金融专业英语

金融英语专业词汇汇总

实用文档Money Markets 货币市场Capital Markets 资本市场Foreign Exchange Markets 外汇市场Gold Markets 黄金市场Derivative Markets 衍生品市场Direct Financing 直接金融市场Indirect Financing 间接金融市场Financial Intermediary 金融中介Deposit 存款Loan 贷款Foreign Currency 外汇Securities 证券Forward transactions 远期交易Foreign currency futures 外汇期货Commercial bank 商业银行Investment bank 投资银行Pension fund 养老基金Central Bank 中央银行Primary Market 一级市场Secondary Market 二级市场Dividends 股息Shareholders 股东Common Stock 普通股Preferred Stock 优先股Financial Institutions 金融机构Default Risk 违约风险Liquidity 流动性Treasury Bills 短期国库券Treasury Notes 中期国库券Treasury Bonds 长期国库券Inter-bank markets 同业拆借London Interbank Offered Rate LIBOR伦敦同业拆借利率Commercial Paper 商业票据Negotiable certificates of deposit大额可转让定期存单Repurchase Agreement 回购协议Reverse repurchase Agreement 逆回购协议Banker’s acceptances 银行承兑汇票Bond 债券Stock 股票Interest (coupon) payments 票面利息Interest (coupon) rate 票面利率Face value (Principle) 面值Maturity date 到期日Municipal bonds 市政债券Corporate bonds 企业债券Treasury Bills (Maturity less than 1 year) Treasury Notes (Maturity 1 to 10 years) Treasury Bonds (Maturity more than 10 years) Annual 一年Semi-annual 半年Mortgage bonds 抵押债券Zero-coupon bonds 零息债券Folate-rate bonds 浮动利率债券Redemption bonds 可赎回债券Convertible bonds 可转换债券Collateral 抵押物Common Stock 普通股Preferred Stock 优先股Residual Claims 剩余追索权Limited Liability 有限责任Capital Gains 资本利得Public placement 公募Private placement 私募Bid price 卖价Ask price 买价Market Order 市价委托指令Limit Order 限价指令Stop Order 停止指令Fundamental Analysis 基本面分析Technical Analysis 技术分析Buy on margin 买空Short sales 卖空Margin 保证金Initial Margin 初始保证金Maintenance Margin 维持保证金Margin Call 保证金催缴通知Exchange Rate 汇率Foreign Exchange Bank 外汇银行Foreign Exchange Broker 外汇经纪人Spot transaction 即期交易Forward transaction 远期交易Appreciation 升值Depreciation 贬值Cross-Exchange rates 交叉汇率Direct Quotation 直接标价法Indirect Quotation 间接标价法实用文档Dollar Quotation 美元标价Balance Sheet 资产负债表Income Statement 损益表Statement of Cash Flow 现金流量表Asset 资产Liability 负债Owner’s Equity 所有者权益Current Asset 流动资产Short-term assets 短期资产Cash 现金Accounts receivable 应收账款Inventory 存货Long-term assets 长期资产Tangible assets 有形资产Intangible assets 无形资产Patent 专利Copyright 版权Goodwill 商誉Long-term Liabilities 长期负债Current Liabilities 流动负债Accounts payable 应付账款Debt due for repayment 应偿还债务Long-term debt 长期债务Common stock and other paid in capital普通股和资本公积Retained Earnings 留存收益Operating Revenues 营业收入Net Sales 销售净收入Operating Expenses 营业费用Cost of Goods Sold 销货成本Selling, general & administrative expenses销售及一般管理性费用Research & Development Expenses 研发费用Depreciation 折旧Operating Income 营业利润Earnings before interest and income taxes息税前利润Interest expenses 利息费用Taxable income 应纳税所得额Net income 净利润Allocation of net income 净利润分配retained earnings 留存收益Return on Equity 净资产收益率Return on Asset 资产收益率Liquidity Ratio 流动性比率Quick Ratio 速动比率Gross Domestic Product 国内生产总值Unemployment rates 失业率Budget deficit 预算赤字Budget surplus 预算盈余Consumer sentiment 消费者心理因素Peak 高峰Trough 谷底Cyclical Industries 周期性行业Defensive Industries 防御性行业Business Cycle 经济周期Industry Analysis 行业分析Operating Leverage 经济杠杆Degree of Operating Leverage经济杠杆系数Sector Rotation 部门转换Industry Life Cycles 行业生命周期Start-up 创业阶段Consolidation 成长阶段Maturity 成熟阶段Relative Decline 衰退阶段Threat of Entry 进入者威胁Rivalry between existing competitors现有竞争者威胁Pressure from substitute products替代品压力Bargaining power of buyers买方议价能力Bargaining power of suppliers卖方议价能力Investment Company 投资公司Net Asset Value 资产净值Open-end Fund 开放式基金Close –end Fund 封闭式基金Discount Price 折价Premium Price 溢价Fund Manager 基金经理人Private Partnerships 私人合伙人Money Market Funds 货币市场基金Equity Funds 股权基金Income Funds 收入型基金Growth Funds 成长性基金Sector Funds 行业基金Bonds Funds 债券净值Balanced Funds 平衡型基金Aggressive Investors 激进型投资者Conservative Investors 保守型投资者Fee Structure 费用结构Operating Expenses 运营费用Front-End Load 前段费用Back-End Load 后端费用Bond Issuer 债券发行者Bond holder 债券持有者Seniority 求偿等级Limited Provisions 限制性条款Call Provisions on Corporate Bonds公司债券的赎回条款Convertible Bonds 可转换债券Conversion ratio 转换比例Market conversion value 转换价值Puttable Bonds 可回卖债券Yield to Maturity 到期收益率Default Risk 违约风险Investment grade bonds 投资级债券Junk bond 垃圾债券Securities Underwriting 证券承销业务Mergers and Acquisitions 兼并与收购Restructuring 重组Leveraged Finance 杠杆融资Initial Public Offerings (IPOs)首次公开发行Seasoned Equity Offerings (SEOs) 再次发行Public placement 公募Private placement 私募Cash Transaction 现金支付Share Transaction 股票支付Horizontal M&A 横向并购Vertical M&A 纵向并购Conglomerate M&A 混合并购Synergy 协同效应Friendly Acquisition 善意并购Hostile Acquisition 敌意并购White Knight 寻找白衣骑士Selling the Crown Jewels 焦土战术Pac-Man defense 帕克门策略Greenmail 绿色勒索Operating Synergy 经营协同效应Management Synergy 管理协同效应Financing Synergy 财务协同效应Leveraged buy-out (LBO) 杠杆收购Management buy-out (MBO) 管理层收购Options 期权Derivatives 衍生品Option Contract 期权合约Call option 看涨期权Put option 看跌期权Strike Price 执行价格Expiration date 到期日Premium 期权费/权利金In the Money 实值期权Out of the Money 虚值期权At the Money 平价期权American Option 美式期权European Option 欧式期权Futures 期货Futures Contract 期货合约Obligation 义务Delivery date 交割时间Delivery price 交割价格Long position 多头头寸Short position 空头头寸Leveraged Effect 杠杆效应Reserve Requirement 存款准备金要求Insurance Company 保险公司Life Insurance 寿险Liability Insurance 责任保险Health Insurance 健康保险Property Insurance 财产保险Accident Insurance 意外保险Term Life 期限人寿保险Whole Life 终身人寿保险Universal Life 万能人寿保险Pension Fund 养老基金Pension Plan 养老金计划Risk Premium 风险溢价Liquidity Premium 流动性溢价Inflation Rate 通货膨胀率Settlement 结算Trust Services 信托Trustee 托管人Beneficiary 受益人Lease 租赁Factoring 保理Syndicated Loan 银团贷款Monetary Policy 货币政策Fiscal Policy 财政政策。

金融专业英语最新词汇大全

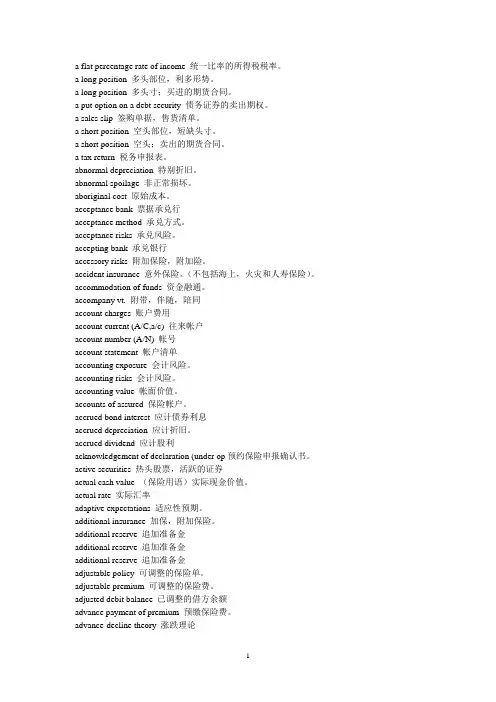

a flat percentage rate of income 统一比率的所得税税率。

a long position 多头部位,利多形势。

a long position 多头寸;买进的期货合同。

a put option on a debt security 债务证券的卖出期权。

a sales slip 签购单据,售货清单。

a short position 空头部位,短缺头寸。

a short position 空头;卖出的期货合同。

a tax return 税务申报表。

abnormal depreciation 特别折旧。

abnormal spoilage 非正常损坏。

aboriginal cost 原始成本。

acceptance bank 票据承兑行acceptance method 承兑方式。

acceptance risks 承兑风险。

accepting bank 承兑银行accessory risks 附加保险,附加险。

accident insurance 意外保险。

(不包括海上,火灾和人寿保险)。

accommodation of funds 资金融通。

accompany vt. 附带,伴随,陪同account charges 账户费用account current (A/C,a/c) 往来帐户account number (A/N) 帐号account statement 帐户清单accounting exposure 会计风险。

