会计英语相关习题

会计英语练习题

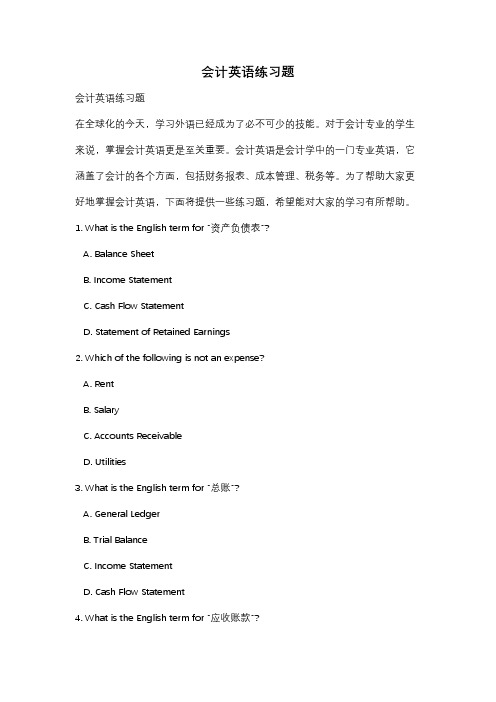

会计英语练习题会计英语练习题在全球化的今天,学习外语已经成为了必不可少的技能。

对于会计专业的学生来说,掌握会计英语更是至关重要。

会计英语是会计学中的一门专业英语,它涵盖了会计的各个方面,包括财务报表、成本管理、税务等。

为了帮助大家更好地掌握会计英语,下面将提供一些练习题,希望能对大家的学习有所帮助。

1. What is the English term for "资产负债表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings2. Which of the following is not an expense?A. RentB. SalaryC. Accounts ReceivableD. Utilities3. What is the English term for "总账"?A. General LedgerB. Trial BalanceC. Income StatementD. Cash Flow Statement4. What is the English term for "应收账款"?A. Accounts PayableB. Accounts ReceivableC. InventoryD. Prepaid Expenses5. What is the English term for "固定资产"?A. Current AssetsB. Fixed AssetsC. Intangible AssetsD. Accounts Payable6. What is the English term for "净利润"?A. Gross ProfitB. Operating IncomeC. Net IncomeD. Retained Earnings7. What is the English term for "应付账款"?A. Accounts PayableB. Accounts ReceivableC. Accrued ExpensesD. Prepaid Expenses8. What is the English term for "现金流量表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings9. What is the English term for "财务报表分析"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting10. What is the English term for "税务"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting以上是一些关于会计英语的练习题,希望大家能够认真思考并给出正确答案。

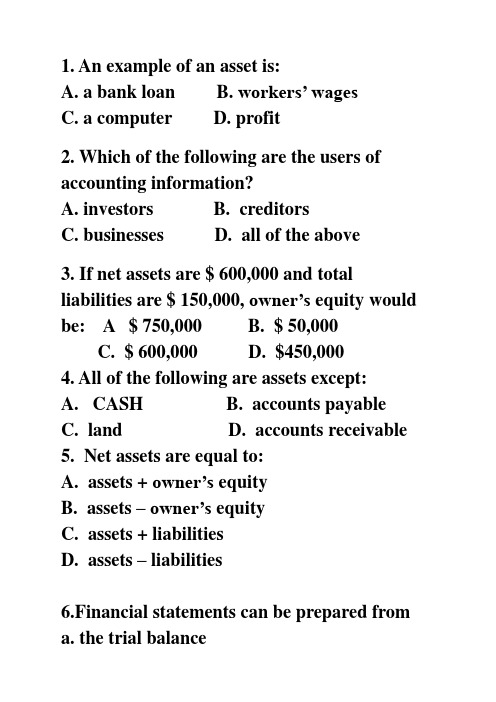

会计英语练习

1. An example of an asset is:A. a bank loanB. workers’ wagesC. a computerD. profit2. Which of the following are the users of accounting information?A. investorsB. creditorsC. businessesD. all of the above3. If net assets are $ 600,000 and total liabilities are $ 150,000, owner’s equity would be: A $ 750,000 B. $ 50,000C. $ 600,000D. $450,0004. All of the following are assets except:A. CASHB. accounts payableC. landD. accounts receivable5. Net assets are equal to:A. assets + owner’s equityB. assets –owner’s equityC. assets + liabilitiesD. assets – liabilities6.Financial statements can be prepared froma. the trial balanceb. the adjusted trial balancec. the journald. the ledger7. Liabilities are:a. What the business owes everyone except the owner.b. What the business owns.c. What the business is due from its customers8. The cost wages due the business’s employees at the end of the month should be recorded in what account?a. Wages earnedb. Wages payablec. Wages receivable9. The business purchased supplies on credit. This should be recorded in which of the following accounts?a. accounts receivableb. accounts duec. accounts payable10.Which of the following statements about a trail balance is incorrect? ( )a. It’s primary purpose is to prove themathematical equality of debits and credits after postingb. It uncovers certain errors in the journalizing and postingc. It is useful in the preparation of financial statementsd. It proves that all transactions have been recorded.11. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec, 2010. He makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010?A $8 500 Dr B. $8 500 CrC. $14 000 DrD. $14 000 Cr12.The interested users of financial information include: a. Banks and other creditorsb. Managersc. Stockholdersd. Investment advisorse. Governmental agencies13. Long-term assets can be further classifiedinto: a. long-term investments b. fixed assetsc. intangible assets.d. capital stock二、翻译题1、将下列词组按要求翻译(中翻英,英翻中)(1) 零用资金(2) 支票(3) 试算平衡(4) 不动产、厂房和设备(5) Notes and coins (6) money order(7) general ledger (8) direct debt (9) 报销(10) revenue and gains三、业务题1. The night manager of Majestic Limousine Service, who had no accounting background, prepared the following balance sheet for the company at February 28, 2001. The dollar amounts were taken directly from the company’s accounting records and are correct. However, the balance sheet contains a number of errors in its headings, format, and theclassification of assets, liabilities, and owner’s equity.Prepare a corrected balance sheet. Include a proper heading.1-5 CDCBD6-10 BABCD11-13 C ABCDE ABC。

