财务管理专业英语 句子及单词翻译

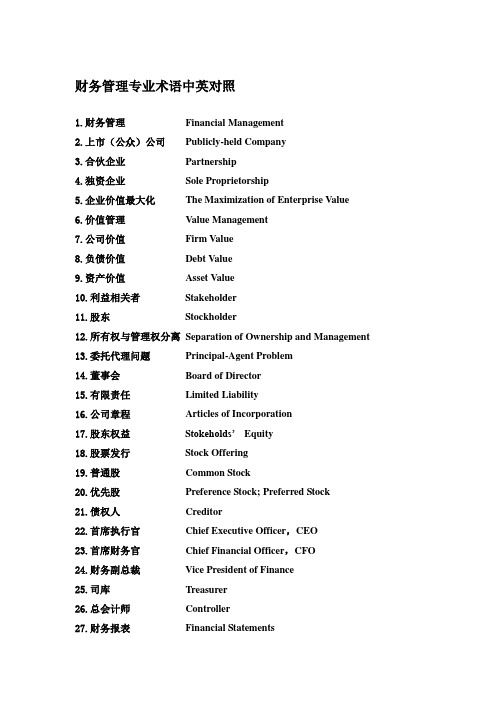

财务管理专业术语中英对照

财务管理专业术语中英对照1.财务管理Financial Management2.上市(公众)公司Publicly-held Company3.合伙企业Partnership4.独资企业Sole Proprietorship5.企业价值最大化The Maximization of Enterprise Value6.价值管理Value Management7.公司价值Firm Value8.负债价值Debt Value9.资产价值Asset Value10.利益相关者Stakeholder11.股东Stockholder12.所有权与管理权分离Separation of Ownership and Management13.委托代理问题Principal-Agent Problem14.董事会Board of Director15.有限责任Limited Liability16.公司章程Articles of Incorporation17.股东权益S tokeholds’ Equity18.股票发行Stock Offering19.普通股Common Stock20.优先股Preference Stock; Preferred Stock21.债权人Creditor22.首席执行官Chief Executive Officer,CEO23.首席财务官Chief Financial Officer,CFO24.财务副总裁Vice President of Finance25.司库Treasurer26.总会计师Controller27.财务报表Financial Statements28.资产负债表Balance Sheet29.损益表Income Statement30.现金流量表Cash Flow Statement31.复利Compound Interest32.现值Present Value33.终值Future Value34.年金Annuity35.后付年金Ordinary Annuity36.先付年金Annuity Due37.延期年金Deferred Annuity38.永续年金Perpetual Annuity39.风险报酬Risk Premiums40.违约风险Default Risk41.市场收益率Market Return, RM42.方差Variance43.标准差Standard Deviation44.系统风险Systematic Risk45.非系统风险Unsystematic Risk46.最低报酬率Hurdle Rate47.资本资产定价模型Capital Asset Pricing Model, CAPM48.贝塔系数Beta Coefficient, β49.边际资金成本Marginal Cost of Capital,MCC50.净现值Net Present Value,NPV51.净现值率Net Present Value Rate,NPVR52.内含报酬率Internal Rate of Return,IRR53.获利指数Profitability Index,PI54.投资回收期Payback Period,PP55.平均报酬率Average Rate of Return,ARR56.投资利润率Return on Investment, ROI57.机会成本Opportunity Cost58.相关成本Relevance Cost59.沉没成本Sunk Cost60.资金成本Cost of Funds61.加权平均资本成本Weighted Average Cost of Capital,WACC62.经营杠杆Operating Leverage63.财务杠杆Financial Leverage64.综合杠杆Comprehensive Leverage / Total Leverage65.营运资金Working Capital66.流动资产Current Asset67.流动负债Current Liability68.经济订货批量Economic Order Quantity, EOQ69.资本预算Capital Budgeting70.筹资组合Financing Mix71.资本结构Capital Structure72.负债与股票的组合Mix of Debt and Equity73.融资租赁Financial Leasing74.股利政策Dividend Policy75.现金股利Cash Dividend76.股票股利Stock Dividend77.股利支付率Dividend-Payout Ratio78.股票回购Stock Repurchase79.股票分割Share Split80.市净率Book-to-Market Ratio81.市盈率Price-Earnings Ratio, P/E82.账面收益率Book rate of Return83.自由现金流量Free Cash Flow, FCF84.小盘股Small-Cap Stocks85.大盘股Large-Cap Stocks86.蓝筹股Blue-Chip Stocks87.成长股Growth Stock89.90.。

