会计准则译文原文

会计准则外文文献翻译-财务会计专业

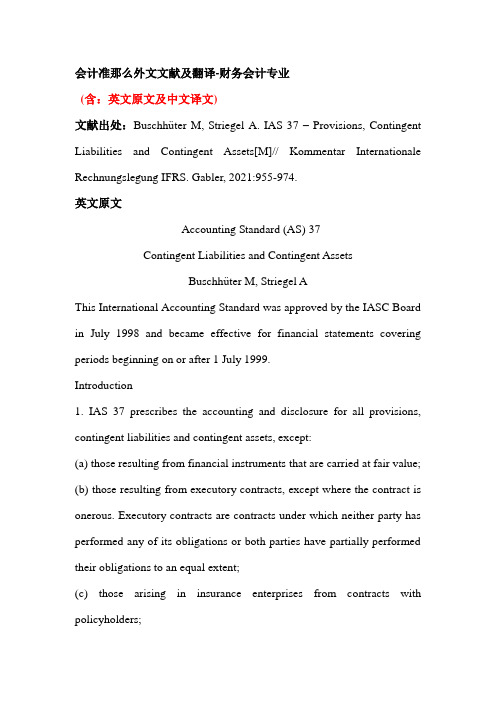

会计准那么外文文献及翻译-财务会计专业(含:英文原文及中文译文)文献出处:Buschhüter M, Striegel A. IAS 37 – Provisions, Contingent Liabilities and Contingent Assets[M]// Kommentar Internationale Rechnungslegung IFRS. Gabler, 2021:955-974.英文原文Accounting Standard (AS) 37Contingent Liabilities and Contingent AssetsBuschhüter M, Striegel AThis International Accounting Standard was approved by the IASC Board in July 1998 and became effective for financial statements covering periods beginning on or after 1 July 1999.Introduction1. IAS 37 prescribes the accounting and disclosure for all provisions, contingent liabilities and contingent assets, except:(a) those resulting from financial instruments that are carried at fair value;(b) those resulting from executory contracts, except where the contract is onerous. Executory contracts are contracts under which neither party has performed any of its obligations or both parties have partially performed their obligations to an equal extent;(c) those arising in insurance enterprises from contracts with policyholders;(d) those covered by another International Accounting Standard. Provisions2. The Standard defines provisions as liabilities of uncertain timing or amount. A provision should be recognised when, and only when:(a) an enterprise has a present obligation (legal or constructive) as a result of a past event; (b) it is probable (i.e. more likely than not) that an outflow of resources embodying economic benefits will be required to settle the obligation;(c) a reliable estimate can be made of the amount of the obligation. The Standard notes that it is only in extremely rare cases that a reliable estimate will not be possible.3. The Standard defines a constructive obligation as an obligation that derives from an enterprise's actions where:(a) by an established pattern of past practice, published policies or a sufficiently specific current statement, the enterprise has indicated to other parties that it will accept certain responsibilities; (b) as a result, the enterprise has created a valid expectation on the part of those other parties that it will discharge those responsibilities.4. In rare cases, for example in a law suit, it may not be clear whether an enterprise has a present obligation. In these cases, a past event is deemed to give rise to a present obligation if, taking account of all available evidence, it is more likely than not that a present obligation exists at thebalance sheet date. An enterprise recognises a provision for that present obligation if the other recognition criteria described above are met. If it is more likely than not that no present obligation exists, the enterprise discloses a contingent liability, unless the possibility of an outflow of resources embodying economic benefits is remote.5. The amount recognized as a provision should be the best estimate of the expenditu required to settle the present obligation at the balance sheet date, in other words, the amount that an enterprise would rationally pay to settle the obligation at the balance sheet date or to transfer it to a third party at that time.6. The Standard requires that an enterprise should, in measuring a provision: (a) take risks and uncertainties into account. However, uncertainty does not justify the creation of excessive provisions or a deliberate overstatement of liabilities;(b) discount the provisions, where the effect of the time value of money is material, using a pre-tax discount rate (or rates) that reflect(s) current market assessments of the time value of money and those risks specific to the liability that have not been reflected in the best estimate of the expenditure. Where discounting is used, the increase in the provision due to the passage of time is recognised as an interest expense;(c) take future events, such as changes in the law and technological changes, into account where there is sufficient objective evidence thatthey will occur; and(d) not take gains from the expected disposal of assets into account, even if the expected disposal is closely linked to the event giving rise to the provision.7. An enterprise may expect reimbursement of some or all of the expenditure required to settle a provision (for example, through insurance contracts, indemnity clauses or suppliers' warranties). An enterprise should:(a) recognise a reimbursement when, and only when, it is virtually certain that reimbursement will be received if the enterprise settles the obligation. The amount recognised for the reimbursement should not exceed the amount of the provision; and(b) recognise the reimbursement as a separate asset. In the income statement, the expense relating to a provision may be presented net of the amount recognised for a reimbursement. 8. Provisions should be reviewed at each balance sheet date and adjusted reflect thecurrent best estimate. If it is no longer probable that an outflow of resources embodying economic benefits will be required to settle the obligation, the provisioshould be reversed.9. A provision should be used only for expenditures for which the provision was originally recognised.Provisions - Specific Applications10. The Standard explains how the general recognition and measurement requirements for provisions should be applied in three specific cases: future operating losses; onerous contracts; and restructurings. Contingent Liabilities11. An enterprise should not recognise a contingent liability. , unless the12. A contingent liability is disclosed, as required by paragraph 86possibility of an outflow of resources embodying economic benefits is remote.13. Where an enterprise is jointly and severally liable for an obligation, the part of tobligation that is expected to be met by other parties is treated as a contingentThe enterprise recognises a provision for the part of the obligation for which an outflow of resources embodying economic benefits is probable, except in the extremely rare circumstances where no reliable estimate can be made.14. Contingent liabilities may develop in a way not initially expected. Therefore, theare assessed continually to determine whether an outflow of resources embodying probable. If it becomes probable that an outflow of economic benefits has become future economic benefits will be required for an item previously dealt with as a contingent liability, a provision is recognised in the financial statements of the period in which the change in probability occurs (except in the extremely rare circumstances where no reliable estimate can be made).Contingent Assets15. An enterprise should not recognise a contingent asset.16. Contingent assets usually arise from unplanned or other unexpected events that give rise to the possibility of an inflow of economic benefits to the enterprise. An example is a claim that an enterprise is pursuing through legal processes, where the outcome is uncertain. 17. Contingent assets are not recognised in financial statements since this may result in the recognition of income that may never be realised. However, when the realisation of income is virtually certain, then the related asset is not a contingent asset and its recognition is appropriate. 18. A contingent asset is disclosed, as required by paragraph 89 economic benefits is probable.19. Contingent assets are assessed continually to ensure that developments are appropriately reflected in the financial statements. If it has become virtually certain that an inflow of economic benefits will arise, the asset and the related income are recognised in the financial statements of the period in which the change occurs. If an inflow of economic benefits has become probable, an enterprise discloses the contingent asset.Measurement20. The amount recognised as a provision should be the best estimate of the expenditure required to settle the present obligation at the balance sheet date.21. The best estimate of the expenditure required to settle the present obligation is the amount that an enterprise would rationally pay to settle the obligation at the balance sheet date or to transfer it to a third party at that time. It will often be impossible or prohibitively expensive to settle or transfer an obligation at the balance sheet date. However, the estimate of the amount that an enterprise would rationally pay to settle or transfer the obligation gives the best estimate of the expenditure required to settle the present obligation at the balance sheet date. 22. The estimates of outcome and financial effect are determined by the judgement of the management of the enterprise, supplemented by experience of similar transactions and, in some cases, reports from independent experts. The evidence considered23. Uncertainties surrounding the amount to be recognised as a provision are dealt with by various means according to the circumstances. Where the provision being measured involves a large population of items, the obligation is estimated by weighting all possible outcomes by their associated probabilities. The name for thistatistical method of estimation is 'expected value'. The provision will therefore be different depending on whether the probability of a loss of a given amount is, for example, 60 per cent or 90 per cent. Where there is a continuous range of possible outcomes, and each point in that range is as likely as any other, the mid-point of thrange is used. 24. Where a single obligation is beingmeasured, the individual most likely outcome