国际结算英文术语

国际结算名词解释

国际结算(International settlement):是指两个处于不同国家的当事人,(因为商品买卖、服务供应、资金调拨、国际借贷)通过银行进行的货币收付业务。

汇票(Bill of Exchange):是由一人向另一人签发的书面的无条件的命令,要求其立即、或定期,或在将来可以确定的时间,把一定金额的货币支付给一个特定的人,或他的指定人,或来人。

本票(Promissory Note):是一项书面的无条件的支付承诺,由一人做成,并交给另一人,经制票人签名承诺即期或定期或在可以确定的将来时间,支付一定数目的金钱给一个特定的人或其指定人或来人。

支票(Cheque):是一种以银行为付款人的即期汇票。

汇款(Remittance):由汇款人委托给银行,将款项汇交给收款人的一种结算方式,是一种顺汇方式。

托收(Collection):是委托收款的简称。

卖方在装船后根据贸易合同的规定,委托当地银行通过买方所在地银行向买方收取货款的行为。

信用证(Letter of Credit):是一种银行开立的有条件的承诺付款的书面文件。

商业发票(COMMERCIAL INVOICE):是出口商向进口商开立的发货价目清单,记载有货物名称、数量、价格等内容,是卖方向买方计收货款的依据。

海运提单(Marine/Ocean Bills of Lading):是要求港至港(Port to Port)的运输单据。

是由承运人或其代理人根据海运合同签发给托运人的证明文件,表明货物已经装上指定船只或已经收妥待运,约定将货物运往载明的目的地,交给收货人或提单持有人。

保险单(INSURANCE policy):是保险公司对被保险人的承保证明,又是双方之间权利义务的契约,在被保险货物遭受损失时,它是被保险人索赔的主要依据,也是保险公司理赔的主要依据。

分行(Branch Bank):到国外开设自己的分支机构。

国外分行是其总行在东道国经营常规银行业务的合法经营机构。

国际结算英文术语

国际结算英文术语国际结算(International settlement)贸易(Trade Settlement)非贸易(Non-Trade Settlement)EDI(Electronic Data Intercharge)电子数据交换,控制文件(Control Documents)有权签字人的印鉴(Specimen Signatures)密押(Test Key)费率表(Terms and Condition)货物单据化,履约证书化,( cargo documentation , guarantee certification) 权利单据(document of title)流通转让性(Negotiability)让与(Assignment)转让(Transfer)流通转让(Negotiation)汇票的定义是:A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sumpayable at days/ months after stated date)④板期付款(bills payable on a fixed future date)⑤延期付款(bills payable at days/months after shipment/ the date of B/L) 收款人名称(payee)同样金额期限的第二张不付款”〔pay this first bill of exchange(second of the same tenor and dated being unpaid)需要时的受托处理人(referee in case of need)出票人(drawer)收款人(payee)背书人(endorser)被背书人(endorsee)出票(issue)(1)制成汇票并签字(to draw a draft and to signit);(2)将制成的汇票交付给收款人(to deliver the draftto payee)背书(endorsement)(1)特别背书(special endorsement),又称为记名背书或正式背书(2)空白背书(blank endorsement),又称不记名背书(3)限制性背书(restrictive endorsement)(4)有条件的背书(conditional endorsement)(5)托收背书(endorsement for collection)提示(presentation)承兑(acceptance)(1)普通承兑(general acceptance)(2)保留承兑(qualified acceptance)付款(payment)退票(dishonor)退票通知(notice of dishonor)拒绝证书(protest)追索(recourse)追索权(right of recourse)保证(guarantee/aval)本票所下的定义是:A promissory note is an unconditional promise in writing made by one person to another signed by the maker, engaging to pay, on demand or at a fixed or determinable future time, a sum certain in money, to, or to the order, of a specified person or to bearer.本票(promissory note)银行本票(Banker’s Note)商业本票(Trader’s Note) 或一般本票(General Promissory Note)即期本票(Sight Note/Demand Note)远期本票(Time Note/Usance Note)本币本票(Domestic Money Note)外币本票(Foreign Money Note)国内本票(Domestic Note)国际本票(International Note)旅行支票(traveler`s cheque)支票所下的定义是:Briefly speaking, a cheque is a bill of exchange drawn on a bank payable on demand. Detailed speaking, acheque is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a sum certain in money to or to the order of a specified person or to bearer. 支票(cheque)非划线支票(open cheque),划线支票(crossed cheque),普通划线支票(general crossing cheque)特别划线支票(special crossing cheque)保付支票(certified cheque)即由付款行在支票上加盖“保付(CERTIFIED)“Orders not to pay”(奉命止付)第三章汇款结算方式顺汇法(remittance)逆汇法(reverse remittance)汇款方式(methods of remittance),汇款人(remitter)即付款人收款人或受益人(payee /beneficiary)汇出行(remitting bank)汇入行(paying bank)或解付行电汇(telegraphic transfer,简称T/T)信汇(mail transfer,简称M/T)信汇委托书(mail transfer advice)和支付委托书(payment order)。

