国贸经济课后习题答案

国贸课后习题答案

Chapter 03Why Everybody Trades: Comparative AdvantageOverviewThis chapter extends the analysis of international trade to consider trade in a multiple-product economy. An economy composed of two products is useful to bring out insights about international trade. This general equilibrium approach explicitly shows the effects of resource reallocations between industries. The chapter culminates in showing the importance of comparative advantage for understanding why countries trade.The story begins with Adam Smith and absolute advantage. (A box on mercantilism summarizes the view that Smith opposed and shows how mercantilist thinking continues today.) The analysis focuses on the productivity of labor (output per hour) in producing each of two products (wheat and cloth) in two countries (the United States and the rest of the world). Smith examined the case of absolute advantage, in which labor productivity in producing one product is higher in one country and labor productivity in producing the other product is higher in the other country. With no trade each country must produce both products to meet national demands. The discussion of the Smith case focuses on the increase in global production efficiency achieved by shifting production in each country toward the product in which it has the higher labor productivity. National demands can be met by international trade—apparently excess supplies can be exported and apparently excess demands can be met by imports. The increase in total world production is the evidence of gains from international trade.Smith's approach does not indicate what would happen if the same country has absolute advantage in both products. Ricardo took up this case and demonstrated the principle of comparative advantage—a country will export products that it can produce at low opportunity cost and import products that it would otherwise produce at high opportunity cost. The Ricardian example is developed in more detail. The ratio of resource costs (or labor hour input-output coefficients, the inverse of labor productivities) indicates the opportunity costs or relative prices of the products in each country with no trade. The difference in prices with no trade sets up the opportunity for arbitrage, with each good being exported from the initially low-price country and imported by the initially high-price country. The shift to a free trade equilibrium results in an equilibrium international price. Without information on demand, we cannot say exactly what this price will be, but we do know that it is in the range bordered by the two no-trade price ratios.The chapter uses the Ricardian example to introduce a key analytical device—the production possibility curve, which shows all combinations of outputs of different goods that an economy can produce with full employment of resources and maximum productivity. The resource costs of producing each product in the country and the total amount of labor hours available in the country are used to graph the country's production possibility curve, a straight line whose slope equals the (negative of the) extra (or marginal) cost of additional cloth. The straight line indicates that the marginal or opportunity cost of each good in each country is constant, following Ricardo's assumptions. The slope of this line also indicates the relative price of cloth (the good on the x-axis) with no trade.If free trade results in an equilibrium international price ratio that is strictly between the two no-trade price ratios (because both countries are "large countries"), then each country specializes completely in producing only the good in which it has the comparative advantage. Each trades at the equilibrium international price ratio (along a trade line or price line) to reach its consumption point. Both countries gain from trade. Each is able to consume more of both goods than it consumed with no trade.TipsThis chapter begins the full sweep of the development of thinking about comparative advantage as an explanation of the pattern of trade, starting with absolute advantage, and continuing with comparative advantage according to Ricardo. Most instructors will want to emphasize the continuity of thinking by tying this chapter closely to Chapter 4, which presents Heckscher and Ohlin's insight that comparative advantage can be based on differences in factor proportions and factor endowments. We have divided the discussion of comparative advantage into these two chapters (3 and 4), because students (especially students who find this conceptual material challenging to master) are likely to appreciate that the reading comes in more manageable sizes. This chapter has the first of a series of boxes that “Focus on Labor.” Issues of wages and work conditions are prominent in criticisms of globalization. These boxes should be of major interest to many students, as they take up these issues. The box in this chapter examines the link between (real) wages and productivity. It argues that wages in developing countries are low because labor productivity is low. This is not caused by international trade or foreign exploitation—wages will be low with or without trade. The key to raising wages and living standards is raising productivity, perhaps through education, better health, and better government policies toward labor markets. Problem 9 at the end of the chapter focuses on the calculation of real wages in a Ricardian example.Suggested answers to questions and problems(in the textbook)2. Agree. Imports permit the country to consume more (or do more capital investment usingimported capital goods). Anything that is exported is not available for domesticconsumption (or capital investment). Although this loss is bad, exports are like anecessary evil because exports are how the country pays for the imports that it wants.4. If the countries trade with each other at the relative price of 1 W/C, then shifting only halfway to complete specialization in production would be worse for each country thanshifting to complete specialization. If the United States shifted only half way, then itsnew “trade line” would be parallel to the trade l ine shown in Figure 3.1, and it would start from the point on the ppc that is half way between S0 and S1. While this new trade line would allow the United States to consume at a point that had more consumption than atthe initial S0, the United States could do even better by shifting production all the way to points S1 and consuming along the trade line shown in Figure 3.1. Consuming at a point like C would have even more consumption than consumin g at a point on the new “half-way” trade line. Essentially the same reasoning can be used for the rest of the world, fora new trade line that is parallel to the rest of the world’s trade line shown in Figure 3.1,but that begins at a point on the rest of the world’s ppc that is half way between S0 and S1.6. Using the information on the number of labor hours to make a unit of each product ineach country, you can determine the relative price of cloth in each country with no trade.With no trade, the relative price of cloth is 2 W/C (= 4/2) in the United States, and it is0.4 W/C (= 1/2.5) in the rest of the world. With free trade the equilibrium world priceof cloth must be in the range bounded by these two no-trade prices. So, yes, it ispossible that the free-trade equilibrium relative price of cloth is 1.5 W/C (1.5 is greaterthan 0.4, and less than 2).8. a. M oonited Republic has an absolute advantage in wine—it takes fewer labor hours toproduce a bottle (10<15). Moonited Republic also has an absolute advantage in producing cheese—it takes fewer labor hours to produce a kilo (4<10).b. Moonited Republic has a comparative advantage in cheese. The opportunity cost ofproducing a kilogram of cheese is 0.4 (= 4/10) bottles of wine in Moonited Republic,while the opportunity of a kilo of cheese in Vintland is 0.67 (= 10/15) bottles. Vintlandhas a comparative advantage in wine. The opportunity cost of a bottle of wine is 1.5 kilos of cheese in Vintland, while it is 2.5 kilos in Moonited Republic.c. 1.5312WineVintland N VCheese Wine 20.835N M Cheese Moonited Republicd. When trade is opened, Moonited Republic exports cheese and Vintland exports wine.If the equilibrium free trade price ratio is 1/2 bottle per kilo, Moonited Republic willspecialize completely in producing cheese, and Vintland will specialize completely inproducing wine.e. With free trade Moonited Republic produces 5 (=20/4) million kilos of cheese. If itexports 2 million kilos, then it consumes 3 million kilos. It consumes the 1 million bottles of wine that it imports. With free trade Vintland produces 2 (=30/15) million bottles of wine. If it exports 1 million bottles, then it consumes 1 million bottles. It consumes the 2 million kilos of cheese that it imports.2Wine Cheese Wine2Cheesef. Each country gains from trade. Each is able to consume combined quantities of wine andcheese that are beyond its ability to produce domestically. The free trade consumptionpoint is outside of the production possibility curve.10. If the number of labor hours to make a bushel of wheat is reduced by half to 1 hour, thisreinforces the U.S. comparative advantage in wheat. (In fact, the United States then hasan absolute advantage in wheat.) The United States is still predicted to export wheat and import cloth. If, instead, the number of hours to make a yard of cloth is reduced by half to2 hours, this reduces the U.S. absolute disadvantage in cloth, but it does not change thepattern of comparative advantage. The relative price of cloth is now 1 (=2/2) bushel peryard in the United States with no trade, but this is still higher than the price of 0.67 bushel per yard in the rest of the world. The United States still has a comparative advantage inwheat, so the United States is still predicted to export wheat and import cloth.。

国际贸易原理课后习题答案(即同步练习)

