外国驻常驻办税收政策英语

外国人来中国需要遵守哪些规定英语作文

Foreigners in China: Rules and Regulationsto FollowChina, a country with a rich cultural heritage and vibrant society, welcomes foreigners from all over the world. However, as with any country, there are certain rules and regulations that foreigners must abide by when visiting or residing in China. These rules ensure the smooth operation of society, protect the rights and interests of all citizens, and promote cultural exchange and mutual understanding.One of the fundamental rules for foreigners in China is to respect the laws and regulations of the country. This includes adhering to the Constitution and other laws, respecting the sovereignty and territorial integrity of China, and not engaging in any activities that violate the law. Foreigners must also comply with the visa and residence permit regulations, ensuring that their stay in China is legal and authorized.Another important aspect is the respect for local customs and traditions. China has a diverse cultural landscape, and foreigners are expected to show respect andtolerance for these differences. This includes respecting local festivals, customs, and traditions, as well as avoiding any behavior that may be considered offensive or disrespectful.In terms of public behavior, foreigners in China are expected to abide by the same rules as local citizens. This includes maintaining public order, respecting the rights and dignity of others, and refraining from any disruptive or illegal activities. Foreigners should also be mindful of their personal hygiene and environmental protection, disposing of waste properly and adhering to local environmental regulations.When it comes to employment, foreigners in China must obtain the necessary work permits and comply with labor laws and regulations. This includes ensuring that their employment is legal and registered with the relevant authorities, as well as adhering to labor contracts and paying taxes as required.Moreover, foreigners in China should also be aware of the country's national security and foreign affairs policies. They should not engage in any activities that mayharm China's national interests or interfere in itsinternal affairs. Additionally, foreigners should respect the privacy and rights of others, and avoid engaging in any form of espionage or illegal intelligence activities.In conclusion, foreigners visiting or residing in China must abide by the country's laws, regulations, and customs. By respecting the local laws and traditions, maintaining public order, and adhering to employment and tax regulations, foreigners can enjoy a safe and pleasant stayin China while contributing to the promotion of cultural exchange and mutual understanding.**外国人在中国:需遵守的规定**中国,一个拥有丰富文化遗产和充满活力的社会,欢迎来自世界各地的外国人。

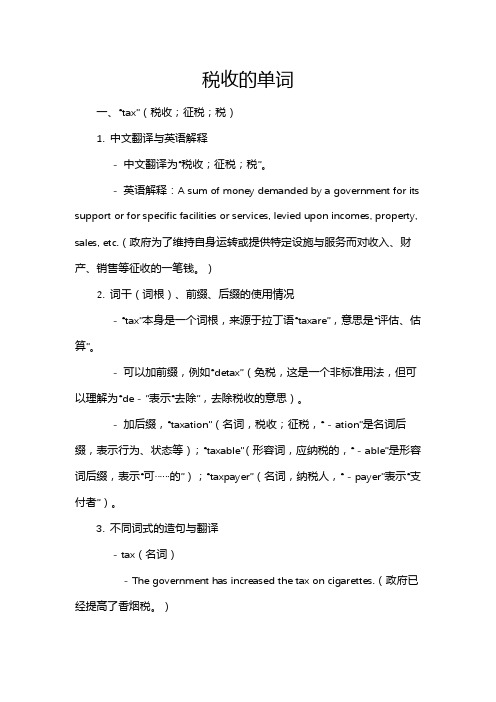

税收的单词

税收的单词一、“tax”(税收;征税;税)1. 中文翻译与英语解释- 中文翻译为“税收;征税;税”。

- 英语解释:A sum of money demanded by a government for its support or for specific facilities or services, levied upon incomes, property, sales, etc.(政府为了维持自身运转或提供特定设施与服务而对收入、财产、销售等征收的一笔钱。

)2. 词干(词根)、前缀、后缀的使用情况- “tax”本身是一个词根,来源于拉丁语“taxare”,意思是“评估、估算”。

- 可以加前缀,例如“detax”(免税,这是一个非标准用法,但可以理解为“de - ”表示“去除”,去除税收的意思)。

- 加后缀,“taxation”(名词,税收;征税,“ - ation”是名词后缀,表示行为、状态等);“taxable”(形容词,应纳税的,“ - able”是形容词后缀,表示“可……的”);“taxpayer”(名词,纳税人,“ - payer”表示“支付者”)。

3. 不同词式的造句与翻译- tax(名词)- The government has increased the tax on cigarettes.(政府已经提高了香烟税。

