国际经济学作业答案-第六章

国际经济学作业及答案

第一章国际贸易理论的微观基础1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

第二章古典贸易理论1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 X、Y的单位产出所需的劳动投入A BX Y 621512表2 X、Y的单位产出所需的劳动投入 A BX Y 10455答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

国际经济学课后练习题答案

绪论部分习题一,填空题1、国际经济学是以(国际经济关系)作为其研究对象的,它包括(国际经济交往活动)和(国际经济相互依存和影响)两层含义。

2、国际贸易的直接原因是(贸易利益的获取),根本原因是(比较优势)、(规模经济)。

3、保护主义性质的贸易政策主要分为(关税壁垒)和(非关税壁垒)两大类。

4、开放经济体系进行宏观经济调控的两个目标是(内部均衡)和(外部均衡)。

5、汇率之所以重要是因为它的实质是(价格),而且它的波动会直接影响一国的(进出口),间接影响一国的(国际收支),进而影响一国的(国内经济均衡)。

6、一个开放的国家,政府制定一项宏观经济政策会带来两种效应,即(溢出效应)和(回振效应)效应。

7、国贸纯理论部分旨在说明(国际贸易产生的原因、贸易模式、贸易利易的产生、贸易利益的分配),国贸政策理论部分旨在说明(保护性的贸易政策对社会经济福利的影响及其理论依据)。

8、西方经济学和国际经济学的共同点在于(研究稀缺资源的优化配置问题)。

二、问答题1、为什么学习国际经济学非常重要?答:①现代世界是一个开放的世界,二战后随着技术创新和制度的不断演进,世界各国为了提高资源配置效率,改善人民经济福利水平,提高综合国力,不断提升开放度,积极地参与国际分工、国际贸易和国际金融活动。

全球经济一体化和区域经济一体化的兴起和发展,跨国公司的迅猛发展,及信息技术革命,使各国国内市场不断延伸和扩展,分工和交易活动不断广化、深化、细化。

各国经济之间的的相互联系、依赖和影响程度不断加强。

因此,专门研究国际经济活动的国际经济学应运而生,并且在经济学中的地位日益提高,成为经济学类学生的一门重要课程。

②西方经济学主要研究在一国范围内经济资源的优化配置及充分就业问题,国际经济学研究在国际格局下经济资源的优化配置及充分就业问题;西方经济学主要研究国内分工贸易等经济活动的规律,而国际经济学则主要研究国际分工贸易等经济活动的规律。

在国际经济活动中,生产要素的流动性、各国制度、法律、语言、文化、宗教、习俗、货币、汇率、各种人为政策等复杂影响使其与国内经济活动呈现出许多不同的规律,故需要一种不同于国内经济活动的理论解释,这样经济学理论才算完整。

国际经济学课后答案

国际经济学课后答案第一章绪论1、列举出体现当前国际经济学问题的一些重要事件,他们为什么重要?他们都是怎么影响中国与欧、美、日的经济和政治关系的?当前的国际金融危机最能体现国际经济学问题,其深刻地影响了世界各国的金融、实体经济、政治等领域,也影响了各国之间的关系因此显得尤为重要;其对中国与欧、美、日的政治和经济关系的影响为:减少中国对上述国家的出口,影响中国外汇储备,贸易摩擦加剧,经济联系加强,因而也会导致中国与上述国家在政治上的对话与合作。

2、我们如何评价一国与他国之间的相互依赖程度?我们可以通过一国的对外贸易依存度来评价该国与他国之间的相互依赖程度,也可以通过其他方式来评价比如一国政府政策的溢出效应和回震效应以及对外贸易对国民生活水平的影响。

3、国际贸易理论及国际贸易政策研究的内容是什么?为什么说他们是国际经济学的微观方面?国际贸易理论分析贸易的基础和所得,国际贸易政策考察贸易限制和新保护主义的原因和效果。

国际贸易理论和政策是国际经济学的微观方面,因为他们把国家看作基本单位,并研究单个商品的(相对)价格。

4、什么是外汇交易市场及国际收支平衡表?调节国际收支平衡意味着什么?为什么说他们是国际经济学的宏观方面?什么是宏观开放经济学及国际金融?外汇交易市场描述一国货币与他国货币交换的框架,国际收支平衡表测度了一国与外部世界交易的总收入与总支出的情况。

