Lecture7期权解读

关于期权的名词解释

关于期权的名词解释引言:期权作为一种金融衍生品,其重要性日益受到关注。

对于投资者和金融专业人士来说,了解期权的相关名词是理解和应用这一领域的关键。

本文将对期权的一些重要名词进行解释,帮助读者更好地理解和使用期权。

一、期权的基本概念期权是指在事先约定的时间内,以约定的价格买入或卖出某项标的物(如股票、商品、外汇等)的权利。

期权的买方有权但无义务在期权到期时执行买入或卖出操作,而期权的卖方则有义务在买方决定执行权利时履约。

期权的存在为投资者提供了在市场波动中实施避险、套利或投机的机会。

二、期权的主要类型1. 看涨期权(Call Option):购买看涨期权的持有人有权在约定价格上进行买入操作。

如果标的物价格上涨,持有人可以以约定价格买入并获取利润。

然而,如果标的物价格下跌,持有人也可以选择不执行权利。

2. 看跌期权(Put Option):购买看跌期权的持有人有权在约定价格上进行卖出操作。

如果标的物价格下跌,持有人可以以约定价格卖出并获取利润。

然而,如果标的物价格上涨,持有人也可以选择不执行权利。

3. 期权交易策略:投资者可以通过期权的买卖组合来构建不同的投资策略。

例如,买入看涨期权和看跌期权可以组成“跨式套利策略”,利用市场的上涨和下跌来获取利润。

此外,还有蝶式、时间价值衰减等策略可供选择。

三、期权的关键要素1. 标的物:期权的标的物是投资者在选择期权时所对应的实际资产,如股票、商品、外汇等。

标的物的波动性和流动性对期权的价格有着重要影响。

2. 认购价格和行权价格:认购价格是指购买期权时约定的价格,行权价格则是在期权到期时买卖标的物的价格。

认购价格决定了期权的成本,行权价格则对投资者的获利情况产生影响。

3. 到期日:期权的到期日是约定的期限,超过该日期,期权将自动失效。

到期日的选择取决于投资者对市场的预期,以及期权策略的目标。

四、期权市场及风险管理1. 交易所交易的期权:许多发达国家设有期权交易所,提供标准化的期权合约进行交易。

第七章外汇期货与外汇期权

Lecture10(Chapter 07)Futures and Options on Foreign Exchange外汇期货与期权1. A put option on $15,000 with a strike price of €10,000 is the same thing as a call option on €10,000 with a strike price of $15,000.TRUE2. A CME contract on €125,000 with Septe mber delivery 交货A. is an example of a forward contract.B. is an example of a futures contract.C. is an example of a put option.D. is an example of a call option.3. Yesterday, you entered into a futures contract to buy €62,500 at $1.50 per €. Suppose t he futures price closes today at $1.46. How much have you made/lost?A. Depends on your margin balance.B. You have made $2,500.00.C. You have lost $2,500.00.D. You have neither made nor lost money, yet.4. In reference to the futures market, a "speculator"A. attempts to profit from a change in the futures priceB. wants to avoid price variation by locking in a purchase price of the underlying asset through a long position in the futures contract or a sales price through a short position in the futures contractC. stands ready to buy or sell contracts in unlimited quantityD. both b) and c)5. Comparing "forward" and "futures" exchange contracts, we can say thatA. they are both "marked-to-market" daily.B. their major difference is in the way the underlying asset is priced for future purchase or sale: futures settle daily and forwards settle at maturity.C. a futures contract is negotiated by open outcry between floor brokers or traders and is traded on organized exchanges, while forward contract is tailor-made by an international bank for its clients and is traded OTC.D. both b) and c)Topic: Futures Contracts: Some Preliminaries6. Comparing "forward"远期合约 and "futures"期货合约 exchange contracts, we can say thatA. delivery of the underlying asset is seldom made in futures contracts.B. delivery of the underlying asset is usually made in forward contracts.C. delivery of the underlying asset is seldom made in either contract—they are typically cash settled at maturity.D. both a) and b)E. both a) and c)7. In which market does a clearinghouse serve as a third party to all transactions?A. FuturesB. ForwardsC. SwapsD. None of the above8. In the event of a default on one side of a futures trade,A. the clearing member stands in for the defaulting party. 结算会员代表为违约方B. the clearing member will seek restitution for the defaulting party.寻求赔偿C. if the default is on the short side, a randomly selected long contract will not get paid. That party will then have standing to initiate a civil suit against the defaulting short.D. both a) and b)9. Yesterday, you entered into a futures contract to buy €62,500 at $1.50 per €. Your initial performance bond is $1,500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted? 题目的意思是,初始保证金余额1500,维持保证金水平为500,当汇率在哪个水平上,客户需要追加保证金?,A.$1.5160 per €.B.$1.208 per €.C.$1.1920 per €.D.$1.4840 per €.10. Yesterday, you entered into a futures contract to sell €62,500 at $1.50 per €. Your initial performance bond is $1,500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted?A.$1.5160 per €.B.$1.208 per €.C.$1.1920 per €.D.$1.1840 per €.11. Yesterday, you entered into a futures contract to buy €62,500 at$1.50/€. Your initial margin was $3,750 (= 0.04 ⨯€62,500 ⨯$1.50/€ = 4 percent of the contract value in dollars). Your maintenance margin is $2,000 (meaning that your broker leaves you alone until your account balance falls to $2,000). At what settle price (use 4 decimal places) do you get a margin call?A.$1.4720/€62500×(1.5-?)=3750-2000B.$1.5280/€C.$1.500/€D. None of the above12. Three days ago, you entered into a futures contract to sell €62,500 at $1.50 per €. Over the past three days the contract has settled at $1.50, $1.52, and $1.54. How much have you made or lost?A.Lost $0.04 per € or $2,500B.Made $0.04 per € or $2,500C.Lost $0.06 per € or $3,750D. None of the above13. Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011/¥100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057/¥100, $0.7996/¥100, and $0.7985/¥100. (The contractual size of one CME Yen contract is ¥12,500,000). If you have a short position 空头in one futures contract, the changes in the margin account from daily marking-to-market will result in the balance of the margin account after the third day to be 日元贬值,赚钱A. $1,425.B. $2,000.C. $2,325.