)- 这家公司必须缴纳高额的企业税。

The company has to pay a high corporate tax.- 他们正在抗议新的财产税。

They are protesting against the new property tax.- tax(动词)- The authorities decided to tax luxury goods at a higher rate.(当局决定对奢侈品征收更高的税率。

)- 政府不应该过度征税穷人。

The government should not over - tax the poor.- 他们计划对进口汽车征税。

税务专用词汇及税收英语对话88026

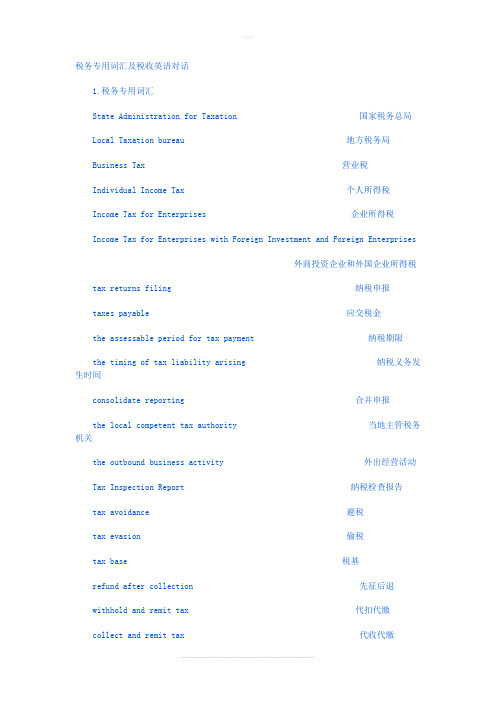

税务专用词汇及税收英语对话1.税务专用词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises 企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 避税tax evasion 偷税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 扣缴所得税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区2. 税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC: Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer: my company will begin business soon, but I have little knowledge about the business tax. Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

号外国企业常驻代表机构税收管理新规定的四大关注点

号外国企业常驻代表机构税收管理新规定的四大关注点一、关注代表机构的税务登记治理要求代表机构应当自领取工商登记证件(或有关部门批准)之日起30日内,向其所在地主管税务机关申报办理税务登记。

办理税务登记时,代表机构应向税务机关提供下列资料:(一)工商营业执照副本或主管部门批准文件的原件及复印件;(二)组织机构代码证书副本原件及复印件;(三)注册地址及经营地址证明(产权证、租赁协议)原件及其复印件;如为自有房产,应提供产权证或买卖契约等合法的产权证明原件及其复印件;如为租赁的场所,应提供租赁协议原件及其复印件,出租人为自然人的还应提供产权证明的原件及复印件;(四)首席代表(负责人)护照或其他合法身份证件的原件及复印件;(五)外国企业设置代表机构的有关决议文件及在中国境内设置的其他代表机构名单(包括名称、地址、联系方式、首席代表姓名等);(六)税务机关要求提供的其他资料。

代表机构其他涉及登记治理的事项应按照《中华人民共和国税收征收治理法》及事实上施细则的有关要求进行。

即代表机构税务登记内容发生变化或者驻在期届满、提早终止业务活动的,应当按照税收征管法及有关规定,向主管税务机关申报办理变更登记或者注销登记;代表机构应当在办理注销登记前,就其清算所得向主管税务机关申报并依法缴纳企业所得税。

二、关注代表机构纳税申报要求《外国企业常驻代表机构税收治理暂行方法》(国税发[2010]18号)第六条明确规定:代表机构应在季度终了之日起15日内向主管税务机关据实申报缴纳企业所得税、营业税,并按照《中华人民共和国增值税暂行条例》及事实上施细则规定的纳税期限,向主管税务机关据实申报缴纳增值税。

在纳税申报方面,我们要注意以下四个方面的咨询题:第一、取消了国税发[2003]28号文中关于不予征税或免税的代表机构,只需要在年度终了后的一个月内,申报其年度生产经营情形的申报要求。

新方法规定,自2010年1月1日起,所有代表机构都应按国税发[2 010]第18号第六条规定的时限办理纳税申报,即使这些代表机构能够按照税收协定享受待遇,也要按第六条规定期限进行申报。