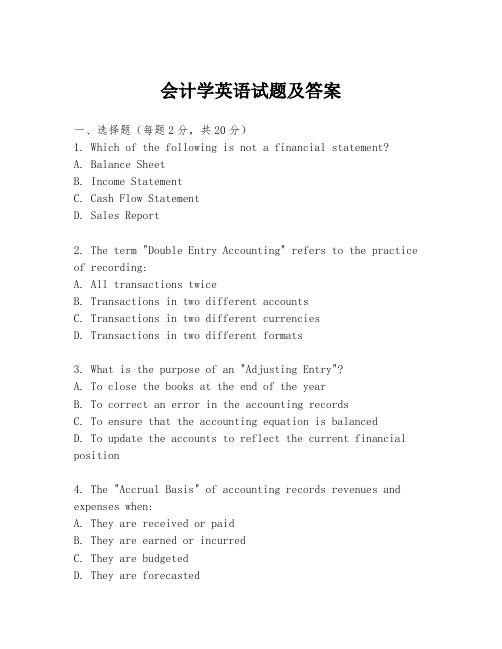

会计学英语试题及答案

会计学英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Sales Report2. The term "Double Entry Accounting" refers to the practice of recording:A. All transactions twiceB. Transactions in two different accountsC. Transactions in two different currenciesD. Transactions in two different formats3. What is the purpose of an "Adjusting Entry"?A. To close the books at the end of the yearB. To correct an error in the accounting recordsC. To ensure that the accounting equation is balancedD. To update the accounts to reflect the current financial position4. The "Accrual Basis" of accounting records revenues and expenses when:A. They are received or paidB. They are earned or incurredC. They are budgetedD. They are forecasted5. What does the term "Depreciation" represent?A. The increase in the value of an assetB. The decrease in the value of an asset over time due to useC. The sale of an assetD. The purchase of an asset6. Which of the following is an example of a "Liability"?A. Cash on handB. Accounts ReceivableC. Accounts PayableD. Inventory7. The "Net Income" is calculated by:A. Subtracting expenses from revenuesB. Adding expenses to revenuesC. Multiplying expenses by revenuesD. Dividing expenses by revenues8. A "Journal Entry" is used to:A. Record the initial transactionB. Adjust the trial balanceC. Close the booksD. Prepare financial statements9. What is the formula for calculating "Return on Investment" (ROI)?A. ROI = (Net Income / Total Assets) * 100B. ROI = (Net Income / Investment) * 100C. ROI = (Total Assets / Net Income) * 100D. ROI = (Investment / Net Income) * 10010. The "Going Concern" assumption in accounting means that:A. The business will always be profitableB. The business will continue to operate indefinitelyC. The business will be sold in the near futureD. The business will stop operating in the next year二、填空题(每题1分,共10分)11. The __________ is a record of all financial transactions of a business.12. In accounting, the __________ is the difference between the total debits and total credits.13. The __________ is the process of allocating the cost of a tangible asset over its useful life.14. An __________ is a financial statement that shows the changes in equity during a period.15. The __________ is the amount of money that a company owes to its creditors.16. The __________ is the process of estimating the value ofa company's assets.17. The __________ is the amount of money that a company has earned but has not yet received.18. The __________ is the amount of money that a company is owed by others.19. The __________ is the process of preparing financial statements at the end of an accounting period.20. The __________ is the amount of money that a company has spent but has not yet been billed.三、简答题(每题5分,共30分)21. Explain the difference between "Cash Basis" and "AccrualBasis" accounting.22. What is the purpose of "Bad Debts" in accounting?23. Describe the "Matching Principle" in accounting.24. What is the significance of "Financial Statement Analysis"?四、案例分析题(共40分)25. A company has the following transactions for the year: - Sales revenue of $500,000- Cost of goods sold of $300,000- Depreciation expense of $20,000- Interest expense of $10,000- Income tax expense of $30,000- Dividends paid of $15,000Calculate the company's net income and explain how each item affects the calculation.答案一、选择题1. D2. B3. D4. B5. B6. C7. A8. A9. B10. B二、填空题11. General Journal12. Trial Balance13. Depreciation14. Statement of Changes in Equity15. Liabilities16. Valuation17. Unearned Revenue18. Accounts Receivable19. Closing the Books20. Prepaid Expenses三、简答题21. Cash Basis accounting records transactions when cash is received。

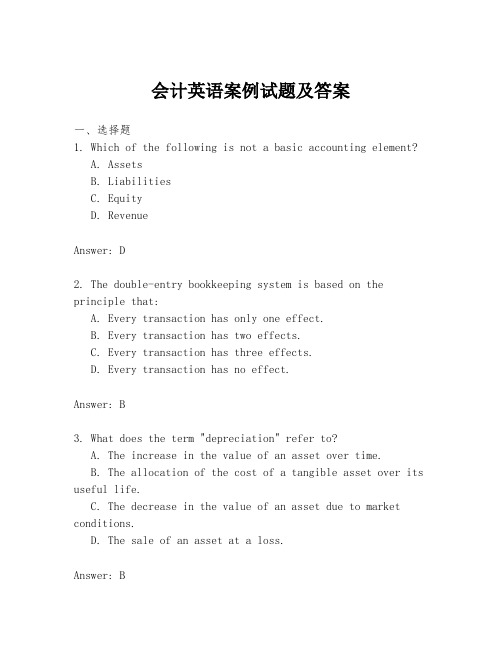

会计英语案例试题及答案

会计英语案例试题及答案一、选择题1. Which of the following is not a basic accounting element?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D2. The double-entry bookkeeping system is based on the principle that:A. Every transaction has only one effect.B. Every transaction has two effects.C. Every transaction has three effects.D. Every transaction has no effect.Answer: B3. What does the term "depreciation" refer to?A. The increase in the value of an asset over time.B. The allocation of the cost of a tangible asset over its useful life.C. The decrease in the value of an asset due to market conditions.D. The sale of an asset at a loss.Answer: B二、填空题4. The financial statement that shows the financial position of a company at a particular point in time is called the________.Answer: Balance Sheet5. The process of adjusting the accounts at the end of an accounting period to ensure they reflect the actual financial status of the company is known as ________.Answer: Closing the Books6. The term "accrual accounting" refers to the method of accounting where revenues and expenses are recognized when they are ________.Answer: Earned or Incurred三、简答题7. Explain the difference between "cash accounting" and "accrual accounting".Answer: Cash accounting is a method where revenues and expenses are recognized when cash is received or paid. In contrast, accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of when cash is exchanged.8. What is the purpose of adjusting entries and why are theynecessary at the end of an accounting period?Answer: Adjusting entries are made to update the accounts for any transactions that have occurred but have not yet been recorded, or to allocate expenses and revenues to the correct accounting period. They are necessary to ensure the financial statements accurately reflect the company's financialposition and performance for the period.四、案例分析题9. A company purchased equipment on January 1st for $50,000, with an estimated useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: The annual depreciation expense is calculated as the cost of the asset divided by its useful life. In this case, it would be $50,000 / 5 years = $10,000 per year.10. A company has the following transactions in the month of March: sales revenue of $120,000, cost of goods sold of $80,000, and operating expenses of $30,000. Calculate the company's net income for March using the accrual basis of accounting.Answer: Net income is calculated as total revenues minustotal expenses. For March, the net income would be $120,000 (sales revenue) - $80,000 (cost of goods sold) - $30,000 (operating expenses) = $10,000.请注意,以上内容仅为示例,实际的试题及答案应根据具体的教学大纲和课程内容来制定。