=(0.8011-0.7985)×125000+2000D. $3,425.14. Today's settlement price on a Chicago Mercantile Exchange (CME) Yen futures contract is $0.8011/¥100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057/¥100, $0.7996/¥100, and $0.7985/¥100. (The contractual size of one CME Yen contract is ¥12,500,000). If you have a long position 多头in one futures contract, the changes in the margin account from daily marking-to-market, will result in the balance of the margin account after the third day to be 日元贬值,亏钱A. $1,425.B. $1,675.C. $2,000.D. $3,425.Topic: Currency Futures Markets15. Suppose the futures price is below the price predicted by IRP. What steps would assure an arbitrage profit?A. Go short in the spot market, go long in the futures contract.B. Go long in the spot market, go short in the futures contract.C. Go short in the spot market, go short in the futures contract.D. Go long in the spot market, go long in the futures contract.16. What paradigm is used to define the futures price?A. IRP利率平价B. Hedge RatioC. Black ScholesD. Risk Neutral Valuation17. Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on €10,000. How much risk-free arbitrage profit could you make on 1 contract at maturity from this mispricing?A. $159.22F=1.45×1.04/1.03=1.4641B. $153.10(1.48-1.4641)×10000=459C. $439.42D. None of the aboveThe futures price of $1.48/€ is above the IRP futures price of $1.4641/€, so we want to sel l (i.e. take a short position in 1 futures contract on €10,000, agreeing to sell €10,000 in 1 year for $14,800).Profit =To hedge, we borrow $14,077.67 today at 4%, convert to euro at the spot rate of $1.45/€, invest at 3%. At maturity, our investme nt matures and pays €10,000, which we sell for $14,800, and then we repay our dollar borrowing with $14,640.78. Our risk-free profit = $159.22 = $14,800 - $14,640.7818. Which equation is used to define the futures price?A.B.C.D.19. Which equation is used to define the futures price? A.B.C.D.E.Topic: Currency Futures Markets20. If a currency futures contract (direct quote) is priced below the price implied by Interest Rate Parity (IRP), arbitrageurs could take advantage of the mispricing by simultaneouslyA. going short in the futures contract, borrowing in the domestic currency, and going long in the foreign currency in the spot market.B. going short in the futures contract, lending in the domestic currency, and going long in the foreign currency in the spot market.C. going long in the futures contract, borrowing in the domestic currency, and going short in the foreign currency in the spot market.D. going long in the futures contract, borrowing in the foreign currency, and going long in the domestic currency, investing the proceeds at the local rate of interest.21. Open interest in currency futures contractsA. tends to be greatest for the near-term contracts.B. tends to be greatest for the longer-term contracts.C. typically decreases with the term to maturity of most futures contracts.D. both a) and c)22. The "open interest" shown in currency futures quotations isA. the total number of people indicating interest in buying the contracts in the near future.B. the total number of people indicating interest in selling the contracts in the near future.C. the total number of people indicating interest in buying or selling the contracts in the near future.D. the total number of long or short contracts outstanding for the particular delivery month.23. If you think that the dollar is going to appreciate against the euro, you shouldA. buy put options on the euro.B. sell call options on the euro.卖出欧元看涨权C. buy call options on the euro.D. none of the above24. From the perspective of the writer 卖家of a put option 看跌期权written on €62,500. If the s trike price执行价格 i s $1.55/€, and the option premium is $1,875, at what exchange rate do you start to lose money?A.$1.52/€B.$1.55/€C.$1.58/€D. None of the above25. A European option is different from an American option in thatA. one is traded in Europe and one in traded in the United States.B. European options can only be exercised at maturity; American options can be exercised prior to maturity.C. European options tend to be worth more than American options, ceteris paribus.D. American options have a fixed exercise price; European options' exercise price is set at the average price of the underlying asset during the life of the option.26. An "option" isA. a contract giving the seller (writer) of the option the right, but not the obligation, to buy (call) or sell (put) a given quantity of an asset at a specified price at some time in the future.B. a contract giving the owner (buyer) of the option the right, but not the obligation, to buy (call) or sell (put) a given quantity of an asset at a specified price at some time in the future.C. a contract giving the owner (buyer) of the option the right, but not the obligation, to buy (put) or sell (call) a given quantity of an asset at a specified price at some time in the future.D. a contract giving the owner (buyer) of the option the right, but not the obligation, to buy (put) or sell (sell) a given quantity of an asset at a specified price at some time in the future.27. An investor believes that the price of a stock, say IBM's shares, will increase in the next 60 days. If the investor is correct, which combination of the following investment strategies will show a profit in all the choices?