会计专业英语复习资料

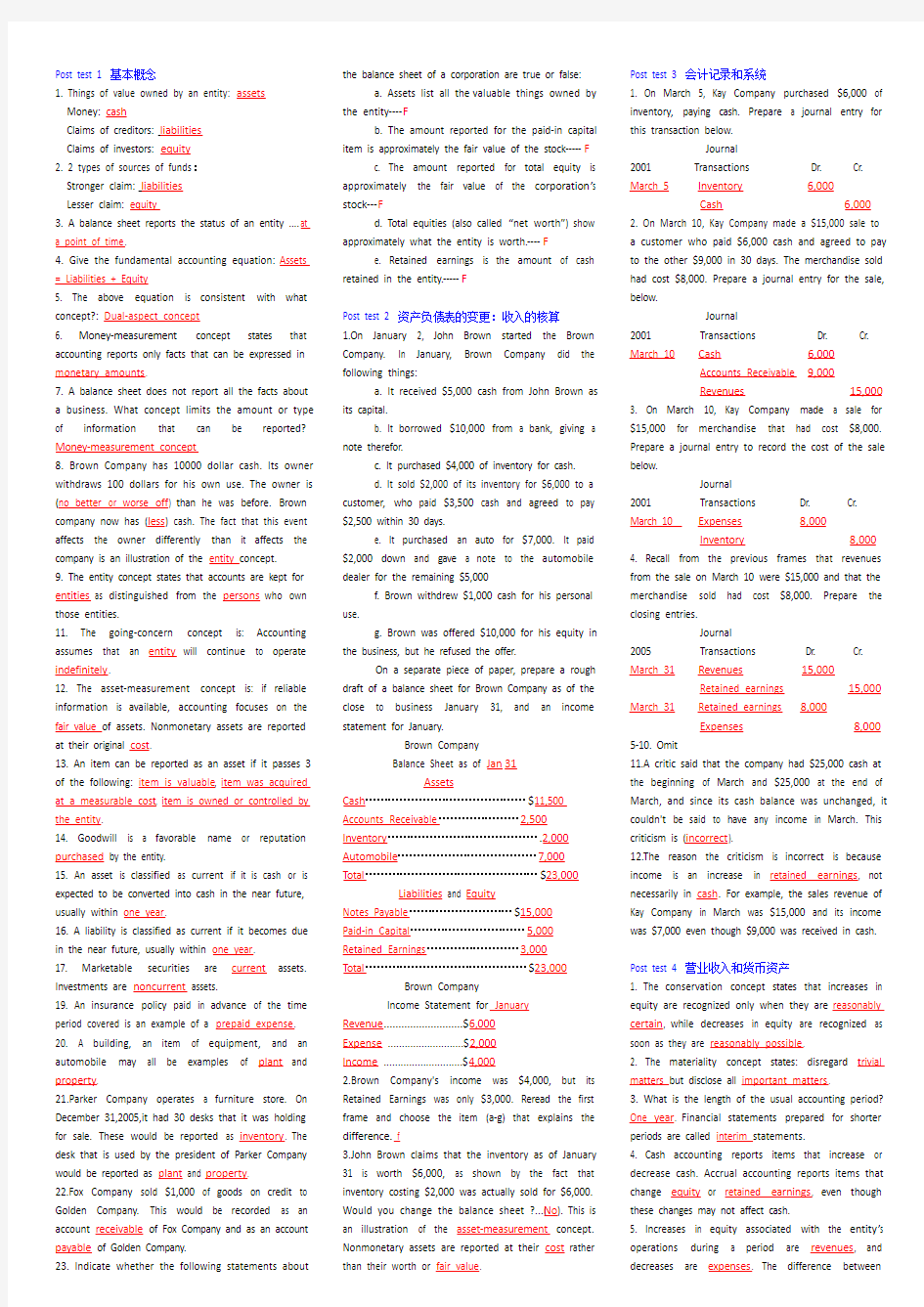

Post test 1 基本概念

1. Things of value owned by an entity: assets Money: cash

Claims of creditors: liabilities

Claims of investors: equity

2. 2 types of sources of funds:

Stronger claim: liabilities

Lesser claim: equity

3. A balance sheet reports the status of an entity ....at

a point of time.

4. Give the fundamental accounting equation: Assets = Liabilities + Equity

5. The above equation is consistent with what concept?: Dual-aspect concept

6. Money-measurement concept states that accounting reports only facts that can be expressed in monetary amounts.

7. A balance sheet does not report all the facts about

a business. What concept limits the amount or type of information that can be reported? Money-measurement concept

8. Brown Company has 10000 dollar cash. Its owner withdraws 100 dollars for his own use. The owner is (no better or worse off) than he was before. Brown company now has (less) cash. The fact that this event affects the owner differently than it affects the company is an illustration of the entity concept.

9. The entity concept states that accounts are kept for entities as distinguished from the persons who own those entities.

11. The going-concern concept is: Accounting assumes that an entity will continue to operate indefinitely.

12. The asset-measurement concept is: if reliable information is available, accounting focuses on the fair value of assets. Nonmonetary assets are reported at their original cost.

13. An item can be reported as an asset if it passes 3 of the following: item is valuable, item was acquired at a measurable cost, item is owned or controlled by the entity.

14. Goodwill is a favorable name or reputation purchased by the entity.

15. An asset is classified as current if it is cash or is expected to be converted into cash in the near future, usually within one year.

