第八章支付方式汇付和托收-资料

8.英文商务函电付款信件

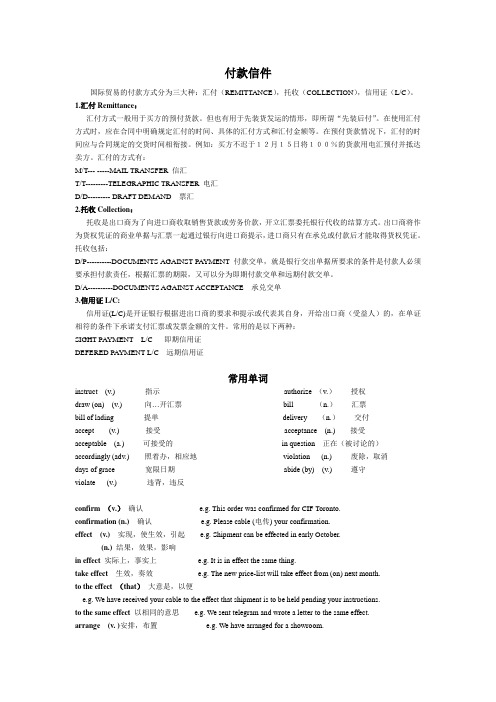

付款信件国际贸易的付款方式分为三大种:汇付(REMITTANCE),托收(COLLECTION),信用证(L/C)。

1.汇付Remittance:汇付方式一般用于买方的预付货款。

但也有用于先装货发运的情形,即所谓“先装后付”。

在使用汇付方式时,应在合同中明确规定汇付的时间、具体的汇付方式和汇付金额等。

在预付货款情况下,汇付的时间应与合同规定的交货时间相衔接。

例如:买方不迟于12月15日将100%的货款用电汇预付并抵达卖方。

汇付的方式有:M/T--- -----MAIL TRANSFER 信汇T/T---------TELEGRAPHIC TRANSFER 电汇D/D--------- DRAFT DEMAND 票汇2.托收Collection:托收是出口商为了向进口商收取销售货款或劳务价款,开立汇票委托银行代收的结算方式。

出口商将作为货权凭证的商业单据与汇票一起通过银行向进口商提示,进口商只有在承兑或付款后才能取得货权凭证。

托收包括:D/P----------DOCUMENTS AGAINST PAYMENT 付款交单,就是银行交出单据所要求的条件是付款人必须要承担付款责任,根据汇票的期限,又可以分为即期付款交单和远期付款交单。

D/A----------DOCUMENTS AGAINST ACCEPTANCE 承兑交单3.信用证L/C:信用证(L/C)是开证银行根据进出口商的要求和提示或代表其自身,开给出口商(受益人)的,在单证相符的条件下承诺支付汇票或发票金额的文件。

