HND-Economics-The-World-Economy世界经济学报告

HND大二经济学导论报告参考Outcome三

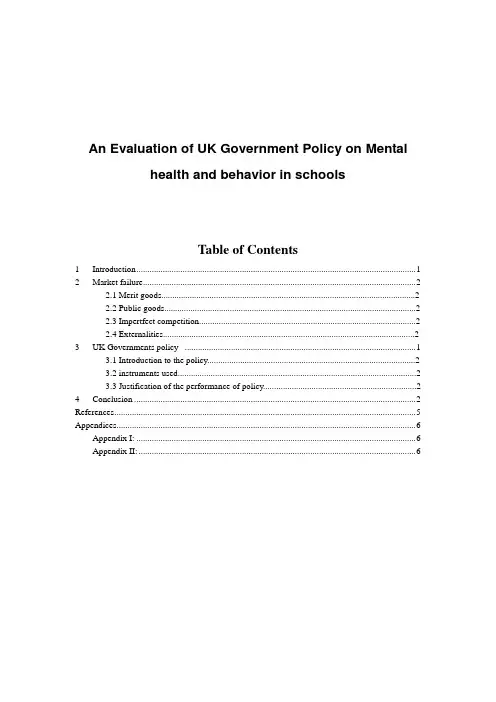

An Evaluation of UK Government Policy on Mentalhealth and behavior in schoolsTable of Contents1 Introduction (1)2 Market failure (2)2.1 Merit goods (2)2.2 Public goods (2)2.3 Impertfect competition (2)2.4 Externalities (2)3 UK Governments policy (1)3.1 Introduction to the policy (2)3.2 instruments used (2)3.3 Justification of the performance of policy (2)4 Conclusion (2)References (5)Appendices (6)Appendix I: (6)Appendix II: (6)1IntroductionThis report aims to explain the‘market failure’and the role of government in relative to merit goods, public goods, imperfect composition and externalities.The policy about mental health and behavior in school will also be introduced.Then it will describe the instruments used to achieve the policy and evaluate the policy.2Market failureMarket fail, that is, they do not provide all of the goods and services needed by the government,nor by society(SQA,2013a p184).2.1Merit goodsThe government provides services that might not be provided by the private sector in sufficient quantities or of a sufficient quantity (SQA,2013a p188).For instance,medical services,education and so on.In China,the government provides the public universities and nine year education,which support children to go to school and get a better education.2.2Public goodsThese are commodities, which would not be provided by the private sector because they would find that many people, even if they benefited from them, would refuse to pay(SQA,2013b p190), for example, grills in the park and Automatic Pet Water Fountain and so on.In many countries, the government provides the Automatic Pet Water Fountain, which is convenient for passerby to drink water whenever they want.2.3Imperfect competitionA company which control their own market , and they have no rival. A monoplist can adjust prices output in the market.for example, on February 5, 1991, pierpont Morgan bought Andrew Carnegie, Rockefeller,several iron ore and all the steel business,became the largest steel company , 65% of steel production by their control.The government could establish perfect competition through the establishment of enterprise competition policy (Peter,2013)2.4ExternalitiesAn externality is an effect of a purchase or use decision by one set of parties on others who did not have a choice and whose interests were not taken into account (SQA,2013d p188).For example, the negative externalities include car exhaust, smoking, kara OK noisy,which will do harm to the environment and people’health.As far as I am concerned, the government should have odd-and-even license plate rule and provide new energy electric vehicle.The positive externalities include new technology like purify the water and restoration of historical buildings.I think the government should support the enterprise to create more new technology.3UK Governments policy3.1 Introduction to the policy--Mental health and behavior in schoolsThe purpose of this policy is to let all pupils benefit from learning and developing in a well ordered school environment that fosters and rewards good behaviour and sanctions poor and disruptive behaviour. Their behaviour and discipline in schools advice sets out the powers and duties for school staff and approaches they can adopt to manage behaviour in their schools. It also says that schools should consider whether continuing disruptive behaviour might be a result of unmet educational or other needs. Published on16 June 2014,last updated on18 March 2016(Gov,UK,16 June 2014)3.2 Instruments usedInstruments- economic variables that governments can control directly for example, tax, public spending(SQA,2013e p194).The government take actions via government spending and relevant regulation.They found the Child and Adolescent Mental Health Services to deal with it.The specific services offered by CAMHS vary depending on the needs of the local area. The best way to influence those services overall is to get involved with the local health and wellbeing board.The government take actions to help them in referring pupils effectively to specialist CAMHS and otherwise working well with the service for the benefit of their vulnerable pupils. These include:1.The government hire some people documenting evidence of the symptoms or behaviour that are causing concern,encouraging the pupil and their parents/carers to speak to their GP2.The government spent some money working with local specialist CAMHS to make the referral process as quick and efficient as possible(Spence, S.H. 2003)3.1Justification of the performance of the policyI think the policy is successful, the mental health care benefits can make children to have a happier life.Thanks to the policy, children now have the ability to develop psychologically, emotionally, intellectually and spiritually.However,I think the policy also has some disadvantages.It has greatly increased government pressure.For example,Set up the CAMHS organization to support the school and some public organization。

