宏观经济学曼昆名词解释英文版第29章到第35章

曼昆经济学原理英文版文案加习题答案29章

曼昆经济学原理英⽂版⽂案加习题答案29章THE MONETARY SYSTEMWHAT’S NEW IN THE S EVENTH EDITION:There is a new In the News box on ―Why Gold?‖LEARNING OBJECTIVES:By the end of this chapter, students should understand:what money is and what functions money has in the economy.what the Federal Reserve System is.how the banking system helps determine the supply of money.what tools the Federal Reserve uses to alter the supply of money.CONTEXT AND PURPOSE:Chapter 16 is the first chapter in a two-chapter sequence dealing with money and prices in the long run. Chapter 16 describes what money is and develops how the Federal Reserve controls the quantity of money. Because the quantity of money influences the rate of inflation in the long run, the followingchapter concentrates on the causes and costs of inflation.The purpose of Chapter 16 is to help students develop an understanding of what money is, what forms money takes, how the banking system helps create money, and how the Federal Reserve controls the quantity of money. An understanding of money is important because the quantity of money affects inflation and interest rates in the long run, and production and employment in the short run.KEY POINTS:The term money refers to assets that people regularly use to buy goods and services.Money serves three functions. As a medium of exchange, it is the item used to make transactions. Asa unit of account, it provides the way in which prices and other economic values are recorded. As astore of value, it offers a way to transfer purchasing power from the present to the future.264Chapter 16/The Monetary System ? 265Commodity money, such as gold, is money that has intrinsic value: It would be valued even if it were not used as money. Fiat money, such as paper dollars, is money without intrinsic value: It would be worthless if it were not used as money.In the U.S. economy, money takes the form of currency and various types of bank deposits, such as checking accounts. The Federal Reserve, the central bank of the United States, is responsible for regulating the U.S. monetary system. The Fed chairman is appointed by the president and confirmed by Congress every four years. The chairman is the lead member of the Federal Open Market Committee, which meets about every six weeks to consider changes in monetary policy.Bank depositors provide resources to banks by depositing their funds into bank accounts. These deposits are part of a bank’s liabilities. Bank owners also provide resources (called bank capital) for the bank. Because of leverage (the use of borrowed funds for investment), a small change in the value of a bank’s assets can lead to a large change in the value of the bank’s capital. To protect depositors, bank regulators require banks to hold a certain minimum amount of capital.The Fed controls the money supply primarily through open-market operations. The purchase of government bonds increases the money supply, and the sale of government bonds decreases the money supply. The Fed also uses other tools to control the money supply. It can expand the money supply by decreasing the discount rate, increasing its lending to banks, lowering reserverequirements, or decreasing the interest rate on reserves. It can contract the money supply by increasing the discount rate, decreasing its lending to banks, raising reserve requirements or increasing the interest rate on reserves.When individuals deposit money in banks and banks loan out some of these deposits, the quantity of money in the economy increases. Because the banking system influences the money supply in this way, the Fed’s control of the money supply is imperfect.The Federal Reserve has in recent years set monetary policy by choosing a target for the federal funds rate, a short-term interest rate at which banks make loans to one another. As the Fed achieves its target, it adjusts the money supply. CHAPTER OUTLINE:I. The Meaning of Money266?Chapter 16/The Monetary SystemA. Definition of money: the set of assets in an economy that people regularly use to buygoods and services from other people.B. The Functions of Money1. Money serves three functions in our economy.a. Definition of medium of exchange: an item that buyers give to sellers when theywant to purchase goods and services.b. Definition of unit of account: the yardstick people use to post prices and recorddebts.c. Definition of store of value: an item that people can use to transfer purchasingpower from the present to the future.2. Definition of liquidity: the ease with which an asset can be converted into theeconomy’s medium of exchange.a. Money is the most liquid asset available.b. Other assets (such as stocks, bonds, and real estate) vary in their liquidity.c. When people decide how to allocate their wealth, they must balance the liquidity of each possible asset against t he asset’s usefulness as a store of value.C. The Kinds of Money1. Definition of commodity money: money that takes the form of a commodity withintrinsic value.2. Definition of fiat money: money without intrinsic value that is used as moneybecause of government decree.3. In the News: Why Gold?a. Historically, societies have used gold, rather than other commodities, for commodity money.b. This article from NPR Morning Edition describes why gold is the best choice for commodity money.D. Money in the U.S. Economy1. The quantity of money circulating in the United States is sometimes called the money stock.2. Included in the measure of the money supply are currency, demand deposits, and other monetary assets.a. Definition of currency: the paper bills and coins in the hands of the public.b. Definition of demand deposits: balances in bank accounts that depositors canaccess on demand by writing a check.Chapter 16/The Monetary System?2673. Figure 1 shows the monetary assets included in two important measures of the money supply, M1 and M2.4. FYI: Why Credit Cards Aren’t Moneya. Credit cards are not a form of money; when a person uses a credit card, he or she issimply deferring payment for the item.b. Because using a debit card is like writing a check, the account balances that lie behind debit cards are included in the measures of money.5. Case Study: Where Is All the Currency?a. If we divide the amount of outstanding currency in the United States by the adult population, we find that the average adult should have approximately $4,490 in currency.b. Of course, most adults carry a much smaller amount.c. One explanation is that a great deal of U.S. currency may be held in other countries.d. Another explanation is that large amounts of currency may be held by criminals because transactions that use currency leave no paper trail.II. The Federal Reserve SystemA. Definition of Federal Reserve (Fed): the central bank of the United States.B. Definition of central bank: An institution designed to oversee the banking system and regulate the quantity of money in the economy.268?Chapter 16/The Monetary SystemC. The Fed’s Organization1. The Fed is run by a Board of Governors with 7 members who serve 14-year terms.a. The Board of Governors has a chairman who is appointed for a four-year term.b. The current chairman is Ben Bernanke.Chapter 16/The Monetary System ? 2692. The Federal Reserve System is made up of 12 regional Federal Reserve Banks located in major cities around the country.3. One job performed by the Fed is the regulation of banks to ensure the health of the nation’s banking system.a. The Fed monitors each bank's financial condition and facilitates bank transactions byclearing checks.b. The Fed also makes loans to banks when they want to borrow.4. The second job of the Fed is to control the quantity of money available in the economy.a. Definition of money supply: the quantity of money available in the economy .b. Definition of monetary policy: the setting of the money supply by policymakersin the central bank .D. The Federal Open Market Committee1. The Federal Open Market Committee (FOMC) consists of the 7 members of the Board ofGovernors and 5 of the 12 regional bank presidents. 2. The primary way in which the Fed increases or decreases the number of dollars in theeconomy is through open market operations (which involve the purchase or sale of U.S. government bonds).a. If the Fed wants to increase the supply of money, it creates dollars and uses them topurchase government bonds from the public through the nation's bond markets.b. If the Fed wants to lower the supply of money, it sells government bonds from itsportfolio to the public. Money is then taken out of the hands of the public and the supply of money falls.III. Banks and the Money Supply270 ? Chapter 16/The Monetary SystemA. The Simple Case of 100-Percent-Reserve Banking 1. Example: Suppose that currency is the only form of money and the total amount of currencyis $100. 