International Taxation国际税收 试卷1

国际税收期末考试试题

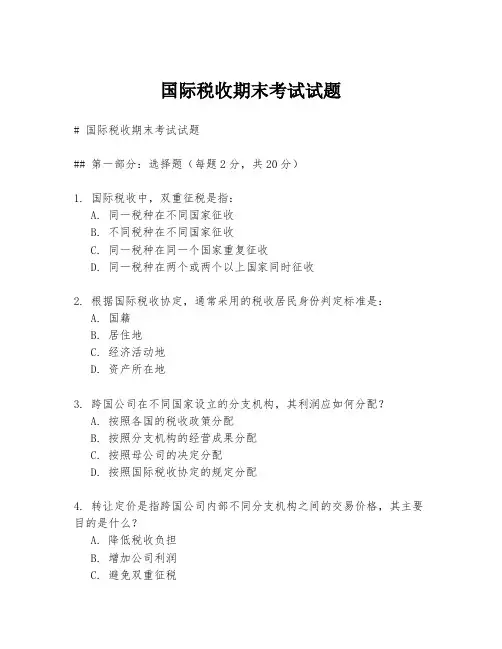

国际税收期末考试试题# 国际税收期末考试试题## 第一部分:选择题(每题2分,共20分)1. 国际税收中,双重征税是指:A. 同一税种在不同国家征收B. 不同税种在不同国家征收C. 同一税种在同一个国家重复征收D. 同一税种在两个或两个以上国家同时征收2. 根据国际税收协定,通常采用的税收居民身份判定标准是:A. 国籍B. 居住地C. 经济活动地D. 资产所在地3. 跨国公司在不同国家设立的分支机构,其利润应如何分配?A. 按照各国的税收政策分配B. 按照分支机构的经营成果分配C. 按照母公司的决定分配D. 按照国际税收协定的规定分配4. 转让定价是指跨国公司内部不同分支机构之间的交易价格,其主要目的是什么?A. 降低税收负担B. 增加公司利润C. 避免双重征税D. 促进国际贸易5. 国际税收中的“常设机构”概念主要用来解决什么问题?A. 确定税收居民身份B. 确定跨国公司的利润分配C. 确定跨国公司分支机构的税收管辖权D. 确定跨国公司在不同国家的税收负担...(此处省略剩余选择题,以保持题目的完整性)## 第二部分:简答题(每题10分,共30分)1. 简述国际税收协定中“独立交易原则”的含义及其重要性。