HnD经济学导论outcome1报告

International CollegeCentral South University of Forestry and TechnologyASSIGNMENT COVER SHEETAssessment Task: _____________________________________________________________ Course Name:__________________________________ Outcome: ____________________ Prepared by:______________________________________________________ (English name) ________________________________ (Chinese name) ___________________ (Candidate Number) Class: ____________________ Name of Tutor:___________________________ Due Date: _______________ Date Submitted: ___________________Your report/essay should meet the following requirements. Please confirm this before submitting your assignment.☐Assignment is presented on A4 size paper and is tidily typed and well presented..☐Pages have been firmly stapled.☐ A copy has been retained by me.☐Declaration below is completed.DeclarationAll forms of plagiarism, cheating and unauthorized collusion are regarded seriously by the University and could result in penalties including failure in the unit and possible exclusion from the University. If you are in doubt, please contact the Unit Coordinator.Expect where I have indicated, the work I am submitting in this assignment is my own work._______________________________________ (Signature)Question1:With reference to the case study, summaries the relationship between goals, objectives and policy and advice the management of Scotia Airways of the contribution each will make to effective managerial performance.Answer1:Goal:Organizational goal is to complete the mission and purpose of the carrier organization. It is a future state that an organization strive to achieve, and it is the basis and motivation to carry out the organization's activities. Every social organization has its own intended purpose or result, it represents an organization's direction and future. For the organization, the purpose is the common goal; to the members, the common goal is to organize the stage needs to reach the destination. The organisations are usually determine the direction that it will take over the long term and are not always very specific, but some goals may be unintelligible and hard to understand.There are 4 types of organization: Operational goals, Product goals, Consumer goals, and Secondary goals.Operational goals that means increase efficiency, promote the work efficiency vigorously. Like the Scotia Airways, they have the culture of trust has been emphasized and developed by both the management and workers, and this has served to enhance the effectiveness, efficiency and overall performance of the business. When they have the awareness, team spirit, have the incentive measures, the working efficiency will increase.Product goals signify better service to consumer and higher products qualify, to ensure sustained and stable quality system. The Scotia Airways do well in this side,it offers several value added services, such as, valets to assist the passengers in boarding the plane, gourmet meals and a range of in-flight services and entertainment. And Scotia Airways is the first airline to offer full business class services, but at prices that are equivalent to the economy class of its competitors. A key driver of the success of Scotia Airways is the management focus upon the level and quality of service output.Consumer goals means satisfied the different demand from the different consumers. Scotia Airways is aimed at it, their operate scheduled flights mainly targeting business and leisure travelers and aims to provide exceptional value for money, unparalleled comfort and convenience to its passengers. It illustrated that everyone in the world is not the same, so an organization especially a company should adapt diverse needs.Secondary goals by organisations which are not the most important things that they would like to achieve but are nevertheless important. It is mainly about the social responsibility, making a profit or improving award. The Scotia Airways has been reinforced by positive management approaches and wide ranging reward policies that were agreed and supported by Trade Union representatives. And as far as possible to promote social harmony and integration, to create a better atmosphere.Object:Business objectives are more clear and specific than goals and identity the specific path to be taken in order to achieve goals. In this step, how can we do next, how quickly can we do it and how do we know when we have been successful are the important questions.The objectives should be SMART, include 5 aspects: Specific, Measurable, Attainable, Realistic and be Time-bound. These are the core of objectives’ requirements.To promote the market share increase, the airline has an increasing presence at Scotland’s main airports in Glasgow, Edinburgh and Aberdeen. And currently covers eight destinations across Europe, including Brussels, Paris, Frankfurt, Madrid, Rome, Lisbon, Amsterdam and Copenhagen as well as domestic flights to Manchester, Birmingham, Bristol and four London airports.It is also expanding to major business centers in Eastern Europe and the Middle and Far East. This several plans for improving the market share, expand the business scope is very effective.Pay more attention to suitable consumer groups is significant, too. The airline to operate flights mainly is the special value of providing funds for business and leisure travelers, incomparable comfort and convenience of passengers. To provide different services for different customer groups demand, is important to increase the performance and able to establish good relationship with customers.Policy:The policy is a require ment for the organization’s operating and transaction. It provides a guideline to channel a manager's thinking in a specific direction, it can also provide the path to complete goals and objectives. It provides a framework of rules or guidance within which management and staff can make decisions. Policies contain some different, for example, Inward investment policy, Welfare policy and Reward or Punishment policy.Inward investment policy: The equipments are freshing, all staff receives adequate training, the establishments of the new division and gain more market share are both in it.It has seen that the company expansion over resent year in many aspects and departments. Then they found new distributions in Eastern Europe and the Middle and Far East during this year.Reward or punishment policy: For the completion of the expansion target, organizations should set standards, regulations and purposes to evaluate employees' performance, and then take reactions respectively. The Scotia Airways has been reinforced by positive management approaches and wide ranging reward policies that were agreed and supported by Trade Union representatives.Relationship: The goal is the totality, it can including many objects, goals and objectives provide different kinds of requirements of organization. After make goals and objectives, the organization must have the policies to guides behavior by defining how something should be done. Suitable policies can help the organization to achieve goals and objectives, but inappropriate polices will result in bad effects and cannot complete the goals and objectives. Finally, healthy relationships among goals, objectives and policies are the basis of effective performance. The three affect each other and are both in hand.Q2: Explain the main principles of Open Systems Theory with reference to Scotia Airways.A2: The environments that are both internal and external would influenced the organization. The inter-related parts of a system can interact with the external environment. Changes in the external environment will affect the internal environment changes, the internal factors will also affect the overall changes, resulting in a chain effect.There are 4 aspects in this system. Input contains Staff, Managers, Clients orders, Bank loan and Equipment. Process contains Admin support, Allocation of projects, Communicate with clients, Promotion and Production. Output consists of High quality designs, Skilled staff,Satisfied clients and Service or product. Environment consists of Economy, Social trends, Policies, Legislation, Technology and Culture.When the EU and UK government relax their control over the licensing of airline provision, the input in the airway will increase, and then the output will also increase with the input. That is the external environment policy affect the change of the internal environment.And the government imposes taxes on high emissions of enterprise, then the cost will rise and the profit will reduce. So the company will decrease production, the airways maybe reduce a few airplane and maybe open up just one or two air lines.Q3: Identify the main differences between the formal and informal organization within Scotia Airways.A3: The Scotia Airways both formal and informal organization characte ristic.The aspects at formal organization characteristic are, it has clear goals, objectives, policies and missions; defined structure, clear division and classification; and the organization will be controlled. For example, the airways currently employ executives and managers in marketing, finance, HR and flight operations with operational and administrative staff within each department. Rosa Dallevic is in overall charge, assisted by her long-term colleague, Azim Ishtiaq. She has also employed the same personal assistant, Katrina Wright. That is a holonomic structure in the company.And the aspect at in formal organization characteristic is, it has ambiguous relationships in the airways. For example,the company is very much regarded as a family-style business and has established a range of suppliers and clients that are seen as the extended family. So it has relaxed and harmonious atmosphere, not very serious and tense.Q4: Describe four primary stakeholders of Scotia Airways and explain their interests in, and influence on the organisation.A4: G overnment: Whether the taxation violate related laws, whether the company compliance to related laws and whether solve the problem of local employment, that are the government concern about, is their interests. The influence in this case is the EU and UK governmentrelax their control over the licensing of airline provision. Then the airways business will improve and the profit will increase, so the government could charge a higher tax.Creditors: The creditors are concern about the credit score, liquidity, repayment ability and new contracts. When to borrow the money and when to return is the most important key to creditors. Only the airways credit rating better, can it borrow much money when they need, so the turnover of the fund more convenient.Investors: Have interest earning income from investment; have profitability, market share and business achievement are the significant matter to the investors. The influence are have big expansion plans and hire a team of administration. The investors in Scotia Airways have set an ambitious programme for expansion over the next 5 years, introducing flights to major European tourist destinations and to establish new branch in Eastern Europe and the Middle and Far East. Besides, They set about appointing a management team whose experience and expertise was firmly grounded in the budget aviation market.Employees: They concern about the rates of pay, job security, respect, truthful communication and work condition. The attitude and enthusiastic in working will influence the quantity and efficiency. The Scotia Airways have t o develop a wide range of rewards and punishment system, let the employees enthusiasm greatly improve.Q5:Identify an effective control strategy that the management of Scotia Airways could successfully implement, and justify its suitability.A5: I think the Bureaucratic control is the most effective control strategy to the Scotia Airways.Bureaucratic control means it can dominate the process, is the use of the determined rules, policies, hierarchy of authority, reward systems and other formal mechanisms to influence employee behavior and assess performance. The advantages are it could increase efficiency of the company, and can be controlled with market or price mechanisms, it is so stable. The disadvantage is the Poor flexibility. Bureaucratic control through the Organization Structure,In Scotia Airways, they begin to appointing a management team in the budget aviation market and currently employs 80 staff across all divisions. Its expansion over recent years has seen the company commit significant resources to the marketing and sales department, its finance department. There has been an increase in staffing levels, in budgets and in capital investment. It currently employs executives and managers in marketing, finance, HR and flight operations with operational and administrative staff within each department. Rosa Dallevic is in overall charge, and she has also employed the same personal assistant, Katrin Wright. In this organization structure, is helped promote consistency and continuity, lead to a positive working relationship within and between different departments. Various departments perform their respective duties, everything in good order and well arranged. The Scotia Airways also have some rules and regulations to guarantee employees behaviors in the company.So the Bureaucratic control is the best choice to the Scotia Airways.Bibliography:1. Stephen P. Robbins, (2008),The Principle of Management, 3edt,Beijing, China Renmin University Pres s Co. LTD2. Stephen P. Robbins, (2012), Organizational Behavior, 4edt,Beijing, China Renmin University Pres s Co. LTD3. Douglas Macgregor, (2008), The human side of enterprise,1edt,Beijing, Chinese International Book Trading Corporation. LTD4. James G.March, Herbert A Simon (2013), Organization, 2edt, Beijing,China Machinery press. LTD。

