财务管理专业英语复习题

财务管理英语知识

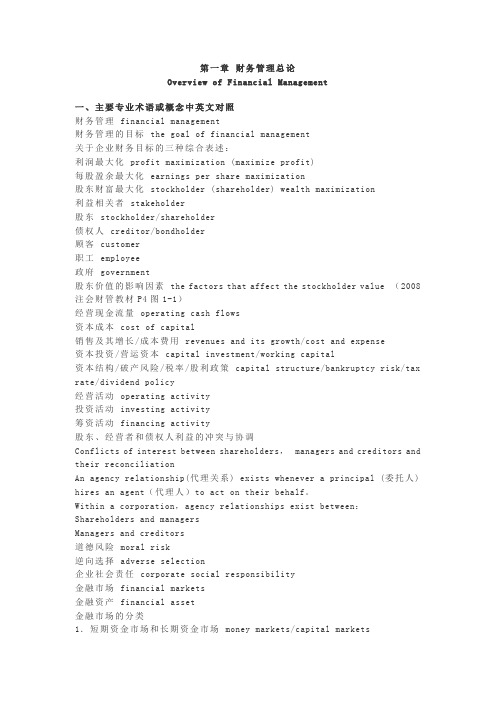

第一章财务管理总论Overview of Financial Man agement一、主要专业术语或概念中英文对照财务管理financial management财务管理的目标the goal of financial management关于企业财务目标的三种综合表述:利润最大化profit maximization (maximize profit)每股盈余最大化earnings per share maximization股东财富最大化stockholder (shareholder) wealth maximization利益相关者stakeholder股东stockholder/shareholder债权人creditor/bondholder顾客customer职工employee政府government股东价值的影响因素the factors that affect the stockholder value (2008注会财管教材P4图1-1)经营现金流量operating cash flows资本成本cost of capital销售及其增长/成本费用revenues and its growth/cost and expense资本投资/营运资本capital investment/working capital资本结构/破产风险/税率/股利政策capital structure/bankruptcy risk/tax rate/dividend policy经营活动operating activity投资活动investing activity筹资活动financing activity股东、经营者和债权人利益的冲突与协调Conflicts of interest between shareholders,managers and creditors and their reconciliationAn agency relationship(代理关系) exists whenever a principal (委托人) hires an agent(代理人)to act on their behalf。

财务管理专业英语 句子及单词翻译

Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity.财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。

Decisions involving a firm’s short-term assets and liabilities refer to working capital management.决断涉及一个公司的短期的资产和负债提到营运资金管理The firm’s long-term financing decisions concern the right-hand side of the balance sheet.该公司的长期融资决断股份资产负债表的右边。

This is an important decision as the legal structure affects the financial risk faced by the owners of the company.这是一个重要的决定作为法律结构影响金融风险面对附近的的业主的公司。

The board includes some members of top management(executive directors), but should also include individuals from outside the company(non-executive directors).董事会包括有些隶属于高层管理人员(执行董事),但将也包括个体从外公司(非执行董事)。

Maximization of shareholder wealth focuses only on stockholders whereas maximization of firm value encompasses all financial claimholders including common stockholders, debt holders, and preferred stockholders.股东财富最大化只集中于股东,而企业价值最大化包含所有的财务债券持有者,包括普通股股东,债权人和优先股股东。

