AccountingBasics英语会计基础教学课件期末复习

合集下载

Accounting Basics英语会计基础教学课件(4)

(to record return of unwanted inventory purchased on account)

ACCY901 A'12

Recording freight costs

If the buyer pays the freight costs, these are treated as part of the cost of the inventory. BUT, we still record freight costs in a separate account This is the SAME entry for the periodic and perpetual systems

Operating cycles

4

SERVICE BUSINESS

Perform service Accounts receivable Send invoice Receive cash

MERCHANDISING BUSINESS

Buy inventory Sell inventory Accounts receivable Send invoice Receive cash

Date Account Debit Credit

Nov 1 Inventory

5,000

Nov 1 le

5,000

Accounts payable

5,000

(to record purchase of inventory on account)

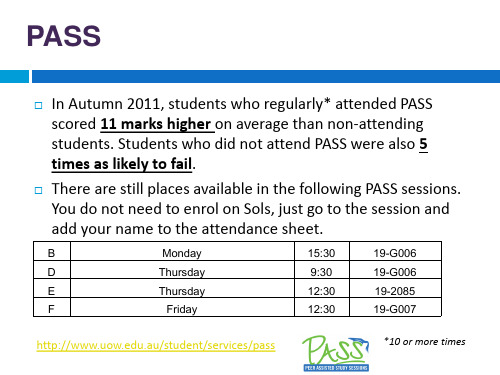

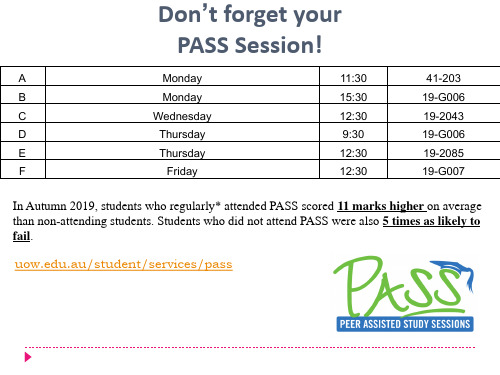

D E

Thursday Thursday

9:30 12:30

19-G006 19-2085

F

Friday

AccountingBasics英语会计基础教学课件期末复习

Chapter 6 - Inventories Chapter 7 - Accounting information systems Chapter 8 - Internal control and cash Chapter 9 - Accounting for receivables Chapter 11 - Current liabilities Chapter 10 - Non-current assets (PPE) Chapter 16 - Non-current liabilities Chapter 14 - Share capital Chapter 15 - Dividends & retained earnings Chapter 19 - Financial statement analysis

Week 13

Revision and exam preparation

Things to cover this week

Subject evaluation Exam overview Preparation techniques Overview of topics Remember: if you have something to ask

One of the compulsory financial statements for annual reporting by companies (along with Balance Sheet and Income Statement)

A lot of financial information in the cash flow statement

How do the chapters fit together?

AccountingBasics英语会计基础教学

2

STATEMENT OF CASH FLOWS: USEFULNESS AND FORMAT

LO1

• A statement of cash flows provides

information about an entity’s cash receipts and cash payments during a period

• Ability to pay dividends and meet obligations • Reasons for difference between profit and net

cash provided (used) by operating activities • Cash investing and financing transactions for the period

1

• Indicate the usefulness of the statement of cash

flows • Distinguish among operating, investing and financing activities • Prepare a statement of cash flows using the direct method • Statement of cash flows- the indirect method

8

Significant non-cash activities

• Significant financing and investing activities that

do not affect cash are not reported in the body of the statement of cash flows, but are disclosed elsewhere in the financial statement • Examples include …

AccountingBasics英语会计基础教学课件

When should Penny record the telephone expense?

The $400 is still a March expense because this is the period in which the expense was incurred. The actual cash won’t go out until April, but the expense is still a March expense.

We need to make sure that asset and liability balances are accurately reflected at the end of the accounting period

Adjusting entries occur after the transactions have been recorded and posted, but before the financial statements are prepared

4

Before we start…

Last week we looked at transactions analysis, journal entries and general ledger accounts…Elena Lee example

Transaction

1 October, office rent for October is paid in cash, $1800

.au/student/services/pass

Chapter 3: Adjusting the accounts

Week 3

2

BEFORE WE START….