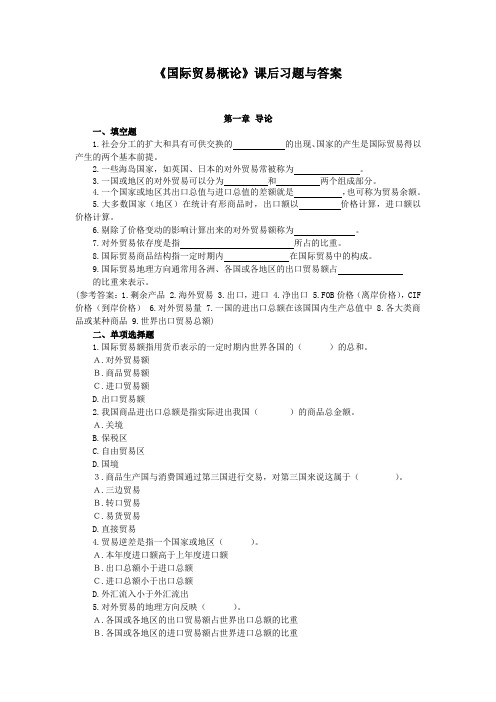

《国际贸易概论》课后习题与答案第一章导论一、填空题1.社会分工的扩大和具有可供交换的的出现、国家的产生是国际贸易得以产生的两个基本前提。

2.一些海岛国家,如英国、日本的对外贸易常被称为。

3.一国或地区的对外贸易可以分为和两个组成部分。

4.一个国家或地区其出口总值与进口总值的差额就是,也可称为贸易余额。

5.大多数国家(地区)在统计有形商品时,出口额以价格计算,进口额以价格计算。

6.剔除了价格变动的影响计算出来的对外贸易额称为。

7.对外贸易依存度是指所占的比重。

8.国际贸易商品结构指一定时期内在国际贸易中的构成。

9.国际贸易地理方向通常用各洲、各国或各地区的出口贸易额占的比重来表示。

(参考答案:1.剩余产品 2.海外贸易 3.出口,进口 4.净出口 5.FOB价格(离岸价格),CIF 价格(到岸价格) 6.对外贸易量 7.一国的进出口总额在该国国内生产总值中 8.各大类商品或某种商品 9.世界出口贸易总额)二、单项选择题1.国际贸易额指用货币表示的一定时期内世界各国的()的总和。

A.对外贸易额B.商品贸易额C.进口贸易额D.出口贸易额2.我国商品进出口总额是指实际进出我国()的商品总金额。

A.关境B.保税区C.自由贸易区D.国境3.商品生产国与消费国通过第三国进行交易,对第三国来说这属于()。

A.三边贸易B.转口贸易C.易货贸易D.直接贸易4.贸易逆差是指一个国家或地区()。

A.本年度进口额高于上年度进口额B.出口总额小于进口总额C.进口总额小于出口总额D.外汇流入小于外汇流出5.对外贸易的地理方向反映()。

A.各国或各地区的出口贸易额占世界出口总额的比重B.各国或各地区的进口贸易额占世界进口总额的比重C.一国各类出口商品在世界出口总额中所占的比重D.一国的出口商品去想和进口商品来源6.国际贸易商品结构指()。

A.各种商品在一国进口总额或出口总额中所占的比重B.各国或各地区的出口贸易额或进口贸易额占世界出口总额或进口总额的比重C.各类商品在世界出口总额中所占的比重D.一国的出口商品去向和进口商品来源7.对外贸易依存度指一国在一定时期内的()的比重。

(完整版)国际贸易课后题参考答案

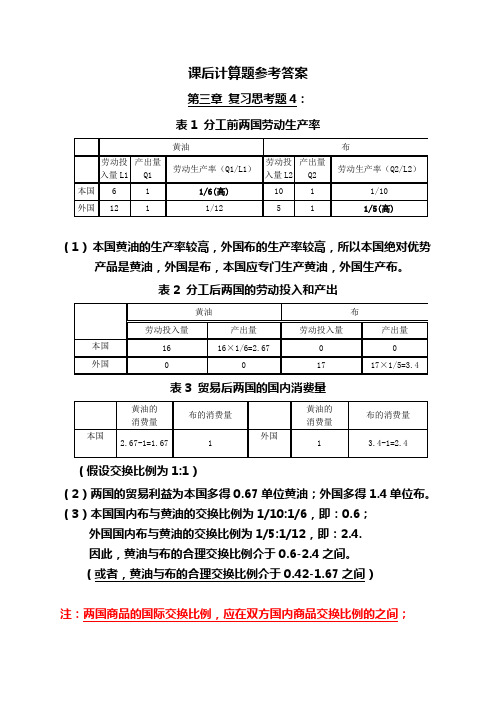

课后计算题参考答案第三章复习思考题4:表1 分工前两国劳动生产率(1)本国黄油的生产率较高,外国布的生产率较高,所以本国绝对优势产品是黄油,外国是布,本国应专门生产黄油,外国生产布。

表2 分工后两国的劳动投入和产出表3 贸易后两国的国内消费量(假设交换比例为1:1)(2)两国的贸易利益为本国多得0.67单位黄油;外国多得1.4单位布。

(3)本国国内布与黄油的交换比例为1/10:1/6,即:0.6;外国国内布与黄油的交换比例为1/5:1/12,即:2.4.因此,黄油与布的合理交换比例介于0.6-2.4之间。

(或者,黄油与布的合理交换比例介于0.42-1.67之间)注:两国商品的国际交换比例,应在双方国内商品交换比例的之间;两种商品的国内交换比例=两种商品的劳动生产率之比。

第三章复习思考题5:表1 分工前两国劳动生产率(1)生产可能性方程为:L=a Lx x+a LY Y,其中L代表总劳动力,a Lx代表X商品的生产成本,x代表X商品的产量,a LY代表Y商品的生产成本,Y代表Y商品的产量。

因此,把已知条件代入上述等式,得出本国的生产可能性方程为:2=10X+4Y,即:Y=0.5-2.5X;同理,得出外国的生产可能性方程为:1.2=3X+2Y,即:Y=0.6-1.5X。

(另一种简洁算法为:画出几何图形,生产可能性曲线与横轴的交点为投入所有劳动生产X的产量,与纵轴的交点为投入所有劳动生产Y的产量,则生产可能性方程为Y=纵轴Y的产量-斜率乘以X)(2)无贸易时的生产组合意味着求生产可能性曲线与社会无差异曲线的交点,即:生产可能性方程与效用函数的交点,在这一交点上,生产可能性方程与效用函数的斜率相等,由(1)可知本国生产可能性方程的斜率为2.5,外国生产可能性方程的斜率为1.5,而两国的效用函数均为U=XY2,效用函数的斜率为效用函数分别对X和Y求导后的比率,即:U X’/U Y’= Y2/2XY,则本国:Y2/2XY=2.5,即:Y=5X,外国:Y2/2XY=1.5,即:Y=3X,把Y=5X与本国的生产可能性方程Y=0.5-2.5X联立,解出X=1/15,Y=1/3,所以本国无贸易时的国内生产组合为(1/15,1/3);把Y=3X与外国的生产可能性方程Y=0.6-1.5X联立,解出X=2/15,Y=2/5,所以外国无贸易时的国内生产组合为(2/15,2/5)。

国经课后练习题有答案 (打印)

第三章新古典国贸理论习题一、名词解释1、劳动价值论:2、机会成本:3哈伯勒的比较优势理论:二、计算题1、美英两国都能生产A、B、C、D、E五种商品,美国生产一单位上述商品所需投入的劳动量分别为10、25、65、80、43(人小时),英国生产上述商品所需投入的劳动量分别为11、30、60、90、55(人小时)。

