国际金融学期末分录题及答案英文

国际金融英语试题及答案

国际金融英语试题及答案1. 以下哪个选项不是国际货币基金组织(IMF)的主要职能?A. 提供技术援助B. 监督成员国的经济政策C. 促进国际贸易D. 提供紧急财政援助答案:C2. 世界银行的主要目标是什么?A. 促进全球贸易B. 减少全球贫困C. 维护国际货币稳定D. 促进全球金融市场发展答案:B3. 什么是外汇储备?A. 一个国家持有的外国货币和黄金B. 一个国家持有的国内货币和黄金C. 一个国家持有的外国货币和证券D. 一个国家持有的国内货币和证券答案:A4. 根据国际收支平衡表,以下哪项交易不属于经常账户?A. 商品出口B. 服务进口C. 外国直接投资D. 工人汇款回国答案:C5. 什么是货币贬值?A. 一个国家的货币价值相对于其他国家货币的减少B. 一个国家的货币价值相对于黄金的减少C. 一个国家的货币价值相对于商品和服务的减少D. 一个国家的货币价值相对于外国投资的减少答案:A6. 什么是浮动汇率制度?A. 货币价值由市场供求关系决定B. 货币价值由政府固定C. 货币价值由国际货币基金组织决定D. 货币价值由中央银行决定答案:A7. 什么是国际金融市场?A. 跨国公司进行商品和服务交易的市场B. 跨国公司进行货币和金融资产交易的市场C. 跨国公司进行商品和金融资产交易的市场D. 跨国公司进行服务和金融资产交易的市场答案:B8. 什么是国际货币体系?A. 国际货币的发行和流通体系B. 国际货币的监管和管理体系C. 国际货币的交换和结算体系D. 国际货币的发行、监管和管理体系答案:D9. 什么是外汇交易?A. 一种货币兑换成另一种货币的交易B. 一种商品兑换成另一种商品的交易C. 一种服务兑换成另一种服务的交易D. 一种资产兑换成另一种资产的交易答案:A10. 什么是国际金融危机?A. 一个国家内部的金融体系崩溃B. 一个国家内部的货币体系崩溃C. 多个国家金融体系的崩溃D. 多个国家货币体系的崩溃答案:C。

