数据,模型与决策练习题含答案

数据模型与决策课程大作业(完整资料).doc

【最新整理,下载后即可编辑】数据模型与决策课程大作业以我国汽油消费量为因变量,乘用车销量、城镇化率和90#汽油吨价与城镇居民人均可支配收入的比值为自变量时行回归(数据为年度时间序列数据)。

试根据得到部分输出结果,回答下列问题:1)“模型汇总表”中的R方和标准估计的误差是多少?2)写出此回归分析所对应的方程;3)将三个自变量对汽油消费量的影响程度进行说明;4)对回归分析结果进行分析和评价,指出其中存在的问题。

1)“模型汇总表”中的R方和标准估计的误差是多少?答案:R方为0.993^2=0.986 ;标准估计的误差为120910.147^(0.5)=347.722)写出此回归分析所对应的方程;答案:假设汽油消费量为Y,乘用车销量为a,城镇化率为b,90#汽油吨价/城镇居民人均可支配收入为c,则回归方程为:Y=240.534+0.00s027a+8649.895b-198.692c3)将三个自变量对汽油消费量的影响程度进行说明;乘用车销量对汽油消费量相关系数只有0.00027,数值太小,几乎没有影响,但是城镇化率对汽油消费量相关系数是8649.895,具有明显正相关,当城镇化率每提高1,汽油消费量增加8649.895。

乘用90#汽油吨价/城镇居民人均可支配收入相关系数为-198.692,呈明显负相关,即乘用90#汽油吨价/城镇居民人均可支配收入每增加1个单位,汽油消费量降低198.692个单位。

a, b, c三个自变量的sig值为0.000、0.000、0.009,在显著性水平0.01情形下,乘用车消费量对汽油消费量的影响显著为正。

(4)对回归分析结果进行分析和评价,指出其中存在的问题。

在学习完本课程之后,我们可以统计方法为特征的不确定性决策、以运筹方法为特征的策略的基本原理和一般方法为基础,结合抽样、参数估计、假设分析、回归分析等知识对我国汽油消费量影响因素进行了模拟回归,并运用软件计算出回归结果,故根据回归结果,对具体回归方程,回归准确性,自变量影响展开分析。

数据模型与决策练习题含答案

1、某企业目前的损益状况如在下:销售收入(1000件×10元/件) 10 000销售成本:变动成本(1000件×6元/件) 6 000固定成本 2 000销售和管理费(全部固定) 1 000利润 1 000(1)假设企业按国家规定普调工资,使单位变动成本增加4%,固定成本增加1%,结果将会导致利润下降。

为了抵销这种影响企业有两个应对措施:一是提高价格5%,而提价会使销量减少10%;二是增加产量20%,为使这些产品能销售出去,要追加500元广告费。

请做出选择,哪一个方案更有利?(2)假设企业欲使利润增加50%,即达到1 500元,可以从哪几个方面着手,采取相应的措施。

2、某企业每月固定制造成本1 000元,固定销售费100元,固定管理费150元;单位变动制造成本6元,单位变动销售费0.70元,单位变动管理费0.30元;该企业生产一种产品,单价10元,所得税税率50%;本月计划产销600件产品,问预期利润是多少?如拟实现净利500元,应产销多少件产品?3、某企业生产甲、乙、丙三种产品,固定成本500000元,有关资料见下表(单位:元):要求:(1)计算各产品的边际贡献;(2)计算加权平均边际贡献率;(3)根据加权平均边际贡献率计算预期税前利润。

4、某企业每年耗用某种材料3 600千克,单位存储成本为2元,一次订货成本25元。

则经济订货批量、每年最佳订货次数、最佳订货周期、与批量有关的存货总成本是多少?5.有10个同类企业的生产性固定资产年平均价值和工业总产值资料如下:(1)说明两变量之间的相关方向;(2)建立直线回归方程;(3)估计生产性固定资产(自变量)为1100万元时总产值(因变量)的可能值。

6、某商店的成本费用本期发生额如表所示,采用账户分析法进行成本估计。

首先,对每个项目进行研究,根据固定成本和变动成本的定义及特点结合企业具体情况来判断,确定它们属于哪一类成本。

例如,商品成本和利息与商店业务量关系密切,基本上属于变动成本;福利费、租金、保险、修理费、水电费、折旧等基本上与业务量无关,视为固定成本。

数据模型与决策试题及参考答案

数据模型与决策试题及参考答案本文为《数据模型与决策》复,共分为五个填空题。

1.已知成年男子的身高服从正态分布N(167.48,6.092),随机调查100位成年男子的身高,那么,这100位男子身高的平均数服从的分布是N(167.48,0.609)。

2.某高校想了解大学生每个月的消费情况,随机抽取了100名大学生,算得平均月消费额为1488元,标准差是2240元。

根据正态分布的“68-95-99”法则,该高校大学生每个月的消费额的95%估计区间为[1040,1936]。

3.从遗传规律看,一个产妇生男生女的概率是一样的,都是50%,但也有个人的特殊情况。

假设某人前一胎是女孩,那么她的下一胎也是女孩的概率为0.55;如果某人前一胎是男孩,那么她的下一胎还是男孩的概率为0.48.已知___第一胎是女孩,那么她的第三胎生男孩的概率是0.4653.4.调查发现,一个刚参加工作的MBA毕业生在顶级管理咨询公司的初始年薪可以用均值为9万美元和标准差是2万美元的正态分布来表示,那么一个这样的毕业生初始年薪超过9万美元的概率是0.5.5.结合生活实际,判断两个量之间的相关系数大概有多大?比如问您孩子身高与父母身高的的相关系数可能是0.6.1.孩子与父母的身高存在相关性,这个相关性可以用相关系数来衡量。

相关系数的取值范围为-1到1,绝对值越接近1表示相关性越强,绝对值越接近0表示相关性越弱。

在这个问题中,孩子与父母平均身高的相关性比较高,应该选0.9作为相关系数。

2.模拟仿真的关键步骤包括:确定仿真目标、建立仿真模型、选择仿真工具、设计实验方案、进行仿真实验、分析仿真结果、验证仿真模型。

模拟仿真是一种通过计算机模拟来研究和分析实际系统的方法,可以帮助人们更好地理解和预测系统的行为,从而提供决策支持和优化方案。

3.___某天上班路上捡到10元钱属于小概率事件。

小概率事件是指在一次试验中,出现的概率很小的事件。

通常认为,小概率事件的概率小于等于0.05.在这个问题中,其他选项中抛硬币的结果全是正面的概率都大于0.05,因此不属于小概率事件。

数据模型与决策--作业大全详解

P45.1.21.2N ewtowne有一副珍贵的油画,并希望被拍卖。

有三个竞争者想得到该幅油画。

第一个竞拍者将于星期一出价,第二个竞拍者将于星期二出价,而第三个竞拍者将于星期三出价。

每个竞拍者必须在当天作出接受或拒绝的决定。

如果三个竞拍者都被拒绝,那个该油画将被标价90万美元出售。

Newtowne 拍卖行的主任对拍卖计算的概率结果列在表1.5中。

例如拍卖人的估计第二个拍卖人出价200万美元的概率p=0.9.(a)对接受拍卖者的决策问题构造决策树。

1、买家1:如果出价300万,就接受,如果出价200万,就拒绝;2、买家2:如果出价400万,就接受,如果出价200万,也接受。

接受买家1200 200200接受买家22002002000.50.9接受买家3买家1出价200万买家2出价200万0.7100 21买家3出价100万100100 0220020010100拒绝买家390拒绝买家290900190接受买家30.3400买家3出价400万400400拒绝买家1104000220拒绝买家3909090接受买家24004004000.1接受买家3买家2出价400万0.71001买家3出价100万100100040010100260拒绝买家390拒绝买家290900190接受买家30.3400买家3出价400万40040010400拒绝买家3909090接受买家1300 300300接受买家22002002000.50.9接受买家3买家1出价300万买家2出价200万0.7100 11买家3出价100万100100 0300020010100拒绝买家390拒绝买家290900190接受买家30.3400买家3出价400万400400拒绝买家1104000220拒绝买家3909090接受买家24004004000.1接受买家3买家2出价400万0.71001买家3出价100万100100040010100拒绝买家390拒绝买家290900190接受买家30.3400买家3出价400万40040010400拒绝买家39090902.9在美国有55万人感染HIV病毒。