美国和英国的工资率之比为1 :0.85。

问美英两国各自在何商品的生产上具有劳动成本方面的比较优势?2、美英两国都能生产A、B、C、D、E五种商品,上述商品的价格在美国国内分别为2、4、6、8、10美元,上述商品在英国国内价格分别为6、4、3、2、1英磅。

如果现在的汇率水平为2美元/英磅,问美国应该进口何种商品、出口何种商品?当汇率水平变为3美元/英磅时呢?国贸理论研究方法与分析工具一、填空题1、国贸理论的三种图形分析工具分别是:分析贸易条件的();分析供给的();分析需求的()。

2、相对价格概念的实质反映了一种()关系,国贸理论研究中引入这一概念的目的是避开()因素对贸易活动的影响,从而使理论研究更简明。

3、经济行为主体根据部分价格信息,而不考虑其他价格信息进行决策的制定,这种现象在经济学中被称为()。

4、完全竞争的市场结构其特征有()、()等,在完全竞争的市场结构中厂商利润最大化的原则是()。

5、封闭条件下,一国经济达到均衡状态需要具备的条件有:()、()、()。

6、开放条件下,一国经济达到均衡状态需要具备的条件有:()、()、()。

7、2*1的完全竞争条件下,一国的生产可能性边界为一条直线,原因是(),这意味着生产可能性边界线上机会成本或边际成本()。

8、2*2的完全竞争条件下,一国的生产可能性边界为一条向外凸的曲线,原因是()和()。

这意味着生产可能性边界线上机会成本或边际成本()。

9、2*2的不完全竞争条件下,一国的生产可能性边界为一条凸向原点的曲线,原因是(规模经济)。

这意味着生产可能性边界线上机会成本或边际成本()。

国贸课后练习答案全 周瑞琪

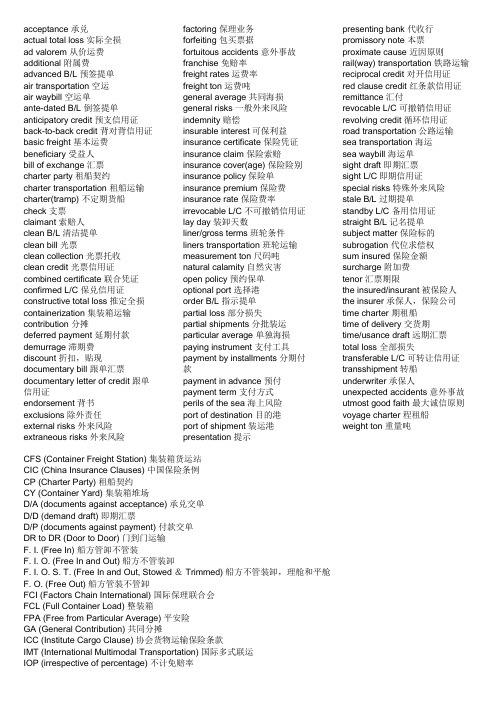

acceptance 承兑actual total loss 实际全损ad valorem 从价运费additional 附属费advanced B/L 预签提单air transportation 空运air waybill 空运单ante-dated B/L 倒签提单anticipatory credit 预支信用证back-to-back credit 背对背信用证basic freight 基本运费beneficiary 受益人bill of exchange 汇票charter party 租船契约charter transportation 租船运输charter(tramp) 不定期货船check 支票claimant 索赔人clean B/L 清洁提单clean bill 光票clean collection 光票托收clean credit 光票信用证combined certificate 联合凭证confirmed L/C 保兑信用证constructive total loss 推定全损containerization 集装箱运输contribution 分摊deferred payment 延期付款demurrage 滞期费discount 折扣,贴现documentary bill 跟单汇票documentary letter of credit 跟单信用证endorsement 背书exclusions 除外责任external risks 外来风险extraneous risks 外来风险factoring 保理业务forfeiting 包买票据fortuitous accidents 意外事故franchise 免赔率freight rates 运费率freight ton 运费吨general average 共同海损general risks 一般外来风险indemnity 赔偿insurable interest 可保利益insurance certificate 保险凭证insurance claim 保险索赔insurance cover(age) 保险险别insurance policy 保险单insurance premium 保险费insurance rate 保险费率irrevocable L/C 不可撤销信用证lay day 装卸天数liner/gross terms 班轮条件liners transportation 班轮运输measurement ton 尺码吨natural calamity 自然灾害open policy 预约保单optional port 选择港order B/L 指示提单partial loss 部分损失partial shipments 分批装运particular average 单独海损paying instrument 支付工具payment by installments 分期付款payment in advance 预付payment term 支付方式perils of the sea 海上风险port of destination 目的港port of shipment 装运港presentation 提示presenting bank 代收行promissory note 本票proximate cause 近因原则rail(way) transportation 铁路运输reciprocal credit 对开信用证red clause credit 红条款信用证remittance 汇付revocable L/C 可撤销信用证revolving credit 循环信用证road transportation 公路运输sea transportation 海运sea waybill 海运单sight draft 即期汇票sight L/C即期信用证special risks 特殊外来风险stale B/L 过期提单standby L/C 备用信用证straight B/L 记名提单subject matter 保险标的subrogation 代位求偿权sum insured 保险金额surcharge 附加费tenor 汇票期限the insured/insurant 被保险人the insurer 承保人,保险公司time charter 期租船time of delivery 交货期time/usance draft 远期汇票total loss 全部损失transferable L/C 可转让信用证transshipment 转船underwriter 承保人unexpected accidents 意外事故utmost good faith 最大诚信原则voyage charter 程租船weight ton 重量吨CFS (Container Freight Station) 集装箱货运站CIC (China Insurance Clauses) 中国保险条例CP (Charter Party) 租船契约CY (Container Yard) 集装箱堆场D/A (documents against acceptance) 承兑交单D/D (demand draft) 即期汇票D/P (documents against payment) 付款交单DR to DR (Door to Door) 门到门运输F. I. (Free In) 船方管卸不管装F. I. O. (Free In and Out) 船方不管装卸F. I. O. S. T. (Free In and Out, Stowed & Trimmed) 船方不管装卸,理舱和平舱F. O. (Free Out) 船方管装不管卸FCI (Factors Chain International) 国际保理联合会FCL (Full Container Load) 整装箱FPA (Free from Particular Average) 平安险GA (General Contribution) 共同分摊ICC (Institute Cargo Clause) 协会货物运输保险条款IMT (International Multimodal Transportation) 国际多式联运L/C (letter of credit) 信用证L/G (letter of guarantee) 保函LCL (Less than Container Load) 拼装箱M (Measurement) 尺码M/T (mail transfer) 信汇MTO (Multimodal Transportation Operator) 多式联运经营人PICC (the People’s Insurance Company of China) 中国人民保险公司SRCC (strikes, riots and civil commotions) 罢工,暴动,民变脸T/T (telegraphic transfer) 电汇TPND (theft, pilferage and non-delivery) 偷窃提货不着险UCP 600 (Uniform Customs and Practice for Documentary Credit 600) 跟单信用证统一惯例 600URC 522 (Uniform Rules for Collection 522) 托收统一规则W (Weight) 重量W/W Clause (Warehouse to Warehouse Clause) 仓至仓条款WPA (With Particular Average) 水渍险Chapter 51. In international cargo transportation, the most widely adopted bill of lading is D. order bill oflading.2. In DES contracts, a reasonable order for time of shipment and time of delivery is B. June 1 andJuly 1.3. A bill of lading is C. ante-dated B/L when its date of shipment is indicated earlier than the actualtime of shipment.4. A (An) D. bill of lading represents title to the cargo.5. In the import and export business, B. an ocean B/L can be made out to negotiable document.6. The bill of lading presented to the consignee or buyer or his bank after the stipulated expiry dateof presentation or after the goods are due at the port of destination is a A. stale B/L.7. A “freight to be collected” B/L is acceptable to the buyer when the contract is based on A. FOB.8. A C. conference liner normally has regular scheduled departures, specified routes andcomparatively fixed freight rates.9. An order B/L with blank endorsement is a B/L showing B. neither the name of consignee northe name of transferee.10. A(n) A. straight B/L refers to one that is made out to a designated consignee.Chapter 61. The main document adopted by the insured to make claims against the insurer is D. insurancedocument.2. Perils of the sea, such as vessel being stranded or grounded covered in an insurance policy areone kind of B. fortuitous accidents.3. According to “Ocean Marine Cargo Clause of the People’s Insurance Company of China”, thecoverage which cannot be effected independently is C. War Risk.4. Company A exported 5 metric tons of tea. The tea suffered heavy storm in transit. The sea waterin the ship’s hold led to the deterioration in the quality of part of the tea exported. This kind of loss is D. particular average.5. The insurance document that is acceptable mostly in Hong Kong of China, Singapore andMalaysia is C. combined certificate.6.7. Risks such as “failure to delivery risk” or “rejection risk” fall within the category of B. specialextraneous risks.8. According to “Ocean Marine Cargo Clause of the People’s Insurance Company of China”, thebasic coverage that is the least extensive is A. FPA.9. In the case of air freight, if the subject matter insured failed to reach the warehouse at destinationstipulated in the insurance policy, the expiration of the insurance is B. 30 days after completion of discharge overside from the overseas vessel at the final port of discharge.10. Under C. ICC(C) coverage of London Institute Cargo Clause, only major casualties are covered,but not natural calamities.1. If there is no specific provision, the draft under a letter of credit should draw on the B. issuingbank.2. The draft used in collection is D. a commercial draft, based on commercial credit.3. A standby credit B. is a special clean credit.4. Under collection once the importer refuses to pay, the C. principal will be responsible for thecargo release, customs clearance, warehousing, and reselling in the importing country.5. The bill of exchange used in D/A must be a D. usance bill.6. If a bank other than the issuing bank guarantees the payment under an L/C, this L/C is A. aconfirmed credit.7. A C. reciprocal credit is normally used in processing trade.8. Which of the following statements is NOT true about remittance? A. It provides highest securityto the buyer but not the seller.9. B. packing loan is a L/C based financing which will provide the exporter funds before the goodsare produced.10. If the exporter finds out mistakes on a received L/C, he should contact the B. importer at the firstplace.Chapter 5T 1 .Liner freight has covered the loading and unloading fee.F 2. When the ship-owner speeds up his ship and arrives at the destination at an earlier date than stipulated, he can obtain dispatch money from the charterer.T 3. When the charterer fails to load or unload the goods within the stipulated period of time, he has to pay demurrage to the ship owner.F 4. Ocean bills of lading, air waybills and rail waybills are property documents presenting title to cargoes, so they are all negotiable.T 5. Bills of lading are usually made out in a full set including several originals and copies.F 6. Since straight B/L bears higher risk than the open B/L , it is rarely used in international transportation.F 7. A clean B/L is issued by the seller to the buyer to certify that the goods delivered are in apparent goods condition.F 8. In international trade practice, the time of shipment is actually the time of delivery.T 9. Sometimes when the buyer cannot determine a specific port of discharge during negotiation, he may require two or three ports to be written on the contract as optional ports.T 10. UCP 600 stipulates that partial shipment and transshipment are allowed unless it is stipulated otherwise.Chapter 6F 1. In marine cargo insurance, general average is to be