外国企业常驻代表机构构成税收协定所述常设机构的判定

外国企业常驻代表机构构成税收协定所述常设机构的判定近期,一些地区询问,在执行《关于对所得避免双重征税和防止偷漏税的协定》及《内陆与香港特别行政区关于对所得避免双重征税的安排》(以下称税收协定及安排),判定在华外国企业常驻代表机构(以下称代表机构)中工作的非中国居民个人的纳税义务,确定其工资薪金所得是否属于税收协定及安排所说的“常设机构”负担时,如何判定该代表机构是否构成税收协定及安排所说的“常设机构”,我国有关税收法规规定不予征税或免予征税的代表机构是否不属于“常设机构”。

对此,解释如下:一、税收协定第五条及安排第一条规定,“‘常设机构’一语特别包括办事处”,但“不包括:(一)专为储存、陈列或者交付本企业货物或者商品的目的而使用的设施;(二)专为储存、陈列或者交付的目的而保存本企业货物或者商品的库存;(三)专为另一企业加工的目的而保存本企业货物或者商品的库存;(四)专为本企业采购货物或者商品,或者搜集情报的目的所设的固定营业场所;(五)专为本企业进行其他准备性或辅助性活动的目的所设的固定营业场所:(六)专为本款第(一)项至第(五)项活动的结合所设的固定营业场所,如果由于这种结合使该固定营业场所全部活动属于准备性质或辅助性质。

”据此规定,代表机构除专门从事上述列举的六项业务活动的以外,均属构成税收协定及安排所说的“常设机构”。

上述列举的六项业务活动中第(五)项所说“其他准备性或辅助性活动”包括的内容,应由税收协定及安排限定的主管当局确定。

因此,凡国家税务总局对此未予明确的,各地税务机关不得自行认定“其他准备性或辅助性活动”的内容。

二、虽然根据我国内陆有关对代表机构征税的法律法规,对一部分从事我国内陆税收法规规定非应税营业活动的代表机构,不予征税或免税,但并不影响对其依照税收协定及安排的规定判定为在我国构成“常设机构”,以及依据有关规定对其非中国居民雇员的工资薪金确定是否为“常设机构”负担。

国家税务总局关于外国企业常驻代表机构是否构成税收协定所述常设机构问题的解释的通知(国税函[1999]607号)。

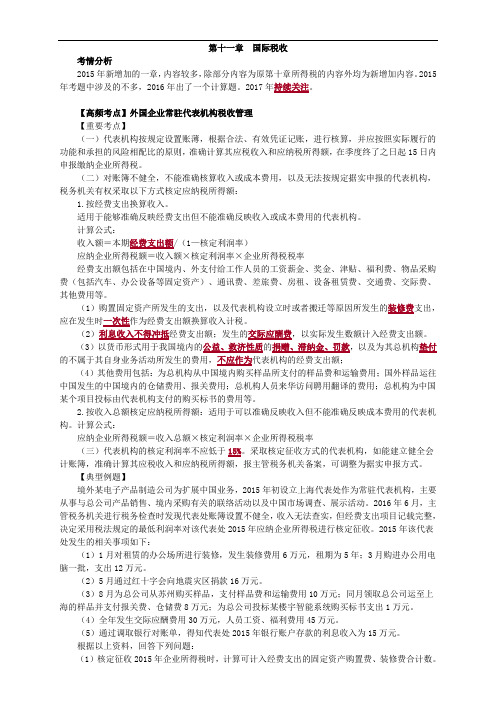

高频考点】外国企业常驻代表机构税收管理

第十一章国际税收考情分析2015年新增加的一章,内容较多,除部分内容为原第十章所得税的内容外均为新增加内容。

2015年考题中涉及的不多,2016年出了一个计算题。

2017年持续关注。

【高频考点】外国企业常驻代表机构税收管理【重要考点】(一)代表机构按规定设置账薄,根据合法、有效凭证记账,进行核算,并应按照实际履行的功能和承担的风险相配比的原则,准确计算其应税收入和应纳税所得额,在季度终了之日起15日内申报缴纳企业所得税。

(二)对账簿不健全,不能准确核算收入或成本费用,以及无法按规定据实申报的代表机构,税务机关有权采取以下方式核定应纳税所得额:1.按经费支出换算收入。

适用于能够准确反映经费支出但不能准确反映收入或成本费用的代表机构。

计算公式:收入额=本期经费支出额/(1—核定利润率)应纳企业所得税额=收入额×核定利润率×企业所得税税率经费支出额包括在中国境内、外支付给工作人员的工资薪金、奖金、津贴、福利费、物品采购费(包括汽车、办公设备等固定资产)、通讯费、差旅费、房租、设备租赁费、交通费、交际费、其他费用等。

