3. 财经英语 Unit 3 International settlement

英语财经报刊选读supplementary

Unit 1 Background MaterialsG20 members20国集团或者廿国集团,由八国集团(美国、日本、德国、法国、英国、意大利、加拿大、俄罗斯)和十一个重要新兴工业国家(中国、阿根廷、澳大利亚、巴西、印度、印度尼西亚、墨西哥、沙特阿拉伯、南非、韩国和土耳其)以及欧盟组成。

按照惯例,国际货币基金组织与世界银行列席该组织的会议。

廿国集团的GDP总量约占世界的85%,人口约为40亿。

中国经济网专门开设了“G20财经要闻精萃”专栏[1],每日报道G20各国财经要闻。

Unit 1 The new structure of the worldEconomy------G20Text A : Group of 201.emerging economy:新兴经济体emerging market economynewly emerging economyindustrialized economy:2.gross national product: 国民生产总值gross domestic productreal gross national productestimated gross national product3.industrial nations :工业国industrialized nations 工业化国家4.Atlantic-oriented: 以…为中心、导向;…主导的5.take on a new prominence 承担新的地位,更重要6.bail out: 帮助摆脱困境,救助7.mortgage market:抵押信贷市场8.on ad hoc basis:临时、即兴的9.rotating council presidency:欧盟理事会轮值主席国Text B The Pittsburgh Summit1.economic cycle: recession, depression, recovery, boom2.fiscal policy 财政政策;monetary policy; financial policy;aggressive policy; passive policy;3.regulation and supervision: 监管4.opaque OTC derivative market:缺乏透明度的场外衍生市场5.race to the top: 力争上游6.phase out: 逐步取消7.fossil fuel subsidy:化石燃料补贴8.future market: 期货市场9.deliver on: 兑现10.t ake stock of: 评估,评价11.g reenhouse gas emission: 温室气体排放12.oversee and regulate: 监督和规范Text C Financial reform and the G20: a hard clime1.reign: dominate2.shore up: support, save3.set the stage for a pow-wow: prepare for the meeting4.expansionary policy: 扩张性政策tight policy 紧缩政策5.rein in :限制、控制6.buffer: 缓冲存货7.pay disclosure:薪酬披露8.a host of: a lot ofa handful of: a small quantity of9. collateralized debt obligation: 抵押化债务债券10. governance reform: 治理结构改革11. cross-border institution:跨境机构12.Tier-1 capital ratio: 一级资本率Unit 2 American Sub-prime Mortgage CrisisText A Debt and Denial1.live within one’s means : 量入为出live beyond one’s means: 入不敷出2.run up debts to….