(i) - buy the stock and hold it for 60 days(ii) - buy a put option(iii) - sell (write) a call option(iv) - buy a call option(v) - sell (write) a put optionA. (i), (ii), and (iii)B. (i), (ii), and (iv)C. (i), (iv), and (v)D. (ii) and (iii)28. Most exchange traded currency optionsA. mature every month, with daily resettlement.B. have original maturities of 1, 2, and 3 years.C. have original maturities of 3, 6, 9, and 12 months.D. mature every month, without daily resettlement.29. The volume of OTC currency options trading isA. much smaller than that of organized-exchange currency option trading.B. much larger than that of organized-exchange currency option trading.C. larger, because the exchanges are only repackaging OTC options for their customers.D. none of the above30. In the CURRENCY TRADING section of The Wall Street Journal, the following appeared under the heading OPTIONS:Which combination of the following statements are true?(i)- The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.(ii)- The 68 May put option has a lower time value (price) than the 69 May put option.(iii)- If everything else is kept constant, the spot price and the put premium are inversely related. (iv)- The time values of the 68 May and 69 May put options are, respectively, 1.63 cents and 0.83 cents.(v)- If everything else is kept constant, the strike price and the put premium are inversely related.A. (i), (ii), and (iii)B. (ii), (iii), and (iv)C. (iii) and (iv)D. ( iv) and (v)31. With currency futures options the underlying asset isA. foreign currency.B. a call or put option written on foreign currency.C. a futures contract on the foreign currency.D. none of the above32. Exercise of a currency futures option results inA. a long futures position for the call buyer or put writer.B. a short futures position for the call buyer or put writer.C. a long futures position for the put buyer or call writer.D. a short futures position for the call buyer or put buyer.33. A currency futures option amounts to a derivative on a derivative. Why would something like that exist?A. For some assets, the futures contract can have lower transactions costs and greater liquidity than the underlying asset. 标的资产B. Tax consequences matter as well, and for some users an option contract on a future is more tax efficient.C. Transactions costs and liquidity.D. All of the above34. The current spot exchange rate目前即期汇率is $1.55 = €1.00 and the three-month forward rate is $1.60 = €1.00. Consi der a three-month American call option on €62,500. For this option to be considered at-the-money, the strike price must beA.$1.60 = €1.00B.$1.55 = €1.00C. $1.55 ⨯ (1+i$)3/12= €1.00 ⨯ (1+i€)3/12D. none of the above35. The current spot exchange rate is $1.55 = €1.00 and the three-month forward rate is $1.60 = €1.00. Consider a three-month American call option on €62,500 with a strike price of $1.50 = €1.00. Immediate exercise of this option will generate a profit ofA. $6,125B. $6,125/(1+i$)3/12C. negative profit, so exercise would not occurD. $3,12536. The current spot exchange rate is $1.55 = €1.00 and the three-month forward rate is $1.60 = €1.00. Consider a three-month American call option on €62,500 with a strike price of $1.50 = €1.00. If you pay an option premium of $5,000 to buy this call, at what exchange rate will you break-even?A.$1.58 = €1.00B.$1.62 = €1.00C.$1.50 = €1.00D.$1.68 = €1.0037. Consider the graph of a call option shown at right. The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125. What are the values of A, B, and C, respectively?A. A = -$3,125 (or -$.05 depending on your scale); B = $1.50; C = $1.55B. A = -€3,750 (or -€.06 depend ing on your scale); B = $1.50; C = $1.55C. A = -$.05; B = $1.55; C = $1.60D. none of the above38. Which of the lines is a graph of the profit at maturity of writing a call option on €62,500 with a strike price of $1.20 = €1.00 and an option premium of $3,125?A. AB. BC. CD. D39. The current spot exchange rate is $1.55 = €1.00; the three-month U.S. dollar interest rate is 2%. Consider a three-month American call option on €62,500 with a strike price of $1.50 =€1.00. What is the least that this option should sell for?A. $0.05 62,500 = $3,125B. $3,125/1.02 = $3,063.73C. $0.00D. none of the above40. Which of the follow options strategies are consistent in their belief about the future behavior of the underlying asset price?A. Selling calls and selling putsB. Buying calls and buying putsC. Buying calls and selling putsD. None of the aboveTopic: American Option-Pricing Relationships41. American call and put premiumsA. should be at least as large as their intrinsic value. 内在价值B. should be at no larger than their moneyness.C. should be exactly equal to their time value.D. should be no larger than their speculative value.42. Which of the following is correct?A. Time value = intrinsic value + option premiumB. Intrinsic value = option premium + time valueC. Option premium = intrinsic value - time valueD. Option premium = intrinsic value + time value43. Which of the following is correct?A. European options can be exercised early.B. American options can be exercised early.C. Asian options can be exercised early.D. All of the above44. Assume that the dollar-euro spot rate is $1.28 and the six-month forward rateis . The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market isA. 0 centsB. 