财务管理英语词汇

financial management 财务管理chief financial officer 首席财务官hurdle rate 最低报酬率capital structure 资本结构cash dividend 现金股利dividend-payout ratio 股利支付率financial risk 财务风险earnings per share 每股盈余net present value 净现值stock option 股票期权earnings per share 每股收益time value of money 货币时间价值simple interest 单利annuity 年金future value 终值present value 现值compound interest 复利capital 本金d iscount rate 折现率opportunity cost 机会成本cost of capital 资本成本ordinary annuity 普通年金annuity due 先付年金deferred annuity 递延年金perpetuity 永续年金liquidity ratio 流动性比率nominal interest rate 名义利率marker value 市场价值intrinsic value 内在价值discounted cash flow valuation 折现现金流量模型earnings before interest and taxes 息税前利润par value 票面价值dividend payout 股利支付率dividend discount model 股利折现模型diversifiable risk可分散风险market risk 市场风险expected return 期望收益volatility 流动性权益融资equity financial债务融资debt financial利润最大化profit maximization股东财富最大化shareholders wealth maximization 每股收益最大化maximization of earning per share 11、投资报酬return on investment风险溢价risk premium货币市场money market偿债基金sinking fund1.financial markets 金融市场2.资本结构capital structure3.risk premium 风险报酬4.净现金流量net cash flow5.credit policy 信用政策6.终值future value7.moral hazard 道德风险8.收账政策collection policy1.chief financial officer 首席财务官2.财务管理financial management3.credit standard 信用标准4.流动性liquidity5.earnings before interest and taxes 息税前利润6.市场价值market value7.capital assets pricing model资本资产定价模型8.每股收益earnings per share。

财务管理专业英语unit6

Words study

12.Allocationally efficient markets 配置有效市场

operationally efficient markets 运营有效市场

informationally efficient markets 信息有效市场

When prices are determined in a way that equates the marginal rates of return (adjusted for risk) for all producers and savers, the market is said to be allocationally efficient.

Words study

14.Anomaly 异常 15.Underpricing 价格低估 16.Monday effect 星期一效应 January effect 元月效应

On average, stocks have lower (negative) returns on Monday, compared to (positive) returns on other days of the week.

place, nor is my whole estate upon the fortune of this present years; Therefore, my merchandise makes me not sad.

——Shakespear, Merchant of Venice

我的买卖的成败并不完全寄托在一艘船上,更不是倚赖着一处地方;我 的全部财产,也不会因为这一年的盈亏而受到影响,所以我的货物并不 能使我忧愁。

Words study

财务管理专业英语第二章

corporate managers cannot effectively serve many masters. Purposeful behavior requires the existence of

这就是说公司经理不能有效的服务多个目标。 a single-valued objective function. 一个单一的价值目标。

2

The article translation 文章翻译

division of opinion exists on the goal of financial management, two leading contenders are stakeholder 对财务管理的目标存在着很大的分歧, theory and value(wealth) maximization. 理论和价值最大化。 但是两种最主要的理论是利益相关者

Why focus on maximizing share price? First, using stock price maximization as an objective function

2.3.1 Stakeholder Theory 2.3.1 利益相关者理论

Stakeholder theory is the main contender to value maximization as the corporate goal. Stakeholder

作为企业的目标,利益相关者理论是价值最大化理论的主要竞争理论。 理论认为管理者所做的决策要考虑公司所有相关者的利益。 stakeholders. Such stakeholders include not only financial claimholders * but also employees, managers, 这些利益相关者不仅包括所有者还包括员工、管理者、 利益相关者

