Principles of Corporate Finance 英文第十版习题解答Chap002

Principles of Corporate Finance 英文第十版习题解答Chap008

CHAPTER 8Portfolio Theory and the Capital Asset Pricing ModelAnswers to Problem Sets1. a. 7%b. 27% with perfect positive correlation; 1% with perfect negative correlation;19.1% with no correlationc. See Figure 1 belowd. No, measure risk by beta, not by standard deviation.2. a. Portfolio A (higher expected return, same risk)b. Cannot say (depends on investor’s attitude -toward risk)c. Portfolio F (lower risk, same -expected return).3. Sharpe ratio = 7.1/20.2 = .3514. a. Figure 8.13b: Diversification reduces risk (e.g., a mixture of portfolios Aand B would have less risk than the average of A and B).b. Those along line AB in Figure 9.13a.c. See Figure 2 below5. a. See Figure 3 belowb. A, D, Gc. Fd. 15% in Ce. Put 25/32 of your money in F and lend 7/32 at 12%: Expected return = 7/32X 12 + 25/32 X 18 = 16.7%; standard deviation = 7/32 X 0 + (25/32) X 32 =25%. If you could borrow without limit, you would achieve as high anexpected return as you’d like, with correspondingly high risk, of course.6. a. 4 + (1.41 X 6) = 12.5%b. Amazon: 4 + (2.16 X 6) = 17.0%c. Campbell Soup: 4 + (.30 X 6) = 5.8%d. Lower. If interest rate is 4%, r = 4 + (1.75 X 6) = 14.5%; if rate = 6%, r = 6 +(1.75 X 4) = 13.0%e. Higher. If interest rate is 4%, r = 4 + (.55 X 6) = 7.3%; if rate = 6%, r = 6 +(.55 X 4) 5 8.2%7. a. Trueb. False (it offers twice the market risk premium)c. False8. a. 7%b. 7 + 1(5) + 1(-1) + 1(2) = 13%c. 7 + 0(5) + 2(-1) + 0(2) = 5%d. 7 + 1(5) + (-1.5)(-1) + 1(2) = 15.5%.9. a. False – investors demand higher expected rates of return on stocks withmore nondiversifiable risk.b. False – a security with a beta of zero will offer the risk-free rate of return.c. False – the beta will be: (1/3 ⨯ 0) + (2/3 ⨯ 1) = 0.67d. Truee. True10. In the following solution, security one is Campbell Soup and security two isBoeing. Then:r1 = 0.031 σ1 = 0.158r2 = 0.095 σ2 = 0.237Further, we know that for a two-security portfolio:r p = x1r1 + x2r2σp2 = x12σ12 + 2x1x2σ1σ2ρ12 + x22σ22 Therefore, we have the following results:x1x2r pσπ σπwhen ρ = 0 when ρ = 0.51 0 3.10% 0.02496 0.02496 0.9 0.1 3.74% 0.02078 0.02415 0.8 0.2 4.38% 0.01822 0.02422 0.7 0.3 5.02% 0.01729 0.02515 0.6 0.4 5.66% 0.01797 0.02696 0.5 0.5 6.30% 0.02028 0.02964 0.4 0.6 6.94% 0.02422 0.03320 0.3 0.7 7.58% 0.02977 0.03763 0.2 0.8 8.22% 0.03695 0.04294 0.1 0.9 8.86% 0.04575 0.04912 0 1 9.50% 0.05617 0.0561711. a.Portfolio r1 10.0% 5.1%2 9.0 4.63 11.0 6.4b. See the figure below. The set of portfolios is represented by the curvedline. The five points are the three portfolios from Part (a) plus thefollowing two portfolios: one consists of 100% invested in X and the otherconsists of 100% invested in Y.c. See the figure below. The best opportunities lie along the straight line.From the diagram, the optimal portfolio of risky assets is portfolio 1, andso Mr. Harrywitz should invest 50 percent in X and 50 percent in Y.12. a. Expected return = (0.6 ⨯ 15) + (0.4 ⨯ 20) = 17%Variance = (0.62⨯ 202) + (0.42⨯ 222) + 2(0.6)(0.4)(0.5)(20)(22) = 327.04Standard deviation = 327.04(1/2) = 18.08%b. Correlation coefficient = 0 ⇒ Standard deviation = 14.88%Correlation coefficient = –0.5 ⇒ Standard deviation = 10.76%c. His portfolio is better. The portfolio has a higher expected return and alower standard deviation.13. a.Average SD Sharpe RatioSauros 14.6 15.2 0.77S&P500 14.4 10.5 1.09Risk Free 2.9 1.7b. We can calculate the Beta of her investment as follows (see Table 7.7):TOTALDeviationfrom Averagemkt return 17.2 -1.9 -8.0 1.4 -8.8Deviationfrom AverageSauros return 24.5 -3.6 -12.0 3.4 -12.3SquaredDeviationfrom Averagemarketreturn 296.5 3.5 63.7 2.0 77.1 442.8Product ofDeviationsfrom Averagereturns 421.9 6.8 95.8 4.8 108.0 637.2Marketvariance 88.6Covariance 127.4Beta 1.4To construct a portfolio with a beta of 1.4, we will borrow .4 at the risk free rateand invest this in the market portfolio. This gives us annual returns as follows:Average1.4 times market 20.1less 0.4 time rf -1.2net return 19.0The Sauros portfolio does not generate sufficient returns to compensate for itsrisk.14. a. The Beta of the first portfolio is 0.714 and offers an average return of 5.9%b. We can devise a superior portfolio with a blend of 85.5% Campbell’s Soupand 14.5% Amazon.15.a.b. Market risk premium = r m – r f = 0.12 – 0.04 = 0.08 = 8.0%c.Use the security market line:r = r f + β(r m – r f )r = 0.04 + [1.5 ⨯ (0.12 – 0.04)] = 0.16 = 16.0%d.For any investment, we can find the opportunity cost of capital using the security market line. With β = 0.8, the opportunity cost of capital is:r = r f + β(r m – r f )r = 0.04 + [0.8 ⨯ (0.12 – 0.04)] = 0.104 = 10.4%The opportunity cost of capital is 10.4% and the investment is expected to earn 9.8%. Therefore, the investment has a negative NPV.e.Again, we use the security market line:r = r f + β(r m – r f )0.112 = 0.04 + β(0.12 – 0.04) ⇒ β = 0.916.a.Percival’s current portfolio provides an expected return of 9% with anannual standard deviation of 10%. First we find the portfolio weights for a combination of Treasury bills (security 1: standard deviation = 0%) and the index fund (security 2: standard deviation = 16%) such that portfolio standard deviation is 10%. In general, for a two security portfolio:σP 2 = x 12σ12 + 2x 1x 2σ1σ2ρ12 + x 22σ22 (0.10)2 = 0 + 0 + x 22(0.16)2 x 2 = 0.625 ⇒ x 1= 0.375Further:r p = x1r1 + x2r2r p = (0.375 ⨯ 0.06) + (0.625 ⨯ 0.14) = 0.11 = 11.0%Therefore, he can improve his expected rate of return without changingthe risk of his portfolio.b. With equal amounts in the corporate bond portfolio (security 1) and theindex fund (security 2), the expected return is:r p = x1r1 + x2r2r p = (0.5 ⨯ 0.09) + (0.5 ⨯ 0.14) = 0.115 = 11.5%σP2 = x12σ12 + 2x1x2σ1σ2ρ12 + x22σ22σP2 = (0.5)2(0.10)2 + 2(0.5)(0.5)(0.10)(0.16)(0.10) + (0.5)2(0.16)2σP2 = 0.0097σP = 0.985 = 9.85%Therefore, he can do even better by investing equal amounts in thecorporate bond portfolio and the index fund. His expected return increasesto 11.5% and the standard deviation of his portfolio decreases to 9.85%. 17. First calculate the required rate of return (assuming the expansion assets bearthe same level of risk as historical assets):r = r f + β(r m– r f)r = 0.04 + [1.4 ⨯ (0.12 – 0.04)] = 0.152 = 15.2%The use this to discount future cash flows; NPV = -25.2918. a. True. By definition, the factors represent macro-economic risks thatcannot be eliminated by diversification.b. False. The APT does not specify the factors.c. True. Different researchers have proposed and empirically investigateddifferent factors, but there is no widely accepted theory as to what thesefactors should be.d. True. To be useful, we must be able to estimate the relevant parameters.If this is impossible, for whatever reason, the model itself will be oftheoretical interest only.19. Stock P: r = 5% + (1.0 ⨯ 6.4%) + [(–2.0) ⨯ (–0.6%)] + [(–0.2) ⨯ 5.1%] = 11.58%Stock P2: r = 5% + (1.2 ⨯ 6.4%) + [0 ⨯ (–0.6%)] + (0.3 ⨯ 5.1%) = 14.21%Stock P3: r = 5% + (0.3 ⨯ 6.4%) + [0.5 ⨯ (–0.6%)] + (1.0 ⨯ 5.1%) = 11.72%20. a. Factor risk exposures:b1(Market) = [(1/3)⨯1.0] + [(1/3)⨯1.2] + [(1/3)⨯0.3] = 0.83b2(Interest rate) = [(1/3)⨯(–2.0)] +[(1/3)⨯0] + [(1/3)⨯0.5] = –0.50b3(Yield spread) = [(1/3)⨯(–0.2)] + [(1/3)⨯0.3] + [(1/3)⨯1.0] = 0.37b. r P = 5% + (0.83⨯6.4%) + [(–0.50)⨯(–0.6%)] + [0.37⨯5.1%] = 12.50%21. r Boeing = 0.2% + (0.66 ⨯ 7%) + (01.19 ⨯ 3.6%) + (-0.76 ⨯ 5.2%) = 5.152%R J&J = 0.2% + (0.54 ⨯ 7%) + (-0.58 ⨯ 3.6%) + (0.19 ⨯ 5.2%) = 2.88%R Dow = 0.2% + (1.05 ⨯ 7%) + (–0.15 ⨯ 3.6%) + (0.77 ⨯ 5.2%) = 11.014%r Msft= 0.2% + (0.91 ⨯ 7%) + ( 0.04 × 3.6%) + (–0.4 ⨯ 5.2%) = 4.346%22. In general, for a two-security portfolio:σp2 = x12σ12 + 2x1x2σ1σ2ρ12 + x22σ22and:x1 + x2 = 1Substituting for x2 in terms of x1 and rearranging:σp2 = σ12x12 + 2σ1σ2ρ12(x1– x12) + σ22(1 – x1)2Taking the derivative of σp2 with respect to x1, setting the derivative equal to zero and rearranging:x1(σ12– 2σ1σ2ρ12 + σ22) + (σ1σ2ρ12–σ22) = 0Let Campbell Soup be security one (σ1 = 0.158) and Boeing be security two(σ2 = 0.237). Substituting these numbers, along with ρ12 = 0.18, we have:x1 = 0.731Therefore:x2 = 0.26923. a. The ratio (expected risk premium/standard deviation) for each of the fourportfolios is as follows:Portfolio A: (22.8 – 10.0)/50.9 = 0.251Portfolio B: (10.5 – 10.0)/16.0 = 0.031Portfolio C: (4.2 – 10.0)/8.8 = -0.659Therefore, an investor should hold Portfolio A.b. The beta for Amazon relative to Portfolio A is identical.c. If the interest rate is 5%, then Portfolio C becomes the optimal portfolio, asindicated by the following calculations:Portfolio A: (22.8 – 5.0)/50.9 = 0.35Portfolio B: (10.5 – 5.0)/16.0 = 0.344Portfolio C: (4.2 – 5.0)/8.8 = -0.091The results do not change.24. Let r x be the risk premium on investment X, let x x be the portfolio weight of X (andsimilarly for Investments Y and Z, respectively).a. r x = (1.75⨯0.04) + (0.25⨯0.08) = 0.09 = 9.0%r y = [(–1.00)⨯0.04] + (2.00⨯0.08) = 0.12 = 12.0%r z = (2.00⨯0.04) + (1.00⨯0.08) = 0.16 = 16.0%b. This portfolio has the following portfolio weights:x x = 200/(200 + 50 – 150) = 2.0x y = 50/(200 + 50 – 150) = 0.5x z = –150/(200 + 50 – 150) = –1.5The portfolio’s sensitivities to the factors are:Factor 1: (2.0⨯1.75) + [0.5⨯(–1.00)] – (1.5⨯2.00) = 0Factor 2: (2.0⨯0.25) + (0.5⨯2.00) – (1.5⨯1.00) = 0Because the sensitivities are both zero, the expected risk premium is zero.c. This portfolio has the following portfolio weights:x x = 80/(80 + 60 – 40) = 0.8x y = 60/(80 + 60 – 40) = 0.6x z = –40/(80 + 60 – 40) = –0.4The sensitivities of this portfolio to the factors are:Factor 1: (0.8⨯1.75) + [0.6⨯(–1.00)] – (0.4⨯2.00) = 0Factor 2: (0.8⨯0.25) + (0.6⨯2.00) – (0.4⨯1.00) = 1.0The expected risk premium for this portfolio is equal to the expected riskpremium for the second factor, or 8 percent.d. This portfolio has the following portfolio weights:x x = 160/(160 + 20 – 80) = 1.6x y = 20/(160 + 20 – 80 ) = 0.2x z = –80/(160 + 20 – 80) = –0.8The sensitivities of this portfolio to the factors are:Factor 1: (1.6⨯1.75) + [0.2⨯(–1.00)] – (0.8⨯2.00) = 1.0Factor 2: (1.6⨯0.25) + (0.2⨯2.00) – (0.8⨯1.00) = 0The expected risk premium for this portfolio is equal to the expected riskpremium for the first factor, or 4 percent.e. The sensitivity requirement can be expressed as:Factor 1: (x x)(1.75) + (x y)(–1.00) + (x z)(2.00) = 0.5In addition, we know that:x x + x y + x z = 1With two linear equations in three variables, there is an infinite number of solutions. Two of these are:1. x x = 0 x y = 0.5 x z = 0.52. x x = 6/11 x y = 5/11 x z = 0The risk premiums for these two funds are:r1 = 0⨯[(1.75 ⨯ 0.04) + (0.25 ⨯ 0.08)]+ (0.5)⨯[(–1.00 ⨯ 0.04) + (2.00 ⨯ 0.08)]+ (0.5)⨯[(2.00 ⨯ 0.04) + (1.00 ⨯ 0.08)] = 0.14 = 14.0%r2 = (6/11)⨯[(1.75 ⨯ 0.04) + (0.25 ⨯ 0.08)]+(5/11)⨯[(–1.00 ⨯ 0.04) + (2.00 ⨯ 0.08)]+0 ⨯ [(2.00 ⨯ 0.04) + (1.00 ⨯ 0.08)] = 0.104 = 10.4%These risk premiums differ because, while each fund has a sensitivity of0.5 to factor 1, they differ in their sensitivities to factor 2.f. Because the sensitivities to the two factors are the same as in Part (b),one portfolio with zero sensitivity to each factor is given by:x x = 2.0 x y = 0.5 x z = –1.5The risk premium for this portfolio is:(2.0⨯0.08) + (0.5⨯0.14) – (1.5⨯0.16) = –0.01Because this is an example of a portfolio with zero sensitivity to eachfactor and a nonzero risk premium, it is clear that the Arbitrage PricingTheory does not hold in this case.A portfolio with a positive risk premium is:x x = –2.0 x y = –0.5 x z = 1.5。