accounting risks 会计风险。

accounting value 帐面价值。

accounts of assured 保险帐户。

accrued bond interest 应计债券利息accrued depreciation 应计折旧。

accrued dividend 应计股利acknowledgement of declaration (under op预约保险申报确认书。

《金融专业英语》习题答案

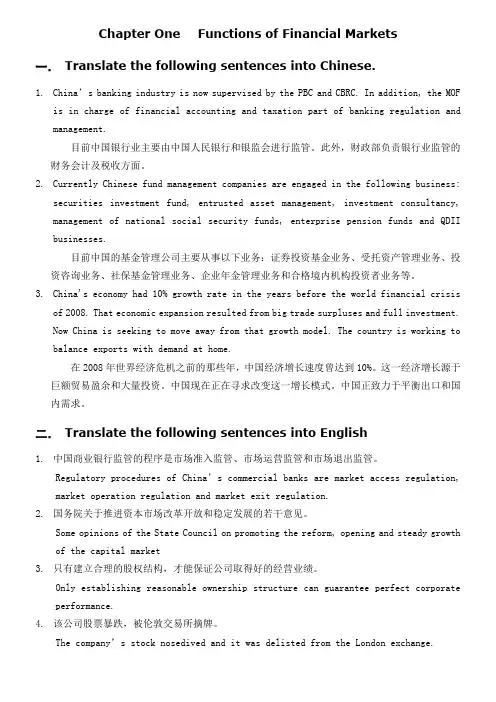

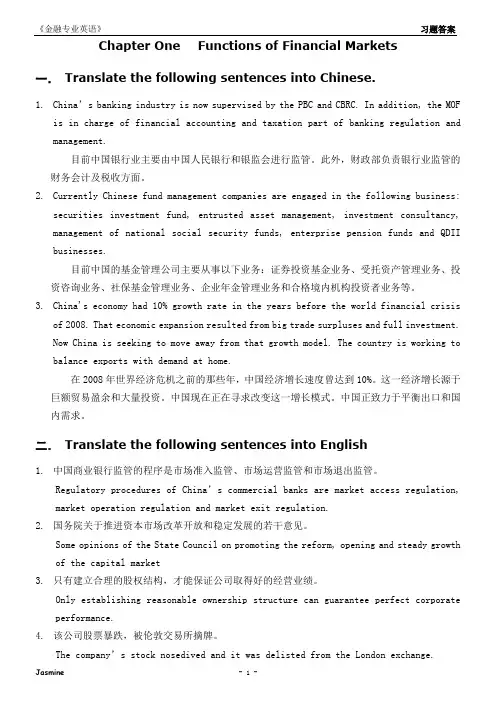

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

《金融专业英语》习题答案

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

金融专业英语单词

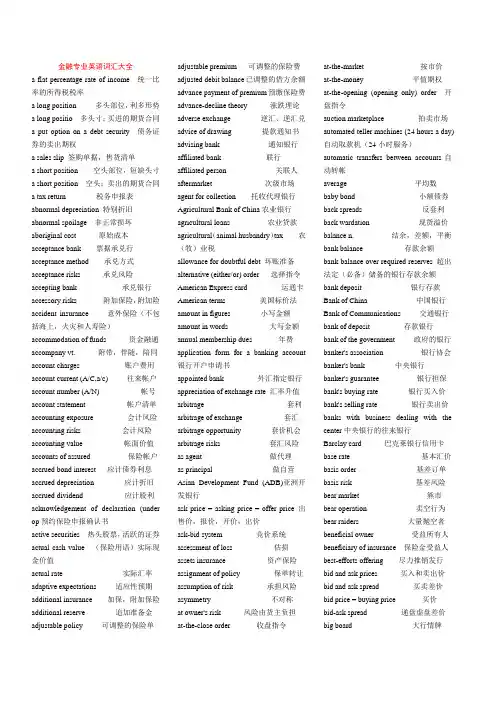

金融专业英语词汇大全a flat percentage rate of income 统一比率的所得税税率a long position 多头部位,利多形势a long positio 多头寸;买进的期货合同a put option on a debt security 债务证券的卖出期权a sales slip 签购单据,售货清单a short position 空头部位,短缺头寸a short position 空头;卖出的期货合同a tax return 税务申报表abnormal depreciation 特别折旧abnormal spoilage 非正常损坏aboriginal cost 原始成本acceptance bank 票据承兑行acceptance method 承兑方式acceptance risks 承兑风险accepting bank 承兑银行accessory risks 附加保险,附加险accident insurance 意外保险(不包括海上,火灾和人寿险)accommodation of funds 资金融通accompany vt. 附带,伴随,陪同account charges 账户费用account current (A/C,a/c) 往来帐户account number (A/N) 帐号account statement 帐户清单accounting exposure 会计风险accounting risks 会计风险accounting value 帐面价值accounts of assured 保险帐户accrued bond interest 应计债券利息accrued depreciation 应计折旧accrued dividend 应计股利acknowledgement of declaration (under op预约保险申报确认书active securities 热头股票,活跃的证券actual cash value (保险用语)实际现金价值actual rate 实际汇率adaptive expectations 适应性预期additional insurance 加保,附加保险additional reserve 追加准备金adjustable policy 可调整的保险单adjustable premium 可调整的保险费adjusted debit balance已调整的借方余额advance payment of premium预缴保险费advance-decline theory 涨跌理论adverse exchange 逆汇、逆汇兑advice of drawing 提款通知书advising bank 通知银行affiliated bank 联行affiliated person 关联人aftermarket 次级市场agent for collection 托收代理银行Agricultural Bank of China农业银行agricultural loans 农业贷款agricultural(animal husbandry)tax 农(牧)业税allowance for doubtful debt 坏账准备alternative (either/or) order 选择指令American Express card 运通卡American terms 美国标价法amount in figures 小写金额amount in words 大写金额annual membership dues 年费application form for a banking account银行开户申请书appointed bank 外汇指定银行appreciation of exchange rate 汇率升值arbitrage 套利arbitrage of exchange 套汇arbitrage opportunity 套价机会arbitrage risks 套汇风险as agent 做代理as principal 做自营Asian Development Fund (ADB)亚洲开发银行ask price = asking price = offer price 出售价,报价,开价,出价ask-bid system 竞价系统assessment of loss 估损assets insurance 资产保险assignment of policy 保单转让assumption of risk 承担风险asymmetry 不对称at owner's risk 风险由货主负担at-the-close order 收盘指令at-the-market 按市价at-the-money 平值期权at-the-opening (opening only) order 开盘指令auction marketplace 拍卖市场automated teller machines (24 hours a day)自动取款机(24小时服务)automatic transfers between accounts自动转帐average 平均数baby bond 小额债券back spreads 反套利back wardation 现货溢价balance n. 结余,差额,平衡bank balance 存款余额bank balance over required reserves 超出法定(必备)储备的银行存款余额bank deposit 银行存款Bank of China 中国银行Bank of Communications 交通银行bank of deposit 存款银行bank of the government 政府的银行banker's association 银行协会banker's bank 中央银行banker's guarantee 银行担保bank's buying rate 银行买入价bank's selling rate 银行卖出价banks with business dealing with thecenter中央银行的往来银行Barclay card 巴克莱银行信用卡base rate 基本汇价basis order 基差订单basis risk 基差风险bear market 熊市bear operation 卖空行为bear raiders 大量抛空者beneficial owner 受益所有人beneficiary of insurance 保险金受益人best-efforts offering 尽力推销发行bid and ask prices 买入和卖出价bid and ask spread 买卖差价bid price = buying price 买价bid-ask spread 递盘虚盘差价big board 大行情牌big slump 大衰退(暴跌)bill-paying services 代付帐款black market 黑市black market financing 黑市筹资black money 黑钱blanket mortgage 总括抵押block positioner 大宗头寸商blowout 畅销blue-chip stocks 蓝筹股board of arbitration 仲裁委员会board of governors 理事会bond fund 债券基金borrowing from affiliates 向联营公司借款borrowing power of securities 证券贷款能力borrowing risks 借款风险bought deal 包销bread and butter business 基本业务breadth index 宽度指数break-even 不亏不盈,收支相抵breakout 突破bridging finance 过渡性融资broker 经纪人,掮客brokerage 经纪人佣金brokerage firm 经纪商(号)broker's loan 经纪人贷款broking house 经纪人事务所building agreement 具有约束力的协定building tax =tax on construction建筑税bullish 行情看涨business insurance 企业保险business risk 营业风险business savings 企业储蓄business tax 营业税business term loan 企业长期贷款bust-up risks 破产风险buyer's risks 买方风险call (option) 买方期权,看涨期权call and put options买入期权和卖出期权call for funds 控股、集资call loan transaction 短期拆放往来call market 活期存款市场call money 拆放款call options on an equity 权益证券的买入期权call-options 认购期权cancellation 取消cancellation money 解约金cap 带利率上限的期权capital assets 资本资产capital lease 资本租赁capital market 信贷市场、资本市场capital resources 资本来源capital surplus 资本盈余capital transfer 资本转移capital turnover rate 资本周转率card issuing institution 发卡单位carefully selected applicant 经仔细选定的申请人cargo insurance 货物保险cash 现金,现款v.兑现,付现款cash a cheque 支票兑现cash account 现金帐户cash advance 差旅预支款cash against bill of lading 凭提单付现cash against documents 凭单付现,凭单据付现金=document against cashcash and carry 付现自运;现金交易和运输自理;现购自运商店cash and carry wholesale 付现自运批发cash assets 现金资产cash audit 现金审核cash balance 现金余额,现款结存cash basis 现金制cash basis accounting 现金收付会计制cash before delivery(C.B.D.)空货前付款,付款后交货,付现款交货cash bonus 现金红利cash book 现金簿;现金帐;现金出纳帐cash boy 送款员cash budget 现金预算cash card1 (银行)自动提款卡cash card2 现金卡cash claim 现金索赔cash collection basis 收现法,收现制cash credit 活期信用放款,现金付出cash credit slip 现金支出传票cash currency 现金通货cash cycle 现金循环,现金周期cash day 付款日cash debit slip 现金收入传票cash department (商业机构中的)出纳部=counting-housecash deposit 现金存款;保证金cash deposit as collateral 保证金,押金cash desk (商店、饭馆的)付款处cash disbursements 现金支出cash discount (c.d.) 现金折扣,付现折扣=settlement discountcash dispenser(美)自动提款机=cashomatcash dividend 现金股利cash down 即付,付现cash equivalent value现金等值,现金相等价值cash flow 现金流动cash flow stream 现金流(量)cash holdings 库存现金cash in advance (c.i.a.) 预付现金cash in bank 存银行现金,银行存款cash in hand (商行的)库存现金cash in transit 在途现金,在运现金cash in transit policy 现金运送保险单cash in treasury 库存现金cash invoice 现购发票cash items 现金帐项,现金科目cash journal 现金日记簿cash liquidity 现金流动情况,现金周转cash loan 现金贷款cash management services现金管理业务cash market 现金交易市场,现货市场,付现市场cash nexus 现金交易关系cash on arrival 货到付现,货到付款cash on bank 银行存款;银行付款;现金支票付款cash on deliver (C.O.D) (英)交货付款,现款交货=collect on deliverycash on delivery (COD) 交割付款cash order(C/O)现金订货cash paid book 现金支出簿cash payment 现金支付cash payments journal 现金支出日记帐cash position 头寸cash price 现金售价,现金付款价格cash purchase 现购,现金购买cash railway (商店中的)货款传送线cash ratio 现金比率cash receipts (CR) 现金收入cash receipts journal 现金收入日记帐cash records 现金记录cash register 现金登记机,现金收入记录机,收银机cash remittance 汇款单;解款单cash remittance note 现金解款单,解款单cash requirement 现金需要量cash reserve 现金储备(金)cash resources 现金资源,现金来源cash resources (reserves) 现金准备cash sale 现金销售=sale by real cash cash sale invoice 现销发票,现售发票cash settlement 现金结算,现汇结算cash short and over 现金尾差,清点现金余差;现金短溢cash slip 现金传票cash statement 现金报表,库存表cash ticket 现销票,门市发票cash transaction 现金交易cash verification 现金核实,现金核查cash voucher 现金凭单;现金收据cash with order (c.w.o., C.W.O.订货时付款,订货付现,落单付现cash without discount 付现无折扣cash yield discount 现金获利率,现金收益率cash-and-carry arbitrage 现货持有套利cashier 出纳员,收支员cashier's cheque (C.C.)银行本票=cashier's ordercentral rate 中心汇率(一国货币对美元的汇率,并据此计算对其他货币的汇率)certificate of balance 存款凭单Certificate of Deposits (CDs) 大额定期存款单certificated security 实物证券certificates of deposit (CDs) 大面额存款单certifying bank 付款保证银行change hands 交换,换手chartered bank 特许银行chattel 动产chattel mortgage 动产抵押chattel mortgage bond (美)动产抵押(公司)债券chattel personal (私人)动产chattel real 准不动产(土地权等)check certificate 检验证明书check deposit 支票存款check list (核对用的)清单check sheet 对帐单checking account 支票帐户checking deposits 支票存款,活期存款checking reserve 支票现金储备checkstand (超级市场的)点货收款台cheque (payable) to bearer 来人支票,不记名支票cheque book 支票簿cheque book stub 支票簿存根cheque card 支票卡cheque collection 支票兑取cheque collector 支票兑取人cheque crossed 划线支票cheque crossed generally 普通划线支票cheque crossed specially 特别划线支票cheque deposit 支票存款cheque drawer 支票出票人cheque holder 支票执票人cheque only for account 转帐支票cheque payable at sight 见票即付支票cheque protector 支票银码机cheque rate 票据汇兑汇率,票汇价格=sight rate ,short ratecheque register 支票登记簿cheque returned 退票,退回的支票cheque signer 支票签名机cheque stub 支票存根cheque to order 记名支票,指定人支票China Investment Bank 中国投资银行circulation risks 流通风险circulation tax (turnover tax)流转税city bank 城市银行claim a refound 索赔clean collections 光票托收clearing bank 清算银行clearing house 清算所clearinghouse 清算公司,票据交换所close out 平仓,结清(账)closed and mortgage 闭口抵押closing order 收市价订单closing rate 收盘价closing transaction 平仓交易collar 带利率上下限的期权collateral loan 抵押借款collecting bank 托收银行collecting bank 托收银行collecting bank 代收行collection instructions 委托的单据collection items 托收业务,托收项目collection of trade charges 托收货款collection on clean bill 光票托收collection on documents 