口译资料:二十国集团金融市场和世界经济峰会的宣言

国际贸易词汇+口译练习

国际贸易District/Local Council 地方议会Executive council 咨询会议/参政会the Congress 美国国会the Senate 美国参议院the House of Representatives 美国众议院the Parliament 英国国会the House of Commons 英国下院the House of Lords 英国上院International Monetary Fund (IMF) 国际货币基金组织Council for Trade in Goods (CTG) 货币贸易理事会ASEAN Free Trade Area (AFTA) 东盟自由贸易区North American Free Trade Area (NAFTA) 北美自由贸易区European Free Trade Association (EFTA) 欧洲自由贸易联盟China-US Joint Commission on Commerce and Trade (JCCT) 中美商贸联委会United Nations Conference on Trade and Development (UNCTAD)联合国贸易与发展会议headquarter/ head office 总公司/总部manufacturer 生产商/制造商distribution channel 分销渠道market 营销wholesaler 批发商subsidiary 子公司supplier 供应商distributor 分销商promotion 促销retailer 零售商branch 分公司dealer 经销商agency 代理机构/经销行acquisition 收购merger and acquisition (M&A) 并购take over 接管/接收leveraged buyout 融资收购company restructuring 企业重组assets reorganization资产重组discount 贴现bankruptcy 破产bankruptcy proceedings破产程序liquidation 破产清算inland /home /domestic trade 国内贸易foreign trade, /external trade 对外贸易exporter/importer license 出/进口许可证international trade 国际贸易blanket purchase order 一揽子采购合同inquiry 询盘counter offer 还盘make a complete entry 正式/完整申报offer 发盘acceptance 接受blank endorsed 空白背书cargo receipt 承运货物收据customs clearance 结关carrier 承运人shipper order 托运单condemned goods 有问题的货物中欧工商峰会China-EU Business SummitConference多指较大型的会议Workshop是泛指较小型,但互动性较高的会议Symposium专指特殊学术讨论的集会Congress基本特点是由专属国家的,政府或非政府组织的代表或委员参加Convention是一种例行会议,大量聚集人群讨论其组织和政团事务Forum论坛实际上是一种公众集会,在那里人们交换思想,讨论问题,特别是重要的公众问题。

口译二阶段热点-话题四:关于二十国集团和金融危机

1.当前,国际金融危机仍在蔓延和深化,对全球实体经济的冲击日益显现,世界经济金融形势依然复杂严峻,不少国家经济陷入衰退、社会稳定面临巨大挑战。

The international financial crisis, however, is still spreading and deepening, and its impact on the global real economy is becoming more and more evident. The world economic and financial situation remains complex and grave. Quite a number of countries have slid into economic recession and are confronted with severe challenges in maintaining social stability.2.这场国际金融危机是在经济全球化深入发展、国与国相互依存日益紧密的大背景下发生的,任何国家都不可能独善其身,合作应对是正确抉择。

The international financial crisis is taking place at a time when economic globalization is gaining momentum and countries are becoming more and more interdependent. No country can stay immune from the crisis, and the only right choice is for all of us to work together and deal with it.3. 作为具有广泛代表性的二十国集团,是国际社会共同应对国际经济金融危机的重要有效平台。

G20峰会相关英文

金句欣赏1.中国改革已经进入攻坚期和深水区;China’s reform has entered the deep water zone where tough challenges must be met.2.我们将以装饰断腕的用起、凤凰涅槃的决心,敢于向积存多年的顽瘴痼疾开刀;We have the resolve to make painful self-adjustment and tackle problems that have built up over many years.3.敢于触及深层次利益关系和矛盾,把改革进行到底。

Particularly underlying issues and enternched interests and carry reform through to the end.4.抓住科技创新就抓住了发展的牛鼻子。

Scientific and technological innovation holds the key to development.5.青山绿水就是金山银山。

Green mountains and clear water are as good as mountains of gold and silver.6.民惟邦本,本固邦宁。

The people are the foundation of a country and only when the people lead a good life can the country thrive.7.轻关易道,通商宽农。

The governance of a country should be based on simple customs procedures, improved intrastructures, convenience for business transaction and preferntial agricultural polices.8.这是建设开放型世界经济的应有之义。

二十国集团(g20)

