THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMI

香港汇丰汇丰简介

香港上海汇丰银行有限公司(The Hongkong and Shanghai Banking Corporation Limited, 简称 HSBC 和汇丰)为汇丰控股有限公司的全资附属公司,属于汇丰集团的创始成员以及 在亚太地区的旗舰,也是香港最大的注册银行,以及香港三大发钞银行之一(其他两个是中 国银行(香港)和渣打银行) ,总部位于中环皇后大道中1号香港汇丰总行大厦,现时香港 上海汇丰银行及各附属公司主要在亚太地区设立约700间分行及办事处。

查看词条图册公司名称: 外文名称: 香港上海汇丰银行有限公司 The Hongkong and Shanghai Banking Corporation Limited 总部地点: 香港中环皇后大道中1号香港汇丰总 行大厦 成立时间: 1865年3月3日 经营范围: 公司性质: 公司口号: 母公司: 董事会主席: 行政总裁: 金融业 有限公司 环球金融 地方智慧(2002年) 汇丰控股有限公司 纪勤 王冬胜发起成立 香港上海汇丰银行由苏格兰人托玛斯· 萨瑟兰德(或译苏石兰,Thomas Sutherland) 于1864年在香港发起,资本500万港圆。

最初的担任发起委员会成员的包括宝顺洋行 (Messrs Dent & Co.;委员会主席)、琼记洋行(Messrs Aug Heard & Co)、沙逊洋行 (Messrs Sassoon Sons & Co)、大英轮船(The Peninsular & Oriental Steam)、禅臣 (Messrs Siemssen & Co)、太平洋行(Gilman & Co)、 顺章洋行(Messr P Cama Co) 等十家洋行。

1865年3月3日正式在香港创立。

香港上海汇丰银行开业后的一个 月,在上海的分行开始营业。

银行荣誉《环球金融》(Global Finance)杂志近日评选出2012年全球50家最安全银行榜单, 根据榜单,汇丰银行榜上有名,排名第23。

中国最大外资银行

中国最大外资银行银行是人们生活中必不可少的第三方,在中国除了五大行为代表的本土银行外,还有很多外资的银行?那么他们都是哪一些?最大的一家又是哪家?.汇丰银行上海汇丰银行有限公司The Hongkong and Shanghai Banking Corporation Limited,中文直译为“香港和上海银行有限公司”,英文缩写HSBC,中文简称汇丰,取“汇款丰裕”之意为汇丰控股有限公司的全资附属公司,属于汇丰集团的创始成员以及在亚太地区的旗舰,也是香港最大的注册银行,以及香港三大发钞银行之一其他两个是中国银行香港和渣打银行。

总部位于中环皇后大道中1号香港汇丰总行大厦,现时香港上海汇丰银行及各附属公司主要在亚太地区设立约700多间分行及办事处。

汇丰银行上海汇丰银行有限公司The Hongkong and Shanghai Banking Corporation Limited,中文直译为“香港和上海银行有限公司”,英文缩写HSBC,中文简称汇丰,取“汇款丰裕”之意为汇丰控股有限公司的全资附属公司,属于汇丰集团的创始成员以及在亚太地区的旗舰,也是香港最大的注册银行,以及香港三大发钞银行之一其他两个是中国银行香港和渣打银行。

总部位于中环皇后大道中1号香港汇丰总行大厦,现时香港上海汇丰银行及各附属公司主要在亚太地区设立约700多间分行及办事处。

渣打银行渣打银行又称标准渣打银行;英语:Standard Chartered Bank;LSE:STAN,港交所:2888,OTCBB:SCBFF是一家建于1853年,总部在伦敦的英国银行。

渣打银行1858年在上海设立首家分行。

2021 年 4 月,上海渣打银行中国有限公司成为第一批本地法人银行之一。

渣打是一家领先的国际银行,为遍布亚洲、非洲和中东市场的个人和企业客户提供金融服务,支持他们进行投资、开展贸易。

渣打集团在伦敦证交所、香港证交所,以及印度的孟买及印度国家证券交易所挂牌上市[1] 。

国际结算实验三答案托收

实验素材三——托收业务一、光票托收(一)2003年5月22日中国进出口公司广州分公司向中国银行广州分行提交下面这张光票托收委托书,托收行按所给问题审核光票托收委托书。