CorporateFinance第十版课程设计

Corporate Finance 第十版课程设计

一、课程简介

本课程是针对财务学专业的本科学生设置的,主要内容涵盖企业财务决策、投

资决策、资本结构等方面内容。

通过课程学习,学生将了解企业财务管理的基本概念和工具,掌握企业的融资、投资和分配决策的方法和技能,逐步形成批判性思维和问题解决能力。

二、教学目标

•理解企业财务管理的目标和作用

•掌握企业财务决策的基本框架和方法

•熟悉投资决策的基本理论和实践操作

•理解资本结构和成本的概念,掌握调整资本结构的技巧

•培养分析企业财务报表和业绩的能力

三、教学方式

本课程采用以理论为主导、实践为主的教学方式。

在课程中将采用案例、实例、讨论和小组演示等多种教学方法,对学生的分析能力、判断能力、团队协作和沟通能力进行培养和锻炼。

四、教学内容

1. 企业财务管理基础

•企业财务管理的概念和目标

•财务报表的理解和分析

•现金流量和时间价值的概念

1。

习题答案Principles-of-Corporate-Finance第十版-Chapter2Wor

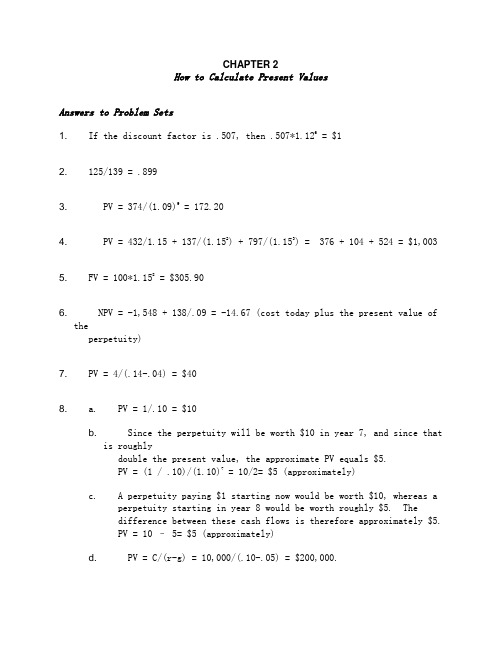

CHAPTER 2How to Calculate Present ValuesAnswers to Problem Sets1. If the discount factor is .507, then .507*1.126 = $12. 125/139 = .8993. PV = 374/(1.09)9 = 172.204. PV = 432/1.15 + 137/(1.152) + 797/(1.153) = 376 + 104 + 524 = $1,0035. FV = 100*1.158 = $305.906. NPV = -1,548 + 138/.09 = -14.67 (cost today plus the present value oftheperpetuity)7. PV = 4/(.14-.04) = $408. a. PV = 1/.10 = $10b. Since the perpetuity will be worth $10 in year 7, and since thatis roughlydouble the present value, the approximate PV equals $5.PV = (1 / .10)/(1.10)7 = 10/2= $5 (approximately)c. A perpetuity paying $1 starting now would be worth $10, whereas aperpetuity starting in year 8 would be worth roughly $5. Thedifference between these cash flows is therefore approximately $5.PV = 10 – 5= $5 (approximately)d. PV = C/(r-g) = 10,000/(.10-.05) = $200,000.9. a. PV = 10,000/(1.055) = $7,835.26 (assuming the cost of the car doesnotappreciate over those five years).b. You need to set aside (12,000 × 6-year annuity factor) = 12,000× 4.623 =$55,476.c. At the end of 6 years you would have 1.086 × (60,476 - 55,476) = $7,934.10. a. FV = 1,000e .12x5 = 1,000e .6 = $1,822.12.b. PV = 5e -.12 x 8 = 5e -.96 = $1.914 millionc. PV = C (1/r – 1/re rt ) = 2,000(1/.12 – 1/.12e .12 x15) = $13,912 11.a. FV = 10,000,000x(1.06)4 = 12,624,770b. FV = 10,000,000x(1 + .06/12)(4x12) = 12,704,892c. FV = 10,000,000xe (4x.06) = 12,712,492 12.a. PV = $100/1.0110= $90.53b. PV = $100/1.1310 = $29.46c. PV = $100/1.2515 = $ 3.52d.PV = $100/1.12 + $100/1.122 + $100/1.123 = $240.1813. a. ⇒=+=0.905r 11DF 11r 1 = 0.1050 = 10.50%b. 0.819(1.105)1)r (11DF 2222==+=c. AF 2 = DF 1 + DF 2 = 0.905 + 0.819 = 1.724d.PV of an annuity = C [Annuity factor at r% for t years]Here: $24.65 = $10[AF 3]AF= 2.4653e. AF3= DF 1 + DF 2 + DF 3 = AF 2 + DF 32.465 = 1.724 + DF 3 DF 3 = 0.74114. The present value of the 10-year stream of cash inflows is:6$886,739.6(1.14)0.1410.141 $170,000PV 10=⎥⎦⎤⎢⎣⎡⨯-⨯= Thus:NPV = –$800,000 + $886,739.66 = +$86,739.66At the end of five years, the factory’s value will be the present value of the five remaining $170,000 cash flows:6$583,623.7(1.14)0.1410.141 $170,000PV 5=⎥⎦⎤⎢⎣⎡⨯-⨯= 15.$23,696.151.12$50,0001.12$68,0001.12$80,0001.12$92,0001.12$92,000 1.12$85,0001.12$80,0001.12$75,0001.12$57,0001.12$50,000$380,000(1.12)C NPV 109876543210t t t =++++++++++-==∑=016. a.Let S t = salary in year t∑=-=301t t1t (1.08)(1.05)40,000PV 3$760,662.5(1.08).05)-(.08(1.05).05)-(.081 43030=⎥⎦⎤⎢⎣⎡⨯-⨯=000,0b.PV(salary) x 0.05 = $38,033.13Future value = $38,018.96 x (1.08)30 = $382,714.30c.$38,980.30 (1.08)0.0810.081$C (1.08)0.0810.081 C $r)(1r 1r 1 C PV 2020t =⎥⎥⎦⎤⎢⎢⎣⎡⨯-=⎥⎦⎤⎢⎣⎡⨯-⨯=⎥⎦⎤⎢⎣⎡+⨯-⨯=382,714.30382,714.3017.Period Present Value400,000.01 +100,000/1.12 = + 89,285.71 2 +200,000/1.122 = +159,438.783 +300,000/1.123 = +213,534.07Total = NPV = $62,258.5618. We can break this down into several different cash flows, such that thesum of these separate cash flows is the total cash flow. Then, the sum of the present values of the separate cash flows is the present value of the entire project. (All dollar figures are in millions.)▪ Cost of the ship is $8 million PV = $8 million▪Revenue is $5 million per year, operating expenses are $4 million. Thus, operating cash flow is $1 million per year for 15 years.million $8.559(1.08)0.0810.081 million 1$PV 15=⎥⎦⎤⎢⎣⎡⨯-⨯= ▪Major refits cost $2 million each, and will occur at times t = 5 and t = 10.PV = ($2 million)/1.085 + ($2 million)/1.0810= $2.288 million▪Sale for scrap brings in revenue of $1.5 million at t = 15.PV = $1.5 million/1.0815 = $0.473 millionAdding these present values gives the present value of the entire project:NPV = $8 million + $8.559 million $2.288 million + $0.473 millionNPV = $1.256 million19. a. PV = $100,000b. PV = $180,000/1.125 = $102,136.83c. PV = $11,400/0.12 = $95,000d. 4$107,354.2(1.12)0.1210.121 $19,000PV 10=⎥⎦⎤⎢⎣⎡⨯-⨯= e.PV = $6,500/(0.120.05) = $92,857.14Prize (d) is the most valuable because it has the highest present value.20. Mr. Basset is buying a security worth $20,000 now. That is its presentvalue. The unknown is the annual payment. Using the present value of an annuity formula, we have:$2,653.90 (1.08)0.0810.081000,20$C (1.08)0.0810.081 C 000,20$r)(1r 1r 1 C PV 1212t =⎥⎥⎦⎤⎢⎢⎣⎡⨯-=⎥⎦⎤⎢⎣⎡⨯-⨯=⎥⎦⎤⎢⎣⎡+⨯-⨯=21. Assume the Zhangs will put aside the same amount each year. Oneapproach to solving this problem is to find the present value of the cost of the boat and then equate that to the present value of the money saved. From this equation, we can solve for the amount to be put aside each year.PV(boat) = $20,000/(1.10)5 = $12,418PV(savings) = Annual savings ⎥⎦⎤⎢⎣⎡⨯-⨯5(1.10)0.1010.101 Because PV(savings) must equal PV(boat):Annual savings 418,12$ =⎥⎦⎤⎢⎣⎡⨯-⨯5(1.10)0.1010.101Annual savings$3,276(1.10)0.1010.101$12,4185=⎥⎦⎤⎢⎣⎡⨯-= Another approach is to use the future value of an annuity formula:$20,0005.10)(1 savings Annual =⎥⎥⎦⎤⎢⎢⎣⎡-+⨯10.1Annual savings = $ 3,27622. The fact that Ka ngaroo Autos is offering “free credit” tells us whatthe cash payments are; it does not change the fact that money has time value. A 10% annual rate of interest is equivalent to a monthly rate of 0.83%:r monthly = r annual /12 = 0.10/12 = 0.0083 = 0.83%The present value of the payments to Kangaroo Autos is:8$8,93(1.0083)0.008310.00831$300$1,00030=⎥⎦⎤⎢⎣⎡⨯-⨯+ A car from Turtle Motors costs $9,000 cash. Therefore, KangarooAutos offers the better deal, i.e., the lower present value of cost.23. The NPVs are:at 5% $25,011(1.05)$320,0001.05$100,000$170,000NPV 2=+--=⇒at 10% $3,554(1.10)320,0001.10$100,000$170,000NPV 2=+--=⇒ at 15% $14,991(1.15)320,0001.15$100,000$170,000NPV 2-=+--=⇒ The figure below shows that the project has zero NPV at about 11%.As a check, NPV at 11% is:$371(1.11)320,0001.11$100,000$170,000NPV 2-=+--=$1,428.570.07$100r C PV ===b.This is worth the PV of stream (a) plus the immediate payment of$100:PV = $100 + $1,428.57 = $1,528.57c.The continuously compounded equivalent to a 7% annually compounded rate is approximately 6.77%, because:e 0.0677 = 1.0700 Thus:$1,477.100.0677$100r C PV ===Note that the pattern of payments in part (b) is more valuable than the pattern of payments in part (c). It is preferable to receive cash flows at the start of every year than to spread thereceipt of cash evenly over the year; with the former pattern of payment, you receive the cash more