国际结算名词解释

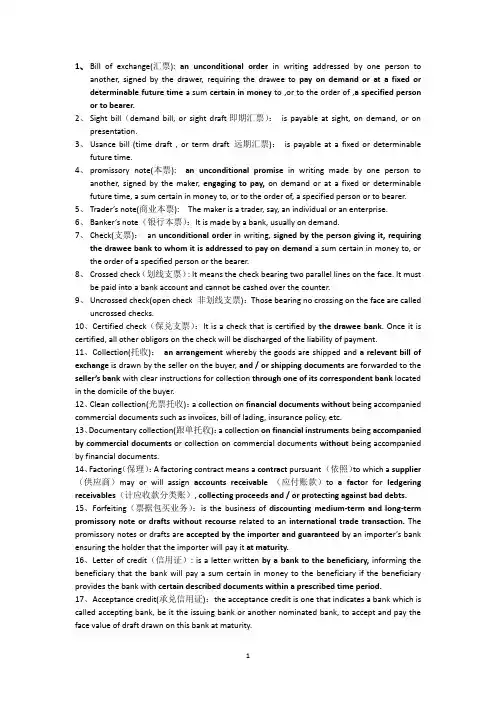

国际结算名词解释1、Bill of exchange(汇票): an unconditional order in writing addressed by one person toanother, signed by the drawer, requiring the drawee to pay on demand or at a fixed or determinable future time a sum certain in money to ,or to the order of ,a specified person or to bearer.2、Sight bill(demand bill, or sight draft即期汇票):is payable at sight, on demand, or onpresentation.3、Usance bill (time draft , or term draft 远期汇票):is payable at a fixed or determinablefuture time.4、promissory note(本票): an unconditional promise in writing made by one person toanother, signed by the maker,engaging to pay,on demand or at a fixed or determinable future time, a sum certain in money to, or to the order of, a specified person or to bearer.5、Trader’s note(商业本票): The maker is a trader, say, an individual or an enterprise.6、Banker’s note(银行本票):It is made by a bank, usually on demand.7、Check(支票):an unconditional order in writing, signed by the person giving it, requiringthe draweebank to whom it is addressed to pay on demand a sum certain in money to, or the order of a specified person or the bearer.8、Crossed check(划线支票):It means the check bearing two parallel lines on the face. It mustbe paid into a bank account and cannot be cashed over the counter.9、Uncrossed check(open check 非划线支票):Those bearing no crossing on the face are calleduncrossed checks.10、Certified check(保兑支票):It is a check that is certified by the drawee bank. Once it is certified, all other obligors on the check will be discharged of the liability of payment.11、Collection(托收):an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and / or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent bank located in the domicile of the buyer.12、Clean collection(光票托收):a collection on financial documentswithout being accompanied commercial documents such as invoices, bill of lading, insurance policy, etc.13、Documentary collection(跟单托收):a collection on financial instruments being accompanied by commercial documents or collection on commercial documents without being accompanied by financial documents.14、Factoring(保理):A factoring contract means a contract pursuant (依照)to which a supplier (供应商)may or will assign accounts receivable (应付账款)to a facto r for ledgering receivables(计应收款分类账), collecting proceeds and / or protecting against bad debts. 15、Forfeiting(票据包买业务):is the business of discounting medium-term and long-term promissory note or draftswithout recourse related to an international trade transaction. The promissory notes or drafts are accepted by the importer and guaranteed b y an importer’sbank ensuring the holder that the importer will pay it at maturity.16、Letter of credit(信用证): is a letter written by a bank to the beneficiary, informing the beneficiary that the bank will pay a sum certain in money to the beneficiary if the beneficiary provides the bank with certain described documents within a prescribed time period.17、Acceptance credit(承兑信用证):the acceptance credit is one that indicates a bank which is called accepting bank, be it the issuing bank or another nominated bank, to accept and pay the face value of draft drawn on this bank at maturity.中心汇票汇款(票汇的一种)寄售consignment 预付payment in advance 赊销open account跟单托收documentary collection 备用信用证standby letters of credit代理行correspondent bank 控制文件control documents费率表schedule of terms and condition 密押telegraphic test keysSwift 核实押swift authentic key 签字样本specimen of authorized signatures我账(往账)Nostro account 你账(来账)vostro account对价持票人Holder for value 正当持票人,善意持票人holder in due course 退票通知Notice of Dishonor 拒绝证书protest (由notary public开立)追索权Right of recourse 远期本票(见票后定期付需要“签见”) 光票托收clean collection买单Bill purchased 托收贷款advance against collections信托收据trust receipt 进口押汇import bill advance担保放货Release of goods against guarantee 偿付行reimbursement bank索偿行claiming bank 光票信用证clean credit跟单信用证documentary credit 保兑信用证confirmed credit 不保兑信用证Unconfirmed credit 即期信用证sight credit延期信用证deferred credit 承兑信用证acceptance credit (包含seller's usance credit和buyer’s usance credit)议付信用证Negotiation credit(自由议付信用证free negotiation credit和限制议付信用证restricted negotiation credit) 预支信用证anticipatory credit可装让信用证transferable credit 背对背信用证Back to back credit对开信用证reciprocal credit 循环信用证revolving credit海运提单marine bills of lading 承运人carrier托运人shipper/consignor 收货人consignee被通知人notify party 已装船提单shipped on board bill of lading备运提单received for shipment B/L 清洁提单clean B/L不清洁提单Unclean B/L 直达提单direct B/L转船提单transshipment B/L 联运提单through B/L记名提单named consignee B/L 指示提单order B/L全式提单long form B/L 简式提单short form B/L班轮提单liner B/L 租船提单charter party B/L集装箱提单container B/L 甲板提单on deck B/L空运单airway bill 铁路运单railway bill多式联运单据Multimodal transport document 保险单insurance policy保险凭证insurance certificate 暂保单cover note 预约保单open account原产地证明certificate of origin 产品检验证书inspection certificate装箱单和重量单packing list and weight list 打包贷款packingloan出口汇押/信用证项下议付negotiation under L/C 汇票贴现bill account投标包含tender guarantee/bill bond 履约保函performance guarantee还贷保函repayment guarantee 预付款保函advance payment guarantee透支保函overdraft guarantee 维修保单maintenance guarantee保函letter of guarantee 国际保理international factoring快邮收据courier receipt。