中国银行 票据托收委托书委托日期:22/05/2003X 款项收妥后,请付我账。

X 你行及国外行所有托收费用,请付我账。

中国进出口公司广州分公司 票据种类 Items 号码 Original No.出票日期 Date of Issue 币别及金额 Currency& Amount 支票 783814/05/2003US$2000.00付款人 Bank of America N.T.& S.A. (进口商开户行,亦即代收行) 出票人 AAA Trading Company, New York (进口商)受益人 China National Imp. & Exp. Corp., Guangzhou (出口商) 开户账号 A/C No.098730-9867-9423银行编号 Ref No. CC09176⑴委托人公司名称 中国进出口公司广州分公司(出口商) ⑵付款人公司名称 AAA Trading Company, New York (进口商) ⑶托收金额US$2000.00⑷托收票据种类、内容支票;号码7838;出票日期14/05/2003;金额US$2000.00 支票当事人:付款人Bank of America N.T.& S.A.;出票人AAA Trading Company, New York ; 收款人China National Imp. & Exp. Corp., Guangzhou⑸银行费用由哪方支付? 中国进出口公司广州分公司 ⑹光票托收适用范围 贸易从属费用,金额较小的贸易货款尾数,佣金、折扣 ⑺托收行是否承担必定收回票款的责任?否⑻托收行办理托收业务的依据是什么?委托人提交的托收委托书(申请书) ⑼哪些票据或凭证可提交给银行办理光票托收?汇票、本票、支票(二)中国银行广州分行根据中国进出口公司广州分公司提交的光票托收委托书,于2003年5月23日缮制并向代收行Bank of America N.T.& S.A.邮寄光票托收指示书,并选择第二、第三、第五、第六项托收指示条款。

国际结算实验-托收实验参考答案

实验3.托收结算业务3.2 实验项目3.2.1实验目标1、托收委托书填写完整、准确性的审核。

2、根据托收委托书和条件正确缮制托收指示。

3、托收指示完整、准确性的审核。

4、掌握拒付中退票通知书、拒付电文的发送、审核和处理。

5、跟单托收处理流程。

6、付款交单、承兑交单处理流程。

7、掌握URC522对托收业务处理中的规定。

3.2.2实验要求1、托收行审核光票托收委托书。

2、托收行根据所给光票托收委托书缮制光票托收指示。

3、托收行审核跟单托收委托书。

4、托收行根据所给跟单托收委托书缮制跟单托收指示。

5、代收行审核跟单托收指示。

6、代收行缮制和发送退票通知、拒付电文。

7、托收行对收到的退票通知和拒付电文进行审核和处理。

3.2.3实验素材一、光票托收(一)2003年5月22日中国进出口公司广州分公司向中国银行广州分行提交下面这张光票托收委托书,托收行按所给问题审核光票托收委托书。

(二)中国银行广州分行根据中国进出口公司广州分公司提交的光票托收委托书,于2003年5月23日缮制并向代收行Bank of America N.T.& S.A.邮寄光票托收指示,并选择第二、第三、第五、第六项托收指示条款。

二、跟单托收(一)2003年5月18日Guangdong Arts & Craft Imp. & Exp. Company向中国银行广州分行提交下面这张跟单托收委托书,托收行按所给问题审核跟单托收委托书。

(二)中国银行广州分行根据Guangdong Arts & Craft Imp.& Exp. Company提交的跟单托收委托书,于2003年5月20日缮制并向代收行Standard Chartered Bank Ltd., Hong Kong邮寄跟单托收指示,其中:①Ten boxes oflamps from Guangzhou to Hong Kong by par of Tianyu vessel on May 12, 2003;②款项划至中国银行香港分行贷记托收行账户;③两次寄单。

