Chapter5 Liabilities

商业银行学答案第八版罗斯Chap005

CHAPTER 5THE FINANCIAL STATEMENTS OF BANKS AND THEIR PRINCIPALCOMPETITORSGoal of This Chapter: The purpose of this chapter is to acquaint the reader with the content, structure and purpose of bank financial statements and to help managers understand how information from bank financial statements can be used as tools to reveal how well their banks are performing.Key Topics in this Chapter•An Overview of the Balance Sheets and Income Statements of Banks and Other Financial Firms•The Balance Sheet or Report of Condition•Asset Items•Liability Items•Recent Expansion of Off-Balance Sheet Items•The Problem of Book-Value Accounting and 〞Window Dressing〞•Components of the Income Statement: Revenues and Expenses•Appendix: Sources of Information on theFinancial-Services IndustryChapter OutlineI. Introduction: The Statements Reviewed in This ChapterII An Overview of Balance Sheets and Income StatementsIII The Balance Sheet (Report of Condition)A. The Principal Types of AccountsB. Assets of the Banking Firm1. Cash and Due from Depository Institutions2. Investment Securities: The Liquid Portion3. Investment Securities: The Income-Generating Portion4. Trading Account Assets5. Federal Funds Sold and Reverse Repurchase Agreements6. Loans and Leases7. Loan Losses8. Specific and General Reserves9. International Loan Reserves10.Unearned Income11.Nonperforming (noncurrent) Loans12.Bank Premises and Fixed Assets13.Other Real Estate Owned (OREO)14.Goodwill and Other Intangible Assets15.All Other AssetsC. Liabilities of the Banking Firm1. Deposits2. Borrowings from Nondeposit Sources3. Equity Capital for the Banking Firma. Preferred Stockb. Common EquityD. Comparative Balance Sheet Ratios for Different Size BanksE. Recent Expansion of Off-Balance-Sheet Items in BankingF. The Problem of Book-Value AccountingG. Auditing: Assuring Reliability of Financial StatementsIV. Components of the Income Statement (Report of Income)A. Financial Flows and Stocks1. Interest Income2. Interest Expenses3. Net Interest Income4. Loan Loss Expense5. Noninterest Income6. Noninterest Expenses7. Net Operating Income and Net IncomeB. Comparative Income Statement Ratios for Different-Size Financial FirmsV. The Financial Statements of Leading Nonbank Financial Firms: A Comparison to Bank StatementsVI. An Overview of Key features of Financial Statements and Their ConsequencesVII. Summary of the ChapterConcept Checks5-1. What are the principal accounts that appear on a bank's balance sheet (Report of Condition)The principal asset items on a bank's Report of Condition are loans, investments in marketable securities, cash, and miscellaneous assets. The principal liability items are deposits and nondeposit borrowings in the money market. Equity capital supplied by the stockholders rounds out the total sources of funds for a bank.5-2. Which accounts are most important and which are least important on the asset side of a bank's balance sheetThe principal bank asset items from most important to least important are::Rank Order Assets1 Cash2 Investment Securities3 Loans4 Miscellaneous Assets5-3. What accounts are most important on the liability side of a balance sheetThe principal bank liability items from most important to least important are:Rank Order Liabilities and Equity Capital1 Deposits2 Nondeposit Borrowings3 Equity Capital4 Miscellaneous Liabilities5-4. What are the essential differences among demand deposits, savings deposits, and time depositsDemand deposits are regular checking accounts against which a customer can write checks or make any number of personalwithdrawals. Regular checking accounts do not bear interest under current U.S. law and regulation.Savings deposits bear interest (normally, they carry the lowest rate paid on bank deposits) but may be withdrawn at will (though a bank usually will reserve the right to require advance notice of a planned withdrawal).Time deposits carry a fixed maturity and the bank may impose a penalty if the customer withdraws funds before the maturity date is reached. The interest rate posted on time deposits is negotiated between the bank and its deposit customer and may be either fixed or floating.A NOW account combines features of a savings account and a checking account, while a money market deposit account encompasses transactional powers similar to a regular checking account (though usually with limitations on the number of checks or drafts that may be written against the account) but also resembles a time deposit with an interest rate fixed for a brief period (such as weekly) but then becomes changeable over longer periods to reflect current market conditions.5-5. What are primary reserves, and secondary reserves and what are they supposed to doPrimary reserves consist of cash, including a bank's vault cash and checkable deposits held with other banks or any other funds such as reserves with the Federal Reserve that are accessible immediately to meet demands for liquidity made against the bank.Secondary reserves consist of assets that pay some interest (though usually pay returns that are much lower than earned on other assets, such as loans) but their principal feature is ready marketability. Most Secondary reserves are marketable securities such as short term government securities and private securities such as commercial paper.Both primary and secondary reserves are held to keep the bank in readiness to meet demands for cash (liquidity) from whatever source those demands may arise.5-6. Suppose that a bank holds cash in its vault of $1.4 million, short-term government securities of $12.4 million, privately issued money market instruments of $5.2 million, deposits at the Federal Reserve banks of $20.1 million, cash items in the process of collection of $0.6 million, and deposits placed with other banks of $16.4 million. How much in primary reserves does this bank hold In secondary reservesThe bank holds primary reserves of:Vault Cash + Deposits at the Fed + Cash Items in Collection +Deposits With Other Banks= $1.4 mill. + $20.1 mill. + $0.6 mill. + $16.4 mill.= $38.5 millionThe bank has secondary reserves of:Short-term Government Securities + Private Money-Market Instruments= $12.4 mill. + $5.2 mill.= $17.6 million5-7. What are off-balance-sheet items and why are they important to some financial firmsOff-balance-sheet items are usually transactions that generate fee income for a bank (such as standby credit guarantees) or help hedge against risk (such as financial futures contracts). They are importantas a supplement to income from loans and to help a bank reduce its exposure to interest-rate and other types of risk.5-8. Why are bank accounting practices under attack right now In what ways could financial institutions improve their accounting methodsThe traditional practice of banks has been to record the value of assets and liabilities at their value on the day the accounts were originally created and not change those values over the life of the account. The SEC and FASB started questioning this practice in the 1980’s because they were concerned that investors in bank securities would be misled about the true value of the bank. Using this historical value accounting method may in fact conceal a bank that insolvent in a current market value sense.The biggest controversy centered on the banks’ investment portfolio which would appear to be easy to value at its current market price. At a minimum, banks could help themselves by marking their investment portfolio to market. This would give investors an indication of the true value of the bank’s investment portfolio. Banks could also consider using the lower of historical or market value for other accounts on the balance sheet.5-9. What accounts make up the Report of Income (income statement of a bank)The Report of Income includes all sources of bank revenue (loan income, investment security income, revenue from deposit service fees, trust fees, and miscellaneous service income) and all bank expenses (including interest on all borrowed funds, salaries, wages, and employee benefits, overhead costs, loan loss expense, taxes, and miscellaneous operating costs.) The difference between operating revenues and expenses (including tax obligations) is referred to as net income.5-10. In rank order, what are the most important revenue and expense items on a Report of IncomeBy dollar volume in most recent years the rank order of the revenue and expense items on a bank's Report of Income is:Rank Order Revenue Items Expense Items1 Loan Income Deposit Interest2 Security Income Interest on Nondeposit Borrowings3 Service Charges on Deposits Salaries, Wages, andand Other Deposit Fees Employee Benefits4 Other Operating Revenues Miscellaneous Expenses5-11. What is the relationship between the provision for loan losses on a bank's Report of Income and the allowance for loan losses on its Report of ConditionGross loans equal the total of all loans currently outstanding that are