The $400 is still a March expense because this is the period in which the expense was incurred. The actual cash won’t go out until April, but the expense is still a March expense.

We need to make sure that asset and liability balances are accurately reflected at the end of the accounting period

Adjusting entries occur after the transactions have been recorded and posted, but before the financial statements are prepared

4

Before we start…

Last week we looked at transactions analysis, journal entries and general ledger accounts…Elena Lee example

Transaction

1 October, office rent for October is paid in cash, $1800

.au/student/services/pass

Chapter 3: Adjusting the accounts

Week 3

2

BEFORE WE START….

2019年最新-AccountingBasics英语会计基础教学课件-精选文档

How much revenue should Penny record for 2019? Revenue for 2019 would be $22,400

Why?

Sales – Cash

$20,000

Sales – Accounts receivable $ 2,400

Total sales for 2019

debit. To increase balance debit again, to credit. To increase balance credit again,

decrease credit out of the account.

to decrease debit out of the account.

7

Accrual versus cash basis of accounting

Cash-based accounting

Revenue recognised when the cash is received or paid.

Accrual-based accounting

Revenue recognised when goods and services are provided

Expenses recognised when the cash is received or paid

8

Expenses recognised when assets are consumed or liabilities incurred

Cash versus accrual basis

Basic analysis

The expense Rent is increased $1800 because the payment pertains only to the current month; the asset Cash is decreased $1800

Accounting Basics英语会计基础教学(3)PPT课件

Journal entry Posting

Oct 1 Rent Expense

601 1800

Cash

101

(Paid October rent)

1800

Rent Expense 601 Oct 1 1800

Cash

101

Oct 1 800

7

This week…

Accrual versus cash basis of accounting Revenue recognition criteria Expense recognition criteria Types of adjusting entries Prepayments Accruals Adjusted trial balance Worksheets Financial statements from worksheets

.au/student/services/pass

1

第一部分

整体概述

THE FIRST PART OF THE OVERALL OVERVIEW, PLEASE SUMMARIZE THE CONTENT

2

Chapter 3: Adjusting the accounts

Expenses recognised when the cash is received or paid

Expenses recognised when assets are consumed or liabilities incurred

9

Cash versus accrual basis

Accrual basis

Income example: assume Penny received $20,000 in cash for sales during 2011 and charged clients $2,400 which was to be paid in the following year.

Accounting Basics英语会计基础教学课件.ppt

Chapter 7 Accounting information systems

1

•Basic principles of accounting information systems •Nature and purpose of a subsidiary ledger •How special journals are used •How to use a multicolumn journal •NOTE: download templates of all these journals from the elearning space!

Relevant, reliable, understandable, timely, comparable

Flexibility

Technological advances, increased competition, changing accounting principles, organisational growth, government regulation and de-regulation

Developing an accounting system

4

1. Analysis

Planning and identifying information needs and sources

2. Design

Creating forms, documents, procedures, job descriptions and reports

Examples

Sales journal Cash receipts journal Purchases journal Cash payments journal

1

•Basic principles of accounting information systems •Nature and purpose of a subsidiary ledger •How special journals are used •How to use a multicolumn journal •NOTE: download templates of all these journals from the elearning space!

Relevant, reliable, understandable, timely, comparable

Flexibility

Technological advances, increased competition, changing accounting principles, organisational growth, government regulation and de-regulation

Developing an accounting system

4

1. Analysis

Planning and identifying information needs and sources

2. Design

Creating forms, documents, procedures, job descriptions and reports

Examples

Sales journal Cash receipts journal Purchases journal Cash payments journal

Accounting Basics英语会计基础教学(8)PPT课件

continued

Factors influencing new share issue price include:

o Anticipated future earnings o Expected dividend rate per share o Current financial position o Current state of the economy o Current state of the securities market

7

Share issue considerations

Issue of Shares

A company can issue ordinary shares

o Directly to investors, or o Indirectly through an underwriter (such as an

o The total amount of cash and other assets paid to the company by shareholders

o Share may be ordinary or preference shares

10

Shareholders’ equity

5

Forming a company

Application filed with ASIC showing

o Name and purpose of company o Number and types of shares o Names of incorporators

