美国转让定价法规 1.482-8

美国转移定价之最优法规则评析与借鉴

规 定并不存在 本质 的 区别,但前者 兼顾 了原则性和灵活性 ,更具有操作 意义。 虽然该 规则也面临着来 自无形 资产 、纳税人证 明负担 、会计准则等的冲击,从 而使该规则的 应用受到限制 ,但 其价值仍 然不容忽视。对于 引进跨国投 资最多、跨 国公 司转移 定价 问题 日趋严 重的我国而言,最优 法规则在原 则性与灵活性 的权衡、 未列明方法的应 用 和创新 、 以及 以比例原 则规制税务机 关的 自由裁量权 等方面对我国转移 定价税 制的完

善 具有 启 示 意 义。

关键词 :转移定价 ; 最优 法规则 ;独 立交易原 则;O E C D指 南 中图分类号 :DF 9 6 3 文献标识码 :A 文章编号 :1 0 0 6 — 1 8 9 4( 2 0 1 4 )0 2 — 0 0 6 5 — 0 8

独立 交易原 则 ( Ar m’ S L e n g t h P r i n c i p l e)是 约 束 关 联 企 业 间 交 易 行 为 和 税 务

G U0 J I S H AN G W U YA NJ I U

M a r . 2 01 4

V O l _ 3 5N O . 1 9 6

美国转移 定价之最优法规则评析 与借 鉴

叶莉娜

( 吉林 大学 法学院 ,吉林 长春 1 3 0 0 1 2)

摘

要 :转移定价方法的选择 对纳税人和税务 ' 3局都很重要。 3前 - - ,在独 立交易原 则下形成 了 " 至 少5 种 可接 受的方法 ,供征 纳双方依据 个案的事实和情况 予以选择 。美国实施 的最 优 法规则 旨在 为转移 定价方法的选择提供 具体指 导。最优法规 则与OE C D指 南的相 关

协 议立 法 的基础 原 则 。见 :O E CD. T r a n s f e r P r i c i n g Gu i d e l i n e s f o r Mu l t i n a t i o n a l E n t e r p r i s e s a n d T a x A d mi n i s t r a t i o n s . 2 2 J UL Y 2 0 1 0 , C h a p t e r I a n d C h a p t e r V I I I( C)。

美国税收政策

美国税收制度美国是我国“走出去”企业主要投资目的地国家之一,因其优越的经济环境、领先的技术水平及包括税收优惠政策在内的政府优惠政策而受到我国投资者的青睐。

为帮助“走出去”企业了解美国税制、做好投资前后的税收因素分析和税收风险控制,掌握税收争议解决的有效途径,深圳地税局“走出去”税收沙龙以“投资美国税务风险控制”为主题进行了专题讨论。

一、美国税制简况美国实行由联邦、州和地方分别立法及征管,联邦以所得税、州和地方以销售税和财产税为主体的税收制度。

联邦税包括所得税、预提所得税、雇佣税、贸易及海关税收;州和地方税包括所得税、特许(权)税、销售和使用税、财产税。

美国的所得税分为公司收入所得税及个人收入所得税。

公司联邦收入所得税采用累进税率制,实行15%至38%的累进税率,在计算公司联邦收入所得税时,净营业损失与资本利得损失分别计算,净营业损失可向前追溯2个纳税年度向后结转20个纳税年度、净资本利得损失可向前追溯3个纳税年度向后结转5个纳税年度。

个人收入所得税是联邦政府税收主要来源,个人收入所得税的缴付方式包括夫妻联合报税、夫妻分别报税、以家庭户主形式报税和单身个人保税四种,采取累进税率制。

雇佣税主要包括社会保险、医疗保险及联邦失业保险税和州政府失业税。

当美国公司或自然人向非美国人(包括非美国公司、非美国合伙企业和非美国自然人)支付来源于美国的服务费、利息、股息、租金、特许权使用费、养老金及其他与业务无关的报酬时要代扣代缴美国联邦税负,即缴纳报酬总额30%的预提所得税,在符合中美税收协定的条件下可享受协定议定的实际税率。

美国各州有权自行制定税收制度,可根据所在州立法机构制定的有关法律和经济发展水平等设立不同的税种和相关税率,因此美国各州的税收制度比联邦税收制度更加多样化。

在计算联邦所得税时,州和地方的所得税可以进行扣除,有些州如内华达州、南达科他州、怀俄明州等免征州公司收入所得税,各州为扩大就业水平、引导投资方向均推出针对公司实体的投资鼓励政策,鼓励和欢迎无污染或较少污染、投资金额大、科技含量高、能提供就业带动经济发展的公司投资,给予相应的税收优惠。

美国预约定价协议转让定价方法探讨

美国预约定价协议转让定价方法探讨作者:乔栋朱清来源:《财会通讯》2009年第04期预约定价协议(Advance Pricing Agreements,简称APA)是指纳税人与税务机关预先约定关联交易所适用的转让定价原则和方法,用以解决和确定未来(或以前)年度关联交易涉及的税收问题所做出的一系列安排的总称。