recorded on the bank's books. Net loans are equal to gross loans less any interest income on loans already collected by the bank but not yet earned and also less the allowance for loan-loss account (orbad-debt reserve).The allowance for loan losses is built up gradually over time by an annual noncash expense item that is charged against the bank's current income, known as the Provision for Loan Losses. The dollar amount of the annual loan-loss provision plus the amount of recovered funds from any loans previously declared worthless (charged off) less any loans charged off as worthless in the current period is added to the allowance-for-loan-losses account.If current charge-offs of worthless loans exceed the annual loan-loss provision plus any recoveries on previously charged-off loans the annual net figure becomes negative and is subtracted from the allowance-for-loan-losses account.5-12. Suppose a bank has an allowance for loan losses of $1.25 million at the beginning of the year, charges current income for a $250,000 provision for loan losses, charges off worthless loans of $150,000, and recovers $50,000 on loans previously charged off. What will be the balance in the allowance for loan losses at year-endThe balance in the allowance for loan loss (ALL) account at year end will be:Beginning ALL = $1.25 millionPlus: Annual ProvisionRecoveries onCharged OffMinus: ChargeOffs of Worthless =LoansEnding ALL = $1.40 million5-13. Who are banking’s chief com petitors in the financial servicesThe closest competitors of banks in recent years (at least in terms of the similarity of their financial statements) are the thrift institutions. These include credit unions and savings associations. If we move a little further away from banks both in terms of what they do and the way their financial statements look, banks also compete with finance companies, life and property casualty insurance companies and security brokers and dealers.5-14. How do the financial statements of major nonbank financial firms resemble or differ from bank financial statements Why do these differences or similarities existBanks have very similar financial statements to credit union and savings associations. The only difference may be in the structure of their loan portfolio. Credit unions probably have more loans to individuals and savings associations may have more real estate loans as well as loans to individuals.More differences exist between banks and other major competitors. These diff erences exist because of each company’s unique function. Finance companies have loans but on their balance sheet they are called accounts receivables. In addition, they show heavy reliance on money market borrowings instead of deposits. Insurance companies are different in that loans they make to businesses show up on the balance sheet as bonds, stocks, mortgages and other securities. On the liability side, insurance companies receive the majority of their funds from insurance premiums paid by customers for insurance protection.Mutual funds hold primarily corporate stocks, bonds, asset-backed securities and money market instruments and their liabilities consist primarily of units of the mutual fund sold to the public. Security brokers and dealers tend to hold a similar range of securities funded by borrowings in the money and capital markets.5-15. What major trends are changing the content of the financial statements prepared by financial firmsThe content of the financial statements of financial firms is changing for several reasons. One trend that has affected the financial statements of financial firms is the call for those statements to reflect the true market value of the assets held by the financial firm. More accounts are being listed at the lower of historical or market value so that investors can get a better understanding of the true value of the firm.Another trend that is affecting financial firms is the increased use of off-balance sheet items. The notional amount of these items issometimes surpassing the value of the items on the balance sheet, especially for larger financial institutions. This has led regulators to change their reporting requirements for financial firms and there are likely to be additional requirements in the future.Another trend that is affecting financial firms is the convergence of the various types of financial firms. In addition, financial firms are becoming larger and more complex and more financial holding companies are formed. These are also leading to changes in the content and structure of the financial statements of financial firms. 5-16. What are the key features or characteristics of the financial statements of banks and similar financial firms What are the consequences of these statement features for managers of financial-service providers and for the publicThe financial statements of financial-service firms exhibit three main characteristics that have important consequences for managers of these firms and the public.The first characteristic of these firms is that they have lower operating leverage. They have small amounts of buildings, equipment and other fixed assets. Operating leverage adds risk to the firm and firms with large amount of operating leverage can face large fluctuations in net income and earnings per share for small changes in revenues.Financial-service firms do not have this problem. However, financial service firms have large amounts of financial leverage. Financial leverage comes from how the firm finances their assets. If a firm borrows a lot, they face have larger financial leverage and have a larger amount of risk as a result. Financial service firms finance approximately 90% of their assets with debt and therefore face significant financial leverage.Small changes in revenues can lead to large changes in net income and earnings per share as a result. In addition, changes in interest rates can have significant effects on the net income and capital position of financial firms. Finally, most of the liabilities of financial firms are short term. This means that financial firms can face significant liquidity problems. A sudden demand by depositors for funds can lead to large problems for financial firms.Problems5-1. Jasper National Bank has just submitted its Report of Condition to the FDIC. Please fill in the missing items from itsstatement shown below (all figures in millions of dollars): Report of ConditionTotal assets $2,50Cash and due from Depository Institutions 87 Securities233 Federal Funds Sold andReverse Repurch.45Gross Loans and Leases 1,90* Gross Loans and Leases = Net Loansand Leases+Loan Loss Allowance200Loan Loss Allowance Net Loans and Leases1700Trading Account Assets20Bank Premises and FixedAssets25*This is the only asset missing and so is total assetsless all of the rest of the assets listed hereOther Real Estate Owned15 Goodwill and Other Intangibles200 All Other Assets175Total Liabilities and Capital 2,50*Total Liabilities and Capital = TotalassetsTotal Liabilities 2,26* Total Liabilities = Total Liabilitiesand Capital-Total Equity CapitalTotal Deposits 1,60*Total Deposits = Total Liabilities LessAll of theOther LiabilitiesFederal Funds Purchased and Repurchase Agreements.80 Trading Liabilities10 Other Borrowed Funds50 Subordinated Debt480 All Other Liabilities40Total Equity Capital240Total Equity Capital = Perpetual Preferred Stock +Common Stock+Surplus+Undivided ProfitPerpetual Preferred Stock2 Common Stock24 Surplus144 Undivided Profit705-2. Along with the Report of Condition submitted above, Jasper has also prepared a Report of Income for the FDIC. Please fill in the missing items from its statement shown below (all figures in millions of dollars):Report of IncomeTotal Interest Income$120Total Interest Expense80* Total Interest Expense = Total Interest Income - Net Interest IncomeNet Interest Income40Provision for Loan and Lease Losses4* Provision for Loan and Lease Losses = Net Interest Income + Total Noninterest Income - Total Noninterest Expense - Pretax Net Operating IncomeTotal Noninterest Income58 Fiduciary Activities8 Service Charges on Deposit Accounts6Trading Account Gains and Fees14* There are four areas of Total NoninterestIncome and only one is missing and the totalis givenAdditional Noninterest Income30 Total Noninterest Expense77Salaries and Benefits47*There are three areas of Total NoninterestExpense and only one is missing and the totalis givenPremises and Equipment Expense10 Additional Noninterest Expense20 Pretax Net Operating Income17 Securities Gains (Losses)1 Applicable Income Taxes5Income Before Extraordinary Income13*Pretax Income Plus Security Gains LessTaxes is income before extraordinary incomeExtraordinary Gains – Net2Net Income15* Net Income = Income Before Extraordinary Income + Extraordinary Gains – Net5-3. If you know the following figures:Total Interest Income$140Provision for Loan Loss$5 Total Interest Expenses100Income Taxes5Total Noninterest Income15Increases in bank’s