quickly.25. a.PV = $1 billion/0.08 = $12.5 billionb. PV = $1 billion/(0.08 – 0.04) = $25.0 billionc.billion $9.818(1.08)0.0810.081billion $1PV 20=⎥⎦⎤⎢⎣⎡⨯-⨯= d.The continuously compounded equivalent to an 8% annually compounded rate is approximately 7.7% , because:e 0.0770 = 1.0800 Thus:billion $10.203e 0.07710.0771billion $1PV )(0.077)(20=⎥⎦⎤⎢⎣⎡⨯-⨯= This result is greater than the answer in Part (c) because theendowment is now earning interest during the entire year.26. With annual compounding: FV = $100(1.15)20 = $1,636.65With continuous compounding: FV = $100e (0.15×20) = $2,008.5527. One way to approach this problem is to solve for the present value of:(1) $100 per year for 10 years, and (2) $100 per year in perpetuity, with the first cash flow at year 11.If this is a fair deal, these present values must be equal, and thus we can solve for the interest rate (r).The present value of $100 per year for 10 years is:⎥⎦⎤⎢⎣⎡+⨯-⨯=10r)(1(r)1r 1$100PV The present value, as of year 10, of $100 per year forever, with thefirst payment in year 11, is: PV 10 = $100/r At t = 0, the present value of PV 10 is:⎥⎦⎤⎢⎣⎡⨯⎥⎦⎤⎢⎣⎡+=r $100r)(11PV 10 Equating these two expressions for present value, we have:⎥⎦⎤⎢⎣⎡⨯⎥⎦⎤⎢⎣⎡+=⎥⎦⎤⎢⎣⎡+⨯-⨯r $100r)(11r)(1(r)1r 1$1001010 Using trial and error or algebraic solution, we find that r = 7.18%.28. Assume the amount invested is one dollar.Let A represent the investment at 12%, compounded annually.Let B represent the investment at 11.7%, compounded semiannually. Let C represent the investment at 11.5%, compounded continuously.After one year:FV A = $1 (1 + 0.12)1 = $1.1200 FV B = $1 (1 + 0.0585)2 = $1.1204FV C = $1e (0.1151)= $1.1219After five years:FV A = $1 (1 + 0.12)5 = $1.7623 FV B = $1 (1 + 0.0585)10 = $1.7657FV C = $1e (0.1155)= $1.7771After twenty years:FV A = $1 (1 + 0.12)20 = $9.6463 FV B = $1 (1 + 0.0585)40 = $9.7193FV C = $1e (0.11520)= $9.9742The preferred investment is C.29. Because the cash flows occur every six months, we first need tocalculate the equivalent semi-annual rate. Thus, 1.08 = (1 + r/2)2 => r = 7.85 semi-annually compounded APR. Therefore the rate for six months is 7.85/2 or 3.925%:081,846039251039250103925010001000001009$).(..,$,$PV =⎥⎦⎤⎢⎣⎡⨯-⨯+=30. a. Each installment is: $9,420,713/19 = $495,827$4,761,724(1.08)0.0810.081$495,827PV 19=⎥⎦⎤⎢⎣⎡⨯-⨯=b.If ERC is willing to pay $4.2 million, then:⎥⎦⎤⎢⎣⎡+⨯-⨯=19r)(1r 1r 1$495,827$4,200,000 Using Excel or a financial calculator, we find that r = 9.81%.31. a. 3$402,264.7(1.08)0.0810.081$70,000PV 8=⎥⎦⎤⎢⎣⎡⨯-⨯=b.Year Beginning-of-Year Balance Year-end Interest on Balance Total Year-end Payment Amortization of Loan End-of-Year Balance 1 402,264.73 32,181.18 70,000.00 37,818.82 364,445.91 2 364,445.91 29,155.67 70,000.00 40,844.33 323,601.58 3 323,601.58 25,888.13 70,000.00 44,111.87 279,489.71 4 279,489.71 22,359.18 70,000.00 47,640.82 231,848.88 5 231,848.88 18,547.91 70,000.00 51,452.09 180,396.79 6 180,396.79 14,431.74 70,000.00 55,568.26 124,828.54 7 124,828.54 9,986.28 70,000.00 60,013.72 64,814.82864,814.825,185.1970,000.0064,814.810.0132. This is an annuity problem with the present value of the annuityequal to $2 million (as of your retirement date), and theinterest rate equal to 8% with 15 time periods. Thus, your annual level of expenditure (C) is determined as follows:$233,659 (1.08)0.0810.081$2,000,000C (1.08)0.0810.081 C $2,000,000r)(1r 1r 1 C PV 1515t =⎥⎥⎦⎤⎢⎢⎣⎡⨯-=⎥⎦⎤⎢⎣⎡⨯-⨯=⎥⎦⎤⎢⎣⎡+⨯-⨯=With an inflation rate of 4% per year, we will still accumulate $2million as of our retirement date. However, because we want to spend a constant amount per year in real terms (R, constant for all t), the nominal amount (Ct ) must increase each year. For each year t: R = Ct/(1 + inflationrate)tTherefore:PV [all Ct] = PV [all R (1 + inflation rate)t] = $2,000,000$2,000,0000.08)(1.04)0(1....08)0(10.04)(10.08)(1.04)0(1R 15152211=⎥⎦⎤⎢⎣⎡+++++++++⨯ R[0.9630 + 0.9273 + . . . + 0.5677] = $2,000,000 R 11.2390 = $2,000,000R = $177,952 Alternatively, consider that the real rate is03846.1=-++0.04)(1.08)0(1. Then, redoing the steps above using the real rate gives a real cash flow equal to:$177,952=⎥⎥⎦⎤⎢⎢⎣⎡⨯-= (1.03846)0.0384610.038461$2,000,000C 15Thus C 1 = ($177,9521.04) = $185,070, C 2 = $192,473, etc.33. a.9$430,925.8(1.055)0.05510.0551$50,000PV 12=⎥⎦⎤⎢⎣⎡⨯-⨯=b. The annually compounded rate is 5.5%, so the semiannual rate is:(1.055)(1/2) – 1 = 0.0271 = 2.71%Since the payments now arrive six months earlier than previously:PV = $430,925.89 × 1.0271 = $442,603.9834. In three years, the balance in the mutual fund will be:FV = $1,000,000 × (1.035)3 = $1,108,718The monthly shortfall will be: $15,000 – ($7,500 + $1,500) = $6,000Annual withdrawals from the mutual fund will be: $6,000 × 12 = $72,000 Assume the first annual withdrawal occurs three years from today, when the balance in the mutual fund will be $1,108,718. Treating thewithdrawals as an annuity due, we solve for t as follows: r)(1r)(1r 1r 1C PV t +⨯⎥⎦⎤⎢⎣⎡+⨯-⨯=1.035(1.035)0.03510.0351$72,000$1,108,718t ⨯⎥⎦⎤⎢⎣⎡⨯-⨯= Using Excel or a financial calculator, we find that t = 22.5 years.35. a. PV = 2/.12 = $16.667 millionb. PV = 939.14$=⎥⎦⎤⎢⎣⎡⨯-⨯20(1.12)0.1210.121$2millionc. PV = 2/(.12-.03) = $22.222 milliond. PV = 061.18$=⎥⎦⎤⎢⎣⎡⨯-⨯2020(1.12).03)-(0.12 1.03.03)-(0.121$2million36. a. Using the Rule of 72, the time for money to double at 12% is72/12, or 6 years. More precisely, if x is the number ofyears for money to double, then:(1.12)x = 2Using logarithms, we find:x (ln 1.12) = ln 2x = 6.12 yearsb. With continuous compounding for interest rate r and time period x:e r x = 2Taking the natural logarithm of each side:r x = ln(2) = 0.693Thus, if r is expressed as a percent, then x (the time for moneyto double) is: x = 69.3/(interest rate, in percent).37. Spreadsheet exercise.38. a. This calls for the growing perpetuity formula with a negativegrowth rate (g = –0.04):million $14.290.14million $20.04)(0.10million $2PV ==--=b. The pipeline’s value at year 20 (i.e., at t = 20), assuming itscash flows last forever, is:gr g)(1C g r C PV 2012120-+=-= With C 1 = $2 million, g = –0.04, and r = 0.10:million $6.3140.14million $0.8840.140.04)(1million)($2PV 2020 ==-⨯= Next, we convert this amount to PV today, and subtract it from the answer to Part (a):million $13.35(1.10)million $6.314million $14.29PV 20=-=(注:可编辑下载,若有不当之处,请指正,谢谢!)。

习题答案Principles-of-Corporate-Finance第十版-Chapter18

5.a.Direct costs of financial distress are the legal and administrativecosts of

10.a.The cumulative requirement for external financing.

b.More profitable firms can rely more on internal cash flow and needless

external financing.

11.Financial slack is most valuable to growth companies with good but uncertain

If individuals could not deduct interest for personal tax purposes, then:

Then:

So the value of the shareholders’ position in the levered firm is relatively greater when no personal interest deduction is allowed.