二十国集团(g20)20国集团(G20)是一个国际经济合作论坛,于1999年9月25日由八国集团(G8)的财长在德国柏林成立,于华盛顿举办了第一届G20峰会,属于非正式对话的一种机制,由原八国集团以及其余12个重要经济体组成。

宗旨是为推动已工业化的发达国家和新兴市场国家之间就实质性问题进行开放及有建设性的讨论和研究,以寻求合作并促进国际金融稳定和经济的持续增长,按照以往惯例,国际货币基金组织与世界银行列席该组织的会议。

[1]20国集团成员涵盖面广,代表性强,该集团的GDP占全球经济的90%,贸易额占全球的80%,因此已取代G8成为全球经济合作的主要论坛。

G20的成立为国际社会齐心协力应对经济危机,推动全球治理机制改革带来了新动力和新契机全球治理开始从“西方治理”向“西方和非西方共同治理”转变。

2016年9月4日至5日二十国集团(G20)领导人第十一次峰会在中国杭州举行,这也是中国首次举办首脑峰会。

20国集团(G20)是一个国际经济合作论坛成立背景20国集团是由包括美国在内的七个工业化国家的财政部长于1999年6月在德国科隆首次提出的。

其目的是防止亚洲金融风暴重演,并允许有关国家就国际经济和货币政策进行非正式对话,这有利于国际金融和货币体系的稳定。

当时G20会议只有各国财长和央行行长参加。

自2008年由美国引发的全球金融危机以来,金融体系成为世界关注的焦点。

20国集团峰会取代了之前的8国集团峰会或20国集团财长会议,扩大了每个国家的发言权。

按照惯例,国际货币基金组织与世界银行列席该组织的会议。

20国集团的GDP总量约占世界的90%,人口约为40亿。

2009年9月举行的匹兹堡峰会将G20确定为国际经济合作主要论坛。

形象标识2016年G20峰会会标图案,用20根线条,描绘出一个桥形轮廓,同时辅以G20 2016 CHINA和篆刻隶书“中国”印章。

桥梁寓意着G20已成为全球经济增长之桥、国际社会合作之桥、面向未来的共赢之桥。

G20峰会公报全文

G20峰会公报全文二十国集团领导人第六次峰会4日在戛纳电影宫会议中心闭幕。

会议通过"戛纳行动计划",并发表《二十国集团戛纳峰会宣言》。

G20戛纳峰会公告出炉。

G20领导人公报核心包括:制定全球增长和就业策略,朝一个更稳定的和富有弹性的国际货币体系,改革金融部门和加强全球市场整合,解决大宗商品价格波动和刺激农业发展,改善能源市场和推进因对全球气候变化,避免保护主义和加强多边贸易体系,应对发展挑战,加强反贪污,以及改革面向21世纪的新全球治理格局。

以下是公报全文:1.我们,G20集团的领导人,于2011年3-4日在法国戛纳聚会。

2.自我们上次会议以来,全球经济的复苏已被削弱,特别是发达国家,导致失业率处于令人难以接受的水平。

在这样的环境下,金融市场的紧张状态持续增长,这主要与欧洲的主权风险有关。

此外还有清晰的迹象表明,新兴市场的经济增长也在放缓。

商品价格的波动已导致经济增长受到威胁。

全球经济的不平衡仍在持续。

3.今天,我们重申我们将致力于共同协作,我们已下定决心重新激活经济增长,创造就业,确保金融市场稳定,促进社会包容,使全球化服务于人们的需求。

增长和就业全球战略4.为解决全球经济面临的迫切挑战,我们承诺将协调我们的行动和政策。

我们每个国家都将尽到自己份内的责任。

5.我们已就《增长和就业行动计划》达成一致,以弥补短期内的经济增长弱点,增强中期内经济增长的基础。

发达经济体承诺采取政策构筑信心,支持经济增长,执行清晰、可靠和有针对性的措施来达成财政的巩固。

我们欢迎2011年10月26日欧洲领导人所做的,旨在恢复希腊债务可持续性,增强欧洲银行系统,构筑防火墙避免危机蔓延,铺设欧元区经济重大改革的基础,以及呼吁各方快速加以执行的相关决定。

我们支持意大利在欧元峰会上所提出的措施,同意由欧洲委员会主导的评估和监控细节。

在当前形势下,我们欢迎意大利决定邀请国际货币基金组织以每个季度评估进行的方式来公开监督其政策的执行。

20国集团首尔宣言(谭福华翻译)