2. A bank is created as a safe place to store currency; all deposits are kept in the vault until thedepositor withdraws them.a. Definition of reserves: deposits that banks have received but have not loanedout . b. Under the example described above, we have 100-percent-reserve banking.3. The financial position of the bank can be described with a T-account:4. The money supply in this economy is unchanged by the creation of a bank.a. Before the bank was created, the money supply consisted of $100 worth of currency.b. Now, with the bank, the money supply consists of $100 worth of deposits.5. This means that, if banks hold all deposits in reserve, banks do not influence the supply of money. B. Money Creation with Fractional-Reserve Banking1. Definition of fractional-reserve banking: a banking system in which banks hold onlya fraction of deposits as reserves .2. Definition of reserve ratio: the fraction of deposits that banks hold as reserves .3. Example: Same as before, but First National decides to set its reserve ratio equal to 10% andlend the remainder of the deposits.4. The bank’s T -account would look like this:Chapter 16/The Monetary System ? 2715. When the bank makes these loans, the money supply changes.a. Before the bank made any loans, the money supply was equal to the $100 worth ofdeposits.b. Now, after the loans, deposits are still equal to $100, but borrowers now also hold $90worth of currency from the loans.c. Therefore, when banks hold only a fraction of deposits in reserve, banks create money. 6. Note that, while new money has been created, so has debt. There is no new wealth createdby this process. C. The Money Multiplier1. The creation of money does not stop at this point.2. Borrowers usually borrow money to purchase something and then the money likely becomesredeposited at a bank.3. Suppose a person borrowed the $90 to purchase something and the funds then getredeposited in Second National Bank. Here is this bank’s T -account (assuming that it also sets its reserve ratio to 10%):4.If the $81 in loans becomes redeposited in another bank, this process will go on and on. 5. Each time the money is deposited and a bank loan is created, more money is created.6. Definition of money multiplier: the amount of money the banking system generateswith each dollar of reserves .7. In our example, the money supply increased from $100 to $1,000 after the establishment of fractional-reserve banking.ALTERNATIVE CLASSROOM EXAMPLE:Reserve ratio = 12.5%Money multiplier = 1/0.125 = 8272?Chapter 16/The Monetary SystemD. Bank Capital, Leverage, and the Financial Crisis of 2008–20091. In reality, banks also get funds from issuing debt and equity.2. Definition of bank capital: the resources a bank’s owners have put into theinstitution.3. A more realistic balance sheet for a bank:4. Definition of leverage: the use of borrowed money to supplement existing funds for purposes of investment.5. Definition of leverage ratio: the ratio of assets to bank capital.a. The leverage ratio is $1,000/$50 = 20.b. A leverage ratio of 20 means that, for every dollar of capital that has been contributed by the owners, the bank has $20 of assets.c. Because of leverage, a small chang e in assets can lead to a large change in owner’s equity.6. Definition of capital requirement: a government regulation specifying a minimumamount of bank capital.7. In 2008 and 2009, many banks realized they had incurred sizable losses on some of their assets.IV. The Fed’s Tools of Monetary ControlA. How the Fed Influences the Quantity of Reserves1. Open-Market Operationsa. Definition of open-market operations: the purchase and sale of U.S. governmentbonds by the Fed.b. If the Fed wants to increase the supply of money, it creates dollars and uses them to purchase government bonds from the public in the nation's bond markets.c. If the Fed wants to lower the supply of money, it sells government bonds from its portfolio to the public in the nation's bond markets. Money is then taken out of the handsof the public and the supply of money falls.d. If the sale or purchase of government bonds affects the amount of deposits in the banking system, the effect will be made larger by the money multiplier.Chapter 16/The Monetary System?273e. Open market operations are easy for the Fed to conduct and are therefore the tool of monetary policy that the Fed uses most often.2. Fed Lending to Banksa. The Fed can also lend reserves to banks.b. Definition of discount rate: the interest rate on the loans that the Fed makes tobanks.c. A higher discount rate discourages banks from borrowing from the Fed and likely encourages banks to hold onto larger amounts of reserves. This in turn lowers themoney supply.d. A lower discount rate encourages banks to lend their reserves (and borrow from the Fed). This will increase the money supply.e. In recent years, the Fed has set up new mechanisms for banks to borrow from the Fed.B. How the Fed Influences the Reserve Ratio1. Reserve Requirementsa. Definition of reserve requirements: regulations on the minimum amount ofreserves that banks must hold against deposits.b. This can affect the size of the money supply through changes in the money multiplier.c. The Fed rarely uses this tool because of the disruptions in the banking industry that would be caused by frequent alterations of reserve requirements. (It is also not effective when banks hold a lot of excess reserves.)2. Paying Interest on Reservesa. In October of 2008, the Fed began paying banks interest on reserves.b. The higher the interest rate, the more reserves a bank will want to hold. This will reducethe money multiplier and the money supply.C. Problems in Controlling the Money Supply1. The Fed does not control the amount of money that consumers choose to deposit in banks.a. The more money that households deposit, the more reserves the banks have, and the more money the banking system can create.b. The less money that households deposit, the less reserves banks have, and the less money the banking system can create.274?Chapter 16/The Monetary System2. The Fed does not control the amount that bankers choose to lend.a. The amount of money created by the banking system depends on loans being made.b. If banks choose to hold onto a greater level of reserves than required by the Fed (called excess reserves), the money supply will fall.3. Therefore, in a system of fractional-reserve banking, the amount of money in the economy depends in part on the behavior of depositors and bankers.4. Because the Fed cannot control or perfectly predict this behavior, it cannot perfectly control the money supply.D. Case Study: Bank Runs and the Money Supply1. Bank runs create a large problem under fractional-reserve banking.2. Because the bank only holds a fraction of its deposits in reserve, it will not have the funds to satisfy all of the withdrawal requests from its depositors.3. Today, deposits are guaranteed through the Federal Depository Insurance Corporation (FDIC).Chapter 16/The Monetary System?275E. The Federal Funds Rate1. Definition of federal funds rate:the short-term interest rate that banks charge one another for loans.2. When the federal funds rate rises or falls, other interest rates often move in the same direction.3. In recent years, the Fed has set a target for the federal funds rate.F. In the News: Bernanke on the Fed’s Toolbox1. During the financial crisis of 2008 and 2009, the Fed expanded reserves to help struggling banks.2. This is an article written by Fed chairman, Ben Bernanke, discussing the Fed’s options for reversing this policy once the economy recovers from this deep recession.276?Chapter 16/The Monetary SystemSOLUTIONS TO TEXT PROBLEMS:Quick Quizzes1. The three functions of money are: (1) medium of exchange; (2) unit of account; and (3) store of value. Money is a medium of exchange because money is the item people use to purchase goods and services. Money is a unit of account because it is the yardstick people use to post prices and record debts. Money is a store of value because people use it totransfer purchasing power from the present to the future.2. The primary responsibilities of the Federal Reserve are to regulate banks, to ensure thehealth of the banking system, and to control the quantity of money that is made available inthe economy. If the Fed wants to increase the supply of money, it usually does so bycreating dollars and using them to purchase government bonds from the public in thenation’s bond markets.3. Banks create money when they hold a fraction of their deposits in reserve and lend out theremainder. If the Fed wanted to use all of its tools to decrease the money supply, it would:(1) sell government bonds from its portfolio in the open market to reduce the number ofdollars in circulation; (2) increase reserve requirements to reduce the money created bybanks; (3) increase the interest rate it pays on reserves to increase the reserves banks willchoose to hold; and (4) increase the discount rate to discourage banks from borrowingreserves from the Fed.Questions for Review1. Money is different from other assets in