国际金融双语期末A卷

国际金融双语期末A卷--————————————————————————————————作者:————————————————————————————————日期:Part I: Multiple choice(1*30=30score)( only one choice for each question)1.Which of the following transactions is recorded in the financial account?A)Ford motor company builds a new plant in ChinaB)A Chinese businessman imports Ford automobiles from the United States.C)A U.S. tourist spends money on a trip to China.D)The New York Yankees are paid $10 million by the Chinese to play anexhibition game in Beijing, China.2.In the balance of payments, the statistical discrepancy or error term is used to:A)Ensure that the sum of all debits matches the sum of all credits.B)Ensure that imports equal the value of exports.C)Obtain an accurate account of a balance-of-payments deficit.D)Obtain an accurate account of a balance-of-payments surplus.3. A deficit in the overall balance generally is an indication that:A)The country’s monetary authorities were selling foreign currency.B)The country’s moneta ry authorities were buying foreign currency.C)The country’s monetary authorities were buying domestic currency.D)The country’s monetary authorities were buying imported goods.4. Suppose that a Korean television set that costs 600 won in Korea costs $400 in the United States. These prices suggest that the exchange rate between the won and the dollar is:A)1.5 won per dollarB)0.75 won per dollarC)$1.50 per wonD)$3 per won5. To the US, U.S. capital inflows will create a __________ foreign currency and a __________ U.S. dollars.A)Demand for; supply ofB)Supply of; demand forC)Shortage of; demand forD)Supply of; shortage of6. U.S. imports of goods and services will create a __________ foreign currency anda __________ U.S. dollars.A) Demand for; supply ofB) Supply of; demand forC) Shortage of; demand forD) Supply of; shortage of7.If the spot price of the euro is $1.10 per euro and the 30-day forward rate is $1.00 per euro, and you believe that the spot rate in 30 days will be $1.05 per euro, you canmaximize speculative gains by:A)Buying euros in the spot market and selling the euros in 30 days at thefuture spot rate.B)Signing a forward foreign exchange contract to sell the euros in 30 days.C)Signing a forward foreign exchange contract to sell the dollars in 30 days.D)Buying dollars in the spot market and selling the dollars in 30 days at thefuture spot rate.8.Assume you are a Chinese exporter and expect to receive $250,000 at the end of 60 days. You can remove the risk of loss due to a devaluation of the dollar by:A)Selling dollars in the forward market for 60-day delivery.B)Buying dollars now and selling it at the end of 60 days.C)Selling the yuan equivalent in the forward market for 60-day delivery.D)Keeping the dollars in the United States after they are delivered to you.9. The interest rate in the U.K. is 4% for 90 days, the current spot rate is $2.00/£ and the forward rate is $1.96/£. If the covered interest rate differential is about 1%, then the interest rate in the U.S. for 90 days would have to be:A)7%B)4%C)3%D)2%10. If the covered interest differential is zero:A)International investments will be unprofitable.B)Parity has not been reached.C)The overall covered return on a foreign-currency investment equals thereturn on a comparable domestic-currency investment.D) A currency is at a forward premium by as much as its interest rate is higherthan the interest rate in the other country.11. When uncovered interest parity holds:A) A currency is expected to appreciate by as much as its interest rate is lowerthan the interest rate in the other country.B) A currency is expected to appreciate by as much as its interest rateis higher than the interest rate in the other countryC) A currency is expected to depreciate by as much as itsinterest rate is lower than the interest rate in the other countryD)The forward premium equals the interest rate differential.12. International Fisher Effect refers to the condition when:A)Covered differential equals zero.B)Expected uncovered differential equals zero.C)Uncovered interest parity holds.D)Both (B) and (C).13. __________ purchasing power parity states that the difference between changes over time in product-price levels in two countries will be offset by the change in the exchange rate over this time.A)FullB)PartialC)RelativeD)Absolute14. The __________ approach to exchange rates emphasizes the importance of the supply and demand for money as a key to understanding the determinants of exchange rates.A)Purchasing-power-parityB)Asset marketC)MonetaryD)Balance of payments15. Based on PPP and the quantity theory of money, if Japan’s real income rises relative to real income in the US, there should be a(n):A)Appreciation of the dollar.B)Appreciation of the yen.C)Interest rate parity.D)Depreciation of the yen.16..The __________ effect can sometimes be destabilizing because it moves the exchange rate away from its long-run equilibrium value.A)BandwagonB)BubbleC)Exchange rateD)Arbitrage17. The law of __________ states that a product that is easily and freely traded in a perfectly competitive global market should have the same price everywhere.A) International tradeB) One priceC) Diminishing returnsD) Relative PPP18..According to the relative version of purchasing power parity, when the foreign country inflation rate increases, the home coun try’s:A)Currency tends to depreciate.B)Currency tends to appreciate.C)Inflation rate tends to decrease.D)Inflation rate tends to stay the same.19..Which of the following are in place when government imposes limits on or requires approvals for payments related to some (or all) international financial activities?A)Exchange controls.B)Capital controls.C)Official interventions.D)Adjustable pegs.20. Pressures in the foreign exchange market are such as to cause the British pound to appreciate with respect to the U.S. dollar. If Britain is trying to maintain a fixed exchange rate with respect to the U.S. dollar, which of the following interventions will stem the pressures for appreciation of the pound?A)Britain should sell pounds and buy dollars.B)Britain should do nothing as a fixed rate will not change.C)Britain should buy pounds and sell dollars.D)Britain should decrease their money supply to contract the economy.21. Faced with ever increasing outflows of gold in the late 1960’s, the United States:A)Used contractionary fiscal policies to rid the nation of deficits.B)Devalued the dollar in terms of gold.C) Suspended the convertibility of dollars into gold.D) Imposed foreign exchange controls.22. .If the marginal propensity to save is 0.3 and the marginal propensity to import is 0.1, and the government increases expenditures by $10 billion, ignoring foreign-income repercussions(回流效应), how much will GDP rise?A)$20 billion.B)$10 billion.C)$25 billion.D)$15 billion.23.The IS curve illustrates:A)All combinations of domestic output levels and interest rates for which thedomestic product market is in equilibrium.B)All combinations of domestic output levels and interest rates for which thedomestic money market is in equilibrium.C)All combinations of domestic output levels and interest rates that results ina zero balance for the country’s official settlements balance.D)All combinations of domestic output levels and interest rates for whichthere is full employment.24.The LM curve has a:A)Positive slope because a higher interest rate leads to a decrease in thedemand for money and thus a higher level of domestic production isneeded to cause people to continue to hold the same amount ofmoney.B)Negative slope because a higher interest rate leads to a decrease in thedemand for money and thus a higher level of domestic production isneeded to cause people to continue to hold the same amount ofmoney.C)Negative slope because a higher interest rate leads to a decrease inaggregate demand and thus a lower level of domestic production isneeded for equilibrium.D)Positive slope because a higher interest rate leads to a decrease inaggregate demand and thus a higher money supply is needed forequilibrium.25. Official intervention in the foreign exchange market to defend a fixed exchange rate when the value of domestic currency is under downward pressure:A)Causes international reserve holdings to rise.B)Has no impact on the domestic money supply.C)Causes the domestic money supply to rise.D)Causes the domestic money supply to fall.26. Floating exchange rates ensure:A) Full employment domestically.B) Domestic price stability.C) Equilibrium in the overall balance of payments.D) A surplus in the trade balance.27. There are limits to the ability of monetary authorities to use sterilized intervention in the case of a surplus because:A)The central bank may be unwilling to increase its holdings of foreigncurrency.B)Pressure from foreign countries to allow the domestic currency todepreciate will lead to large losses.C)The central bank is limited in its ability to obtain foreign currency.D)There are no limits on the use of sterilized intervention.28. Under a floating exchange rate regime, following an expansion in the money supply, monetary authorities will:A) Buy foreign currency in the foreign exchange market.B) Buy domestic currency