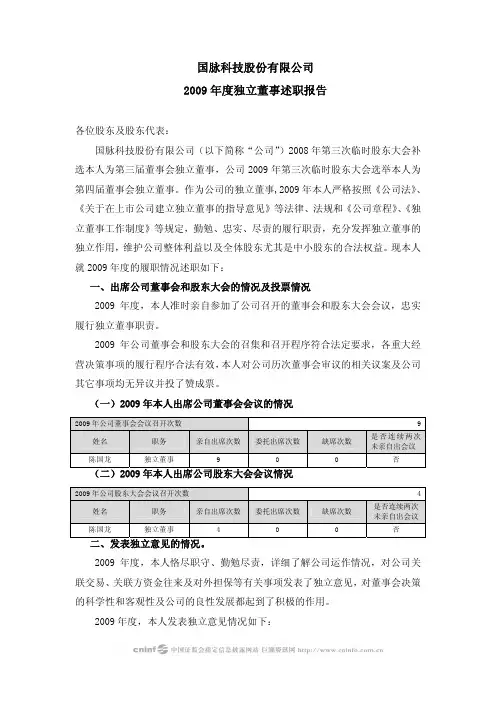

(一)2009年本人出席公司董事会会议的情况2009年公司董事会会议召开次数 9姓名 职务 亲自出席次数委托出席次数缺席次数 是否连续两次未亲自出会议陈国龙 独立董事 9 0 0 否 (二)2009年本人出席公司股东大会会议情况2009年公司股东大会会议召开次数 4姓名 职务 亲自出席次数委托出席次数缺席次数 是否连续两次未亲自出会议陈国龙 独立董事 4 0 0 否二、发表独立意见的情况。

2009年度,本人恪尽职守、勤勉尽责,详细了解公司运作情况,对公司关联交易、关联方资金往来及对外担保等有关事项发表了独立意见,对董事会决策的科学性和客观性及公司的良性发展都起到了积极的作用。

2009年度,本人发表独立意见情况如下:(一)关于第三届董事会第二十五次会议的相关事项的独立意见1、关于对关联方资金往来和对外担保情况的专项说明和独立意见本人认为公司建立了防止控股股东及关联方占用公司资金的长效机制,有效杜绝控股股东及关联方资金占用行为的发生,2008年度不存在公司控股股东及其他关联方、公司持有50%以下股份的关联方占用公司资金的情况;2008年度,公司对外担保严格按照法律法规的规定履行必要的审议程序和信息披露义务,决策程序合法、有效。

2010年度独立董事述职报告(杨嵘)

2010年度独立董事述职报告杨嵘各位董事:大家好!本人作为陕西省天然气股份有限公司(以下简称“公司”)的独立董事,在2010年任职期间,根据《公司法》、《上市公司治理准则》、《关于在上市公司建立独立董事制度的指导意见》、《关于加强社会公众股股东权益保护的若干规定》等法律法规及《公司章程》、《独立董事工作细则》的规定,恪尽职守,勤勉尽责,充分发挥了独立董事在公司规范运作等方面的监督作用,维护了公司整体利益,维护了全体股东尤其是中小股东的合法权益。

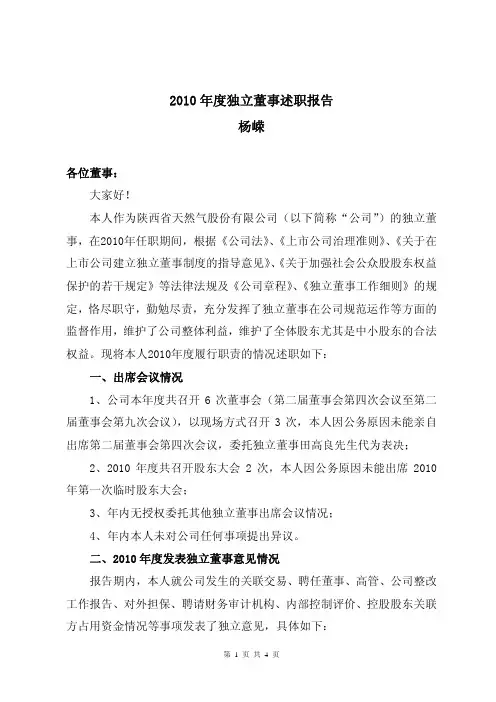

现将本人2010年度履行职责的情况述职如下:一、出席会议情况1、公司本年度共召开6次董事会(第二届董事会第四次会议至第二届董事会第九次会议),以现场方式召开3次,本人因公务原因未能亲自出席第二届董事会第四次会议,委托独立董事田高良先生代为表决;2、2010年度共召开股东大会2次,本人因公务原因未能出席2010年第一次临时股东大会;3、年内无授权委托其他独立董事出席会议情况;4、年内本人未对公司任何事项提出异议。

二、2010年度发表独立董事意见情况报告期内,本人就公司发生的关联交易、聘任董事、高管、公司整改工作报告、对外担保、聘请财务审计机构、内部控制评价、控股股东关联方占用资金情况等事项发表了独立意见,具体如下:(一)2010年1月18日第二届董事会第四次会议:1.对关于与渭南市天然气有限公司、咸阳新科能源有限公司发生的关联交易发表独立意见;2.对提名董事会董事候选人发表独立意见;3.对聘任公司高级管理人员发表独立意见。

(二)2010年3月10日第二届董事会第五次会议:对审议《关于审议<陕西省天然气股份有限公司整改工作报告>的议案》发表独立意见。

(三)2010年4月21日第二届董事会第六次会议:1.对公司2009年度对外担保情况和控股股东及其他关联方占用资金情况发表独立意见;2.对《关于聘请公司2010年度年报审计会计师事务所的议案》发表独立意见;3.对公司《2009年度内部控制的自我评价报告》发表独立意见;4.对聘任公司董事会秘书事项发表独立意见;5.对《关于审议受让陕西省燃机热电有限公司部分资产清偿拖欠天然气气款的议案》发表独立意见;6.对《关于受让渭南市天然气有限公司股权的议案》发表独立意见。

天康生物:独立董事2009年度述职报告(孙卫红) 2010-04-27

新疆天康畜牧生物技术股份有限公司独立董事2009年度述职报告各位股东及股东代表:作为新疆天康畜牧生物技术股份有限公司(以下简称“公司)的独立董事,2009年本人严格按照《公司法》、《上市公司治理准则》、《关于在上市公司建立独立董事的指导意见》、《深圳证券交易所中小企业板上市公司董事行为指引》等法律、法规的规定,认真履行职责,充分发挥独立董事的独立作用,维护了公司了整体利益,保护了全体股东的合法权益。

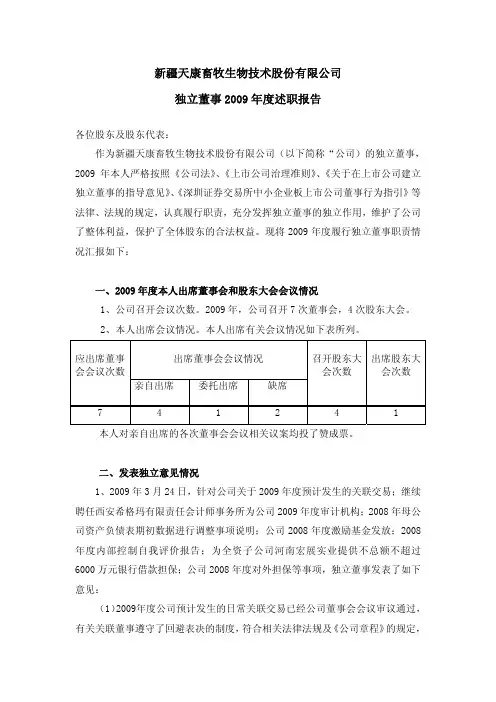

现将2009年度履行独立董事职责情况汇报如下:一、2009年度本人出席董事会和股东大会会议情况1、公司召开会议次数。

2009年,公司召开7次董事会,4次股东大会。

2、本人出席会议情况。

本人出席有关会议情况如下表所列。

出席董事会会议情况应出席董事会会议次数亲自出席 委托出席 缺席 召开股东大会次数出席股东大会次数7 4 1 2 4 1本人对亲自出席的各次董事会会议相关议案均投了赞成票。