调节国际收支平衡意味着调节一国与外部世界交易出现的不均衡(赤字或盈余);由于国际收支平衡表涉及总收入和总支出,调节政策影响国家收入水平和价格总指数,因而他们是国际经济学的宏观方面;外汇交易及国际收支平衡调节涉及总收入和总支出,调整政策影响国家收入水平和价格总指数,这些内容被称为宏观开放经济学或国际金融。

5、浏览报刊并做下列题目:(1)找出5条有关国际经济学的新闻(2)每条新闻对中国经济的重要性或影响(3)每条新闻对你个人有何影响4、如果按照比较劣势的原则进行国际分工,那么会对世界生产带来什么净影响?试对下列说法加以评价:1)由于发达国家工资水平高于发展中国家,所以发达国家与发展中国家进行贸易会无利可图;2)因为美国的工资水平很高,所以美国产品在世界市场缺乏竞争力;3)发展中国家的工资水平比较低是因为国际贸易的缘故。

国际经济学作业答案-第六章【范本模板】

Chapter 6 Economies of Scale, Imperfect Competition,and International TradeMultiple Choice Questions1。

External economies of scale arise when the cost per unit(a) rises as the industry grows larger.(b)falls as the industry grows larger rises as the average firm grows larger。

(c)falls as the average firm grows larger.(d) remains constant。

(e) None of the above.Answer: B2。

Internal economies of scale arise when the cost per unit(a) rises as the industry grows larger。

(b) falls as the industry grows larger。

(c)rises as the average firm grows larger.(d)falls as the average firm grows larger.(e)None of the above。

Answer: D3。

External economies of scale(a)may be associated with a perfectly competitive industry.(b)cannot be associated with a perfectly competitive industry。

(c) tends to result in one huge monopoly。

(d)tends to result in large profits for each firm。

国际经济学课程学习题集与参考答案

国际经济学习题集及参考答案一、填空、选择、判断题(每题1分):第一章:1、国际贸易理论以微观经济学原理为基础,讨论世界围的资源配置问题。

2、最常用国际贸易模型的结构形式为两个国家、两种产品(或部门)和两种要素。

3、在完竞争的假设前提下,封闭条件下的相对价格是国际贸易产生的基础。

4、国家间的供给、需求方面的差异是造成相对价格的根源。

5、贸易后,国际均衡价格由两国的供需共同决定,国际均衡价格处于两国封闭下的相对价格之间。

6、国际贸易利益包括两个部分:来自交换的利益和来自专业化的利益。

7、贸易理论主要围绕三个问题展开:国际贸易的格局、国际贸易的条件、国际贸易的收益。

第二章:1、斯密的绝对优势论认为国际贸易的基础是各国之间劳动生产率的绝对差别;嘉图的比较优势论认为国际贸易的基础是各国之间劳动生产率的相对差别。

2、哈伯勒首先用机会成本概念来阐明比较优势论。

3、重商主义者提倡的国家经济政策有:限制进口和鼓励出口,采取奖金、退税、协定和殖民地贸易等措施鼓励出口。

4、嘉图认为在国际贸易中起决定作用的不是绝对成本,而是相对成本。

5、斯密的绝对优势论认为国际贸易的基础是各国之间劳动生产率的绝对差别;劳动生产率的比较优势论认为国际贸易的基础是各国之间劳动生产率的相对差别。

6、在嘉图模型中,生产可能性边界线方程是一个线性方程式,表示A、B两国的PPF曲线是一条直线段。

7、重商主义者提倡的国家经济政策有:限制进口和鼓励出口,采取奖金、退税、协定和殖民地贸易等措施鼓励出口。

8、嘉图认为在国际贸易中起决定作用的不是绝对成本,而是相对成本。

9、机会成本概念表明:彼种选择的机会成本就构成此种选择的机会成本。

选择题:1、首先用机会成本理论来解释比较优势原理的学者是: C、A、嘉图B、罗布津斯基C、哈伯勒D、穆勒第三章:1、要素禀赋理论最初是由赫克歇尔和俄林提出的,后经萨缪尔森等人加工不断完善。

2、要素禀赋理论由H-O定理、要素价格均等化定理和罗伯津斯基定理、斯托伯-萨缪尔森定理等构成3、要素价格均等化理论指出国际贸易通过商品价格的均等化会导致要素价格的均等化,从而在世界围实现资源的最佳配置。