2. 描述“税收天堂”的概念,并分析其对国际税收体系的影响。

3. 阐述国际税收中“税收抵免”的概念及其对跨国公司税务规划的意义。

## 第三部分:案例分析题(每题25分,共50分)1. 假设一家总部位于A国的跨国公司在B国设立了一家全资子公司,B国的公司税为30%,A国的公司税为20%。

该公司在B国的子公司年利润为100万美元。

请分析并计算该公司在A国和B国的税务处理情况。

2. 某跨国公司在不同国家设立了多个分支机构,其内部交易的转让定价低于市场价。

请分析这种定价策略可能带来的税收影响,并讨论如何通过国际税收协定来解决这一问题。

## 第四部分:论述题(共30分)请结合当前国际税收环境,论述“数字经济”对国际税收体系带来的挑战,并提出可能的解决方案。

International Taxation国际税收 试卷1

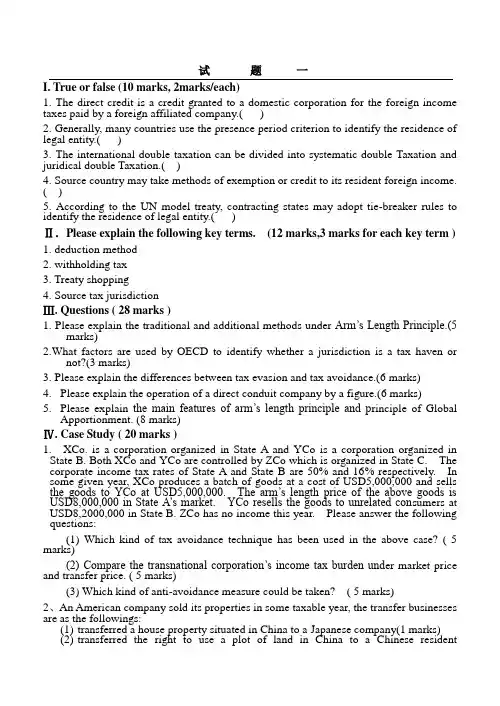

试题一I. True or false (10 marks, 2marks/each)1. The direct credit is a credit granted to a domestic corporation for the foreign income taxes paid by a foreign affiliated company.( )2. Generally, many countries use the presence period criterion to identify the residence of legal entity.( )3. The international double taxation can be divided into systematic double Taxation and juridical double Taxation.( )4. Source country may take methods of exemption or credit to its resident foreign income. ( )5. According to the UN model treaty, contracting states may adopt tie-breaker rules to identify the residence of legal entity.( )Ⅱ.Please explain the following key terms. (12 marks,3 marks for each key term )1. deduction method2. withholding tax3. Treaty shopping4. Source tax jurisdictionⅢ. Questions ( 28 marks )1. Please explain the traditional and additional methods under Arm’s Length Principle.(5marks)2.What factors are used by OECD to identify whether a jurisdiction is a tax haven ornot?(3 marks)3. Please explain the differences between tax evasion and tax avoidance.(6 marks)4.Please explain the operation of a direct conduit company by a figure.(6 marks)5.Please explain the main features of arm’s length principle and p rinciple of GlobalApportionment. (8 marks)Ⅳ. Case Study ( 20 marks )1.XCo. is a corporation organized in State A and YCo is a corporation organized in State B. Both XCo and YCo are controlled by ZCo which is organized in State C. The corporate income tax rates of State A and State B are 50% and 16% respectively. In some given year, XCo produces a batch of goods at a cost of USD5,000,000 and sells the goods to YCo at USD5,000,000. The arm’s length price of the above goods is USD8,000,000 in State A’s market. YCo resells the goods to unrelated con sumers at USD8,2000,000 in State B. ZCo has no income this year. Please answer the following questions:(1) Which kind of tax avoidance technique has been used in the above case? ( 5 marks)(2) Compare the transnational corporation’s income tax burden und er market price and transfer price. ( 5 marks)(3) Which kind of anti-avoidance measure could be taken? ( 5 marks)2、An American company sold its properties in some taxable year, the transfer businesses are as the followings:(1)transferred a house property situated in China to a Japanese company(1 marks)(2)transferred the right to use a plot of land in China to a Chinese residentcompany(1 marks)(3)transferred a sales centre located in China to a Singapore company(1 marks)(4)transferred its share of a Chinese resident company and derived gains, its sharewas 30% of company’s equity (2 marks)Could Chinese government exercise its tax jurisdiction over the above transactions? V. Computation ( 30 marks)1. Assume M, a taxpayer in country A, has 9000 of domestic-source income and 8000 of income from country B, and 3000 from country C . Country B levies tax at the rate of 20%, country C at the rate of 40%, Country A levies income tax at a extra- progressivehow many taxes M should pay?(6marks)2) If country A adopts deduction method, how many taxes M should pay to country A? (6marks)3) If country A adopts full exemption method, how many taxes M should pay to country A? (4marks)4) If country A adopts the method of exemption with progression, how many taxes M should pay to country A? (4marks)2. Corporation RCo is established in country A, and earns 20 in some taxable year, the income tax in country A is 40%. RCo has a branch in country B, which has the income of 10 and country B’s normal tax rate is 30%. Country B offers halved tax rate to the branch. Country A is willing to give a tax sparing credit to Rco. Please calculate the tax RCo should pay to Country A.(10marks)答案及评分标准I.True and False ( 10marks, 2points/each): ××√√×Ⅱ.Please explain the following key terms. (12 marks,3 marks for each key term ) 1. Deduction method: The residence country allows its taxpayers to claim a deduction for taxes, including income taxes(2 marks), paid to a foreign government in respect of foreign-source income(1 mark).2.Withholding tax : a tax levied by the source country at a flat rate on the gross amount of dividends(1marks) ,royalities,interest,or other payments made by residents to nonresidents(1marks). The tax is collected and paid to the government by the resident payer.(1marks)3. Treaty shopping occurs when a person who is not a resident of either country (1 mark) seeks certain benefits (1 mark )under the income tax treaty between the two countries(1 mark) .4. Source tax jurisdiction:Income may be taxable under the tax laws of a country because of a nexus between that country and the activies that generated the income.(2 marks) A jurisdiction claim based on such a nexus is called source tax jurisdiction.(1 marks)Ⅲ. Questions ( 28 marks )1. Traditional methods include comparable uncontrolled price method, resale price method, cost plus method (2.5method) and additional methods include profit-split method, transactional net margin method and comparable profit method (2.5 marks)2.No or only nominal taxes (1 mark);Protection of personal financial information(1 mark); Lack of transparency(1 mark).3. Tax evasion is illegal, and uses criminal means, and there are punishments on the taxpayer (3 marks). Tax avoidance is legal,and uses acceptable tax planning and it requires improvements on tax laws (3 marks)4. (6 marks)5.ALP is set according to the market economy theory and its price is the real market price, which reflects the principle of equity(1 mark).It often imposes unreasonable burdens of proof on taxpayers(1 mark).It is extremely time-consuming and expensive to enforces(1 mark). ALP is likely to continue to be the internationally accepted and the most objective approach for resolving transfer pricing issues except in special circumstances(1 mark).FA is more easily to enforces and it also avoids some of the difficult audit problems.The arbitrariness of the predetermined formulas makes it difficult to reflect the particular circumstances of each multinational enterprises(1 mark).It relies heavily on access to foreign-based information.Substantial cooperation among governments would be needed to solve these problems(1 mark).FA is used by some subnational jurisdictions(1 mark). And it is likely to continue to be an important part of the international tax scene(1 mark). Ⅳ. Case Study ( 20 marks )一. (1) transfer pricing (2 mark)(2) Taxable income under transfer price:XCo’s taxable income = 8000000- 5000000 = 3000000 (1 mark)YCo’s taxable income = 8200000 -8000000 = 200000; (1 mark)Income tax paid under transfer price:XCo’s income tax = 3000000x 50% = 1500000; (1 mark)YCo’s income tax = 200000 x 16% = 32000; (1 mark)Total income tax=1532000 (1 mark)Taxable income under transfer price:XCo’s taxable income = 5000000- 5000000 = 0 (1 mark)YCo’s taxable income = 8200000 -5000000 = 3200000; (1 mark)Income tax paid under transfer price:XCo’s income t ax = 0 x 50% = 0; (1 mark)YCo’s income tax = 3200000 x 16% = 512000; (1 mark)Total tax=512000 (1 mark)Tax difference=1532000-512000=1020000 (1 mark)(3) transfer pricing rules ( 2 marks) or Arm’s length principle ( 2 marks)二.(1)Yes, Chinese government has the priority to exercise its tax jurisdiction. (1mark)(2)Yes, Chinese government has the priority to exercise its tax jurisdiction.(1mark)(3)Yes, Chinese government has the priority to exercise its tax jurisdiction.(1mark)(4) Yes, Chinese government can exercise its tax jurisdiction since the share holding exceeds 25%.(2 marks)Ⅴ. Computation (30 marks)一. 1 If country A doesn’t adopt any method to eliminate the double taxation,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600(1 mark)Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200(1 mark)Net Domestic income:9 000+8 000+3 000=20 000(1mark)Domestic tax: 5000×10%+10 000×20%+5000×30% = 4000(2 mark)The total domestic and foreign tax:4000+1600+1200=6800(1 mark)2 If country A adopts deduction method,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200Net Domestic income:20 000-1600-1200= 16400(2 mark) Domestic tax: 5000×10%+10000×20%+1400×30% =2920(2 mark)The total domestic and foreign tax:2920+1600+1200= 5720 (2 mark)3 If country A adopts the full exemption method,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200Net Domestic income: 9000Domestic tax: 5000×10%+4000×20% = 1300(2 mark)The total domestic and foreign tax:1300+1600+1200= 4100(2 mark)4 If country A adopts the method of exemption with progression,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200Net Domestic income: 9000Domestic tax: (5000×10%+10 000×20%+5000×30% ) ×9000/20000=1800(2 mark) The total domestic and foreign tax:1800+1600+1200= 4600(2 mark) 二.1)Foreign tax (10x30%x50%) 1.5 (2marks)2)tax relief treated as foreign tax paid (10x30x50%) =1.5(2marks)3)Credit limitation (10x40%) 4(2marks)Credit (1.5+1.5)] 3(2marks)4)Tax paid by R [(20+10)x40%-3] 9(2marks)。

