管理会计双语考试试卷

cma考试试题及答案

cma考试试题及答案CMA(Certified Management Accountant)是国际管理会计师资格认证,对于从事管理会计和财务管理领域的人士具有较高的认可和权威性。

准备CMA考试是很多财务从业人员的目标,下面将介绍一些CMA考试的试题及答案。

一、单选题1. Which of the following is not a purpose of budgeting?A. Planning and goal-settingB. Evaluating performanceC. Providing feedbackD. Identifying riskAnswer: D2. Which of the following is not an example of a critical financial ratio?A. Current ratioB. Return on investment (ROI)C. Gross profit marginD. Customer satisfaction ratioAnswer: D3. Which of the following is an example of a fixed cost?A. Direct materials costB. Direct labor costC. Rent expenseD. Sales commissionAnswer: C二、多选题1. Which of the following are advantages of using activity-based costing (ABC) system? (Select all that apply.)A. More accurate product costingB. Better cost controlC. Improved decision-makingD. Lower implementation costsAnswer: A, B, C2. Which of the following are components of the income statement? (Select all that apply.)A. RevenueB. Cost of goods soldC. Operating expensesD. AssetsAnswer: A, B, C3. Which of the following are methods used to evaluate capital budgeting projects? (Select all that apply.)A. Net present value (NPV)B. Internal rate of return (IRR)C. Payback periodD. Return on investment (ROI)Answer: A, B, C三、问答题1. What is the purpose of variance analysis in management accounting?Variance analysis is used to compare the actual performance of a business with the planned or expected performance. It helps identify the reasons behind any differences between the two, allowing management to take corrective actions if necessary. By analyzing variances, management can assess the effectiveness of their planning and control systems and make informed decisions to improve future performance.2. How does cost-volume-profit analysis help in decision-making?Cost-volume-profit (CVP) analysis is a tool used to examine the relationships between sales volume, costs, and profits. It helps in decision-making by providing insights into the impact of changes in sales volume, selling price, variable costs, and fixed costs on the profitability of a product or service. CVP analysis can aid in determining the breakeven point,assessing the impact of price changes, and evaluating the profitability of different product lines or business segments.四、案例分析XYZ Company is considering two investment projects: Project A and Project B. The following information is available:Project A:Initial investment: $100,000Estimated annual cash flows: $30,000 for the next 5 yearsDiscount rate: 10%Project B:Initial investment: $150,000Estimated annual cash flows: $40,000 for the next 5 yearsDiscount rate: 12%Using the net present value (NPV) method, calculate the net present value for each project and recommend which project should be chosen.Solution:To calculate the NPV, we need to discount the annual cash flows to their present value. The formula for calculating the present value of cash flows is:PV = CF / (1 + r)^nFor Project A:PV = $30,000 / (1 + 0.10)^1 + $30,000 / (1 + 0.10)^2 + $30,000 / (1 +0.10)^3 + $30,000 / (1 + 0.10)^4 + $30,000 / (1 + 0.10)^5PV = $27,272.73 + $24,794.43 + $22,540.39 + $20,491.26 + $18,628.42PV = $113,727.23For Project B:PV = $40,000 / (1 + 0.12)^1 + $40,000 / (1 + 0.12)^2 + $40,000 / (1 +0.12)^3 + $40,000 / (1 + 0.12)^4 + $40,000 / (1 + 0.12)^5PV = $35,714.29 + $31,878.42 + $28,449.06 + $25,393.12 + $22,682.43PV = $144,117.32Based on the NPV calculations, Project B has a higher net present value than Project A. Therefore, it is recommended to choose Project B as it is expected to generate higher returns.请注意,以上案例为示例,实际的CMA考试试题及答案会因时间而变化,考生需以最新的资料为准。