世界经济2

The current account is one of the two primary components of the balance of payments, the other being the capital account. It is the sum of the balance of trade (exports minus imports of goods and services), net factor income (such as interest and dividends) and net transfer payments (such as foreign aid). From the chart, the current balance is the lowest -15.9 in the first quarter of 2007, when the income is least all of the quarter at -0.7, and trade in goods is not so well at one of the smallest of those. The least present of the current balance as percent of GDP is -4.5% the firstFinancial account shows a net inflow (inward investment) £9.1billiono in the second quarter, compared with the previous quarter; net inflow is £6.5 billion pounds. In the latest quarter net foreign investment, reduce£326.1 billion, this is the highest record, in the first quarter in the netBillion----------------from <Pink Book>Since 1984, UK had always been deficit in every year. From 1987 the deficit was expanding from -8 billion to -11 billion, then the second phase from 1992 to 1997,recovery to -1 billion which is good view for UK in current payment.payment was facing the disaster which is the current account recorded in nearly -52 billion, aboutTable B。

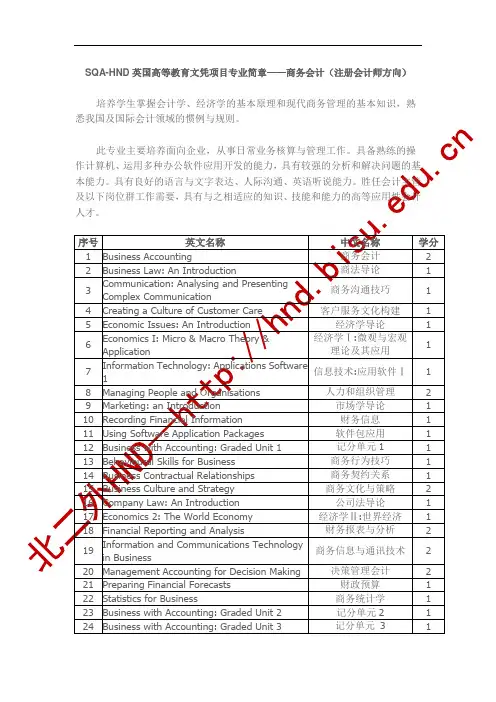

SQA-HND英国高等教育文凭项目专业简章——商务会计(注册会计师方向)

SQA-HND英国高等教育文凭项目专业简章——商务会计(注册会计师方向)