跟单托收collection order 托收委托书collection risk 托收风险collection risks 托收风险collection service 托收服务collective-owned enterprise bonus tax 集体企业奖金税collective-owned enterprise income tax集体企业所得税commercial and industrial loans工商贷款commercial deposit 商业存款commercial paper 商业票据commercial paper house 经营商业票据的商号commercial risk 商业风险commercial terms 商业条件commission 佣金commodity futures 商品期货commodity insurance 商品保险common collateral 共同担保common fund 共同基金common stock 普通股common trust fund 共同信托基金compensatory financing 补偿性融资competitive risks 竞争风险composite depreciation 综合折旧compound interest 复利compound rate 复利率compound rate deposit 复利存款comprehensive insurance 综合保险condominium 公寓私有共有方式confirming bank 保兑银行congestion area 震荡区congestion tape 统一自动行情显示conservatism and liquidity 稳健性与流动性consortium bank 银团银行constructure risk 建设风险consumer financing 消费融资contingent risks 或有风险contract money 合同保证金contract size 合约容量contracts of difference 差异合约contractual value 合同价格controlled rates 控制的汇率converge 集聚,(为共同利益)结合一起conversion 汇兑、兑换convertible currency 可兑换的货币cooling-off period 等待期cooperative financing 合作金融cornering the market 操纵市场corners 垄断corporate deposits 法人存款correspondent 代理行cost of maintenance 维修费counter-inflation policy 反通货膨胀对策cover 弥补(损失等);负担(开支);补进(商品或股票等);保险coverage 承保险别;保险总额;范围保险coverage ratio 偿债能力比率cover-note 暂保单;投保通知单credit 信用,信贷credit account 赊帐=open account2 credit agreement 信贷协定credit amount 信贷金额;信用证金额credit analysis 信用分析credit balance 贷方余额,结欠,贷余credit bank 信贷银行credit beneficiary 信用证受益人credit business 赊售,信用买卖credit buying 赊购credit capital 信贷资本credit cards 信用卡credit control 信用控制credit control instrument 信用调节手段credit expansion 信用扩张credit extending policy 融资方针credit facility 信用透支credit limit 信用额度credit restriction 信用限额credit risk 信用风险credit union 信用合作社creditor bank 债权银行crop up (out) 出现,呈现cross hedge 交叉套做cross hedging 交叉保值cum dividend 附息cum rights 含权cumulative preferred stock 累积优先股currency futures 外币期货currency futures contract 货币期货合约current fund 流动基金current futures price 现时的期货价格current ratio 流动比率customize 按顾客的具体要求制作customs duty(tariffs)关税D/D (Banker's Demand Draft) 票汇daily interest 日息daily limit 每日涨(跌)停板date of delivery 交割期dealers 批发商death and gift tax 遗产和赠与税debt of honour 信用借款debtor bank 借方银行decision-making under risk风险下的决策deed 契约deed tax 契税deferred savings 定期存款deficit covering 弥补赤字deficit-covering finance 赤字财政deflation 通货紧缩delivery date 交割日demand pull inflation需求拉动通货膨胀demand-deposit or checking-accounts 活期存款或支票帐户deposit account (D/A) 存款帐户deposit at call 通知存款deposit bank 存款银行deposit money 存款货币deposit rate 存款利率deposit turnover 存款周转率depreciation risks 贬值风险derivative deposit 派生存款derived deposit 派生存款designated currency 指定货币deutsche marks (=DM) 西德马克devaluation of dollar 美元贬值developer 发展商Development Bank 开发银行development financing 发展融资devise 遗赠die intestate 死时没有遗嘱Diners card 大莱信用卡direct exchange 直接汇兑direct financing 直接融资direct hedging 直接套做direct leases 直接租赁direct taxation 直接税discount credit 贴现融资discount market 贴现市场discount on bills 票据贴现discount paid 已付贴现额discounted cash flow 净现金量discounting bank 贴现银行dishonour risks 拒付风险disintermediation 脱媒distant futures 远期期货diversification 分散投资dividends 红利document of title 物权单据documentary collection 跟单托收Documents against Acceptance 承兑交单Documents against Payment 付款交单domestic correspondent 国内通汇银行domestic deposit 国内存款domestic exchange 国内汇兑double leasing 双重租赁double mortgage 双重抵押double option 双向期权Dow Jones average 道·琼斯平均数down payment 首期downgrade 降级downside 下降趋势downtick 跌点交易Dragon card 龙卡draw 提款draw cheque 签发票据drawee bank 付款银行drawing account 提款帐户dual exchange market 双重外汇市场dual trading 双重交易due from other funds 应收其他基金款due to other funds 应付其他基金款dumping 抛售early warning system 预警系统easy credit 放松信贷economic exposure 经济风险efficient portfolio 有效证券组合electronic accounting machine 电子记帐机electronic cash 电子现金electronic cash register 电子收款机electronic debts 电子借贷electronic funds transfer 电子资金转帐electronic transfer 电子转帐emergency tariff 非常关税encumbrance 债权(在不动产上设定的债权)endorsement for collection 托收背书engage in arbitrage (to) 套汇entity n. 单位,整体,个体entrance fee 申请费equalization fund (外汇)平衡基金equipment leasing services设备租赁业务equity portfolio 股票资产establishing bank 开证银行ethics risks 道德风险Euro-bank 欧洲银行Eurocard 欧洲系统卡European terms 欧洲标价法evaluation of property 房产估价evasion of foreign currency 逃汇exception clause 免责条款excess insurance 超额保险exchange adjustment 汇率调整exchange alteration 更改汇率exchange arbitrage 外汇套利exchange bank 外汇银行exchange broker 外汇经纪人exchange brokerage 外汇经纪人佣金exchange business 外汇业务exchange clearing agreement 外汇结算协定exchange clearing system 汇结算制exchange competition 外汇竞争exchange contract 外汇成交单exchange control 外汇管制exchange convertibility 外汇兑换exchange customs 交易所惯例exchange depreciation 外汇下降exchange dumping 汇率倾销exchange fluctuations 汇价变动exchange for forward delivery 远期外汇业务exchange for spot delivery即期外汇业务exchange freedom 外汇自由兑换exchange loss 汇率损失exchange parity 外汇平价exchange position 外汇头寸exchange position 外汇头寸;外汇动态exchange premium 外汇升水exchange profit 外汇利润exchange proviso clause 外汇保值条款exchange quota system 外汇配额制exchange rate 汇价exchange rate fluctuations 外汇价的波动exchange rate parity 外汇兑换的固定汇率exchange rate risks 外汇汇率风险exchange reserves 外汇储备exchange restrictions 外汇限制exchange risk 外汇风险exchange risk 兑换风险exchange settlement 结汇exchange speculation 外汇投机exchange stability 汇率稳定exchange surrender certificate 外汇移转证exchange transactions 外汇交易exchange value 外汇价值exchange war 外汇战excise 货物税,消费税exercise date 执行日exercise price, striking price 履约价格,认购价格expenditure tax 支出税expenditure tax regime 支出税税制expenses incurred in the purchase 购买物业开支expiration date 到期日export and import bank 进出口银行export gold point 黄金输出点exposure 风险external account 对外帐户extraneous risks 附加险extrinsic value 外在价值face value 面值facultative insurance 临时保险fair and reasonable 公平合理far future risks 长远期风险farm subsidies 农产品补贴farmland occupancy tax 耕地占用税favourable exchange 顺汇fax base 税基feast tax 筵席税feathered assets 掺水资产fee 不动产fee interest 不动产产权fictions payee 虚构抬头人fictitious assets 虚拟资产fictitious capital 虚拟资本fiduciary a. 信托的,受信托的(人)fiduciary field 信用领域,信托领域finance broker 金融经纪人financial advising services金融咨询服务financial arrangement 筹资安排financial crisis 金融危机financial forward contract 金融远期合约financial futures 金融期货financial futures contract 金融期货合约financial insolvency 无力支付financial institutions' deposit 同业存款financial lease 金融租赁financial risk 金融风险financial statement analysis 财务报表分析financial system 金融体系financial transaction 金融业务financial unrest 金融动荡financial world 金融界first mortgage 第一抵押权fiscal and monetary policy财政金融政策fixed assets 固定资产fixed assets ratio 固定资产比率fixed assets turnover ratio 固定资产周转率fixed capital 固定资本fixed costs 固定成本fixed deposit (=time deposit) 定期存款fixed deposit by installment 零存整取fixed exchange rate 固定汇率fixed par of exchange 法定汇兑平价fixed savings withdrawal 定期储蓄提款fixed-rate leases 固定利率租赁flexibility and mobility 灵活性与机动性flexibility of exchange rates 汇率伸缩性flexible exchange rate 浮动汇率floating exchange rate 浮动汇率floating policy 流动保险单floating-rate leases 浮动利率租赁floor 带利率下限的期权floor broker 场内经纪人fluctuations in prices 汇率波动foregift 权利金foreign banks 外国银行foreign correspondent 国外代理银行foreign currency futures 外汇期货foreign enterprises income tax 外国企业所得税foreign exchange certificate 外汇兑换券foreign exchange crisis 外汇危机foreign exchange cushion 外汇缓冲foreign exchange dumping 外汇倾销foreign exchange earnings 外汇收入foreign exchange liabilities 外汇负债foreign exchange loans 外汇贷款foreign exchange parity 外汇平价foreign exchange quotations 外汇行情foreign exchange regulations 外汇条例foreign exchange reserves 外汇储备foreign exchange restrictions 外汇限制foreign exchange retaining system 外汇留存制foreign exchange risk 外汇风险foreign exchange services 外汇业务foreign exchange transaction centre 外汇交易中心forward exchange 期货外汇forward exchange intervention 期货外汇干预forward exchange sold 卖出期货外汇forward foreign exchange 远期外汇汇率forward operation 远期(经营)业务forward swap 远期掉期fraternal insurance 互助保险free depreciation 自由折旧free foreign exchange 自由外汇freight tax 运费税fringe bank 边缘银行full insurance 定额保险full payout leases 充分偿付租赁full progressive income tax 全额累进所得税fund 资金、基金fund account 基金帐户fund allocation 基金分配fund appropriation 基金拨款fund balance 基金结存款fund demand 资金需求fund for relief 救济基金fund for special use 专用基金fund in trust 信托基金fund liability 基金负债fund obligation 基金负担fund raising 基金筹措fundamental insurance 基本险funds statement 资金表futures commission merchants 期货经纪公司futures contract 期货合约futures delivery 期货交割futures margin 期货保证金futures market 期货市场futures price 期货价格futures transaction 期货交易FX futures contract 外汇期货合约galloping inflation 恶性通货膨胀gap 跳空general endorsement 不记名背书general fund 普通基金general mortgage 一般抵押Giro bank 