国际税务考试试题及答案

国际税务考试试题及答案在进行国际税务考试前,了解试题及答案是备考的重要一环。

本文将为读者提供一系列国际税务考试试题及答案,以帮助考生更好地准备考试。

第一部分:税收基础知识1. 税收的定义是什么?税收是一种政府征收的强制性财政收入,用于满足公共支出和社会福利的需求。

2. 什么是税收筹划?税收筹划是指合法合规地利用税收政策和规定,以减少纳税额或推迟支付税款的方式来优化税负结构。

3. 不同国家税法存在的差异有哪些方面?不同国家税法存在的差异包括税收种类、税率、纳税义务、税收征收方式等。

第二部分:国际税收1. 什么是国际税收原则?国际税收原则是指各国在对跨国经济活动课征税时所遵循的一系列原则,如税收主权、避免双重征税、信息交换等。

2. 请解释税收协定的作用。

税收协定是两个国家之间达成的协议,用于解决跨国经济活动中可能产生的双重征税问题,以促进国际经济交流和投资。

3. 请解释转移定价的概念。

转移定价是指跨国企业在内部交易中确定产品和服务的价格,以合理分配利润和税负的原则。

第三部分:税收合规与风险管理1. 什么是税收合规?税收合规是指纳税人依法遵守税收法律法规,主动履行相应税收义务,并按要求申报和缴纳税款。

2. 如何进行税务风险管理?税务风险管理包括风险识别、评估和控制等一系列措施,旨在减少纳税风险和避免未来的纠纷。

3. 全球反避税组织(OECD)的主要作用是什么?全球反避税组织主要致力于推动跨国税收规则的完善,打击国际税收漏税和避税行为,促进全球税收合作和信息交换。

结语:本文提供了一些国际税务考试的试题及答案,包括税收基础知识、国际税收和税收合规与风险管理等方面的内容。

希望本文对考生在备考过程中有所帮助,能够更好地掌握相关知识,取得优异的考试成绩。

祝愿各位考生顺利通过税务考试!。

国际税收协定与涉外税务处理试卷

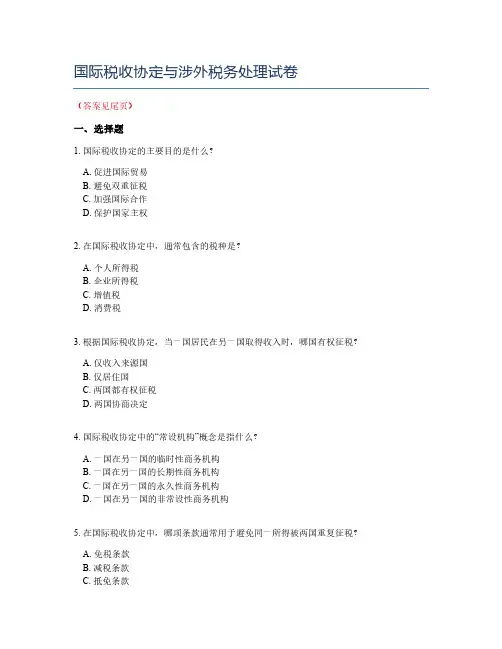

国际税收协定与涉外税务处理试卷(答案见尾页)一、选择题1. 国际税收协定的主要目的是什么?A. 促进国际贸易B. 避免双重征税C. 加强国际合作D. 保护国家主权2. 在国际税收协定中,通常包含的税种是?A. 个人所得税B. 企业所得税C. 增值税D. 消费税3. 根据国际税收协定,当一国居民在另一国取得收入时,哪国有权征税?A. 仅收入来源国B. 仅居住国C. 两国都有权征税D. 两国协商决定4. 国际税收协定中的“常设机构”概念是指什么?A. 一国在另一国的临时性商务机构B. 一国在另一国的长期性商务机构C. 一国在另一国的永久性商务机构D. 一国在另一国的非常设性商务机构5. 在国际税收协定中,哪项条款通常用于避免同一所得被两国重复征税?A. 免税条款B. 减税条款C. 抵免条款D. 豁免条款6. 国际税收协定中的“预扣税”是指什么?A. 居住国对居民取得的境外收入征税B. 来源国对非居民取得的境内收入征税C. 来源国对居民取得的境内收入征税D. 居住国对非居民取得的境外收入征税7. 在国际税收协定中,哪项条款用于解决两国间税收争议?A. 仲裁条款B. 协商条款C. 调解条款D. 诉讼条款8. 国际税收协定中的“资本利得税”通常是指什么?A. 对资本交易取得的收益征税B. 对固定资产处置取得的收益征税C. 对股票转让取得的收益征税D. 对知识产权许可取得的收益征税9. 在国际税收协定中,哪项条款用于确定税收居民的归属?A. 住所标准B. 国籍标准C. 住所和国籍标准D. 实际居住标准10. 国际税收协定的签订通常是由哪两个国家或地区发起的?A. 发达国家与发展中国家B. 邻国之间C. 同一经济区域的国家D. 国际组织11. 下列哪个不是国际税收协定的常见条款?A. 税收居民定义B. 常设机构原则C. 资本利得税D. 股息、利息和特许权使用费的最惠国待遇12. 在国际税收协定中,“常设机构”通常指的是什么?A. 一国境内的固定场所B. 一国境内非独立性的固定场所C. 一国境内临时性的固定场所D. 一国境内与税收协定无关的场所13. 根据国际税收协定,哪一类收入通常被视为来源地税收?A. 股息B. 利息C. 特许权使用费D. 工资薪金14. 在国际税收协定中,哪一方通常负责征收源泉扣缴税?A. 居住国B. 来源国C. 双边协议规定的任何一方D. 第三国15. 在国际税收协定中,“税收饶让”通常是指什么?A. 居住地国对居民在来源国已缴税款给予抵免B. 来源国对居民在居住地国取得的收入给予税收优惠C. 居住地国对居民在来源国的投资给予税收优惠D. 来源国对非居民在居住地国的收入给予税收优惠16. 下列哪个选项不是国际税收协定中常见的税种?A. 增值税B. 个人所得税C. 企业所得税D. 社会保险税17. 在国际税收协定中,“无限纳税义务”通常指的是什么?A. 纳税人只需在其居住国缴纳税款B. 纳税人需在其居住国和来源国都缴纳税款C. 纳税人只需在其来源国缴纳税款D. 纳税人需在其居住地国和所有来源国都缴纳税款18. 下列哪个机构通常负责处理国际税收协定中的纠纷?A. 世界贸易组织B. 国际货币基金组织C. 联合国D. 国际税务委员会19. 下列哪个国家不是中国签订的国际税收协定的伙伴国?A. 美国B. 英国C. 