16. A liability is classified as current if it becomes due in the near future, usually within one year.

17. Marketable securities are current assets. Investments are noncurrent assets.

19. An insurance policy paid in advance of the time period covered is an example of a prepaid expense.

20. A building, an item of equipment, and an automobile may all be examples of plant and property.

21.Parker Company operates a furniture store. On December 31,2005,it had 30 desks that it was holding for sale. These would be reported as inventory. The desk that is used by the president of Parker Company would be reported as plant and property.

22.Fox Company sold $1,000 of goods on credit to Golden Company. This would be recorded as an account receivable of Fox Company and as an account payable of Golden Company.

23. Indicate whether the following statements about the balance sheet of a corporation are true or false:

a. Assets list all the valuable things owned by

the entity----F

b. The amount reported for the paid-in capital

item is approximately the fair value of the stock-----F

c. The amount reported for total equity is

approximately the fair value of the corporation’s

stock---F

d. Total equities (also called “net worth”) show

approximately what the entity is worth.----F

e. Retained earnings is the amount of cash

retained in the entity.-----F

Post test 2 资产负债表的变更:收入的核算

1.On January 2, John Brown started the Brown

Company. In January, Brown Company did the

following things:

a. It received $5,000 cash from John Brown as

its capital.

b. It borrowed $10,000 from a bank, giving a

note therefor.

c. It purchased $4,000 of inventory for cash.

d. It sold $2,000 of its inventory for $6,000 to a

customer, who paid $3,500 cash and agreed to pay

$2,500 within 30 days.

e. It purchased an auto for $7,000. It paid

$2,000 down and gave a note to the automobile

dealer for the remaining $5,000

f. Brown withdrew $1,000 cash for his personal

use.

g. Brown was offered $10,000 for his equity in

the business, but he refused the offer.

On a separate piece of paper, prepare a rough

draft of a balance sheet for Brown Company as of the

close to business January 31, and an income

statement for January.

Brown Company

Balance Sheet as of Jan31

Assets

Cash……………………………………$11,500

Accounts Receivable…………………2,500

Inventory………………………………….2,000

Automobile………………………………7,000

Total………………………………………$23,000

Liabilities and Equity

Notes Payable………………………$15,000

Paid-in Capital…………………………5,000

Retained Earnings……………………3,000

Total……………………………………$23,000

Brown Company

Income Statement for January Revenue...........................$6,000

Expense ...........................$2,000

Income ............................$4,000

2.Brown Company's income was $4,000, but its

Retained Earnings was only $3,000. Reread the first

frame and choose the item (a-g) that explains the

difference. f

3.John Brown claims that the inventory as of January

31 is worth $6,000, as shown by the fact that

inventory costing $2,000 was actually sold for $6,000.

Would you change the balance sheet ?...(No). This is

an illustration of the asset-measurement concept.

Nonmonetary assets are reported at their cost rather

than their worth or fair value.

Post test 3 会计记录和系统

1. On March 5, Kay Company purchased $6,000 of

inventory, paying cash. Prepare a journal entry for

this transaction below.

Journal

2001 Transactions Dr. Cr.

March 5Inventory6,000

Cash6,000

2. On March 10, Kay Company made a $15,000 sale to

a customer who paid $6,000 cash and agreed to pay

to the other $9,000 in 30 days. The merchandise sold

had cost $8,000. Prepare a journal entry for the sale,

below.

Journal

2001 Transactions Dr. Cr.

March 10Cash6,000

Accounts Receivable9,000

Revenues15,000

3. On March 10, Kay Company made a sale for

$15,000 for merchandise that had cost $8,000.

Prepare a journal entry to record the cost of the sale

below.

Journal

2001 Transactions Dr. Cr.

March 10 Expenses8,000

Inventory8,000

4. Recall from the previous frames that revenues

from the sale on March 10 were $15,000 and that the

merchandise sold had cost $8,000. Prepare the

closing entries.

Journal

2005 Transactions Dr. Cr.

March 31Revenues15,000

Retained earnings15,000

March 31Retained earnings8,000

Expenses8,000

5-10. Omit

11.A critic said that the company had $25,000 cash at

the beginning of March and $25,000 at the end of

March, and since its cash balance was unchanged, it

couldn't be said to have any income in March. This

criticism is (incorrect).

12.The reason the criticism is incorrect is because

income is an increase in retained earnings, not

necessarily in cash. For example, the sales revenue of

Kay Company in March was $15,000 and its income

was $7,000 even though $9,000 was received in cash.

Post test 4 营业收入和货币资产

1. The conservation concept states that increases in

equity are recognized only when they are reasonably

certain, while decreases in equity are recognized as

soon as they are reasonably possible.

2. The materiality concept states: disregard trivial

matters but disclose all important matters.

3. What is the length of the usual accounting period?

One year. Financial statements prepared for shorter

periods are called interim statements.

4. Cash accounting reports items that increase or

decrease cash. Accrual accounting reports items that

change equity or retained earnings, even though

these changes may not affect cash.

5. Increases in equity associated with the entity’s

operations during a period are revenues, and

decreases are expenses. The difference between

them is labeled income.

6. The realization concept states that revenues are recognized when goods or services are delivered.

7. H Company manufactures a table in August and places it in its retail store in September. R Smith, a customer, agrees to buy the table in October, it is delivered to him in November, and he pays the bill in December. In what month is the revenue is recognized? (November)

8. The receipt of cash is a debit to Cash. What is the offsetting credit and (type of account) for the following types of sales transactions?

Account Credited

a. Cash received prior to delivery. Advances from customers (a liability)

b. Cash received in same period as delivery. Revenue

c. Cash received after the period of delivery. Accounts receivable (an asset)

9.Similarly, revenue is a credit entry. What is the offsetting debit when revenue is recognized in each of these periods?