borne by the carrier, who may, upon presentation of evidence of the loss, recover the loss from the insurance underwriter.F 2. In Chinese insurance practice, open policy is the same as the insurance certificate.T 3. Special additional coverages such as war risks, strikes and so on must be taken out together with FPA, WPA or ALL Risks.F 4. In ocean marine insurance, natural calamities include heavy weather, earthquake, tsunami, flood, collision, etc.T 5. The coverage of Land Transportation Risk and Air Transportation Risk are almost equivalent to WPA in marine cargo insurance.F 6. Subrogation Principle states that in the event of loss of or damage to the subject matter insured resulting from an insured peril, the insured is placed in the same position that he enjoyed immediately before the loss occurred.T 7. The 10% markup rate of the commercial invoice value in an insurance policy is to cover an anticipated profit as well as other additional costs involved.T 8. Under a deductible franchise, where the loss or damage exceeds the percentage allowed, the insurance company needs merely indemnify the exceeding part to the insured.F 9. Ocean marine insurance covers ships and their cargo only on the high seas and not on inland waterways.F 10. The claimant is the party who suffers loss of or damage to the subject matter insured byChapter 7F 1. If the remittance is m ade by a banker’s demand draft, this payment is based on bank credit.T 2. For a confirmed credit, the confirming bank holds the same liability as the issuing bank.T 3. A letter of credit which does not indicate whether it is revocable or not is regarded as irrevocable.F 4. A letter of credit not mentioning ti is non-transferable will be seen as transferable.F 5. Using a third currency in collecting payment is the best protection against currency risk for the seller.T 6. Since under L/C the seller gets payment from a party independent of the buyer, it is the safest mode for him.T 7. Open account and payment in advance indicate the minimum and maximum risk for the importer.F 8. Dishonor only refers to the rejection to the presentation for payment, but not rejection to the presentation for acceptance.T 9. Under collection though the seller collects payment through banks, it is not guaranteed that he will receive the money as collection is still based on commercial credit.F 10. In international trade clean collection is more frequently used than documentary collection. Chapter 51. Under what circumstances does the time of shipment equal to the time of delivery?Time of shipment refers to the time limit for loading the goods on board the vessel at the port of shipment while time of delivery refers to the time limit during which the seller shall deliver the goods to the buyer at the agreed place.For all shipment contracts, time of shipment equals to time of delivery, and according to Incoterms 2010, contracts concluded on the basis terms like FOB, CFR, CIF, FCA, CPT, CIP are shipment contracts. Under the shipment contract, the seller fulfills his obligation of delivery when the goods are shipped on board the vessel or delivered to the carrier and the seller only bears all risks prior to shipment.2. What are the functions of a bill of a lading?A cargo receipt, evidence of a contract of carriage, a document of title to the goods.3. What are the main types of bills of lading?·According to whether the goods have been loaded on board the carrying vessel: Shipped B/L and received for shipment B/L·According to the apparent condition of the received cargo: Clean B/L and Unclean B/L,·According to the address of the consignee: Straight B/L, Order B/L and Bear B/L,·According to whether transshipment is involved in transit: Direct B/L and Transshipment B/L, ·According to the perplexity or simplicity of the bill content: Long term B/L and Short term B/L, ·According to the payment condition of freight: Freight prepaid B/L and Freight to be Collected B/L ·According to the validity: Original B/L and Copy B/L·Other forms of bill of lading also exist according to different circumstances: Stale B/L, Ante-dated B/L, Advanced B/L, On-deck B/L.4. What are the ways of dividing charges of loading and unloading in a charter party?·Liner Terms/ Gross Terms or In and out: The ship-owner bears loading and unloading cost.·Free in: The ship-owner is only responsible for unloading cost.·Free out: The ship-owner is only responsible for loading cost.·Free in and out: The ship-owner does not bear loading and unloading cost. OR F. I. O. S. T.: The ship-owner does not bear loading and unloading cost, not even bear the expenses of stowing and trimming.Time of delivery(time of shipment), port (place) of shipment and port (place) of destination, partial shipment, transshipment, or lay days, demurrage and dispatch money.Chapter 61. What are the differences between general average and particular average?Although both general average and particular average belong to the category of partial loss, there is still some differences between them:·Causes: Particular average is a kind of cargo loss usually caused directly by sea perils, while general average is caused by intentional measures taken to save the common interest. ·Indemnification: Particular average is often borne by the party whose cargo is damaged, while general average should be proportionally contributed among all parties benefited from the intentional measures.2. What are the conditions for general average?·The danger that threatens the common safety of cargo and/or vessel shall be materially existent and is not foreseen.·The measures taken by the master shall be aimed to remove the common danger of both vessel and cargo and shall be undertaken deliberately and reasonably for common safety.·The sacrifice shall be specialized and not caused by perils directly and the expense incurred shall be additional expense which is not within the operation budget.·The actions of the ship’s master shall be successful in saving the voyage3. What are the differences between the scope of ICC(B) and ICC(C)?The scope of ICC(C) covers loss of damage to the cargo attributable to fire or explosion, vessel of craft being stranded, grounded, sunk or capsized, overturning or derailment of land conveyance, collision or contract of vessel, craft or conveyance with any external object other than water, or discharge of cargo at a port of distress, general average sacrifice, or jettison.Apart from those covered under ICC(C), the scope of ICC(B) also covers loss of or damage to the subject matter insured attributable to earthquake, volcanic eruption or conveyance, container, liftvan or place of storage, or total loss of any package lost overboard or dropped whilst loading onto or unloading form, vessel or craft.4. What are the risks that are known as general additional coverage1)T.P.N.D(Theft, Pilferage and Non-delivery), 2)Fresh Water Rain Damage, 3)Risk of Shortage,4)Risk of Inter Mixture and Contamination, 5)Risk of Leakage, 6)Risk of Clash and Breakage,7)Risk of Odor, 8)Heating and Sweating Risk, 9)Hook Damage, 10)Risk of Rust, 11)Breakage ofPacking Damage5. What are the main expenses involved in ocean marine insurance? How to define them?Marine cargo insurance also covers the expenses incurred to avoid or reduce the damage to or loss of the subject matter insured. There are mainly two types of expenses. One is Sue and labor expense, the other is salvage charges.Sue and labor expense are extraordinary expenses made in a time of peril by the insured to act to avert, or minimize any loss of or damage to the subject matter insured. Salvage charges are expenses resulting from measures properly taken by a third party other than the insured, his agent, or any person employed by them to preserve maritime property from peril at sea.6. What documents are needed when an insurance claim is made?