Net working capital

$30

$29

Bonds outstanding

Fixed assets

8

9

Common stock

Total assets

PrinciplesofCorporateFinance英文第十版习题解答Chap005

PrinciplesofCorporateFinance英⽂第⼗版习题解答Chap005CHAPTER 5Net Present Value and Other Investment CriteriaAnswers to Problem Sets1. a. A = 3 years, B = 2 years, C = 3 yearsb. Bc. A, B, and Cd. B and C (NPV B = $3,378; NPV C = $2,405)e. Truef. It will accept no negative-NPV projects but will turn down some withpositive NPVs. A project can have positive NPV if all future cash flows areconsidered but still do not meet the stated cutoff period.2. Given the cash flows C0, C1, . . . , C T, IRR is defined by:It is calculated by trial and error, by financial calculators, or by spreadsheetprograms.3. a. $15,750; $4,250; $0b. 100%.4. No (you are effectively “borrowing” at a rate of interest highe r than theopportunity cost of capital).5. a. Twob. -50% and +50%c. Yes, NPV = +14.6.6. The incremental flows from investing in Alpha rather than Beta are -200,000;+110,000; and 121,000. The IRR on the incremental cash flow is 10% (i.e., -200 + 110/1.10 + 121/1.102 = 0). The IRR on Beta exceeds the cost of capital and so does the IRR on the incremental investment in Alpha. Choose Alpha.7. 1, 2, 4, and 68. a. $90.91.10)(1$10001000NP V A -=+-=$$4,044.7310)(1.$1000(1.10)$1000(1.10)$4000(1.10)$1000(1.10)$10002000NP V 5432B +=+++++-=$$39.4710)(1.$1000.10)(1$1000(1.10)$1000(1.10)$10003000NP V 542C +=++++-=$ b.Payback A = 1 year Payback B = 2 years Payback C = 4 years c. A and Bd.$909.09.10)(1$1000P V 1A ==The present value of the cash inflows for Project A never recovers the initial outlay for the project, which is always the case for a negative NPV project. The present values of the cash inflows for Project B are shown in the third row of the table below, and the cumulative net present values are shown in the fourth row:C 0 C 1C 2C 3C 4C 5-2,000.00 +1,000.00 +1,000.00 +4,000.00 +1,000.00 +1,000.00-2,000.00909.09 826.45 3,005.26 683.01 620.92-1,090.91 -264.46 2,740.803,423.81 4,044.73Since the cumulative NPV turns positive between year two and year three,the discounted payback period is:years 2.093,005.26264.462=+The present values of the cash inflows for Project C are shown in the third row of the table below, and the cumulative net present values are shown in the fourth row:C 0C 1C 2C 3 C 4C 5-3,000.00 +1,000.00 +1,000.00 0.00 +1,000.00 +1,000.00-3,000.00 909.09 826.450.00 683.01 620.92 -2,090.91 -1,264.46-1,264.46-581.45 39.47Since the cumulative NPV turns positive between year four and year five,the discounted payback period is:years 4.94620.92581.454=+e. Using the discounted payback period rule with a cutoff of three years, the firm would accept only Project B.9. a.When using the IRR rule, the firm must still compare the IRR with the opportunity cost of capital. Thus, even with the IRR method, one must specify the appropriate discount rate.b.Risky cash flows should be discounted at a higher rate than the rate used to discount less risky cash flows. Using the payback rule is equivalent to using the NPV rule with a zero discount rate for cash flows before the payback period and an infinite discount rate for cash flows thereafter. 10.The two IRRs for this project are (approximately): –17.44% and 45.27% Between these two discount rates, the NPV is positive. 11.a.The figure on the next page was drawn from the following points: Discount Rate0% 10% 20%NPV A +20.00 +4.13 -8.33 NPV B +40.00 +5.18 -18.98b.From the graph, we can estimate the IRR of each project from the point where its line crosses the horizontal axis:IRR A = 13.1% and IRR B = 11.9%c. The company should accept Project A if its NPV is positive and higherthan that of Project B; that is, the company should accept Project A if thediscount rate is greater than 10.7% (the intersection of NPV A and NPV B on the graph below) and less than 13.1%.d. The cash flows for (B – A) are:C0 = $ 0C1 = –$60C2 = –$60C3 = +$140Therefore:Discount Rate0% 10% 20%NPV B-A +20.00 +1.05 -10.65IRR B-A = 10.7%The company should accept Project A if the discount rate is greater than10.7% and less than 13.1%. As shown in the graph, for these discountrates, the IRR for the incremental investment is less than the opportunitycost of capital.12. a.Because Project A requires a larger capital outlay, it is possible that Project A has both a lower IRR and a higher NPV than Project B. (In fact, NPV A is greater than NPV B for all discount rates less than 10 percent.) Because the goal is to maximize shareholder wealth, NPV is the correct criterion.b.To use the IRR criterion for mutually exclusive projects, calculate the IRR for the incremental cash flows:C 0C 1C 2IRRA -B -200 +110 +121 10%Because the IRR for the incremental cash flows exceeds the cost of capital, the additional investment in A is worthwhile. c.81.86$(1.09)$3001.09$250400NPV 2A =++-=$ $79.10(1.09)$1791.09$140200NPV 2B =++-=$ 13.Use incremental analysis:C 1C 2 C 3Current arrangement -250,000 -250,000 +650,000 Extra shift -550,000 +650,000 0 Incremental flows -300,000+900,000 -650,000The IRRs for the incremental flows are (approximately): 21.13% and 78.87% If the cost of capital is between these rates, Titanic should work the extra shift.14. a..82010,0008,18210,000)( 1.1020,00010,000PI D ==--+-=.59020,00011,81820,000)( 1.1035,00020,000PI E ==--+-=b.Each project has a Profitability Index greater than zero, and so both areacceptable projects. In order to choose between these projects, we must use incremental analysis. For the incremental cash flows:0.3610,0003,63610,000)( 1.1015,00010,000PI D E ==--+-=-The increment is thus an acceptable project, and so the larger project should be accepted, i.e., accept Project E. (Note that, in this case, the better project has the lower profitability index.)15.Using the fact that Profitability Index = (Net Present Value/Investment), we find:Project Profitability Index 1 0.22 2 -0.02 3 0.17 4 0.14 5 0.07 6 0.18 70.12Thus, given the budget of $1 million, the best the company can do is to acceptProjects 1, 3, 4, and 6.If the company accepted all positive NPV projects, the market value (compared to the market value under the budget limitation) would increase by the NPV of Project 5 plus the NPV of Project 7: $7,000 + $48,000 = $55,000Thus, the budget limit costs the company $55,000 in terms of its market value. 16.The IRR is the discount rate which, when applied to a project’s cash flows, yields NPV = 0. Thus, it does not represent an opportunity cost. However, if eachproject’s cash flows could be invested at that project’s IRR, then the NPV of each project would be zero because the IRR would then be the opportunity cost of capital for each project. The discount rate used in an NPV calculation is the opportunity cost of capital. Therefore, it is true that the NPV rule does assume that cash flows are reinvested at the opportunity cost of capital.17.a.C 0 = –3,000 C 0 = –3,000 C 1 = +3,500 C 1 = +3,500 C 2 = +4,000 C 2 + PV(C 3) = +4,000 – 3,571.43 = 428.57 C 3 = –4,000 MIRR = 27.84%b.2321 1.12C 1.12xC xC -=+(1.122)(xC 1) + (1.12)(xC 2) = –C 3 (x)[(1.122)(C 1) + (1.12C 2)] = –C 3)()21231.12C )(C (1.12C -x +=0.4501.12)(4,00)(3,500(1.124,000x 2=+=)()0IRR)(1x)C -(1IRR)(1x)C -(1C 2210=++++0IRR)(10)0.45)(4,00-(1IRR)(10)0.45)(3,50-(13,0002=++++- Now, find MIRR using either trial and error or the IRR function (on afinancial calculator or Excel). We find that MIRR = 23.53%.It is not clear that either of these modified IRRs is at all meaningful.Rather, these calculations seem to highlight the fact that MIRR really has no economic meaning.18.Maximize: NPV = 6,700x W + 9,000x X + 0X Y – 1,500x Z subject to:10,000x W + 0x X + 10,000x Y + 15,000x Z ≤ 20,000 10,000x W + 20,000x X – 5,000x Y – 5,000x Z ≤ 20,000 0x W - 5,000x X– 5,000x Y – 4,000x Z ≤ 20,000 0 ≤ x W ≤ 1 0 ≤ x X ≤ 1 0 ≤ x Z ≤ 1Using Excel Spreadsheet Add-in Linear Programming Module:Optimized NPV = $13,450with x W = 1; x X = 0.75; x Y = 1 and x Z = 0If financing available at t = 0 is $21,000:Optimized NPV = $13,500with x W = 1; x X = (23/30); x Y = 1 and x Z = (2/30)Here, the shadow price for the constraint at t = 0 is $50, the increase in NPV for a $1,000 increase in financing available at t = 0.In this case, the program viewed x Z as a viable choice even though the NPV of Project Z is negative. The reason for this result is that Project Z provides a positive cash flow in periods 1 and 2.If the financing available at t = 1 is $21,000:Optimized NPV = $13,900with x W = 1; x X = 0.8; x Y = 1 and x Z = 0Hence, the shadow price of an additional $1,000 in t =1 financing is $450.。

