商务英语题(管理会计)

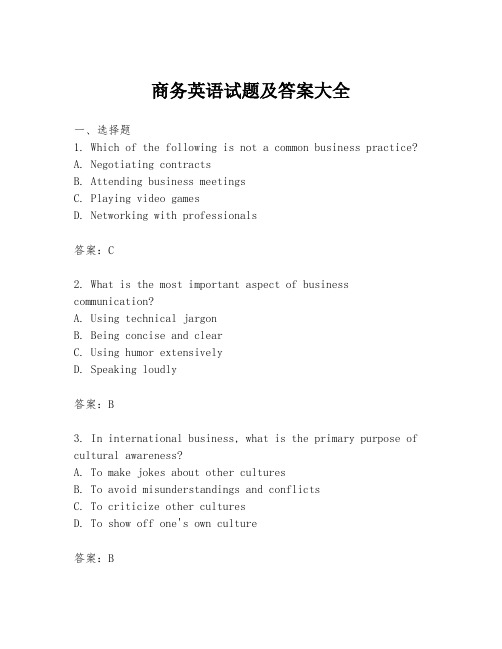

商务英语试题及答案大全

商务英语试题及答案大全一、选择题1. Which of the following is not a common business practice?A. Negotiating contractsB. Attending business meetingsC. Playing video gamesD. Networking with professionals答案:C2. What is the most important aspect of business communication?A. Using technical jargonB. Being concise and clearC. Using humor extensivelyD. Speaking loudly答案:B3. In international business, what is the primary purpose of cultural awareness?A. To make jokes about other culturesB. To avoid misunderstandings and conflictsC. To criticize other culturesD. To show off one's own culture答案:B二、填空题4. When writing a business proposal, it is crucial to include a(n) ________ section that outlines the benefits of your product or service.答案:benefits5. In a business setting, it is polite to address someone as________ if you do not know their name or title.答案:sir/madam6. When conducting market research, it is important to gather ________ data to make informed decisions.答案:reliable三、阅读理解题Read the following passage and answer the questions.In today's global market, businesses are constantly lookingfor ways to expand their reach and increase their customer base. One effective strategy is to enter into partnershipswith companies in other countries. This not only opens up new markets but also allows for the sharing of resources and expertise. However, such partnerships require carefulplanning and negotiation to ensure that both parties benefit equally.7. What is one advantage of partnering with a foreign company? 答案:Opens up new markets8. What is necessary for a successful international partnership?答案:Careful planning and negotiation9. What should be the goal of such partnerships?答案:Ensuring that both parties benefit equally四、写作题10. Write a short email to a potential business partner, introducing your company and expressing interest in exploring a partnership.[Your Name][Your Position][Your Company Name][Your Contact Information]Dear [Recipient's Name],I hope this email finds you well. My name is [Your Name] and I am the [Your Position] at [Your Company Name]. We have been following your company's work in [specific field/industry] and are impressed by your achievements.We believe that a partnership between our two companies could be mutually beneficial. Our company specializes in [briefly describe your company's expertise], and we think that our strengths could complement yours in [specific areas of potential collaboration].We would like to propose a meeting to discuss this further. Please let us know if you are interested and available for a call or video conference at your earliest convenience.Looking forward to the possibility of working together.Best regards,[Your Name]答案:(写作题无固定答案,以上为参考模板)请注意,以上内容为示例性质,实际的商务英语试题及答案可能会根据具体的教学大纲和考试要求有所不同。

管理会计英文试题及答案

管理会计英文试题及答案Management Accounting English Exam Questions and AnswersQuestion 1:The following information is available for XYZ Company:Sales Revenue: $500,000Variable Costs: $150,000Fixed Costs: $100,000Total Assets: $800,000Tax Rate: 30%Calculate the company's contribution margin ratio and net operating income.Answer 1:Contribution Margin Ratio = (Sales Revenue - Variable Costs) / Sales Revenue= ($500,000 - $150,000) / $500,000= 70%Net Operating Income = Contribution Margin - Fixed Costs= ($500,000 - $150,000) - $100,000= $250,000Question 2:ABC Company produces and sells a product with the following data:Selling Price per Unit: $20Variable Cost per Unit: $10Fixed Costs: $50,000Expected Sales Volume: 10,000 unitsCalculate the breakeven point in units and dollars.Answer 2:Breakeven Point in Units = Fixed Costs / Contribution Margin per Unit= $50,000 / ($20 - $10)= 5,000 unitsBreakeven Point in Dollars = Breakeven Point in Units * Selling Price per Unit= 5,000 units * $20= $100,000Question 3:Determine the total cost and average cost per unit for a company based on the following data:Fixed Costs: $30,000Variable Costs per Unit: $5Production Volume: 8,000 unitsAnswer 3:Total Costs = Fixed Costs + (Variable Costs per Unit * Production Volume)= $30,000 + ($5 * 8,000)= $70,000Average Cost per Unit = Total Costs / Production Volume= $70,000 / 8,000= $8.75Question 4:A company has the following cost information:Direct Materials: $20,000Direct Labor: $30,000Other Manufacturing Overhead: $5,000Selling and Administrative Expenses: $10,000Calculate the Cost of Goods Manufactured and Cost of Goods Sold.Answer 4:Cost of Goods Manufactured = Direct Materials + Direct Labor + Other Manufacturing Overhead= $20,000 + $30,000 + $5,000= $55,000Cost of Goods Sold = Cost of Goods Manufactured + Opening Finished Goods Inventory - Closing Finished Goods Inventory= $55,000 + (Opening Finished Goods Inventory - Closing Finished Goods Inventory)Question 5:The following information is available for a company:Gross Profit: $80,000Operating Expenses: $50,000Other Income: $10,000Other Expenses: $5,000Calculate the Net Operating Income.Answer 5:Net Operating Income = Gross Profit - Operating Expenses + Other Income - Other Expenses= $80,000 - $50,000 + $10,000 - $5,000= $35,000Conclusion:In this article, we have discussed various management accounting questions and provided their corresponding answers. These questions covertopics such as contribution margin ratio, breakeven analysis, cost calculation, and net operating income. By understanding and applying these concepts, managers can make informed decisions regarding the financial aspects of their businesses.。

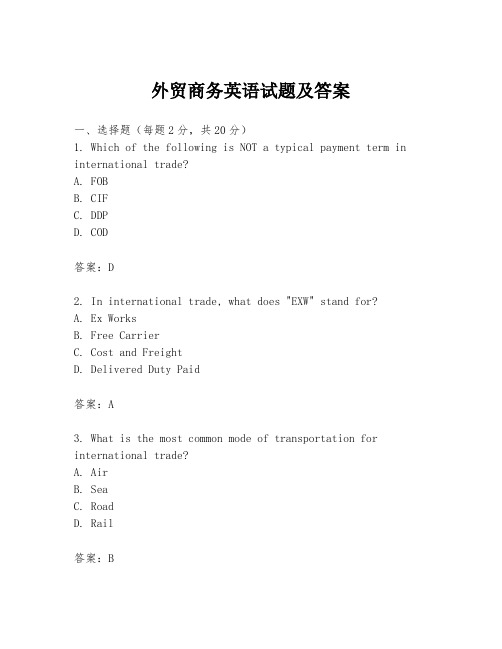

外贸商务英语试题及答案

外贸商务英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a typical payment term in international trade?A. FOBB. CIFC. DDPD. COD答案:D2. In international trade, what does "EXW" stand for?A. Ex WorksB. Free CarrierC. Cost and FreightD. Delivered Duty Paid答案:A3. What is the most common mode of transportation for international trade?A. AirB. SeaC. RoadD. Rail答案:B4. Which of the following is not a document required for exporting goods?A. Commercial InvoiceB. Packing ListC. Certificate of OriginD. Birth Certificate答案:D5. What is the primary function of a Letter of Credit in international trade?A. To guarantee paymentB. To provide insuranceC. To offer a discountD. To arrange transportation答案:A6. In which currency is the price of oil typically quoted in international markets?A. USDB. EURC. GBPD. JPY答案:A7. What is the meaning of "T/T" in international trade transactions?A. Telex TransferB. Trust TransferC. Trade TransferD. Telegraphic Transfer答案:D8. Which of the following is a type of non-tariff barrier to trade?A. QuotasB. Import dutiesC. SubsidiesD. Embargoes答案:A9. What is the term used to describe the process of adjusting prices to reflect changes in exchange rates?A. Price adjustmentB. Currency fluctuationC. Exchange rate adjustmentD. Price stabilization答案:C10. What does "MOQ" stand for in the context of international trade?A. Minimum Order QuantityB. Maximum Order QuantityC. Market Order QuantityD. Merchandise Order Quantity答案:A二、填空题(每题2分,共20分)1. The ________ is the document that proves the ownership of goods in international trade.答案:Bill of Lading2. When goods are sold on a ________ basis, the seller bears all costs and risks until the goods are delivered to the buyer.答案:DDP3. A ________ is a formal request from a buyer to a sellerfor a specific product or service.答案:Purchase Order4. The ________ is a document that provides details about the goods being exported, including their description, quantity, and price.答案:Commercial Invoice5. In international trade, a ________ is a document that certifies the origin of the goods.答案:Certificate of Origin6. The ________ is a document that lists the types and quantities of goods being shipped, often used for customs clearance.答案:Packing List7. A ________ is a type of insurance that covers the risk of loss or damage to goods during transportation.答案:Marine Insurance8. The ________ is a document that shows the terms and conditions agreed upon by the buyer and seller for the saleof goods.答案:Sales Contract9. In international trade, a ________ is a document thatlists the goods being transported, their weight, and other relevant details.答案:Manifest10. The ________ is a document that provides proof of the quality, quantity, and condition of the goods at the time of shipment.答案:Inspection Certificate三、简答题(每题10分,共40分)1. Explain the difference between FOB and CIF terms in international trade.答案:FOB (Free On Board) means the seller's responsibility ends once the goods are loaded onto the ship, while CIF (Cost, Insurance and Freight) includes the seller's responsibilityfor the cost of the goods, insurance, and freight until they reach the destination port.2. What are the advantages and disadvantages of using aLetter of Credit in international trade?答案:Advantages include security of payment for the seller and assurance of goods for the buyer. Disadvantages include higher bank fees and potential delays in payment due todocumentation issues.3. Describe the process of negotiating a contract in international trade.答案:The process includes initial contact, exchange of information, negotiation of terms, drafting the contract, legal review, and final signing by both parties.4. What are the main factors that influence the choice of transportation mode in international trade?答案:Factors include cost, speed, reliability, cargo type, distance, and infrastructure availability.四、案例分析题(每题20分,共20分)A company has received an order for 1000 units of a product, with the following terms: EXW, payment by T/T, and delivery within 30 days. The company needs。