法国D. 德国20. 中国与哪个国家签订了第一个双边税收协定?A. 日本B. 韩国C. 印度D. 俄罗斯21. 在国际税收协定中,常设机构原则是指什么?A. 缔约国一方企业在缔约国另一方设有固定场所,其活动全部或部分由缔约国另一方的企业控制B. 两个国家的税收协定仅适用于缔约国一方的企业在缔约国另一方有实际经营活动的情形C. 常设机构的利润仅包括在固定场所从事经营活动取得的利润D. 以上都是22. 在国际税收协定中,哪项不属于避免双重征税的措施?A. 免税B. 减税C. 抵免D. 延期纳税23. 国际税收协定中的预扣税是什么?A. 源泉扣缴的所得税B. 缔约国双方对非居民取得的股息、红利等所得实行的税收C. 对非居民支付的利息、特许权使用费征收的税D. 以上都是24. 在国际税收协定中,哪项不是税收饶让的条件?A. 居住国给予非居民的税收优惠B. 非居民在来源国没有实际缴纳所得税C. 税收饶让仅适用于预扣税D. 饶让抵免的税额不能超过按国内法计算的应纳税额25. 下列哪个选项不是国际税收协定中的国际反避税条款?A. 防止税收协定滥用B. 打击税收逃避C. 限制税收优惠政策的使用D. 促进国际合作26. 在处理涉外税务时,注册会计师应特别注意哪些方面?A. 遵守国内税法B. 了解并遵守国际税收协定C. 掌握涉外税务申报和缴纳程序D. 以上都是27. 在国际税收协定中,哪项通常不是确定常设机构标准的一部分?A. 营业场所B. 代理人C. 雇员D. 股东28. 根据国际税收协定,哪类收入通常不予征税?A. 股息B. 利息C. 特许权使用费D. 财产转让所得29. 在国际税收协定中,哪项是确定税收居民身份的关键因素?A. 住所B. 国籍C. 居住地D. 经济实质30. 国际税收协定中关于预扣税的规定通常适用于哪种类型的收入?A. 经营所得B. 劳务所得C. 投资所得D. 财产转让所得31. 在国际税收协定中,哪项原则用于解决双重征税问题?A. 领土原则B. 居民原则C. 来源地原则D. 税收饶让32. 下列哪项不是国际税收协定中的“常设机构”定义的一部分?A. 管理机构B. 营业场所C. 仓库D. 办事处33. 在国际税收协定中,哪项通常被视为来源地国家?A. 收入产生的国家B. 纳税人居住的国家C. 资产所在的国家D. 合同签订的国家34. 国际税收协定中关于资本利得的规定通常适用于哪种类型的资产?A. 不动产B. 动产C. 无形资产D. 知识产权35. 在国际税收协定中,哪项通常用于确定股息收入征税权?A. 实际管理机构所在地B. 股息支付者所在地C. 股息收入来源地D. 纳税人居住地36. 在国际税收协定中,哪一项通常不是主要的税种?A. 所得税B. 增值税C. 财产税D. 关税37. 下列哪个国家不属于“OECD”成员国?A. 美国B. 德国C. 日本D. 巴西38. 在国际税收协定中,“常设机构”的定义通常包括哪些?A. 办事处B. 分支机构C. 工厂D. 仓库39. 如果一个外国居民在我国有来源于我国境内的所得,但该居民所在国与我国没有签订税收协定,那么我国对其征税的原则是:A. 按我国税法规定征税B. 按其居民国的税法规定征税C. 按两国共同适用的税法规定征税D. 不征税40. 在国际税收协定中,关于预扣税的规定通常适用于哪种类型的收入?A. 股息B. 利息C. 工资D. 租金41. 如果一个我国居民在外国投资并获得了所得,但该外国与我国签订了税收协定,那么我国对该居民的税收待遇是:A. 按照我国税法征税B. 按照协定规定的税率征税C. 按照我国税法规定的税率和协定规定的税率中的较高者征税D. 不征税42. 国际税收协定中的“资本利得”通常指的是什么?A. 销售固定资产所得B. 销售无形资产所得C. 销售股票或其他证券所得D. 销售存货所得43. 在国际税收协定中,哪一项通常不被视为常设机构?A. 定期提供劳务的办事处B. 分支机构C. 季节性工厂D. 单一交易中的临时场所44. 如果一个外国居民在我国设有分支机构,并且该分支机构在我国的营业利润超过了总营业利润的一定比例,那么这个比例通常被称为:A. 营业利润率B. 分支机构利润率C. 资本利得率D. 预扣税率二、问答题1. 什么是国际税收协定?2. 国际税收协定通常包括哪些内容?3. 什么是双重征税?如何避免?4. 国际税收协定中的常设机构原则是指什么?5. 什么是国际税收协定中的预扣税?6. 国际税收协定中的税收饶让是什么?7. 如何处理国际税收协定中的争议?8. 签订国际税收协定的意义是什么?参考答案选择题:1. B2. A3. C4. B5. C6. B7. A8. C9. A 10. B11. C 12. B 13. A 14. B 15. A 16. A 17. B 18. D 19. D 20. A21. D 22. D 23. D 24. B 25. D 26. D 27. D 28. A 29. A 30. B31. C 32. D 33. A 34. B 35. C 36. D 37. D 38. ABCD 39. A 40. ABD41. B 42. C 43. D 44. B问答题:1. 什么是国际税收协定?国际税收协定是两个或两个以上国家(或地区)签订的关于处理跨国纳税人税收关系的法律协议。