借债3.make sense: 有意义,有道理,讲得通4.budget deficit: 预算赤字5.adjusted for: 调整6.debt financing: 债务融资7.home equity:房屋净值8.spending money:零用钱9.borrowing binge: 疯狂借款10.t rade deficit:贸易赤字soft landing: 软着陆11.s nap up :抢购bubble zone: 泡沫区12.e conomic fundamentals:经济基本面13.i llusory wealth: 虚幻财富14.d rop off: 减少rude awakening: 猛然惊醒15.h edge fund: 对冲基金Text B1.meet payments: 满足支付,付款1.fall behind: 拖欠2.pay off: 偿还3.conventional mortgage:传统按揭方式4.squeeze out of: 挤压出5.be stuck with: be burdened with6.per capita income: 人均收入7.economic gap: 经济差距8.spillover effect: 溢出效应9.tax base: 税基10.i n reverse: 相反地11.g utting: 破坏,供应紧张12.d eindustrialization: 限制工业化,产业空洞化Text C Three trillion dollars later….1.fill on e’s boots with risk: take risk2.palm off: get rid of , dispose of3.write down: 资产减记4.let the devil take the hindmost: 人人自保,落后遭殃5.hold … to ransom: 绑架6.cordon off: skirt, 绕过7.the scale and scope: 规模与范围8.the risk of insolvency: 资不抵债的风险9.identify with: 认为等同于10.trade off: 权衡Unit 3 Obama’s Economic Recovery PlanText A1.take office: 就职2.economic stimulus package:经济刺激一揽子方案3.make one’s way through:努力通过4.public housing公租房5.tax credit:税收抵免6.tuition credit: 学费税收抵免7.mortgage relief:抵押贷款减免8.mortgage-backed securities: 不动产放款抵押债券9.legislative overreach: 立法出拳过重10.weatherize :适应气候条件11.preventive care: 预防保健护理12.distressed security: 不良债券Text B: America’s Vulnerable Half-Speed Recovery1.on a gloomy note: 沉重,不景气,暗淡2.overhanging debt: 债务积压3.weigh down projection: reduce prediction4.write-down: 减记gging indicator : 滞后指标6.double-dip recession: 双底衰退7.baby boomers:(1):尤指1946年至1965年美国)出生于生育高峰期的人,生育高峰儿(2)出生于生育高峰期的一代人之一员,生育高峰代人(3) baby boomers经济困难的一代人8. put a damper on: restrainText C: Obama Unveils Green Jobs Plan aster Economy Loses 85,000 jobs in December1.tax credit: 税收抵免2.slip back: 滑回,后退,陷进去3.jump-start:启动,发动4.discouraged workers: 失业而不积极寻找工作的人(气馁工人;失去信心工人)5.point in the right direction: 指向正确方向,提供依据等6.in the same vein: 以同样方式;以同一思路Unit 4 Obama’s Medical PlanText A1.The House of Representative:众议院Senate参议院st-minute: 最后关头的3.universal health coverage:全民医保4.sign up for: 签约从事、获得;申请。