undivided profits6Total Noninterest Expenses35 Please calculate these items:Net Interest Income40*Total Interest Income Less Total Interest ExpenseNet Noninterest Income -2*Total Noninterest Income Less Total Noninterest ExpensePretax net operating income15*Net Interest Income Plus Net Noninterest Income Less PLLNet Income After Taxes10*Pretax net operating income less PLL less TaxesTotal Operating Revenues 155*Interest Income Plus Noninterest IncomeTotal Operating Expenses 14*Interest Expenses Plus Noninterest Expenses Plus PLLDividends paid to Common Stockholders4Net Income After Taxes Less Increases in bank’s undivided profits5-4. If you know the following figures:Gross Loans$275Trading Account Securities Allowance for Loan Losses5Other Real Estate Owned Investment Securities36Goodwill and other Intangibles Common Stock5Total LiabilitiesSurplus19Preferred StockTotal Equity Capital39Nondeposit BorrowingsCash and Due from Banks9Bank Premises and Equipment, Ne Miscellaneous Assets38Bank Premises and Equipment, Gross34Please calculate these items:Total Assets414*Total Liabilities Plus Total Equity CapitalNet Loans270*Gross Loans Less ALLUndivided Profit12*Total Equity Capital less PS less CS Less Surpl Fed funds sold23*This is the only asset missing so subtract all otassets from total assetsDepreciation5* Bank Premises and Equipment, Gross less Ban Total Deposits355*Total Liabilities less Nondeposit Borrowings5-5. The Mountain High Bank has Gross Loans of $750 million with an ALL account of $45 million. Two years ago the bank made a loan for $10 million to finance the Mountain View Hotel. Two million in principal was repaid before the borrowers defaulted on the loan. The Loan Committee at Mountain High Bank believes the hotel will sell at auction for $7 million and they want to charge off the remainder immediately.a. The dollar figure for Net Loans before the charge-off isNet Loans = Gross Loans –ALL = $750 - $45 = $705b. After the charge-off, what are the dollar figures for GrossLoans, ALL and Net Loans assuming no other transactions.Gross Loans = $750 - $1 = $749 The gross loans nowreflect the realizable value.ALL = $45 - $1 = $44 *The amount of the loan that is badNet Loans = $749 -$44 = $705c. If the Mountain View Hotel sells at auction for $8 million, thebank recovers full principal on the loan.Gross Loans = $750 - $8 = $742ALL = $45 ALL is restored to original amountNet Loans = $742 -$45 = $6975-6. For each of the following transactions, which items on a bank’s statement of income and expenses (Report of Income) would be affecteda. Office supplies are purchased so the bank will have enoughdeposit slips and other necessary forms for customer andemployee use next week.This would be part of Additional noninterest expense and part of Total Noninterest Expense.b. The bank sets aside funds to be contributed through itsmonthly payroll to the employee pension plan in the name of all its eligible employees.This would be part of Salaries and Benefits and part of Total Noninterest Expenses.c. The bank posts the amount of interest earned on the savings account of one of its customers.This would be part of Total Interest Expenses.d. Management expects that among a series of real estate loans recently granted the default rate will probably be close to 3 percent.This would be part of PLL to go into reserves for future bad debts.e. Mr. And Mrs. Harold Jones just purchased a safety deposit box to hold their stock certificates and wills.This would be part of Additional Noninterest Income and part of Total Noninterest Incomef. The bank colleges $1 million in interest payments from loans it made earlier this year to Intel Composition Corp.This would be part of Total Interest Incomeg. Hal Jones’s checking account is charged $30 for two of Hal’s checks that were returned for insufficient funds.This would be part of Service Charges on Deposit Accounts and then part of Total Noninterest Incomeh. The bank earns $5 million in interest on government securities it has held since the middle of last year.This would be part of Total Interest Income.i. The bank has to pay its $5,000 monthly utility bill today to the local electric company.This would be part of Premises and Equipment Expenses and part of Total Noninterest Expensesj. A sale of government securities has just netted the bank a $290,000 capital gain (net of taxes).This would be part of Security Gains (Losses)5-7. For each of the transactions described here, which of at least two accounts on a bank’s balance sheet (Report of Condition) would be affected by each transactiona. Sally Mayfield has just opened a time deposit in the amountof $6,000 and these funds are immediately loaned to RobertJones to purchase a used car.Gross Loans +$6,000Total Deposits +$6,000b. Arthur Blode deposits his payroll check for $1000 in the bank and the bank invests the funds in a government security.Securities + $1,000Total Deposits +$1,000c. The bank sells a new issue of common stock for $100,000 to investors living in its community, and the proceeds of that sale are spent on the installation of new ATMs,Bank Premises & Equipment, Gross +$100,000Common Stock /Surplus +$100,000d. Jane Gavel withdraws her checking account balance of $2,500 from the bank and moves her deposit to a credit union; the bank employs the funds received from Mr. Alan James, who just paid off his home equity loan, to provide Ms. Gavel with the funds she withdrew.Gross Loans -$2,500Total Deposits -$2,500e. The bank purchases a bulldozer from Ace Manufacturing Company for $750,000 and leases it to Cespan Construction Company.Cash and Due from Bank-$750,000Gross Loans and Leases+750,000f. Signet National Bank makes a loan of reserves in the amount of $5 million to Quesan State Bank and the funds are returned the next day.On the day the funds are loaned the accounts are affected in the following manner:Cash and Due from Bank-$5,000,000Federal Funds Sold+$5,000,000and when the finds are returned the next day, the process is reversed.g. The bank declares its outstanding loan of $1 million from theDeprina Corp. to be uncollectible.Gross Loans -$1,000,000ALL -$1,000,0005-8. The Nitty Gritty Bank is developing a list of off-balance-sheet items for its call report. Please fill in the missing items from its statement shown below. Using Table 5-5, describe how Nitty Gritty compares with other banks in the same size category regarding its off-balance sheet activities.Off-balance-sheet items for Nitty Gritty Bank (in millions of $)Total unused commitments$7,000Standby letters of credit andforeign office guarantees$1,350(Amount conveyed to others)($50)Commercial Letters of Credit$48Securities Lent$2,200Derivatives (total)$97,000Notional Amount of CreditDerivatives$22,000Interest Rate Contracts54000Foreign Exchange Rate Contracts 19,800Total Derivatives LessAll Other DerivativesContracts on other commoditiesand equities$1,200 All other off - balance -sheetliabilities$49Total off-balance-sheet Items$107,597 The sum of all of the off-balance sheet itemTotal Assets (on-balance sheet)$10,500Off-balance-sheet assets ÷1025%on-balance-sheet assetsThis looks very similar to other banks of the same size.5-9. See if you can determine the amount of Cardinal State Bank’s current net income after taxes from the figures below (stated in millions of dollars) and the amount of its retained earnings from current income that it will be able to reinvest in the bank. (Be sure to arrange all the figures given in correct sequence to derive the bank’s Report of Income.)Total Interest IncomeInterest on Loans$86Int earned on Govt. Bonds andNotes$9Total$95Total Interest ExpenseInterest Paid on Fed FundsPurchased$5Interest Paid to Customers Timeand Savings Deposits$34Total$39Net Interest Income$56Provision for Loan Loss$2Total Noninterest IncomeService Charges Paid byDepositors$3Trust Department Fees$3Total$6Total Noninterest ExpensesEmployee Wages, Salaries andBenefits$13Overhead Expenses$3Total$16 Net Noninterest Income($10) Pretax Income$44 Taxes Paid (28%)$12 Securities Gains/(Losses)$(7) Net Income$25 Less Dividends$4 Retained Earnings from CurrentIncome$215-10. Which of these account items or entries would normally occur on a ba nk’s balance sheet (Report of Condition) and which on a bank’s income and expense statement (Report of Income)The items which would normally appear on a bank's balance sheet are:Federal funds sold Deposits due to BankCredit card loans Leases of BusinessEquipment ToCustomersVault cash Savings DepositAllowance for loanlossesUndivided profitsCommercial and Industrial Loans Mortgage Owed on the Bank’s BuildingsRepayment of Credit Card Loan Other Real Estate OwnedCommon Stock Additions toUndivided profitsFederal fundspurchasedThe items which would normally appear on a bank’s income statement are:Interest Receivedon Credit CardLoansDepreciation on Plantand EquipmentInterest Paid on Money Market Deposits Provision for Loan LossesSecurity Gains or Losses Service Charges on。