may be the best estimate of the liability. However, even in such a case, the enterprise considers other possible outcomes. Where other possible outcomes are either mostly higher or mostly lower than the most likely outcome, the best estimate will be a higher or lower amount. For example, if an enterprise has to rectify a serious fault in a major plant that it has constructed for a customer, the individual most likely outcome may be for the repair to succeed at the first attempt at a cost of1,000, but a provision for a larger amount is made if there is a significant chance that further attempts will be necessary.25. The provision is measured before tax, as the tax consequences of the provision, , Income Taxes. and changes in it, are dealt with under IAS 12,Income Taxes.Risks and Uncertainties26. The risks and uncertainties that inevitably surround many events and the best estimate of a circumstances should be taken into account in reachin the best estmeate of a provision.27. Risk describes variability of outcome. A risk adjustment may increase the amount at which a liability is measured. Caution is needed in making judgements under conditions of uncertainty, so that income or assets are not overstated and expenses or liabilities are not understated. However, uncertainty does not justify the creation of excessive provisions or adeliberate overstatement of liabilities. For example, if the projected costs of a particularly adverse outcome are estimated on a prudent basis, that outcome is not then deliberately treated as more probable than is realistically the case. Care is needed to avoid duplicating adjustments for risk and uncertainty with consequent overstatement of a provision. Present Value28. Where the effect of the time value of money is material, the amount ofa provision should be the present value of the expenditures expected to be required to settle the obligation.29. The discount rate (or rates) should be a pre-tax rate (or rates) that reflect(s) current market assessments of the time value of money and the risks specific to the liability. The discount rate(s) should not reflect risks for which future cash flow estimates have been adjusted. Future Events 30. Future events that may affect the amount required to settle an obligation should be reflected in the amount of a provision where there is sufficient objective evidence that they will occur.31. Expected future events may be particularly important in measuring provisions. For example, an enterprise may believe that the cost of cleaning up a site at the end of its life will be reduced by future changes in technology. The amount recognised reflects a reasonable expectation of technically qualified, objective observers, taking account of all available evidence as to the technology that will be available at the time of theclean-up. Thus it is appropriate to include, for example, expected cost reductions associated with increased experience in applying existing technology or the expected cost of applying existing technology to a larger or more complex clean-up operation than has previously been carried out. However, an enterprise does not anticipate the new technology for cleaning up unless it is supported by development of a completel sufficient objective evidence.32. The effect of possible new legislation is taken into consideration in measuring an existing obligation when sufficient objective evidence exists that the legislation is virtually certain to beenacted. The variety of circumstances that arise in practice makes it impossible to specify a single event that will provide sufficient, objective evidence in every case. Evidence is required both of what legislation will demand and of whether it is virtually certain to be enacted and implemented in due course. In many cases sufficient objective evidence will not exist until the new legislation is enacted.Expected Disposal of Assets33. Gains from the expected disposal of assets should not be taken into account in measuring a provision.34. Gains on the expected disposal of assets are not taken into account in measuring a provision, even if the expected disposal is closely linked to the event giving rise to the provision. Instead, an enterprise recognisesgains on expected disposals of assets at the time specified by the International Accounting Standard dealing with the assets concerned. Reimbursements35. Where some or all of the expenditure required to settle a provision is expected to be reimbursed by another party, the reimbursement should be recognised when, and only when, it is virtually certain that reimbursement will be received if the enterprise settles the obligation. The reimbursement should be treated as a separate asset. The amount recognised for the reimbursement should not exceed the amount of the provision.36. In the income statement, the expense relating to a provision may be presented net of the amount recognised for a reimbursement.37. Sometimes, an enterprise is able to look to another party to pay part or all of the expenditure required to settle a provision (for example, through insurance contracts, indemnity clauses or suppliers' warranties). The other party may either reimburse amounts paid by the enterprise or pay the amounts directly.38. In most cases the enterprise will remain liable for the whole of the amount in question so that the enterprise would have to settle the full amount if the third party failed to pay for any reason. In this situation, a provision is recognised for the full amount of the liability, and a separate asset for the expected reimbursement is recognised when it is virtuallycertain that reimbursement will be received if the enterprise settles the liability.39. In some cases, the enterprise will not be liable for the costs in question if the third party fails to pay. In such a case the enterprise has no liability for those costs and they are not included in the provision.40. As noted in paragraph 29,severally liable is a contingent liability to the extent that it is expected that the obligation will be settled by the other parties.Changes in Provisions41. Provisions should be reviewed at each balance sheet date and adjusted to reflect the current best estimate. If it is no longer probable that an outflow of resources embodying economic benefits will be required to settle the obligation, the provision should be reversed.42. Where discounting is used, the carrying amount of a provision increases in each period to reflect the passage of time. This increase is recognised as borrowing cost.Use of Provisions43. A provision should be used only for expenditures for which the provision was originally recognised.44. Only expenditures that relate to the original provision are set against it. Setting expenditures against a provision that was originally recognised for another purpose would conceal the impact of two different events.Future Operating Losses45. Provisions should not be recognised for future operating losses.46. Future operating losses do not meet the definition of a liability in paragraph 10.the general recognition criteria set out for provisions in paragraph 1447. An expectation of future operating losses is an indication that certain assets of the operation may be impaired. An enterprise tests these assets for impairment under IAS 36, Impairment of Assets.Onerous Contracts48. If an enterprise has a contract that is onerous, the present obligation under the contract should be recognised and measured as a provision. 49. Many contracts (for example, some routine purchase orders) can be cancelled without paying compensation to the other party, and therefore there is no obligation. Other contracts establish both rights and obligations for each of the contracting parties. Where events make such a contract onerous, the contract falls within the scope of this Standard and a liability exists which is recognised. Executory contracts that are not onerous fall outside the scope of this Standard. 50. This Standard defines an onerous contract as a contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it. The unavoidable costs under a contract reflect the least net cost of exiting from the contract, which is the lower ofthe cost of fulfilling it and any compensation or penalties arising from failure to fulfil it.51. Before a separate provision for an onerous contract is established, an enterprise recognises any impairment loss that has occurred on assets dedicated to that contract(see IAS 36, Impairment of Assets). Restructuring52. The following are examples of events that may fall under the definition of restructuring: (a) sale or termination of a line of business; (b) the closure of business locations in a country or region or the relocation of business activities from one country or region to another; (c) changes in management structure, for example, eliminating a layer of management; (d) fundamental reorganisations that have a material effect on the nature and focus of the enterprise's operations.53. A provision for restructuring costs is recognised only when the general recognition are met. Paragraphs 72-83 set out how criteria for provisions set out in paragraph 14the general recognition criteria apply to restructurings.54. A constructive obligation to restructure arises only when an enterprise:(a) has a detailed formal plan for the restructuring identifying at least: (i) the business or part of a business concerned;(ii) the principal locations affected;(iii) the location, function, and