simtrade进出口预算[1]

Simtrade进出口预算表计算器

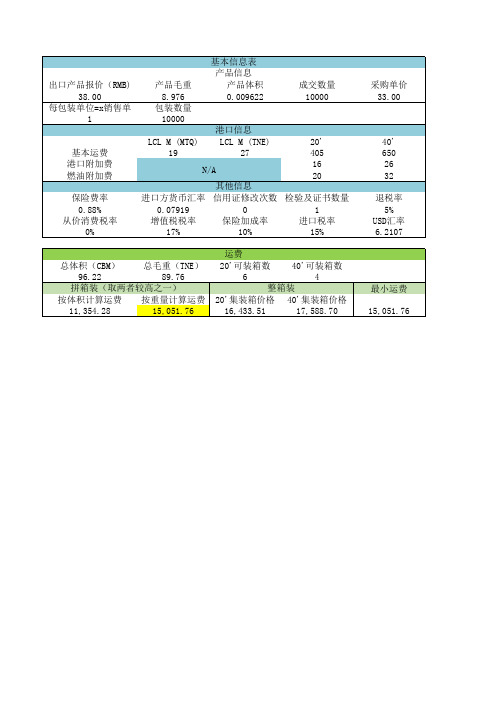

6

4

整箱装

20'集装箱价格 40'集装箱价格

16,433.51

17,588.70

采购单价 33.00

40' 650 26 32 退税率 5% USD汇率 6.2107

最小运费 15,051.76

工厂报价

项目

预算金额(RMB)

单位生产成本

25.60

生产总成本

256,000.00

预估报价

33.00

内合同金额

330,000.00

增值税

47,948.72

消费税

0.00

公司综合费用

16,500.00

利润

9,551.28

出口预算表

项目

预算金额(RMB)

合同金额

380,001.13

采购成本

330,000.00

FOB总价

361,270.98

内陆运费

5,773.20

报检费

200.00

报关费

200.00

海运费

15,051.76

保险费

3,678.40

核销费

10.00

银行费用

694.00

其他费用

19,200.06

退税收入

14,102.56

利润

19,296.28

进口预算表

项目

预算金额(JPY)合同Βιβλιοθήκη 额4,798,600.00

CIF总价

4,798,600.00

内陆运费

72,903.14

报检费

2,525.57

报关费

2,525.57

16 20

其他信息

进口方货币汇率 信用证修改次数 检验及证书数量

simtrade 计算

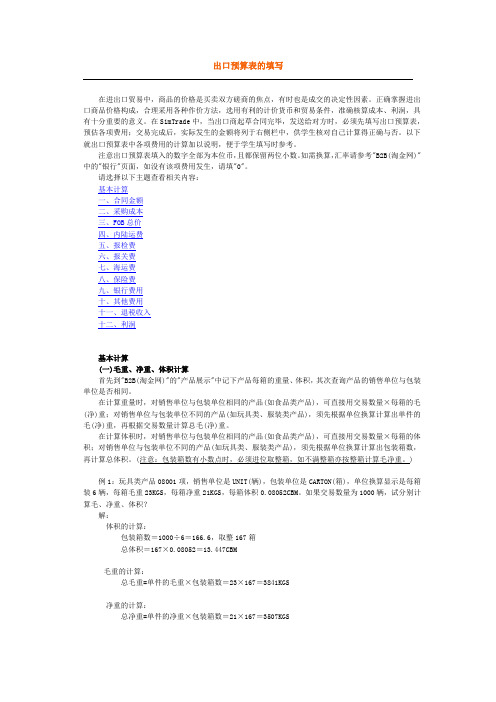

出口预算表的填写在进出口贸易中,商品的价格是买卖双方磋商的焦点,有时也是成交的决定性因素。

正确掌握进出口商品价格构成,合理采用各种作价方法,选用有利的计价货币和贸易条件,准确核算成本、利润,具有十分重要的意义。

在SimTrade中,当出口商起草合同完毕,发送给对方时,必须先填写出口预算表,预估各项费用;交易完成后,实际发生的金额将列于右侧栏中,供学生核对自己计算得正确与否。

以下就出口预算表中各项费用的计算加以说明,便于学生填写时参考。

注意出口预算表填入的数字全部为本位币,且都保留两位小数。

如需换算,汇率请参考"B2B(淘金网)"中的"银行"页面,如没有该项费用发生,请填"0"。

请选择以下主题查看相关内容:基本计算一、合同金额二、采购成本三、FOB总价四、内陆运费五、报检费六、报关费七、海运费八、保险费九、银行费用十、其他费用十一、退税收入十二、利润基本计算(一)毛重、净重、体积计算首先到"B2B(淘金网)"的"产品展示"中记下产品每箱的重量、体积,其次查询产品的销售单位与包装单位是否相同。

在计算重量时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的毛(净)重;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出单件的毛(净)重,再根据交易数量计算总毛(净)重。

在计算体积时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的体积;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出包装箱数,再计算总体积。