国际结算名词

国际结算(international settlement)是指为了清偿国际债权债务关系或跨国转移资金而发生在不用国家之间的货币收付活动。

汇出行(Remitting Bank)是受汇款人委托而汇出款项的银行。

汇入行(Paying Bank)也称解付行,是接收汇出行委托并将款项支付给收款人的银行收款人(Payee)是汇出款的最终接受者。

电汇(Telegraphic Transfer, T/T)是汇出行应汇款人的申请,通过加押电报或电传的方式指示汇入行解付一定款项给收款人的方式。

信汇(mail transfer,M/T)是指汇出行应汇款人的申请,通过信函指示汇入行解付一定款项给收款人的方式。

票汇(Demand Draft,D/D)是汇出行应汇款人的申请,开立以汇入行为付款人的银行汇票,交汇款人由其自行携带出国或寄给收款人凭票取款的汇款方式。

汇款(remittance)是指银行接受客户的委托,通过其自身建立的通汇网络,委托国外联行或代理行将客户的款项交付给收款人的一种结算方式。

托收(collection)指银行根据手袋的指示(托收指示)处理金融单据和/或商业票据,以便取得付款和/或承兑;凭付款和/或承兑交单;按照其他条款和条件交单的一种结算方式。

信用证(letter of credit,L/C)是银行开立的有条件的承担第一性付款责任的书面文件。

具体来说,它是银行(开证行)根据进口方(开证申请人)的要求和指示,向出口方(受益人)开立的,在一定期限内凭符合信用证款规定的单据,即期或在可以确定的将来的日期,对出口方支付一定金额的书面保证文件。

付款交单(Documents against Payment, D/P)是指委托人指示代收行在付款人付清款项后将单据交出。

即付款人“付款在先,取单在后”,付款是取单的先决条件。

承兑交单(documents against acceptance,D/A)买方对卖方开具的见票后当天付款的跟单汇票,于提示时应即承兑,并应于汇票到期日即予付款。

(完整版)国际结算名词解释

1、Bill of exchange(汇票): an unconditional order in writing addressed by one person toanother, signed by the drawer, requiring the drawee to pay on demand or at a fixed or determinable future time a sum certain in money to ,or to the order of ,a specified person or to bearer.2、Sight bill(demand bill, or sight draft即期汇票):is payable at sight, on demand, or onpresentation.3、Usance bill (time draft , or term draft 远期汇票):is payable at a fixed or determinablefuture time.4、promissory note(本票): an unconditional promise in writing made by one person toanother, signed by the maker,engaging to pay,on demand or at a fixed or determinable future time, a sum certain in money to, or to the order of, a specified person or to bearer.5、Trader’s note(商业本票): The maker is a trader, say, an individual or an enterprise.6、Banker’s note(银行本票):It is made by a bank, usually on demand.7、Check(支票):an unconditional order in writing, signed by the person giving it, requiringthe drawee bank to whom it is addressed to pay on demand a sum certain in money to, or the order of a specified person or the bearer.8、Crossed check(划线支票): It means the check bearing two parallel lines on the face. It mustbe paid into a bank account and cannot be cashed over the counter.9、Uncrossed check(open check 非划线支票):Those bearing no crossing on the face are calleduncrossed checks.10、Certified check(保兑支票):It is a check that is certified by the drawee bank. Once it is certified, all other obligors on the check will be discharged of the liability of payment.11、Collection(托收):an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and / or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent bank located in the domicile of the buyer.12、Clean collection(光票托收):a collection on financial documents without being accompanied commercial documents such as invoices, bill of lading, insurance policy, etc.13、Documentary collection(跟单托收):a collection on financial instruments being accompanied by commercial documents or collection on commercial documents without being accompanied by financial documents.14、Factoring(保理):A factoring contract means a contract pursuant (依照)to which a supplier (供应商)may or will assign accounts receivable (应付账款)to a facto r for ledgering receivables(计应收款分类账), collecting proceeds and / or protecting against bad debts. 15、Forfeiting(票据包买业务):is the business of discounting medium-term and long-term promissory note or drafts without recourse related to an international trade transaction. The promissory notes or drafts are accepted by the importer and guaranteed b y an importer’s bank ensuring the holder that the importer will pay it at maturity.16、Letter of credit(信用证): is a letter written by a bank to the beneficiary, informing the beneficiary that the bank will pay a sum certain in money to the beneficiary if the beneficiary provides the bank with certain described documents within a prescribed time period.17、Acceptance credit(承兑信用证):the acceptance credit is one that indicates a bank which is called accepting bank, be it the issuing bank or another nominated bank, to accept and pay the face value of draft drawn on this bank at maturity.中心汇票汇款(票汇的一种)寄售consignment 预付payment in advance 赊销open account跟单托收documentary collection 备用信用证standby letters of credit代理行correspondent bank 控制文件control documents费率表schedule of terms and condition 密押telegraphic test keysSwift 核实押swift authentic key 签字样本specimen of authorized signatures我账(往账)Nostro account 你账(来账)vostro account对价持票人Holder for value 正当持票人,善意持票人holder in due course 退票通知Notice of Dishonor 拒绝证书protest (由notary public开立)追索权Right of recourse 远期本票(见票后定期付需要“签见”) 光票托收clean collection买单Bill purchased 托收贷款advance against collections信托收据trust receipt 进口押汇import bill advance担保放货Release of goods against guarantee 偿付行reimbursement bank索偿行claiming bank 光票信用证clean credit跟单信用证documentary credit 保兑信用证confirmed credit不保兑信用证Unconfirmed credit 即期信用证sight credit延期信用证deferred credit 承兑信用证acceptance credit (包含seller's usance credit和buyer’s usance credit)议付信用证Negotiation credit(自由议付信用证free negotiation credit和限制议付信用证restricted negotiation credit) 预支信用证anticipatory credit可装让信用证transferable credit 背对背信用证Back to back credit对开信用证reciprocal credit 循环信用证revolving credit海运提单marine bills of lading 承运人carrier托运人shipper/consignor 收货人consignee被通知人notify party 已装船提单shipped on board bill of lading备运提单received for shipment B/L 清洁提单clean B/L不清洁提单Unclean B/L 直达提单direct B/L转船提单transshipment B/L 联运提单through B/L记名提单named consignee B/L 指示提单order B/L全式提单long form B/L 简式提单short form B/L班轮提单liner B/L 租船提单charter party B/L集装箱提单container B/L 甲板提单on deck B/L空运单airway bill 铁路运单railway bill多式联运单据Multimodal transport document 保险单insurance policy保险凭证insurance certificate 暂保单cover note 预约保单open account原产地证明certificate of origin 产品检验证书inspection certificate装箱单和重量单packing list and weight list 打包贷款packing loan出口汇押/信用证项下议付negotiation under L/C 汇票贴现bill account投标包含tender guarantee/bill bond 履约保函performance guarantee还贷保函repayment guarantee 预付款保函advance payment guarantee透支保函overdraft guarantee 维修保单maintenance guarantee保函letter of guarantee 国际保理international factoring快邮收据courier receipt。