中英文对照,专业名词,财务成本管理(完整版)

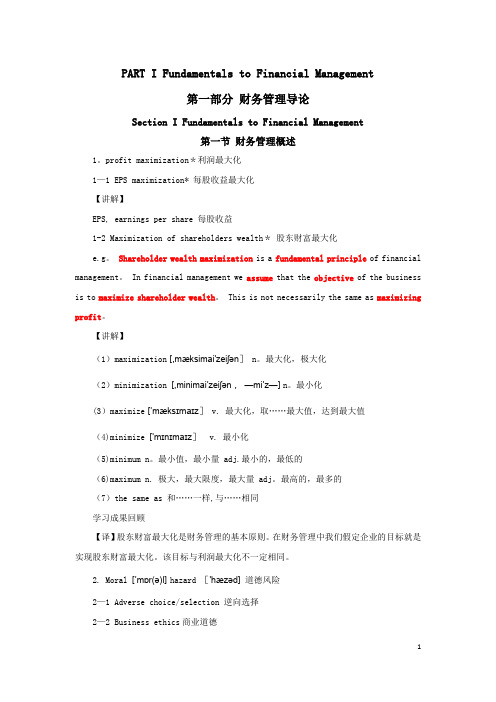

PART I Fundamentals to Financial Management第一部分财务管理导论Section I Fundamentals to Financial Management第一节财务管理概述1。

profit maximization*利润最大化1—1 EPS maximization* 每股收益最大化【讲解】EPS, earnings per share 每股收益1-2 Maximization of shareholders wealth*股东财富最大化e.g。

Shareholder wealth maximization is a fundamental principle of financial management。

In financial management we assume that the objective of the business is to maximize shareholder wealth。

This is not necessarily the same as maximizing profit。

【讲解】(1)maximization[,mæksimai'zeiʃən]n。

最大化,极大化(2)minimization [,minimai’zeiʃən,—mi’z—]n。

最小化(3)maximize[’mæksɪmaɪz]v. 最大化,取……最大值,达到最大值(4)minimize ['mɪnɪmaɪz] v. 最小化(5)minimum n。

最小值,最小量 adj.最小的,最低的(6)maximum n. 极大,最大限度,最大量 adj。

最高的,最多的(7)the same as 和……一样,与……相同学习成果回顾【译】股东财富最大化是财务管理的基本原则。

在财务管理中我们假定企业的目标就是实现股东财富最大化。

财务管理常用术语(英汉对照)