培养学生掌握会计学、经济学的基本原理和现代商务管理的基本知识,熟悉我国及国际会计领域的惯例与规则。

此专业主要培养面向企业,从事日常业务核算与管理工作。

具备熟练的操作计算机、运用多种办公软件应用开发的能力,具有较强的分析和解决问题的基本能力。

具有良好的语言与文字表达、人际沟通、英语听说能力。

胜任会计主管及以下岗位群工作需要,具有与之相适应的知识、技能和能力的高等应用性会计。

HND_Economics_2_The_World_Economy世界经济学报告

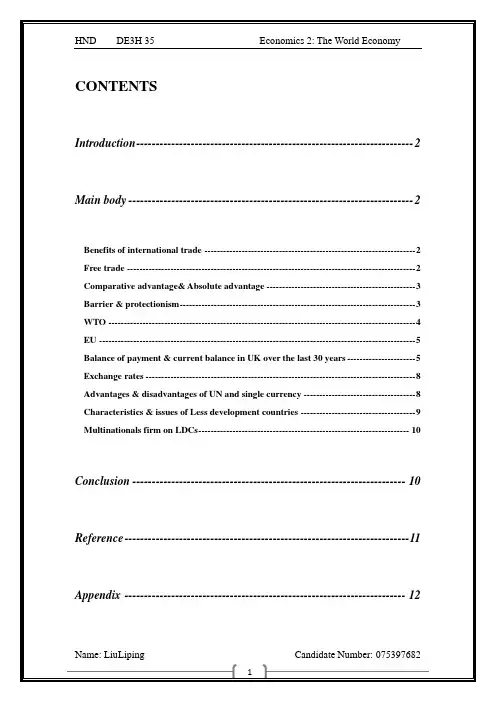

Economics 2: The WorldEconomyReworkContentIntroduction----------------------------------------------------------------3 Section 1: International TradeThree gains from trading internationally---------------------------------------3 Free Trade--------------------------------------------------------------------------3 Absolute and Comparative Advantage-----------------------------------------3 Protectionism----------------------------------------------------------------------4 Barriers to trade-------------------------------------------------------------------4 WTO and EU----------------------------------------------------------------------5 Section 2: International FinanceBalance of Payments and General trends in UK Trade----------------------6 Relationship between the exchange rate and the balance of payments—14 Single Currency------------------------------------------------------------------15 Effects on individuals and business of the Euro-----------------------------15 Section 3: Less Developed Countries (LDCs)Characteristics of a LDC--------------------------------------------------------16 Current issues that face LDCs--------------------------------------------------16 The impacts of multinationals on LDCs and NICs--------------------------16 Conclusion-----------------------------------------------------------------16 References------------------------------------------------------------------17Introduction:As a member of the government of nation on the periphery of Europe, it is my obligation to illustrate the benefits of joining the EU to the Premier. In this report, I will analyze 15elements in next three parts to make a clear explanation of benefits of joining the EU.Section 1: International TradeThree gains from trading internationally:To begin with, the international trade could increase world out-put. The tendency of globalization brings the firms more opportunities to gain the labor, resources, contracts and new technology. The supply and demand will be improved with the improvement of company’s productivity.Once the supply has been improved, the goods and services were produced at lower cost and there are more and more competitions, the price of the product might fall which means consumers could get more choices and cheaper goods.In addition, the most important gaining of international trade is it can generate economic growth. Free trade could increase sales, profit margins, and market shares and the both demand and supply level has updated. Meanwhile, the producer needs more resources, labor and capital to produce more to satisfy the global market. It direct result in improving the material market, finance market, and may decline the unemployment rate.Free tradeFree trade is a concept that there is no barrier to goods and services exchanged between countries. Since different countries have different terrain, weather, resources and technology, the international trade would bring the goods which are more valuable than the local people produce it by themselves.A good example for free trade is in Nov.18, 2004, Chinese President and Chilean President declared the start of the FTA negotiations. According to the agreement, the two countries would start tariff reduction of goods trade from July 1, 2006. Tariff of products accounting for 97% of the total of the two countries would be zero in ten years. China and Chile would carry out free trade in education, science & technology, environment protection, labor, social security, IPR, investment and promotion, mineral and industry. This agreement has promoted the free trade between China and Chile successfully.Absolute and comparative advantageAbsolute advantage refers to the ability of a particular person or a country to produce a particular good with fewer resources than another person or country. Absolute advantage is said to occur when one country can produce a good or service topre-determined quality more cheaply than anther country. It stands contrasted with the concept of comparative advantage which refers to the ability to produce a particular good at a lower opportunity cost. Opportunity cost is defined as the cost of choosing a good or service measured in terms of the next best alternative given up. A country has a comparative advantage in producing a good if the opportunity cost of producing that good in term of other goods is lower in that country than it is in other countries. Example: Korea and Japan have following production possibilities for two commodities, mobile phones and computers; assume that all the resources owned bythe advantage it has is much greater for mobiles. Using the same resources as Korea it can make twice as many mobile phones.For Japan the ‘cost’ of 1 Mobile phone is 10 bales of Computers, i.e. 20000/2000For Korea it is 15, i.e. 15000/1000But if we look at the case of computers we will find that here for Japan the cost of a bale of computers is one-tenth of a Mobile phone while for Korea it is one fifteenth. In terms of the output of Mobile phone foregone (opportunity cost), computer is cheaper in Korea than Japan. Korea has a Comparative advantage in computer while Japan has comparative advantage in mobile phone.ProtectionismProtectionism is the economic policy of restraining trade between nations, through methods such as high tariffs on imported goods, restrictive quotas, a variety of restrictive government regulations designed to discourage imports and anti-dumping laws in an attempt to protect domestic industries in a particular nation from foreign take-over or competition.Here are two examples of protectionism:1: Britain imports bananas from its ex-colonies in South America while USA owns huge banana plantations in South America. In 1999 Britain refused to import bananas from South America, so the US government slapped tariffs on some British-made goods. The most serious one was a punitive tariff of 100% on Scottish wool products in order to limit the import from Britain.2: Another example of protectionism is in January, 2009, American government settled a policy that only the American steel can be used in America. The American government tended to use this policy to reduce the loss in financial crisis and it helps the steel workers to keep their jobs. In this example, protectionism protects the domestic lower-skilled labor and domestic industries.Barriers to tradeTo protect a country’s own industries, the country which in adverse side need to find some ways to be barriers to limit the import products, usually, the two methodsare—tariff and non tariffs.Tariff is taxes or customs duties placed on foreign products to artificially raise their prices and this hopefully, suppresses domestic demand for them. This tax may be ad value, that is, a percentage of the price of the goods or specific, that is, a tax per unit of weight or physical quantity.For example, in January 12, 2009 the Russian government raised the expropriation tariff (up to 30 percent) for the cars import in the next nine months. The import car’s price will be increased to be WP (price for the whole world) adds the tariff, since the price is increasing, the sales of the import cars must fall down. The customers might choose the Russian car instead of import cars since it is cheaper.Non-tariff barriers traditionally have been actions such Quotas, embargoes, exchange control and import deposits. Probably the best known of these is the quota. This is a physical limitation on the quantity of import. Quota is a physical limitation on the quantity of imports which had been acknowledged by local laws. Usually the