在预约定价协议中,纳税人和税务机关确定的核心条款是关联交易中使用的转让定价方法(TPM)。

美国的预约定价协议发展最快、最完善,也最具有操作性,对于各种转让定价方法作了详细的规定,其转让定价方法实践值得探讨。

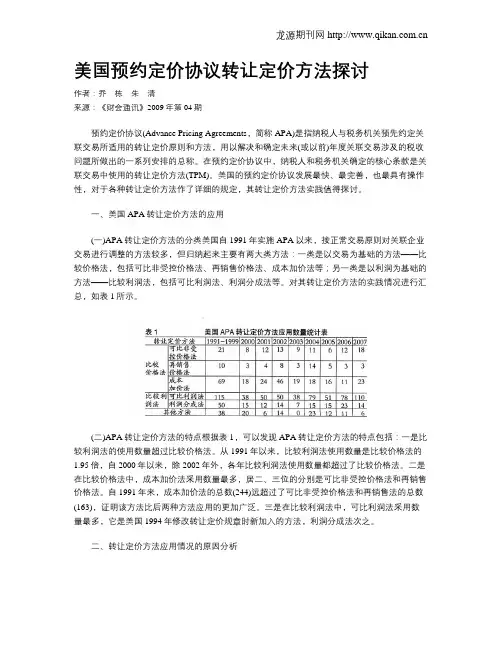

一、美国APA转让定价方法的应用(一)APA转让定价方法的分类美国自1991年实施APA以来,按正常交易原则对关联企业交易进行调整的方法较多,但归纳起来主要有两大类方法:一类是以交易为基础的方法——比较价格法,包括可比非受控价格法、再销售价格法、成本加价法等;另一类是以利润为基础的方法——比较利润法,包括可比利润法、利润分成法等。

对其转让定价方法的实践情况进行汇总,如表1所示。

(二)APA转让定价方法的特点根据表1,可以发现APA转让定价方法的特点包括:一是比较利润法的使用数量超过比较价格法。

从1991年以来,比较利润法使用数量是比较价格法的1.95倍,自2000年以来,除2002年外,各年比较利润法使用数量都超过了比较价格法。

二是在比较价格法中,成本加价法采用数量最多,居二、三位的分别是可比非受控价格法和再销售价格法。

自1991年来,成本加价法的总数(244)远超过了可比非受控价格法和再销售法的总数(163),证明该方法比后两种方法应用的更加广泛。

三是在比较利润法中,可比利润法采用数量最多,它是美国1994年修改转让定价规章时新加入的方法,利润分成法次之。

二、转让定价方法应用情况的原因分析(一)应用比较利润法超过比较价格法的原因一是比较价格法在现实采用过程中存在困难。

从APA理论和原则两方面看,比较价格法是最合理、最简便的方法,但以非关联企业之间交易数据为基础的比较价格法,最关键的是要找到适用的可比价格,其可靠性程度取决于受控交易与非受控交易之间的可比程度,可比性越高可靠性越强。

美国转让定价税制介绍

营利润所作的贡献值 , 来对汇总的经营利润进行分配。利润分成法具体有多种方

直接或间接地为同一利益拥有或控制的情况下 , 财政部长如果

系, 包 含的有关法典 、 法规达百部之 多。可以说 , 美 国现行 的转

让定价税制 , 处在世界领先水平。 ( 二) 美 国转 让 定 价 税制 的改 革 过 程 。 美 国转 让 定 价 税 制 自 创 立 以来 , 在理论 、 指 导原 则 等 方 面 , 税 务 当局 和跨 国 纳税 人 已

配, 也不汇回美国 , 要记入美 国各股东名下 , 视同当年分配的股

项 内部转让 定价 是否符合正常交易价?因此 , 如何确定 合理的

价 格就成为转让 定价税制 最大 的难点 之一 。为了解决这个 问 题, 美 国长期 以来一直 在不断地 修正完善转 让定价税 制 , 力图 充 分体 现正 常交易原则 。 但是, 不管怎 么进 行改革 , 最终 都离不 开核心 问题——价 格调整。对价格 的调整 , 无非 是“ 价格 比较” 或“ 利润 比较 ” 两类

一

、

美 国转 让 定 价 税 制 的概 况

的“ 预约定价协 议制度 ” , 1 9 9 3 年 发布 的“ 美 国国 内收入法 典第 4 8 2 节转让定价 的暂行条例 ” , 1 9 9 4 年发布 的 “ 全球 贸易预约定 价协议制度” ; 美国国 内税务局 1 9 9 2 年发布 的“ 关联公 司转让定 价和成本分摊暂行条例” , 1 9 9 4 年3 月发 布的 “ 关于第6 6 6 2 节有 关准确性处罚的暂行条例” , 1 9 9 4 年7 月发布的“ 关 于第4 8 2 节转 让定价的最终 条例 ” 等。 此外 , 美 国在有 关这方 面案例 的司法处理 中 , 也形 成 了众 多案例法 。不仅如此 , 美国还在已签订的与几十个 国家 的避免