经贸英语Unit3

Unit 3

Business Negotiation

Reading A

Offers can be classified into two types: firm offers and non-firm offers. A firm offer is usually a seller’s promise to sell specified goods or services at specified prices, and valid for a specified period, with packing, payment, etc. described clearly. Once the firm offer is accepted by the buyer within the validity, the seller is not permitted to revise or withdraw his/her offer and is obliged to enter into a contract with the buyer. In contrast, a nonfirm offer is actually an offer without engagement which often contains reservation clauses like “ We make you an offer subject to our final confirmation.” Next step is “counter-offer”. When an offer reaches the offeree,

Confirming what they have agreed

Home

财经英语词汇

简明金融英语词汇彭炳铭AAccounts payable 应付帐款Accounts receivable 应收帐款Accrued interest 应计利息Accredited Investors 合资格投资者;受信投资人指符合美国证券交易委员(SEC)条例,可参与一般美国非公开(私募)发行的部份机构和高净值个人投资者Accredit value 自然增长值ACE 美国商品交易所ADB 亚洲开发银行ADR 美国存股证;美国预托收据;美国存托凭证[股市] 指由负责保管所存托外国股票的存托银行所发行一种表明持有人拥有多少外国股票(即存托股份)的收据。

ADR一般以美元计价和进行交易,及被视为美国证券。

对很多美国投资者而言,买卖ADR比买卖ADR所代表的股票更加方便、更流动、成本较低和容易。

大部份预托收据为ADR;但也可以指全球预托收(GDR) ,欧洲预托收据(EDR) 或国际预托收据(IDR) 。

从法律和行政立场而言,所有预托收据具有同样的意义。

ADS 美国存托股份Affiliated company 关联公司;联营公司After-market 后市[股市] 指某只新发行股票在定价和配置后的交易市场。

市场参与者关注的是紧随的后市情况,即头几个交易日。

有人把后市定义为股价稳定期,即发行结束后的30天。

也有人认为后市应指稳定期过后的交易市况。

然而,较为普遍的是把这段时期视为二级市场AGM 周年大会Agreement 协议;协定All-or-none order 整批委托Allocation 分配;配置Allotment 配股Alpha (Market Alpha) 阿尔法;预期市场可得收益水平Alternative investment 另类投资American Commodities Exchange 美国商品交易所American Depository Receipt 美国存股证;美国预托收据;美国存托凭证(简称“ADR ”参见ADR栏目) American Depository Share 美国存托股份Amercian Stock Exchange 美国证券交易所American style option 美式期权Amex 美国证券交易所Amortization 摊销Amsterdam Stock Exchange 阿姆斯特丹证券交易所Annual General Meeting 周年大会Annualized 年度化;按年计Antitrust 反垄断APEC 亚太区经济合作组织(亚太经合组织)Arbitrage 套利;套汇;套戥Arbitration 仲裁Arm's length transaction 公平交易Articles of Association 公司章程;组织细则At-the-money option 平价期权;等价期权ASEAN 东南亚国家联盟(东盟)Asian bank syndication market 亚洲银团市场Asian dollar bonds 亚洲美元债券Asset Allocation 资产配置Asset Management 资产管理Asset swap 资产掉期Assignment method 转让方法;指定分配方法ASX 澳大利亚证券交易所Auckland Stock Exchange 奥克兰证券交易所Auction market 竞价市场Authorized capital 法定股本;核准资本Authorized fund 认可基金Authorized representative 授权代表Australian Options Market 澳大利亚期权交易所Australian Stock Exchange 澳大利亚证券交易所BBack-door listing 借壳上市Back-end load 撤离费;后收费用Back office 后勤办公室Back to back FX agreement 背靠背外汇协议Balance of trade 贸易平衡Balance sheet 资产负债表Balloon maturity 期末放气式偿还Balloon payment 最末期大笔还清Bank, Banker, Banking 银行;银行家;银行业Bank for International Settlements 国际结算银行Bankruptcy 破产Base day 基准日Base rate 基准利率Basis point 基点;点子Basis swap 基准掉期Bear market 熊市;股市行情看淡Bearer 持票人Bearer stock 不记名股票Behind-the-scene 未开拓市场Below par 低于平值Benchmark 比较基准Beneficiary 受益人Beta (Market beta) 贝他(系数);市场风险指数Best practice 最佳做法;典范做法Bills department 押汇部BIS 国际结算银行Blackout period 封锁期Block trade 大额交易;大宗买卖Blue chips 蓝筹股Board of directors 董事会Bona fide buyer 真诚买家Bond market 债券市场,债市Bonds 债券,债票Bonus issue 派送红股Bonus share 红股Book value 帐面值Bookbuilding 建立投资者购股意愿档案[股市] 包销商用以定价一笔发行的方法。