汇丰银行在中国的发展

汇丰银行Hongkong and Shanghai Banking Corp. ,全称“香港上海汇丰银行”。

汇丰银行的中文名字“汇丰”,按照英文念作“Wayfoong”。

该行的主要角色就是为中国和亚洲其他地区以及欧洲、美国等地的贸易往来提供融资。

虽然汇丰银行被认为是一家典型的英国银行,但它的第一任经理克雷梭(Victor Kresser)却是一名法国人。

汇丰银行是为了向从事对华贸易的公司提供融资和结算服务而于1864年在香港建立的。

1865年开始营业,同年在上海设立第一家分行,而后在天津、北京、汉口、重庆等地设立分支机构。

1865-1942年,汇丰银行在旧中国的业务主要有国际汇兑、发行纸币、存贷款业务、经办和举放对中国政府的外债、经理中国的关税、盐税业务等。

1980年10月4日,汇丰银行设立北京代表处,这是建国以后汇丰银行在中国新设立的第一家分支机构。

1984年,汇丰银行上海分行被授权从事出口押汇方面的业务。

1985年8月16日,汇丰银行深圳代表处升格为分行,其年10月31日深圳分行正式开业,汇丰银行在中国内地开始有了可以从事较全面银行业务的营业机构。

1986年1月9日,解放前遗留下来的汇丰银行厦门分行(仅保有营业执照)被获准重新开始营业。

1986年3月19日,汇丰银行在天津成立了办事处。

1989年7月6日,汇丰银行在大连成立了代表处。

1990年底,汇丰银行上海分行获准重新注册,扩大了营业范围,并允许汇丰银行自行招聘工作人员。

1994年和1995年,中国进一步开放沿海及部分内陆经济中心城市后,汇丰银行在青岛、天津、及北京的代表处相继升格成为分行。

汇丰银行在中国各分行的主要业务可分为两类:一是工商银行(3.48,-0.03,-0.85%)业务(Corporate Banking),包括项目方面的贷款与房地产贷款、进出口押汇与票据托收、证券托管与B股业务、外汇资金安排等四个方面;二是零售银行业务(Retail Banking),如存储账户、汇款、旅行支票、信用卡、商户服务等。

誉满全球的国际老牌银行-汇丰银行...