常用的是以下两种:SIGHT PAYMENT L/C 即期信用证DEFERED PAYMENT L/C 远期信用证常用单词instruct (v.) 指示authorize (v.)授权draw (on) (v.) 向…开汇票bill (n.)汇票bill of lading 提单delivery (n.)交付accept (v.) 接受acceptance (n.) 接受acceptable (a.) 可接受的in question 正在(被讨论的)accordingly (adv.) 照着办,相应地violation (n.) 废除,取消days of grace 宽限日期abide (by) (v.) 遵守violate (v.) 违背,违反confirm (v.)确认 e.g. This order was confirmed for CIF Toronto.confirmation (n.) 确认 e.g. Please cable (电传) your confirmation.effect (v.) 实现,使生效,引起 e.g. Shipment can be effected in early October.(n.) 结果,效果,影响in effect 实际上,事实上 e.g. It is in effect the same thing.take effect 生效,奏效 e.g. The new price-list will take effect from (on) next month.to the effect (that)大意是,以便e.g. We have received your cable to the effect that shipment is to be held pending your instructions.to the same effect 以相同的意思 e.g. We sent telegram and wrote a letter to the same effect.arrange (v. )安排,布置 e.g. We have arranged for a showroom.verify (v.) 证实,核实 e.g. Please recheck the coding (译码) and verify it.recall (v.) 回忆,忆起 e.g. We cannot recall the details.取消,撤销 e.g. The order has been recalled.样信1.付款条款Dear Sirs,We have thoroughly considered the terms of payment discussed with your Mr. Wu. We are in agreement with your proposals and hereby give you in writing the terms and conditions which have been agreed upon as follows:(1)Your terms of payment are confirmed, irrevocable L/C with draft at sight instead of D/P at sight.(2)The price quoted to us is net with no discount whatsoever.The above terms of payment were approved by our manager and will be acted upon accordingly. The relative order is now being prepared and will be sent to you in the course of next week.Taking this opportunity, we would like to inform you that our representative at the forthcoming Guangzhou Fair will be Mr. Brown, who will doubtlessly write to you about it. We sincerely hope that future discussions between our two companies will result in further business to our mutual advantage.Yours faithfully,xxx2.开立汇票以支付装运费Dear Sirs,In order to cover the shipment we will draw a draft at sight on you under an irrevocable letter of credit and ask you to honor it on presentation to you.Yours,xxx3.要求变更汇票日期Dear Sirs,You require a draft at sight under irrevocable L/C as payment terms.However would you make them a little easier?We would like you to allow us a draft at 90 d/s under an irrevocable L/C.Yours,xxx4.要求对方开立包括各种费用的汇票Dear Sirs,As for the payment,we would like you to draw a draft at 30 d/s on us for the invoice amount plus shipping and other expenses with a 10% commission.Yours,Xxx5.要求连同汇票寄来装船文件Dear Sirs,Please draw on us for the full amount of your invoice at 60 d/s and attach such relative shipping documents as the commercial invoices, bill of lading, insurance policy, packing lists, certificate and list of weight and/ormeasurement, to your draft. ……6.同意变更汇票的付款条件Dear Sirs,As our maximum concession to the payment, we will admit your payment of a draft at 60 d/s under documents against acceptance.Therefore please let us know immediately if thes e terms are acceptable to you. ……7.要求寄送装运的汇票及提单Dear Sirs,As to the execution of this order, we agree to accept our order in three shipments. Therefore we request you send a sight draft on us under documents against payment at every shipment attaching the B/L. ……8.通知对方愿意接受汇票Dear Sirs,In order to ensure your earlier shipment, we have instructed The Mitsui Bank, New York to accept a draft drawn on them by you for a sum of US $35 000.Yours,Xxx9.通知接受汇票,并要求迅速履行订货Dear Sirs,We have today instructed our bankers, the Bank of Tokyo, London to accept your draft at 90 d/s on us drawn under irrevocable L/C and would ask you to execute our order promptly. ……10.要求接受汇票并付款Dear Sirs,As to this business, we will draw our draft at 30 d/s on you against the 100 units of the construction machines for a sum amounting to US$750 000 under the L/C.We ask you to accept it on presentation and honor it on maturity. …..11.提议变更付款条件Dear Sirs,Concerning the payment of this transaction, we suggest a 90 d/s draft under D/A apart from the usual terms of business. The market here is quite dull and we are overstocked now. Therefore we believe this is quite acceptable to you. ……12.建议使用见票后30天应付的信用证支付Dear Sirs,We wish to place with you an order for 1 000 casks Iron Nails at your price of US $150.00 per cask CIF Lagos for shipment during July/August.For this particular order we would like to pay by 30 days L/C. Involving about US $150 000, this order is comparatively a big one. As we have only moderate means at hand, the tie-up of funds for as long as three to four months indeed presents problem to us.It goes without saying that we very much appreciate the support you have extended us in the past. If you can do us a special favour this time, please send us your contract, upon receipt of which we will establish the relative L/C immediately.Yours faithfully,xxx13.要求更易于接受的付款条款Dear Sirs,Our past purchase of Mild Steel Sheet from you has been paid as a rule by confirmed, irrevocable L/C.On this basis, it has indeed cost us a great deal. From the moment to open credit till the time our buyers pay us, the tie-up of our funds lasts about four months. Under the present circumstances, this question is particularly taxing owing to the tight money condition and unprecedentedly high bank interest.If you would kindly make easier payment terms, we are sure that such an accommodation would be conducive to encouraging business between us. We propose either “Cash against Documents on Arrival of Goods” or “Drawing on Us at Three Months’ Sight”. Your kindness in giving priority to the consideration of the above request and giving us an early favourable reply will be highly appreciated.Yours faithfully,xxx14.