国际结算名词解释

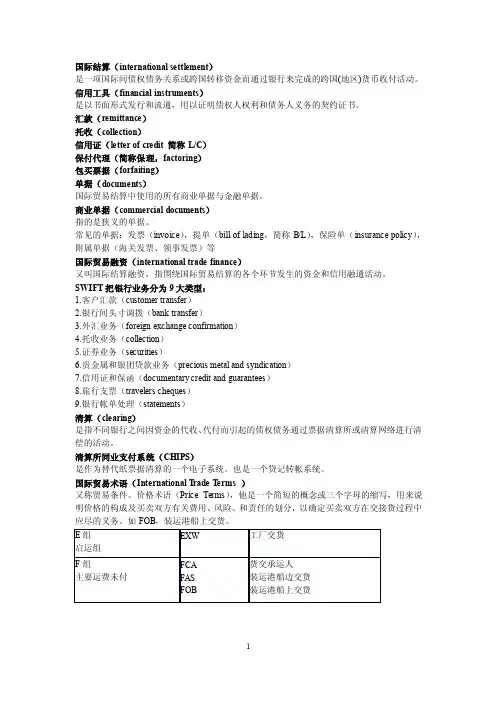

国际结算(international settlement)是一项国际间债权债务关系或跨国转移资金而通过银行来完成的跨国(地区)货币收付活动。

信用工具(financial instruments)是以书面形式发行和流通,用以证明债权人权利和债务人义务的契约证书。

汇款(remittance)托收(collection)信用证(letter of credit 简称L/C)保付代理(简称保理,factoring)包买票据(forfaiting)单据(documents)国际贸易结算中使用的所有商业单据与金融单据。

商业单据(commercial documents)指的是狭义的单据。

常见的单据:发票(invoice),提单(bill of lading,简称B/L),保险单(insurance policy),附属单据(海关发票、领事发票)等国际贸易融资(international trade finance)又叫国际结算融资,指围绕国际贸易结算的各个环节发生的资金和信用融通活动。

SWIFT把银行业务分为9大类型:1.客户汇款(customer transfer)2.银行间头寸调拨(bank transfer)3.外汇业务(foreign exchange confirmation)4.托收业务(collection)5.证券业务(securities)6.贵金属和银团贷款业务(precious metal and syndication)7.信用证和保函(documentary credit and guarantees)8.旅行支票(travelers cheques)9.银行帐单处理(statements)清算(clearing)是指不同银行之间因资金的代收、代付而引起的债权债务通过票据清算所或清算网络进行清偿的活动。