(注意:包装箱数有小数点时,必须进位取整箱,如不满整箱亦按整箱计算毛净重。

)例1:玩具类产品08001项,销售单位是UNIT(辆),包装单位是CARTON(箱),单位换算显示是每箱装6辆,每箱毛重23KGS,每箱净重21KGS,每箱体积0.08052CBM。

simtrade进出口预算

进出口预算的编制流程

确定预算目标

根据企业战略规划和实际情况, 确定进出口业务预算的目标。

编制具体预算

根据收集的信息和确定的预算目 标,编制具体的进出口预算,包 括规模、结构、成本、收益等方 面的预算。

审核与调整

对编制的预算进行审核和调整, 确保预算的科学性和可行性。

收集信息

收集国内外市场信息、政策法规、 行业动态等相关信息,为编制预 算提供依据。

优化资源配置

通过对预算的优化配置,提高资源利用效率和 企业的盈利能力。

动态调整策略

根据市场变化和企业发展需要,动态调整进出口预算策略。

预算效果评估和反馈

效果评估

对进出口预算的实施效果进行评估,分析预算的合理性和有效性。

反馈机制

建立有效的反馈机制,收集业务部门对预算的意见和建议,不断完 善和改进预算方案。

持续改进

根据预算效果评估和反馈结果,持续优化进出口预算方案,提高预 算管理水平。

THANKS FOR WATCHING

感谢您的观看

运输成本

根据运输方式、距离和数量计算,包括国内运输和国际运输费用。

出口运营成本

营销费用

包括广告宣传、展览、促销活动等费用,用 于提高产品知名度和市场占有率。

保险费用

为出口商品购买保险,以降低运输途中的风 险和损失。

报关费用

办理出口报关手续所需的费用,包括报关代 理费、关税、增值税等。

售后服务费用

提供维口预算

目 录

• 进出口预算概述 • 进口预算 • 出口预算 • 进出口预算的执行与监控

01 进出口预算概述

进出口预算的定义

进出口预算是对企业进出口业务进行 预测和规划的过程,包括对未来一段 时间内的进出口规模、结构、成本和 收益等方面的预测和计划。

simtrade(5.0进出口预算表)

公司综合费用

0

0

8

增值税

23.24786325

5

业务费用(从价)

业务费用(从量)

31.24786325

31.24786325

单位税后生产成本(从价)

单位税后生产成本(从量)

单位生产成本(取最大值)

103.8478632

103.8478632

103.8478632

(内)合同金额(真实)

工厂产成本

960000 工厂利润 336912.8205

进口商出售价 363.873202

第二步:确定工厂售价

商品信息(填写)

出口商采购价

件数(每1包装)

(内)合同金额(算税用)

4

160

6

160

工厂生产成本

算真实单位成本用(勿改)

真实销售数量

2

72.6

1

6000

增值税率

消费税率

消费税单位税额度

17.00%

0.00%

0.00%

税率(可得)

从价商品消费税

从量商品消费税

定价估算

第一步(估算工厂售价-与出口商)

进口商出售(USD/销售)

1USD=CNY

1

43.01

8.4602

3 大概

进口商出售(CNY/销售) 363.873202

利润空间(CNY.销售单位) 291.273202 除以三 97.09106733 工厂出售价 169.6910673

出口商出售价 266.7821347

星

623087.1795 出口商利润估计

424217.2979

进口商利润估计 488460.0309

使用流程 1 2 3

SimTrade出口预算表的填写

出口交易中,采用CFR、CIF贸易术语成交的条件下,出口商需核算海运费。如为FOB方式,则此栏填"0"。

在出口交易中,集装箱类型的选用,货物的装箱方法对于出口商减少运费开支起着很大的作用。集装箱的尺码、重量,货物在集装箱内的配装、排放以及堆栈都有一定的讲究,需要在实践中摸索。

(一)运费计算的基础

解:每20'集装箱:

按体积算可装箱数=25÷0.025736=971.402

按重量算可装箱数=17.5÷20.196×1000=866.51

取两者中较小的值,因此最大可装箱数取整866箱

由于销售单位与包装单位相同,该商品的报价数量为866箱。

B 拼箱装:由船方以能收取较高运价为准,运价表上常注记M/W或R/T,表示船公司将就货品的重量吨或体积吨二者中择其运费较高者计算。

拼箱装时计算运费的单位为:

1. 重量吨(Weight Ton):按货物总毛重,以一公吨(1 TNE=1000KGM)为一个运费吨;

2. 体积吨(Measurement Ton):按货物总毛体积,以一立方公尺(1 Cubic Meter;简称1MTQ或1CBM或1CUM;又称一才积吨)为一个运费吨。

运费单位(Freight Unit),是指船公司用以计算运费的基本单位。由于货物种类繁多,打包情况不同,装运方式有别,计算运费标准不一。

A 整箱装:以集装箱为运费的单位,在SimTrade中有20'集装箱与40'集装箱两种。20'集装箱的有效容积为25CBM,限重17.5TNE,40'集装箱的有效容积为55CBM,限重26TNE,其中1TNE=1000KGS;

在计算重量时,对销售单位与包装单位相同的产品(如食品类产品),可直接用交易数量×每箱的毛(净)重;对销售单位与包装单位不同的产品(如玩具类、服装类产品),须先根据单位换算计算出单件的毛(净)重,再根据交易数量计算总毛(净)重。