数据模型与决策试题及参考答案

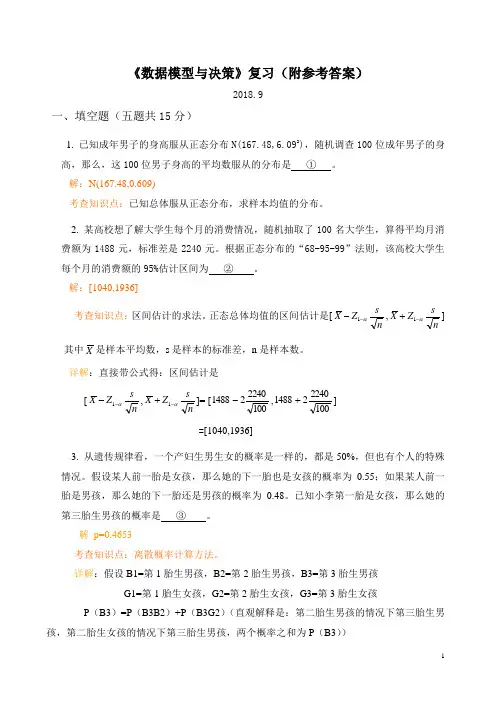

《数据模型与决策》复习(附参考答案)2018.9一、填空题(五题共15分)1. 已知成年男子的身高服从正态分布N(167.48,6.092),随机调查100位成年男子的身高,那么,这100位男子身高的平均数服从的分布是 ① 。

解:N(167.48,0.609)考查知识点:已知总体服从正态分布,求样本均值的分布。

2. 某高校想了解大学生每个月的消费情况,随机抽取了100名大学生,算得平均月消费额为1488元,标准差是2240元。

根据正态分布的“68-95-99”法则,该高校大学生每个月的消费额的95%估计区间为 ② 。

解:[1040,1936]考查知识点:区间估计的求法。

正态总体均值的区间估计是[n s Z X α--1,nsZ X α-+1] 其中X 是样本平均数,s 是样本的标准差,n 是样本数。

详解:直接带公式得:区间估计是 [n s Z X α--1,nsZ X α-+1]= [100224021488-,100224021488+]=[1040,1936]3. 从遗传规律看,一个产妇生男生女的概率是一样的,都是50%,但也有个人的特殊情况。

假设某人前一胎是女孩,那么她的下一胎也是女孩的概率为0.55;如果某人前一胎是男孩,那么她的下一胎还是男孩的概率为0.48。

已知小李第一胎是女孩,那么她的第三胎生男孩的概率是 ③ 。

解 p=0.4653考查知识点:离散概率计算方法。

详解:假设B1=第1胎生男孩,B2=第2胎生男孩,B3=第3胎生男孩 G1=第1胎生女孩,G2=第2胎生女孩,G3=第3胎生女孩P (B3)=P (B3B2)+P (B3G2)(直观解释是:第二胎生男孩的情况下第三胎生男孩,第二胎生女孩的情况下第三胎生男孩,两个概率之和为P (B3))= P(B3|B2)P(B2)+P(B3|G2)P(G2)=0.48×(1-0.55)+(1-0.55) ×0.55=0.46534. 调查发现,一个刚参加工作的MBA毕业生在顶级管理咨询公司的初始年薪可以用均值为9万美元和标准差是2万美元的正态分布来表示,那么一个这样的毕业生初始年薪超过9万美元的概率是④。

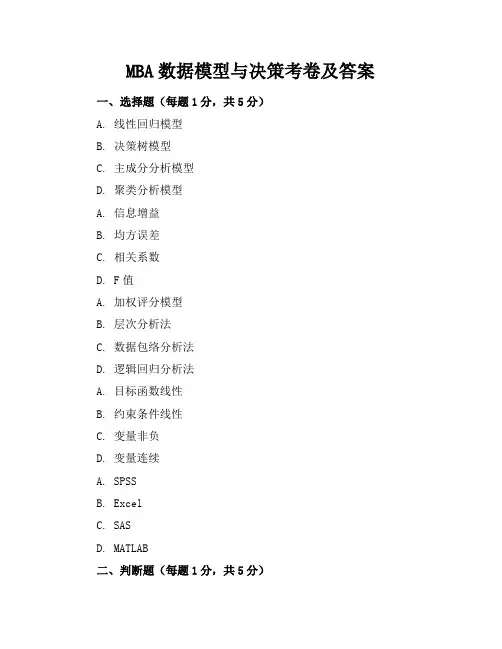

MBA数据模型与决策考卷及答案

MBA数据模型与决策考卷及答案一、选择题(每题1分,共5分)A. 线性回归模型B. 决策树模型C. 主成分分析模型D. 聚类分析模型A. 信息增益B. 均方误差C. 相关系数D. F值A. 加权评分模型B. 层次分析法C. 数据包络分析法D. 逻辑回归分析法A. 目标函数线性B. 约束条件线性C. 变量非负D. 变量连续A. SPSSB. ExcelC. SASD. MATLAB二、判断题(每题1分,共5分)1. 数据模型可以用来描述现实世界中的数据关系和规律。

(√)2. 在决策分析中,只需要关注定量数据,无需考虑定性数据。

(×)3. 熵值法可以用于评估决策树的节点纯度。

(√)4. 线性规划问题中,目标函数和约束条件都必须是线性的。

(√)5. 数据挖掘就是从大量数据中提取有价值信息的过程。

(√)三、填空题(每题1分,共5分)1. 在决策树中,用于分割节点的属性称为______属性。

2. 多属性决策方法中,加权评分模型的核心是确定各属性的______。

3. 线性规划问题中,目标函数的取值称为______。

4. 在数据挖掘过程中,将原始数据转换为适合挖掘的格式的过程称为______。

5. ______是一种基于样本相似度的分类方法。

四、简答题(每题2分,共10分)1. 简述决策树的基本原理。

2. 什么是线性规划?它有哪些应用场景?3. 简述主成分分析的基本步骤。

4. 聚类分析的主要目的是什么?5. 请列举三种常用的多属性决策方法。

五、应用题(每题2分,共10分)1. 某企业拟投资两个项目,项目A的预期收益为100万元,风险系数为0.6;项目B的预期收益为150万元,风险系数为0.8。

请使用加权评分模型为企业选择投资项目。

2. 某公司生产两种产品,产品1的单件利润为10元,产品2的单件利润为15元。

生产一件产品1需要2小时,生产一件产品2需要3小时。

公司每月最多生产100件产品,且生产时间不超过240小时。

数据模型与决策练习题含答案

1、某企业目前的损益状况如在下:销售收入(1000件×10元/件) 10 000销售成本:变动成本(1000件×6元/件) 6 000固定成本 2 000销售和管理费(全部固定) 1 000利润 1 000(1)假设企业按国家规定普调工资,使单位变动成本增加4%,固定成本增加1%,结果将会导致利润下降。

为了抵销这种影响企业有两个应对措施:一是提高价格5%,而提价会使销量减少10%;二是增加产量20%,为使这些产品能销售出去,要追加500元广告费。

请做出选择,哪一个方案更有利?(2)假设企业欲使利润增加50%,即达到1 500元,可以从哪几个方面着手,采取相应的措施。

2、某企业每月固定制造成本1 000元,固定销售费100元,固定管理费150元;单位变动制造成本6元,单位变动销售费0.70元,单位变动管理费0.30元;该企业生产一种产品,单价10元,所得税税率50%;本月计划产销600件产品,问预期利润是多少?如拟实现净利500元,应产销多少件产品?3、某企业生产甲、乙、丙三种产品,固定成本500000元,有关资料见下表(单位:元):要求:(1)计算各产品的边际贡献;(2)计算加权平均边际贡献率;(3)根据加权平均边际贡献率计算预期税前利润。