the economy because it is the most liquid assetavailable. Other assets vary widely in their liquidity.2. Commodity money is money with intrinsic value, like gold, which can be used for purposesother than as a medium of exchange. Fiat money is money without intrinsic value; it has novalue other than its use as a medium of exchange. Our economy uses fiat money.3. Demand deposits are balances in bank accounts that depositors can access on demandsimply by writing a check or using a debit card. They should be included in the supply ofmoney because they can be used as a medium of exchange.4. The Federal Open Market Committee (FOMC) is responsible for setting monetary policy in theUnited States. The FOMC consists of the 7 members of the Federal Reserve Board ofGovernors and 5 of the 12 presidents of Federal Reserve Banks. Members of the Board ofGovernors are appointed by the president of the United States and confirmed by the U.S.Senate. The presidents of the Federal Reserve Banks are chosen by each bank’s board ofdirectors.5. If the Fed wants to increase the supply of money with open-market operations, it purchasesU.S. government bonds from the public on the open market. The purchase increases thenumber of dollars in the hands of the public, thus raising the money supply.6. Banks do not hold 100% reserves because it is more profitable to use the reserves to makeloans, which earn interest, instead of leaving the money as reserves. The amount of reservesChapter 16/The Monetary System?277 banks hold is related to the amount of money the banking system creates through the moneymultiplier. The smaller the fraction of reserves banks hold, the larger the money multiplier,because each dollar of reserves is used to create more money.7. Bank B will show a larger change in bank capital. The decrease in assets will render Bank B insolvent because its assets will fall below its liabilities, a decrease in bank capital of 140%. Bank A will suffer a large decline in bank capital (70%) but will remain solvent.8. The discount rate is the interest rate on loans that the Federal Reserve makes to banks. If the Fed raises the discount rate, fewer banks will borrow from the Fed, so both banks' reserves and the money supply will be lower.9. Reserve requirements are regulations on the minimum amount of reserves that banks must hold against deposits. An increase in reserve requirements raises the reserve ratio, lowersthe money multiplier, and decreases the money supply.10. The Fed cannot control the money supply perfectly because: (1) the Fed does not control the amount of money that households choose to hold as deposits in banks; and (2) the Fed does not control the amount that bankers choose to lend. The actions of households and banks affect the money supply in ways the Fed cannot perfectly control or predict.Quick Check Multiple Choice1. c2. c3. d4. a5. c6. aProblems and Applications1. a. A U.S. penny is considered money in the U.S. economy because it is used as a mediumof exchange to buy goods or services, it serves as a unit of account because prices instores are listed in terms of dollars and cents, and it serves as a store of value foranyone who holds it over time.b. A Mexican peso is not considered money in the U.S. economy, because it is not used as a medium of exchange, and prices are not given in terms of pesos, so it is not a unit of account. It could serve as a store of value, though.c. A Picasso painting is not considered money, because you cannot exchange it for goods or services, and prices are not given in terms of Picasso paintings. It does, however, serveas a store of value.d. A plastic credit card is similar to money, but represents deferred payment rather than immediate payment. So credit cards do not fully represent the medium of exchangefunction of money, nor are they stores of value, because they represent short-term loansrather than being an asset like currency.278?Chapter 16/The Monetary System2. When your uncle repays a $100 loan from Tenth National Bank (TNB) by writing a check from his TNB checking account, the result is a change in the assets and liabilities of both your uncle and TNB, as shown in these T-accounts:By paying off the loan, your uncle simply eliminated the outstanding loan using the assets in his checking account. Your uncle's wealth has not changed; he simply has fewer assets and fewer liabilities.3. a. Here is BSB's T-account:b. When BSB's largest depositor withdraws $10 million in cash and BSB reduces its loans outstanding to maintain the same reserve ratio, its T-account is now:c. Because BSB is cutting back on its loans, other banks will find themselves short of reserves and they may also cut back on their loans as well.d. BSB may find it difficult to cut back on its loans immediately, because it cannot force people to pay off loans. Instead, it can stop making new loans. But for a time it mightfind itself with more loans than it wants. It could try to attract additional deposits to get additional reserves, or borrow from another bank or from the Fed.4. If you take $100 that you held as currency and put it into the banking system, then the total amount of deposits in the banking system increases by $1,000, because a reserve ratio of 10% means the money multiplier is 1/0.10 = 10. Thus, the money supply increases by $900, because deposits increase by $1,000 but currency declines by $100.Chapter 16/The Monetary System?279 5. a.b. The leverage ratio = $1,000/$200 = 5.c.d. Assets decline by 9%. The bank's capital declines by 45%. The reduction in bank capitalis larger than the reduction in assets because all of the defaulted loans are covered bybank capital.6. With a required reserve ratio of 10%, the money multiplier could be as high as 1/0.10 = 10,if banks hold no excess reserves and people do not keep some additional currency. So the maximum increase in the money supply from a $10 million open-market purchase is $100 million. The smallest possible increase is $10 million if all of the money is held by banks as excess reserves.7. The money supply will expand more if the Fed buys $2,000 worth of bonds. Both depositswill lead to monetary expansion, b ut the Fed’s deposit is new money. With a 5% reserve requirement, the multiplier is 20 (1/0.05). The $2,000 from the Fed will increase the money supply by $40,000 ($2,000 x 20). The $2,000 from the cookie jar is already part of themoney supply as currency. When it is deposited the money supply increases by $38,000.Deposits increase by $40,000 ($2,000 x 20) but currency decreases by $2,000.8. a. With a required reserve ratio of 10% and no excess reserves, the money multiplier is1/0.10 = 10. If the Fed sells $1 million of government bonds, reserves will decline by $1 million and the money supply will contract by 10 × $1 million = $10 million.b. Banks might wish to hold excess reserves if they need to hold the reserves for their day-to-day operations, such as paying other banks for customers' transactions, makingchange, cashing paychecks, and so on. If banks increase excess reserves such that there is no overall change in the total reserve ratio, then the money multiplier does not change and there is no effect on the money supply.9. a. With banks holding only required reserves of 10%, the money multiplier is 1/0.10 = 10.Because reserves are $100 billion, the money supply is 10 × $100 billion = $1,000 billion or $1 trillion.b. If the required reserve ratio is raised to 20%, the money multiplier declines to 1/0.20 = 5.With reserves of $100 billion, the money supply would decline to $500 billion, a declineof $500 billion. Reserves would be unchanged.10. a. To expand the money supply, the Fed should buy bonds.280?Chapter 16/The Monetary Systemb. With a reserve requirement of 20%, the money multiplier is 1/0.20 = 5. Therefore toexpand the money supply by $40 million, the Fed should buy $40 million/5 = $8 millionworth of bonds.11. a. If people hold all money as currency, the quantity of money is $2,000.b. If people hold all money as demand deposits at banks with 100% reserves, the quantity of money is $2,000.c. If people have $1,000 in currency and $1,000 in demand deposits, the quantity of money is $2,000.d. If banks have a reserve ratio of 10%, the money multiplier is 1/0.10 = 10. So if people hold all money as demand deposits, the quantity of money is 10 × $2,000 = $20,000.e. If people hold equal amounts of currency (C) and demand deposits (D) and the money multiplier for reserves is 10, then two equations must be satisfied:(1) C = D, so that people have equal amounts of currency and demand deposits; and (2) 10 × ($2,000 –C) = D, so that the money multiplier (10) times the number of dollar bills that are not being held by people ($2,000 –C) equals the amount of demand deposits (D). Using the first equation in the second gives 10 × ($2,000 –D) = D, or $20,000 –10D = D, or $20,000 = 11 D, so D = $1,818.18. Then C = $1,818.18. The quantity of money is C + D = $3,636.36.。