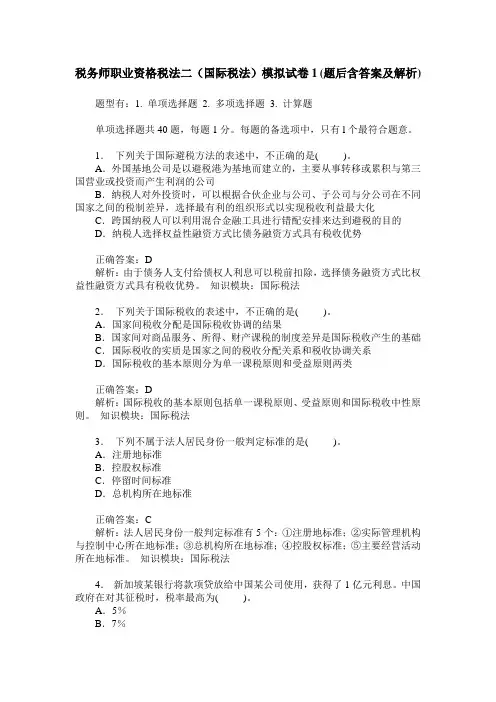

税务师职业资格税法二(国际税法)模拟试卷1(题后含答案及解析)

税务师职业资格税法二(国际税法)模拟试卷1(题后含答案及解析) 题型有:1. 单项选择题 2. 多项选择题 3. 计算题单项选择题共40题,每题1分。

每题的备选项中,只有l个最符合题意。

1.下列关于国际避税方法的表述中,不正确的是( )。

A.外国基地公司是以避税港为基地而建立的,主要从事转移或累积与第三国营业或投资而产生利润的公司B.纳税人对外投资时,可以根据合伙企业与公司、子公司与分公司在不同国家之间的税制差异,选择最有利的组织形式以实现税收利益最大化C.跨国纳税人可以利用混合金融工具进行错配安排来达到避税的目的D.纳税人选择权益性融资方式比债务融资方式具有税收优势正确答案:D解析:由于债务人支付给债权人利息可以税前扣除,选择债务融资方式比权益性融资方式具有税收优势。

知识模块:国际税法2.下列关于国际税收的表述中,不正确的是( )。

A.国家间税收分配是国际税收协调的结果B.国家间对商品服务、所得、财产课税的制度差异是国际税收产生的基础C.国际税收的实质是国家之间的税收分配关系和税收协调关系D.国际税收的基本原则分为单一课税原则和受益原则两类正确答案:D解析:国际税收的基本原则包括单一课税原则、受益原则和国际税收中性原则。

知识模块:国际税法3.下列不属于法人居民身份一般判定标准的是( )。

A.注册地标准B.控股权标准C.停留时间标准D.总机构所在地标准正确答案:C解析:法人居民身份一般判定标准有5个:①注册地标准;②实际管理机构与控制中心所在地标准;③总机构所在地标准;④控股权标准;⑤主要经营活动所在地标准。

知识模块:国际税法4.新加坡某银行将款项贷放给中国某公司使用,获得了1亿元利息。

中国政府在对其征税时,税率最高为( )。

A.5%B.7%C.8%D.10%正确答案:B解析:利息来源国对利息也有征税的权利,但对征税权的行使进行了限制,即设定了最高税率,且限制税率与受益所有人自身性质有关,受益所有人为银行或金融机构的情况下,利息的征税税率为7%。

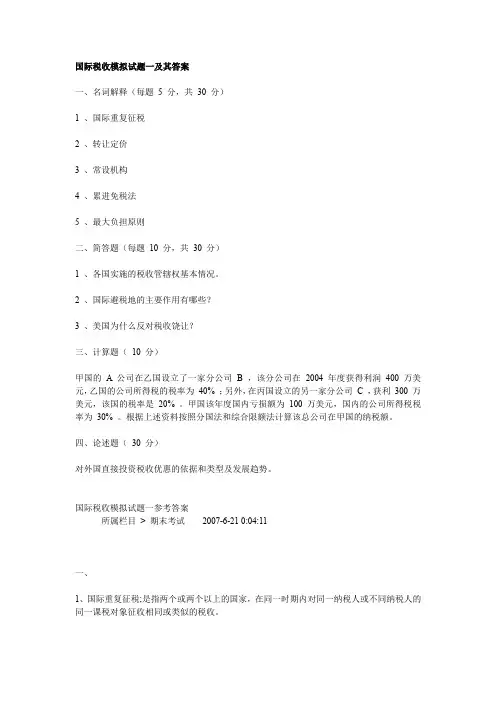

国际税收_朱青_国际税收模拟试题一及答案

国际税收模拟试题一及其答案一、名词解释(每题5 分,共30 分)1 、国际重复征税2 、转让定价3 、常设机构4 、累进免税法5 、最大负担原则二、简答题(每题10 分,共30 分)1 、各国实施的税收管辖权基本情况。

2 、国际避税地的主要作用有哪些?3 、美国为什么反对税收饶让?三、计算题(10 分)甲国的 A 公司在乙国设立了一家分公司 B ,该分公司在2004 年度获得利润400 万美元,乙国的公司所得税的税率为40% ;另外,在丙国设立的另一家分公司C ,获利300 万美元,该国的税率是20% 。

甲国该年度国内亏损额为100 万美元,国内的公司所得税税率为30% 。

根据上述资料按照分国法和综合限额法计算该总公司在甲国的纳税额。

四、论述题(30 分)对外国直接投资税收优惠的依据和类型及发展趋势。

国际税收模拟试题一参考答案所属栏目> 期末考试2007-6-21 0:04:11一、1、国际重复征税;是指两个或两个以上的国家,在同一时期内对同一纳税人或不同纳税人的同一课税对象征收相同或类似的税收。

