财务管理ppt英文课件Cha(9)

合集下载

英文财务管理.2021完整版PPT

5- 12

Manhattan Island Sale

Peter Minuit bought Manhattan Island for $24 in 1626. Was this a good deal?

To answer, determine $24 is worth in the year 2008, compounded at 8%.

Interest Earned Per Year =Prior Year Balance x .06

5- 7

Future Values

Example - Compound Interest

Interest earned at a rate of 6% for five years on the previous year’s balance.

After 3 years: FV3 = PV ( 1 + i )3 = $100 (1.10)3 =$133.10

After n years (general case): FVn = PV ( 1 + i )n

5- 10

Future Values

FV$100(1r)t

Example - FV What is the future value of $100 if interest is compounded annually at a rate of 6% for five years?

Today

Interest Earned

Value

100

Future Years

1

2345

6 6.36 6.74 7.15 7.57

106 112.36 119.10 126.25 133.82

财务管理英文课件

Early 20th century:

Concentrated on reporting to outsiders.

Early 21st century:

Insiders managing and controlling

the firm’s financial operations.

Copyright © 2003 Pearson Education Australia Pty Limited

• Interest in these topics grew and in turn spurred interest in security analysis, portfolio theory and caopyright © 2003 Pearson Education Australia Pty Limited

Slide: 1 - 7

Chief accountant is also called financial controller, whose responsibilities include financial reporting to outsiders as well as cost and managerial accounting and financial analysis on behalf of the firm’s managers.

Copyright © 2003 Pearson Education Australia Pty Limited

Slide: 1 - 5

• Capital budgeting became a major topic in finance.

• This led to an increased interest in related topics, most notably firm valuation.

财务专业英语ppt课件

E1-2 Divide into groups as instructed by your professor and discuss the following:

a. How does the description of accounting as the "language of business" relate to accounting as being useful for investors and creditors?

a. Information used to determine which products to produce. b. Information about economic resources, claims to those resources,

and changes in both resources and claims. c. Information that is useful in assessing the amount, timing, and

•Definition of Accounting: business language information system basis for decisions

•Types of Accounting Information: (1)Financial Accounting: •Internal users

篮球比赛是根据运动队在规定的比赛 时间里 得分多 少来决 定胜负 的,因 此,篮 球比赛 的计时 计分系 统是一 种得分 类型的 系统

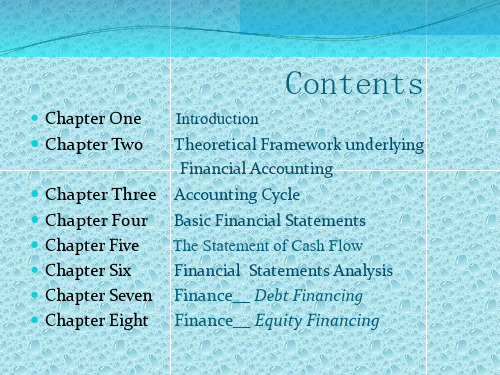

Contents

Chapter One

Chapter Two

Chapter Three Chapter Four

a. How does the description of accounting as the "language of business" relate to accounting as being useful for investors and creditors?

a. Information used to determine which products to produce. b. Information about economic resources, claims to those resources,

and changes in both resources and claims. c. Information that is useful in assessing the amount, timing, and

•Definition of Accounting: business language information system basis for decisions

•Types of Accounting Information: (1)Financial Accounting: •Internal users

篮球比赛是根据运动队在规定的比赛 时间里 得分多 少来决 定胜负 的,因 此,篮 球比赛 的计时 计分系 统是一 种得分 类型的 系统

Contents

Chapter One

Chapter Two

Chapter Three Chapter Four

财务管理英文课件

Copyright © 2003 Pearson Education Australia Pty Limited

Slide: 1 - 5

• Capital budgeting became a major topic in finance.

• This led to an increased interest in related topics, most notably firm valuation.

The more risk the firm is willing to assume, the higher the expected return from a given course of action.

Copyright © 2003 Pearson Education Australia Pty Limited

chapter 1 & 3 Scope and environment of

financial management

Copyright © 2003 Pearson Education Australia Pty Limited

Slide: 1 - 1

Development of Financial Management

Copyright © 2003 Pearson Education Australia Pty Limited

Slide: 1 - 10

Shareholder wealth maximisation?