汇划银行given rate 已知汇率go long 买进,多头go short 短缺;卖空,空头going away 分批买进going rate 现行汇率Gold Ear Credit Card 金穗卡government revenue 政府收入graduated reserve requirement 分级法定准备金Great Wall card 长城卡gross cash flow 现金总流量guarantee of payment 付款保证guaranteed fund 保证准备金hammering the market 打压市场handling charge 手续费harmony of fiscal and monetary policies财政政策和金融政策的协调hedge 套头交易hedge against inflation 为防通货膨胀而套购hedge buying 买进保值期货hedge fund 套利基金hedging mechanism 规避机制hedging risk 套期保值风险hire purchase 租购hit the bid 拍板成交hoarded money 储存的货币holding the market 托盘horizontal price movement 横盘hot issue 抢手证券hot money deposits 游资存款hot stock 抢手股票house property tax 房产税hypothecation 抵押idle capital 闲置资本idle cash (money) 闲散现金,游资idle demand deposits 闲置的活期存款immobilized capital 固定化的资产immovable property 不动产import regulation tax 进口调节税imposition 征税;税;税款imprest bank account 定额银行存款专户in force (法律上)有效的in the tank 跳水inactive market 不活跃市场income in kind 实物所得income tax liabilities 所得税债务income taxes 所得税indemnity 赔偿,补偿indirect arbitrage 间接套汇indirect finance 间接金融indirect hedging 间接套做indirect leases 间接租赁(即:杠杆租赁) indirect rate 间接汇率indirect taxation 间接税individual income regulation tax 个人调节税individual income tax 个人所得税individual savings 私人储蓄Industrial and Commercial Bank of China 中国工商银行industrial financing 工业融资industrial-commercial consolidated tax工商统一税industrial-commercial income tax 工商所得税industrial-commercial tax 工商税inflation 通货膨胀inflation rate 通货膨胀率inflationary spiral 螺旋式上升的通货膨胀inflationary trends 通货膨胀趋势infrastructure bank 基本建设投资银行initial margin 初始保证金initial margin 期初保证权initial margins 初始保证金initial reserve 初期准备金insider 内幕人installment savings 零存整取储蓄institution 机构投资者insurance appraiser 保险损失评价人insurance broker 保险经纪人insurance contract 保险契约,保险合同insurance saleman 保险外勤insurance services 保险业务insure against fire 保火险insured 被保险人interbank market 银行同业市场inter-business credit 同行放帐interest on deposit 存款利息interest per annum 年息interest per month 月息interest rate futures contract 利率期货合约interest rate policy 利率政策interest rate position 利率头寸interest rate risk 利率风险interest restriction 利息限制interest subsidy 利息补贴interest-rate risk 利息率风险interim finance 中间金融intermediary bank 中间银行intermediate account 中间帐户internal reserves 内部准备金international banking services 国际银行业务International Investment Bank (IIB) 国际投资银行international leasing 国际租赁in-the-money 有内在价值的期权intraday 日内intrinsic utility 内在效用intrinsic value 实际价值,内部价值inward documentary bill for collection进口跟单汇票,进口押汇(汇票)isolation of risk 风险隔离issue bank 发行银行JCB card JCB卡joint financing 共同贷款key risk 关键风险kill a bet 终止赌博land use tax 土地使用税large deposit 大额存款large leases 大型租赁latent inflation 潜在的通货膨胀lease agreement 租约lease and release 租借和停租lease broker 租赁经纪人lease financing 租赁筹租lease immovable 租借的不动产lease in perpetuity 永租权lease insurance 租赁保险lease interest insurance 租赁权益保险lease land 租赁土地lease mortgage 租借抵押lease out 租出lease property 租赁财产lease purchase 租借购买lease rental 租赁费lease territory 租借地leaseback 回租leasebroker 租赁经纪人leased immovable 租借的不动产leasehold 租赁土地leasehold 租借期,租赁营业,租赁权leasehold property 租赁财产leaseholder 租赁人leaseholder 承租人,租借人leases agent 租赁代理leases arrangement 租赁安排leases company 租赁公司leases structure 租赁结构leasing 出租leasing agreement 租赁协议leasing amount 租赁金额leasing asset 出租财产,租赁财产leasing clauses 租赁条款leasing consultant 租赁顾问leasing contract 租赁合同leasing cost 租赁成本leasing country 承租国leasing division 租赁部leasing equipment 租赁设备leasing industry 租赁业leasing industry (trade) 租赁业leasing money 租赁资金leasing period 租赁期leasing regulations 租赁条例legal interest 法定利息legal tender 法定货币legal tender 本位货币,法定货币lessee 承租人,租户lessor 出租人letter of confirmation 确认书letter transfer 信汇leveraged leases 杠杆租赁lien 扣押权,抵押权life insurance 人寿保险life of assets 资产寿命limit order 限价指令limited floating rate 有限浮动汇率line of business 营业范围,经营种类liquidation 清仓liquidity 流动性liquidity of bank 银行资产流动性listed stock 上市股票livestock transaction tax 牲畜交易税loan account 贷款帐户loan amount 贷款额loan at call 拆放loan bank 放款银行loan volume 贷款额loan-deposit ratio 存放款比率loans to financial institutions 金融机构贷款loans to government 政府贷款local bank 地方银行local income tax (local surtax) 地方所得税local surtax 地方附加税local tax 地方税long arbitrage 多头套利long position 多头头寸long-term certificate of deposit 长期存款单long-term credit bank 长期信用银行long-term finance 长期资金融通loss leader 特价商品,亏损大项loss of profits insurance 收益损失保险loss on exchange 汇兑损失low-currency dumping 低汇倾销low-currency dumping 低汇倾销M/T (= Mail Transfer) 信汇main bank 主要银行maintenance margin 最低保证金,维持保证金major market index 主要市场指数management risk 管理风险managing bank of a syndicate 财团的经理银行manipulation 操纵margin 保证金margin call 保证金通知margin call 追加保证金的通知margin money 预收保证金,开设信用证保证金margin rate 保证金率markdown 跌价market discount rate 市场贴现率market expectations 市场预期market makers 造市者market order 市价订单market risk 市场风险marketability 流动性market-clearing 市场结算Master card 万事达卡matching 搭配mature liquid contracts 到期合约maximum limit of overdraft 透支额度measures for monetary ease 金融缓和措施medium rate 中间汇率medium-term finance 中期金融member bank 会员银行Million card 百万卡minimum cash requirements 最低现金持有量(需求)minimum reserve ratio 法定最低准备比率mint parity 法定平价monetary action 金融措施monetary aggregates 货币流通额monetary and credit control 货币信用管理monetary and financial crisis 货币金融危机monetary area 货币区monetary assets 货币性资产monetary base 货币基础monetary circulation 货币流通monetary device 金融调节手段monetary ease 银根松动monetary market 金融市场monetary risk 货币风险monetary stringency 银根奇紧monetary unit 货币单位money capital 货币资本money collector 收款人money credit 货币信用money down 付现款money equivalent 货币等价money paid on account 定金money-flow analysis 货币流量分析money-over-money leases 货币加成租赁moral hazard 道德风险mortgage bank 抵押银行motor vehicle and highway user tax 机动车和公路使用税movables all risks insurance 动产综合保险movables insurance 动产保险multinational bank 跨国银行multiunit 公寓楼mutual insurance company 相互保险公司national bank 国家银行nationalized bank 国有化银行near money 准货币nearby contracts 近期合约nearby futures 近期期货nearby risks 近期风险negotiability 流通性negotiating bank 议付银行nesting 配套net settlement status 净结算状况,净结算头寸neutral money 中介货币neutrality of the central bank 中央银行的中立性nominal account 名义帐户nominal deposit 名义存款non-member bank 非会员银行non-resident account 非居民存款notional principal 名义本金notional sum 名义金额off-balance-sheet 表外业务offer rate 卖出汇率official borrowing 政府借款official devaluation 法定贬值official rate (of exchange) 官方汇价official short-term credit 官方短期信用offset reserve 坏帐准备金on a discount basis (以)折价形式open account business (= open account trade)赊帐交易open an account 开户open fair transaction tax 集市交易税open market 公开市场open market operation 公开市场业务open market policy 公开市场政策open mortgage 可资抵押open negotiation 公开议付open outcry 公开喊价,公开叫价open policy 预约保单open position (期货交易中的)头寸open positions 敞口头寸open-ended 无限制的,无限度的opening order 开市价订单operating bank 营业银行operating cash flow 营运现金流(量)operating lease 经营租赁operating leases 操作租赁operating risk 经营风险operation account 交易帐户option 期权,选择权,买卖权option buyer 期权的买方option fee (=option premium or premiumo期权费option purchase price 期权的购进价格option seller 期权的卖方options on futures contract 期货合同的期权交易ordinary bank 普通银行ordinary deposit 普通存款ordinary time deposit 普通定期存款our bank 开户银行out-of-the-money 无内在价值的期权output-capital ratio 产出与资本的比率outright position 单笔头寸outward documentary bill for collection出口跟单汇票,出口押汇outward remittance 汇出汇款over-loan position 贷款超额overnight call loan 日拆overseas bank 海外银行overseas branches 国外分行oversold 超卖over-the-counter 场外的,买卖双方直接交易的,不通过交易所交易的over-the-counter (OTC) option 场外交易市场overvalued 估价过高Pacific card 太平洋卡package policy 一揽子保险painting the tape 粉饰行情pairing 配对parking 寄售partial assignment 部分转让parties to a collection 托收各当事人pawn 典当pay up 付清,缴清payee or beneficiary 受款人,收款人paying bank 付款银行paying bank 汇入行,付款行payment facilities 支付服务设施payment of account 预付金payment of exchange 结汇payment reserve 支付准备payment risks 支付风险payroll tax 薪金税pegging 固定汇率permanent capital 永久性资本personal account 个人帐户personal deposit 私人存款personal loans 个人贷款petty current deposit 小额活期存款petty insurance 小额保险place an order 订购;下单plastic card 塑料卡Po card 牡丹卡point of delivery 交割地点policy of discount window窗口指导政策political risk 政治风险poor for insurance 风险大的保险户popularity bank 庶民银行position 头寸;交易部位;部位post 过帐;登入总帐postal remittance 邮政汇款postal savings 邮政储蓄pre-credit risk 信贷前风险predetermined 预先约定的premium 期权费premium 期权权利金premium for lease 租赁保证金premium rate 保险费率premium rates 优惠率premium tariff 保险费率表present discount value 贴现现值presenting bank 提示银行prevailing rate 现行汇率price discovery 价格发现primary insurance 基本险principal 本金principal (= drawer,consignor) 委托人principal and interest 本利principals (stockholders) 股东privately owned enterprise income tax私营企业所得税product tax 产品税productivity risk 产量风险profit and loss accounts 损益帐户。