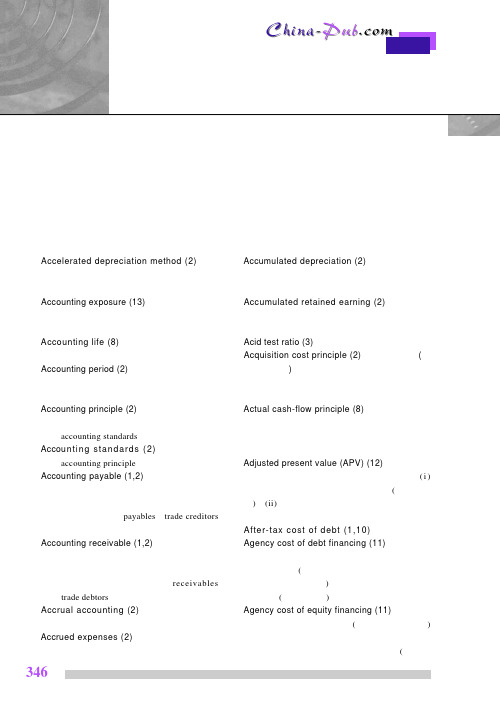

Asse t r o t a t i o n ( 1 ) 资产周转率 参见 a s s e t turnover或turns。

Asset turnover or turns (1, 5) 资产周转率 销 售额除以资产。一种测量资产管理效率的 比率。

Assets (of a firm) (2) 资产 在资产负债表中公 司股东共同拥有的财物。

347

公经理人员财务管理—创造价值的过程

下载

作为发行证券公司的代理人尽最大努力销售 证券的一种证券分销方式。 Beta (coefficient) (10) ß系数 基于一种私人股 票的回报率变化相对于股票市场指数回报率 变化的敏感性的风险测量工具。与系统风 险,市场风险,不可分散风险,和相对风险 同义。 Bid-ask spread (13) 买卖价差 买价与卖价之间 的差额。 Bid price (13) 买价 市场交易者愿意购买的价 格。 Bidder (12) 投标商 在收购中,想购买另一家 公司全部或部分股份的公司。 Bond (9) 债券 说明债权人与发行公司之间关系和 规定资金借入和偿还的条件和条款的一种负 债证券。 Bond market (9) 债券市场 发行和交易债券的 市场。 Bond rating (9) 债券等级评定 由代理机构 (例 如标准普尔和莫迪投资服务公司 )评定的等 级以提供一种债券信用风险的估计。 Bond value (9) 债券价值 债券预期现金流序列 以与现金流序列的风险相联系的贴现率折 现的现值。 Bond value of a convertible bond (9)可转换债 券的债券价值 如果可转换债券没有转换选择权 的价值。 Bonding costs (11) 债券发行成本 贷款人对管 理灵活性设置限制性条款导致的成本 (由股 东承担 )。 Book value of asset (2) 资产的账面价值 资产 在公司资产负债表中列示的价值。 Book value of equity (1,2) 所有者权益的账面价 值 Book value multiple (12) 账面价值乘数 股价 除以每股权益账面价值。与 price-to-book ratio同义。用于公司价值估计。 Bookrunner (9) 发起人 Bottom line (2) 净收益 Brokers (9) 经纪人 不拥有证券,代表第三方 进行证券交易的个人或机构。 Business assets (5) 营业资产 营运资本需求 加净固定资产。

财务管理的英文翻译

财务管理的英文翻译financial managementmanagement through finance1. In running a company, strict financial management means everything.经营一家公司, 严格的财务管理是至关重要的.2. Prudent financial management products to the attention of only bonds, the market.稳健理财产品的注意力只能转向债券、票据市场.3. Then in 2021 the currency - type sound financial management will be going?那么2021年的外币稳健型理财将走向何方?4. Financial management is key in any company or enterprise.在任何公司和企业单位中财务管理是关键.5. My assignment of strategy Financial Management is due today.我的转让的战略财务管理,是今天上交.6. Corporate enterprise, there are three levels of financial management.公司制企业财务管理存在着三个层次.7. Budgetary management is the financial management means of current west popularity.预算治理是当今西方流行的财务治理方式.8. Financing is an eternal topic in business development and financial management.融资是企业经营发展和财务管理的永恒话题.9. Outside the financial management division of the income disparity.在境外,理财师的收入相当悬殊.10. Traditional financial management software, request that you rivets attention and dedication kanpan.传统的理财软件, 要求您目不转睛、专心致志看盘.n.财政; 金融; 财源; 资金vt.为…供给资金,从事金融活动; 赊货给…; 掌握财政;1. The finance minister will continue to mastermind Poland's economic reform.财政部长将继续策划波兰的经济改革。

财务管理专业英语句子及单词翻译

财务管理专业英语句子及单词翻译Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity.财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。

Decisions involving a firm’s short-term assets and liabilities refer to working capital management.决断涉及一个公司的短期的资产和负债提到营运资金管理The firm’s long-term financing decisions concern the right-hand side of the balance sheet.该公司的长期融资决断股份资产负债表的右边。

This is an important decision as the legal structure affects the financial risk faced by the owners of the company.这是一个重要的决定作为法律结构影响金融风险面对附近的的业主的公司。

The board includes some members of top management(executive directors), but should also include individuals from outside the company(non-executive directors).董事会包括有些隶属于高层管理人员(执行董事),但将也包括个体从外公司(非执行董事)。