Account Debited

a. Revenue recognized prior to receipt of cash. Accounts receivable

b. Revenue recognized in same period as receipt of cash. Cash

c. Revenue recognized in the period following receipt of cash. Advances from customers

10.In February, H Company agrees to sell a table to a customer for $600, and the customer makes a down payment of $100 at that time. The cost of the table is $400. The table is delivered to the customer in March, and the customer pays the remaining $500 in April. Give the journal entries (if any) that would be made in February, March, and April for both the revenue and expense aspects of this transaction. February:

Cash100

Advances from customers100

March:

Accounts receivable500

Advances from customers100

Revenue600

March:

Expenses400

Inventory400

April:

Cash500

Accounts receivable500

11.At the end of 2005, M Company had accounts receivable of $200,000, and it estimated that $2,000 of this amount was a bad debt. Its revenue in 2005, with no allowance for the bad debts, was $600,000. A. What account should be debited for the $2,000 bad debt? Revenue

B. What account should be credited? Allowance for doubtful accounts

C. What amount would be reported as net accounts receivable on the balance sheet? $198,000

D. What amount would be reported as revenue on the 2005 income statement? $598,000

12.In 2006, the $2,000 of bad debt was written off.

A. What account should be debited for this written off? Allowance for doubtful accounts

B. What account should be credited? Accounts

receivable

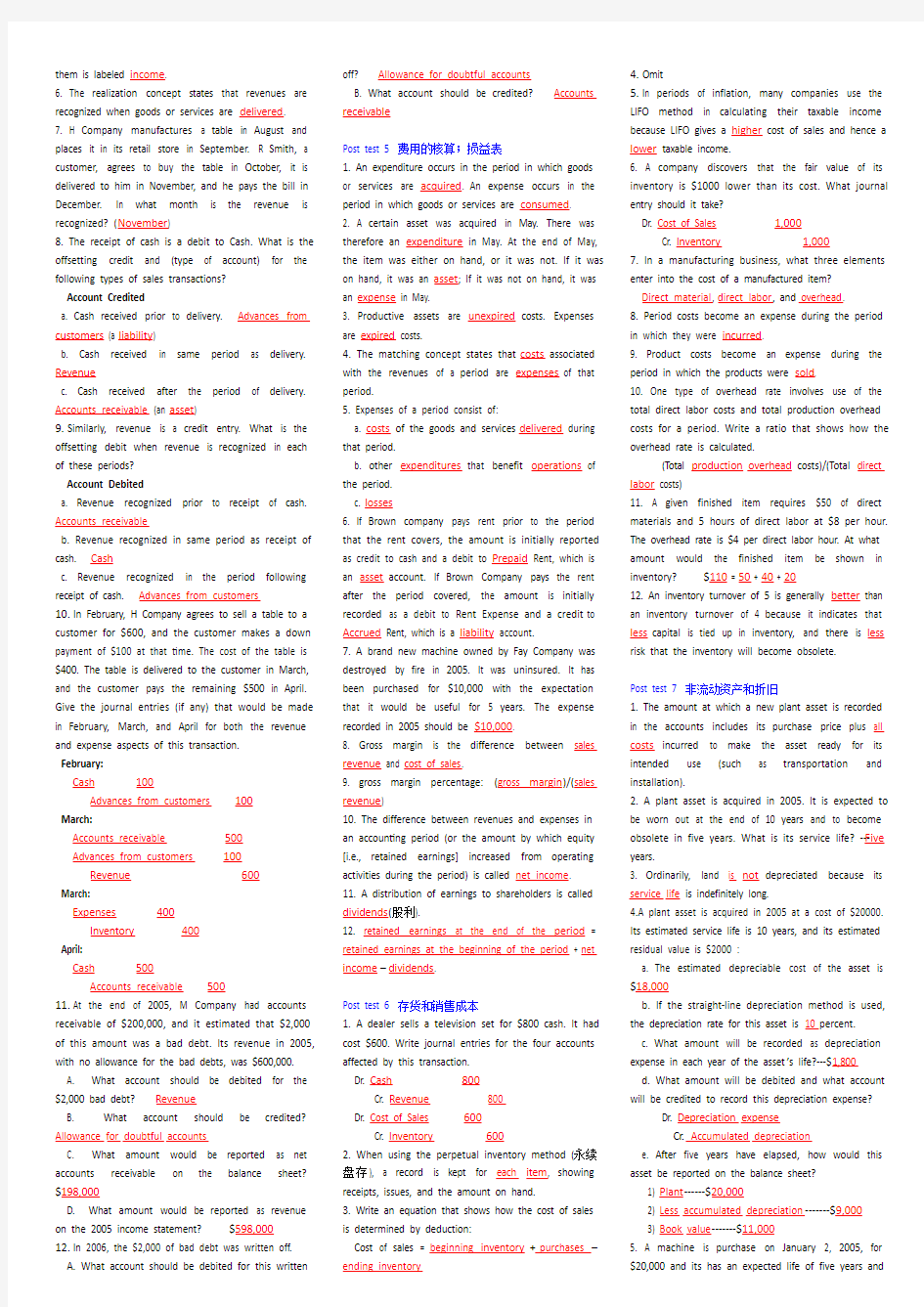

Post test 5 费用的核算;损益表

1. An expenditure occurs in the period in which goods

or services are acquired. An expense occurs in the

period in which goods or services are consumed.

2. A certain asset was acquired in May. There was

therefore an expenditure in May. At the end of May,

the item was either on hand, or it was not. If it was

on hand, it was an asset; If it was not on hand, it was

an expense in May.

3. Productive assets are unexpired costs. Expenses

are expired costs.