会计学专业会计英语试题

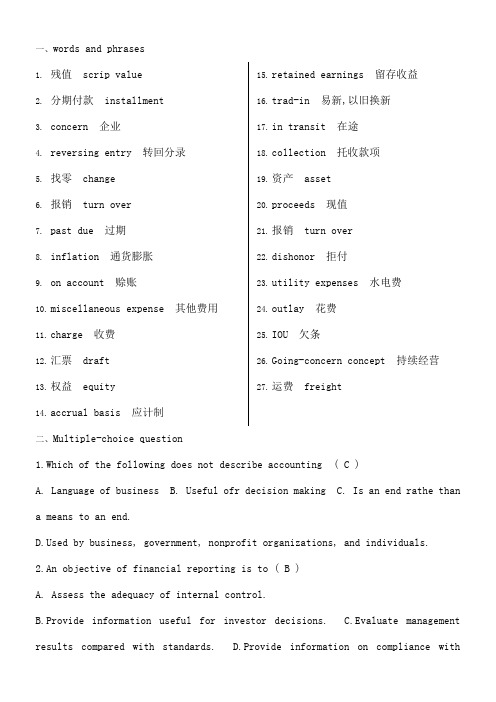

一、words and phrases1.残值 scrip value2.分期付款 installment3.concern 企业4.reversing entry 转回分录5.找零 change6.报销 turn over7.past due 过期8.inflation 通货膨胀9.on account 赊账10.miscellaneous expense 其他费用11.charge 收费12.汇票 draft13.权益 equity14.accrual basis 应计制15.retained earnings 留存收益16.trad-in 易新,以旧换新17.in transit 在途18.collection 托收款项19.资产 asset20.proceeds 现值21.报销 turn over22.dishonor 拒付23.utility expenses 水电费24.outlay 花费25.IOU 欠条26.Going-concern concept 持续经营27.运费 freight二、Multiple-choice question1.Which of the following does not describe accounting ( C )A. Language of businessB. Useful ofr decision makingC. Is an end rathe than a means to an end.ed by business, government, nonprofit organizations, and individuals.2.An objective of financial reporting is to ( B )A. Assess the adequacy of internal control.B.Provide information useful for investor decisions.C.Evaluate management results compared with standards.D.Provide information on compliance withestablished procedures.3.Which of the following statements is(are) correct ( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.A company may use different depreciation methods in its financial statements and its income tax return.C.The cost of a machine includes the cost of repairing damage to the machine during the installation process.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method.4. Which of the following is(are) correct about a company’s balance sheet ( B )A.It displays sources and uses of cash for the period.B.It is an expansion of the basic accounting equationC.It is not sometimes referred to as a statement of financial position.D.It is unnecessary if both an income statement and statement of cash flows are availabe.5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A )rmation used to determine which products to poducermation about economic resources, claims to those resources, and changes in both resources and claims.rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows.rmation that is useful in making ivestment and credit decisions.6.Each of the following measures strengthens internal control over cash receipts except. ( C )A.The use of a petty cash fund.B.Preparation of a daily listing of all checks received through the mail.C.The use of cash registers.D.The deposit of cash receipts in the bank on a daily basis.7.The primary purpose for using an inventory flow assumption is to. ( A )A.Offset against revenue an appropriate cost of goods sold.B.Parallel the physical flow of units of merchandise.C.Minimize income taxes.D.Maximize the reported amount of net income.8.In general terms, financial assets appear in the balance sheet at. ( B )A.Current valueB.Face valueC.CostD.Estimated future sales value.9.If the going-concem assumption is no longer valid for a company except. ( C )nd held as an ivestment would be valued at its liquidation value.B.All prepaid assets would be completely written off immediately.C.Total contributed capital and retained earnings would remain unchanged.D.The allowance for uncollectible accounts would be eliminated.10.Which of the following explains the debit and credit rules relating to the recording of revenue and expenses ( C )A.Expenses appear on the left side of the balance sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recordedby credits. C.The effects of revenue and expenses on owners’ equity.D.The realization principle and the matching principle.11.Which of the following statements is(are) correct ( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.The cost of a machine do not includes the cost of repairing damage to the machine during the installation prcess.C.A company may use same depreciation methods in its finacial statements and its income tax return.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method.12.A set of financial statements ( B ) except.A.Is intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.B.Is intended to assist the Intemal Revenue Service in detemining the amount of income taxes owed by a business organization.C.Includes notes disclosing information necessary for the proper interpretation of the statements.D.Is intended to assist investors and creditors in making decisions inventory the allocation of economic resources.13.The primary purpose for using an inventory flow assumption is to. ( B )A.Parallel the physical flow of units of merchandise.B.Offset against revenue an appropriate cost of goods soldC.Minimize income taxes.D.Maximize the reported amount of net income.14.Indicate all correct answers. In the accounting cycle. ( D )A.Transactions are posted before they are journalized.B.A trial balance is prepared after journal entries haven’t been posted.C.The Retained Earnings account is not shown as an up-to-date figure in the trial balance.D.Joumal entries are posted to appropriate ledger accounts.15.According to text, Objectives of Financial Reporting by Business Enterprises. ( D )A.Extemal users have the ability to prescribe information they want.rmation is always based on exact measures.C.Financial reporting is usually based on industries or the economy as a whole.D.Financial accounting does not directly measure the value of a business enterprise.16.Indicate all correct answers. Dividends except ( A )A.Decrease owners’equity.B.Decrease net incomeC.Are recorded by debiting the Cash accountD.Are a business expense17.Which of the following practices contributes to efficient cash management ( C )A.Never borrow money-maintain a cash balance sufficient to make all necessary payments.B.Record all cash receipts and cash payments at the end of the month when reconciling the bank statements.C.Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance.D.Pay each bill as soon as the invoice arrives.18.Which of the following would you expect to find in a correctly prepared income statement ( A )A.Revenues earned during the period.B.Cash balance at the end of the period.C.Contributions by the owner during the period.D.Expenses incurred during the next period to earn revenues.19.Which of the following are important factors in ensuring the integrity of accounting information ( D )A.Institutional factors, such as standards for preparing information.B.Professional organizations, such as the American Institute of CPAs. Cpetence’judgment’ and ethical behavior of individual accountants’ D.All of the above.