09年SOA北美精算师考试第二门FM官方样题第一部分(主要是金融数学)答案

金融精算考试题及答案解析

金融精算考试题及答案解析一、单项选择题(每题2分,共20分)1. 精算学中,用于评估未来现金流的现值的折现率是()。

A. 市场利率B. 风险利率C. 无风险利率D. 预期收益率答案:C2. 在寿险精算中,死亡率表的主要作用是()。

A. 预测未来的疾病发生率B. 计算保险产品的定价C. 评估保险公司的财务状况D. 确定保险合同的条款答案:B3. 以下哪项不是寿险精算中常用的生命表类型()。

A. 选择表B. 经验表C. 综合表D. 精算表答案:D4. 年金现值的计算公式为()。

A. PV = P * (1 + r)^nB. PV = P / (1 + r)^nC. PV = P * (1 - (1 + r)^-n) / rD. PV = P / (1 - (1 + r)^-n) * r答案:C5. 以下哪项是金融衍生品的基本功能()。

A. 风险转移B. 资产增值C. 投资组合管理D. 以上都是答案:D6. 以下哪项不是金融监管的主要目的()。

A. 保护投资者B. 维护市场稳定C. 促进金融创新D. 预防和控制金融风险答案:C7. 以下哪项是债券定价的基本原理()。

A. 债券价格等于其未来现金流的现值B. 债券价格与其票息率成正比C. 债券价格与其到期收益率成反比D. 债券价格与其信用等级成正比答案:A8. 以下哪项是信用风险管理的主要工具()。

A. 信用评级B. 信用衍生品C. 信用保险D. 以上都是答案:D9. 以下哪项是金融工程的主要应用领域()。

A. 资产证券化B. 风险管理C. 金融产品设计D. 以上都是答案:D10. 以下哪项是金融市场的基本功能()。

A. 资金筹集B. 价格发现C. 风险管理D. 以上都是答案:D二、多项选择题(每题3分,共15分)1. 精算师在进行寿险产品定价时需要考虑的因素包括()。

A. 死亡率B. 投资收益率C. 管理费用D. 税收政策答案:ABCD2. 以下哪些属于金融市场的参与者()。

09年SOA北美精算师考试第二门FM官方样题第一部分(主要是金融数学)答案

09年SOA北美精算师考试第二门FM官方样题第一部分(主要是金融数学)答案SAMPLE SOLUTIONS FOR DERIVATIVES MARKETSQuestion #1Answer is DIf the call is at-the-money, the put option with the same cost will have a higher strike price.A purchased collar requires that the put have a lower strike price. (Page 76)Question #2Answer is C66.59 – 18.64 = 500 – K exp(–0.06) for K = 480 (Page 69)Question #3Answer is DThe accumulated cost of the hedge is (84.30-74.80)exp(.06) = 10.09.Let x be the market price.If x < 0.12 the put is in the money and the payoff is 10,000(0.12 – x) = 1,200 – 10,000x. The sale of the jalapenos has a payoff of 10,000x –1,000 for a profit of 1,200 –10,000x + 10,000x – 1,000 – 10.09 = 190.From 0.12 to 0.14 neither option has a payoff and the profit is 10,000x – 1,000 – 10.09 = 10,000x – 1,010.If x >0.14 the call is in the money and the payoff is –10,000(x – 0.14) = 1,400 – 10,000x. The profit is 1,400 – 10,000x + 10,000x – 1,000 – 10.09 = 390.The range is 190 to 390. (Pages 33-41)Question #4Answer is BThe present value of the forward prices is 10,000(3.89)/1.06 + 15,000(4.11)/1.0652 +20,000(4.16)/1.073 = 158,968. Any sequence of payments with that present value is acceptable. All but B have that value. (Page 248)Question #5Answer is EIf the index exceeds 1,025, you will receive x – 1,025. After buying the index for x you will have spent 1,025. If the index is below 1,025, you will pay 1,025 – x and after buying the index for x you will have spent 1,025. One way to get the cost is to note that the forward price is 1,000(1.05) = 1,050. You want to pay 25 less and so must spend 25/1.05 = 23.81 today. (Page 112) Question #6Answer is EIn general, an investor should be compensated for time and risk. A forward contract has no investment, so the extra 5 represents the risk premium. Those who buy the stock expect to earn both the risk premium and the time value of their purchase and thus the expected stock value is greater than 100 + 5 = 105. (Page 140)Question #7Answer is CAll four of answers A-D are methods of acquiring the stock. The prepaid forward has the payment at time 0 and the delivery at time T. (Pages 128-129)Question #8Answer is BOnly straddles use at-the-money options and buying is correct for this speculation. (Page 78)Question #9Answer is DThis is based on Exercise 3.18 on Page 89. To see that D does not produce the desired outcome, begin with the case where the stock price is S and is below 90. The payoff is S + 0 + (110 – S) –2(100 – S) = 2S – 90 which is not constant and so cannot produce the given diagram. On the other hand, for example, answer E hasa payoff of S + (90 – S) + 0 – 2(0) = 90. The cost is 100 + 0.24 +2.17 – 2(6.80) = 88.81. With interest it is 93.36. The profit is 90 –93.36 = –3.36 which matches the diagram.Question #10Answer is D[rationale-a] True, since forward contracts have no initial premium[rationale-b] True, both payoffs and profits of long forwards are opposite to short forwards.[rationale-c] True, to invest in the stock, one must borrow 100 at t=0, and then pay back 110 = 100*(1+.1) at t=1, which is like buying a forward at t=1 for 110. [rationale-d] False, repeating the calculation shown above in part c), but with 10% as a continuously compounded rate, the stock investor must now pay back100*e.1 = 110.52 at t=1; this is more expensive than buying a forward at t=1for 110.00.[rationale-e] True, the calculation would be the same as shown above in part c), but now the stock investor gets an additional dividend of 3.00 at t=.5, which theforward investor does not receive (due to not owning the stock until t=1). [This is based on Exercise 2-7 on p.54-55 ofMcDonald][McDonald, Chapter 2, p.21-28]Question #11Answer is CSolution: The 35-strike call has future cost (at t=1) of 9.12*(1+.08) = 9.85The 40-strike call has future cost (at t=1) of 6.22*(1+.08) = 6.72The 45-strike call has future cost (at t=1) of 4.08*(1+.08) = 4.41If S1<35, the profits of the 3 calls, respectively, are -9.85, -6.72, and -4.41.If 35<s1<="" -6.72,="" 3="" and="" are="" bdsfid="114" calls,="" of="" p="" profits="" respectively,="" s1-44.85,="" the=""></s1If 40<s1<="" 3="" and="" are="" bdsfid="116" calls,="" of="" p="" profits="" respectively,="" s1-44.85,="" s1-46.72,="" the=""></s1If S1>45, the profits of the 3 calls, respectively, are S1-44.85, S1-46.72, and S1-49.41.The cutoff points for when the relative profit ranking of the 3 calls change are:S1-44.85=-6.72, S1-44.85=-4.41, and S1-46.72=-4.41, yielding cutoffs of 38.13, 40.44, and 42.31.If S1<38.13, the 45-strike call has the highest profit, and the 35-strike call the lowest.If 38.13<s1<="" p="" profit,="" the=""></s1If 40.44<s1<="" p="" profit,="" the=""></s1If S1<42.31, the 35-strike call has the highest profit, and the 45-strike call the lowest.We are looking for the case where the 35-strike call has the highest profit, and the 40-strike call has the lowest profit, which occurs when S1 is between 40.44 and 42.31.[This is based on Exercise 2-13 on p.55-56 of McDonald][McDonald, Chapter 2, p.33-37]Question #12Answer is BSolution: The put premium has future value (at t=.5) of 74.20 * (1+(.04/2)) = 75.68 Then, the 6-month profit on a long put position is: max(1,000-S.5,0)-75.68. Correspondingly, the 6-month profit on a short put position is 75.68-max(1,000-S.5,0). These two profits are opposites (naturally, since long and short positions have opposite payoff and profit). Thus, they can only be equal if producing 0 profit. 0 profit is only obtained if 75.68 = max(1,000-S.5,0), or 1,000-S.5 = 75.68, or S.5 = 924.32. [McDonald, Chapter 2, p.39-42]Question #13Answer is DSolution: Buying a call, in conjunction with a short position in a stock index, is a form of insurance called a cap. Answers (A) and (B) are incorrect because they relate to a floor, which is the purchase of a put to insure against a long position in a stock index. Answer (E) is incorrect because it relates to writing a covered call, which is the sale of a call along with a long position in the stock index, so that the investor is selling rather than buying insurance. Note that a cap can also be thought of as ‘buying’ a covered call. Now, let’s calculate the profit: 2-year profit = payoff at time 2 – the future value of the initial cost to establish the position = (-75 + max(75-60,0)) –(-50 + 10)*(1+.03)2 = -75+15+40*(1.03)2 = 42.44-60 = -17.56. Thus,we’ve lost more from holding the short position in the index (since the index went up) than we’ve gained from owning the long call option.[McDonald, Chapter 3, p.59-65]Question #14Answer is ASolution: This consists of standard applications of the put-call parity equation on p.69. Let C be the price for the 40-strike call option. Then, C + 3.35 is the price for the 35-strike call option. Similarly, let P be the price for the 40-strike put option. Then, P –x is the price for the 35-strike put option, where x is what we’re trying to find. Using put-call parity, we have:(C + 3.35) + 35*e-.02 - 40 = P – x (this is for the 35-strike options)C + 40*e-.02 – 40 = P (this is for the 40-strike options)Subtracting the first equation from the second, 5*e-.02 – 3.35 = x = 1.55.[McDonald, Chapter 3, p.68-69]Answer is CSolution: The initial cost to establish this position is 5*2.78 –3*6.13 = -4.49. Thus, you are receiving 4.49 up front. This grows to 4.49*e .08*.25 = 4.58 after 3 months. Then, the following payoff/profit table can be constructed at T=.25 years: S T : 5*max(S T – 40, 0) – 3*max(S T – 35, 0) + 4.58 = Profit S T <35 0 - 0 + 4.58 = 4.58 35 <= S T <= 40 0 - 3*(S T – 35) + 4.58 = 109.58-3S T S T > 40 5*(S T -40) - 3*(S T – 35) + 4.58 = 2S T -90.42Thus, the maximum profit is unlimited (as S T increases beyond 40, so does the profit) Also, the maximum loss is 10.42(occurs at S T = 40, where profit = 109.58-120 = -10.42) [Notes] The above problem is an example of a ratio spread.