财务英语试题及答案

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

基于能力培养的财务管理专业英语课

作者简介:李曜铎(1992-),男,山东安丘人,硕士,广东培正学院会计学院教师,主要研究方向为财务管理㊁成本结构领域㊂基于能力培养的财务管理专业英语课程标准改革和实践李曜铎(广东培正学院会计学院,广东广州510830)摘㊀要:财务管理专业英语是重要的专业必修课程,基于学生能力培养的课程标准改革势在必行㊂教学策略坚持以学生为本,开展多种教学形式,及时作业点评与答疑,发现学生学习不足和改进方向,多方面考核评定成绩,使学生既掌握扎实的财务管理专业理论知识,又具备良好的英语实践应用能力,适应日趋激烈的竞争环境㊂关键词:学生能力;财务管理专业英语;课程标准;改革;实践中图分类号:F23㊀㊀㊀㊀㊀文献标识码:A㊀㊀㊀㊀㊀㊀doi:10.19311/ki.1672-3198.2022.24.055㊀㊀随着经济全球化和技术竞争的进程加快, 一带一路 倡议得到更多国家的认可,参与全球合作和竞争,精通财务管理知识和掌握外语的国际化人才的需求快速增加,财务管理毕业生面临的劳动力市场,将会多方面接触原材料采购和跨国并购等海外业务,因此加强财务管理专业英语教学,学生既掌握专业知识,又具有专业英语的交流和实践应用技能,是应用型本科院校人才培养的大势所趋㊂财务管理专业英语是财务管理专业的一门双语教学的基础课程,是用英语阐述财务管理概况㊁诠释财务报表㊁财务比率分析㊁货币时间价值与估价㊁风险与收益㊁资本预算㊁资本市场与资金筹集㊁资本结构㊁股利政策和营运资本管理等专题㊂课程标准是学生接受一定教育阶段以后,对于其学习效果的具体描述,是教学质量应该达到的具体指标,是基于学生学习结果的具体行为描述,更多侧重于对学生实际能力的培养,课程标准尽可能是可以达到的㊁理解的和评估的,范围应该涉及认知㊁技能与情感这三个领域,目标的行为主体不是教师,而应该是学生,关注的是学生学习的过程和方法,以及由此产生正确的职业素质和价值观,积极的情感体验,教师主要关注的是怎样有效的利用课程所特有的优势促进每一个学生的健康发展㊂1㊀财务管理专业英语教学现状的分析1.1㊀人才培养目标不明确财务管理工作理论和实际操作性很强,需要对利润分配和企业筹资等进行科学的计量,做出正确的决策,财务管理专业英语教学培养的学生要求既有扎实的理论知识,又具备较强实践能力㊂目前,财务管理专业英语教学大纲要求学生掌握英文财务管理专业术语,经典理论㊁重要知点,能够阅读和翻译财务管理领域的英文文献㊂显然,这难以培养学生财务管理实际工作中使用英语的能力,无法从根本上满足企业对人才的需求㊂1.2㊀学生英语基础薄弱财务管理专业英语课程标准的达成,要求学生具有一定程度英语词汇量,阅读和写作的基础,从广东培正学院财务管理专业英语教学情况分析,大部分学生听说能力偏低,词汇量少,阅读㊁写作㊁翻译能力缺乏,英语思维能力薄弱,很少有学生读过英文原版书籍㊂很多学生不敢使用英语参与课堂讨论,课后做的复习不多,课堂基本是 教师讲学生听 的传统模式,难以丰富和创新教学内容体系,教师及学生均无法从教学过程中获取成就感,教学效果难以达到理想效果㊂1.3㊀缺乏适合应用型本科学生英文水平的教材适合应用型本科院校财务管理专业英语教学的教材目前还是比较缺乏,英文原版教材内容和语法准确,专业知识覆盖面广,学生可以既学习财务管理专业知识,又能接触到纯正英语,应该是最好的教学资源,但是其专业难度大,相对于国内教材价格高昂,很多学生不愿意接受,国内很多是中文财务管理教材的翻译版,对于学生群体的特点没有很好的区分和定位,又很难买到配套习题集和教辅材料,给课后自主学习造成了困难㊂1.4㊀缺乏高素质的师资队伍财务管理专业英语课程要求任课教师既具备扎实的英语教学能力,同时具有财务管理的专业知识,但是目前应用型本科院校的教学现状,还是比较缺乏能同时符合两项要求的教师,师资队伍或者是英语背景,或者是商科背景,对专业词汇发音不够准确,造成教学质量比较低的现象㊂1.5㊀教学方式单一,考核方式不完善目前,财务管理专业英语教学方式大多以教师为中心,课堂上单一灌输式,很多时间用于专业术语的讲解和发音,为了能够引导学生阅读和翻译教材,要求记忆大量的专业词汇,而忽略了必需的听㊁说㊁写的基本英语应用技能的培养;在考核方式方面,也不够完善,总评成绩主要是平时成绩和期末考试成绩,其优点是能对学生专业文章阅读和翻译能力,专业词汇的掌握程度进行一定的客观评价,缺点是不能有效地评价英语的听,说和写的实践和运用能力㊂2㊀财务管理专业英语课程教学标准的改革和实施2.1㊀教学策略的改进坚持以学生为本,注重教学方式的适时改进与优化,激发学生学习兴趣和学习潜力,引导学生深层次学习,支㊃821㊃持教学目标达成㊂可采用课程先导练习+教师理论知识点讲授+讨论点评的方式,进行财务管理专业英语基本理论部分的教学;同时,采用专题专项课堂习题㊁复习㊁辅导指导的方式,开展内容㊁目标明确的随堂实践性学习㊂在教学总体设计方面,以学习财务管理专业英语基本理论知识为主线,将理论与应用贯穿于整个课程