(1)购置固定资产所发生的支出,以及代表机构设立时或者搬迁等原因所发生的装修费支出,应在发生时一次性作为经费支出额换算收入计税。

(2)利息收入不得冲抵经费支出额;发生的交际应酬费,以实际发生数额计入经费支出额。

(3)以货币形式用于我国境内的公益、救济性质的捐赠、滞纳金、罚款,以及为其总机构垫付的不属于其自身业务活动所发生的费用,不应作为代表机构的经费支出额;(4)其他费用包括:为总机构从中国境内购买样品所支付的样品费和运输费用;国外样品运往中国发生的中国境内的仓储费用、报关费用;总机构人员来华访问聘用翻译的费用;总机构为中国某个项目投标由代表机构支付的购买标书的费用等。

2.按收入总额核定应纳税所得额:适用于可以准确反映收入但不能准确反映成本费用的代表机构。

计算公式:应纳企业所得税额=收入总额×核定利润率×企业所得税税率(三)代表机构的核定利润率不应低于15%。

税务专业英语常用词汇整理

税务专业英语常用词汇整理随着全球经济的发展和国际贸易的增加,税务专业英语的重要性日益凸显。

无论是从事税务工作的专业人士,还是对税务有兴趣的学习者,掌握一些常用的税务专业英语词汇是必不可少的。

本文将整理一些常用的税务专业英语词汇,帮助读者更好地理解和运用。

一、税收类型(Types of Taxes)1. Income Tax - 所得税2. Value Added Tax (VAT) - 增值税3. Corporate Tax - 企业所得税4. Sales Tax - 销售税5. Property Tax - 房产税6. Excise Tax - 特别消费税7. Customs Duty - 关税8. Gift Tax - 赠与税9. Inheritance Tax - 遗产税10. Payroll Tax - 工资税二、税务部门(Tax Authorities)1. Tax Administration - 税务管理机构2. Internal Revenue Service (IRS) - 美国国内税务局3. Her Majesty's Revenue and Customs (HMRC) - 英国国家税务和海关总署4. State Tax Department - 州税务部门5. Tax Inspectorate - 税务检查机构6. Tax Court - 税务法院三、纳税申报(Tax Filing)1. Tax Return - 纳税申报表2. Taxpayer Identification Number (TIN) - 纳税人识别号3. Taxable Income - 应税收入4. Deductions - 扣除项5. Tax Exemptions - 免税额6. Tax Refund - 税款退还7. Tax Evasion - 逃税8. Tax Avoidance - 避税四、税务审计(Tax Auditing)1. Tax Audit - 税务审计2. Audit Trail - 审计轨迹3. Tax Compliance - 税务合规4. Taxpayer's Rights - 纳税人权益5. Tax Assessment - 税务评估6. Tax Penalty - 税务罚款7. Tax Fraud - 税务欺诈五、国际税务(International Taxation)1. Double Taxation - 双重征税2. Tax Treaty - 税收协定3. Transfer Pricing - 转让定价4. Base Erosion and Profit Shifting (BEPS) - 基地侵蚀和利润转移5. Controlled Foreign Corporation (CFC) - 受控外国公司6. Permanent Establishment (PE) - 永久机构7. Thin Capitalization - 薄资本化六、税务报告(Tax Reporting)1. Financial Statements - 财务报表2. Tax Provision - 税务准备3. Taxable Year - 纳税年度4. Taxable Period - 纳税期间5. Taxable Event - 应税事件6. Withholding Tax - 预扣税7. Taxable Gain - 应税收益8. Tax Loss - 税务损失七、税务筹划(Tax Planning)1. Tax Incentives - 税收激励措施2. Tax Credits - 税收抵免3. Tax Shelters - 避税港4. Offshore Tax Planning - 离岸税务筹划5. Tax Optimization - 税务优化6. Tax Haven - 避税天堂八、税务法律(Tax Laws)1. Tax Code - 税法典2. Tax Regulations - 税法规定3. Tax Treaties - 税收协定4. Tax Court Rulings - 税务法院裁决5. Tax Dispute Resolution - 税务争议解决结语:以上是一些常用的税务专业英语词汇,涵盖了税收类型、税务部门、纳税申报、税务审计、国际税务、税务报告、税务筹划和税务法律等方面。