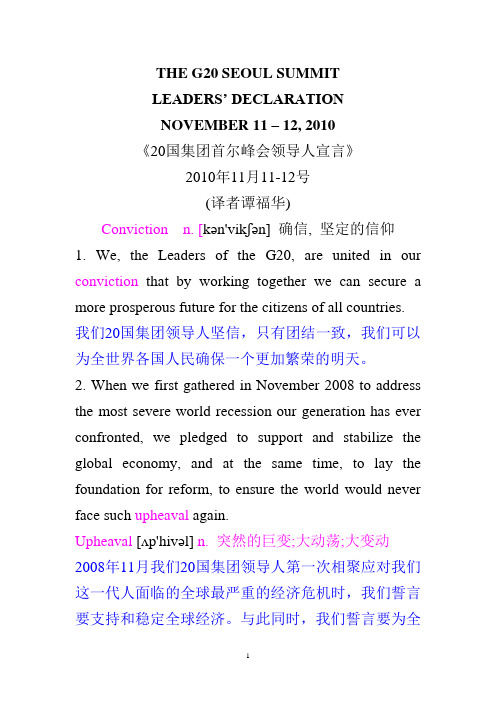

THE G20 SEOUL SUMMITLEADERS’ DECLARATIONNOVEMBER 11 – 12, 2010《20国集团首尔峰会领导人宣言》2010年11月11-12号(译者谭福华)Conviction n. [kən'vikʃən] 确信, 坚定的信仰1. We, the Leaders of the G20, are united in our conviction that by working together we can secure a more prosperous future for the citizens of all countries. 我们20国集团领导人坚信,只有团结一致,我们可以为全世界各国人民确保一个更加繁荣的明天。

2. When we first gathered in November 2008 to address the most severe world recession our generation has ever confronted, we pledged to support and stabilize the global economy, and at the same time, to lay the foundation for reform, to ensure the world would never face such upheaval again.Upheaval [ʌp'hivəl] n. 突然的巨变;大动荡;大变动2008年11月我们20国集团领导人第一次相聚应对我们这一代人面临的全球最严重的经济危机时,我们誓言要支持和稳定全球经济。

与此同时,我们誓言要为全球改革打下基础,要确保全世界不会再出现这种大动荡。

3. Over the past four Summits, we have worked with unprecedented cooperation to break the dramatic fall in the global economy to establish the basis for recovery and renewed growth.在过去的4届峰会中,我们精诚合作,规模空前,防止全球经济衰退,为全球经济恢复和新的增长奠定了基础。

首尔宣言 中文版

1、作为G20领导人,我们一致坚信能通过共同努力为所有国家创造一个更繁荣的未来。

2、我们在2008年11月举行首届G20峰会时,为应对有史以来最严重的全球衰退,我们承诺将支持并维护全球经济的稳定,同时为改革铺路,以避免此类危机的重演。

3、过去四届峰会上,我们通过前所未有的紧密合作,遏制了全球经济的急剧下滑趋势,从而为经济复苏、再次实现增长奠定了基础。

4、我们所采取的具体行动将帮助我们为防范未来危机做好更充分的准备。

我们承诺将继续同心协力、共同致力于打造稳健、持续、均衡的经济增长。

5、我们承认解决弱势群体所担忧的问题至关重要。

为此,我们决心将就业问题作为经济复苏的核心工作,向公民提供社会保障、体面的工作,同时确保低收入国家实现加速经济增长。

6、过去两年,我们通过不懈的合作努力取得显著成果。

然而,我们必须依然保持警惕。

7、风险依然存在。

G20中,有些国家的经济增长强劲,而其他国家却面临失业率居高不下与经济复苏疲软的困境。

经济增长不均衡、收支不平衡扩大等问题刺激各国各自为政。

然而,不能协调一致的行动只会带来更严重的后果。

8、2008年以来,我们就全球经济所面临的挑战达成共识,认为有必要采取应对措施,并决心抵制贸易保护主义,这让我们得以解决危机的根源、并实现经济复苏。

今天我们就应对这些新挑战一致达成共识,并确定实现危机后稳健、持续及均衡的经济增长的方案。

9、今天,首尔峰会取得了以下成果:《首尔行动计划》是由全面的、合作的和具体国别的政策行动所组成,以期向我们共同的目标迈进。

该计划包含我们下述承诺:·实施宏观经济政策、包括在必要时进行财政重整,确保实现不间断的复苏和可持续的增长,提高金融市场的稳定性,尤其是迈向更为市场化的汇率形成机制,令汇率变动能够反映内在的经济基本面,同时要避免各国货币的竞争性贬值。