4、某企业每年耗用某种材料3 600千克,单位存储成本为2元,一次订货成本25元。

则经济订货批量、每年最佳订货次数、最佳订货周期、与批量有关的存货总成本是多少?5.有10个同类企业的生产性固定资产年平均价值和工业总产值资料如下:(1)说明两变量之间的相关方向;(2)建立直线回归方程;(3)估计生产性固定资产(自变量)为1100万元时总产值(因变量)的可能值。

6、某商店的成本费用本期发生额如表所示,采用账户分析法进行成本估计。

首先,对每个项目进行研究,根据固定成本和变动成本的定义及特点结合企业具体情况来判断,确定它们属于哪一类成本。

例如,商品成本和利息与商店业务量关系密切,基本上属于变动成本;福利费、租金、保险、修理费、水电费、折旧等基本上与业务量无关,视为固定成本。

数据,模型与决策练习题含答案

1、某企业目前的损益状况如在下:销售收入(1000件×10元/件) 10 000销售成本:变动成本(1000件×6元/件) 6 000固定成本 2 000销售和管理费(全部固定) 1 000利润 1 000(1)假设企业按国家规定普调工资,使单位变动成本增加4%,固定成本增加1%,结果将会导致利润下降。

为了抵销这种影响企业有两个应对措施:一是提高价格5%,而提价会使销量减少10%;二是增加产量20%,为使这些产品能销售出去,要追加500元广告费。

请做出选择,哪一个方案更有利(2)假设企业欲使利润增加50%,即达到1 500元,可以从哪几个方面着手,采取相应的措施。

2、某企业每月固定制造成本1 000元,固定销售费100元,固定管理费150元;单位变动制造成本6元,单位变动销售费元,单位变动管理费元;该企业生产一种产品,单价10元,所得税税率50%;本月计划产销600件产品,问预期利润是多少如拟实现净利500元,应产销多少件产品3、某企业生产甲、乙、丙三种产品,固定成本500000元,有关资料见下表(单位:元):要求:(1)计算各产品的边际贡献;(2)计算加权平均边际贡献率;(3)根据加权平均边际贡献率计算预期税前利润。

4、某企业每年耗用某种材料3 600千克,单位存储成本为2元,一次订货成本25元。

则经济订货批量、每年最佳订货次数、最佳订货周期、与批量有关的存货总成本是多少5.有10个同类企业的生产性固定资产年平均价值和工业总产值资料如下:(1)说明两变量之间的相关方向;(2)建立直线回归方程;(3)估计生产性固定资产(自变量)为1100万元时总产值(因变量)的可能值。