二、发表独立意见情况1、2009年3月24日,针对公司关于2009年度预计发生的关联交易;继续聘任西安希格玛有限责任会计师事务所为公司2009年度审计机构;2008年母公司资产负债表期初数据进行调整事项说明;公司2008年度激励基金发放;2008年度内部控制自我评价报告;为全资子公司河南宏展实业提供不总额不超过6000万元银行借款担保;公司2008年度对外担保等事项,独立董事发表了如下意见:(1)2009年度公司预计发生的日常关联交易已经公司董事会会议审议通过,有关关联董事遵守了回避表决的制度,符合相关法律法规及《公司章程》的规定,决策机构程序合法有效。

关联交易的定价原则遵循公平公允原则,公司与各关联方同意参照市场价格来确定,不存在损害公司和非关联股东利益的行为,不会对公司持续经营发展造成影响。

(2)西安希格玛有限责任会计师事务所为公司出具的《2008年度审计报告》真实、准确的反映了公司2008年度的财务状况和经营成果,同意公司继续聘请西安希格玛有限责任会计师事务所为公司2009年度的财务审计机构。

瓦 轴B:2009年年度审计报告(英文版) 2010-04-27

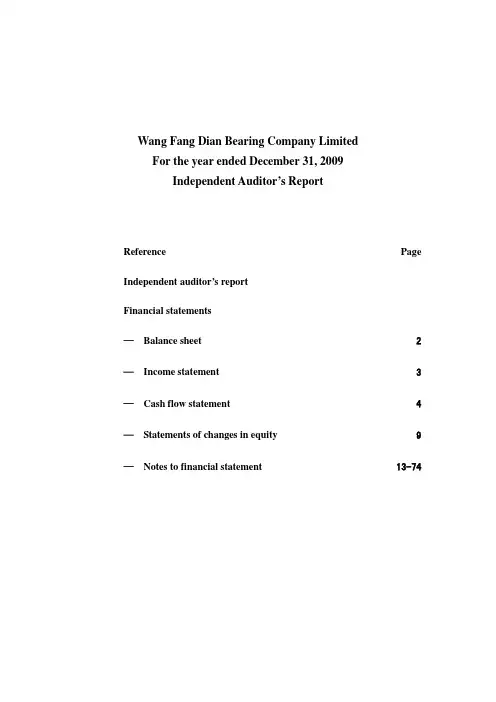

Wang Fang Dian Bearing Company LimitedFor the year ended December 31, 2009Independent Auditor’s ReportReference Page Independent auditor’s reportFinancial statements— Balance sheet 2— Income statement 3— Cash flow statement4— Statements of changes in equity9— Notes to financial statement13-74Wa Fangdian Bearing Co.,LtdBalance SheetFrom 2009.01.01 to 2009.12.31Unit:RMByuan2009.12.31 2009.01.01ItemConsolidated Parent Consolidated Parent Current assets :Monetary fund 77,261,663.9176,715,002.71129,512,540.80 128,066,634.31 Financial assets held-for-tradingBills receivable 117,701,535.41117,431,535.4161,344,054.83 61,344,054.83 Account receivable 771,097,770.88759,943,634.29701,641,881.64 683,979,031.00 Account paid in advance 9,127,147.957,866,246.825,355,110.87 4,302,394.09 Interest receivableOther receivables 12,723,050.7610,124,344.5510,688,266.07 7,481,880.49 Inventory 1,027,440,008.01983,273,301.101,072,250,663.70 1,006,291,300.51 Non-current assets due within 1 yearOther current assets 221,222.75221,222.75309,149.38 309,149.38 Total current assets 2,015,572,399.671,955,575,287.631,981,101,667.29 1,891,774,444.61 Non-current assetsFinancial assets available-for-saleInvestments held-to-maturityLong-term receivableLong-term equity investment 80,559,428.39118,687,019.5878,810,523.20 125,256,859.80 Investment propertyFixed assets 639,604,148.49626,552,835.18573,368,279.75 562,834,590.51 Construction in progress 39,734,642.6139,691,247.9671,494,307.74 70,884,787.01 Construction materialsFixed assets disposalBiological assetsGas and petrol assetsIntangible assets 140,433,015.99140,433,015.99144,793,523.11 144,793,523.11 Development expenditureGoodwillLong-term prepaid expense 1,473,551.611,473,551.612,276,409.35 2,276,409.35 Deferred tax assets 15,813,373.2714,765,098.6417,927,307.42 16,955,726.02 Other non-current assetsTotal non-current assets 917,618,160.36941,602,768.96888,670,350.57 923,001,895.80 Total assets 2,933,190,560.032,897,178,056.592,869,772,017.86 2,814,776,340.41Wa Fangdian Bearing Co.,LtdBalance Sheet (continue)From 2009.01.01 to 2009.12.31Unit:RMByuanCurrent liabilitiesShort-term loan 550,160,235.14529,000,000.00325,393,777.75 304,233,542.61 Note payable 96,650,000.0096,650,000.00115,330,000.00 115,330,000.00 Accounts payable 614,127,370.45587,102,072.55632,582,740.43 591,553,783.91 Accounts received in advance 49,516,448.2946,031,381.4529,344,299.86 23,259,217.24 Commission charge payableAccrued payroll 28,419,726.4818,424,966.2329,872,800.60 20,072,752.22 Tax payable 20,739,046.6714,665,350.31-402,118.38 -6,521,357.08 Interest payableDividends payableOther payables 94,836,512.2490,832,531.1987,802,183.41 82,874,804.88 Non-current liabilities due within I year 20,000,000.0020,000,000.00190,000,000.00 190,000,000.00 Other current liabilities 27,463.10 27,463.10 Total current liabilities 1,474,449,339.271,402,706,301.731,409,951,146.77 1,320,830,206.88 Non-current liabilitiesLong-term loan 98,000,000.0098,000,000.00149,500,000.00 148,000,000.00 Debenture payableLong-term payables 100,000.00100,000.00Special payables 201,698.98201,698.98201,698.98 201,698.98 Contingent liabilitiesDeferred tax liabilitiesOther non-current liabilities 5,896,000.005,896,000.006,633,000.00 6,633,000.00 Total non-current liabilities 104,197,698.98104,097,698.98156,434,698.98 154,834,698.98 Total liabilities 1,578,647,038.251,506,804,000.711,566,385,845.75 1,475,664,905.86 Owner’s equity (shareholders’ equity)Capital stock 402,600,000.00402,600,000.00402,600,000.00 402,600,000.00 Capital public reserves 485,431,518.07482,563,945.37485,431,518.07 482,563,945.37 Less: treasury shareSurplus reserve 108,140,566.51108,140,566.51101,403,904.38 101,403,904.38 Undistributed profit 356,113,130.88397,069,544.00311,344,774.64 352,543,584.80 Difference of foreign currency translationEquity attributable to parent company 1,352,285,215.461,390,374,055.881,300,780,197.09 1,339,111,434.55 Minority interest 2,258,306.322,605,975.02Total owner’s equity 1,354,543,521.781,390,374,055.881,303,386,172.11 1,339,111,434.55 Total owner’s equity and liabilities 2,933,190,560.032,897,178,056.592,869,772,017.86 2,814,776,340.41Wa Fangdian Bearing Co.,LtdIncome statementFrom 2009.01.01 to 2009.12.31Unit:RMByuan2009.12.31 2009.01.01ItemConsolidated Parent Consolidated 1.Total operating income 2,309,906,963.192,283,160,114.842,978,120,632.05 2,927,127,375.11 Including: Operating revenue 2,309,906,963.192,283,160,114.842,978,120,632.05 2,927,127,375.11 Interest incomeHandling charge and commission income2.Total operating cost 2,269,242,687.932,235,310,656.692,860,185,983.21 2,807,008,330.93 Including: Operating cost 2,008,075,631.821,988,006,014.412,532,813,927.93 2,499,787,579.06 Interest expensesHandling charge and commission incomeTax & surcharges for main operations 10,915,707.7810,329,065.2810,696,122.23 10,300,074.47 Selling expenses 136,240,314.99134,764,567.82142,615,399.27 140,846,092.26 Administrative expense 82,598,284.3972,805,673.1688,652,341.44 73,972,795.86 Financial expense 19,829,096.1118,812,568.1534,946,715.34 33,345,386.44 Loss of impairment of assets 11,583,652.8410,592,767.8750,461,477.00 48,756,402.84 Add: Gains of change of fair value ofassets(loss with"-")Investment income(loss with "-") 6,738,963.435,400,239.368,799,387.31 8,799,387.31 Including: Income form investment on6,738,963.435,400,239.368,799,387.31 8,799,387.31 associated enterprise and jointlyenterprise3.Operating profit (loss with"-") 47,403,238.6953,249,697.51126,734,036.15 128,918,431.49 Add: Non-operating revenue 45,441,264.7538,627,115.9412,692,548.02 7,450,556.18 Less: Non-operating cost 4,591,309.753,441,654.8712,781,736.12 11,424,904.21Including: loss on disposal of non-current218,554.376,152.243,747,871.22 3,747,871.22 assets4.Profit before tax(loss with"-") 88,253,193.6988,435,158.58126,644,848.05 124,944,083.46 Less: Income tax expenses 20,991,844.0221,068,537.2523,721,408.49 23,411,648.375. Net profit(Loss with"-") 67,261,349.6767,366,621.33102,923,439.56 101,532,435.09Net profit attributable to shareholders of67,609,018.3767,366,621.33102,953,094.55 101,532,435.09 parent companyMinority interests -347,668.70-29,654.996.Earnings per share(1) Basic earnings per share 0.170.26(2) Diluted earnings per share 0.170.267. Other comprehensive returns8. Total comprehensive returns 67,261,349.6767,366,621.33102,923,439.56 101,532,435.09Total comprehensive returns available for67,609,018.3767,366,621.33102,953,094.55 101,532,435.09 parent companyTotal comprehensive returns available for-347,668.70-29,654.99minority shareholdersThe financial statements attached in the Notes are a