习题答案Principles of Corporate Finance第十版 Chapter19

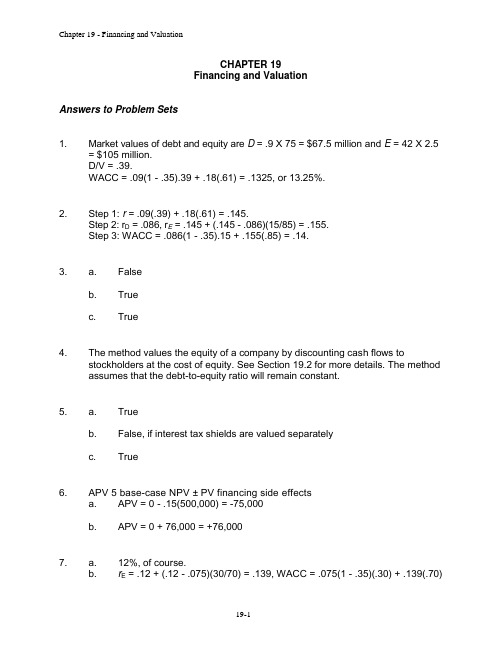

CHAPTER 19Financing and ValuationAnswers to Problem Sets1. Market values of debt and equity are D = .9 X 75 = $67.5 million and E = 42 X2.5= $105 million.D/V = .39.WACC = .09(1 - .35).39 + .18(.61) = .1325, or 13.25%.2. Step 1: r = .09(.39) + .18(.61) = .145.Step 2: r D = .086,r E = .145 + (.145 - .086)(15/85) = .155.Step 3: WACC = .086(1 - .35).15 + .155(.85) = .14.3. a. Falseb. Truec. True4. The method values the equity of a company by discounting cash flows tostockholders at the cost of equity. See Section 19.2 for more details. The method assumes that the debt-to-equity ratio will remain constant.5. a. Trueb. False, if interest tax shields are valued separatelyc. True6. APV 5 base-case NPV ± PV financing side effectsa. APV = 0 - .15(500,000) = -75,000b. APV = 0 + 76,000 = +76,0007. a. 12%, of course.b. r E = .12 + (.12 - .075)(30/70) = .139, WACC = .075(1 - .35)(.30) + .139(.70)= .112, or 11.2%.8. a. Base-case NPV = -1,000 + 1200/1.20 = 0b. PV tax shield = (.35 X .1 X .3(1000))/1.1 = 9.55. APV = 0 + 9.55 = $9.559. No. The more debt you use, the higher rate of -return equity investors willrequire. (Lenders may demand more also.) Thus there is a hidden cost of the“cheap” debt: It makes equity more expensive.10. Patagonia does not have 90% debt capacity. KCS is borrowing $45 million partlyon the strength of its existing assets. Also the decision to raise bank finance for the purchase does not mean that KCS has changed its target debt ratio. An APV valuation of Patagonia would probably assume a 50% debt ratio.11. If the bank debt is treated as permanent financing, the capital structureproportions are:Bank debt (r D = 10 percent) $280 9.4%Long-term debt (r D = 9 percent) 1800 60.4Equity (r E = 18 percent, 90 x 10 million shares) 900 30.2$2980 100.0% WACC* = [0.10⨯(1 - 0.35)⨯0.094] + [0.09⨯(1 - 0.35)⨯0.604] + [0.18⨯0.302]= 0.096 = 9.6%12. Forecast after-tax incremental cash flows as explained in Section 6.1. Interest isnot included; the forecasts assume an all-equity financed firm.13. Calculate APV by subtracting $4 million from base-case NPV.14. We make three adjustments to the balance sheet:∙Ignore deferred taxes; this is an accounting entry and represents neither a liability nor a source of funds∙…Net out‟ accounts payable against current assets∙Use the market value of equity (7.46 million x $46)Now the right-hand side of the balance sheet (in thousands) is:Short-term debt $75,600Long-term debt 208,600Shareholders‟ equity343,160Total $627,360The after-tax weighted-average cost of capital formula, with oneelement for each source of funding, is:WACC = [r D-ST⨯(1 – T c)⨯(D-ST/V)]+[r D-LT⨯(1 – T c)⨯(D-LT/V)]+[r E⨯(E/V)]WACC = [0.06⨯(1 – 0.35)⨯(75,600/627,360)]+[0.08⨯(1 – 0.35)⨯(208,600/627,360)] + [0.15⨯(343,160/627,360)]= 0.004700 + 0.017290 + 0.082049 = 0.1040 = 10.40%15. Assume that short-term debt is temporary. From Problem 14:Long-term debt $208,600Share holder equity 343,160Total $551,760Therefore:D/V = $208,600/$551,760 = 0.378E/V = $343,160/$551,760 = 0.622Step 1:r = r D (D/V) + r E (E/V) = (0.08 ⨯ 0.378) + (0.15 ⨯ 0.622) = 0.1235 Step 2:r E = r + (r – r D) (D/E) = 0.1235 + (0.1235 – 0.08) ⨯ 0.403 = 0.1410 Step 3:WACC = [r D⨯ (1 – T C) ⨯ (D/V)] + [r E⨯ (E/V)]= (0.08 ⨯ 0.65 ⨯ 0.287) + (0.1410 ⨯ 0.713) = 0.1155 = 11.55%16. Base case NPV = –$1,000 + ($600/1.12) + ($700/1.122) = $93.75 or $93,750YearDebtOutstanding atStart Of Year InterestInterestTax ShieldPV(Tax Shield)1 300 24 7.20 6.672 150 12 3.60 3.09APV = $93.75 + $6.67 + $3.09 = 103.5 or $103,50017. a. Base-case NPV = –$1,000,000 + ($95,000/0.10) = –$50,000PV(tax shields) = 0.35 ⨯ $400,000 = $140,000APV = –$50,000 + $140,000 = $90,000b. PV(tax shields, approximate) = (0.35 ⨯ 0.07 ⨯ $400,000)/0.10 =$98,000APV = –$50,000 + $98,000 = $48,000The present value of the tax shield is higher when the debt is fixed andtherefore the tax shield is certain. When borrowing a constant proportion of the market value of the project, the interest tax shields are as uncertain as the value of the project, and therefore must be discounted at the project‟s opportunity cost of capital. 18.The immediate source of funds (i.e., both the proportion borrowed and the expected return on the stocks sold) is irrelevant. The project would not be any more valuable if the university sold stocks offering a lower return. If borrowing is a zero-NPV activity for a tax-exempt university, then base-case NPV equals APV, and the adjusted cost of capital r* equals the opportunity cost of capital with all-equity financing. Here, base-case NPV is negative; the university should not invest.19.a.Base-case $0.111.12$1.7510NP V 101t t-=+-=∑=$or – $110,000 APV = Base-case NPV + PV(tax shield)PV(tax shield) is computed from the following table: Year Debt Outstanding at Start of Year InterestInterest Tax Shield Present Valueof Tax Shield 1 $5,000 $400 $140 $129.632 4,500 360 126 108.023 4,000 320 112 88.914 3,500 280 98 72.035 3,000 240 84 57.176 2,500 200 70 44.117 2,000 160 56 32.68 8 1,500 120 42 22.69 9 1,000 80 28 14.01 10 5004014 6.48Total575.74APV = –$110,000 + $575,740 = $465,740b. APV = Base-case NPV + PV(tax shield) – equity issue costs= –$110,000 + $575,740 – $400,000 = $65,74020. Spreadsheet exercise; answers will vary.21.Note the following:∙ The costs of debt and equity are not 8.5% and 19%, respectively. These figures assume the issue costs are paid every year, not just at issue.∙ The fact that Bunsen can finance the entire cost of the project with debt is irrelevant. The cost of capital does not depend on the immediate source of funds; what matters is the project‟s contribution to the firm‟s overall borrowing power.∙ The project is expected to support debt in perpetuity. The fact that the first debt issue is for only 20 years is irrelevant. Assume the project has the same business risk as the firm‟s other assets.Because it is a perpetuity , we can use the firm‟s weighted -average cost of capital. If we ignore issue costs:WACC = [r D ⨯ (1 – T C ) ⨯ (D/V)] + [r E ⨯ (E/V)]WACC = [0.07 ⨯ (1 – 0.35) ⨯ 0.4] + [0.14 ⨯ 0.6] = 0.1022 = 10.22%Using this discount rate:$272,0160.1022$130,000$1,000,000NPV =+-=The issue costs are:Stock issue: 0.050 ⨯ $1,000,000 = $50,000 Bond issue:0.015 ⨯ $1,000,000 = $15,000Debt is clearly less expensive. Project NPV net of issue costs is reduced to: ($272,016 – $15,000) = $257,016. However, if debt is used, the firm‟s debt rat io will be above the target ratio, and more equity will have to be raised later. If debt financing can be obtained using retaining earnings, then there are no other issue costs to consider. If stock will be issued to regain the target debt ratio, an additional issue cost is incurred.A careful estimate of the issue costs attributable to this project would require a comparison of Bunsen‟s financial plan …with‟ as compared to …without‟ this project.22.Disagree. The Goldensacks calculations are based on the assumption that the cost of debt will remain constant, and that the cost of equity capital will not change even though the firm‟s financial structure has changed. The former assumption is appropriate while the latter is not.23.LatestyearForecast0 1 2 3 4 5 1. Sales 40,123.0 36,351.0 30,155.0 28,345.0 29,982.0 30,450.0 2. Cost of Goods Sold 22,879.0 21,678.0 17,560.0 16,459.0 15,631.0 14,987.0 3. Other Costs 8,025.0 6,797.0 5,078.0 4,678.0 4,987.0 5,134.0 4. EBITDA (1 – 2 – 3) 9,219.0 7,876.0 7,517.0 7,208.0 9,364.0 10,329.0 5. Depreciation and Amortization 5,678.0 5,890.0 5,670.0 5,908.0 6,107.0 5,908.0 6. EBIT (Pretax profit) (4 – 5) 3,541.0 1,986.0 1,847.0 1,300.0 3,257.0 4,421.0 7. Tax at 35% 1,239.4 695.1 646.5 455.0 1,140.0 1,547.4 8. Profit after tax (6 – 7) 2,301.7 1,290.9 1,200.6 845.0 2,117.1 2,873.79. Change in working capital 784.0 -54.0 -342.0 -245.0127.0235.010. Investment(change in Gross PP&E) 6,547.0 7,345.0 5,398.0 5,470.0 6,420.0 6,598.0 11. Free Cash Flow (8 + 5 – 9 – 10) 648.7 -110.11,814.61,528.0 1,677.1 1,948.7PV Free cash flow, years 1-4 3,501.6 Horizon value in year 4PV Horizon value 15,480.0 24,358.1PV of company 18,981.7The total value of the equity is: $18,981.7 – $5,000 = $13,981.7 Value per share = $13,981.7/865 = $16.1624. a.For a one-period project to have zero APV:Rearranging gives:For a one-period project, the left-hand side of this equation is the projectIRR. Also, (D/ -C 0) is the project‟s debt capacity. Therefore, the minimum acceptable return is:b. .094051.061.09840.20)0.06(0.350.0984r *=⎪⎭⎫⎝⎛⨯⨯-=0r 1D)r (T r 1C C AP V DD C A 10=+⨯⨯+++=⎪⎪⎭⎫⎝⎛++⎪⎪⎭⎫ ⎝⎛-⨯-=--D A 0D C 01r 1r 1 C D )r T (r 1C C ⎪⎪⎭⎫ ⎝⎛++⨯⨯-=D AD C A r1r 1)L r T (r *r25. Fixed debt levels, without rebalancing, are not necessarily better for stockholders.Note that, when the debt is rebalanced, next year‟s inte rest tax shields are fixedand, thus, discounted at a lower rate. The following year‟s interest is not knownwith certainty for one year and, hence, is discounted for one year at the higherrisky rate and for one year at the lower rate. This is much more realistic since itrecognizes the uncertainty of future events.26. The table below is a modification of Table 19.1 based on the assumption that,after year 7:∙Sales remain constant (that is, growth = 0%);∙Costs remain at 76.0% of sales;∙Depreciation remains at 14.0% of net fixed assets;∙Net fixed assets remain constant at 93.8;∙Working capital remains at 13.0% of sales.TABLE 20.1 Free cash flow projections and company value for Rio Corporation ($ millions)Latestyear Forecast0 1 2 3 4 5 6 7 81. Sales 83.6 89.5 95.8 102.5 106.6 110.8 115.2 118.7 118.72. Cost of goods sold 63.1 66.2 71.3 76.3 79.9 83.1 87.0 90.2 90.23. EBITDA (1 - 2) 20.5 23.3 24.4 26.1 26.6 27.7 28.2 28.5 28.54. Depreciation 3.3 9.9 10.6 11.3 11.8 12.3 12.7 13.1 13.15. Profit before tax (EBIT) (3 - 4) 17.2 13.4 13.8 14.8 14.9 15.4 15.5 15.4 15.46. Tax 6.0 4.7 4.8 5.2 5.2 5.4 5.4 5.4 5.47. Profit after tax (5 - 6) 11.2 8.7 9.0 9.6 9.7 10.0 10.1 10.0 10.08. Investment in fixed assets 11.0 14.6 15.5 16.6 15.0 15.6 16.2 15.9 13.19. Investment in working capital 1.0 0.5 0.8 0.9 0.5 0.6 0.6 0.4 0.010. Free cash flow (7 + 4 - 8 - 9) 2.5 3.5 3.2 3.4 5.9 6.1 6.0 6.8 10.0PV Free cash flow, years 1-7 24.0 (Horizon value in year 7) PV Horizon value 60.7 110.9PV of company 84.7Assumptions:Sales growth (percent) 6.7 7.0 7.0 7.0 4.0 4.0 4.0 3.0 0.0 Costs (percent of sales) 75.5 74.0 74.5 74.5 75.0 75.0 75.5 76.0 76.0 Working capital(% of sales) 13.3 13.0 13.0 13.0 13.0 13.0 13.0 13.0 13.0 Net fixed assets (% of sales) 79.2 79.0 79.0 79.0 79.0 79.0 79.0 79.0 79.0 Depreciation (% net fixed assets) 5.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 Tax rate, % 35.0Cost of debt, % (r D) 6.0Cost of equity, % (r E) 12.4Debt ratio (D/V) 0.4WACC, % 9.0Long-term growth forecast, % 0.0Fixed assets and working capitalGross fixed assets 95.0 109.6 125.1 141.8 156.8 172.4 188.6 204.5 217.6 Less accumulated depreciation29.0 38.9 49.5 60.8 72.6 84.9 97.6 110.7 123.9 Net fixed assets 66.0 70.7 75.6 80.9 84.2 87.5 91.0 93.8 93.8 Net working capital 11.1 11.6 12.4 13.3 13.9 14.4 15.0 15.4 15.4 Appendix Problems1. The award is risk-free because it is owed by the U.S. government. The after-taxamount of the award is: 0.65 × $16 million = $10.40 millionThe after-tax discount rate is: 0.65 × 0.055 = 0.03575 = 3.575%The present value of the award is: $10.4 million/1.03575 = $10.04 million2. The after-tax cash flows are: 0.65 × $100,000 = $65,000 per yearThe after-tax discount rate is: 0.65 × 0.09 = 0.0585 = 5.85%The present value of the lease is equal to the present value of a five-year annuityof $65,000 per year plus the immediate $65,000 payment:$65,000 × [annuity factor, 5.85%, 5 years] + $65,000 =($65,000 × 4.2296) + $65,000 = $339,924。