approximate number of employees whowill be compensated for terminating their services;(iv) the expenditures that will be undertaken;(v) when the plan will be implemented;(b) has raised a valid expectation in those affected that it will carry out the restructuring by starting to implement that plan or announcing its main features to those affected by it. . Evidence that an enterprise has started to implement a restructuring plan would be provided, 55for example, by dismantling plant or selling assets or by the public announcement of the main features of the plan. A public announcement of a detailed plan to restructure constitutes a constructive obligation to restructure only if it is made in such a way and in sufficient detail (i.e. setting out the main features of the plan) that it gives rise to valid expectations in other parties such as customers, suppliers and employees (or their representatives) that the enterprise will carry out the restructuring.56. For a plan to be sufficient to give rise to a constructive obligation when communicated to those affected by it, its implementation needs to be planned to begin as soon as possible and to be completed in a timeframe that makes significant changes to the plan unlikely. If it is expected that there will be a long delay before the restructuring begins or that the restructuring will take an unreasonably long time, it is unlikely that the plan will raise a valid expectation on the part of others that theenterprise is at present committed to restructuring, because the timeframe allows opportunities for the enterprise to change its plans.57. A management or board decision to restructure taken before the balance sheet date does not give rise to a constructive obligation at the balance sheet date unless the enterprise has, before the balance sheet date:(a) started to implement the restructuring plan;(b) announced the main features of the restructuring plan to those affected by it in a sufficiently specific manner to raise a valid expectation in them that the enterprise will carry out the restructuring. In some cases, an enterprise starts to implement a restructuring plan, or announces its main features to those affected, only after the balance sheet date. Disclosure may be , Events After the Balance Sheet Date, if the restructuring is of required under IAS 10 such importance that its non-disclosure would affect the ability of the users of the financial statements to make proper evaluations and decisions.58. Although a constructive obligation is not created solely by a management decision, an obligation may result from other earlier events together with such a decision. For example, negotiations with employee representatives for termination payments, or with purchasers for the sale of an operation, may have been concluded subject only to board approval. Once that approval has been obtained and communicated to the other parties, the enterprise has a constructive obligation to restructure, if theconditions of paragraph 72 are met.. 59. In some countries, the ultimate authority is vested in a board whose membership gement (e.g. employees) includes representatives of interests other than those of managment.or notification to such representatives may be necessary before the board decision is taken. Because a decision by such a board involves communication to these representatives, it may result in a constructive obligation to restructure.60. No obligation arises for the sale of an operation until the enterprise is committed to the sale, i.e. there is a binding sale agreement.61. Even when an enterprise has taken a decision to sell an operation and announced that decision publicly, it cannot be committed to the sale until a purchaser has been identified and there is a binding sale agreement. Until there is a binding sale agreement, the enterprise will be able to change its mind and indeed will have to take another course of action if a purchaser cannot be found on acceptable terms. When the sale of an operation is envisaged as part of a restructuring, the assets of the operation , Impairment of Assets. When a sale is only are reviewed for impairme-ent under IAS 36part of a restructuring, a constructive obligation can arise for the other parts of the restructuring before a binding sale agreement exists.62. A restructuring provision should include only the direct expenditures arising form the restrict-uring,which are those that are both:(a) necessarily entailed by the restructuring; and(b) not associated with the ongoing activities of the enterprise.63. A restructuring provision does not include such costs as:(a) retraining or relocating continuing staff;(b) marketing; or(c) investment in new systems and distribution networks.These expenditures relate to the future conduct of the business and are not liabilities for restructuring at the balance sheet date. Such expenditures are recognised on the same basis as if they arose independently of a restructuring.64. Identifiable future operating losses up to the date of a restructuring are not included in a provision, unless they relate to an onerous contract as defined in paragraph 10. , gains on the expected disposal of assets are not taken65. As required by paragraph 51into account in measuring a restructuring provision, even if the sale of assets is envisaged as part of the restructuring.Disclosure66. For each class of provision, an enterprise should disclose:(a) the carrying amount at the beginning and end of the period;(b) additional provisions made in the period, including increases toexisting provisions; (c) amounts used (i.e. incurred and charged against the provision) during the period; (d) unused amounts reversed during the period; and(e) the increase during the period in the discounted amount arising from the passage of time and the effect of any change in the discount rate. Comparative information is not required67. An enterprise should disclose the following for each class of provision:(a) a brief description of the nature of the obligation and the expected timing of any resulting outflows of economic benefits;(b) an indication of the uncertainties about the amount or timing of those outflows. Where necessary to provide adequate information, an enterprise should disclose the major assumptions made concerning future events, as addressed in paragraph 48(c) the amount of any expected reimbursement, stating the amount of any asset that has been recognised for that expected reimbursement.68. Unless the possibility of any outflow in settlement is remote, an enterprise should disclose for each class of contingent liability at the balance sheet date a brief description of the nature of the contingent liability and, where practicable:;(a) an estimate of its financial effect, measured under paragraphs 36(b) an indication of the uncertainties relating to the amount or timing of any outflow; (c) the possibility of any reimbursement.69. In determining which provisions or contingent liabilities may be aggregated to form a class, it is necessary to consider whether the nature of the items is sufficiently similar for a single statement about them to fulfil the requirements of paragraphs 85(a)and (b) and 86(a) and (b). Thus, it may be appropriate to treat as a single class of provision amounts relating to warranties of different products, but it would not be appropriate to treat as a single class amounts relating to normal warranties and amounts that are subject to legal proceedings.70. Where a provision and a contingent liability arise from the same set of -86 in a circumstances, an enterprise makes the disclosures required by paragraphs 84 that shows the link between the provision and the contingent liability.71. Where an inflow of economic benefits is probable, an enterprise should disclose a brief description of the nature of the contingent assets at the balance sheet date, and, where practicable, an estimate of their financial effect, measured using the principles set out for provisions in paragraphs 3672. It is important that disclosures for contingent assets avoid giving misleading ndications of the likelihood of income arising.73 In extremely rare cases, disclosure of some or all of the information required by paragraphs 84-89 can be expected to prejudice seriously the position of the enterprise a dispute with other parties on the subject matterof the provision, contingent or contingent asset. In such cases, an enterprise need not disclose the information, but should disclose the general nature of the dispute, together with the fact that, and reason why, the information has not been disclosed. Transitional Provisions74. The effect of adopting this Standard on its effective date (or earlier) should be reported as an adjustment to the opening balance of retained earnings for the period in which the Standard is first adopted. Enterprises are encouraged, but not required, to adjust the opening balance of retained earnings for the earliest period presented and to restate comparative information. If comparative information is not restated, this fact should be disclosed. , Net Profit or Loss for the75. The Standard requires a different treatment from IAS 8requires Period, Fundamental Errors and Changes in Accounting Policies. IAS 8comparative information to be restated (benchmark treatment) or additional pro forma comparative information on a restated basis to be disclosed (allowed alternative reatment) unless it is impracticable to do so.。