in the foreign exchange market.C) Do nothing in the foreign exchange market.D) Sell domestic currency in the foreign exchange market.29.Given the IS-LM-FE framework and an overall payments balance of zero, if the country implements expansionary monetary policy, the LM curve will shift to the __________ which will lead to the country's currency __________. In response, the FE and IS curves will shift to the __________ and external balance will be reestablished.A) left; appreciating; rightB) left; depreciating; leftC) right; depreciating; rightD) right; appreciating; right30. Under a floating exchange rate regime with a low degree of capital mobility, expansionary fiscal policy will lead to:A) Higher interest rates.B) Lower interest rates.C) Capital outflows.D) A surplus in the official settlements balance.Part II, True or False (10*1.5=15 score)( T for true and F For false, you are not required to give reason for your choice) 1.If a currency is at a forward premium by as much as its interest rate is lower than the interest rate in the other country, covered interest parity holds.2. Contractionary fiscal policy with floating exchange rates and low capital mobility leads to currency depreciation.3. Over the long-run, a country with a relatively high inflation rate tends to have a depreciating currency.4.The quantity theory of money says that in any country the money supply isequated to the demand for money, which is directly proportional to the money value of the gross domestic product.5.With fixed exchange rates, external capital flow shocks have little impact on theinternal economy.6.The Bretton Woods conference created the International Monetary Fund (IMF).7.The official settlements balance is in deficit if the IS-LM intersection is to theright of the FE curve.8.(P f*e / P) is a useful indicator of a country’s international price competitiveness.9.The assignment rule says that, with fixed exchange rates, fiscal policy should beassigned to stabilizing the balance of payments and monetary policy should be assigned to stabilizing the domestic economy.10.The J curve shows a typical response of the current account balance to a drop inthe exchange rate value of a country's currency.Part III: Questions(6*6=36 score)1.You are provided with the following information about a country's internationaltransactions during a given year:Service exports $ 346Service imports $354Merchandise exports $480Merchandise imports $348Income flow, net $153Unilateral transfers, net $142Increase in the country holding of foreign assets, net $352(excluding official reserves assets)Increase in foreign holding of foreign assets, net $252(excluding official reserves assets)Statistical discrepancy, net $154Calculate the official settlements balance and the current account balance. Is the country increasing or decreasing its net holdings of official reserve assets? Why? 2. The following rates exist:Current spot exchange rate: $1.8/£Annualized interest rate on 90-day dollar-denominated bonds: 8% (2% for 90 days) Annualized interest rate on 90-day pound-denominated bonds: 12% (3% for 90 days)Financial investor expect the spot exchange rate to be $1.77/£ in 90 days,A)With the uncovered interest differential to make judgment that if he bases his decisions solely on the difference in the expected rate of return, should a U.S.-based investor make an uncovered investment in pound-denominated bonds rather than investing in dollar-denominated bonds? Why?B) if there is substantial uncovered investment seeking higher expected returns, what pressure is placed on the current spot exchange rate?3.What is the exchange rate overshooting, why does it occur?4.Assume that a government has become committed to maintaining a fixedexchange rate that officially values foreign currencies less, and the domestic currency (here the dollar) more, than the free market equilibrium rate. The official rate is, say, $1.0 per pound sterling. This exchange controls result in considerable costs to a country whose government imposes them. Describe these costs and the role that bribery and parallel markets can play in economies with exchange controls.Figure: Welfare Losses from Exchange Controls5. Use the standard IS-LM-FE framework and assume the country begins at a triple intersection under floating exchange rate. What effect will the following have on domestic interest rates, output levels, and the official settlements balance, assuming low capital mobility?(you are suggested explain with figure)a. The central bank increases the money supply.b. The government increases its spending.6.Explain the effects of expanding the money supply on the economy of a country with fixed exchange rates. (Assume the country begins at a triple intersection ,you are suggested explain with figure)Part III, Reading and analysis (9 score for paper1 and 10 score for paper 2)1: China to further reform RMB exchange rate regime (体制)The People's Bank of China (PBOC ), China's central bank, has decided to proceed further with the reform of the Renminbi (RMB ) exchange rate regime to enhance the RMB exchange rate flexibility, a spokesperson of the central bank said on Jun 19, 2010, Saturday Beijing. The decision was made in view of the recent economic situation and financial market developments at home and abroad, and the balance of payments (BOP) situation in China, the spokesperson said in a statement.In further proceeding with the reform, continued emphasis would be placed to reflecting market supply and demand with reference to a basket of currencies. The exchange rate floating bands will remain the same as previously announced in the inter-bank foreign exchange market, the spokesman said.The spokesperson said China's external trade is becoming more balanced. The ratio of current account surplus to GDP, after a notable reduction in 2009, has been declining since the beginning of 2010. 30$/££B S £ B1.5D £ EA C"With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist," the spokesperson said.The PBOC will further enable market to play a fundamental role in resource allocation, promote a more balanced BOP account, maintain the RMB exchange rate basically stable at an adaptive and equilibrium level, and achieve the macroeconomic and financial stability in China, the spokesperson said.China has moved into a managed floating exchange rate regime based on market supply and demand with reference of a basket of currencies since July 1, 2005.The spokesperson said the reform of the RMB exchange rate regime has been making steady progress since 2005, producing the anticipated results and playing a positive role. ( On July 21, 2005, the People's Bank of China, announced that the RMB yuan, will be traded at a rate of 8.11 to the US and the yuan to US dollar pegging system is switched to a basket of foreign currencies.) With the current round of international financial crisis was at its worst, the exchange rate of a number of sovereign currencies to the US dollar depreciated by varying margins."The stability of the RMB exchange rate has played an important role in mitigating(缓解) the crisis' impact, contributing significantly to Asian and global recovery, and demonstrating China's efforts in promoting global rebalancing," the spokesperson said.The gradual recovery of the global economy and upturn of the Chinese economy has become more solid with enhanced economic stability. It is desirable to proceed further with reform of the RMB exchange rate regime and increase the RMB exchange rate flexibility, said the spokesperson.Question1:Why the spokesperson said. "With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist,"Question2: Why the Chinese Central bank would like to proceed the reform of the Renminbi (RMB)exchange rate regime to enhance the RMB exchange rate flexibility. Can you explain the benefit by making the RMB more flexible?2: Hot money flow and its explanationThe generally accepted view is that the inflow of short-term speculative money (so-called hot-money) began in 2007 in China targeting capital gains derived from rising stock and property prices an d the anticipated appreciation of the RMB. “hot money” is defined as the flow of funds counted as capital and financial account other than for direct investment and errors and omissions. In other words, “hot money” is defined as “changes in reserve assets”minus “changes in current account” minus “direct investment flows”. This is the simplest way to express the movement of short-term funds, and the most conservative, as the estimates tend to be smaller.When adjustments are made for the some policy measures, the BoP statistics indicate that “hot money” inflows into China accelerated from 22.5 billion USD in the first half of 2007, to 70.2 billion USD in the second half of 2007, and up to 139.1 billion USD in the first half of 2008. In contrast, a huge 184.8 billion USD of “hot money” flowed out in the second half of 2008 (2008, 2H)(Figure 1).Figure 1: Hot money in China after adjustmentForeignDirectCurrentHotSome people says that the huge inflow of hot money is the reason for the increasing price of stock price and property price. In order to check this point, here we give two