进出口价格预算案例

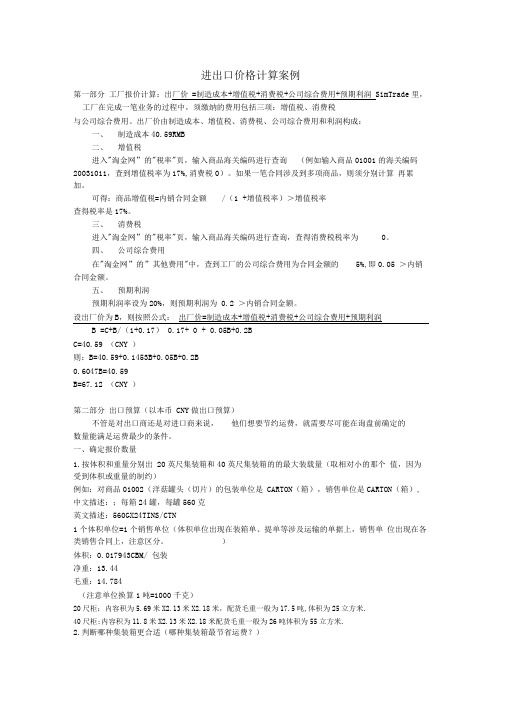

进出口价格计算案例第一部分工厂报价计算:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润SimTrade里,工厂在完成一笔业务的过程中,须缴纳的费用包括三项:增值税、消费税与公司综合费用。

出厂价由制造成本、增值税、消费税、公司综合费用和利润构成:一、制造成本40.59RMB二、增值税进入"淘金网”的"税率"页,输入商品海关编码进行查询(例如输入商品01001的海关编码20031011,查到增值税率为17%,消费税0)。

如果一笔合同涉及到多项商品,则须分别计算再累加。

可得:商品增值税=内销合同金额/(1 +增值税率)>增值税率查得税率是17%。

三、消费税进入"淘金网”的"税率"页,输入商品海关编码进行查询,查得消费税税率为0。

四、公司综合费用在"淘金网”的”其他费用"中,查到工厂的公司综合费用为合同金额的5%,即0.05 >内销合同金额。

五、预期利润预期利润率设为20%,则预期利润为0.2 >内销合同金额。

设出厂价为B,则按照公式:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润B =C+B/(1+0.17) 0.17+ 0 + 0.05B+0.2BC=40.59 (CNY )则:B=40.59+0.1453B+0.05B+0.2B0.6047B=40.59B=67.12 (CNY )第二部分出口预算(以本币CNY做出口预算)不管是对出口商还是对进口商来说,他们想要节约运费,就需要尽可能在询盘前确定的数量能满足运费最少的条件。

一、确定报价数量1.按体积和重量分别出20英尺集装箱和40英尺集装箱的的最大装载量(取相对小的那个值,因为受到体积或重量的制约)例如:对商品01002(洋菇罐头(切片)的包装单位是CARTON(箱),销售单位是CARTON(箱), 中文描述:;每箱24罐,每罐560克英文描述:560GX24TINS/CTN1个体积单位=1个销售单位(体积单位出现在装箱单、提单等涉及运输的单据上,销售单位出现在各类销售合同上,注意区分。