企业会计准则2024中英对照

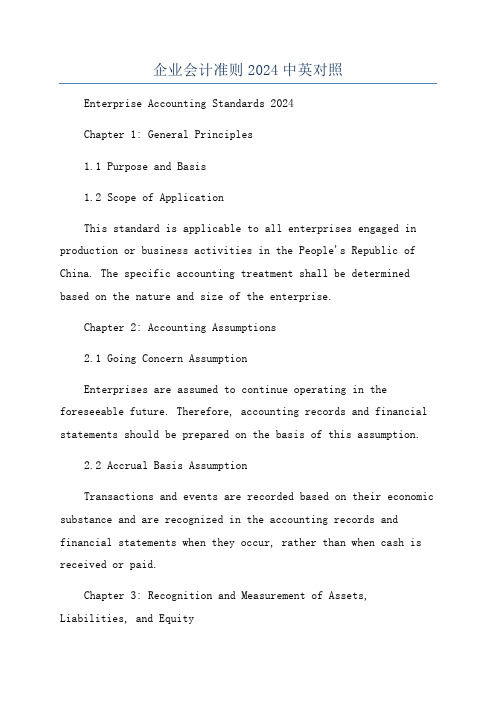

企业会计准则2024中英对照Enterprise Accounting Standards 2024Chapter 1: General Principles1.1 Purpose and Basis1.2 Scope of ApplicationThis standard is applicable to all enterprises engaged in production or business activities in the People's Republic of China. The specific accounting treatment shall be determined based on the nature and size of the enterprise.Chapter 2: Accounting Assumptions2.1 Going Concern AssumptionEnterprises are assumed to continue operating in the foreseeable future. Therefore, accounting records and financial statements should be prepared on the basis of this assumption.2.2 Accrual Basis AssumptionTransactions and events are recorded based on their economic substance and are recognized in the accounting records and financial statements when they occur, rather than when cash is received or paid.Chapter 3: Recognition and Measurement of Assets, Liabilities, and Equity3.1 Recognition of AssetsAn asset should be recognized if it is probable that future economic benefits associated with the asset will flow to the enterprise and the cost or value of the asset can be reliably measured.3.2 Recognition of LiabilitiesA liability should be recognized if it is probable that an outflow of economic benefits will be required to settle the obligation and the amount of the obligation can be reliably measured.3.3 Measurement of AssetsAssets should be initially measured at cost. Subsequently, assets should be measured at cost less accumulated depreciation, impairment loss, or fair value if the fair value is reliably measurable.3.4 Measurement of LiabilitiesLiabilities should be measured at the amount of proceeds received or receivable in exchange for the obligation. If the amount received or receivable is not fair value, the present value of the future cash outflows should be used as the measurement basis.4.1 Revenue RecognitionRevenue should be recognized when it is probable that future economic benefits will flow to the enterprise, and the amount of revenue can be reliably measured.4.2 Expense RecognitionExpenses should be recognized when it is probable that an outflow of economic benefits will be required to settle the related obligations and the amount of the expense can bereliably measured.Chapter 5: Presentation and Disclosure of Financial Statements5.1 Balance SheetThe balance sheet should present the financial position of the enterprise at a particular date, presenting assets, liabilities, and equity.5.3 Statement of Cash FlowsThe statement of cash flows should provide information about the cash flows of the enterprise during a particular period, classified into operating activities, investing activities, and financing activities.Chapter 6: Consolidated Financial Statements6.1 Consolidation PrinciplesConsolidated financial statements should be prepared when an enterprise has control over another entity or entities.6.2 Consolidation Procedures7.1 Acquisition Method7.2 Goodwill。