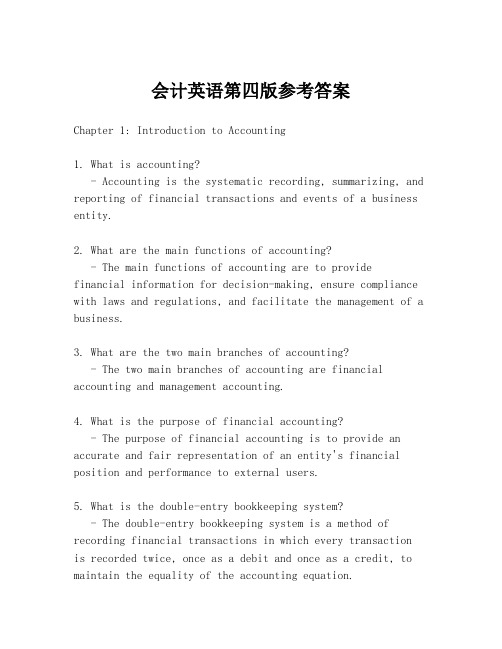

会计英语第四版参考答案

会计英语第四版参考答案Chapter 1: Introduction to Accounting1. What is accounting?- Accounting is the systematic recording, summarizing, and reporting of financial transactions and events of a business entity.2. What are the main functions of accounting?- The main functions of accounting are to providefinancial information for decision-making, ensure compliance with laws and regulations, and facilitate the management of a business.3. What are the two main branches of accounting?- The two main branches of accounting are financial accounting and management accounting.4. What is the purpose of financial accounting?- The purpose of financial accounting is to provide an accurate and fair representation of an entity's financial position and performance to external users.5. What is the double-entry bookkeeping system?- The double-entry bookkeeping system is a method of recording financial transactions in which every transactionis recorded twice, once as a debit and once as a credit, to maintain the equality of the accounting equation.Chapter 2: Accounting Concepts and Principles1. What are the fundamental accounting concepts?- The fundamental accounting concepts include the accrual basis of accounting, going concern, consistency, and materiality.2. What is the accrual basis of accounting?- The accrual basis of accounting records transactions when they occur, regardless of when cash is received or paid.3. What is the going concern assumption?- The going concern assumption is the premise that a business will continue to operate for the foreseeable future.4. What is the principle of consistency?- The principle of consistency requires that an entity should apply accounting policies consistently over time.5. What is the principle of materiality?- The principle of materiality states that only items that could potentially affect the decisions of users of financial statements are included in the financial statements.Chapter 3: The Accounting Equation and Financial Statements1. What is the accounting equation?- The accounting equation is Assets = Liabilities +Owner's Equity.2. What are the four main financial statements?- The four main financial statements are the balance sheet, income statement, statement of changes in equity, and cashflow statement.3. What is the purpose of the balance sheet?- The balance sheet provides a snapshot of an entity's financial position at a specific point in time.4. What is the purpose of the income statement?- The income statement reports the revenues, expenses, and net income of an entity over a period of time.5. What is the purpose of the cash flow statement?- The cash flow statement reports the cash inflows and outflows of an entity over a period of time.Chapter 4: Recording Transactions1. What is a journal entry?- A journal entry is the initial recording of atransaction in the general journal.2. What are the steps in the accounting cycle?- The steps in the accounting cycle are analyzing transactions, journalizing, posting, preparing a trial balance, adjusting entries, preparing financial statements, and closing entries.3. What is the difference between a debit and a credit?- A debit is an increase in assets or a decrease inliabilities or equity, while a credit is an increase in liabilities or equity or a decrease in assets.4. What are adjusting entries?- Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are recorded in the correct period.5. What is the purpose of closing entries?- Closing entries are made to transfer the balances of temporary accounts to the owner's equity account and to prepare the accounts for the next accounting period.Chapter 5: Accounting for Merchandising Businesses1. What is a merchandise inventory?- A merchandise inventory is the stock of goods held by a business for sale to customers.2. What is the cost of goods sold?- The cost of goods sold is the direct cost of producing the merchandise sold during an accounting period.3. What is the gross profit?- The gross profit is the difference between the sales revenue and the cost of goods sold.4. What is the difference between a perpetual and a periodic inventory system?- A perpetual inventory system updates inventory records in real-time with each sale or purchase, while a periodicinventory system updates inventory records at specific intervals, such as at the end of an accounting period.5. What is the retail method of inventory pricing?- The retail method of inventory pricing is a method of estimating the cost of ending inventory by applying a cost-to-retail ratio to the retail value of the inventory.Chapter 6: Accounting for Service Businesses1. What are the main differences in accounting for service businesses compared to merchandise businesses?- Service businesses do not have inventory and their primary expenses are typically labor and overhead costs.2. What is the main source of revenue for service businesses? - The main source of revenue for service businesses is the fees charged for the services provided.3. What are the typical expenses。