component of this statement.Wa Fangdian Bearing Co.,LtdCash Flow StatementFrom 2009.01.01 to 2009.12.31Unit:RMByuan2009.12.31 2009.01.01ItemConsolidated Parent Consolidated Parent1.Cash from operating activitiesCash received from sale of goods or1,110,389,237.771,064,528,447.971,539,179,133.65 1,464,738,454.98 rendering of servicesRefund of taxes and fares 41,089.9841,089.9811,561,241.71 11,561,241.71Other cash received relating to operating23,882,347.7623,833,590.993,022,309.90 2,815,815.85 activitiesSub-total of cash inflows 1,134,312,675.511,088,403,128.941,553,762,685.26 1,479,115,512.54Cash paid for goods and services 670,630,874.79650,990,946.08937,885,897.51 893,116,415.78Cash paid to or on behalf of the employees 226,230,458.00212,996,276.77222,105,818.90 206,208,398.01Tax payments 108,119,065.82102,055,344.36130,649,107.52 126,138,716.53Other cash paid relating to operating112,775,085.35107,368,151.6094,838,189.24 87,474,326.98 activitiesSub-total of cash outflows 1,117,755,483.961,073,410,718.811,385,479,013.17 1,312,937,857.30Net cash flows from operating activities 16,557,191.5514,992,410.13168,283,672.09 166,177,655.242.Cash flows from investing activitiesCash received from return of investmentCash received from investment incomes 360,000.00360,000.00Net cash received from disposal of fixed226,514.32121,514.32796,217.01 773,217.01 assets, intangible assets and otherlong-term assetsProceeds from sale of subsidiaries andother operating unitsOther cash received relating to investingactivitiesSub-total of cash inflows 586,514.32481,514.32796,217.01 773,217.01Cash paid to acquire fixed assets,37,194,727.6335,428,022.6344,139,364.86 43,289,533.86 intangible assets and other long-termassetsCash paid to acquire investmentNet cash used in acquiring subsidiariesand other operating unitsOther cash paid relating to investing12,300.00 12,300.00activitiesSub-total of cash outflows 37,194,727.6335,428,022.6344,151,664.86 43,301,833.86Net cash flows from investment-36,608,213.31-34,946,508.31-43,355,447.85 -42,528,616.85activities3.Cash flows from financing activitiesCash received from absorbing investmentIncluding: Cash received from increase inminority interestProceeds from borrowings 655,000,000.00655,000,000.00472,037,422.72 472,037,422.72Other proceeds relating to financing3,550,000.003,550,000.0010,709,364.49 10,709,364.49activitiesSub-total of cash inflows 658,550,000.00658,550,000.00482,746,787.21 482,746,787.21Repayment of borrowings 650,233,542.61650,233,542.61500,529,467.81 500,219,467.81Distribution of dividends or profits &37,818,962.2237,016,640.5136,757,649.17 35,823,915.11interest expensesIncluding: dividends or profit paid tominority interestCash paid for other financing activities 15,030,000.0015,030,000.007,525,387.96 7,525,387.96Sub-total of cash outflows 703,082,504.83702,280,183.12544,812,504.94 543,568,770.88Net cash flows from financing activities -44,532,504.83-43,730,183.12-62,065,717.73 -60,821,983.674. Effects of foreign exchange rate629,392.50629,392.50-2,433,250.92 -2,433,250.92changes on cash increases in cash and cash-63,954,134.09-63,054,888.8060,429,255.59 60,393,803.80equivalentsAdd:cash and cash equivalent, at the125,662,540.80124,216,634.3165,233,285.21 63,822,830.51beginning of year6.Cash and cash equivalent at the end61,708,406.7161,161,745.51125,662,540.80 124,216,634.31of the yearThe financial statements attached in the Notes are a component of this statement.The above balance sheet (consolidated and parent), income statement (consolidated and parent), and cashflow statement (consolidated and parent) have been passed at the board meeting held on Apr.22, 2009.Charger: Sun Najuan Charger: Su ShaoliWa Fangdian Bearing Co.,LtdThe Supplement of Cash Flow StatementFrom 2009.01.01 to 2009.12.31Unit :RMByuan2008 Items 2009Adjusting net profit into cash flows of operating activitiesNet profit 67,261,349.67 102,923,439.56 Add: Provision for impairment of assets 11,583,652.84 50,461,477.00 Depreciation of fixed assets 76,153,550.29 82,746,845.17 Amortization of intangible assets 4,380,507.12 4,363,099.68 Amortization of long-term deferred expenses 802,857.74 740,509.68 Loss of disposal of fixed assets, intangible assets, and long-term assets-972,075.06 2,976,798.78 (income listed with”-”)Loss of rejection of fixed assets (income listed with”-”) 0.00 0.00 Profit and loss in fair value (income listed with”-”) 0.00 0.00 Financial expense (income listed with”-”) 21,983,540.96 32,350,420.13 Investment loss(income listed with”-”) -6,738,963.43 -8,799,387.31 Decrease of deferred tax assets(increase listed with”-”) 2,113,934.15 -9,059,935.53 Decrease of inventories(increase listed with”-”) 55,136,474.91 -190,791,260.79 Decrease of operating receivable (increase listed with”-”) -178,161,750.35 11,835,955.23 Increase of operating payable (decrease listed with”-”) -36,985,887.29 88,535,710.49 Others 0.00 0.00 Net cash flows arising from operating activities16,557,191.55 168,283,672.09 2.Significant investment and financing activities unrelating to cashincome and expensesLiabilities transferred to capital 0.00 0.00 Convertible bonds within 1 year 0.00 0.00 Financing lease fixed assets 0.00 0.00 3. Net increase( decrease) of cash and cash equivalentEnding balance of cash 61,708,406.71 125,662,540.80 Less: Beginning balance of cash 125,662,540.80 65,233,285.21 Add: Ending balance of cash equivalent 0.00 0.00 Less: Beginning balance of cash equivalent 0.00 0.00 Net increase of cash and cash equivalent -63,954,134.09 60,429,255.59 The financial statements attached in the Notes are a component of this statement.Wa Fangdian Bearing Co.,LtdThe breakdown of the impairment of assetsUnit:RMByuanDecrease2009.12.31 Items 2008.12.31 IncreaseReverse Others transferredout1.Provision for bad debts 45,266,219.5711,583,652.840.0010,491,656.26 46,358,216.152.Provision for impairment ofinventories71,481,454.920.000.0010,325,819.22 61,155,635.70 3.Provision for impairment offinancial assets held for sale4.Provision for impairment ofinvestment held for maturity5.Provision for impairment oflong term equity investment6.Provision for impairment ofinvestment property7.Provision for impairment offixed assets4,341,838.310.000.00169,622.97 4,172,215.34 8.Provision for impairment ofproject materials9.Provision for impairment ofconstruction in progress1,403,093.550.000.000.00 1,403,093.55 10.Provision for impairment ofbiological assets11.Provision for impairment ofoil & gas assets12.Provision for impairment ofintangible assets13.Provision for impairment ofreputation14.OthersTotal122,492,606.3511,583,652.840.0020,987,098.45113,089,160.74Wa Fangdian Bearing Co.,LtdLoss of impairment of assetsUnit:RMByuan Items 2009 2008Provision for bad debts 11,583,652.847,478,538.73 Provision for impairment of inventories 0.0039,984,362.20 Provision for impairment of financial assets held for saleProvision for impairment of investment held for maturityProvision for impairment of long term equity investmentProvision for impairment of investment propertyProvision for impairment of fixed assets 0.002,998,576.07 Provision for impairment of project materialsProvision for impairment of