曼昆宏观经济学第二十九章

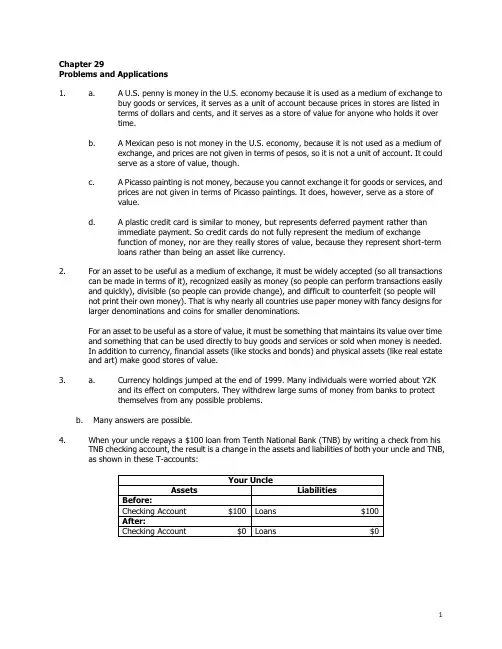

THE FEDERAL RESERVE SYSTEM

• The Structure of the Federal Reserve System:

– The primary elements in the Federal Reserve System are:

• 1) The Board of Governors • 2) The Regional Federal Reserve Banks • 3) The Federal Open Market Committee

• Problems in controlling the money supply

THE MEANING OF MONEY

• Money is the set of assets in an economy that people regularly use to buy goods and services from other people.