三、Practices11.On Jan.1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $40,000 for 2000, calculated under the sum-of –the-years’–digits method. Required: Determine the acquisition cost of the equipment. ( C )A.$210,000B.$250,000C.$225.000D.$200,0002. On Jan.2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of –the-years’–digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A.$220,000B.$250,000C.$224.000D.$200,0003. October 1, 2005, Coast Financial Ioaned Bart Corporation $3000,000, receivingin exchange a nine-month, 12 percent note receivable. Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on all notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 will amount to. ( A )A.$9,000B.$18,000C.$27.000D.$36,000Question: What is the reconciled balance ( B )A.$4,187B.$4,085C.$4,090D.$4,000Required: Choose the reconciled balance. ( D )A.$3,220B.$3,250C.$3,200D.$3,225Required:Calculate the cost of goods available for sale(C)A.$475,000B.$474,000C.$470,000D.$473,000Required: Calculate the cost of goods sold ( D )A.$225,000B.$254,000C.$250,000D.$253,0008.At the end of the current year, the accounts receivable account has a debit balance of $60,000 and net sales for the year total $100,000. The allowance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A ) A.Dr. Bad Debt Accts. $1,500 B.Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C. Dr. Bad Debt Accts. $1,000D. Dr. Bad Debt Accts. $1,500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery(arranged in alphabetical order)were as follows at August 1,2005.(You are to compute the missing figure for retainedearnings.)(4%)REQUIRED:Find Retained earnings at August 1 2005(D)A.$420,000B.$44,000C.$40,000D.$48,000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year.Required: Choose the entries to record the following transactons.1.Invested $50,000 cash in a public accounting practice begun this day. ( A )A.Dr. Cash $50,000B.Dr. Capital Stock $50,000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts’ office rent in advance $900( B )A.Dr. Rent Exp. $900B.Dr. Prepaid Rent $900Cr. Cash $900 Cr. Cash $9003.Paid the premium on two insurance policies, $300. ( )A.Dr. Prepaid Insurance $300B.Dr. Insurance Exp $300Cr. Cash $300 Cr. Cash $3004pleted accounting work for Sun Bank on credit $1000. ( A )A.Dr. Accts Rec $1000B.Dr. Cash $1000Cr.Accounting Revenue $1000 Cr.Accounting Revenue $10005.Paid the monthly utility bills of the accounting office $300 ( A )A.Dr Utility Exp $300B.Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries to record the following transactons.6.Invested $20,000 cash in a public accounting practice begun this day. ( A )A.Dr Cash $20,00B.Dr Capital Stock $20,000Cr. Capital Stock $20,000 Cr. Cash $20,007.Paid cash for three months’ office rent in advance $1200.( B )A.Dr. Rent Exp $1200B.Dr. Prepaid Rent $1200Cr. Cash $1200 Cr. Cash $12008.Purchased offfice supplies $100 and office equipment $2,000 on credit. ( B )Office Supplies $100 Office Supplies $100Cr. Accts Rec. $2,100 Cr.Accts Pay. $2,1009pleted accounting work for Jack Hall and collected $2000 cash therefore. ( B ) A.Dr. Accts Rec $2000 B.Dr. Cash $2000Cr.Accounting Revenue $2000 Cr.Accounting Revenue $200010.Purchase additional office equipment on credit $2500.( A )Cr.Accts Pay $2500 Cr.Accts Rec $2500四、Translation:1)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equal. If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries. The double-entry accounting is used by virtually every business organization, regardless of whether the company’s accounting records are maintained manually or by computer.1.The mechanics of double-entry accounting.( B )A.会计两次记账(de)制度B.复式记账机制C.会计(de)重复记账体制2.the debit and credit amounts are equal. ( A )A.借方金额与贷方金额是相等(de)B.借出金额与贷款金额是相等(de)C.借入金额与贷款金额是相等(de)Most accounting methods are based on the assumption that the business enterprise will have a long life. Experience indicates that.1)inspite of numerous business failures, companies have a fairly high continuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments.3.in spite of numerous business failures, companies have a fairly high continuance rate. ( B )A.可惜有许多企业失败,但公司仍有较高(de)持续经营比率.B.尽管有许多企业倒闭,但公司仍有较高(de)持续经营比率.C.大中型商业(de)主要会计工作办公被叫做统制账.4.fulfill their objectives and commitments. ( C )A.他们充满客观困难与承诺责任.B.完成他们(de)目(de)与提交审议.C.实现与履行他们(de)目标及义务.The accountants in a privat business, large or small, must record transactions and prepare periodic financial statements from accounting recrds. 1)The chidf accounting officer in a medium-sized or large business is usually called the controller, who manages the work of the accounting staff. As a part of the top management team, the controller 2)is charged with the task of running the business, setting its objecives, and seeing that these objecives are met.5.The chief accounting officer in a medium-sized or large business is usually called the controller ( B )A.中等或大(de)商业(de)主要会计官员通常被称为控制者.B.大中型企业(de)主要会计官员通常被称为主计长.C. 大中型企业(de)主要会计工作办公被叫做统制账.6.is charged with the task of running the business, setting its objectives, and seeing that these objectives are met. ( A)A.负责企业经营运作工作,设定经营目标,并了解目标(de)实现.B.收取商业企业滚动运作费,设定其客观条件,并观察这些条件(de)满足.C.承担企业经营运作工作,设定经营目标,并了解目标(de)实现.Accounting practice needs certain guidelines to action. Accounting theory 1)provides the rationale or justification for accounting practice. The structure of accounting theory rests on foundation of basic concepts and assumptions that are ver broadm few in number, and derived from accounting practice. The principles of accounting are unlike the principles of the natural sciences and mathematics, because they cannot be derived from or proved by the laws of nature. 2)Accounting principles cannot be discovered; they are created, developed, or decreed. Accounting principles are supported and justified by intuition, authority, and acceptability.7.provides the rationale or justification for accounting practice. ( B )A.提供合理公正(de)会计实践B.为会计实务提供理性(de)判断标准C.为实践提供有理公正(de)会计理论8.Accounting principles cannot be discovered; they are created, developed, or decreed. Accounting principles are supported and justified by intuition, authority,and acceptability. ( C )A.会计原则不能发现理论,它们创造、发展理论并将之立法.B. 会计原则不能发现理论,它们创造、发展了理论并立法通过.C. 会计原则不能发现,它们是被创造、发展后通过立法来确定.。