教学的过程,开展多媒体教学㊁案例教学㊁启发式教学㊁讨论式教学等多种教学形式,重点以新闻视听㊁微型案例㊁正文㊁核心词汇㊁思考与探索和知识扩展等多个板块作为切入点,教会学生能把财务管理知识的相关概念和专业英语进行充分结合㊁提高学生学习积极性;同时加强训练学生快速阅读财务管理英文教材㊁掌握财务管理英语术语及其习惯用法,提高其专业英语的听说读写译能力,达到课堂教学的预期效果㊂教师提供扩展性案例材料,提出观点㊁问题,学生分组讨论㊁表达个人观点㊁进行课堂演示或进行小组汇报㊂教师针对发言或小组报告情况进行补充及点评,对具体的教学环节㊁方法㊁手段㊁小目标等作灵活㊁具体的设计,以求教学与实际需求匹配最大化,更好地助力课程目标的实现㊂在教学组织方面,原则上要求学生独力完成课程的学习与课程作业,如若课程作业目标较大㊁较复杂,时间需求较多,可酌情允许学生组成小组,但人数宜以3-5人为宜㊂分组工作应在完成课程第一部分教学内容的讲授后即进行㊂在教学实施方面,应在第一部分课程内容的讲授完成后,即安排学生开始着手课程作业实施;在财务管理专业英语课程教学的实施过程中,教师应控制好课堂讲授在整个课程学时中的比例,尽量分配安排更多的学时给予学生主动讨论课堂环节,应适时将阶段作业与考核情况,在课堂上进行公开展示与点评,以促进学生的学习积极性,同时,让学生及时发现学习存在的不足和今后提高的方向㊂2.2㊀学生自主学习的支持每周组织一次作业点评与答疑,及时发现并指出学生学习方面的不足及改进的方向;同时,教师对作业完成情况进行点评,对教学总体进度效果作出评估,及时发现教学方面的短板与不足,及时给予调整补充;教师需通过课堂教学过程㊁作业批改等途径,注意观察和发现学习困难的学生,并及时针对他们的具体情况给予额外的学习帮助与支持㊂课程结束时,教师须认真撰写成绩分析报告,并结合日常教学中的观察,对课程教学进行总结反思,为开展课程教学研究积累第一手资料,以对教学持续地改进㊂2.3㊀成绩评定与反馈在考核内容方面,与学生基于英语处理财务管理业务的综合实践能力培养高度关联㊂考核侧重于对学生财务管理专业英语基础知识㊁基本业务的综合实践能力的考核,考核的主要内容为财务管理概况㊁诠释财务报表㊁财务比率分析㊁货币时间价值与估价㊁风险与收益㊁资本预算㊁资本市场与资金筹集㊁资本结构㊁股利政策和营运资本管理等专题,藉此全面考核学生的学习成效及掌握业务处理技术的水平㊂成绩评定,按照考试模式改革实施方案评定成绩,期末考试成绩占60%,平时成绩占40%㊂其中:平时成绩由课后作业㊁课堂考核(出勤情况㊁听课情况㊁回答问题情况)等构成㊂平时作业(课后作业)要依循课程教学大纲所拟教学内容,按照 财务比率分析㊁货币时间价值与估价㊁风险与收益㊁资本预算等专题 分别安排4次阶段性作业㊂但具体作业内容㊁次数可在严格执行课程教学安排的前提下,由教师根据实际情况灵活设计与安排,并以相对应的教学分段的知识目标要求与能力目标要求为依据,对阶段性作业情况进行及时的评点㊁剖析㊂3㊀结束语通过学习财务管理专业英语课程,使学生既具备扎实的财务管理专业知识理论,又具有良好的英语实践应用能力,在教学中强化对学生基本技能的训练,提高学生实际能力,适应日趋激烈的竞争环境,劳动力市场对财务管理岗位中英双语高素质应用型人才的需求日渐增长需求㊂课程标准的改革有助于学生获得如下学习成果㊂3.1㊀提升政治思想素质学生通过本课程学习,熟悉基本财务管理法规和政策,守法意识和纪律观念明显增强;熟悉财务管理职业道德,社会公德意识和社会责任感明显增强;具有诚实守信㊁爱岗敬业㊁干好财务管理工作的职业意识㊂3.2㊀掌握财务管理专业英语基本的理论知识学生通过本课程学习,熟悉财务管理概况㊁诠释财务报表㊁财务比率分析㊁货币时间价值与估价㊁风险与收益㊁资本预算㊁资本市场与资金筹集㊁资本结构㊁股利政策和营运资本管理等专题;掌握财务管理的英语习惯表达,以及基于英文分析解决财务管理的基本问题㊂3.3㊀具备基于英语理解财务管理的基本能力学生通过本课程学习,会运用财务比率对财务报表进行初步基础分析,会运用货币时间价值理论对股票债券进行估价,会运用风险收益分析对资本预算决策㊁资金筹集决策以及资本结构决策做出初步基础分析判断㊂参考文献[1]王勇,赵振智.国际会计专业㊁学生英语能力与国际化会计人才培养:基于山东省高校ACCA专业问卷数据的递归模型检验[J].财会通讯,2018,(34):43-46.[2]纪金莲,王凤羽.应用型财务管理专业实践教学体系构建:基于职业岗位能力导向[J].财会通讯,2019,(16):49-53.[3]闫启盈.财务管理专业英语新考核方式的探讨[J].科教文汇,2020,(9):119-120.[4]刘利.新形势下英语在财务管理本科专业课程教学中的应用[J].宁波职业技术学院学报,2020,(5):40-46.[5]容荻风.应用型高校专业英语课程教学改革与实践 以广西民族大学相思湖学院财务管理专业英语课程教学为例[J].大学教育, 2021,(7):135-138.[6]林琳.地方本科院校财务管理专业英语课程考核模式探讨[J].现代商贸工业,2019,(14):179-180.㊃921㊃。