财税英语税务专用词汇及税收英语

财税英语税务专用词汇及税收英语财税英语-税务专用词汇及税收英语财税英语-税务专用词汇及税收英语对话1.税务专用词汇State Administration for Taxation国家税务总局Local Taxation bureau地方税务局Business Tax营业税Individual Income Tax个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing纳税申报taxes payable应交税金the assessable period for tax payment纳税期限the timing of tax liability arising纳税义务发生时间consolidate reporting合并申报the local competent tax authority当地主管税务机关the outbound business activity外出经营活动Tax Inspection Report纳税检查报告tax avoidance逃税tax evasion避税tax base税基refund after collection先征后退withhold and remit tax代扣代缴collect and remit tax代收代缴income from authors remuneration稿酬所得income from remuneration for personal service劳务报酬所得income from lease of property财产租赁所得income from transfer of property财产转让所得contingent income偶然所得resident居民non-resident非居民tax year纳税年度temporary trips out of临时离境flat rate比例税率withholding income tax预提税withholding at source源泉扣缴State Treasury国库tax preference税收优惠the first profit-making year第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise出口型企业technologically advanced enterprise先进技术企业Special Economic Zone经济特区2.税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC:Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer:my company will begin business soon,but I have little knowledgeabout the business tax.Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

国家税务总局关于印发《外国企业常驻代表机构税收管理暂行办法》的通知

第三 十八 条

上 级 税 务 机 关 应 当 加 强 对 下 级 税 务 机 关 纳 税

( ) 务机 关要 求提 供的 其他 资料 。 六 税 第五 条 代表 机构 税务 登 记 内容发 生 变化 或 者驻 在期 届满 、

服 务 投 诉 工 作 的 指 导 与 监 督

准) 日起 3 之 0日内 , 以下 资 料 , 持 向其 所 在 地主 管 税务 机 关 申报

办 理税 务登 记 : ( ) 商 营 业 执 照 副 本 或 主 管 部 门 批 准 文 件 的 原 件 及 复 印 一 工 件 :

进 行调查 的 。 务 机关 可以 即时进 行处 理 。 税 第 三 十 四 条 纳 税 人 当 场 投 诉 事 实 成 立 的 . 投 诉 人 应 立 即 被 停 止 或 者 改 正 被 投 诉 的 行 为 . 向 纳 税 人 赔 礼 道 歉 : 诉 事 实 不 并 投 成立 的 , 理 投诉事 项的 税务 人员应 当 向纳税 人做 好 解释 工作 。 处 第 三 十 五 条 即 时 处 理 的 投 诉 案 件 , 后 应 补 填 《 税 服 务 事 纳 投诉 事项 登记表 》 行备 案 。 进

共和 国营业 税 暂行 条例 》 其实 施细 则 、 中 华人 民 共和 国增 值税 及 《 暂行 条例 》 及其 实施 细则 , 以及相 关税 收 法律 法规 , 定本办 法 。 制

第 二条 本 办 法 所 称 外 国 企 业 常 驻 代 表 机 构 。 指 按 照 国 务 是

第 三 十 条 纳 税 服 务 投 诉 事 项 应 当 自 受 理 之 日 起 3 日 内 办 O 结 ; 况 复 杂 的 , 受 理 税 务 机 关 负 责 人 批 准 , 以 适 当 延 长 办 理 情 经 可