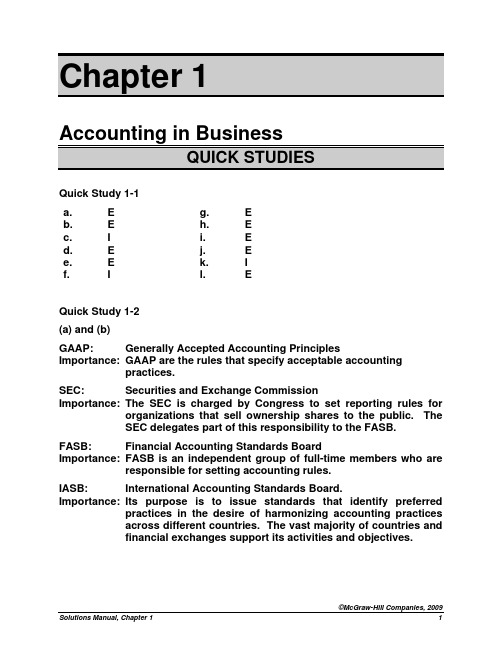

Chapter_01会计学原理答案 principles of accounting 19th edition john j.wild 人大出版社

Importance: GAAP are the rules that specify acceptable accounting

practices.

SEC:

Securities and Exchange Commission

Importance: The SEC is charged by Congress to set reporting rules for

To illustrate, many companies base compensation of managers on the amount of reported income. When the choice of an accounting method affects the amount of reported income, the amount of compensation is also affected. Similarly, if workers in a division receive bonuses based on the division’s income, its computation has direct financial implications for these individuals.

Quick Study 1-7

Assets

=

$375,000 (b) $250,000

$185,000

Liabilities (a) $125,000

$ 90,000 $ 60,000

+

Equity

$250,000

$160,000

(c) $125,000

Quick Study 1-8

Assets

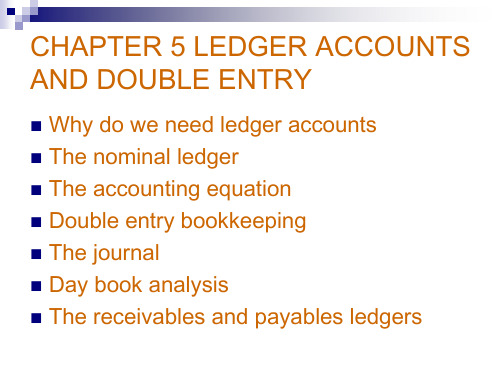

chapter5-ledger accounts and double entry

FINANCIAL STATEMENTS

Ledger accounts and nominal ledger

1.

The records of transactions, assets and liabilities should be kept in the following ways.

In chronological order, and dated so that transactions can be related to a particular period of time. Build up in cumulative totals. Books of original entry then to summarize these records.

The

wages of employee is the deduction of profit. Any amount paid by a business to its proprietor is treated by accountants as withdrawals of profit (the usual term is appropriations of profit) and not as expenses incurred by the business. The drawings of owner are the deduction of capital.

2.

The entries in the books of prime entry are posted to ledgers.

The books of prime entry are totaled up and two entries will be made in these accounts with each of these totals – this is called double entry. Ledger accounts summarise all the individual transactions listed in the books of pd general ledger, is an accounting record which summarizes the financial affairs of a business. It is the double entry books of account.