财务管理专业英语复习题(参考答案)

D. working sheet D. equipment depreciation C. capital budgeting. A. time deposits A. the initial cost of the project can be reduced. C. notes payable B. sunk A. I and III only C. salaries payable D. product producing C. initial public offering (IPO). A. total A. future value D. (1+8%/2)2-1 B. $295,000 D. collecting accounts receivable faster A. m D. common stock A. gross profit margin A. liquidity ratios B. degree to which the net present value reacts to changes in a single variable.B. the transaction is complete and the goods or services delivered.A. Return on equity A. general economic risk D. It does not include depreciation.C. Interest. B.$108 B. $37.62 B. Corporate investment decisions have nothing to do with financial markets,A. Financial management A. double taxation of dividends D. compound interest D. The market is overvaluing the stock.B. approximately 10 B.640,000 D. issue common stock.A. Net profit margin ×Total asset turnover ×Equity multiplier B.bond issuing C. capital budgeting B. marketability A. future value流动比率Current ratio= Current assets/ Current liabilities=1.91速动比率Quick ratio=( Current assets- Inventory)/ Current liabilities=1.27应收账款周转率Accounts receivables turnover ratio=Sales/Accounts receivable=4.37债务比率Debt ratio= Total liabilities/ Total assets=50.3%资产收益率Return on assets= Net income/ Total assets=3.45%Price/earnings ratio= Market price per share/ Earnings per share=45.83Current ratio = Current assets / Current liabilities = 1.1Total debt ratio =(Total assets – Total equity) / Total assets = 0.58Total asset turnover = Sales / Total assets = 0.27Profit margin = Net income / Sales = 0.22Equity multiplier = Total assets / Total equity = 2.375ROA= Net income / Total assets = 0.061ROE= Net income / Total equity = 0.1452) ROE= Profit margin * Equity multiplier * Total assets turnover = 14.56%Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. Other names for financial management include managerial finance, corporate finance, and business finance. Making financial decisions is an integral part of all forms and sizes of business organizations from small privately-held firms to large publicly-traded corporations财务管理是一个通过收购、融资和资产管理来完成一些企业总体目标的综合决策过程。

财务管理专业英语

Analyzing Financial Ratios

Some preliminary comments are warranted:

1. Financial ratios are not standardized.

4.2.1 Current ratio

Excessively high current ratios, however, may indicated a firm may have too much of its long-term investor-supplied capital invested in short-term low-earning current assets.