各种税收名称英文翻译

accessions tax 财产增益税admission tax 通行税,入场税advertisement tax 广告税agricultural(animal husbandry)tax 农(牧)业税alcohol tax 酒精税all-phase transaction tax 全阶段交易税amusement tax 娱乐税anchorage dues 停泊税anti-dumping duty 反倾销税anti-profiteering tax 暴力税anti-subsidy/bounty/duty 反补贴税assimilation tax 入籍税automobile acquisition tax 汽车购置税aviation fuel tax 航空燃料税bazaar transaction 市场交易税benefit tax 受益税betterment tax 改良税beverage tax 饮料税bonus tax 奖金税border tax 边境税bourse tax 证券交易所税bourse transaction tax(securities exchange tax)有价证券交易税business consolidated tax 综合营业税business income tax 营利所得税business profit tax 营业利润税business receipts tax 营业收入税business tax 营业税canal dues/tolls 运河通行税capital gain tax 财产收益税capital interest tax 资本利息税capital levy 资本税capital transfer tax 资本转移税capitation tax 人头税car license 汽车执照税car tax 汽车税church tax 教堂税circulation tax 流通税city planning tax 城市规划税collective-owned enterprise income tax 集体企业奖金税collective-owned enterprise income tax 集体企业所得税commercial business tax 商业营业税commodity circulation tax 商业流通税commodity excise tax 商品国内消费税company income tax 公司所得税compensating tariff 补偿关税comprehensive income t ax 综合所得税consolidated tax 综合税consumption tax 消费税contingent duty 应变关税contract tax 契约税corn duty 谷物税corporate income tax 法人所得税corporate inhabitant tax 法人居民税corporate licensing tax 公司执照税corporate profit tax 公司利润税corporation franchise tax 法人登记税corporation tax 公司税,法人税coupon tax 息票利息税customs duties 关税death duty 遗产税deed tax 契税defense surtax 防卫附加税defense tax 国防税development land tax 改良土地税development tax 开发税direct consumption tax 直接消费税dividend tax 股息税document tax 凭证熟domestic rates 住宅税donation tax 赠与税earmarked tax 专用目的税earned income tax 劳物所得税easement tax 地役权税education duty 教育税electricity and gas tax 电力煤气税emergency import duties 临时进口税emergency special tax 非常特别税emergency tariff 非常关税employment tax 就业税enterprise income tax 企业所得税entertainment tax 娱乐税,筵席税entrepot duty 转口税environmental tax 环境税equalization charge/duty 平衡税estate tax 遗产税,地产税examination of deed tax 验契税excess profit tax 超额利润税excessive profit tax 过分利得税exchange tax 外汇税excise on eating,drinking and lodging 饮食旅店业消费税excise tax 国内消费税expenditure tax 消费支出税export duty(export tax)出口税extra duties 特税extra tax on profit increased 利润增长额特别税facilities services tax 设施和服务税factory tax 出厂税farm tax 田赋税feast tax 筵席税fixed assets betterment tax 固定资产改良税fixed assets tax 固定资产税foreign enterprise tax 外国公司税foreign personal holding company tax 外国私人控股公司税franchise tax 特许权税freight tax 运费税frontier tax 国境税gas tax 天然气税gasoline tax 汽油税general excise tax 普通消费税,一般消费税general property tax 一般财产税general sales tax 一般销售税gift and estate tax 赠与及财产税gift tax 赠与税good tax 货物税graduated income tax 分级所得税gross receipts tax 收入税harbor tax 港口税head tax/money 人头税highway hole tax 公路隧道通行税highway maintenance 养路税highway motor vehicle use tax 公路车辆使用税highway tax 公路税highway user tax 公路使用税house and land tax 房地产税house(property)tax 房产税household tax 户税hunter‘s license tax 狩猎执照税hunting tax 狩猎税immovable property tax 不动产税import duty 进口关税import surcharge/surtax 进口附加税import tax 进口税import turnover tax 进口商品流转税impost 进口关税incidental duties 杂捐income tax of urban and rural self-employed industrial and commercial household 城乡个体工商业户所得税income tax 所得税incorporate tax 法人税increment tax on land value 土地增值税indirect consumption tax 间接消费税indirect tax 间接税individual inhabitant tax 个人居民税individual/personal income tax 个人所得税industrial-commercial consolidated/unified tax 工商统一税industrial-commercial income tax 工商所得税industrial-commercial tax 工商税inhabitant income tax 居民所得税inheritance tax 遗产税,继承税insurance tax 保险税interest equilibrium tax 利息平衡税interest income tax 利息所得税interest tax 利息税internal revenue tax 国内收入税internal taxation of commodities 国内商品税internal taxes 国内税investment surcharge 投资收入附加税irregular tax(miscellaneous taxes)杂税issue tax 证券发行税joint venture with chinese and foreign investment income tax 中外合资经营企业所得税keelage 入港税,停泊税land holding tax 地产税land tax 土地税land use tax 土地使用税land value increment tax 地价增值税land value tax 地价税landing tax 入境税legacy tax/duty 遗产税license tax 牌照税,执照税liquidation tax 清算所得税liquor tax 酒税livestock transaction/trade tax 牲畜交易税local benefit tax 地方收益税local entertainment tax 地方娱乐税,地方筵席税local improvement tax 地方改良税local income tax 地方所得税local inhabitant tax 地方居民税local road tax‘地方公路税local surcharge 地方附加local surtax 地方附加税local taxes/duties 地方各税luxury(goods)tax 奢侈品税manufacturer‘s excise tax 生产者消费税mine area/lot tax mine tax(mineral product tax)矿区税mineral exploitation tax 矿产税mining tax 矿业税motor fuel tax 机动车燃料税motor vehicle tonnage tax 汽车吨位税municipal inhabitants tax 市镇居民税municipal locality tax 市地方税municipal tax市政税municipal trade tax 城市交易税negotiable note tax 有价证券税net worth tax 资产净值税nuisance tax 小额消费品税object tax 