金融专业英语词汇大全

金融专业英语词汇大全一、基本金融术语1. 金融(Finance):指货币的筹集、分配和管理活动。

2. 银行(Bank):提供存款、贷款、支付结算等金融服务的机构。

3. 证券(Securities):代表财产所有权或债权的凭证,如股票、债券等。

4. 投资(Investment):将资金投入到某个项目或资产,以获取收益的行为。

5. 债务(Debt):借款人向债权人承诺在一定期限内偿还本息的义务。

6. 股票(Stock):股份有限公司发行的,代表股东对公司所有权和收益分配权的凭证。

7. 债券(Bond):债务人向债权人发行的,承诺按一定利率支付利息并在到期日偿还本金的债务凭证。

8. 利率(Interest Rate):资金的价格,反映资金借贷的成本。

9. 汇率(Exchange Rate):一种货币兑换另一种货币的比率。

10. 通货膨胀(Inflation):货币购买力下降,物价普遍持续上涨的现象。

二、金融衍生品词汇1. 金融衍生品(Financial Derivatives):基于现货金融工具派生出来的新型金融工具。

2. 期货(Futures):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

3. 期权(Options):买卖双方在未来一定期限内,按约定价格买入或卖出某种标的物的权利。

4. 掉期(Swap):双方约定在未来某一时间,相互交换一系列现金流的合约。

5. 远期合约(Forward Contract):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

三、金融机构及监管部门词汇1. 中央银行(Central Bank):国家金融政策制定和执行的机构,如中国人民银行。

2. 商业银行(Commercial Bank):以盈利为目的,提供存款、贷款、支付结算等金融服务的银行。

3. 证券公司(Securities Company):从事证券经纪、投资咨询、资产管理等业务的金融机构。

金融英语词汇大全(整理打印版)