财务管理专业英语词汇表(很全面)

财务管理专业英语词汇表(很全面)Chapter 1 An Overview of Financial Management business 企业,商业,业务finance 财务,理财management 管理,管理层revenue 收入return 回报shareholder 股东stakeholder 利益相关者stock 股票profit maximization 利润最大化shareholder wealth maximization 股东财富最大化enterprise value maximization 企业价值最大化hedge risks 规避风险inventory 存货current assets 流动资产current liabilities 流动负债financing 筹资corporation 股份公司earning per share(EPS)每股收益exchange rate 汇率inflation 通货膨胀Chapter 3 Risk and Rewardcapital asset pricing model(CAPM)资本资产定价模型diversification 分散化efficient capital market 有效资本市场expected return 期望回报market, systematic, or undiversifiable risk 市场风险、系统风险或不可分散风险portfolio 组合reward 收益,溢酬,溢价risk-aversion 风险厌恶risk-neutrality 风险中性risk preference 风险偏好risk premium 风险溢价security markets line(SML)证券市场线semi-strong capital market efficiency 半强式资本市场有效spread out 分散square root 平方根standard deviation 标准差strong capital market efficiency 强式资本市场有效transaction cost 交易成本unique, firm-specific, idiosyncratic, unsystematic, or diversifiable risk 特殊风险、特有风险、虚假风险、非系统风险或可分散风险variance 方差volatility 波动性weak capital market efficiency 弱式资本市场有效Chapter 4 Financial Assets and Their Valuation asset 资产security 证券issue (股票,钞票)分发,发行coupon rate 票面利率,息面利率annual 每年的,年度的,一年一次的obligate 使(某人)负有责任或义务outstanding 未解决的,未偿付的,杰出的calculate 估计,预测compensation 报酬,工资,补偿物perpetual 永久的,永恒的infinite 无限的,无穷的substitute 替代,取代yield 出产,产,出(果实、利润、结果)approximation 相似,近似trial-and-error 试误法illustrate 说明,阐明entitle 使人有权拥有……liability 负债intrinsic value 内在价值asymmetry 不对称constant 不变的,可靠的phase 阶段,时期preferred stock 优先股Chapter 5 Capital Budgeting and Investment Decision capital budgeting 资本预算estimating net present value 预期净现值the average accounting return 平均会计报酬率stand-alone principle 独立原则the internal rate of return 内部收益率the payback rule 回收期法erosion 侵蚀net working capital 净营运资本opportunity cost 机会成本hard rationing 硬约束soft rationing 软约束sunk cost 沉没成本incremental cash flow 增量现金流量pro forma financial statement 预估财务报表forecasting risk 预测风险scenario analysis 情景分析investment criteria 投资决策标准cash flow 现金流量project cash flow 项目现金流量depreciation 折旧capital spending 资本性支出garbage-in garbage-out system 垃圾进、垃圾出系统best case and worst case 最优情形和最差情形Chapter 6 Working Capital Management working capital 营运资本speculative 投机precautionary 预防的buffer 缓冲器invoice 发票deposit 存款disbursement 支付expenditure 消费trade-off 权衡attorney 代理人applicant 申请人utilization 应用dampen 使沮丧ordering cost 订货成本carrying cost 储存成本raw material 原材料insurance 保险linear 线性的bad-debt 坏账Chapter 7 Financing Mod es debt financing 债务筹资equity financing 权益投资prospectus 招股说明书the general cash offer 普通现金发行the rights offer 配股发行initial public offering(IPO) 首次公开发行underwriting discount 承销折价the subscription price 认购价格collateral 抵押品mortgage securities 抵押债券debenture 信用债券sinking fund 偿债基金call provision 赎回条款call-protected 赎回保护operating leases 经营性租赁financial leases 融资租赁sale and lease-back 售后租回leveraged leases 杠杆租赁warrants 认股权证convertibles 可转换债券call options 看涨期权straight bond value 纯粹债券价值conversion value 转换价值secured loans 抵押贷款committed lines of credit 承诺式信贷额度compensating balances 补偿性余额trust receipt 信托收据Chapter 8 Capital Structure capital structure 资本结构optimal capital structure 最佳资本结构financial leverage 财务杠杆homemade leverage 自制杠杆payoff 回报proceeds 收益financial risk 财务风险interest tax shield 利息税盾direct bankruptcy costs 直接破产成本indirect bankruptcy costs 间接破产成本liquidation 清偿reorganization 重组absolute priority rule 绝对优先原则qualification 限定条件cost of equity 股权成本business risk 经营风险pie model 饼状模型break-even point 收益均衡点indifference point 无差异点Chapter 9 Divid end Distribution dividend irrelevance theory 股利无关理论retained earnings 留存收益capital surplus 资本公积earned surplus 盈余公积legal surplus 法定盈余公积free surplus reserves 任意盈余公积stockholder meeting 股东会declaration date 宣告日holder-of-record date 股权登记日ex-dividend date 除息日stock split 股票分割stock dividend 股票股利stock repurchase 股票回购declaration date 股利宣布日record date 股权登记日regular dividend 正常股利cash dividend 现金股利stock dividend 股票股利stock price appreciation 股价增值open market 公开市场payment date 股利支付日going concern 持续经营。