国家开放大学电大《商务英语4》试题及答案

有关考试的注意事项:一、考试时注意事项:1、考生参加闭卷考试,除携带2B铅笔、书写兰(黑)字迹的钢笔、圆珠笔或0.5mm签字笔、直尺、圆规、三角板、橡皮外(其他科目有特殊规定的除外),其它任何物品不准带入考场。

参加非闭卷考试的考生除携带必要的文具外,可携带该考试科目规定允许的相关资料。

严禁携带各种无限通讯工具、电子存储记忆录放设备以及涂改液、修正带等物品进入考场。

2、考试开始前15分钟考生凭学生证、考试通知单和身份证进入规定考场对号入座。

证件不全不允许进入考场(有听力考试的科目,磁带只放一遍;且磁带播放期间迟到者不允许进入考场)考场编排贴在一层大厅内。

考生根据考试通知单认真查看所考科目的考场号、座位号,找到对应教室,对号入座。

试卷登分以座位号进行盲登,故要求考生一定不要做错考场及相应的座位。

3、考生答卷前,在试卷密封线内填写指定内容(如姓名、学号等),考场座位号填写在试卷中上的方框内。

凡漏写姓名、学生证号、座位号,或字迹模糊无法辨认,以及在试卷密封线外填写学生证号、姓名或作其他标记的试卷一律按零分处理。

4、答题时不得使用红笔或铅笔(除填涂答题卡外)答题,或一份试卷使用多种颜色的笔答题,不得使用修改液(带)、胶带纸、不得在试卷上做任何和答题无关的标记,不允许把试卷当草稿纸,上述任何情况存在的话,试卷均以零分处理。