·Original bill of lading or other transport document·Commercial invoice·Packing list·Certificate of Loss(Survey)·The landing account or weight notes(notes on weight) at destination·Any correspondence with the carrier or any other party who could be responsible for the loss or damage·Master’s protest.Chapter 71. After Bank X advised exporter Y of the L/C, the shipment was made. When the cargo was onthe way, the importer filed for bankruptcy. Is Y out luck of collecting the payment? Can the opening bank refuse to make reimbursement to the negotiating bank? Why or why not?No, exporter Y does not need to worry about the payment. Because the payment is by L/C, the issuing bank is responsible for making payment regardless of the importer’s situation. But the condition is that exporter Y can fulfill all the requirements listed on the L/C. According to UCP600,a credit constitutes a definite undertaking of the opening bank to pay or to pay at maturity in caseof acceptance. Therefore once the stipulated documents are presented to the opening bank and the terms and conditions of the credit are complied with, the opening bank cannot refuse to make reimbursement to the negotiating bank.2. An L/C does not indicate whether it is revocable or not. Is it revocable? Can a revocablecredit be transferable?According to UCP600, if an L/C does not indicate whether it is irrevocable or not, it will beconsidered as irrevocable. And a transferable L/C must be irrevocable.3. After a gullible importer paid Bank C against the seemingly correct shipping documents, hewent to take the delivery, but found out that the goods were inferior counterfeits. Is Bank C liable under UCP600? Can the importer do anything in order to recover the loss?Bank C is not liable in this case because UCP600 stipulates that in credit operations all parties concerned deal with documents, and not with goods, services and/or other performances to which the documents may relate. In order to recover the loss, the importer should rely on the sales contract and seek for solution.4. An exporter, Wu Co., received an L/C issued by Bank B and confirmed by Bank K. After Wushipped the goods, Bank B declared bankruptcy. Will Wu have sleepless nights?No, Wu Co. Does not need to worry about the payment. When the L/C is confirmed, the confirming bank holds the same definite undertaking as the issuing bank to pay or to pay at maturity in case of acceptance.5. Does a payment credit differ from a sight credit?A payment credit could be settled by sight payment or deferred payment. In both cases, a draftdrawn on the issuing bank may not be necessary. While when a sight credit is used, payment would be made immediately against a sight draft and required commercial documents.6. Are the following credits transferable? (A)This L/C assignable; (B)This L/C is transmissible;(C)This L/C is fractionable; (D)This L/C is divisible.According to UCP600, a credit can be transferred only if it is expressly designated as“transferable” by the issuing bank. Terms such as “divisible”, “fractionable”, “assignable”, and “transmissible” do not render the Credit transferable.7. Under an anticipatory credit, the exporter made an advance, but disappeared withoutpresenting the documents as required. Who is liable for repayment of the advance?The special clause is required by the applicant, as a result he has to make repayment of the advances if the beneficiary fails to present documents for settlement.8. Why a back-to-back credit is needed? Give an example.A back-to-back credit is normally used by middleperson for the protection of his interest. Forexample, agent A received a documentary credit from the end buyer B, A can use this credit as a backup to apply for the opening of a new credit in favor of the end supplier C. By doing so A can be sure that neither B nor C would know each other, therefore well protecting A’s businessconfidentiality.9. What is the difference between a back-to-back credit and a transferable credit?When a back-to-back credit is used, there actually involve two credits. When a transferable credit is used, operation is based on only one credit.Chapter 51. The price quoted by an exporter was “USD38 per case FOB Liverpool”. The importerrequested a revised CFR Liverpool price. If the size of each case was 50cm*40cm*30cm, gross weight per case was 40kg, freight basis was W/M and the quotation for London is USD100 per ton of carriage, plus 20% bunker adjustment factor (BAF) and 10% currency adjustment factor (CAF), what would be the CFR price?W=40kg=0.04M/T M=50cm*40cm*30cm=0.5*0.4*0.3=0.06cm3 M>WM will be used as freight basis for freight calculation.Freight per case=M*basic freight*(1+BAF rate)=0.06*100*(1+20%)=USD 7.2Total freight per case=7.2*(1+10%)=USD 7.92CFR=FOB+Freight=38+7.92=USD 45.92The CFR price would be USD 45.92 per case CFR Liverpool2. There is one consignment of 10 cartons of leather shoes, measurement of each carton is50*50*50cm, gross weight of each is 15KG. The air freight are quoted for the flight required is USD1.3KG. How much air freight should be paid to the carrier?W=15kg M= (50*50*50)/6000=20.83kg M>WFreight=USD 1.3/kg*20.83*10 cartons=USD 270.79The air freight is USD 270.793. Suppose: Company A exports 1000 cases of Commodity Y to London. The volume per caseis 40cm x 30cm x 20cm, and the gross weight is 30kg per case. For Commodity Y, the freight rate basis is W/M, and the Freight Tariff (China —London) is USD230, with a 10% port surcharge. How much is the total freight?Total weight: 0.03 M/T*1000 cases=30M/T Total measurement: 0.4x0.3x0.2*1000cases=24M3W > M, “W” is the freight basisTotal Freight=Total weight× Basic Freight Rate×(1+ Surcharge)=30×230×(1+10%)= USD 7590 The total freight cost is USD7590.4. Company A wants to send one consignment to Sydney, Australia. The goods are packed in50 cartons, each weighing 15kgs, with measurement as 50 x 40 x 30cm. The air freight rateis quoted at USD2.00/KG (W/M). How much would the total air freight cost?W: 15 kg M: (50x40x30)/6000=10kg W> M, so W will be adopted for the calculation of air freightAir freight=Total Quantity× Basic Freight Rate=50 cartons×15kg×USD2.00/kg =USD 15005. Suppose the working period at Port X is 8 hours a day and 7 days in a week. If there are four rainy hours unable for loading and unloading in a week, how many standard days are there under the above three methods of stipulation for lay time respectively?Days or Running Days or Consecutive Days=7 days Weather Working Days of 24 Hours=8*7- 4(rainy hours)=52 hours=2 61 days Weather Working Days of 24 Consecutive Hours=7*24-4=164 hours=6 65 days Chapter 611. A Chinese company offered to a British counterpart at USD500 per case FOB Shanghai. The British importer asked the exporter to offer a CIF price. Suppose the freight is USD 50 per case and premium rate is 0.6%, what would the new offer be?CIF=(FOB+F)/(1-110%*R)=(500+50)/(1-110%*0.5%)=USD 533The new offer is USD 533 per case CIF Shanghai.12. Company A transacted with Company B, exporting frozen food under CIF. The total amount of the invoice value was USD 10 000. The premium rate was 0.4% and the goods were insured for FPA with a markup of 10%. Please calculate the insurance amount and insurance premium respectively?Insurance amount=CIF*(1+markup rate)=10 000*110%=USD 1100Insurance premium=CIF insurance amount*insurance rate=1100*0.4%=USD 44The insurance amount and insurance premium are USD 1100 and USD 44 respectively.13. Our exporting company offered light industrial products to a British importer at GBP10 000 per metric ton CIF London (insurance for All Risks with 10% markup and 1% premium rate). However, the importer intended to effect insurance by himself, as a result, he count-offered CFR price. What is the CFR price? How much premium should the exporter need to deduct from the CIF price?CFR=CIF*(1-110%*R)=10 000*(1-110%*1%)=GBP 9890Insurance premium=CIF-CFR=10 000-9890=GBP 110The CFR price is GBP 9890 per metric ton CFR London and the exporter need to deduct GBP 110 from the CIF price as the premium.14. Suppose a cargo vessel loaded with cargo of Party A and Party B stranded in transit. To save the vessel as well as the goods on it, the master ordered to throw 1000 cases of goods to the sea. The value of the goods thrown overboard for Party A is 20% of his goods (the total value of his goods is CNY20000) and that for Party B is 10% of his goods (the total value of his goods is CNY60000). Extra wages for the seamen to perform the act amounted to CNY5000. The value of the vessel is about CNY5000000. Based on the information above what is the G.A. contribution for each party involved?Total GA loss=20000x20%+60000x10%+5000=CNY 15000Total GA contributory value=20 000x 80%+ 60 000x90%+5 000 000+15 000= CNY 5 080 000 GA percentage = (Total GA loss / GA Total Benefit) x 100%=(15 000/5 080 000)x100%=0.295% GA Contribution by Party A=20 000 x 0.295% = CNY 59GA Contribution by Party B=60 000 x 0.295% = CNY 177GA Contribution by the Carrier=5 000 000x0.295% =CNY 1475015. Suppose the CIF invoice value is USD50 000 and goods are insured against All Risks and War Risks with premium rate to be 0.5% and 0.05% respectively. If markup rate is 10%, the insurance premium will be:Insurance Premium (I)=50 000*(1+10%)*(0.5%+0.05%)=55 000*0.0055=USD 302.5Chapter 51. ABC Co. signed a contract to export 200 M/T of beans. The letter of credit stipulated, “Partial shipment not allowed”. When the shipment was being made, the exporter loaded 100 M/T each on board the same vessel for the same voyage at the port of Shanghai and the port of Dalian. The shipment document was clearly marked with the ports of shipment and the dates of shipment. Did the exporter violate the terms of the L/C?析:No, 卖方没有违反信用证“不允许装船” 的规定。