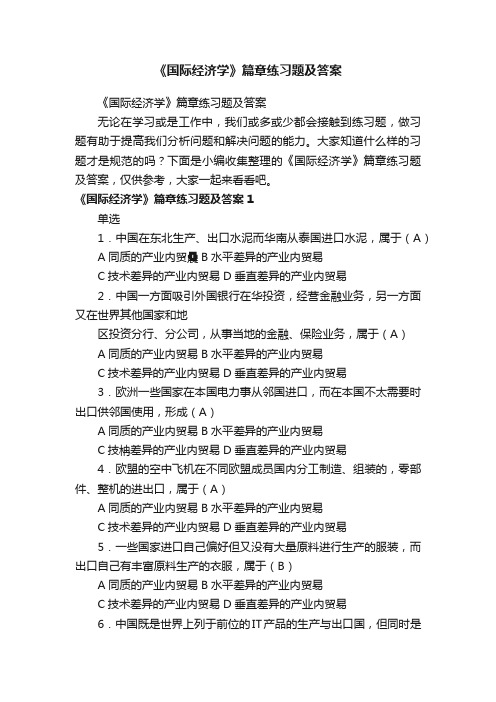

《国际经济学》篇章练习题及答案

《国际经济学》篇章练习题及答案《国际经济学》篇章练习题及答案无论在学习或是工作中,我们或多或少都会接触到练习题,做习题有助于提高我们分析问题和解决问题的能力。

大家知道什么样的习题才是规范的吗?下面是小编收集整理的《国际经济学》篇章练习题及答案,仅供参考,大家一起来看看吧。

《国际经济学》篇章练习题及答案1单选1.中国在东北生产、出口水泥而华南从泰国进口水泥,属于(A)A同质的产业内贸曟B水平差异的产业内贸易C技术差异的产业内贸易D垂直差异的产业内贸易2.中国一方面吸引外国银行在华投资,经营金融业务,另一方面又在世界其他国家和地区投资分行、分公司,从事当地的金融、保险业务,属于(A)A同质的产业内贸易B水平差异的产业内贸易C技术差异的产业内贸易D垂直差异的产业内贸易3.欧洲一些国家在本国电力事从邻国进口,而在本国不太需要时出口供邻国使用,形成(A)A同质的产业内贸易B水平差异的产业内贸易C技柟差异的产业内贸易D垂直差异的产业内贸易4.欧盟的空中飞机在不同欧盟成员国内分工制造、组装的,零部件、整机的进出口,属于(A)A同质的产业内贸易B水平差异的产业内贸易C技术差异的产业内贸易D垂直差异的产业内贸易5.一些国家进口自己偏好但又没有大量原料进行生产的服装,而出口自己有丰富原料生产的衣服,属于(B)A同质的产业内贸易B水平差异的产业内贸易C技术差异的产业内贸易D垂直差异的产业内贸易6.中国既是世界上列于前位的IT产品的生产与出口国,但同时是高科技IT产品的进口国,属于(C)A同质的产业内贸易B水平差异的产业内贸易C技术差异的产业内贸易D垂直差异的产业内贸易7.发达国家在出口高档豪华车的同时,从其他发展中国家进口一些中、低质量的同类产品,属于(D)A同质的产业内贸易B水平差异的产业内贸易C技术差异的产业内贸易D垂直差异的产业内贸易8.新H-O模型解释的国际贸易类型是(D)A同质的产业内贸易B水平差异的产业内贸曟C技术差异的产业内贸易D垂直差异的产业内贸易9.克鲁格曼认为,产生产业内贸易的根本原因是(B)A差异产品的可选择性B规模经济C收入相似D经济发展水平相同10.林德需求重叠理论(B)。

国际经济学习题及答案

第一章导论1.国际经济学是怎样产生并发展成为一门独立学科的?答案提示:(1)国际经济学产生的客观基础及其最初表现形式:客观基础为跨越国界的经济活动;最初表现形式是国际贸易活动;(2)国际经济学产生的学科前提是国际贸易学和国际金融学;(3)国际经济学的发展:20世纪60年代后成为一门独立的学科,并不断发展。