新会计准则中英对照

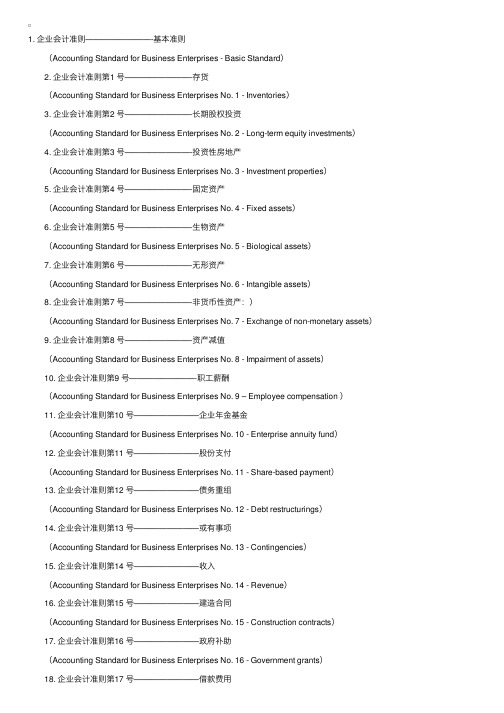

1. 企业会计准则————————-基本准则 (Accounting Standard for Business Enterprises - Basic Standard) 2. 企业会计准则第1 号————————-存货 (Accounting Standard for Business Enterprises No. 1 - Inventories) 3. 企业会计准则第2 号————————-长期股权投资 (Accounting Standard for Business Enterprises No. 2 - Long-term equity investments) 4. 企业会计准则第3 号————————-投资性房地产 (Accounting Standard for Business Enterprises No. 3 - Investment properties) 5. 企业会计准则第4 号————————-固定资产 (Accounting Standard for Business Enterprises No. 4 - Fixed assets) 6. 企业会计准则第5 号————————-⽣物资产 (Accounting Standard for Business Enterprises No. 5 - Biological assets) 7. 企业会计准则第6 号————————-⽆形资产 (Accounting Standard for Business Enterprises No. 6 - Intangible assets) 8. 企业会计准则第7 号————————-⾮货币性资产:) (Accounting Standard for Business Enterprises No. 7 - Exchange of non-monetary assets) 9. 企业会计准则第8 号————————-资产减值 (Accounting Standard for Business Enterprises No. 8 - Impairment of assets) 10. 企业会计准则第9 号————————-职⼯薪酬 (Accounting Standard for Business Enterprises No. 9 – Employee compensation ) 11. 企业会计准则第10 号————————企业年⾦基⾦ (Accounting Standard for Business Enterprises No. 10 - Enterprise annuity fund) 12. 企业会计准则第11 号————————股份⽀付 (Accounting Standard for Business Enterprises No. 11 - Share-based payment) 13. 企业会计准则第12 号————————债务重组 (Accounting Standard for Business Enterprises No. 12 - Debt restructurings) 14. 企业会计准则第13 号————————或有事项 (Accounting Standard for Business Enterprises No. 13 - Contingencies) 15. 企业会计准则第14 号————————收⼊ (Accounting Standard for Business Enterprises No. 14 - Revenue) 16. 企业会计准则第15 号————————建造合同 (Accounting Standard for Business Enterprises No. 15 - Construction contracts) 17. 企业会计准则第16 号————————政府补助 (Accounting Standard for Business Enterprises No. 16 - Government grants) 18. 企业会计准则第17 号————————借款费⽤ (Accounting Standard for Business Enterprises No. 17 - Borrowing costs) 19. 企业会计准则第18 号————————所得税 (Accounting Standard for Business Enterprises No. 18 - Income taxes) 20. 企业会计准则第19 号————————外币折算 (Accounting Standard for Business Enterprises No. 19 - Foreign currency translation) 21. 企业会计准则第20 号————————企业合并 (Accounting Standard for Business Enterprises No. 20 - Business Combinations) 22. 企业会计准则第21 号————————租赁 (Accounting Standard for Business Enterprises No. 21 - Leases) 23. 企业会计准则第22 号————————⾦融⼯具确认和计量 (Accounting Standard for Business Enterprises No. 22 - Recognition and measurement of financial instruments) 24. 企业会计准则第23 号————————⾦融资产转移 (Accounting Standard for Business Enterprises No. 23 - Transfer of financial assets) 25. 企业会计准则第24 号————————套期保值 (Accounting Standard for Business Enterprises No. 24 - Hedging) 26. 企业会计准则第25 号————————原保险合同 (Accounting Standard for Business Enterprises No. 25 - Direct insurance contracts) 27. 企业会计准则第26 号————————再保险合同 (Accounting Standard for Business Enterprises No. 26 - Re-insurance contracts) 28. 企业会计准则第27 号————————⽯油天然⽓开采 (Accounting Standard for Business Enterprises No. 27 - Extraction of petroleum and natural gas) 29. 企业会计准则第28 号————————会计政策、会计估计变更和差错更正 (Accounting Standard for Business Enterprises No. 28 - Changes in accounting policie and estimates, and correction of errors) 30. 企业会计准则第29 号————————资产负债表⽇后事项 (Accounting Standard for Business Enterprises No. 29 - Events occurring after the balance sheet date) 31. 企业会计准则第30 号————————财务报表列报 (Accounting Standard for Business Enterprises No. 30 - Presentation of financial statements) 32. 企业会计准则第31 号————————现⾦流量表 (Accounting Standard for Business Enterprises No. 31 - Cash flow statements) 33. 企业会计准则第32 号————————中期财务报告 (Accounting Standard for Business Enterprises No. 32 - Interim financial reporting) 34. 企业会计准则第33 号————————合并财务报表 (Accounting Standard for Business Enterprises No. 33 - Consolidated financial statements) 35. 企业会计准则第34 号————————每股收益 (Accounting Standard for Business Enterprises No. 34 - Earnings per share) 36. 企业会计准则第35 号————————分部报告 (Accounting Standard for Business Enterprises No. 35 - Segment reporting) 37. 企业会计准则第36 号————————关联⽅披露 (Accounting Standard for Business Enterprises No. 36 - Related party disclosure) 38. 企业会计准则第37 号————————⾦融⼯具列报 (Accounting Standard for Business Enterprises No. 37 - Presentation of financial instruments) 39. 企业会计准则第38 号————————⾸次执⾏企业会计准则 (Accounting Standard for Business Enterprises No. 38 - First time adoption of Accounting Standards for Business Enterprises)。