浅谈对跨国企业转移定价的法律规制

浅谈对跨国企业转移定价的法律规制作者:王文辉来源:《法制与社会》2009年第15期摘要本文通过对美国及国际上转移定价制度的阐述,重点分析了ALP、预约定价协议(advance pricing agreement, APA)等制度,以期对我国相关制度的完善有所助益。

关键词转移定价转移定价方法预约定价协议中图分类号:D922.29 文献标识码:A 文章编号:1009-0592(2009)05-383-01随着我国经济的迅猛发展,参与国际间经济交往的不断增多,跨国公司在我国迅速发展,亟需对转移定价进行法律上的规范以保护我国税收。

目前,我国立法基本上遵循了国际通行的正常交易原则(arm’s length principle, ALP),但相比制度更加成熟的美国等发达国家,我国的法律规范仍存在不少缺陷。

本文通过对美国及国际上转移定价制度的分析阐述,重点分析预约定价协议(advance pricing agreement, APA)制度,对跨国企业转移定价的规范从事后调整转变为事前防范,并对我国相关制度的完善提供参考。

一、转移定价制度的成因及基本含义跨国企业这种经营模式的不断发展及其取得的巨大成功,使得在全球范围内贸易的开展日益成为商业往来的常态。

尽管跨国公司下属各关联企业间存在国界线的分割,但是几乎每天它们之间都在进行货物、服务、无形财产的流转,这种涉及多个国家的交易必然会导致税收难题。

对于在多个国家均设有分公司或机构的跨国公司而言,每个国家所能收取的税收底线是多少,之间又应按照何种比例分配?当跨国公司通过内部关联交易在不同国家间转移收入或费用时,每个国家又如何确定该笔交易在本国境内的真正收入?税收问题涉及国家的主权行使以及每个国家的财政政策,因此很难在各个国家间达成统一的税收规则。

而实际上对于完全位于一国境内的交易收税,没有必要通过国际统一的规则进行约束。

但是经济的全球化以及跨国企业的不断增长,跨国企业频频运用转移定价规避税收的做法引起了各国税务机关的关注。

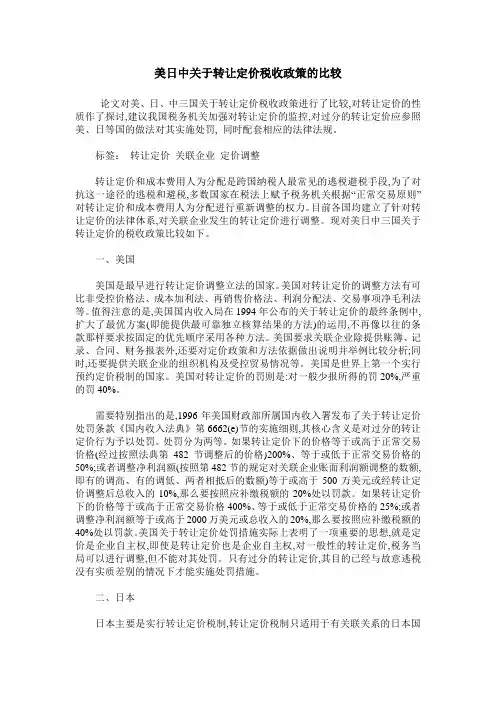

美日中关于转让定价税收政策的比较

美日中关于转让定价税收政策的比较论文对美、日、中三国关于转让定价税收政策进行了比较,对转让定价的性质作了探讨,建议我国税务机关加强对转让定价的监控,对过分的转让定价应参照美、日等国的做法对其实施处罚, 同时配套相应的法律法规。

标签:转让定价关联企业定价调整转让定价和成本费用人为分配是跨国纳税人最常见的逃税避税手段,为了对抗这一途径的逃税和避税,多数国家在税法上赋予税务机关根据“正常交易原则”对转让定价和成本费用人为分配进行重新调整的权力。

目前各国均建立了针对转让定价的法律体系,对关联企业发生的转让定价进行调整。

现对美日中三国关于转让定价的税收政策比较如下。

一、美国美国是最早进行转让定价调整立法的国家。

美国对转让定价的调整方法有可比非受控价格法、成本加利法、再销售价格法、利润分配法、交易事项净毛利法等。

值得注意的是,美国国内收入局在1994年公布的关于转让定价的最终条例中,扩大了最优方案(即能提供最可靠独立核算结果的方法)的运用,不再像以往的条款那样要求按固定的优先顺序采用各种方法。

美国要求关联企业除提供账簿、记录、合同、财务报表外,还要对定价政策和方法依据做出说明并举例比较分析;同时,还要提供关联企业的组织机构及受控贸易情况等。

美国是世界上第一个实行预约定价税制的国家。

美国对转让定价的罚则是:对一般少报所得的罚20%,严重的罚40%。

需要特别指出的是,1996年美国财政部所属国内收入署发布了关于转让定价处罚条款《国内收入法典》第6662(e)节的实施细则,其核心含义是对过分的转让定价行为予以处罚。