construction in progressProvision for impairment of biological assetsProvision for impairment of oil & gas assetsProvision for impairment of intangible assetsProvision for impairment of reputationOthersTotal 11,583,652.8450,461,477.00Wa Fanghdian Bearing Co.,LtdThe changes in shareholder’s equity (consolidated)2009.1.1-2009.12.31 unit:RMB yuan Amount in current period Amount in previous period Owner’s equity attributable to parent company Owner’s equity attributable to parent companyItemCapitalstock Capitalpublicreservesless:treasure stockSurpluspublicreservesGeneralprovision forriskUndistributed profitsOthersMinorityshareholders’equityOwner’s equity CapitalstockCapitalpublicreservesless:treasurestockSurpluspublicreservesGeneralprovision forriskUndistributedprofitsOthersMinorityshareholders’equityOwner’s equity1.Balance at the end of last year 402,600,000.0485,431,518.07101,403,904.38311,344,774.642,605,975.021,303,386,172.11402,600,000.0485,431,518.0768,449,533.31243,660,433.162,635,630.011,202,777,114.55Add: changes in accounting policiesChanges in previous errors 2,068,442.7011,721,175.3013,789,618.00Others2.Balance at the beginning of this year 402,600,000.0485,431,518.07101,403,904.38311,344,774.642,605,975.021,303,386,172.11402,600,000.0485,431,518.0770,517,976.01255,381,608.462,635,630.011,216,566,732.553. The changes in this year (decrease with“-”)6,736,662.1344,768,356.24-347,668.7051,157,349.6730,885,928.3755,963,166.18-29,654.9986,819,439.56(1) Net profits 67,609,018.37-347,668.7067,261,349.67102,953,094.55-29,654.99102,923,439.56(2) Other comprehensive returnsTotal (1) and (2) 67,609,018.37-347,668.7067,261,349.67102,953,094.55-29,654.99102,923,439.56(3) The assets invested orreturned by the owners91) capital invested by owners2)The amount of share payment recorded owner’s equity3) others(4)Profits distribution 6,736,662.13-22,840,662.13-16,104,000.030,885,928.37-46,989,928.37-16,104,000.01)Provision for surplus public reserves 6,736,662.13-6,736,662.1330,885,928.37-30,885,928.372)provision for general risks3)distribution for owner(shareholders) -16,104,000.00-16,104,000.00-16,104,000.00-16,104,000.04)others(5)interior transference of owner’s equity1)capital (capital stock)transferred by the capital public reserves2)capital (capital stock)transferred by the surplus public reserves3)loss offset by the surplus public reserves4)others4. Balance at the end of the current period 402,600,000.0485,431,518.07108,140,566.51356,113,130.882,258,306.321,354,543,521.78402,600,000.00485,431,518.07101,403,904.38311,344,774.642,605,975.0210Wa Fanghdian Bearing Co.,LtdThe changes in shareholder’s equity (Parent company)2009.1.1-2009.12.31 unit:RMB yuan Amount in current period Amount in previous periodItem CapitalstockCapitalpublicreservesless:treasurestockSpecialprojectreserve sSurpluspublicreservesGeneralprovisionfor riskUndistributedprofitsOwner’sequityCapitalstockCapitalpublicreservesless:treasurestockSpecialprojectreserve sSurpluspublicreservesGeneralprovisionfor riskUndistributedprofitsOwner’sequity1.Balance at the end of last year 402,600,000.00482,563,945.37101,403,904.38352,543,584.801,339,111,434.55402,600,000.00482,563,945.3768,449,533.31286,279,902.781,239,893,381.46Add: changes in accounting policiesChanges in previous errors 2,068,442.7011,721,175.3013,789,618.00Others2.Balance at the beginning of this year 402,600,000.00482,563,945.37101,403,904.38352,543,584.801,339,111,434.55402,600,000.00482,563,945.3770,517,976.01298,001,078.081,253,682,999.463. The changes in this year (decrease with“-”)6,736,662.1344,525,959.2051,262,621.3330,885,928.3754,542,506.7285,428,435.09(1) Net profits 67,366,621.3367,366,621.33101,532,435.09101,532,435.09(2) Other comprehensive returnsTotal (1) and (2) 67,366,621.3367,366,621.33101,532,435.09101,532,435.09(3) The assets invested or returned by the owners 1) capital invested by owners2)The amount of share payment recorded owner’s equity3) others(4)Profits distribution 6,736,662.13-22,840,662.13-16,104,000.0030,885,928.37-46,989,928.37-16,104,000.001)Provision for surplus public reserves 6,736,662.13-6,736,662.1330,885,928.37-30,885,928.372)provision for general risks3)distribution for owner(shareholders) -16,104,000.00-16,104,000.00-16,104,000.00-16,104,000.004)others(5)interior transference of owner’s equity1)capital (capital stock)transferred by the capital public reserves2)capital (capital stock)transferred by the surplus public reserves 3)loss offset by the surplus public reserves4)others4. Balance at the end of the current period 402,600,000.00482,563,945.37108,140,566.51397,069,544.001,390,374,055.88402,600,000.00482,563,945.37101,403,904.38352,543,584.801,339,111,434.55Wafangdian Bearing Co., LtdNotes to financial statements for the year ended December 31 2009(The currency is in RMB Yuan except otherwise indicated)(English translation for reference only)1. General informationWafangdian Bearing Company Limited (the “Company”) is a joint stock limited company established in the People’s Republic of China (the “PRC”) on 20 March 1997. In the opinion of the directors, its parent and ultimate holding company is Wafangdian Bearing Group Company Limited (“Wazhou Group”).The Company’s B shares have been listed on the Shenzhen Stock Exchange since 25 March 1997. The addresses of the registered office and principal place of business of the Company are No.1, Phrase 1, Gongji Street, Wafangdian North, Liaoning Province, and the PRC.The Group is principally engaged in the manufacturing and sale of bearing products, engineering equipment, automobile spare parts and relating products.The Company together with its subsidiaries is collectively referred to as the “Group”.2. Basis for the preparation of financial statementsThe Group prepares the financial statements on the basis of going concern and actual transactions and events, and in accordance with the Accounting Standards for Business Enterprises issued by the Ministry of Finance of the People’s Republic of China, and based on the accounting policies and estimates in the note 4 ‘Significant accounting policies, accounting estimates and method for preparation of consolidated financial statements’.3. Complying with Accounting Standard for Business EnterpriseThe financial statements are prepared by the Group according to the requirements of Accounting Standard for Business Enterprise, and reflect the relative information for the financial position, operating performance, cash flow of the Group truly and fully.4. Significant accounting policies, accounting estimates and method for preparation of consolidated financial statements4.1 Accounting periodThe Group adopts the Gregorian calendar year as accounting period, i.e. from Jan 1 to Dec 31.4.2 Funcitonal currencyThe Group adopts RMB as functional currency.4.3 Recording basis and pricing principleThe accrual basis shall be adopted for accounting treatment to follow the historical cost method, except that the financial assets held for trading and sale are measured at fair value.4.4 Cash and cash equivalentThe cash listed on the cash flow statements of the Group refers to cash on hand and bank deposit. The cash equivalents refer to