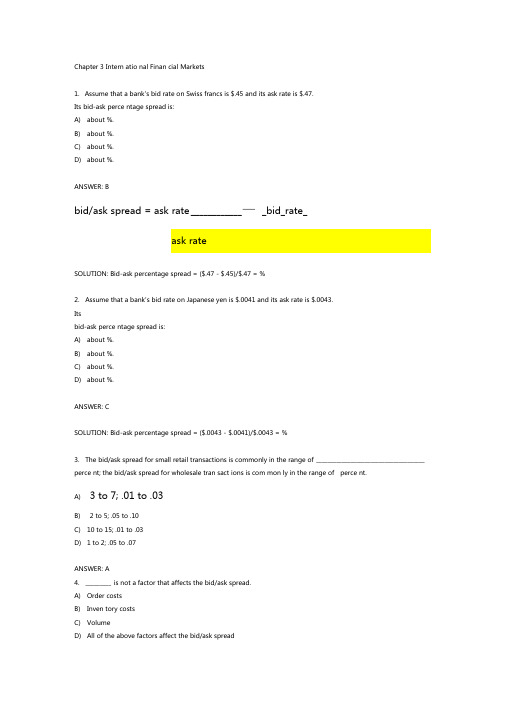

Chapter3InternationalFinancialMarkets练习答案+详解

Chapter 3 Intern atio nal Finan cial Markets1.Assume that a bank's bid rate on Swiss francs is $.45 and its ask rate is $.47.Its bid-ask perce ntage spread is:A)about %.B)about %.C)about %.D)about %.ANSWER: Bbid/ask spread = ask rate ____________ —_bid_rate_SOLUTION: Bid-ask percentage spread = ($.47 - $.45)/$.47 = %2.Assume that a bank's bid rate on Japanese yen is $.0041 and its ask rate is $.0043.Itsbid-ask perce ntage spread is:A)about %.B)about %.C)about %.D)about %.ANSWER: CSOLUTION: Bid-ask percentage spread = ($.0043 - $.0041)/$.0043 = %3.The bid/ask spread for small retail transactions is commonly in the range of ______________________________________ perce nt; the bid/ask spread for wholesale tran sact ions is com mon ly in the range of perce nt.A) 3 to 7; .01 to .03B) 2 to 5; .05 to .10C)10 to 15; .01 to .03D) 1 to 2; .05 to .07ANSWER: A4._________ is not a factor that affects the bid/ask spread.A)Order costsB)Inven tory costsC)VolumeD)All of the above factors affect the bid/ask spread5.The forward rate is the exchange rate used for immediate exchange of currencies.A)true.B)false.ANSWER: B6.The ask quote is the price for which a bank offers to sell a curre ncy.A)true.B)false.ANSWER: A7.According to the text, the forward rate is commonly used for:A)hedgi ng.B)Eurocurre ncy tran sact ions.C)Eurocredit tran sact ions.D)Eurob ond tran sacti ons.ANSWER: A8.If a U.S. firm desires to avoid the risk from exchange rate fluctuations, andit is receivi ng100,000 in 90 days, it could:A)obta in a 90-day forward purchase con tract on euros.B)obta in a 90-day forward sale con tract on euros.C)purchase euros 90 days from now at the spot rate.D)sell euros 90 days from now at the spot rate.ANSWER: B9.If a U.S. firm desires to avoid the risk from exchange rate fluctuations, andit will n eedC$200,000 in 90 days to make payme nt on imports from Can ada, it could:A)obta in a 90-day forward purchase con tract on Can adia n dollars.B)obta in a 90-day forward sale con tract on Can adia n dollars.C)purchase Can adia n dollars 90 days from now at the spot rate.D)sell Can adia n dollars 90 days from now at the spot rate.10.Assume the Canadian dollar is equal to $.88 and the Peruvian Sol is equal to$.35. Thevalue of the Peruvian Sol in Canadian dollars is:A)about .3621 Ca nadian dollars.B)about .3977 Canadian dollars.C)about Can adia n dollars.D)about Can adia n dollars.ANSWER: BSOLUTION: $.35/$.88 = .397711.Which of the follow ing is not true with respect to spot market liquidity? 现货市场流动性A)The more willing buyers and sellers there are, the more liquid a market is.B)The spot markets for heavily traded currencies such as the Japanese yen are veryliquid.C) A currency's liquidity affects the ease with which an MNGcan obtain or sell thatcurre ncy.D)If a curre ncy is illiquid, an MNC is typically able to quickly purchase thatcurre ncy at a reas on able excha nge rate.ANSWER: D12.Forward markets for curre ncies of develop ing coun tries are:A)prohibited.B)less liquid tha n markets for developed coun tries.C)more liquid than markets for developed countries.D)only available for use by gover nment age ncies.