财务管理术语中英文对照

财务管理术语表Absorption costing 吸收成本法:Total Cost Methods全部成本法: 将某会计期间内发生的固定成本除以销售量,得出单位产品的固定成本,再加上单位变动成本,算出单位产品的总成本。

Accounting 会计:对企业活动的财务信息进行测量和综合,从而向股东、经理和员工提供企业活动的信息。

请参看管理会计和财务会计。

Accounting convention会计原则:会计师在会计报表的处理中所遵循的原则或惯例。

正因为有了这些原则,不同企业的会计报表以及同一企业不同时期的会计报表才具有可比性。

如果会计原则在实行中发生了一些变化,那么审计师就应该在年度报表附注中对此进行披露。

Accounts 会计报表和账簿: 这是英国的叫法,在美国,会计报表或财务报表叫做Financial Statements,是指企业对其财务活动的记录。

Chief financial officerAccounts payable应付账款: 这是美国的叫法,在英国,应付账款叫做Creditors,是指公司从供应商处购买货物、但尚未支付的货款。

Accounts receivable 应收账款:这是美国的叫法,在英国,应收账款叫做Debtors,是指客户从公司购买商品或服务,公司已经对其开具发票,但客户尚未支付的货款。

Accrual accounting 权责发生制会计:这种方法在确认收入和费用时,不考虑交易发生时有没有现金流的变化。

比如,公司购买一项机器设备,要等到好几个月才支付现金,但会计师却在购买当时就确认这项费用。

如果不使用权责发生制会计,那么该会计系统称作“收付制”或“现金会计”。

Accumulated depreciation 累计折旧:它显示截止到目前为止的折旧总额。

将资产成本减去累计折旧,所得结果就是账面净值。

Acid test 酸性测试:这是美国的叫法,请参看quick ratio速动比率(英国叫法)。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity.财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。

Decisions involving a firm’s short-term assets and liabilities refer to working capital management.决断涉及一个公司的短期的资产和负债提到营运资金管理The firm’s long-term financing decisions concern the right-hand side of the balance sheet.该公司的长期融资决断股份资产负债表的右边。

This is an important decision as the legal structure affects the financial risk faced by the owners of the company.这是一个重要的决定作为法律结构影响金融风险面对附近的的业主的公司。

The board includes some members of top management(executive directors), but should also include individuals from outside the company(non-executive directors).董事会包括有些隶属于高层管理人员(执行董事),但将也包括个体从外公司(非执行董事)。

Maximization of shareholder wealth focuses only on stockholders whereas maximization of firm value encompasses all financial claimholders including common stockholders, debt holders, and preferred stockholders.股东财富最大化只集中于股东,而企业价值最大化包含所有的财务债券持有者,包括普通股股东,债权人和优先股股东。