6、某商店的成本费用本期发生额如表所示,采用账户分析法进行成本估计。

首先,对每个项目进行研究,根据固定成本和变动成本的定义及特点结合企业具体情况来判断,确定它们属于哪一类成本。

例如,商品成本和利息与商店业务量关系密切,基本上属于变动成本;福利费、租金、保险、修理费、水电费、折旧等基本上与业务量无关,视为固定成本。

数据、模型与决策(运筹学)课后习题和案例答案004

CHAPTER 4 LINEAR PROGRAMMING: FORMULATION AND APPLICATIONSReview Questions4.1-1 Determine which levels should be chosen of different advertising media to obtain the mosteffective advertising mix for the new cereal.4.1-2 The expected number of exposures.4.1-3 TV commercials are not being used and that is the primary method of reaching youngchildren.4.1-4 They need to check the assumption that fractional solutions are allowed and the assumptionof proportionality.4.2-1 Each functional constraint in the linear programming model is a resource constraint.4.2-2 Amount of resource used ≤ Amount of resource available.4.2-3 1) The amount available of each limited resource.2) The amount of each resource needed by each activity. Specifically, for eachcombination of resource and activity, the amount of resource used per unit of activitymust be estimated.3) The contribution per unit of each activity to the overall measure of performance.4.2-4 The three activities in the examples are determining the most profitable mix of productionrates for two new products, capital budgeting, and choosing the mix of advertising media.4.2-5 The resources in the examples are available production capacities of different plants,cumulative investment capital available by certain times, financial allocations foradvertising and for planning purposes, and TV commercial spots available for purchase. 4.3-1 For resource-allocation problems, limits are set on the use of various resources, and thenthe objective is to make the most effective use of these given resources. For cost-benefit-tradeoff problems, management takes a more aggressive stance, prescribing what benefitsmust be achieved by the activities under consideration, and then the objective is to achieve all these benefits with minimum cost.4.3-2 The identifying feature for a cost-benefit-tradeoff problem is that each functional constraintis a benefit constraint.4.3-3 Level achieved ≥ Minimum acceptable level.4.3-4 1) The minimum acceptable level for each benefit (a managerial policy decision).2) For each benefit, the contribution of each activity to that benefit (per unit of theactivity).3) The cost per unit of each activity.4.3-5 The activities for the examples are choosing the mix of advertising media, personnelscheduling, and controlling air pollution.4.3-6 The benefits for the examples are increased market share, minimizing total personnel costswhile meeting service requirements, and reductions in the emission of pollutants.4.4-1 Distribution-network problems deal with the distribution of goods through a distributionnetwork at minimum cost.4.4-2 An identifying feature for a distribution-network problem is that each functional constraintis a fixed-requirement constraint.4.4-3 In contrast to the ≤ form for resource constraints and the ≥ form for benefit constraints,fixed-requirement constraints have an = form.4.4-4 Factory 1 must ship 12 lathes, Factory 2 must ship 15 lathes, Customer 1 must receive 10lathes, Customer 2 must receive 8 lathes, and Customer 3 must receive 9 lathes.4.5-1 Two new goals need to be incorporated into the model. The first is that the advertisingshould be seen by at least 5 million young children. The second is that the advertisingshould be seen by at least 5 million parents of young children.4.5-2 Two benefit constraints and a fixed-requirement constraint are included in the new linearprogramming model.4.5-3 Management decided to adopt the new plan because it does a much better job of meeting allof management’s goals f or the campaign.4.6-1 Mixed problems may contain all three types of functional constraints: resource constraints,benefit constraints, and fixed-requirement constraints.4.6-2 The Save-It Co. problem is an example of a blending problem where the objective is to findthe best blend of ingredients into final products to meet certain specifications.4.7-1 A linear programming model must accurately reflect the managerial view of the problem.4.7-2 Large linear programming models generally are formulated by management science teams.4.7-3 The line of communication between the management science team and the manager is vital.4.7-4 Model validation is a testing process used on an initial version of a model to identify theerrors and omissions that inevitably occur when constructing large models.4.7-5 The process of model enrichment involves beginning with a relatively simple version of themodel and then using the experience gained with this model to evolve toward moreelaborate models that more nearly reflect the complexity of the real problem.4.7-6 What-if analysis is an important part of a linear programming study because an optimalsolution can only be solved for with respect to one specific version of the model at a time.Management may have “what-if” quest ions about how the solution will change givenchanges in the model formulation.4.8-1 The Ponderosa problem falls into the mixed problem category. The United Airlinesproblem is basically a cost-benefit-tradeoff problem. The Citgo problem is a distribution-network problem.4.8-2 The Ponderosa problem has 90 decision variables, the United Airlines problem has over20,000 decision variables, and the Citgo problem has about 15,000 decision variables.4.8-3 Two factors helped make the Ponderosa application successful. One is that theyimplemented a financial planning system with a natural-language user interface, with theoptimization codes operating in the background. The other success factor was that theoptimization system used was interactive.4.8-4 The most important success factor in the United Airlines application was the support ofoperational managers and their staffs.4.8-5 The factors that helped make the Citgo application successful were developing outputreports in the language of managers to mee t their needs, using “what-if” analysis, thesupport of operational managers, and, most importantly, the unlimited support provided the management science task force by top management.Problems4.1 a)Data cells: B2:E2, B6:E7, H6:H7, B13, and D13Changing cells: B11:E11Target cell: H114 5 6 7FBudgetSpent=SUMPRODUCT(B6:E6,$B$11:$E$11)=SUMPRODUCT(B7:E7,$B$11:$E$11)91011HTotal Exposures(thousands)=SUMPRODUCT(B2:E2,B11:E11)b) This is a linear programming model because the decisions are represented by changing cells that can have any value that satisfy the constraints. Each constraint has an output cell on the left, a mathematical sign in the middle, and a data cell on the right. The overall level of performance is represented by the target cell and the objective is to maximize that cell. Also, the Excel equation for each output cell is expressed as aSUMPRODUCT function where each term in the sum is the product of a data cell and a changing cell.c) Let T = number of commercials on TV M = number of advertisements in magazines R = number of commercials on radio S = number of advertisements in Sunday supplements. Maximize Exposures (thousands) = 140T + 60M + 90R + 50S subject to 300T + 150M + 200R + 100S ≤ 4,000 ($thousands) 90T + 30M + 50R + 40S ≤ 1,000 ($thousands) T ≤ 5 spots R ≤ 10 spots and T ≥ 0, M ≥ 0, R ≥ 0, S ≥ 0. 4.2b)Bestd) Let x1 = level of activity 1x2 = level of activity 2Maximize Contribution = $20x1 + $30x2subject to 2x1 + x2≤ 103x1 + 3x2≤ 202x1 + 4x2≤ 20and x1≥ 0, x2≥ 0.e) Optimal Solution: (x1, x2) = (3.333, 3.333) and Total Contribution = $166.67.4.3 a)b) Let x1 = level of activity 1x2 = level of activity 2x3 = level of activity 3Maximize Contribution = $50x1 + $40x2 + $70x3subject to 30x1 + 20x2≤ 50010x2 + 40x3≤ 60020x1 + 20x2 + 30x3≤ 1,000and x1≥ 0, x2≥ 0, x3≥ 0.4.4b) Below are five possible guesses (many answers are possible).Best4.5 a) The activities are the production rates of products 1, 2, and 3. The limited resources are hours available per week on the milling machine, lathe, and grinder.b) The decisions to be made are how many of each product should be produced per week. The constraints on these decisions are the number of hours available per week on the milling machine, lathe, and grinder as well as the sales potential of product 3. The overall measure of performance is total profit, which is to be maximized.c) milling machine: 9(# units of 1) + 3(# units of 2) + 5(# units of 3) ≤ 500 lathe: 5(# units of 1) + 4(# units of 2) ≤ 350 grinder: 3(# units of 1) + 2(# units of 3) ≤ 150 sales: (# units of 3) ≤ 20Nonnegativity: (# units of 1) ≥ 0, (# units of 2) ≥ 0, (# units of 3) ≥ 0Profit = $50(# units of 1) + $20(# units of 2) + $25(# units of 3)d)Data cells: B2:D2, B5:D7, G5:G7, and D12 Changing cells: B10:D10 Target cell: G10 Output cells: E5:E734567E Hours Used=SUMPRODUCT(B5:D5,$B$10:$D$10)=SUMPRODUCT(B6:D6,$B$10:$D$10)=SUMPRODUCT(B7:D7,$B$10:$D$10)910GTotal Prof it=SUMPRODUCT(B2:D2,B10:D10)e) Let x 1 = units of product 1 produced per weekx 2 = units of product 2 produced per week x 3 = units of product 3 produced per week Maximize Profit = $50x 1 + $20x 2 + $25x 3 subject to 9x 1 3x 2 + 5x 3 ≤ 500 hours 5x 1 + 4x 2 ≤ 350 hours 3x 1 + 2x 3 ≤ 150 hours x 3 ≤ 20 