发达经济体,包括那些拥有储备货币的国家,将对汇率的过度波动和无序运动保持警惕。

这些行动将有助于缓和部分新兴市场国家面临的资本流动过度波动的风险。

二十国集团领导人利雅得峰会宣言

二十国集团领导人利雅得峰会宣言文章属性•【缔约国】二十国集团•【条约领域】文化教育,医疗卫生,经济,贸易,金融,投资,税收,环境资源能源•【公布日期】2020.11.23•【条约类别】声明/宣言•【签订地点】正文二十国集团领导人利雅得峰会宣言1. 我们,二十国集团领导人,在沙特主席国任期内第二次举行会议。

我们团结一致,坚信现在比以往任何时候更加需要全球协调行动、团结和多边合作,以克服当前挑战,并通过赋权人民、保护地球和塑造新疆域来实现21世纪所有人的机遇。

我们致力于在共建强劲、可持续、平衡、包容的后新冠肺炎疫情时代方面发挥引领作用。

一、共同应对挑战2. 新冠肺炎大流行及其对生命健康、民生与经济造成的空前影响给我们带来前所未有的冲击,暴露出我们在疫情防范应对方面的脆弱性,突显了我们面临的共同挑战。

我们重申3月26日二十国集团领导人应对新冠肺炎特别峰会所作承诺,欢迎此后取得的进展,并将继续不遗余力地保护生命,给予最脆弱群体特别关注与支持,使各国经济重回恢复增长、保护和创造就业的轨道。

在继续抗击疫情的同时,我们向医务人员和其他一线工作者表示感谢与支持。

我们继续坚定支持所有发展中国家和最不发达国家应对疫情引发的卫生、经济和社会影响,注意到非洲和小岛国面临的特殊挑战。

3. 我们已动员资源,以解决当前全球卫生领域融资需求,支持安全有效的新冠病毒诊断、治疗和疫苗的研发、生产和分配,并将根据各成员创新激励政策,不遗余力实现人人可负担和公平获取。

为此,我们全力支持所有合作努力,特别是“全球合作加速开发、生产、公平获取新冠肺炎防控新工具倡议”及其“新冠肺炎疫苗实施计划”,以及知识产权自愿许可。

我们承诺解决当前的全球融资需求,欢迎多边开发银行根据目前的多边行动,加强对各国获得新冠肺炎防控工具的资金支持,并鼓励他们采取更多行动。

我们认识到广泛免疫接种作为全球公共产品的作用。

4. 尽管受新冠肺炎疫情影响,全球经济在2020年出现急剧收缩,但随着各国经济逐渐重新开放及重大政策行动的积极影响开始显现,全球经济活动已部分回升。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