誉满全球的国际老牌银行-汇丰银行(The world famousinternational brand - HSBC bank)The world famous international brand - HSBC bankHongkong and Shanghai Banking Corporation Limited, in order to provide financing and settlement services to engage in trade with China company established in Hongkong in 1864. Opened in 1865, established the first branch in Shanghai in the same year, and then set up branches in Tianjin, Beijing, Hankou, Chongqing and other places.brief introductionThe full name for the British HSBC, is a world famous international old bank, its branches all over the world, including Chinese. Headquartered in London, belonging to the HSBC group. The HSBC Group has approximately 10000 offices in Europe, Asia, America, Middle East and Africa, 82 countries and regions. HSBC is listed on the London, Hongkong, New York, Paris and Bermuda stock exchange, global shareholders about 200000, distributed in more than 100 countries and regions. By connecting with advanced technology of international network and the rapid development of electronic commerce, HSBC provides banking and financial services are: personal financial services; business; corporate banking, investment banking and capital markets; private banking and other business.Chinese backgroundHongkong and Shanghai Banking Corporation Limited (The HongKong and Shanghai Banking Corporation Limited), founded in 1865 in Hongkong and Shanghai. HSBC is a founding member of the HSBC Group and its flagship in the Asia Pacific region, the Hongkong Special Administrative Region is also the largest locally incorporated banks and issuing banks of three. The first objective is for the bank to set up in East Asia (especially Chinese) of the British businessmen to provide financing services, so HSBC established that set up offices in London, and in June 1865 in Shanghai set up a branch Chinese. Subsequently, HSBC has in Tianjin, Beijing, China Hankou, Chongqing, Fuzhou, Ningbo, Shantou, Xiamen, Zhifu, Jiujiang, Macao, Haikou, Takao (Kaohsiung) and other places to set up a branch, the first British bank and in 1866 in Japan, 1880 in New York, 1888 in Thailand set up in the local. In Philippines, Singapore, Sri Lanka, India, Malaysia and other places also has a branch of HSBC. At the beginning of the twentieth Century, HSBC has established a China and Far East region as the center of the branch network has a considerable scale.Brief introduction.HSBC headquarters in HongkongHSBC is to provide financing and settlement services to engage in trade with China company established in Hongkong in 1864. Opened in 1865, established the first branch in Shanghai in the same year, and then set up branches in Tianjin, Beijing, Hankou, Chongqing and other places.HSBC in the old China main business of international exchange, issuing notes, deposit and loan business, handling and give theright Chinese government debt, manager China tariff and business tax.HSBC in the Asia Pacific region in more than 20 countries and regions with more than 600 branches and offices in 8 countries in the Asia Pacific region and set up 23 branches and representative offices. HSBC and its affiliated financial company employs 36350 people, of which 24870 were HSBC employees.HSBC since 1865 opened in Shanghai, the mainland has never stopped,Especially good at trade financing. Since April 2002, HSBC began to offer foreign currency services to domestic residents, is the first approved to operate the business of foreign banks. At present, HSBC has 9 branches in the mainland China, located in Shanghai, Beijing, Dalian, Guangzhou, Qingdao, Shenzhen, Tianjin, Wuhan and Xiamen, is the largest foreign banks in Chinese branch. HSBC in Chinese general representative office in Shanghai, the other a representative office in Chengdu and Chongqing. HSBC has more than 700 employees in China, more than 92% of them in the local recruitment.Hongkong HSBC HSBC, is Hongkong's largest commercial bank, but also Asia outside of Japan's largest commercial bank, one of the world's largest multinational banks. In 1995 the bank's assets of $344 billion, ranking thirty-first in the world bank, the deposit amount of $81 billion 837 million, capital and reserves of billions of dollars, a capital ratio of 9.4%, the total capital ratio was 14.5%, (1995 June) hired 100000employees, the head office in Hongkong.HSBC was established in Hongkong in 1864 to provide financing services and Chinese trade company. Opened in 1865, established a branch in Shanghai in the same year, and set up branches in Tianjin, Beijing, Hankou, Chongqing and other places. In the UK people more precisely the Scots established. It is the capital of economic aggression in old China and control of the old Chinese financial market institutions issued paper money in Chinese, monopoly of foreign exchange market. Get off after 1911, salt tax savings and loans to China's leading power, Imperial Bank Group, providing aggressive political loans and railway and mining economy borrowing. After the liberation, the China branch in Shanghai branch of foreign exchange business by the government to allow China, the other has closed. HSBC in the first in its establishment in stepping up overseas activities. In 1866 the bank established the first branch in Japan, and the first run banks in Thailand. In 1880 the bank was founded in New York, the first British bank. Nineteenth Century, twentieth Century, HSBC in Philippines, Singapore, Sri Lanka, India and Malaysia have set up more lines. In the meantime, the bank is also in London, Leon, Hamburg and other places to set up branches. In the United States, France and Germany, HSBC has been operating in the long Bank of england.Logo InterpretationHexagonal logo HSBC Hexagon, central