{财务管理财务会计}管理会计示范性双语讲义习题

{财务管理财务会计}管理会计示范性双语讲义习题CHAPTER1MANAGEMENTACCOUNTING:INFORMATIONTHATCREATESVALUE TRUE/FALSE1.Managementaccountinggathersshort-term,long-term,financial,andnonfinancialinformation.a.Trueb.False2.Managementaccountinginformationgenerallyreportsontheorganizationas awhole.a.Trueb.Falsepanieshavetofollowstrictguidelineswhendesigningamanagementacco untingsystem.a.Trueb.False4.Agoodmanagementaccountingsystemisintendedtomeetspecificdecision-makingneedsatalllevelsintheorganization.a.Trueb.False5.Duringthehistoryofmanagementaccounting,innovationsweredevelopedto addressthedecision-makingneedsofmanagers.a.Trueb.False6.Akeyelementinanyorganization’sstrategyistoidentifyitstargetcustomersandtodeliverwhatthosetargetcustomerswant.a.Trueb.False7.Thevaluepropositionhasonlytwoelements:costandquality.a.Trueb.False8.Qualityisthedegreeofconformancebetweenwhatthecustomerispromisedan dwhatthecustomerreceives.a.Trueb.False9.Recently,thedemandforimprovedmanagementaccountingandcontrolinfor mationwithinmanufacturingfirmshasalsooccurredinserviceorganizations.a.Trueb.False10.Recently,thepetitiveenvironmentforbothmanufacturingandservicepanies hasbeefarmorechallenginganddemanding.a.Trueb.False11.Servicepaniesareverysimilartomanufacturingpaniesinmayways,includingt hefactthatmanyemployeeshavedirectcontactwithcustomers.a.Trueb.False12.Sensitivitytotimelinessandqualityofserviceisespeciallyimportanttoservice organizations.b.Falseernmentandnonprofitorganizations,aswellasprofit-seekingenterprises,arefeelingthepressuresforimprovedperformance.a.Trueb.False14.Managementaccountinginformationallowsmanagerstopareactualandpla nnedcostsandtoidentifyareasandopportunitiesforprocessimprovement.a.Trueb.False15.Managementaccountingcanprovideinformationoncustomersatisfaction.a.Trueb.False16.ROI(returnoninvestment)binestwoprofitabilitymeasurestoproduceasingle measureofdepartmentalordivisionalperformance.a.Trueb.False17.Around1920,centralizedcontrolofdecentralizedoperationswasacplishedb yhavingcorporatemanagersreceivefinancialreportsaboutdivisionaloperation sandprofitability.a.Trueb.False18.Inthelate1990s,littleinterestorattentionwaspaidtoevaluatingmanagement ’sappropriategovernanceandstrategychoices.b.False19.Financialinformationidentifiesandexplainstheunderlyingproblems.a.Trueb.False20.Managementaccountingmeasurescanprovideadvancewarningsofproble ms.a.Trueb.False21.Customersatisfactionisanexampleoffinancialinformation.a.Trueb.False22.Operatingprofitisanexampleofnonfinancialinformation.a.Trueb.Falseanizationalleadershipplaysacriticalroleinfosteringanorganization’s c ultureofhighethicalstandards.a.Trueb.Falsermationisneverneutral;justtheactofmeasuringandreportinginformatio naffectstheindividualsinvolved.a.Trueb.False25.Boundarysystemsarealwaysstatedinpositivetermsthatoutlinemaximumsta ndardsofbehavior.a.Trueb.FalseMULTIPLECHOICE26.Managementaccountinghelpsapanyachieve:a.itsstrategicobjectivesb.itsoperationalobjectivesc.controlandalsosupportsperformanceevaluationd.Alloftheabovearecorrect.27.Whichofthefollowingtypesofinformationareusedinmanagementaccounti ng?a.financialinformationb.nonfinancialinformationrmationfocusedonthelongtermd.Alloftheabovearecorrect.28.Managementaccounting:a.focusesonestimatingfuturerevenues,costs,andothermeasurestoforecastacti vitiesandtheirresultsb.providesinformationaboutthepanyasawholec.reportsinformationthathasoccurredinthepastthatisverifiableandreliabled.providesinformationthatisgenerallyavailableonlyonaquarterlyorannualbasi s29.Whichofthefollowingdescriptorsrefertomanagementaccountinginformati on?a.Itisverifiableandreliable.b.Itisdrivenbyrules.c.Itispreparedforshareholders.d.Itprovidesreasonableandtimelyestimates.30.Whichofthefollowingstatementsreferstomanagementaccountinginformat ion?a.Therearenoregulationsgoverningthereports.b.Thereportsaregenerallydelayedandhistorical.c.Theaudiencetendstobestockholders,creditors,andtaxauthorities.d.Thescopetendstobehighlyaggregate.31.Managementaccountinginformationincludes:a.tabulatedresultsofcustomersatisfactionsurveysb.thecostofproducingaproductc.thepercentageofunitsproducedthatisdefectived.Alloftheabovearecorrect.32.ManagementaccountingreportsMOSTlikelyincludeinformationabout:a.customerplaintsinefortheyearc.totalassetsd.Alloftheabovearecorrect.33.ThepersonMOSTlikelytousemanagementaccountinginformationisa(n):a.bankerevaluatingacreditapplicationb.shareholderevaluatingastockinvestmenternmentaltaxingauthorityd.assemblydepartmentsupervisor34.WhichofthefollowingisNOTafunctionofamanagementaccountingsystem?a.strategicplanningb.financialreportingc.operationalcontrold.productcosting35.FinancialaccountingprovidesthePRIMARYsourceofinformationfor:a.decisionmakinginthefinishingdepartmentb.improvingcustomerservicec.preparingtheinestatementforshareholdersd.planningnextyear’soperatingbudget36.Financialaccounting:a.focusesonthefutureandincludesactivitiessuchaspreparingnextyear'soperati ngbudgetb.mustplywithGAAP(generallyacceptedaccountingprinciples)c.reportsincludedetailedinformationonthevariousoperatingsegmentsoftheb usinesssuchasproductlinesordepartmentsd.ispreparedfortheuseofdepartmentheadsandotheremployees37.ThepersonMOSTlikelytouseONLYfinancialaccountinginformationisa:a.factoryshiftsupervisorb.vicepresidentofoperationsc.currentshareholderd.departmentmanager38.Theaccountingprocessisconstrainedbymandatedreportingrequirementsb yallofthefollowingorganizationsEXCEPTthe:a.InternalRevenueService(IRS)b.InstituteofManagementAccountants(IMA)c.FinancialAccountingStandardsBoard(FASB)d.SecuritiesandExchangeCommission(SEC)forpaniesthatarepubliclytraded39.Historically:a.inthebeginningofthe20th century,theGuildskeptdetailedrecordsofrawmateri alsandlaborcostsasevidenceofproductqualityb.inmedievalEngland,thebasicsofmodernmanagementaccountingemergedw ithstandardsformaterialuse,employeeproductivity,andbudgetsc.inthelate19th century,railroadmanagersimplementedlargeandplexcostingsy stemstoputethecostofdifferenttypesoffreightd.from1400-1600,largeandintegratedpaniessuchasDuPontandGeneralMotors,developed waystomeasurereturnoninvestment40.Ingeneral,itwasnotuntilthe1970sthatmanagementaccountingsystems:a.wereimprovedbecauseofdemandsbytheFASBandtheSECb.stagnatedandprovedinadequatec.startedtodevelopinnovationsincostingandperformance-measurementsystemsduetointensepressurefromoverseaspetitorsd.startedtoaddressthedecision-makingneedsofmanagers41.Allsuccessfulorganizationsmustidentifyandunderstandtheir:a.weaknessesb.petitionc.strategyd.definitionofquality42.Akeyelementofanyorganization’sstrategyisidentifying:a.itspotentialshareholdersb.itstargetcustomersc.petitor’sproductsd.employeeneeds43.Whatanorganizationtriestodelivertocustomersiscalleditsvalueproposition ,whichincludestheelementsof:a.costandqualityb.cost,quality,andfunctionalityandfeaturesc.cost,quality,functionalityandfeatures,andserviced.cost,quality,functionalityandfeatures,service,andindustrystandards44.Thepricepaidbythecustomer,giventheproductfeaturesandpetitor’sprices ,isreferredtoasthe__________elementofthevalueproposition.a.costb.industrystandardsc.qualityd.service45.Thedegreeofconformancebetweenwhatthecustomerispromisedandwhatt hecustomerreceivesisreferredtoasthe__________elementofthevaluepropositio n.a.costb.industrystandardsc.qualityd.service46.Theperformanceoftheproduct,forexample,amealinarestaurantprovidesth edinerwiththelevelofsatisfactionexpectedforthepricepaid,isreferredtoasthe__ ________elementofthevalueproposition.a.functionalityandfeaturesb.industrystandardsc.qualityd.service47.Howthecustomeristreatedatthetimeofthepurchaseisanexampleofthe_____ _____elementofthevalueproposition.a.functionalityandfeaturesb.industrystandardsc.qualityd.service48.Managementaccountingprovides:rmationontheefficiencyoffactorylaborrmationonthecostofservicingmercialcustomersrmationontheperformanceofanoperatingdivisiond.Alloftheabovearecorrect.49.WhichofthefollowinggroupswouldbeLEASTlikelytoreceivedetailedmanag ementaccountingreports?a.stockholdersb.customerservicerepresentativesc.productionsupervisord.vicepresidentofoperations50.Topexecutivesofamulti-plantfirmareLEASTlikelytousemanagementaccountinginformation:a.tosupportdecisionsthatresultinlong-termconsequencesb.toevaluatetheperformanceofindividualplantsc.forstrategicplanningd.foroperationalcontrol51.ManagersofservicedepartmentsneedallofthefollowinginformationEXCEPT:a.efficiencydataonworkperformanceb.qualitydataonworkperformancec.profitabilitydataofthewholepanyd.profitabilitydataoftheservicedepartmentrmationMOSTus efultothe employeewhoassembles thefurnitureincludes:a.adailyreportparingtheactualtimeittooktoassembleapieceoffurnituretothest andardtimeallowedb.amonthlyreportontheportionoffurniturepiecesassembledwithdefectsc.thenumberoffurniturepiecessoldthismonthd.revenueperemployeermationMOSTus efultothe topexecutive includes:a.individualjobsummariesofmaterialsusedb.monthlyfinancialreportsonthepany’sprofitabilitybyproductlinec.timereportssubmittedbyeachemployeed.scheduleddowntimeforroutinemaintenanceonmachines54.AquarterlyreportdisclosingdecliningmarketshareinformationisMOSTusef ulto:a.afront-lineemployeeb.themanagerofoperationsc.thechiefexecutiveofficerd.theaccountingdepartment55.Aweeklyreportparingmachinetimeusedtoavailablemachinetimeisinformat ionMOSTusefulto:a.afront-lineemployeeb.themanagerofoperationsc.thechiefexecutiveofficerd.theaccountingdepartment56.Adailyreportonthenumberofqualityunitsassembledbyeachemployeeisinf ormationMOSTusefulto:a.afront-lineassemblyworkerb.theaccountingdepartmentc.thechiefexecutiveofficerd.thepersonneldepartment57.WhichofthefollowingwouldbeLEASThelpfulforatopmanagerofapany?a.profitabilityreportofthepanyrmationtomonitorhourlyanddailyoperationsc.numberofcustomerplaintsd.operatingexpensesummaryreportedbydepartment58.Recently,increaseddemandformanagementaccountinginformationhasbeen:a.primarilyfrommanufacturingfirmsb.primarilyfromserviceorganizationsc.fromboththemanufacturingandtheserviceindustriesd.anillusion;infact,thedemandformanagementaccountinghaschangedverylitt le59.Managementaccountingcanplayacriticalroleintheserviceindustrybecause ofallthefollowingreasonsEXCEPT:a.firmsmustbeespeciallysensitivetothetimelinessandqualityofcustomerservic eb.manyemployeeshaveverylittlecontactwithcustomersc.customersimmediatelynoticedefectsandadelayinserviced.dissatisfiedcustomersmayneverreturn60.Historically,theNEGLECTofmanagementaccountingintheserviceindustryw asaresultof:a.nonpetitiveenvironmentsb.globalcustomerdemandsc.theswitchtofreemarketeconomiesd.aninfluxofhigher-qualityandlower-pricedproductsfromoverseas61.Currently,managementaccountinginformationwithingovernmentandnon profitorganizationsisingreaterdemandbecause:a.publicandprivatedonorsaredemandingaccountabilityb.citizensarerequestingresponsiveandefficientperformancefromtheirgoverni ngunitsc.morenonprofitorganizationsarepetingforlimitedfundsd.Alloftheabovearecorrect.62.Currently,pressuresforimprovedcostandperformancemeasurementsarebe