figures about the Shanghai Stock index and Property (资产) Price index of different regions including ShangHai, Shengzhen, Beijing.Figure 2: Shanghai Stock IndexFigure 3: Property Price index.We find that Stock prices peaked in October 2008, and thereafter began a downward trend(Figure 2). Growth in property prices began to fall in the first half of 2008 (c) (Figure 3) althoughthe hot money inflow go to its peak at the same time.Figure 4: RMB exchange rate and interest rate parityInterestRMBForwardChange of From the above figure 4, we find that the RMB forward exchange rate shifted after therapid appreciation of the RMB spot exchange rate, and deviated from interest rateparity from late-2007 until the autumn of 2008. The distance from interest rate parity widened most in the first half of 2008. This is because spot exchange rates are underthe control of the authorities while forward exchange rates are not, and their appreciation reflected market pa rticipants’ expectation of spot rate appreciation in the following period. As a consequence, the RMB forward exchange rate movedtoward appreciation, and the difference between the RMB forward rate and spot ratebegan to deviate from interest rate parity in May 2007, peaking in March 2008.Figure 5: Returns from arbitrage transactions using RMB forward exchangerateQuestion 1: From fighre1,2,3, do you agree with the such idea that the huge hot money inflow is the main force that pushes the Chinese stock price and property price increase and raises the bubbles. Why?Question 2: With the figure 1, 4, 5 would you please explain the relationship between RMB appreciation and hot money inflow by the asset market approach, say, the covered interest differential equation and covered interest parity.浙江财经学院2009~2010学年第一学期《国际金融(双语)》课程期末考试试卷( A 卷)答案PART I: Multiple choice(10*1=10)1-5 AAAAB 6-10 ACACC 11-15 ADCCB 16-20 ABBBA21-25 CCAAD 26-30CACCAPART II TRUTH OR FALSE(10*1.5=15)1T 2 F 3 T 4T 5F. 6T 7T 8T 9 F 10 TPART III: Questions(6*6=36)Question 1:POSSIBLE RESPONSE:Current account balance: $346 - 354 + 480 - 348 + 153 - 142 = $135Official settlements balance: $346 - 354 + 480 - 348 +153 -142 + 252 – 352 + 154 = $189Change in official reserve assets (net) = -official settlements balance = -$189.The country is increasing its net holdings of official reserve assets.Question 2:POSSIBLE RESPONSE:a)From the point of view of the U.S.-based investor, the expected uncovered interest differential is [(1+0.03)*1.77/1.8]-(1+0.02)=-0.0072. Because the differential is negative, the U.S –based investor should stay at home, investing in dollar-denominated bonds, if he bases his decision on the difference in expected reurns.b) If there is substantial uncovered investment flowing from Britain to the United States, this increases the supply of pounds in the spot exchange market. There is downward pressure on the spot exchange rate to drop below $1.8/pound. The pound teds to depreciate.Question 3:POSSIBLE RESPONSE:Overshooting occurs because in this sticky price version of the monetary approach, prices are assumed to be fixed in the short run and completely flexible in the long run.A considerable amount of time must pass for the increase in money supply to lead to an increase in domestic prices. Thus, purchasing power parity is more realistically assumed to hold in the long run but not in the short run. Because prices are sticky at first, the increase in money supply drives down domestic interest rates. This shift favors foreign currency assets which results in immediate depreciation of the domestic currency. As prices adjust, the domestic currency reverts back to its new long run equilibrium.Question4、Assume that a government has become committed to maintaining a fixed exchange rate that officially values foreign currencies less, and the domestic currency (here the dollar) more, than the free market equilibrium rate. The official rate is, say, $1.0 per pound sterling. This exchange controls result in considerable costs to a country whose government imposes them. Describe these costs and the role that bribery and parallel markets can play in economies with exchange controls. Figure: Welfare Losses from Exchange ControlsPOSSIBLE RESPONSE:The exchange controls require exporters to turn over all their revenues from foreign buyers to the government. The government, in turn, gives them $1.0 in domestic bank deposits for each pound sterling they have earned. In Figure 20.2, the exchange control limits the foreign currency available to 30 billion pounds, which is the amount earned by the country’s exporters at the exchange rate of $1.0 per pound. Even if those who most value the limited foreign currency get it, the country suffers a loss of well being equal to the triangular area depicted by CEA.Actual exchange control regimes are likely to have other effects and costs. One such example is the efforts evade exchange controls. People are frustrated when they are not allowed to buy foreign exchange, even though they are willing to pay more than the recipients of foreign exchange will get from the government when these holders sell their foreign currency. The frustrated demanders will look for other ways to obtain foreign exchange. One way is to bribe the government functionaries in charge of determining the official approvals. Another is to offer more to recipients of foreign exchange than the government is offering. In this way a second foreign exchange market, a parallel market or black market, develops as a way for private demanders and sellers of foreign exchange to evade exchange controls. Parallel markets exist in most countries that have exchange controls.5. Use the standard IS-LM-FE framework and assume the country begins at a triple intersection under floating exchange rate. What effect will the following have on domestic interest rates, output levels, and the official settlements balance, assuming low capital mobility?(you are suggested explain with figure)a.The central bank increases the money supply.b.The government increases its spending.POSSIBLE RESPONSE:a.The LM curve shifts to the right, and the country moves to a new short-runequilibrium at the intersection of the IS curve and the new LM curve.The domestic interest rate decreases, real GDP increases, and the officialsettlements balance goes into deficit. With the increase in the moneysupply, it is temporarily greater than money demand. To bring about anequilibrium in the money market, interest rates must fall. The fall ininterest rates increases interest-sensitive spending, so the GDP outputlevel increases. There is now a payment deficit because the newintersection of the IS and LM curves takes place to the right of the FEcurve.b.The IS curve shifts to the right, and the country moves to a new short-runequilibrium at the intersection of the LM curve and the new IS curve.Real GDP increases, the domestic interest rate increases, and the officialsettlements balance goes into deficit. This new intersection occurs to theright of the relatively steep FE curve, which corresponds to a paymentsdeficit.The figure is neglected.6. Explain the effects of expanding the money supply on the economy of a country with fixed exchange rates. (Assume the country begins at a triple intersection , you are suggested explain with figure)POSSIBLE RESPONSE:Beginning from an external balance, an expansion in the money supply increases bank liquidity. In the short run, as banks compete with each other to lend money, interest rates are bid down. The fall in interest rates causes some holders of financial assets denominated in the domestic currency to seek higher returns abroad. The international capital outflow causes the financial account to deteriorate. the currency of this country will under the pressure of depreciate, thus the central bank should intervene the foreign market by buying the domestic currency. Thus the concretionary monetary policy will be applied.Finally we will find it that the expansionary monetary policy can not make effect on the economy..The figure is neglected.Part III, Reading and analysisReading 1 ,9 scoreQuestion1:Why the spokesperson said. "With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist,"POSSIBLE RESPONSE:The policy makers usually will pursuer both the external balance and internal balance, the external balance means that the Balance of Payments or the current account balance plus the financial account balance is close to zero. In this situation, it means that the export value (including goods, services and financial products) is equal to the import value in China. Thus in the foreign exchange market the supply of foreign currency is similar to the demand of the foreign currency and the foreign exchange market is close to the equilibrium. The values of Chinese currency RMB will not experience the appreciation pressure more. So the spokesperson said the basis for large-scale appreciation of the RMB exchange rate does not exist. This basis means the BOP account moving closer to equilibrium.Question2: Why the Chinese Central bank would like to proceed the reform of the Renminbi (RMB)exchange rate regime to enhance the RMB exchange rate flexibility. Can。