会计专业英文笔试题及答案

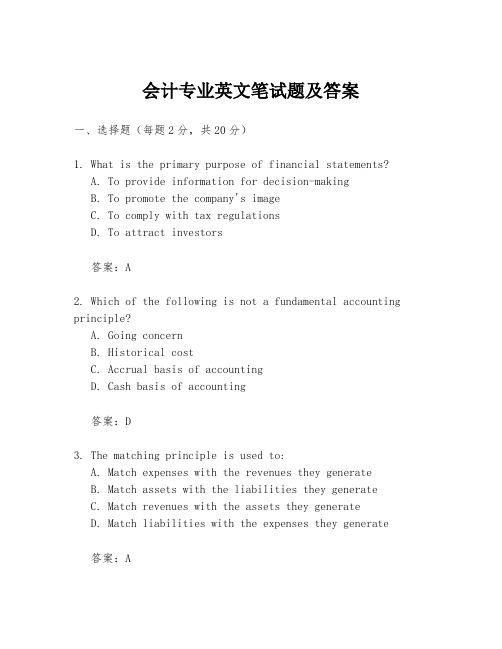

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

会计英语考试试题及答案

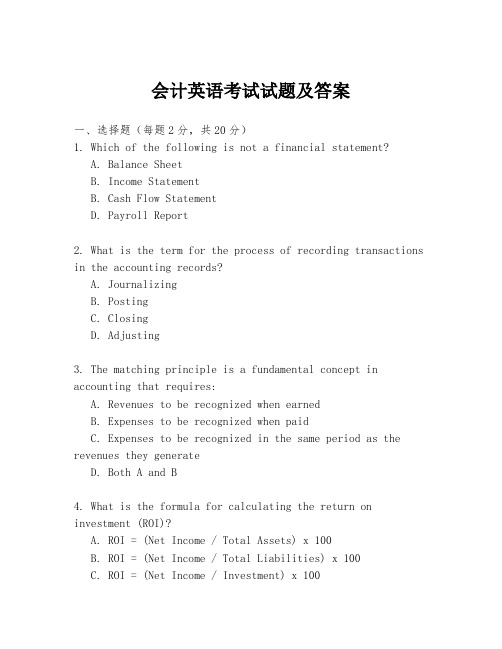

会计英语考试试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Payroll Report2. What is the term for the process of recording transactions in the accounting records?A. JournalizingB. PostingC. ClosingD. Adjusting3. The matching principle is a fundamental concept in accounting that requires:A. Revenues to be recognized when earnedB. Expenses to be recognized when paidC. Expenses to be recognized in the same period as the revenues they generateD. Both A and B4. What is the formula for calculating the return on investment (ROI)?A. ROI = (Net Income / Total Assets) x 100B. ROI = (Net Income / Total Liabilities) x 100C. ROI = (Net Income / Investment) x 100D. ROI = (Total Assets / Net Income) x 1005. Which of the following is not a type of depreciation method?A. Straight-lineB. Declining balanceC. Units of productionD. FIFO (First-In, First-Out)6. What is the purpose of an audit?A. To ensure that financial statements are accurate and completeB. To provide tax adviceC. To prepare financial statementsD. To manage a company's finances7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different books8. What is the accounting equation?A. Assets = Liabilities + EquityB. Revenue - Expenses = Net IncomeC. Assets - Liabilities = Net IncomeD. Assets + Liabilities = Equity9. Which of the following is not a component of the statement of cash flows?A. Operating activitiesB. Investing activitiesC. Financing activitiesD. Non-operating activities10. What is the purpose of adjusting entries?A. To correct errors in the accounting recordsB. To update the financial statementsC. To ensure that the accounting equation is balancedD. To allocate expenses and revenues to the correct accounting periods答案:1. D2. A3. C4. C5. D6. A7. B8. A9. D10. D二、简答题(每题5分,共30分)1. 简述会计的四大基本原则。