and x 1 ≥ 0, x 2 ≥ 0,x 3 ≥ 0.4.6 a) The activities are the production quantities of parts A, B, and C. The limited resourcesare the hours available on machine 1 and machine 2.c) Below are three possible guesses (many answers are possible).Beste)B = number of part B producedC = number of part C producedMaximize Profit = $50A + $40B + $30Csubject to 0.02A + 0.03B + 0.05C≤ 40 hours0.05A + 0.02B + 0.04C≤ 40 hoursand A≥ 0, B≥ 0, C≥ 0.4.74.8b)Bestd) 1x2 = level of activity 2Minimize Cost = $60x1 + $50x2subject to 5x1 + 3x2≥ 602x1 + 2x2≥ 307x1 + 9x2≥ 126and x1≥ 0, x2≥ 0.e) Optimal Solution: (x1, x2) = (6.75, 8.75) and Total Cost = $842.50.4.9b) Below are five possible guesses (many answers are possible).Best4.10b) (x1, x2, x3) = (1,2,2) is a feasible solution with a daily cost of $3.48. This diet willprovide 210 kg of carbohydrates, 310 kg of protein, and 170 kg of vitamins daily.c) Answers will vary.e) Let C = kg of corn to feed each pigT = kg of tankage to feed each pigA = kg of alfalfa to feed each pigMinimize Cost = $0.84C + $0.72T + $0.60Asubject to 90C + 20T + 40A≥ 20030C + 80T + 40A≥ 18010C + 20T + 60A≥ 150and C≥ 0, T≥ 0, A≥ 0.4.11c) (x1, x2, x3) = (100,100,200) is a feasible solution. This would generate $400 million in5 years, $300 million in 10 years, and $550 million in 20 years. The total invested willbe $400 million.d) Answers will vary.f) Let x1 = units of Asset 1 purchasedx2 = units of Asset 2 purchasedx3 = units of Asset 3 purchasedMinimize Cost = x1 + x2 + x3 ($millions)subject to 2x1 + x2 + 0.5x3≥ 400 ($millions)0.5x1 + 0.5x2 + x3≥ 100 ($millions)1.5x2 + 2x3≥ 300 ($millions)and x1≥ 0, x2≥ 0, x3≥ 0.4.12 a) The activities are leasing space in each month for a number of months. The benefit ismeeting the space requirements for each month.b) The decisions to be made are how much space to lease and for how many months. Theconstraints on these decisions are the minimum required space. The overall measure ofperformance is cost which is to be minimized.c) Month 1: (M1 1mo lease) + (M1 2mo lease) + (M1 3mo lease) + (M1 4mo lease) + (M15 mo lease) ≥ 30,000 square feet.Month 2: (M1 2mo lease) + M1 3 mo lease) + (M1 4 mo lease) + (M1 5mo lease) +(M2 1 mo lease) + (M2 2 mo lease) + (M2 3 mo lease) + (M2 4 mo lease) ≥ 20,000square feet.Month 3: (M1 3mo lease) + (M1 4mo lease) + (M1 5mo lease) + (M2 2mo lease) + (M23mo lease) + (M2 4mo lease) + (M3 1mo lease) + (M3 2mo lease) + (M3 3mo lease) ≥40,000 square feet.Month 4: (M1 4mo lease) + (M1 5mo lease) + (M2 3mo lease) + (M2 4mo lease) + (M32 mo lease) + (M3 3mo lease) + (M4 1mo lease) + (M4 2mo lease) ≥ 10,000 square feet.Month 5: (M1 5mo lease) + (M2 4mo lease) + (M3 3mo lease) + (M4 2 mo lease) +(M5 1mo lease) ≥ 50,000 square feet.Nonnegativity: (M1 1mo lease) ≥ 0, (M1 2mo lease) ≥ 0, (M1 3 mo lease) ≥ 0, (M1 4mo lease) ≥ 0, (M1 5mo lease) ≥ 0, (M2 1mo lease) ≥ 0, (M2 2mo lease) ≥ 0, (M2 3 molease) ≥ 0, (M2 4mo lease) ≥ 0, (M3 1mo lease) ≥ 0, (M3 2mo lease) ≥ 0, (M3 3molease) ≥ 0, (M4 1mo lease) ≥ 0, (M4 2mo lease) ≥ 0, (M5 1mo lease) ≥ 0.Cost = ($650)[(M1 1mo lease) + (M2 1mo lease) + (M3 1mo lease) + (M4 1mo lease) +(M5 1mo lease)] + ($1,000)[(M1 2mo lease) + (M2 2mo lease) + (M3 2mo lease) +(M4 2mo lease)] + ($1,350)[(M1 3mo lease) + (M2 3mo lease) + (M3 3mo lease)] +($1,600)[(M1 4mo lease) + (M2 4mo lease)] + ($1,900)[M1 5mo lease]d)Data cells: B4:P8, B10:P10, and S4:S8 Changing cells: B13:P13 Target cell: S13 Output cells: Q4:Q812345678QTotal Leased (sq. ft.)=SUMPRODUCT(B4:P4,$B$13:$P$13)=SUMPRODUCT(B5:P5,$B$13:$P$13)=SUMPRODUCT(B6:P6,$B$13:$P$13)=SUMPRODUCT(B7:P7,$B$13:$P$13)=SUMPRODUCT(B8:P8,$B$13:$P$13)1213STotal Cost=SUMPRODUCT(B10:P10,B13:P13)e) Let x ij = square feet of space leased in month i for a period of j months. for i = 1, ... , 5 and j = 1, ... , 6-i .Minimize C = $650(x 11 + x 21 + x 31 + x 41 + x 51) + $1,000(x 12 + x 22 + x 32 + x 42) +$1,350(x 13 + x 23 + x 33) + $1,600(x 14 + x 24) + $1,900x 15 subject to x 11 + x 12 + x 13 + x 14 + x 15 ≥ 30,000 square feet x 12 + x 13 + x 14 + x 15 + x 21 + x 22 + x 23 + x 24 ≥ 20,000 square feetx 13 + x 14 + x 15 + x 22 + x 23 + x 24 + x 31 + x 32 + x 33 ≥ 40,000 sq. feet x 14 + x 15 + x 23 + x 24 + x 32 + x 33 + x 41 + x 42 ≥ 10,000 square feet x 15 + x 24 + x 33 + x 42 + x 51 ≥ 50,000 square feet and x ij ≥ 0, for i = 1, ... , 5 and j = 1 , ... , 6-i . 4.134.14a) This is a cost-benefit-tradeoff problem because it asks you to meet minimum required benefit levels (number of consultants working each time period) at minimum cost.b)c) Let f1 = number of full-time consultants working the morning shift (8 a.m.-4 p.m.),f2 = number of full-time consultants working the afternoon shift (12 p.m.-8 p.m.),f3 = number of full-time consultants working the evening shift (4 p.m.-midnight),p1 = number of part-time consultants working the first shift (8 a.m.-12 p.m.),p2 = number of part-time consultants working the second shift (12 p.m.-4 p.m.),p3 = number of part-time consultants working the third shift (4 p.m.-8 p.m.),p4 = number of part-time consultants working the fourth shift (8 p.m.-midnight).Minimize C = ($14 / hour)(8 hours)(f1 + f2 + f3) + ($5 / hour)(4 hours)(p1 + p2 + p3 + p4)subject to f1 + p1≥ 6f1 + f2 + p2≥ 8f2 + f3 + p3≥ 12f3 + p4≥ 6f1≥ 2p1f1 + f2≥ 2p2f2 + f3≥ 2p3f3≥ 2p4and f1≥ 0, f2≥ 0, f3≥ 0, p1≥ 0, p2≥ 0, p3≥ 0, p4≥ 0.4.15 a) This is a distribution-network problem because it deals with the distribution of goodsthrough a distribution network at minimum cost.b)c) Let x ij = number of units to ship from Factory i to Customer j (i = 1,2; j = 1, 2, 3)Minimize Cost = $600x11 + $800x12 + $700x13 + $400x21 + $900x22 + $600x23subject to x11 + x12 + x13 = 400x21 + x22 + x23 = 500x11 + x21 = 300x12 + x22 = 200x13 + x23 = 400and x11≥ 0, x12≥ 0, x13≥ 0, x21≥ 0, x22≥ 0, x23≥ 0.4.16 a) Requirement 1: The total amount shipped from Mine 1 must be 40 tons.Requirement 2: The total amount shipped from Mine 2 must be 60 tons.Requirement 3: The total amount shipped to the Plant must be 100 tons.Requirement 4: For Storage 1, the amount shipped out = the amount in.Requirement 5: For Storage 2, the amount shipped out = the amount in.b)c) Let x M1S1 = number of units shipped from Mine 1 to Storage 1x M1S2 = number of units shipped from Mine 1 to Storage 2x M2S1 = number of units shipped from Mine 2 to Storage 1x M2S2 = number of units shipped from Mine 2 to Storage 2x S1P = number of units shipped from Storage 1 to the Plantx S2P = number of units shipped from Storage 2 to the PlantMinimize Cost = $2,000x M1S1 + $1,700x M1S2 + $1,600x M2S1 + $1,100x M2S2+$400x S1P + $800x S2Psubject to x M1S1 + x M1S2 = 40x M2S1 + x M2S2 = 60x M1S1 + x M2S1 = x S1Px M1S2 + x M2S2 = x S2Px S1P + x S2P = 100x M1S1≤ 30, x M1S2≤ 30, x M2S1≤ 50, x M2S2≤ 50, x S1P≤ 70, x S2P≤ 70 and x M1S1≥ 0, x M1S2≥ 0, x M2S1≥ 0, x M2S2≥ 0, x S1P≥ 0, x S2P≥ 0.4.17 a) A1 + B1 + R1 = $60,000A2 + B2 + C2 + R2 = R1A3 + B3 + R3 = R2 + 1.40A1A4 + R4 = R3 + 1.40A2 + 1.70B1A5 + D5 + R5 = R4 + 1.40A3 + 1.70B2b) Let A t = amount invested in investment A at the beginning of year t.B t = amount invested in investment B at the beginning of year t.C t = amount invested in investment C at the beginning of year t.D t = amount invested in investment D at the beginning of year t.R t = amount not invested at the beginninf of year t.Maximize Return = 1.40A4 + 1.70B3 + 1.90C2 + 1.30D5 + R5subject to A1 + B1 + R1 = $60,000A2 + B2 + C2–R1 + R2 = 0–1.40A1 + A3 + B3–R2 + R3 = 0–1.40A2 + A4– 1.70B1–R3 + R4 = 0–1.40A3– 1.70B2 + D5–R4 + R5 = 0and A t≥ 0, B t≥ 0, C t≥ 0, D t≥ 0, R t≥ 0.c)4.18 a) Let x i = percentage of alloy i in the new alloy (i = 1, 2, 3, 4, 5).(60%)x1 + (25%)x2 + (45%)x3 + (20%)x4 + (50%)x5 = 40%(10%)x1 + (15%)x2 + (45%)x3 + (50%)x4 + (40%)x5 = 35%(30%)x1 + (60%)x2 + (10%)x3 + (30%)x4 + (10%)x5 = 25%x1 + x2 + x3 + x4+ x5 = 100%b)c) Let x i = percentage of alloy i in the new alloy (i = 1, 2, 3, 4, 5).Minimize Cost = $22x1 + $20x2 + $25x3 + $24x4 + $27x5subject to (60%)x1 + (25%)x2 + (45%)x3 + (20%)x4 + (50%)x5 = 40%(10%)x1 + (15%)x2 + (45%)x3 + (50%)x4 + (40%)x5 = 35%(30%)x1+ (60%)x2 + (10%)x3 + (30%)x4 + (10%)x5 = 25% and x1≥ 0, x2≥ 0, x3≥ 0, x4≥ 0, x5≥ 0.4.19 a)b) Let x ij = number of units produced at plant i of product j (i = 1, 2, 3; j = L, M, S).Maximize Profit = $420(x1L + x2L + x3L) + $360(x1M + x2M + x3M) + $300(x1S + x2S + x3S)subject to x1L + x1M + x1S≤ 750x2L + x2M + x2S≤ 900x3L + x3M + x3S≤ 45020x1L + 15x1M + 12x1S≤ 13,000 square feet20x2L + 15x2M + 12x2S≤ 12,000 square feet20x3L + 15x3M + 12x3S≤ 5,000 square feetx1L + x2L + x3L≤ 900x1M + x2M + x3M≤ 1,200x1S + x2S + x3S≤ 750(x1L + x1M + x1S) / 750 = (x2L + x2M + x2S) / 900(x1L + x1M + x1S) / 750 = (x3L + x3M + x3S) / 450and x1L≥ 0, x1M≥ 0, x1S≥ 0, x2L≥ 0, x2M≥ 0, x2S≥ 0, x3L≥ 0, x3M≥ 0, x3S≥ 0.4.20 a)b) Let x ij = tons of cargo i stowed in compartment j (i = 1,2,3,4; j = F, C, B)Maximize Profit = $320(x1F + x1C + x1B) + $400(x2F + x2C + x2B)+ $360(x3F + x3C + x3B) + $290(x4F + x4C + x4B)subject to x1F + x2F + x3F + x4F≤ 12 tonsx1C + x2C + x3C + x4C≤ 18 tonsx1B + x2B + x3B + x4B≤ 10 tonsx1F + x1C + x1B≤ 20 tonsx2F + x2C + x2B≤ 16 tonsx3F + x3C + x3B≤ 25 tonsx4F + x4C + x4B≤ 13 tons500x1F + 700x2F + 600x3F + 400x4F≤ 7,000 cubic feet500x1C + 700x2C + 600x3C + 400x4C≤ 9,000 cubic feet500x1B + 700x2B + 600x3B + 400x4B≤ 5,000 cubic feet(x1F + x2F + x3F + x4F) / 12 = (x1C + x2C + x3C + x4C) / 18(x1F + x2F + x3F + x4F) / 12 = (x1B + x2B + x3B + x4B) / 10and x1F≥ 0, x1C≥ 0, x1B≥ 0, x2F≥ 0, x2C≥ 0, x2B≥ 0,x3F≥ 0, x3C≥ 0, x3B≥ 0, x4F≥ 0, x4C≥ 0, x4B≥ 0.4.21 a)b) Let M=number of men’s gloves to produce per week,W= number of women’s gloves to produce per week,C= number of children’s gloves to produce per week,F = number of full-time workers to employ,PT = number of part-time workers to employ.Maximize Profit = $8M + $10W + $6C– $13(40)F– $10(20)PTsubject to 2M + 1.5W + C≤ 5,000 square feet30M + 45W + 40C≤ 40(60)F + 20(60)PT hoursF≥ 20F≥ 2PTand M≥ 0, W≥ 0, C≥ 0, F≥ 0, PT≥ 0.4.224.23 a) Resource Constraints:Calories must be no more than 420.No more than 20% of total calories from fat.Benefit Constraints:Calories must be at least 380There must be at least 50 mg of vitamin content.There must be at least 2 times as much strawberry flavoring as sweetener.Fixed-Requirement Constraints:There must be 15 mg of thickeners.b)c) Let S = Tablespoons of strawberry flavoring,CR = Tablespoons of cream,V = Tablespoons of vitamin supplement,A = Tablespoons of artificial sweetener,T = Tablespoons of thickening agent,Minimize C = $0.10S + $0.08CR + $0.25V + $0.15A + $0.06Tsubject to 50S + 100CR + 120A + 80T≥ 380 calories50S + 100CR + 120A + 80T≤ 420 caloriesS + 75CR + 30T≤ 0.2(50S + 100C + 120A + 80T)20S + 50V + 2T≥ 50 mg VitaminsS≥ 2A3S + 8CR + V + 2A + 25T = 15 mg Thickenersand S≥ 0, CR≥ 0, V≥ 0, A≥ 0, T≥ 0.4.24 a) Resource Constraints:Calories must be no more than 600.No more than 30% of total calories from fat.Benefit Constraints:Calories must be at least 400There must be at least 60 mg of vitamin C.There must be at least 12 g of protein.There must be at least 2 times as much peanut butter as jelly.There must be at least 1 cup of liquidFixed-Requirement Constraints:There must be 2 slices of bread.b)c) Let B = slices of bread,P= Tablespoons of peanut butter,S = Tablespoons of strawberry jelly,G = graham crackers,M = cups of milk,J = cups of juice.Minimize C = $0.05B + $0.04P + $0.07S + $0.08G + $0.15M + $0.35Jsubject to 70B + 100P + 50S + 60G + 150M + 100J≥ 400 calories70B + 100P + 50S + 60G + 150M + 100J≤ 600 calories10B + 75P + 20G + 70M≤ 0.3(70B + 100P + 50S + 60G + 150M + 100J)3S + 2M + 120J≥ 60mg Vitamin C3B + 4P + G + 8M + J≥ 12mg ProteinB = 2 slicesP≥ 2SM + J≥ 1 cupand B≥ 0, P≥ 0, S≥ 0, G≥ 0, M≥ 0, J≥ 0.Cases4.1 a) The fixed design and fashion costs are sunk costs and therefore should not beconsidered when setting the production now in July. Since the velvet shirts have apositive contribution to covering the sunk costs, they should be produced or at leastconsidered for production according to the linear programming model. Had Ted raisedthese concerns before any fixed costs were made, then he would have been correct toadvise against designing and producing the shirts. With a contribution of $22 and ademand of 6000 units, maximum expected profit will be only $132,000. This amountwill not be enough to cover the $500,000 in fixed costs directly attributable to thisproduct.b) The linear programming spreadsheet model for this problem is shown below.67B C DMaterial Cost =SUMPRODUCT(CostOf Material,C11:C17)=SUMPRODUCT(CostOf Material,D11:D17)Net Contribution=Price-LMCost-MaterialCost =Price-LMCost-MaterialCost91011121314151617N Material Used=SUMPRODUCT(C11:M11,ItemsProduced)=SUMPRODUCT(C12:M12,ItemsProduced)=SUMPRODUCT(C13:M13,ItemsProduced)=SUMPRODUCT(C14:M14,ItemsProduced)=SUMPRODUCT(C15:M15,ItemsProduced)=SUMPRODUCT(C16:M16,ItemsProduced)=SUMPRODUCT(C17:M17,ItemsProduced)2021222324OP Total Contribution=SUMPRODUCT(NetContribution,ItemsProduced)Fixed Cost8960000Total Prof it=TotalContribution-FixedCostTrendLine should produce 4,200 Wool Slacks, 4,000 Cashmere Sweaters, 7,000 Silk Blouses, 15,000 Silk Camisoles, 8,067 Tailored Skirts, 5,000 Wool Blazers, 40,000 Cotton Minis, 6,000 Velvet Shirts, and 9,244 Button-Down Blouses. The total net contribution of all clothing items is $6,862,933. However, with the total fixed cost of $860,000 + 3($2,700,000) or $8,960,000, TrendLines actually loses $2,097,067.c) If velvet cannot be sent back to the textile wholesaler, then the whole quantity will beconsidered as a sunk cost and therefore added to the fixed costs. The objective function coefficients of items using velvet will no longer include the material cost. The netcontribution of the velvet pants and shirts are now $175 and $40, respectively. The revised spreadsheet model is as follows.20 21 22 23 24 25O PTotalContribution=SUMPRODUCT(NetContribution,ItemsProduced) Original Fixed Cost8960000Velv et Sunk Cost=B16*P16Total Prof it=TotalContribution-FixedCost-Velv etSunkCostThe production plan changes considerably. TrendLines should produce 3,178 tailored skirts (down from 8,067), 3,667 velvet pants (up from 0), 60,000 cotton minis (up from 40,000), and 15,763 button-down blouses (up from 9,244). The production decisions for all other items are unaffected by the change. The total net contribution of allclothing items equals $840,000 + $1,226,00 + $ 2,025,000 + $2,983,822.22 =$7,085,822. The sunk costs now include the material cost for velvet and totals$9,200,000. The loss now equals $2,114,178.d) When TrendLines cannot return the velvet to the wholesaler, the costs for velvet cannotbe recovered. These cost are no longer variable cost but now are sunk cost. As aconsequence the increased net contribution of the velvet items makes them moreattractive to produce. This way the revenues from selling these items can contribute to the recovery of at least some of the fixed costs. Instead of zero TrendLines nowproduces 3,667 velvet pants. These pants also require some acetate and thus theirproduction affects the production plan for all other items. Since it is not optimal to make full use of the ordered velvet in part (b) it comes as no surprise that the loss in part (c) is even bigger than in part (b).e) The unit contribution of a wool blazer changes to $75.25.TrendLines should produce 10,067 skirts (up from 8,067), the minimum of 3,000 wool blazers (down from 5,000), and 6,578 button-down blouses (down from 9,244). The production decisions for all other items are unaffected by the change. The total net contribution of all clothing items is $6,527,933.33. The total loss is $2,432,067.f) The available acetate changes from 28,000 to 38,000 square yards. The resultingspreadsheet solution is shown below.TrendLines should produce 14,733 skirts (up from 8,067) and 356 button-down blouses (down from 9,244). The production decisions for all other items are unaffected by the change. The total net contribution of all clothing items is $7,581,267. The loss is$1,378,733.g) We need to include new decision variables representing the number of clothing itemsthat are sold during the November sale. The new spreadsheet model is shown below.91011B C D Nov Discount 0.4Price (Nov )=(1-Nov Discount)*Price =(1-Nov Discount)*PriceNet Contribution (Nov )=PriceNov -LMCost-MaterialCost =PriceNov -LMCost-MaterialCost131415161718192021N Material Used=SUMPRODUCT(C15:M15,TotalSales)=SUMPRODUCT(C16:M16,TotalSales)=SUMPRODUCT(C17:M17,TotalSales)=SUMPRODUCT(C18:M18,TotalSales)=SUMPRODUCT(C19:M19,TotalSales)=SUMPRODUCT(C20:M20,TotalSales)=SUMPRODUCT(C21:M21,TotalSales)2425262728OP Total Contribution=SUMPRODUCT(NetContribution,SeptOctSales)+SUMPRODUCT(NetContributionNov ,Nov SalesFixed Cost8960000Total Prof it=TotalContribution-FixedCostIt only pays to produce 2,000 more Cashmere sweaters. The production plan for all other items is the same as in part (b). The sale of the Cashmere sweaters increases the total net contribution by $60,000 to $6,922,933, and reduces the loss to $2,037,066.67.4.2 a) We define 12 decision variables, one for each age group surveyed in each region. Rob'srestrictions are easily modeled as constraints. For example, his condition that at least 20percent of the surveyed customers have to be from the first age group requires that thesum of the variables for the age group "18 to 25" across all three regions is at least 400.All his other requirements are modeled similarly. Finally, the sum of all variables has toequal 2000, because that is the number of customers Rob wants to have interviewed.Range Name CellsCostOf Surv ey C3:F5NumberToSurv ey C9:F11PercentageRequiredInAG C15:F15PercentageRequiredInRegion J9:J11RequiredInAG C14:F14RequiredInRegion I9:I11RequiredSurv ey s J15TotalCost J17 TotalInAG C12:F12 TotalInRegion G9:G11 TotalSurv ey s J137891011G H ITotal Requiredin Region in Region =SUM(C9:F9)>==J9*RequiredSurv ey s=SUM(C10:F10)>==J10*RequiredSurv ey s =SUM(C11:F11)>==J11*RequiredSurv ey s12 13 14B C DTotal in A.G.=SUM(C9:C11)=SUM(D9:D11)>=>=Required in A.G.=C15*RequiredSurv ey s=D15*RequiredSurv ey s1314151617I JTotal Surv ey s=SUM(NumberToSurv ey)=Required Surv ey s2000Total Cost=SUMPRODUCT(CostOf Surv ey,NumberToSurv ey)The cost of conducting the survey meeting all constraints imposed by AmeriBank incurs cost of $11,200. The mix of customers is displayed in the spreadsheet above.b) Sophisticated Surveys will submit a bid of (1.15)($11,200) = $12,880.。