4. The matching concept states that costs associated

with the revenues of a period are expenses of that

period.

5. Expenses of a period consist of:

a. costs of the goods and services delivered during

that period.

b. other expenditures that benefit operations of

the period.

c. losses

6. If Brown company pays rent prior to the period

that the rent covers, the amount is initially reported

as credit to cash and a debit to Prepaid Rent, which is

an asset account. If Brown Company pays the rent

after the period covered, the amount is initially

recorded as a debit to Rent Expense and a credit to

Accrued Rent, which is a liability account.

7. A brand new machine owned by Fay Company was

destroyed by fire in 2005. It was uninsured. It has

been purchased for $10,000 with the expectation

that it would be useful for 5 years. The expense

recorded in 2005 should be $10,000.

8. Gross margin is the difference between sales

revenue and cost of sales.

9. gross margin percentage: (gross margin)/(sales

revenue)

10. The difference between revenues and expenses in

an accounting period (or the amount by which equity

[i.e., retained earnings] increased from operating

activities during the period) is called net income.

11. A distribution of earnings to shareholders is called

dividends(股利).

12. retained earnings at the end of the period=

retained earnings at the beginning of the period + net

income–dividends.

Post test 6 存货和销售成本

1. A dealer sells a television set for $800 cash. It had

cost $600. Write journal entries for the four accounts

affected by this transaction.

Dr. Cash800

Cr. Revenue800

Dr. Cost of Sales600

Cr. Inventory600

2. When using the perpetual inventory method (永续

盘存), a record is kept for each item, showing

receipts, issues, and the amount on hand.

3. Write an equation that shows how the cost of sales

is determined by deduction:

Cost of sales = beginning inventory+purchases –

ending inventory

4.Omit

5.In periods of inflation, many companies use the

LIFO method in calculating their taxable income

because LIFO gives a higher cost of sales and hence a

lower taxable income.

6. A company discovers that the fair value of its

inventory is $1000 lower than its cost. What journal

entry should it take?

Dr. Cost of Sales1,000

Cr. Inventory1,000

7. In a manufacturing business, what three elements

enter into the cost of a manufactured item?

Direct material, direct labor, and overhead.

8. Period costs become an expense during the period

in which they were incurred.

9. Product costs become an expense during the

period in which the products were sold.

10. One type of overhead rate involves use of the

total direct labor costs and total production overhead

costs for a period. Write a ratio that shows how the

overhead rate is calculated.

(Total production overhead costs)/(Total direct

labor costs)

11. A given finished item requires $50 of direct

materials and 5 hours of direct labor at $8 per hour.

The overhead rate is $4 per direct labor hour. At what

amount would the finished item be shown in

inventory? $110 = 50 + 40 + 20

12. An inventory turnover of 5 is generally better than

an inventory turnover of 4 because it indicates that

less capital is tied up in inventory, and there is less

risk that the inventory will become obsolete.

Post test 7 非流动资产和折旧

1. The amount at which a new plant asset is recorded

in the accounts includes its purchase price plus all

costs incurred to make the asset ready for its

intended use (such as transportation and

installation).

2. A plant asset is acquired in 2005. It is expected to

be worn out at the end of 10 years and to become

obsolete in five years. What is its service life? ---Five

years.

3. Ordinarily, land is not depreciated because its

service life is indefinitely long.

4.A plant asset is acquired in 2005 at a cost of $20000.

Its estimated service life is 10 years, and its estimated

residual value is $2000 :

a. The estimated depreciable cost of the asset is

$18,000

b. If the straight-line depreciation method is used,

the depreciation rate for this asset is 10 percent.

c. What amount will be recorded as depreciation

expense in each year of the asset’s life?---$1,800

d. What amount will be debited and what account

will be credited to record this depreciation expense?

Dr. Depreciation expense

Cr. Accumulated depreciation

e. After five years have elapsed, how would this

asset be reported on the balance sheet?

1) Plant------$20,000

2) Less accumulated depreciation-------$9,000

3) Book value-------$11,000

5. A machine is purchase on January 2, 2005, for

$20,000 and its has an expected life of five years and

no estimated residual value.

a. If the a machine is still in use six years later, what amount of depreciation expense will be reported in for the sixth year?----zero

b. What amount, if any, will be reported on the balance sheet at the end of the sixth year?

1) It will not be reported.-----X

2) It will be reported as follows:

Machine$20,000

Accumulated depreciation$20,000

Book value$0

6. A machine is purchase on January 2, 2005, for $50,000. It has an expected service life for 10 years and no residual value. Eleven years later it is sold for $3,000 cash.

a. There will be a gain of $3,000

b. What account will be debited and what account credited to record this amount?

Dr. Cash

Cr. Gain on disposition of assets.

7. Given an example of each of the following types of assets, and give the name of the process used in writing off the cost of the second and third type. Asset type\Example\Write-off process

Plant Asset\m achine, b uilding\Depreciation Wasting asset\c oal, o il ,m inerals\Depletion Intangible asset\g oodwill, t rademark \Amortization 8. Conoil Company purchased a producing oil property for $10,000,000 on January 2, 2005. It estimated that the property contained one million barrels of oil and that the property had a service life of 20 years. In 2005, 40,000 barrels of oil were recovered from the property. What amount should be charged as an expense in 2005?------$400,000

9. Wasting assets and intangible assets are reported on the balance sheet in a different way than building, equipment, and similar plant assets. The difference is that wasting assets are reported at the net amount and plant assets are reported at cost, accumulated depreciation, and net amount.

10. In calculating its taxable income, a company tries to report its income as low as it can. In calculating its financial accounting income, a company tries to report its income as fairly as it can.