3.47 centsC. 3.55 centsD. 3 cents45. For European options, what of the effect of an increase in S t?A. Decrease the value of calls and puts ceteris paribusB. Increase the value of calls and puts ceteris paribusC. Decrease the value of calls, increase the value of puts ceteris paribusD. Increase the value of calls, decrease the value of puts ceteris paribus46. For an American call option, A and B in the graph areA. time value and intrinsic value.B. intrinsic value and time value.C. in-the-money and out-of-the money.D. none of the above47. For European options, what of the effect of an increase in the strike price E?A. Decrease the value of calls and puts ceteris paribusB. Increase the value of calls and puts ceteris paribusC. Decrease the value of calls, increase the value of puts ceteris paribusD. Increase the value of calls, decrease the value of puts ceteris paribus48. For European currency options written on euro with a strike price in dollars, what of the effect of an increase in r$ relative to r€?A. Decrease the value of calls and puts ceteris paribusB. Increase the value of calls and puts ceteris paribusC. Decrease the value of calls, increase the value of puts ceteris paribusD. Increase the value of calls, decrease the value of puts ceteris paribus49. For European currency options written on euro with a strike price in dollars, what of the effect of an increase in r$?A. Decrease the value of calls and puts ceteris paribusB. Increase the value of calls and puts ceteris paribusC. Decrease the value of calls, increase the value of puts ceteris paribusD. Increase the value of calls, decrease the value of puts ceteris paribusTopic: European Option-Pricing Relationships50. For European currency options written on euro with a strike price in dollars, what of the effect of an increase r€?A. Decrease the value of calls and puts ceteris paribusB. Increase the value of calls and puts ceteris paribusC. Decrease the value of calls, increase the value of puts ceteris paribusD. Increase the value of calls, decrease the value of puts ceteris paribus51. For European currency options written on euro with a strike price in dollars, what of the effect of an increase in the exchange rate S($/€)?A. Decrease the value of calls and puts ceteris paribusB. Increase the value of calls and puts ceteris paribusC. Decrease the value of calls, increase the value of puts ceteris paribusD. Increase the value of calls, decrease the value of puts ceteris paribus52. For European currency options written on euro with a strike price in dollars, what of the effect of an increase in the exchange rate S(€/$)?A. Decrease the value of calls and puts ceteris paribusB. Increase the value of calls and puts ceteris paribusC. Decrease the value of calls, increase the value of puts ceteris paribusD. Increase the value of calls, decrease the value of puts ceteris paribus53. The hedge ratioA. Is the size of the long (short) position the investor must have in the underlying asset per option the investor must write (buy) to have a risk-free offsetting investment that will result in the investor perfectly hedging the option.B.C. Is related to the number of options that an investor can write without unlimited loss while holding a certain amount of the underlying asset.D. All of the above54. Find the value of a call option written on €100 with a strike price of $1.00 = €1.00. In one period there are two possibilities: the exchange rate will move up by 15% or down by 15% (i.e. $1.15 = €1.00 or $0.85 = €1.00). The U.S. risk-free rate is 5% over the period. The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.A. $9.5238B. $0.0952C. $0D. $3.174655. Use the binomial option pricing model to find the value of a call option on £10,000 with a strike price of €12,500.The current exchange rate is €1.50/£1.00 and in the next period the exchange rate can increase to €2.40/£ or decrease to €0.9375/€1.00 (i.e. u = 1.6 and d = 1/u = 0.625).The current interest rates are i€ = 3% and are i£ = 4%.Choose the answer closest to yours.A.€3,275B.€2,500C.€3,373D.€3,24356. Find the hedge ratio for a call option on £10,000 with a strike price of €12,500.The current exchange rate is €1.50/£1.00 and in the next period the exchange rate can increase to €2.40/£ or decrease to €0.9375/€1.00 (i.e. u = 1.6 and d = 1/u = 0.625).The current interest rates are i€ = 3% and are i£ = 4%.Choose the answer closest to yours.A. 5/9B. 8/13C. 2/3D. 3/8E. None of the above57. You have written a call option on £10,000 with a strike price of $20,000. The current exchange rate is $2.00/£1.00 and in the next period the exchange rate can increase to$4.00/£1.00 or decrease to $1.00/€1.00 (i.e. u = 2 and d = 1/u = 0. 