2.国际经济学的研究对象和研究方法是什么?答案提示:(1)国际经济学的研究对象:跨越国界的经济活动及其运动规律(2)国际经济学的研究方法:与经济学的一般研究方法比较,基本相同,即:宏观与微观相结合、静态与动态相结合、定性与定量分析相结合、局部均衡与一般均衡相结合、理论与政策相结合国际经济学的具体分析框架为2×2×2模型(两个国家、两种产品、两种生产要素),通过不断放松假设,使理论逼近现实。

第二章古典国际贸易理论一、单项选择题1.重商主义贸易理论认为贸易是()。

A.正和博弈B.零和博弈C.国际分工D.财富2.贸易福利的国际间的相互比较是指()。

A.比较优势B.比较利益C.比较成本D.国际分工3.国际间商品生产成本比率的相互比较是()。

A.比较优势B.比较利益C.比较成本D.国际分工4.亚当·斯密认为贸易的基础是()。

A.比较优势B.劳动生产率C.国际分工D.绝对优势5.大卫·李嘉图认为贸易的基础是()A.比较优势B.劳动生产率C.国际分工D.绝对优势二、多项选择题1.古典国际贸易理论讨论的主要问题包括()A.绝对优势B.比较优势C.规模经济D.消费者偏好E.比较利益2、大卫·李嘉图的理论的假设前提有()。

A.生产要素只在一国内部自由流动B.生产要素在一国国内及国际间均自由流动C.政府对贸易进行干预D.贸易国的生产成本不变E.商品的价值由劳动量决定三、判断题1.重商主义贸易理论认为国际贸易利益是通过损害他国利益实现的。

2.贸易差额论代表着晚期重商主义理论的核心思想。

(完整版)国际经济学课后习题答案

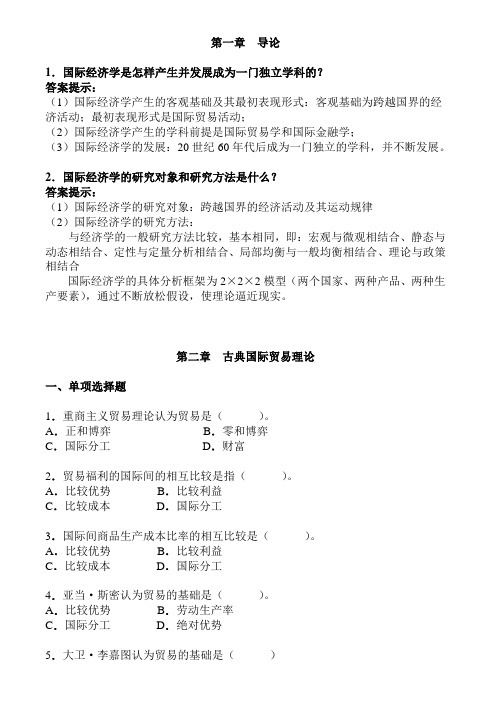

思路:中国的生产可能性曲线为2Y=300-X,大米的机会成本为1/2单位的钢铁,根据福利函数知每一条效用曲线上大米对钢铁的边际替代率为

(1)封闭经济中的福利最大化必在大米的边际替代率与机会成本相等处,即 ,或X=Y处,代入生产可能性曲线得X=Y=100,U0=100*1002=106

3.一个小国和一个大国发生贸易,哪一个国家的福利水平提高的幅度更大一些?画图说明。

思路:一般来说,小国福利水平提高的幅度更大一些。以大国向小国进口为例。从下图中可以看出虽然贸易后的价格均为PW,但是大国价格变动幅度小于小国,所以大国福利仅提高ABE,而小国福利提高A’B’E’。大国原来福利水平为OMEN,福利提高幅度为ABE/OMEN,而小国福利原来水平为O’M’E’N’,福利提高幅度为A’B’E’/O’M’E’N’,显然小国的福利水平提高幅度要比大国大。