口译资料:二十国集团金融市场和世界经济峰会的宣言Declaration of the Summit on Financial Markets and the World Economy1. We, the Leaders of the Group of Twenty, held an initial meeting in Washington on November 15, 2008, amid serious challenges to the world economy and financial markets. We are determined to enhance our cooperation and work together to restore global growth and achieve needed reforms in the world’s financial systems.2. Over the past months our countries have taken urgent and exceptional measures to support the global economy and stabilize financial markets. These efforts must continue. At the same time, we must lay the foundation for reform to help to ensure that a global crisis, such as this one, does not happen again. Our work will be guided by a shared belief that market principles, open trade and investment regimes, and effectively regulated financial markets foster the dynamism, innovation, and entrepreneurship that are essential for economic growth, employment, and poverty reduction.Root Causes of the Current Crisis3. During a period of strong global growth, growing capital flows, and prolonged stability earlier this decade, market participants sought higher yields without an adequate appreciation of the risks and failed to exercise proper due diligence. At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system. Policy-makers, regulators and supervisors, in some advanced countries, did not adequately appreciate and address the risks building up in financial markets, keep pace with financial innovation, or take into account the systemic ramifications of domestic regulatory actions.4. Major underlying factors to the current situation were, among others, inconsistent and insufficiently coordinated macroeconomic policies, inadequate structural reforms, which led to unsustainable global macroeconomic outcomes. These developments, together, contributed to excesses and ultimately resulted in severe market disruption.Actions Taken and to Be Taken5. We have taken strong and significant actions to date to stimulate our economies, provide liquidity, strengthen the capital of financial institutions, protect savings and deposits, address regulatory deficiencies, unfreeze credit markets, and are working to ensure that international financial institutions (IFIs) can provide critical support for the global economy.6. But more needs to be done to stabilize financial markets and support economic growth. Economic momentum is slowing substantially in major economies and the global outlook has weakened. Many emerging market economies, which helped sustain the world economy this decade, are still experiencing good growth but increasingly are being adversely impacted by the worldwide slowdown.7. Against this background of deteriorating economic conditions worldwide, we agreed that a broader policy response is needed, based on closer macroeconomic cooperation, to restore growth, avoid negative spillovers and support emerging market economies and developing countries. As immediate steps to achieve these objectives, as well as to address longer-term challenges, we will:Continue our vigorous efforts and take whatever further actions are necessary to stabilize the financial system.Recognize the importance of monetary policy support, as deemed appropriate to domestic conditions. Use fiscal measures to stimulate domestic demand to rapid effect, as appropriate, while maintaining a policy framework conducive to fiscal sustainability.Help emerging and developing economies gain access to finance in current difficult financial conditions, including through liquidity facilities and program support. We stress the International Monetary Fund’s (IMF) important role in crisis response, welcome its new short-term liquidity facility, and urge the ongoing review of its instruments and facilities to ensure flexibility. Encourage the World Bank and other multilateral development banks (MDBs) to use their full capacity in support of their development agenda, and we welcome the recent introduction of new facilities by the World Bank in the areas of infrastructure and trade finance.Ensure that the IMF, World Bank and other MDBs have sufficient resources to continue playing their role in overcoming the crisis.Common Principles for Reform of Financial Markets8. In addition to the actions taken above, we will implement reforms that will strengthen financial markets and regulatory regimes so as to avoid future crises. Regulation is first and foremost the responsibility of national regulators who constitute the first line of defense against market instability. However, our financial markets are global in scope, therefore, intensified international cooperation among regulators and strengthening of international standards, where necessary, and their consistent implementation is necessary to protect against adverse cross-border, regional and global developments affecting international financial stability. Regulators must ensure that their actions support market discipline, avoid potentially adverse impacts on other countries, including regulatory arbitrage, and support competition, dynamism and innovation in the marketplace. Financial institutions must also bear their responsibility for the turmoil and should do their part to overcome it including by recognizing losses, improving disclosure and strengthening their governance and risk management practices.9. We commit to implementing policies consistent with the following common principles for reform.Strengthening Transparency and Accountability: We will strengthen financial market transparency, including by enhancing required disclosure on complex financial products and ensuring complete and accurate disclosure by firms of their financial conditions. Incentives should be aligned to avoid excessive risk-taking.Enhancing Sound Regulation: We pledge to strengthen our regulatory regimes, prudential oversight, and risk management, and ensure that all financial markets, products and participants are regulated or subject to oversight, as appropriate to their circumstances. We will exercise strong oversight over credit rating agencies, consistent with the agreed and strengthened international code of conduct. We will also make regulatory regimes more effective over the economic cycle, while ensuring that regulation is efficient, does not