short-term (normally with original maturities of three months or less) and liquid investments which are readily convertible to known amounts of cash and subject to an insignificant risk of changes in value.4.5 Translation of foreign currency(1) Foreign currency transactionForeign currency transactions are translated at the spot exchange rate issued by People’s Bank of China (“PBOC”) when the transaction incurs. Monetary assets and liabilities in foreign currencies are translated into RMB at the exchange rate prevailing at the balance sheet day. Exchange differences arising from the settlement of monetary items are charged as in profit or loss for the period. Exchange differences of specific borrowings related to the acquisition or construction of a fixed asset should be capitalized as occurred, before the relevant fixed asset being acquired or constructed is ready for its intended uses. The foreign currency non-monetary items recorded at fair value are translated at the exchange rate issued on the date of fair value recognized. Exchange differences are charged as profit and loss of change of fair value. The foreign currency non-monetary items recorded at historical cost are translated at the exchange rate issued on the date when the transaction incurs, and don’t change the RMB amount.(2) Translation of foreign currency financial statementsThe asset and liability items in the foreign currency balance sheet should be translated at a spot exchange rate at the balance sheet date. Among the ower’s equity items except “undistributed profit”, others should be translated at the spot exchange rate when they are incurred. The income and expense should be translated at spot exchange rate when the transaction incurs. Translation difference of foreign currency financial statements should be presented separately under the ower’s equity item. For the foreign currency monetary items that form substantially the oversea business net investment, their exchange difference of movement of exchange rate should be presented separately as translation difference of foreign currency financial statement under the ower’s equity item when prepare the consolidated financial statements. When disposing an overseas business, the Group should shift the translation difference of foreign currency financial statement related to the overseas business into the disposal profits and losses of current period. Foreign currency cash flows are translated at the spot exchange rate on the day when the cash flows incur. The amounts resulted from change of exchange rate are presented separately in the cash flow statement.4.6 Financial assets and financial liabilities(1) Financial assetsThe financial assets are classified into the following four categories according to investment purpose and economic substance.1) Financial asset measured at fair value and the amount of the change in fair value of a financial asset is recognized in profit or loss in current period: mainly represents the objective of being held for sale in short term and presented at financial asset held for transaction in balance sheet.2) Investment held to maturity: non-derivative financial assets of fixed maturity, fixed or confirmable recoverable amount, which management have definite purpose and capacity to hold to maturity.3) Accounts receivable: represents non-derivative financial assets of no quote, fixed or confirmable recoverable amount, including notes receivable, accounts receivable, interest receivable, dividends receivable and others receivable etc.4) Financial assets available for sale: financial assets available for sale include non-derivative financial assets available for sale when initially recognized and others financial assets which are classified.Financial assets should be initially recognized at fair value. Financial assets which are measured at fair value and the variation of fair value is charged as the profit or loss for the current period, related transaction expenses incurred when acquiring financial assets shall be directly charged as profit or loss for the current period. The transaction expenses of others financial assets shall be charged as initial amount. When the contractual rights for collecting the cash flow of the said financial asset are terminated, or when the risk and reward accompanied with the ownership of the said financial assets have been transferred to the receiving party, the recognition of financial assets shall be terminated.For the financial assets measured at their fair values and of which the variation is charged as the profit or loss for the current period and financial assets held for sale shall be measured subsequently at fair value. Accounts receivable and investment held to maturity shall be measured on the basis of the amortization costs by adopting actual interest rate method.For the financial assets measured at fair values and of which the variation is charged as profit or loss for the current period, changes of their fair values shall be recorded into changes of fair value of financial assets. The interest and cash dividends from financial assets when held shall be recognized investment income. When the financial assets are disposed, the difference between its fair value and initial recognition amount shall be recognized into investment profit or loss, and meanwhile, adjust the change of fair value of financial assets.The change of fair value of financial assets held for sale shall be recorded as owner’s equity. The interests of the financial assets held for sale calculated according to the actual interest rate method shall be recorded into the investment income of the current period. The cash dividends of the equity instrument investments available-for-sale shall be recorded into the investment income of the current period when the investee announces the distribution of dividends. When the financial assets are disposed, the difference between the prices with carrying amount deducted accumulated change amounts of fair values which recorded into owner’s equity shall be recorded into investment profit and loss.The Group carries out an inspection, on the balance sheet day, on the carrying amount of the financial assets other than those measured at their fair values. Where there is any objective evidence indicating that such financial asset has been impaired, an impairment provision shall be made. Where a financial asset available-for-sale is impaired, even if the recognition of the financial asset has not been terminated, the accumulative losses arising from the decrease of the fair value of the owner’s equity which was directly included shall be transferred out and charged as the profit or loss for the current period. As for the debt instruments available-for-sale whose impairment-related losses have been recognized, if, within the accounting period thereafter, the fair value has risen and are objectively related to the subsequent events that occur after the originally impairment losses were recognized, the originally recognized impairment losses shall be reversed and be charged as the profit and loss for the current period. As for the debt instruments available-for-sale whose。