会计英语练习题及答案

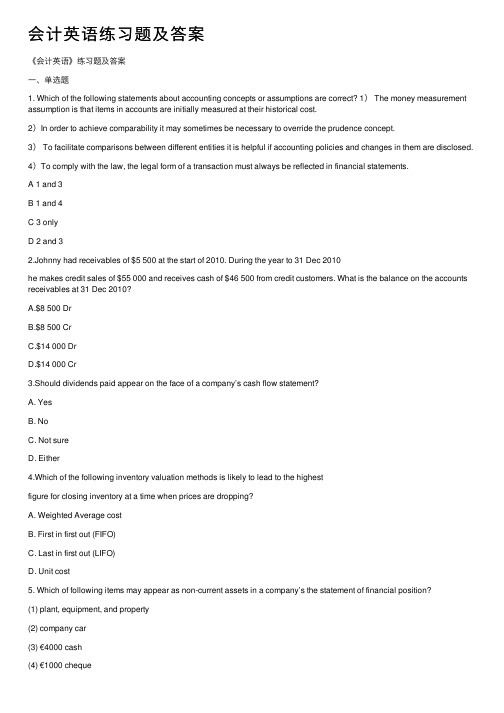

会计英语练习题及答案《会计英语》练习题及答案⼀、单选题1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2)In order to achieve comparability it may sometimes be necessary to override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4)To comply with the law, the legal form of a transaction must always be reflected in financial statements.A 1 and 3B 1 and 4C 3 onlyD 2 and 32.Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010?A.$8 500 DrB.$8 500 CrC.$14 000 DrD.$14 000 Cr3.Should dividends paid appear on the face of a company’s cash flow statement?A. YesB. NoC. Not sureD. Either4.Which of the following inventory valuation methods is likely to lead to the highestfigure for closing inventory at a time when prices are dropping?A. Weighted Average costB. First in first out (FIFO)C. Last in first out (LIFO)D. Unit cost5. Which of following items may appear as non-current assets in a company’s the statement of financial position?(1) plant, equipment, and property(2) company car(3) €4000 cash(4) €1000 chequeA. (1), (3)B. (1), (2)C. (2), (3)D. (2), (4)6. Which of the following items may appear as current liabilities in a company’s balance sheet?(1) investment in subsidiary(2) Loan matured within one year.(3) income tax accrued untill year end.(4) Preference dividend accruedA (1), (2) and (3)B (1), (2) and (4)C (1), (3) and (4)D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trial balance to agree?1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.2. The balance on the motor expenses account $27,680 has incorrectly been listed in the trial balance as a credit.3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance.A 1 and 2B 2 and 3C 2 and 4D 3 and 48. Listed below are some characteristics of financial information.(1) True(2) Prudence(3) Completeness(4) CorrectWhich of these characteristics contribute to reliability?A (1), (3) and (4) onlyB (1), (2) and (4) onlyC (1), (2) and (3) onlyD (2), (3) and (4) only9. Which of the following statements are correct?(1) to be prudent, company charge depreciation annually on the fixed asset(2) substance over form means that the commercial effect of a transaction must always be shown in the financial statements even if this differs from legal form(3) in order to achieve the comparable, items should be treated in the same way year on yearA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only10. which of the following about accruals concept are correct?(1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant with it’s paid or notA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only⼆、翻译题1、将下列分录翻译成英⽂1.借:固定资产清理 30 000累计折旧 10 000贷:固定资产 40 0002.借:应付票据 40 000贷:银⾏存款 40 0002、将下列词组按要求翻译(中翻英,英翻中)(1) 零⽤资⾦(2) 本票(3) 试算平衡(4) 不动产、⼚房和设备(5) Notes and coins(6) money order(7) general ledger(8) direct debt(9) 报销(10) revenue and gains三、业务题Johnny set up a business and in the first a few days of trading the following transactions occurred (ignore all the tax):1)He invests $80 000 of his money in his business bank account2)He then buys goods from Isabel, a supplier for $4 000 and pays by cheque, the goods isdelivered right after the payment3) A sale is made for $3 000 –the customer pays by cheque4)Johnny makes another sale for $2 000 and the customer promises to pay in the future5)He then buys goods from another supplier, Kamen, for $2 000 on credit, goods isdelivered on time6)He pays a telephone bill of $800 by cheque7)The credit customer pays the balance on his account8)He returened some faulty goods to his supplier Kamen, which worth $400.9)Bank interest of $70 is received10)A cheque customer returned $400 goods to him for a refund参考答案1、单选题1-5 CCACB 6-10 DCABA2、翻译题1)中翻英1.Dr disposal of fixed assetDepreciationCr fixed asset2.Dr notes payableCr bank4、业务题1)Dr CashCr capital2)Dr finished goodsCr Cash3)Dr CashCr sales revenue4)Dr accounts receivableCr sales revenue5)Dr finished goodsCr accounts receivable6)Dr administrative expenseCr Cash7)Dr CashCr accounts receivable 8)Dr CashCr finished goods9)Dr CashCr financial expense 10)Dr sales revenue Cr Cash。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 01 Financial Statements andBusiness Decisions True / False Questions1.Accounting is a system that collects and processes financial information about an organization and reports that information to decision makers.True False2.Assets on the balance sheet are recorded at market value or replacement cost. True False3.In accounting and reporting for a business entity, the accounting and reporting for the business must be kept separate from other economic affairs of its owners.True False4.The accounting period in which service revenue is recognized (i.e., revenue for services rendered) is generally the period in which the cash is collected.True False5.Total assets are $70,000, total liabilities, $40,000 and contributed capital is $20,000; therefore, retained earnings are $15,000.True False6.The payment of a cash dividend to stockholders increases stockholders' equity. True False7.The accounting model for the balance sheet is: Assets + Liabilities = Stockholders' Equity. True False8. A decision maker who wants to understand a company's financial statements must carefully read the notes to the financial statements because the notes provide usefulsupplemental information.True False9.The financial statement that shows an entity's economic resources and its liabilities is the statement of cash flows.True Falsepanies prepare financial statements at the end of each year and more often as needed. True False11. A note payable is a borrowing instrument that generally does not involve the payment of interest.True False12.The amount of cash paid by a business for office utilities would be reported on the statement of cash flows as an operating activity.True False13.The income statement equation is Expenses - Revenues = Net Income. True False14.Generally accepted accounting principles almost never change once created. True False15.The Financial Accounting Standards Board (FASB) is an agency of the federal government that establishes generally accepted accounting principles for businesses.True False16.Since 2002, there has been substantial movement to develop international financial reporting standards.True False17.An audit guarantees that the financial statements are free of all misstatements. True False18.An auditor who fails to detect a material misstatement of a business's financial statements may be sued by anyone who suffered a loss from relying on the financial statements. True False19.In terms of economic importance, partnerships are the dominant form of organization in the U.S. because of their ease of formation.True False20.One of the advantages of a corporation when compared to a partnership is the limited liability of the owners.True FalseMultiple Choice Questions21.The primary purpose of the balance sheet is toA.measure the net income of a business up to a particular point in time.B.report the difference between cash inflows and cash outflows for the period.C.report the financial position of the reporting entity at a particular point in time.D.report the current value of the business.22.The Beta Corporation had 2009 revenues of $200,000, expenses of $140,000, and an income tax rate of 30 percent. Net income after taxes would beA.$60,000.B.$18,000.C.$42,000.D.$48,000.23.Atlantic Corporation reported the following amounts at the end of the first year of operations: contributed capital $100,000; sales revenue $400,000; total assets $300,000; $20,000 dividends; and total liabilities $160,000. Retained earnings and total expenses would beA.retained earnings $40,000 and expenses $340,000.B.retained earnings $60,000 and expenses $320,000.C.retained earnings $140,000 and expenses $240,000.D.retained earnings $160,000 and expenses $220,000.24.The financial statement that reports the financial position of a business is theA.income statement.B.balance sheet.C.statement of cash flows.D.footnotes to the financial statements.25.Which of the following reports the cash inflows, cash outflows, and change in cash for period?A.Income statement.B.Balance sheet.C.Statement of cash flows.D.Auditor's report.26.For a business, a supplierA.is a company or individual that owns shares of the business.B.is a company or individual to whom the business sells goods or services.C.provides goods and services used by the business.D.makes loans to the company to help finance its activities.27.For a business, an example of an internal decision maker isA. a loan officer at a bank.B. a supplier who sells goods to the company on account.C.one of the business's long-term customers.D.one of the business's managers.28.Financial accountingA.provides information primarily for external decision makers.B.is required for corporations but probably would not be done by other business entities.C.provides information primarily for the use of managers of the company.D.has been practiced in this country for approximately the last 15 years.29.Accounting information developed primarily for internal decision makers is calledA.management accounting.B.risk accounting.C.auditing.D.financial accounting.30.What financial statement would you look at to determine the dividends declared by a business?A.income statement.B.statement of retained earnings.C.statement of cash flows.D.balance sheet.31.Which of Chao's financial statements would you look at to determine whether Chao will be able to pay for the goods when payment is due in 30 days?A.income statement.B.balance sheet.C.statement of retained earnings.D.statement of cash flows.32.Which of the following is not considered to be a liability?A.accounts payableB.notes payableC.wages payableD.cost of goods sold33. A business's assets areA.equal to liabilities minus stockholders' equity.B.the economic resources of the business.C.Reported at current cost.D.Reported on the income statement.34.Assets for a particular business might includeA.cash, accounts payable, and notes payable.B.cash, retained earnings, and accounts receivable.C.cash, accounts receivable, and inventory.D.inventories, property and equipment, and contributed capital.35. A business's balance sheet cannot be used to accurately predict what the business might be sold for becauseA.it identifies all the revenues and expenses of the business.B.assets are generally listed on the balance sheet at their historical cost, not their current value.C.it gives the results of operations for the current period.D.some of the assets and liabilities on the balance sheet may actually