Principles of Corporate Finance 英文第十版习题解答Chap003

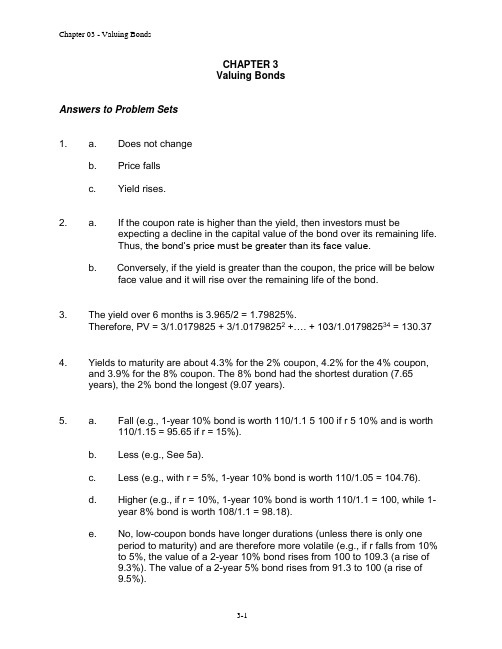

CHAPTER 3Valuing BondsAnswers to Problem Sets1. a. Does not changeb. Price fallsc. Yield rises.2. a. If the coupon rate is higher than the yield, then investors must beexpecting a decline in the capital value of the bond over its remaining life.Thus, the bond’s price must be greater than its face value.b. Conversely, if the yield is greater than the coupon, the price will be belowface value and it will rise over the remaining life of the bond.3. The yield over 6 months is 3.965/2 = 1.79825%.Therefore, PV = 3/1.0179825 + 3/1.01798252+…. + 103/1.017982534 = 130.37 4. Yields to maturity are about 4.3% for the 2% coupon, 4.2% for the 4% coupon,and 3.9% for the 8% coupon. The 8% bond had the shortest duration (7.65years), the 2% bond the longest (9.07 years).5. a. Fall (e.g., 1-year 10% bond is worth 110/1.1 5 100 if r 5 10% and is worth110/1.15 = 95.65 if r = 15%).b. Less (e.g., See 5a).c. Less (e.g., with r = 5%, 1-year 10% bond is worth 110/1.05 = 104.76).d. Higher (e.g., if r = 10%, 1-year 10% bond is worth 110/1.1 = 100, while 1-year 8% bond is worth 108/1.1 = 98.18).e. No, low-coupon bonds have longer durations (unless there is only oneperiod to maturity) and are therefore more volatile (e.g., if r falls from 10%to 5%, the value of a 2-year 10% bond rises from 100 to 109.3 (a rise of9.3%). The value of a 2-year 5% bond rises from 91.3 to 100 (a rise of9.5%).6. a. Spot interest rates. Yield to maturity is a complicated average of the separate spot rates of interest.b. Bond prices. The bond price is determined by the bond’s cash flows andthe spot rates of interest. Once you know the bond price and the bond’s cash flows, it is possible to calculate the yield to maturity.7. a. 4%b.PV = $1,075.448. a. PV ()2211050,1150r r +++=b.PV ()21050,1150y y +++= c. Less (it is between the 1-year and 2-year spot rates).9. a. r 1 = 100/99.423 – 1 = .58%; r 2 = (100/97.546).5 – 1 = 1.25%; r 3 = (100/94.510).33 -.1 = 1.90%; r 4 = (100/90.524).25 – 1 = 2.52%.b. Upward-sloping.c.Lower (the yield on the bond is a complicated average of the separate spot rates).10. a. Price today is 108.425; price after 1 year is 106.930.b. Return = (106.930 1 8)/108.425 - 1 = .06, or 6%.c. If a bond’s yield to maturity is unchanged, the return to the bondholder is equal to the yield.11. a. False. Duration depends on the coupon as well as the maturity.b. False. Given the yield to maturity, volatility is proportional to duration.c. True. A lower coupon rate means longer duration and therefore higher volatility.d.False. A higher interest rate reduces the relative present value of (distant) principal repayments.12.13. 7.01% (the extra return that you earn for investing for two years rather than oneis 1.062/1.05 – 1 = .0701).14. a. Real rate = 1.10/1.05 – 1 = .0476, or 4.76%b. The real rate does not change. The nominal rate increases to 1.0476 x1.07 – 1 = .1209, or 12.9%.15. With annual coupon payments:=+⎥⎦⎤⎢⎣⎡⨯-⨯=1010(1.06)100(1.06)0.0610.0615PV €92.6416. a.$10,231.64(1.026)10,000(1.026)0.02610.0261275PV 2020=+⎥⎦⎤⎢⎣⎡⨯-⨯=b.Interest rate PV of Interest PV of Face value PV of Bond 1.0% $5,221.54 $9,050.63 $14,272.17 2.0% 4,962.53 8,195.44 13,157.97 3.0% 4,721.38 7,424.70 12,146.08 4.0% 4,496.64 6,729.71 11,226.36 5.0% 4,287.02 6,102.71 10,389.73 6.0% 4,091.31 5,536.76 9,628.06 7.0% 3,908.41 5,025.66 8,934.07 8.0% 3,737.34 4,563.87 8,301.21 9.0% 3,577.18 4,146.43 7,723.61 10.0% 3,427.11 3,768.89 7,196.00 11.0% 3,286.36 3,427.29 6,713.64 12.0% 3,154.23 3,118.05 6,272.28 13.0% 3,030.09 2,837.97 5,868.06 14.0% 2,913.35 2,584.19 5,497.54 15.0%2,803.492,354.135,157.6217.Purchase price for a 6-year government bond with 5 percent annual coupon:1,108.34(1.03)1,000(1.03)0.0310.03150PV 66$=+⎥⎦⎤⎢⎣⎡⨯-⨯= Price one year later (yield = 3%):1,091.59(1.03)1,000(1.03)0.0310.03150PV 55$=+⎥⎦⎤⎢⎣⎡⨯-⨯= Rate of return = [$50 + ($1,091.59 – $1,108.34)]/$1,108.34 = 3.00% Price one year later (yield = 2%):1,141.40(1.02)1,000(1.02)0.0210.02150PV 55$=+⎥⎦⎤⎢⎣⎡⨯-⨯= Rate of return = [$50 + ($1,141.40 – $1,108.34)]/$1,108.34 = 7.49%18.The key here is to find a combination of these two bonds (i.e., a portfolio ofbonds) that has a cash flow only at t = 6. Then, knowing the price of the portfolio and the cash flow at t = 6, we can calculate the 6-year spot rate.We begin by specifying the cash flows of each bond and using these and their yields to calculate their current prices:Investment Yield C 1 . . . C 5 C 6 Price 6% bond 12% 60 . . . 60 1,060 $753.32 10% bond 8%100. . .1001,100$1,092.46From the cash flows in years one through five, we can see that buying two 6% bonds produces the same annual payments as buying 1.2 of the 10% bonds. To see the value of a cash flow only in year six, consider the portfolio of two 6% bonds minus 1.2 10% bonds. This portfolio costs:($753.32 × 2) – (1.2 ⨯ $1,092.46) = $195.68The cash flow for this portfolio is equal to zero for years one through five and, for year 6, is equal to:(1,060 × 2) – (1.2 ⨯ 1,100) = $800Thus:$195.68 ⨯ (1 + r 6)6 = 800 r 6 = 0.2645 = 26.45%19. Downward sloping. This is because high coupon bonds provide a greaterproportion of their cash flows in the early years. In essence, a high coupon bond is a ‘shorter’ bond than a low coupon bond of the same maturity. 20.a.Year Discount Factor Forward Rate 1 1/1.05 = 0.9522 1/(1.054)2 = 0.900 (1.0542/1.05) – 1 = 0.0580 = 5.80% 3 1/(1.057)3 = 0.847 (1.0573 /1.0542 ) – 1 = 0.0630 = 6.30% 4 1/(1.059)4 = 0.795 (1.0594 /1.0573 ) – 1 = 0.0650 = 6.50% 51/(1.060)5 = 0.747(1.0605 /1.0594 ) – 1 = 0.0640 = 6.40%b.i.5%, two-year note:$992.79(1.054)$10501.05$50PV 2=+=ii. 5%, five-year bond:$959.34(1.060)$1050(1.059)$50(1.057)$50(1.054)$501.05$50PV 5432=++++=iii. 10%, five-year bond:$1,171.43(1.060)$1100(1.059)$100(1.057)$100(1.054)$1001.05$100PV 5432=++++=c. First, we calculate the yield for each of the two bonds. For the 5% bond, this means solving for r in the following equation:5432r)(1$1050r)(1$50r)(1$50r)(1$50r 1$50$959.34+++++++++=r = 0.05964 = 5.964% For the 10% bond:5432r)(1$1100r)(1$100r)(1$100r)(1$100r 1$100$1171.43+++++++++=r = 0.05937 = 5.937%The yield depends upon both the coupon payment and the spot rate at thetime of the coupon payment. The 10% bond has a slightly greater proportion of its total payments coming earlier, when interest rates are low, than does the 5% bond. Thus, the yield of the 10% bond is slightly lower.d. The yield to maturity on a five-year zero coupon bond is the five-year spotrate, here 6.00%.e. First, we find the price of the five-year annuity, assuming that the annual payment is $1:Now we find the yield to maturity for this annuity:r = 0.05745 = 5.745%f.The yield on the five-year note lies between the yield on a five-year zero-coupon bond and the yield on a 5-year annuity because the cash flows of the Treasury bond lie between the cash flows of these other two financial instruments during a period of rising interest rates. That is, the annuity has fixed, equal payments, the zero-coupon bond has one payment at the end, and the bond’s payments are a combination of these.21. Assuming we are calculating the durations as of February 2009, the strip’sduration equals$4.2417(1.060)1.059)(11.057)(11.054)(111.051PV 5432=++++=5432r)(11r)(11r)(11r)(11r 114.2417+++++++++=6uration ==88.7456x88.745D , and the modified duration equals 6/1.02 = 5.88. At asemi-annual yield of 1.5%, the price of the 6-year strips equals 91.424, and at a semi-annual yield of 2.5%, the price of the strips equals 86.151. The difference in the prices, 5.273 is 5.94% of the price of the strips. This is close to the 5.88 duration, and the difference is due to the first-order approximation of the price change provided by duration.To calculate the duration for the 4% bonds, consider the following table similar toTotal PV = 111.26, and the duration = 5.432. The modified duration equals 5.432/1.02 = 5.325.The price of the 4% coupon bond at 1.5% and 2.5% equals 114.294 and 108.310, respectively. This price difference, 5.984, is 5.38% of the original price, which is very close to the 5.33 duration.22. Table 3.3 can be flipped and recalculated as follows:This makes sense as we are now receiving smaller payments early in the life of the bond.Payments at the end of the bonds life are discounted more heavily, resulting in a greater fraction of total value being paid early.23. The duration of a perpetual bond is: [(1 + yield)/yield]The duration of a perpetual bond with a yield of 5% is:D5 = 1.05/0.05 = 21 yearsThe duration of a perpetual bond yielding 10% is:D10 = 1.10/0.10 = 11 yearsBecause the duration of a zero-coupon bond is equal to its maturity, the 15-year zero-coupon bond has a duration of 15 years.Thus, comparing