11. As compared with straight-line depreciation, accelerated depreciation writes off more depreciation in the early years of an asset’s life and less in the later years. Over the whole life of asset, accelerated depreciation writes off the same total cost as straight-line depreciation.

12. Companies usually use accelerated depreciation in tax accounting because it reduces taxable income and hence income tax in the early years.

13. Assume an income tax rate of 40%. If a company calculated its financial accounting income (before income taxes) in 2005 as $6 million and its taxable income as$4 million, what amount would it report as income tax expense on its 2005 income statement?----$2,400,000

14. Fill in the missing name on the following table:

Income tax expense $100,000

Income tax paid -60,000

Deferred income tax$ 40,000 The $40,000 would be reported on the balance sheet as a liability.

会计专业英语翻译题知识分享

Account 、Accounting 和Accountant Account 有很多意思,常见的主要是“说明、解释;计算、帐单;银行帐户”。例如: 1、He gave me a full account of his plan。 他把计划给我做了完整的说明。 2、Charge it to my account。 把它记在我的帐上。 3、Cashier:Good afternoon。Can I help you ? 银行出纳:下午好,能为您做什么? Man :I’d like to open a bank account . 男人:我想开一个银行存款帐户。 还有account title(帐户名称、会计科目)、income account(收益帐户)、account book(帐簿)等。在account 后面加上词缀ing 就成为accounting ,其意义也相应变为会计、会计学。例如: 1、Accounting is a process of recording, classifying,summarizing and interpreting of those business activities that can be expressed in monetary terms. 会计是一个以货币形式对经济活动进行记录、分类、汇总以及解释的过程。 2、It has been said that Accounting is the language of business. 据说会计是“商业语言” 3、Accounting is one of the fastest growing profession in the modern business world. 会计是当今经济社会中发展最快的职业之一。 4、Financial Accounting and Managerial Accounting are two major specialized fields in Accounting. 财务会计和管理会计是会计的两个主要的专门领域。 其他还有accounting profession(会计职业)、accounting elements(会计要素)等。 Accountant 比Account只多ant三个字母,其意思是会计师、会计人员。例如: 1、A certified public accountant or CP A, as the term is usually abbreviated, must pass a series of examinations, after which he or she receives a certificate. 注册会计师(或,注册会计师的缩写),必须通过一系列考试方可取得证书。 2、Private accountant , also called executive or administrative accountant, handle the financial records of a business. 私人会计师,也叫做主管或行政会计师,负责处理公司的财务帐目。总之,这三个词,有很深的渊源关系。

会计专业专业术语中英文对照

会计专业专业术语中英文对照 一、会计与会计理论 会计 accounting 决策人 Decision Maker 投资人 Investor 股东 Shareholder 债权人 Creditor 财务会计 Financial Accounting 管理会计 Management Accounting 成本会计 Cost Accounting 私业会计 Private Accounting 公众会计 Public Accounting 注册会计师 CPA Certified Public Accountant 国际会计准则委员会 IASC 美国注册会计师协会 AICPA 财务会计准则委员会 FASB 管理会计协会 IMA 美国会计学会 AAA 税务稽核署 IRS 独资企业 Proprietorship 合伙人企业 Partnership 公司 Corporation

会计目标 Accounting Objectives 会计假设 Accounting Assumptions 会计要素 Accounting Elements 会计原则 Accounting Principles 会计实务过程 Accounting Procedures 财务报表 Financial Statements 财务分析Financial Analysis 会计主体假设 Separate-entity Assumption 货币计量假设 Unit-of-measure Assumption 持续经营假设 Continuity(Going-concern) Assumption 会计分期假设 Time-period Assumption 资产 Asset 负债 Liability 业主权益 Owner's Equity 收入 Revenue 费用 Expense 收益 Income 亏损 Loss 历史成本原则 Cost Principle 收入实现原则 Revenue Principle 配比原则 Matching Principle

会计专业英语重点1

Unit 1 Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。 Unit 2 Each proprietorship, partnership, and corporation is a separate entity. 每一独资企业、合伙企业和股份公司都是一个单独的主体。 In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements. 在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。即,收入是在赚取时确认,费用是在发生时确认——而不是在现金转手时。如果现金收付制替代权责发生制,那么收入和费用仅仅依靠各种现金收付活动的时间确定来确认。 Unit 3 During each accounting year ,a sequence of accounting procedures called the accounting cycle is completed. 在每一会计年度内,要依次完成被称为会计循环的会计程序。 Transactions are analyzed on the basis of the business documents known as source documents and are recorded in either the general journal or the special journal, i. e . the sales journal ,the purchases journal (invoice register ) ,cash receipts journal and cash disbursements journal . 根据业务凭证即原始凭证分析各项交易,并记入普通日记账或特种日记账,也就是销货日记账,购货日记账(发票登记簿),现金收入日记账和现金支出日记账。 A trial balance is prepared from the account balance in the ledger to prove the equality of debits and credits. 根据分类账户的余额编制试算平衡表,借以验证借项和贷项是否相等。 A T-account has a left-hand side and a right-hand side, called respectively the debit side and credit side. 一个T 型账户有左方和右方,分别称做借方和贷方。 After transactions are entered ,account balance (the difference between the sum of its debits and the sum of its credits ) can be computed.