importers need to apply to pay for a license to sell goods.For instance, Russia uses another method to limit foreign car import since 2008—to limit the quantity of import; only a few companies which have the import license could import cars and have a selling upper limit. Russia uses these methods to restrict the import quantity, and during the government limited foreign goods import, it can promote the domestic industries.WTO and EUIn 1948, the General Agreement on Tariffs and Trade (GATT) was established by the developed countries. In 1 Jan 1995, the GATT was supplanted by a new institution, the World Trade Organization (WTO) and aims to improve trade and investment flows around the world. It is an international body seeking to promote free trade by opening markets through the elimination of import tariffs. The organization administers trade agreements, monitors international trade policy and acts as a forum for trade negotiations. The four main goals of WTO are: freeing global trade through universally lowered tariffs, imposing the same rules on all members in order to homogenize the trade process, spurring competition through lowered subsidies, and ensuring the same trade concessions for all member nations. The WTO also provides technical assistance and training for developing countries. WTO aims for equal representation among members by granting each member country "most-favored nation" status; when a member country bestows a trade privilege on another nation, the privilege must be extended to all other member countries. Another tenet is "national treatment," which behooves countries to treat foreign imports equally with those produced domestically.The best example for joining the WTO is the join of China in 2007, after that, China achieves lots of benefits from the decrease of tariff, limitations and the simplification of trading procedures.EU stands for European Union and is an economic union, which aims to abolish tariffs and quotas among members, common tariff and quota system, restrictions onfactor movements and harmonization and unification of economic policies and institutions. It draws out regulations, monitors member states, solves disputes and problems among member states and negotiates with other countries or international organizations on the behalf of EU members. The European Union aims to promote and smooth free trade among internal European Union and initiatives for simplifying national and community rules include simpler legislation for the internal market (SLIM) and European Business Test Panel. For example, in Oct 16, 2009, EU and Korean government signed a free trade agreement of 100 billion US dollars after two years’ negotiation and EU will cancel the tariffs on imports of textile and cars from Korea in the next three years. This will promote the free trade of EU and have positive impact on the economy.Section 2: International FinanceBalance of Payments and General trends in UK TradeBalance of payment is the name given to the record of transactions between the residents of the country and the rest of the world over a period of time. It is a key economic statistics and UK’s Balance of Payments is comprises by the current account, the capital account, the financial account which deals with flow of direct portfolio and investments and reserve assets and the International Investment Position which shows the Stock of External Financial Assets and Liabilities. The chart below shows the composition if Balance of Payments in 2008:a) The current account can be divided into four categories: trade in goods, trade in service, income and current transfers. Positive net income from abroad corresponds to a current account surplus; negative net income from abroad corresponds to a current account deficit.Here are the trade figures of recent years:Here are the Current Account Balance Chart and the Chart of trade in Goods and services of UK in last 20 years.The current balance has usually been in deficit over the last 30 years.The UK has recorded a current account deficit in every year since 1984. Prior to 1984, the current account recorded a surplus in 1980 to 1983. From 1984 to 1989, the current account deficit increased steadily to reach a high of 25.5 billion pounds in 1989, equivalent to -4.9 per cent of Gross Domestic Product (GDP). From 1990 until 1997, the current account deficit declined to a low of 1.0 billion pounds in 1997. Between 1998 and 2006, the current account deficit widened sharply, peaking at 43.8 billion pounds in 2006. This was the highest recorded in cash terms but only equated to -3.3 per cent of GDP. In the past two years, there has been a reduction in the current account deficit –in 2008 it currently stands at 25.1 billion, equivalent to -1.7 per cent of GDP.It is obvious that UK had a large deficit in trade of goods in the last 30 years and the deficit becomes lager and increases greatly from 1998 to 2008 while the surplus of trade in service grows smoothly but not as markedly as the goods deficit. The trade in goods account recorded net surpluses in the years 1980 to 1982, largely as a result of growth in exports of North Sea oil. Since then however, the trade in goods account has remained in deficit. The deficit grew significantly in the late 1980s to reach a peak of 24.7 billion in 1989, before narrowing in the 1990s to levels of around 10 billion to 14 billion. In 1998 the deficit jumped by over 9 billion, and it has continued to rise since, reaching a cash record of 92.9 billion in 2008.There are two different of Income—Direct Investment Income and Portfolio Investment Income. The Direct Investment Income means the profits earned by UK companies from overseas branches and associated company. And the Portfolio Investment Income is the interest on bonds and dividends, held abroad by UK companies and residents.Here are charts of income over the 10 years:The income section has shown positive growth from 2006 to 2008 and is very much in surplus recently.As for the current transfer, it also has two different parts:The taxes, payments and receipts to the EU, Social Security Payments abroad, and military expenditure abroad is the Central Government Transfer. And for Other Sector Transfers, it includes receipts from the EU Social Fund, taxes on income and wealth paid by UK workers and businesses to foreign governments, insurance premiums and claims.There is the Chart of Current transfer in last 10 yearsThe transfers account has shown a deficit in every year since 1960. The deficit increased steadily to reach 4.8 billion in 1990. In 1991, the deficit reduced to 1.0 billion, reflecting 2.1 billion receipts from other countries towards the UK’s cost of the first Gulf conflict. The deficit has since increased, to reach a record 13.6 billion in 2008.b) Compared with Current Accounts, the composition of the Capital and Financial Account is more complicate.Capital Account has two categories:Capital transfer: It is investment grants by the government and debts which the government has agreed with the creditor do not need to be met.Acquisition and disposal of non produced/nonfinancial assets: Purchase or sales of property by foreign embassy or patents, copyrights, trademarks, franchises and leases.The capital account has shown strong steady surplus growth especially from the year of 2006 to 2008.The financial account has four categories and here are the charts of the four categories over the last ten years:According to these graphs, investment increased dramatically from the mid-1990s, reflecting the increased globalization of the world economy. Between 2000 and 2007, other investment dominated cross-border investment, primarily banking activity. In 2008 however, other investment, has recorded net disinvestment as the global financial crisis deepened leading to a reduction in loans internationally and a repatriation of