Company constitution regulates internal management

4

Characteristics of a

Factors influencing new share issue price include:

o Anticipated future earnings o Expected dividend rate per share o Current financial position o Current state of the economy o Current state of the securities market

7

Share issue considerations

Issue of Shares

A company can issue ordinary shares

o Directly to investors, or o Indirectly through an underwriter (such as an

o The total amount of cash and other assets paid to the company by shareholders

o Share may be ordinary or preference shares

10

Shareholders’ equity

5

Forming a company

Application filed with ASIC showing

o Name and purpose of company o Number and types of shares o Names of incorporators

Company constitution regulates internal management

4

Characteristics of a

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Estimate of the future costs that may be incurred for repairing or replacing defective goods

The amount of the estimate for each year is recorded as an adjustment to the Warranty Provision account

Overview | LIABILITIES ~ Current liabilities

Types of current liabilities we’ve covered

Accounts payable Notes payable – same as accounts payable but with interest Unearned revenue – remember the concert example Accrued liabilities – provisions e.g. warranty liability

In this chapter, the focus is mostly on depreciation methods

Straight line (based on years of useful life) Units of production (based on units of useful life) Diminishing (or reducing) balance

EVERYONE wants it!!! So, we need internal control procedures. A fundamental internal control procedure for cash is the bank

reconciliation statement. In Week 5, our example was Friends Ltd. Key items in a bank reconciliation

Overview | ASSETS ~ Accounts receivable

What we’re interested here is how to account for measurement of accounts receivable and impairment.

If there is impairment, reduce accounts receivable via

Week 13

Revision and exam preparation

Things to cover this week

Subject evaluation Exam overview Preparation techniques Overview of topics Remember: if you have something to ask

Here we’re interested in calculating the value of ending inventory so we can complete the COGS calculation…

COGS = beginning inventory + net purchases – ending inventory.

One of the compulsory financial statements for annual reporting by companies (along with Balance Sheet and Income Statement)

A lot of financial information in the cash flow statement

Dividends

Overview | ASSETS ~ Non- current assets

Important to recognise that sometimes many costs can contribute to the actual cost of an asset (ie more than just purchase price)

EQUITY

Share capital, dividends & retained earnings

FINANCIAL STATEMENT ANALYSIS

Analysing financial statements

What about these topics?

CASH FLOW STATEMENTS

NON-CURRENT LIABILITIEerview | EQUITY ~ Share capital, dividends, retained earnings

Several elements of share issuing covered. Main focus:

BUDGETING

Budgeting is a basic life skill! Also important for all business/commerce majors, not just accounting.

Overview | ASSETS ~ Cash

What’s the problem with cash from a business point of view?

IGNORE any existing balance in impairment account

If using ageing method

ADJUST for any existing balance in impairment account

Overview | ASSETS ~ Inventories

Direct method Allowance method

Percentage of sales method Ageing of accounts receivable method

Key things to remember with allowance method

If using percentage of sales method

me about the final exam, it has to happen NOW!!! i.e. while the lecture is happening!!!! Thank you ☺

Exam overview

8 questions. No multiple choice. Problem-style questions. Similar to tutorials. Chapters covered include those AFTER mid-semester… More on the exam after we review the chapters…

Chapters…remember these ones???

Chapter 6 - Inventories – FIFO/LIFO/WA Chapter 7 - Accounting information systems Chapter 8 - Internal control and cash Chapter 9 - Accounting for receivables Chapter 11 - Current liabilities Chapter 10 - Non-current assets (PPE) Chapter 16 - Non-current liabilities Chapter 14 - Share capital Chapter 15 - Dividends & retained earnings Chapter 19 - Financial statement analysis Chapter 18 - Cash flow statements Chapter 20 - Management accounting Chapter 23 - Budgeting

First in, First out (FIFO) Last in, First out (LIFO) Average cost

Key things to remember:

Think about what it is you are working out…is it ending inventory or COGS?

Outstanding deposits Unpresented cheques Dishonoured cheques Bank or company errors Bank changes or collections on behalf of the company Any associated adjusting entries that might be required

Chapter 6 - Inventories Chapter 7 - Accounting information systems Chapter 8 - Internal control and cash Chapter 9 - Accounting for receivables Chapter 11 - Current liabilities Chapter 10 - Non-current assets (PPE) Chapter 16 - Non-current liabilities Chapter 14 - Share capital Chapter 15 - Dividends & retained earnings Chapter 19 - Financial statement analysis

Issuing of ordinary shares payable by installments

E.g. if a company wishes to issue 10,000 shares at an issue price of $20 per share with $10 payable on application, $5 payable on allotment and $5 payable on call.