Given these assumptions,shareholders’ wealth maximization is consistent with the best interests of stakeholders and society in the long run。

根据这些假设,从长期来看,股东财富最大化与利益相关者和社会的最好利润是相一致的。

No competing measure that can provide as comprehensive a measure of a firm’s standi ng. Given these assumptions, shareholders’ wealth maximization is consistent with the best interests of stakeholders and society in the long run.没有竞争措施,能提供由于全面的一个措施的一个公司的站。

给这些臆说,股东'财富最大化一贯不比任何人差项目干系人项目利益相关者的利益,社会从长远说来。

In reality, managers may ignore the interests of shareholders, and choose instead to make investment and financing decisions that benefit themselves.在现实中,经理可能忽视股东的利益,而是选择利于自身的投资和融资决策。

Financial statements are probably the important source of information from which these variousstakeholders(other than management) can assess afirm’s financial health.财务报表可能是最重要的信息来源,除管理者以外的各种利益相关者可以利用这些报表来评估一个公司的财务状况。

The stockholders’ equity section lists preferred stock, common stock and capital surplus and accumulated retained earnings.股东权益列示有优先股,普通股,资本盈余和累积留存收益。

The assets, which are the “things” the company owns, are listed in the order of decreasing liquidity, or length of time it typically takes to convert them to cash at fair market values, beginningwith the firm’s current assets.资产,也就是公司拥有的东西,是按照流动性递减的顺序或将它们转换为公允市场价值所需要的时间来排列的,通常从流动资产开始。

The market value of a firm’s equity is equal to the number of shares of common stock outstanding times the price per share, while the amoun t reported on the firm’s balance sheet is basically the cumulative amount the firm raised when issuing common stock and any reinvested net income(retained earnings).公司权益的市场价值等于其发行在外的普通股份数乘以每股价格,而资产负债表上的总额则主要是公司在发行普通股以及分配任何再投资净收益(留存收益)时累积的数额。

When compared to accelerated methods, straight-line depreciation has lower depreciation expense in the early years of asset life, which tends to a higher tax expense but higher net income.与加速折旧法相比,直线折旧法在资产使用年限的早期折旧费用较低,这也会趋向于较高的税金费用和较高的净收入。

The statement of cash flows consists of threesections:(1)operating cash flows,(2)investing cash flows,and(3)financing cash flows. Activities in each area that bring in cash represent sources of cash while activities that involve spending cash are uses of cash.该声明现金流量表包含三个部分:(1)经营现金流,(2)投资的现金流,(3)融资现金流。

在每个地区活动带来现金来源的现金而代表活动涉及到花钱是使用现金Financing activities include new debt issuances, debt repayments or retirements, stock sales and repurchases, and cash dividend payments.筹资活动,包括发行新债券,偿还债务,股票销售和回购,以及现金股利支付。

Not surprisingly, Enron’s executives had realized some $750 million in salaries, bonuses and profits from stock options in the 12 months before the company went bankrupt.毫不奇怪, 公司破产前的十二个月里,安然的高管们实现了7.5亿美金的工资、奖金和股票期权利润。

First, financial ratios are not standardized. A perusal of the many financial textbooks and other sources that are available will often show differences in how to calculate some ratios.首先,财务比率不规范。

一个参考的许多金融教科书及来源,可将经常表现出差异如何计算一些率。

Liquidity ratios indicate a firm’s ability to pay its obligations in the short run.流动性比率表明公司的支付能力在短期内它的义务。

Excessively high current ratios, however, may indicate a firm may have too much of its long-terminvestor-supplied capital invested in short-term low-earning current assets.当前的比率过高,然而,可能表明,一个公司可能有太多的长期investor-supplied资本投资于短期low-earning流动资产In an inflationary environment, firms that use last-in,first-out(LIFO)inventory valuation will likely have lower current ratios than firms that use first-in,first-out(FIFO).在一个通货膨胀的环境下,企业选择使用后进先出法对存货计价的公司比采用先进先出法的公司有一个低的流动比率。