国际会计准则(1~41)中英文目录对照

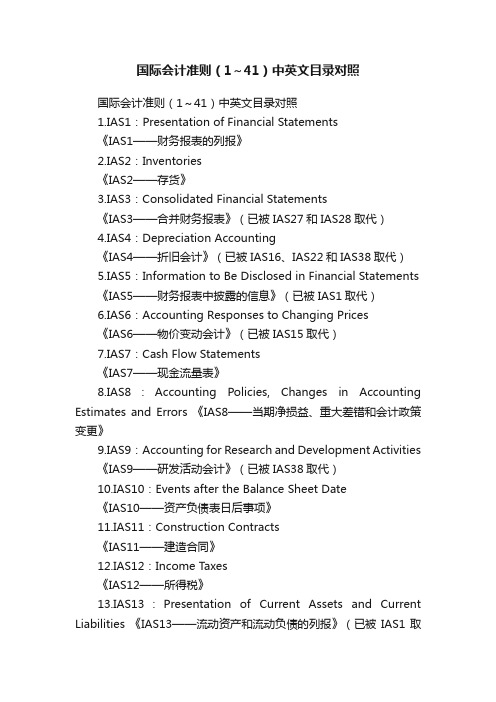

国际会计准则(1~41)中英文目录对照国际会计准则(1~41)中英文目录对照1.IAS1:Presentation of Financial Statements《IAS1——财务报表的列报》2.IAS2:Inventories《IAS2——存货》3.IAS3:Consolidated Financial Statements《IAS3——合并财务报表》(已被IAS27和IAS28取代)4.IAS4:Depreciation Accounting《IAS4——折旧会计》(已被IAS16、IAS22和IAS38取代)5.IAS5:Information to Be Disclosed in Financial Statements《IAS5——财务报表中披露的信息》(已被IAS1取代)6.IAS6:Accounting Responses to Changing Prices《IAS6——物价变动会计》(已被IAS15取代)7.IAS7:Cash Flow Statements《IAS7——现金流量表》8.IAS8:Accounting Policies, Changes in Accounting Estimates and Errors 《IAS8——当期净损益、重大差错和会计政策变更》9.IAS9:Accounting for Research and Development Activities《IAS9——研发活动会计》(已被IAS38取代)10.IAS10:Events after the Balance Sheet Date《IAS10——资产负债表日后事项》11.IAS11:Construction Contracts《IAS11——建造合同》12.IAS12:Income Taxes《IAS12——所得税》13.IAS13:Presentation of Current Assets and Current Liabilities 《IAS13——流动资产和流动负债的列报》(已被IAS1取代)14.IAS14:Segment Reporting《IAS14——分部报告》15.IAS15:Information Reflecting the Effects of Changing Prices《IAS15——反映物价变动影响的信息》(2003年已被撤销)16.IAS16:Property, Plant and Equipment《IAS16——不动产、厂场和设备》17.IAS17:Leases《IAS17——租赁》18.IAS18:Revenue《IAS18——收入》19.IAS19:Employee Benefits《IAS19——雇员福利》20.IAS20:Accounting for Government Grants and Disclosure of Government Assistance《IAS20——政府补助会计和政府援助的披露》21.IAS21:The Effects of Changes in Foreign Exchange Rates《IAS21——汇率变动的影响》22.IAS22:Business Combinations《IAS22——企业合并》(已被IFRS3取代)23.IAS23:Borrowing Costs《IAS23——借款费用》24.IAS24:Related Party Disclosures《IAS24——关联方披露》25.IAS25:Accounting for Investments《IAS25——投资会计》(已被IAS39 和IAS40取代)26.IAS26:Accounting and Reporting by Retirement Benefit Plans《IAS26——退休福利计划的会计和报告》27.IAS27:Consolidated and Separate Financial Statements《IAS27——合并财务报表及对子公司投资会计》28.IAS28:Investments in Associates《IAS28——对联合企业投资会计》29.IAS29:Financial Reporting in Hyperinflationary Economies《IAS29——恶性通货膨胀经济中的财务报告》30.IAS30:Disclosures in the Financial Statements of Banks and Similar Financial Institutions《IAS30——银行和类似金融机构财务报表中的披露》31.IAS31:Interests in Joint Ventures《IAS31——合营中权益的财务报告》32.IAS32:Financial Instruments: Disclosure and Presentation《IAS32——金融工具:披露和列报》33.IAS33:Earnings per Share《IAS33——每股收益》34.IAS34:Interim Financial Reporting《IAS34——中期财务报告》35.IAS35:Discontinuing Operations《IAS35——终止经营》(已被IFRS5取代)36.IAS36:Impairment of Assets《IAS36——资产减值》37.IAS37:Provisions, Contingent Liabilities and Contingent Assets 《IAS37——准备、或有负债和或有资产》38.IAS38:Intangible Assets《IAS38——无形资产》39.IAS39:Financial Instruments: Recognition and Measurement《IAS39——金融工具:确认和计量》40.IAS40:Investment Property《IAS40——投资性房地产》41.IAS41:Agriculture《IAS41——农业》国际会计准则中文版文件格式:Pdf可复制性:可复制TAG标签:会计学点击次数:更新时间:2010-03-30 15:23介绍国际会计准则中文版,国际会计准则在2008年做了更新,中文版不知道是否同步更新,这个对于会计从业人员的帮助很大,在网上找了很久中文版都是2003的老版本,不知道楼主上传的版本对我是否有用。

美国会计准则-中文版

目录23 2 存货(试行版) (7)2.存货(试行版) (11)3 所得税会计 (15)4A资本化资产和折旧 (26)4B 长期资产减值的会计处理 (30)4C 已减值资产的处置 (41)5 应收帐款(坏帐准备) (49)6 养老金核算 (52)7 租赁会计核算 (59)8 海外经营和货币折算 (61)9 衍生工具和套期活动 (65)10.缺勤补偿 (70)11 或有损失和产品担保 (72)12 合并和权益法会计核算 (77)13 中期财务报表(包括季度财务报表) (81)14 政府补助 (83)15 金融工具的公允价值 (84)16 内部使用软件的开发费用 (86)17 股东权益 (88)18 研究开发费用 (90)19 重组(退出或处置活动) (92)20 企业的发展阶段 (96)1 收入确认1-1. 会计定义概述只有当收入实现时或者收入可以实现并能取得相关利益时才能予以确认。

一般情况下,只有当以下条件同时得到满足时才可确认收入:(SAB No. 101 & 104):1.有说服力的证据表明销售约定存在;2.货物已经交付或者劳务已经提供;3.卖方向买方提供的商品价格是固定的或者是可以确定的;4.可以合理确信能够收到货款。

有些收入约定包含有多个销售商品或提供服务的活动。

在一般情况下,企业应该在交易完成时确认收入,并根据可能收不回来的金额按适当比例计提坏帐准备。

但若买方拥有退回货物的权利时,卖方只能按照一定的标准确认销售收入。

供应商可能会偶尔地或持续地给予其顾客各种各样的优惠(促销),诸如:折扣、礼券、回扣、"免费"的产品或服务等(紧急问题工作组01-9《卖方给予买方回报的会计处理》)。

顾客可以是直接的,也可以是间接的。

例如,供应商销售货物给分销商,分销商再将该货物销售给零售商。

紧急问题工作组01-9还涵盖了制造商给零售商或分销商的顾客促销奖励,诸如:折扣、礼券、回扣、"免费"的产品或服务以及各项其他安排如展位费、协作广告等。

ifrs准则中英文对照

ifrs准则中英文对照

IFRS准则(International Financial Reporting Standards)是国际

财务报告准则,又称国际会计准则(International Accounting Standards),是世界各国财务报告标准的国际统一标准。

其目的是为了促进全球财务信息的透明度和比较性,提高投资者和利益相关方对

企业财务状况的理解和信任度。

IFRS准则的起源可以追溯到20世纪70年代,当时国际航空运输协会建立了一个财务报告委员会,专门负责制定全球标准财务报告准则。

1989年,国际会计准则委员会(IASB)成立,被授权制定IFRS准则

并推进其全球范围内的推广和实施。

IFRS准则适用于所有上市公司和银行,以及一些非盈利性组织。

其主

要特点是强调财务报告的透明度、可比性和真实性。

其中,最重要的

标准包括IAS 1 (财务报告),IAS 2(存货),IAS 7(现金流量表)和IAS 8(会计政策、会计估计和会计错误)。

IFRS准则的全球推广和实施,旨在促进全球财务信息的透明度和比较性,增强投资者和利益相关方对企业财务状况的理解和信任度。

同时,IFRS准则为企业提供了更好的机会,通过全球化的财务报告标准,获

得更多的国际投资和融资。

当然,IFRS准则在全球范围内的推广和实施也面临诸多挑战,如地域差异、语言障碍、文化差异等。

因此,IFRS准则的设计和实施需要各国政府、监管部门、投资者、企业和专业人士的共同努力和支持,以确保IFRS准则能够真正发挥其充分作用,为全球金融市场的稳定和发展做出更大的贡献。