ingfeltby:a.nonprofitorganizationsernmentalagenciesc.profit-seekingenterprisesd.Alloftheabovearecorrect.63.Financialaccountinginformation:a.providesasignalthatsomethingiswrongb.identifieswhatiswrongc.explainswhatiswrongd.simplysummarizesinformationbutgivesnoindicationthatanythingiswrong64.Decentralizedresponsibilityreferstoallowinglower-levelmanagerstodoallofthefollowingEXCEPT:a.makedecisionswithoutseekinghigherapprovalb.takeadvantageoflocalopportunitiesc.makeperiodicfinancialreportstoupper-managementd.pursueindividualobjectiveseventhoughtheymaynotcontributetotheentirepany65.Thereturnoninvestment(ROI)performancemeasureuses__________toevalua tetheperformanceofoperatingdivisions.a.asinglenumberb.fournumbersc.fivenumbersd.tennumbers66.Thereturnoninvestment(ROI)performancemeasurebines__________toprod uceameasureofdepartmentalperformance.a.twoprofitabilitymeasuresb.twocapitalutilizationmeasuresc.oneprofitabilitymeasureandonecapitalintensitymeasured.twoprofitabilitymeasuresandtwocapitalintensitymeasures67.Allofthefollowingaretrueregardingthereturnoninvestment(ROI)formulade velopedatDupontEXCEPTthat:a.itisthesolemeasuretop-managementutilizestoevaluatewhichdivisionshouldreceiveadditionalcapitalb.itallowspaniestohavecentralizedcontrolwithdecentralizedresponsibilityc.itproducesameasureofdivisionalperformanced.itequals(Operatingine/Sales)x(Sales/Investment) THEFOLLOWINGINFORMATIONAPPLIESTOQUESTIONS68AND69. Thefollowinginformationpertainstothreedivisions: FlowersShrubsTreesSales$15,000$28,000$120,000Operatingine$2,000$2,000$6,000Investment$22,000$40,000$100,00068.WhatisthereturnoninvestmentfortheShrubDivision?a.2.00%b.5.00%c.7.14%d.70.00%69.WhichdivisionismoreprofitablebasedonROI?a.Flowersb.Shrubsc.Treesd.BothFlowersandShrubsareequallymoreprofitablethanTrees.70.Tohelpevaluatemanagement’sappropriategovernanceandstrategicchoic es,organizationshavecalledonmanagementaccountantstodevelop:a.internalcontrolsystemstoprotectassetsfromtheftb.measurestomonitorpliancewithbehaviorthatisconsistentwiththeorganizati on’sbesti nterestsc.systemstoevaluateprofitabilityd.reportstohighlightvariancesfromamountsplanned71.ManagementaccountinginformationisBESTdescribedas:a.providingasignalthatsomethingiswrongb.identifyingandhelpingtoexplainwhatiswrongc.simplysummarizinginformation,butgivingnoindicationthatanythingiswron gd.measuringoverallorganizationalperformance72.Forimprovingoperationalefficienciesandcustomersatisfaction,nonfinancia linformationis:a.criticalb.helpfulc.infrequentlyusedd.unnecessary73.Nonfinancialinformationmightbeusedto:a.improvequalityb.reducecycletimesc.satisfycustomerneedsd.Alloftheabovearecorrect.74.Theactofsimplymeasuringandreportinginformation:a.focusestheattentionofemployeesonthoseprocessesb.divertstheemployee’sattentiontootheractivitiesc.disprovesthesaying“Whatgetsmeasuredgetsmanaged.”d.hasnoeffectonemployeebehavior75.WhichstatementbelowisFALSE?a.“Whatgetsmeasuredgetsmanaged.”b.Peoplereacttomeasurements.c.Employeesspendmoreattentiononthosevariablesthatarenotgettingmeasur ed.d.“IfIcan’tmeasureit,Ican’tmanageit.”76.Whenachangeisintroduced,employeestendto:a.embracethechangeb.beindifferenttothechangec.exhibitnochangeinbehaviord.resistthechange77.TheintroductionofanewmanagementsystemisMOSTlikelytomotivateUNW ANTEDemployeebehaviorwhenitisusedfor:a.evaluationb.planningc.decisionmakingd.coordinatingindividualefforts78.ManagementaccountantsareMOSTlikelytofeeloutsidepressuretofavorabl yinfluencethenumbersfavorablywhentheinformationisusedfor:a.budgetingb.pensationandpromotionsc.continuousimprovementd.productcosting79.FosteringacultureofhighethicalstandardsincludesallofthefollowingEXCEP T:a.followingthegoodexamplesetbyseniormanagementb.municatingtoemployeesabeliefsystemthatinspiresandpromotesmitmentto theorganization’scorevaluesc.followingthegeneralexamplessetbyfront-lineemployeesd.municatingtoallemployeesaboundarysystemthatstateswhatactionswillnot betolerated80.TheInstituteofManagementAccountants(IMA):a.isaprofessionalorganizationofmanagementaccountantsb.isaprofessionalorganizationoffinancialaccountantsc.issuesstandardsformanagementaccountingd.issuesstandardsforfinancialaccountingCRITICALTHINKING/ESSAY81.Describemanagementaccountingandfinancialaccounting.82.Whatisthepurposeofmanagementaccounting?83.Brieflydescribehowmanagersmakeuseofmanagementaccountinginformat ion.84.Describethevaluepropositionandtheelementsthatpriseit.85.Isfinancialaccountingormanagementaccountingmoreusefultoanoperatio nsmanager?Why?86.Whatrolehastheincreasinglypetitivebusinessenvironmentplayedinthedev elopmentofmanagementaccounting?87.Describereturnoninvestment(ROI).Whywasitdeveloped?Whenwasitdevel oped?88.Givetwoexamplesoffinancialinformationandnonfinancialinformation.89.Discussthepotentialbehaviorimplicationsofperformanceevaluation.CHAPTER1SOLUTIONSMANAGEMENTACCOUNTING:INFORMATIONTHATCREATESVALUETRUE/FALSE LO11.aLO12.bLO13.bLO14.aLO15.aLO26.aLO27.bLO28.aLO39.aLO310.aLO311.bLO312.aLO313.aLO314.aLO315.aLO416.bLO417.aLO518.aLO519.bLO520.aLO521.b LO522.bLO623.aLO624.aLO625.bMULTIPLECHOICELO126.dLO127.dLO128.aLO129.dLO130.aLO131.dLO132.aLO133.dLO134.bLO135.cLO136.bLO137.cLO138.bLO139.cLO140.cLO241.cLO242.bLO243.cLO244.aLO245.cLO246.aLO247.dLO348.d LO349.a LO350.d LO351.c LO352.a LO353.b LO354.c LO355.b LO356.aLO357.bLO358.cLO359.bLO360.aLO361.dLO362.dLO463.aLO464.dLO465.aLO466.cLO467.aLO468.bLO469.aLO570.bLO571.bLO572.aLO573.dLO674.aLO675.cLO676.dLO677.aLO678.bLO679.cLO680.aMULTIPLECHOICE68.$2,000/$40,000=5.00%69.$2,000/$22,000=9.09%;$2,000/$40,000=5.00%;$6,000/$100,000=6.00%CRITICALTHINKING/ESSAYLO181.Describemanagementaccountingandfinancialaccounting.Solution:Managementaccountingprovidesinformationtointernaldecisionma kersofthebusinesssuchastopexecutives.Itspurposeistohelpmanagerspredicta ndevaluatefutureresults.Reportsaregeneratedoftenandareusuallybrokendo wnintosmallerreportingdivisionssuchasdepartmentorproductline.Therearen orulestobepliedwithsincethesereportsareforinternaluseonly. Financialaccountingprovidesinformationtoexternaldecisionmakerssuchasinv estorsandcreditors.Itspurposeistopresentafairpictureofthefinancialcondition ofthepany.Reportsaregeneratedquarterlyorannuallyandreportonthepanyasa whole.ThefinancialstatementsmustplywithGAAP(generallyacceptedaccounti ngprinciples).ACPAaudits,orverifies,thattheGAAParebeingfollowed.LO182.Whatisthepurposeofmanagementaccounting?Solution:Managementaccountinggathersshort-termandlong-termfinancialandnonfinancialinformationtoplan,coordinate,motivate,improv e,control,andevaluatesuccessfactorsofanorganization.Managementaccounti ngconvertsdataintousableinformationthatsupportsstrategic,operational,and controldecisionmaking.LO183.Brieflydescribehowmanagersmakeuseofmanagementaccountinginformat ion.Solution:Managersuseaccountinginformationforthreebroadpurposes.ONE:Toplanbusinessoperationsthatincludespreparingstrategiesandbudgets anddeterminingthepricesandcostsofproductsandservices.Apanymustknowt hecostofeachproductandservicetodecidewhichproductstoofferandwhethert oexpandordiscontinueproductlines.TWO:Tocontrolbusinessoperationsthatincludesparingactualresultstothebud getedresultsandtakingcorrectiveactionwhenneeded.THREE:Toevaluateperformance.LO284.Describethevaluepropositionandtheelementsthatpriseit.Solution:Thevaluepropositioniswhatanorganizationtriestodelivertoitstargetc ustomers–itdefinestheorganizationalstrategy. Thefourelementsarecost,quality,functionalityandfeatures,andservice. •Cost isthepricepaidbythecustomer,giventheproductfeaturesandpetitor’s prices.•Quality isthedegreeofconformancebetweenwhatthecustomerispromiseda ndwhatthecustomerreceives.•Functionalityandfeatures referstotheperformanceoftheproduct.Forexamp le:Amealinarestaurantprovidesthedinerwiththelevelofsatisfactionexpectedfo rthepricepaid.•Service isalloftheotherelementsoftheproduct.Forexample:Howthecustom eristreatedatthetimeofthepurchase.LO385.Isfinancialaccountingormanagementaccountingmoreusefultoanoperatio nsmanager?Why?Solution:Managementaccountingismoreusefultoanoperationsmanagerbeca usemanagementaccountingreportsoperatingresultsbydepartmentorunitrath erthanforthepanyasawhole,itincludesfinancialaswellasnonfinancialdatasuch ason-timedeliveriesandcycletimes,anditincludesquantitativeaswellasqualitativedat asuchasthetypeofreworkthatwasneededondefectiveunits.LO386.Whatrolehastheincreasinglypetitivebusinessenvironmentplayedinthedev elopmentofmanagementaccounting?Solution:Thepetitiveenvironmenthaschangeddramatically.Therehasbeenade regulationmovementinNorthAmericaandEuropeduringthe1970sand1980sth atchangedthegroundrulesunderwhichservicepaniesoperated.Inaddition,org anizationsencounteredseverepetitionfromoverseaspaniesthatofferedhigh-qualityproductsatlowprices.Therehasbeenanimprovementofoperationalcont rolsystemssuchthatinformationismorecurrentandprovidedmorefrequently.T henatureofworkhaschangedfromcontrollingtoinforming.Firmsareconcerned aboutcontinuousimprovement,employeeempowerment,andtotalquality.No nfinancialinformationhasbeeacriticalfeedbackmeasure.Finally,thefocusofma nyfirmsisnowonmeasuringandmanagingactivities.LO487.Describereturnoninvestment(ROI).Whywasitdeveloped?Whenwasitdevel oped?Solution:ROI=(operatingine/sales)x(sales/investment) TheROImeasurebinesaprofitabilitymeasure(operatingine/sales)withacapitali ntensitymeasure(sales/investment)toprovideasinglemeasureofdepartmental anddivisionalperformance. ROIwasdevelopedintheearlydecadesofthe1900ssothatseniormanagersatmul ti-divisionaldiversifiedcorporations,suchasDuPontandGeneralMotors,couldeva luatetheoperatingperformanceoftheirdecentralizeddivisions.LO588.Givetwoexamplesoffinancialinformationandnonfinancialinformation. Solution:Financialinformationincludesamountsthatcanbeexpressedindollara mountssuchassales,netine,andtotalassets.Italsoincludesratiospreparedusing financialinformationsuchasincreaseinsales,return-on-sales,andreturn-on-investment. Nonfinancialinformationincludesmeasuresthatarenotexpressedindollaramo unts.Forexample,nonfinancialmeasuresofcustomersatisfactionincludethenu mberofrepeatcustomersorrankedestimatesofsatisfactionlevels.Nonfinancial measuresofproductionqualityincludepercentofon-timedeliveries,thenumberofdefects,productionyield,andcycletimes.LO689.Discussthepotentialbehaviorimplicationsofperformanceevaluation.Solution:Asmeasurementsaremadeonoperationsand,especially,onindividual sandgroups,thebehavioroftheindividualsandgroupsareaffected.Peoplereactt othemeasurementsbeingmade.Theywillfocusonthosevariablesorthebehavior beingmeasuredandspendlessattentiononvariablesandbehaviorthatarenotm easured.Inaddition,ifmanagersattempttointroduceorredesigncostandperfor mancemeasurementsystems,peoplefamiliarwiththeprevioussystemwillresist. Managementaccountantsmustunderstandandanticipatethereactionsofindivi dualstoinformationandmeasurements.Thedesignandintroductionofnewmea surementsandsystemsmustbeacpaniedwithananalysisofthelikelyreactionstot heinnovations.感谢阅读多年企业管理咨询经验,专注为企业和个人提供精品管理方案,企业诊断方案,制度参考模板等欢迎您下载,均可自由编辑。