stifle innovation, and encourages expanded trade in financial products and services. We commit to transparent assessments of our national regulatory systems.Promoting Integrity in Financial Markets: We commit to protect the integrity of the world’s financial markets by bolstering investor and consumer protection, avoiding conflicts of interest, preventing illegal market manipulation, fraudulent activities and abuse, and protecting againstillicit finance risks arising from non-cooperative jurisdictions. We will also promote information sharing, including with respect to jurisdictions that have yet to commit to international standards with respect to bank secrecy and transparency.Reinforcing International Cooperation: We call upon our national and regional regulators to formulate their regulations and other measures in a consistent manner. Regulators should enhance their coordination and cooperation across all segments of financial markets, including with respect to cross-border capital flows. Regulators and other relevant authorities as a matter of priority should strengthen cooperation on crisis prevention, management, and resolution.Reforming International Financial Institutions: We are committed to advancing the reform of the Bretton Woods Institutions so that they can more adequately reflect changing economic weights in the world economy in order to increase their legitimacy and effectiveness. In this respect, emerging and developing economies, including the poorest countries, should have greater voice and representation. The Financial Stability Forum (FSF) must expand urgently to a broader membership of emerging economies, and other major standard setting bodies should promptly review their membership. The IMF, in collaboration with the expanded FSF and other bodies, should work to better identify vulnerabilities, anticipate potential stresses, and act swiftly to play a key role in crisis response.Tasking of Ministers and Experts10. We are committed to taking rapid action to implement these principles. We instruct our Finance Ministers, as coordinated by their 2009 G-20 leadership (Brazil, UK, Republic of Korea), to initiate processes and a timeline to do so. An initial list of specific measures is set forth in the attached Action Plan, including high priority actions to be completed prior to March 31, 2009.In consultation with other economies and existing bodies, drawing upon the recommendations of such eminent independent experts as they may appoint, we request our Finance Ministers to formulate additional recommendations, including in the following specific areas:Mitigating against pro-cyclicality in regulatory policy;Reviewing and aligning global accounting standards, particularly for complex securities in times of stress;Strengthening the resilience and transparency of credit derivatives markets and reducing their systemic risks, including by improving the infrastructure of over-the-counter markets; Reviewing compensation practices as they relate to incentives for risk taking and innovation; Reviewing the mandates, governance, and resource requirements of the IFIs; andDefining the scope of systemically important institutions and determining their appropriate regulation or oversight.11. In view of the role of the G-20 in financial systems reform, we will meet again by April 30, 2009, to review the implementation of the principles and decisions agreed today.Commitment to an Open Global Economy12. We recognize that these reforms will only be successful if grounded in a commitment to free market principles, including the rule of law, respect for private property, open trade and investment, competitive markets, and efficient, effectively regulated financial systems. These principles areessential to economic growth and prosperity and have lifted millions out of poverty, and have significantly raised the global standard of living. Recognizing the necessity to improve financial sector regulation, we must avoid over-regulation that would hamper economic growth and exacerbate the contraction of capital flows, including to developing countries.13. We underscore the critical importance of rejecting protectionism and not turning inward in times of financial uncertainty. In this regard, within the next 12 months, we will refrain from raising new barriers to investment or to trade in goods and services, imposing new export restrictions, or implementing World Trade Organization (WTO) inconsistent measures to stimulate exports. Further, we shall strive to reach agreement this year on modalities that leads to a successful conclusion to the WTO’s Doha Devel opment Agenda with an ambitious and balanced outcome. We instruct our Trade Ministers to achieve this objective and stand ready to assist directly, as necessary. We also agree that our countries have the largest stake in the global trading system and therefore each must make the positive contributions necessary to achieve such an outcome.14. We are mindful of the impact of the current crisis on developing countries, particularly the most vulnerable. We reaffirm the importance of the Millennium Development Goals, the development assistance commitments we have made, and urge both developed and emerging economies to undertake commitments consistent with their capacities and roles in the global economy. In this regard, we reaffirm the development principles agreed at the 2002 United Nations Conference on Financing for Development in Monterrey, Mexico, which emphasized country ownership and mobilizing all sources of financing for development.15. We remain committed to addressing other critical challenges such as energy security and climate change, food security, the rule of law, and the fight against terrorism, poverty and disease.16. As we move forward, we are confident that through continued partnership, cooperation, and multilateralism, we will overcome the challenges before us and restore stability and prosperity to the world economy.Action Plan to Implement Principles for ReformThis Action Plan sets forth a comprehensive work plan to implement the five agreed principles for reform. Our finance ministers will work to ensure that the taskings set forth in this Action Plan are fully and vigorously implemented. They are responsible for the development and implementation of these recommendations