5). The current interest rates are i$ = 3% and are i£ = 2%. Find the hedge ratio and use it to create a position in the underlying asset that will hedge your option position.A. Buy £10,000 today at $2.00/£1.00.B. Enter into a short position in a futures contract on £6,666.67.C. Lend the present value of £6,666.67 today at i£ = 2%.D. Enter into a long position in a futures contract on £6,666.67.E. Both c) and d) would workF. None of the above58. Draw the tree for a put option on $20,000 with a strike price of £10,000. The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are i$ = 3% and are i£ = 2%.A.B.C. None of the above59. Draw the tree for a call option on $20,000 with a strike price of £10,000. The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are i$ = 3% and are i£ = 2%.A.B.C. None of the above60. Find the hedge ratio for a put option on $15,000 with a strike price of €10,000. In one period the exchange rate (currently S($/€) = $1.50/€) can increase by 60% or decrease by 37.5% (i.e.u = 1.6 and d = 0.625).A. -15/49B. 5/13C. 3/2D. 15/4961. Find the hedge ratio for a put option on €10,000 with a strike price of $15,000. In one period the exchange rate (currently S($/€) = $1.50/€) can increase by 60% or decrease by 37.5% (i.e. u = 1.6 and d = 0.625).A. -15/49B. 8/13C. -5/13D. 15/4962. Find the dollar value today of a 1-period at-the-money call option on €10,000. The spot exchange rate is €1.00 = $1.25. In the next period, the euro can increase in dollar value to $2.00 or fall to $1.00. The interest rate in dollars is i$ = 27.50%; the interest rate in euro is i€ = 2%.A. $3,308.82B. $0C. $3,294.12D. $4,218.7563. Suppose that you have written a call option on €10,000 with a strike price in dollars. Suppose further that the hedge ratio is ½. Which of the following would be an appropriate hedge for a short position in this call option?A.Buy €10,000 today at today's spot exchange rate.B.Buy €5,000 today at today's spot exchange rate.C.Agree to buy €5,000 at the maturity of the option at the forward exchange rate for the maturity of the option that prevails today (i.e., go long i n a forward contract on €5,000).D.Buy the present value of €5,000 discounted at i€ for the maturity of the option.E. Both c) and d) would work.F. None of the above64. Find the value of a one-year put option on $15,000 with a strike price of €10,000. I n one year the exchange rate (currently S0($/€) = $1.50/€) can increase by 60% or decrease by 37.5% (i.e. u = 1.6 and d = 0.625). The current one-year interest rate in the U.S. is i$ = 4% and the current one-year interest rate in the euro zone is i€ = 4%.A.€1,525.52B. $3,328.40C. $4,992.60D.€2,218.94E. None of the above65. Find the value of a one-year call option on €10,000 with a strike price of $15,000. In one year the exchange rate (currently S0($/€) = $1.50/€) can increase by 60% or decrease by 37.5% (i.e. u = 1.6 and d = 0.625). The current one-year interest rate in the U.S. is i$ = 4% and the current one-year interest rate in the euro zone is i€ = 4%.A.€1,525.52B. $3,328.40C. $4,992.60D.€2,218.94E. None of the above66. Consider a 1-year call option written on £10,000 with an exercise price of $2.00 = £1.00. The current exchange rate is $2.00 = £1.00; The U.S. risk-free rate is 5% over the period and the U.K. risk-free rate is also 5%. In the next year, the pound will either double in dollar terms or fall by half (i.e. u = 2 and d = ½). If you write 1 call option, what is the value today (in dollars) of the hedge portfolio?A. £6,666.67B. £6,349.21C. $12,698.41D. $20,000E. None of the above67. Value a 1-year call option written on £10,000 with an exercise price of $2.00 = £1.00. The spot exchange rate is $2.00 = £1.00; The U.S. risk-free rate is 5% and the U.K. risk-free rate is also 5%. In the next year, the pound will either double in dollar terms or fall by half (i.e. u = 2 and d = ½). Hint: H= ⅔.A. $6,349.21B.C.D. None of the aboveTopic: Binomial Option-Pricing Model68. Which of the following is correct?A. The value (in dollars) of a call option on £5,000 with a strike price of $10,000 is equal to the value (in dollars) of a put option on $10,000 with a strike price of £5,000 only when the spot exchange rate is $2 = £1.B. The value (in dollars) of a call option on £5,000 with a strike price of $10,000 is equal to the value (in dollars) of a put option on $10,000 with a strike price of £5,000.69. Find the input d1 of the Black-Scholes price of a six-month call option written on €100,000 with a strike price of $1.00 = €1.00. The current exchange rate is $1.25 = €1.00; The U.S. risk-free rate is 5% over the period and the euro-zone risk-free rate is 4%. The volatility of the underlying asset is 10.7 percent.A.d1 = 0.103915B.d1 = 2.9871C.d1 = -0.0283D. none of the above70. Find the input d1 of the Black-Scholes price of a six-month call option on Japanese yen. The strike price is $1 = ¥100. The volatility is 25 percent per annum; r$ = 5.5% and r¥ = 6%.A.d1 = 0.074246B.d1 = 0.005982C.d1 = $0.006137/¥D. None of the above71. The Black-Scholes option pricing formulaeA. are used widely in practice, especially by international banks in trading OTC options.B. are not widely used outside of the academic world.C. work well enough, but are not used in the real world because no one has the time to flog their calculator for five minutes on the trading floor.D. none of the above72. Find the Black-Scholes price of a six-month call option written on €100,000 with a strike price of $1.00 = €1.00. The current exchange rate is $1.25 = €1.00; The U.S. risk-free rate is 5% over the period and the euro-zone risk-free rate is 4%. The volatility of the underlying asset is10.7 percent.A.C e = $0.63577B.C e = $0.0998C.C e = $1.6331D. none of the aboveINSTRUCTOR NOTE: YOU WILL HAVE TO PROVIDE YOUR STUDENTS WITH A TABLE OF THE NORMAL DISTRIBUTION.。