accounting principle 中文版

accounting principle 中文版

会计原则是指在会计实践中所遵循的一系列规则和准则,它们为会计工作提供了基本的指导和约束。

会计原则的制定旨在保证会计信息的准确性、可靠性和一致性,从而为企业的决策提供有力的支持。

会计原则的核心是会计基本假设,即企业实体假设、会计期间假设、货币计量假设和会计核算方法假设。

企业实体假设指企业应该被视为一个独立的经济实体,与其所有者和其他企业区分开来。

会计期间假设指企业的财务报表应该按照一定的时间间隔进行编制,通常是每年一次。

货币计量假设指企业的财务报表应该以货币为计量单位,以反映企业的财务状况和经营成果。

会计核算方法假设指企业应该采用一定的会计核算方法,如成本法、市场价值法等,来计量和报告其财务信息。

除了基本假设外,会计原则还包括会计核算原则、会计确认原则、会计计量原则和会计披露原则。

会计核算原则指企业应该按照一定的程序和方法进行会计核算,以保证财务信息的准确性和可靠性。

会计确认原则指企业应该在实际发生时确认其收入和费用,而不是在收到或支付现金时确认。

会计计量原则指企业应该按照一定的计量方法来计量其资产、负债、收入和费用。

会计披露原则指企业应该按照一定的规定和要求,对其财务信息进行披露,以便外部利益相关者了解企业

的财务状况和经营成果。

总之,会计原则是会计工作的基础和核心,它们为企业提供了一套完整的会计体系和标准,以保证财务信息的准确性、可靠性和一致性。

在实践中,企业应该严格遵守会计原则,加强内部控制,提高财务报告的透明度和可信度,以满足外部利益相关者的需求和期望。

企业会计准则 会计科目 英文版

企业会计准则会计科目英文版(中英文版)**Enterprise Accounting Standards: Accounting Subjects**In the realm of enterprise accounting, the establishment of standardized accounting subjects is of paramount importance.These subjects serve as the fundamental framework for categorizing and recording financial transactions, ensuring accuracy, transparency, and comparability in financial reporting.The following is an outline of the key accounting subjects in accordance with the enterprise accounting standards.1.Assets- Current Assets: Including cash, accounts receivable, inventory, and short-term investments.- Non-Current Assets: Comprising property, plant, and equipment, intangible assets, and long-term investments.2.Liabilities- Current Liabilities: Encompassing accounts payable, short-term loans, and accrued expenses.- Non-Current Liabilities: Including long-term loans, bonds payable, and deferred tax liabilities.3.Equity- Owner"s Equity: Reflecting the owner"s investment and retained- Minority Interest: Representing the portion of equity in subsidiaries not owned by the parent company.4.Revenue- Sales Revenue: Arising from the main operations of the enterprise.- Other Revenue: Including non-operating income such as interest and gains from the sale of assets.5.Expenses- Cost of Goods Sold: Relating to the production or purchase of goods sold.- Operating Expenses: Including salaries, rent, utilities, and marketing expenses.- Non-Operating Expenses: Comprising interest expenses and losses from the sale of assets.6.Gains and Losses- Gain or Loss on Disposal of Assets: Resulting from the sale or retirement of assets.- Unrealized Gains or Losses: Associated with changes in the fair value of certain financial instruments.7.Income Taxes- Current Tax Expense: Relating to taxes payable on current year"s- Deferred Tax Expense: Resulting from temporary differences between accounting and tax treatments.8.Other Comprehensive Income- Items of Other Comprehensive Income: Including foreign currency translation adjustments, gains or losses on available-for-sale financial assets, and certain pension adjustments.Adherence to these accounting subjects as per the enterprise accounting standards ensures that financial statements are prepared in a manner that is consistent, reliable, and informative for stakeholders.**企业会计准则:会计科目**在企业会计领域,建立标准化的会计科目至关重要。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Analysis of the 2006 System of the new accounting standardsIn 2006 the Ministry of Finance on corporate accounting standards were revised. New guidelines for income tax from the international accounting standards, combined with China's actual situation, called for a new income tax on the balance sheet of debt accounting method. The previous income tax accounting, enterprise income tax accounting method great choice, we can choose to meet the tax law, also have the option to tax effect accounting method. The introduction of tax effect accounting method, we can use deferred law, the debt can also be used by a profit report. However, these methods can not meet the needs of accounting changes in the environment, because China's current and future for a long period of time will be dedicated to the transformation of state-owned enterprises, will have a significant impact on income tax, while the previous accounting method can not reflect and address these aspects of the temporary Difference. Therefore, in order to improve the quality of accounting information, accounting information for users to meet a higher level of demand, the new guidelines explicitly proposed income tax accounting to adopt the balance sheet of debt.First, the balance sheet debt of the accounting procedures Balance sheet debt on the balance sheet of a focus on corporate assets, liabilities and the carrying amount of the tax provisions of the tax basis of the difference between the calculated temporary differences, according to confirm the deferred income tax liabilities or assets, and then confirmed Income tax expense accounting method. This includes income tax expense recognized in the current income tax charges and deferred income tax expense. Changes in tax rates, should have recognized deferred income tax assets and liabilities adjustments and the impact of changes in the current period included income tax expenses. Therefore, deferred income tax assets and deferred income tax liabilities of the measures reflected the balance sheet of enterprises, is expected to recover assets or liabilities of the book value of the settlement of tax effect.The use of off-balance sheet debt to income tax accounting, the balance sheetitems directly confirmed that the project is a profit report indirectly confirmed. Corporate earnings should be based on "assets / liabilities concept" to define and thus calculate the cost of income tax should also be deferred income tax assets and deferred income tax liabilities on the confirmation of squeezing projected to be inverted, the specific accounting procedures are as follows:(1) identification of each asset or liability of the tax base. Assets of tax base, refers to the book value of assets recovery process, the calculation of taxable income, in accordance with the provisions of the tax law since the taxable economic benefits can be offset in the amount of tax liability is based on the book value of that debt reduction To the future taxable income during the calculation of the amount in accordance with the provisions of the tax laws may be deductible amount.(2) based on the assets or liabilities of the carrying amount of its taxable basis of the difference between the established temporary differences.(3) multiplied by the applicable tax rates temporary differences are deferred income tax assets and deferred income tax liabilities or the End of the period;(4) in the current period and back to the deferred income tax assets or deferred income tax liabilities (the amount of tax effects) should be their end, the difference between the opening balance, that is, deferred income tax assets = of the temporary differences can be offset by the Income tax impact amount - back to the temporary differences can be offset by the impact of a disability income tax adjustment amount of deferred income tax liabilities = of taxable temporary differences in income tax rates affect - back to the taxable temporary differences in income tax ±affect the amount of adjustment.(5) the current income tax cost of redeeming the current income tax allowance = + (the end of the beginning of a deferred income tax liabilities, deferred income tax liabilities) - (end of deferred income tax assets - beginning of deferred income tax assets) = current redeeming the beginning of deferred income tax allowance + Net income tax assets - the end of the net deferred tax assets.Second, the balance sheet of debt and debt of difference of a profit reportAs a debt of the specific analysis method, the original debt of a profit report and thenew balance sheet debt to the owners of all rights based on the theory of income tax expenses will be considered as operating expenses rather than distribution of profits, are continuing operations in line with assumptions and principles of proportion, delivery Represent the future extension of income tax payable or receivable from the income tax. But they also have great differences between.