5、考试通知单上显示有同一时间考多科目的学生为留考生。

通知单上显示“留考”的科目为滞后考试科目,应先考通知单上未显示“∨”的科目。

凡留考考生必须服从监考人员的安排,不得与其他考生或场外人员接触。

二、参加半开卷考试的考生注意:(1.)考生只能携带盖有分校章的‘一页纸’进入考场,考前2周发到学生手里。

(2.)每位考生每一次考试只发一张,考生必须妥善保存此页纸,若将其丢失或破损等,不能补发。

(3.)此专用纸只能由考生用钢等、圆珠笔手写,可正反面书写,并认真填写完整专用纸上学生基本信息。

(4.)参加考试时,考生携带此专用纸经监考人员确认后进入考场。

管理会计英文版答案

CHAPTER 1Managerial Accounting, the Business Organization, andProfessional Ethics1-A1 Solution:Information is often useful for more than one function, so the following classifications for each activity are not definitive but serve as a starting point for discussion:1. Scorekeeping. A depreciation schedule is used in preparing financialstatements to report the results of activities.2. Problem solving. Helps a manager assess the impact of a purchase decision.3. Scorekeeping. Reports on the results of an operation. Could also beattention directing if scrap is an area that might require management attention.4. Attention directing. Focuses attention on areas that need attention.5. Attention directing. Helps managers learn about the information contained ina performance report.6. Scorekeeping. The statement reports what has happened. Could also beattention directing if the report highlights a problem or issue.7. Problem solving. Assuming the cost comparison is to help the managerdecide between two alternatives, this is problem solving.8. Attention directing. Variances point out areas where results differ fromexpectations. Interpreting them directs attention to possible causes of thedifferences.9. Problem solving. Aids a decision about where to make parts.10. Attention directing and problem solving. Budgeting involves makingdecisions about planned activities -- hence, aiding problem solving. Budgets also direct attention to areas of opportunity or concern --hence, directingattention. Reporting against the budget also has a scorekeeping dimension.1-A2 Solution:1. Budgeted Actual DeviationsAmounts Amounts or Variances Room rental $ 140 $ 140 $ 0Food 700 865 165UEntertainment 600 600 0Decorations 220 260 40UTotal $1,660 $1,865 $205U 2. Because of the management by exception rule, room rental and entertainmentrequire no explanation. The actual expenditure for food exceeded the budget by $165. Of this $165, $150 is explained by attendance of 15 persons morethan budgeted (at a budget of $10 per person for food) and $15 is explained by expenditures above $10 per person.Actual expenditures for decorations were $40 more than the budget. Thedecorations committee should be asked for an explanation of the excessexpenditures.1-29 Solution:1. Controller. Financial statements are generally produced by the controller'sdepartment.2. Controller. Advising managers aids operating decisions.3. Controller. Advice on cost analysis aids managers' operating decisions.4. Treasurer. Analysts affect the company's ability to raise capital, which is theresponsibility of the treasurer.5. Treasurer. Financing the business is the responsibility of the treasurer.6. Controller. Tax returns are part of the accounting process overseen by thecontroller.7. Treasurer. Insurance, as with other risk management activities, is usually theresponsibility of the treasurer.8. Treasurer. Allowing credit is a financial decision.CHAPTER 2INTRODUCTION TO COST BEHAVIOR AND COST-VOLUME RELATIONSHIPS2-A3 Solution:The following format is only one of many ways to present a solution. This situation is reallya demonstration of "sensitivity analysis," whereby a basic solution is tested to see how much it is affected by changes in critical factors. Much discussion can ensue, particularly about the finalthree changes.The basic contribution margin per revenue mile is $1.50 - $1.30 = $.20(1) (2) (3) (4) (5)(1)×(2) (3)-(4)Revenue Cont ri buti on To talMi l es Margi n Pe r Cont ri buti on Fi xed NetSol d Revenue Mi l e Margi n Expen se s In co me 1. 800,000$.20$160,000$120,000$ 40,0002. (a) 800,000.35280,000120,000160,000(b) 880,000.20176,000120,00056,000(c) 800,000.0756,000120,000(64,000)(d) 800,000.20160,000132,00028,000(e) 840,000.17142,800120,00022,800(f) 720,000.25180,000120,00060,000(g) 840,000.20168,000132,00036,0002-B2 Solution:1. $2,300 ÷ ($30 - $10) = 115 child-days or 115 × $30 = $3,450 revenue dollars.2. 176 × ($30 - $10) - $2,300 = $3,520 - $2,300 = $1,2203. a. 198 × ($30 - $10) - $2,300 = $3,960 - $2,300 = $1,660 or (22 × $20) + $1,220 = $440 + $1,220 = $1,660 b. 176 × ($30 - $12) - $2,300 = $3,168 - $2,300 = $868 or $1,220 - ($2 × 176) = $868 c. $1,220 - $220 = $1,000d. [(9.5 × 22) × ($30 - $10)] - ($2,300 + $300) = $4,180 - $2,600 = $1,580e.[(7 × 22) × ($33 - $10)] - $2,300 = $3,542 - $2,300 = $1,2422-B 3 So lu tio n :1.$16)($20$5,000- = $4$5,000= 1,250 units2. Contribution margin ratio:($40,000)$30,000)($40,000- = 25%$8,000 ÷ 25% = $32,0003.$14)($30$7,000)($33,000-+ = $16$40,000 = 2,500 units4. ($50,000 - $20,000)(110%) = $33,000 contribution margin;$33,000 - $20,000 = $13,0005. New contribution margin:$40 - ($30 - 20% of $30)= $40 - ($30 - $6) = $16;New fixed expenses: $80,000 × 110% = $88,000;$16$20,000)($88,000+ = $16$108,000 = 6,750 units2-27 Soluti on:2-38Sol uti on:1. 100% Full 50% FullRoom revenue @ $50 $1,825,000 a$ 912,500 bVariable costs @ $10 365,000 182,500Contribution margin 1,460,000 730,000Fixed costs 1,200,000 1,200,000Net income (loss) $ 260,000 $ (470,000)a 100 × 365 = 36,500 rooms per year36,500 × $50 = $1,825,000b50% of $1,825,000 = $912,5002. Let N = number of rooms$50N -$10N - $1,200,000 = 0N = $1,200,000 ÷ $40 = 30,000 rooms Percentage occupancy = 30,000 ÷ 36,500 = 82.2%2-40 Solution:1. Let R = pints of raspberries and 2R = pints of strawberriessales - variable expenses - fixed expenses = zero net income$1.10(2R) + $1.45(R) - $.75(2R) - $.95(R) - $15,600 = 0$2.20R + $1.45R - $1.50R - $.95R -$15,600 = 0$1.2R - $15,600 = 0 R = 13,000 pints of raspberries2R = 26,000 pints of strawberries2. Let S = pints of strawberries($1.10 - $.75) × S - $15,600 = 0.35S - $15,600 = 0S = 44,571 pints of strawberries3. Let R = pints of raspberries($1.45 - $.95) × R - $15,600 = 0$.50R - $15,600 = 0R = 31,200 pints of raspberries2-42 Solution:Several variations of the following general approach are possible:Sales - Variable expenses - Fixed expenses = Target after-tax net income 1 - tax rateS - .75S - $440,000 =.3)-(1$84,000.25S = $440,000 + $120,000 3-A1 Solution:Some of these answers are controversial, and reasonable cases can be built for alternative classifications. Class discussion of these answers should lead to worthwhile disagreements about anticipated cost behavior with regard to alternative cost drivers.1. (b) Discretionary fixed cost.2. (e) Step cost.3. (a) Purely variable cost with respect to revenue.4. (a) Purely variable cost with respect to miles flown.5. (d) Mixed cost with respect to miles driven.6. (c) Committed fixed cost.7. (b) Discretionary fixed cost.8. (c) Committed fixed cost.9. (a) Purely variable cost with respect to cases of Coca-Cola.10. (b) Discretionary fixed cost.11. (b) Discretionary fixed cost.3-A2 Solution:1. Support costs based on 60% of the cost of materials:Sign A Sign B Direct materials cost $400 $200 Support cost (60% of m ater ial s c o st) $240 $120 Support costs based on $50 per power tool operation:Sign A Sign B Power tool operations 3 6 Support cost $150 $300 2. If the activity analysis is reliable, by using the current method, Evergreen Signs is predicting too much cost for signs that use few power tool operations and is predicting too little cost for signs that use many power tool operations. As a result the company could be losing jobs that require few power tool operations because its bids are too high -- it could afford to bid less on these jobs. Conversely, the company could be getting too many jobs that require many power tool operations, because its bids are too low -- given what the "true" costs will be, the company cannot afford these jobs at those prices. Either way, the sign business could be more profitable if the owner better understood and used activity analysis. Evergreen Signs would be advised to adopt the activity-analysis recommendation, but also to closely monitor costs to see if the activity-analysis predictions of support costs are accurate.3-B2 Solution:Board Z15 Board Q52Mark-up method:Material cost $40 $60Support costs (100%) $40 $60Activity analysis method:Manual operations 15 7Support costs (@$4) $60 $28The support costs are different because different cost behavior is assumed by the two methods. If the activity analyses are reliable, then boards with few manual operations are overcosted with the markup method, and boards with many manual operatio ns are undercosted with the markup method.3-B3 Solution:Variable cost per machine hour =Change in Repair Cost Change in Machine Hours= (P260,000,000 - P200,000,000) (12,000 - 8,000)= P15,000 per machine hourFixed cost per month = total cost - variable cost= P260,000,000 - P15,000 x 12,000= P260,000,000 - P180,000,000= P 80,000,000 per monthor = P200,000,000 - P15,000 x 8,000= P200,000,000 - P120,000,000= P 80,000,000 per month3-32 Solution:1. Machining labor: G, number of units completed or labor hours2. Raw material: B, units produced; could also be D if the company’s purchases do not affect the price of the raw material.3. Annual wage: C or E (depending on work levels), labor hours4. Water bill: H, gallons used5. Quantity discounts: A, amount purchased6. Depreciation: E, capacity7. Sheet steel: D, number of implements of various types8. Salaries: F, number of solicitors9. Natural gas bill: C, energy usage3-34 Solution:1. 2001 2002Sales revenues $57 $116Less: Operating income (loss) (19) 18Operating expenses $76 $ 982. Change in operating expenses ÷ Change in revenues = Variable cost percentage($98 - $76) ÷ ($116 - $57) = $22 ÷ $59 = .37 or 37%Fixed cost = Total cost – Variable cost= $76 - .37 × $57= $55or= $98 - .37 × $116= $55Cost function = $55 + .37 × Sales revenue3. Because fixed costs to not change, the entire additional total contributionmargin is added to operating income. The $57 sales revenue in 2001generated a total contribution margin of $57 × (1 - .37) = $36, which was $19 short of covering the $55 of fixed cost. But the additional $59 of salesrevenue in 2002 generated a total contribution margin of $59 × (1 - .37) = $37 that could go directly to operating income because there was no increase infixed costs. It wiped out the $19 operating loss and left $18 of operatingincome.3-35 Solution:1. Fuel costs: $.40 × 16,000 miles per month = $6,400 per month.2. Equipment rental: $5,000 × 7 × 3 = $105,000 for seven pieces of equipment for three months3. Ambulance and EMT cost: $1,200 × (2,400/200) = $1,200 × 12 = $14,4004. Purchasing: $7,500 + $5 × 4,000 = $27,500 for the month.3-36 Solution:There may be some disagreement about these classifications, but reasons for alternative classifications should be explored.Cost Discretionary Committed Advertising $22,000Depreciation $ 47,000 Company health insurance 21,000 Management salaries 85,000 Payment of long-term debt 50,000 Property tax 32,000 Grounds maintenance 9,000Office remodeling 21,000Research and development 46,000Totals $98,000 $235,000。