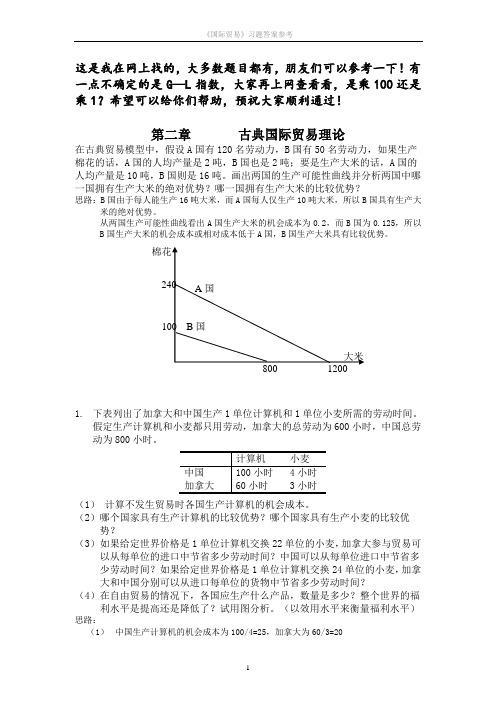

(3)如果各国按照比较优势生产和出口,加拿大进口小麦出口计算机,中国进口计算机出口小麦。

加拿大进口一单位小麦需要出口1/22单位计算机,折合成劳动时间来算,生产一单位小麦本国要用3小时,但生产1/22单位计算机本国要用60/22小时劳动,所以加拿大进口一单位小麦相当于用60/22小时的劳动换回本国3小时生产的产品,节省了3-60/22=3/11小时的劳动时间。中国进口一单位计算机需要出口22单位小麦,相当于用22*4=88小时的劳动换回本国需用100小时生产的产品,节省了100-88=12小时的劳动时间。

生产者利润减少a=1/2*(1400+1600)*10000=1.5*107

社会福利增加b=(a+b)-a=2*106

6.假设A、B两国生产技术相同且在短期内不变:生产一单位衣服需要的资本为1,需要的劳动为3;生产一单位食品需要的资本为2,需要的劳动为2。A国拥有160单位劳动和100单位资本;B国拥有120单位劳动和80单位资本。则