($580 billion)

M2 • Savings deposits • Small time deposits • Money market mutual funds • A few minor categories ($4,276 billion)

• Everything in M1 ($1,179 billion)

Discussion

• Which of the following are money in the U.S economy? Which are not? Explain your answers by discussing each of the three functions of money.

• Money has three functions in the economy:

曼昆宏观经济学第29章

联邦储备的体制结构

• 理事会

任期14年,而且任期错开以便每两年有一 个空缺。 总统任命其中一个成员为主席,任期4年。

© 2007 Thomson South-Western

The Fed’s Organization

联邦储备的体制结构

• The Federal Reserve System is made up of the Federal Reserve Board in Washington, D.C., and twelve regional Federal Reserve Banks.

联邦公开市场委员会 (FOMC)

• 货币政策是由联邦公开市场委员会执行的。

• 货币供给——经济中可得到的货币量。 • 货币政策——中央银行的决策者决定货币供给。

© 2007 Thomson South-Western

联邦公开市场委员会

• 公开市场活动 • 货币供给是经济中流通的货币量。 • 美联储改变货币供给的主要手段就是公 开市场活动。

© 2007 Thomson South-Western

联邦储备的体制结构

• 联邦储备的三个主要职能

• 管制银行,确保它们遵守联邦法律,以提高银行 业运行的安全性和合理性。

• 作为银行的银行,是最后一个贷款者,向银行贷 款。

• 通过控制货币供给,执行货币政策。

© 2007 Thomson South-Western

计价单位

Store of value

价值储藏

© 2007 Thomson South-Western

货币的职能

• 交换媒介

• 交换媒介——当买者在购买物品与劳务时给 予卖者的东西。

宏观经济学学习笔记(曼昆经济学原理)29章节

《经济学原理_宏观经济学》第29章货币制度一、重要名词解释货币:经济中人们经常用于向其他人购买物品与服务的一组资产。

交换媒介:买者在购买物品与服务时给予卖者的东西。

计价单位:人们用来表示价格和记录债务的标准。

价值储藏手段:人们可以用来把现在的购买力转变为未来的购买力的东西。

流动性:一种资产兑换为经济中交换媒介的容易程度。

(衡量资产流动性的标准有两个:资产变现的成本和速度。

)商品货币:以有内在价值的商品为形式的货币。

法定货币:没有内在价值、由政府法令确定作为通货使用的货币。

通货:公众手中持有的纸币钞票和铸币。

活期存款:储户可以通过开支票而随时支取的银行账户余额。

联邦储备:美国的中央银行。

中央银行:为了监管银行体系和调节经济中的货币量而设计的机构。

(央行的三个特征:非盈利性、相对独立性、权威性和垄断性。

)货币供给:经济中可得到的货币量。

货币政策:中央银行的决策者对货币供给的安排。

(货币政策是指中央银行采用各种工具调节货币供求以实现宏观经济调控目标的方针和策略的总称,是国家宏观经济政策的重要组成部分。

货币政策由货币政策目标、货币政策工具、货币政策传导机制等组成。

)准备金:银行得到但没有贷出去的存款。

部分准备金银行:只把部分存款作为准备金的银行制度。

准备金率:银行作为准备金持有的存款比例。

货币乘数:银行体系用1美元准备金所产生的货币量。

(又称“货币扩张系数”或“货币扩张乘数”,指中央银行创造或消灭一单位的基础货币所能增加或减少的货币供应量。

) 银行资本:银行的所有者投入机构的资源。

杠杆:将借到的货币追加到用于投资的现有资金上。

杠杆率:银行总资产与银行资本的比率。

资本需要量:政府管制确定的最低银行资本量。

公开市场操作:美联储买卖美国政府债券。

贴现率:美联储向银行发放贷款的利率。

法定准备金:关于银行必须根据其存款持有的最低准备金量的规定。

联邦基金利率:银行向另一家银行进行隔夜贷款时的利率。

二、重要摘抄1.物物交换的交易要求需求的双向一致性,这样的经济难以有效地配置其稀缺资源。

曼昆 宏观经济学 第29章 货币制度

The Monetary System货币制度29货币的含义货币(Money)——经济中人们经常用来向其他人购买物品与劳务的一组资产。

货币的三大职能Medium of exchange 交换媒介 Unit of account 计价单位 Store of value 价值储藏正是这三项职能将货币跟其它资产区分开来!货币的职能•交换媒介–交换媒介——当买者在购买物品与劳务时给予卖者的东西。

–交换媒介是被乐意接受为支付的任何东西。

货币的职能•计价单位–计价单位——人们用来表示价格和记录债务的标准。

•价值储藏–价值储藏——人们可以用来把现在的购买力转变为未来的购买力的东西。

货币的流动性¾流动性(Liquidity)——一种资产可以兑换为经济中交换媒介的容易程度¾货币是流动性最强的一种资产¾物价的变动会影响货币的储藏价值货币的种类¾商品货币——以有内在价值的商品为形式的货币。