键桥通讯:2009年度独立董事述职报告(法岳省) 2010-04-10

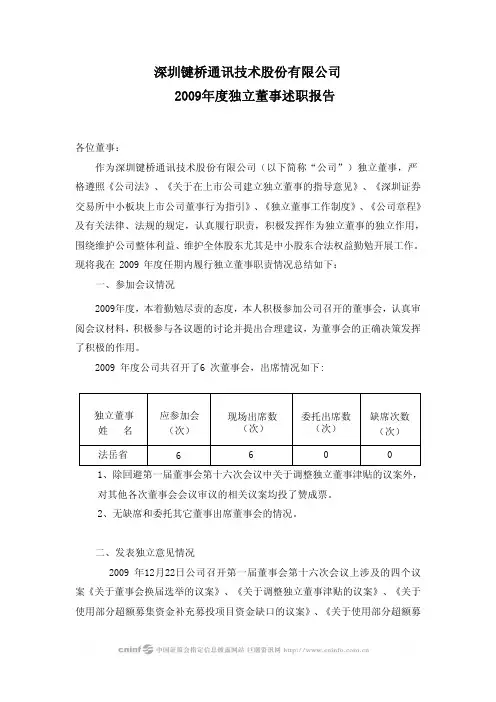

深圳键桥通讯技术股份有限公司2009年度独立董事述职报告各位董事:作为深圳键桥通讯技术股份有限公司(以下简称“公司”)独立董事,严格遵照《公司法》、《关于在上市公司建立独立董事的指导意见》、《深圳证券交易所中小板块上市公司董事行为指引》、《独立董事工作制度》、《公司章程》及有关法律、法规的规定,认真履行职责,积极发挥作为独立董事的独立作用,围绕维护公司整体利益、维护全体股东尤其是中小股东合法权益勤勉开展工作。

现将我在 2009 年度任期内履行独立董事职责情况总结如下:一、参加会议情况2009年度,本着勤勉尽责的态度,本人积极参加公司召开的董事会,认真审阅会议材料,积极参与各议题的讨论并提出合理建议,为董事会的正确决策发挥了积极的作用。

2009 年度公司共召开了6 次董事会,出席情况如下:独立董事 姓 名 应参加会(次)现场出席数(次)委托出席数(次)缺席次数(次)法岳省 6 6 0 01、除回避第一届董事会第十六次会议中关于调整独立董事津贴的议案外,对其他各次董事会会议审议的相关议案均投了赞成票。

2、无缺席和委托其它董事出席董事会的情况。

二、发表独立意见情况2009 年12月22日公司召开第一届董事会第十六次会议上涉及的四个议案《关于董事会换届选举的议案》、《关于调整独立董事津贴的议案》、《关于使用部分超额募集资金补充募投项目资金缺口的议案》、《关于使用部分超额募集资金暂时补充流动资金的议案》发表的独立意见。

三、 日常工作情况1、作为公司独立董事,本人严格履行独立董事的职责,积极关注公司经营情况。

按时参加公司董事会会议,认真审核了公司提供的材料,并用自己专业知识做出独立、公正、客观的结论。

2、2009年度,认真学习了中国证监会、深圳证监局以及深交所的有关法律法规及相关文件,提高履职能力,切实加强对公司投资者利益的保护能力,形成自觉保护社会公众股东权益的思想意识。

3、积极推动董事会审计委员会工作。

2009年度公司独立董事述职报告

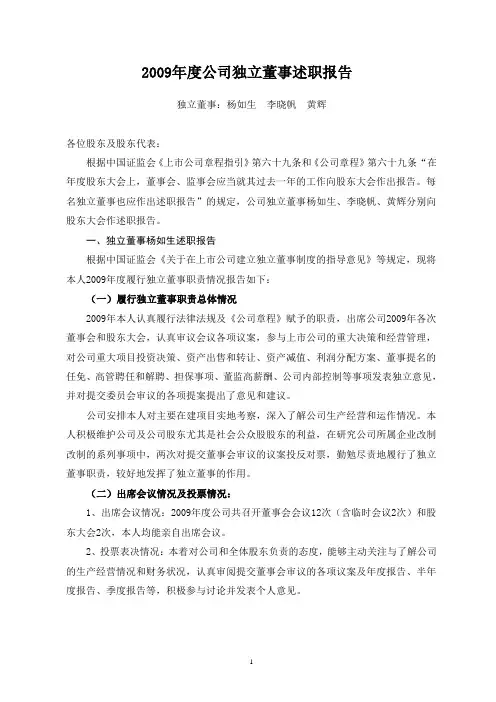

2009年度公司独立董事述职报告独立董事:杨如生李晓帆黄辉各位股东及股东代表:根据中国证监会《上市公司章程指引》第六十九条和《公司章程》第六十九条“在年度股东大会上,董事会、监事会应当就其过去一年的工作向股东大会作出报告。

每名独立董事也应作出述职报告”的规定,公司独立董事杨如生、李晓帆、黄辉分别向股东大会作述职报告。

一、独立董事杨如生述职报告根据中国证监会《关于在上市公司建立独立董事制度的指导意见》等规定,现将本人2009年度履行独立董事职责情况报告如下:(一)履行独立董事职责总体情况2009年本人认真履行法律法规及《公司章程》赋予的职责,出席公司2009年各次董事会和股东大会,认真审议会议各项议案,参与上市公司的重大决策和经营管理,对公司重大项目投资决策、资产出售和转让、资产减值、利润分配方案、董事提名的任免、高管聘任和解聘、担保事项、董监高薪酬、公司内部控制等事项发表独立意见,并对提交委员会审议的各项提案提出了意见和建议。

公司安排本人对主要在建项目实地考察,深入了解公司生产经营和运作情况。

本人积极维护公司及公司股东尤其是社会公众股股东的利益,在研究公司所属企业改制改制的系列事项中,两次对提交董事会审议的议案投反对票,勤勉尽责地履行了独立董事职责,较好地发挥了独立董事的作用。

(二)出席会议情况及投票情况:1、出席会议情况:2009年度公司共召开董事会会议12次(含临时会议2次)和股东大会2次,本人均能亲自出席会议。

2、投票表决情况:本着对公司和全体股东负责的态度,能够主动关注与了解公司的生产经营情况和财务状况,认真审阅提交董事会审议的各项议案及年度报告、半年度报告、季度报告等,积极参与讨论并发表个人意见。

投票表决中,在2009年6月30日五届二十九次董事会审议《关于补充调整深圳市市政工程总公司资产的议案》时,我们从维护中小股东的利益出发,认为将市政工程总公司名下的两台盾构机设备协议转让给本公司的理由不充分,投了反对票。

独立董事2009年度述职报告

独立董事2009年度述职报告各位股东及股东代表:作为北京超图软件股份有限公司(以下简称“公司”)的独立董事,本人2009年度严格按照《中华人民共和国公司法》、《深圳证券交易所创业板股票上市规则》、《深圳证券交易所创业板上市公司规范运作指引》、《关于在上市公司建立独立董事的指导意见》等有关法律法规以及《北京超图软件股份有限公司独立董事工作制度》、各专门委员会实施细则的相关规定和要求,忠实勤勉履行了独立董事的职责,按时参加应出席的会议,认真审议议案,对重大事项发表独立意见,充分发挥了独立董事及各专业委员会的作用,维护了公司的整体利益以及全体股东特别是中小股东的合法权益。