deposits. In recent years, including the latest, the UK has needed to borrow from abroad to finance a continuing current account deficit, which has resulted in inward investment (UK liabilities) exceeding outward investment (UK assets).c) The international investment position is the balance sheet of the stock of external assets and liabilities. Between 1966 and 1994 the UK’s assets tended to exceed itsliabilities, by up to a record 86.4 billion pounds in 1986. But from 1995 to 2007, the UK recorded a net liability position in every year, reaching a record 352.6 billion pounds in 2006. In 2008, the UK returned to a net asset position of 92.9 billion pounds mainly due to exchange rate effects.The chart below indicates UK’s international investment position:Relationship between the exchange rate and the balance of paymentsThe exchange rate is the price of a currency in terms of other currencies. Its effect on balance of payments will depend upon its relationship with other currencies and how its value will change. As the currency weakens (devalues) the exports will become cheaper abroad but the country has to pay more for imports but the goods and services would become internationally cheaper and lead to more goods a services being purchased. If demand remains the same then the value of goods and services to the country will reduce and the current account balance may deteriorate. If the exchange rate rises then the country’s goods and services might suffer and demand from abroad could fall. If the demand remains the same however then the value of exports will rise and the current account balance should improve.For instance, when the UK market needs to import American goods (such as corns) the exchange market in UK would be the demand of U.S dollars is larger than the supply of UK pounds. If the American markets needs import more British goods, they need to exchange more pounds in the currency market, so the both of demand of US Dollar and supply of UK Pounds is increasing, meanwhile, the exchange rate of £/$is increasing. UK pound is more valuable means the goods of UK are usually more expensive and American people need to spend more US dollars compared to thesame amount of pounds. That is why the currency exchange rate is so important for the balance of payments. For example, if the exchange rate of £/$is increasing, the American business man might not choose UK goods, because of the high price. Single CurrencyEuropean single currency Euro came to exist since 1999. There are 12 member states of EU who use Euro while UK is still not one of the members since there are both advantages and disadvantages to join it.Advantages:At firstly, the single currency reduces the exchange rate uncertainty because people don't have to convert money from one currency to another when purchase goods. Meanwhile, using the single currency will increase foreign investment such as direct inward investment since the reduction of uncertainty. Then it may produce a great transparency. Whether people buy or sell goods, consumers can compare price in a single currency. It will help to decrease the scope for price discriminations and create pressure to lower the price. Moreover, it could maintain interest rate lower and the commitment to low inflation should allow economies to operate with lower cost. Disadvantages:A country may lose the independent monetary policy if it joins the single currency. The single currency forces a country to forgo an independent monetary policy. After the single currency has been used, the country's monetary policy will determined by the supranational central bank and not by the domestic central bank. This is why the theory of optimal currency areas emphasizes the importance of flexible prices, labor mobility and fiscal transfers. Flexible prices and labor mobility become more important when a currency union exists; governments have an incentive to make markets work more efficiently.Besides, there are also political costs to the country. If the government loses control over monetary policy to the supranational central bank, politicians are limited to using fiscal policy to influence economy.Effects on individuals and business of the EuroAs for the individuals,they can get lower prices and higher quality goods and services when they have more choices due to increased competition among companies through the Euro zones; they can measure the good price through Europe and choose the best one. In addition, single currency reduces the transaction costs of traveling in Europe. Individuals could travel more frequently than past since it is more convenient and cheaper. People do not need to concern the exchange rate and commission fee when visiting the other countries in Europe.As for the business, people could avoid the exchange rate risk and traders do not need to waste time and cost on purchasing foreign currencies. Moreover, the business market could be expanded there are more opportunities.Section 3: Less Developed Countries (LDCs) Characteristics of a LDCLess Developed Countries (LDCs) mainly exist in Asia and Africa. Most LDCs’subsistence is agriculture. The land of LDCs is very ineffectively used and is very low in productivity, there are normally no modern techniques or equipment available, and the land is always threatened by floods or droughts. The birth rates in LDCs are very high but there is very heavy infant mortality since the health care system is poor.A good example for LDC is Angola. A 2007 survey concluded that low and deficient niacin status was common in Angola. Many regions in this country have high incidence rates of tuberculosis and high HIV prevalence rates. Angola has one of the highest infant mortality rates in the world and one of the world's lowest life expectancies.Current issues that face LDCsThe World Bank offers aid programs to Angola to support the health care system of Angola to reduce the infections of HIV but the aid programs they get from the World Bank of IMF carry conditions which they feel are difficult to comply with, and are expensive.Besides, the indebtedness of Angola keeps increasing year on year. This makes Angola almost impossible to borrow more.They borrow a huge amount of money to develop their economy, purchase foreign goods and service. However, the high interest or other factors make debts become a great stress on LDCs. They are in the trip of debts, which prevent the development of their economy.The impacts of multinationals on LDCs and NICsNow days, there are more and more multi-national firms which have branches in various countries since it can reduce the labor, material, transport cost. Companies from newly industrialized countries tend to be MNCs. A good example for multinationals on NICs and LDCs is Great Wall Computer Corporation from China. This company invests 120 million dollars to build a new factory in Algeria to expand its market and increase 34 percent of its foreign sale income. The company offers more jobs to the people in Algeria thus increase the employment and income of Algerian. The company also brings new technology to this less developed country. However, the company transfers most of profits back to China and uses their financial strength to impose their will in host counties either.ConclusionAfter analyzing these 15 elements, you may have a clear acknowledge of the international trade, finance and LDCs and as for the economic environment of the whole area, it can be benefit to join the EU. It will enhance our country’s economic growth by attracting more free capital, using single currency and enlarge the market.References:Web research:/downloads/theme_economy/PB09.pdfRelated Web sites Book resource:The Economics 2: The World Economy: Higher National Diploma. Scottish Qualifications AuthorityUnited Kingdom Balance of Payments the Pink Book 2009: Office for National Statistics。