处罚分为两等。

如果转让定价下的价格等于或高于正常交易价格(经过按照法典第482节调整后的价格)200%、等于或低于正常交易价格的50%;或者调整净利润额(按照第482节的规定对关联企业账面利润额调整的数额,即有的调高、有的调低、两者相抵后的数额)等于或高于500万美元或经转让定价调整后总收入的10%,那么要按照应补缴税额的20%处以罚款。

转让定价调整的具体方法——美国和OECD转让定价规则比较研究之三

济环境中的细微差别.也会实质

,时析分性比可行进存外此

和整完的据数用所虑考分充要还 准确程度.眦及为使用这利r力。

剖地影响非受控交易的价格,因

此水方法下的可比性.依赖于这 赖依或,性似相度高有具桊因雌

。度程靠可的提前定设做所法 开公从以可据数格价控受非比可 交易所或}瞳价媒介获得,但必额

之易交控受与易交控受非项某 、异差的格价响影会在存不,间 或者两者之间只有一些细微岫差 参照的非受控交易并应用前进关 于可比性的分析思路。所有的比 特萼日f,虑考“于须必都素因较

生相同的净利水平,而同样生产 经营相同的产品或服务也可能产 生不同的净利水平;对比营业费 用毛利牢等毛利指标.净利指标 较少地受功能差异的影响.,功能 差异往往就反映在营业费用的不 同之中.水利是毛利扣除营业费 用后的余额.同样的功能可能产 生不同的净利,不同的功能可能 导致相同的净利水平。因此这一 方法可用于对涉及无形资产交易 等交易对象的性质、功能存在较 大特殊性的受控交易结果的评价 和调档。o 交易挣利洁也存在不足之 扯。由j二营_n利润不仅曼价格 因求帕雌响.迁通常曼州垃谢 管理水半.新的竟牛对手的威 胁.替代产品的威胁、二L厂和 世需新lH不同而产牛的成本结 构、自辨资盘和贷教比例所反 映的资本结构、经传经验等非 价格、非市场因泰的影响.而 其中的每一个因絮又受到其它因 索的彤响.如竞争对手的威胁 程度又是由产品的质量花色品 种、政府补贴程度等决定的。而 对这些因索进行差异分析并决定 调整通常有较大的困难。这就 使得可比陛分析的可靠性降低, 从而使应用交易净利法来}平价受 控交易是否符合正常交易原则的

能不在被试验方和可比方财务报

告中明确记录的部分。营运资产 必须姒年初和年终价值的平均值 来衡量,除非这一年使用年平均

美国转让定价白皮书述评

美国转让定价白皮书述评

王铁军

【期刊名称】《财经问题研究》

【年(卷),期】1993(000)008

【摘要】一、白皮书问世的背景多年来,美国在对转让定价问题的处理上,一直坚持实行正常交易原则。

这一原则的基本精神就是关联企业之间的交易,应象在相同或类似条件下,从事相同或类似交易的无关联方之间那样进行定价与收费。

该原则集中体现在美国《国内收入法典》第482节这一重要法律条款中。

为了使第482节得以贯彻执行,美国财政部于1968年公布的财政法规Regs.§.

【总页数】5页(P31-35)

【作者】王铁军

【作者单位】无

【正文语种】中文

【中图分类】F817.123

【相关文献】

1.跨国企业转让定价避税理论述评 [J], 姜凌;王君

2.无形资产转让定价发展趋势及对我国的启示——基于OECD《无形资产转让定价指引》的分析 [J], 王蕾

3.无形资产转让定价发展趋势及对我国的启示——基于OECD《无形资产转让定价指引》的分析 [J], 王蕾

4.基于文献计量的国内转让定价研究述评 [J], 李佳坤

5.美国预约定价协议转让定价方法探讨 [J], 乔栋;朱清

因版权原因,仅展示原文概要,查看原文内容请购买。

转让定价的税务管理

(3)交易净利润率法(TNMM)

• 它是一种以独立企业在一项可比交易中所得获得的净利润 为基础来确定转让定价的方法。我国税法称其为“净利润 法”。根据交易净利润率法,纳税人在受控交易下取得的 净利润率应与可比交易情况下非受控纳税人取得的净利润 率大致相同。

转让定价的税务管理

交易净利润法建立的基础是,从长期来看,那些 在相同产业以及相同条件下经营的企业应取得相 同的利润水平。

的税务管理工作。

转让定价的税务管理

2003年~2005年期间,对美国6大 跨国医药公司调查发现:

转让定价的税务管理

6.2 转让定价审核、 调整的原则与方法

转让定价的税务管理

6.2.1 跨国关联企业间收入和费用分配的原则 6.2.2 转让定价的审核和调整方法 6.2.3 转让定价调整中的国际重复征税问题

• 1.英国与1915年颁布了转让定价法规—世界最早。 • 2.美国于1917年颁布了相同的法规。

转让定价的税务管理

• 仅仅立法已经不能够限制跨国公司的转让定价行为, 税务部门必须有一套详尽的法律措施来限制并纠正 跨国企业的转让定价行为。

• 美国在这方面是最早采取行动。 • 20世纪80年代以后,在执法方面也更加严格。 • 90年代开始,一些发展中国家也开始重视转让定价

转让定价的税务管理

6.2.2 转让定价的审核和调整方法

• 可比非受控价格法 • 再销售价格法 • 成本加成法 • 其他合理方法。

• 传统交易法或价格法 • 利润法

转让定价的税务管理

• 无论采用何种方法,税务机关都要将纳税人的关

联交易与所要参照的非关联交易进行可比性分析。 根据国税发[2009]2号文件,可比性分析的内容包 括:

oecd转让定价指南

OECD转让定价指南前言:1. 近20年来,跨国公司在国际贸易中的作用急剧增强。

这部分地反映出各国经济与技术进步的结合在加强,特别在通讯领域更是如此。

由于不能孤立地看待一国关于跨国公司的税收政策,而必须将其置于广阔的国际范畴中加以讨论,因此跨国公司的增长不仅对税务机关而且对跨国公司本身提出了日益复杂的税务问题。

2. 这些税务问题,无论对税务机关还是跨国公司而言,主要源于实践中的困难,即出于税收管辖权的考虑,对跨国集团中某一公司或常设机构的收入与费用难以确定,这种情况在跨国集团的经营运作高度一体化时尤为突出。

3. 对跨国公司而言,要遵从因国而异的法律和管理要求,还会遇到其他问题。

相对于单一企业在单一税收管辖权下的运营,对(不同管辖权下)不同管理要求的遵从,会给跨国公司带来更重的负担,导致其承担更多的遵从成本。

4. 对税务机关而言,在政策和实践两方面都会遇到具体问题。

在政策方面,各国要相互协调其合法征税权,避免对同一所得因一个以上税收管辖权的存在而被重复征税,合法征税权是基于纳税人收入和成本相抵后的利润所得并且这种所得能够被合理判定产生于该国境内。