SimTrade出口预算表的填写

SimTrade出口预算表的填写5 x 1000=3500KGSCalculation of volume:Packing box number = 1000 / 6 = 166.6, 167 round boxTotal volume = 167 * 0.08052 = 13.447CBMExample 2: food products 01001, the sales unit is CARTON (box), packaging units are CARTON (case), gross weight of 11.2KGS per carton, net weight of 10.2KGS per box, 0.014739CBM per box volume. If the quantity of the transaction is 2000CARTON, the gross, net weight and volume shall be calculated separatelySolution: gross weight = 2000 * 11.2 = 22400KGSNet weight = 2000 * 10.2 = 20400KGSVolume = 2000 * 0.014739 = 29.478CBMNote: because the units of this kind of product are the same as those of the packaging units, the contents of unit conversions may not be considered when calculating.(two) quotation quantity accounting;In the international transport of goods, often using the20'container and 40' container, the effective volume of 20'container is 25CBM, weight limit 17.5TNE, the effective volume of 40' container is 55CBM, weight limit 26TNE, 1TNE =1000KGS. The exporter proposes to calculate the quoted quantity in accordance with the maximum number of packages the container can accommodate in order to save sea freight.In the "gold rush net" product display in view of product details, according to the volume of products, packaging units, sales units, units converted to calculate the number of quotations.Example 1: 08003 (children Scooter), commodity sales unit UNIT (cars), packaging unit CARTON (box), unit conversion for 6 per box, each box volume is 0.0576CBM, the gross weight is 21KGS, try to calculate respectively the goods with maximum packing number and the corresponding number of quotations, 20'40' of the container transportation.Solution: per 20'containerBy volume the packing number is 25 / 0.0576 = 434.028By weight the packing number is 17.5 / 21 x 1000 = 833.33Whichever is smaller, so the maximum packing number rounding 434 boxes, the corresponding sales volume = 434 * 6 = 2604Per 40'containerBy volume the packing number is 55 / 0.0576 = 954.861By weight the packing number is 26 / 21 x 1000 = 1238.095Whichever is smaller, so the maximum packing number rounding 954 boxes, the corresponding sales volume = 954 * 6 = 5724Example 2: 01005 commodities (canned sweet corn), sales units and packaging units are CARTON (box), each box volume is 0.025736CBM, the gross weight is 20.196KGS, try to calculate respectively the maximumnumber of goods by 20', the number of cases and offer the export container transportation 40'.Solution: per 20'container:By volume packing number = 25 / 0.025736 = 971.402By weight packing number = 17.5 / 20.196 x 1000 = 866.51Whichever is smaller, so the maximum number of 866 rounded box packingAs the selling unit is the same as the packing unit, the quoted quantity of the goods is 866 cases.Per 40'container:By volume packing number = 55 / 0.025736 = 2137.084By weight packing number = 26 / 20.196 x 1000 = 1287.35Whichever is smaller, so the maximum number of 1287 rounded box packingAs the selling unit is the same as the packing unit, the quoted quantity of the goods is 1287 cases.[].I. contract amountThat is, the amount of the contract agreed upon by both parties, note that the cost currency shall be converted.For example: commodity 01005 "canned sweet corn", the contract value of USD16000, found that the current U.S. dollar (USD) exchange rate of 6.8261, try converting into local currency.Solution: contract amount = 16000 * 6.8261 = RMB 109217.6[].Two, procurement costsThrough mail and factory liaison, ask about the purchase price for cost accounting.For example: goods 01005 "sweet corn canned", the factory quoted price for each RMB80, purchase 971 only cost?Solution: procurement cost = 80 * 971 = RMB 77680[].Three, FOB total priceThat is, the total amount of FOB value of the goods ordered by both parties during the signing of the contract. The exporter should be considered in the export price, first calculate the purchasing cost, then plus expenses (which can be roughly estimated), and give a certain profit space, on the basis of the price, if not FOB price, to convert.Converted from CFR to FOB: FOB = CFR - ocean freightConverted from CIF to FOB: FOB = CIF - Ocean Freight - PremiumFor ocean freight and insurance, please refer to the following instructions.Note: the amount must be converted into the cost currency. The exchange rate can be found on the bank page of the gold rush net.Suppose, for example, that the total value of the contract FOB is USD26500, and in the "bank" page, the current dollar (USD) rate is found to be 6.8261.The amount to be filled in this column is: 26500 x 6.8261 =180891.65[].Four inland freightIn the "gold rush net" other costs, the inland freight rate wasRMB60/ cubic meters (Note: cubic meter or CBM).Available: inland freight = total volume of exported goods * 60The total volume algorithm, please refer to the basic calculations".[].Five. Inspection feeIn the "gold rush net" other costs, the inspection fee was found RMB200/ times.Availability: inspection fee = RMB200[].Six, customs feesIn the "gold rush net" other fees, check customs fees for RMB200/ times.Available: Customs fee = RMB200[].Seven, shipping chargesIn export transactions, exporters use CFR and CIF trade terms, and exporters have to pay for shipping charges. In the form of FOB, fill in the column "0"".In the export trade, the selection of container type and the method of goods packing are very important for exporters to reduce freight expenses. Size and weight of container,The loading, discharging and stack of the goods in the container are particular and need to be explored in practice.(I) basis of freight calculation;Freight unit (Freight Unit) means the basic unit used by a shipping company to calculate freight charges. Because of the wide variety of goods, the packing situation is different, the method of shipment is different, the calculation of freight standards vary.A: FCL containers in the container freight unit in the SimTrade20'container and 40' container two. The effective volume of the20'container is 25CBM, the weight limit is 17.5TNE, and the effective volume of the 40' container is 55CBM, and the weight limit is 26TNE, wherein 1TNE = 1000KGS;LCL: B by the ship to charge a higher price for the quasi tariff, often note on M/W or R/T, said the company will ship the goods weight or volume of two tons of tons of freight to choose the higher calculation.In LCL, the unit of freight is calculated as:1. weight ton (Weight Ton): one ton (1 TNE=1000KGM) for one tonof freight per gross gross weight of the goods;2. volume ton (Measurement Ton): according to total gross volume of goods, to a cubic meter (1 Cubic Meter), referred to as 1MTQ or 1CBM or 1CUM, also known as a product ton, as a freight ton.In the calculation of shipping time, the exporter must firstcalculate the volume of the goods according to the quantity quoted, and then to the "gold rush net" of the "freight inquiry" page, to find the goods should be approved at the port of destination tariff. If the quantity is just enough installed FCL (20'container or 40' container), directly take the freight for basic freight; if not installed FCL, with the total volume of products (or the total weight, take more freight LCL) * price to calculate shipping costs.