答应改变付款方式Dear Sirs,Thank you for your letter of 9th February. We have carefully considered your proposal to receive a trial delivery of our cutlery on D/A, but wish to inform you that to promote business the best we can exceptionally do as a trial will be on D/P at sight terms. In accepting our proposal you assume no risks since our cutlery is well-known for its good quality, attractive design and reasonable price. This cutlery sells well in many other countries and we think it will have a good sale in your store.If you are interested in our proposal, please write to us by return and we will approach you further.Yours faithfully,Xxx15.要求银行开立信用证Dear Sirs:We request you to open for our account by air mail with the Bank of China, Shanghai Branch, an Irrevocable and Without Recourse letter of Credit in favor of Shanghai Textile Import & Export Corp, China to the extent of US $30 000(US Dollars Thirty Thousand only)available by draft in duplicate drawn on us at 90 days after sight for full invoice value against shipment of 20 000 yards Shanghai Printed Pure Silk Fabrics as per our order No.3154 dated 15 May 2007 accompanied by the following documents:(1)Invoice in triplicate.(2)Packing list in triplicate.(3)Full set Clean Bills of Lading made out to order and endorsed in blank notify Buyers marked freight payable at destination.(4)Evidence of shipment of the said merchandise to be effected on or before end of June 2007 from Shanghai to San Francisco. Partial shipments are not permitted. Transshipments are not allowed.(5)Marine insurance to be effected by Buyers in San Francisco.We hereby agree duly to accept the above mentioned draft on presentation, and pay the amount thereof at maturity, provided such draft shall be negotiated within three months from this date.Yours faithfully,xxx16.索取形式发票Dear Sirs,One of our clients has asked us to obtain a pro forma invoice for the following product:Lion Brand Nail Clippers Model 21 chrome plated.Please send us your pro forma invoice in triplicate for 500 dozens of the above product as soon as possible so that we can get our client’s confirmation. We will have no problem in obtaining the import licence. As soon as this is approved, a letter of credit will be opened in your favour.Yours faithfully,Tom17.寄送形式发票Dear Mr. Green,In reply to your request, dated 14 July 2006,we have much pleasure in sending you our pro forma invoice in triplicate. For your information, our offers usually remain open for about a week. Seeing that our nail clippers are selling very fast, we suggest that you act on the quotation without delay. We look forward to hearing from you. Yours sincerely,Lui18.付款通知Dear Sir/MadamWe refer to your payment request of 1st November,2006. We have made an application to our bank for remittance as requested. Our remittance details are as follows:(1)Amount of 1st Installment: US $50 000.(2)Value Date of Payment: 30th November,2006.(3)Payment Method: By T.T. remittance.(4)Remitting Bank: The Bank of Newcastle, Queensway Branch, London.If you do not receive advice on our remittance from your bank within one week, please do not hesitate to contact us. ……19.告知付款账户Dear Sir,Firstly, We’d like to apologize for the late reply due to the problem of our computer network. We have repaired the machine and mailed back to you. Do you receive it? The repair charge is US$1 500,and the receipt will be based on the US$1 200 as you requested. After the confirmation, please transfer US$1 500 repairing charge to the following a/c. To show our sincerity, we are willing to reduce price of US$120 000 to the lowest US $114 000.Besides,regarding to the 3 items you request, we will mail to you by express. Thank you for your cooperation and we wish you success in your business.Yours,xxxP.S.: We are the SMT Machine manufacturer, and we only produce the new machines. Since we do not carry on the sales of used machines, we are unable to provide you the related information.20.通知收到付款Dear Mr. Green,Thank you for your letter dated yesterday, advising us of your remittance.We confirm receipt of US $50 000 in our account with The Bank of China, Dinghuisi Branch, his morning. Thank you again for your remittance. ……21.回函拒绝对方付款方式Dear Sirs,We thank you for your order No.23A46 for 200 Air Conditioners and appreciate your intention to push the sales of our products in your country. However, your suggestion of payment by time L/C is unacceptable. Our usual practice is to accept orders against confirmed, irrevocable L/C at sight, valid for 3 weeks after shipment is made and allow transshipment and partial shipments.As per the above terms we have done substantial business. We hope you will not hesitate to come to the agreement with us on payment terms so as to get the first transaction concluded.Your favorable reply will be highly appreciated. ……22.接受对方付款方式Dear Sirs,Thank you for your order of Iron Nails as per your letter of May 5.Your proposal of paying by letter of credit at 30 days has been carefully studied by us. Usually, time credit is not acceptable to us. However, in view of our long pleasant relations as well as our willingness to support our African friends, we agree with you this time. But let us make it clear that this accommodation is only for this transaction, which will in no case set a precedent.Attached here with is our Sales Contract No.105 covering the above order. Please follow the usual procedure…….。