国贸总结及课后题答案

国贸总结及课后题答案第一章3.在只有两种商品的情况下,当一种商品到达均衡时,另一种商品是否也同时到达均衡。

试解释原因。

答:肯定均衡,只有两种商品的情况下,当一种商品到达均衡时,一种生产要素的分配固定,这种商品价格一定,供应一定,需求一定,由生产可能性均衡边界可得,另一种商品也同时到达均衡。

7.如果国防贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答:大国。

在两国贸易时,小国得到的福利比拟明显,而进行贸易后,面对的价格水平不影响自身价格,所以,国际相对价格更接近于大国。

8.根据上一题的答案,你认为哪个国家在国际贸易中的福利改善程度更为明显些?答:小国。

如下图,国际贸易发生后,大国的相对价格更接近封闭状态下的均衡价格,而小国的相对价格与封闭条件下的均衡价格差距比大国要大,贸易后的无差异曲线的位置就越偏上,因此贸易利益也就越大。

第二章5.假设某一国家拥有20000单位的劳动,x,y的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界。

答:由题意可列出生产函数5x+4y=20000所以生产可能性边界为y=5000-5/4x 6.根据上一题的条件,再加上以下几个条件,试确定该图的出口量,并在图中画出贸易三角。

〔1〕X的图标相对价格为答:Pw=2,PA=Px/Py=5/4如下图,△DA’CA贸易三角〔2〕进口为2000个单位,因为Pw=2,所以答:△Y=2000,出口:△X=10007.在图中,过剩供应曲线两端是否有界线?试解释原因。

答:有界限,因为一个国家的供应能力是有限的。

9.试对以下说法加以评价〔1〕由于兴旺国家工资水平高于开展中国家,所以兴旺国家与开展中国家进行贸易会无利可图。

答:错,参与双方都获利,兴旺国家劳动力贵,劳动本钱高,在劳动密集型产品上无优势,其他产品上有优势,仍会获利,贸易是一个双赢的结构。

〔2〕因为美国的工资水平很高,所以美国产品在世界市场上缺乏竞争力。

国贸课后习题答案

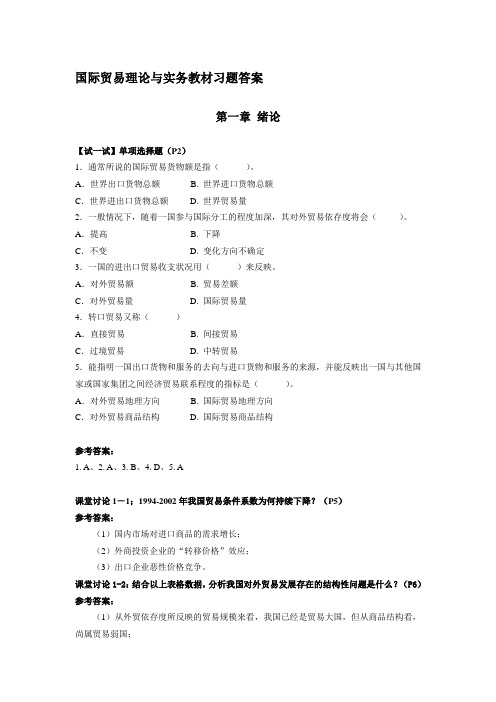

国际贸易理论与实务教材习题答案第一章绪论【试一试】单项选择题(P2)1.通常所说的国际贸易货物额是指()。

A.世界出口货物总额 B. 世界进口货物总额C.世界进出口货物总额 D. 世界贸易量2.一般情况下,随着一国参与国际分工的程度加深,其对外贸易依存度将会()。

A.提高 B. 下降C.不变 D. 变化方向不确定3.一国的进出口贸易收支状况用()来反映。

A.对外贸易额 B. 贸易差额C.对外贸易量 D. 国际贸易量4.转口贸易又称()A.直接贸易 B. 间接贸易C.过境贸易 D. 中转贸易5.能指明一国出口货物和服务的去向与进口货物和服务的来源,并能反映出一国与其他国家或国家集团之间经济贸易联系程度的指标是()。