目的税objective tax 专用税occupancy tax占用税occupation tax 开业税occupational tax:开业许可税occupier‘s tax 农民所得税oil duties 石油进口税organization tax 开办税outlay tax 购货支出税passenger duty 客运税pavage 筑路税payroll tax 薪金工资税personal expenditures tax 个人消费支出税petrol duties 汽油税petroleum revenue tax 石油收益税pier tax 码头税plate tax 牌照税poll tax 人头税poor rate 贫民救济税port toll/duty 港口税,入港税premium tax 保险费税probate duty 遗嘱认证税processing tax 加工商品税product tax 产品税profit-seeking enterprise income tax 营利企业所得税progressive income tax 累进所得税progressive inheritance tax 累进遗产税property tax 财产税public utility tax 公用事业税purchase tax 购买税real estate tax 不动产税real estate transfer tax 不动产转让税real property acquisition tax 不动产购置税receipts tax 收入税recreation tax 娱乐税registration and license tax 登记及执照税registration tax 注册税regulation tax 调节税remittance tax 汇出税resident tax 居民税resource tax 资源税retail excise tax 零售消费税retail sales tax 零售营业税retaliatory tariff 报复性关税revenue tax/duty 营业收入税rural land tax农业土地税,田赋rural open fair tax农村集市交易税salaries tax 薪金税sales tax 营业税,销售税salt tax 盐税scot and lot 英国教区税seabed mining tax 海底矿产税securities exchange tax 证券交易税securities issue tax 证券发行税securities transfer /transaction tax 证券转让税selective employment tax 对一定行业课征的营业税selective sales tax 对一定范围课征的营业税self-employment tax 从业税service tax 劳务税settlement estate duty 遗产税severance tax 开采税,采掘熟shipping tax 船舶税slaughtering tax 屠宰税social security tax 社会保险税special commodity sales tax 特殊商品销售税special fuel oil tax 烧油特别税special land holding tax特种土地税special motor fuel retailers tax 汽车特种燃料零售商税special purpose tax 特种目的税special sales tax 特种销售税,特种经营税special tonnage tax/duty 特别吨位税spirit duty 烈酒税split tax 股本分散转移税stamp tax 印花税state income tax 州所得税state unemployment insurance tax 州失业保险税state-owned enterprise bonus tax 国营企业奖金熟state-owned enterprise income tax 国营企业所得税state-owned enterprise regulation tax 国企营业调节税state-owned enterprise wages regulation tax 国营企业工资调节税stock transfer tax 股票交易税stock-holders income tax股票所有者所得税succession tax 继承税,遗产税sugar excise tax 糖类消费税sumptuary tax 奢侈取缔税super tax 附加税supplementary income tax 补充所得税target job tax 临时工收入税tariff equalization tax 平衡关税tariff for bargaining purpose 谈判目的的关税tariff for military security 军事按关税tariff 关税tax for the examination of deed 契约检验税tax of energy resource 能源税tax on aggregate income 综合所得税tax on agriculture 农业税tax on alcohol and alcoholic liquors 酒精饮料税tax on bank note 银行券发行税tax on beer 啤酒税tax on business 企业税tax on capital gain 资本利得税tax on communication 交通税tax on consumption at hotel and restaurant 旅馆酒店消费税tax on deposit 股息税tax on dividends 契税tax on earning from employment 雇佣收入税tax on enterprise 企业税tax on goods and possessions 货物急财产税tax on house 房屋税tax on income and profit 所得及利润税tax on income from movable capital 动产所得税tax on land and building 土地房产税tax on land revenue 土地收入税tax on land value 地价税tax on luxury 奢侈品税tax on mine 矿税tax on pari-mutuels 赛马税,赌博税tax on produce 产品税tax on property paid to local authority for local purpose 由地方征收使用的财产税tax on property 财产税tax on receipts from public enterprises 公营企业收入税tax on revaluation 资产重估税tax on sale and turnover 货物销售及周转税tax on sale of property 财产出让税tax on specific products 特种产品税tax on stalls 摊贩税tax on the acquisition of immovable property tax 不动产购置税tax on the occupancy or use of business property 营业资产占有或使用税tax on transaction (tax on transfer of goods)商品交易税tax on transfer of property 财产转移税tax on transport 运输税tax on undistributed profit 未分配利润税tax on urban land 城市地产税tax on value add 增值税edtea duty 茶叶税television duty 电视税timber delivery tax 木材交易税tobacco consumption tax 烟草消费税toll turn 英国的牲畜市场税toll(toll on transit)通行税tonnage duty (tonnage dues)吨位税,船税tourist tax(travel tax)旅游税trade tax 贸易税transaction tax 交易税transfer tax 证券过户税,证券交易税transit dues 过境税,转口税turnover tax 周转税,流通税undertaking unit bonus 事业单位奖金税unemployment compensation tax 州失业补助税unemployment insurance tax 失业保险税unemployment tax 失业税unemployment tax 州失业税unified income tax 统一所得税unified transfer tax 财产转移统一税unitary income tax 综合所得税unused land tax 土地闲置熟urban house tax 城市房产税urban house-land tax 城市房地产水urban maintenance and construction tax 城市维护建设税urban real estate tax 城市房地产税use tax 使用税users tax 使用人头税utility tax 公用事业税vacant land tax 土地闲置税value added tax 增值税variable levy 差额税,差价税vehicle and vessel license-plate tax 车船牌照税vehicle and vessel use tax 车船使用税wages regulation tax 工资调节税wages tax 工资税war profit tax 战时利润税water utilization tax 水利受益税wealth /worth tax 财富税whisky tax 威士忌酒税windfall profit tax 暴利税window tax 窗税wine and tobacco tax 烟酒税wine duty 酒税withholding income tax 预提所得税withholding tax 预提税yield tax 收益税。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Reading a circular (guoshuifa [2010]. 18: resident representative offices of foreign enterprises tax management new rule