汇付和托收的名词解释

汇付和托收的名词解释对于许多人来说,汇付和托收这两个词经常出现在金融交易中,但他们的确切含义和用法可能并不为大家所熟悉。

本文将为读者解释汇付和托收这两个名词的含义,并探讨它们在商业和金融领域中的重要性。

1. 汇付的含义和用途汇付一词通常用来指代资金的转移和支付过程。

在国内贸易和跨国贸易中,汇付是不可或缺的环节。

当一方向另一方提供商品或服务时,商品或服务的支付就需要进行汇付。

这个过程涉及到支付人将款项转移到收款人的账户中。

假设有两个公司,公司A和公司B,公司A向公司B提供了一批商品。

公司B通过银行账户支付给公司A相应的账款。

这个支付过程就是一种汇付。

在这种情况下,公司B扮演着“支付人”的角色,公司A是“收款人”。

除了公司之间的交易,个人之间的付款也属于汇付范畴。

例如,当你用手机支付购买商品时,你的银行账户会将款项支付给商家的账户,以完成交易。

这也是一种汇付。

需要注意的是,汇付并不仅仅限于电子支付。

传统的汇票、现金支付等方式也都是汇付的方式。

不同的国家和地区可能有不同的汇付规定和手续,但基本原理是相同的。

2. 托收的含义和用途托收是指将一方的票据、汇票或支票等委托给银行或金融机构进行收款或兑现的过程。

在托收过程中,一方将支付工具(例如支票)交给银行,并授权银行代表其收款。

假设有个人A开出了一张支票,写给个人B作为支付。

个人A可以选择将此支票交给自己的银行,请求银行将其转交给个人B进行兑现。

这个过程就是一种托收。

托收的另一种常见形式是,企业将其销售给客户的产品的付款条款交给银行处理。

如此一来,企业可以确保收款的安全和及时性。

在国际贸易中,托收的作用和重要性更加显现。

当跨国公司或个人进行交易时,双方可能不信任对方的支付能力或履约能力。

因此,他们可以通过将汇票托收给银行来确保交易能够安全进行。

这样一来,银行将充当一个中间人的角色,以确保款项的安全转移。

托收和汇付的区别在于,托收更加强调了委托和代理性质,而汇付更加强调了资金的支付过程。

第八章国际货款的结算一

10.出票根据。即汇票上的出票条款。如“凭(Drawn Under)**银行、信用证号码(L/C No.)、日 期(Date)”。

上述基本内容,一般为汇票的要项,但并不是汇票的全部内容。按照各国票据法的规定,汇票 的要项必须齐全,否则受票人有权拒付。

2024/6/18

国际贸易实务-第八章

7

(二) 汇票当事人

出票人(DRAWER):签发命令或委托付款的人。在国际贸易结算中,

一般为出口商或信用证中的受益人。

付款人(PAYER),又称受票人(DRAWEE):接受出票人命令或委托支付 汇票金额的人,通常是进口商或其指定银行。

收款人(PAYEE),又称受款人:凭汇票享有受领票据金额的人。通常

“汇票是出票人签发的,委托付款人在见票时或者在指定日期无条件支付 确定的金额给收款人或持票人的票据”-《中国票据法》 “汇票是一个人向另一个人签发的,要求见票时或在将来的固定时间或可以 确定的时间,对某人或其指定的人或持票人支付一定金额的无条件的书面支 付命令”-《英国票据法》

出票人

付款人

收款人 (持票人)

(1)汇票有三个当事人,即出票人、付款人和收款人;本票的基本当

事人只有出票人和收款人两个。本票的付款人就出票人自己。

(2)远期汇票基本上都要经过付款承兑;而本票的出票人就是付款人,

而本票由他自己签发,承诺在本票到期日付款,因此无须承兑。

(3)汇票在承兑前由出票人是主债务人,承兑后则由承兑人承担主债

务人,出票人成为次债务人;本票的出票人是绝对的主债务人。

现代商务英语第8章支付条款(Terms of Payment)