发展中国家现货市场流动性较低ANSWER: B13. A forward con tract can be used to lock in the _________________________ of a specified curre ncy for afuture point in time.A)purchase priceB)sale priceD)none of the aboveANSWER: C14.The forward market:A)for euros is very illiquid.B)for Easter n Europea n coun tries is very liquid.C)does not exist for some curre ncies.in n eed of foreig n in need of foreignD) none of the aboveANSWER: C15. _________ is not a bank characteristic important to customersexchange.A) Quote competitive nessB) Speed of executi onC) Forecast ing adviceD) Advice about curre nt market con diti onsE) All of the above are important bank characteristics to customers exchange. ANSWER: E16. The Basel II accord would:A) replace the Basel Accord.B) reduce the amount of capital banks are required to hold.C) require banks to take more risks and to document their risk.D) correct some incon siste ncies that still exist. Operati on risk -1ANSWER: D17. The international money market primarily concentrates on:A) short-term len di ng (one year or less). IMM短期借款B) medium-term lending.C) Ion g-term lending.D) placi ng bonds with in vestors.E) placi ng n ewly issued stock in foreig n markets. ANSWER: A18. The international credit market primarily concentrates on:A) short-term lending (less tha n one year).B) medium-term lending.C) Ion g-term lending. 欧洲信用贷款市场D) provid ing an excha nge of foreig n curre ncies for firms who n eed them.E) placi ng n ewly issued stock in foreig n markets.ANSWER: B19. The main participants in the international money market are:A) con sumers.B) small firms.C) large corporati ons.D) small Europea n firms n eedi ng Europea n curre ncies for intern ati onal trade.ANSWER: C20.LIBOR is: 同业拆借利率A)the in terest rate com monly charged for loa ns betwee n ban ks.B)the average inflation rate in European countries.C)the maximum loa n rate ceili ng on loa ns in the intern ati onal money market.D)the maximumdeposit rate ceiling on deposits in the international money market.E)the maximum in terest rate offered on bonds that are issued in London.ANSWER: A21. A syn dicated Eurocredit loa n:A)represe nts a loa n by a sin gle bank to a syn dicate of corporati ons.B)represe nts a loa n by a si ngle bank to a syn dicate of country gover nmen ts.C)represe nts a direct loa n by a syn dicate of oil-produci ng exporters to a less developedcoun try.D)represe nts a loa n by a group of banks to a borrower.E) A and BANSWER: D22.The international money market is primarily served by:A)the gover nments of Europea n coun tries, which directly in terve ne in foreig ncurre ncymarkets.B)gover nment age ncies such as the Intern atio nal Mon etary Fund that enhance developme nt of coun tries.C)several large banks that accept deposits and provide loans in various currencies.D)small banks that convert foreig n curre ncy for tourists and bus in ess visitors.ANSWER: C。