[McDonald, Chapter 3, p.73]Question #16Answer is DSolution: The ‘straddle’ consists of buying a 40-strike call and buying a 40-strike put. This costs 2.78 + 1.99 = 4.77 at t=0, and grows to 4.77*e .02 = 4.87 at t=.25. The ‘strangle’ consists of buying a 35-strike put and a 45-strike call. This costs 0.44 + 0.97 = 1.41 at t=0, and grows to 1.41*e .02 = 1.44 at t=.25. For S T <40, the ‘straddle’ has a profit of 40-S T -4.87 = 35.13, and for S T >=40, the ‘straddle’ has a profit of S T -40-4.87 = 44.87. For S T <35, the ‘strangle’ has a profit of 35-S T -1.44 = 33.56, and for S T >45, the ‘strangle’ has a profit of S T -45-1.44 = 46.44. However, for 35<=S T <=45, the ‘strangle’ has a profit of -1.44 (since both options would not be exercised). Comparing the payoff structures between the ‘straddle’ and ‘strangle,’ we see that if S T <35 or if S T >45, the ‘straddle’ would outperform the ‘strangle’ (since 35.13 > 33.56,and since -44.87 > -46.44). However, if 35<=S T <=45, we can solve for the two cutoff points for S T , where the ‘strangle’ would outperform the ‘straddle’ as follows:-1.44 > 35.13 – S T, and -1.44 > S T - 44.87. The first inequality gives S T > 36.57, and the second inequality gives S T < 43.43. Thus, 36.57 < S T < 43.43.[McDonald, Chapter 3, p.78-80]Answer is B[rationale I] Yes, since Strategy I is a bear spread using calls, and bear spreads perform better when the prices of the underlying asset goes down.[rationale II] Yes, since Strategy II is also a bear spread – it just uses puts instead! [rationale III] No, since Strategy III is a box spread, which has no price risk; thus, the payoff is the same (1,000-950 = 50), no matter what the price of theunderlying asset.[Note]: An alternative, but much longer, solution is to develop payoff tables for all 3 strategies.[McDonald, Chapter 3, p.70-73]Question #18Answer is BSolution: First, let’s calculate the expected one-year profit without using the forward. This would be .2*(700+150-750) + .5(700+170-850) + .3*(700+190-950) = 20 + 10 - 18 = 12. Next, let’s calculate the expected one-year profit when buying the 1-year forward for 850. This would be 1*(700+170-850) = 20. Thus, the expected profit increases by 20 - 12 = 8 as a result of using the forward.[This is based on Exercise 4-7 on p.122 of McDonald][McDonald, Chapter 4, p.98-100]Question #19Answer is DSolution: There are 3 cases, one for each row in the above probability table.For all 3 cases, the future value of the put premium (at t=1) = 100*e.06 = 106.18.In Case 1, the 1-year profit would be: 750 - 800 - 106.18 + max(900-750,0) = -6.18In Case 2, the 1-year profit would be: 850 - 800 - 106.18 + max(900-850,0) = -6.18In Case 3, the 1-year profit would be: 950 - 800 - 106.18 +max(900-950,0) = 43.82 Thus, the expected 1-year profit = .7 * -6.18 + .3 * 43.82 = -4.326 + 13.146 = 8.82.[This is based on Exercise 4-3 on p.121 of McDonald][McDonald, Chapter 4, p.92-96]Answer is BSolution: This is an example of pricing a forward contract using discrete dividends. Thus, we need the future value of the current stock price minus the future value of each of the 12 dividends, where the valuation date is T=3. Thus, the valuation equation is: Forward price = 200*e.04(3) –[1.50*e.04(2.75) + 1.50*1.01*e.04(2.5) + 1.50*(1.01)2*e.04(2.25) + …1.50*(1.01)12] = 200*e.12 - 1.50*e.11{[1-(1.01*e-.01)12]/[1-(1.01*e.01)]}, using the geometric series formula from interest theory. This simplifies numerically to 225.50 -1.67442*11.99666 = 205.41.[This problem combines the material from interest theory and derivatives, although one could also simplify the above expression by brute force (instead of geometric series), since there are only 12 dividends to accumulate forward to T=3.] [McDonald, Chapter 5, p.133-134]Question #21Answer is ESolution: Here, the fair value of the forward contract is given by S0 * e(r-d)T =110 * e(.05-.02).5 = 110 * e.015 = 111.66. This is 0.34 less than the observed price. Thus, one could exploit this arbitrage opportunity by selling the observed forward at 112 and buying a synthetic forward at 111.66, making 112-111.66 = 0.34 profit.[This is based on Exercise 5-8 on p.163-164 of McDonald][McDonald, Chapter 5, p.135-138]Answer is BSolution: First, we must determine the present value of the forward contracts. On a per ton basis, this is: 1,600/1.05 + 1,700/(1.055)2 + 1,800/(1.06)3 = 4,562.49.Then, we must solve for the level swap price, which is labeled x below, as follows:4,562.49 = x/1.05 + x/(1.055)2 + x/(1.06)3 = x*[1/1.05 + 1/(1.055)2 + 1/(1.06)3] =2.69045*x.Thus, x = 4,562.49 / 2.69045 = 1,695.81.Thus, the amount he would receive each year is 50*1,695.81 = 84,790.38. [McDonald, Chapter 8, p.247-248]Question #23Answer is ESolution: First, note that the notional amount and the future 1-year LIBOR rates (not given) do not factor into the calculation of the swap’s fixed rate. All we need at the various zero-coupon bond prices P(0, t) for t=1,2,3,4,5, along with the 1-year implied forward rates, which are given by r0(t-1,t), for t=1,2,3,4,5. These calculations are shown in the following table:t 1 2 3 4 5P(0,t) (1.04)-1(1.045)-2 (1.0525)-3 (1.0625)-4 (1.075)-5=.96154 =.91573 =.85770 =.78466 =.69656 r0(t-1,t) s1[1.0452/1.04]-1 [1.05253/1.0452]-1 [1.06254/1.05253]-1 [1.0755/1.06254]-1 =.04000 =.05002 =.06766 =.09307 =.12649 Thus, the fixed swap rate = R = [(.96154)*(.04)+…+(.69656)*(.12649)] / [.96154 +…+.69656]= [.03846 + .04580 + .05803 + .07303 + .08811]/[.96154 + .91573 + .85770 + .78466 +.69656]= .30344 / 4.21619 = .07197 = 7.20% (approximately).[Note: This is much less calculation-intensive if you realize that the numerator (.30344) for R can also be obtained by taking 1- P(0,n) = 1 – P(0,5) = 1 - .69656 = .30344. Then, you would not need to calculate any of the implied forward rates!][McDonald, Chapter 8, p.255-258]Answer is D[rationale-a] True, hedging reduces the risk of loss, which is a primary function of derivatives.[rationale-b] True, derivatives can be used the hedge some risks that could result in bankruptcy.[rationale-c] True, derivatives can provide a lower-cost way to effect a financialtransaction.[rationale-d] False, derivatives are often used to avoid these types of restrictions. [rationale-e] True, an insurance contract can be thought of as a hedge against the risk of loss.[McDonald, Chapter 1, p.2-3]Question #25Answer is C[rationale-a] True, both types of individuals are involved in the risk-sharing process. [rationale-b] True, this is the primary reason reinsurance companies exist.[rationale-c] False, reinsurance companies share risk by issuing rather than investing in catastrophic bonds. In effect, they are ceding this excess risk to thebondholder.[rationale-d] True, it is diversifiable risk which is reduced or eliminated when risks are shared.[rationale-e] True, this is a fundamental idea underlying risk management andderivatives.[McDonald, Chapter 1, p.5-6]Question #26Answer is B[rationale-I] True, the forward seller has unlimited exposure if the underlying asset’s price increases.[rationale-II] True, the call issuer has unlimited exposure if the underlying asset’s price rises.[rationale-III] False, the maximum loss on selling a put is FV(put premium) – strike price. [McDonald, Chapter 2, p.43 (Table 2.4)]Answer is A[rationale-I] True, as prices go down, the value of holding a put option increases.canbe thought of as a put option.insuranceHomeowner’s[rationale-II] False, returns from equity-linked CDs are zero if prices decline, but positive if prices rise. Thus, owners of these CDs benefit from rising prices. [rationale-III] False, a synthetic forward consists of a long call and a short put, both of which benefit from rising prices (so the net position also benefits as such). [McDonald, Chapter 2, p.44-48]Question #28Answer is E[rationale-a] True, derivatives are used to shift income, thereby potentially lowering taxes.[rationale-b] True, as with taxes, the transfer of income lowers the probability ofbankruptcy.[rationale-c] True, hedging can safeguard reserves, and reduce the need for external financing, which has both explicit (e.g. – fees) and implicit (e.g. –reputational) costs.[rationale-d] True, when operating internationally, hedging can reduce exchange rate risk. [rationale-e] False, a firm that credibly hedges will reduce the riskiness of its cash flows, and will be able to increase debt capacity, which will lead to tax savings, since interest is deductible.[McDonald, Chapter 4, p.103-106]Question #29Answer is ASolution: If S0 is the price of the stock at time-0, then the following payments are required: Outright purchase – payment at time 0 – amount of payment = S0.Fully leveraged purchase – payment at time T – amount of payment = S0*e rT.Prepaid forward contract – payment at time 0 – amount of payment = S0*e-dT.Forward contract – payment at time T – amount of payment = S0*e(r-d)T.Since r>d>0, it must be true that S0*e-dT < S0 < S0*e(r-d)T < S0*e rT.Thus, the correct ranking is given by choice (A).[McDonald, Chapter 5, p.127-134]Answer is C[rationale-a] True, marking to market is done for futures, andcan lead to pricedifferences relative to forward contracts.[rationale-b] True, futures are more liquid; in fact, if you use the same broker to buy and sell, your position is effectively cancelled.[rationale-c] False, forwards are more customized, and futures are more standardized. [rationale-d] True, because of the daily settlement, credit risk is less with futures (v.forwards).[rationale-e] True, futures markets, like stock exchanges, do have daily price limits. [McDonald, Chapter 5, p.142]。