drawing on the ongoing work of relevant bodies, including the International Monetary Fund (IMF), an expanded Financial Stability Forum (FSF), and standard setting bodies.Strengthening Transparency and AccountabilityImmediate Actions by March 31, 2009The key global accounting standards bodies should work to enhance guidance for valuation of securities, also taking into account the valuation of complex, illiquid products, especially during times of stress.Accounting standard setters should significantly advance their work to address weaknesses in accounting and disclosure standards for off-balance sheet vehicles.Regulators and accounting standard setters should enhance the required disclosure of complex financial instruments by firms to market participants.With a view toward promoting financial stability, the governance of the international accounting standard setting body should be further enhanced, including by undertaking a review of its membership, in particular in order to ensure transparency, accountability, and an appropriate relationship between this independent body and the relevant authorities.Private sector bodies that have already developed best practices for private pools of capital and/or hedge funds should bring forward proposals for a set of unified best practices. Finance Ministers should assess the adequacy of these proposals, drawing upon the analysis of regulators, the expanded FSF, and other relevant bodies.Medium-term actionsThe key global accounting standards bodies should work intensively toward the objective of creating a single high-quality global standard.Regulators, supervisors, and accounting standard setters, as appropriate, should work with each other and the private sector on an ongoing basis to ensure consistent application and enforcement of high-quality accounting standards.Financial institutions should provide enhanced risk disclosures in their reporting and disclose all losses on an ongoing basis, consistent with international best practice, as appropriate. Regulators should work to ensure that a financial institution’ financial statements include a complete, accurate, and timely picture of the firm’s activities (including off-balance sheet activities) and are reported on a consistent and regular basis.Enhancing Sound RegulationRegulatory RegimesImmediate Actions by March 31, 2009The IMF, expanded FSF, and other regulators and bodies should develop recommendations to mitigate pro-cyclicality, including the review of how valuation and leverage, bank capital, executive compensation, and provisioning practices may exacerbate cyclical trends.Medium-term actionsTo the extent countries or regions have not already done so, each country or region pledges to review and report on the structure and principles of its regulatory system to ensure it is compatible with a modern and increasingly globalized financial system. To this end, all G-20 members commit to undertake a Financial Sector Assessment Program (FSAP) report and support the transparent assessments of countries’ n ational regulatory systems.The appropriate bodies should review the differentiated nature of regulation in the banking, securities, and insurance sectors and provide a report outlining the issue and making recommendations on needed improvements. A review of the scope of financial regulation, with a special emphasis on institutions, instruments, and markets that are currently unregulated, along with ensuring that all systemically-important institutions are appropriately regulated, should also be undertaken. National and regional authorities should review resolution regimes and bankruptcy laws in light of recent experience to ensure that they permit an orderly wind-down of large complex cross-border financial institutions.Definitions of capital should be harmonized in order to achieve consistent measures of capital andcapital adequacy.Prudential OversightImmediate Actions by March 31, 2009Regulators should take steps to ensure that credit rating agencies meet the highest standards of the international organization of securities regulators and that they avoid conflicts of interest, provide greater disclosure to investors and to issuers, and differentiate ratings for complex products. This will help ensure that credit rating agencies have the right incentives and appropriate oversight to enable them to perform their important role in providing unbiased information and assessments to markets.The international organization of securities regulators should review credit rating agencies’ adoption of the standards and mechanisms for monitoring compliance.Authorities should ensure that financial institutions maintain adequate capital in amounts necessary to sustain confidence. International standard setters should set out strengthened capital requirements for banks’ structured credit and securitization activities.Supervisors and regulators, building on the imminent launch of central counterparty services for credit default swaps (CDS) in some countries, should: speed efforts to reduce the systemic risks of CDS and over-the-counter (OTC) derivatives transactions; insist that market participants support exchange traded or electronic trading platforms for CDS contracts; expand OTC derivatives market transparency; and ensure that the infrastructure for OTC derivatives can support growing volumes. Medium-term actionsCredit Ratings Agencies that provide public ratings should be registered.Supervisors and central banks should develop robust and internationally consistent approaches for liquidity supervision of, and central bank liquidity operations for, cross-border banks.Risk ManagementImmediate Actions by March 31, 2009Regulators should develop enhanced guidance to strengthen banks’ risk management practices,in line with international best practices, and should encourage financial firms to reexamine their internal controls and implement strengthened policies for sound risk management.Regulators should develop and implement procedures to ensure that financial firms implement policies to better manage liquidity risk, including by creating strong liquidity cushions.Supervisors should ensure that financial firms develop processes that provide for timely and comprehensive measurement of risk concentrations and large counterparty risk positions across products