2、转让定价:是指公司集团内部机构之间或关联企业之间相互提供产品、劳务或财产而进行的内部交易作价。

3 、常设机构:是指一个企业进行其全部或部分营业的固定场所。

(1) 常设机构是一个固定场所,是一种在另一国的看得见的客观存在;(2) 外国纳税人对该固定场所有权长期使用;(3) 该固定场所要服务于外国纳税人的经营活动,而不是从属其经营活动;4 、累进免税法:即一国政府对本国居民的国外所得不予征税,但在确定对其国内所得征税的税率时,要将这笔免予征税的国外所得与国内所得汇总进行考虑。

5 、最大负担原则:是指对外国企业或外商投资企业从重征税,使其税收负担高于本国企业或内资企业,最大负担原则又称从重原则。

二、1答:税收管辖权属于国家主权,因而每个主权国家都有权根据自己的国情选择适合自己的税收管辖权类型。

从目前世界各国的现行税制来看,所得税管辖权的实施主要有以下三种情况。

国际税收英语期末考试试题

国际税收英语期末考试试题# International Taxation Final Examination QuestionsSection A: Multiple Choice Questions (40 marks)1. Which of the following is not a principle of international taxation?- A. Residence-based taxation- B. Source-based taxation- C. Consumption-based taxation- D. Citizenship-based taxation2. What is the primary purpose of transfer pricing regulations?- A. To encourage international trade- B. To prevent tax evasion through intercompany transactions- C. To standardize accounting practices globally- D. To increase corporate tax rates3. In the context of international taxation, what does the term "permanent establishment" refer to?- A. A fixed place of business through which the business of an enterprise is wholly or partly carried on- B. A temporary location where business activities are conducted- C. An online platform for conducting business transactions- D. A subsidiary company operating in a foreign country4. Which of the following is not a method of allocating profits to a permanent establishment under international tax law?- A. Separate accounting method- B. Consolidated accounting method- C. Apportionment method- D. Attribution method5. Double taxation agreements (DTAs) primarily aim to:- A. Increase tax revenue for both countries- B. Prevent double taxation of income- C. Simplify tax filing procedures- D. Encourage tax evasionSection B: Short Answer Questions (30 marks)6. Define "tax haven" and explain its implications for international taxation.7. What are the main differences between the arm's length principle and the cost-plus method in transfer pricing?8. Explain the concept of "deemed dividend" in the context of international tax avoidance strategies.9. Describe the role of the Organization for Economic Co-operation and Development (OECD) in shaping international tax policies.10. What is the Base Erosion and Profit Shifting (BEPS) action plan, and how does it affect multinational corporations?Section C: Essay Questions (30 marks)11. Discuss the challenges that digitalization poses to the traditional models of international taxation and how countries are adapting to these changes.12. Critically evaluate the effectiveness of double taxation agreements in preventing international tax evasion and avoidance.13. Analyze the impact of the global minimum corporate tax rate on multinational corporations and the countries in which they operate.Section D: Case Study (20 marks)14. Case Study: XYZ Corporation, a multinational company headquartered in Country A, has a subsidiary in Country B. The subsidiary has been accused of using transfer pricing to shift profits to Country A, where the corporate tax rate is lower. Discuss the potential implications for XYZ Corporation and the strategies it could employ to mitigate its tax liabilities while remaining compliant with international tax laws.Instructions:- Answer all questions.- Ensure your responses are well-structured and concise.- Use appropriate terminology and provide clear examples where necessary.- Total word count for the examination should not exceed 800 words.Good luck with your final examination!。

国际税收综合练习题(附答案)

《国际税收》习题及答案第一章国际税收的概念和研究对象一、单项选择题(在每小题列出的四个选项中只有一个选项是符合题目要求的,请将正确选项前的字母填在题后的括号内)1.国际税收是一个()。

A.经济范畴B.历史范围C.社会范畴D.制度范畴2.国际税收是关于()。

A.发生在国家之间的一切税务关系B.本国税制中有关涉外的部分C.发生在国家之间的税收分配关系D.对某些外国税制所进行的比较研究3.下列选项中,属于国际税收的研究对象的是()。

A.各国政府处理与其管辖范围内的纳税人之间征纳关系的准则和规范B.各国政府处理与其管辖范围内的外国纳税人之间征纳关系的准则和规范C.各国政府处理与其它国家之间的税收分配关系的准则和规范D.各国政府处理它同外国籍跨国纳税人之间的税收征纳关系和与其他国家之间的税收分配关系的准则和规范4.下列选项中属于国际税收的研究范围的是( )。

A.所得税问题B.土地税问题C.关税问题D.消费税问题5.下列关于国际税收与国际税务关系的区别表述正确的是()。

A.前者协调国家间经济贸易关系,后者协调国家间税收分配关系B.前者主要涉及流转税和关税,后者主要涉及所得税和财产税C.前者涉及国家间的财权利益分配,后者涉及国家间经济贸易关系D.前者涉及国家间的经济贸易关系,后者涉及国家间的财权利益分配二、多项选择题(在每小题列出的五个选项中有二至五个选项是符合题目要求的,请将正确选项前的字母填在题后的括号内)1.下列各项属于国际税收含义的有()。

A.国际税收不能脱离国家税收而单独存在B.国际税收是指发生在国家间的一切税收关系C.国际税收是对跨国所得的征税D.国际税收是一种国家与国家之间的税收分配关系E.国际税收是指各国税制中有关涉外的部分2.下列税种属于国际税收的研究范围的有()。

A.增值税B.房产税C.公司所得税D.个人所得税E.遗产税3.下列税种中,不会引起国家间财权利益分配问题的有()。

A.所得税B.商品税C.遗产税D.关税E.增值税4.下列关于国际税务关系与国际税收的区别表述正确的有()。

国际税收测习题答案

第一章国际税收题目一、术语解释1.国际税收国际税收是指两个或两个以上的国家政府凭借其政治权力,对跨国纳税人的跨国所得或财产进行重叠交叉课税,以及由此所形成的国家之间的税收分配关系。