¾例子:黄金,白银,香烟¾法定货币——由政府法令而为通货使用的货币。

¾它不具有内在价值。

¾例子:硬币,纸币,存款支票美国经济中的货币¾现金——公众手中持有的纸币钞票和铸币。

¾活期存款——储户可以随时开支票的银行帐户余额。

图1. 美国经济中的货币(2004年)10亿美元•现金($580 billion)•活期存款•旅行支票’•其他支票存款($599 billion)•M1中的每一种($1,179 billion)•储蓄存款•小额定期存款•货币市场共同基金•几种不重要的项目($4,276 billion)0M1$1,179M2$5,455图2. 中国经济中的货币(截止到2007年3月末)万亿人民币•现金(2.74 )•活期存款•旅行支票’•其他支票存款(10.05)•M1中的每一种(12.79)•储蓄存款•小额定期存款•货币市场共同基金•几种不重要的项目(23.62)M112.79M236.41所有的现金都在哪里?¾在2001年,未清偿的通货有5800亿美元左右。

曼昆宏观经济学最新英文版参考答案第29章

Chapter 29Problems and Applications1. a. A U.S. penny is money in the U.S. economy because it is used as a medium of exchange tobuy goods or services, it serves as a unit of account because prices in stores are listed interms of dollars and cents, and it serves as a store of value for anyone who holds it overtime.b. A Mexican peso is not money in the U.S. economy, because it is not used as a medium ofexchange, and prices are not given in terms of pesos, so it is not a unit of account. It couldserve as a store of value, though.c. A Picasso painting is not money, because you cannot exchange it for goods or services, andprices are not given in terms of Picasso paintings. It does, however, serve as a store ofvalue.d. A plastic credit card is similar to money, but represents deferred payment rather thanimmediate payment. So credit cards do not fully represent the medium of exchangefunction of money, nor are they really stores of value, because they represent short-termloans rather than being an asset like currency.2. For an asset to be useful as a medium of exchange, it must be widely accepted (so all transactionscan be made in terms of it), recognized easily as money (so people can perform transactions easily and quickly), divisible (so people can provide change), and difficult to counterfeit (so people will not print their own money). That is why nearly all countries use paper money with fancy designs for larger denominations and coins for smaller denominations.For an asset to be useful as a store of value, it must be something that maintains its value over time and something that can be used directly to buy goods and services or sold when money is needed.In addition to currency, financial assets (like stocks and bonds) and physical assets (like real estate and art) make good stores of value.3. a. Currency holdings jumped at the end of 1999. Many individuals were worried about Y2Kand its effect on computers. They withdrew large sums of money from banks to protectthemselves from any possible problems.b. Many answers are possible.4. When your uncle repays a $100 loan from Tenth National Bank (TNB) by writing a check from hisTNB checking account, the result is a change in the assets and liabilities of both your uncle and TNB, as shown in these T-accounts:1Chapter 29/The Monetary System 2By paying off the loan, your uncle simply eliminated the outstanding loan using the assets in his checking account. Your uncle's wealth has not changed; he simply has fewer assets and fewerliabilities.5. a. Here is BSB's T-account:b. When BSB's largest depositor withdraws $10 million in cash and BSB reduces its loansoutstanding to maintain the same reserve ratio, its T-account is now:c. Because BSB is cutting back on its loans, other banks will find themselves short of reservesand they may also cut back on their loans as well.d. BSB may find it difficult to cut back on its loans immediately, because it cannot forcepeople to pay off loans. Instead, it can stop making new loans. But for a time it might finditself with more loans than it wants. It could try to attract additional deposits to getadditional reserves, or borrow from another bank or from the Fed.6. If you take $100 that you held as currency and put it into the banking system, then the totalamount of deposits in the banking system increases by $1,000, because a reserve ratio of 10%means the money multiplier is 1/.10 = 10. Thus, the money supply increases by $900, becausedeposits increase by $1,000 but currency declines by $100.7. With a required reserve ratio of 10%, the money multiplier could be as high as 1/.10 = 10, if bankshold no excess reserves and people do not keep some additional currency. So the maximumincrease in the money supply from a $10 million open-market purchase is $100 million. Thesmallest possible increase is $10 million if all of the money is held by banks as excess reserves.8. a. If the required reserve ratio is 5%, then First National Bank's required reserves are$500,000 x .05 = $25,000. Because the bank’s total reserves are $100,000, it has excessreserves of $75,000.b. With a required reserve ratio of 5%, the money multiplier is 1/.05 = 20. If First Nationallends out its excess reserves of $75,000, the money supply will eventually increase by$75,000 x 20 = $1,500,000.Chapter 29/The Monetary System 39. a. With a required reserve ratio of 10% and no excess reserves, the money multiplier is 1/.10= 10. If the Fed sells $1 million of bonds, reserves will decline by $1 million and the moneysupply will contract by 10 x $1 million = $10 million.b. Banks might wish to hold excess reserves if they need to hold the reserves for theirday-to-day operations, such as paying other banks for customers' transactions, makingchange, cashing paychecks, and so on. If banks increase excess reserves such that there isno overall change in the total reserve ratio, then the money multiplier does not change andthere is no effect on the money supply.10. a. With banks holding only required reserves of 10%, the money multiplier is 1/.10 = 10.Because reserves are $100 billion, the money supply is 10 x $100 billion = $1,000 billion.b. If the required reserve ratio is raised to 20%, the money multiplier declines to 1/.20 = 5.With reserves of $100 billion, the money supply would decline to $500 billion, a decline of$500 billion. Reserves would be unchanged.11. a. If people hold all money as currency, the quantity of money is $2,000.b. If people hold all money as demand deposits at banks with 100% reserves, the quantity ofmoney is $2,000.c. If people have $1,000 in currency and $1,000 in demand deposits, the quantity of money is$2,000.d. If banks have a reserve ratio of 10%, the money multiplier is 1/.10 = 10. So if people holdall money as demand deposits, the quantity of money is 10 x $2,000 = $20,000.e. If people hold equal amounts of currency (C) and demand deposits (D) and the moneymultiplier for reserves is 10, then two equations must be satisfied:(1) C = D, so that people have equal amounts of currency and demand deposits; and (2)10 x ($2,000 –C) = D, so that the money multiplier (10) times the number of dollar billsthat are not being held by people ($2,000 –C) equals the amount of demand deposits (D).Using the first equation in the second gives 10 x ($2,000 –D) = D, or $20,000 – 10D = D,or $20,000 = 11 D, so D = $1,818.18. Then C = $1,818.18. The quantity of money is C +D = $3,636.36.。