two red triangle angle relative, which is shaped like an hourglass, a symbol of wealth accumulation; both sides have a sharp red triangle, pointing to the left and right sides, a symbol of business expansion.The origin of historyAfter the Opium War, China portal was opened, the Western powers to expand economic interests in china. Soon, the establishment of the Royal Bank of Mumbai Chinese in India of a group of British businessmen, trying to control the Far East market, which engaged in trade with China in Hongkong, protagonist of discontent. In order to compete with the Royal Bank of China, they decided to set up the bank, the British leader is Hongkong steamship company supervisors Su Shilan. After six months of preparation, the HongKong Shanghai Bank Corporation in 1865 (Tongzhi four years) on March officially opened its headquarters in Hongkong, Queens Road No. 1 wardley building, first manager for French Klebsiella shuttle.For second years, was renamed the Bank of Shanghai Hongkong, Hongkong Chinese call it HSBC. In 1881, Zeng Jize for the bank bill inscription, including "HSBC". Since then, the Qing government and the society are called HSBC.HSBC Shanghai branch and head office set up in the same year, due to British interests in China concentrated in the Yangtze River Basin, Shanghai branch has become China HSBC business hub in China, with each branch of the command authority, turnover far beyond Hongkong head office.The first Shanghai Branch Manager (Taipan) is the Scottish Mcclain, visit the site located in Nanjing the Bund road. In 1874, HSBC in the Bund customs by building a 3 storey building as a new, brick structure, exquisite carving, in the year ofthe Huangpu River are numbered. 40 years later, the the Bund high-rise buildings standing side by side, HSBC and build a new building, inferior by comparison, founded in May 5, 1921. In June 23, 1923, HSBC was inaugurated, Chinese and foreign people to celebrate, this is recognized as the Bund's most striking building. 10 years later, a new building HSBC headquarters in Hongkong, on the use of local granite, more modern style, delivered in October 1935.After the outbreak of the Pacific War, the Japanese in the occupied area over the HSBC branch, most of its businesses were forced to stop, the situation is very embarrassing. In January 13, 1943, the Privy Council ordered the HSBC headquarters moved to set up in London, at the beginning of the same year, the new manager Morse decided to open a branch in Chongqing, mainly to the British government's military officials to open account.Japan surrendered in 1945, HSBC quickly resumed full head office moved back to Hongkong, 1946. In March 1947, HSBC branches all over the world business almost all of the industry, after 1 years of business institutions increased to 46.With the change of political situation in China, HSBC business in China have been shrinking, the liberation of the mainland, HSBC branch only Shanghai, Beijing, Tianjin and Shantou. 1954 Shantou, Tianjin branch of Beijing branch business closed, 1955. In April of the same year, HSBC in the mainland property including the Shanghai branch building to Chinese government, Shanghai branch to continue operating on rental housing for workers in Old Summer Palace road address, Shanghai branch to narrow the scope of business.History and evolutionNotes issued in 1907HSBC (HSBC, Hongkong&ShanghaiBankingCorporation) was founded in Hongkong in 1864, March 3, 1865 officially opened, founder of Scottish Thomas Su Zelan (Thomas Sutherland) and some other mainly engaged in trade with China Merchants in Shanghai set up a branch in June 1865 Chinese.HSBC in 1866 in Japan, 1880 in New York, 1888 in Thailand established the first UK local banks.In 1959, HSBC acquired in 1889, the Arabia region's largest foreign banks, the British Bank of the Middle East (The British Bankof theMiddleEast), the HSBC bank network extended to the Middle East, especially in the United Arab Emirates, Saudi Arabia and Iran.In 1959, HSBC bought India's oldest bank, founded in 1854 in Mumbai India Commercial Bank (The Mercantile Bank of India)In 1965, HSBC acquired the second largest bank in Hongkong, the Hang Seng Bank (Hang Seng Bank) 61.5% of the shares.The 1980 acquisition of the seventeenth largest commercial bank - the Bank of Haifeng (MarineMidland Bank, Inc.) 51% of the shares, and in July 1987 to HK $5 billion acquisition of the remaining shares of the bank.In 1983, HSBC acquired the U.S. Treasury bonds. Mccann Carroll primary dealer pedicle and McKinsey (CarrollMcEntee&McGinley) 51% of the shares.In 1987, HSBC bought four British clearing bank shares of Midland Bank in 14.9%, and in June 1992 acquired the line more than 50% of the shares, this is the pinnacle of the HSBC Group expansion activities, is also the largest ever bank acquisitions.HSBC was founded in Malaysia in 1994, it was first registered in Malaysia foreign banks.In 1995 WellsFargo&Co. and HSBC in California was Wells Fargo HSBC Trade Bank, provide trade financing and international banking services to two corporate customers. In HSBC through mergers and acquisitions, rapid development has become a global financial institutions, overseas branches, HSBC has made great development. At present, HSBC has been in the world more than 70 countries and regions (including 45 for emerging markets) opened about 3000 branches, of which about 600 more than in asia.HSBC honorsHSBC services has been widely recognized, including awards:"Asian financial" Chinese best foreign bank"Assets" best fund management bank China"GlobalFinance" best private bank"Banker" Asia and the best bank in Western Europe"European currencies" named "best foreign bank China" (for 4 years)The