(two) freight classification calculation method;A: Freight FCL FCL is divided into three parts, the total freightfee and = three.1. basic freightThe basic unit of basic freight freight FCL number = x2. port surchargePort surcharge port surcharge * FCL = unit number3. fuel surchargeFuel surcharge = unit fuel surcharge * FCL numberB LCL: LCL freight only basic freight, divided by volume and weight calculated in two ways1. by volume, X1 = unit, basic freight (MTQ) * total volume2. by weight, X2 = unit, basic freight (TNE) * gross weightTake the larger one in X1 and X2For example: 08003 (children Scooter) goods to be exported to Canada, Toronto port port. Try to calculate the number of transactions for 1000 and 2604 shipping charges respectively.Solution:The first step: calculate the volume and weight of the productIn the "Pan gold net" product display, we find that the volume ofthe commodity 08003 is 0.0576CBM per carton, gross weight of 21KGS per carton, 6 cars per carton. According to the product data, calculate the volume of the product first.The quoted quantity is 1000The total number of packing box = 1000 / 6 = 166.6, 167 round box, total volume = 167 x 0.0576 = 9.6CBMTotal gross weight = 1000 / 6 x 21 = 3500KGS = 3.5TNEThe quoted quantity is 2604The total number of packing box = 2604 / 6 = 434, total volume = 434 x 0.0576 = 24.998CBMTotal gross weight = 2604 / 6 x 21 = 9114KGS = 9.114TNEThe second step: check the freight rateIn the "gold rush net", "freight inquiry", the shipping to Toronto, Canada, the basic freight is: 20'per container USD3290, 40' containers per USD4410, LCL, per volume ton (MTQ) USD151, per ton (TNE) USD216;Port surcharge: USD132 per 20'container, USD176 per 40' container;Fuel surcharge is USD160 per 20'container, USD215 per 40' container;In addition, in the "gold rush net" in the "bank" page, can be found, the U. S. dollar exchange rate of 6.8261.The first step according to the calculated results, according to specifications of container (in freight calculated on the basis of that, the effective volume of 20'container is 25CBM, weight limit 17.5TNE, the effective volume of 40' container is 55CBM, weight limit 26TNE, 1TNE = 1000KGS), 1000 units of freight will be used for shipping LCL, 2604 vehicles fees should adopt the 20'container.1 the quantity quoted is 1000, and the basic freight by volume = 9.6 * 151 = 1449.6 (US dollars)By weight, the basic freight = 3.5 x 216 = 756 (US dollars)In comparison, the volume of freight is larger, shipping companies charge larger, the basic freight is USD1449.6Total freight = 1449.6 * 6.8261 = 9895.11 (RMB)2 the quoted quantity is 2604 pieces, because the volume and the weight are not more than one 20'container's volume and the limit weight, therefore installs a 20' container to be possibleTotal freight = 1 * (3290+132+160) * 6.8261= 3582 * 6.8261= 24451.09 (RMB)[].Eight, insurance premiumIn the export transaction, under the condition of "CIF", exporters need to inquire the premium rate on the "premium" page in the "gold rushnet", so as to calculate the insurance premium. In the form of "CFR" or "FOB", fill in "0" in this column". The formula is as follows: Insurance = insurance amount * insurance rateInsurance amount = CIF price * (1 + insurance plus rate)In the import and export trade, according to the relevant international practice, the insurance premium rate is usually 10%. The exporter may also agree with the insurance company on different insurance premium rates according to the importer's requirements.For example: CIF 03001 of the total price of the goods is USD8937.6, according to the requirements of the importer transaction price 110% covering institute cargo clauses (A) (insurance rate 0.8%) and war risk (insurance rate 0.08%), calculate the exporters due to the insurance cost?Explanation: the amount of insurance = 8937.6 * 110% = 9831.36 (US dollars)Insurance premium = 9831.36 x (0.8%0.08%) = 86.52 ($)The exchange rate for us dollars is 6.8261, RMB = 86.52 * 6.8261 = 590.59Note: 1.Since all risks (or A risks) cover all the additional coverage, the insurance company will not charge any additional coverage for all risks except for all risks (or A). In calculating the insured amount, the insurance premium for the general additional insurance may not be included.2. basic insurance can only choose one of them, special additional risks based on basic insurance on the insurance coverage, if at the same time, special additional risks of war risks and strike risk premium is calculated according to the only one, not cumulative (simultaneously against war risks and strike risk, the rate is 0.80 per thousand, instead of 1.60 per thousand).[].Nine, verification feesIn the "gold rush net" other costs, check out the write off fee of RMB10/ times.Availability: write off fee = RMB 10[].Ten, bank chargesDifferent methods of payment, bank fees are different (in which T/T export banks do not charge fees), usually for the total amount of X bank charges, in the "gold network" and "other expenses" can be found in the related rate.For example: when the total amount of the contract is USD28846.4,the bank charges are calculated in L/C, D/P and D/A respectively (modify a credit once the L/C method is assumed)Solution:The first step: query ratesRichard L/C in the "gold rush" "other expenses" page notification fees RMB200/ times, RMB100/ times, negotiating fees amendment rate of0.13% (minimum 200 yuan), D/A rate of 0.1% (the lowest 100 yuan, highest 2000 yuan), D/P rate of 0.1% (the lowest 100 yuan, highest 2000 yuan).The second step: inquires the exchange rateOn the bank page, the exchange rate of the dollar is 6.8261.The third step: calculate bank chargesL/C bank charges = 28846.4 * 0.13% * 6.8261 + 200 + 100 = 255.98 + 300 = 555.98D/P bank charges = 28846.4 * 0.1% * 6.8261 = 196.91D/A bank charges = 28846.4 * 0.1% * 6.8261 = 196.91[].Eleven, other expensesThis column includes the cost of a company: comprehensive cost, certificate of inspection fees, postage and certificate of origin certificate of inspection fees for books, which fill in the declaration form the exporter exit, inspection certificateapplication, such as health certificates, plant quarantine certificate, a certificate fee of 200 yuan; the postage is in the form of T/T exporters send documents to the importer in charge, $28 each.The above fees can be found in the "other charges" page of the "gold rush net", and accumulated in this column according to the actual conditions of this contract.For example: when the total amount of the contract under T/T isUSD8846.4, please calculate the amount that should be filled in thiscolumn. (assuming that a health certificate, a certificate of origin and a shipping document were sent to the importer) in this contractSolution:The first step: query ratesIn the "gold rush net" of the "other costs" page, check the exporter company comprehensive rate of 5%, to prove that RMB200/ copies of the book price, postage USD28/ times.The second step: inquires the exchange rateOn the bank page, the exchange rate of the dollar is 6.8261.The third step: calculate other expensesOther charges = 8846.4 x 5% x 6.8261 + 200 + 200 + 28 * 6.8261= 3019.32 + 400 + 191.13= 3610.45 (RMB)[].Twelve, tax refund incomeIn the "gold rush net" in the "tax rate" page, enter the commodity customs code for inquiries (for example, enter the commodity 10001 customs code 33041000, found that the export tax rebate rate of 17%, consumption tax from the price of 30%). If a contract involves a number of goods, it must be calculated separately and accumulated.Available: commodity export tax refund income = = VAT should be refunded + refund of consumption tax = purchasing cost / (1+ VAT rate) * export rebate rate + purchasing cost * consumption tax rate [].Thirteen, profitsThe above income and expenditure together to calculate, you can calculate.The calculation formula is: Profit = contract value + tax refund income - purchasing cost - inland freight - inspection fee - customs declaration - Ocean Freight - Premium - write off fees - bank charges - other fees[].。