国际金融中英文版(带解析)

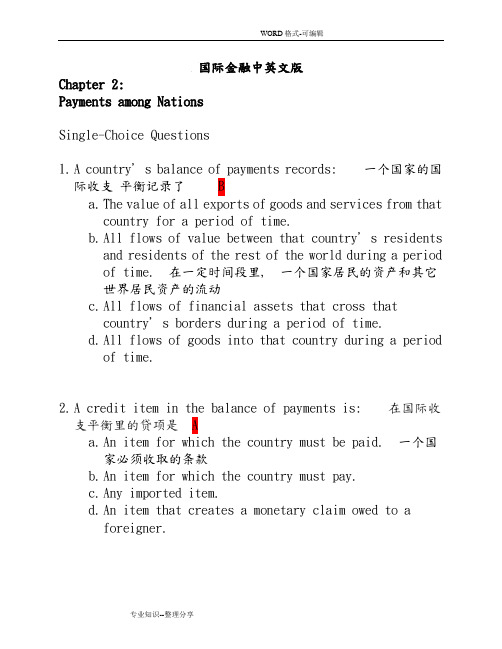

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1. A country’s balance of payments records: 一个国家的国际收支平衡记录了Ba.The value of all exports of goods and services from that country for aperiod of time.b.All flows of value between that country’s residents and residents of therest of the world during a period of time. 在一定时间段里, 一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country’s borders duringa period of time.d.All flows of goods into that country during a period of time.2.3. A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid. 一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to a foreigner.4.Every international exchange of value is entered into the balance-of-paymentsaccounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba. 1b. 2c. 3d. 45. A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay. 一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.6.In a nation's balance of payments, which one of the following items is alwaysrecorded as a positive entry? D 在国际收支中, 下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country. 国外游客在本国发生的购买7.The sum of all of the debit items in the balance of payments: 在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors and omissions.8.Which of the following capital transactions are entered as debits in the U.S.balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项? Ba. A U.S. resident transfers $100 from his account at Credit Suisse in Basel(Switzerland) to his account at a San Francisco branch of Wells Fargo Bank.b. A French resident transfers $100 from his account at Wells Fargo Bank inSan Francisco to his Credit Suisse account in Basel. 一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c. A U.S. resident sells his IBM stock to a French resident.d. A U.S. resident sells his Credit Suisse stock to a French resident.9.An increase in a nation's financial liabilities to foreign residents is a: 一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.10.___A_______ are money-like assets that are held by governments and that arerecognized by governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets11.Which of the following is considered a capital inflow? 下列哪项被视为资本流入 Aa. A sale of U.S. financial assets to a foreign buyer. 美国一金融资产卖给一外国买家b. A loan from a U.S. bank to a foreign borrower.c. A purchase of foreign financial assets by a U.S. buyer.d. A U.S. citizen’s repayment of a loan from a foreign bank.12.In a country’s balance of payments, which of the following transactions aredebits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners are decreased. 外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents are decreased.c.Assets owned by domestic residents are sold to nonresidents.d.Securities are sold by domestic residents to nonresidents.13.The role of ___D_______ is to direct one nation’s savings into another nation’sinvestments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows 资金流14.The net value of flows of goods, services, income, and unilateral transfers iscalled the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.15.The net value of flows of financial assets and similar claims (excluding officialinternational reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫 Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the U.S. balance of payments includes: 美国国家收支表中的金融帐包括: Ba.Everything in the current account.b.U.S. government payments to other countries for the use of military bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.A U.S. resident increasing her holdings of a foreign financial asset causesa: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account. 美国资本帐的借帐17.A foreign resident increasing her holdings of a U.S. financial asset causes a:一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18.A deficit in the current account: 经常帐户中的赤字 Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasing imports.19.In September, 2005, exports of goods from the U.S. decreased $3.3 billion to$73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion.This increased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account. 经常帐户d.Unilateral transfers.20.Which of the following would contribute to a U.S. current account surplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reduction on imported goods.b.The United States cuts back on American military personnel stationed inJapan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in the United States.21.Which of the following transactions is recorded in the financial account?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b. A Chinese businessman imports Ford automobiles from the United States.c. A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chinese to play anexhibition game in Beijing, China.22.If a British business buys U.S. government securities, how will this be enteredin the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是? Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increase in U.S. assets heldby foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decrease in U.S. assets heldby foreigners.23.In the balance of payments, the statistical discrepancy or error term is usedto: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum of all credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-payments deficit.d.Obtain an accurate account of a balance-of-payments surplus.24.Official reserve assets are: 官方储备资产是 Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments and that are recognizedby governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.Which of the following constitutes the largest component of the world’sinternational reserve assets? 下列哪项构成了世界国际储备资产的大部份?Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies. 外汇(币)26.The net accumulation of foreign assets minus foreign liabilities is: 海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment. 国外投资净值 foreign deficit.27.A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and service trade,international income payments and receipts and international transfers.28.The ___C_______ measures the sum of the current account balance plus the privatecapital account balance. 官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.If the overall balance is in __A________, there is an accumulation of officialreserve assets by the country or a decrease in foreign official reserve holdings of the country's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOT equal to? 以下哪项不等同于现金帐 Da.The difference between domestic product and domestic expenditure.b.The difference between national saving and domestic investment. foreign investment.d.The difference between government saving and government investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows are credits. 资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, and gifts is the currentaccount balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims is the private currentaccount balance. 金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets are now foreign exchangeassets, financial assets denominated in a foreign currency that is readily acceptable in international transactions. (T) 大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35.A country's financial account balance equals the country's net foreigninvestment.一个国家的金融帐差额相当于一个国家的净国外投资36.A country has a current account deficit if it is saving more than it is investingdomestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of the capital account balanceplus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38.A nation's international investment position shows its stock of internationalassets and liabilities at a moment in time. (T) 一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39.A nation is a borrower if its current account is in deficit during a time period.(T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40.A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41.A transaction leading to a foreign resident increasing her holdings of a U.S.financial asset will be recorded as a debit on the U.S. financial account.如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42.A credit item is an item for which a country must pay. 贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often used in official reservetransactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the difference between domestic productand national expenditure.(T) 经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government were buying more goods andservices than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