清算所同业支付系统(CHIPS)是作为替代纸票据清算的一个电子系统。

也是一个贷记转帐系统。

国际结算术语盘点

International settlement 国际结算money transfer 资金转移3. settle accounts 结清帐款4. debts 欠债5. claims 债权6. international trade 国际贸易7. tangible goods 有形商品8. intangible service transactions 无形服务贸易9. international lending and investments 国际借贷和投资10. international aids and grants 国际援助11. cross-border personal remittance 跨国个人汇款12. international commercial settlement 国际贸易结算13. international non-commercial settlement 国际非贸易结算14. payment methods 支付方式15. sales amount 销售金额16. currency 货币17. make payments 进行支付18. collect payments 收取货款19. cash payments 现金支付20. sales contract 销售合同21. financial instrument 金融单据22. commercial document 商业单据23. Instrument Act 票据法24. bills of exchange 汇票25. cheque 支票26. promissory note 本票27. commercial invoice 商业发票28. packing list 装箱单29. bill of lading 提单30. insurance policy 保险单31. inspection certificate 检验证书32. certificate of origin 原产地证书33. collection 托收34. international factoring国际保理35. letter of credit 信用证36. letter of guarantee 保函37. internationalconvertible currency 国际可兑货币38. medium of exchange交换的媒介39. intermediary 中间人40. title 物权41. constructive delivery象征性交货42. actual delivery 实际交货43. price terms / incoterms价格术语44. FAS 船边交货价45. FOB 离岸价46. CFR 成本加运费价47. CIF 到岸价/成本、保险加运费价48. quoted price 报价49. port of loading 装运港50. port of destination 目的港51. certificate of deposit大额存单52. treasury bills 国库券53. bearer securities 不记名债券54. draw (a bill ) by sb. 由某人出票55. draw (a bill ) on sb. 以某人为付款人56. (a bill ) payable to sb. 付款给57. drawer 出票人58. drawee 受票人59. payee 收款人60. bearer 持票来人61. to debit 借记62. to credit 贷记63. drawn under 在…….开立64. drawn clause 出票条款65. tenor 期限66. on demand 即期67. a fixed or determinablefuture time 在固定的或可以确定的未来某一日68. due date / maturity date到期日69. demand /sight bill 即期汇票70. usance / time / term bill远期汇票71. to accept (a bill) 承兑72. a valid bill 有效汇票73. an invalid bill 无效汇票74. interest 利息75. the amount in words大写金额76. the amount in figures小写金额77. negotiation 流通转让;议付78. restrictive order 限制性抬头79. demonstrative /indicative order 指示性抬头80. bearer order 持票来人抬头81. endorsement 背书82. delivery of a bill 汇票的交付83. in alternative 有选择性的84. in sequence 按先后顺序85. value received 对价付讫86. a set of bill 一套汇票87. acceptor 承兑人88. to honor a bill 兑付汇票89. to dishonor a bill 退票90. endorser 背书任91. endorsee 被背书人92. holder 持票人93. prior party 前手94. subsequent party 后手95. right of recourse 追索权96. to issue a bill 出票97. special endorsement 特别背书98. blank endorsement 空白背书99. to sign 签名100. the authorized signature 有权签名101. presentment 提示102. general acceptance 普通承兑103. qualified acceptance 限制性承兑104. payment in due course 正当付款105. discharge 注销106. notice of dishonor 拒付通知107. protest 拒绝证书108. notary party 公证人109. domestic / inland bill 国内汇票110. foreign bill 国际汇票111. banker’s / bank draft 银行汇票112. banker’s acceptance bill 银行承兑汇票113. commercial / trader’s bill 商业汇票114. trader’s accep tance bill 商业承兑汇票115. clean bill 光票116. documentary bill 跟单汇票117. finance 融资118. discounting 贴现119. discount house 贴现行120. net proceeds 净款121. balance 余额122. discount interest 贴现息123. face value 面值124. discounting days 贴现天数125. discounting rate 贴现率126. forfeiting 弗费廷/票据包买127. correspondentbanking relationship 代理行关系128. correspondent bank代理行129. representative office代表处130. subsidiary 字银行131. affiliate 附属行132. branch 分行133. accept deposits 接受存款134. issue loans 发放贷款135. a separatelyincorporated bank 一家独立注册的银行136. conduct bankingbusiness 叙作银行业务137. agency 代理138. control documents 控制文件139. test key 密押140. schedule of terms andconditions 费率表141. mail message 信函信息142. telegraphic message电子信息143. authenticate 验证144. sign a cooperateagreement 签定合作协议145. maintain / opencurrent accounts 开立活期帐户146. deposit accounts 存款帐户147. initial deposit 开户存款额148. minimum creditbalance 最底贷方余额149. statement of balance对帐单150. your account / vostroaccount 你帐151. our account / nostroaccount 我帐152. principal 委托人153. beneficiary 受益人154. trader’s credit 商业信用155. banker’s credit 银行信用156. remittance 顺汇;汇款157. reverse remittance 逆汇158. remitter 汇款人159. the remitting bank 汇出行160. the paying bank 解付行161. remittance by airmail(M/T) 信汇162. remittance bytelegraphic transfer (T/T) 电汇163. remittance bybanker’s demand draft (D/D) 票汇164. clean collection 光票托收165. documentarycollection 跟单托收166. documents releaseconditions 交单条件167. documents againstpayment at sight (D/P sight) 即期付款交单168. documents againstpayment after sight (D/P aftersight) 远期付款交单169. D/P after sight againsttrust receipt (D/P, T/R) 凭信托收据远期付款交单170. Documents agaistacceptance (D/A) 承兑交单171. collection order 托收指示172. application form for collection 托收申请书173. L/C applicant 信用证申请人174. undertaking 承诺175. L/C issuing bank 信用证开证行176. the advising bank 通知行177. the confirming bank 保兑行178. the negotiating bank 议付行179 the paying bank 付款行180. the accepting bank 承兑行181. the reimbursing bank 偿付行182. the nominated bank 指定银行183. credit number 信用证号码184. date of expiry 到期日185. place of expiry 到期地点186. the validity of a credit 信用证有效期187. partial shipment 分船装运188. transhipment 转船装运189. clean credit 光票信用证190. documentary credit 跟单信用证191. irrevocable credit 不可撤消信用证192. revvocable credit 可撤消信用证193. confirmed credit 保兑信用证194. unconfirmed credit 不保兑信用证195. sight payment credit 即期付款信用证196. deferred payment credit 延期付款信用证197. acceptance credit 承兑信用证198. negotiation credit 即期信用证199. sight /demand credit远期信用证200. time / usance credit201. marine insurance 海上保险202. contract of indemnity赔付契约203. the insurer 保险人204. the insured 投保人205. premium 保费206. the amount insured保险金额207. risks to be covered 承保险别208. maritime losses 海上损失209. total loss 全部损失210. actual total loss 实际全损211. constructive total loss推定全损212. total loss of aproportional part 部分全损213. patial loss / average部分损失214. general average (G.A.)共同海损215. particular average(P.A) 单独海损216. external losses 外来险217. general risks 一般险218. TPND 偷窃、提货不着险219. risk of leakage 渗漏险220. risk of clash andbreakage 碰撞破碎险221. risk of hook damage钩损险222. FWRD 淡水雨淋险223. risk of shortage 短量险224. risk of inermixtureand contamination 混杂污染险225. risk of taint of odor串味险226. risk of sweat andheating 受潮受热险227. risk of rust 锈损险228. risk of breakage ofpacking 包装破损险229. special risks 特别险230. failure to diliver 提货不着231. import duty 进口税232. on deck 仓面险233. rejection 拒收险234. aflatoxin 黄曲酶素险235. FREC存仓火险责任扩展条约236. war risk 战争险237. risk of import duty 进口税险238. SRCC 罢工、暴动、内乱险239. coverage 险别240. basic marine insuracecoverage 基本险241. FPA (free fromparticular average) 单独海损不赔/平安险242. WA/WPA (withaverage / with particular average)单独海损要赔/ 水渍险243. All risks 一切险244. additional risks 附加险245. insurance clause 保险条款246. London InstituteCargo Clause 伦敦协会条款247. underwriter 保险商248. claim payableat 索赔地点249. International Chamberof Commerce 国际商会。