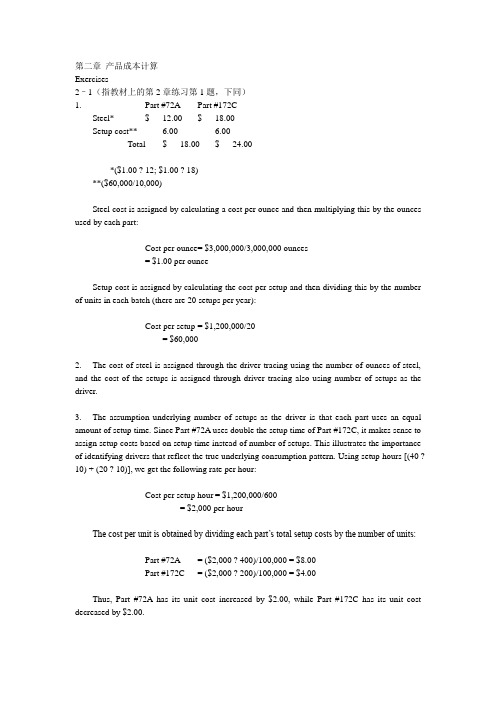

《管理会计》英文版课后习题答案

第二章产品成本计算Exercises2–1(指教材上的第2章练习第1题,下同)1. Part #72A Part #172CSteel* $ 12.00 $ 18.00Setup cost** 6.00 6.00Total $ 18.00 $ 24.00*($1.00 ? 12; $1.00 ? 18)**($60,000/10,000)Steel cost is assigned by calculating a cost per ounce and then multiplying this by the ounces used by each part:Cost per ounce= $3,000,000/3,000,000 ounces= $1.00 per ounceSetup cost is assigned by calculating the cost per setup and then dividing this by the number of units in each batch (there are 20 setups per year):Cost per setup = $1,200,000/20= $60,0002. The cost of steel is assigned through the driver tracing using the number of ounces of steel, and the cost of the setups is assigned through driver tracing also using number of setups as the driver.3. The assumption underlying number of setups as the driver is that each part uses an equal amount of setup time. Since Part #72A uses double the setup time of Part #172C, it makes sense to assign setup costs based on setup time instead of number of setups. This illustrates the importance of identifying drivers that reflect the true underlying consumption pattern. Using setup hours [(40 ?10) + (20 ? 10)], we get the following rate per hour:Cost per setup hour = $1,200,000/600= $2,000 per hourThe cost per unit is obtained by dividing each part’s total setup costs by the number of units:Part #72A = ($2,000 ? 400)/100,000 = $8.00Part #172C = ($2,000 ? 200)/100,000 = $4.00Thus, Part #72A has its unit cost increased by $2.00, while Part #172C has its unit cost decreased by $2.00.problems2–51. Nursing hours required per year: 4 ? 24 hours ? 364 days* = 34,944*Note: 364 days = 7 days ? 52 weeksNumber of nurses = 34,944 hrs./2,000 hrs. per nurse = 17.472Annual nursing cost = (17 ? $45,000) + $22,500= $787,500Cost per patient day = $787,500/10,000 days= $78.75 per day (for either type of patient)2. Nursing hours act as the driver. If intensive care uses half of the hours and normal care the other half, then 50 percent of the cost is assigned to each patient category. Thus, the cost per patient day by patient category is as follows:Intensive care = $393,750*/2,000 days= $196.88 per dayNormal care = $393,750/8,000 days= $49.22 per day*$525,000/2 = $262,500The cost assignment reflects the actual usage of the nursing resource and, thus, should be more accurate. Patient days would be accurate only if intensive care patients used the same nursing hours per day as normal care patients.3. The salary of the nurse assigned only to intensive care is a directly traceable cost. To assign the other nursing costs, the hours of additional usage would need to be measured. Thus, both direct tracing and driver tracing would be used to assign nursing costs for this new setting.2–61. Bella Obra CompanyStatement of Cost of Services SoldFor the Year Ended June 30, 2006Direct materials:Beginning inventory $ 300,000Add: Purchases 600,000Materials available $ 900,000Less: Ending inventory 450,000*Direct materials used $ 450,000Direct labor 12,000,000Overhead 1,500,000Total service costs added $ 13,950,000Add: Beginning work in process 900,000Total production costs $ 14,850,000Less: Ending work in process 1,500,000Cost of services sold $ 13,350,000*Materials available less materials used2. The dominant cost is direct labor (presumably the salaries of the 100 professionals). Although labor is the major cost of providing many services, it is not always the case. For example, the dominant cost for some medical services may be overhead (e.g., CAT scans). In some services, the dominant cost may be materials (e.g., funeral services).3. Bella Obra CompanyIncome StatementFor the Year Ended June 30, 2006Sales $ 21,000,000Cost of services sold 13,350,000Gross margin $ 7,650,000Less operating expenses:Selling expenses $ 900,000Administrative expenses 750,000 1,650,000Income before income taxes $ 6,000,0004. Services have four attributes that are not possessed by tangible products: (1) intangibility, (2) perishability, (3) inseparability, and (4) heterogeneity. Intangibility means that the buyers of services cannot see, feel, hear, or taste a service before it is bought. Perishability means that services cannot be stored. This property affects the computation in Requirement 1. Inability to store services means that there will never be any finished goods inventories, thus making the cost of services produced equivalent to cost of services sold. Inseparability simply means that providers and buyers of services must be in direct contact for an exchange to take place. Heterogeneity refers to the greater chance for variation in the performance of services than in the production of tangible products.2–71. Direct materials:Magazine (5,000 ? $0.40) $ 2,000Brochure (10,000 ? $0.08) 800 $ 2,800Direct labor:Magazine [(5,000/20) ? $10] $ 2,500Brochure [(10,000/100) ? $10] 1,000 3,500Manufacturing overhead:Rent $ 1,400Depreciation [($40,000/20,000) ? 350*] 700Setups 600Insurance 140Power 350 3,190Cost of goods manufactured $ 9,490*Production is 20 units per printing hour for magazines and 100 units per printing hour for brochures, yielding monthly machine hours of 350 [(5,000/20) + (10,000/100)]. This is also monthly labor hours, as machine labor only operates the presses.2. Direct materials $ 2,800Direct labor 3,500Total prime costs $ 6,300Magazine:Direct materials $ 2,000Direct labor 2,500Total prime costs $ 4,500Brochure:Direct materials $ 800Direct labor 1,000Total prime costs $ 1,800Direct tracing was used to assign prime costs to the two products.3. Total monthly conversion cost:Direct labor $ 3,500Overhead 3,190Total $ 6,690Magazine:Direct labor $ 2,500Overhead:Power ($1 ? 250) $ 250Depreciation ($2 ? 250) 500Setups (2/3 ? $600) 400Rent and insurance ($4.40 ? 250 DLH)* 1,100 2,250Total $ 4,750Brochure:Direct labor $ 1,000Overhead:Power ($1 ? 100) $ 100Depreciation ($2 ? 100) 200Setups (1/3 ? $600) 200Rent and insurance ($4.40 ? 100 DLH)* 440 940Total $ 1,940*Rent and insurance cannot be traced to each product so the costs are assigned using direct labor hours: $1,540/350 DLH = $4.40 per direct labor hour. The other overhead costs are traced according to their usage. Depreciation and power are assigned by using machine hours (250 for magazines and 100 for brochures): $350/350 = $1.00 per machine hour for power and $40,000/20,000 = $2.00 per machine hour for depreciation. Setups are assigned according to the time required. Since magazines use twice as much time, they receive twice the cost: Letting X = the pro?portion of setup time used for brochures, 2X + X = 1 implies a cost assignment ratio of 2/3 for magazines and 1/3 for brochures.Exercises3–11. Resource Total Cost Unit CostPlastic1 $ 10,800 $0.027Direct labor andvariable overhead2 8,000 0.020Mold sets3 20,000 0.050Other facility costs4 10,000 0.025Total $ 48,800 $0.12210.90 ? $0.03 ? 400,000 = $10,800; $10,800/400,000 = $0.0272$0.02 ? 400,000 = $8,000; $8,000/400,000 = $0.023$5,000 ? 4 quarters = $20,000; $20,000/400,000 = $0.054$10,000; $10,000/400,000 = $0.0252. Plastic, direct labor, and variable overhead are flexible resources; molds and other facility costs are committed resources. The cost of plastic, direct labor, and variable overhead are strictly variable. The cost of the molds is fixed for the particular action figure being produced; it is a step cost for the production of action figures in general. Other facility costs are strictly fixed.3–3High (1,400, $7,950); Low (700, $5,150)V = ($7,950 – $5,150)/(1,400 – 700)= $2,800/700 = $4 per oil changeF = $5,150 – $4(700)= $5,150 – $2,800 = $2,350Cost = $2,350 + $4 (oil changes)Predicted cost for January = $2,350 + $4(1,000) = $6,350problems3–61. High (1,700, $21,000); Low (700, $15,000)V = (Y2 – Y1)/(X2 – X1)= ($21,000 – $15,000)/(1,700 – 700) = $6 per receiving orderF = Y2 – VX2= $21,000 – ($6)(1,700) = $10,800Y = $10,800 + $6X2. Output of spreadsheet regression routine with number of receiving orders as the independent variable:Constant 4512.98701298698Std. Err. of Y Est. 3456.24317476605R Squared 0.633710482694768No. of Observations 10Degrees of Freedom 8X Coefficient(s) 13.3766233766234Std. Err. of Coef. 3.59557461331427V = $13.38 per receiving order (rounded)F = $4,513 (rounded)Y = $4,513 + $13.38XR2 = 0.634, or 63.4%Receiving orders explain about 63.4 percent of the variability in receiving cost, providing evidence that Tracy’s choice o f a cost driver is reasonable. However, other drivers may need to be considered because 63.4 percent may not be strong enough to justify the use of only receiving orders.3. Regression with pounds of material as the independent variable:Constant 5632.28109733183Std. Err. of Y Est. 2390.10628259277R Squared 0.824833789433823No. of Observations 10Degrees of Freedom 8X Coefficient(s) 0.0449642991356633Std. Err. of Coef. 0.0073259640055344V = $0.045 per pound of material delivered (rounded)F = $5,632 (rounded)Y = $5,632 + $0.045XR2 = 0.825, or 82.5%Pounds of material delivered explains about 82.5 percent of the variability in receiving cost. This is a better result than that of the receiving orders and should convince Tracy to try multiple regression.4. Regression routine with pounds of material and number of receiving orders as the independent variables:Constant 752.104072925631Std. Err. of Y Est. 1350.46286973443R Squared 0.951068418023306No. of Observations 10Degrees of Freedom 7X Coefficient(s) 0.0333883151096915 7.14702865269395Std. Err. of Coef. 0.00495524841198368 1.68182916088492V1 = $0.033 per pound of material delivered (rounded)V2 = $7.147 per receiving order (rounded)F = $752 (rounded)Y = $752 + $0.033a + $7.147bR2 = 0.95, or 95%Multiple regression with both variables explains 95 percent of the variability in receiving cost. This is the best result.5–21. Job #57 Job #58 Job #59Balance, 7/1 $ 22,450 $ 0 $ 0Direct materials 12,900 9,900 35,350Direct labor 20,000 6,500 13,000Applied overhead:Power 750 600 3,600Material handling 1,500 300 6,000Purchasing 250 1,000 250Total cost $ 57,850 $ 18,300 $ 58,2002. Ending balance in Work in Process = Job #58 = $18,3003. Ending balance in Finished Goods = Job #59 = $58,2004. Cost of Goods Sold = Job #57 = $57,850problems5–31. Overhead rate = $180/$900 = 0.20 or 20% of direct labor dollars.(This rate was calculated using information from the Ladan job; however, the Myron and Coe jobs would give the same answer.)2. Ladan Myron Coe Walker WillisBeginning WIP $ 1,730 $1,180 $2,500 $ 0 $ 0Direct materials 400 150 260 800 760Direct labor 800 900 650 350 900Applied overhead 160 180 130 70 180Total $ 3,090 $2,410 $3,540 $ 1,220 $ 1,840Note: This is just one way of setting up the job-order cost sheets. You might prefer to keep the detail on the materials, labor, and overhead in beginning inventory costs.3. Since the Ladan and Myron jobs were completed, the others must still be in process. Therefore, the ending balance in Work in Process is the sum of the costs of the Coe, Walker, and Willis jobs.Coe $3,540Walker 1,220Willis 1,840Ending Work in Process $6,600Cost of Goods Sold = Ladan job + Myron job = $3,090 + $2,410 = $5,5004. Naman CompanyIncome StatementFor the Month Ended June 30, 20XXSales (1.5 ? $5,500) $8,250Cost of goods sold 5,500Gross margin $2,750Marketing and administrative expenses 1,200Operating income $1,5505–201. Overhead rate = $470,000/50,000 = $9.40 per MHr2. Department A: $250,000/40,000 = $6.25 per MHrDepartment B: $220,000/10,000 = $22.00 per MHr3. Job #73 Job #74Plantwide:70 ? $9.40 = $658 70 ? $9.40 = $658Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $22 1,100.00 20 ? $22 440.00$ 1,225.00 $ 752.50Department B appears to be more overhead intensive, so jobs spending more time in Department B ought to receive more overhead. Thus, departmental rates provide more accuracy.4. Plantwide rate: $250,000/40,000 = $6.25Department B: $62,500/10,000 = $6.25Job #73 Job #74Plantwide:70 ? $6.25 = $437.50 70 ? $6.25 = $437.50Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $6.25 312.50 20 ? $6.25 125.00$ 437.50 $ 437.50Assuming that machine hours is a good cost driver, the departmental rates reveal that overhead consumption is the same in each department. In this case, there is no need for departmental rates, and a plantwide rate is sufficient.5–41. Overhead rate = $470,000/50,000 = $9.40 per MHr2. Department A: $250,000/40,000 = $6.25 per MHrDepartment B: $220,000/10,000 = $22.00 per MHr3. Job #73 Job #74Plantwide:70 ? $9.40 = $658 70 ? $9.40 = $658Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $22 1,100.00 20 ? $22 440.00$ 1,225.00 $ 752.50Department B appears to be more overhead intensive, so jobs spending more time in Department B ought to receive more overhead. Thus, departmental rates provide more accuracy.4. Plantwide rate: $250,000/40,000 = $6.25Department B: $62,500/10,000 = $6.25Job #73 Job #74Plantwide:70 ? $6.25 = $437.50 70 ? $6.25 = $437.50Departmental:20 ? $6.25 $ 125.00 50 ? $6.25 $ 312.5050 ? $6.25 312.50 20 ? $6.25 125.00$ 437.50 $ 437.50Assuming that machine hours is a good cost driver, the departmental rates reveal that overhead consumption is the same in each department. In this case, there is no need for departmental rates, and a plantwide rate is sufficient.5–51. Last year’s unit-based overhead rate = $50,000/10,000 = $5This year’s unit-based overhead rate = $100,000/10,000 = $10Last Year This YearBike cost:2 ? $20 $ 40 $ 403 ? $12 36 36Overhead:5 ? $5 255 ? $10 50Total $101 $126Price last year = $101 ? 1.40 = $141.40/dayPrice this year = $126 ? 1.40 = $176.40/dayThis is a $35 increase over last year, nearly a 25 percent increase. No doubt the Carsons arenot pleased and would consider looking around for other recreational possibilities.2. Purchasing rate = $30,000/10,000 = $3 per purchase orderPower rate = $20,000/50,000 = $0.40 per kilowatt hourMaintenance rate = $6,000/600 = $10 per maintenance hourOther rate = $44,000/22,000 = $2 per DLHBike Rental Picnic CateringPurchasing$3 ? 7,000 $21,000$3 ? 3,000 $ 9,000Power$0.40 ? 5,000 2,000$0.40 ? 45,000 18,000Maintenance$10 ? 500 5,000$10 ? 100 1,000Other$2 ? 11,000 22,000 22,000Total overhead $50,000 $50,0003. This year’s bike rental overhead rate = $50,000/10,000 = $5Carson rental cost = (2 ? $20) + (3 ? $12) + (5 ? $5) = $101Price = 1.4 ? $101 = $141.40/day4. Catering rate = $50,000/11,000 = $4.55* per DLHCost of Estes job:Bike rental rate (2 ? $7.50) $15.00Bike conversion cost (2 ? $5.00) 10.00Catering materials 12.00Catering conversion (1 ? $4.55) 4.55Total cost $41.55*Rounded5. The use of ABC gives Mountain View Rentals a better idea of the types and costs of activities that are used in their business. Adding Level 4 bikes will increase the use of the most expensive activities, meaning that the rental rate will no longer be an average of $5 per rental day. Mountain View Rentals might need to set a Level 4 price based on the increased cost of both the bike and conversion cost.分步成本法6–11. Cutting Sewing PackagingDepartment Department DepartmentDirect materials $5,400 $ 900 $ 225Direct labor 150 1,800 900Applied overhead 750 3,600 900Transferred-in cost:From cutting 6,300From sewing 12,600Total manufacturing cost $6,300 $12,600 $14,6252. a. Work in Process—Sewing 6,300Work in Process—Cutting 6,300b. Work in Process—Packaging 12,600Work in Process—Sewing 12,600c. Finished Goods 14,625Work in Process—Packaging 14,625 3. Unit cost = $14,625/600 = $24.38* per pair6–21. Units transferred out: 27,000 + 33,000 – 16,200 = 43,8002. Units started and completed: 43,800 – 27,000 = 16,8003. Physical flow schedule:Units in beginning work in process 27,000Units started during the period 33,000Total units to account for 60,000Units started and completed 16,800Units completed from beginning work in process 27,000Units in ending work in process 16,200Total units accounted for 60,0004. Equivalent units of production:Materials ConversionUnits completed 43,800 43,800Add: Units in ending work in process:(16,200 ? 100%) 16,200(16,200 ? 25%) 4,050 Equivalent units of output 60,000 47,8506–31. Physical flow schedule:Units to account for:Units in beginning work in process 80,000Units started during the period 160,000Total units to account for 240,000Units accounted for:Units completed and transferred out:Started and completed 120,000From beginning work in process 80,000 200,000 Units in ending work in process 40,000Total units accounted for 240,0002. Units completed 200,000Add: Units in ending WIP ? Fraction complete(40,000 ? 20%) 8,000Equivalent units of output 208,0003. Unit cost = ($374,400 + $1,258,400)/208,000 = $7.854. Cost transferred out = 200,000 ? $7.85 = $1,570,000Cost of ending WIP = 8,000 ? $7.85 = $62,8005. Costs to account for:Beginning work in process $ 374,400Incurred during June 1,258,400Total costs to account for $ 1,632,800Costs accounted for:Goods transferred out $ 1,570,000Goods in ending work in process 62,800Total costs accounted for $ 1,632,8006–31、Units t0 account for:Units in beginning work in process(25% completed) 10000Units started during the period 70000 Total units to account for 80000 Units accounted forUnits completed and transferred outStarted and completed 50000From beginning work in process 10000 60000 Units in ending work in process(60% completed) 20000 Total units accounted for 80000 2、60000+20000×60%=72000(units)3、Unit cost for materials:($/unit)Unit cost for convension:($/unit)Total unit cost:5+1.13=6.13($/unit)4、The cost of units of transferred out:60000×6.13=367800($)The cost of units of ending work in process:20000×5+20000×20%×1.13=113560($)作业成本法4–21. Predetermined rates:Drilling Department: Rate = $600,000/280,000 = $2.14* per MHrAssembly Department: Rate = $392,000/200,000= $1.96 per DLH*Rounded2. Applied overhead:Drilling Department: $2.14 ? 288,000 = $616,320Assembly Department: $1.96 ? 