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 6 Economies of Scale, Imperfect Competition, and International TradeMultiple Choice Questions1. External economies of scale arise when the cost per unit(a) rises as the industry grows larger.(b) falls as the industry grows larger rises as the average firm grows larger.(c) falls as the average firm grows larger.(d) remains constant.(e) None of the above.Answer: B2. Internal economies of scale arise when the cost per unit(a) rises as the industry grows larger.(b) falls as the industry grows larger.(c) rises as the average firm grows larger.(d) falls as the average firm grows larger.(e) None of the above.Answer: D3. External economies of scale(a) may be associated with a perfectly competitive industry.(b) cannot be associated with a perfectly competitive industry.(c) tends to result in one huge monopoly.(d) tends to result in large profits for each firm.(e) None of the above.Answer: A4. Internal economies of scale(a) may be associated with a perfectly competitive industry.(b) cannot be associated with a perfectly competitive industry.(c) are associated only with sophisticated products such as aircraft.(d) cannot form the basis for international trade.(e) None of the above.Answer: B5. A monopolistic firm(a) can sell as much as it wants for any price it determines in the market.(b) cannot determine the price, which is determined by consumer demand.(c) will never sell a product whose demand is inelastic at the quantity sold.(d) cannot sell additional quantity unless it raises the price on each unit.(e) None of the above.Answer: C6. Monopolistic competition is associated with(a) cut-throat price competition.(b) product differentiation.(c) explicit consideration at firm level of the feedback effects of other firms’ pr icing decisions.(d) high profit margins.(e) None of the above.Answer: B7. The most common market structure is(a) perfect competition.(b) monopolistic competition.(c) small-group oligopoly.(d) perfectly vertical integration.(e) None of the above.Answer: C8. Modeling trade in monopolistic industries is problematic because(a) there is no one generally accepted model of oligopoly behavior.(b) there are no models of oligopoly behavior.(c) it is difficult to find an oligopoly in the real world.(d) collusion among oligopolists makes usable data rare.(e) None of the above.Answer: A9. Where there are economies of scale, the scale of production possible in a country is constrained by(a) the size of the country.(b) the size of the trading partner’s country.(c) the size of the domestic market.(d) the size of the domestic plus the foreign market.(e) None of the above.Answer: D63 / 1163 / 1163 / 1110. Where there are economies of scale, an increase in the size of the market will(a) increase the number of firms and raise the price per unit.(b) decrease the number of firms and raise the price per unit.(c) increase the number of firms and lower the price per unit.(d) decrease the number of firms and lower the price per unit.(e) None of the above.Answer: C11. The simultaneous export and import of widgets by the United States is an example of(a) increasing returns to scale.(b) imperfect competition.(c) intra-industry trade.(d) inter-industry trade.(e) None of the above.Answer: C12. If output more than doubles when all inputs are doubled, production is said to occur underconditions of(a) increasing returns to scale.(b) imperfect competition.(c) intra-industry trade.(d) inter-industry trade.(e) None of the above.Answer: A13. Intra-industry trade can be explained in part by(a) transportation costs within and between countries.(b) problems of data aggregation and categorization.(c) increasing returns to scale.(d) All of the above.(e) None of the above.Answer: D14. If some industries exhibit internal (firm specific) increasing returns to scale in each country, weshould not expect to see(a) intra-industry trade between countries.(b) perfect competition in these industries.(c) inter-industry trade between countries.(d) high levels of specialization in both countries.(e) None of the above.Answer: B15. Intra-industry trade is most common in the trade patterns of(a) developing countries of Asia and Africa.(b) industrial countries of Western Europe.(c) all countries.(d) North-South trade.(e) None of the above.Answer: B16. International trade based on scale economies is likely to be associated with(a) Ricardian comparative advantage.(b) comparative advantage associated with Heckscher-Ohlin factor-proportions.(c) comparative advantage based on quality and service.(d) comparative advantage based on diminishing returns.(e) None of the above.Answer: E17. International trade based on external scale economies in both countries is likely to be carried outby a(a) relatively large number of price competing firms.(b) relatively small number of price competing firms.(c) relatively small number of competing oligopolists.(d) monopoly firms in each country/industry.(e) None of the above.Answer: A18. International trade based solely on internal scale economies in both countries is likely to be carriedout by a(a) relatively large number of price competing firms.(b) relatively small number of price competing firms.(c) relatively small number of competing oligopolists.(d) monopoly firms in each country/industry.(e) None of the above.Answer: D19. A monopoly firm engaged in international trade will(a) equate average to local costs.(b) equate marginal costs with foreign marginal revenues.(c) equate marginal costs with the highest price the market will bear.(d) equate marginal costs with marginal revenues in both domestic and in foreign markets.(e) None of the above.Answer: D65 / 1165 / 1165 / 1120. A monopoly firm will maximize profits by(a) charging the same price in domestic and in foreign markets.(b) producing where the marginal revenue is higher in foreign markets.(c) producing where the marginal revenue is higher in the domestic market.(d) equating the marginal revenues in domestic and foreign markets.(e) None of the above.Answer: D21. A firm in monopolistic competition(a) earns positive monopoly profits because each sells a differentiated product.(b) earns positive oligopoly profits because each firm sells a differentiated product.(c) earns zero economic profits because it is in perfectly or pure competition.(d) earns zero economic profits because of free entry.