2.财政降格由于存在国际税收竞争,各国的资本所得税税率下降到一个不合理的低水平,造成国家的财政实力大幅度下降的现象和趋势。

二、填空1.个人所得税制按照课征方法不同可以分为:分类所得税制、综合所得税制以及(混合所得税制)。

2.按照课税对象的不同,税收课大致分为:商品课税、(所得课税)和财产课税三大类。

3.销售税有多种课征模式,在产制、批发、零售三个环节中选择某一环节课税的,称为(单一环节销售税)。

4.根据商品在国际上的流通方式不同,可将关税分为:(进口关税)、出口税和过境税。

三、判断题1.欧盟的“自有财源”从本质上看,是强加在成员国政府上的税收收入。

×2.一国对跨国纳税人课征的税收属于属于国际税收的范畴。

×3.一般情况下,一国的国境和关境不是一致的。

×4.销售税是仅以销售商品为课征对象的一个税种。

×5.预提税是按预提方式对支付的所得课征的一个独立税种。

×6.国际税收关系的发展趋势在商品课税领域的体现是:关税和增值税的协调是商品课税国际协调的核心内容。

×7.没有区域性国际税收协调就没有区域国际经济的一体化。

√8.一国为吸引外资而实施较低的税率也是恶性税收竞争的一种形式。

×四、选择题1.国际税收的本质是(C)。

A.涉外税收B.对外国居民征税C.国家之间的税收关系D.国际组织对各国居民征税2.20世纪80年代中期,发生在西方国家的大规模降税浪潮实质上是(D)。

A.税负过重的必然结果B.美国减税政策的国际延伸C.促进国际贸易的客观需要D.税收国际竞争的具体体现3.1991年,北欧的挪威、瑞典、芬兰、丹麦和冰岛5过就加强税收征管方面合作问题签订了(C)。

A.《同期税务稽查协议范本》B.《税收管理互助多变条约》C.《税务互助多边条约》D.UN范本五、问答题未来国际税收的发展趋势是什么?答:国际税收问题和国际经济问题密切相关,国际税收将出现以下发展趋势(1)在商品课税领域,增值税和消费税的国际协调将逐步取代关税的国际协调成为商品课税国际协调的核心内容。

国际税收考核试卷

B.合理的转移定价

C.利用税收优惠政策

D.人为制造亏损

3.国际税收中,以下哪些属于税收管辖权的类型?()

A.来源地税收管辖权

B.居民税收管辖权

C.收益税收管辖权

D.世界税收管辖权

4.以下哪些组织或机构参与国际税收规则的制定与协调?()

A. OECD

B. IMF

C.联合国

D.欧洲联盟

5.国际税收协定通常涵盖以下哪些类型的所得?()

1.国际税收的主要目的是避免______征税。

2.跨国公司通过在不同国家之间转移利润,这种行为称为______定价。

3.国际税收协定通常由______和______两个主体签订。

4.在国际税收中,______是指两个或两个以上国家的税务机关对同一纳税人同一征税对象的重复征税。

5.国际税收筹划的合法手段包括利用______、合理安排资本结构等。

A.来源地原则

B.居民原则

C.税收分享原则

D.最惠国待遇原则

7.以下哪个不属于国际税收筹划的合法手段?()

A.利用国际税收协定

B.转移定价

C.利用税收优惠政策

D.逃税

8.以下哪个组织发布了《国际增值税/商品与服务税指南》?()

A. OECD

B. IMF

C.联合国

D.世界银行

9.在国际税收中,常用来衡量跨国公司税收负担的指标是?()

6.在国际税收中,来源地税收管辖权适用于所有类型的所得。()

7.国际税收筹划不需要考虑税收风险。()

8.仲裁是解决国际税收争议的一种有效方式。(√)

9.国际税收筹划的目标是使企业税负最小化。(√)

10.国际税收合规仅涉及跨国公司的税务登记和申报。()