The amount of the estimate for each year is recorded as an adjustment to the Warranty Provision account

Overview | LIABILITIES ~ Current liabilities

Types of current liabilities we’ve covered

Accounts payable Notes payable – same as accounts payable but with interest Unearned revenue – remember the concert example Accrued liabilities – provisions e.g. warranty liability

In this chapter, the focus is mostly on depreciation methods

Straight line (based on years of useful life) Units of production (based on units of useful life) Diminishing (or reducing) balance

EVERYONE wants it!!! So, we need internal control procedures. A fundamental internal control procedure for cash is the bank

reconciliation statement. In Week 5, our example was Friends Ltd. Key items in a bank reconciliation

Overview | ASSETS ~ Accounts receivable

What we’re interested here is how to account for measurement of accounts receivable and impairment.

If there is impairment, reduce accounts receivable via

Week 13

Revision and exam preparation

Things to cover this week

Subject evaluation Exam overview Preparation techniques Overview of topics Remember: if you have something to ask

Here we’re interested in calculating the value of ending inventory so we can complete the COGS calculation…

COGS = beginning inventory + net purchases – ending inventory.

One of the compulsory financial statements for annual reporting by companies (along with Balance Sheet and Income Statement)

A lot of financial information in the cash flow statement

Dividends

Overview | ASSETS ~ Non- current assets

Important to recognise that sometimes many costs can contribute to the actual cost of an asset (ie more than just purchase price)

EQUITY

Share capital, dividends & retained earnings

FINANCIAL STATEMENT ANALYSIS

Analysing financial statements

What about these topics?

CASH FLOW STATEMENTS

NON-CURRENT LIABILITIEerview | EQUITY ~ Share capital, dividends, retained earnings

Several elements of share issuing covered. Main focus:

BUDGETING

Budgeting is a basic life skill! Also important for all business/commerce majors, not just accounting.

Overview | ASSETS ~ Cash

What’s the problem with cash from a business point of view?

IGNORE any existing balance in impairment account

If using ageing method

ADJUST for any existing balance in impairment account

Overview | ASSETS ~ Inventories

Direct method Allowance method

Percentage of sales method Ageing of accounts receivable method

Key things to remember with allowance method

If using percentage of sales method

me about the final exam, it has to happen NOW!!! i.e. while the lecture is happening!!!! Thank you ☺

Exam overview

8 questions. No multiple choice. Problem-style questions. Similar to tutorials. Chapters covered include those AFTER mid-semester… More on the exam after we review the chapters…

Chapters…remember these ones???

Chapter 6 - Inventories – FIFO/LIFO/WA Chapter 7 - Accounting information systems Chapter 8 - Internal control and cash Chapter 9 - Accounting for receivables Chapter 11 - Current liabilities Chapter 10 - Non-current assets (PPE) Chapter 16 - Non-current liabilities Chapter 14 - Share capital Chapter 15 - Dividends & retained earnings Chapter 19 - Financial statement analysis Chapter 18 - Cash flow statements Chapter 20 - Management accounting Chapter 23 - Budgeting

First in, First out (FIFO) Last in, First out (LIFO) Average cost

Key things to remember:

Think about what it is you are working out…is it ending inventory or COGS?

Outstanding deposits Unpresented cheques Dishonoured cheques Bank or company errors Bank changes or collections on behalf of the company Any associated adjusting entries that might be required

Chapter 6 - Inventories Chapter 7 - Accounting information systems Chapter 8 - Internal control and cash Chapter 9 - Accounting for receivables Chapter 11 - Current liabilities Chapter 10 - Non-current assets (PPE) Chapter 16 - Non-current liabilities Chapter 14 - Share capital Chapter 15 - Dividends & retained earnings Chapter 19 - Financial statement analysis

Issuing of ordinary shares payable by installments

E.g. if a company wishes to issue 10,000 shares at an issue price of $20 per share with $10 payable on application, $5 payable on allotment and $5 payable on call.