HNDEconomicsTheWorldEconomy世界经济学报告

Economics 2: The WorldEconomyReworkContentIntroduction----------------------------------------------------------------3 Section 1: International TradeThree gains from trading internationally---------------------------------------3 FreeTrade--------------------------------------------------------------------------3Absolute and Comparative Advantage-----------------------------------------3 Protectionism----------------------------------------------------------------------4Barriers to trade-------------------------------------------------------------------4WTO and EU----------------------------------------------------------------------5Section 2: International FinanceBalance of Payments and General trends in UK Trade----------------------6 Relationship between the exchange rate and the balance of payments—14SingleCurrency------------------------------------------------------------------15 Effects on individuals and business of the Euro-----------------------------15 Section 3: Less Developed Countries (LDCs)Characteristics of a LDC--------------------------------------------------------16Current issues that face LDCs--------------------------------------------------16The impacts of multinationals on LDCs and NICs--------------------------16 Conclusion-----------------------------------------------------------------16 References------------------------------------------------------------------17 Introduction:As a member of the government of nation on the periphery of Europe, it is my obligation to illustrate the benefits of joining the EU to the Premier. In this report, I will analyze 15elements in next three parts to make a clear explanationof benefits of joining the EU.Section 1: International TradeThree gains from trading internationally:To begin with, the international trade could increase world out-put. The tendency of globalization brings the firms more opportunities to gain the labor, resources, contracts and new technology. The supply and demand will be improved with the improvement of company’s productivity.Once the supply has been improved, the goods and services were produced at lower cost and there are more and more competitions, the price of the product might fall which means consumers could get more choices and cheaper goods.In addition, the most important gaining of international trade is it can generate economic growth. Free trade could increase sales, profit margins, and market shares and the both demand and supply level has updated. Meanwhile, the producer needs more resources, labor and capital to produce more to satisfy the global market. It direct result in improving the material market, finance market, and may decline the unemployment rate.Free tradeFree trade is a concept that there is no barrier to goods and services exchanged between countries. Since different countries have different terrain, weather, resources and technology, the international trade would bring the goods which aremore valuable than the local people produce it by themselves.A good example for free trade is in Nov.18, 2004, Chinese President and Chilean President declared the start of the FTA negotiations. According to the agreement, the two countries would start tariff reduction of goods trade from July 1, 2006. Tariff of products accounting for 97% of the total of the two countries would be zero in ten years. China and Chile would carry out free trade in education, science & technology, environment protection, labor, social security, IPR, investment and promotion, mineral and industry. This agreement has promoted the free trade between China and Chile successfully.Absolute and comparative advantageAbsolute advantage refers to the ability of a particular person or a country to produce a particular good with fewer resources than another person or country. Absolute advantage is said to occur when one country can produce a good or service to pre-determined quality more cheaply than anther country. It stands contrasted with the concept of comparative advantage which refers to the ability to produce a particular good at a lower opportunity cost. Opportunity cost is defined as the cost of choosing a good or service measured in terms of the next best alternative given up. A country has a comparative advantage in producing a good if the opportunity cost of producing that good in term of other goods is lower in that country than it is in other countries.Example: Korea and Japan have following production possibilities for twocommodities, mobile phones and computers; assume that all the resources owned by each country are same.It is clear that Japan has an Absolute advantage over Korea in both commodities. But the advantage it has is much greater for mobiles. Using the same resources as Korea it can make twice as many mobile phones.For Japan the ‘cost’ of 1 Mobile phone is 10 bales of Computers, i.e. 20000/2000 For Korea it is 15, i.e. 15000/1000But if we look at the case of computers we will find that here for Japan the cost of a bale of computers is one-tenth of a Mobile phone while for Korea it is one fifteenth. In terms of the output of Mobile phone foregone (opportunity cost), computer is cheaper in Korea than Japan. Korea has a Comparative advantage in computer while Japan has comparative advantage in mobile phone.ProtectionismProtectionism is the economic policy of restraining trade between nations, throughmethods such as high tariffs on imported goods, restrictive quotas, a variety of restrictive government regulations designed to discourage imports and anti-dumping laws in an attempt to protect domestic industries in a particular nation from foreign take-over or competition.Here are two examples of protectionism:1: Britain imports bananas from its ex-colonies in South America while USA owns huge banana plantations in South America. In 1999 Britain refused to import bananas from South America, so the US government slapped tariffs on some British-made goods. The most serious one was a punitive tariff of 100% on Scottish wool products in order to limit the import from Britain.2: Another example of protectionism is in January, 2009, American government settled a policy that only the American steel can be used in America. The American government tended to use this policy to reduce the loss in financial crisis and it helps the steel workers to keep their jobs. In this example, protectionism protects the domestic lower-skilled labor and domestic industries.Barriers to tradeTo protect a country’s own industries, the country which in adverse side need to find some ways to be barriers to limit the import products, usually, the two methods are—tariff and non tariffs.Tariff is taxes or customs duties placed on foreign products to artificially raise their prices and this hopefully, suppresses domestic demand for them. This tax maybe ad value, that is, a percentage of the price of the goods or specific, that is, a tax per unit of weight or physical quantity.For example, in January 12, 2009 the Russian government raised the expropriation tariff (up to 30 percent) for the cars import in the next nine months. The import car’s price will be increased to be WP (price for the whole world) adds the tariff, since the price is increasing, the sales of the import cars must fall down. The customers might choose the Russian car instead of import cars since it is cheaper. Non-tariff barriers traditionally have been actions such Quotas, embargoes, exchange control and import deposits. Probably the best known of these is the quota. This is a physical limitation on the quantity of import. Quota is a physical limitation on the quantity of imports which had been acknowledged by local laws. Usually the importers need to apply to pay for a license to sell goods.For instance, Russia uses another method to limit foreign car import since 2008—to limit the quantity of import; only a few companies which have the import license could import cars and have a selling upper limit. Russia uses these methods to restrict the import quantity, and during the government limited foreign goods import, it can promote the domestic industries.WTO and EUIn 1948, the General Agreement on Tariffs and Trade (GATT) was established by the developed countries. In 1 Jan 1995, the GATT was supplanted by a new institution, the World Trade Organization (WTO) and aims to improve trade and investment flowsaround the world. It is an international body seeking to promote free trade by opening markets through the elimination of import tariffs. The organization administers trade agreements, monitors international trade policy and acts as a forum for trade negotiations. The four main goals of WTO are: freeing global trade through universally lowered tariffs, imposing the same rules on all members in order to homogenize the trade process, spurring competition through lowered subsidies, and ensuring the same trade concessions for all member nations. The WTO also provides technical assistance and training for developing countries. WTO aims for equal representation among members by granting each member country "most-favored nation" status; when a member country bestows a trade privilege on another nation, the privilege must be extended to all other member countries. Another tenet is "national treatment," which behooves countries to treat foreign imports equally with those produced domestically.The best example for joining the WTO is the join of China in 2007, after that, China achieves lots of benefits from the decrease of tariff, limitations and the simplification of trading procedures.EU stands for European Union and is an economic union, which aims to abolish tariffs and quotas among members, common tariff and quota system, restrictions on factor movements and harmonization and unification of economic policies and institutions. It draws out regulations, monitors member states, solves disputes and problems among member states and negotiates with other countries or international organizations on the behalf of EU members. The European Union aims to promote andsmooth free trade among internal European Union and initiatives for simplifying national and community rules include simpler legislation for the internal market (SLIM) and European Business Test Panel. For example, in Oct 16, 2009, EU and Korean government signed a free trade agreement of 100 billion US dollars after two years’negotiation and EU will cancel the tariffs on imports of textile and cars from Korea in the next three years. This will promote the free trade of EU and have positive impact on the economy.Section 2: International FinanceBalance of Payments and General trends in UK TradeBalance of payment is the name given to the record of transactions between the residents of the country and the rest of the world over a period of time. It is a key economic statistics and UK’s Balance of Payments is comprises by the current account, the capital account, the financial account which deals with flow of direct portfolio and investments and reserve assets and the International Investment Position which shows the Stock of External Financial Assets and Liabilities. The chart below shows the composition if Balance of Payments in 2008:a) The current account can be divided into four categories: trade in goods, trade in service, income and current transfers. Positive net income from abroad corresponds to a current account surplus; negative net income from abroad corresponds to a current account deficit.Here are the trade figures of recent years:Here are the Current Account Balance Chart and the Chart of trade in Goods and services of UK in last 20 years.The current balance has usually been in deficit over the last 30 years. The UK has recorded a current