Bdioaq2009年度春季中国精算师资格考试

生命是永恒不断的创造,因为在它内部蕴含着过剩的精力,它不断流溢,越出时间和空间的界限,它不停地追求,以形形色色的自我表现的形式表现出来。

--泰戈尔2009年度春季中国精算师资格考试-考试指南第I部分中国精算师资格考试准精算师部分科目01~0901数学基础Ⅰ考试时间:3小时考试形式:客观判断题考试内容和要求:考生应掌握微积分、线性代数和运筹学的基本概念和主要内容。

A. 微积分(分数比例约为60%)1. 函数、极限、连续2. 一元函数微积分3. 多元函数微积分4. 级数5. 常微分方程B. 线性代数(分数比例约为30%)1. 行列式2. 矩阵3. 线性方程组4. 向量空间5. 特征值和特征向量6. 二次型C. 运筹学(分数比例约为10%)1. 线性规划3. 动态规划参考书目:1. 《高等数学讲义》(第二篇数学分析)樊映川编著高等教育出版社(本书可网上购买)或其他包含内容A的高等数学教材2. 《线性代数》胡显佑四川人民出版社(本书可网上购买)或其他包含内容B的线性代数教材3. 《运筹学》(修订版)1990年《运筹学》教材编写组清华大学出版社(本书可网上购买)或其他包含内容C的运筹学教材02数学基础Ⅱ考试时间:3小时考试形式:客观判断题考试内容和要求:A. 概率论(分数比例约为50%)1. 概率的计算、条件概率、全概公式和贝叶斯公式2. 随机变量的数字特征,特征函数;3. 联合分布律、边际分布函数及边际概率密度的计算4. 大数定律及其应用5. 条件期望和条件方差6. 混合型随机变量的分布函数、期望和方差等B. 数理统计(分数比例约为35%)1. 统计量及其分布2. 参数估计3. 假设检验4. 方差分析5. 列联分析C. 应用统计(分数比例约为15%)2. 时间序列分析(移动平滑,指数平滑法及ARIMA模型)参考书目:1、《概率论与数理统计》茆诗松,周纪芗编著,中国统计出版社1996年7月第1版。