196,000 = $384,160Overhead variances:Drilling Assembly TotalActual overhead $602,000 $ 412,000 $ 1,014,000Applied overhead 616,320 384,160 1,000,480Overhead variance $ (14,320) over $ 27,840 under $ 13,5203. Unit overhead cost = [($2.14 ? 4,000) + ($1.96 ? 1,600)]/8,000= $11,696/8,000= $1.46**Rounded4–31. Yes. Since direct materials and direct labor are directly traceable to each product, their cost assignment should be accurate.2. Elegant: (1.75 ? $9,000)/3,000 = $5.25 per briefcaseFina: (1.75 ? $3,000)/3,000 = $1.75 per briefcaseNote: Overhead rate = $21,000/$12,000 = $1.75 per direct labor dollar (or 175 percent of direct labor cost).There are more machine and setup costs assigned to Elegant than Fina. This is clearly a distortion because the production of Fina is automated and uses the machine resources much more than the handcrafted Elegant. In fact, the consumption ratio for machining is 0.10 and 0.90 (using machine hours as the measure of usage). Thus, Fina uses nine times the machining resources as Elegant. Setup costs are similarly distorted. The products use an equal number of setups hours. Yet, if direct labor dollars are used, then the Elegant briefcase receives three times more machining costs than the Fina briefcase.3. Overhead rate = $21,000/5,000= $4.20 per MHrElegant: ($4.20 ? 500)/3,000 = $0.70 per briefcaseFina: ($4.20 ? 4,500)/3,000 = $6.30 per briefcaseThis cost assignment appears more reasonable given the relative demands each product places on machine resources. However, once a firm moves to a multiproduct setting, using only one activity driver to assign costs will likely produce product cost distortions. Products tend to make different demands on overhead activities, and this should be reflected in overhead cost assignments. Usually, this means the use of both unit- and nonunit-level activity drivers. In this example, there is a unit-level activity (machining) and a nonunit-level activity (setting up equipment). The consumption ratios for each (using machine hours and setup hours as the activity drivers) are as follows:Elegant FinaMachining 0.10 0.90 (500/5,000 and 4,500/5,000)Setups 0.50 0.50 (100/200 and 100/200)Setup costs are not assigned accurately. Two activity rates are needed—one based on machine hours and the other on setup hours:Machine rate: $18,000/5,000 = $3.60 per MHrSetup rate: $3,000/200 = $15 per setup hourCosts assigned to each product:Machining: Elegant Fina$3.60 ? 500 $ 1,800$3.60 ? 4,500 $ 16,200Setups:$15 ? 100 1,500 1,500Total $ 3,300 $ 17,700Units ÷3,000 ÷3,000Unit overhead cost $ 1.10 $ 5.904:Elegant Unit overhead cost:[9000+3000+18000*500/5000+3000/2]/3000=$5.1 Fina Unit overhead cost:[3000+3000+18000*4500/5000+3000/2]/3000=$7.94–51. Deluxe Percent Regular PercentPrice $900 100% $750 100%Cost 576 64 600 80Unit gross profit $324 36% $150 20%Total gross profit:($324 ? 100,000) $32,400,000($150 ? 800,000) $120,000,0002. Calculation of unit overhead costs:Deluxe gularUnit-level:Machining:$200 ? 100,000 $20,000,000$200 ? 300,000 $60,000,000Batch-level:Setups:$3,000 ? 300 900,000$3,000 ? 200 600,000Packing:$20 ? 100,000 2,000,000$20 ? 400,000 8,000,000Product-level:Engineering:$40 ? 50,000 2,000,000$40 ? 100,000 4,000,000Facility-level:Providing space:$1 ? 200,000 200,000$1 ? 800,000 800,000Total overhead $25,100,000 $73,400,000Units ÷100,000 ÷800,000Overhead per unit $251 $91.75Deluxe Percent Regular PercentPrice $900 100% $750.00 100%Cost 780* 87*** 574.50** 77***Unit gross profit $120 13%*** $175.50 23%***Total gross profit:($120 ? 100,000) $12,000,000($175.50 ? 800,000) $140,400,000*$529 + $251**$482.75 + $91.753. Using activity-based costing, a much different picture of the deluxe and regular products emerges. The regular model appears to be more profitable. Perhaps it should be emphasized.4–61. JIT Non-JITSalesa $12,500,000 $12,500,000Allocationb 750,000 750,000a$125 ? 100,000, where $125 = $100 + ($100 ? 0.25), and 100,000 is the average order size times the number of ordersb0.50 ? $1,500,0002. Activity rates:Ordering rate = $880,000/220 = $4,000 per sales orderSelling rate = $320,000/40 = $8,000 per sales callService rate = $300,000/150 = $2,000 per service callJIT Non-JITOrdering costs:$4,000 ? 200 $ 800,000$4,000 ? 20 $ 80,000Selling costs:$8,000 ? 20 160,000$8,000 ? 20 160,000Service costs:$2,000 ? 100 200,000$2,000 ? 50 100,000Total $1,160,000 $340,0 0For the non-JIT customers, the customer costs amount to $750,000/20 = $37,500 per order under the original allocation. Using activity assign?ments, this drops to $340,000/20 = $17,000 per order, a difference of $20,500 per order. For an order of 5,000 units, the order price can be decreased by $4.10 per unit without affecting customer profitability. Overall profitability will decrease, however, unless the price for orders is increased to JIT customers.3. It sounds like the JIT buyers are switching their inventory carrying costs to Emery without any significant benefit to Emery. Emery needs to increase prices to reflect the additional demands on customer-support activities. Furthermore, additional price increases may be needed to reflectthe increased number of setups, purchases, and so on, that are likely occurring inside the plant. Emery should also immediately initiate discussions with its JIT customers to begin negotiations for achieving some of the benefits that a JIT supplier should have, such as long-term contracts. The benefits of long-term contracting may offset most or all of the increased costs from the additional demands made on other activities.4–71. Supplier cost:First, calculate the activity rates for assigning costs to suppliers:Inspecting components: $240,000/2,000 = $120 per sampling hourReworking products: $760,500/1,500 = $507 per rework hourWarranty work: $4,800/8,000 = $600 per warranty hourNext, calculate the cost per component by supplier:Supplier cost:Vance FoyPurchase cost:$23.50 ? 400,000 $ 9,400,000$21.50 ? 1,600,000 $ 34,400,000Inspecting components:$120 ? 40 4,800$120 ? 1,960 235,200Reworking products:$507 ? 90 45,630$507 ? 1,410 714,870Warranty work:$600 ? 400 240,000$600 ? 7,600 4,560,000Total supplier cost $ 9,690,430 $ 39,910,070Units supplied ÷400,000 ÷1,600,000Unit cost $ 24.23* $ 24.94**RoundedThe difference is in favor of Vance; however, when the price concession is considered, the cost of Vance is $23.23, which is less than Foy’s component. Lumus should accept the contractual offer made by Vance.4–7 Concluded2. Warranty hours would act as the best driver of the three choices. Using this driver, the rate is $1,000,000/8,000 = $125 per warranty hour. The cost assigned to each component would be:Vance FoyLost sales:$125 ? 400 $ 50,000$125 ? 7,600 $ 950,000$ 50,000 $ 950,000Units supplied ÷400,000 ÷1,600,000Increase in unit cost $ 0.13* $ 0.59**Rounded$0.075 per unitCategory II: $45/1,000 = $0.045 per unitCategory III: $45/1,500 = $0.03 per unitCategory I, which has the smallest batches, is the most undercosted of the three categories. Furthermore, the unit ordering cost is quite high relative to Category I’s selling price (9 to 15 percent of the selling price). This suggests that something should be done to reduce the order-filling costs.3. With the pricing incentive feature, the average order size has been increased to 2,000 units for all three product families. The number of orders now processed can be calculated as follows:Orders = [(600 ? 50,000) + (1,000 ? 30,000) + (1,500 ? 20,000)]/2,000= 45,000Reduction in orders = 100,000 – 45,000 = 55,000Steps that can be reduced = 55,000/2,000 = 27 (rounding down to nearest whole number)There were initially 50 steps: 100,000/2,000Reduction in resource spending:Step-fixed costs: $50,000 ? 27 = $1,350,000Variable activity costs: $20 ? 55,000 = 1,100,000$2,450,000预算9-4Norton, Inc.Sales Budget For the Coming YearModel Units Price Total SalesLB-1 50,400 $29.00 $1,461,600LB-2 19,800 15.00 297,000WE-6 25,200 10.40 262,080 WE-7 17,820 10.00 178,200 WE-8 9,600 22.00 211,200 WE-9 4,000 26.00 104,000 Total $2,514,080二、1. Raylene’s Flowers and GiftsProduction Budget for Gift BasketsFor September, October, November, and DecemberSept. Oct. Nov. D ec.Sales 200 150 180 250Desired ending inventory 15 18 25 10Total needs 215 168 205 260Less: Beginning inventory 20 15 18 25 Units produced 195 153 187 2352. Raylene’s Flowers and GiftsDirect Materials Purchases BudgetFor September, October, and NovemberFruit: Sept. Oct. Nov.Production 195 153 187? Amount/basket (lbs.) ? 1 ? 1 ?1Needed for production 195 153 187Desired ending inventory 8 9 12Needed 203 162 200Less: Beginning inventory 10 8 9Purchases193 154 190Small gifts: Sept. Oct. Nov.Production 195 153 187 ? Amount/basket (items) ? 5 ? 5 ? 5Needed for production 975 765 935Desired ending inventory 383 468 588Needed 1,358 1,233 1,523Less: Beginning inventory 488 383 468Purchases 870 850 1,055Cellophane: Sept. Oct. Nov.Production 195 153 187。