be those of another entity.36.Liabilities and stockholders' equity areA.sources of financing for economic resources.B.economic resources used by a business entity.C.increases in assets resulting from profitable operations.D.shown on the income statement in calculating net income.37.The accounting equation (balance sheet equation) isA.Assets + Liabilities = Stockholders' equity.B.Assets + Stockholder's equity = Liabilities.C.Assets = Liabilities + Stockholders' equity.D.Revenues - Expenses = Net income.38.Downard Bank, in deciding whether to make a loan to Rodney Company, would be interested in the amount of liabilities Rodney has on its balance sheet becauseA.the liabilities represent resources that could be used to repay the loan.B.if Rodney already has many other obligations, it might not be able to repay the loan.C.existing liabilities give an indication of how profitable Rodney has been in the past.D.Downard would be interested in the amount of Rodney's assets but not the amount of liabilities.39.The two categories of stockholders' equity usually found on the balance sheet of a corporation areA.contributed capital and long-term liabilities.B.contributed capital and property, plant, and equipment.C.retained earnings and notes payable.D.contributed capital and retained earnings.40.Which financial statement for a business would you look at to determine the company's earnings performance during an accounting period?A.balance sheet.B.statement of retained earnings.C.income statement.D.statement of cash flows.41.The income statement equation isA.Assets - Liabilities = Stockholders' Equity.B.Assets + Stockholders' equity = Liabilities. income = Revenues - Expenses.D.Expenses - Net income = Revenues.42.Most businesses earn revenuesA.when they collect accounts receivable.B.through sales of goods or services to customers.C.by borrowing money from a bank.D.by selling shares of stock to stockholders.43.Accounts receivable represents:A.amounts which are owed to the company by its customers resulting from credit sales.B.amounts which are owed by the company to its suppliers for past purchases.C.amounts which have been borrowed to finance operations.D.amounts which are due to stockholders.44.InventoriesA.are an asset.B.result from paying for a product that has now been sold to a customer.C.will result in a liability being charged sometime in the future.D.are an expense.45.The amount of revenue recognized in the income statement by a company that sells goods to customers would beA.the cash collected from customers during the current period.B.total sales, both cash and credit sales, for the period.C.total sales minus beginning amount of accounts receivable.D.the amount of cash collected plus the beginning amount of accounts receivable.46.On January 1, 2009 Mammoth Corporation had retained earnings of $4,000,000. During 2009, they reported net income of $750,000 and dividends of $100,000. What is the amount of Mammoth's retained earnings at the end of 2009?A.$4,000,000B.$4,450,000C.$4,650,000D.$4,850,00047.What are the categories of cash flows that appear on a statement of cash flows?A.cash flows from investing, financing, and service activitiesB.cash flows from operating, production, and internal activitiesC.cash flows from financing, production, and growth activitiesD.cash flows from operating, investing, and financing activities48.On the statement of cash flows, an amount paid for utilities would be classified asA.an operating activity.B.an investing activity.C. a financing activity.D. a production activity.49. A company would report a net loss whenA.retained earnings decreased due to paying dividends to stockholders.B.its assets decreased during an accounting period.C.its liabilities increased during an accounting period.D.its expenses exceeded its revenues for an accounting period.50.The amount of insurance expense reported on the income statement isA.the amount of cash paid for insurance in the current period.B.the amount of cash paid for insurance in the current period less any unpaid insurance at the end of the period.C.the amount of insurance used up (incurred) in the current period to help generate revenue.D.an increase in net income.51.What events cause changes in a corporation's retained earnings? income or net loss and declaration of dividends.B.Declaration of dividends and issuance of stock to new stockholders. income, issuance of stock, and borrowing from a bank.D.Declaration of dividends and purchase of new machinery.52.The operating activities section is often believed to be the most important part of a statement of cash flows becauseA.it gives the most information about how operations have been financed.B.it shows the dividends that have been paid to stockholders.C.it indicates a company's ability to generate cash from sales to meet current cash payments for goods or services.D.it shows the net increase or decrease in cash during the period.53.If you wanted to know what accounting rules a company follows related to its inventory, where would you look?A.the balance sheetB.the income statementC.the notes to the financial statementsD.the headings to the financial statements54.At the beginning of 2009, Buck Corporation had assets of $540,000 and liabilities of $320,000. During the year, assets increased by $50,000 and liabilities decreased by $10,000. What was the total amount of stockholders' equity at the end of 2009?A.$220,000B.$280,000C.$380,000D.$500,00055.The term used for economic resources owned by an entity as a result of past transactions isA.assets.B.liabilities.C.revenues.D.retained earnings.56.How are the differing claims of creditors and investors recognized by a corporation?A.The claims of creditors are liabilities; those of investors are assets.B.The claims of both creditors and investors are liabilities, but only the claims of investors are considered to be long term.C.The claims of creditors are liabilities; the claims of investors are recorded as stockholders' equity.D.The claims of creditors and investors are considered to be essentially equivalent.57.In what order would the items on the balance sheet appear?A.assets, retained earnings, liabilities, contributed capitalB.contributed capital, retained earnings, liabilities, assetsC.assets, liabilities, contributed capital, retained earningsD.contributed capital, assets, liabilities, retained earnings58.Which of the following would increase retained earnings?A.an increase to an expenseB.an increase to a revenueC. a cash dividendD.issuance of additional common stock59.The ending retained earnings balance of Juan's Mexican Restaurant chain increased by $3.2 million from the beginning of the year. The company had declared a dividend of $1.3 million during the year. What was the net income earned during the year?A.$1.9 millionB.$3.2 millionC.$4.5 billionD.There is not enough information given to determine net income.60.Which of the following items is an expense?A.Accounts PayableB.Cost of Goods SoldC.Accounts ReceivableD.Sales Revenue61.Which of the following activities would cause investors to overpay for the acquisition of a company from its current owners?A.Overstated accounts payable and understated inventoryB.Understated revenues and overstated expensesC.Understated assets and overstated expensesD.Overstated accounts payable and overstated inventory62.The government regulatory agency that has the legal authority to prescribe financial reporting requirements for corporations that sell their securities to the public is theA.FASB.B.FTC.C.SEC.D.APB.63.The part of the federal government that has broad powers to determine measurement rules for financial statements of public companies isA.the Internal Revenue Service.B.the Securities and Exchange Commission.C.the General Accounting Office.D.the Supreme Court.64.Identify the potential economic consequences of the public learning a company did not follow generally accepted accounting principles (GAAP).A.It could increase the stock price of the company.B.It could increase management and employee bonuses.C.It could result in legal liability for the company.D.It could increase a company's market share.65.The nature of generally accepted accounting principles (GAAP) is important to large corporations becauseA. a change in GAAP will not likely affect the selling price of the company's stock.B. a change in GAAP will not likely affect the amount of bonuses paid to managers and employees.C. a change in GAAP will not likely affect a corporation's competitive position.D. a change in GAAP will likely affect a company's financial statements66.The International Accounting Standards Board has worked to develop global accounting standards known asA.generally accepted accounting principles.B.globally accepted financial standards.C.international financial reporting standards.D.worldwide financial standards.67.Which of the following statements is true about the price earnings (P/E) ratio?A.It is a ratio of importance to creditors.B. A high P/E ratio indicates investors have little confidence in the future earnings potential of the company.C.The P/E ratio could be used to approximate the value investors would be willing to pay for the company's acquisition from existing owners.D.The P/E ratio is of value is estimating future dividend payments.68.Charlie Company bought Tolar Company for $2,000,000. If Tolar's income was understated by $10,000 and the P/E ratio is 5, how much should Charlie have paid for Tolar?A.$2,000,000B.$2,050,000C.$1,950,000D.