现将本人2009年度我履行独立董事职责情况汇报如下:一、2009年度出席公司会议情况2009年度,本着勤勉尽责的态度,本人积极参加公司召开的董事会和股东大会,认真审阅和积极讨论各项议案,并提出诸多合理建议,履行了独立董事的义务。

本人认为2009年度公司董事会、专业委员会和股东大会的召集召开符合法定程序,重大经营决策事项和其它重大事项均履行了相关程序,合法有效。

2009年度公司共召开5次董事会,3次股东大会,本人亲自出席了以上全部会议,对提交董事会的全部议案进行了认真审议,认为这些议案与真实情况一致并符合公司经营发展目标,未损害全体股东、特别是中小股东的利益,因此均投出赞成票,没有反对、弃权的情况。

二、对公司重大事项发表独立意见情况2009年度,公司未发生需要发表独立意见的事项。

三、专业委员会履职情况公司于2008年5月9日召开第一届董事会2008年第3次会议,会议决定设立审计委员会、薪酬与考核委员会、提名委员会以及战略与发展委员会四个专业委员会。

本人作为审计委员会委员、薪酬与考核委员会召集人、提名委员会委员按照《审计委员会实施细则》、《薪酬与考核委员会实施细则》、《提名委员会实施细则》和有关文件的相关规定和要求,在2009年度履行了如下职责:1)对公司公开发行股票并在创业板上市相关事宜向董事会提出了建议;2)参与了公司创业板上市申报材料业务和技术部分资料的审核;3)审查了公司高管及董事管理人员2009年度履行职责情况和绩效考核情况;4)对公司薪酬体系和相关制度的建设提出了意见和建议;5)对公司未来业务发展提出了意见和建议。

轴研科技:独立董事2009年度述职报告(卢秉恒) 2010-03-25

洛阳轴研科技股份有限公司独立董事2009年度述职报告各位股东及代表:大家好!我作为洛阳轴研科技股份有限公司的独立董事,在2009年根据《关于在上市公司建立独立董事制度的指导意见》、《公司法》、《公司章程》、《公司独立董事制度》及有关法律法规的规定和要求,勤勉、尽职、忠实履行职责,积极出席相关会议,认真审议董事会各项议案,对公司相关事项发表独立意见,切实维护了公司和股东的利益。

现将2009年度我履行独立董事职责情况述职如下:一、出席会议情况2009年度,公司共召开了6次董事会会议,每次会议我均亲自参加,未有缺席董事会会议的情况。

本年度,我对各次董事会会议所审议的议案均投了赞成票。

二、发表独立董事意见情况1、2009年3月23日,发表独立意见5项,内容如下:(1)《关于洛阳轴研科技股份有限公司2009年日常关联交易的独立意见》认为:该关联交易经公司第三届董事会第六次会议审议通过,审议时,关联董事回避了董事会表决。

因此,该关联交易的审议程序符合有关法律、法规和公司章程的规定;该关联交易符合上市公司和全体股东的利益,未损害公司及其他股东,特别是中、小股东和非关联股东的利益;对该交易,我表示同意。

(2)《关于洛阳轴研科技股份有限公司董事、高管薪酬的独立意见》认为:2008年度,公司能严格执行董事及高级管理人员薪酬制度和考核激励制度,薪酬发放的程序符合有关法律法规及公司章程、规章制度的规定。

(3)对洛阳轴研科技股份有限公司累计和当期对外担保情况发表专项说明和独立意见如下:截止2008年12月31日,公司没有发生对外担保、违规对外担保、关联方占用资金等情况,也不存在以前年度发生并累计至2008年12月31日的对外担保、违规对外担保、关联方占用资金等情况。

(4)《关于洛阳轴研科技股份有限公司2008 年度内部控制自我评价报告的独立意见》认为:公司建立了较为完善的法人治理结构,内部控制体系较为健全,符合有关法律法规和证券监管部门的要求,公司内部控制的自我评价报告真实、客观地反映了公司内部控制制度的建设及运行情况。

富安娜:独立董事2009年度述职报告(李斌) 2010-04-28

报告期内董事会会议召 开次数

6

董事姓名

职务

亲自出 席次数

委托出席 次数

缺席次数Βιβλιοθήκη 是否连续两次未亲 自出席会议李斌 独立董事

6

0

0

否

2009年度,本人对提交董事会的全部议案进行了认真审议,认为这些议案均未 损害全体股东,特别是中小股东的利益,因此全部投出赞成票,对公司董事会审议 事项没有提出异议。

二、发表独立董事意见情况

三、保护社会公众股股东合法权益方面所做的工作

作为公司独立董事,本人在2009年内勤勉尽责,忠实履行独立董事职务,对公 司生产经营、财务管理、关联交易、重大担保等情况,认真听取了相关人员的汇报, 主动调查、获取了做出决策所需要的情况及资料,在公司的关联交易等事项上发表 了独立意见,不受公司和主要股东的影响。及时了解公司的日常经营状态和可能产 生的经营风险,在董事会上独立、客观、审慎地行使各项表决权,积极有效地履行 了独立董事的职责,维护了公司和中小股东的合法权益。同时通过学习相关法律法 规和规章制度,积极参加深圳证监局及深圳证券交易所组织的相关培训及会议,加 深对相关法规尤其是涉及到规范公司法人治理结构和保护社会公众股股东权益保护 等相关法规的认识和理解,以切实加强对公司和投资者利益的保护能力,形成自觉 保护社会公众股东权益的思想意识。

深圳市富安娜家居用品股份有限公司

独立董事2009年度述职报告

各位股东及代表: 本人作为深圳市富安娜家居用品股份有限公司的独立董事,2009年按照《公司

法》、《关于在上市公司建立独立董事制度的指导意见》、公司章程、《独立董事 工作细则》及有关法律、法规的规定,忠实的履行了独立董事的职责,谨慎、认真、 勤勉地行使公司所赋予的权利,出席了公司2009年的相关会议,对董事会的相关议 案发表了独立意见。现将2009年一年的工作情况向各位股东进行汇报。

网宿科技:独立董事2009年度述职报告(许成富) 2010-03-24

独立董事 2009年度述职报告尊敬的各位股东:我是上海网宿科技股份有限公司(以下简称“公司”或“网宿科技”)独立董事【 许成富 】。

2009 年我按照《公司法》、《关于在上市公司建立独立董事制度的指导意见》及《公司章程》、《独立董事工作制度》等相关法律、法规、制度的规定和要求,充分发挥独立董事的作用,恪尽职守,勤勉尽责,维护公司利益,维护全体股东尤其是中小股东的利益,履行了独立董事的职责,谨慎、认真、勤勉地行使法律所赋予的权利,出席了公司2009 年的各次相关会议,对有关议案或议题发表了独立意见,现将2009年度履行独立董事职责的情况述职如下:一、出席会议情况:上市前董事会会议情况1)2009年3月15日召开了第一届董事会第六次会议(2008年度董事会)会议议程如下:1)审议2008年度董事会工作报告2)审议2008年度财务决算方案3)审议2008年度利润分配方案4)审议关于聘请2009年度审计机构并决定其报酬的议案5)审议关于审核董事、高级管理人员薪酬的议案6)审议《财务管理制度》7)审议关于清理固定资产的议案8)审议关于同意天津网宿科技有限公司开展业务的议案9)审议关于上海网宿科技股份有限公司北京分公司房屋租赁关联交易的议案10)审议关于聘请洪珂为公司副总裁的议案11)审议关于提名吴波为公司独立董事候选人的议案12)审议关于召集2008年度股东大会的议案2)2009年3月25日公司召开第一届董事会第七次会议。