(e) None of the above.Answer: D22. The larger the number of firms in a monopolistic competition situation,(a) the larger are that country’s exports.(b) the higher is the price charged.(c) the fewer varieties are sold.(d) the lower is the price charged.(e) None of the above.Answer: D23. The monopolistic competition model is one in which there is/are(a) a monopoly.(b) perfect competition.(c) economies of scale.(d) government intervention in the market.(e) None of the above.Answer: C24. In industries in which there are scale economies, the variety of goods that a country can produce isconstrained by(a) the size of the labor force.(b) anti-trust legislation.(c) the size of the market.(d) the fixed cost.(e) None of the above.Answer: C25. An industry is characterized by scale economies, and exists in two countries. Should these twocountries engage in trade such that the combined market is supplied by one country’s industry, then(a) consumers in both countries would suffer higher prices and fewer varieties.(b) consumers in the importing country would suffer higher prices and fewer varieties.(c) consumers in the exporting country would suffer higher prices and fewer varieties.(d) consumers in both countries would enjoy fewer varieties available but lower prices.(e) None of the above.Answer: E26. An industry is characterized by scale economies and exists in two countries. In order for consumersof its products to enjoy both lower prices and more variety of choice,(a) each country’s marginal cost must equal that of the other country.(b) the marginal cost of this industry must equal marginal revenue in the other.(c) the monopoly must lower prices in order to sell more.(d) the two countries must engage in international trade one with the other.(e) None of the above.Answer: D27. A product is produced in a monopolistically competitive industry with scale economies. If thisindustry exists in two countries, and these two countries engage in trade one with the other, then we would expect(a) the country in which the price of the product is lower will export the product.(b) the country with a relative abundance of the factor of production in which production of theproduct is intensive will export this product.(c) each of the countries will export different varieties of the product to the other.(d) neither country will export this product since there is no comparative advantage.(e) None of the above.Answer: C28. The reason why one country may export a product which is produced with positive scaleeconomies is(a) its labor productivity will tend to be higher.(b) it enjoys a relative abundance of the factor intensely used in the product’s production.(c) its demand is biased in favor of the product.(d) its demand is biased against the product.(e) None of the above.Answer: E29. Two countries engaged in trade in products with no scale economies, produced under conditions ofperfect competition, are likely to be engaged in(a) monopolistic competition.(b) inter-industry trade.(c) intra-industry trade.(d) Heckscher-Ohlin trade.(e) None of the above.Answer: B67 / 1167 / 1167 / 1130. Two countries engaged in trade in products with scale economies, produced under conditions ofmonopolistic competition, are likely to be engaged in(a) price competition.(b) inter-industry trade.(c) intra-industry trade.(d) Heckscher-Ohlinean trade.(e) None of the above.Answer: C31. History and accident determine the details of trade involving(a) Ricardian and Classical comparative advantage.(b) Heckscher-Ohlin model consideration.(c) taste reversals.(d) scale economies.(e) None of the above.Answer: D32. We often observe intra-industry North-South trade in “computers and related devices.” This isdue to(a) classification and aggregation ambiguities.(b) monopolistic competition.(c) specific factors issues.(d) scale economies.(e) None of the above.Answer: A33. We often observe “pseudo-intra-industry trade” between the United States and Mexico. Actually,such trade is consistent with(a) oligopolistic markets.(b) comparative advantage associated with Heckscher-Ohlin model.(c) optimal tariff issues.(d) huge sucking sound.(e) None of the above.Answer: B34. Intra-industry trade will tend to dominate trade flows when which of the following exists?(a) Large differences between relative country factor availabilities(b) Small differences between relative country factor availabilities(c) Homogeneous products that cannot be differentiated(d) Constant cost industries(e) None of the above.Answer: B35. The most common form of price discrimination in international trade is(a) non-tariff barriers.(b) Voluntary Export Restraints.(c) dumping.(d) preferential trade arrangements.(e) None of the above.Answer: CEssay Questions1. Why is it that if an industry were operating under conditions of domestic internal scale economies(applies to firm in the country)—then the resultant equilibrium cannot be consistent with the pure competition model?Answer: Because once one firm became bigger than another, or if one firm began the industry, then no other firm would be able to match its per unit cost, so that they would be driven out ofthe industry.2. Is it possible that if positive scale economies characterize an industry, that its equilibrium may beconsistent with purely competitive conditions? Explain how this could happen.Answer: Yes. If the scale economies were external to the firm, then there is no reason why the firms may not be in perfect competition.3. If a scale economy is the dominant technological factor defining or establishing comparativeadvantage, then the underlying facts explaining why a particular country dominates world markets in some product may be pure chance, or historical accident. Explain, and compare this with the answer you would give for the Heckscher-Ohlin model of comparative advantage.Answer: This statement is true, since the reason the seller is a monopolist may be that it happened to have been the first to produce this product in this country. It may have no connection toany supply or demand related factors; nor to any natural or man-made availability. This isall exactly the opposite of the Heckscher-Ohlin Neo-Classical model’s explanation of thedeterminants of comparative advantage.4. It is possible that trade based on external scale economies may leave a country worse off than itwould have been without trade. Explain how this could happen.Answer: One answer is that the terms of trade effects may dominate any other