2、《统计预测——方法与应用》,易丹辉编著,中国统计出版社,2001年4月第一版。

中国精算师考试《金融数学》试题(网友回忆版)二

中国精算师考试《金融数学》试题(网友回忆版)二[单选题]1.若风险用方差度量,则下列关于投资组合的风险陈述正确的是()。

a(江南博哥).等比例投资于两只股票的组合风险比这两只股票的平均风险小b.一个完全分散化的投资组合可以消除系统风险c.相互独立的单个股票的风险决定了该股票在一个完全分散化的投资组合中的风险贡献程度A.只有a正确B.只有b正确C.只有c正确D.a,c正确E.a,b,c都不正确参考答案:A参考解析:a.设两只股票的收益率为r a和r b,对应的方差为,相关系数为,则等比例投资于两只股票的组合风险为:b.一个完全分散化的投资组合只能消除非系统风险,不能消除系统风险。

c.在一个完全分散化的投资组合中,只有来自股票间相关性的系统风险,由于股票之间相互独立,故该组合不存在风险。

[单选题]2.已知在未来三年中,银行第一年的实际利率为7.5%,第二年按计息两次的名义利率12%计息,第三年按计息四次的名义利率12.5%计息,某人为了在第三年未得到500000元的款项,第一年初需要存入银行多少?()A.365001B.365389C.366011D.366718E.367282参考答案:C参考解析:设第一年初需存入银行X元,则得:X=366010.853。

[单选题]3.一个一年期欧式看涨期权,其标的资产为一只公开交易的普通股票,已知:a.股票现价为122元b.股票年收益率标准差为0.2c.ln(股票现价/执行价现价)=0.2利用Black-scholes期权定价公式计算该期权的价格()。

A.18B.20C.22D.24E.26参考答案:D参考解析:利用Black?scholes期权定价公式可得:由得:。

于是[单选题]4.已知=5,=7,则δ=()。

A.0.0238B.0.0286C.0.0333D.0.0476E.0.0571参考答案:E参考解析:由于于是[单选题]5.某投资组合包括两只股票,已知:a.股票A的期望收益率为10%,年收益率的标准差为Z;b.股票B的期望收益率为20%,年收益率的标准差为1.5Z;c.投资组合的年收益率为12%,年收益率的标准差为Z;则股票A和股票B的收益相关系数为()。

FM-Formulas北美精算师SOA考试第二门FM公式汇总

n|i

i

a = vn ⋅ s

n|i

n|i

s = (1 + )i n−1 + (1 + )i n−2 + + 1 = (1 + i)n −1

n|i

i

s = (1 + i)n ⋅ a

n|i

n|i

Annuity Due a =1+v +

n|i

+ vn−1 = 1 − vn d

a = vn ⋅ s

n|i

n|i

s = (1+ i)n + (1+ )i n−1 + + (1+ i) = (1+ i)n −1

n|i

d

s = (1 + i)n ⋅ a

n|i

n|i

Identities for Annuity Immediate and Annuity Due

a = i a = (1+ i) a

d n |

n|

n|

s = i s = (1+ i) s

(Ia)n|i

=

a n|

− i

nv n

(Ia)n|i

=

i d

(Ia)n|i

=

(1 +

i)(Ia)n|i

=

a n|

− nvn d

(Is)n|i

=

(1 + i)n (Ia)n|i

=

s− n| i

n

(Is )n|i

=

i d

(Is)n|i

=

(1 + i)n (Ia)n|i

=

s− n| d

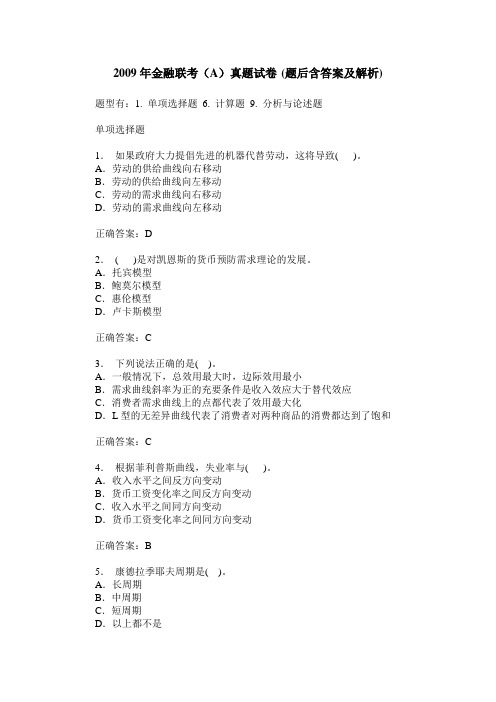

2009年金融联考(A)真题试卷(题后含答案及解析)

2009年金融联考(A)真题试卷(题后含答案及解析) 题型有:1. 单项选择题 6. 计算题9. 分析与论述题单项选择题1.如果政府大力提倡先进的机器代替劳动,这将导致( )。

A.劳动的供给曲线向右移动B.劳动的供给曲线向左移动C.劳动的需求曲线向右移动D.劳动的需求曲线向左移动正确答案:D2.( )是对凯恩斯的货币预防需求理论的发展。

A.托宾模型B.鲍莫尔模型C.惠伦模型D.卢卡斯模型正确答案:C3.下列说法正确的是( )。

A.一般情况下,总效用最大时,边际效用最小B.需求曲线斜率为正的充要条件是收入效应大于替代效应C.消费者需求曲线上的点都代表了效用最大化D.L型的无差异曲线代表了消费者对两种商品的消费都达到了饱和正确答案:C4.根据菲利普斯曲线,失业率与( )。

A.收入水平之间反方向变动B.货币工资变化率之间反方向变动C.收入水平之间同方向变动D.货币工资变化率之间同方向变动正确答案:B5.康德拉季耶夫周期是( )。

A.长周期B.中周期C.短周期D.以上都不是正确答案:A6.垄断厂商采用价格歧视的原则是( )。

A.根据不同市场的人均收入决定不同的价格B.不同市场上的边际收益分别等于厂商的边际成本C.保证边际收益高于平均收益以获得超额利润D.保证边际收益高于边际成本以获得超额利润正确答案:B7.在完全竞争的产品和要素市场中经营的厂商,设厂商以要素生产商品,其中利润达到最大的条件为( )。

A.Px=MCx,且MCx上升B.MPPa/Pa=MPPb/PbC.MPPa/Pa=MPPb/Pb=1/MCxD.MPPa/Pa=MPPb/Pb=1/MCx=1/Px正确答案:D8.消费者只购买面包和黄油,如果面包价格下降,那么( )。

A.收入效应与替代效应都引起黄油消费的上升B.收入效应与替代效应都引起黄油消费的下降C.收入效应使黄油的消费上升,但替代效应作用相反D.收入效应和替代效应将相互低效,从而商品需求保持不变正确答案:A9.如果劳动的边际产值大于工资率,可能是因为( )。