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

试题一I. True or false (10 marks, 2marks/each)1. The direct credit is a credit granted to a domestic corporation for the foreign income taxes paid by a foreign affiliated company.( )2. Generally, many countries use the presence period criterion to identify the residence of legal entity.( )3. The international double taxation can be divided into systematic double Taxation and juridical double Taxation.( )4. Source country may take methods of exemption or credit to its resident foreign income. ( )5. According to the UN model treaty, contracting states may adopt tie-breaker rules to identify the residence of legal entity.( )Ⅱ.Please explain the following key terms. (12 marks,3 marks for each key term )1. deduction method2. withholding tax3. Treaty shopping4. Source tax jurisdictionⅢ. Questions ( 28 marks )1. Please explain the traditional and additional methods under Arm’s Length Principle.(5marks)2.What factors are used by OECD to identify whether a jurisdiction is a tax haven ornot?(3 marks)3. Please explain the differences between tax evasion and tax avoidance.(6 marks)4.Please explain the operation of a direct conduit company by a figure.(6 marks)5.Please explain the main features of arm’s length principle and p rinciple of GlobalApportionment. (8 marks)Ⅳ. Case Study ( 20 marks )1.XCo. is a corporation organized in State A and YCo is a corporation organized in State B. Both XCo and YCo are controlled by ZCo which is organized in State C. The corporate income tax rates of State A and State B are 50% and 16% respectively. In some given year, XCo produces a batch of goods at a cost of USD5,000,000 and sells the goods to YCo at USD5,000,000. The arm’s length price of the above goods is USD8,000,000 in State A’s market. YCo resells the goods to unrelated con sumers at USD8,2000,000 in State B. ZCo has no income this year. Please answer the following questions:(1) Which kind of tax avoidance technique has been used in the above case? ( 5 marks)(2) Compare the transnational corporation’s income tax burden und er market price and transfer price. ( 5 marks)(3) Which kind of anti-avoidance measure could be taken? ( 5 marks)2、An American company sold its properties in some taxable year, the transfer businesses are as the followings:(1)transferred a house property situated in China to a Japanese company(1 marks)(2)transferred the right to use a plot of land in China to a Chinese residentcompany(1 marks)(3)transferred a sales centre located in China to a Singapore company(1 marks)(4)transferred its share of a Chinese resident company and derived gains, its sharewas 30% of company’s equity (2 marks)Could Chinese government exercise its tax jurisdiction over the above transactions? V. Computation ( 30 marks)1. Assume M, a taxpayer in country A, has 9000 of domestic-source income and 8000 of income from country B, and 3000 from country C . Country B levies tax at the rate of 20%, country C at the rate of 40%, Country A levies income tax at a extra- progressivehow many taxes M should pay?(6marks)2) If country A adopts deduction method, how many taxes M should pay to country A? (6marks)3) If country A adopts full exemption method, how many taxes M should pay to country A? (4marks)4) If country A adopts the method of exemption with progression, how many taxes M should pay to country A? (4marks)2. Corporation RCo is established in country A, and earns 20 in some taxable year, the income tax in country A is 40%. RCo has a branch in country B, which has the income of 10 and country B’s normal tax rate is 30%. Country B offers halved tax rate to the branch. Country A is willing to give a tax sparing credit to Rco. Please calculate the tax RCo should pay to Country A.(10marks)答案及评分标准I.True and False ( 10marks, 2points/each): ××√√×Ⅱ.Please explain the following key terms. (12 marks,3 marks for each key term ) 1. Deduction method: The residence country allows its taxpayers to claim a deduction for taxes, including income taxes(2 marks), paid to a foreign government in respect of foreign-source income(1 mark).2.Withholding tax : a tax levied by the source country at a flat rate on the gross amount of dividends(1marks) ,royalities,interest,or other payments made by residents to nonresidents(1marks). The tax is collected and paid to the government by the resident payer.(1marks)3. Treaty shopping occurs when a person who is not a resident of either country (1 mark) seeks certain benefits (1 mark )under the income tax treaty between the two countries(1 mark) .4. Source tax jurisdiction:Income may be taxable under the tax laws of a country because of a nexus between that country and the activies that generated the income.(2 marks) A jurisdiction claim based on such a nexus is called source tax jurisdiction.(1 marks)Ⅲ. Questions ( 28 marks )1. Traditional methods include comparable uncontrolled price method, resale price method, cost plus method (2.5method) and additional methods include profit-split method, transactional net margin method and comparable profit method (2.5 marks)2.No or only nominal taxes (1 mark);Protection of personal financial information(1 mark); Lack of transparency(1 mark).3. Tax evasion is illegal, and uses criminal means, and there are punishments on the taxpayer (3 marks). Tax avoidance is legal,and uses acceptable tax planning and it requires improvements on tax laws (3 marks)4. (6 marks)5.ALP is set according to the market economy theory and its price is the real market price, which reflects the principle of equity(1 mark).It often imposes unreasonable burdens of proof on taxpayers(1 mark).It is extremely time-consuming and expensive to enforces(1 mark). ALP is likely to continue to be the internationally accepted and the most objective approach for resolving transfer pricing issues except in special circumstances(1 mark).FA is more easily to enforces and it also avoids some of the difficult audit problems.The arbitrariness of the predetermined formulas makes it difficult to reflect the particular circumstances of each multinational enterprises(1 mark).It relies heavily on access to foreign-based information.Substantial cooperation among governments would be needed to solve these problems(1 mark).FA is used by some subnational jurisdictions(1 mark). And it is likely to continue to be an important part of the international tax scene(1 mark). Ⅳ. Case Study ( 20 marks )一. (1) transfer pricing (2 mark)(2) Taxable income under transfer price:XCo’s taxable income = 8000000- 5000000 = 3000000 (1 mark)YCo’s taxable income = 8200000 -8000000 = 200000; (1 mark)Income tax paid under transfer price:XCo’s income tax = 3000000x 50% = 1500000; (1 mark)YCo’s income tax = 200000 x 16% = 32000; (1 mark)Total income tax=1532000 (1 mark)Taxable income under transfer price:XCo’s taxable income = 5000000- 5000000 = 0 (1 mark)YCo’s taxable income = 8200000 -5000000 = 3200000; (1 mark)Income tax paid under transfer price:XCo’s income t ax = 0 x 50% = 0; (1 mark)YCo’s income tax = 3200000 x 16% = 512000; (1 mark)Total tax=512000 (1 mark)Tax difference=1532000-512000=1020000 (1 mark)(3) transfer pricing rules ( 2 marks) or Arm’s length principle ( 2 marks)二.(1)Yes, Chinese government has the priority to exercise its tax jurisdiction. (1mark)(2)Yes, Chinese government has the priority to exercise its tax jurisdiction.(1mark)(3)Yes, Chinese government has the priority to exercise its tax jurisdiction.(1mark)(4) Yes, Chinese government can exercise its tax jurisdiction since the share holding exceeds 25%.(2 marks)Ⅴ. Computation (30 marks)一. 1 If country A doesn’t adopt any method to eliminate the double taxation,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600(1 mark)Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200(1 mark)Net Domestic income:9 000+8 000+3 000=20 000(1mark)Domestic tax: 5000×10%+10 000×20%+5000×30% = 4000(2 mark)The total domestic and foreign tax:4000+1600+1200=6800(1 mark)2 If country A adopts deduction method,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200Net Domestic income:20 000-1600-1200= 16400(2 mark) Domestic tax: 5000×10%+10000×20%+1400×30% =2920(2 mark)The total domestic and foreign tax:2920+1600+1200= 5720 (2 mark)3 If country A adopts the full exemption method,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200Net Domestic income: 9000Domestic tax: 5000×10%+4000×20% = 1300(2 mark)The total domestic and foreign tax:1300+1600+1200= 4100(2 mark)4 If country A adopts the method of exemption with progression,Foreign-source income from country B: 8 000Foreign tax(B country) : 8 000×20%=1600Foreign-source income from country C: 3 000Foreign tax(C country) : 3 000×40%=1200Net Domestic income: 9000Domestic tax: (5000×10%+10 000×20%+5000×30% ) ×9000/20000=1800(2 mark) The total domestic and foreign tax:1800+1600+1200= 4600(2 mark) 二.1)Foreign tax (10x30%x50%) 1.5 (2marks)2)tax relief treated as foreign tax paid (10x30x50%) =1.5(2marks)3)Credit limitation (10x40%) 4(2marks)Credit (1.5+1.5)] 3(2marks)4)Tax paid by R [(20+10)x40%-3] 9(2marks)。