国际贸易中,货物和货款的相对给付一般不 是由买卖双方当面完成的。卖方发货交单,买方 凭单付款,以银行为中介,以票据为工具进行结 算,是当代国际贸易结算的基本特征。结算过程 中买卖双方所承受的手续费用、风险和资金负担 是双方选择结算方式所考虑的主要因素。因此, 交易双方在签订订单时,就要对每笔交易的付款 方式达成共识。在当今国际贸易结算方式中,有3 种主要的付款方式:

7

arrangement contrary to our usual practice, especially for a new customer. Therefore, we should like you to accept L/C terms for this transaction and future ones. All the stipulations in your L/C should be in conformity with those in the contract. We hope the above payment terms are acceptable to you and look forward to your confirmation. If you agree, please expedite the establishment of the L/C to enable us to effect shipment. Yours faithfully, (signature)括预付货款和订货付 现)、托收(Collection)(付款交单和承兑交单)和 信用证(Letter of Credit)。汇付和托收属于商业信用, 习惯上称为无证结算业务;信用证属于银行信用,习 惯上称之为有证结算业务。信用证付款是当前国际贸 易中最常采用的付款方式,即买卖双方签订了购货合 同和售货确认书后,买方应根据合同中的支付条款, 通常在发货前一个月开立信用证。它可以确保出口商 按信用证条款发完货后,而不是进口商收到货后,就 可从银行得到货款,这样,就给了出口商最大限度的 收款保障。因此出口商通常要求信用证支付。汇付和 托收对出口商的保护程度不如信用证大,它们通常是 在交易金额较小时使用。

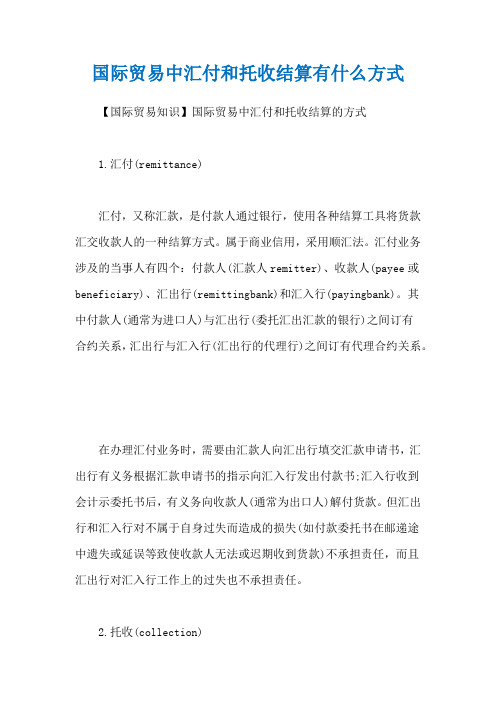

国际贸易中汇付和托收结算有什么方式

国际贸易中汇付和托收结算有什么方式【国际贸易知识】国际贸易中汇付和托收结算的方式1.汇付(remittance)汇付,又称汇款,是付款人通过银行,使用各种结算工具将货款汇交收款人的一种结算方式。

属于商业信用,采用顺汇法。

汇付业务涉及的当事人有四个:付款人(汇款人remitter)、收款人(payee或beneficiary)、汇出行(remittingbank)和汇入行(payingbank)。

其中付款人(通常为进口人)与汇出行(委托汇出汇款的银行)之间订有合约关系,汇出行与汇入行(汇出行的代理行)之间订有代理合约关系。

在办理汇付业务时,需要由汇款人向汇出行填交汇款申请书,汇出行有义务根据汇款申请书的指示向汇入行发出付款书;汇入行收到会计示委托书后,有义务向收款人(通常为出口人)解付货款。

但汇出行和汇入行对不属于自身过失而造成的损失(如付款委托书在邮递途中遗失或延误等致使收款人无法或迟期收到货款)不承担责任,而且汇出行对汇入行工作上的过失也不承担责任。

2.托收(collection)托收是出口人在货物装运后,开具以进口方为付款人的汇款人的汇票(随附或不随付货运单据),委托出口地银行通过它在进口地的分行或代理行代进口人收取货款一种结算方式。