金融英语期末试题及答案

金融英语期末试题及答案一、选择题1. What is the time value of money?A. The concept of money having different values at different times.B. The concept of money having the same value at all times.C. The concept of money having no value over time.D. The concept of money having a fixed value regardless of time.答案:A2. Which of the following is a type of risk in finance?A. Exchange rate riskB. Market riskC. Interest rate riskD. All of the above答案:D3. What is the purpose of diversification in investment?A. To concentrate investments in a single assetB. To reduce the overall risk of a portfolioC. To increase the potential return of a portfolioD. To eliminate all risk from a portfolio答案:B4. What is the function of a stock exchange?A. To regulate the trading of stocks and other securitiesB. To provide loans to individuals and businessesC. To monitor interest rates in the economyD. To facilitate international trade transactions答案:A5. What is the role of a financial analyst?A. To analyze economic trends and make investment recommendationsB. To issue and sell financial products to customersC. To manage the day-to-day operations of a financial institutionD. To set monetary policies for an economy答案:A二、填空题1. The process of buying and selling securities on the stock market is known as _________.答案:trading2. A document that outlines the terms and conditions of a loan is called a _________.答案:loan agreement3. The risk that an investment will lose value due to changes in the overall market is known as _________ risk.答案:market4. The interest rate at which banks lend money to each other overnight is called the _________ rate.答案:overnight5. The process by which a company raises capital by selling shares to the public is known as _________.答案:initial public offering (IPO)三、简答题1. Explain the difference between stocks and bonds.答案:Stocks represent ownership in a company and give investors the right to share in the company's profits and voting rights. Bonds, on the other hand, are debt securities issued by companies or governments to raise capital. Bondholders lend money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.2. What factors can affect currency exchange rates?答案:Currency exchange rates can be influenced by factors such as interest rates, inflation, political stability, economic performance, and market speculation. Changes in these factors can cause the value of a currency to fluctuate relative to other currencies.3. What is the difference between a mutual fund and an exchange-traded fund (ETF)?答案:A mutual fund is a pooled investment vehicle that collects money from multiple investors to invest in a diversified portfolio of securities. Investors in mutual funds buy shares directly from the fund at the net asset value (NAV) price. An ETF, on the other hand, is a type of investment fund that is traded on a stock exchange like a common stock. ETFs can be bought and sold throughout the trading day at market prices, and their prices may deviate slightly from the underlying asset value.四、解释题1. Explain the concept of compound interest.答案:Compound interest is the interest that is earned on both the initial principal amount and any accumulated interest from previous periods. In other words, it is interest on interest. As interest is added to the principal, the total amount grows over time, and subsequently, the amount of interest earned in each period also increases. This compounding effect allows investments to grow at an accelerated rate compared to simple interest, where interest is only calculated on the initial principal.2. What is diversification in investment and why is it important?答案:Diversification refers to the practice of spreading investments across different assets, industries, or geographical regions to reduce risk. By diversifying a portfolio, an investor can decrease the impact of any single investment's performance on the overall portfolio. Different investments may have different risk levels and may react differently to economic or market conditions. Therefore, if one investment performs poorly, other investments in the portfolio may provide a buffer against potential losses. Diversification can help to achieve a more balanced risk-return profile and enhance the potential for long-term investment success.五、翻译题Translate the following sentence into English:中国货币政策的调整对全球金融市场有重要影响。

国际金融中英文版答案解析)

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from thatcountry for a period of time.b.All flows of value between that c ountry’s residentsand residents of the rest of the world during a periodof time. 在一定时间段里, 一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross thatcountry’s borders during a period of time.d.All flows of goods into that country during a periodof time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid. 一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to aforeigner.3.Every international exchange of value is entered into thebalance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay. 一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the followingitems is always recorded as a positive entry? D 在国际收支中, 下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments:在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors andomissions.7.Which of the following capital transactions are entered asdebits in the U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba.A U.S. resident transfers $100 from his account atCredit Suisse in Basel (Switzerland) to his account ata San Francisco branch of Wells Fargo Bank.b.A French resident transfers $100 from his account atWells Fargo Bank in San Francisco to his Credit Suisseaccount in Basel. 一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A U.S. resident sells his IBM stock to a Frenchresident.d.A U.S. resident sells his Credit Suisse stock to aFrench resident.8.An increase in a nation's financial liabilities to foreignresidents is a: 一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held bygovernments and that are recognized by governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.Which of the following is considered a capital inflow?下列哪项被视为资本流入 Aa.A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b.A loan from a U.S. bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S. buyer.d.A U.S. citizen’s repayment of a loan from a foreignbank.11.In a country’s balance of payments, which of thefollowing transactions are debits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners aredecreased. 外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents aredecreased.c.Assets owned by domestic residents are sold tononresidents.d.Securities are sold by domestic residents tononresidents.12.The role of ___D_______ is to direct one nation’ssavings into another nation’s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows 资金流13.The net value of flows of goods, services, income, andunilateral transfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.The net value of flows of financial assets and similarclaims (excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫 Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the U.S. balance of paymentsincludes: 美国国家收支表中的金融帐包括: Ba.Everything in the current account.b.U.S. government payments to other countries for the useof military bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.A U.S. resident increasing her holdings of a foreignfinancial asset causes a: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account. 美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S.financial asset causes a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18. A deficit in the current account: 经常帐户中的赤字 Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasingimports.19.In September, 2005, exports of goods from the U.S.decreased $3.3 billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. Thisincreased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account. 经常帐户d.Unilateral transfers.20.Which of the following would contribute to a U.S. currentaccount surplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reductionon imported goods.b.The United States cuts back on American militarypersonnel stationed in Japan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in theUnited States.21.Which of the following transactions is recorded in thefinancial account?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobiles from theUnited States.c.A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chineseto play an exhibition game in Beijing, China.22.If a British business buys U.S. government securities,how will this be entered in the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是? Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increasein U.S. assets held by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decreasein U.S. assets held by foreigners.23.In the balance of payments, the statistical discrepancyor error term is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum ofall credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-paymentsdeficit.d.Obtain an accurate account of a balance-of-paymentssurplus.24.Official reserve assets are: 官方储备资产是Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments and thatare recognized by governments as fully acceptable forpayments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.Which of the following constitutes the largest componentof the world’s international reserve assets?下列哪项构成了世界国际储备资产的大部份? Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies. 外汇(币)26.The net accumulation of foreign assets minus foreignliabilities is: 海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment. 国外投资净值 foreign deficit.27. A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and servicetrade, international income payments and receipts andinternational transfers.28.The ___C_______ measures the sum of the current accountbalance plus the private capital account balance. 官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.If the overall balance is in __A________, there is anaccumulation of official reserve assets by the country ora decrease in foreign official reserve holdings of thecountry's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOTequal to? 以下哪项不等同于现金帐 Da.The difference between domestic product and domesticexpenditure.b.The difference between national saving and domesticinvestment. foreign investment.d.The difference between government saving andgovernment investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows arecredits. 资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, andgifts is the current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims isthe private current account balance. 金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets arenow foreign exchange assets, financial assets denominated in a foreign currency that is readily acceptable ininternational transactions. (T) 大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35. A country's financial account balance equals thecountry's net foreign investment.一个国家的金融帐差额相当于一个国家的净国外投资36. A country has a current account deficit if it is savingmore than it is investing domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of thecapital account balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38. A nation's international investment position shows itsstock of international assets and liabilities at a moment in time. (T) 一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39. A nation is a borrower if its current account is indeficit during a time period. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40. A nation is a debtor if its net stock of foreign assetsis positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41. A transaction leading to a foreign resident increasingher holdings of a U.S. financial asset will be recorded asa debit on the U.S. financial account. 如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay.贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often usedin official reserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the differencebetween domestic product and national expenditure.(T) 经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government werebuying more goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