进出口价格预算案例

进出口价格计算案例第一部分工厂报价计算:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润SimTrade里,工厂在完成一笔业务的过程中,须缴纳的费用包括三项:增值税、消费税与公司综合费用。

出厂价由制造成本、增值税、消费税、公司综合费用和利润构成:一、制造成本40.59RMB二、增值税进入"淘金网"的"税率"页,输入商品海关编码进行查询(例如输入商品01001的海关编码20031011,查到增值税率为17%,消费税0)。

如果一笔合同涉及到多项商品,则须分别计算再累加。

可得:商品增值税=内销合同金额/(1+增值税率)×增值税率查得税率是17%。

三、消费税进入"淘金网"的"税率"页,输入商品海关编码进行查询,查得消费税税率为0。

四、公司综合费用在"淘金网"的"其他费用"中,查到工厂的公司综合费用为合同金额的5%,即0.05×内销合同金额。

五、预期利润预期利润率设为20%,则预期利润为0.2×内销合同金额。

设出厂价为B,则按照公式:出厂价=制造成本+增值税+消费税+公司综合费用+预期利润B =C+B/(1+0.17)×0.17+ 0 + 0.05B+0.2BC=40.59(CNY)则:B=40.59+0.1453B+0.05B+0.2B0.6047B=40.59B=67.12(CNY)第二部分出口预算(以本币CNY做出口预算)不管是对出口商还是对进口商来说,他们想要节约运费,就需要尽可能在询盘前确定的数量能满足运费最少的条件。

一、确定报价数量1. 按体积和重量分别出20英尺集装箱和40英尺集装箱的的最大装载量(取相对小的那个值,因为受到体积或重量的制约)例如:对商品01002(洋菇罐头(切片)的包装单位是CARTON(箱),销售单位是CARTON(箱),中文描述:;每箱24罐,每罐560克英文描述:560Gx24TINS/CTN体积:0.017943CBM/包装净重:13.44毛重:14.784试分别体积和重量计算该商品用20英尺、40英尺集装箱运输出口时的最大包装数量和报价数量。

SIMTRADE进出口计算

SIMTRADE进出口计算

首先,SIMTRADE可以帮助企业计算进出口货物的价值。

在进口方面,用户可以输入货物的数量、单价和运输费用等信息,然后软件会自动计算

货物总价值。

在出口方面,用户可以输入货物的数量、单价和其他费用

(如包装费用、检验费用等),软件会自动计算货物的总价值。

其次,SIMTRADE还可以帮助企业计算进出口货物的税费。

用户可以

输入货物的种类和国际货物编码,软件会根据相应的税率计算出应缴纳的

关税和其他税费。

此外,软件还可以根据用户输入的货物价值和税率计算

出销项税和进项税。

此外,SIMTRADE还可以帮助企业计算进出口货物的运输费用。

用户

可以输入货物的重量、尺寸和目的地等信息,软件会根据相应的运输规则

和费率计算出运输费用。

此外,软件还可以提供货物跟踪服务,帮助企业

了解货物在运输过程中的实时位置和状态。

除了以上功能,SIMTRADE还提供了其他辅助功能,如货物报关、合

同管理和供应链管理等。

用户可以通过输入相关信息,软件会生成相应的

报关文件和合同文件。

此外,软件还可以帮助企业管理供应链,包括订单

管理、库存管理和物流管理等。

总之,SIMTRADE是一款功能强大的进出口计算软件,可以帮助企业

进行进出口业务的计算和分析。

它提供了多种功能,包括货物价值计算、

税费计算、运输费用计算等。

通过使用这些功能,企业可以更加高效地处

理进出口业务,提高业务效率和盈利能力。

探析SIMTRADE操作中进出口预算表的填写方法

联系, 以更好地了解其学生个性特征, 探讨学生就业方向, 以 的舆论导向为独立学院毕业生就业创造良好的社会环境。 保证为每个学生制定符合 自 身特色的职业生涯规划, 同时学