金融英语听说unit6 international settlement

金融英语听说 Unit 6: International Settlement OverviewIn the world of international finance, the process of settling transactions between entities in different countries is known as international settlement. This involves the transfer of funds, securities, and other financial instruments to ensure the completion of a transaction. International settlement plays a crucial role in facilitating global trade and investment, as well as promoting financial stability.In this unit, we will explore the key concepts and practices related to international settlement in the field of finance. We will examine the various methods and instruments used in international settlements, as well as the roles of different entities involved in the process. Through this unit, you will gain a deeper understanding of the complexities and importance of international settlement in the global financial system.Key Concepts1. Foreign Exchange MarketThe foreign exchange market is where the currencies of different countries are bought and sold. It is a crucial component of international settlement, as currency exchange plays a vital role in facilitating cross-border transactions. Understanding the dynamics of the foreign exchange market is essential for effective international settlement.2. Payment SystemsPayment systems are the infrastructure that enables the transfer of funds between parties involved in international settlements. These systems ensure the secure and efficient movement of money across borders. Some commonly used payment systems include SWIFT (Society for Worldwide Interbank Financial Telecommunication) and CHIPS (Clearing House Interbank Payments System).3. Letter of CreditA letter of credit is a financial instrument issued by a bank on behalf of a buyer. It guarantees payment to the seller upon the completion of certain conditions. Letters of credit provide security and assurance to exporters, allowing them to mitigate the risk of non-payment.4. Documentary CollectionDocumentary collection is another method used in international settlement. It involves the use of documents, usually handled by banks, to ensure the transfer of goods and payment between buyers and sellers. In documentary collection, the documents are sent through the banking system, and the payment is released once the conditions are met.5. International Trade FinanceInternational trade finance refers to the financial activities and instruments used to facilitate international trade. This includes methods like factoring, export credit, and trade insurance. Understanding the various aspects of internationaltrade finance is essential for successful international settlement.Roles and ResponsibilitiesIn addition to understanding the key concepts, it is important to be familiar with the roles and responsibilities of the entities involved in international settlement. These include:1. BanksBanks play a crucial role in international settlement. They act as intermediaries between buyers and sellers, facilitating the transfer of funds and ensuring the completion of transactions. Banks also provide various financial instruments and services, such as letters of credit and documentary collections.2. Importers and ExportersImporters and exporters are the parties involved in cross-border transactions. Importers are the buyers who purchase goods or services from another country, while exporters are the sellers who supply these goods or services. Both importers and exporters are responsible for complying with the requirements and conditions of international settlement.3. Government AgenciesGovernment agencies, such as central banks and customs authorities, also play a role in international settlement. They regulate and oversee the flow of funds and goods acrossborders, ensuring compliance with legal and regulatory frameworks.ConclusionInternational settlement is a vital component of the global financial system. It enables cross-border trade and investment, while promoting financial stability. Understanding the key concepts, methods, and entities involved in international settlement is essential for professionals in the field of finance. By familiarizing yourself with these concepts, you will be better equipped to navigate the complexities of international finance and contribute to the efficiency of global transactions.*Note: This document is written in Markdown format for easy readability and formatting.。

国际结算(双语)

EXW

FCA

EX WORKS(…named place)工厂交货条件

FREE CARRIER(… named place)交至承运人条件

FAS

FOB

FREE ALONGSIDE SHIP (… named port of shipment)船边交货条件

FREE ON BOARD (… named port of shipment)装运港船上交货条件

A Bank

Current a/c XXX

B Bank

B Bank‟s currency

Nostro A/C XXX is A Bank‟s __________________a/c

Exercise:

Current a/c XXX

A Bank

B Bank

A Bank‟s currency

Vostro A/C XXX is A Bank‟s __________________a/c,

Establish a correspondent relationship between two banks.

Agency arrangement Control documents

What do control documents include?

Control Documents

Lists of specimen of authorized signatures 印鉴 是银行列示的所有有权签字的人的有权签字额度、签字范围、 有效签字组合方式以及亲笔签字字样。代理行可凭其核对对 Verify the messages, letters(airmailed) are 方银行发来的电报、电传等的真实性。 authentic Telegraphic test keys密押 Verify the telex and cable are authentic 是两家代理行之间事先约定的专用押码,在发送电报时,由