and geographies.Firms should reassess their risk management models to guard against stress and report to supervisors on their efforts.The Basel Committee should study the need for and help develop firms’ new stress testing models, as appropriate.Financial institutions should have clear internal incentives to promote stability, and action needs to be taken, through voluntary effort or regulatory action, to avoid compensation schemes which reward excessive short-term returns or risk taking.Banks should exercise effective risk management and due diligence over structured products and securitization.Medium -term actionsInternational standard setting bodies, working with a broad range of economies and other appropriate bodies, should ensure that regulatory policy makers are aware and able to respond rapidly to evolution and innovation in financial markets and products.Authorities should monitor substantial changes in asset prices and their implications for the macroeconomy and the financial system.Promoting Integrity in Financial MarketsImmediate Actions by March 31, 2009Our national and regional authorities should work together to enhance regulatory cooperation between jurisdictions on a regional and international level.National and regional authorities should work to promote information sharing about domestic and cross-border threats to market stability and ensure that national (or regional, where applicable) legal provisions are adequate to address these threats.National and regional authorities should also review business conduct rules to protect markets and investors, especially against market manipulation and fraud and strengthen their cross-border cooperation to protect the international financial system from illicit actors. In case of misconduct, there should be an appropriate sanctions regime.Medium -term actionsNational and regional authorities should implement national and international measures that protect the global financial system from uncooperative and non-transparent jurisdictions that pose risks of illicit financial activity.The Financial Action Task Force should continue its important work against money laundering and terrorist financing, and we support the efforts of the World Bank - UN Stolen Asset Recovery (StAR) Initiative.Tax authorities, drawing upon the work of relevant bodies such as the Organization for Economic Cooperation and Development (OECD), should continue efforts to promote tax information exchange. Lack of transparency and a failure to exchange tax information should be vigorously addressed. Reinforcing International CooperationImmediate Actions by March 31, 2009Supervisors should collaborate to establish supervisory colleges for all major cross-border financial institutions, as part of efforts to strengthen the surveillance of cross-border firms. Major global banks should meet regularly with their supervisory college for comprehensive discussions of the firm’s activities and assessment of the risks it faces.Regulators should take all steps necessary to strengthen cross-border crisis management arrangements, including on cooperation and communication with each other and with appropriate authorities, and develop comprehensive contact lists and conduct simulation exercises, as appropriate.Medium -term actionsAuthorities, drawing especially on the work of regulators, should collect information on areas where convergence in regulatory practices such as accounting standards, auditing, and deposit insurance is making progress, is in need of accelerated progress, or where there may be potential for progress.Authorities should ensure that temporary measures to restore stability and confidence have minimal distortions and are unwound in a timely, well-sequenced and coordinated manner.Reforming International Financial InstitutionsImmediate Actions by March 31, 2009The FSF should expand to a broader membership of emerging economies.The IMF, with its focus on surveillance, and the expanded FSF, with its focus on standard setting, should strengthen their collaboration, enhancing efforts to better integrate regulatory and supervisory responses into the macro-prudential policy framework and conduct early warning exercises. The IMF, given its universal membership and core macro-financial expertise, should, in close coordination with the FSF and others, take a leading role in drawing lessons from the current crisis, consistent with its mandate.We should review the adequacy of the resources of the IMF, the World Bank Group and other multilateral development banks and stand ready to increase them where necessary. The IFIs should also continue to review and adapt their lendin g instruments to adequately meet their members’ needs and revise their lending role in the light of the ongoing financial crisis.We should explore ways to restore emerging and developing countries’ access to credit and resume private capital flows which are critical for sustainable growth and development, including ongoing infrastructure investment.In cases where severe market disruptions have limited access to the necessary financing for counter-cyclical fiscal policies, multilateral development banks must ensure arrangements are in place to support, as needed, those countries with a good track record and sound policies.Medium -term actionsWe underscored that the Bretton Woods Institutions must be comprehensively reformed so that they can more adequately reflect changing economic weights in the world economy and be more responsive to future challenges. Emerging and developing economies should have greater voice and representation in these institutions.The IMF should conduct vigorous and even-handed surveillance reviews of all countries, as well as giving greater attention to their financial sectors and better integrating the reviews with the joint IMF/World Bank financial sector assessment programs. On this basis, the role of the IMF in providing macro-financial policy advice would be strengthened.Advanced economies, the IMF, and other international organizations should provide capacity-building programs for emerging market economies and developing countries on the formulation and the implementation of new major regulations, consistent with international standards.部分译文:声明分析了危机产生的根源、说明各国已采取并将采取的行动、阐述改革金融市场的共同原则和实施这些原则的行动计划、承诺各国将继续致力于对开放的全球经济。