国际金融中英文版答案

国际金融中英文版答案 Company number:【0089WT-8898YT-W8CCB-BUUT-202108】国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from thatcountry for a period of time.b.All flows of value between that country’s residents andresidents of the rest of the world during a period of time.在一定时间段里,一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country’s bordersduring a period of time.d.All flows of goods into that country during a period of time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid.一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to a foreigner.3.Every international exchange of value is entered into the balance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay.一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the following itemsis always recorded as a positive entry D在国际收支中,下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments: 在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors and omissions.7.Which of the following capital transactions are entered as debits inthe . balance of payments 下列哪个资本交易在美国的收支平衡中当作借项Ba.A . resident transfers $100 from his account at Credit Suisse inBasel (Switzerland) to his account at a San Francisco branch ofWells Fargo Bank.b.A French resident transfers $100 from his account at WellsFargo Bank in San Francisco to his Credit Suisse account inBasel.一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A . resident sells his IBM stock to a French resident.d.A . resident sells his Credit Suisse stock to a French resident.8.An increase in a nation's financial liabilities to foreign residents is a:一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held by governmentsand that are recognized by governments as fully acceptable forpayments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.Which of the following is considered a capital inflow下列哪项被视为资本流入 Aa.A sale of . financial assets to a foreign buyer.美国一金融资产卖给一外国买家b.A loan from a . bank to a foreign borrower.c.A purchase of foreign financial assets by a . buyer.d.A . citizen’s repayment of a loan from a foreign bank.11.In a country’s balance of payments, which of the followingtransactions are debits一个国家的收支平衡表中,哪个交易属于借项 Aa.Domestic bank balances owned by foreigners are decreased.外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents aredecreased.c.Assets owned by domestic residents are sold to nonresidents.d.Securities are sold by domestic residents to nonresidents.12.The role of ___D_______ is to direct one nation’s savings intoanother nation’s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows资金流13.The net value of flows of goods, services, income, and unilateraltransfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.The net value of flows of financial assets and similar claims(excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫 Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the . balance of payments includes: 美国国家收支表中的金融帐包括: Ba.Everything in the current account.b.. government payments to other countries for the use ofmilitary bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New . investments in foreign countries.16.A . resident increasing her holdings of a foreign financial assetcauses a: 一个美国居民增持一外国金融资产会引起Da.Credit in the . current account.b.Debit in the . current account.c.Credit in the . capital account.d.Debit in the . capital account.美国资本帐的借帐17. A foreign resident increasing her holdings of a . financial assetcauses a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the . current account.b.Debit in the . current account.c.Credit in the . capital account.美国资本帐的贷帐d.Debit in the . capital account.18. A deficit in the current account: 经常帐户中的赤字Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasing imports.19.In September, 2005, exports of goods from the . decreased$ billion to $ billion, and imports of goods increased $ billion to$ billion. This increased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字Ca.The balance of payments.b.The financial account.c.The current account.经常帐户d.Unilateral transfers.20.Which of the following would contribute to a . current accountsurplus 以下哪项有助于美国现金帐的盈余 Ba.The United States makes a unilateral tariff reduction onimported goods.b.The United States cuts back on American military personnelstationed in Japan.美国削减在日本的军事人员c.. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in the UnitedStates.21.Which of the following transactions is recorded in the financialaccount以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobiles from theUnited States.c.A . tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chinese toplay an exhibition game in Beijing, China.22.If a British business buys . government securities, how will thisbe entered in the balance of payments 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是 Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increase in . assetsheld by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decrease in . assetsheld by foreigners.23.In the balance of payments, the statistical discrepancy or errorterm is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum of all credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-payments deficit.d.Obtain an accurate account of a balance-of-payments surplus.24.Official reserve assets are: 官方储备资产是 Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments and that arerecognized by governments as fully acceptable for paymentsbetween them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.Which of the following constitutes the largest component of theworld’s international reserve assets下列哪项构成了世界国际储备资产的大部份 Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies.外汇(币)26.The net accumulation of foreign assets minus foreign liabilities is:海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment.国外投资净值 foreign deficit.27. A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and service trade,international income payments and receipts and internationaltransfers.28.The ___C_______ measures the sum of the current accountbalance plus the private capital account balance.官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.If the overall balance is in __A________, there is anaccumulation of official reserve assets by the country or a decrease in foreign official reserve holdings of the country's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOT equalto 以下哪项不等同于现金帐 Da.The difference between domestic product and domesticexpenditure.b.The difference between national saving and domesticinvestment. foreign investment.d.The difference between government saving and governmentinvestment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows are credits. 资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, and gifts isthe current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims is the privatecurrent account balance. 金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets are now foreignexchange assets, financial assets denominated in a foreign currency that is readily acceptable in international transactions. (T)大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35. A country's financial account balance equals the country's netforeign investment.一个国家的金融帐差额相当于一个国家的净国外投资36. A country has a current account deficit if it is saving more than itis investing domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of the capitalaccount balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38. A nation's international investment position shows its stock ofinternational assets and liabilities at a moment in time. (T)一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39. A nation is a borrower if its current account is in deficit during atime period. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40. A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41. A transaction leading to a foreign resident increasing her holdingsof a . financial asset will be recorded as a debit on the . financialaccount.如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay. 贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often used inofficial reserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the difference betweendomestic product and national expenditure.(T)经常项目余额等于国民生产与国民支出的差额45.In 2007 . households, businesses and government were buyingmore goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