管理会计双语课程习题chapter2

管理会计双语课程习题chapter2CH02COST MANAGEMENT CONCEPTS AND COST BEHAVIORTRUE/FALSE1. There is no single definition of cost.a. Trueb. False2. The role of the management accountant is to tailor the cost calculationto fit the current decision situation.a. Trueb. False3. A cost that is useful for one decision may not be useful information foranother decision.a. Trueb. False4. In most organizations, managing nonmanufacturing costs as well asmanufacturing costs is important for financial success.a. Trueb. False5. The cost of a customized machine only used in the production of a singleproduct would be classified as a direct cost.a. Trueb. False6. The wages of a plant supervisor would be classified as a period cost.a. Trueb. False7. The classification of product and period costs is particularly valuablein management accounting.a. Trueb. False8. For external reporting, generally accepted accounting principles requirethat costs be classified as either flexible or capacity-related costs.a. Trueb. False9. Knowing whether a cost is a period or a product cost helps to estimatetotal cost at a new level of activity.a. Trueb. False10. Flexible costs are always direct costs.a. Trueb. False11. Capacity-related costs vary with the level of production or sales volume.a. Trueb. False12. Currently, most personnel costs are classified as capacity-related costs.a. Trueb. False13. Some capacity-related costs might be classified as directmanufacturingcosts.a. Trueb. False14. Capacity-related costs depend on the resources used, not the resourcesacquired.a. Trueb. False15. Break-even point is NOT an important concept since the goal of businessis to make a profit.a. Trueb. False16. To perform cost-volume-profit analysis, a company must be able toseparate costs into capacity-related and flexible components.a. Trueb. False17. Cost-volume-profit analysis may be used for single-product andmultiproduct analysis.a. Trueb. False18. Selling price per unit is $30, flexible cost per unit is $15, andcapacity-related cost per unit is $10. When this company operates above the break-even point, the sale of one more unit will increase net income by $5.a. True19. A company with sales of $100,000, flexible costs of $70,000, andcapacity-related costs of $50,000 will reach its break-even point ifsales are increased by $20,000.a. Trueb. False20. In multiproduct situations when the sales mix shifts toward the productwith the lowest contribution margin, the break-even quantity willdecrease.a. Trueb. False21. The opportunity cost of a resource is zero if there is excess capacity ofthat resource.a. Trueb. False22. When a firm maximizes profits it will simultaneously minimize opportunitycosts.a. Trueb. False23. Even when the only constraint limiting production is machine time, acompany should be most concerned with maximizing contribution margin per unit.a. True24. The time over which a decision maker can adjust capacity is referred toas the short run.a. Trueb. False25. For general customers, the price charged for a product must cover itslong-run cost to the organization.a. Trueb. False26. In recent years, capacity-related costs have increased asa proportion oftotal manufacturing costs.a. Trueb. False27. Machine setup costs are usually classified as a business-sustainingactivity.a. Trueb. False28. The benefits of classifying activities using the broader framework ofunit-related, batch-related, product-sustaining, customer-sustaining, and business-sustaining activities are there are generally more costs thatare directly traceable to cost objects.a. Trueb. False29. Product life-cycle costing helps organizations decidewhether a newproduct should be launched.a. Trueb. FalseMULTIPLE CHOICE30. An example of a cost object is:a. a productb. a customerc. a departmentd. All of the above are correct.31. Manufacturing costs include:a. machinery used inside of the factoryb. research and development costsc. costs of dealing with customers after the saled. general and administrative costs32. Manufacturing costs include all of the following EXCEPT:a. costs incurred inside the factoryb. both direct and indirect costsc. both flexible and capacity-related costsd. both product and period costs33. Nonmanufacturing costs:a. include only capacity-related costsb. seldom influence financial success or failurec. include the cost of selling, distribution, and after-sales costs forcustomersd. are considered by GAAP to be an element of product costs34. Product costs:a. include administrative and marketing costsb. are particularly useful in financial accountingc. are expensed in the accounting period manufacturedd. are also referred to as nonmanufacturing costs35. For external reporting:a. costs are classified as either product or period costsb. costs reflect current valuesc. there are no prescribed rules since no one is exactly sure how theinvestors and creditors will use these numbersd. expenses include amounts that reflect current and future benefits36. Product costs are expensed on the income statement when:a. raw materials for the product are purchasedb. raw materials are requisitioned for the productc. the product completes the manufacturing processd. the product is sold37. Depreciation of plant facilities is classified as a(n):a. direct material costb. direct labor costc. indirect manufacturing costd. general and administrative cost38. The cost of inventory reported on the balance sheet may include the costof all the following EXCEPT:a. advertisingb. wages of the plant supervisorc. depreciation of the factory equipmentd. parts used in the manufacturing process39. A plant manufactures several different products. The wages of the plantsupervisor can be classified as a:a. direct costb. product costc. flexible costd. nonmanufacturing cost40. Period costs:a. are treated as expenses in the period they are incurredb. are directly traceable to productsc. include direct labord. are also referred to as indirect manufacturing costs41. Which of the following is NOT a period costa. marketing costsb. general and administrative costsc. research and development costsd. manufacturing costs42. Advertising is an example of a _________ cost expensed on the incomestatement in the accounting period incurred.a. directb. manufacturingc. periodd. product43. (CMA adapted, June 1992) The terms "direct cost" and "indirect cost" arecommonly used in cost accounting. Classifying a cost as either direct or indirect depends upon:a. the behavior of the cost in response to volume changesb. whether the cost is expended in the period in which it is incurredc. whether the cost can be related readily to resourcesconsumed for acost objectd. whether an expenditure is unavoidable because it cannot be changedregardless of any action taken44. Indirect manufacturing costs:a. can be traced to the product that created the costsb. may have a cause-and-effect relationship with capacity rather thanwith individual units of productionc. generally include the cost of material and the cost of labord. are included in period costs45. A manufacturing plant produces two product lines: football equipment andhockey equipment. An indirect cost for the hockey equipment line is the:a. material used to make the hockey sticksb. labor to bind the shaft to the blade of the hockey stickc. shift supervisor for the hockey lined. plant supervisor46. A manufacturing plant produces two product lines: football equipment andhockey equipment. Direct costs for the football equipment line are the:a. beverages provided daily in the plant break roomb. monthly lease payments for a specialized piece of equipment needed tomanufacture the football helmetc. salaries of the clerical staff that work in the companyadministrative officesd. utilities paid for the manufacturing plantTHE FOLLOWING INFORMATION APPLIES TO QUESTIONS 47 THROUGH 53.The Bowley Company manufactures several different products. Unit costs associated with product ICT101 are as follows:Direct materials $ 60Direct labor 10Flexible manufacturing support costs 18Capacity-related manufacturing support costs 32Sales commissions (2% of sales) 4Administrative salaries 16Total $14047. Total product costs associated with product ICT101 are:a. $ 50b. $ 88c. $120d. $14048. Total period costs associated with product ICT101 are:a. $ 4b. $16c. $20d. $5249. Total flexible costs associated with product ICT101 are:a. $18b. $22c. $88d. $9250. Total capacity-related costs associated with product ICT101 are:a. $16b. $32c. $48d. $5251. Total nonmanufacturing costs associated with product ICT101 are:a. $ 4b. $16c. $20d. $5252. Total manufacturing costs associated with product ICT101 are:a. $70b. $88c. $120d. $14053. Direct manufacturing costs associated with product ICT101 are:a. $70b. $88c. $92d. $10854. Cost behavior refers to:a. how costs react to a change in the level of activityb. whether a cost is incurred in a manufacturing, merchandising, orservice companyc. classifying costs as either product or period costsd. whether a particular expense has been ethically incurred55. Which statement is FALSEa. All flexible costs are direct costs.b. Because of a cost-benefit tradeoff, some direct costs may be treatedas indirect costs.c. All capacity-related costs are indirect costs.d. Direct costs may be flexible or capacity-related.56. An understanding of the underlying behavior of costs helps in all of thefollowing EXCEPT:a. sales volume can be better estimatedb. costs can be better estimated as volume expands and contractsc. true costs of processes can be better evaluatedd. process inefficiencies can be better identified and, as a result,improved57. Capacity-related costs:a. may be either direct or indirect costsb. vary with production or sales volumec. include parts and materials used to manufacture a productd. can be adjusted in the short run to meet actual demands58. Capacity-related costs depend on:a. the amount of resources usedb. the amount of resources acquiredc. the volume of productiond. the volume of sales59. Currently, most companies consider annual labor costs as:a. a capacity-related costb. a flexible costc. an opportunity costd. a period cost60. Which of the following does NOT describe a flexible costa. Flexible cost are always indirect costs.b. Flexible costs increase in total when the actual level of activityincreases.c. Flexible costs include most personnel costs and depreciation onmachinery.d. Flexible costs can always be traced directly to the cost object.61. Cost-volume-profit analysis is used PRIMARILY by management:a. as a planning toolb. for control purposesc. to establish a target net income for next yeard. to attain extremely accurate financial results62. Contribution margin equals revenues minus:a. product costsb. period costsc. flexible costsd. capacity-related costs63. The break-even point is the level at which revenues:a. equal capacity-related costsb. equal flexible costsc. equal capacity-related costs minus flexible costsd. equal flexible costs plus capacity-related costs64. The break-even point is:a. total costs divided by flexible costs per unitb. contribution margin per unit divided by revenue per unitc. capacity-related costs divided by contribution margin per unitd. (capacity-related costs plus flexible costs) divided by contributionmargin per unit65. Cost-volume-profit analysis assumes all of the following EXCEPT:a. all costs are purely flexible or capacity relatedb. units manufactured equal units soldc. total flexible costs remain the same over the relevant ranged. total capacity-related costs remain the same over the relevant range66. All of the following are assumed in a cost-volume-profit analysis EXCEPT:a. a constant product mixb. capacity-related costs increase when activity increasesc. revenue per unit does not change as volume changesd. all costs can be classified as either capacity-related or flexible67. In multiproduct situations, when sales mix shifts toward the product withthe highest contribution margin, then:a. total revenues will decreaseb. breakeven quantity will increasec. total contribution margin will decreased. operating income will increaseTHE FOLLOWING INFORMATION APPLIES TO QUESTIONS 68 THROUGH 71.Karen’s Kraft Korner, Inc., sells a single product. This year, 7,000 units were sold resulting in $70,000 of sales revenue,$28,000 of flexible costs, and $12,000 of capacity-related costs.68. Contribution margin per unit is:a. $b. $c. $d. None of the above is correct.69. Break-even point in units is:a. 2,000 unitsb. 3,000 unitsc. 5,000 unitsd. None of the above is correct.70. The number of units that must be sold to achieve $60,000 of profits is:a. 10,000 unitsb. 11,666 unitsc. 12,000 unitsd. None of the above is correct.71. If sales increase by $25,000, profits will increase by:a. $10,000b. $15,000c. $22,200d. an unknown amountTHE FOLLOWING INFORMATION APPLIES TO QUESTIONS 72 THROUGH 74.Mr. Paul’s Company sells several products for an average price of $20 per unit and the average flexible costs per unit are as follows:Direct material $Direct labor $Indirect manufacturing costs $Selling commissions $Mr. Paul’s annual capacity-related costs total $96,000.72. The contribution margin per unit is:a. $6b. $8c. $12d. $1473. The number of units that Mr. Paul’s must sell each year to break evenis:a. 8,000 unitsb. 12,000 unitsc. 16,000 unitsd. an unknown amount74. The number of units that Mr. Paul’s must sell annually to make a profitof $144,000 is:a. 12,000 units。