会议议程:1)审议关于非公开发行股票的议案。

2)审议关于变更公司股东和注册资本的议案。

3)审议关于修订《上海网宿科技股份有限公司章程》的议案。

4)审议关于提请股东大会授权董事会办理非公开发行股票及相关事宜的议案。

5)审议关于召集2009年第一次临时股东大会的议案。

3)2009年6月19日召开了第一届董事会第八次会议会议议程:1)审议关于在南京设立子公司的议案2)审议关于在深圳设立子公司的议案3)审议公司三年一期审计报告4)审议关于公司提供对外担保的议案5)审议关于由吴波担任董事会薪酬与考核委员会主席的议案6)审议关于由吴波担任董事会审计委员会委员的议案4)2009年7月7日召开第一届董事会第九次会议会议议程:1)审议《关于申请首次公开发行人民币普通股(A 股)股票并于创业板上市的议案》2)审议《关于首次公开发行人民币普通股(A 股)股票募集资金投资项目的议案》3)审议《关于首次公开发行人民币普通股(A股)股票前滚存利润分配方案的议案》4)审议发行上市后所适用《公司章程(草案)》5)审议《关于提请股东大会授权董事会全权办理发行上市相关事宜的议案》6)审议《关于确认聘请本次发行上市有关中介机构的议案》7)审议《关于确认公司2006年以来关联交易价格公允性的议案》8)审议《2009年度内部审计计划》9)审议《上海网宿科技股份有限公司子公司管理制度》10)审议《关于修订<上海网宿科技股份有限公司总裁工作细则>的议案》11)审议《关于召集2009年第二次临时股东大会的议案》5)2009年7月20日召开第一届董事会第十次会议,会议议程:1)审议《关于公司三年又一期审计报告的议案》2)审议《避免同业竞争协议》6)2009年9月24日召开第一届董事会第十一次会议会议议程:1)审议关于《上海网宿科技股份有限公司防范大股东及关联方资金占用管理办法》上市后董事会会议情况7)2009年11月15日召开第一届董事会第十二次会议会议议程:1)审议《关于上海网宿科技股份有限公司设立募集资金专项账户的议案》 8)2009年12月23日召开第一届董事会第十三次会议会议议程:1)审议《关于在杭州设立子公司的议案》2)审议《关于在济南设立子公司的议案》3)审议《关于在西安设立子公司的议案》4)审议《关于在沈阳设立子公司的议案》5)审议《关于在长沙设立子公司的议案》6)审议《关于在成都设立子公司的议案》7)审议《关于在郑州设立子公司的议案》8)审议《关于在香港设立子公司的议案》9)审议《关于上海网宿科技股份有限公司投资者关系管理制度的议案》10)审议《关于上海网宿科技股份有限公司重大信息内部报告制度的议案》在召开上述会议时,本人认真审议董事会议案,审慎行使表决权,诚信、勤勉地履行独立董事职责,维护了公司的利益和全体股东特别是中小股东的利益。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

瓦轴股份有限公司

2009年度独立董事述职报告

瓦房店轴承股份有限公司第四届董事会于2009年6月29日任期届满,公司按照《公司法》等相关法律法规的规定和公司章程的要求,进行了换届选举。

独立董事候选人汪克夷、张启銮、刘玉平、王华彬先生先后于2009年6月29日和8月20日经公司年度股东大会和2009年第一次临时股东大会选举后担任。

一、公司第四届独立董事履行职责情况

公司第四届董事会中的独立董事贵立义、武春友、李延喜先生和张丽女士在任期间,均亲自参加公司历次董事会,严格按照《公司法》、《证券法》、《关于在上市公司建立独立董事制度的指导意见》、《关于加强社会公众股股东权益保护的若干规定》以及《公司章程》等有关规定和要求,坚持独立、诚信、勤勉的原则,维护中小股东的合法权益。

独立董事对公司的长足发展,对公司的规范运作献计献策,对公司重大事项均予以关注,并站在保护中小股东的立场,严格按照监管部门的要求发表独立董事事前认可意见及独立董事意见,公司及时将其意见予以公开的信息披露,公司严格做到信息的公开、公平、公正性。

公司现任独立董事王华彬、汪克夷、张启銮、刘玉平对第四届独立董事所作出的工作予以肯定。

并将克勉职责,继续为股东会、董事会及中小股东负责和服务,对公司的发展倾其绵薄之力。

二、公司现任独立董事出席会议情况

现任独立董事投入了足够的时间和精力,专业、高效地履行职责,持续地了解公司生产经营和运作情况,主动调查、获取做出决策所需要的情况和资料,充分掌握信息,对重大事务作出独立的判断和决策。

独立董事亲自出席董事会会议,2009年独立董事自上任以来出席会议情

况如下:

独立董事姓 名 报告期任职后应

参加董事会次数

亲自出席委托出席 缺席 提出异议

情 况

王华彬 2 2 0 0 无 汪克夷 3 3 0 0 无 张启銮 3 3 0 0 无 刘玉平 3 3 0 0 无

三、第五届独立董事发表意见的情况

现任独立董事除履行董事的一般职责外,关注公司的重大事项,独立履行职责,不受公司的主要股东、实际控制人的影响,对董事会讨论重大事项发表客观、公正的独立意见,尤其关注高级管理人员的聘任、关注大股东是否存在资金占用等重大事项,公司将独立董事的意见进行了公告,其具体情况如下:

1、关于聘任公司总经理、副总经理、总会计师的独立意见

公司总经理邵阳先生本届三年任期已满,依据《公司章程》的规定及本公司的实际情况,提名委员会认真研究了公司总经理的聘任条件,对邵阳先生的任职资格进行了审查,并对其担任上届总经理任职期间的工作表现和业绩进行了综合评价,我们认为邵阳先生符合了股份公司总经理的任职条件,具备了任职资格,且工作表现和业绩突出,因此同意邵阳先生继续担任瓦轴股份公司总经理。

根据总经理提名,公司同时聘任了副总经理及总会计师。

独立董事发表意见,同意此事项。

2、关于公司关联方资金占用的独立意见

根据中国证监会证监发(2003)56号《关于规范上市公司与关联方资金往来及上市公司对外担保若干问题的通知》、《关于规范上市公司对外担保行为的通知》(证监发[2005]120号)等的规定和要求,本着对公司及投资者负责的态度,独立董事按照实事求是的原则对公司控股股东及其它关联方占用资金

的情况和公司对外担保情况进行了认真负责的核查和落实,发表了如下独立意见:

公司不存在控股股东及其它关联方非经营性占用公司资金的情况。

四、公司保证独立董事有效行使职权

公司保证独立董事享有与其他董事同等的知情权,提供独立董事履行职责所必需的工作条件,公司有关人员积极配合独立董事履行职责,未有任何干预其独立行使职权的情形。

经股东大会审议通过,公司给予独立董事适当的津贴,并在年报中进行了披露,公司历届独立董事未从公司及其主要股东或有利害关系的机构人员取得额外的、未予披露的其他利益。

全体独立董事承诺将继续独立、公正、勤勉、尽责地行使权利、履行义务,维护公司和全体股东的权益。

特此报告。

独立董事: 王华彬 刘玉平 张启銮 汪克夷

2010年4月22日。