管理会计 考题 (management accounting)

Managerial Accounting Acct 2301 –Exam 3 – Version INOTE: Rounding error within $5 is acceptable on all time-value-of-money problems. Name: …1.The Home Run batting cages chain has invested in ice cream stands for its variouslocations. The investment cost the company $100,000. The company expects tosell 10,000 ice cream servings per year. Variable materials, preparation andmarketing costs are expected to be $0.50 per serving. Fixed costs are expected to be $3,000 per year. If the company wants an ROI of 12%, how much should they charge for each serving of ice cream?a.$2.00b.$4.00c.$1.25d.$0.50e.There is not enough information available.2.Hoover Football Corporation desires a 10% ROI on all investment projects. Thefollowing information was available for the company in 2005:Sales $28,000Operating Income $ 5,600Turnover 1.0What is the corporation‟s ROI?a.40%b.30%c.24%d.20%e.None of the above3.Peek Company started the accounting period with the following beginningbalances in 2005:Raw material inventory $10,000Work in process inventory $30,000Finished goods inventory $20,000During the year, the company purchased $50,000 of raw materials and ended theyear with $20,000 in raw material inventory. Direct labor costs for the periodwere $80,000 and $10,000 of manufacturing overhead was applied to work inprocess. (There was no over or under applied overhead.) Ending work in process was $40,000 and ending finished goods sold $40,000. What was the amount ofcost of goods manufactured for the year? (i.e. How much was transferred tofinished goods?)a.$100,000b.$ 40,000c.$120,000d.$ 90,000e.None of the above4.An investment that costs $25,000 will produce annual cash flows of $5,000 for aperiod of 6 years. Further, the investment has an expected salvage value of$3,000. What is the net present value of the investment if the desired rate ofreturn is 12%?a.($25,000)b.$ 1,520c.$ 20,557d.($ 2,923)e.None of the above5.The management of Tarallo Industries obtained the following information aboutthe performance of a major investment project.Revenues $200,000Cost of Investment 300,000Margin 24%Assuming Tarallo has a desired rate of return of 14%, the project‟s residual income wasa.$42,000b.$28,000c.$ 6,000d.$72,000e.None of the above6.First Quay Company earns annual cash revenues of $25,000 for 8 years on aninvestment in a new machine that cost $120,000 cash. The machine isdepreciated $8,750 each year and the business pays an income tax rate of 30%.Annual cash operating expenses other than depreciation on the machine are$1,000. What is the annual cash inflow from the investment?a.$15,250b.$10,675c.$19,425d.$24,000e.$25,0007.Mark Johnson turned 18 years old today. His grandfather established a trust fundthat will pay Mark $50,000 on his 21st birthday. Unfortunately, Mark needsmoney today to start his college education and his father is willing to help. Hehas agreed to give Mark the present value of the future cash inflow, assuming a10% rate of return. How much cash should Mark‟s father give him today?a.$ 45,455b.$ 37,566c.$ 35,589d.$124,343e.None of the above8.At the beginning of the year, Riley Company estimated that its productionworkers would work 100,000 direct labor hours during the upcoming year and that overhead costs would amount to $500,000. The company‟s productionworkers actually worked 101,000 direct labor hours during the year. Theoverhead actually amounted to $495,000 for the year. What is the amount of over or underapplied overhead for the year?a.Overapplied by $5,000b.Underapplied by $5,000c.Overapplied by $10,000d.Underapplied by $10,000e.None of the above9.Tharpe Painting Company is considering a capital project that costs $30,000. Theproject will deliver the following cash inflows:Year 1 - $10,500Year 2 - $ 9,000Year 3 - $ 8,500Year 4 - $ 5,000Year 5 - $ 4,500Using the incremental approach, what is the payback period for the investment?a. 3.4 yearsb. 4.0 yearsc. 4.2 yearsd. 5.0 yearse.None of the above10.The accounting records for Lillehammer Manufacturing Company disclosed thefollowing cost information for 2005:Direct Materials $30,000Direct Labor $40,000Fixed manufacturing overhead $50,000Variable manufacturing overhead $10,000The company produced 10,000 units of inventory and sold 6,000 units during 2005 for $98,000. There was no beginning inventory. What amount of ending inventory will be reported on the balance sheet under absorption costing?a.$32,000b.$130,000c.$48,000d.$52,000e.None of the above11.Plummer Industries estimated overhead for 2005 to be $500,000 for 100,000direct labor hours. If 9,000 hours were actually worked in August, how much overhead would be allocated to work in process during the month?a.$45,000b.$41,667c.$40,000d.$38,000e.None of the above12.An investment project has a net present value of $2,500. The company‟s desiredrate of return is 16%. This impliesa.the company follows universal best practices.b.the investment project has an internal rate of return less than 16%.c.the investment project has an internal rate of return greater than 16%.d.the company follows cost-based pricinge.None of the above13.Havenbrook Inc. is considering purchasing a new machine for $125,000. Themachine is expected to yield a return of 15%. The company expects expenses to increase $8,000 from the new machine. Based on this information, how much does the company anticipate sales increasing from the new machine?a.$18,750b.$26,750c.$10,750d.$ 0e.None of the above14.Which of the following would increase residual income?a.Decrease in revenuesb.Increase in expensesc.Increase in the required ROId.Increase in investmente.None of the above15.Eastern Company can purchase an asset that costs $2,700,000. The asset isexpected to produce net cash inflows of $300,000 per year for 19 years. Based on this information, the investment is expected to yield an internal rate of returnclosest toa.5%b.7%c.9%d.11%e.13%16.The Londinium Company began business on January 1, 2005. The companyincurred the following transactions during the year. (All transactions are cash.)1.)Acquired $5,000 of capital from the owners.2.)Purchased $1,000 of raw materials.3.)Used $800 of these raw materials in the production process.4.)Paid production worker $600.5.)Applied manufacturing overhead of $200.6.)Started and completed 800 units of inventory.7.)Sold 650 units at a price of $5 each.8.)Paid $150 for selling and administrative expensesWhat is the amount of cost of goods sold for 2005?a. $1,600b.$1,300c.$1,463d.$1,138e.$3,25017.Konstanz Company uses a job order cost system. During the month of October,the company worked on three jobs. The job order cost sheets for the three jobsThe company‟s manufacturing overhead rate is $0.50 per labor dollar. During October, Job #102 was completed and sold. At the end of October, what was the total cost in Work in Process?a.$16,250b.$18,250c.$25,500d.$28,250e.None of the above18.The entry to dispose of underapplied manufacturing overhead will include aa.Credit to manufacturing overhead and a debit to cost of goods soldb.Credit to manufacturing overhead and a credit to cost of goods soldc.Debit to manufacturing overhead and a debit to cost of goods soldd.Debit to manufacturing overhead and a credit to cost of goods solde.No entry is needed19.Annie Boutiques has an average rate of return of 12%. Details of a proposedinvestment include the following:Sales Revenue $20,000Expenses 14,000Cost of Asset 30,000Which of the following statements is(are) correct?a.The investment should be accepted because it will yield an ROI that ishigher that the average ROI.b.Acceptance of the investment opportunity will decrease the company wideROI.c.The investment should be rejected because the investment opportunity willnot yield any additional residual income.d.Acceptance of the investment opportunity will yield residual income of$2,400.e.More than one answer is correct.pany A and Company B have the same amount of actual overhead. Neithercompany began the period with inventory, but both produced 100 items, using the same amount of material and labor. Both used direct labor hours as a cost driver.Both sold 75 items at identical prices. Company A over applied overhead, but Company B did not. Both companies adjust for the over or under appliedoverhead if there is any.Based on this information, after adjustments have been madepany A will have a higher profit than Company B.pany B will have a higher profit than Company A.pany A and Company B will have the same profit.d.There is only one true profit.e.None of the above.21.Vernon Company began business on January 1st, so it had no beginning inventory.Its total manufacturing costs for the year were $500,000. Cost of goodsmanufactured was $450,000 and cost of goods sold was $350,000 for the year.What is the balance in finished goods at the end of the year?a.$150,000b.$ 50,000c.$200,000d.$100,000e.None of the abovewless Company reported the following information for 2005:Sales $1,574,000Operating Assets $ 750,000Desired ROI 9%Residual Income $ 22,500The company‟s net income for 2005 wasa.$74,160b.$67,500c.$95,000d.$363,750e.None of the above23.Ventaren Company worked on two housing projects during 2005. Overhead wasapplied on the basis of direct labor hours. At the beginning of the year, thecompany estimated that overhead would be $50,000 and 10,000 direct labor hours would be worked. Both projects were started and completed in the currentaccounting period. The following transactions were completed during the period: ∙Project #1 – Used $8,000 of direct material; Incurred $10,000 of labor cost for 2,000 hours∙Project #2 – Used $12,000 of direct material; Incurred $9,000 of labor cost for 1,800 hoursProject #1 was sold for $35,000 in November 2005. What was the balance of Finished Goods on December 31, 2005 for the company?a.$58,000b.$40,000c.$28,000d.$ 0e.None of the above24.Fischer Price manufactures the “Little People Playhouse” in an assembly lineenvironment and uses the FIFO equivalent units method for accounting purposes.On March 1st, there were 5,000 physical units that were, on average, ½ finished.On March 31st, there were 10,000 physical units that were, on average, 60%finished. During March, 25,000 units were completed.If total production costs during March were $513,000, what is the cost per unit (specifically, wha t is the cost per …equivalent unit‟)?a.$20.52b.$17.10c.$25.65d.$18.00e.None of the above.25.An investment that costs $30,000 will produce annual cash flows of $10,000 for aperiod of 4 years. Given a desired rate of return of 8%, the investment willgenerate aa.Positive net present value of $33,121b.Positive net present value of $3,121c.Negative net present value of $33,121d.Negative net present value of $3,121e.None of the above。