会计英语课后习题答案作者叶建芳会计英语课后习题参考答案

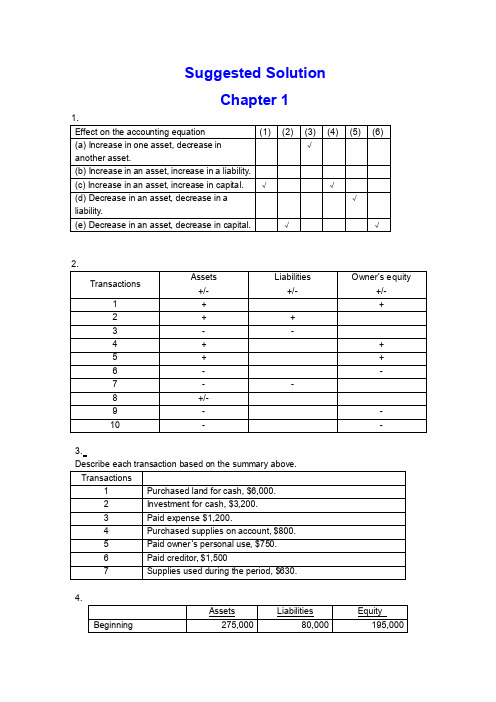

Suggested SolutionChapter 11.3.4.5.(a)(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ................................................. 1,800 b.Revenue ................................................................. 4,500Accounts receivable ..................................... 4,500c.Owner’s withdrawals............................................... 1,500Salaries Expense ........................................... 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 –60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000 December 31, 2009 Cash 42,500Investment in K 42,500Investment in K 146,000Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000 Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability 2,400Income tax payable 21,600 20⨯9 Deferred income tax is an asset 600Income tax payable 26,100(2) 20⨯8: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 20⨯9: Dr: Tax expense 25,500Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 20⨯9: Income statement: tax expense 25,500 Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000 +Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25).g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory .................................................................................... 480,000 Cash/Accounts payable ........................................................ 480,000 To record purchase of inventoryInventory .................................................................................... 124,000 Cash/Accounts payable ........................................................ 124,000 To record refurbishment of inventoryAccounts receivable ................................................................... 310,000 Sales revenue ...................................................................... 310,000 To record sale of goods on accountCost of goods sold...................................................................... 220,000 Inventory .............................................................................. 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ...................................................................... 15,500* Allowance for sales returns (B/S).......................................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ...................................................................... 31,000* Provision for warranties (B/S) ............................................... 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns......................................................... 12,400 Accounts receivable ............................................................. 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) ..................................................... 18,600 Cash/Accounts payable ........................................................ 18,600 To record expenditures in year 1 for warranty workCash .......................................................................................... 297,600*Accounts receivable ............................................................. 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) ..................................................... 8,400 Cash/Accounts payable ........................................................ 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory .................................................................................... 480,000 Cash/Accounts payable ........................................................ 480,000 To record purchase of inventoryInventory .................................................................................... 124,000 Cash/Accounts payable ........................................................ 124,000 To record refurbishment of inventoryAccounts receivable ................................................................... 310,000 Inventory .............................................................................. 220,000 Deferred gross margin .......................................................... 90,000 To record sale of goods on accountDeferred gross margin ................................................................ 12,400 Accounts receivable ............................................................. 12,400 To record return of goods within the 30-day return period. It is assumed the goods haveno value and are disposed of.Deferred warranty costs (B/S)..................................................... 18,600 Cash/Accounts payable ........................................................ 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash .......................................................................................... 297,600* Accounts receivable ............................................................. 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ............................................................. 8,400 Cash/Accounts payable ........................................................ 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin ................................................................ **77,600Cost of goods sold...................................................................... 220,000 Sales revenue ...................................................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ...................................................................... 27,000* Deferred warranty costs ....................................................... 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty periodhas expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it will eventually earn on the sales. The performance criteria might also be invoked here.The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determine the percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recorded in revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30% $ 6,0002006 $20,000 × 70% $ 14,0002007 $20,000 × 100% $ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under thepercentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress................. 5,400 7,550 5,850 Cash, payables, etc. ..... 5,400 7,550 5,850 2. Progress billings:Accounts receivable ........... 3,100 4,900 12,000 Progress billings ........... 3,100 4,900 12,000 3. Collections on billings:Cash .................................. 2,400 4,000 12,400 Accounts receivable ..... 2,400 4,000 12,400 4. Recognition of profit:Construction in progress..... 600 450 150Construction expense ......... 5,400 7,550 5,850 Revenue from long-termcontract..................... 6,000 8,000 6,000 5. To close construction in progress:Progress billings ................. 20,000 Construction in progress 20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000 Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products, IAS18 defines performance as the point when the seller of the goods has transferred therisks and rewards of ownership to the buyer. Normally, this means that performance is done at the time of sale. Although the seller may have performed much of the work prior to the sale (production, selling efforts, etc.), there is still significant risk to theseller that a buyer may not be found. Therefore, from a reliability point of view,revenue recognition is delayed until the point of sale. Also, there may be significant risks remaining with the seller of the product even after the sale. Warranties given by the seller are a risk that remains with the seller. However, if this risk can be reliably estimated at the time of sale, revenue can be recognized at the point of sale.Performance is quite different under a long-term construction contract. Here,performance really is considered to be a measure of the work done. Revenue isrecognized over the production period as the work is performed. It is intended toreflect the amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can be recognized because there is a known and committed buyer. If the contractor is not able toestimate how much of the work has been done (perhaps because he or she can’treliably estimate how much work must still be done), then profit would not berecognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliablyestimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set). However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account.This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment. As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection ofamounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenuerecognition.b. Because of the performance criterion of revenue recognition, it would seem to bemost appropriate to recognize most revenue as the seller or service provider per forms the work. This would be the best measure of performance. This would mean, for example,that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because,in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowingthe selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser tobuy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100) $ 20,000 Additional lessons ((200 × 8) × $30) 48,000 Examinations ((200 × 80%) × $130) 20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3)) 3,600 Additional lessons ((200 × 8) × $3)) 4,800Examinations ((200 × 80%) × $30) 4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000) 36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division 2,100,000 Enterprise net profit $ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ……………………….-48,000 Payment of income tax ………………………………-13,000 Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ……………………….. -34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000Add: increases in current liabilities 180,000Net cash flows from operating -200,000Investing activitiesSale of land -50,000Purchase of PPE -1,500,000Net cash flows from investing -1,550,000Financing activitiesIssuance of common shares 400,000Payment of cash dividend -50,000Issuance of non-current liabilities 1,000,000Net cash flows from financing 1,350,000 Net changes in cash -400,000 5.。