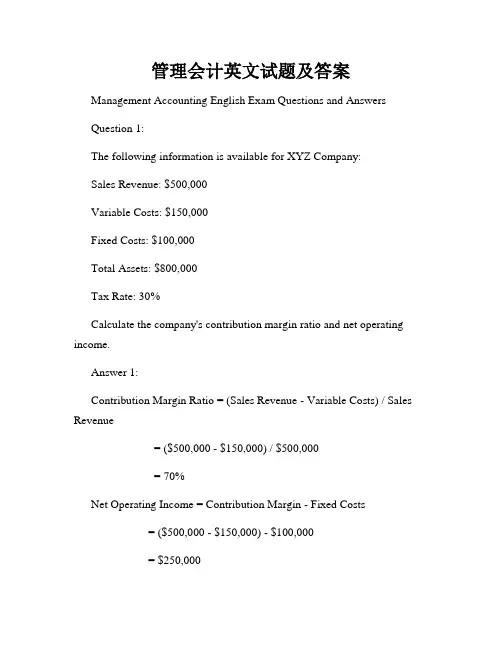

管理会计英文试题及答案

管理会计英文试题及答案Management Accounting English Exam Questions and AnswersQuestion 1:The following information is available for XYZ Company:Sales Revenue: $500,000Variable Costs: $150,000Fixed Costs: $100,000Total Assets: $800,000Tax Rate: 30%Calculate the company's contribution margin ratio and net operating income.Answer 1:Contribution Margin Ratio = (Sales Revenue - Variable Costs) / Sales Revenue= ($500,000 - $150,000) / $500,000= 70%Net Operating Income = Contribution Margin - Fixed Costs= ($500,000 - $150,000) - $100,000= $250,000Question 2:ABC Company produces and sells a product with the following data:Selling Price per Unit: $20Variable Cost per Unit: $10Fixed Costs: $50,000Expected Sales Volume: 10,000 unitsCalculate the breakeven point in units and dollars.Answer 2:Breakeven Point in Units = Fixed Costs / Contribution Margin per Unit= $50,000 / ($20 - $10)= 5,000 unitsBreakeven Point in Dollars = Breakeven Point in Units * Selling Price per Unit= 5,000 units * $20= $100,000Question 3:Determine the total cost and average cost per unit for a company based on the following data:Fixed Costs: $30,000Variable Costs per Unit: $5Production Volume: 8,000 unitsAnswer 3:Total Costs = Fixed Costs + (Variable Costs per Unit * Production Volume)= $30,000 + ($5 * 8,000)= $70,000Average Cost per Unit = Total Costs / Production Volume= $70,000 / 8,000= $8.75Question 4:A company has the following cost information:Direct Materials: $20,000Direct Labor: $30,000Other Manufacturing Overhead: $5,000Selling and Administrative Expenses: $10,000Calculate the Cost of Goods Manufactured and Cost of Goods Sold.Answer 4:Cost of Goods Manufactured = Direct Materials + Direct Labor + Other Manufacturing Overhead= $20,000 + $30,000 + $5,000= $55,000Cost of Goods Sold = Cost of Goods Manufactured + Opening Finished Goods Inventory - Closing Finished Goods Inventory= $55,000 + (Opening Finished Goods Inventory - Closing Finished Goods Inventory)Question 5:The following information is available for a company:Gross Profit: $80,000Operating Expenses: $50,000Other Income: $10,000Other Expenses: $5,000Calculate the Net Operating Income.Answer 5:Net Operating Income = Gross Profit - Operating Expenses + Other Income - Other Expenses= $80,000 - $50,000 + $10,000 - $5,000= $35,000Conclusion:In this article, we have discussed various management accounting questions and provided their corresponding answers. These questions covertopics such as contribution margin ratio, breakeven analysis, cost calculation, and net operating income. By understanding and applying these concepts, managers can make informed decisions regarding the financial aspects of their businesses.。

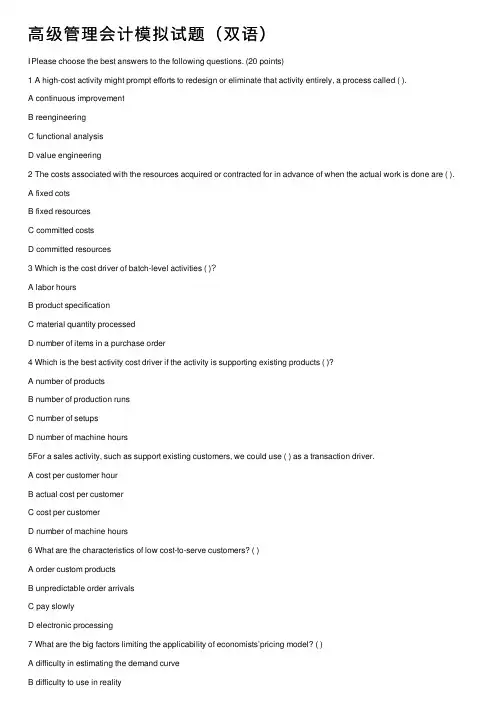

高级管理会计模拟试题(双语)

⾼级管理会计模拟试题(双语)ⅠPlease choose the best answers to the following questions. (20 points)1 A high-cost activity might prompt efforts to redesign or eliminate that activity entirely, a process called ( ).A continuous improvementB reengineeringC functional analysisD value engineering2 The costs associated with the resources acquired or contracted for in advance of when the actual work is done are ( ).A fixed cotsB fixed resourcesC committed costsD committed resources3 Which is the cost driver of batch-level activities ( )?A labor hoursB product specificationC material quantity processedD number of items in a purchase order4 Which is the best activity cost driver if the activity is supporting existing products ( )?A number of productsB number of production runsC number of setupsD number of machine hours5For a sales activity, such as support existing customers, we could use ( ) as a transaction driver.A cost per customer hourB actual cost per customerC cost per customerD number of machine hours6 What are the characteristics of low cost-to-serve customers? ( )A order custom productsB unpredictable order arrivalsC pay slowlyD electronic processing7 What are the big factors limiting the applicability of economists’pricing model? ( )A difficulty in estimating the demand curveB difficulty to use in realityC difficulty in estimating the cost curveD difficulty in identifying the cost drivers8 A supplier of telephone services charges a fixed line rental per period. The first 10 hours of telephone calls by the customer are free, after that all calls are charged at a constant rate per minute up to a maximum, thereafter all calls in the period are again free. Which of the following graphs depicts the total cost to the customer of the telephone services in a period? ( )9The total cost of production for two levels of activity is as follows:Level 1 Level 2Production(units)3,000 5,000Total cost ($)6,750 9,250The variable production cost per unit and the total fixed production cost both remain constant in the range of activity shown. What is the variable production cost per unit? ( )A $ 0.80B $ 1.25C $ 1.85D $ 2.2510 Which measures take the cost of capital into account? ( )A ROEB RIC ROID EV A11 A high-cost activity might prompt efforts to make the activity more efficient and less costly, a process called ( ).A continuous improvementB reengineeringC functional analysisD value engineering12 Resources acquired or contracted for in advance of when the actual work is done are ( ).A committed costsB committed resourcesC fixed cotsD fixed resources13 Which is the cost driver of unit-level activities ( )?A customer market supportB product specificationC labor hoursD number of items in a purchase order14 Which is the best activity cost driver if the activity is scheduling production jobs ( )?A number of machine hoursB number of production runsC number of setupsD number of products15 For a sales activity, such as support existing customers, we could use ( ) as a duration driver.A number of labor hoursB actual cost per customerC cost per customerD cost per customer hour16 What are the characteristics of high cost-to-serve customers? ( )A order standard productsB predictable order arrivalsC manual processingD electronic processing17 When total purchases of raw material exceed 30,000 units in any one period then all units purchased, including the initial 30,000, are invoiced at a lower cost per unit. Which of the following graphs is consistent with the behavior of the total materials cost in a period? ( )18 What are not the big factors limiting the applicability of economists’ pricing model? ( )A difficulty in calculating the cost driver rateB difficulty in estimating the demand curveC difficulty in estimating the cost curveD difficulty in identifying the cost drivers19An organization has the following total costs at three activity levels: Activity level (units) 8,000 12,000 15,000Total cost ($) 204,000 250,000 274,000Variable cost per unit is constant within this activity range and there is a step up of 10% in the total fixed costs when the activity level exceeds 11,000 units. What is the total cost at an activity level of 10,000 units? ( )A $ 234,000B $ 227,000C $ 224,000D $ 220,00020 The dysfunctional behavior from concentration on ROI was perceived probably under the influence of ( ) activities in 1980s.A GAAPB LBOC MBOD MVAⅡ Please fill the following blanks. (15 points)1When designing the optimal ABC system, one should balance the made from inaccurate estimates with the .2 The describes that the most profitable 20% of products generate about 300% of profits.3 Customers in the quadrant generate high margins and have low cost toserve.4 Recent work on (FMS) articulates how advanced manufacturing technologies can break through tradeoffs between mass production efficiency and flexibility.5 There are three broad phases in a product’s life cycle: , , .6 , , are some techniques of target costing.7 The role of is to direct the continuous improvement of process cost performance.8 EV A makes many adjustments such as , , to eliminate the distortions introduced by GAAP.9 is another costing tool to manage the total cost of quality. And is the variation of it.10 helps to derive a cost of capital based on the industry and risk characteristics of individual divisions.11 Economists show mathematically that firms in s somewhat monopolistic situation can maximize their profits at the price-output combination where equals .12 The capabilities of FMS and other information-intensive production technologies such as , , can all be viewed as greatly reducing the cost of performing batch and product-sustaining activities.ⅢPlease answer the following questions in your own words. (15 points)1 How many types of activity cost drivers are there in an ABC system? What is the difference between them?2 Please illustrate the types of quality costs with proper examples.ⅣRead the material and answer the following questions.Stellar Systems Company manufactures guidance systems for rockets used to launch commercial satellites. The company’s Software Division reported the following results for 20x1. Income…………………………………………………..$ 300,000Sales revenue………………………………………… … 2,000,000Invested capital (total assets)…………………………... 3,000,000Average balance in current liabilities…………………. 20,000Stellar Systems’weighted-average cost of capital (WACC) is 9 percent, and the company’s tax rate is 40 percent. Moreover, the company’s required rate of return on invested capital is 9 percent.Required:(1) Compute the Software Division’s sales margin, capital turnover,return on investment (ROI), residual income, and economic value added (EV A) for 20x1.(2) If income and sales remain the same in 20x2, but the division’s capital turnover improves to 80 percent, compute the following for 20x2: (a) invested capital and (b) ROI.。