双重或多重征税会对跨国商品交易和劳务交易以及资本流动产生阻碍。

在实践方面,一国对跨国收入和费用的分配,会因难以获得其管辖权之外的相关资料而受到阻碍。

5. 从根本上说,各国所坚持的征税权取决于其税收体制是采取居民依据的税收体制、还是收入源泉依据的税收体制、还是两者并举。

在居民依据的税收体制下,一国会将其税收管辖权范围内的任一居民(包括居民公司)的全部或部分收入,包括产生于该国境外的收入,均纳入其税基。

在收入源泉依据的税收体制下,一国会将产生于其税收管辖权范围内的所有收入纳入其税基,而不考虑纳税人的居民身份。

当对跨国公司行使征税权时,经常把这两种征税依据结合在一起运用,将跨国公司内的每一个企业都看作一个独立实体来行事征税权。

OECD成员国选择这种独立实体征税法作为最合理的方法,既能够获得公平结果又使双重征税风险降低到最小。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Internal Revenue Service, Treasury §1.482–8(a)(3), (d)(2) and (j)(2)(i)(F) of this sec-tion apply for stock-based compensa-tion granted in taxable years beginning on or after August 26, 2003.(l) Transition rule. A cost sharing ar-rangement will be considered a quali-fied cost sharing arrangement, within the meaning of this section, if, prior to January 1, 1996, the arrangement was a bona fide cost sharing arrangement under the provisions of §1.482–7T (as contained in the 26 C FR part 1 edition revised as of April 1, 1995), but only if the arrangement is amended, if nec-essary, to conform with the provisions of this section by December 31, 1996.[T.D. 8632, 60 FR 65557, Dec. 20, 1995, as amended by T.D. 8670, 61 FR 21956, May 13, 1996; 61 FR 33656, June 28, 1996; T.D. 8930, 66 FR 295, Jan. 3, 2001; T.D. 9088, 68 FR 51177, Aug. 26, 2003; 69 FR 13473, Mar. 23, 2004]§1.482–8Examples of the best method rule.In accordance with the best method rule of §1.482–1(c), a method may be ap-plied in a particular case only if the comparability, quality of data, and re-liability of assumptions under that method make it more reliable than any other available measure of the arm’s length result. The following examples illustrate the comparative analysis re-quired to apply this rule. As with all of the examples in these regulations, these examples are based on simplified facts, are provided solely for purposes of illustrating the type of analysis re-quired under the relevant rule, and do not provide rules of general applica-tion. Thus, conclusions reached in these examples as to the relative reli-ability of methods are based on the as-sumed facts of the examples, and are not general conclusions concerning the relative reliability of any method. Example 1. Preference for comparable uncon-trolled price method. C ompany A is the U.S. distribution subsidiary of Company B, a for-eign manufacturer of consumer electrical ap-pliances. Company A purchases toaster ovens from Company B for resale in the U.S. mar-ket. To exploit other outlets for its toaster ovens, Company B also sells its toaster ovens to Company C, an unrelated U.S. distributor of toaster ovens. The products sold to C om-pany A and Company C are identical in every respect and there are no material differences between the transactions. In this case appli-cation of the CUP method, using the sales of toaster ovens to C ompany C, generally will provide a more reliable measure of an arm’s length result for the controlled sale of toast-er ovens to Company A than the application of any other method. See §§1.482–1(c)(2)(i) and –3(b)(2)(ii)(A).Example 2. Resale price method preferred to comparable uncontrolled price method. The facts are the same as in Example 1, except that the toaster ovens sold to C ompany A are of substantially higher quality than those sold to C ompany C and the effect on price of such quality differences cannot be accurately determined. In addition, in order to round out its line of consumer appliances C ompany A purchases blenders from unre-lated parties for resale in the United States. The blenders are resold to substantially the same customers as the toaster ovens, have a similar resale value to the toaster ovens, and are purchased under similar terms and in similar volumes. The distribution functions performed by Company A appear to be simi-lar for toaster ovens and blenders. Given the product differences between the toaster ovens, application of the resale price method using the purchases and resales of blenders as the uncontrolled comparables is likely to provide a more reliable measure of an arm’s length result than application of the com-parable uncontrolled price method using C ompany B’s sales of toaster ovens to C om-pany C.Example 3. Resale price method preferred to comparable profits method. (i) The facts are the same as in Example 2 except that C om-pany A purchases all its products from Com-pany B and C ompany B makes no uncon-trolled sales into the United States. How-ever, six uncontrolled U.S. distributors are identified that purchase a similar line of products from unrelated parties. The uncon-trolled distributors purchase toaster ovens from unrelated parties, but there are signifi-cant differences in the characteristics of the toaster ovens, including the brandnames under which they are sold.(ii) Under the facts of this case, reliable ad-justments for the effect of the different brandnames cannot be made. Except for some differences in payment terms and in-ventory levels, the purchases and resales of toaster ovens by the three uncontrolled dis-tributors are closely similar to the con-trolled purchases in terms of the markets in which they occur, the volume of the trans-actions, the marketing activities undertaken by the distributor, inventory levels, warran-ties, allocation of currency risk, and other relevant functions and risks. Reliable adjust-ments can be made for the differences in pay-ment terms and inventory levels. In addi-tion, sufficiently detailed accounting infor-mation is available to permit adjustments to be made for differences in accounting meth-ods or in reporting of costs between cost of goods sold and operating expenses. There are26 CFR Ch. I (4–1–06 Edition) §1.482–8no other material differences between the controlled and uncontrolled transactions. (iii) Because reliable adjustments for the differences between the toaster ovens, in-cluding the trademarks under which they are sold, cannot be made, these uncontrolled transactions will not serve as reliable meas-ures of an arm’s length result under the com-parable uncontrolled price method. There is, however, close functional similarity between the controlled and uncontrolled transactions and reliable adjustments have been made for material differences that would be likely to affect gross profit. Under these cir-cumstances, the gross profit margins derived under the resale price method are less likely to be susceptible to any unidentified dif-ferences than the operating profit measures used under the comparable profits method. Therefore, given the close functional com-parability between the controlled and uncon-trolled transactions, and the high quality of the data, the resale price method achieves a higher degree of comparability and will pro-vide a more reliable measure of an arm’s length result. See §1.482–1(c) (Best method rule).Example 4. Comparable profits method pre-ferred to resale price method. The facts are the same as in Example 3, except that the ac-counting information available for the un-controlled comparables is not sufficiently detailed to ensure consistent reporting be-tween cost of goods sold and operating ex-penses of material items such as discounts, insurance, warranty