《数据、模型和决策》习题解答

第二章习题(P46)14.某天40只普通股票的收盘价(单位:元/股)如下:29.625 18.000 8.625 18.5009.250 79.375 1.250 14.00010.000 8.750 24.250 35.25032.250 53.375 11.500 9.37534.000 8.000 7.625 33.62516.500 11.375 48.375 9.00037.000 37.875 21.625 19.37529.625 16.625 52.000 9.25043.250 28.500 30.375 31.12538.000 38.875 18.000 33.500(1)构建频数分布*。

(2)分组,并绘制直方图,说明股价的规律。

(3)绘制茎叶图*、箱线图,说明其分布特征。

(4)计算描述统计量,利用你的计算结果,对普通股价进行解释。

解:(1)将数据按照从小到大的顺序排列1.25, 7.625, 8, 8.625, 8.75, 9, 9.25, 9.25, 9.375, 10, 11.375, 11.5, 14, 16.5, 16.625, 18, 18, 18.5, 19.375, 21.625, 24.25, 28.5, 29.625, 29.625, 30.375, 31.125, 32.25, 33.5, 33.625, 34, 35.25, 37, 37.875, 38, 38.875, 43.25, 48.375, 52, 53.375, 79.375,结合(2)建立频数分布。

(2)将数据分为6组,组距为10。

分组结果以及频数分布表。

为了方便分组数据样本均值与样本方差的计算,将基础计算结果也列入下表。

根据频数分布与累积频数分布,画出频率分布直方图与累积频率分布的直方图。

频率分布直方图从频率直方图和累计频率直方图可以看出股价的规律。

股价分布10元以下、10—20元、30—40元占到60%,股价在40元以下占87.5%,分布不服从正态分布等等。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1、某企业目前的损益状况如在下:销售收入(1000件×10元/件)10 000销售成本:变动成本(1000件×6元/件) 6 000固定成本 2 000销售和管理费(全部固定) 1 000利润 1 000(1)假设企业按国家规定普调工资,使单位变动成本增加4%,固定成本增加1%,结果将会导致利润下降。

为了抵销这种影响企业有两个应对措施:一是提高价格5%,而提价会使销量减少10%;二是增加产量20%,为使这些产品能销售出去,要追加500元广告费。

请做出选择,哪一个方案更有利?(2)假设企业欲使利润增加50%,即达到1 500元,可以从哪几个方面着手,采取相应的措施。

2、某企业每月固定制造成本1 000元,固定销售费100元,固定管理费150元;单位变动制造成本6元,单位变动销售费0.70元,单位变动管理费0.30元;该企业生产一种产品,单价10元,所得税税率50%;本月计划产销600件产品,问预期利润是多少?如拟实现净利500元,应产销多少件产品?3、某企业生产甲、乙、丙三种产品,固定成本500000元,有关资料见下表(单位:元):要求:(1)计算各产品的边际贡献;(2)计算加权平均边际贡献率;(3)根据加权平均边际贡献率计算预期税前利润。

4、某企业每年耗用某种材料3 600千克,单位存储成本为2元,一次订货成本25元。

则经济订货批量、每年最佳订货次数、最佳订货周期、与批量有关的存货总成本是多少?5.有10个同类企业的生产性固定资产年平均价值和工业总产值资料如下:(2)建立直线回归方程;(3)估计生产性固定资产(自变量)为1100万元时总产值(因变量)的可能值。