属于商业信用,采用的是逆汇法。

托收方式的当事人有委托人、托收行、代收行和付款人。

委托人,即开出汇票委托银行向国外付款人代收货款的人,也称为出票人,通常为出口人;托收行即接受出口人的委托代为收款的出口地银行;代收行,即接受托收行的委托代付款人收取货款的进口地银行;付款人,汇票上的付款人即托收的付付款人,通常为进口人。

上述当事人中,委托人与托收行之间、托收行与代收行之间都是委托代理关系,付款人与代收行之间则不存在任何法律关系,付款人是根据买卖合同付款的。

所以,委托人能否收到货款,完全视进口人的信誉好坏,代收行与托收行均不承担责任。

国际支付、汇付、托收

国际支付(一)汇付、托收国际支付国际贸易中常用的支付方式主要是三种:汇付、托收和信用证. 以汇付方式支付货款是由债务人主动将款项通过银行汇付给国外的债权人,故称之为顺汇(Remitance)。

以托收、信用证方式支付货款,都是债权人主动向债务人索取款项的业务,故称之为逆汇(Re-verseRemitance)。

一、国际支付方式(一)、汇付1、汇付的定义及当事人。

汇付是指汇款人将一笔款项交给银行,由银行根据指示汇交给收款人的一种付款方式. 在国际贸易中,汇付方式的当事人通常为:(1)汇款人(Remiter),是国际贸易的买方,承担付款义务.(2)收款人(Paye),是国际贸易的卖方.(3)汇出行(RemitingBank),是接受汇款人申请,代其汇出货款的银行,一般是进口地银行.(4)汇入行(PayingBank),是受汇出行委托,对收款人付款的银行,一般是出口地银行.2、汇付的方式(1)信汇(MailTransfer,MT)。

信汇是指汇款人将款项交给汇出行,请该行以航空信函委托收款人所在地银行付款给收款人.汇出行接受客户委托以后,用信汇委托书通知外国代理行. 委托书上记载汇款人、收款人、金额等内容. 汇出行与汇入行事前无约定时,委托书上还要写明资金是如何转移给该代理行,这种说明称为“偿付指示”。

(2)电汇(TelegraphicTransfer,TT)。

电汇是指汇款人请求当地汇出行以电讯方式委托收款人所在地银行付款给收款人. 由于电讯技术的发展,银行之间都建立了直接通讯,电汇费用降低,差错率低,所以,现在电汇使用得较普遍.(3)票汇(DemandDraft,DD)。

票汇是汇出行应汇款人的申请,代汇款人开立以其分行或代理行为付款行的银行即期汇票(Banker′sDemandDraft),由汇款人寄国外的收款人,并凭以向汇票上指定的银行取款. 票汇有很大的灵活性,因为汇票是流通证券,只要抬头允许,汇款人既可以将汇票带到国外亲自取款,也可以将汇票寄给国外债权人由其自取.并且票汇不象信汇那样,收款人只能向汇入行一家取款,一般来说,国外银行只要能核对汇票上签字的真伪,就会买入汇票. 所以,使用票汇方式,汇票的持有人可以将汇票卖给任何一家汇出行的代理行而取得现金.(4)凭单付款(RemitanceAgainstDocuments)。

8 汇付与托收

3、票汇(remittance by banker’s draft, D/D) 票汇是汇出银行应汇款人的申请,代汇款人开 立以其分行或代理行为解付行的即期汇票,支付 一定金额给收款人的另一种汇款方式。 票汇的汇入行无需通知收款人提款,由收 款人持票登门,且汇票常可转让流通。

电汇业务程序图

汇 款 人 (买方) (1) (2) 汇 出 行 (4) 汇 入 行 收 款 人 (卖方) (3)

( 二 ) 跟 单 托 收 (documentary bill for collection) 跟单托收是对商业单据的托收,可以附带金 融单据,也可以不附带金融单据。由卖方开立汇 票连同整套货运单据一起交给国内托收行,委托 其代收货款。 欧洲一些国家的出口商为了避免因签发汇票 而支付印花税(stamp duty)一般都仅凭商业票 据托收。

承兑交单中货运单据一经进口商承兑汇票 后就交付给进口商,是出口商对进口商的资金 融通。进口商无需付款即可得到物权,汇票到 期时,如果进口商违约拒付,或者发生破产、 倒闭等事件而无力偿付货款,出口商就会陷于 既得不到货款又收不回货物的境地,因此承兑 交单的方式风险很大,在我国对外贸易实务中 很少使用。