国际结算英文术语

国际结算英文术语国际结算英文术语国际结算(International settlement) 贸易(Trade Settlement) 非贸易(Non-Trade Settlement) EDI (Electro nic Data In tercharge )电子数据交换,控制文件(Control Documents ) 有权签字人的印鉴(Specimen Sig natures ) 密押(Test Key) 费率表(Terms and Condition )货物单据化,履约证书化,(cargo documentation , guarantee certification)权利单据(document of title )流通转让性(Negotiability ) 让与(Assignment) 转让(Transfer ) 流通转让(Negotiation ) 汇票的定义是: A bill of exchange is an uncon diti onal order in writ ing, addressed by one person to another,signed by thepers on giv ing it, requiri ng the pers on to whom it is addressed to pay on dema nd or at a fixed or determ in able future time a sum certa in in money to the order or specified pers on or to bearer.“汇票” (bill of exchange , exchange 或draft) 无条件支付命令(unconditional order to pay) 出票条款(drawn clause )利息条款(with interest )分期付款(by stated instalment)支付等值其它货币(pay the other curre ncy according to an indicated rate of exchange) 付款人(payer) 受票人(drawee) 付款期限(time of payment )或(tenor) 即期(at sight, on dema nd, on prese ntati on )付款。

国际结算常用英语词汇

国际结算常用英语词汇Promissory Note 本票Check or Check 支票Remittance 汇付Mail Transfer,M/T 信汇Telegraphic Transfer,T/T 电汇Demand Draft,D/D 票汇Payment in Advance 预付货款Payment after Arrival of Goods 货到付款Collection 托收Principal 委托人Remitting Bank 托收银行Collecting Bank 代收银行Presenting Bank 提示行Documents against Payment,D/P 付款交单Documents against Payment at sight,D/P sight 即期付款交单Documents against Payment after sight,D/P after sight 远期付款交单Documents against Acceptance,D/A 承兑交单不可不知的国际贸易英语国际贸易的价格表示方法,除了具体金额外,还要包括贸易术语,交货地点及所使用的货币。

如:USD150 FOB Hongkong, STG2000 CIF Liverpool,其中USD指的是以美金作价,而STG为英镑;Hongkong香港和Liverpool利物浦为交货地点;FOB与CIF 则为两个较为常用的贸易术语。

以下是国际商会出版的《2000年国际贸易术语解释通则》中规定的全部贸易术语的分类。

第一组:E组(卖方在其所在地点把货物交给买方)Ex Works (named place) 工厂交货(指定地点)第二组:F组(卖方须将货物交至买方指定的承运人)FCA: Free Carrier (named place) 货交承运人(指定地点)FAS: Free Alongside Ship (named port of shipment)船边交货(指定装运港)FOB: Free On Board (named port of shipment)船上交货(指定装运港)第三组:C组(卖方必须签定运输合同,但对货物灭失或损坏的风险以及装船和启运后发生事件所产生的额外费用不承担责任)CFR: Cost & Freight (named port of destination)成本加运费(指定目的港)CIF: Cost, Insurance and Freight (named port of destination)成本,保险加运费(指定目的港)CPT: Carriage Paid To (named place of destination)运费付至(指定目的地)CIP: Carriage and Insurance Paid To(named place of estination)运费保险费付至(指定目的地)第四组:D组(卖方必须承担把货物交至目的地国家所需的全部费用和风险)DAF: Delivered at Frontier (named place) 边境交货(指定地点)DES: Delivered ex Ship (named port of destination)船上交货(指定目的港)DEQ: Delivered ex Quay (named place of destination)码头交货(指定目的地)DDU: Delivered Duty Unpaid (named place of destination)未完税交货(指定目的地)DDP: Delivered Duty Paid (named place of destination)完税后交货(指定目的地)企业外贸业务用语大全一:基本短语 Time to volume 及时大量生产Time to money 及时大量交货FOUR CONTROL YSTEM 四大管制系统Engineering control system 工程管制系统Quality control system质量管理系统Manufacturing control system生产管制系统Management control system经营管制系统Classification整理(sorting, organization)-seiri Regulation整顿(arrangement, tidiness)-seiton Cleanliness清扫(sweeping, purity)-seiso Conservation清洁(cleaning, cleanliness)-seiktsu Culture教养(discipline)-shitsukeSave 节约Safety安全二:英文缩写质量人员名称类QC quality control 品质管理人员FQC final quality control 终点质量管理人员IPQC in process quality control 制程中的质量管理人员OQC output quality control 最终出货质量管理人员IQC incoming quality control 进料质量管理人员TQC total quality control 全面质量管理POC passage quality control 段检人员QA quality assurance 质量保证人员OQA output quality assurance 出货质量保证人员QE quality engineering 质量工程人员质量保证类FAI first article inspection 新品首件检查FAA first article assurance 首件确认CP capability index 能力指数CPK capability process index 模具制程能力参数SSQA standardized supplier quality audit 合格供货商质量评估FMEA failure model effectiveness analysis 失效模式分析FQC运作类AQL Acceptable Quality Level 运作类允收质量水平S/S Sample size 抽样检验样本大小ACC Accept 允收REE Reject 拒收CR Critical 极严重的MAJ Major 主要的MIN Minor 轻微的Q/R/S Quality/Reliability/Service 质量/可靠度/服务P/N Part Number 料号L/N Lot Number 批号AOD Accept On Deviation 特采UAI Use As It 特采FPIR First Piece Inspection Report 首件检查报告PPM Percent Per Million 百万分之一制程统计品管专类SPC Statistical Process Control 统计制程管制SQC Statistical Quality Control 统计质量管理GRR Gauge Reproductiveness & Repeatability 量具之再制性及重测性判断量可靠与否DIM Dimension 尺寸DIA Diameter 直径N Number 样品数三:其它质量术语类QIT Quality Improvement Team 质量改善小组ZD Zero Defect 零缺点QI Quality Improvement 质量改善QP Quality Policy 目标方针TQM Total Quality Management 全面质量管理RMA Return Material Audit 退料认可7QCTools 7 Quality Control Tools 品管七大手法通用之件类ECN Engineering Change Notice 工程变更通知(供货商)ECO Engineering Change Order 工程改动要求(客户)PCN Process Change Notice 工序改动通知PMP Product Management Plan 生产管制计划SIP Standard Inspection Procedure 制程检验标准程序SOP Standard Operation Procedure 制造作业规范IS Inspection Specification 成品检验规范BOM Bill Of Material 物料清单PS Package Specification 包装规范SPEC Specification 规格DWG Drawing 图面系统文件类ES Engineering Standard 工程标准CGOO China General PCE龙华厂文件IWS International Workman Standard 工艺标准ISO International Standard Organization 国际标准化组织GS General Specification 一般规格部门类PMC Production & Material Control 生产和物料控制PCC Product control center 生产管制中心PPC Production Plan Control 生产计划控制MC Material Control 物料控制DC Document Center 资料中心QE Quality Engineering 质量工程(部)QA Quality Assurance 质量保证(处)QC Quality Control 质量管理(课)PD Product Department 生产部LAB Laboratory 实验室IE Industrial Engineering 工业工程R&D Research & Design 设计开发部。