costs, and supervisory, general and administrative expenses. These expenses are significant in amount. There-fore, whether these expenses are treated as costs of goods sold or operating expenses would have a significant effect on gross mar-gins. Because in this case reliable adjust-ments can not be made for such accounting differences, the reliability of the resale price method is significantly reduced. There is, however, close functional similarity between the controlled and uncontrolled transactions and reliable adjustments have been made for all material differences other than the po-tential accounting differences. Because the comparable profits method is not adversely affected by the potential accounting dif-ferences, under these circumstances the comparable profits method is likely to produce a more reliable measure of an arm’s length result than the resale price method. See §1.482–1(c) (Best method rule).Example 5. Cost plus method preferred to com-parable profits method. (i) USS is a U.S. com-pany that manufactures machine tool parts and sells them to its foreign parent corpora-tion, FP. Four U.S. companies are identified that also manufacture various types of ma-chine tool parts but sell them to uncon-trolled purchasers.(ii) Except for some differences in payment terms, the manufacture and sales of machine tool parts by the four uncontrolled compa-nies are closely similar to the controlled transactions in terms of the functions per-formed and risks assumed. Reliable adjust-ments can be made for the differences in pay-ment terms. In addition, sufficiently de-tailed accounting information is available to permit adjustments to be made for dif-ferences between the controlled transaction and the uncontrolled comparables in ac-counting methods and in the reporting of costs between cost of goods sold and oper-ating expenses.(iii) There is close functional similarity be-tween the controlled and uncontrolled trans-actions and reliable adjustments can be made for material differences that would be likely to affect gross profit. Under these cir-cumstances, the gross profit markups de-rived under the cost plus method are less likely to be susceptible to any unidentified differences than the operating profit meas-ures used under the comparable profits method. Therefore, given the close func-tional comparability between the controlled and uncontrolled transactions, and the high quality of the data, the cost plus method achieves a higher degree of comparability and will provide a more reliable measure of an arm’s length result. See §1.482–1(c) (Best method rule).Example 6. Comparable profits method pre-ferred to cost plus method. The facts are the same as in Example 5, except that there are significant differences between the con-trolled and uncontrolled transactions in terms of the types of parts and components manufactured and the complexity of the manufacturing process. The resulting func-tional differences are likely to materially af-fect gross profit margins, but it is not pos-sible to identify the specific differences and reliably adjust for their effect on gross prof-it. Because these functional differences would be reflected in differences in operating expenses, the operating profit measures used under the comparable profits method implic-itly reflect to some extent these functional differences. Therefore, because in this case the comparable profits method is less sen-sitive than the cost plus method to the po-tentially significant functional differences between the controlled and uncontrolled transactions, the comparable profits method is likely to produce a more reliable measure of an arm’s length result than the cost plus method. See §1.482–1(c) (Best method rule). Example 7. Preference for comparable uncon-trolled transaction method. (i) USpharm, a U.S. pharmaceutical company, develops a new drug Z that is a safe and effective treat-ment for the disease zeezee. USpharm has ob-tained patents covering drug Z in the United States and in various foreign countries. USpharm has also obtained the regulatory authorizations necessary to market drug ZInternal Revenue Service, Treasury §1.482–8in the United States and in foreign coun-tries.(ii) USpharm licenses its subsidiary in country X, Xpharm, to produce and sell drug Z in country X. At the same time, it licenses an unrelated company, Ydrug, to produce and sell drug Z in country Y, a neighboring country. Prior to licensing the drug, USpharm had obtained patent protection and regulatory approvals in both countries and both countries provide similar protection for intellectual property rights. C ountry X and country Y are similar countries in terms of population, per capita income and the inci-dence of disease zeezee. Consequently, drug Z is expected to sell in similar quantities and at similar prices in both countries. In addi-tion, costs of producing drug Z in each coun-try are expected to be approximately the same.(iii) USpharm and Xpharm establish terms for the license of drug Z that are identical in every material respect, including royalty rate, to the terms established between USpharm and Ydrug. In this case the district director determines that the royalty rate es-tablished in the Ydrug license agreement is a reliable measure of the arm’s length royalty rate for the Xpharm license agreement. Given that the same property is transferred in the controlled and uncontrolled trans-actions, and that the circumstances under which the transactions occurred are substan-tially the same, in this case the comparable uncontrolled transaction method is likely to provide a more reliable measure of an arm’s length result than any other method. See §1.482–4(c)(2)(ii).Example 8. Residual profit split method pre-ferred to other methods. (i) USC is a U.S. com-pany that develops, manufactures and sells communications equipment. EC is the Euro-pean subsidiary of USC. EC is an established company that carries out extensive research and development activities and develops, manufactures and sells communications equipment in Europe. There are extensive transactions between USC and EC. USC li-censes valuable technology it has developed to EC for use in the European market but EC also licenses valuable technology it has de-veloped to USC. Each company uses compo-nents manufactured by the other in some of its products and purchases products from the other for resale in its own market.(ii) Detailed accounting information is available for both USC and EC and adjust-ments can be made to achieve a high degree of consistency in accounting practices be-tween them. Relatively reliable allocations of costs, income and assets can be made be-tween the business activities that are related to the controlled transactions and those that are not. Relevant marketing and research and development expenditures can be identi-fied and reasonable estimates of the useful life of the related intangibles are available so that the capitalized value of the intan-gible development expenses of USC and EC can be calculated. In this case there is no reason to believe that the relative value of these capitalized expenses is substantially different from the relative value of the in-tangible property of USC and EC. Further-more, comparables are identified that could be used to estimate a market return for the routine contributions of USC and EC. Based on these facts, the residual profit split could provide a reliable measure of an arm’s length result.