同时, 独立学院愿意接受社会媒体的监督, 学校可以通

校可以向家长讲明学校的发展方针、 办学特色 , 取得学生家 过 社会评价为学校的发展提供信息 , 社会可以通过独立学

订 舱、 办理保险、 报检报关和制单结汇等外贸业务。 其中, 在 1方法1 : 先商议价格再核算利润和利润率 进出1 : 1 商签订合同之前, 需要 由进出口商分别添加和填 写进 出口预算表, 而预算表是 S I MT RA DE 整个操作流程中, 唯

一 一

1 . 1出口预算表填写的方法 首先 , 确定出口商品的合同总金额。 出重要组成部分, 是实 会健康发展。 施教 育教学改革的前沿阵地 , 也是提高我国办学活力的重

要 保证。 但社会对于民办教育的怀疑和 否定依然存在。 所 参考文献 1 ]陈忠平 , 王朝霞 , 杜品 . 提升 大学生 就业 核心竞争 力的 以, 需要国家在办学政策、 财政支持等方面扶持民办教育的 [ 几点思考[ J ] . 中国成人教育 , 2 0 1 2 ( 0 5 ) . 发展 , 以激活中国教育的改革与发展。

学术论坛 I F o r u m

探析S I M T R A D E 操作 中进 出口预算表的填写方法

青岛理工大学琴 岛学院 孙智贤

摘 要: 在S I M T R A D E 软件操 作中 , 进 出口预算表的填制非常关键 , 事关贸易的盈亏和最终得分。 在填写进 出口预算表时

有两种不同方法, 这两种方法有相同之处, 也存在明显的不同。 两种方法各有利弊, 均可以使用, 但是 第二种方法更加

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

消费税是价内税,增值税是价外税

simtrade进出口预算[1]

(七)出口商的利润核算

利润=合同金额-采购成本-内陆运费-报检费-报关费 -核销费-其他费用-公司综合费用-银行费用-海 运费-保险费+退税收入

两者相比较,取体积运费 总运费 12.384×6.2721 = CNY77.674

simtrade进出口预算[1]

(三)保险费的计算

出口交易中,在CIF成交时,出口商需要到"淘金网"中"保险 费"页查询保险费率,用以核算保险费。如用CFR或FOB方式,此 栏填"0"。

公式:保险费= CIF货价 ×(1+保险加成率)× 保险费率 在进出口贸易中,根据有关的国际惯例,保险加成率通常为 10%,出口商也可按进口商要求与保险公司约定不同的保险加成率 例:EUR 60 per bottle CIF Oslo 进口商要求按成交价格的 110%投保协会货物保险条款(A)(保险费率0.8%)和战争险(保险费率 0.08%), 解:保险金额=60×1000×110%=EUR 66,000

simtrade进出口预算[1]

(六)出口商退税收入

商品出口退税收入=应退增值税 + 应退消费税 = 采购成本/(1+增值税率)×出口退税率 + 采购成本×消费税税率 = 350/(1+17%)×17% + 350×30% = 50.855+105= 155.855 一共1000瓶,共退税CNY155.855×1000=CNY 15585.5

币) /出口销售外汇净收入(美元)

simtrade进出口预算[1]

外贸公司有一个换回成本速算法 v 保本报价=工厂收购价/保本换汇成本 v 保本换汇成本=汇率x(1+退税率)

simtrade进出口预算[1]

工厂、出口商、进口商相关预算 v 出口商报价时,首先要了解工厂报价,所以先讲内

销合同,计算工厂利润。

5、货款CNY350000进入工厂账户,公司综合费用为合同额的 5%,即¥17500 CNY350000×5%

6、工厂增值税=内合同金额/(1+增值税率)×增值税率 = CNY350000×17%÷(1+17%)= ¥50854.701

工厂消费税(从价)=内合同金额/(1+增值税率)×消费税率 =¥350000÷(1+17%)×30%= ¥89743.59

simtrade进出口预算[1]

(二)主要贸易术语的价格构成

simtrade进出口预算[1]

simtrade进出口预算[1]

v 详细内容见国际贸易术语2010 ppt。

simtrade进出口预算[1]

FOB、CFR、CIF的价格构成

v FOB=进货成本价+国内费用+净利润 v CFR=进货成本价+国内费用+国外运费+净利润 v CIF=进货成本价+国内费用+国外运费+国外保险

167箱,总体积=167×0.0576=9.6CBM 总毛重=1000÷6×21=3500KGS=3.5TNE

报价数量为2604辆:总包装箱数=2604÷6=434, 总体积=434×0.0576=24.998CBM 总毛重=2604÷6×21=9114KGS=sim9tr.a1de1进4出T口N预算E[1]

根据第1步计算出的结果来看,比照 集装箱规格,1000辆的运费宜采用拼箱, 2604辆的海运费宜采用20'集装箱

(1) 报价数量为1000辆, 按体积的基本运费=9.6×151=$1449.6 按重量计算基本运费=3.5×216=$756

两者比较,体积运费较大,船公司收取 较大者,则基本运费为USD1449.6 总运费=1449.6×6.272=CNY 9091.891 (2) 报价数量为2604辆,体积和重量均未 超过一个20'集装箱的体积与限重,所以 装一个20'集装箱即可