国际结算常用英语词汇资料

国际结算常用英语词汇Promissory Note 本票Check or Check 支票Remittance 汇付Mail Transfer,M/T 信汇Telegraphic Transfer,T/T 电汇Demand Draft,D/D 票汇Payment in Advance 预付货款Payment after Arrival of Goods 货到付款Collection 托收Principal 委托人Remitting Bank 托收银行Collecting Bank 代收银行Presenting Bank 提示行Documents against Payment,D/P 付款交单Documents against Payment at sight,D/P sight 即期付款交单Documents against Payment after sight,D/P after sight 远期付款交单Documents against Acceptance,D/A 承兑交单不可不知的国际贸易英语国际贸易的价格表示方法,除了具体金额外,还要包括贸易术语,交货地点及所使用的货币。

如:USD150 FOB Hongkong, STG2000 CIF Liverpool,其中USD指的是以美金作价,而STG为英镑;Hongkong香港和Liverpool利物浦为交货地点;FOB与CIF 则为两个较为常用的贸易术语。

以下是国际商会出版的《2000年国际贸易术语解释通则》中规定的全部贸易术语的分类。

第一组:E组(卖方在其所在地点把货物交给买方)Ex Works (named place) 工厂交货(指定地点)第二组:F组(卖方须将货物交至买方指定的承运人)FCA: Free Carrier (named place) 货交承运人(指定地点)FAS: Free Alongside Ship (named port of shipment)船边交货(指定装运港)FOB: Free On Board (named port of shipment)船上交货(指定装运港)第三组:C组(卖方必须签定运输合同,但对货物灭失或损坏的风险以及装船和启运后发生事件所产生的额外费用不承担责任)CFR: Cost & Freight (named port of destination)成本加运费(指定目的港)CIF: Cost, Insurance and Freight (named port of destination)成本,保险加运费(指定目的港)CPT: Carriage Paid To (named place of destination)运费付至(指定目的地)CIP: Carriage and Insurance Paid To(named place of estination)运费保险费付至(指定目的地)第四组:D组(卖方必须承担把货物交至目的地国家所需的全部费用和风险)DAF: Delivered at Frontier (named place) 边境交货(指定地点)DES: Delivered ex Ship (named port of destination)船上交货(指定目的港)DEQ: Delivered ex Quay (named place of destination)码头交货(指定目的地)DDU: Delivered Duty Unpaid (named place of destination)未完税交货(指定目的地)DDP: Delivered Duty Paid (named place of destination)完税后交货(指定目的地)企业外贸业务用语大全一:基本短语 Time to volume 及时大量生产Time to money 及时大量交货FOUR CONTROL YSTEM 四大管制系统Engineering control system 工程管制系统Quality control system质量管理系统Manufacturing control system生产管制系统Management control system经营管制系统Classification整理(sorting, organization)-seiri Regulation整顿(arrangement, tidiness)-seiton Cleanliness清扫(sweeping, purity)-seiso Conservation清洁(cleaning, cleanliness)-seiktsu Culture教养(discipline)-shitsukeSave 节约Safety安全二:英文缩写质量人员名称类QC quality control 品质管理人员FQC final quality control 终点质量管理人员IPQC in process quality control 制程中的质量管理人员OQC output quality control 最终出货质量管理人员IQC incoming quality control 进料质量管理人员TQC total quality control 全面质量管理POC passage quality control 段检人员QA quality assurance 质量保证人员OQA output quality assurance 出货质量保证人员QE quality engineering 质量工程人员质量保证类FAI first article inspection 新品首件检查FAA first article assurance 首件确认CP capability index 能力指数CPK capability process index 模具制程能力参数SSQA standardized supplier quality audit 合格供货商质量评估FMEA failure model effectiveness analysis 失效模式分析FQC运作类AQL Acceptable Quality Level 运作类允收质量水平S/S Sample size 抽样检验样本大小ACC Accept 允收REE Reject 拒收CR Critical 极严重的MAJ Major 主要的MIN Minor 轻微的Q/R/S Quality/Reliability/Service 质量/可靠度/服务P/N Part Number 料号L/N Lot Number 批号AOD Accept On Deviation 特采UAI Use As It 特采FPIR First Piece Inspection Report 首件检查报告PPM Percent Per Million 百万分之一制程统计品管专类SPC Statistical Process Control 统计制程管制SQC Statistical Quality Control 统计质量管理GRR Gauge Reproductiveness & Repeatability 量具之再制性及重测性判断量可靠与否DIM Dimension 尺寸DIA Diameter 直径N Number 样品数三:其它质量术语类QIT Quality Improvement Team 质量改善小组ZD Zero Defect 零缺点QI Quality Improvement 质量改善QP Quality Policy 目标方针TQM Total Quality Management 全面质量管理RMA Return Material Audit 退料认可7QCTools 7 Quality Control Tools 品管七大手法通用之件类ECN Engineering Change Notice 工程变更通知(供货商)ECO Engineering Change Order 工程改动要求(客户)PCN Process Change Notice 工序改动通知PMP Product Management Plan 生产管制计划SIP Standard Inspection Procedure 制程检验标准程序SOP Standard Operation Procedure 制造作业规范IS Inspection Specification 成品检验规范BOM Bill Of Material 物料清单PS Package Specification 包装规范SPEC Specification 规格DWG Drawing 图面系统文件类ES Engineering Standard 工程标准CGOO China General PCE龙华厂文件IWS International Workman Standard 工艺标准ISO International Standard Organization 国际标准化组织GS General Specification 一般规格部门类PMC Production & Material Control 生产和物料控制PCC Product control center 生产管制中心PPC Production Plan Control 生产计划控制MC Material Control 物料控制DC Document Center 资料中心QE Quality Engineering 质量工程(部)QA Quality Assurance 质量保证(处)QC Quality Control 质量管理(课)PD Product Department 生产部LAB Laboratory 实验室IE Industrial Engineering 工业工程R&D Research & Design 设计开发部。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