factors.5. If scale economies were not only external to firms, but were also external to individual countries.That is, the larger the worldwide industry (regardless of where firms or plants are located), thecheaper would be the per-unit cost of production. Describe what world trade would look like in this case.Answer: Presumably each country would specialize in some component of the final product. This would result in much observed intra-industry trade.69 / 1169 / 1169 / 116. Why are increasing returns to scale and fixed costs important in models of international trade andmonopolistic competition?Answer: There are many answers. Three of these are(a) Increasing returns to scale, and high fixed costs may be inconsistent with perfectcompetition. In such a case, the initial autarkic state may be a suboptimal equilibrium.For example, relative prices may not equal marginal rates of transformation. It followsfrom this that a change in output compositions associated with trade may result in anational welfare for one or both trading countries that is inferior to that associatedwith the initial autarkic conditions. Hence no “gains from trade.”(b) In a case of increasing scale economies at the firm or plant level, the determination ofwhich product will be exported by which country is ex-ante indeterminate. Therefore,deriving clear implications concerning the effects of trade on income distributionssuch as may be derived from the Samuelson-Stolper Theorem is no longer generallypossible.(c) Market structures containing positive scale economies and imperfect competition mayallow for “two-way trade,” or intra-industry trade. As in b. above, the varioustheorems derivable from the Heckscher-Ohlin model concerning directions of tradeand income distributions are no longer generally applicable.7. Explain why it may be argued that the relative importance of the intra-industry component of worldtrade is likely to lessen economic strife or confrontation (a la Stolper-Samuelson) associated with commercial policy within countries in which overall trade is expanding?Answer: In the case of the Neo-Classical H-O model, the expansion of trade will tend to increase the incomes of those factors in which the exports are relatively intense. This may createsituations in which unskilled lab or’s already relatively low relative incomes would worsenin a country such as the U.S., hence heating up “class warfare.” In the case of intra-industry trade, the expanding exports will tend to be in relatively fragmented subsets ofproducts (“brands”). S uch export expansion will have no determinant or systematictendency to affect relative factor returns in any deterministic manner.8. Explain why positive economies of scale in one (of two) sectors may establish a comparativeadvantage for the large (as compared to the small) country in the production of the commoditywhich exhibits positive scale economies.Answer: In the case of the H-O model, the actual size of the country is irrelevant in thedetermination of the direction of trade (though it may affect the equilibrium terms oftrade). When positive scale economies apply to the production of one product, the countrythat can devote more resources (in absolute terms) will be able to sell that product cheaper,and therefore will be more likely to gain a “revealed” comparative advantage in thatproduct. This will be the country with more factors (both labor and capital)—the largercountry.Quantitative/Graphing Problemsmonopolist. If it were unable to export, and was constrained by its domestic market, what quantity would it sell at what price?Answer: It would sell 5 (million tons) at a price of $8/ton.2. Now the monopolist discovers that it can export as much as it likes of its steel at the world price of$5/ton. It will therefore expand for-export production up to the point where its marginal cost equals $5. How much steel will the monopolist sell, and at what price?Answer: It would sell 10 million tons at $5/ton.3. Given the opportunity to sell at world prices, the marginal (opportunity) cost of selling a tondomestically is what?Answer: $5/ton.4. While selling exports it would also maximize its domestic sales by equating its marginal(opportunity) cost to its marginal revenue of $5. How much steel would the firm sell domestically, and at what price?Answer: 4 million tons at $10/ton.5. The Brazilian firm is charging its foreign (U.S.) customers one half the price it is charging itsdomestic customers. Is this good or bad for the real income or economic welfare of theUnited States? Is the Brazilian firm engaged in dumping? Is this predatory behavior on the partof the Brazilian steel company?Answer: Good. Yes, if you define dumping as selling abroad at a price lower than domestically. No, if by dumping you mean selling below marginal cost. No—this is not being done in orderto capture market shares, but rather is “mere” static profit maximization behavior, as isexpected of any self-respecting monopolist.71 / 1171 / 1171 / 116. The following Table describes the labor-input coefficients needed to produce one Widget in Englandand Portugal. Both countries are identical in size, tastes, technology. This technology is described in the table below:To Produce This Many Widgets, Or This Many Apples Labor-Hour Requirements1 32 53 64 75 86 97 10Let us assume that each country has 10 labor-hours available. Further, consumers always consume an equal amount of apples and widgets.(a) How of each product will be produced in England under autarky? 2 widgets and 2 apples.(b) Judging from autarky conditions, which country has a comparative advantage in widgets?(c) If England (completely) specialized in widgets, how many widgets would be produced, and howmany apples?(d) If the world terms of trade were established at 3.5 widgets 3.5 Apples, which country wouldenjoy gains from trade (as compared to The autarky solution?)(e) If Portugal were to completely specialize in widgets, how would the answers to c and d change?(f) What would the production possibility curve look like in each country?Answers: (a) 2 widgets and 2 apples(b) None(c) 7 widgets in England and 7 apples in Portugal(d) both would gain from trade. Instead of consuming 2 widgets and 2 apples, they wouldeach consume 3.5 widgets and 3.5 apples.(e) Same numbers as c, except that the countries will each be assigned a different product.Exactly the same answer for d.(f) convex to the origin.。