Same as:

1. Maximising firm value 2. Maximising share values

Slide: 1 - 16

Risk and Returns

财务管理专业英语PPT课件

2020/2/21

山东轻工业学院商学院

9

1)Account、Accounting & Accountant

Accountant:会计师、会计人员 Certified Public Accountant 注册会计师(CPA)

2020/2/21

山东轻工业学院商学院

10

2)Assets、Liabilities & Owner’s Equity

2020/2/21

山东轻工业学院商学院

16

Cash

$50,000 Current liabilities (4)

Accounts receivable 50,000 Long-term debt

(5)

Inventory

(1)

Shareholders’ equity (6)

Plant and equipment

10% Total assets turnover = 2 times Sales = $2 million Debt ratio = 50%

9. Capital Structure 资本结构

10. Dividend Policy 股利政策

11. Working Capital Management 营运资本管理

2020/2/21

山东轻工业学院商学院

5

一、Contents—内容

12. International Financial Management 国际财务管理

会计科目;账户

2020/2/21

山东轻工业学院商学院

8

1)Account、Accounting & Accountant

Accounting:会计、会计学 Financial Accounting and Managerial Accounting are two major specialized fields in Accounting. 财务会计和管理会计是会 计的两个主要的专门领域。 Accounting elements 会计要素

财务管理英文版166页PPT文档

Basket Wonders Statement of Earnings (in thousands) for Year Ending December 31, 2019a

Ⅰ.Primary Types of Financial Statements

Balance Sheet

A summary of a firm’s financial position on a given date that shows total assets = total liabilities + owners’ equity.

Examples of External Uses of Statement Analysis

Trade Creditors -- Focus on the liquidity of the firm. Bondholders -- Focus on the long-term cash flow of

Basket Wonders Balance Sheet (thousands) Dec. 31, 2019a

Cash and C.E.

$

a. How the firm stands on

90 Acct. Rec.c

a specific date.

394 Inventories

b. What BW owned.

16

Other Accrued Liab. d 100

Current Liab. e $ 500

Long-Term Debt f

530

Shareholders’ Equity

Com. Stock ($1 par) g

200

Add Pd in Capital g

财务管理学及财务知识分析(英文版)(PPT 31页)

= 7.0% + (6.0%)1.2 = 14.2%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 17

What’s the DCF cost of common equity, ks? Given: D0 = $4.19; P0 = $50; g = 5%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 14

Opportunity cost: The return stockholders could earn on alternative investments of equal risk.

Use this formula: kpD P p p$1 $1 1 .1 0 1 00.09 9 0 .0%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 8

Picture of Preferred Stock

0

kp = ?

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 16

What’s the cost of common equity based on the CAPM?

kRF = 7%, RPM = 6%, b = 1.2.

ks = kRF + (kM – kRF )b.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 17

What’s the DCF cost of common equity, ks? Given: D0 = $4.19; P0 = $50; g = 5%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 14

Opportunity cost: The return stockholders could earn on alternative investments of equal risk.

Use this formula: kpD P p p$1 $1 1 .1 0 1 00.09 9 0 .0%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 8

Picture of Preferred Stock

0

kp = ?

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 16

What’s the cost of common equity based on the CAPM?

kRF = 7%, RPM = 6%, b = 1.2.

ks = kRF + (kM – kRF )b.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

财务管理英文课件 (9)

9-1

CHAPTER 9

Stocks and Their Valuation

nFeatures of common stock nDetermining common stock

values nEfficient markets nPreferred stock

Copyright © 2001 by Harcourt, Inc.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

9-5

When is a stock sale an initial public offering (IPO)?

A firm “goes public” through an IPO when the stock is first offered to the public.

nCould classify existing stock as founders’ shares, with voting rights but dividend restrictions.

nNew shares might be called “Class A” shares, with voting restrictions but full dividend rights.

All rights reserved.

9-2

Facts about Common Stock

nRepresents ownership. nOwnership implies control. nStockholders elect directors. nDirectors elect management. nManagement’s goal: Maximize

CHAPTER 9

Stocks and Their Valuation

nFeatures of common stock nDetermining common stock

values nEfficient markets nPreferred stock

Copyright © 2001 by Harcourt, Inc.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

9-5

When is a stock sale an initial public offering (IPO)?

A firm “goes public” through an IPO when the stock is first offered to the public.

nCould classify existing stock as founders’ shares, with voting rights but dividend restrictions.

nNew shares might be called “Class A” shares, with voting restrictions but full dividend rights.

All rights reserved.

9-2

Facts about Common Stock

nRepresents ownership. nOwnership implies control. nStockholders elect directors. nDirectors elect management. nManagement’s goal: Maximize