商务英语考试 选择题 63题

1. What does the acronym "B2B" stand for in the context of business?A) Business to BusinessB) Business to BuyerC) Business to BankD) Business to Broker2. Which of the following is NOT a typical component of a business plan?A) Executive SummaryB) Market AnalysisC) Personal BiographyD) Financial Projections3. In international trade, what does "FOB" mean?A) Free On BoardB) Fixed Office BudgetC) Foreign Original BrandD) Full Operational Balance4. Which document is used to confirm the terms of a sale between a buye r and a seller?A) InvoiceB) Purchase OrderC) Sales AgreementD) Quotation5. What is the primary purpose of a SWOT analysis?A) To identify strengths, weaknesses, opportunities, and threatsB) To secure a business loanC) To increase employee productivityD) To reduce company taxes6. Which of the following is a key element of effective communication i n a business setting?A) Using technical jargonB) Being concise and clearC) Speaking only in native languageD) Avoiding eye contact7. What does "ROI" stand for in business terms?A) Return on InvestmentB) Rate of InterestC) Risk of InjuryD) Revenue of Income8. Which of the following is a characteristic of a successful entrepren eur?A) Fear of riskB) Lack of persistenceC) Strong leadership skillsD) Reluctance to innovate9. What is the main purpose of a balance sheet in accounting?A) To track daily salesB) To show the financial position at a specific point in timeC) To record employee salariesD) To analyze market trends10. In a business context, what does "due diligence" refer to?A) The process of thoroughly investigating a business or person pri or to signing a contractB) The act of paying bills on timeC) The practice of maintaining a clean officeD) The skill of negotiating prices11. What is the term for the process of setting prices based on competi tors' prices?A) Cost-plus pricingB) Value-based pricingC) Competitive pricingD) Psychological pricing12. Which of the following is a benefit of using cloud computing in bus iness?A) Increased need for physical storage spaceB) Enhanced data securityC) Reduced accessibilityD) Higher operating costs13. What does "M&A" stand for in the business world?A) Marketing and AdvertisingB) Mergers and AcquisitionsC) Management and AdministrationD) Money and Assets14. Which of the following is a key factor in brand loyalty?A) High pricesB) Poor customer serviceC) Consistent qualityD) Infrequent advertising15. What is the main goal of a business proposal?A) To entertain the readerB) To persuade the reader to take actionC) To inform about company historyD) To showcase artistic skills16. In project management, what does "PERT" stand for?A) Program Evaluation and Review TechniqueB) Project Execution and Review TimeC) Performance Enhancement and Retention TrainingD) Personal Efficiency and Responsibility Training17. What is the purpose of a non-disclosure agreement (NDA)?A) To allow public disclosure of confidential informationB) To protect the privacy of company employeesC) To prevent the sharing of confidential informationD) To promote open communication within a team18. Which of the following is a common business document used to reques t payment for goods or services?A) Purchase OrderB) InvoiceC) QuotationD) Proposal19. What is the term for the strategy of selling the same product to di fferent market segments with slightly different features or marketing?A) Market penetrationB) Market developmentC) Product developmentD) Product differentiation20. In business, what does "KPI" stand for?A) Key Performance IndicatorB) Key Productivity IndexC) Knowledge Process ImprovementD) Key Profitability Indicator21. What is the main purpose of a business model?A) To describe how a business intends to make a profitB) To outline the company's organizational structureC) To list all employee names and rolesD) To provide a detailed history of the industry22. Which of the following is a common method for businesses to raise c apital?A) Selling products at a lossB) Issuing bondsC) Giving away free samplesD) Reducing employee salaries23. What does "EBITDA" stand for in financial terms?A) Earnings Before Interest, Taxes, Depreciation, and AmortizationB) Estimated Business Income and Tax Deductions AvailableC) Economic Benefits in Total, Directly AppliedD) Enterprise Budgeting and Investment Techniques and Analysis24. In the context of business negotiations, what does "BATNA" stand fo r?A) Best Alternative To a Negotiated AgreementB) Business Analysis and Technical AssistanceC) Budget Allocation and Taxation AuthorityD) Basic Accounting and Transaction Analysis25. What is the primary purpose of a business letter?A) To send personal messagesB) To communicate business-related information formallyC) To advertise productsD) To entertain colleagues26. Which of the following is a type of market research?A) Intuitive forecastingB) Focus groupsC) Random guessingD) Personal opinions27. What is the term for the process of analyzing financial statements to evaluate a company's performance?A) Financial planningB) Financial analysisC) Financial forecastingD) Financial reporting28. In business, what does "CAPEX" stand for?A) Capital ExpenditureB) Current Asset PositionC) Corporate Action PlanD) Customer Acquisition Process29. What is the main purpose of a business case?A) To justify the need for a project or investmentB) To list all company assetsC) To provide entertainment at corporate eventsD) To outline daily tasks30. Which of the following is a key component of a business's marketing strategy?A) Ignoring customer feedbackB) Focusing solely on high-priced itemsC) Identifying target marketsD) Avoiding technological advancements31. What does "SEO" stand for in the context of digital marketing?A) Social Engagement OptimizationB) Search Engine OptimizationC) Strategic Email OutreachD) Systematic Evaluation of Outputs32. In business communication, what is the purpose of a memo?A) To communicate internally within an organizationB) To send personal messagesC) To advertise productsD) To entertain clients33. What is the term for the process of setting prices to reflect the p erceived value of a product or service to the customer?A) Cost-plus pricingB) Value-based pricingC) Competitive pricingD) Psychological pricing34. Which of the following is a common type of business entity?A) Sole proprietorshipB) Single partnershipC) Solitary corporationD) Singleton limited35. What is the main purpose of a business report?A) To provide detailed analysis or information on a specific topicB) To list personal hobbies of employeesC) To outline daily jokesD) To provide entertainment at corporate events36. In the context of business ethics, what does "CSR" stand for?A) Corporate Social ResponsibilityB) Customer Service RepresentativeC) Centralized Sales ReportD) Comprehensive Security Review37. What is the term for the process of planning and managing a company 's long-term goals and strategies?A) Strategic planningB) Tactical planningC) Operational planningD) Contingency planning38. Which of the following is a key element of a successful business st rategy?A) Lack of focusB) Inconsistent goalsC) Strong competitive advantageD) Ignoring market trends39. What is the main purpose of a business plan?A) To provide a roadmap for the company's future actionsB) To list all company assetsC) To provide entertainment at corporate eventsD) To outline daily tasks40. In business, what does "VC" stand for?A) Venture CapitalB) Value ChainC) Virtual CurrencyD) Variable Cost41. What is the term for the process of identifying and analyzing the s trengths and weaknesses of competitors?A) Competitive analysisB) Market analysisC) SWOT analysisD) PEST analysis42. Which of the following is a common business document used to outline the terms and conditions of a contract?A) InvoiceB) Purchase OrderC) Sales AgreementD) Quotation43. What is the main purpose of a business presentation?A) To provide detailed information in a structured formatB) To list personal hobbies of employeesC) To outline daily jokesD) To provide entertainment at corporate events44. In business, what does "IPO" stand for?A) Initial Public OfferingB) Internal Process OptimizationC) Integrated Project OutlineD) Innovative Product Offer45. What is the term for the process of setting prices based on the cos t of producing and marketing a product?A) Cost-plus pricingB) Value-based pricingC) Competitive pricingD) Psychological pricing46. Which of the following is a key component of a business's financial strategy?A) Ignoring economic indicatorsB) Focusing solely on short-term gainsC) Managing cash flowD) Avoiding technological advancements47. What is the main purpose of a business proposal?A) To justify the need for a project or investmentB) To list all company assetsC) To provide entertainment at corporate eventsD) To outline daily tasks48. In business, what does "MBO" stand for?A) Management by ObjectivesB) Market-Based OperationsC) Monetary Budgeting OfficeD) Master Business Officer49. What is the term for the process of planning and managing a company 's resources to achieve specific goals?A) Strategic planningB) Tactical planningC) Operational planningD) Contingency planning50. Which of the following is a common method for businesses to measure customer satisfaction?A) Customer surveysB) Random guessingC) Personal opinionsD) Ignoring customer feedback51. What is the main purpose of a business letter?A) To communicate business-related information formallyB) To send personal messagesC) To advertise productsD) To entertain colleagues52. In business, what does "R&D" stand for?A) Research and DevelopmentB) Revenue and DistributionC) Risk and DebtD) Retail and Delivery53. What is the term for the process of setting prices to reflect the p erceived value of a product or service to the customer?A) Cost-plus pricingB) Value-based pricingC) Competitive pricingD) Psychological pricing54. Which of the following is a common type of business entity?A) Sole proprietorshipB) Single partnershipC) Solitary corporationD) Singleton limited55. What is the main purpose of a business report?A) To provide detailed analysis or information on a specific topicB) To list personal hobbies of employeesC) To outline daily jokesD) To provide entertainment at corporate events56. In the context of business ethics, what does "CSR" stand for?A) Corporate Social ResponsibilityB) Customer Service RepresentativeC) Centralized Sales ReportD) Comprehensive Security Review57. What is the term for the process of planning and managing a company 's long-term goals and strategies?A) Strategic planningB) Tactical planningC) Operational planningD) Contingency planning58. Which of the following is a key element of a successful business st rategy?A) Lack of focusB) Inconsistent goalsC) Strong competitive advantageD) Ignoring market trends59. What is the main purpose of a business plan?A) To provide a roadmap for the company's future actionsB) To list all company assetsC) To provide entertainment at corporate eventsD) To outline daily tasks60. In business, what does "VC" stand for?A) Venture CapitalB) Value ChainC) Virtual CurrencyD) Variable Cost61. What is the term for the process of identifying and analyzing the s trengths and weaknesses of competitors?A) Competitive analysisB) Market analysisC) SWOT analysisD) PEST analysis62. Which of the following is a common business document used to outline the terms and conditions of a contract?A) InvoiceB) Purchase OrderC) Sales AgreementD) Quotation63. What is the main purpose of a business presentation?A) To provide detailed information in a structured formatB) To list personal hobbies of employeesC) To outline daily jokesD) To provide entertainment at corporate events答案1. A2. C3. A4. C5. A6. B7. A8. C9. B10. A11. C12. B13. B14. C15. B16. A17. C18. B19. D20. A21. A22. B23. A24. A25. B26. B27. B28. A29. A30. C31. B32. A33. B34. A35. A36. A37. A38. C39. A40. A41. A42. C43. A44. A45. A46. C47. A48. A49. C50. A51. A52. A53. B54. A55. A56. A57. A58. C59. A60. A61. A62. C63. A。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。