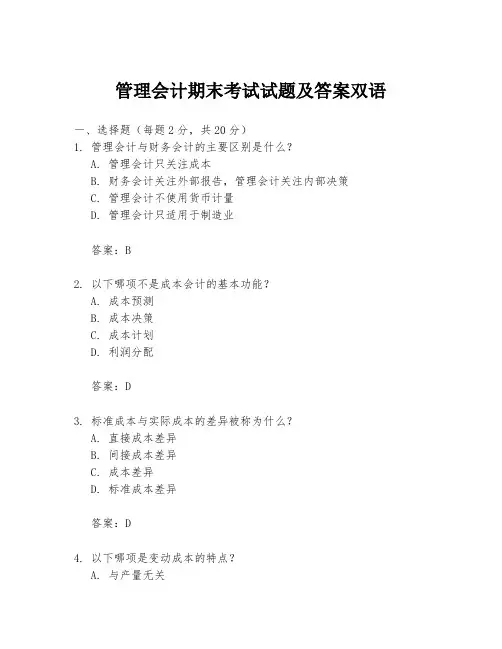

管理会计期末考试试题及答案双语

管理会计期末考试试题及答案双语一、选择题(每题2分,共20分)1. 管理会计与财务会计的主要区别是什么?A. 管理会计只关注成本B. 财务会计关注外部报告,管理会计关注内部决策C. 管理会计不使用货币计量D. 管理会计只适用于制造业答案:B2. 以下哪项不是成本会计的基本功能?A. 成本预测B. 成本决策C. 成本计划D. 利润分配答案:D3. 标准成本与实际成本的差异被称为什么?A. 直接成本差异B. 间接成本差异C. 成本差异D. 标准成本差异答案:D4. 以下哪项是变动成本的特点?A. 与产量无关B. 随产量的增加而减少C. 随产量的增加而增加D. 固定不变答案:C5. 预算管理的首要步骤是什么?A. 预算审批B. 预算编制C. 预算执行D. 预算分析答案:B...二、简答题(每题10分,共30分)1. 简述管理会计在企业决策中的作用。

答案:管理会计在企业决策中的作用主要体现在以下几个方面:首先,它通过成本分析帮助企业确定产品定价;其次,它参与企业的预算编制,为企业的经营活动提供财务规划;再次,管理会计通过成本控制帮助企业降低成本,提高效率;最后,它通过各种决策分析工具,如边际分析、本量利分析等,为企业的长期战略决策提供支持。

2. 解释什么是直接成本和间接成本,并举例说明。

答案:直接成本是指那些可以明确归属于特定产品或服务的成本,如原材料成本和直接人工成本。

例如,制造一台电脑的直接成本可能包括电脑零件和组装工人的工资。

间接成本则是指不能直接归属于特定产品或服务的成本,通常需要通过某种方法分配到各个产品上,如工厂租金、管理人员工资等。

3. 描述预算编制的一般流程。

答案:预算编制的一般流程包括以下几个步骤:首先,确定预算目标和预算范围;其次,收集和分析历史数据,预测未来趋势;然后,根据预测结果和企业目标,制定预算草案;接着,进行预算的内部沟通和协调,确保各部门的预算需求得到满足;最后,经过审批后,正式发布预算,并进行监控和调整。

《成本管理会计》双语课程试卷的定量分析

《成本管理会计》双语课程试卷的定量分析

本次双语课程试卷的定量分析,主要从三个方面进行:

一、考试内容的定量分析

1. 考试内容的比例:本次双语课程试卷的考试内容分为三大部分,分别为成本管理会计的理论知识、实践操作和案例分析,比例分别为40%、40%和20%。

2. 考试题型的比例:本次双语课程试卷的考试题型分为单选题、多选题、判断题、填空题和问答题,比例分别为50%、20%、10%、15%和5%。

二、考试难度的定量分析

1. 单选题难度:本次双语课程试卷的单选题难度较低,其中有40%的题目属于简单类型,30%的题目属于中等类型,30%的

题目属于困难类型。

2. 多选题难度:本次双语课程试卷的多选题难度较低,其中有50%的题目属于简单类型,30%的题目属于中等类型,20%的

题目属于困难类型。

三、考试时间的定量分析

1. 整体考试时间:本次双语课程试卷的整体考试时间为90分钟。

2. 每道题的平均考试时间:本次双语课程试卷的每道题的平均考试时间为1.5分钟。

管理会计 考题 (management accounting)