商业银行管理第2章习题答案

Chapter 2Analyzing Bank PerformanceChapter Objectives1.Introduce bank financial statements, including the basic balance sheet and income statement, and discuss theinterrelationship between them.2.Provide a framework for analyzing bank performance over time and relative to peer banks. Introduce key financial ratios that can be used to evaluate profitability and the different types of risks faced by banks. Focus on the trade-off between bank profitability and risk.3.Identify performance measures that differentiate between small, independent banks (specialty banks) and largerbanks that are part of multibank holding companies or financial holding companies.4. Distinguish between types of bank risk; credit, liquidity, interest rate, capital, operational, and reputational.5. Describe the nature of and meaning of regulatory CAMELS ratings for banks.6.Provide applications of data analysis to sample banks’ financial information.7.Describe performance characteristics of different-sized banks.8. Describe how banks can manipulate financial information to ‘window-dress’ performance.Key Concepts1. Bank managers must balance banking risks and returns because there is a fundamental trade-off between profitability, liquidity, asset quality, market risk and solvency. Decisions that increase banking risk must offer above average profits. The more liquid a bank is and the more equity capital used to fund operations, the less profitable is a bank, ceteris paribus.2. Banks face five basic types of risk in day-to-day operations: credit risk, liquidity risk, market risk, capital/solvency risk, and operational risk. Market risk encompasses interest rate risk, foreign exchange risk and price risk. Each type of risk refers to the potential variation in a ba nk's net income or market value of stockholders’ equity resulting from problems that affect that part of the bank's activities.3. Banks also face risks in the areas of country risk associated with loans or other activity with foreign government units and off-balance sheet activities, which create contingent liabilities. More recently, banks have focused on reputation risk. For example, from 2002-2005 Citigroup, JP Morgan Chase, and Bank of America found that even though they continued to report strong pro fits, they experienced strong criticism for 1) their roles in facilitating strategies to disguise Enron’s true financial status, 2) problems in sub-prime lending programs via the Associates Corp. and their own internal finance company activities, 3) problems with underwriting subsidiaries with analyst conflicts between stock reports and the firm’s investment banking relationships; facilitating market timing of stock trades to their detriment of their own mutual fund holders, 4) lack of supervision of trading groups, and 5) facilitating improper borrowing at Parmalat.4. A bank's return on equity (ROE) can be decomposed in terms of the duPont system of financial ratio analysis. This examination of historical balance sheet and income statement data enables an analyst to evaluate the comparative strengths and weaknesses of performance over time and versus peer banks. The Uniform Bank Performance Report (UBPR) data reflect the basic ratios from this return on equity model.5. Different-sized commercial banks exhibit different operating characteristics and thus performance measures. Small banks typically report a higher return on assets (ROA) than large banks because they earn higher gross yields on assets and pay less interest on liabilities.6. High performance banks generally benefit from lower interest and non-interest expense and limit credit risk so that loan losses are relatively low. They also operate with above average stockholders' equity.7. Many banks can successfully "window-dress" performance by manipulating the reporting of financial data. They may accelerate revenue recognition and defer expenses or selectively alter when they take securities gains or losses and time when to charge off loans or report loans as non-performing. As such, they may inappropriately smooth earnings with provisions for loan losses or by other means. Analysts must be careful when evaluating extraordinary transactions that have one-time gain or loss features.Answers to End of Chapter Questions1. For a large bank, assets consist approximately of marketable securities (20%), loans (70%), and other assets (10%). Liabilities consist of core deposits (40%-60%), noncore, purchased liabilities (20%-40%), and other liabilities (5 %-10%) as a fraction of assets. Small banks typically obtain more funds in the form of core deposits and less in the form of noncore, purchased liabilities. Small banks often invest more in securities as well. Of course, the actual percentages for any bank depend on that bank’s business strategy, mark et competition, and ownership.2. A bank's interest income consists of interest earned on loans and securities while noninterest income includes revenues from deposit service charges, trust department fees, fees from nonbank subsidiaries, etc. Interest expense consists of interest paid on interest-bearing core deposits and noncore liabilities while noninterest expense is comprised of overhead costs, personnel costs, and other costs. A bank’s net interest income equals its interest income minus interest expense. Note that interest income may be calculated on a tax-equivalent basis in which tax-exempt interest is converted to its pre-tax equivalent. A bank’s burden is defined as its noninterest expense minus noninterest income. This is often quoted as a fract ion of total assets. A bank’s efficiency ratio is calculated as noninterest expense divided by the sum of net interest income and noninterest income. The denominator effectively measures net operating revenue after subtracting interest expense. The efficiency ratio measure the noninterest cost per $1of operating revenue generated. Analysts often interpret the efficiency ratio as a measure of a bank’s ability to control overhead relative to its ability to generate noninterest income (and overall revenue). A lower number is presumably better because it reflects better cost control compared with revenue generation.3. Balance sheet accounts:a. Increase liability: money market deposit account (+$5,000)Increase asset: federal funds sold (+$5,000)b. Decrease asset: real estate loanIncrease asset: mortgage loanc. Increase equity: common stock (common and preferred capital)Increase asset: commercial loans4. Income statementInterest on U.S. Treasury & agency securities $44,500Interest on municipal bonds 60,000Interest and fees on loans 189,700Interest income = $294,200Interest paid on interest-checking accounts $33,500Interest paid on time deposits 100,000Interest paid on jumbo CDs 101,000Interest expense = $234,500Net interest income = $59,700Provisions for loan losses = $ 18,000Net interest income after provisions = $41,700Fees received on mortgage originations $23,000Service charge receipts 41,000Trust department income 15,000Non-interest income = $79,000Employee salaries and benefits $145,000Occupancy expense 22,000Non-interest expense = $167,000Income before income taxes -$46,300Income taxes 15,742Net income = -$30,558Cash dividends declared 2,500Retained earnings = -$33,058This assumes that expenses associated with the purchase of the new computer are included in occupancy expense. If not, the computer expense (depreciation) will increase the loss for the period. Also, the bank can receive a tax refund from prior tax payments if the bank made a taxable profit within recent years.5. The primary risks faced by banks are credit risk, liquidity risk, interest rate risk, foreign exchange risk (the latter two represent market risk), operational risk, reputational risk, and capital solvency. In general, promised, or expected, returns should be higher for banks that assume increased risk. There should also be greater volatility in returns over time.a. Credit risk: Net loan charge-offs/LoansHigh risk - high ratio; Low risk - low ratioHigh risk manifests itself in occasional high charge-offs, which requires above average provisions for loan lossses to replenish the loan loss reserve. Thus, net income is volatile over time.b. Liquidity risk: Core deposits/AssetsHigh risk - low ratio; Low risk - high ratioHigh risk manifests itself in less stable funding as a bank relies more on noncore, purchased liabilities thatfluctuate over time. These noncore liabilities are also higher cost, which raises interest expense.c. Interest rate risk: (|Repriceable assets-repriceable liabilities|)/AssetsHigh risk - high ratio; Low risk - low ratioHigh risk banks do not closely match the amount of repriceable assets and repriceable liabilities. Largedifferences suggest that net interest income may vary sharply over time as the level of interest rates changes.d. Foreign exchange risk: Assets denominated in a foreign currency minus liabilities denominated in the same foreign currency.High risk – a large difference; Low risk – a small differenceHigh risk manifests itself when exchange rates change adversely and the value of the bank’s net position of assets versus liabilities denominated in a currency changes sharply.e. Operational risk: total assets/number of employeesHigh risk – low ratio; Low risk – high ratioHigh risk manifests itself when the bank operates at low productivity measured by more employees per amount of assetsf. Capital/solvency risk: Stockholders’ equity/AssetsHigh risk - low ratio; Low risk - high ratioHigh risk manifests itself because fewer assets must go into default before a bank is insolvent and can be closed down by regulators.g. Reputational risk is difficult to measure ex ante. It is more observable by announced problems and issues.6. Equity multiplierBank L: Equity/Assets = 0.06 indicates Assets/Equity = 16.67XBank S: Equity/Assets = 0.10 indicates Assets/Equity = 10XIf each bank earns 1.5% on assets (ROA = 0.015), then the ROEs will equal 25% (Bank L) and 15% (Bank S). If, instead, each bank reports a loss with ROA = -0.012, then the ROEs will equal -20% (Bank L) and -15% (Bank S). When banksare profitable, financial leverage has the positive effect of increasing ROE; when banks report losses, financial leverage increases the magnitude of loss in terms of a negative ROE.7. ROE= net income/stockholders' equityROA = net income/total assetsEM = total assets/stockholders' equityER = total operating expense/total