operating principleThe HSBC group with the five basic principles of operation: Maintain excellent customer serviceOperating efficiency, benefitStrong capital and liquidityPrudent lending policyStrict control of expensesGroup of loyal employees, the implementation of the above principles, while strengthening the establishment of long-term relationship with customers, employees and promote international cooperation.Sense of worth1, the company under the highest standards of personal integrity with everyone2, maintain the fact that even bargain3, encourage hands-on management style4, pay attention to quality and practice ability, establish a good image of the public praise5, eliminate bureaucracy6, to rapidly develop and implement decisions7, team interests, personal interests for the light8, appropriate delegation of authority over the required to bear the responsibilities9, the principle of objectivity, fair treatment of employees10, to choose the principle of recruitment, selection and promotion of employees, the diversified team11, the business area with all regulations and the provisions of the spirit12, actively fulfill the social responsibility of the enterprise, including a detailed assessment of the loan and investment plan, the promotion of good environmental practice and sustainable development, to contribute to the welfare and development of people everywhere.HSBC in ChinaHSBC President Long DeanHSBC (China) Co. Ltd. was officially opened in April 2, 2007, headquartered in Shanghai, Hongkong and Shanghai Banking Corporation Limited is a wholly-owned foreign bank, its predecessor is China mainland branch of Hongkong and Shanghai Banking Corporation Limited.Hongkong and Shanghai Banking Corporation Limited 143 years uninterrupted service in the mainland, is one of the largest investment in foreign banks in mainland China, the total investment in the mainland Chinese financial institutions and their development has more than $5 billion, including a 19% stake in Bank of communications, a 16.80% stake in Ping An insurance, and an 8% stake in Bank of Shanghai. Hongkong and Shanghai Banking Corporation Limited has a branch in Shanghai, engaged in the wholesale business of foreign exchange.At present, China HSBC has a total of 75 outlets, including 18 branches in Beijing, Chengdu, Chongqing, Changsha, Dalian, Dongguan, Guangzhou, Hangzhou, Qingdao, Shanghai, Shenyang, Shenzhen, Suzhou, Tianjin, Wuhan, Xiamen, Xi'an and Zhengzhou; and 57 sub branches in Beijing, Chengdu, Chongqing, Dalian, Guangzhou, Hangzhou, Qingdao, Shanghai, Shenzhen, Suzhou, Tianjin, Wuhan, Xiamen and Xi'an.The leading one of the largest networks of foreign banks in the mainland. Blend of international experience and in-depth understanding of the local market, HSBC China unique advantages, providing a wide range of banking and financial services forthe public service.social responsibilityHSBC China main corporate social responsibility activities include:HSBC since 2006 and the Tongji University Institute of environment and sustainable development of the United Nations Environment Programme of cooperation, the establishment of "environment and sustainable development of the future leaders of the seminar". In April 2007, the State Environmental Protection Administration and education center to join HSBC and Tongji, the three parties jointly held third "environment and sustainable development of the future leaders seminar", created three party cooperation of government, universities, enterprises, the new model teamed up to promote environmental protection and sustainable development. Provides a platform for two times a year, each time for three days of training classes, so that local government officials and international well-known environmental experts China forefront of environmental protection, environmental protection and the sharing of best practices.Actively support the Shanghai municipal government of the city green action, the adoption of the 20000 square metres of green city, support environment construction, and the adoption of Shanghai Baoshan District Forest Park gun Taiwan wetland along Yangtze River within the 10000 square meters of wetland.For HSBC group spent $one hundred million to carry out five yearplan "HSBC Climate Partnership" to provide local support and help to solve the urgent threat of global climate change.Tsinghua University School of economics and management support for a period of three years of "China rural financial development research project", to support the new rural construction of China. In 2006 and 2007, more than 50 HSBC employees Chinese volunteers and teachers and students together, deeply in many provinces in rural areas, to assist in the collection of local financial needs first-hand information.In cooperation with the State Department's "China development research foundation, carry out the" project "nutrition of poor children in rural". HSBC is the main sponsor of the project unit. This project aims to provide suggestions for the formulation of relevant policies, improve government decision-making and execution efficiency, finally establish the guarantee mechanism of children's nutrition policy based on government.The long-term sponsorship held at Fudan University, "Fudan - HSBC Economic Forum" held at the Peking University and Peking University HSBC "Economic Forum", is committed to promoting international exchange economics, support the mainland education.Full participation in the 2007 Special Olympics World Summer Games held in Shanghai, sponsored by the "special issue", issued in all of the city's primary and secondary schools. In addition, there are nearly 300 HSBC Chinese colleagues as Special Olympics volunteer.。