the 5% perpetual bond and the zero-coupon bond, the 5%perpetual bond has the longer duration. Comparing the 10% perpetual bond and the 15 year zero, the zero has a longer duration.24. Answers will differ. Generally, we would expect yield changes to have thegreatest impact on long-maturity and low coupon bonds.25. The calculations are shown in the table below:26. We will borrow $1000 at a five year loan rate of 2.5% and buy a 4-year strippaying 4%. We may not know what interest rates we will earn on the last year(4 5) but our $1000 will come due and we put it in under our mattress earning0% if necessary to pay off the loan.Let’s turn to present value calculations: As shown above, the cost of the strip is $854.80. We will receive proceeds from the 2.5% loan = 1000 / (1.025)^5 =$883.90. Pocket the difference of $29.10, smile, and repeat.The minimum sensible value would set the discount factors used in year 5 equal to that of year 4, which would assume a 0% interest rate from year 4 to 5. Wecan solve for the interest rate where 1/ (1+r)5 = 0.8548, which is roughly 3.19%27.a. If the expectations theory of term structure is right, then we can determinethe expected future one year spot rate (at t=3) as follows: investing $100in a 3-year instrument at 4.2% gives us 100 * (1+.042)^3 = 113.136.Investing $100 in a 4-year instrument at 4.0% gives us 100 * (1+.04)^4 =116.986. This reveals a one year spot rate from year 3 to 4 of (116.98 –113.136) / 113.136 = 3.4%b. If investing in long-term bonds carries additional risks, then the riskequivalent one year spot rate in year three would be even less (reflectingthe fact that some risk premium must be built into this 3.4% spot rate).28.a. Your nominal return will be1.082 -1 = 16.64% over the two years. Yourreal return is (1.08/1.03) x (1.08/1.05) - 1 = 7.85%b. With the TIPS, the real return will remain at 8% per year, or 16.64% overtwo years. The nominal return on the TIPS will equal (1.08x1.03) x(1.08x1.05) – 1 = 26.15%.29. The bond price at a 5.41% yield is:1,196.49(1.0541)1,000(1.0541)0.054110.05411100PV 55$=+⎥⎦⎤⎢⎣⎡⨯-⨯= If the yield increases to 8.47%, the price would decline to:1,060.34(1.0847)1,000(1.0847)0.084710.08471100PV 55$=+⎥⎦⎤⎢⎣⎡⨯-⨯=30. Spreadsheet problem; answers will vary.31. Arbitrage opportunities can be identified by finding situations where the impliedforward rates or spot rates are different.We begin with the shortest-term bond, Bond G, which has a two-year maturity. Since G is a zero-coupon bond, we determine the two-year spot rate directly by finding the yield for Bond G. The yield is 9.5 percent, so the implied two-year spot rate (r 2) is 9.5 percent. Using the same approach for Bond A, we find that the three-year spot rate (r 3) is 10.0 percent.Next we use Bonds B and D to find the four-year spot rate. The followingposition in these bonds provides a cash payoff only in year four:a long position in two of Bond B and a short position in Bond D.Cash flows for this position are:[(–2 ⨯ $842.30) + $980.57] = –$704.03 today[(2 ⨯ $50) – $100] = $0 in years 1, 2 and 3[(2 ⨯ $1050) – $1100] = $1000 in year 4 We determine the four-year spot rate from this position as follows:4)4r (1$1000$704.03+= r 4 = 0.0917 = 9.17%Next, we use r 2, r 3 and r 4 with one of the four-year coupon bonds to determine r 1. For Bond C:978.74r 1$120(1.0917)$1120(1.100)$120(1.095)$120r 1$120$1,065.2814321$++=++++= r 1 = 0.3867 = 38.67%Now, in order to determine whether arbitrage opportunities exist, we use these spot rates to value the remaining two four-year bonds. This produces thefollowing results: for Bond B, the present value is $854.55, and for Bond D, thepresent value is $1,005.07. Since neither of these values equals the currentmarket price of the respective bonds, arbitrage opportunities exist. Similarly, the spot rates derived above produce the following values for the three-year bonds: $1,074.22 for Bond E and $912.77 for Bond F.32.We begin with the definition of duration as applied to a bond with yield r and an annual payment of C in perpetuityWe first simplify by dividing both the numerator and the denominator by C:The denominator is the present value of a perpetuity of $1 per year, which isequal to (1/r). To simplify the numerator, we first denote the numerator S and then divide S by (1 + r):Note that this new quantity [S/(1 + r)] is equal to the square of denominator in the duration formula above, that is:Therefore:Thus, for a perpetual bond paying C dollars per year:33.We begin with the definition of duration as applied to a common stock with yield r and dividends that grow at a constant rate g in perpetuity: ++++++++++++++++++=t 32t 32r)(1C r)(1C r)(1C r 1C r)(1tC r)(13C r)(12C r 11C DUR ++++++++++++++++++=t 32t 32r)(11r)(11r)(11r 11r)(1t r)(13r)(12r)(11DUR+++++++++=++1t 432r)(1t r)(13r)(12r)(11r)(1S 2t 32r)(11r)(11r)(11r 11r)(1S ⎪⎪⎭⎫ ⎝⎛+++++++++=+ 22r r 1S r 1r)(1S +=⇒⎪⎭⎫ ⎝⎛=+r r 1r)/(11r r 1DUR 2+=⨯+= ++++++++++++++++++++++++++=t t3322tt3322r)(1g)C(1r)(1g)C(1r)(1g)C(1r 1g)C(1r)(1g)tC(1r)(1g)3C(1r)(1g)2C(1r 1g)1C(1DURWe first simplify by dividing each term by [C(1 + g)]:The denominator is the present value of a growing perpetuity of $1 per year,which is equal to [1/(r - g)]. To simplify the numerator, we first denote thenumerator S and then divide S by (1 + r):Note that this new quantity [S/(1 + r)] is equal to the square of denominator in the duration formula above, that is:Therefore:Thus, for a perpetual bond paying C dollars per year:34. a. We make use of the one-year Treasury bill information in order to determine the one-year spot rate as follows:1r 1$100$93.46+= r 1 = 0.0700 = 7.00% The following position provides a cash payoff only in year two:++++++++++++++++++++++++=--t 1t 322t 1t 322r)(1g)(1r)(1g)(1r)(1g 1r 11r)(1g)t(1r)(1g)3(1r)(1g)2(1r 11DUR ++++++++++++=++-1t 2t 4232r)(1g)t(1r)(1g)3(1r)(1g)2(1r)(11 r)(1S 2t 1t 322r)(1g)(1r)(1g)(1r)(1g 1r 11r)(1S ⎪⎪⎭⎫ ⎝⎛++++++++++++=+- 22g)(r r 1S g r 1r)(1S -+=⇒⎪⎪⎭⎫ ⎝⎛-=+g r r 1g)](r /[11g)(r r 1DUR 2-+=-⨯-+=a long position in twenty-five two-year bonds and a short position in oneone-year Treasury bill. Cash flows for this position are:[(–25 ⨯ $94.92) + (1 ⨯ $93.46)] = –$2,279.54 today[(25 ⨯ $4) – (1 ⨯ $100)] = $0 in year 1(25 ⨯ $104) = $2,600 in year 2 We determine the two-year spot rate from this position as follows:2)2r (1$2,600$2,279.54+= r 2 = 0.0680 = 6.80%The forward rate f 2 is computed as follows:f 2 = [(1.0680)2/1.0700] – 1 = 0.0660 = 6.60%The following position provides a cash payoff only in year three:a long position in the three-year bond and a short position equal to (8/104)times a package consisting of a one-year Treasury bill and a two-yearbond. Cash flows for this position are:[(–1 ⨯ $103.64) + (8/104) ⨯ ($93.46 + $94.92)] = –$89.15 today[(1 ⨯ $8) – (8/104) ⨯ ($100 + $4)] = $0 in year 1[(1 ⨯ $8) – (8/104) ⨯ $104] = $0 in year 21 ⨯ $108 = $108 in year 3 We determine the three-year spot rate from this position as follows:3)3r (1$108$89.15+= r 3 = 0.0660 = 6.60%The forward rate f 3 is computed as follows:f 3 = [(1.0660)3/(1.0680)2] – 1 = 0.0620 = 6.20%b. We make use of the spot and forward rates to calculate the price of the4 percent coupon bond:The actual price of the bond ($950) is significantly greater than the pricededuced using the spot and forward rates embedded in the prices of theother bonds ($931.01). Hence, a profit opportunity exists. In order to takeadvantage of this opportunity, one should sell the 4 percent coupon bondshort and purchase the 8 percent coupon bond.$931.01(1.062)(1.066)(1.07)1040(1.066)(1.07)40(1.07)40P =++=35.a. Bond D allows us to calculate the four year spot rate by solving for the YTM using the 841.78 price of Bond D: 432r)(1$1000r)(1$0r)(1$0r 1$0$841.78+++++++=r 4 = 4.4%We can then set up the following three equations using the prices of bonds A, B, and C: Using bond A: 2r2)(1$1080r11$80$1075.82+++=Using bond B: 32r3)(1$1110r2)(1$110r11$110$1189.10+++++=Using bond C: 432r4)(1$1060r3)(1$60r2)(1$60r11$60$1058.76+++++++=We know r4 = 4.4% so we can substitute that into the last equation. Nowwe have three equations and three unknowns and can solve this withvariable substitution or linear programming to get r1 = 3.5%, r2 = 4%; r3 =4.2%; r4 = 4.4%b.We will want to invest in the underpriced C and borrow money at thecurrent spot market rates to construct an offsetting position. For example,we might borrow $60 at the 1 year rate of 3.5%, 60 at the 2 year rate of4%, 60 at the 3 year rate of 4.2% and 1060 at the 4 year rate of 4.4%. Ofcourse the PV amount we will receive on these loans is $1058.76. Now wepurchase the discounted bond C at $1040, use the proceeds of this bondto repay our loans as they come due. We can pocket the difference of$18.76, smile, and repeat.。