account deficit in every year since 1984. Prior to 1984, the current account recorded a surplus in 1980 to 1983. From 1984 to 1989, the current account deficit increased steadily to reach a high of 25.5 billion pounds in 1989, equivalent to -4.9 per cent of Gross Domestic Product (GDP). From 1990 until 1997, the current account deficit declined to a low of 1.0 billion pounds in 1997. Between 1998 and 2006, the current account deficit widened sharply, peaking at 43.8 billion pounds in 2006. This was the highest recorded in cash terms but only equated to -3.3 per cent of GDP. In the past two years, there has been a reduction in the current account deficit –in 2008 it currently stands at 25.1 billion, equivalent to -1.7 per cent of GDP.It is obvious that UK had a large deficit in trade of goods in the last 30 years and the deficit becomes lager and increases greatly from 1998 to 2008 while the surplus of trade in service grows smoothly but not as markedly as the goods deficit. The trade in goods account recorded net surpluses in the years 1980 to 1982, largely as a result of growth in exports of North Sea oil. Since then however, the trade in goods account has remained in deficit. The deficit grew significantly in the late 1980s to reach a peak of 24.7 billion in 1989, before narrowing in the 1990s to levels of around 10 billion to 14 billion. In 1998 the deficit jumped by over 9 billion, and it has continued to rise since, reaching a cash record of 92.9 billionin 2008.There are two different of Income—Direct Investment Income and Portfolio Investment Income. The Direct Investment Income means the profits earned by UK companies from overseas branches and associated company. And the Portfolio Investment Income is the interest on bonds and dividends, held abroad by UK companies and residents.Here are charts of income over the 10 years:The income section has shown positive growth from 2006 to 2008 and is very much in surplus recently.As for the current transfer, it also has two different parts:The taxes, payments and receipts to the EU, Social Security Payments abroad, and military expenditure abroad is the Central Government Transfer. And for Other Sector Transfers, it includes receipts from the EU Social Fund, taxes on income and wealth paid by UK workers and businesses to foreign governments, insurance premiums and claims.There is the Chart of Current transfer in last 10 yearsThe transfers account has shown a deficit in every year since 1960. The deficit increased steadily to reach 4.8 billion in 1990. In 1991, the deficit reduced to 1.0 billion, reflecting 2.1 billion receipts from other countries towards the UK’s cost of the first Gulf conflict. The deficit has since increased, to reach a record13.6 billion in 2008.b) Compared with Current Accounts, the composition of the Capital and Financial Account is more complicate.Capital Account has two categories:Capital transfer: It is investment grants by the government and debts which the government has agreed with the creditor do not need to be met.Acquisition and disposal of non produced/nonfinancial assets: Purchase or sales of property by foreign embassy or patents, copyrights, trademarks, franchises and leases.The capital account has shown strong steady surplus growth especially from the year of 2006 to 2008.The financial account has four categories and here are the charts of the four categories over the last ten years:According to these graphs, investment increased dramatically from the mid-1990s, reflecting the increased globalization of the world economy. Between 2000 and 2007, other investment dominated cross-border investment, primarily banking activity. In 2008 however, other investment, has recorded net disinvestment as the global financial crisis deepened leading to a reduction in loans internationally and a repatriation of deposits. In recent years, including the latest, the UK has needed to borrow from abroad to finance a continuing current account deficit, which hasresulted in inward investment (UK liabilities) exceeding outward investment (UK assets).c) The international investment position is the balance sheet of the stock of external assets and liabilities. Between 1966 and 1994 the UK’s assets tended to exceed its liabilities, by up to a record 86.4 billion pounds in 1986. But from 1995 to 2007, the UK recorded a net liability position in every year, reaching a record 352.6 billion pounds in 2006. In 2008, the UK returned to a net asset position of 92.9 billion pounds mainly due to exchange rate effects.The chart below indicates UK’s international investment position:Relationship between the exchange rate and the balance of paymentsThe exchange rate is the price of a currency in terms of other currencies. Its effect on balance of payments will depend upon its relationship with other currencies and how its value will change. As the currency weakens (devalues) the exports will become cheaper abroad but the country has to pay more for imports but the goods and services would become internationally cheaper and lead to more goods a services being purchased. If demand remains the same then the value of goods and services to the country will reduce and the current account balance may deteriorate. If the exchange rate rises then the country’s goods and services might suffer and demand from abroad could fall. If the demand remains the same however then the value of exports will rise and the current account balance should improve.For instance, when the UK market needs to import American goods (such as corns)the exchange market in UK would be the demand of U.S dollars is larger than the supply of UK pounds. If the American markets needs import more British goods, they need to exchange more pounds in the currency market, so the both of demand of US Dollar and supply of UK Pounds is increasing, meanwhile, the exchange rate of £/$ is increasing. UK pound is more valuable means the goods of UK are usually more expensive and American people need to spend more US dollars compared to the same amount of pounds. That is why the currency exchange rate is so important for the balance of payments. For example, if the exchange rate of £/$ is increasing, the American business man might not choose UK goods, because of the high price. Single CurrencyEuropean single currency Euro came to exist since 1999. There are 12 member states of EU who use Euro while UK is still not one of the members since there are both advantages and disadvantages to join it.Advantages:At firstly, the single currency reduces the exchange rate uncertainty because people don't have to convert money from one currency to another when purchase goods. Meanwhile, using the single currency will increase foreign investment such as direct inward investment since the reduction of uncertainty. Then it may produce a great transparency. Whether people buy or sell goods, consumers can compare price in a single currency. It will help to decrease the scope for price discriminations and create pressure to lower the price. Moreover, it could maintain interest ratelower and the commitment to low inflation should allow economies to operate with lower cost.Disadvantages:A country may lose the independent monetary policy if it joins the single currency. The single currency forces a country to forgo an independent monetary policy. After the single currency has been used, the country's monetary policy will determined by the supranational central bank and not by the domestic central bank. This is why the theory of optimal currency areas emphasizes the importance of flexible prices, labor mobility and fiscal transfers. Flexible prices and labor mobility become more important when a currency union exists; governments have an incentive to make markets work more efficiently.Besides, there are also political costs to the country. If the government loses control over monetary policy to the supranational central bank, politicians are limited to using fiscal policy to influence economy.Effects on individuals and business of the EuroAs for the individuals,they can get lower prices and higher quality goods and services when they have more choices due to increased competition among companies through the Euro zones; they can measure the good price through Europe and choose the best one. In addition, single currency reduces the transaction costs of traveling in Europe. Individuals could travel more frequently than past since it is more convenient and cheaper. People do not need to concern the exchange rateand commission fee when visiting the other countries in Europe.As for the business, people could avoid the exchange rate risk and traders do not need to waste time and cost on purchasing foreign currencies. Moreover, the business market could be expanded there are more opportunities.Section 3: Less Developed Countries (LDCs)Characteristics of a LDCLess Developed Countries (LDCs) mainly exist in Asia and Africa. Most LDCs’subsistence is agriculture. The land of LDCs is very ineffectively used and is very low in productivity, there are normally no modern techniques or equipment available, and the land is always threatened by floods or droughts. The birth rates in LDCs are very high but there is very heavy infant mortality since the health care system is poor.A good example for LDC is Angola. A 2007 survey concluded that low and deficient niacin status was common in Angola. Many regions in this country have high incidence rates of tuberculosis and high HIV prevalence rates. Angola has one of the highest infant mortality rates in the world and one of the world's lowest life expectancies. Current issues that face LDCsThe World Bank offers aid programs to Angola to support the health care system of Angola to reduce the infections of HIV but the aid programs they get from the World Bank of IMF carry conditions which they feel are difficult to comply with, and areexpensive.Besides, the indebtedness of Angola keeps increasing year on year. This makes Angola almost impossible to borrow more.They borrow a huge amount of money to develop their economy, purchase foreign goods and service. However, the high interest or other factors make debts become a great stress on LDCs. They are in the trip of debts, which prevent the development of their economy.The impacts of multinationals on LDCs and NICsNow days, there are more and more multi-national firms which have branches in various countries since it can reduce the labor, material, transport cost. Companies from newly industrialized countries tend to be MNCs. A good example for multinationals on NICs and LDCs is Great Wall Computer Corporation from China. This company invests 120 million dollars to build a new factory in Algeria to expand its market and increase 34 percent of its foreign sale income. The company offers more jobs to the people in Algeria thus increase the employment and income of Algerian. The company also brings new technology to this less developed country. However, the company transfers most of profits back to China and uses their financial strength to impose their will in host counties either.ConclusionAfter analyzing these 15 elements, you may have a clear acknowledge of the international trade, finance and LDCs and as for the economic environment of the whole area, it can be benefit to join the EU. It will enhance our country’s economicgrowth by attracting more free capital, using single currency and enlarge the market.References:Web research:/downloads/theme_economy/PB09.pdfRelated Web sites /wiki/Protectionism/eurocash.asp/Book resource:The Economics 2: The World Economy: Higher National Diploma. Scottish Qualifications AuthorityUnited Kingdom Balance of Payments the Pink Book 2009: Office for National Statistics。

hnd经济学2世界经济学