Information source: honor 2010-09-26 judge accountant release date: browse times: 100 times the author:

The state administration of taxation has promulgated on printing and distributing the resident representative offices of foreign enterprises interim measures for the administration of the tax > circular (guoshuifa [2010] no. 18), were further standardized resident representative offices of foreign enterprises in the taxation management issues.

Resident representative offices of tax registration management A representative office shall receipt of industry and commerce registration certificate (or relevant departments approved), within 30 days from the date of the relevant information, to the local competent tax authority to apply for tax registration. These material include: industry and commerce business license is approved by the competent department files or a copy of the original and photocopy; Organization code certificate copy original and photocopy; Registered address and business address proof (property right card, lease agreement) original and photocopy; As for private property, shall provide property right card or the purchase contract lawful property right proof as original and photocopy; As for leasing sites, should provide the original and photocopy, rental agreement of lease artificial natural person should also provide property proof of the original and photocopy; The chief representative (or responsible person) passport or other lawful identity, original and photocopy; The establishment of a representative office of a foreign enterprise relevant resolutions documents and set up in the territory of China other representative offices list (including name, address, telephone, and chief representative's, etc.), and the tax authority is required to provide other material. Meanwhile representative organization tax registration content changes or in the period expires, terminate business activities of the tax administration law shall, in accordance with the related regulations, and to the competent taxation authority to apply for alteration registration or cancellation of registration should be done before, and cancellation of enterprise income tax liquidation.

The tax resident representative office A circular (guoshuifa [2010], stipulated in article 6 document no. 18 representative agency shall end in quarter within 15 days from the date of the competent tax authorities shall truthfully declare and pay enterprise income tax, business tax, and in accordance with the provisional regulations on VAT and its implementing rules, the tax deadline to the competent tax authorities truthfully declare and pay VAT. Meanwhile, foreign enterprises permanent office in China belong to a non-resident enterprise, relevant enterprise income tax liquidation management shall, according to the state administration of taxation on printing and distributing the non-resident business-income tax > notice of the measures for the administration of guoshuifa [2009] 6) hereof.

The taxation of resident representative offices method A circular (guoshuifa [2010] after document no. 18, the state administration of taxation issued concerning the resident representative offices of foreign enterprises related tax management circular guoshuifa [2003] no. 28) shall be repealed, no longer press representative offices respectively business nature of different tax provisions, but according to the way the financial accounting level representative offices of the tax rules different methods.

All of the representative office shall, in accordance with the relevant laws and administrative regulations of the state council and the competent department of finance and taxation, according to the regulation, set up account books, legal, effective vouchers, accounting, and accounting in accordance with the actual performance should be the function of the risks is matched with the principle, accurate calculation taxable income and taxable income.

Also, for the incomplete of books, not accurate accounting income or the cost, and not according to a circular (guoshuifa [2010] 18 documents stipulated in article 6 truthfully declare representative organization, tax authorities shall have the right to take the following two ways to check its taxable income amount.