Principles of Corporate Finance 英文第十版习题解答Chap004

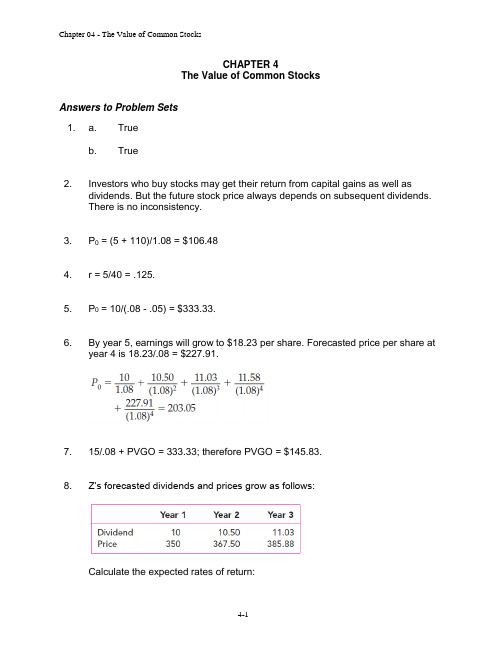

CHAPTER 4The Value of Common StocksAnswers to Problem Sets1. a. Trueb. True2. Investors who buy stocks may get their return from capital gains as well asdividends. But the future stock price always depends on subsequent dividends.There is no inconsistency.3. P0 = (5 + 110)/1.08 = $106.484. r = 5/40 = .125.5. P0 = 10/(.08 - .05) = $333.33.6. By year 5, earnings will grow to $18.23 per share. Forecasted price per share atyear 4 is 18.23/.08 = $227.91.7. 15/.08 + PVGO = 333.33; therefore PVGO = $145.83.8. Z’s forecasted dividends and prices grow as follows:Calculate the expected rates of return:From year 0 to 1: 08.33.333)33.333350(10=-+From year 1 to 2: 08.350)35050.367(50.10=-+From year 2 to 3:08.50.367)50.36788.385(03.11=-+Double expects 8% in each of the first 2 years. Triple expects 8% in each of the first 3 years.9. a. Falseb. True.10. PVGO = 0, and EPS 1 equals the average future earnings the firm could generate under no-growth policy.11. Free cash flow is the amount of cash thrown off by a business after allinvestments necessary for growth. In our simple examples, free cash flow equals operating cash flow minus capital expenditure. Free cash flow can be negative if investments are large.12. The value at the end of a forecast period. Horizon value can be estimated using the constant-growth DCF formula or by using price –earnings or market – book ratios for similar companies.13. If PVGO = 0 at the horizon date H , horizon value = earnings forecasted for H + 1 divided by r .14. Newspaper exercise, answers will vary15.Expected Future Values Present Values Horizon Period (H) Dividend (DIV t ) Price (P t ) Cumulative Dividends FuturePrice Total0 100.00 100.00100.001 10.00 105.00 8.70 91.30 100.002 10.50 110.25 16.64 83.36 100.003 11.03 115.76 23.88 76.12 100.004 11.58 121.55 30.50 69.50 100.00 10 15.51 162.89 59.74 40.26 100.00 20 25.27 265.33 83.79 16.21 100.00 50 109.21 1,146.74 98.94 1.06 100.00 100 1,252.39 13,150.13 99.99 0.01 100.00Assumptions 1. Dividends increase at 5% per year compounded. 2. Capitalization rate is 15%.16.$100.000.10$10r DIV P 1A ===$83.33.0400.10$5g r DIV P 1B =-=-=⎪⎭⎫⎝⎛⨯++++++=67665544332211C 1.1010.10DIV 1.10DIV 1.10DIV 1.10DIV 1.10DIV 1.10DIV 1.10DIV P $104.501.1010.1012.441.1012.441.1010.371.108.641.107.201.106.001.105.00P 6654321C =⎪⎭⎫⎝⎛⨯++++++=At a capitalization rate of 10%, Stock C is the most valuable. For a capitalization rate of 7%, the calculations are similar. The results are:P A = $142.86 P B = $166.67 P C = $156.48Therefore, Stock B is the most valuable.17. a. $21.90.027500.095 1.0275$1.35$1.35g r DIV DIV P 100=-⨯+=-+=b.First, compute the real discount rate as follows:(1 + r nominal ) = (1 + r real ) ⨯ (1 + inflation rate)1.095 = (1 + r real ) ⨯ 1.0275(1 + r real ) = (1.095/1.0275) – 1 = .0657 = 6.57%In real terms, g = 0. Therefore:$21.900.0657$1.35$1.35g r DIV DIV P 100=+=-+= 18.a. Plowback ratio = 1 – payout ratio = 1.0 – 0.5 = 0.5Dividend growth rate = g= Plowback ratio × ROE = 0.5 × 0.14 = 0.07 Next, compute EPS 0 as follows:ROE = EPS 0 /Book equity per share 0.14 = EPS 0 /$50 ⇒ EPS 0 = $7.00Therefore: DIV 0 = payout ratio × EPS 0 = 0.5 × $7.00 = $3.50 EPS and dividends for subsequent years are:YearEPS DIV0 $7.00$7.00 × 0.5 = $3.501 $7.00 × 1.07 = $7.4900 $7.4900 × 0.5 = $3.50 × 1.07 = $3.74502 $7.00 × 1.072 = $8.0143 $8.0143 × 0.5 = $3.50 × 1.072 = $4.0072 3 $7.00 × 1.073 = $8.5753 $8.5753 × 0.5 = $3.50 × 1.073 = $4.28774 $7.00 × 1.074 = $9.1756$9.1756 × 0.5 = $3.50 × 1.074 = $4.58785 $7.00 × 1.074 × 1.023 = $9.3866 $9.3866 × 0.5 = $3.50 × 1.074 × 1.023 = $4.6933EPS and dividends for year 5 and subsequent years grow at 2.3% per year, as indicated by the following calculation:Dividend growth rate = g = Plowback ratio × ROE = (1 – 0.08) × 0.115 = 0.023b.⎪⎭⎫ ⎝⎛⨯++++=45443322110 1.11510.115DIV 1.115DIV 1.115DIV 1.115DIV 1.115DIV P $45.651.1010.023-0.1154.6931.1154.5881.1154.2881.1154.0071.1153.74544321=⎪⎭⎫⎝⎛⨯++++=The last term in the above calculation is dependent on the payout ratioand the growth rate after year 4.19. a.11.75%0.11750.0752008.5g P DIV r 01==+=+=b.g = Plowback ratio × ROE = (1 − 0.5) × 0.12 = 0.06 = 6.0%The stated payout ratio and ROE are inconsistent with the security analysts’ forecasts. With g = 6.0% (and assuming r remains at 11.75%) then:pesos 147.830.06- 0.11758.5g r DIV P 10==-=20.The security analyst’s forecast is wrong because it a ssumes a perpetual constant growth rate of 15% when, in fact, growth will continue for two years at this rate and then there will be no further growth in EPS or dividends. The value of the company’s stock is the present value of the expected divi dend of $2.30 to be paid in 2020 plus the present value of the perpetuity of $2.65 beginning in 2021. Therefore, the actual expected rate of return is the solution for r in the following equation:r)r(1$2.65r 1$2.30$21.75+++=Solving algebraically (using the quadratic formula) or by trial and error, we find that: r = 0.1201= 12.01% 21.a.An Incorrect Application . Hotshot Semiconductor’s earnings anddividends have grown by 30 percent per year since the firm’s founding ten years ago. Current stock price is $100, and next year’s dividend is projected at $1.25. Thus:31.25%.31250.3001001.25g P DIV r 01==+=+=This is wrong because the formula assumes perpetual growth; it is notpossible for Hotshot to grow at 30 percent per year forever.A Correct Application. The formula might be correctly applied to the Old Faithful Railroad, which has been growing at a steady 5 percent rate for decades. Its EPS 1 = $10, DIV 1 = $5, and P 0 = $100. Thus:10.0%.100.0501005g P DIV r 01==+=+=Even here, you should be careful not to blindly project past growth into thefuture. If Old Faithful hauls coal, an energy crisis could turn it into a growth stock.b.An Incorrect Application. Hotshot has current earnings of $5.00 per share. Thus:5.0%.0501005P EPS r 01====This is too low to be realistic. The reason P 0 is so high relative to earningsis not that r is low, but rather that Hotshot is endowed with valuable growth opportunities. Suppose PVGO = $60:PVGO rEPS P 10+=60r5100+=Therefore, r = 12.5%A Correct Application. Unfortunately, Old Faithful has run out of valuable growth opportunities. Since PVGO = 0:PVGO r EPS P 10+=0r10100+=Therefore, r = 10.0%22.gr NPVr EPS price Share 1-+= Therefore:0.15)(r NP V r E P S Ραα1αα-+=α0.08)(r NP V r E P S Ρββββ1β-+=The statement in the question implies the following:⎪⎪⎭⎫⎝⎛-+->⎪⎪⎭⎫ ⎝⎛-+-0.15)(r NPV r EPS 0.15)(r NPV 0.08)(r NPV r EPS 0.08)(r NPV αααα1ααββββ1ββ Rearranging, we have:β1βββα1αααE P S r 0.08)(r NP V E P S r0.15)(r NP V ⨯-<⨯- a.NPV α < NPV β, everything else equal.b. (r α - 0.15) > (r β - 0.08), everything else equal.c.0.08)(r NP V 0.15)(r NP V ββαα-<-, everything else equal. d. β1βα1αE P S r E P S r <, everything else equal. 23.a.Growth-Tech’s stock price should be:23.81.08)0(0.12$1.24(1.12)1(1.12)$1.15(1.12)$0.60(1.12)$0.50P 332$=⎪⎪⎭⎫ ⎝⎛-⨯+++=b.The horizon value contributes:$22.07.08)0(0.12$1.24(1.12)1)P V(P 3H =-⨯=c.Without PVGO, P 3 would equal earnings for year 4 capitalized at 12 percent:$20.750.12$2.49= Therefore: PVGO = $31.00 – $20.75 = $10.25d.The PVGO of $10.25 is lost at year 3. Therefore, the current stock price of $23.81 will decrease by:$7.30(1.12)$10.253= The new stock price will be: $23.81 – $7.30 = $16.5124.a.Here we can apply the standard growing perpetuity formula with DIV 1 = $4, g = 0.04 and P 0 = $100:8.0%.080.040$100$4g P DIV r 01==+=+=The $4 dividend is 60 percent of earnings. Thus:EPS 1 = 4/0.6 = $6.67Also:PVGO rEPS P 10+=PVGO 0.08$6.67$100+=PVGO = $16.63b.DIV 1 will decrease to: 0.20 ⨯ 6.67 = $1.33However, by plowing back 80 percent of earnings, CSI will grow by 8 percent per year for five years. Thus: Year 1 2 3 4 5 6 7, 8 . . . DIV t 1.33 1.44 1.55 1.68 1.81 5.88 Continued growth at EPS t6.677.207.788.409.079.80 4 percentNote that DIV 6 increases sharply as the firm switches back to a 60 percent payout policy. Forecasted stock price in year 5 is:$147.0400.085.88g r DIV P 65=-=-=Therefore, CSI’s stock price will increase to:$106.211.081471.811.081.681.081.551.081.441.081.33P 54320=+++++=25.a.First, we use the following Excel spreadsheet to compute net income (or dividends) for 2009 through 2013:2009 2010 2011 2012 2013 Production (million barrels) 1.8000 1.6740 1.5568 1.4478 1.3465 Price of oil/barrel 65 60 55 50 52.5 Costs/barrel 25 25 25 25 25 Revenue 117,000,000 100,440,000 85,625,100 72,392,130 70,690,915 Expenses 45,000,000 41,850,000 38,920,500 36,196,065 33,662,340 Net Income (= Dividends) 72,000,000 58,590,000 46,704,600 36,196,065 37,028,574Next, we compute the present value of the dividends to be paid in 2010,2011 and 2012:=++=320 1.0936,196,0651.0946,704,6001.0958,590,000P $121,012,624 The present value of dividends to be paid in 2013 and subsequent yearscan be computed by recognizing that both revenues and expenses can be treated as growing perpetuities. Since production will decrease 7%per year while costs per barrel remain constant, the growth rate of expenses is: –7.0%To compute the growth rate of revenues, we use the fact that production decreases 7% per year while the price of oil increases 5% per year, so that the growth rate of revenues is:[1.05 × (1 – 0.07)] – 1 = –0.0235 = –2.35%Therefore, the present value (in 2012) of revenues beginning in 2013 is:45$622,827,4(-0.0235)-0.0970,690,915PV 2012==Similarly, the present value (in 2012) of expenses beginning in 2013 is:25$210,389,6(-0.07)-0.0933,662,340P V 2012==Subtracting these present values gives the present value (in 2012) of net income, and then discounting back three years to 2009, we find that the present value of dividends paid in 2013 and subsequent years is: $318,477,671The total value of the company is:$121,012,624 + $318,477,671 = $439,490,295Since there are 7,000,000 shares outstanding, the present value per share is:$439,490,295 / 7,000,000 = $62.78b. EPS 2009 = $72,000,000/7,000,000 = $10.29 EPS/P = $10.29/$62.78 = 0.16426.[Note: In this problem, the long-term growth rate, in year 9 and all later years, should be 8%.]The free cash flow for years 1 through 10 is computed in the following table:Year1 2 3 4 5 6 7 8 9 10 Asset value 10.00 12.00 14.40 17.28 20.74 23.12 25.66 28.36 30.63 33.08 Earnings 1.20 1.44 1.73 2.07 2.49 2.77 3.08 3.40 3.68 3.97 Investment 2.00 2.40 2.88 3.46 2.38 2.54 2.69 2.27 2.45 2.65 Free cash flow -0.80-0.96-1.15-1.380.100.230.381.131.23 1.32 Earnings growth from previous period20.0% 20.0% 20.0% 20.0% 20.0% 11.5% 11.0% 10.5%8.0%8.0%Computing the present value of the free cash flows, following the approach from Section 4.5, we find that the present value of the free cash flows occurring in years 1 through 7 is:654321 1.100.231.100.101.101.38-1.101.15-1.100.96-1.100.80-PV +++++==+71.100.38-$2.94 The present value of the growing perpetuity that begins in year 8 is:29.10.08)0(0.101.1343(1.10)1PV 7$=⎪⎪⎭⎫ ⎝⎛-⨯= Therefore, the present value of the business is:-$2.94 + $29.10 = $26.16 million27.From the equation given in the problem, it follows that:bROE )/(r b1ROE )(b r b)(1ROE BVP S P 0--=⨯--⨯= Consider three cases:ROE < r ⇒ (P 0/BVPS) < 1 ROE = r ⇒ (P 0/BVPS) = 1 ROE > r ⇒ (P 0/BVPS) > 1Thus, as ROE increases, the price-to-book ratio also increases, and, when ROE = r, price-to-book equals one. 28.Assume the portfolio value given, $100 million, is the value as of the end of the first year. Then, assuming constant growth, the value of the contract is given by the first payment (0.5 percent of portfolio value) divided by (r – g). Also:r = dividend yield + growth rateHence:r – growth rate = dividend yield = 0.05 = 5.0%Thus, the value of the contract, V, is:million $100.05million$1000.005V =⨯=For stocks with a 4 percent yield:r – growth rate = dividend yield = 0.04 = 4.0%Thus, the value of the contract, V, is:Chapter 04 - The Value of Common Stocks 4-11 million $12.50.04million $1000.005V =⨯=29. If existing stockholders buy newly issued shares to cover the $3.6 millionfinancing requirement, then the value of Concatco equals the discounted value of the cash flows (as computed in Section 4.5): $18.8 million.Since the existing stockholders own 1 million shares, the value pershare is $18.80.Now suppose instead that the $3.6 million comes from new investors, who buy shares each year at a fair price. Since the new investors buy shares at a fair price, the value of the existing stockholders’ shares must remain at $18.8 million. Since existing stockholders expect to earn 10% on their investment, the expected value of their shares in year 6 is:$18.8 million × (1.10) 6 = $33.39 millionThe total value of the firm in year 6 is:$1.59 million / (0.10 – 0.06) = $39.75 millionCompensation to new stockholders in year 6 is:$39.75 million – $33.39 million = $6.36 millionSince existing stockholders own 1 million shares, then in year 6, newstockholders will own:($6.36 million / $33.39 million) × 1,000,000 = 190,300 sharesShare price in year 6 equals:$39.75 million / 1.1903 million = $33.39。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。