金融专业英语词汇大全A (2)B (4)C (6)D (12)E (14)F (16)G (19)H (19)I (20)J (21)K (21)L (22)M (24)N (25)O (26)P (27)Q (28)R (29)S (31)T (33)U (34)V (35)W (35)Z (35)A1. a flat percentage rate of income统一比率的所得税税率2. a long position多头部位,利多形势,多头寸;买进的期货合同3. a put option on a debt security债务证券的卖出期权4. a sales slip签购单据,售货清单,空头部位,短缺头寸5. a short position空头;卖出的期货合同6. a tax return税务申报表7.abnormal depreciation特别折旧8.abnormal spoilage非正常损坏9.aboriginal cost原始成本10.acceptance bank票据承兑行11.acceptance method承兑方式12.acceptance risks承兑风险13.accepting bank承兑银行14.accessory risks附加保险,附加险15.accident insurance意外保险(不包括海上,火灾和人寿险)16.accommodation of funds资金融通17.accompany vt.附带,伴随,陪同18.account charges账户费用19.account current (A/C,a/c)往来帐户20.account number (A/N)帐号21.account statement帐户清单22.accounting exposure会计风险23.accounting risks会计风险24.accounting value帐面价值25.accounts of assured保险帐户26.accrued bond interest应计债券利息27.accrued depreciation应计折旧28.accrued dividend应计股利29.acknowledgement of declaration预约保险申报确认书30.active securities热头股票,活跃的证券31.actual cash value(保险用语)实际现金价值32.actual rate实际汇率33.adaptive expectations适应性预期34.additional insurance加保,附加保险35.additional reserve追加准备金36.adjustable policy可调整的保险单37.adjustable premium可调整的保险费38.adjusted debit balance已调整的借方余额39.advance payment of premium预缴保险费40.advance-decline theory涨跌理论41.adverse exchange逆汇、逆汇兑42.advice of drawing提款通知书43.advising bank通知银行44.affiliated bank联行45.affiliated person关联人46.aftermarket次级市场47.agent for collection托收代理银行48.Agricultural Bank of China中国农业银行49.agricultural loans农业贷款50.agricultural(animal husbandry)tax农(牧)业税51.allowance for doubtful debt备抵呆帐款项52.alternative (either/or) order选择指令53.American Express card运通卡54.American terms美国标价法55.amount in figures小写金额56.amount in words大写金额57.annual membership dues年费58.application form for a banking account银行开户申请书59.appointed bank外汇指定银行60.appreciation of exchange rate汇率升值61.arbitrage套利62.arbitrage套购,套利,套汇63.arbitrage of exchange套汇64.arbitrage of exchange or stock套汇或套股65.arbitrage opportunity套价机会66.arbitrage risks套汇风险67.as agent做代理68.as principal做自营n Development Fund (ADB)亚洲开发银行70.ask price = asking price = offer price出售价,报价,开价,出价71.ask-bid system竞价系统72.assessment of loss估损73.assets insurance资产保险74.assignment of policy保单转让75.assumption of risk承担风险76.asymmetry不对称77.at owner's risk风险由货主负担78.at-the-close order收盘指令79.at-the-market按市价80.at-the-money平值期权81.at-the-opening (opening only) order开盘指令82.auction marketplace拍卖市场83.automated teller machines (24 hours a day)自动取款机(24小时服务)84.automatic transfers between accounts自动转帐85.average平均数.B86. baby bond 小额债券 87. back spreads 反套利 88. back wardation 现货溢价 89. balance n. 结余,差额,平衡 90. bank balance 存款余额 91. bank balance over required reserves 超出法定(必备)储备的银行存款余额 92. bank deposit 银行存款 93. Bank of China 中国银行 94. Bank of Communications 交通银行 95. bank of deposit 存款银行 96. bank of the government 政府的银行 97. banker's association 银行协会 98. banker's bank 中央银行 99. banker's guarantee 银行担保 100. bank's buying rate 银行买入价 101. bank's selling rate 银行卖出价 102. banks with business dealing with the center 中央银行的往来银行 103. Barclay card 巴克莱银行信用卡 104. base rate 基本汇价 105. basis order 基差订单 106. basis risk 基差风险 107. bear market 熊市 108. bear operation 卖空行为 109. bear raiders 大量抛空者 110. beneficial owner 受益所有人 111. beneficiary of insurance 保险金受益人 112. best-efforts offering 尽力推销(代销)发行 113. bid and ask prices买入和卖出价114. bid and ask spread 买卖差价115. bid price = buying price 买价116. bid-ask spread 递盘虚盘差价117. big board 大行情牌118. big slump 大衰退(暴跌)119. bill-paying services 代付帐款120. black market 黑市121. black market financing 黑市筹资122. black money 黑钱123. blanket mortgage 总括抵押124. block positioner 大宗头寸商125. blowout 畅销126. blue-chip stocks 蓝筹股127. board of arbitration 仲裁委员会128. board of governors 理事会129. bond fund 债券基金130. borrowing from affiliates 向联营公司借款131. borrowing power of securities 证券贷款能力132. borrowing risks 借款风险133. bought deal 包销134. bread and butter business 基本业务135. breadth index 宽度指数136. break-even 不亏不盈,收支相抵137. breakout 突破138. bridging finance 过渡性融资139. broker 经纪人,掮客. 140.brokerage 经纪人佣金141.brokerage 经纪业;付给经纪人的佣金142.brokerage firm 经纪商(号)143.broker's loan 经纪人贷款144.broking house 经纪人事务所145.building agreement 具有约束力的协定146.building tax (tax on construction)建筑税147.bullish 行情看涨148.business insurance 企业保险149.business risk 营业风险150.business savings 企业储蓄151.business tax 营业税152.business term loan 企业长期贷款153.bust-up risks 破产风险154.buyer's risks 买方风险.C155. call (option) 买方期权,看涨期权 156. call and put options 买入期权和卖出期权 157. call for funds 控股、集资 158. call loan transaction 短期拆放往来 159. call market 活期存款市场 160. call money 拆放款 161. call options on an equity 权益(证券)的买入期权 162. call-options 认购期权 163. cancellation 取消 164. cancellation money 解约金 165. cap 带利率上限的期权 166. capital assets 资本资产 167. capital lease 资本租赁 168. capital market 信贷市场、资本市场 169. capital resources 资本来源 170. capital surplus 资本盈余 171. capital transfer 资本转移 172. capital turnover rate 资本周转率 173. card issuing institution 发卡单位 174. carefully selected applicant 经仔细选定的申请人 175. cargo insurance 货物保险 176. cash 现金,现款v.兑现,付现款 177. cash a cheque 支票兑现 178. cash account 现金帐户 179. cash advance 差旅预支款 180. cash against bill of lading 凭提单付现 181. cash against documents (C.A.D.)凭单付现,凭单据付现金=document against cash 182. cash and carry付现自运;现金交易和运输自理;现购自运商店183. cash and carry wholesale 付现自运批发184. cash assets 现金资产185. cash audit 现金审核186. cash audit 现金审核,现金审计187. cash balance 现金余额,现款结存188. cash basis 现金制189. cash basis 现金制,现金基础190. cash basis accounting 现金收付会计制191. cash before delivery (C.B.D.) 空货前付款,付款后交货,付现款交货192. cash bonus 现金红利193. cash book 现金簿;现金帐;现金出纳帐194. cash boy 送款员195. cash budget 现金预算196. cash card1 (银行)自动提款卡197. cash card2 现金卡198. cash claim 现金索赔199. cash collection basis 收现法,收现制200. cash credit 活期信用放款,现金付出201. cash credit slip 现金支出传票202. cash currency 现金通货203. cash cycle 现金循环,现金周期204. cash day 付款日205. cash debit slip 现金收入传票206. cash department (商业机构中的)出纳部 =counting-house207. cash deposit 现金存款;保证金 208. cash deposit as collateral 保证金,押金 209. cash desk (商店、饭馆的)付款处 210. cash disbursements 现金支出 211. cash discount (c.d.) 现金折扣,付现折扣 =settlement discount 212. cash dispenser (美)自动提款机 =cashomat 213. cash dividend 现金股利 214. cash down 即付,付现 215. cash equivalent value 现金等值,现金相等价值 216. cash flow 资金流动 217. cash flow 现金流动 218. cash flow stream 现金流(量) 219. cash holdings 库存现金 220. cash holdings 库存现金 221. cash in advance (c.i.a.) 预付现金 222. cash in bank 存银行现金,银行存款 223. cash in hand (商行的)手头现金,库存现金 =cash on hand 224. cash in transit 在途现金,在运现金 225. cash in transit policy 现金运送保险单 226. cash in treasury 库存现金 227. cash invoice 现购发票 228. cash items 现金帐项,现金科目 229. cash journal 现金日记簿 230. cash liquidity 现金流动(情况);现金周转 231. cash loan 现金贷款 232. cash management services 现金管理业务 233. cash market现金交易市场,现货市场,付现市场 234. cash nexus现金交易关系 235. cash on arrival货到付现,货到付款 236. cash on bank银行存款;银行付款;现金支票付款 237. cash on deliver (C.O.D)(英)交货付款,现款交货 =collect on delivery 238. cash on delivery (COD)交割付款 239. cash order (C/O ) 现金订货240. cash paid book 现金支出簿241. cash payment 现金支付242. cash payment 现金付款,现付243. cash payments journal 现金支出日记帐244. cash position 头寸245. cash position 现金状况,现金头寸246. cash price 现金售价,现金付款价格247. cash purchase 现购,现金购买248. cash railway (商店中的)货款传送线249. cash ratio 现金比率250. cash receipts (CR) 现金收入251. cash receipts journal现金收入日记帐 252. cash records现金记录 253. cash register现金登记机,现金收入记录机,收银机 254. cash remittance汇款单;解款单255. cash remittance note现金解款单,解款单 256. cash requirement现金需要量 257. cash reserve现金储备(金) 258. cash resources现金资源,现金来源 259. cash resources (reserves)现金准备260. cash sale 现售,现金销售=sale by real cash 261. cash sale invoice 现销发票,现售发票 262. cash settlement 现金结算,现汇结算 263. cash short and over 现金尾差,清点现金余差;现金短溢 264. cash slip 现金传票 265. cash statement 现金报表,(现金)库存表 266. cash ticket 现销票,门市发票 267. cash transaction 现金交易 268. cash verification 现金核实,现金核查 269. cash voucher 现金凭单;现金收据 270. cash with order (c.w.o., C.W.O.订货时付款,订货付现,落单付现 271. cash without discount 付现无折扣 272. cash yield discount 现金获利率,现金收益率 273. cash-and-carry arbitrage 现货持有套利 274. cashier 出纳员,收支员 275. cashier's cheque (C.C.) 银行本票 =cashier's order 276. central rate 中心汇率(一国货币对美元的汇率,并据此计算对其他货币的汇率) 277. certificate of balance 存款凭单 278. Certificate of Deposits (CDs) 大额定期存款单 279. certificated security 实物证券 280. certificates of deposit (CDs) 大面额存款单 281. certifying bank 付款保证银行 282. change hands 交换,换手 283. chartered bank 特许银行 284. chattel 动产 285. chattel mortgage 动产抵押 286. chattel mortgage bond(美)动产抵押(公司)债券287. chattel personal(私人)动产288. chattel real准不动产(土地权等) 289. check certificate检验证明书 290. check deposit支票存款 291. check list(核对用的)清单 292. check sheet对帐单 293. checking account支票帐户 294. checking deposits支票存款,活期存款295. checking reserve支票现金储备 296. checkstand(超级市场的)点货收款台 297. cheque (payable) to bearer来人支票,不记名支票 298. cheque book支票簿 299. cheque book stub支票簿存根 300. cheque card支票卡 301. cheque collection支票兑取 302. cheque collector 支票兑取人303. cheque crossed 划线支票 304. cheque crossed generally普通划线支票 305. cheque crossed specially特别划线支票 306. cheque deposit支票存款 307. cheque drawer支票出票人 308. cheque holder支票执票人 309. cheque only for account转帐支票 310. cheque payable at sight见票即付支票 311. cheque protector支票银码机 312. cheque rate票据汇兑汇率,票汇价格 =sight rate ,short rate313. cheque register 支票登记簿 314. cheque returned 退票,退回的支票 315. cheque signer 支票签名机 316. cheque stub 支票存根 317. cheque to order 记名支票,指定人支票 318. China Investment Bank 中国投资银行 319. circulation risks 流通风险 320. circulation tax (turnover tax ) 流转税 321. city bank 城市银行 322. claim a refound 索赔 323. clean collections 光票托收 324. clearing bank 清算银行 325. clearing house 清算所 326. clearinghouse 清算公司,票据交换所 327. close out 平仓,结清(账) 328. closed and mortgage 闭口抵押 329. closing order 收市价订单 330. closing rate 收盘价 331. closing transaction 平仓交易 332. collar 带利率上下限的期权 333. collateral loan 抵押借款 334. collecting bank 托收银行,代收行 335. collection instructions 委托(托收的)单据 336. collection items 托收业务,托收项目 337. collection of trade charges 托收货款 338. collection on clean bill 光票托收 339. collection on documents 跟单托收 340. collection order托收委托书341. collection risk托收风险 342. collection risks托收风险 343. collection service托收服务 344. collective-owned enterprise bonus tax集体企业奖金税 345. collective-owned enterprise income tax集体企业所得税 346. commercial and industrial loans工商贷款 347. commercial deposit商业存款 348. commercial paper商业票据 349. commercial paper house经营商业票据的商号 350. commercial risk商业风险 351. commercial terms商业条件 352. commission佣金 353. commodity futures商品期货 354. commodity insurance商品保险 355. common collateral共同担保 356. common fund共同基金 357. common stock普通股 358. common trust fund共同信托基金 359. compensatory financing补偿性融资 360. competitive risks竞争风险 361. composite depreciation综合折旧 362. compound interest复利363. compound rate复利率 364. compound rate deposit复利存款 365. comprehensive insurance综合保险 366. condominium公寓私有共有方式367. confirming bank 保兑银行 368. congestion area 震荡区 369. congestion tape 统一自动行情显示 370. conservatism and liquidity 稳健性与流动性 371. consortium bank 银团银行 372. constructure risk 建设风险 373. consumer financing 消费融资 374. contingent risks 或有风险 375. contract money 合同保证金 376. contract size 合约容量 377. contracts of difference 差异合约 378. contractual value 合同价格 379. controlled rates 控制的汇率 380. converge 集聚,(为共同利益而)结合一起 381. conversion 汇兑、兑换 382. convertible currency 可兑换的货币 383. cooling-off period 等待期 384. cooperative financing 合作金融 385. cornering the market 操纵市场 386. corners 垄断 387. corporate deposits 法人存款 388. correspondent 代理行 389. cost of maintenance 维修费 390. counter-inflation policy 反通货膨胀对策 391. cover 弥补,补进(卖完的商品等)弥补(损失等);负担(开支);补进(商品或股票等);保险 392. coverage 承保险别;保险总额;范围保险 393. coverage ratio偿债能力比率 394. cover-note暂保单;投保通知单395. credit信用,信贷 396. credit account (C.A., C/A)赊帐=open account397. credit agreement 信贷协定398. credit amount 信贷金额;赊帐金额;信用证金额399. credit analysis 信用分析400. credit balance 贷方余额,结欠,贷余401. credit bank 信贷银行402. credit beneficiary 信用证受益人403. credit business 赊售,信用买卖404. credit buying 赊购405. credit capital 信贷资本406. credit cards 信用卡407. credit control 信用控制408. credit control instrument 信用调节手段409. credit expansion 信用扩张410. credit extending policy 融资方针411. credit facility 信用透支412. credit limit 信用额度413. credit restriction 信用限额414. credit risk 信用风险415. credit union 信用合作社416. creditor bank 债权银行417. crop up (out) 出现,呈现 418. cross hedge 交叉套做419. cross hedging 交叉保值. 420.cum dividend 附息421.cum rights 含权422.cumulative preferred stock 累积优先股423.currency futures 外币期货424.currency futures contract 货币期货合约425.current fund 流动基金426.current futures price 现时的期货价格427.current ratio 流动比率428.customize 按顾客的具体要求制作429.customs duty(tariffs)关税.D430. D/D (Banker's Demand Draft) 票汇 431. daily interest 日息 432. daily limit 每日涨(跌)停板 433. date of delivery 交割期 434. dealers 批发商 435. death and gift tax 遗产和赠与税 436. debt of honour 信用借款 437. debtor bank 借方银行 438. decision-making under risk 风险下的决策 439. deed 契约 440. deed tax 契税 441. deferred savings 定期存款 442. deficit covering 弥补赤字 443. deficit-covering finance 赤字财政 444. deflation 通货紧缩 445. delivery date 交割日 446. demand pull inflation 需求拉动通货膨胀 447. demand-deposit