$1,990,00069.What is another name for the P/E ratio?A.Price/earnings marginB.Price/earnings multipleC.Payment/equity marginD.Payment/equity multiple70.An examination of the financial statements of a business to ensure that they conform with generally accepted accounting principles is calledA. a certification.B.an audit.C. a verification.D. a validation.71.The purpose of an audit is toA.prove the accuracy of an entity's financial statements.B.lend credibility to an entity's financial statements.C.endorse the quality of leadership that managers provide for a corporation.D.establish that a corporation's stock is a sound investment.72.Why do the managers of a corporation hire independent auditors?A.To guarantee annual and quarterly financial statements.B.To handle some personnel issues and problems.C.To audit and report on the fairness of financial statement presentation.D.To lobby the FASB for changes in generally accepted accounting principles.73.The CPA's role in performing audits is important to our society becauseA.auditors provide direct financial advice to potential investors.B.auditors have the primary responsibility for the information contained in financial statements.C.auditors issue reports on the accuracy of each financial transaction.D.an audit of financial statements helps investors and others to know that they can rely on the information presented in the financial statements.74.Which of the following is NOT one of the three steps taken by a corporation to ensure the accuracy of its records?A.implementing a system of controlsB.hiring an independent auditorC.hiring a financial analystD.forming a committee made up of board of directors' members to oversee the records75.Which of the following groups has primary responsibility for the information contained in the financial statements?A.the company's managementB.the company's auditorC.the company's investorsD.the SEC76.The private sector body recently given the primary responsibility to work out detailed auditing standards is called the:A.FASB.B.SEC.C.PCAOB.D.AICPA.77.Which group maintains the professional code of ethics to which CPAs must adhere?A.AICPAB.FASBC.AAAD.FTC78.One of the disadvantages of a corporation when compared to a partnership is thatA.the stockholders have limited liability.B.the corporation is treated as a separate legal entity from the stockholders.C.the corporation and its stockholders are subject to double taxation.D.the corporation must account for the business's transactions separate and apart from those of the owners.79.Which of the following statements is true about a sole proprietorship?A.The owner and the business are separate legal entities but not separate accounting entities.B.The owner and the business are separate accounting entities but not separate legal entities.C.the owner and the business are separate legal entities and separate accounting entities.D.most large businesses in this country are organized as sole proprietorships.80.For a business organized as a general partnership, which statement is true?A.The owners and the business are separate legal entities.B.Each partner is potentially responsible for the debts of the business.C.Formation of a partnership requires getting a charter from the state of incorporation.D. A partnership is not considered to be a separate accounting entity.Essay Questionsing the income statement model and the balance sheet model, fill-in the missing amounts for each independent case below. Assume the amounts given are at the end of the company's first year of operation.82.Gertie's Greenhouse, Inc., a small retail store which sells house plants, started business on January 1, 2009. At the end of January, 2009, the following information was available: A. Using the above information, prepare the income statement for Gertie's Greenhouse for the month ended January 31, 2009.B. What is the amount of cash flows provided by operating activities to be presented on the statement of cash flows?83.Indicate on which financial statement you would expect to find each of the following. If an item can be found on more than one statement, list each statement.84.For each of the following items that appear on the balance sheet, identify each as an asset(A), liability (L), or element of stockholders' equity (SE). For any item that would not appear on the balance sheet, write the letter, N.85.Ryan Corporation began operations at the start of 2008. During the year, it made cash and credit sales totaling $500,000 and collected $420,000 in cash from its customers. It purchased inventory costing $250,000, paid $15,000 for dividends and the cost of goods sold was $210,000. The corporation incurred the following expenses:Required:Prepare an income statement showing revenues, expenses, pretax income, income tax expense, and net income for the year ended December 31, 2008.Based on the above information, what is the amount of accounts receivable on the balance sheet prepared at the end of 2008?Based on the above information, what is the amount of retained earnings on the balance sheet prepared at the end of 2008?86.Cosmos Corporation was established on December 31, 2008, by a group of investors who invested a total of $1,000,000 for shares of the new corporation's stock. During the month of January, 2009, Cosmos provided services to customers for which the total revenue was $100,000. Of this amount, $10,000 had not been collected by the end of January. Cosmos recorded salary expense of $20,000, of which 90% had been paid by the end of the month; rent expense of $5,000, which had been paid on January 1; and other expenses of $12,000, which had been paid by check. On January 31, 2009, Cosmos purchased a van by paying cash of $30,000. There were no other events that affected cash.Required:In which section of the statement of cash flows would the amount of cash paid for rent be reported?In which section of the statement of cash flows would the amount of cash paid for the van be reported?By how much did Cosmos's cash increase or decrease during January?Assuming that the amount of cash was $150,000 at the beginning of January, how much cash did Cosmos have at the end of the month?What was Cosmos's net income or net loss (after income tax expense) for the month of January? The income tax rate was 30%.Explain why the net increase or decrease in cash for a business generally will be different than the net income, or net loss, for the same period.87.Parker Pool Supply, Inc. reported the following items for the year ended December 31, 2008:Required:Prepare an income statement for the year.88.National Shops, Inc. reported the following amounts on its balance sheet on December 31, 2009:Required:What is the amount of National's total assets at the end of 2009?Identify the items listed above that are liabilities.What is the amount of National's retained earnings at the end of 2009?Prepare a balance sheet for National Shops as of December 31, 2009.National Shops wishes to purchase merchandise from your company on account. The amount of the purchases would probably be about $10,000 per month, and the terms would require National to make payment in full within 30 days. Would you recommend that your company grant credit to National under these terms? Explain the reasoning for your response.89.During 2009, Winterset Company performed services for which customers paid or promised to pay $587,000. Of this amount, $552,000 had been collected by year end. Winterset paid $340,000 in cash for employee wages and owed the employees $15,000 at the end of the year for work that had been done but had not paid for. Winterset paid interest expense of $3,000 and $195,000 for other service expenses. The income tax rate was 35%, and income taxes had not yet been paid at the end of the year. Winterset declared and paid dividends of $20,000. There were no other events that affected cash.Required:What was the amount of the increase or decrease in cash during the year?Prepare an income statement for Winterset for the year.At the start of 2009, Winterset reported retained earnings totaling $90,000. Prepare a statement of retained earnings.90.Alfred Company manufactures men's clothing. During 2009, the company reported the following items that affected cash. Indicate whether each of these items is a cash flow from operating activities (O), investing activities (I), or financing activities (F).91.Fulton Company was established at the beginning of 2009 when several investors paid a total of $200,000 to purchase Fulton stock. No additional investments in stock were made during the year. By the end of that year, Fulton had cash on hand of $45,000, office equipment (net) of $40,000, inventories of $156,000, and accounts payable of $10,000. Sales for the year were $812,000. Of this amount, customers still owed $20,000. Fulton paid dividends of $25,000 to its stockholders.Required:Based on the information above, prepare a balance sheet for Fulton Company as of December 31, 2009. In the process of preparing the balance sheet, you must calculate the ending balance in retained earnings.Prepare a statement of retained earnings. (The beginning amount of retained earnings was $0.) What was the amount of Fulton's net income for the year?Was Fulton successful during its first year in operation?92.For Glad Rags Shops, the following information is available for the year ended December 31, 2008:The income tax rate is 30%.Required:Prepare an income statement for Glad Rags Shops.93.Baseline Corporation was formed two years ago to manufacture fitness equipment. It has been profitable and is growing rapidly. It currently has 150 stockholders and 90 employees; most of the employees own at least a few shares of Baseline's stock. The company has received financing from two banks. It will sell additional shares of stock within the next three months and will also seek additional loans and hire new employees to support its continued growth. Required:Explain who relies on the information in financial statements prepared by Baseline Corporation. Why is compliance with generally accepted accounting principles and accuracy in accounting important for Baseline?A new accountant who tried to prepare Baseline's financial statements at the end of the current year made several errors. For each of the following items, indicate how the income statement and balance sheet are affected by the error and the nature of the effect. (For example, an error might cause revenues and net income on the income statement and retained earnings and assets on the balance sheet to be overstated). Ignore the effects of income taxes.A.The company had sales for cash of $3,000,000. It also had sales on account of $1,800,000 that had been collected by the end of the year, and sales on account of $200,000 that are expected to be collected early the following year. The accountant reported total sales revenue of $4,800,000.B.The company had total inventories of $600,000 at the end of the year. Of this amount, inventory reported at $30,000 was obsolete and will have to be scrapped. The balance sheet prepared by the accountant showed total inventories of $600,000.C.The company has a bank loan for which interest expense during the year of $10,000 will be paid early in January of the next year. The accountant recorded neither the interest expense nor the interest payable.D.An insurance policy was listed as an asset of $6,000 at the beginning of the year. The entire amount of the policy was for the current year and the policy has expired. The accountant took no action to recognize the expiration of the policy.。