一、工厂与出口商的交易--内销合同

2、点进业务中心,起草合同,并将合同送至出口商,等出口 商签字确认合同。

3、合同确认后,工厂再进业务中心,点击市场,选到相关产 品后进行生产,则产品变为工厂的库存。

4、再进入业务中心,点击出口商,再点击s放imtra货de进出口预算[trade进出口预算[1]

出口换汇成本 v 出口换汇成本=出口总成本(人民币) /出

口销售外汇净收入(美元) v 表示出口需要用多少人民币换回一美元。

simtrade进出口预算[1]

有出口退税时

v 退税收入=货价(出厂价)X出口退税率 v 购货成本(含税价或采购价)=货价(出厂

价)X(1+增值税率) v 实际成本=购货成本-退税收入 v 出口换汇成本=实际成本+国内费用(人民

成交方式EUR 60 per bottle CIF Oslo 1000 bottles

1、合同金额 60×1000=EUR60,000

simtrade进出口预算[1]

一、工厂与出口商的交易--内销合同

工厂利润 = 合同金额-成本-公司费用-增值税-消费税

1、从市场或产品展示中查得产品生产成本 如:10004 香水 成本 CNY130 (先根据成本估算税费)

点入税率查询,输入海关代码33030000 得到税率

增值税=合同金额/(1+增值税率)×增值税= 220×17% ÷1.17= 31.966

simtrade进出口预算[1]

二、出口商与进口商交易--外销合同

1、先与进口商签订销货合同 Sales Confirmation

合同内容可以先不填写

2、通过添加单据,加入出口 预算表,做出口预算

simtrade进出口预算[1]

3、如何做出口预算(用本币)

进出口商商议成交方式,贸易 术语,出口商掌握进货成本, 进口商了解进口国市场价格, 可以先制定个大致价格和数量

simtrade进出口预算

2020/10/31

simtrade进出口预算[1]

国

一、价格构成及换算

际

贸

易

实 务

v

国际贸易价格:

v EUR500.00 per M/T FOB Shanghai (计价货

币、单价、计量单位、贸易术语)

第 一 章

simtrade进出口预算[1]

(一)出口费用构成

v 1.出厂价 v 2.商检费 v 3.报关费 v 4.国内运费及国内港口码头杂费 v 5.海运费 v 6.保险费 v 7.国外港口卸货及码头杂费 v 8.进口报关费 v 9.进口国国内运费(目的港至客户指定地) v 常见的做到第4 或第6项

合同金额--双方议定的 合同金额,需换算成本币 EUR 60 per bottle CIF Oslo 合同金额=60×8.2456×1000=CNY494,736

出口商估算时,成本是CNY350,约为EUR42.45,若CIF成 交,先估算下运费和保险费,可提高报价,公司综合费5%;

进口商估算时,关税为10%P,消费税为0.47P,增值税为 0.27P,市场价为119,41,估算盈亏平衡点为s1im2tra0d/e1进.出8口4预=算E[1]UR 65

保险费=66,000×(0.8%+0.08%)=EUR 580.8 查欧元的汇率为8.2456,EUR 580.8×8.245s6im=tradeC进N出口Y预4算7[18] 9.044

(四)银行费用的计算

不同的结算方式,银行收取的费用也不同,通常为总金额×银 行费率,在"淘金网"的"其它费用"中可以查到相关费率

总运费=1×(3290+132+160)×6.272 = CNY2si2m4tra6d6e进.出30口4预算[1]

(二)海运费的计算

总体积 0.036×4=0.144CBM 总毛重 21.5×10÷1000=0.086TNE

按体积计算的基本运费 0.144×86=USD 12.384

按重量计算的基本运费 0.086×123= USD 10.578

费+净利润 即:CFR=FOB+国外运费 v 例如,FOB价格为USD4.77,国外运费为USD0.4,

那么,CFR为USD5.17。 CIF=CFR+保费= FOB+国外运费+国外保险费 v 国外保险费=CIF*(1+投保加成)*保险费率

simtrade进出口预算[1]

二、出口报价核算

v 出口商报价,是出口作价的重要环节,直接影响贸 易利益的实现。报价的关键是了解出口换汇成本及 出口退税核算方法、原理及公式。

例如:合同总金额为EUR 60,000时,计算在L/C方式下的银行费 (假设L/C方式时修改过一次信用证)

第1步:查询费率 第2步:查询汇率 8.2456

第3步:计算银行费用 信用证议付费 60,000×0.13%×8.2456=CNY643.157

银行费用=643.157+200+100=CNY943.157

(一)如何做出口预算(用本币)

采购成本--内销合同金额,则采购成本 =CNY350×1000=350,000 FOB总价——交易双方签订合同时所订货物FOB价 总金额

FOB=CIF-F-I=

simtrade进出口预算[1]

(二)如何计算内陆运费和海运费

内陆运费——在"淘金网"的"其他费用"中,查到内陆运费率为 RMB60/CBM 则运费=0.036×4×60= 8.64(成交4CTN)

消费税=合同金额/(1+增值税率)×消费税=220×30% ÷1.17= 56.41 公司费用(通过其他费用查询)= 220×5%=11 利润:220-130-31.966-56.410-11= -9.376 simtrade进出口预算[1]