ቤተ መጻሕፍቲ ባይዱ

⑥ 代收行(提示行)向进口人做出承兑提示。 ⑦ 进口人验单无误后承兑汇票,代收行收回并 保留汇票。 ⑧ 代收行将全套货运单据交给进口人。 ⑨ 代收行向托收行签发承兑通知书。 ⑩ 汇票到期日代收行再做付款提示。 ⑾ 进口人付清货款 ⑿ 代收行通知(电告或函告)托收行货款已收 妥,并转入托收行账户。 ⒀ 托收行将货款交给出口人。

收款人是汇款人指定的、收 取款项的人,通常是出口商。

汇付方式的种类:

付款方式详解

付款方式详解(含英文简称)付款方式分为三大种:汇付(REMITTANCE),托收(COLLECTION),信用证(L/C)。

1.汇付包括:M/T--------- MAIL TRANSFER 信汇T/T--------- TELEGRAPHIC TRANSFER 电汇D/D--------- DRAFT DEMAND 票汇2.托收包括:D/P----------DOCUMENTS AGAINST PAYMENT 付款交单D/A----------DOCUMENTS AGAINST ACCEPTANCE 承兑交单3.信用证:L/C----------LETTER OF CREDIT (以下为最常用的二种)SIGHT PAYMENT L/C 即期信用证DEFERED PAYMENT L/C 远期信用证下面是详细解释1.汇付(Remittance)汇付的方式有:信汇(M/T)、电汇(T/T)、票汇(D/D)。

汇付方式一般用于买方的预付货款。

但也有用于先装货发运的情形,即所谓“先装后付”。

在使用汇付方式时,应在合同中明确规定汇付的时间、具体的汇付方式和汇付金额等。

在预付货款情况下,汇付的时间应与合同规定的交货时间相衔接。

例如:买方不迟于12月15日将100%的货款用电汇预付并抵达卖方。

2.托收(Collection)托收是出口商为了向进口商收取销售货款或劳务价款,开立汇票委托银行代收的结算方式。

出口商将作为货权凭证的商业单据与汇票一起通过银行向进口商提示,进口商只有在承兑或付款后才能取得货权凭证。

托收有光票托收和跟单托收之分。

跟单托收按交单条件的不同,又有“付款交单”和“承兑交单”两种。

而付款交单又有“即期付款交单”和“远期付款交单”之分,远期汇票的付款日期又有“见票后××天付款”“提单日后××天付款”和出票日后××天付款”3种规定方法。

但在有的国家还有货到后××天付款的规定方法。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

国际贸易实务-第八章 魏铁梅

10

汇付的特点

对于货到付款的卖方或对于预付货款的买方: 1. 风险大:完全取决于对方的信用 2. 资金负担不平衡 3. 手续简便,费用少

国际贸易实务-第八章 魏铁梅

11

二、托收(Collection)

国际贸易实务-第八章 魏铁梅

货款尾数、样品费、佣金)及索赔款等。

国际贸易实务-第八章 魏铁梅

17

2、跟单托收(Documentary Collection)

• 指金融单据附有商业单据或不附有金融单据的商业单据的 托收

• 如以汇票作为收款凭证,则使用跟单汇票 • 按照向进口人交单条件的不同,可分为

❖付款交单 ❖承兑交单

国际贸易实务-第八章 魏铁梅

解付汇款

Paying Bank 汇入行

国际贸易实务-第八章 魏铁梅

7

票汇

票汇(Remittance by Banker’s Demand Draft, D/D )

Remitter 汇款人 (进口商)

购买银行

即期汇票

进出口合同 交付银行汇票

付款灵活便捷

Payee 收款人 (出口商)

提示银行汇票 解付汇款12Fra bibliotek托收的含义

• 托收是指债权人(出口人)出具汇票及/或单据委托银行向债务 人(进口人)收取货款的一种支付方式。

• 一般都通过银行办理,又叫银行托收。 • 基本做法是:出口人根据买卖合同先行发运货物,然后开立汇

票(或不开汇票)连同商业单据,向出口地银行提出托收申请, 委托出口地银行(托收行)通过其在进口地的代理行或往来银行 (代收行)向进口人收取货款。

18

(1)付款交单(Documents against Payment, D/P)