国际结算(International settlement)贸易(Trade Settlement)非贸易(Non-Trade Settlement)EDI(Electronic Data Intercharge)电子数据交换,控制文件(Control Documents)有权签字人的印鉴(Specimen Signatures)密押(Test Key)费率表(Terms and Condition)货物单据化,履约证书化,( cargo documentation , guarantee certification)权利单据(document of title)流通转让性(Negotiability)让与(Assignment)转让(Transfer)流通转让(Negotiation)汇票的定义是:A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to the order or specified person or to bearer.“汇票” (bill of exchange,exchange或draft)无条件支付命令(unconditional order to pay)出票条款(drawn clause)利息条款(with interest)分期付款(by stated instalment)支付等值其它货币( pay the other currency according to an indicated rate of exchange) 付款人(payer)受票人(drawee)付款期限(time of payment)或(tenor)即期(at sight, on demand, on presentation)付款。

远期(at a determinable future time , time/ usance / term bill)付款。

期限远期付款的表现形式:①见票后若干天(月)付款(bills payable at days/ months after sight)②出票后若干天(月)付款(bills payable at days/ months after date)③预定日期后若干天(月)付款(bills payable at days/ months after stated date)④板期付款(bills payable on a fixed future date)⑤延期付款(bills payable at days/months after shipment/ the date of B/L) 收款人名称(payee)同样金额期限的第二张不付款”〔pay this first bill of exchange(second of the same tenor and dated being unpaid)需要时的受托处理人(referee in case of need)出票人(drawer)收款人(payee)背书人(endorser)被背书人(endorsee)出票(issue)(1)制成汇票并签字(to draw a draft and to signit);(2)将制成的汇票交付给收款人(to deliver the draftto payee)背书(endorsement)(1)特别背书(special endorsement),又称为记名背书或正式背书(2)空白背书(blank endorsement),又称不记名背书(3)限制性背书(restrictive endorsement)(4)有条件的背书(conditional endorsement)(5)托收背书(endorsement for collection)提示(presentation)承兑(acceptance)(1)普通承兑(general acceptance)(2)保留承兑(qualified acceptance)付款(payment)退票(dishonor)退票通知(notice of dishonor)拒绝证书(protest)追索(recourse)追索权(right of recourse)保证(guarantee/aval)本票所下的定义是:A promissory note is an unconditional promise in writing made by one person to another signed by the maker, engaging to pay, on demand or at a fixed or determinable future time, a sum certain in money, to, or to the order, of a specified person or to bearer.本票(promissory note)银行本票(Banker’s Note)商业本票(Trader’s Note) 或一般本票(General Promissory Note)即期本票(Sight Note/Demand Note)远期本票(Time Note/Usance Note)本币本票(Domestic Money Note)外币本票(Foreign Money Note)国内本票(Domestic Note)国际本票(International Note)旅行支票(traveler`s cheque)支票所下的定义是:Briefly speaking, a cheque is a bill of exchange drawn on a bank payable on demand. Detailed speaking, a cheque is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a sum certain in money to or to the order of a specified person or to bearer.支票(cheque)非划线支票(open cheque),划线支票(crossed cheque),普通划线支票(general crossing cheque)特别划线支票(special crossing cheque)保付支票(certified cheque)即由付款行在支票上加盖“保付(CERTIFIED)“Orders not to pay”(奉命止付)第三章汇款结算方式顺汇法(remittance)逆汇法(reverse remittance)汇款方式(methods of remittance),汇款人(remitter)即付款人收款人或受益人(payee /beneficiary)汇出行(remitting bank)汇入行(paying bank)或解付行电汇(telegraphic transfer,简称T/T)信汇(mail transfer,简称M/T)信汇委托书(mail transfer advice)和支付委托书(payment order)。

票汇(remittance by banker’s demand draft,简称D/D)票汇业务程序(remittance by banker’s demand draft,简称D/D)中心汇票(draft on center)拨头寸的指示:“Please debit our a/c with you”或“In cover ,we authorized you to debit the sum to our a/c with you.”(“请借记”或“授权借记”)拨头寸的指示:“In cover ,we have credited the sum to your a/c with us”. (“已贷记”或“主动贷记”)拨头寸指示为:“In cover ,we have authorized X Bank to debit our a/c and credit your a/c with them.”预付货款(payment in advance)货到付款(payment after arrival of the goods)赊账交易(open account transaction),具有延期付款(deferred payment)性质。

交单付现(cash against documents, 简称CAD)第四章托收结算方式托收(collection)金融单据(financial documents)商业单据(commercial documents)委托人(Principal)托收行(Remitting Bank)代收行(Collecting Bank)付款人(Payer或Drawee)提示行(Presenting Bank)"需要时的代理"(a representative to act as case-of-need)光票托收(clean collection)跟单托收(documentary bill for collection)付款交单(documents against payment,简称D/P)即期付款交单(D/P at sight)远期付款交单(D/P at XX days after sight)承兑交单(documents against acceptance,简称为 D/A)直接托收(direct collection)托收指示(collection instruction)出票条款,通常以“Drawn against shipment of (merchandise) for collection”为固定格式。

托收出口押汇(collection bills purchased)出口贷款(advance against collection)融通票据[Accommodation Bill\Accommodation Paper]也称空票。