金融精算考试题及答案大全

金融精算考试题及答案大全一、单项选择题(每题2分,共40分)1. 精算学中,以下哪项是寿险精算中的生命表?A. 经验生命表B. 理论生命表C. 人口生命表D. 经济生命表答案:A2. 以下哪个不是精算师在进行风险评估时考虑的因素?A. 死亡率B. 利率C. 通货膨胀率D. 法律风险答案:D3. 在寿险中,年金的计算不包括以下哪项?A. 即期年金B. 递延年金C. 等额年金D. 非等额年金答案:D4. 精算学中,以下哪项是用于评估保险公司偿付能力的指标?A. 偿付能力比率B. 资产负债比率C. 投资回报率D. 利润率5. 以下哪个不是精算师在产品设计时需要考虑的因素?A. 保险责任B. 定价策略C. 投资策略D. 市场趋势答案:C6. 在精算学中,以下哪项是用于评估保险合同财务状况的指标?A. 净现值B. 内部收益率C. 偿付能力充足率D. 资产负债匹配答案:A7. 以下哪个不是精算师在进行资产负债管理时需要考虑的因素?A. 资产配置B. 负债期限C. 利率风险D. 市场风险答案:D8. 在精算学中,以下哪项是用于评估保险合同盈利能力的指标?A. 利润测试B. 损失率C. 费用率D. 赔付率答案:A9. 以下哪个不是精算师在进行寿险定价时需要考虑的因素?B. 利率C. 费用率D. 投资回报率答案:D10. 在精算学中,以下哪项是用于评估保险公司财务稳定性的指标?A. 资本充足率B. 偿付能力比率C. 资产负债比率D. 利润率答案:B11. 以下哪个不是精算师在进行健康保险定价时需要考虑的因素?A. 疾病发生率B. 医疗费用C. 死亡率D. 投资回报率答案:D12. 在精算学中,以下哪项是用于评估保险合同风险的指标?A. 风险调整资本B. 偿付能力充足率C. 资产负债匹配D. 利润率答案:A13. 以下哪个不是精算师在进行非寿险定价时需要考虑的因素?A. 损失频率B. 损失严重度C. 费用率D. 投资回报率答案:D14. 在精算学中,以下哪项是用于评估保险公司盈利能力的指标?A. 净现值B. 内部收益率C. 利润率D. 资产负债比率答案:C15. 以下哪个不是精算师在进行再保险定价时需要考虑的因素?A. 再保险合同条款B. 再保险市场状况C. 再保险费用D. 投资回报率答案:D16. 在精算学中,以下哪项是用于评估保险合同公平性的指标?A. 保费充足率B. 偿付能力充足率C. 资产负债匹配D. 利润率答案:A17. 以下哪个不是精算师在进行年金定价时需要考虑的因素?A. 年金类型B. 利率C. 死亡率D. 投资回报率答案:D18. 在精算学中,以下哪项是用于评估保险合同持续性的指标?A. 持续率B. 损失率C. 费用率D. 赔付率答案:A19. 以下哪个不是精算师在进行团体保险定价时需要考虑的因素?A. 团体规模B. 团体健康状况C. 死亡率D. 投资回报率答案:D20. 在精算学中,以下哪项是用于评估保险公司流动性的指标?A. 流动比率B. 偿付能力比率C. 资产负债比率D. 利润率答案:A二、多项选择题(每题3分,共30分。

soa 北美精算师 第二门 FM TIA 样题一

The Infinite Actuary’sJoint Exam2/FMSample Exam1by James Washer,FSA,MAAAlast updated-August14,2009Take this sample exam under strict exam conditions.Start a timer for3hours and stop imme-diately when the timer is done.Do not stop the clock when you go to the bathroom.Do not look at your notes.Do not look at the answer key.This exam contains35questions.Do not spend too much time on any one question.Choose the best available answer for each question.1.Which of the following is not a way to create a40-45-50butterfly?A.buy40-strike call,write two45-strike calls,buy50-strike callB.buy40-strike put,write two45-strike puts,buy50-strike putC.buy40-strike put,write45-strike call,write45-strike put,buy50-strike callD.buy40-strike call,write45-strike call,write45-strike put,buy50-strike putE.all of the above will create a40-45-50butterfly2.Letδt=14+t,0≤t≤15What is thefirst year for which the effective rate of discount is less than12.5%?A.3B.4C.5D.6E.73.A bond will pay a coupon of100at the end of each of the next three years and will pay the facevalue of1000at the end of the three-year period.The bond’s modified duration when valued using an annual effective interest rate of20%is X.Calculate X.A.2.25B.2.61C.2.70D.2.77E.2.894.You are given the following table of interest rates:CalendarYear of PortfolioOriginal RatesInvestment Investment Year Rates(in%)(in%)y i y1i y2i y3i y4i y5i y+519928.258.258.408.508.508.3519938.508.708.758.909.008.6019949.009.009.109.109.208.8519959.009.109.209.309.409.1019969.259.359.509.559.609.3519979.509.509.609.709.70199810.0010.009.909.80199910.009.809.7020009.509.5020019.00A person deposits1000on January1,1997.Let the following be the accumulated value of the 1000on January1,2000.P:under the investment year methodQ:under the portfolio yield methodCalculate P+Q.A.2575B.2595C.2610D.2655E.27005.A loan is repaid with10annual payments.Thefirst payment occurs one year after the loan.Thefirst payment is100and each subsequent payment increases by10.The annual effective rate of interest is5%.The amount of principal repaid in the4th payment is X.Determine X.A.71B.76C.80D.84E.916.A1000par value10-year bond that pays9%coupons semiannually is purchased for X.Thecoupons are reinvested at a nominal rate of7%convertible semiannually.The bond investor’s nominal annual yield rate convertible semiannually over the10-year period is9.2%.Determine X.A.924B.987C.1024D.1386E.14427.Bill writes a$100-strike call option on stock XYZ with6months to expiration for a premium of$7.24.The risk-free rate is5%convertible semiannually.For what rage of prices at expiration does Bill make a profit?A.[0,92.58)B.(92.58,∞)C.[0,107.42)D.(107.42,∞)E.[0,107.60)8.10deposits of$2000are made every other year with thefirst deposit made immediately.Theresulting fund is used to buy a perpetuity with payments made once every3years following the pattern X,4X,7X,10X,...Thefirst perpetuity payment is made3years after the last deposit of$2000.The annual effective rate of interest is6%.Determine X.A.408B.458C.471D.512E.6039.John buys a perpetuity-due with annual payments that are adjusted each year for inflation.Thefirst payment is100.Inflation is3%for years1-5and2%thereafter.Calculate the price of the perpetuity if the yield rate is an effective6%per annum.A.2750B.2760C.2770D.2780E.279010.Given the following information about the treasury market:Term Coupon Price10%96.6220%X30%88.90It is known that the2-year forward rate is4.5%.Calculate X.A.87.65B.89.70C.92.90D.93.45E.95.5011.A20-year bond is priced at par and pays R%coupons semiannually.The bond’s duration is13.95years.Determine R.A.2B.3C.4D.5E.612.Which of the following is not true?A.An asset insured with afloor is equivalent to investing in a zero-coupon bond and buying a calloption on the asset.B.A short position insured with a cap is equivalent to writing a zero-coupon bond and buying aput option on the asset.C.A covered written call is equivalent to investing in a zero-coupon bond and writing a put optionon the asset.D.A covered written put is equivalent to writing a zero-coupon bond and writing a call option onthe asset.E.All of the above are true.13.A fairly smart actuary(also know as an FSA)is offered the following rates on a loan:1.X%nominal annual rate of interest compounded monthly2.X%nominal annual rate of discount compounded monthly3.X%annual effective rate of interest4.X%annual effective rate of discount5.X%constant force of interestWhich rate does the FSA take?A.1B.2C.3D.4E.514.An annuity pays1at the beginning of each year for n ing an annual effective interestrate of i,the present value of the annuity at time0is8.55948.It is also known that(1+i)n=3.172169.Find the accumulated value of the annuity immediately after the last payment.A.27.152B.28.456C.29.324D.30.765E.31.97315.Deposits are made at the beginning of every month into a fund earning a nominal annual rateof6%convertible monthly.Thefirst deposit is100and deposit increase2%every year.In other