or checking-accounts 活期存款或支票帐户 448. deposit account (D/A) 存款帐户 449. deposit at call 通知存款 450. deposit bank 存款银行 451. deposit money 存款货币 452. deposit rate 存款利率 453. deposit turnover 存款周转率 454. depreciation risks 贬值风险 455. derivative deposit 派生存款 456. derived deposit 派生存款 457. designated currency指定货币458. deutsche marks (=DM) 西德马克459. devaluation of dollar 美元贬值460. developer 发展商461. Development Bank 开发银行462. development financing 发展融资463. devise 遗赠464. die intestate 死时没有遗嘱465. Diners card 大莱信用卡466. direct exchange 直接汇兑467. direct financing 直接融资468. direct hedging 直接套做469. direct leases 直接租赁470. direct taxation 直接税471. discount credit 贴现融资472. discount market 贴现市场473. discount on bills 票据贴现474. discount paid 已付贴现额475. discounted cash flow 净现金量476. discounting bank 贴现银行477. dishonour risks 拒付风险478. disintermediation 脱媒479. distant futures 远期期货480. diversification 分散投资481. dividends 红利482. document of title 物权单据483. documentary collection 跟单托收.484. Documents against Acceptance,D/A 承兑交单 485. Documents against Payment,D/P 付款交单 486. domestic correspondent 国内通汇银行 487. domestic deposit 国内存款 488. domestic exchange 国内汇兑 489. double leasing 双重租赁 490. double mortgage 双重抵押 491. double option 双向期权 492. Dow Jones average 道·琼斯平均数 493. down payment 首期 494. downgrade 降级495. downside下降趋势496. downtick跌点交易497. Dragon card 龙卡498. draw 提款499. draw cheque 签发票据500. drawee bank 付款银行501. drawing account 提款帐户502. dual exchange market 双重外汇市场503. dual trading 双重交易504. due from other funds 应收其他基金款505. due to other funds 应付其他基金款506. dumping 抛售.E507. early warning system 预警系统 508. easy credit 放松信贷 509. economic exposure 经济风险 510. efficient portfolio 有效证券组合 511. electronic accounting machine 电子记帐机 512. electronic cash 电子现金 513. electronic cash register 电子收款机 514. electronic debts 电子借贷 515. electronic funds transfer 电子资金转帐 516. electronic transfer 电子转帐 517. emergency tariff 非常关税 518. encumbrance 债权(在不动产上设定的债权) 519. endorsement for collection 托收背书 520. engage in arbitrage (to) 套汇 521. entity n. 单位,整体,个体 522. entrance fee 申请费 523. equalization fund (外汇)平衡基金 524. equipment leasing services 设备租赁业务 525. equity portfolio 股票资产 526. establishing bank 开证银行 527. ethics risks 道德风险 528. Euro-bank 欧洲银行 529. Eurocard 欧洲系统卡 530. European terms 欧洲标价法 531. evaluation of property 房产估价 532. evasion of foreign currency 逃汇 533. exception clause 免责条款 534. excess insurance超额保险535. exchange adjustment 汇率调整536. exchange alteration 更改汇率537. exchange arbitrage 外汇套利538. exchange bank 外汇银行539. exchange broker 外汇经纪人540. exchange brokerage 外汇经纪人佣金541. exchange business 外汇业务542. exchange clearing agreement 外汇结算协定543. exchange clearing system 汇结算制544. exchange competition 外汇竞争545. exchange contract 外汇成交单546. exchange control 外汇管制547. exchange convertibility 外汇兑换548. exchange customs 交易所惯例549. exchange depreciation 外汇下降550. exchange dumping 汇率倾销551. exchange fluctuations 汇价变动552. exchange for forward delivery 远期外汇业务553. exchange for spot delivery 即期外汇业务554. exchange freedom 外汇自由兑换555. exchange loss 汇率损失556. exchange parity 外汇平价557. exchange position 外汇头寸558. exchange position 外汇头寸;外汇动态559. exchange premium 外汇升水560. exchange profit 外汇利润.561. exchange proviso clause 外汇保值条款 562. exchange quota system 外汇配额制 563. exchange rate 汇价 564. exchange rate fluctuations 外汇汇价的波动 565. exchange rate parity 外汇兑换的固定汇率 566. exchange rate risks 外汇汇率风险 567. exchange reserves 外汇储备 568. exchange restrictions 外汇限制 569. exchange risk 外汇风险,兑换风险 570. exchange settlement 结汇 571. exchange speculation 外汇投机 572. exchange stability 汇率稳定 573. exchange surrender certificate 外汇移转证574. exchange transactions外汇交易575. exchange value外汇价值576. exchange war外汇战577. excise货物税,消费税578. exercise date 执行日579. exercise price, striking price 履约价格,认购价格580. expenditure tax 支出税581. expenditure tax regime 支出税税制582. expenses incurred in the purchase 购买物业开支583. expiration date 到期日584. export and import bank 进出口银行585. export gold point 黄金输出点586. exposure 风险587. external account 对外帐户588. extraneous risks 附加险589. extrinsic value 外在价值.F590. face value 面值 591. facultative insurance 临时保险 592. fair and reasonable 公平合理 593. far future risks 长远期风险 594. farm subsidies 农产品补贴 595. farmland occupancy tax 耕地占用税 596. favourable exchange 顺汇 597. fax base 税基 598. feast tax 筵席税 599. feathered assets 掺水资产 600. fee 不动产 601. fee interest 不动产产权 602. fictions payee 虚构抬头人 603. fictitious assets 虚拟资产 604. fictitious capital 虚拟资本 605. fiduciary a. 信托的,信用的,受信托的(人) 606. fiduciary field 信用领域,信托领域 607. finance broker 金融经纪人 608. financial advising services 金融咨询服务 609. financial arrangement 筹资安排 610. financial crisis 金融危机 611. financial forward contract 金融远期合约 612. financial futures 金融期货 613. financial futures contract 金融期货合约 614. financial insolvency 无力支付 615. financial institutions' deposit 同业存款 616. financial lease 金融租赁 617. financial risk金融风险618. financial statement analysis 财务报表分析619. financial system 金融体系620. financial transaction 金融业务621. financial unrest 金融动荡622. financial world 金融界623. first mortgage 第一抵押权624. fiscal and monetary policy 财政金融政策625. fixed assets 固定资产626. fixed assets ratio 固定资产比率627. fixed assets turnover ratio 固定资产周转率628. fixed capital 固定资本629. fixed costs 固定成本630. fixed deposit (=time deposit) 定期存款631. fixed deposit by installment 零存整取632. fixed exchange rate 固定汇率633. fixed par of exchange 法定汇兑平价634. fixed savings withdrawal 定期储蓄提款635. fixed-rate leases 固定利率租赁636. flexibility and mobility 灵活性与机动性637. flexibility of exchange rates 汇率伸缩性638. flexible exchange rate 浮动汇率639. floating exchange rate 浮动汇率640. floating policy 流动保险单641. floating-rate leases 浮动利率租赁642. floor 带利率下限的期权643. floor broker 场内经纪人644. fluctuations in prices 汇率波动 645. foregift 权利金 646. foreign banks 外国银行 647. foreign correspondent 国外代理银行 648. foreign currency futures 外汇期货 649. foreign enterprises income tax 外国企业所得税 650. foreign exchange certificate 外汇兑换券 651. foreign exchange crisis 外汇危机 652. foreign exchange cushion 外汇缓冲 653. foreign exchange dumping 外汇倾销 654. foreign exchange earnings 外汇收入 655. foreign exchange liabilities 外汇负债 656. foreign exchange loans 外汇贷款 657. foreign exchange parity 外汇平价 658. foreign exchange quotations 外汇行情 659. foreign exchange regulations 外汇条例 660. foreign exchange reserves 外汇储备 661. foreign exchange restrictions 外汇限制 662. foreign exchange retaining system 外汇留存制 663. foreign exchange risk 外汇风险 664. foreign exchange services 外汇业务 665. foreign exchange transaction centre 外汇交易中心 666. forward exchange 期货外汇 667. forward exchange intervention 期货外汇干预 668. forward exchange sold 卖出期货外汇 669. forward foreign exchange 远期外汇汇率 670. forward operation 远期(经营)业务 671. forward swap远期掉期 672. fraternal insurance互助保险 673. free depreciation自由折旧 674. free foreign exchange自由外汇 675. freight tax运费税 676. fringe bank边缘银行 677. full insurance定额保险 678. full payout leases充分偿付租赁 679. full progressive income tax全额累进所得税 680. fund资金、基金 681. fund account基金帐户 682. fund allocation基金分配 683. fund appropriation基金拨款 684. fund balance基金结存款 685. fund demand资金需求 686. fund for relief救济基金 687. fund for special use专用基金 688. fund in trust信托基金 689. fund liability基金负债 690. fund obligation基金负担 691. fund raising基金筹措 692. fundamental insurance基本险 693. funds statement资金表 694. futures commission merchants期货经纪公司 695. futures contract期货合约 696. futures delivery期货交割 697. futures margin期货保证金698.futures market 期货市场699.futures price 期货价格700.futures transaction 期货交易701.FX futures contract 外汇期货合约.G702. galloping inflation 恶性通货膨胀 703. gap 跳空 704. general endorsement 不记名背书 705. general fund 普通基金 706. general mortgage 一般抵押 707. Giro bank 汇划银行 708. given rate 已知汇率 709. go long 买进,多头 710. go short 短缺;卖空,空头 711. going away 分批买进 712. going rate 现行汇率 713. Gold Ear Credit Card 金穗卡 714. government revenue 政府收入 715. graduated reserve requirement 分级法定准备金 716. Great Wall card 长城卡 717. gross cash flow 现金总流量 718. guarantee of payment 付款保证 719. guaranteed fund 保证准备金 H720. hammering the market打压市场 721. handling charge手续费 722. harmony of fiscal and monetary policies财政政策和金融政策的协调 723. hedge套头交易 724. hedge against inflation为防通货膨胀而套购 725. hedge buying买进保值期货 726. hedge fund套利基金 727. hedging mechanism规避机制728. hedging risk套期保值风险 729. hire purchase租购 730. hit the bid拍板成交 731. hoarded money储存的货币 732. holding the market托盘 733. horizontal price movement横盘 734. hot issue抢手证券 735. hot money deposits游资存款 736. hot stock抢手股票 737. house property tax房产税738. hypothecation抵押.I739. idle capital 闲置资本 740. idle cash (money) 闲散现金,游资 741. idle demand deposits 闲置的活期存款 742. immobilized capital 固定化的资产 743. immovable property 不动产 744. import regulation tax 进口调节税 745. imposition 征税;税;税款 746. imprest bank account 定额银行存款专户 747. in force (法律上)有效的 748. in the tank 跳水 749. inactive market 不活跃市场 750. income in kind 实物所得 751. income tax liabilities 所得税责任,所得税债务 752. income taxes 所得税 753. indemnity 赔偿,补偿 754. indirect arbitrage 间接套汇 755. indirect finance 间接金融 756. indirect hedging 间接套做 757. indirect leases 间接租赁(即:杠杆租赁) 758. indirect rate 间接汇率 759. indirect taxation 间接税 760. individual income regulation tax 个人调节税 761. individual income tax 个人所得税 762. individual savings 私人储蓄 763. Industrial and Commercial Bank of China 中国工商银行 764. industrial financing 工业融资 765. industrial-commercial consolidated tax 工商统一税 766. industrial-commercial income tax工商所得税767. industrial-commercial tax 工商税768. inflation 通货膨胀769. inflation rate 通货膨胀率770. inflationary spiral 螺旋式上升的通货膨胀771. inflationary trends 通货膨胀趋势772. infrastructure bank 基本建设投资银行773. initial margin 初始保证金774. initial margin 期初保证权775. initial margins 初始保证金776. initial reserve 初期准备金777. insider 内幕人778. installment savings 零存整取储蓄779. institution 机构投资者780. insurance appraiser 保险损失评价人781. insurance broker 保险经纪人782. insurance contract 保险契约,保险合同783. insurance saleman 保险外勤784. insurance services 保险业务785. insure against fire 保火险786. insured 被保险人787. interbank market 银行同业市场788. inter-business credit 同行放帐789. interest on deposit 存款利息790. interest per annum 年息791. interest per month 月息792. interest rate futures contract 利率期货合约.793. interest rate policy 利率政策 794. interest rate position 利率头寸 795. interest rate risk 利率风险 796. interest restriction 利息限制 797. interest subsidy 利息补贴 798. interest-rate risk 利息率风险 799. interim finance中间金融800. intermediary bank中间银行801. intermediate account中间帐户802. internal reserves内部准备金803. international banking services国际银行业务804. International Investment Bank (IIB)国际投资银行805. international leasing国际租赁806. in-the-money有内在价值的期权807. intraday日内808. intrinsic utility内在效用809. intrinsic value实际价值,内部价值810. inward documentary bill for collection进口跟单汇票,进口押汇(汇票)811. isolation of risk风险隔离812. issue bank发行银行J 813. JCB card JCB 卡814. joint financing 共同贷款K 815. key risk关键风险 816. kill a bet终止赌博.L817. land use tax 土地使用税 818. large deposit 大额存款 819. large leases 大型租赁 820. latent inflation 潜在的通货膨胀 821. latent inflation 潜在的通货膨胀 822. lease agreement 租约 823. lease and release 租借和停租 824. lease broker 租赁经纪人 825. lease financing 租赁筹租 826. lease immovable 租借的不动产 827. lease in perpetuity 永租权 828. lease insurance 租赁保险 829. lease interest insurance 租赁权益保险 830. lease land 租赁土地 831. lease mortgage 租借抵押 832. lease out 租出 833. lease property 租赁财产 834. lease purchase 租借购买 835. lease rental 租赁费 836. lease territory 租借地 837. leaseback 回租 838. leasebroker 租赁经纪人 839. leased immovable 租借的不动产 840. leasehold 租赁土地,租借期,租赁营业,租赁权 841. leasehold property 租赁财产 842. leaseholder 租赁人,承租人,租借人 843. leases agent 租赁代理 844. leases arrangement租赁安排845. leases company 租赁公司846. leases structure 租赁结构847. leasing 出租848. leasing agreement 租赁协议849. leasing amount 租赁金额850. leasing asset 出租财产,租赁财产851. leasing clauses 租赁条款852. leasing consultant 租赁顾问853. leasing contract 租赁合同854. leasing cost 租赁成本855. leasing country 承租国856. leasing division 租赁部857. leasing equipment 租赁设备858. leasing industry 租赁业859. leasing industry (trade) 租赁业860. leasing money 租赁资金861. leasing period 租赁期862. leasing regulations 租赁条例863. legal interest 法定利息864. legal tender 法定货币,本位货币,法定货币865. lessee 承租人,租户866. lessor 出租人867. letter of confirmation 确认书868. letter transfer 信汇869. leveraged leases 杠杆租赁870. lien 扣押权,抵押权.871. life insurance 人寿保险 872. life of assets 资产寿命 873. limit order 限价指令 874. limited floating rate 有限浮动汇率 875. line of business 行业,营业范围,经营种类 876. liquidation 清仓 877. liquidity 流动性 878. liquidity of bank 银行资产流动性 879. listed stock 上市股票 880. livestock transaction tax 牲畜交易税 881. loan account 贷款帐户 882. loan amount 贷款额 883. loan at call 拆放 884. loan bank 放款银行 885. loan volume贷款额886. loan-deposit ratio存放款比率887. loans to financial institutions金融机构贷款888. loans to government政府贷款889. local bank 地方银行890. local income tax (local surtax) 地方所得税 891. local surtax地方附加税 892. local tax地方税 893. long arbitrage多头套 894. long position多头头寸 895. long position多头寸;买进的期货合同 896. long-term certificate of deposit长期存款单 897. long-term credit bank长期信用银行 898. long-term finance长期资金融通 899. loss leader特价商品,亏损大项 900. loss of profits insurance收益损失保险 901. loss on exchange汇兑损失 902. low-currency dumping低汇倾销,低汇倾销。