电汇电文改写

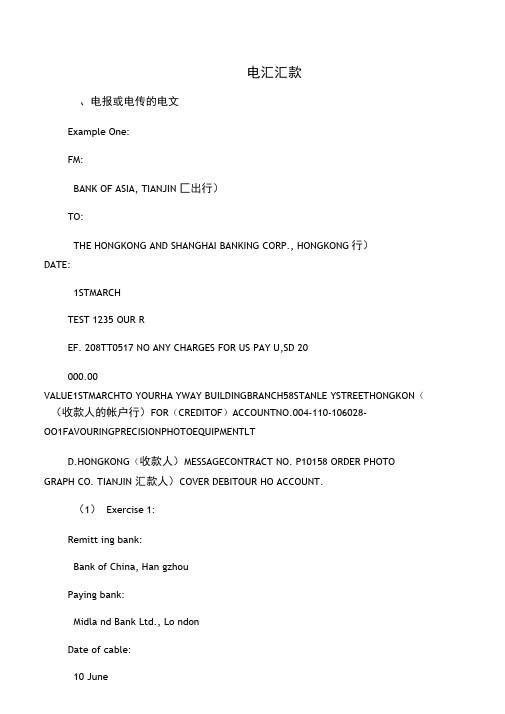

电汇电文改写电汇汇款一、电报或电传的电文Example One:FM: BANK OF ASIA, TIANJIN (汇出行)TO: THE HONGKONG AND SHANGHAI BANKING CORP., HONGKONG(汇入行) DATE: 1ST MARCHTEST 1235 OUR REF. 208TT0517 NO ANY CHARGES FOR US PAY USD 20,000.00 VALUE 1ST MARCH TO YOUR HAY WAY BUILDING BRANCH 58 STANLEY STREET HONGKONG(收款人的帐户行)FOR (CREDITOF) ACCOUNT NO. 004--001 FAVOURING PRECISION PHOTO EQUIPMENT LTD. HONGKONG(收款人)MESSAGE CONTRACT NO. P10158 ORDER PHOTO GRAPH CO. TIANJIN(汇款人)COVER DEBITOUR HO ACCOUNT.(1)Exercise 1:Remitting bank: Bank of China, HangzhouPaying bank: Midland Bank Ltd., LondonDate of cable: 10 June1Test: 1234Ref No. 208TT0992Amount: GBP62,000.00Value on: 10 JunePayee: Anglo International Co., Ltd, LondonAccount No. 36998044 with Midland Bank Ltd., LondonMessage: Contrat No. 201541Remitter: Zhejiang International Trust & Investment Corp., HangzhouCover: Debit our HO account1)请根据提示的信息撰写一篇电文:2)如payee这一栏改成:Payee: Anglo International Co., Ltd, LondonAccount No. 36998044 with The First National Bank, London则电文为:二(SWIFT的电文(样本参考)MT100 CUSTOMER TRANSFER(客户汇款)Date050315Sent to2BKCHCNBJ910BANK OF CHINA, ZHEJIANGFrom04HSBCHK25264HONGKONG AND SHANGHAI BANKING CORP.,HONGKONG: 20/ transaction reference number (交易编号)TT31506:32A/ value date, currency code, amount(起息日,货币代码,金额)05315USD50,000.00:50/ ordering customer(汇款人)ANDERSON CO., HONGKONG:57/ account with bank(收款行)BANK OF CHINA, ZHEJIANG:59/ beneficiary customer(受益人)ZHEJIANG INTERNATIONAL TRUST &INVESTMENT CORP., HANGZHOU :70/ details ofpayment(汇款附言)CONTRACT NO 12345: 71A/ details of charges(费用明细)BENEFICIARY:72/ bank to bank information(银行指示)3COVER DEBIT US篇二:电汇的简单介绍电汇的简单介绍1. 定义:电汇也叫T/T,英语名是:Telegraphic Transfer,:是指银行以电报(CABLE)、电传(TELEX)或环球银行间金融电讯网络(SWIFT)方式指示代理行将款项支付给指定收款人的汇款方式。