words,deposits1-12are100,deposits13-24are100×1.02=102,deposits25-36are 100×1.022=104.04,and so on.Calculate the fund balance at the end of10years.A.16,569B.16,893C.17,257D.17,770E.17,85916.On January1a fund has a balance of$100.Sometime during the year a withdrawal of$20ismade.Immediately before the withdrawal the fund balance is$110.At year-end the balance is $95.If the time weighted and dollar weighted rates for the year are equal,then in what month was the$20withdrawal made?A.JuneB.JulyC.AugustD.SeptemberE.October17.A common stock pays annual dividends at the end of each year.The earnings per share inthe year just ended were J.Earnings are assumed to grow10%per year in the future.The percentage of earnings paid out as a dividend will be0%for the next5years and50%thereafter.Calculate the theoretical price of the stock to yield the investor21%.A.5J(1.1)4B.5J(1.1)5C.5J(1.1)6D.10J(1.1)5E.10J(1.1)618.You are the CFO of Infinite Life.Infinite Life only has one liability of$5000due in8years.Infinite Life uses a nominal rate of6%convertible semiannual to discount all liability cashflows.You call up your favorite bond broker and ask him what bonds he has for sale today.Your broker says he has5-year and10-year bonds.Both bonds are priced to yield6%convertible semiannually.The5-year bond pays6%coupons semiannually and the10-year bond is a zero-coupon bond.The bonds can be bought in any face amount.What face amount of the5-year bond should you buy in order to meet thefirst two conditions of immunization?A.777B.888C.999D.1111E.222219.You are given the following prices for$100zero-coupon bonds:Term Price195.24289.00381.63R is the swap rate in a3-year swap contract.Determine R.A.5.7%B.6.1%C.6.5%D.6.9%E.7.2%20.A fund earns simple interest of i.Which of the following are true?1.The effective rate of interest is constant for each period.2.The amount of interest is constant for each period.3.The equivalent force of interest is ln(1+i).A.1onlyB.2onlyC.3onlyD.2and3onlyE.The correct answer is not given by A,B,C or D.21.Ifδt=t1+t2,t≥0and¯I¯an=13.03567.Determine n.A.10B.11C.12D.13E.1422.You are given the following information about3funds:Fund Effective RateInterest Payments per YearA j%paid directly to investorB5%paid directly to investorC4%automatically reinvestedAn investor deposits$10,000into fund A.He reinvests fund A’s interest payments into fund B. He reinvests fund B’s interest payments into fund C.The total value of all three funds after10 years is$20,000.Determine j.A.6B.7C.8D.9E.1023.Which of the following are true?1.Modified duration is greater for bonds with higher par values.2.Modified duration is greater for yields compound more frequently.3.The modified duration of a single cashflow is the time remaining until the cashflow.A.1onlyB.2onlyC.3onlyD.2and3onlyE.The correct answer is not given by A,B,C or D.24.An annuity-immediate has the following payments:10,20,30,40,50,40,30,20,10Which of the following expressions represents the present value of the annuity?A.10a5a5B.10a5¨a5C.10a5a4D.10a5¨a4E.10(Ia)5+10(Da)425.You are given the following term structure of interest rates.TermSpot Rate(in years)1 5.00%2 5.75%3 6.25%4 6.50%rounded to the nearest100.Calculate1000(Da)4A.8700B.8800C.8900D.9000E.910026.Suppose you desire to short-sale200shares of ABC stock,which has a bid price of$24.82andan ask price of$25.01.You cover the short position three months later when the bid price is $21.45and the ask price is$21.64.Your broker charges a0.3%commission to engage in the short-sale and a0.3%commission to close the position.He also requires a50%haircut on the net proceeds of the short-sale.The market rate of interest is6%convertible continuously and the short-rebate on the haircut is4% convertible continuously.No dividends were paid on the stock during the three months.Calculate the profit on the short-sale.A.$595.60B.$608.13C.$652.33D.$671.50E.$684.1227.Which of the following are true?1.The payoffon a short forward is the spot price at expiration minus forward price.2.Zero coupon bonds can be used to shift profit diagrams.3.For forward contacts,cash settlements often reduce transaction costs.A.1onlyB.2onlyC.3onlyD.2and3onlyE.The correct answer is not given by A,B,C or D.28.A$10,000loan is repaid with level annual payments.Thefirst payment is made one year aftertaking out the loan.The outstanding balance just after the8th payment is$7,112.10.The outstanding balance just after the16th payment is$2,845.36.Calculate the outstanding balance just after the17th payment.A.$1,185B.$1,485C.$1,885D.$1,985E.$2,18529.A10-year1000par value bond pays4%coupons semiannually and is redeemable at1200.Thebond is priced to yield an annual nominal rate of6%convertible semiannually.Calculate the adjustment to the book value during the6th year.A.12.26write-upB.24.17write-downC.24.17write-upD.35.73write-downE.35.73write-up30.The present value of a25-year annuity-immediate with afirst payment of$2500and decreasingby X each year thereafter is$15,923.The annual effective rate of interest is10%.Determine X.A.70B.80C.90D.100E.11031.Which of the following expression does not represent a definition for m|a n?A.v m a nB.a m+n−a mC.v m+n s nD.v m+v m+1+...+v m+nE.All of the above represent a definition for m|a n32.At an annual effective interest rate i:(i)1grows to5in x years(ii)2grows to8in y years(iii)3grows to20in z yearsCalculate12(1+i)3x−2y+z.A.625B.650C.675D.700E.72533.Jane takes out a$100,000loan at a nominal annual rate of12%convertible monthly.Janemakes monthly interest only payments for thefirst3years and then she pays$1500per month until the loan is paid off.How many total payments does Jane make including thefinal smaller payment?A.110B.111C.142D.146E.14734.A corporation borrows10,000for25years,at an annual effective interest rate of5%.A sinkingfund is used to accumulate the principal by means of25annual deposits earning an effective annual interest rate of4%.Calculate the sum of the net amount of interest paid in the12th installment and the increment in the sinking fund for the8th year.A.676B.686C.696D.706E.71635.You are given the following prices for6-month options on S&R:Type Strike PremiumCall100093.809Put100074.201The risk-free rate is4%convertible semiannually.Calculate the six-month forward price for S&R.A.980B.1000C.1020D.1040E.1060。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