(2024年)期权系列之基础讲解ppt课件

法律法规与监管政策解读

2024/3/26

法律法规

《证券法》、《期货交易管理条例》 等法律法规为期权市场的规范发展提 供了法律依据。

监管政策

中国证监会及其派出机构依法对期权 市场实行监督管理,制定并发布了一 系列监管政策和自律规则,以保障市 场的公平、公正和透明。

11

投资者适当性管理要求

投资者分类

2024/3/26

20

常见策略类型及适用场景分析

01

02

03

04

买入看涨期权

适用于预期标的资产价格上涨 的情况,以较低成本获取上涨

收益。

买入看跌期权

适用于预期标的资产价格下跌 的情况,通过支付权利金获得

下跌保护。

卖出看涨期权

适用于预期标的资产价格不会 上涨或小幅上涨的情况,获取

权利金收入。

卖出看跌期权

适用于预期标的资产价格不会 下跌或小幅下跌的情况,获取

权利金收入。

2024/3/26

21

策略构建思路和方法分享

确定投资目标和风险承受能力

选择合适的期权合约

明确投资期限、预期收益和风险水平等要 素。

根据投资目标和市场情况选择合适的期权 合约类型和执行价格。

构建策略组合

动态调整策略

通过买入或卖出不同到期日、执行价格和 类型的期权合约构建策略组合。

30

未来发展趋势预测

2024/3/26

期权市场创新

随着金融市场的不断发展,未来期权市场将会出现更多的创新产品, 满足投资者多样化的需求。

技术进步推动期权交易发展

随着大数据、人工智能等技术的不断进步,未来期权交易将更加便捷 、高效。

期权在风险管理中的应用

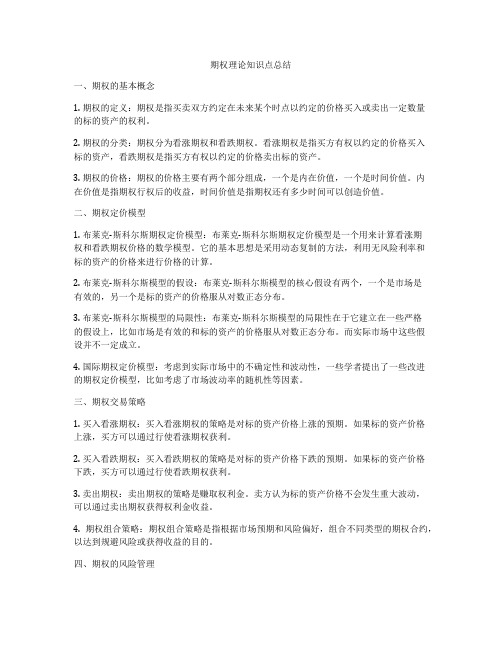

期权理论知识点总结

期权理论知识点总结一、期权的基本概念1. 期权的定义:期权是指买卖双方约定在未来某个时点以约定的价格买入或卖出一定数量的标的资产的权利。

2. 期权的分类:期权分为看涨期权和看跌期权。

看涨期权是指买方有权以约定的价格买入标的资产,看跌期权是指买方有权以约定的价格卖出标的资产。

3. 期权的价格:期权的价格主要有两个部分组成,一个是内在价值,一个是时间价值。

内在价值是指期权行权后的收益,时间价值是指期权还有多少时间可以创造价值。

二、期权定价模型1. 布莱克-斯科尔斯期权定价模型:布莱克-斯科尔斯期权定价模型是一个用来计算看涨期权和看跌期权价格的数学模型。

它的基本思想是采用动态复制的方法,利用无风险利率和标的资产的价格来进行价格的计算。

2. 布莱克-斯科尔斯模型的假设:布莱克-斯科尔斯模型的核心假设有两个,一个是市场是有效的,另一个是标的资产的价格服从对数正态分布。

3. 布莱克-斯科尔斯模型的局限性:布莱克-斯科尔斯模型的局限性在于它建立在一些严格的假设上,比如市场是有效的和标的资产的价格服从对数正态分布。

而实际市场中这些假设并不一定成立。

4. 国际期权定价模型:考虑到实际市场中的不确定性和波动性,一些学者提出了一些改进的期权定价模型,比如考虑了市场波动率的随机性等因素。

三、期权交易策略1. 买入看涨期权:买入看涨期权的策略是对标的资产价格上涨的预期。

如果标的资产价格上涨,买方可以通过行使看涨期权获利。

2. 买入看跌期权:买入看跌期权的策略是对标的资产价格下跌的预期。

如果标的资产价格下跌,买方可以通过行使看跌期权获利。

3. 卖出期权:卖出期权的策略是赚取权利金。

卖方认为标的资产价格不会发生重大波动,可以通过卖出期权获得权利金收益。

4. 期权组合策略:期权组合策略是指根据市场预期和风险偏好,组合不同类型的期权合约,以达到规避风险或获得收益的目的。

四、期权的风险管理1. 期权的波动率风险:期权的价格与标的资产价格波动率有密切关系,标的资产价格波动率增大,期权价格也会增大。

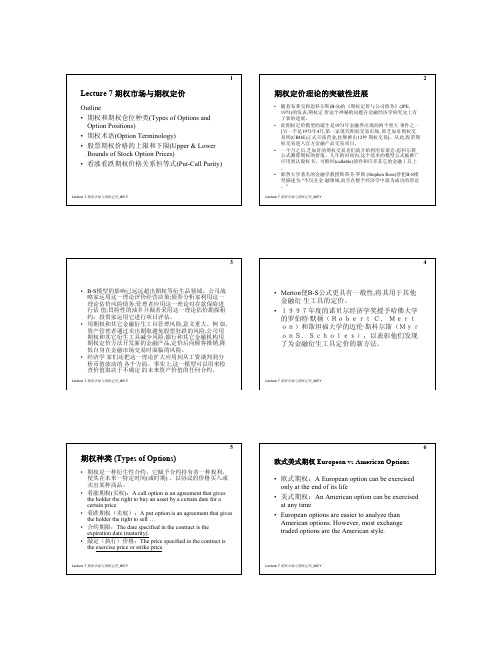

第七章 期权市场与期权定价

2

期权定价理论的突破性进展

• 随着布莱克和思科尔斯(B-S)的《期权定价与公司债务》(JPE, 1973)的发表,期权定 价这个神秘的问题在金融经济学研究史上有 了新的进展。

• 此期权定价模型的诞生是1973年金融界出现的两个重大 事件之一 [另一个是1973年4月,第一家现代期权交易市场, 即芝加哥期权交 易所(CBOE)正式开张营业,挂牌推出12种 期权交易]。从此,股票期 权交易进入官方金融产品交易项目。

flows result (S0 >X for a call, S0 <X for a put)- the option is an in-the-money (价内)option. • Negative moneyness: if an option is exercised, negative cash flows result (S0 <X call, S0 >X for put) – option is out-of-the-money(价外). • If S0 =X, option is at-the-money(价平).

16

货币性(Moneyness)

• Moneyness of an option 是立即执行期权所实现的收入 ( 假定执行期权是可行的).

• Moneyness is S0 –X for a call, X- S0 for a put • Positive moneyness: if an option is exercised, positive cash

• 敲定(执行)价格:The price specified in the contract is the exercise price or strike price.