A.对外贸易地理方向 B. 国际贸易地理方向C.对外贸易商品结构 D. 国际贸易商品结构参考答案:1. A、2. A、3. B、4. D、5. A课堂讨论1-1;1994-2002年我国贸易条件系数为何持续下降?(P5)参考答案:(1)国内市场对进口商品的需求增长;(2)外商投资企业的“转移价格”效应;(3)出口企业恶性价格竞争。

课堂讨论1-2:结合以上表格数据,分析我国对外贸易发展存在的结构性问题是什么?(P6)参考答案:(1)从外贸依存度所反映的贸易规模来看,我国已经是贸易大国,但从商品结构看,尚属贸易弱国;(2)重要资源性商品、关键设备和零部件的外贸依存度过高,存在贸易安全隐患;(3)服装、纺织及家电等产业出口依存度过高;(4)对发达国家市场依赖性过高;(5)贸易条件恶化,我国对国外的供给依赖远远大于国外对我国产品的需求依赖,容易陷入比较优势陷阱;(6)外贸规模增大,但对国内经济的贡献在相对下降。

第二章国际贸易理论【试一试】单项选择题(P12)1.绝对成本理论的代表人物是()。

A.亚当.斯密 B. 大卫.李嘉图C.赫克歇尔 D. 俄林2.在李嘉图的比较成本学说中,国际贸易产生的原因是由于两国的()。

国际贸易课后习题答案

国际贸易课后习题答案国际贸易课后思考题第⼀章1.有⼈认为“全球化是美国经济称霸世界的结果”请对此观点进⾏评论。

全球化包括国际贸易的全球化、国际资本流动的全球化、国际⾦融交易的全球化,但⽆论从贸易还是资本流动还是⾦融交易看,美元都占有绝对主导地位。

从国际货币制度出发分析,尽管布雷顿森林体系已经解体,但是美元作为事实上的国际货币的地位仍旧没有动摇,欧元要想取代美元的地位为时尚早。

因此,美国可以充分利⽤美元国际货币特权带给它的利益:国内储蓄不⾜、发货币弥补;国际贸易逆差,发货币解决。

通过充分发挥货币特权,美国⼏乎可以⽆成本地享受到它国的物质财富,这是其它任何⼀个国家做不到的,所以我认为美国经济称霸世界凭借的就是美元霸权。

2..如何衡量⼀国的“开放度”关于经济开放度的内涵,学术界已经有⽐较⼀致的看法,认为经济"开放度"的内涵有两层:⼀是本国经济以何种⽅式,何种程度,何种代价进⼊世界;⼆是允许别国经济渗透本国经济的⽅式和程度,但在衡量经济开放度的⽅法及指标问题上却存在众多不同的观点.根据现有的研究,衡量经济开放度的⽅法和指标主有:(1)⽤对外贸易⽐率,对外融资⽐率和对外投资⽐率来衡量经济开放度 (2)采⽤国际收⽀⾃主性交易项⽬的借⽅余额和贷⽅余额占GDP 的⽐重来反映经济对外开放程度.(3)⽤外贸依要存度,价格差异,实际关税率以及外汇市场扭曲度等指标测算贸易开放度 (4)开放度包括数量开放度和价格开放度,数量开放度是衡量资本流动对⼀国经济总量规模的影响程度,价格开放度是指⼀国经济活动与国外经济活动在价格上的关联程度 (5)贸易开放度和⾦融开放度综合起来才是⼀国经济的总量开放度 (6)从考察⼀国经济体制的开放性来判断经济的开放度,关税税率和⾮关税壁垒覆盖率是⼈们使⽤频率最⾼的指标 (7)以⼀国国内市场价格与国际市场价格相⽐的扭曲,或者名义汇率与实际汇率的差异程度来评估⼀国经济的开放度3.1985:世界贸易量=19586.75×113=2213302.75 亿美元1990:世界贸易量=34861.40×152=5298932.8 亿美元1995:世界贸易量=50751.25×199=10099498.75 亿美元4. 对于经济全球化的利弊得失问题,我认为既不能⼀般地赞成或反对全球化利⼤于弊的论断,也不能⼀般地赞成或反对全球化利⼩于弊的论断。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第二章世界贸易概览1、引力模型的作用:引力模型不仅能够解释两国间贸易量的大小,而且能够说明在当今经济全球化中仍然制约国际贸易发展的障碍因素。

2、国内生产总值(gross domestic product—GDP)——全部最终产品和服务的市场价值之和。

亦可等于对该国所生产产品和服务的购买支出之和。

3、引力模型产生的基础是:现实充分说明一国的经济规模与其进出口总额息息相关。

4、国际贸易的引力模型是指,在其他条件不变的情况下,两国间的贸易规模和两国的GDP 成正比,与两国间的距离成反比。

其方程式为:T ij=A*Y i*(Y j/D ij) 其中,A是常量,T ij是i国与j国间的贸易额,Y i是i国的国内生产总值,Y j是j国的国内生产总值,D ij是两国间的距离。

5、引力模型的内在逻辑,即其有效的原因:广义的讲,大的经济体由于收入高,因而大量进口产品。

同时,由于大的经济体可以生产更多品种的系列产品,因而更能满足其他国家的需求,进而大量出口产品。

(在两国贸易中,任一方的经济规模越大,则双方的贸易量就越大。

)6、引力模型的重要用途之一就是有助于明确国际贸易中的异常现象。

文化的亲和性、地理位置、运输成本等都会影响贸易规模。

7、所有估计出来的引力模型都表明两国距离对贸易有负的效应。

典型的估计是两国距离每增加1%,则两国的贸易量要降低0.7%~1%。

下降幅度部分地体现为产品和服务运输成本增加的幅度。

8、在各国GDP和距离给定的情况下,有效贸易协定(trade agreement)比无效的贸易协定更能显著增加成员国的贸易量。

贸易协定虽然可以消除成员方间的贸易壁垒,但是对各国国界几乎没有任何影响。

最近的经济学研究成果表明,即便产品和服务可以免关税和无限制地进入疆界,在一个国家内部各地区之间产生的贸易量也要比在同样条件下国家之间产生的贸易量大。

9、服务外包(service outsourcing),亦称为离岸服务,是指曾经必须在一国国内实现的服务现在可以在国外实现。

10、国际贸易的主要内容:工业制成品,如汽车、计算机、服装等;矿产品,包括从铜矿砂到煤炭各种产品,如石油;农产品,如小麦、大豆、棉花等;服务出口,包括传统的运费、保费和旅游收入(运费由航空公司和船舶公司收取,保费由国外客商支付,旅游收入由国外游客提供。

);服务贸易、电子传输等。

本章重点习题(P23~24)1、加拿大和澳大利亚都是英语国家,两国的人口规模也相差不太大(加拿大多60%),但是相对各自GDP而言,加拿大的贸易额是澳大利亚的两倍。