会计专业词汇英语翻译

会计专业词汇英语翻译 今天是2011年8月5日星期五2011年8月4日星期四| 首页| 财经英语| 视听| 课堂| 资源| 互动| 动态| 在线电影| 英语论坛| 英语角| 8 您现在的位置:西财英语>>财经英语学习>>会计英语>>文章正文 专题栏目 财经词汇 文献专题 财经词汇 文献专题 最新热门 母亲节专题 会计英语词汇漫谈(六) 会计英语词汇漫谈(五) 金融专业名词翻译(八) 金融专业名词翻译(七) 商务英语口语(十四) 商务英语口语(十三) 席慕容《一棵开花的树》(… 放松,微笑,创造 [图文]跳舞学数学函数图象… 最新推荐 体育英语——水上运动英语 外贸常用词语和术语(五) 外贸常用词语和术语(四) 商务英语email高手如何询… 外贸常用词语和术语(三) 外贸常用词语和术语(二) 外贸常用词语和术语(一) 外国经典名著导读《完》附… 外国经典名著导读31-40 外国经典名著导读21-30

相关文章 会计英语词汇漫谈(六) 会计英语词汇漫谈(五) 会计英语词汇漫谈(四) 会计专业词汇英语翻译 政治风险political risk 再开票中心re-invoicing center 现代管理会计专门方法special methods of modern management accounting 现代管理会计modern management accounting 提前与延期支付Leads and Lags 特许权使用管理费fees and royalties 跨国资本成本的计算the cost of capital for foreign investments 跨国运转资本会计multinational working capital management 跨国经营企业业绩评价multinational performance evaluation 经济风险管理managing economic exposure 交易风险管理managing transaction exposure 换算风险管理managing translation exposure 国际投资决策会计foreign project appraisal 国际存货管理international inventory management 股利转移dividend remittances 公司内部贷款inter-company loans 冻结资金转移repatriating blocked funds 冻结资金保值maintaining the value of blocked funds 调整后的净现值adjusted net present value 配比原则matching 旅游、饮食服务企业会计accounting of tourism and service 施工企业会计accounting of construction enterprises 民航运输企业会计accounting of civil aviation transportation enterprises 企业会计business accounting 商品流通企业会计accounting of commercial enterprises 权责发生制原则accrual basis 农业会计accounting of agricultural enterprises 实现原则realization principle 历史成本原则principle of historical cost 外商投资企业会计accounting of enterprises with foreign investment 通用报表all-purpose financial statements 铁路运输企业会计accounting of rail way transportation enterprises

会计专业术语中英文对比(最新整理)

财务术语中英文对照大全,财务人必备! 2015-05-28注册会计师注册会计师 知道“会计”的英语怎么说吗?不会?那可真够无语的额! 想要进入外资企业做会计?想要进入四大会计师事务所工作?好的英语水平是必不可少的!所以小编特地整理了财务数中英文大全,赶紧从基础英语学起,拿起笔做好笔记吧! 增加见识也好,装装逼也行。 目录 一、会计与会计理论 二、会计循环 三、现金与应收账款 四、存货 五、长期投资 六、固定资产 七、无形资产

八、流动负债 九、长期负债 十、业主权益 十一、财务报表 十二、财务状况变动表 十三、财务报表分析 十四、合并财务报表 十五、物价变动中的会计计量 一、会计与会计理论 会计accounting 决策人Decision Maker 投资人Investor 股东Shareholder 债权人Creditor 财务会计Financial Accounting 管理会计Management Accounting 成本会计Cost Accounting

私业会计Private Accounting 公众会计Public Accounting 注册会计师CPA Certified Public Accountant 国际会计准则委员会IASC 美国注册会计师协会AICPA 财务会计准则委员会FASB 管理会计协会IMA 美国会计学会AAA 税务稽核署IRS 独资企业Proprietorship 合伙人企业Partnership 公司Corporation 会计目标Accounting Objectives 会计假设Accounting Assumptions 会计要素Accounting Elements 会计原则Accounting Principles 会计实务过程Accounting Procedures 财务报表Financial Statements 财务分析Financial Analysis 会计主体假设Separate-entity Assumption 货币计量假设Unit-of-measure Assumption 持续经营假设Continuity(Going-concern) Assumption

会计专业英语翻译

. 1. Accounting first is an economic calculation. Economic calculation includes both static phenomenon on the economy's stock of the situation, including the situation of the period of dynamic flow, including both pre-calculated plan, but also after the actual calculation. Accounting is a typical example of economic calculation, calculation of economic calculation in addition to accounting, which includes statistical computing and business computing. 2. Accounting is an economic information systems. It would be a company dispersed into the business activities of a group of objective data, providing the company's performance, problems, and enterprise funds, labor, ownership, income, costs, profits, debt, and other information. Clearly, the accounting is to provide financial information-based economy information systems, business is the licensing of a points, thus accounting has been called "corporate language." 3. Accounting is an economic management.The accounting is social production develops to a certain stage of the product development and production is to meet the needs of the management, especially with the development of the commodity economy and the emergence of competition in the market through demand management on the economy activities strict control and supervision. At the same time, the content and form of accounting constantly improve and change, from a purely accounting, scores, mainly for accounting operations, external submit accounting statements, as in prior operating forecasts, decision-making, on the matter of economic activities control and supervision, in hindsight, check. Clearly, accounting whether past, present or future, it is people's economic management activities.