期权交易入门:了解期权的基本知识

期权交易入门:了解期权的基本知识随着金融市场的快速发展,投资者们越来越多地关注期权交易。

作为一种金融衍生品,期权交易为投资者提供了更多的投资和风险管理选择。

本文将为您介绍期权的基本知识,帮助您了解期权交易的入门知识。

一、期权的定义和分类期权是一种金融合约,赋予持有者在未来某个特定时间以约定价格买入或卖出一种标的资产的权利,而非义务。

期权可以分为认购期权(Call Option)和认沽期权(Put Option)两种。

认购期权赋予持有者以约定价格购买标的资产的权利,当标的资产价格高于约定价格时,持有者可以通过行使期权来获利。

而认沽期权赋予持有者以约定价格卖出标的资产的权利,在标的资产价格低于约定价格时,持有者可以通过行使期权来获利。

二、期权的基本要素1. 标的资产:期权合约所关联的具体资产,可以是股票、商品、指数等金融工具。

2. 行权价格(又称约定价格):在合约到期时,标的资产的买卖价格。

3. 合约到期日:期权合约有效的截止日期。

4. 期权类型:认购期权或认沽期权。

5. 合约单位:每一个期权合约所对应的标的资产数量。

三、期权交易的基本策略1. 买入认购期权(看涨):当投资者预期标的资产价格上涨时,可以选择买入认购期权来获取上涨收益。

2. 买入认沽期权(看跌):当投资者预期标的资产价格下跌时,可以选择买入认沽期权来获取下跌收益。

3. 卖出认购期权(Covered Call):投资者已经持有标的资产,可以通过卖出认购期权获取权利金收益。

4. 卖出认沽期权(Covered Put):投资者已经持有标的资产,可以通过卖出认沽期权获取权利金收益。

四、期权交易的风险和收益与其他金融工具相比,期权交易具有较高的杠杆效应和风险。

在期权交易中,投资者可以通过支付较低的成本来参与高价标的资产的投资,但同时也要承担价值可能损失的风险。

期权交易可以为投资者提供多元化的投资策略,但需要投资者具备一定的市场分析和风险管理能力。

Lecture7 嵌期权债券

因此, 可赎回债券的价格=不可赎回债券的价格― 赎回期权的价格。 在任意给定的收益率水平下,不可赎回债 券与可赎回债券之间的价格差就是嵌入式 期权的价格。 同样, 可回售债券的价格=不可赎回债券的价格+ 回售期权的价格。

7.3 定价模型

当存在嵌入式期权时,需要计算该期权的价 格,而期权的价格与利率的波动性密切相关, 因而, 当存在嵌入式期权时,就必须考虑利率的 波动性。 常用的利率模型是根据短期利率如何随时 间变化而建立的无套利模型。

r1H : 从现在起 1年后较低的 1年期远期利率 ; r1L : 从现在起 1年后较高的 1年期远期利率 ; r1H r1L e 2

确定节点处债券的价值:

Value of Two-Period Option-Free Bond: C = 8 and F =100

Buu 108

Bu

.5[97.297 8].5[98.630 8] 110 . B0 96.330 B0

第一种债券相当于拥有一只20年期不可赎回债券, 且债券持有人给债券发行人一项赎回期权,使发行 人拥有5年后可以104元的价格赎回15年的现金流权 利。 第二种债券相当于拥有一支10年期不可赎回债券, 且债券持有人出售给债券发行人一项赎回期权,使 发行人拥有以100元的价格赎回合约中规定的现金流, 或债券被赎回时所有剩余现金流的权利。 因此,债券持有人购买可赎回债券相当于进行了两 笔独立的交易:以某个价格从债券发行人那里购买 了不可赎回债券,同时,又向债券发行人出售了一 项赎回期权。

Lecture 7 嵌期权债券

7.1 债券嵌期权概述

常见的债权嵌期权主要有: 赎回权、回售权、 转股权、提前偿付权、本息截留权、利率 上下限选择权等。 期权的嵌入可能影响债券现金流的大小、 方向及时间。利率上下限选择权则将影响 债券适用的利率。

期权知识课件

期权标的资产

总结词

期权的标的资产是期权合约中涉及的资产,可以是股票、期货、外汇或商品等 。

详细描述

期权的标的资产是期权合约中可以买卖的资产。这些资产可以是股票、期货、 外汇或商品等。标的资产的价格变动是期权价值的主要来源,因为期权的购买 者赚取或损失的价值取决于标的资产的价格变动。

02

期权交易策略

波动率

解释波动率的概念及其在期权交易中的重要性。

波动率是衡量标的资产价格变动的不确定性的指标。在期权交易中,波动率是影响期权价格的重要因 素之一。一般来说,波动率越高,期权价格越高。了解和预测波动率对于期权交易者来说非常重要, 因为这可以帮助他们评估期权的风险和潜在收益。

04

期权实战案例

买入看涨期权案例

希腊字母

描述用于衡量和管理期权风险的希腊字母。

希腊字母是用于衡量和管理期权风险的指标,包括delta、gamma、vega、theta和rho。Delta衡量标的资产变动一个单位 时,期权价格的变动;gamma衡量delta的变动;vega衡量波动率变动一个单位时,期权价格的变动;theta衡量时间流逝一 个单位时,期权价格的变动;rho衡量利率变动一个单位时,期权价格的变动。