曼昆宏观经济学名词解释

曼昆宏观经济学名词解释2018年中央财经大学801经济学指定参考教材发生变动,《西方经济学》由原来的高鸿业版本换成范里安的《微观经济学:现代观点》和曼昆的《宏观经济学》,同学们的复习策略也要做出相应调整,下面凯程陈老师为大家总结了曼昆的宏观经济学名词解释,以供2018考研学子使用。

第一篇国内生产总值(GDP)一个国家(地区)领土范围内,本国(地区)居民和外国居民在一定时期内所生产和提供的全部最终产品和劳务的市场价值。

含义:1.地域概念;2.市场价值概念;3.测度的是最终产品的价值,因而是流量概念;4.在一定时期内生产而非售卖掉的最终产品价值。

国民生产总值(GNP)某国国民所拥有的全部生产要素在一定时期内所生产的的最终产品和劳务的市场价值。

是一个国民概念。

GNP = GDP +来自国外的要素收入—面向国外的要素支付名义GDP与实际GDP名义GDP是用生产产品和劳务的当期价格计算的全部最终产品的市场价值;实际GDP是用从前某一年的价格作为基期价格所计算出来的当年全部最终产品的市场价值。

二者的关系:实际GDP=名义GDP/GDP平减指数国内生产总值(GDP)平减指数(帕氏)按当年价格计算的国内生产总值和按基期价格计算的国内生产总值的比率。

用公式表示为:GDP平减指数=名义GDP/实际GDP*100%优点:范围广泛,能比较准确地反映一般物价水平的变动趋向;缺点:资料较难搜集,需要对未在市场上发生交易的商品和劳务进行换算,并且可能受到价格结构因素的影响。

另外,GDP平减指数倾向于低估生活成本的增加。

消费者物价指数(CPI)(拉氏)也称消费者价格指数,是指一篮子产品与服务的价格相对于同一篮子产品与服务在某个基年的价格的比值,一般用加权平均法来编制。

用公式表示为:CPI =(一组固定商品按当期价格计算的价值、一组固定商品按基期价格计算的价值)*100优点:能及时反映消费品供给和需求的对比关系,资料容易搜集,能够迅速直接地反映影响居民生活的价格趋势;缺点:范围较窄,只包括社会最终产品中的居民消费品的这一部分,因此不足以说明全面的情况。

曼昆宏观经济学第二十九章

CASE STUDY: Where Is All The Currency?

• In 2001 there was about $580 billion of U.S. currency outstanding.

– Examples: Gold, silver, cigarettes.

• Fiat money is used as money because of government decree.

– It does not have intrinsic value. – Examples: Coins, currency, check deposits.

Discussion

• Which of the following are money in the U.S economy? Which are not? Explain your answers by discussing each of the three functions of money.

• Problems in controlling the money supply

THE MEANING OF MONEY

• Money is the set of assets in an economy that people regularly use to buy goods and services from other people.

– A medium of exchange is anything that is readily acceptable as payment.

• Unit of Account

曼昆《经济学原理第三版》宏观分册原版中英文双语Chap_29

The Functions of Money • Money has three functions in the

economy:

• Medium of exchange • Unit of account • Store of value

commodity with intrinsic value.

• Examples: Gold, silver, cigarettes.

• Fiat money is used as money because of

government decree.

• It does not have intrinsic value. • Examples: Coins, currency, check

Copyright © 2004 South-Western

THE FEDERAL RESERVE SYSTEM

• The Fed was created in 1914 after a series of bank failures convinced Congress that the United States needed

deposits.

Copyright © 2004 South-Western

Money in the U.S. Economy

• Currency is the paper bills and coins

in the hands of the public.

• Demand deposits are balances in bank

THE FEDERAL RESERVE SYSTEM

• The Federal Reserve (Fed) serves as

曼昆宏观经济学名词解释-(中英文)

宏观经济学第十五章MEASUREING A NATION’S INCOME一国收入的衡量Microeconomics the study of how households and firms make decisions and how they interact in markets.微观经济学:研究家庭和企业如何做出决策,以及他们如何在市场上相互交易。

Macroeconomics the study of economy-wide phenomena,including inflation,unemployment,and economic growth宏观经济学:研究整体经济现象,包括通货膨胀、失业和经济增长。

GDP is the market value of final goods and services produced within a country in a given period of time.国内生产总值GDP:给定时期的一个经济体内生产的所有最终产品和服务的市场价值Consumption is spending by households on goods and services, with the exception of purchased of new housing.消费:除了购买新住房,家庭用于物品与劳务的支出。

Investment is spending on capital equipment inventories, and structures, including household purchases of new housing.投资:用于资本设备、存货和建筑物的支出,包括家庭用于购买新住房的支出。