Managerial Accounting Acct 2301 –Exam 3 – Version INOTE: Rounding error within $5 is acceptable on all time-value-of-money problems. Name: …1.The Home Run batting cages chain has invested in ice cream stands for its variouslocations. The investment cost the company $100,000. The company expects tosell 10,000 ice cream servings per year. Variable materials, preparation andmarketing costs are expected to be $0.50 per serving. Fixed costs are expected to be $3,000 per year. If the company wants an ROI of 12%, how much should they charge for each serving of ice cream?a.$2.00b.$4.00c.$1.25d.$0.50e.There is not enough information available.2.Hoover Football Corporation desires a 10% ROI on all investment projects. Thefollowing information was available for the company in 2005:Sales $28,000Operating Income $ 5,600Turnover 1.0What is the corporation‟s ROI?a.40%b.30%c.24%d.20%e.None of the above3.Peek Company started the accounting period with the following beginningbalances in 2005:Raw material inventory $10,000Work in process inventory $30,000Finished goods inventory $20,000During the year, the company purchased $50,000 of raw materials and ended theyear with $20,000 in raw material inventory. Direct labor costs for the periodwere $80,000 and $10,000 of manufacturing overhead was applied to work inprocess. (There was no over or under applied overhead.) Ending work in process was $40,000 and ending finished goods sold $40,000. What was the amount ofcost of goods manufactured for the year? (i.e. How much was transferred tofinished goods?)a.$100,000b.$ 40,000c.$120,000d.$ 90,000e.None of the above4.An investment that costs $25,000 will produce annual cash flows of $5,000 for aperiod of 6 years. Further, the investment has an expected salvage value of$3,000. What is the net present value of the investment if the desired rate ofreturn is 12%?a.($25,000)b.$ 1,520c.$ 20,557d.($ 2,923)e.None of the above5.The management of Tarallo Industries obtained the following information aboutthe performance of a major investment project.Revenues $200,000Cost of Investment 300,000Margin 24%Assuming Tarallo has a desired rate of return of 14%, the project‟s residual income wasa.$42,000b.$28,000c.$ 6,000d.$72,000e.None of the above6.First Quay Company earns annual cash revenues of $25,000 for 8 years on aninvestment in a new machine that cost $120,000 cash. The machine isdepreciated $8,750 each year and the business pays an income tax rate of 30%.Annual cash operating expenses other than depreciation on the machine are$1,000. What is the annual cash inflow from the investment?a.$15,250b.$10,675c.$19,425d.$24,000e.$25,0007.Mark Johnson turned 18 years old today. His grandfather established a trust fundthat will pay Mark $50,000 on his 21st birthday. Unfortunately, Mark needsmoney today to start his college education and his father is willing to help. Hehas agreed to give Mark the present value of the future cash inflow, assuming a10% rate of return. How much cash should Mark‟s father give him today?a.$ 45,455b.$ 37,566c.$ 35,589d.$124,343e.None of the above8.At the beginning of the year, Riley Company estimated that its productionworkers would work 100,000 direct labor hours during the upcoming year and that overhead costs would amount to $500,000. The company‟s productionworkers actually worked 101,000 direct labor hours during the year. Theoverhead actually amounted to $495,000 for the year. What is the amount of over or underapplied overhead for the year?a.Overapplied by $5,000b.Underapplied by $5,000c.Overapplied by $10,000d.Underapplied by $10,000e.None of the above9.Tharpe Painting Company is considering a capital project that costs $30,000. Theproject will deliver the following cash inflows:Year 1 - $10,500Year 2 - $ 9,000Year 3 - $ 8,500Year 4 - $ 5,000Year 5 - $ 4,500Using the incremental approach, what is the payback period for the investment?a. 3.4 yearsb. 4.0 yearsc. 4.2 yearsd. 5.0 yearse.None of the above10.The accounting records for Lillehammer Manufacturing Company disclosed thefollowing cost information for 2005:Direct Materials $30,000Direct Labor $40,000Fixed manufacturing overhead $50,000Variable manufacturing overhead $10,000The company produced 10,000 units of inventory and sold 6,000 units during 2005 for $98,000. There was no beginning inventory. What amount of ending inventory will be reported on the balance sheet under absorption costing?a.$32,000b.$130,000c.$48,000d.$52,000e.None of the above11.Plummer Industries estimated overhead for 2005 to be $500,000 for 100,000direct labor hours. If 9,000 hours were actually worked in August, how much overhead would be allocated to work in process during the month?a.$45,000b.$41,667c.$40,000d.$38,000e.None of the above12.An investment project has a net present value of $2,500. The company‟s desiredrate of return is 16%. This impliesa.the company follows universal best practices.b.the investment project has an internal rate of return less than 16%.c.the investment project has an internal rate of return greater than 16%.d.the company follows cost-based pricinge.None of the above13.Havenbrook Inc. is considering purchasing a new machine for $125,000. Themachine is expected to yield a return of 15%. The company expects expenses to increase $8,000 from the new machine. Based on this information, how much does the company anticipate sales increasing from the new machine?a.$18,750b.$26,750c.$10,750d.$ 0e.None of the above14.Which of the following would increase residual income?a.Decrease in revenuesb.Increase in expensesc.Increase in the required ROId.Increase in investmente.None of the above15.Eastern Company can purchase an asset that costs $2,700,000. The asset isexpected to produce net cash inflows of $300,000 per year for 19 years. Based on this information, the investment is expected to yield an internal rate of returnclosest toa.5%b.7%c.9%d.11%e.13%16.The Londinium Company began business on January 1, 2005. The companyincurred the following transactions during the year. (All transactions are cash.)1.)Acquired $5,000 of capital from the owners.2.)Purchased $1,000 of raw materials.3.)Used $800 of these raw materials in the production process.4.)Paid production worker $600.5.)Applied manufacturing overhead of $200.6.)Started and completed 800 units of inventory.7.)Sold 650 units at a price of $5 each.8.)Paid $150 for selling and administrative expensesWhat is the amount of cost of goods sold for 2005?a. $1,600b.$1,300c.$1,463d.$1,138e.$3,25017.Konstanz Company uses a job order cost system. During the month of October,the company worked on three jobs. The job order cost sheets for the three jobsThe company‟s manufacturing overhead rate is $0.50 per labor dollar. During October, Job #102 was completed and sold. At the end of October, what was the total cost in Work in Process?a.$16,250b.$18,250c.$25,500d.$28,250e.None of the above18.The entry to dispose of underapplied manufacturing overhead will include aa.Credit to manufacturing overhead and a debit to cost of goods soldb.Credit to manufacturing overhead and a credit to cost of goods soldc.Debit to manufacturing overhead and a debit to cost of goods soldd.Debit to manufacturing overhead and a credit to cost of goods solde.No entry is needed19.Annie Boutiques has an average rate of return of 12%. Details of a proposedinvestment include the following:Sales Revenue $20,000Expenses 14,000Cost of Asset 30,000Which of the following statements is(are) correct?a.The investment should be accepted because it will yield an ROI that ishigher that the average ROI.b.Acceptance of the investment opportunity will decrease the company wideROI.c.The investment should be rejected because the investment opportunity willnot yield any additional residual income.d.Acceptance of the investment opportunity will yield residual income of$2,400.e.More than one answer is correct.pany A and Company B have the same amount of actual overhead. Neithercompany began the period with inventory, but both produced 100 items, using the same amount of material and labor. Both used direct labor hours as a cost driver.Both sold 75 items at identical prices. Company A over applied overhead, but Company B did not. Both companies adjust for the over or under appliedoverhead if there is any.Based on this information, after adjustments have been madepany A will have a higher profit than Company B.pany B will have a higher profit than Company A.pany A and Company B will have the same profit.d.There is only one true profit.e.None of the above.21.Vernon Company began business on January 1st, so it had no beginning inventory.Its total manufacturing costs for the year were $500,000. Cost of goodsmanufactured was $450,000 and cost of goods sold was $350,000 for the year.What is the balance in finished goods at the end of the year?a.$150,000b.$ 50,000c.$200,000d.$100,000e.None of the abovewless Company reported the following information for 2005:Sales $1,574,000Operating Assets $ 750,000Desired ROI 9%Residual Income $ 22,500The company‟s net income for 2005 wasa.$74,160b.$67,500c.$95,000d.$363,750e.None of the above23.Ventaren Company worked on two housing projects during 2005. Overhead wasapplied on the basis of direct labor hours. At the beginning of the year, thecompany estimated that overhead would be $50,000 and 10,000 direct labor hours would be worked. Both projects were started and completed in the currentaccounting period. The following transactions were completed during the period: ∙Project #1 – Used $8,000 of direct material; Incurred $10,000 of labor cost for 2,000 hours∙Project #2 – Used $12,000 of direct material; Incurred $9,000 of labor cost for 1,800 hoursProject #1 was sold for $35,000 in November 2005. What was the balance of Finished Goods on December 31, 2005 for the company?a.$58,000b.$40,000c.$28,000d.$ 0e.None of the above24.Fischer Price manufactures the “Little People Playhouse” in an assembly lineenvironment and uses the FIFO equivalent units method for accounting purposes.On March 1st, there were 5,000 physical units that were, on average, ½ finished.On March 31st, there were 10,000 physical units that were, on average, 60%finished. During March, 25,000 units were completed.If total production costs during March were $513,000, what is the cost per unit (specifically, wha t is the cost per …equivalent unit‟)?a.$20.52b.$17.10c.$25.65d.$18.00e.None of the above.25.An investment that costs $30,000 will produce annual cash flows of $10,000 for aperiod of 4 years. Given a desired rate of return of 8%, the investment willgenerate aa.Positive net present value of $33,121b.Positive net present value of $3,121c.Negative net present value of $33,121d.Negative net present value of $3,121e.None of the above。

cma英文试题及答案

cma英文试题及答案CMA英文试题及答案1. What does CMA stand for?A. Certified Management AccountantB. Certified Marketing AnalystC. Certified Medical AssistantD. Certified Management AnalystAnswer: A2. Which of the following is a primary responsibility of a CMA?A. Managing hospital operationsB. Analyzing financial dataC. Conducting market researchD. Developing marketing strategiesAnswer: B3. What is the minimum educational requirement to sit for the CMA exam?A. High school diplomaB. Associate degreeC. Bachelor's degreeD. Master's degreeAnswer: C4. The CMA exam consists of how many parts?A. OneB. TwoC. ThreeD. FourAnswer: B5. Which of the following is not a part of the CMA exam?A. Financial Planning, Performance, and AnalyticsB. Strategic Financial ManagementC. Auditing and AssuranceD. Financial Decision MakingAnswer: C6. How many multiple-choice questions are there in each part of the CMA exam?A. 100B. 150C. 200D. 300Answer: B7. What is the passing score for the CMA exam?A. 360B. 400C. 500D. 600Answer: C8. How many years of professional experience are required to obtain the CMA certification?A. 1B. 2C. 3D. 5Answer: B9. Which organization is responsible for administering the CMA exam?A. American Institute of Certified Public Accountants (AICPA)B. Institute of Management Accountants (IMA)C. Association of Certified Fraud Examiners (ACFE)D. Financial Accounting Standards Board (FASB)Answer: B10. What is the CMA's professional code of conduct called?A. The CMA CodeB. The IMA Statement of Ethical Professional PracticeC. The AICPA Code of Professional ConductD. The CMA Professional StandardsAnswer: B。

中英合作金融管理专业管理会计(二)样卷

高等教育教育自学考试中英合作商务管理专业与金融管理专业管理会计样卷注意事项1、样卷试题包括必答题与选答题两部分,必答题满分60分,选答题满分40分。

必答题为一、二、三题,每题20分。

选答题为四、五、六、七题,每题20分,任选两题回答,不得多选,多选者整个选答题部分不给分。

60分为及格线。

2、考试时间为150分钟。

3、可使用计算器及直尺等文具答题。

第一部分必答题(满分60分)(必答题部分包括第一、二、三题,每题20分)一、本题包括1-20题二十个小题,每小题1分,共20分。

在每小题给出的四个选项中,只有一项符合题目要求,把所选项前的字母填在题后括号内。

1.资产负债表反映A.收入和费用状况B.现金流入C.公司的财务状况D.公司在一定的会计期间内的经营状况2.会计信息的内部使用者包括A.股东B.经理C.债权人D.政府3.下列关于管理会计的提法中,正确的是A.管理会计受到政府或法律的管制B.管理会计是事后会计C.管理会计应需要而生D.管理会计是对外报告会计4.管理过程不包括下列哪个环节A.定义B.鼓励C.组织D.计划5.对上市公司而言,下列哪项信息可以不公开A.资产负债表B.经营目标C.现金流量表D.利润表6.总成本的构成是A.固定成本加上间接成本B.固定成本加上变成成本C.直接成本加上变动成本D.基本成本加上直接成本7.固定成本A.与产量有关B.与销量有关C.与利润额有关D.不随产量变动而变动8.安全边际是指A.最大产量B.盈亏临界点产量C.最大产量减去临界点产量D.最大产量加上盈亏临界点产量9.作业成本法A.建立了销售收入和成本之间的关系B.明确了制造费用的动因及制造费用与产品的关系C.是用于计划与控制成本、收入及利润的具体技术D.揭示了实际成本及收入与计划成本及收入之间的差异10.某个产品的标准成本是A.直接材料与直接人工之和B.直接人工与间接费用之和C.直接人工、直接材料与分摊的制造费用之和D.直接材料与分摊的制造费用之和11.边际成本法也叫A.变动成本法B.固定成本法C.完全成本法D.产品成本法12.短期定价方法包括A.撇脂定价法B.渗透定价法C.贡献毛益定价法D.竞争定价法13.预算的两个主要目标是A.现金预算和成本预算B.现金预算和材料预算C.资源预算和利润规划D.资源预算与材料预算14.资源预算不包括A.现金的取得B.资本性设备的取得C.人力资源的取得D.利润的来源15.预算的缺点有A.缺乏弹性B.前瞻性C.激励管理者D.对整个组织进行控制16.编制预算的第一步A.确定限制因素B.建立预算委员会C.编制预算草案D.编制销售预算17.下列各项情况中,存在风险的是A、信息不充分B、存在几种可能的结果C、不能确定地预测结果D、经理无意投资18.当净现值大于零时,下列说法不正确的是A、内部报酬率小于资本成本B、该项目不可行C、现值指数(又称利润指数)大于1D、经理无意投资19.投资评估净现值法的前提是A、等额资金在现在和未来具有同样的价值B、等额资金在未来的价值大于现在的价值C、等额资金在未来的价值大于现在的价值D、不管何时取得收入其价值是一样的20.损益表反映A、公司的财富B、一定会计期间内公司的现金流入和流出情况C、一定会计期间内公司的经营状况D、公司的资产、负债和所有者权益情况请认真阅读下面的案例,然后回答第二、三题。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