(A) objects of different accountingBalance sheet debt and a profit report of the debt under the law as a debt of two different analytical methods, the most important difference is that in the former income tax accounting when the object is temporary differences, while the latter is the timing differences. Timing differences in a period that is generated in a later period or more during the taxable profits back to the accounting profit and the difference between the focus on revenue and costs from the perspective of accounting profits and taxable income the difference between , Revealed that a certain period of time differences, differences in emphasis and differences in the formation of the back; temporary differences is an asset or liability in the tax base and its balance sheet in the difference between the book value, Focus on assets and liabilities from the perspective of accounting profits and taxable income the difference between, reveals that the differences in a de facto, more emphasis on the content and the reasons for differences. From the connotation of temporary differences of view, it's different than the timing of a broader range, not only including all the timing differences, including the timing differences are not the temporary differences. For example: certain types of asset evaluation before the book value of 300 million, after assessment by the end of the book value of its provisions will be transferred to 3.5 million, while the other party in the balance sheet directly increase the rights and interests of owners, the tax does not affect a profit report Before profit. Debt to a profit report of the view that this business does not involve a profit report earnings, in fact need not pay tax, so the carrying value of the assets on the need for income tax treatment, but on balance sheet debt of the position, the book value of assets 3.5 million, the tax base of 300 million, and regardless of whether the impact on the value-added tax receipts of a profit report that it has formed a 50 million in temporary differences, the difference of each taxyear as the assets depreciation, Amortization, and other treatment, the book value of assets and gradually narrow the differences between the tax base and back.(B) the "deferred tax" to understand the meaning of differentEnterprises to adopt the balance sheet of debt to all temporary differences recognized as a deferred income tax assets or deferred income tax liabilities, greatly expand the "deferred tax" meaning, and a profit report debt of the use of the "deferred tax , "Compared with the former more practical significance. First of all debt of a profit report will be divided into timing differences in the next period of time difference between taxable and tax credits timing differences, respectively, will pay tax timing differences can be offset by timing differences and multiplied by the applicable tax rates that delivery Extension of income tax liabilities and deferred income tax assets. Because of the timing differences are reflected in current revenue and cost of the difference is revealed by a certain period of time differences, so at this time to confirm the deferred income tax assets or liabilities should be the impact of the current period, while in assets and liabilities Table of debt under the law, despite the temporary differences will be divided into taxable temporary differences and can be offset by temporary differences, and this recognition of deferred income tax liabilities and assets, but due to a temporary difference reflects the carrying amount of assets or liabilities Instead the difference between the tax base, from the nature of its causes and its analysis of the end of the assets, liabilities, the effect is a de facto reveal the differences. Thus the cumulative effect of temporary differences is the amount of deferred income tax assets or liabilities reflect the book value is the difference between the total.(C) of the proceeds of understanding of differentA profit report "revenue / cost of the" definition of income, that income is the ratio of income and expenses. Law and a profit report this income obligations relative concept should, in the calculation of income accounting for all income and the impact on income tax, and income tax expenses listed in a profit report, the income tax is deferred income tax accounting for income taxes and tax laws, shall be relative Than the result of the balance sheet "assets / liabilities of the apparent" definition of income,proposed a "comprehensive income". This requires that revenue recognition and measurement should submit to the balance sheet assets, liabilities, and other accounting requirements of the concept. Balance Sheet adapt to this method of income, assets or liabilities carrying amount of its tax base rate multiplied by the difference between a direct form of deferred income tax assets or liabilities of the End of the period, while income tax expense based on current tax and deferred income tax payable Assets or liabilities of the end of the period, compared to the beginning to be determined. In comparison, the debt calculated a profit report complicated procedures, and the confirmation and measurement of income tax assets and liabilities of the standard difficult to grasp.(D) the calculation of income tax expense of different proceduresLaw debt to a profit report a profit report of income and expenses for the focus of attention, recognition of income and expenses each item in the accounting and tax laws on the timing differences, and this timing differences on the impact of future income tax as income tax in the current period Costs of the restructuring and balance sheet debt to rule on the balance sheet of assets and liabilities for the focus of the project, one by one to confirm assets and liabilities of the carrying amount of its tax base temporary differences between the calculated cumulative temporary Differences, and then multiplied by the cumulative temporary differences applicable rate of formation of deferred income tax assets or liabilities of the End of the period, while income tax expenses, shall be based on the current income tax and deferred income tax assets or liabilities of the end of the period, compared to the opening balance to be determined. Therefore, can only be the beginning of the end of temporary differences and the taxable temporary differences affect the difference between the amount as income tax expenses in the current period of adjustment.Third, the use of off-balance sheet debt should pay attention to the issue of law(A) confirmed to be cautious in deferred income tax assetsOn-balance sheet debt under the law, if there can be offset by temporary differences, there will be "deferred tax" amount of the borrower, known as the deferred income tax assets that the withholding of income tax expense, to be back tothe period after . Deferred tax assets is a temporary differences can be offset by the impact of the current income tax rates, after back to when offset by the amount of income tax due to the realization, after the period to reduce the taxable amount. But after back to when the need for accounting of profits taxable income is greater than the precondition for, which means in practical work, due to temporary differences can be offset by the recognition of deferred income tax assets, in many cases need to Rely on the professional judgement to measure, such a professional judgement must be reasonable evidence that the expected future income tax benefits will be realized, if the temporary differences of resellers period, the enterprises do not have enough available to offset taxable income, it means that Can not resell the income tax assets, then the balance sheet to confirm the deferred income tax assets is inflated assets, less the cost of mind. Therefore, enterprises should be the taxable income may be subject to the deductible temporary differences can have a deferred income tax assets to confirm.(B) deferred income tax assets and needs Provision for impairmentTo reflect sound principles, enterprises can set up "deferred income tax assets for impairment" accounts, accounting for enterprises due to some factors of uncertainty and can not be achieved revenue receipts. Enterprises should regularly on deferred income tax assets and the carrying amount of inspection, at least the end of each year check again. If there is evidence that, during the very future may not be able to obtain sufficient taxable income to offset the deferred income tax assets and interests, namely the expected future income tax benefits can not be achieved and should be expected to achieve some of the Provision for impairment , The write-down of deferred income tax assets and the book value, to reflect on the deferred income tax assets can be realized, while recognizing the current income tax expense. If confirmed after the loss of deferred income tax assets to restore the book value should be identified in the original amount of the loss back to be within the scope. In this way, can be greatly reduced because of the accounting professional judgement too optimistic income tax accounting information to the statements of the negative impact of the user.。