《金融英语听说》Unit3

《⾦融英语听说》Unit3Unit 3Lending BusinessWarm-up1. Match the Chinese terms in Column A with their English equivalents in Column B.Answers for Reference1 汽车贷款auto loan2 个⼈房屋贷款personal housing loan3 次级按揭贷款subprime mortgage loan4 信贷风险credit risk5 商业贷款commercial loan6 财务状况financial standing7 按揭抵押的房产mortgaged property8 利率风险interest rate risk9 分期付款pay by instalments10⼀次性付款pay in a lump sum2. Discuss in pairs and answer the following questions.Answers for Reference1. Do you know the types of personal loans offered by Canadian Imperial Bank of Commerce (CIBC)?Personal housing loan 个⼈住房贷款– Personal second-hand housing loan 个⼈⼆⼿房屋贷款,个⼈再交易住房贷款– Personal commercial space purchase loan 个⼈商业⽤房贷款– Individual housing loans at fixed interest rate 固定利率个⼈住房贷款– Personal housing mixed loan 个⼈住房组合贷款– Individual housing provident fund loan 公积⾦个⼈房屋贷款– Personal mortgage loan 个⼈住房抵押贷款Personal purchase loan 个⼈消费贷款Personal operation loan 个⼈经营贷款Personal auto loan 个⼈汽车贷款Personal housing improving loan 个⼈房屋维修贷款Personal consumer durables loan 个⼈耐⽤品消费贷款Commercial educational loan 商业助学贷款Government-subsidized educational loan 政府助学贷款Personal loan backed by pledged rights 个⼈产权质押贷款2. What do you think should be prepared for a loan proposal before you go to apply for a personal housing loan to CCB?valid identify certificate 有效⾝份证明, e.g., ID card ⾝份证, Hukou 户⼝, certificate of permanent residence 永久居民证or passport 护照Employment certificate ⼯作证Property right/title certificate 房产证Income statement 收⼊证明3. What should be considered if you were handling a loan proposal as a manager of the Credit Department?People 借款⼈(the identification of potential borrower, information about the person, their family, their income, their financial standing, etc. 申请借款⼈的⾝份、个⼈信息、家庭状况、收⼊、资信等)Purpose 借款的⽤途(the purpose of the borrowing and how to use the money borrowed 借款的⽬的以及如何使⽤借款) Payment 还款计划(how to effect repayment: by instalments or in a lump sum 如何还款:分期付款还是⼀次付清)– Repayment schedule 还款计划– Amount of the loan granted 审批贷款的⾦额– Term of the loan 贷款的期限Protection 还款保障(what to be used as collateral or security for the loan and who to be the guarantee 什么做贷款的抵押品以及谁是担保⼈)Perspective 还款风险预测(the assessment of risk of credit in perspective 客观地评估信⽤风险)Short DialoguesTask 1 Multiple ChoiceListen carefully and choose the best answer to the question after each dialog.Scripts & AnswersDialog 1 M: Hi, Xiaohong. There is news about bankruptcies of some U.S. banks. It seems the banks are subject to some risks in their operation.W: Yes. Excessive interest rate ri sk can pose a significant threat to a bank’s earnings and capital base.M: Do you know the exact meaning of the interest rate risk?W: It is difficult to explain it in a few words. Let me see, eh… Generallyspeaking, interest rate risk is the risk arising from the change in value ofan interest-bearing asset, such as a loan or a bond, due to fluctuation ininterest rates. As rates rise, the price of a fixed rate bond will fall. As ratesfall, the price of the bond will rise.M: So the task of control over the interest rate risk would be critical to banks, because the change in interest rates will affect the value of a bank’s interest-bearing assets.W: Right, but sometimes it is beyond the control of one bank.Question: What is usually considered the cause of interest rate risk according to the woman? (D)译⽂男:嗨,晓红。

财务会计英语unit3

Section 1 Current Liabilities

• 1.7 Taxes payable (应交税费)

Sales taxes (销售税) These taxes are paid by customers to the sellers, who in turn forward to the state or city.

• 1.1 Accounts Payable Accounts payable are amounts owed to suppliers. They are incurred when purchase occurs. Example 3.1 To illustrate, let’s refer to the information in Example 2.7. In the book of Lott Law Firm, there was a debit entry of $550 in Accounts Receivable, but in Dickson Hunter’s book the entry would be: Legal Consultancy Services 550 Other Accounts Payable 550

Purchase 1000 Accounts Payable 1000

April 28 Purchase 2000 Accounts Payable 2000

Section 1 Current Liabilities

• 1.2 Notes payable Notes payable are of both short and long terms. Short-term notes payable are obligations represented by promissory notes.