《财务管理》全套PPT课件

企业并购与重组中的财务管理问题

企业并购的动因与财务分析

阐述企业并购的驱动因素,如协同效应、市场份额扩张等,并分析 并购过程中的财务分析要点。

企业重组的财务策略与实施

探讨企业在重组过程中可采取的财务策略,如资产剥离、债务重组 等,并分析其实施步骤与注意事项。

并购与重组中的财务风险防范

分析企业在并购与重组过程中可能面临的财务风险,如估值风险、 融资风险等,并提出相应的防范措施。

资本成本与资本结构

01

02

03

资本成本

包括筹资费用和用资费用 ,反映企业为筹集和使用 资金而付出的代价。

资本结构

指企业各种资本的构成及 其比例关系,包括债务资 本和权益资本的构成。

最优资本结构

在风险可控的情况下,使 得企业加权平均资本成本 最低,企业价值最大的资 本结构。

杠杆效应与风险控制

杠杆效应

有价证券管理

根据企业的投资目标和风险承受能力,选择适当的有价证券进行投资 ,实现资金的保值增值。

应收账款与存货管理

应收账款管理

制定信用政策,评估客户信用状 况,加强应收账款的催收工作, 减少坏账损失。

存货管理

建立科学的存货管理制度,合理 确定存货规模和结构,采用先进 的存货控制方法,降低存货成本 。

流动性分析

计算流动比率和速动比率等指标,评估企业短期偿债能力。

长期偿债能力分析

运用资产负债率、产权比率等指标,衡量企业长期偿债能力和财 务风险。

利润表分析

收入分析

分析企业主营业务收入、其他业 务收入及投资收益等收入来源, 评估企业盈利能力。

成本费用分析

研究企业营业成本、期间费用等 支出情况,揭示企业成本控制能 力和经营效率。

财务管理英文课件

利润分配原则: 公平、公正、公 开

利润分配方式: 现金分红、股票 分红、实物分红 等

利润分配比例: 根据公司经营状 况、股东权益等 因素确定

利润分配时间: 根据公司财务状 况和股东需求确 定

财务预算

预算编制:根据公司战略和经营计划,制定财务预算 预算内容:包括收入、成本、费用、利润等各项财务指标 预算执行:按照预算执行,确保各项财务指标的实现 预算调整:根据实际情况,对预算进行调整,确保预算的准确性和可行性

社会环境:社会文化、价值观等 对企业财务管理的影响

添加标题

添加标题

添加标题

添加标题

法律环境:企业财务管理的法律 框架和规定

技术环境:新技术对企业财务管 理的影响,如云计算、大数据等

财务决策制定

投资决策

投资目标:确定 投资目标,如收 益最大化、风险 最小化等

投资策略:选择 合适的投资策略, 如分散投资、长 期投资等

财务分析

财务比率分析

流动比率:衡量企业短期偿债能力

权益乘数:衡量企业财务杠杆水平

速动比率:衡量企业立即偿债能力 资产负债率:衡量企业长期偿债能力

利息保障倍数:衡量企业偿付利息能 力

现金流量比率:衡量企业现金流量状 况

财务趋势分析

趋势分析的定义和目的 趋势分析的方法和工具 趋势分析的步骤和流程 趋势分析的应用和案例

财务管理基础知识

财务管理的概念

财务管理是组织 对资金、资产、 负债、收入、支 出等财务活动的 管理

财务管理的目标 是实现企业价值 最大化

财务管理的内容 包括财务计划、 财务控制、财务 决策、财务分析 等

财务管理的原则 包括成本效益原 则、风险控制原 则、信息透明原 则等

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

精选课件

3

Payback Period

PP is the period of time required for the cumulative expected cash flows from an investment project to equal the initial cash outflow.

3

1,039

4

1,244

Discounted payback period is just under 3 years

精选课件

10

Ordinary & Discounted Payback

Cash Flow

Year Undiscounted Discounted

1

$100

$89

2

100

79

3

100

Assume the project is independent of any other potential projects undertook.

Independent -- A project whose acceptance (or rejection) does not prevent the acceptance of other projects under consideriod Illustrated (con.)

Initial outlay -$1 000

Year

1 2 3

Cash flow

$200 400 600

Year

1 2 3

Accumulated Cash flow

$200 600

1 200

Payback period = 2+400/600= 2 2/3 years

精选课件

7

Disadvantages of Payback Period

Time value of money and risk ignored. Ad hoc determination of acceptable payback period. Ignores cash flows beyond the cut-off date. Biased against long-term and new projects.

精选课件

1

Project Evaluation: Alternative Methods

Payback Period (PP)

Internal Rate of Return (IRR)

Net Present Value (NPV)

Profitability Index (PI)

精选课件

2

Independent Project

Chapter 13

Capital Budgeting Techniques

Chapter Objectives

Discuss the various investment evaluation techniques, including their advantages and disadvantages.

Example

Year 1 2 3 4

Cash flow $ 200

400 700 300

Initial outlay -$1,000 R = 10%

PV of Cash flow $ 182

331

526

205

Accumulated

Year

discounted cash flow

1

$ 182

2

513

70

4

100

Apply these techniques to the evaluation of projects.

Interpret the results of the application of these techniques in accordance with their respective decision rules.

精选课件

8

Discounted Payback Period

Defined as the time it takes to recover the initial cash outlay (IO) on a present value basis

Compute the present value of each cash flow and then determine how long it takes to payback on a discounted basis

精选课件

4

Payback Period Illustrated

Initial outlay -$1 000

Year

1 2 3

Cash flow

$400 400 400

Year

1 2 3

Accumulated Cash flow

$400 800

1 200

Payback period =1000/400 = 2.5years

精选课件

6

Advantages of Payback Period

No need for detailed analysis. Simple to calculate and understand. Adjusts for uncertainty of later cash flows. Biased towards liquidity.

Computation

➢ Estimate the cash flows ➢ Subtract the future cash flows from the initial cost until

the initial investment has been recovered

Decision Rule – Accept if the payback period is less than some preset limit

Compare to a specified required period Decision Rule - Accept the project if it pays

back on a discounted basis within the specified time

精选课件

9

Discounted Payback