• 出口人的交单以进口人的付款为条件 • 按付款时间的不同,又可分为

➢ 即期付款交单(D/P at sight) ➢ 远期付款交单(D/P after sight)

国际贸易实务-第八章 魏铁梅

19

A.即期付款交单

出口人发货后开具即期汇票连同商业单据,通过银行向进口人提示,进口

国际贸易实务-第八章 魏铁梅

14

托收的种类

• 光票托收(Clean Collection, Collection on Clean Bill) • 跟单托收 (Documentary Collection, Collection on

Documents) ❖付款交单 (Documents against Payment,D/P)

➢即期付款交单(Documents against Payment at sight, D/P at sight)

➢远期付款交单(Documents against Payment after sight, D/P after sight)

❖承兑交单 (Documents against Acceptance,D/A)

• 信汇、电汇优缺点

国际贸易实务-第八章 魏铁梅

9

在国际贸易中的使用

根据付款时间的不同,汇付在国际贸易中通常用于: • 货到付款(Payment after Arrival of the Goods) 、

赊销(Open Account Transaction) • 预付货款(Payment in Advance)等业务

❖ 日后如进口人到期拒付的风险,应由出口人自己承担

国际贸易实务-第八章 魏铁梅

20

(2)承兑交单(Documents against Acceptance,D/A)

• 出口人的交单是以进口人在汇票上承兑为条件 • 只适用于远期汇票的托收 • 这种做法必须从严掌握--出口人有货物与货款两空的风险

Remitting Bank 汇出行

Paying Bank

通知汇入行

汇入行

国际贸易实务-第八章 魏铁梅

8

• 银行即期汇票(Banker‘s Demand Draft)

• 与电汇、信汇的不同之处

(1)M/T、T/T下,收款人是在收到汇入行的通知后去取款, D/D下由收款人直接持票登门取款;

(2) D/D下,除非使用有限制转让和流通规定的汇票,收款 人一般可将汇票背书转让;而电汇、信汇的收款人则不能将 收款权转让。

第八章支付方式汇付和托收-资料

第二节 汇付与托收

国际贸易实务-第八章 魏铁梅

2

一、汇付(Remittance)

国际贸易实务-第八章 魏铁梅

3

汇付的含义

• 汇付又称汇款,指付款人主动通过银行或其他途径将款

项汇交收款人。 • 国际贸易货款的收付如采用汇付,一般是由买方按合同约

定的条件(如收到单据或货物)和时间,将货款通过银行汇 交给卖方。

人见票后立即付款,进口人在付清货款后向银行领取商业单据

B、远期付款交单

• 出口人发货后开具远期汇票连同商业单据,通过银行向进口人提示,进 口人审核无误后即在汇票上进行承兑,于汇票到期日付清货款后再领取 商业单据

• 若货物早于交款日到达

提前付款赎单 凭信托收据借单 Trust Receipt (进口押汇) ✓ 远期付款交单凭信托收据借单(D/P·T/R)

• 须附具一份托收指示书(Collection Instruction)

• 国际商会《托收统一规则》(URC522):2019年1月1日实施

国际贸易实务-第八章 魏铁梅

13

托收方式的当事人

根据《URC522》第3条规定,托收方式所涉及的主要当事人 • 委托人(Principal) • 托收银行 (Remitting Bank):也叫寄单行 • 代收银行 / 提示行 (Collecting/Presenting Bank) • 付款人(Drawee)

国际贸易实务-第八章 魏铁梅

15

托收的种类

托收

跟单托收

光票托收

付款交单(D/P)

承兑交单(D/A)

即期付款交单

远期付款交单

国际贸易实务-第八章 魏铁梅

16

1、光票托收(Clean Collection)

• 是指不附有商业单据的托收 • 如以汇票作为收款凭证,则使用光票 • 在国际贸易中,主要用于小额交易、从属费用(如

国际贸易实务-第八章 魏铁梅

4

Remitter 汇款人

(进口商)

进出口合同

Payee 收款人

(出口商)

信汇/电汇委托书 (M/T、T/T Advice) 或支付通知书 (Payment Order

Remitting Bank 汇出行

信/加押电报(tested cable) 、电传、SWIFT

委托付款