SAMPLE SOLUTIONS FOR DERIVATIVES MARKETSQuestion #1Answer is DIf the call is at-the-money, the put option with the same cost will have a higher strike price.A purchased collar requires that the put have a lower strike price. (Page 76)Question #2Answer is C66.59 – 18.64 = 500 – K exp(–0.06) for K = 480 (Page 69)Question #3Answer is DThe accumulated cost of the hedge is (84.30-74.80)exp(.06) = 10.09.Let x be the market price.If x < 0.12 the put is in the money and the payoff is 10,000(0.12 – x) = 1,200 – 10,000x. The sale of the jalapenos has a payoff of 10,000x – 1,000 for a profit of 1,200 – 10,000x + 10,000x – 1,000 – 10.09 = 190.From 0.12 to 0.14 neither option has a payoff and the profit is 10,000x – 1,000 – 10.09 = 10,000x – 1,010.If x >0.14 the call is in the money and the payoff is –10,000(x – 0.14) = 1,400 – 10,000x. The profit is 1,400 – 10,000x + 10,000x – 1,000 – 10.09 = 390.The range is 190 to 390. (Pages 33-41)Question #4Answer is BThe present value of the forward prices is 10,000(3.89)/1.06 + 15,000(4.11)/1.0652 +20,000(4.16)/1.073 = 158,968. Any sequence of payments with that present value is acceptable. All but B have that value. (Page 248)Question #5Answer is EIf the index exceeds 1,025, you will receive x – 1,025. After buying the index for x you will have spent 1,025. If the index is below 1,025, you will pay 1,025 – x and after buying the index for x you will have spent 1,025. One way to get the cost is to note that the forward price is 1,000(1.05) = 1,050. You want to pay 25 less and so must spend 25/1.05 = 23.81 today. (Page 112)Question #6Answer is EIn general, an investor should be compensated for time and risk. A forward contract has no investment, so the extra 5 represents the risk premium. Those who buy the stock expect to earn both the risk premium and the time value of their purchase and thus the expected stock value is greater than 100 + 5 = 105. (Page 140)Question #7Answer is CAll four of answers A-D are methods of acquiring the stock. The prepaid forward has the payment at time 0 and the delivery at time T. (Pages 128-129)Question #8Answer is BOnly straddles use at-the-money options and buying is correct for this speculation. (Page 78)Question #9Answer is DThis is based on Exercise 3.18 on Page 89. To see that D does not produce the desired outcome, begin with the case where the stock price is S and is below 90. The payoff is S + 0 + (110 – S) – 2(100 – S) = 2S – 90 which is not constant and so cannot produce the given diagram. On the other hand, for example, answer E has a payoff of S + (90 – S) + 0 – 2(0) = 90. The cost is 100 + 0.24 + 2.17 – 2(6.80) = 88.81. With interest it is 93.36. The profit is 90 – 93.36 = –3.36 which matches the diagram.Question #10Answer is D[rationale-a] True, since forward contracts have no initial premium[rationale-b] True, both payoffs and profits of long forwards are opposite to short forwards.[rationale-c] True, to invest in the stock, one must borrow 100 at t=0, and then pay back 110 = 100*(1+.1) at t=1, which is like buying a forward at t=1 for 110. [rationale-d] False, repeating the calculation shown above in part c), but with 10% as a continuously compounded rate, the stock investor must now pay back100*e.1 = 110.52 at t=1; this is more expensive than buying a forward at t=1for 110.00.[rationale-e] True, the calculation would be the same as shown above in part c), but now the stock investor gets an additional dividend of 3.00 at t=.5, which theforward investor does not receive (due to not owning the stock until t=1). [This is based on Exercise 2-7 on p.54-55 of McDonald][McDonald, Chapter 2, p.21-28]Question #11Answer is CSolution: The 35-strike call has future cost (at t=1) of 9.12*(1+.08) = 9.85The 40-strike call has future cost (at t=1) of 6.22*(1+.08) = 6.72The 45-strike call has future cost (at t=1) of 4.08*(1+.08) = 4.41If S1<35, the profits of the 3 calls, respectively, are -9.85, -6.72, and -4.41.If 35<S1<40, the profits of the 3 calls, respectively, are S1-44.85, -6.72, and -4.41.If 40<S1<45, the profits of the 3 calls, respectively, are S1-44.85, S1-46.72, and -4.41.If S1>45, the profits of the 3 calls, respectively, are S1-44.85, S1-46.72, and S1-49.41.The cutoff points for when the relative profit ranking of the 3 calls change are:S1-44.85=-6.72, S1-44.85=-4.41, and S1-46.72=-4.41, yielding cutoffs of 38.13, 40.44, and 42.31.If S1<38.13, the 45-strike call has the highest profit, and the 35-strike call the lowest.If 38.13<S1<40.44, the 45-strike call has the highest profit, and the 40-strike call the lowest.If 40.44<S1<42.31, the 35-strike call has the highest profit, and the 40-strike call the lowest.If S1<42.31, the 35-strike call has the highest profit, and the 45-strike call the lowest.We are looking for the case where the 35-strike call has the highest profit, and the 40-strike call has the lowest profit, which occurs when S1 is between 40.44 and 42.31.[This is based on Exercise 2-13 on p.55-56 of McDonald][McDonald, Chapter 2, p.33-37]Question #12Answer is BSolution: The put premium has future value (at t=.5) of 74.20 * (1+(.04/2)) = 75.68 Then, the 6-month profit on a long put position is: max(1,000-S.5,0)-75.68. Correspondingly, the 6-month profit on a short put position is 75.68-max(1,000-S.5,0). These two profits are opposites (naturally, since long and short positions have opposite payoff and profit). Thus, they can only be equal if producing 0 profit. 0 profit is only obtained if 75.68 = max(1,000-S.5,0), or 1,000-S.5 = 75.68, or S.5 = 924.32. [McDonald, Chapter 2, p.39-42]Question #13Answer is DSolution: Buying a call, in conjunction with a short position in a stock index, is a form of insurance called a cap. Answers (A) and (B) are incorrect because they relate to a floor, which is the purchase of a put to insure against a long position in a stock index. Answer (E) is incorrect because it relates to writing a covered call, which is the sale of a call along with a long position in the stock index, so that the investor is selling rather than buying insurance. Note that a cap can also be thought of as ‘buying’ a covered call. Now, let’s calculate the profit:2-year profit = payoff at time 2 – the future value of the initial cost to establish the position = (-75 + max(75-60,0)) – (-50 + 10)*(1+.03)2 = -75+15+40*(1.03)2 = 42.44-60 = -17.56. Thus, we’ve lost more from holding the short position in the index (since the index went up) than we’ve gained from owning the long call option.[McDonald, Chapter 3, p.59-65]Question #14Answer is ASolution: This consists of standard applications of the put-call parity equation on p.69. Let C be the price for the 40-strike call option. Then, C + 3.35 is the price for the 35-strike call option. Similarly, let P be the price for the 40-strike put option. Then, P – x is the price for the 35-strike put option, where x is what we’re trying to find. Using put-call parity, we have:(C + 3.35) + 35*e-.02 - 40 = P – x (this is for the 35-strike options)C + 40*e-.02 – 40 = P (this is for the 40-strike options)Subtracting the first equation from the second, 5*e-.02 – 3.35 = x = 1.55.[McDonald, Chapter 3, p.68-69]Answer is CSolution: The initial cost to establish this position is 5*2.78 – 3*6.13 = -4.49. Thus, you are receiving 4.49 up front. This grows to 4.49*e .08*.25 = 4.58 after 3 months. Then, the following payoff/profit table can be constructed at T=.25 years:S T : 5*max(S T – 40, 0) – 3*max(S T – 35, 0) + 4.58 = ProfitS T <35 0 - 0 + 4.58 = 4.58 35 <= S T <= 40 0 - 3*(S T – 35) + 4.58 = 109.58-3S T S T > 40 5*(S T -40) - 3*(S T – 35) + 4.58 = 2S T -90.42Thus, the maximum profit is unlimited (as S T increases beyond 40, so does the profit) Also, the maximum loss is 10.42 (occurs at S T = 40, where profit = 109.58-120 = -10.42)[Notes] The above problem is an example of a ratio spread.[McDonald, Chapter 3, p.73]Question #16Answer is DSolution: The ‘straddle’ consists of buying a 40-strike call and buying a 40-strike put. This costs 2.78 + 1.99 = 4.77 at t=0, and grows to 4.77*e .02 = 4.87 at t=.25. The ‘strangle’ consists of buying a 35-strike put and a 45-strike call. This costs 0.44 + 0.97 = 1.41 at t=0, and grows to 1.41*e .02 = 1.44 at t=.25. For S T <40, the ‘straddle’ has a profit of 40-S T -4.87 = 35.13, and for S T >=40, the ‘straddle’ has a profit of S T -40-4.87 = 44.87. For S T <35, the ‘strangle’ has a profit of 35-S T -1.44 = 33.56, and for S T >45, the ‘strangle’ has a profit of S T -45-1.44 = 46.44. However, for 35<=S T <=45, the ‘strangle’ has a profit of -1.44 (since both options would not be exercised). Comparing the payoff structures between the ‘straddle’ and ‘strangle,’ we see that if S T <35 or if S T >45, the ‘straddle’ would outperform the ‘strangle’ (since 35.13 > 33.56, and since -44.87 > -46.44). However, if 35<=S T <=45, we can solve for the two cutoff points for S T , where the ‘strangle’ would outperform the ‘straddle’ as follows:-1.44 > 35.13 – S T, and -1.44 > S T - 44.87. The first inequality gives S T > 36.57, and the second inequality gives S T < 43.43. Thus, 36.57 < S T < 43.43.