电汇汇款电文练习

电汇汇款、电报或电传的电文Example One:FM:BANK OF ASIA, TIANJIN 匚出行)TO:THE HONGKONG AND SHANGHAI BANKING CORP., HONGKONG行)DATE:1STMARCHTEST 1235 OUR REF. 208TT0517 NO ANY CHARGES FOR US PAY U,SD 20000.00VALUE1STMARCHTO YOURHA YWAY BUILDINGBRANCH58STANLE YSTREETHONGKON((收款人的帐户行)FOR(CREDITOF)ACCOUNTNO.004-110-106028-OO1FAVOURINGPRECISIONPHOTOEQUIPMENTLTD.HONGKONG(收款人)MESSAGECONTRACT NO. P10158 ORDER PHOTO GRAPH CO. TIANJIN 汇款人)COVER DEBITOUR HO ACCOUNT.(1)Exercise 1:Remitt ing bank:Bank of China, Han gzhouPaying bank:Midla nd Bank Ltd., Lo ndonDate of cable:10 JuneTest:1234Ref No. 208TT0992Amount:GBP62,000.00Value on:10 JunePayee:An glo Intern ati onal Co., Ltd, LondonAccou nt No. with Midla nd Bank Ltd., L ondonMessage:Co ntrat No. 201541Remitter:Zhejia ng Intern atio nal Trust & Inv estme nt Corp., Han gzhou Cover:Debit our HO account1)请根据提示的信息撰写一篇电文:2)女口payee这一栏改成:Payee:An glo Intern ati onal Co., Ltd, LondonAcco unt No. with The First Nati onal Bank, London则电文为:二.SWIFT勺电文(样本参考)MT100CUSTOMER TRANSF E R户汇款)Date050315Sent toBKCHCNBJ910BANK OF CHINA, ZHEJIANGFrom04HSBCHK25264HONGKONG AND SHANGHAI BANKING CORP., HONGKONG: 20/ tran saction referenee number (交易编号)TT31506:32A/ value date, currency code, amount (起息日,货币代码,金额)05315USD50,000.00:50/ ordering customer (汇款人)ANDERSON CO., HONGKONG:57/ account with bank (收款行)BANK OF CHINA, ZHEJIANG3 / 4:59/ beneficiary customer (受益人)ZHEJIANG INTERNATIONAL TRUST & INVESTMENT CORP., HANGZHOU:70/ details of payment(汇款附言)CONTRACT NO 12345: 71A/ details of charges费用明细)BENEFICIAR Y:72/ bank to bank information (银行指示)COVER DEBIT US。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

5.1 被执行人信息

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

5.2 失信信息

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

THE

HONGKONG

AND

SHANGHAI

BANKING

CORPORATION LIMITED

企业信用报告

本报告生成时间为 2018 年 11 月 01 日 10:36:22, 您所看到的报告内容为截至该时间点该公司的天眼查数据快照。

一、企业背景

1.1 工商信息

企业名称:

THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED

工商注册号: /

统一信用代码: /

法定代表人: /

组织机构代码: /

企业类型:

/

所属行业:

/

经营状态:

/

注册资本:

/

注册时间:

/

注册地址:

/

营业期限:

/至/

二、股东信息

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

三、对外投资信息

企业名称

注册时间

广东恩平汇丰村镇银行有 限责任公司

2009-01-07

注册资本

状态

4000 万元人民币 存续

法定代表人

黄昇

投资数额(万 元)

4,000

4

四、企业发展

4.1 融资历史

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

5.5 行政处罚

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

5.6 严重违法

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

4.4 企业业务

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

5

4.5 竞品信息

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

4.2 投资事件

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

4.3 核心团队

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

1.4 主要人员

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

经营范围:

/

登记机关:

/

核准日期:

/

1.2 分支机构

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参

3

考。

1.3 变更记录

品信息、进出口信息 八.年报信息

*以上内容由天眼查经过数据验证生成,供您参考 *敬启者:本报告内容是天眼查接受您的委托,查询公开信息所得结果。天眼查不对该查询结果的全面、准确、真实性负

责。本报告概不负责。

2

5.3 法律诉讼

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

6

5.4 法院公告

截止 2018 年 11 月 01 日,根据国内相关网站检索及天眼查数据库分析,未查询到相关信息。不排除因信 息公开来源尚未公开、公开形式存在差异等情况导致的信息与客观事实不完全一致的情形。仅供客户参 考。

目录

一.企业背景:工商信息、分支机构、变更记录、主要人员 二.股东信息 三.对外投资信息 四.企业发展:融资历史、投资事件、核心团队、企业业务、竞品信息 五.风险信息:失信信息、被执行人、法律诉讼、法院公告、行政处罚、严重违法、股权出质、

动产抵押、欠税公告、经营异常、开庭公告、司法拍卖 六.知识产权信息:商标信息、专利信息、软件著作权、作品著作权、网站备案 七.经营信息:招投标、债券信息、招聘信息、税务评级、购地信息、资质证书、抽查检查、产