英文版国际金融试题和答案

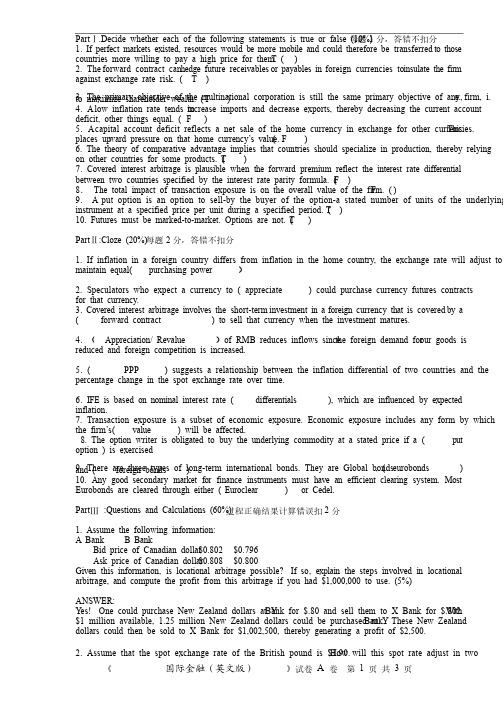

Part Ⅰ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分分,答错不扣分1. 1. If If If perfect perfect perfect markets markets markets existed, existed, existed, resources resources resources would would would be be be more more more mobile mobile mobile and and and could could could therefore therefore therefore be transferred be transferred to to those those countries more willing to pay a high price for them. ( T ) 2. The forward contract can h edge hedge hedge future receivables future receivables or or payables payables payables in in in foreign currencies to foreign currencies to i nsulate insulate insulate the the the firm firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. 7. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage is is is plausible plausible plausible when when when the the the forward forward forward premium premium premium reflect reflect reflect the the the interest interest interest rate rate rate differential differential between two countries specified by the interest rate parity formula. ( F ) 8. The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) Part Ⅱ:Cloze (20%)每题2分,答错不扣分分,答错不扣分1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power )2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. 3. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage involves involves involves the short-term the short-term investment investment in in in a a a foreign foreign foreign currency currency currency that that that is covered is covered by by a a ( forward contract ) to sell that currency when the investment matures. 4. ( Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. 6. IFE IFE IFE is is is based based based on on on nominal nominal nominal interest interest interest rate rate rate ( ( differentials ), ), which which which are are are influenced influenced influenced by by by expected expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( ( value ) will be affected. 8. 8. The The The option option option writer writer writer is is is obligated obligated obligated to to to buy buy buy the the the underlying underlying underlying commodity commodity commodity at at at a a a stated stated stated price price price if if if a a a ( ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. 10. Any Any Any good good good secondary secondary secondary market market market for for for finance finance finance instruments instruments instruments must must must have have have an an an efficient efficient efficient clearing clearing clearing system. system. system. Most Most Eurobonds are cleared through either ( Euroclear ) or Cedel. Part Ⅲ :Questions and Calculations (60%)过程正确结果计算错误扣2分1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given Given this this this information, information, information, is is is locational locational locational arbitrage arbitrage arbitrage possible? possible? If If so, so, so, explain explain explain the the the steps steps steps involved involved involved in in in locational locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Y es! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in two years if if the the the United United United Kingdom Kingdom Kingdom experiences experiences experiences an an an inflation inflation inflation rate rate rate of of of 7 7 7 percent percent percent per per per year year year while while while the the the United United United States States experiences an inflation rate of 2 percent per year?(10%) ANSWER: According to PPP , forward rate/spot=indexdom/indexfor the exchange rate of the pound will depreciate by 4.7 percent. Therefore, the spot rate would adjust to $1.90 × [1 + (–.047)] = $1.8107 3. 3. Assume Assume Assume that that that the spot the spot exchange exchange rate rate rate of the of the Singapore Singapore dollar dollar dollar is is is $0.70. $0.70. The The one-year one-year one-year interest interest interest rate rate rate is is is 11 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (5%) (5%) ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf) $.70 × (1 + .04) = $0.728 4. Assume that XYZ Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interest rate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise . (10%) ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be be received received received could could could be be be used used used to to to pay pay pay off off off the the the loan. loan. This This amounts amounts amounts to to to (100,000/1.02) (100,000/1.02) (100,000/1.02) = = = about about about S$98,039, which S$98,039, which could could be be be converted converted converted to to to about about about $49,020 $49,020 $49,020 and and and invested. invested. The The borrowing borrowing borrowing of of of Singapore Singapore Singapore dollars dollars dollars has has has offset offset offset the the transaction exposure due to the future receivables in Singapore dollars. 5. 5. A A U.S. company ordered ordered a a a Jaguar Jaguar Jaguar sedan. In sedan. In 6 6 months , months , it will pay pay ££30,000 30,000 for for for the the the car. car. car. It It worried worried that that pound ster1ing might rise sharply from the current rate($1.90). So, the company bought a 6 month pound call (supposed contract size = £35,000) with a strike price of $1.90 for a premium of 2.3 cents/£. (1)Is hedging in the options market better if the £ rose to $1.92 in 6 months? (2)what did the exchange rate have to be for the company to break even?(15%)Solution: (1)If the £ rose to $1.92 in 6 months, the U.S. company would rose to $1.92 in 6 months, the U.S. company would exercise the pound call option. The sum of the strike price and premium is $1.90 + $0.023 = $1.9230/£This is bigger than $1.92. So hedging in the options market is not better. (2) when we say the company can break even, we mean that hedging or not hedging doesn’t matter. And only when (strike price + premium )= the exchange rate , hedging or not doesn’t matter. So, the exchange rate =$1.923/£. 6. Discuss the advantages and disadvantages of fixed exchange rate system.(15%) textbook page50 答案以教材第50 页为准页为准P AR T Ⅳ: Diagram(10%) The strike price for a call is $1.67/£. The premium quoted at the Exchange is $0.0222 per British pound. Diagram the profit and loss potential, and the break-even price for this call option Solution: Following diagram shows the profit and loss potential, and the break-even price of this put option: P AR T Ⅴ:Additional Question Suppose Suppose that that that you you you are are are expecting expecting expecting revenues revenues revenues of of of Y Y 100,000 100,000 from from from Japan Japan Japan in in in one one one month. month. Currently, Currently, 1 1 1 month month forward contracts are trading at $1 = $105 Y en. Y ou have the following estimate of the Y en/$ exchange rate in one month. Price Probability 90 Y en/$ 4% 95 Y en/$ 25% 100 Y/$ 45% 105 Y en/$ 20% 110 Y en/$ 6% a) What position in forward contracts would you take to hedge your exchange risk? b) Calculate the expected value of the hedge. c) How could you replicate this hedge in the money market? Y ou are expecting revenues of Y100,000 in one month that you will need to covert to dollars. Y ou could hedge this in forward markets by taking long positions in US dollars (short positions in Japanese Y en). By locking in your price at $1 = Y105, your dollar revenues are guaranteed to be Y100,000/ 105 = $952 On the other hand, you can wait and use the spot markets. Exchange Rate Probability Revenue w/Hedge Revenue w/out Hedge V alue of Hedge 90 Y/$ 4% $1,111 $952 -$159 95 Y/$ 25% $1,052 $952 -$100 100 Y/$ 45% $1,000 $952 -$48 105 Y/$ 20% $952 $952 $0 110 Y/$ 6% $909 $952 $43 Expected V alue = (.02)(-159) + (.25)(-100) + (.45)(-48) + (.20)(0) + (.08)(43) = -$24 Y ou could replicate this hedge by using the following: a) Borrow in Japan b) Convert the Y en to dollars c) Invest the dollars in the US d) Pay back the loan when you receive the Y100,000 。

(完整word版)国际金融题库(英文版).doc