会计专业英语练习.doc

I ? Matching each of the following statements with its proper term. 1.Temporary account () 2.Working papers () 3.Fiscal year () 4.Accrual accounting () 5.Posting 6.General ledger () 7.Liquidity () 8.Withdrawals () 9.CPA () 10.Transaction () 11.Accounting cycle () 12.Closing entries () 13.Reversing entry () 14.Accounting equation() 15.Double entry accounting() 16.T account () 17.Chart of accounts() 18.Account form () 19.Business entity concept () 20.Financial accounting () A.Assets taken from the business by the owner for personal use. B.The annual accounting period adopted by a business. C.Convertibility to cash D.Assets=liabilities+ owner" s equity. E.Documents that help accountants organize their work. F.An condition or directly affects its results of accounting event or condition that directly changes an entity's financial operation. G.The idea that revenues are recorded (recognized) when earned and that expenses are recorded when incurred. H.The book that contains the individual account (or control account), grouped

会计英语试题及复习资料

会计英语试题及答案 会计专业英语是会计专业人员职业发展的必要工具。学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。 一、单选题 1. ? 1) . 2) . 3) . 4) , a . A 1 3 B 1 4 C 3 D 2 3 2. $5 500 2010. 31 2010 $55 000 $46 500 . 31 2010? A. $8 500 B. $8 500 C. $14 000 D. $14 000 3. a ’s ? A. B. C. D. 4. a ? A. B. () C. () D. 5. a ’s ? (1) , , (2) (3) 4000 (4) 1000 A. (1), (3) B. (1), (2) C. (2), (3) D. (2), (4)

6. a ’s ? (1) (2) . (3) . (4) A (1), (2) (3) B (1), (2) (4) C (1), (3) (4) D (2), (3) (4) 7. 30 2010 : $992,640 $1,026,480 , , ? 1. $6,160 . 2. $27,680 a . 3. $6,160 a . 4. $21,520 . A 1 2 B 2 3 C 2 4 D 3 4 8. . (1) (2) (3) (4) ? A (1), (3) (4) B (1), (2) (4) C (1), (2) (3) D (2), (3) (4) ( = [])({ : "u3054369" }); 9. ? (1) , (2) a (3) , A. 2 3 B. C. 1 2 D. 3 10. ? (1)

会计英语专业词汇2009

1.The accounting equation and the balance sheet Accounting 会计 Assets 资产 Balance sheet 资产负债表 Bookkeeping 笔记 Budget 预算表 Capital 资本 Creditor 应付账款 Debtor 应收账款 Equity 股东基金 Horizontal balance sheet 横式资产负债表 Liabilities 负债 V ertical balance sheets 竖式资产负债表 2.The double entry system for assets, liabilities and capital Account 帐户 Credit 借方 Debit 贷方 Double entry bookkeeping 复式笔记 3 The asset of stock Purchases 购

Returns inwards 销货退回 Returns outwards 购货退出 Sales 销货 4 The effect of profit or loss on capital and the double entry system for expenses and revenues Drawings 提取 Expenses 费用 Profit 利润 Revenues 收入 5 Balancing off accounts Balancing the account 平帐 6 The trial balance Trial balance 试算表 7 Trading and profit and loss account: an introduction Gross loss 毛损 Gross profit 毛利润 Net loss 纯损 Net profit 纯利

(完整版)会计专业英语重点词汇大全

?accounting 会计、会计学 ?account 账户 ?account for / as 核算 ?certified public accountant / CPA 注册会计师?chief financial officer 财务总监?budgeting 预算 ?auditing 审计 ?agency 机构 ?fair value 公允价值 ?historical cost 历史成本?replacement cost 重置成本?reimbursement 偿还、补偿?executive 行政部门、行政人员?measure 计量 ?tax returns 纳税申报表 ?tax exempt 免税 ?director 懂事长 ?board of director 董事会 ?ethics of accounting 会计职业道德?integrity 诚信 ?competence 能力 ?business transaction 经济交易?account payee 转账支票?accounting data 会计数据、信息?accounting equation 会计等式?account title 会计科目 ?assets 资产 ?liabilities 负债 ?owners’ equity 所有者权益 ?revenue 收入 ?income 收益

?gains 利得 ?abnormal loss 非常损失 ?bookkeeping 账簿、簿记 ?double-entry system 复式记账法 ?tax bearer 纳税人 ?custom duties 关税 ?consumption tax 消费税 ?service fees earned 服务性收入 ?value added tax / VAT 增值税?enterprise income tax 企业所得税?individual income tax 个人所得税?withdrawal / withdrew 提款、撤资?balance 余额 ?mortgage 抵押 ?incur 产生、招致 ?apportion 分配、分摊 ?accounting cycle会计循环、会计周期?entry分录、记录 ?trial balance试算平衡?worksheet 工作草表、工作底稿?post reference / post .ref过账依据、过账参考?debit 借、借方 ?credit 贷、贷方、信用 ?summary/ explanation 摘要?insurance 保险 ?premium policy 保险单 ?current assets 流动资产 ?long-term assets 长期资产 ?property 财产、物资 ?cash / currency 货币资金、现金

会计专业英语习题答案

会计专业英语习题答案

Chapter. 1 1-1 As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough." 1-2 1. B 2. B 3. E 4. F 5. B 6. F 7. X 8. E 9. X 10. B 1-3 a. $96,500 ($25,000 + $71,500) b. $67,750 ($82,750 – $15,000) c. $19,500 ($37,000 – $17,500) 1-4 a. $275,000 ($475,000 – $200,000) b. $310,000 ($275,000 + $75,000 – $40,000) c. $233,000 ($275,000 – $15,000 – $27,000) d. $465,000 ($275,000 + $125,000 + $65,000) e. Net income: $45,000 ($425,000 – $105,000 – $275,000) 1-5 a. owner's equity b.liability c.asset d.asset e.owner's equity f. asset 1-6 a. Increases assets and increases owner’s equity. b. Increases assets and increases owner’s equity. c. Decreases assets and decreases owner’s equity.