金融专业英语

True or false:1.Those financial markets that facilitate the flow of short-term funds are known asmoney markets. (t)2.Those financial markets that facilitate the flow of long-term funds are known ascapital markets. (t)3.Treasury notes and bonds belong to money market securities. (f)4.Eurodollar deposits are capital market securities. (f)5.Speculation is the same as investment. (f)6.Indirect quotation refers that domestic currency is expressed by unit foreigncurrency (f)7.If economic conditions become more favorable, the expected cash flows onvarious proposed projects will increase. (t)8.If the Fed determines that a change in its monetary policy is appropriate, itsdecision is forwarded to the trading desk. (t)9.The Federal Reserve chairman serves for a 14-year term. (f)10.M1 includes currency, checking deposits and MMDA. (f)True or false:真或假:1. Those financial markets that facilitate the flow of short-term funds are known as money markets. (true)1。

金融专业英语重要概念和理论

❶Economy: An economy or economic system consists of the production, distribution or trade, and consumption of limited goods and services .❷Finance: Finance is a field that deals with the allocation of assets and liabilities over time under conditions of certainty and uncertainty. ( ---A key point in finance is the time value of money, which states that purchasing power of one unit of currency can vary over time. Finance aims to price assets based on their risk level and their expected rate of return. )Bodies' <finance>: finance is the study of how people allocate scarce resources over time. Financial system is the set of markets and other institutions used for financial contracting and the exchange of assets and risks.<wiki>:A financial market is a market in which people and entities can trade financial securities.<Mishkin>: financial market is a market in which funds are transferred from people who have an excess of available funds to people who have a shortage.❸Corporate finance: Corporate finance is about how toincrease the value of the firm by dealing with the sources of funding and the capital structure of the firm.——(The primary goal of corporate finance is to maximize or increase shareholder value.)——or say corporate finance is a branch of finance dealing with financial decisions of firms.❹Option: an option is a contract which gives the buyer (the owner) the right, but not the obligation, to buy or sell an underlying asset at a specified strike price on or before a specified date.<more about option>The seller has the corresponding obligation to fulfill the transaction – that is to sell or buy – if the buyer (owner) "exercises" the option. The buyer pays a premium to the seller for this right. An option that conveys to the owner the right to buy something at a specific price is referred to as a call; an option that conveys the right of the owner to sell something at a specific price is referred to as a put.In basic terms, the value of an option is commonly decomposed into two parts:The first part is the intrinsic value, which is defined as the difference between the market value of the underlying asset and the strike price of the given option.The second part is the time value.❺Future: a futures contract is a contract between two parties to buy or sell an asset for a price agreed upon today (the futures price) with delivery and payment occurring at a future point, the delivery date. The buyer of the contract is said to be "long", and the party selling the contract is said to be "short".[1]❻APT: arbitrage pricing theory (APT) is a general theory of asset pricing that holds that the expected return of a financial asset can be modeled as a linear function of various macro-economic factors or theoretical market indices, where sensitivity to changes in each factor is represented by a factor-specific beta coefficient.The model-derived rate of return will then be used to price the asset correctly - the asset price should equal the present value of the future cash inflow at an interest rate or discount rate calculated by APT.❼MM theorem: The basic theorem states that the value of a firm is not affected by it's capital structure under certain assumptions. Instead it's decided by the value of it's real assets.Assumption: such as frictionless market,no asymmetric information.(a frictionless market is a financial market without transaction costs.)Consequently the Modigliani–Miller theorem is also often called the capital structure irrelevance principle.❽CAPM: the capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return of an asset if every investor hold the effective portfolio according to Markowitz model.The main idea of CAPM is that if all investors only hold risk-free asset and market portfolio, there will be a linear relation between the expected rate of return and the risks of the asset.The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM ―suggests that an investor’s cost of equity capi tal is determined by beta.‖❾EMH: the efficient-market hypothesis (EMH) asserts that financial markets are "informationally efficient". In consequence of this, one cannot consistently achieve returns in excess of average market returns .There are three major versions of the hypothesis: "weak", "semi-strong", and "strong". The weak form of the EMH claims that prices on traded assets already reflect all past publicly available information. The semi-strong form of the EMH claims both that prices reflect all publicly available information and that prices instantly change to reflect new public information. The strong form of the EMH additionally claims that prices instantly reflect even hidden or "insider" information.【10】DuPont analysis: DuPont Analysis is an expression which breaks ROE (Return On Equity) into three parts in order to analyze a company's financial condition,operating efficiency &profitability.【Basic formula 】ROE = (Profit margin)*(Asset turnover)*(Equity multiplier) = (Net profit/Sales)*(Sales/Assets)*(Assets/Equity)= (Net Profit/Equity)Profitability (measured by profit margin)Operating efficiency (measured by asset turnover)Financial leverage (measured by equity multiplier)【11】asymmetric information: Asymmetric information deals with the study of decisions in transactions where one party has more or better information than the other. This creates an imbalance of power in transactions, which can sometimes cause the transactions to go awry, a kind of market failure in the worst case. Examples of this problem are adverse selection,[1] moral hazard, and information monopoly.[2]Information asymmetry is in contrast to perfect information, which is a key assumption in neo-classical economics.【12】Derivative: Derivatives are financial instruments that derive their value from the prices of one or more other assets. Their principal function is to serve as tools for managing risks associated with the underlying assets.【13】Investment bankAn investment bank is a financial institution that assists individuals, corporations, and governments in raising financial capital. An investment bank may also assist companies involved in mergers and acquisitions (M&A).--Comparing the commercial bank and investment bank--(1).They are both intermediaries between those people who have an excess of available funds and people who have a shortage. But commercial banks are intermediaries of indirect finance and investment bank direct finance.(2).Basic business: the basic business of commercial banks is making loans and taking deposits. Investment banks securities underwriting business.(3).Commercial banks do their business in money market,whereas investment bank in capital market.【14】Open market operation: An open market operation (also known as OMO) is an activity by a central bank to buy or sell government bonds on the open market. A central bank uses them as the primary means of implementing monetary policy. The usual aim of open market operations is to manipulate the short-term interest rate and the supply of base money in an economy, and thus indirectly control the total money supply, in effect expanding money or contracting the money supply.【15】Quantitative easing: Quantitative easing (QE) is monetary policy used by a central bank to stimulate an economy when standard monetary policy has become ineffective.[1][2][3] A central bank implements quantitative easing by buying specified amounts of financial assets from commercial banks and other private institutions, thus raising the prices of those financial assets and lowering their yield, while simultaneously increasing the monetary base.Expansionary(扩张性的)monetary policy to stimulate the economy typically involves the central bank buying short-term government bonds in order to lower short-term market interest rates.However, when short-term interest rates reach or approach zero, this method can no longer work.[14] In such circumstances monetary authorities may then use quantitative easing to further stimulate the economy by buying assets of longer maturity than short-term government bonds, thereby lowering longer-term interest rates further out on the yieldcurve.[15][16]【16】direct finance:Direct finance is a method of financing where borrowers borrow funds directly from the financial market without using a third party service, such as a financial intermediary. This is different from indirect financing where a financial intermediary takes the money from the lender against an interest rate and lends it to a borrower against a higher interest rate. Direct financing is usually done by borrowers that sell securities and/or shares to raise money and circumvent the high interest rate of financial intermediary(banks).[1] We may regard transactions as direct finance, even when a financial intermediary is included, in case no asset transformation has taken place.【17】operating leverage means that because of fixed cost the percentage change in EBIT( earnings before interest and taxes) is larger than the % change in sales. It can be measured by DOL( the degree of operating leverage ) which is equal to the % change in EBIT divided by the % change in sales.---- financial leverage: because of the fixed cost of borrowing. EPS/EBIT. Earning per share.DFL: the degree of financial leverage.【18】exchange rate: an exchange rate between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency.【19】interest rate: is the cost of borrowing funds.【20】swap: a derivative in which two parties exchange future cash flows.【21】warrant: a warrant is a security that entitles the holder to buy the underlying stock of the issuing company at a fixed exercise price until the expiry date.【22】convertible bond: a convertible bond is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company.【23】Financial engineering: there is no exact definition of FE. It mainly includes three parts: the theory of financial risk management; pricing derivatives; developing new financial product;【24】期权定价模型【25】PPP理论(purchasing power parity)【26】interest parity利率与汇率的关系1.利率变动对汇率的影响首先,利率政策通过影响经常项目对汇率产生影响。

金融学专业英语词汇

金融学专业英语词汇(1)流动资本circulating capital, working capital可用资产available capital准备金,储备金reserve催缴资本calling up of capital资金捐献contribution of funds周转基金working capital fund循环基金,周转性基金revolving fund准备金reserve fund偿债基金sinking fund投资,资产investment投资人investor自筹经费,经费自给self-financing银行bank经常帐户current account (美作:checking account)支票帐户current-account holder (美作:checking-account holder) 支票cheque (美作:check)无记名支票,来人支票bearer cheque, cheque payable to bearer划线支票crossed cheque支票簿,支票本chequebook (美作:checkbook)背书endorsement转让,转帐,过户transfer货币money发行issue现钱ready money现金cash现金交易,概不赊欠ready money business, no credit given 零钱change钞票,纸币banknote, note (美作:bill)付现金to pay (in) cash本国货币domestic currency, local currency]可兑换性convertibility可兑换货币convertible currencies汇率,兑换率exchange rate外汇foreign exchange浮动汇率f loating exchange rate汇兑市场free exchange rates外汇兑换券foreign exchange certificate硬通货hard currency投机speculation储装,存款saving减价,贬值depreciation无法控制的通货膨胀runaway inflation通货紧缩deflation证券市场securities business证券交易所stock exchange corporation报价,牌价quotation股份,贡share贡持有人,股东shareholder, stockholder股息,红利dividend现金配股cash dividend贡投资stock investment投资信托investment trust贡经纪人stock-jobber证券公司stock company, stock brokerage firm 有价证券securities普通股share, common stock优先股preference stock股利收入income gain发行贡issue股面价格, 票面价格par value买手, 多头bull卖手, 空头bear过户assigned开盘opening price收盘closing price低潮hard times景气衰退business recession 景气停滞doldrums盘整dull松弛ease涨停板raising limit暴跌break债券bond, debenture短期贷款short term loan长期贷款long term loan中期贷款medium term loan 债权人lender债权人creditor债务人,借方debtor借方,借款人borrower借款borrowing利息interest利率rate of interest贴现,折扣discount再贴现rediscount年金annuity到期日,偿还日maturity摊销,摊还,分期偿付amortization偿还redemption保险insurance抵押mortgage拨款allotment短期信贷short term credit固定债务,长期债务funded debt流动债务floating debt提款,提存drawing援助aid补贴,补助金,津贴allowance, grant, subsidy 短期贷款short term loan长期贷款long term loan中期贷款medium term loan债权人lender债权人creditor债务人,借方debtor借方,借款人borrower借款borrowing成本,费用cost开支,支出expenditure, outgoings固定成本fixed costs营业间接成本overhead costs生产费用,营业成本operating costs营业费用operating expenses日常费用,经营费用running expenses间接费用,管理费用overhead expenses维修费用,养护费用upkeep costs, maintenance costs 运输费用transport costs社会负担费用social charges或有费用contingent expenses, contingencies分摊费用apportionment of expenses收入,收益income利润,收益earnings总收入,总收益gross income, gross earnings毛利,总利润,利益毛额gross profit, gross benefit纯收益,净收入,收益净额net income平均收入average income国收入national income利润率,赢利率profitability, profit earning capacity 产量收益,收益率yield增值,升值increase in value, appreciation税duty税制taxation system征税,纳税taxation财务税收fiscal charges累进税graduated tax增值税value added tax所得税income tax地租,地价税land tax检查fiscality免税的tax-free免税tax exemption纳税人taxpayer收税员tax collector职业经理人必备的英文单词目标mission/ objective集体目标group objective内部环境internal environment外部环境external environment计划planning组织organizing人事staffing领导leading控制controlling步骤process原理principle方法technique经理manager总经理general manager行政人员administrator主管人员supervisor企业enterprise商业business产业industry公司company效果effectiveness效率efficiency企业家entrepreneur权利power职权authority职责responsibility科学管理scientific management现代经营管理modern operational management 行为科学behavior science生产率productivity激励motivate动机motive法律law法规regulation经济体系economic system管理职能managerial function产品product服务service利润profit满意satisfaction归属affiliation尊敬esteem自我实现self-actualization人力投入human input盈余surplus收入income成本cost资本货物capital goods机器machinery设备equipment建筑building存货inventory经验法the empirical approach人际行为法the interpersonal behavior approach集体行为法the group behavior approach协作社会系统法the cooperative social systems approach 社会技术系统法the social-technical systems approach决策理论法the decision theory approach数学法the mathematical approach系统法the systems approach随机制宜法the contingency approach管理任务法the managerial roles approach经营法the operational approach人际关系human relation心理学psychology态度attitude压力pressure冲突conflict招聘recruit鉴定appraisal选拔select培训train报酬compensation授权delegation of authority协调coordinate业绩performance考绩制度merit system表现behavior下级subordinate偏差deviation检验记录inspection record误工记录record of labor-hours lost 销售量sales volume产品质量quality of products先进技术advanced technology顾客服务customer service策略strategy结构structure领先性primacy普遍性pervasiveness忧虑fear忿恨resentment士气morale解雇layoff批发wholesale零售retail程序procedure规则rule规划program预算budget共同作用synergy大型联合企业conglomerate资源resource购买acquisition增长目标growth goal专利产品proprietary product竞争对手rival晋升promotion管理决策managerial decision商业道德business ethics有竞争力的价格competitive price 供货商supplier小贩vendor利益冲突conflict of interests派生政策derivative policy开支帐户expense account批准程序approval procedure病假sick leave休假vacation工时labor-hour机时machine-hour资本支出capital outlay现金流量cash flow工资率wage rate税收率tax rate股息dividend现金状况cash position资金短缺capital shortage总预算overall budget资产负债表balance sheet可行性feasibility投入原则the commitment principle 投资回报return on investment生产能力capacity to produce实际工作者practitioner最终结果end result业绩performance个人利益personal interest福利welfare市场占有率market share创新innovation。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。