Government purchases are spending on goods and services by local, state, and federal government.政府支出:地方、州和联邦政府用于物品和与劳务的支出。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第29 章1.Definition of money: the set of assets in an economy that people regularly use to buy goods and services from other people.2.Definition of medium of exchange: an item that buyers give to sellers when they want to purchase goods and services.3. Definition of unit of account: the yardstick people use to post prices and record debts.4. Definition of store of value: an item that people can use to transfer purchasing power from the present to the future.5.Definition of liquidity: the ease wi th which an asset can be converted into the economy’s medium of exchange.6.Definition of commodity money: money that takes the form of a commodity with intrinsic value.7. Definition of fiat money: money without intrinsic value that is used as money because of government decree.8.Definition of currency: the paper bills and coins in the hands of the public.9.Definition of demand deposits: balances in bank accounts that depositors can access on demand by writing a check.10.Definition of Federal Reserve (Fed): the central bank of the United States.11. Definition of central bank: An institution designed to oversee the banking system and regulate the quantity of money in the economy.12. Definition of money supply: the quantity of money available in the economy.13. Definition of monetary policy: the setting of the money supply by policymakers in the central bank.14. Definition of reserves: deposits that banks have received but have not loaned out.15. Definition of fractional-reserve banking: a banking system in which banks hold only a fraction of deposits as reserves.16. Definition of reserve ratio: the fraction of deposits that banks hold as reserves.17.Definition of money multiplier: the amount of money the banking system generates with each dollar of reserves.18.Definition of bank capital: the resources a bank’s owners have put into the institution.19.Definition of leverage: the use of borrowed money to supplement existing funds for purposes of investment.20.Definition of leverage ratio: the ratio of assets to bank capital.21. Definition of capital requirement: a government regulation specifying a minimum amount of bank capital.22. Definition of open-market operations: the purchase and sale of U.S. government bonds by the Fed.23. Definition of discount rate: the interest rate on the loans that the Fed makes to banks.24.Definition of reserve requirements: regulations on the minimum amount of reserves that banks must hold against deposits.25.Definition of federal funds rate: the short-term interest rate that banks charge one another for loans.第30章1. Definition of quantity theory of money: a theory asserting that the quantity of money available determines the price level and that the growth rate in the quantity of money available determines the inflation rate.2. Definition of nominal variables: variables measured in monetary units3. Definition of real variables: variables measured in physical units.4. Definition of classical dichotomy: the theoretical separation of nominal and real variables.5. Definition of monetary neutrality: the proposition that changes in the money supply do not affect real variables.6. Definition of velocity of money: the rate at which money changes hands.7. Definition of quantity equation: the equation M × V = P × Y which relates the quantity of money the velocity of money and the dollar value of the economy’s output of goods and services.8. Definition of inflation tax: the revenue the government raises by creating money.9. Definition of Fisher effect: the one-for-one adjustment of the nominal interest rate to the inflation rate.10. Definition of shoeleather costs: the resources wasted when inflation encourages people to reduce their money holdings.11. Definition of menu costs: the costs of changing prices.第31章1.Definition of closed economy: an economy that does not interact with other economies in the world.2. Definition of open economy: an economy that interacts freely with other economies around the world.3. Definition of exports: goods and services that are produced domestically and sold abroad.4. Definition of imports: goods and services that are produced abroad and sold domestically.5.Definition of net exports: the value of a nation’s exports minus the value of its imports also calle d the trade balance.6. Definition of trade balance: the value of a nation’s exports minus the value of its imports also called net exports.7. Definition of trade surplus: an excess of exports over imports.8.Definition of trade deficit: an excess of imports over exports.9.Definition of balanced trade: a situation in which exports equal imports.10. Definition of net capital outflow (NCO): the purchase of foreign assets by domestic residents minus the purchase of domestic assets by foreigners.11. Definition of nominal exchange rate: the rate at which a person can trade the currency of one country for the currency of another.12. Definition of appreciation: an increase in the value of a currency as measured by the amount of foreign currency it can buy.13. Definition of depreciation: a decrease in the value of a currency as measured by the amount of foreign currency it can buy.14.Definition of real exchange rate: the rate at which a person can trade the goods and services of one country for the goods and services of another.15.Definition of purchasing-power parity: a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries.第32章1.Definition of trade policy: a government policy that directly influences the quantity of goods and services that a country imports or exports.2.2. Definition of capital flight: a large and sudden reduction in the demand for assets located in a country.第33章1. Definition of recession: a period of declining real incomes and rising unemployment.2. Definition of depression: a severe recession.3. Definition of model of aggregate demand and aggregate supply: the model that most economists use to explain short-run fluctuations in economic activity around its long-run trend.4. Definition of aggregate-demand curve: a curve that shows the quantity of goods and services that households firms and the government want to buy at each price level.5. Definition of aggregate-supply curve: a curve that shows the quantity of goods and services that firms choose to produce and sell at each price level6.Dfinition of natural level of output: the production of goods and services that an economy achieves in the long run when unemployment is at its natural rate.7. Definition of stagflation: a period of falling output and rising prices.第三十四章1.Definition of theory of liquidity preference: Keynes’s theory that the interest rate adjusts to bring money supply and money demand into balance.2.Definition of fiscal policy: the setting of the level of government spending and taxation by government policymakers.3.Definition of multiplier effect: the additional shifts in aggregate demand that result when expansionary fiscal policy increases income and thereby increases consumer spending.4. Definition of crowding-out effect: the offset in aggregate demand that results when expansionary fiscal policy raises the interest rate and thereby reduces investment spending.5. Definition of automatic stabilizers: changes in fiscal policy that stimulate aggregate demand when the economy goes into a recession without policymakers having to take any deliberate action.第三十五章1. Definition of Phillips curve: a curve that shows the short-run trade-off between inflation and unemployment.2. Definition of the natural-rate hypothesis: the claim that unemployment eventually returns to its normal or natural rate regardless of the rate of inflation.3.Definition of supply shock: an event that directly alters firms’ costs and prices shif ting the economy’s aggregate-supply curve and thus the Phillips curve.4. Definition of sacrifice ratio: the number of percentage points of annual output lost in the process of reducing inflation by one percentage point.5. Definition of rational expectations: the theory according to which people optimally use all the information they have including information about government policies when forecasting the future.。