为什么会如此?根据引力模型,我们可以看到,两国间贸易量的大小不仅与两国的GDP相关,同时两国间的距离也是关键因素。

澳大利亚由于地处偏远而面临着成本相对较高的运输进出口贸易,从而减少贸易的吸引力。

加拿大的边界有一个大型经济体——美国,而澳大利亚附近没有主要经济体,这使得加拿大的经济更加开放而澳大利亚的经济就相对独立。

2、墨西哥和巴西各自的贸易伙伴不同。

墨西哥主要与美国贸易,巴西与美国和欧盟的贸易量大致相当。

墨西哥的贸易量相对其GDP而言很大。

用引力模型解释这种现象。

墨西哥在地理上相当接近美国,但却远离欧盟,这就导致了墨西哥主要与美国贸易。

巴西在地理上与这两个经济体的距离相当,所以它与这两个经济体间的贸易量是大致均分的。

墨西哥的贸易量比巴西的大,部分原因是因为墨西哥接近一个主要经济体——美国,另一部分原因则是墨西哥是它是一个庞大的经济自由贸易协定(NAFTA)的成员。

巴西是远离任何大型经济体,并且它是一个与相对较小的国家组成的经济自由贸易协定的成员。

第三章劳动生产率和比较优势:李嘉图模型1、各国参与国际贸易的基本原因有两个,这两个原因都有助于各国从贸易中获益。

第一,进行贸易的各个国家之间存在着千差万别。

第二,国家之间通过贸易能达到生产的规模经济,即如果每个国家只生产一种或少数几种产品,就能进行大规模生产,达到规模经济。

2、工资体现了劳动生产率,贸易规模体现了相对劳动生产率。

国际贸易使得世界产出增长的原因在于:它允许每个国家专门生产自己有比较优势的产品。

3、机会成本(opportunity cost),一种资源(如资金或劳力等)用于本项目而放弃用于其他机会时,所可能损失的利益。

4、比较优势(comparative advantage),是指一个国家在本国生产一种产品的机会成本(用其他产品来衡量)低于在其他国家生产该种产品的机会成本时,这个国家在生产该种产品上拥有的优势。

5、李嘉图模型(Ricardian model)——国际间劳动生产率的不同是国际贸易的唯一决定因素。

6、单位产品劳动投入(unit labor requirement),是指生产每一单位的产品所需要投入的劳动小时数。

7、生产可能性边界(production possibility frontier),图中一般表示为直线PF,表示经济社会在既定资源和技术条件下所能生产的各种商品最大数量的组合,反映了产品替代的情况。

其斜率的绝对值等于该机会成本。

8、绝对优势(absolute advantage),是指若一个国家能够以少于其他国家的劳动投入生产出同样单位的商品,则该国在生产这种商品上具有的优势。

9、局部均衡分析(partial equilibrium analysis),是假定在其他条件不变的情况下来分析某一时间、某一市场的某种商品(或生产要素)供给与需求达到均衡时的价格决定。

10、一般均衡分析(general equilibrium analysis),是在分析某种商品的价格决定时,在各种商品和生产要素的供给、需求、价格相互影响的条件下来分析所有商品和生产要素的供给和需求同时达到均衡时所有商品的价格如何被决定。

11、相对需求曲线(relative demand curve),图中一般表示为曲线RD,是指是在消费者的收入、偏好及其他商品的价格不变情况下,某种商品的相对需求量与相对价格之间的数量关系。

12、相对供给曲线(relative supply curve),图中一般表示为曲线RS,是指是在消费者的收入、偏好及其他商品的价格不变情况下,某种商品的相对供给量与相对价格之间的数量关系。

13、世界均衡相对价格有曲线RD和曲线RS的交点确定。

曲线RS呈阶梯型,曲线RD呈下降趋势反映了替代效应。

一般来说,国际贸易的结果是,一种贸易产品对另一种贸易产品的相对价格停留在贸易前两国的相对价格之间。

14、贸易所得(gains from trade),是指国家通过行业间相对劳动生产率不同的国家在不同的产品生产中进行专业化分工而获得的利益。

15、相对工资(relative wage),是指该国工人每小时的工资与外国工人每小时的工资的比值。

16、一个部门的比较优势不仅取决于该部门相对于其他国家同一部门的劳动生产率,也取决于本国相对于外国的工资率,而一个国家的工资率又取决于其他产业部门的相对劳动生产率。

17、贫民劳动论(pauper labor argument),是指如果来自外国的竞争建立在低工资的基础上,那么这种竞争就是不公平的,而且会损害其他参与竞争的国家。

本章重点习题(P49~50)1、本国共有1200单位的劳动,能生产两种产品:苹果和香蕉。

苹果的单位产品劳动投入是3,香蕉的单位产品劳动投入是2。

a.画出本国的生产可能性边界。

b.用香蕉衡量的苹果的机会成本是多少?c.贸易前,苹果对橡胶的相对价格是多少?为什么?a.当所有劳动用于生产苹果时,苹果的产量=劳动总供给/苹果的单位产品劳动投入=1200/3=400;当所有劳动用于生产香蕉时,香蕉的产量=劳动总供给/香蕉的单位产品劳动投入=1200/2=600边界如下所示:b. P a /P b =a La 1.5。

它表示需要三个单位的劳动收获苹果,但只需要两个单位的劳动收获香蕉。

如果一个人放弃收获苹果,这释放了三个单位的劳动,这3个单位的劳动可以被用来收获1.5个香蕉。

c. 劳动力流动确保每个部门拥有共同的工资和竞争确保商品的价格等于其生产成本。

因此,相对价格等于相对成本,它等于苹果的单位产品劳动投入的工资除以香蕉的单位产品劳动投入的工资。

由于假设各部门的工资都是一致的,所以价格比的比值等于单位产品劳动投入的比值,即苹果对香蕉的相对价格是3/2=1.5。

2、本国的情况与第1题相同。

外国拥有800单位的劳动。

外国苹果的单位产品劳动投入是5,香蕉的单位产品劳动投入是1。

a.画出国外的生产可能性边界。

b.画出世界相对供给曲线。

a.当所有劳动用于生产苹果时,苹果的产量=劳动总供给/苹果的单位产品劳动投入=800/5=160;当所有劳动用于生产香蕉时,香蕉的产量=劳动总供给/香蕉的单位产品劳动投入=800/1=800;以香蕉的产量为纵轴,以苹果的产量为横纵,可画出国外的生产可能性边界如下所示:b.世界相对供给曲线是由确定苹果供应相对于香蕉供应的每个相对价格。

最低的相对价格是用本国的单位产品劳动投入进行计算,即a La /a Lb =3/2=1.5。

在这个价格,相对供给曲线是平的。

最高的相对价格是用国外的单位产品劳动投入进行计算,即a L *a /a L *b =5/1=5。

当苹果的相对价格位于最高和最低相对价格之间时,苹果的相对供应量(L/a La )/(L */a L *b )=(1200/3)/(800/1)=0.5。

以苹果的相对价格为纵轴,相对产量为横轴,可得世界相对供给曲线如下图所示:3、假定世界相对需求的表示如下:对苹果的需求/对香蕉的需求=香蕉价格/苹果价格。

a.在相对供给曲线的同一张图上画出世界相对需求曲线。

b.苹果的均衡相对价格是多少?c.描述本题的贸易模式。

d.说明本国和外国都可以从贸易中获利。

a.由题目可得,相对需求曲线包括点(0.2,5),(0.5,2),(1,1),(2,0.5)b.苹果的均衡相对价格由相对供给和相对需求曲线的交点决定,而在这里,这个交点是(0.5,2),所以苹果的均衡相对价格是2。

c.本题的贸易模式是本国只生产苹果,国外只生产香蕉,然后每个国家都用自己的产品去交换对方的产品,从而进行贸易。

d.在没有贸易的时候,由上述情况可以知道,本国的两个苹果可以获得三个香蕉,而国外的五个香蕉可以获得一个苹果。

贸易允许每个国家用两个香蕉去换一个苹果。

由上述情况中,本国可以用两个苹果去换四个香蕉,而国外可以用两个香蕉去换一个苹果。

每个国家都更好地去权衡贸易。

4、假定本国现有2400名工人而不是1200名,求新的均衡价格。

请评论在这种情况下世界的生产效率和两国之间贸易所得的分配。

本国工人人数的增加使相对供应曲线移出导致其转折点由(0.5,1.5)和(0.5,5)变成了(1,1.5)和(1,5)。