(完整版)会计专业英语词汇大全

一.专业术语 Accelerated Depreciation Method 计算折旧时,初期所提的折旧大于后期各年。加速折旧法主要包括余额递减折旧法 declining balance depreciation,双倍余额递减折旧法 double declining balance depreciation,年限总额折旧法 sum of the years' depreciation Account 科目,帐户 Account format 帐户式 Account payable 应付帐款 Account receivable 应收帐款 Accounting cycle 会计循环,指按顺序进行记录,归类,汇总和编表的全过程。在连续的会计期间周而复始的循环进行 Accounting equation 会计等式:资产= 负债+ 业主权益 Accounts receivable turnover 应收帐款周转率:一个时期的赊销净额/ 应收帐款平均余额 Accrual basis accounting 应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。 Accrued dividend 应计股利 Accrued expense 应记费用:指本期已经发生而尚未支付的各项费用。 Accrued revenue 应记收入 Accumulated depreciation 累计折旧 Acid-test ratio 酸性试验比率,企业速动资产与流动负债的比率,又称quick ratio Acquisition cost 购置成本 Adjusted trial balance 调整后试算表,指已作调整分录但尚未作结账分录的试算表。 Adjusting entry 调整分录:在会计期末所做的分录,将会计期内因某些原因而未曾记录或未适当记录的会计事项予以记录入帐。 Adverse 应收帐款的帐龄分类 Aging of accounts receivable 应收帐款的帐龄分类 Allocable 应分配的 Allowance for bad debts 备抵坏帐 Allowance for depreciation 备抵折旧 Allowance for doubtful accounts 呆帐备抵 Allowance for uncollectible accounts 呆帐备抵 Allowance method 备抵法:用备抵帐户作为各项资产帐户的抵销帐户,以使交易的费用与收入相互配合的方法。 Amortization 摊销,清偿 Annuity due 期初年金 Annuity method 年金法 Appraisal method 估价法 Asset 资产 Bad debt 坏帐 Bad debt expense 坏帐费用:将坏帐传人费用帐户,冲销应收帐款 Balance sheet 资产负债表 Bank discount 银行贴现折价 Bank reconciliation 银行往来调节:企业自身的存款帐户余额和银行对帐单的余额不符时,应对未达帐进行调节。 Bank statement 银行对帐单,银行每月寄给活期存款客户的对帐单,列明存款兑现支票和服务费用。

会计专业英语模拟试题及答案word版本

《会计专业英语》模拟试题及答案 一、单选题 (每题 1 分,共20分) 1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost. 2) In order to achieve comparability it may sometimes be necessaryto override the prudence concept. 3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 2. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010? A. $8 500 Dr B. $8 500 Cr C. $14 000 Dr D. $14 000 Cr 3. Should dividends paid appear on the face of a companycash flow sta'tesment? A. Yes B. No C. Not sure D. Either 4. Which of the following inventory valuation methods is likely to lead to the highest figure for closing inventory at a time when prices are dropping? A. Weighted Average cost B. First in first out (FIFO) C. Last in first out (LIFO) D. Unit cost 5. Which of following items may appear as non-currentassets in a company the'stsatement of financial position? (1) plant, equipment, and property (2) company car (3) ?4000 cash (4) ?1000 cheque A. (1), (3)

会计专业英语-模拟题

《会计专业英语》模拟题 一.单选题 1.The Realization Principle indicates that revenue usually should be recognized and recorded in the accounting record(). A.when goods are sole or services are rendered to customers B.when cash is collected from customers C.at the end of the accounting period D.only when the revenue can be matched by an equal dollar amount of expenses [答案]:A 2.The Matching Principle:(). A.applies only to situations in which a cash payment occurs before an expense is recognized B.applies only to situations in which a cash receipt occurs before revenue is recognized C.is used in accrual accounting to determine the proper period for recognition of expenses D.is used in accrual accounting to determine the proper period in which to recognize revenue [答案]:C 3.Xxx company paid $2850 on account. The effect of this transaction on the accounting equation is to (). A.decrease assets and decrease owner’s equity B.increase liabilities and decrease owner’s equity C.have no effect on total assets D.decrease assets and decrease liabilities [答案]:D 4.Which of the following concepts belongs to accounting assumption?(). A.Conservation B.Money measurement C.Materiality D.Consistency [答案]:B 5.Which of these is/are an example of an asset account?___ A.service revenue B.withdrawals C.supplies D.all of the above [答案]:C 6.Which of these statements is false?(). A.increase in assets and increase in revenues are recorded with a debit B.increase in liabilities and increase in owner’s equity are recorded with a c redit

管理会计专业术语词汇大全(英文版)

管理会计专业术语词汇大全(英文版)

changes. Batch-level activities Activities that are performed each time a batch is produced. Benchmarking An approach that uses best practices as the standard for evaluating activity performance. Best-fitting line The line that fits a set of data points the best in the sense that the sum of the squared deviations of the data points from the line is the smallest. Binding constraints Constraints whose resources are fully utilized. Break-even point The point where total sales revenue equals total costs; the point of zero profits. Activity output The result or product of an activity. Activity output measure The number of times an activity is performed. It is the quantifiable measure of the output. Activity reduction Decreasing the time and resources required by an activity. Activity selection The process of choosing among sets of activities caused by competing strategies. Activity sharing Increasing the efficiency of necessary activities by using economies of scale. Activity volume variance The cost of the actual activity capacity acquired and the capacity that should be used. Activity-based cost (ABC) system A cost system that first traces costs to activities and then traces costs from activities to products. Activity-based costing (ABC) A cost assignment approach that first uses direct and driver tracing to assign costs to activities and then uses drivers to assign costs to cost objects. Activity-based management (ABM) A systemwide, integrated approach that