6、某商店的成本费用本期发生额如表所示,采用账户分析法进行成本估计。

首先,对每个项目进行研究,根据固定成本和变动成本的定义及特点结合企业具体情况来判断,确定它们属于哪一类成本。

例如,商品成本和利息与商店业务量关系密切,基本上属于变动成本;福利费、租金、保险、修理费、水电费、折旧等基本上与业务量无关,视为固定成本。

其次,剩下的工资、广告和易耗品等与典型的两种成本性态差别较大,不便归入固定成本或变动成本。

对于这些混合成本,要使用工业工程法、契约检查法或历史成本分析法,寻找一个比例,将其分为固定和变动成本两部分。

7、某企业每年耗用某种材料3 600千克,单位存储成本为2元,一次订货成本25元。

则经济订货批量、每年最佳订货次数、最佳订货周期、与批量有关的存货总成本是多少?8、某生产企业使用A零件,可以外购,也可以自制。

如果外购,单价4元,一次订货成本10元:如果自制,单位成本3元,每次生产准备成本600元。

每日产量50件。

零件的全年需求量为3 600件,储存变动成本为零件价值的20%,每日平均需求最为10件。

下面分别计算零件外购和自制的总成本,以选择较优的方案。

9 请建立最简单的单阶段存贮模型,推导出经济批量公式,要求说明模型成立的假设条件,所用字母的经济意义,并要有一定的推理过程。

10 若某工厂每年对某种零件的需要量为10000件,订货的固定费用为2000元,采购一个零件的单价为100元,保管费为每年每个零件20元,求最优订购批量。

11 某厂对某种材料的全年需要量为1040吨,其单价为1200元/吨。

每次采购该种材料的订货费为2040元,每年保管费为170元/吨。

试求工厂对该材料的最优订货批量、每年订货次数。

12 某货物每周的需要量为2000件,每次订货的固定费用为15元,每件产品每周保管费为0.30元,求最优订货批量及订货时间。

13 加工制作羽绒服的某厂预测下年度的销售量为15000件,准备在全年的300个工作日内均衡组织生产。

假如为加工制作一件羽绒服所需的各种原材料成本为48元,又制作一件羽绒服所需原料的年存贮费为其成本的22%,提出一次订货所需费用为250元,订货提前期为零,不允许缺货,试求经济订货批量。

14 一条生产线如果全部用于某种型号产品生产时,其年生产能力为600000台。

据预测对该型号产品的年需求量为260000台,并在全年内需求基本保持平衡,因此该生产线将用于多品种的轮番生产。

已知在生产线上更换一种产品时,需准备结束费1350元,该产品每台成本为45元,年存贮费用为产品成本的24%,不允许发生供应短缺,求使费用最小的该产品的生产批量。

15 某生产线单独生产一种产品时的能力为8000件/年,但对该产品的需求仅为2000件/年,故在生产线上组织多品种轮番生产。

已知该产品的存贮费为60元/年·件,不允许缺货,更换生产品种时,需准备结束费300元。

目前该生产线上每季度安排生产该产品500件,问这样安排是否经济合理。

如不合理,提出你的建议,并计算你建议实施后可能带来的节约。

16某电子设备厂对一种元件的需求为R=2000件/年,订货提前期为零,每次订货费为25元。

该元件每件成本为50元,年存储费为成本的20%。

如发生缺货,可在下批货到达时补上,但缺货损失费为每件每年30元。

求:(1)经济订货批量及全年的总费用;(2)如不允许发生缺货,重新求经济订货批量,并同(1)的结果进行比较。

17 某出租汽车公司拥有2500辆出租车,均由一个统一的维修厂进行维修。

维修中某个部件的月需量为8套。

每套价格8500元。

已知每提出一次订货需订货费1200元,年存贮费为每套价格的30%,订货提前期为2周。

又每台出租车如因该部件损坏后不能及时更换每停止出车一周,损失为400元,试决定该公司维修厂订购该种部件的最优策略。

18 对某产品的需求量服从正态分布,已知μ=150,σ=25。

又知每个产品的进价为8元,售价为15元,如销售不完全按每个5元退回原单位。

问该产品的订货量应为多少个,使预期的利润为最大。

19 用图解法求解下列线性规划问题,并指出各问题是具有唯一最优解、无穷多最优解、无界解或无可行解。

(1) min z =6x1+4x2(2) max z =4x1+8x2st. 2x1+x2≥1 st. 2x1+2x2≤103x1+4x2≥1.5 -x1+x2≥8x1, x2≥0 x1, x2≥0(3) max z =x1+x2(4) max z =3x1-2x2st. 8x1+6x2≥24 st. x1+x2≤14x1+6x2≥-12 2x1+2x2≥42x2≥4 x1, x2≥0x1, x2≥0(5) max z =3x1+9x2(6) max z =3x1+4x2st. x1+3x2≤22 st. -x1+2x2≤8-x1+x2≤4 x1+2x2≤12x2≤6 2x1+x2≤162x1-5x2≤0 x1, x2≥0x1, x2≥020、用图解法求解以下线性规划问题:max z= x1+3x2s.t. x1+x2≤10-2x1+2x2≤12x1≤7x1, x2≥021、用图解法求解以下线性规划问题:min z= x1-3x2s.t. 2x1-x2≤4x1+x2≥3x2≥5x1≤4x1, x2≥022、按下表提供的条件绘制箭线型网络图, 计算结点时间参数,并说明作业F、I的最早结束时间和最迟开始时间;求出关键路线。

23根据有关资料预测各状态发生的概率依次为0.3,0.4,0.3,请用决策树法求解此问题。

24、获得大学毕业学位的毕业生,“双向选择”时,用人单位与毕业生都有各自的选择标准和要求。

就毕业生来说选择单位的标准和要求是多方面的,例如:①能发挥自己的才干为国家作出较好贡献(即工作岗位适合发挥专长);②工作收入较好(待遇好);③生活环境好(大城市、气候等工作条件等);④单位名声好(声誉-Reputation);⑤工作环境好(人际关系和谐等)⑥发展晋升(promote, promotion)机会多(如新单位或单位发展有后劲)等。

问题:现在有多个用人单位可供他选择,因此,他面临多种选择和决策,问题是他将如何作出决策和选择?(运用AHP)1、解:(1)调资后的利润为:1000×[10-6×(1+4%)]-3000×(1+10%)=730元方案一利润为:1000×(1-10%)×[10×(1+5%)-6×(1+4%)]-3000×(1+1%)=804元方案二利润为:1000×(1+20%)[10-6×(1+4%)]-[3000×(1+1%)+500]=982元综上可知,选择方案二更有利。

(2)假设企业欲使利润增加50%,即达到1 500元,可以从以下四个方面着手。

①减少固定成本将固定成本(FC)作为未知数,目标利润1500元作为已知数,其他因素不变,代入本量利关系方程式:1500=1000×10-1000×6-FC可得FC=2500元如其他条件不变,将固定成本由3000元减少到2500元,降低16.7%,可保证实现目标利润。

②减少变动成本同上述方法,将变动成本(VC)作为未知数代入本量利关系方程式:1500=1000×10-1000×VC-3000可得VC=5.50元如其他条件不变,将变动成本由6元减少到5.50元,降低8.3%,可保证实现目标利润。

③提高售价同上述方法,将单位产品的售价(SP)作为未知数代入本量利关系方程式:1500=1000×SP-1000×6-3000可得SP=10.50元如其他条件不变,将单位产品售价由10元提升到10.50元,提高5%,可保证实现目标利润。

④增加产销量同上述方法,将产销数量(V)作为未知数代入本量利关系方程式:1500=V×10-V×6-3000可得V=1125件如其他条件不变,将产销量由1000件增加到1125件,提高12.5%,可保证实现目标利润。

2、解:预期利润=10×600-(6+0.7+0.3)×600-(1000+100+150)=550元设产销X件产品可实现净利500元则:利润总额为500÷(1-50%)=1000元10X-(6+0.7+0.3)X-(1000+100+150)=1000得X=750答:预期利润是550元。

如拟实现净利500元,应产销750件产品。

3、解:(1)甲产品的边际贡献=12000×(100-80)=240000元乙产品的边际贡献=15000×(90-75)=225000元丙产品的边际贡献=8000×(95-80)=120000元(2)甲产品销售收入=12000×100=1200000元乙产品销售收入=15000×90=1350000元丙产品=8000×95=760000元总的销售收入=1200000+1350000+760000=3310000元总的边际贡献=240000+225000+120000=585000元加权平均边际贡献率=585000÷3310000×100%=17.67%(3)预期税前利润=总的销售收入×加权平均边际贡献率-固定成本=3310000×17.67%-500000=84877元答:(1)甲产品的边际贡献为240000元,乙产品的边际贡献为225000元,丙产品的边际贡献为120000元。