操作风险

总结词

操作风险是指因交易系统、通讯故障 等技术问题导致的交易失败或错误的 风险。

详细描述

在期权交易中,由于交易系统故障、 通讯延迟等技术问题,可能导致交易 无法完成或执行价格偏差,从而影响 投资者的利益。

06

期权市场展望

国际期权市场发展

成熟市场期权交易

以美国、欧洲、日本等成熟市场为代表 ,期权交易历史悠久,市场规模大,流 动性强。

期权类型

总结词

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2020/11/11

13/18406Leabharlann 标准化(六)交割规定

期权交割的比例要比期货高得多 现货期权的交割:直接以执行价格对标的资产进行实际

的交收

指数期权的交割:按照执行价格与期权执行日当天交易 结束时的市场价格之差以现金进行结算

期货期权的交割:买方执行期权时,将从期权卖方处获 得标的期货合约的相应头寸,再加上执行价格与期货价 格之间的差额。

2020/11/11

14/18406

CBOE部分期权合约基本规格一览

2020/11/11

15/18406

基本交易制度

头寸限额(Position Limit):每个投资者在市 场的一方所能持有的头寸总额

看涨多头/看跌空头 看涨空头/看跌多头 执行限额( Exercise Limit ):一个期权买方 在规定的一段时间内所能执行的期权合约的最大 限额

2020/11/11

6/180

美国三类期权交易所

专门的期权交易所 芝加哥期权交易所( CBOE ) 国际证券交易所( ISE )(被Eurex收购)

传统股票交易所提供期权交易 美国费城股票交易所( PHLX )(被 NASDAQ收购) 美国股票交易所( AMEX )(被纽约-泛欧 交易所收购)

Lecture 7 Options

期权的产生与发展

较早的期权交易主要是用于实物商品等的现货 期权。

20世纪20年代,美国出现了股票的期权交易。 1936年,美国商品交易法案禁止对各种具体商

品进行期权交易。

1973年以后,期权市场快速发展,成立了第一 个期权交易市场——芝加哥期权交易所 (CBOE)。

目前期权作为世界衍生产品市场的重要组成部 分,已成为回避风险的重要手段。

2020/11/11

1/180

期权合约的定义

期权(Option)是指赋予其购买者在规定期限内按 双方约定的价格即协议价格( Striking Price)或 执行价格(Exercise Price),购买或出售一定数 量某种标的资产的权利的合约。

权 62 500 欧元

2020/11/11

11/18406

标准化合约

(二)执行价格

执行价格由交易所事先确定 当交易所准备上市某种期权合约时,首先根据该合约标

的资产的最近收盘价,依据某一特定的形式来确定一个

中心执行价格,然后再根据特定的幅度设定该中心价格 的上下各若干级距( Intervals )的执行价格。 因此, 在期权合约规格中,交易所通常只规定执行价格的级距。

期货交易所 CME 、ICE等。

2020/11/11

7/180

美国主要期权交易品种

2020/11/11

8/180

2010年美国期权市场份额

2020/11/11

9/180

期权交易的特征和趋势

日益增多的奇异期权:期权市场的激烈竞争和普 通期权利润空间的缩小。

交易所交易产品的灵活化:灵活期权(Flex options)

2020/11/11

12/18406

标准化合约 (三)到期循环、到期月、到期日、最后交易日

和执行日

(四)红利和股票分割

早期的场外期权受红利保护:除权日后执行价格要相 应调整;但现在的交易所期权不受红利保护,但在股 票分割或送红股时要调整

在 n 对 m (即 m 股股票分割为 n 股)股票分割之 后,执行价格降为原来执行价格的 m/n ,每一期权 合约所包含的标的资产数量上升到原来的 n/m 倍。

计算标准:合约数量/合约总金额 有些交易所规定期货期权中期权头寸与相应的期

货头寸合并计算

2020/11/11

16/18406

买卖指令

买入建仓:买入期权建立新头寸 卖出建仓:卖出期权建立新头寸 买入平仓:买入期权对冲原有的空头头寸 卖出平仓:卖出期权对冲原有的多头头寸 买卖对未平仓合约的影响

对于场内交易的期权来说,其合约有效期一般 不超过9个月,以3个月和6个月最为常见。由 于有效期不同,同一种标的资产可以有好几个 期权品种。

同一标的资产还可以规定不同的协议价格而使 期权有更多的品种,同时还分为看涨期权和看 跌期权,因此期权品种远比期货品种多得多。

2020/11/11

5/180

全球OTC主要期权品种概况

交易所之间的合作日益加强:一家交易所上市的 期权产品可以在其他交易所进行交易;或在一家 交易所交易,而在其他交易所平盘或交割;另外 有一些交易所则允许其他交易所的会员在本所进 行交易,等等。

高频交易日益盛行。

2020/11/11

10/18406

期权交易机制

标准化合约

(一)交易单位

一张期权合约中标的资产的交易数量 股票期权:100 股股票 指数期权:标的指数执行价格与 100 美元的乘积 期货期权:一张标的期货合约 PHLX 的外汇期权:英镑期权 31 250 英镑,欧元期

对于期权的买者来说,期权合约赋予他的只有权利, 而没有任何义务。

期权费(Premium)是在期权交易成交时支付的,即 便期权持有人最终没有执行这项期权,期权费也不 能收回,它是作为获取这种权利的对价 (consideration) 。

2020/11/11

2/180

期权交易的两个重要特征

权利和义务的不对称性。 期权交易的潜在收益与风险有明显的非对

2020/11/11

17/18406

交易所的清算制度与保证金制度

按照期权合约的标的资产划分,期权合约可分为利 率期权、货币期权(或称外汇期权)、股价指数期 权、股票期权以及金融期货期权,而金融期货又可 分为利率期货、外汇期货和股价指数期货三种。

2020/11/11

4/180

期权的交易场所

期权交易场所既有正规的交易所,也有场外交 易市场。交易所交易的是标准化的期权合约, 场外交易的则是非标准化的期权合约。

称性。

2020/11/11

3/180

期权的分类

按期权买者的权利划分,期权可分为看涨期权 (Call Option)和看跌期权(Put Option)。

按期权买者执行期权的时限划分,期权可分为欧式 期权和美式期权。欧式期权只能在期权到期日才能 执行期权,而美式期权允许多头在期权到期日前的 任何时间行权。