[McDonald, Chapter 3, p.78-80]Answer is B[rationale I] Yes, since Strategy I is a bear spread using calls, and bear spreads perform better when the prices of the underlying asset goes down.[rationale II] Yes, since Strategy II is also a bear spread – it just uses puts instead! [rationale III] No, since Strategy III is a box spread, which has no price risk; thus, the payoff is the same (1,000-950 = 50), no matter what the price of theunderlying asset.[Note]: An alternative, but much longer, solution is to develop payoff tables for all 3 strategies.[McDonald, Chapter 3, p.70-73]Question #18Answer is BSolution: First, let’s calculate the expected one-year profit without using the forward. This would be .2*(700+150-750) + .5(700+170-850) + .3*(700+190-950) = 20 + 10 - 18 = 12. Next, let’s calculate the expected one-year profit when buying the 1-year forward for 850. This would be 1*(700+170-850) = 20. Thus, the expected profit increases by 20 - 12 = 8 as a result of using the forward.[This is based on Exercise 4-7 on p.122 of McDonald][McDonald, Chapter 4, p.98-100]Question #19Answer is DSolution: There are 3 cases, one for each row in the above probability table.For all 3 cases, the future value of the put premium (at t=1) = 100*e.06 = 106.18.In Case 1, the 1-year profit would be: 750 - 800 - 106.18 + max(900-750,0) = -6.18In Case 2, the 1-year profit would be: 850 - 800 - 106.18 + max(900-850,0) = -6.18In Case 3, the 1-year profit would be: 950 - 800 - 106.18 + max(900-950,0) = 43.82 Thus, the expected 1-year profit = .7 * -6.18 + .3 * 43.82 = -4.326 + 13.146 = 8.82.[This is based on Exercise 4-3 on p.121 of McDonald][McDonald, Chapter 4, p.92-96]Answer is BSolution: This is an example of pricing a forward contract using discrete dividends. Thus, we need the future value of the current stock price minus the future value of each of the 12 dividends, where the valuation date is T=3. Thus, the valuation equation is: Forward price = 200*e.04(3) – [1.50*e.04(2.75) + 1.50*1.01*e.04(2.5) + 1.50*(1.01)2*e.04(2.25) + …1.50*(1.01)12] = 200*e.12 - 1.50*e.11{[1-(1.01*e-.01)12]/[1-(1.01*e.01)]}, using the geometric series formula from interest theory. This simplifies numerically to 225.50 -1.67442*11.99666 = 205.41.[This problem combines the material from interest theory and derivatives, although one could also simplify the above expression by brute force (instead of geometric series), since there are only 12 dividends to accumulate forward to T=3.][McDonald, Chapter 5, p.133-134]Question #21Answer is ESolution: Here, the fair value of the forward contract is given by S0 * e(r-d)T =110 * e(.05-.02).5 = 110 * e.015 = 111.66. This is 0.34 less than the observed price. Thus, one could exploit this arbitrage opportunity by selling the observed forward at 112 and buying a synthetic forward at 111.66, making 112-111.66 = 0.34 profit.[This is based on Exercise 5-8 on p.163-164 of McDonald][McDonald, Chapter 5, p.135-138]Answer is BSolution: First, we must determine the present value of the forward contracts. On a per ton basis, this is: 1,600/1.05 + 1,700/(1.055)2 + 1,800/(1.06)3 = 4,562.49.Then, we must solve for the level swap price, which is labeled x below, as follows:4,562.49 = x/1.05 + x/(1.055)2 + x/(1.06)3 = x*[1/1.05 + 1/(1.055)2 + 1/(1.06)3] =2.69045*x.Thus, x = 4,562.49 / 2.69045 = 1,695.81.Thus, the amount he would receive each year is 50*1,695.81 = 84,790.38. [McDonald, Chapter 8, p.247-248]Question #23Answer is ESolution: First, note that the notional amount and the future 1-year LIBOR rates (not given) do not factor into the calculation of the swap’s fixed rate. All we need at the various zero-coupon bond prices P(0, t) for t=1,2,3,4,5, along with the 1-year implied forward rates, which are given by r0(t-1,t), for t=1,2,3,4,5. These calculations are shown in the following table:t 1 2 3 4 5P(0,t) (1.04)-1(1.045)-2 (1.0525)-3 (1.0625)-4 (1.075)-5=.96154 =.91573 =.85770 =.78466 =.69656 r0(t-1,t) s1[1.0452/1.04]-1 [1.05253/1.0452]-1 [1.06254/1.05253]-1 [1.0755/1.06254]-1 =.04000 =.05002 =.06766 =.09307 =.12649 Thus, the fixed swap rate = R = [(.96154)*(.04)+…+(.69656)*(.12649)] / [.96154 +…+.69656]= [.03846 + .04580 + .05803 + .07303 + .08811]/[.96154 + .91573 + .85770 + .78466 +.69656]= .30344 / 4.21619 = .07197 = 7.20% (approximately).[Note: This is much less calculation-intensive if you realize that the numerator (.30344) for R can also be obtained by taking 1- P(0,n) = 1 – P(0,5) = 1 - .69656 = .30344. Then, you would not need to calculate any of the implied forward rates!][McDonald, Chapter 8, p.255-258]Answer is D[rationale-a] True, hedging reduces the risk of loss, which is a primary function of derivatives.[rationale-b] True, derivatives can be used the hedge some risks that could result in bankruptcy.[rationale-c] True, derivatives can provide a lower-cost way to effect a financialtransaction.[rationale-d] False, derivatives are often used to avoid these types of restrictions. [rationale-e] True, an insurance contract can be thought of as a hedge against the risk of loss.[McDonald, Chapter 1, p.2-3]Question #25Answer is C[rationale-a] True, both types of individuals are involved in the risk-sharing process. [rationale-b] True, this is the primary reason reinsurance companies exist.[rationale-c] False, reinsurance companies share risk by issuing rather than investing in catastrophic bonds. In effect, they are ceding this excess risk to thebondholder.[rationale-d] True, it is diversifiable risk which is reduced or eliminated when risks are shared.[rationale-e] True, this is a fundamental idea underlying risk management andderivatives.[McDonald, Chapter 1, p.5-6]Question #26Answer is B[rationale-I] True, the forward seller has unlimited exposure if the underlying asset’s price increases.[rationale-II] True, the call issuer has unlimited exposure if the underlying asset’s price rises.[rationale-III] False, the maximum loss on selling a put is FV(put premium) – strike price. [McDonald, Chapter 2, p.43 (Table 2.4)]Answer is A[rationale-I] True, as prices go down, the value of holding a put option increases.canbe thought of as a put option.insuranceHomeowner’s[rationale-II] False, returns from equity-linked CDs are zero if prices decline, but positive if prices rise. Thus, owners of these CDs benefit from rising prices. [rationale-III] False, a synthetic forward consists of a long call and a short put, both of which benefit from rising prices (so the net position also benefits as such). [McDonald, Chapter 2, p.44-48]Question #28Answer is E[rationale-a] True, derivatives are used to shift income, thereby potentially lowering taxes.[rationale-b] True, as with taxes, the transfer of income lowers the probability ofbankruptcy.[rationale-c] True, hedging can safeguard reserves, and reduce the need for external financing, which has both explicit (e.g. – fees) and implicit (e.g. –reputational) costs.[rationale-d] True, when operating internationally, hedging can reduce exchange rate risk. [rationale-e] False, a firm that credibly hedges will reduce the riskiness of its cash flows, and will be able to increase debt capacity, which will lead to tax savings,since interest is deductible.[McDonald, Chapter 4, p.103-106]Question #29Answer is ASolution: If S0 is the price of the stock at time-0, then the following payments are required: Outright purchase – payment at time 0 – amount of payment = S0.Fully leveraged purchase – payment at time T – amount of payment = S0*e rT.Prepaid forward contract – payment at time 0 – amount of payment = S0*e-dT.Forward contract – payment at time T – amount of payment = S0*e(r-d)T.Since r>d>0, it must be true that S0*e-dT < S0 < S0*e(r-d)T < S0*e rT.Thus, the correct ranking is given by choice (A).[McDonald, Chapter 5, p.127-134]Question #30Answer is C[rationale-a] True, marking to market is done for futures, and can lead to pricedifferences relative to forward contracts.[rationale-b] True, futures are more liquid; in fact, if you use the same broker to buy and sell, your position is effectively cancelled.[rationale-c] False, forwards are more customized, and futures are more standardized. [rationale-d] True, because of the daily settlement, credit risk is less with futures (v.forwards).[rationale-e] True, futures markets, like stock exchanges, do have daily price limits. [McDonald, Chapter 5, p.142]11。