长江大学国际学院2011-2012学年度第1学期《管理会计学》试卷考试方式:闭卷满分:100分时间:2小时姓名: 学号: 班级: 专业:考生注意:1、所有考题请回答在考卷指定位置上;2、请考生务必把专业、班级、学号及姓名填写在试卷上。

I Single Choice (1'× 15 = 15')1.Several factors affect the classification of a cost as direct or indirect. ( ) A. The materiality of the cost in question B. Cost allocation C. Cost assignment D. Cost object2.A ( ) remains unchanged in total for a given time period, despite wide changes in the related level of total activity or volume.A. Variable costB. Fixed costC. Direct costD. Indirect cost3.If your inventory balance at the beginning of the month was $1,000,you bought $300 during the month ,and sold $300 during the month, what would be the balance at the end of the month. ( )A. $1000B. $800C. $1200D. $2004.The total costs is the sum of fixed costs and variable costs. Fixed costs is $2,000 at all quantities of units sold within the relevant range, variable cost per unit is $150, so total costs at 40 units sold equal ( )A. $7,800B. $8,000C. $6,800D. $5,0005. At the breakeven point, operating income is by definition ( )Single choiceMultiple-choiceJudgmentCalculationObtained marksA. $1B. $0C. Not sureD. - $16.Operating leverage describes the effects that fixed costs have on changes in operating income as changes occur in units sold and contribution margin. Contribution margin is $3,600.Operating income is $1,600,the degree of operating leverage is ( )A. 2.25B. 1.67C. 0.67D. 17.The simplest form of quantitative analysis to “fit”a line to data points is the high-low method.CostDriver:Machine-Hours(X) Indirect Manufacturing labor costsHighest observation of costdriver80 $2,000Lowest observation of costdriver20 800Difference 60 $1200The high-low estimate of the cost function is ( )A. $230+$14XB.$400+$20XC. $230+$14.98XD.$200+420X8.ABC company production candy, the unit cost data such as table.items sumDirect Materials $55.00Direct Labor $15.00Variable Manufacturing Overhead $10.00Contribution margin ration is 20%, please use the Variable Costs Addition Method,the sale price of candy is ( )A.$50.00 B$100.00 C.$45.00 D.$56.009.( ) is any cost that is primarily subject to the influence of a given responsibility center manager for a given period.A. The opportunity costB. The sunk costC. The controllable costD. The quality cost10. The starting point for the operating budget is generally ( )A. The product budgetB. The profit budgetC. The costs budgetD. The revenues budget11.V arious cost-behavior patterns. Select the graph that matches the numbered manufacturing cost data. Indicate by letter which graph best fits the situation or item described.Electricity bill---a flat fixed charge, plus a variable cost after a certain number of kilowatt-hours are used, in which the quantity of kilowatt-hours used varies proportionately with quantity of units produced. ( )A BC D12. which aren’t the categories of costs associated with goods for sale.( )A. Purchasing costsB. Ordering costsC. Postsales-service costsD. Carrying costs13. In the Top-spin, he carbon-fiber machine costs $200,000,has a five-year expected useful lift and generates $100,000 uniform cash flow each year. he payback period is ( )A.2 yearsB.1 yearsC. 3.8 yearsD.4 years14. Various cost-behavior patterns. Select the graph that matches the numbered manufacturing cost data. Indicate by letter which graph best fits the situation or item described.City water bill, which is computed as follows:First 1,000,000 gallons $1,000 flat feeNext 10,000 gallons $0.003 per gallon usedNext 10,000gallons $0.006 per gallon usedNext 10,000gallons $0.009 per gallon usedAnd so on and so onThe gallons of water used vary proportionately with the quantity of production.( )A BC D15. The selling prices computed under cost-plus pricing are prospective prices. Suppose Aste’s initial product design results in a $750 full cost for ProvalueⅡ.Assuming a 12% marup, Astel sets a prospective price of ( )A. $780B. $660C. $825D.$840ⅡMultiple-choice (4'× 9= 36')1. Recording the costs of resources acquired and used allows managers to see how behave. Consider two basic types of cost-behavior patterns found in many accounting systems. There are ( )A. Variable costsB. Direct costsC. Fixed costsD. Indirect costs2. Most professional accounting organizations around the globe issue statements about professional ethics. There are ( )A. CompetencyB. ConfidentialityC. IntegrityD. Credibility3. What guidelines do management accountants use? ( )A. Employ a cost-benefit approachB. Recognize behavioral as well as technical considerationC. Identify different costs for different purposesD. The key management accounting guidelines4. We define three sectors of the economy and provide examples of companies in each sector. There are ( )A. Manufacturing-sector companiesB. Merchandising-sector companiesC. Service-sector companiesD. Direct material costs5.You have seen how CVP analysis works, please think about the following assumptions(假设) we made during the analysis. There are ( )A. Changes in the levels of revenues and costs arise only because of changes in the number ofproduct (or service) units sold.B. Total costs can be separated into two components: fixed costs and variable costs.C. Selling price, variable cost per unit, and total fixed costs are known and constant.D. When represented graphically, the behaviors of total revenues and total costs are linear inrelation to units sold within a relevant range.6. Be sure you understand that to be relevant costs and relevant revenues they must ( )A. Occur in the futureB. Occur in the pastC. differ among the alternative courses of actionD. Revenues and costs are relevant.7. Major influences on pricing decisions is ( )A. customersB. CompetitorsC. CostsD. Suppliers8. The light and dark blue boxes in the exhibit are the financial budget, which is that part of ( )A. The capital expenditures budgetB. The operating budgetC. The budgeted balance sheetD. The cash budget9. Describe the perspectives of the balance scorecard .That are ( )A. Financial perspectiveB. Customer perspectiveC. Postsales-service ProcessD. Learning-and-growth perspectiveIII Judgment (1'×10= 10')1. Management accounting information and reports do not have to follow set principles or rules. ( )2. Cost object is the collection of cost data in some organized way by means of an accounting system. ( )3. Relevant range is the band of normal activity level or volume in which there is a specific relationship between the level of activity or volume and the cost in question.( ) 4. The breakeven point (BEP) is that quantity of output sold at which total revenues equal total costs. ( )5. High-low Method estimates cost functions by classifying various cost account as variable, fixed, or mixed with respect to the identified level of activity. ( )6. Book value of existing equipment is a past (historical or sunk) cost and therefore, is irrelevant in equipment-replacement decisions. ( )7. Opportunity cost is the contribution to operating income that is forgone by not using a limited resource in its next-best alternative use . ( )8. A responsibility accounting system could either exclude all uncontrollable costs from a manager’s performance report or segregare such costs from the controllable costs. ( )9. Variable costing and absorption costing differ in only one respect: how to account for fixed manufacturing costs. Under variable costing, fixed manufacturing costs are excluded from inventoriable costs and are a cost of the period in which they are incurred. ( ) 10. Under Variable costing, fixed manufacturing cost are inventoriable and become a part of goods sold in the period when sales occur. ( )IV Calculation(39')1. (7') CD word is an independent electronics store that sells blank compact disks. CD Word purchases the CDs from Sontek at $14 a package (each package contains 10 disks).Sontek pays for all incoming freight. No inspection is necessary at CD world because Sontek supplies quality merchandise. CD word′s annual demand is 2,000 packages,at a rate of 250 packages per week. The purchase-Order lead time is two weeks. Relevant ordering cost per purchase order is $100.Relevant carrying cost per package per year is $10.Required:(1) calculate the EOQ from CD(2) calculate the number of orders that will be placed each year(3) calculate the reorder point for CD2.(7')CVP computations. Fill in the blanks for each of the following independent cases.case Revenues VariableCosts FixedCostsTotal Costs OperatingIncomeContributionMarginpercentagea $500 $800 $1,200b $2,000 $300 $200c $1,000 $700 $1,0003.(10')Returning to the Top-Spin carbon-fiber machine project, assume that Top-Spin is a nonprofit organization and that the expected additional operating cash inflows are $100,000 in years 1 through 5 and $90,000 in year 5.The net initial investment is $371,000(new machine,$300,000 plus additional working capital,$60,000 minus terminal disposal value of old machine,$11,000).All other facts are unchanged a five-year useful life, no terminal disposal value, and an 8% RRR. Year 5 cash inflows are $100,000, which includes a $10,000 recovery of working capital. (P∕A,8%,5)=3.993 (P∕A,10%,5)=3.791 (P∕A,12%,5)=3.605 Calculate the following:(1) Net present value(2) Payback(3) Internal rate of return4. Mary Frost is considering selling DO-All software, a home-office software package, at a computer convention in Chicago. The selling price is $200,the variable cost a is $120.She must pay to computer conventions, Inc. offers Mary three rental alternatives:Option 1: $2000 fixed feeOption 2: $800 fixed fee plus 15%of convention revenues.A. (1) calculate the breakeven point in units for option 1 and option 2(2) calculate the degree of operating leverage at sales of 40 units for the teorental options.(At this quantity, Mary’s operating income is $1200 )B. Suppose Mary choose option 2 ,she would pay $800 fixed fee and 15% of conventionrevenues. The selling price is $200 ,the variable costs is $120.Mary anticipates selling 40 units at the convention. Mary’s operating income will be $1200,Mary is considering placing an advertisement describing the product and its features in the convention brochure. The advertisement will cost $500.This cost is a fixed cost because it will not change regardless of the number of units Mary sells. She thinks that advertising will increase sales by 10% to44 packages.(1) The following table presents the CVP analysis, please fill in the blanks.40 Packages Sold with No Advertising 44 Packages Soldwith AdvertisingDifferenceRevenuesVariable costsContributionMarginFixed costsOperating incomeShould Mary advertise?(2) Suppose Mary decides not to advertise. Mary is contemplating whether to reduce the selling price to $175. At this price, she thinks she will sell 50 units. At this quantity, the software wholesaler who supplies DO-All software will sell the packages to Mary for $115 per unit instead of 120.Shold Mary reduce the selling price? Please give a CVP shows.。