4.2 Liquidity Ratios

Net working capital to total assets ratio= Net working capital Total assets

净营运资本比总资产比率

4.2.1 Current ratio

Current ratio Current assets Current liabilities

Denominator 分母 Numerator 分子

4.2.1 Current ratio

For example, a current ratio of 1.5 implies that a firm has $1.5 in current assets for every $1 in current liabilities and thus has 1.5 times the current assets, or has its current liabilities covered 1.5 times over.

财务管理专业英语第二章

corporate managers cannot effectively serve many masters. Purposeful behavior requires the existence of

这就是说公司经理不能有效的服务多个目标。 a single-valued objective function. 一个单一的价值目标。

2

The article translation 文章翻译

division of opinion exists on the goal of financial management, two leading contenders are stakeholder 对财务管理的目标存在着很大的分歧, theory and value(wealth) maximization. 理论和价值最大化。 但是两种最主要的理论是利益相关者

Why focus on maximizing share price? First, using stock price maximization as an objective function

2.3.1 Stakeholder Theory 2.3.1 利益相关者理论

Stakeholder theory is the main contender to value maximization as the corporate goal. Stakeholder

作为企业的目标,利益相关者理论是价值最大化理论的主要竞争理论。 理论认为管理者所做的决策要考虑公司所有相关者的利益。 stakeholders. Such stakeholders include not only financial claimholders * but also employees, managers, 这些利益相关者不仅包括所有者还包括员工、管理者、 利益相关者

财务管理专业英语一和三章全部翻译

第一单元财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。

另一种说法是财务管理包括管理财务、公司理财、和和商业理财。

做财务决策对于所有形式和规模的商业组织,无论是小型私人公司还是大型股份公开交易的公司来说,都是不可分割的一部分。

和财务管理工作打交道的人一般是公司的高层例如财务副总裁或首席财务官。

他们一般直接向董事长或首席执行官报告,在今天快速变化的大环境中,财务管理者必须有去适应外界诸如经济的不确定性、全球竞争、技术变更、利率和汇率变动、法律制度的变动以及道德方面的考虑等因素。

作为一个公司功能领域的的首要部分,财务管理者在实现公司目标的过程中扮演着一个关键的领导人角色。

财务管理者的职责和责任是难以达到的。

在广义上,财务管理者两个最主要的功能是在公司的活动中获得和配置资源。

这些功能也就是制定政策的职责。

财务管理者是联系财务部的人员和其他管理部门的人员重要纽带。

财务管理包含了三个主要方面的决策:长期投资决策,长期融资决策和营运资金管理决策。

这三个决定意味着如何在公司多样化的活动中获得和分配资源。

前两个决策本质上是长期决策,第三个是短期决策。

管理者从不单独考虑这些决策而是作为一个整体来看待,因为他们每一个从不独立于另外一个。

投资决策总是影响着融资决策反之亦然。

例如,建立一个新厂房或者购买新设备需要考虑其他的决策如怎样获得项目融资和管理已获得资产所需要的资金。

长期投资决策涉及到决定公司想持有的资产的类型和数量。

那儿就是包含了资金的配置和使用。

财务管理者必须对各种类型的资产作出决策——资产负债表中的左边项目。

这些决策经常包含购买,持有,减少,替换,出售、和管理资产。

这个计划和管理一个公司长期投资项目的过程就称为资产预算。

作出投资决策要求运用财务管理的重要规则。

投资原则是公司应该投资在回报率高过最低报酬率的资产和项目。

门坎利率是将资源投资在一个项目中所要求的最低可接受程度额回报。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