(iii) There are no uncontrolled trans-actions involving property that is suffi-ciently comparable to much of the tangible and intangible property transferred between USC and EC to permit use of the comparable uncontrolled price method or the comparable uncontrolled transaction method. Uncon-trolled companies are identified in Europe and the United States that perform some-what similar activities to USC and EC; how-ever, the activities of none of these compa-nies are as complex as those of USC and EC and they do not use similar levels of highly valuable intangible property that they have developed themselves. Under these cir-cumstances, the uncontrolled companies may be useful in determining a market re-turn for the routine contributions of USC and EC, but that return would not reflect the value of the intangible property employed by USC and EC. Thus, none of the uncontrolled companies is sufficiently similar so that reli-able results would be obtained using the re-sale price, cost plus, or comparable profits methods. Moreover, no uncontrolled compa-nies can be identified that engaged in suffi-ciently similar activities and transactions with each other to employ the comparable profit split method.(iv) Given the difficulties in applying the other methods, the reliability of the internal data on USC and EC, and the fact that ac-ceptable comparables are available for deriv-ing a market return for the routine contribu-tions of USC and EC, the residual profit split method is likely to provide the most reliable measure of an arm’s length result in this case.Example 9. Comparable profits method pre-ferred to profit split. (i) Company X is a large, complex U.S. company that carries out ex-tensive research and development activities and manufactures and markets a variety of products. C ompany X has developed a new process by which compact disks can be fab-ricated at a fraction of the cost previously required. The process is expected to prove highly profitable, since there is a large mar-ket for compact disks. C ompany X estab-lishes a new foreign subsidiary, Company Y, and licenses it the rights to use the process to fabricate compact disks for the foreign26 CFR Ch. I (4–1–06 Edition) §1.483–1market as well as continuing technical sup-port and improvements to the process. Com-pany Y uses the process to fabricate compact disks which it supplies to related and unre-lated parties.(ii) The process licensed to C ompany Y is unique and highly valuable and no uncon-trolled transfers of intangible property can be found that are sufficiently comparable to permit reliable application of the com-parable uncontrolled transaction method. Company X is a large, complex company en-gaged in a variety of activities that owns unique and highly valuable intangible prop-erty. C onsequently, no uncontrolled compa-nies can be found that are similar to C om-pany X. Furthermore, application of the profit split method in this case would in-volve the difficult and problematic tasks of allocating Company X’s costs and assets be-tween the relevant business activity and other activities and assigning a value to C ompany X’s intangible contributions. On the other hand, C ompany Y performs rel-atively routine manufacturing and mar-keting activities and there are a number of similar uncontrolled companies. Thus, appli-cation of the comparable profits method using Company Y as the tested party is like-ly to produce a more reliable measure of an arm’s length result than a profit split in this case.[T.D. 8552, 59 FR 35028, July 8, 1994]§1.483–1Interest on certain deferred payments.(a) Amount constituting interest in cer-tain deferred payment transactions—(1) I n general. Except as provided in para-graph (c) of this section, section 483 ap-plies to a contract for the sale or ex-change of property if the contract pro-vides for one or more payments due more than 1 year after the date of the sale or exchange, and the contract does not provide for adequate stated inter-est. In general, a contract has adequate stated interest if the contract provides for a stated rate of interest that is at least equal to the test rate (determined under §1.483–3) and the interest is paid or compounded at least annually. Sec-tion 483 may apply to a contract whether the contract is express (writ-ten or oral) or implied. For purposes of section 483, a sale or exchange is any transaction treated as a sale or ex-change for tax purposes. In addition, for purposes of section 483, property in-cludes debt instruments and invest-ment units, but does not include money, services, or the right to use property. For the treatment of certain obligations given in exchange for serv-ices or the use of property, see sections 404 and 467. For purposes of this para-graph (a), money includes functional currency and, in certain cir-cumstances, nonfunctional currency. See §1.988–2(b)(2) for circumstances when nonfunctional currency is treated as money rather than as property.(2) Treatment of contracts to which sec-tion 483 applies—(i) Treatment of unstated interest. If section 483 applies to a contract, unstated interest under the contract is treated as interest for tax purposes. Thus, for example, unstated interest is not treated as partof the amount realized from the sale or exchange of property (in the case of the seller), and is not included in the pur-chaser’s basis in the property acquiredin the sale or exchange.(ii) Method of accounting for interest on contracts subject to section 483. Any stated or unstated interest on a con-tract subject to section 483 is taken into account by a taxpayer under the taxpayer’s regular method of account-ing (e.g., an accrual method or the cash receipts and disbursements method). See §§1.446–1, 1.451–1, and 1.461–1. For purposes of the preceding sentence, the amount of interest (including unstated interest) allocable to a payment under a contract to which section 483 appliesis determined under §1.446–2(e).(b) Definitions—(1) Deferred payments. For purposes of the regulations under section 483, a deferred payment means any payment that constitutes all or a part of the sales price (as defined in paragraph (b)(2) of this section), and that is due more than 6 months after the date of the sale or exchange. Ex-cept as provided in section 483(c)(2) (re-lating to the treatment of a debt in-strument of the purchaser), a payment may be made in the form of cash, stock or securities, or other property.(2) Sales price. For purposes of section 483, the sales price for any sale or ex-change is the sum of the amount due under the contract (other than stated interest) and the amount of any liabil-ity included in the amount realized from the sale or exchange. See §1.1001– 2. Thus, the sales price for any sale or exchange includes any amount of unstated interest under the contract.。