assetsAU = total revenue/total assetsBalance sheet figures should be measured as averages over the period of time the income number is generated.ROE = ROA x EM ROA = AU – ER – TAXwhere TAX = applicable income tax/total assets.8. Profitability ratios differ across banks of different size as measured by assets. The primary reasons are that different size banks have different asset and liability compositions and engage in different amounts of off-balance sheet activities. Typically, small banks report higher net interest margins because their average asset yields are relatively high while their average cost of funds is relatively low. This reflects loans to higher risk borrowers, on average, and proportionately more funding from lower cost core deposits. ROEs, in turn, are often lower because small banks operate with more capital relative to assets, that is with lower equity multipliers, so that even with comparable ROAs the ROEs are lower. Large banks ROAs are increasing faster over time because large banks operate with lower efficiency ratios as they have been more successful in generating fee income.9. CAMELSa. C =capital adequacy: equity/assetsb. A = asset quality: nonperforming loans/loans; loan charge-offs/loansc. M = management: no single ratio is good, although all ratios indicate overall strategyd. E = earnings: aggregate profit ratios; ROE, ROA, net interest margin, burden, efficiencye. L = liquidity: core deposits/assets; noncore, purchased liabilities/assets; marketable securities/assetsf. S = sensitivity to market risk; |repriceable assets-repriceable liabilities|/assets; difference in assets and liabilitiesdenominated in the same currency; size of trading positions in commodities, equities and other tradeable assets.10. Lowest to highest liquidity risk: 3-month T-bills, 5-year Treasury bond, 5-year municipal bond (if high quality and from a known issuer), 4-year car loan with monthly payments (receive some principal monthly, may be saleable), 1-year construction loan, 1-year loan to individual, pledged 3-month T-bill. As stated, the 3-month T-bill that is pledged as collateral is illiquid unless the bank can change its collateral status.11. Comparative credit riska. loan to a comer grocery store representing a little known borrower with uncertain financialsb. loan collateralized with inventory (work in process) because the collateral is less liquid and more difficult to value;this assumes that the receivables are still viable and not too aged.c. normally the Ba-rated municipal bond, unless the agency bond is an "exotic" mortgage backed security, because theagency bond carries an implied guarantee in that Freddie Mac is a quasi-public borrower.d. 1-year car loan because the student loan is typically government guaranteed12. For the balance sheet: high core deposits/assets; high equity/assets; low noncore, purchased liabilities/assets; high investment securities/assets; high agriculture loans/assets (the value refers to that for small banks); For the income statement: net interest margin (high); burden/assets (high), efficiency ratio (high); (the descriptor in parentheses refers to the relationship for small banks versus larger banks).13. Extending a loana. the new loan is typically not classified as nonperforming because no payments are past dueb. often a bank recognizes that the loan is in the problem stage and the borrower renegotiates the terms in its favor;rationale is that the borrower may default if the loan is not restructured. Note that this restructuring gives theappearance that asset quality is higher.c. the primary risk is that the bank is throwing more money down a sink hole and will never recover any of its loan.14. Dividend payment: For: the loss is temporary and stockholders expect the dividend payment. Failure to make the payment will sharply lower the stock price because stockholders will be alienated. Against: the bank has not generated sufficient cash to make the payment from normal operations. By paying the cash dividend, the bank is self-liquidating. The cash dividend will lower the bank’s capital. What normally decides the issue is whether the loss is truly temporary or more permanent. Management typically errs by assuming that losses are temporary, and thus continues to make dividend payments when it should be reducing or eliminating them.15.Liquidity risk:a.Securities classified as held-to-maturity cannot be sold unless there has been an unusual change in the underlyingcredit quality of the security issuer. A high fraction indicates low liquidity because few securities (just 5% of the total) can be sold.b. A low core deposit base indicates a bank that relies proportionately more on noncore, volatile liabilities that are lessstable and more likely to leave the bank if rates change. This makes a bank’s funding sources less reliable and the bank subject to greater liquidity risk.c. A bank that holds long-term securities (8 years is long term) has assumed significant price risk even if the securitiescan be readily sold because they are classified as available-for-sale. Such securities will fall in value if interest rates rise. This indicates high liquidity risk.d.Assuming that $10 million in securities is sufficient, the fact that none are pledged makes them more liquid and isindicative of lower liquidity risk than if any securities were pledged.Problems1. Community National Bank (CNB)1. Profitability analysis for 2004 using UBPR figures:RATIO Community National Bank Peer BanksROE 8.67% 11.72%ROA 0.63 1.09EM 13.97X 10.67XAU 5.91 6.23ER 4.94 4.73TAX 0.34 0.41a.Aggregate profitability for CNB is substantially lower measured both by both ROE and ROA. Because CNB has less equity relative to assets, it has greater financial leverage. Thus, the greater financial leverage increases CNB’s ROE relative to peer banks. The fact that its ROE is lower, despite the greater leverage, indicates that the higher risk does not produce higher overall profitability. CNB has assumed a riskier profile with its greater financial leverage in that fewer assets can default before the bank is insolvent. CNB’s ROA is lower because it earns a lower average yield on assets (AU), pays more in operating expense (ER), offset somewhat by the fact that it pays less in taxes (TAX).b.Risk ComparisonCredit risk: same net charge-offs, much lower nonperforming (more than 90 days past due) and nonaccrual loans, higher provisions for loan losses (.30% versus 0.18%); loan loss reserve is a greater fraction of total loans and leases and a much greater fraction of noncurrent loans. Overall, the ratios indicate below-average risk. Of course, these figures represent only one year of data.Liquidity risk: lower equity to assets suggests higher liquidity risk from a funding perspective, higher available for sale securities and lower pledged securities suggests lower liquidity risk from the asset sale perspective; very high core deposits, low noncore funding (liabilities), low loans and leases and high ST securities suggest lowerliquidity risk. Overall, liquidity risk appears lower because the bank has a strong core deposit base, fewer loans and more securities can be readily sold. Still, the bank might have difficulty borrowing if loans exhibit low qualityand deposit outflows arise. Conclusion: below-average liquidity risk.Capital Risk: low capital to asset ratios; low equity to assets indicate above average capital risk; bank pays less out in dividends and its growth rate in equity capital is lower. Overall, the bank exhibits greater capital risk. Thissituation is offset by the bank’s apparent higher quality assets.Operational risk: low assets to employees ratio, high personnel expense to employees and high efficiency ratio indicate high operational risk. Of course, these data do not capture the likelihood of fraud and other potentialoperational problems.c.Recommendations:1)Impro ve the bank’s capital position; slow asset growth and pursue greater profits.2)Evaluate credit risk carefully; ensure that loans are adequately diversified and that any default of a single loan ortype of loans cannot place the bank’s capital at risk to where regulators will restrict the bank’s activities. Slow loan growth until capital base is at target. Implement a formal credit risk review process.3)Improve operating efficiency. Review noninterest expense sources and cut costs where possible.4)The first t wo suggestions will have the impact of lowering the bank’s earnings, ceteris paribus. Therefore,management should focus on growing sources of noninterest income that currently are not being pursued.2.Citibank UBPRa.In 2004, Citibank’s ROE equaled 15.26% while its ROA equaled 1.49% versus peers’ figures of 14.58% and 1.31%,respectively. Citibank’s equity multiplier (EM = ROE/ROA) equaled approximately 10.24X versus 11.13X for peers. Citibank’s AU is higher at 8.83% (5.25% + 3.58%) versus 7.69% (4.46% + 3.23%) at peers. Citibank clearly generated higher gross revenues from both interest and noninterest sources. Citibank’s expense ratio (ER), in turn, equaled 6.27% while ER for peers was much lower for each type of expense and in total at 4.23%. Based on the profit figures alone, Citibank appears to be a high performance bank and achieves that by generating greater relative revenues.b.Citibank’s credit risk (as evidenced only by the ratios provided) appears high as net losses to loans is higher thanPeers (1.58% versus 0.25%), as is noncurrent loans and leases as a fraction of loans (1.78% versus 0.59%). The loss allowance (reserve) is a higher fraction of loans, but a much smaller fraction of net losses (charge-offs) andnoncurrent loans indicating that more reserves might be appropriate.c.Citibank’s liquidity risk appears high as the bank has a lower equity to asset (tier 1 leverage capital) ratio and reliesmuch more on noncore liabilities (noncore fund dependence). With its greater credit risk, you might expect it to operate with greater equity capital. Similarly, the bank is growing at a fast pace which generally increases overall risk because management cannot easily control risk from growth.d.Recommendations:Carefully assess credit risk; realign portfolio where appropriate.Increase the loan loss reserve.Slow loan growth and/or shift loans to less risky classes.Line up additional sources of liquidity.Review pricing of loans and deposits; identify sources of fees/noninterest income to see if they are sustainable.。

《商业银行管理》课后习题答案IMChap5