《11级财务管理专业英语》复习资料考试题型:一、短语中英互译(20x1=20分)二、从下列选项中选出最佳答案(20x1=20分)三、计算题(25分)四、段落中英互译(35分)同学们:考试的时候请带上没有存储功能的计算器,试卷上只要是涉及到计算的题里面的数字可能与复习资料上的数字不完全一样,但是计算方法是完全一样的,所以大家要掌握计算方法,考试的时候要自己计算。

预祝同学们取得好成绩。

Part I terminology translation (1*20 points)Directions: interpret the following terminology in English or Chinese.(范围课后核心词汇)e.g.:1. financial management---译成汉语2.普通股----译成英语Part II Choice questions (1*20 points) (Please write your answer in the following table)1. Financial statement does not include ( )A. balance sheetB. income statementC. cash flow statementD. working sheet2. An increase in which one of the following will increase the operating cash flow?A.employee salariesB. office rentC. building maintenanceD. equipment depreciation3. The process of planning and managing a firm’s long-term investments is called:A. working capital management.B. financial depreciation.C. capital budgeting.D. capital structure.4. Cash equivalents include ( )A. time depositsB. inventoriesC. accounts receivableD. prepaid expenses5. The internal rate of return for a project will increase if:A. the initial cost of the project can be reduced.B. the total amount of the cash inflows is reduced.C. the required rate of return is reduced.D. the salvage value of the project is omitted from the analysis.6. Which of the following belongs to current liabilities?( )A. mortgages payableB. prepaid expensesC. notes payableD. bonds payable7. You spent $500 last week fixing the transmission in your car. Now, the brakes are acting up and you are trying to decide whether to fix them or trade the car in for a newer model. In analyzing the brake situation, the $500 you spent fixing the transmission is a(n) ___ cost.A. opportunityB. sunkC. incrementalD. fixed8. Which of the following statements are correct concerning diversifiable risks?I. Diversifiable risks can be essentially eliminated by investing in several securities.II. The market rewards investors for diversifiable risk by paying a risk premium.III. Diversifiable risks are generally associated with an individual firm or industry.IV. Beta measures diversifiable risk.A. I and III onlyB. II and IV onlyC. I and IV onlyD. II and III only9. Which of the following is a liability account?()A. prepaid insuranceB. additional paid-in capitalC. salaries payableD. accumulated depreciation10. Accountants employed by large corporations may work in the areas of the following except ( )A. product costing and pricingB. budgetingC. internal auditingD. product producing11. A corporation’s first sale of equity made available to the public is called a(n):()A. share repurchase program.B. private placement.C. initial public offering (IPO).D.seasoned equity offering (SEO).12. Standard deviation measures ____ risk.A. totalB. nondiversifiableC. unsystematicD. systematic13. ( ) is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate.A. future valueB. present valueC. intrinsic valueD. market value14. Ellesmere Corporation issues 1 million $1 par value bonds. The stated interest rate is 8% per year and the interest is paid twice a year. What is the real interest rate of the bond? ( )A. 6%B.4%C. 10%D. (1+8%/2)2-115. Your firm purchased a warehouse for $335,000 six years ago. Four years ago, repairs were made to the building which cost $60,000. The annual taxes on the property are $20,000. The warehouse has a current book value of $268,000 and a market value of $295,000. The warehouse is totally paid for and solely owned by your firm. If the company decides to assign this warehouse to a new project, what value, if any, should be included in the initial cash flow of the project for this building? ()A. $268,000B. $295,000C. $395,000D. $515,00016.Which one of the following will decrease the operating cycle?A. paying accounts payable fasterB. discontinuing the discount given for early payment of an accounts receivableC. decreasing the inventory turnover rateD. collecting accounts receivable faster17. Assume that dividends of a common stock will be maintained at D forever, and the required return of the stockholder is r, the par value of the stock is m, the value of the stock is ( )A. mB. m+DC. m+D/rD. D/r18. Which of the following items has the most risk? ( )A. treasury billB. corporate bondC. preferred stockD. common stock19. ( ) equals the gross profit divided by net sales of a firm.A. gross profit marginB. net profit marginC. return on investmentD. return on equity20. ( ) is the ratios that measure a firm’s ability to meet short-term obligationsA. liquidity ratiosB. leverage ratiosC. coverage ratiosD. activity ratios21.Sensitivity analysis helps you determine the:A. range of possible outcomes given possible ranges