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Task 6

Fill in the blanks with the words or expressions given below. Change their

forms where necessary.

specify assume set forth acknowledge obtain due prior to in advance compliance draw up

Column B A. 原产地证 B. 装箱单 C. 检验证明书 D. 汇票 E. 提单

6 Commercial Invoice

7 Bill of Lading 8 Check Keys:1. C 5. B 2. D 6. F 3. G 7. E

F. 商业发票

G. 本票 H. 支票 4. A 8. H

Task 7

Complete the following sentences by translating the parts given in Chinese.

1. It is the issuing bank that is obligated to make the payment to the exporter (要负责向出口商付款)when proper documents are presented.

STATEMENTS 1 2 A bank plays a role of guarantor by issuing an L/C. The beneficiary of an L/C obtains payment from the issuing bank immediately after delivering goods. TRUE FALSE

The sight draft requires the bank to pay on demand, while the time draft is payable at a particular time in the future.

Task 3

Read Passage A and judge whether the following statements are TURE or FALSE. Put a tick (√) in the related box.

3 The sales contract

4 Those goods have to be inspected 5

Assuming one blog per person, this comes to 8 million US blogs alone.

specify

set forth

obtain

prior to

4. The bill of lading is a contract between (10) the exporter and (11) the shipping company . When properly prepared, it is (12) a document of title .

3

4 5 6 7

The exporter must see to it that the terms and conditions specified in the L/C are fulfilled.

When the terms in L/C have been met and the documentation is prepared, the fund can be paid out. Governments never prevent banks from honoring letters of credit that have already been issued. An importer might worry about the delivery of the imported goods if not under an L/C device. The draft is a financial instrument that requires the importer to pay or to accept.

8

The B/L is a document of title because it is issued by the exporter.

Task 4 Match each of the terms in Column A with its appropriate definition in column B.

Task 1 Match each of the items in Column A with its Chinese equivalents in Column B.

Column A 1 Certificate of Inspection 2 Bill of Exchange (Draft) 3 Promissory Note 4 Certificate of Origin 5 Packing List

5. letter of credit 6. importer

7. bill of lading

8. acceptance

Task 5

Complete the following note-taking according to Passage A.

1. From an exporter’s point of view, letters of credit have four advantages. They are: (1) the issuing bank becomes the guarantor of payment (2) the payment is assured when terms and conditions are fulfilled (3) payment can be obtained as soon as the necessary documentation has been properly provided ; (4) the risk of government restrictions on payment can be largely reduced . 2. The two advantages of letters of credit for the importers are: (5) the seller’s noncompliance is reduced ; ; ;

1 A documentary draft is a draft accompanied by documents of title to goods. The draft documents. 2 We cannot acknowledgeyour claim for damage due to defective packing. specifies container shipment for the goods. prior to shipment. is drawn up by the exporter who also collects other necessary

2. We wish to point out that if you fail to effect shipment within the time specified, we shall not be able to fulfill the contract with our client (与我方客人履行合同). they are in proper order

5. They a honce

(预先支付50美元) and made reservations at

6. The exporter can obtain immediate cash payment (能够立刻得到现金支付) by discounting it with the forfeiting bank in his country.

central bank should carry out a loose monetary policy. 8 The contract becomes

due

9 Don’t worry, all the case are strongly packed in compliancewith your request. 10 Fortunately our company local government. has obtained a loan for the project from the

(6) payment can be delayed until the documentation is properly presented .

3. The draft is drawn by (7) the exporter . It can be a (8) or a (9) time draft . sight draft ,

Column A 1. guarantor 2. receipt 3. contract 4. sight draft

Column B a. a draft payable as soon as it is presented b. formal agreement between 2 or more parties c. a signed agreement to pay a draft d. someone who promises to pay a debt if the person who should pay it does not e. a contract between a carrier and a shipper f. a piece of paper that proved that money, goods, or information have been received. g. a person, company, or country that buys goods from other countries so they can be sold in their own country. h. an official letter from a bank allowing a particular person to take money from another bank.