for every variable.B. degree to which the net present value reacts to changes in a single variable.C. net present value given the best and the worst possible situations.D. degree to which a project is reliant upon the fixed costs.22. According GAAP revenue is recognized as income when: ()A. a contract is signed to perform a service or deliver a good.B. the transaction is complete and the goods or services delivered.C. payment is received.D. income taxes are paid.E. all of the above.23. ( ) is the result of Net Profit Margin × total asset turnover × (total assets/shareholders’ equity)A. Return on equityB. return on investmentC. current ratioD. quick ratio24. Government tax law adjustment is ( ) to a firm.A. general economic riskB. inflation and deflation riskC. firm-specific risk25.Which of the following statements concerning the income statement is not true?A. It measures performance over a specific period of time.B. It determines after-tax income of the firm.C. It includes deferred taxes.D. It does not include depreciation.E. it treats interest as an expense.26.Which of the following is not a noncash deduction?A. Depreciation.B. Deferred taxes.C. Interest.D. Two of the aboveE. All of the above.27.Sasha Corp had an ROA of 10%. Sasha’s profit margin was 6% on sales of $180. What are total assets? ()A.$300B.$108C.$48. D$162.28. Calculate net income based on the following information ( )Sales = $200.00Cost of goods sold = $100.00Depreciation = $18.00Interest paid = $25.00Tax rate = 34%A. $16.50B. $37.62C. $34.60D. $4.6029.Which of the following is not true? ()A. Financial markets can be used to adjust consumption patterns over time.B. Corporate investment decisions have nothing to do with financial markets,C. Financial markets deal with cash flows over time.D. Investment decisions rely on the economic principles of financial markets.E. None of the above.30. ( ) is concerned with the acquisition, financing, and management of assets with some overall goal in mind.A. Financial managementB. Profit maximizationC. Agency theoryD. Social responsibility31. A major disadvantage of the corporate form of organization is the ( ).A. double taxation of dividendsB. inability of the firm to raise large sums of additional capitalC. limited liability of shareholdersD. limited life of the corporate form.32. Interest paid (earned) on both the original principal borrowed (lent) and previous interest earned is often referred to as ( ).A. present valueB. simple interestC. future valueD. compound interest33. If the intrinsic value of a share of common stock is less than its market value, which of the following is the most reasonable conclusion? ( )A. The stock has a low level of risk.B. The stock offers a high dividend payout ratio.C. The market is undervaluing the stock.D. The market is overvaluing the stock.34. A 250 face value share of preferred stock, pays a 20 annual dividend and investors require a 7% return on this investment. If the security is currently selling for 276, what is the difference (overvaluation) between its intrinsic and market value (rounded to the nearest whole dollar)?A. approximately 26B. approximately 10C. approximately 6D. approximately 135. Felton Farm Supplies, Inc., has an 8 percent return on total assets of 480,000 and a net profit margin of 6percent. What are its sales? ( )A. 3,750,000B.640,000C. 480,000D. 1,500,00036. A company can improve (lower) its debt-to-total asset ratio by doing which of the following?A. Borrow more.B. Shift short-term to long-term debt.C. Shift long-term to short-term debt.D. issue common stock.37. The DuPont Approach breaks down the earning power on shareholders' book value (ROE) as follows: ROE = ( ).A. Net profit margin × Total asset turnover × Equity multiplierB. Total asset turnover × Gross profit margin × Debt ratioC. Total asset turnover × Net profit marginD. Total asset turnover × Gross profit margin × Equity multiplier38. Which of the following items concerns financing decision? ( )A. sales forecastingB. bond issuingC. receivables collectionD. investment project selection39. Which of the following items is the function of a treasurer? ( )A. cost accountingB. internal controlC. capital budgetingD. general ledger40. For financial instruments, ( ) is judged in relation to the ability to sell a significant volume of securities ina short period of time without significant price concession.A. maturityB. marketabilityC. defaultD. inflation41. ( ) is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate.A. future valueB. present valueC. intrinsic valueD. market valuePart III: Calculation Questions ( 2*10 points)(注意:要写出计算公式和计算过程,否则不得分;需要用文字描述的问题回答内容要详细,语句正确、完整。