国际经济学第8版第五章标准贸易模型中文答案

克鲁格曼《国际经济学》第八版课后答案(英文)-Ch05

Chapter 5The Standard Trade ModelChapter OrganizationA Standard Model of a Trading EconomyProduction Possibilities and Relative SupplyRelative Prices and DemandThe Welfare Effect of Changes in the Terms of TradeDetermining Relative PricesEconomic Growth: A Shift of the RS CurveGrowth and the Production Possibility FrontierRelative Supply and the Terms of TradeInternational Effects of GrowthCase Study: Has the Growth of Newly Industrializing Countries Hurt Advanced Nations? International Transfers of Income: Shifting the RD CurveThe Transfer ProblemEffects of a Transfer on the Terms of TradePresumptions about the Terms of Trade Effects of TransfersCase Study: The Transfer Problem and the Asian CrisisTariffs and Export Subsidies: Simultaneous Shifts in RS and RDRelative Demand and Supply Effects of a TariffEffects of an Export SubsidyImplications of Terms of Trade Effects: Who Gains and Who Loses?SummaryAppendix: Representing International Equilibrium with Offer CurvesDeriving a Country’s Offer CurveInternational EquilibriumChapter 5 The Standard Trade Model 17Chapter OverviewPrevious chapters have highlighted specific sources of comparative advantage which give rise to international trade. This chapter presents a general model which admits previous models as special cases. This “standard trade model” is the workhorse of international trade theory and can be used to address a wide range of issues. Some of these issues, such as the welfare and distributional effects of economic growth, transfers between nations, and tariffs and subsidies on traded goods are considered in this chapter. The standard trade model is based upon four relationships. First, an economy will produce at the point where the production possibilities curve is tangent to the relative price line (called the isovalue line). Second, indifference curves describe the tastes of an economy, and the consumption point for that economy is found at the tangency of the budget line and the highest indifference curve. These two relationships yield the familiar general equilibrium trade diagram for a small economy (one which takes as given the terms of trade), where the consumption point and production point are the tangencies of the isovalue line with the highest indifference curve and the production possibilities frontier, respectively.You may want to work with this standard diagram to demonstrate a number of basic points. First, an autarkic economy must produce what it consumes, which determines the equilibrium price ratio; and second, opening an economy to trade shifts the price ratio line and unambiguously increases welfare. Third, an improvement in the terms of trade increases welfare in the economy. Fourth, it is straightforward to move from a small country analysis to a two country analysis by introducing a structure of world relative demand and supply curves which determine relative prices.These relationships can be used in conjunction with the Rybczynski and the Stolper-Samuelson Theorems from the previous chapter to address a range of issues. For example, you can consider whether the dramatic economic growth of countries like Japan and Korea has helped or hurt the United States as a whole, and also identify the classes of individuals within the United States who have been hurt by the particular growth biases of these countries. In teaching these points, it might be interesting and useful to relate them to current events. For example, you can lead a class discussion of the implications for the United States of the provision of forms of technical and economic assistance to the emerging economies around the world or the ways in which a world recession can lead to a fall in demand for U.S. export goods.The example provided in the text considers the popular arguments in the media that growth in Japan or Korea hurts the United States. The analysis presented in this chapter demonstrates that the bias of growth is important in determining welfare effects rather than the country in which growth occurs. The existence of biased growth, and the possibility of immiserizing growth is discussed. The Relative Supply (RS) and Relative Demand (RD) curves illustrate the effect of biased growth on the terms of trade. The new terms of trade line can be used with the general equilibrium analysis to find the welfare effects of growth. A general principle which emerges is that a country which experiences export-biased growth will have a deterioration in its terms of trade, while a country which experiences import-biased growth has an improvement in its terms of trade. A case study points out that growth in the rest of the world has made other countries more like the United States. This import-biased growth has worsened the terms of trade for the United States. The second issue addressed in the context of the standard trade model is the effect of international transfers. The salient point here is the direction, if any, in which the relative demand curve shifts in response to the redistribution of income from a transfer. A transfer worsens the donor’s ter ms of trade if it has a higher marginal propensity to consume its export good than the recipient. The presence of non-traded goods tends to reinforce the deterioration of terms of trade for the donor country. The case study attendant to this issue involves the deterioration of many Asian countries’ terms of trade due to the large capital withdrawals at the end of the 1990s.18 Krugman/Obstfeld •International Economics: Theory and Policy, Eighth EditionThe third area to which the standard trade model is applied are the effects of tariffs and export subsidies on welfare and terms of trade. The analysis proceeds by recognizing that tariffs or subsidies shift both the relative supply and relative demand curves. A tariff on imports improves the terms of trade, expressed in external prices, while a subsidy on exports worsens terms of trade. The size of the effect depends upon the size of the country in the world. Tariffs and subsidies also impose distortionary costs upon the economy. Thus, if a country is large enough, there may be an optimum, non-zero tariff. Export subsidies, however, only impose costs upon an economy. Intranationally, tariffs aid import-competing sectors and hurt export sectors while subsidies have the opposite effect. An appendix presents offer curve diagrams and explains this mode of analysis.Answers to Textbook Problems1.Note how welfare in both countries increases as the two countries move from productionpatterns governed by domestic prices (dashed line) to production patterns governed by worldprices (straight line).2.3. An increase in the terms of trade increases welfare when the PPF is right-angled. The production pointis the corner of the PPF. The consumption point is the tangency of the relative price line and the highest indifference curve. An improvement in the terms of trade rotates the relative price line about its intercept with the PPF rectangle (since there is no substitution of immobile factors, the production point stays fixed). The economy can then reach a higher indifference curve. Intuitively, although there is no supply response, the economy receives more for the exports it supplies and pays less for the imports it purchases.Chapter 5 The Standard Trade Model 19 4. The difference from the standard diagram is that the indifference curves are right angles rather thansmooth curves. Here, a terms of trade increase enables an economy to move to a higher indifference curve. The income expansion path for this economy is a ray from the origin. A terms of tradeimprovement moves the consumption point further out along the ray.5. The terms of trade of Japan, a manufactures (M) exporter and a raw materials (R) importer, is the worldrelative price of manufactures in terms of raw materials (p M/p R). The terms of trade change can be determined by the shifts in the world relative supply and demand (manufactures relative to raw materials) curves. Note that in the following answers, world relative supply (RS) and relative demand (RD) are always M relative to R. We consider all countries to be large, such that changes affect the world relative price.a. Oil supply disruption from the Middle East decreases the supply of raw materials, which increasesthe world relative supply. The world relative supply curve shifts out, decreasing the world relative price of manufactured goods and deteriorating Japan’s terms of t rade.b. Korea’s increased automobile production increases the supply of manufactures, which increasesthe world RS. The world relative supply curve shifts out, decreasing the world relative price ofmanufactured goods and deteriorating Japan’s terms of tr ade.c. U.S. development of a substitute for fossil fuel decreases the demand for raw materials. Thisincreases world RD, and the world relative demand curve shifts out, increasing the world relative price of manufactured goods and improving Japan’s terms of trade. This occurs even if no fusion reactors are installed in Japan since world demand for raw materials falls.d. A harvest failure in Russia decreases the supply of raw materials, which increases the world RS.The world relative supply curve shifts o ut. Also, Russia’s demand for manufactures decreases,which reduces world demand so that the world relative demand curve shifts in. These forcesdecrease the world relative price of manufactured goods and deteriorate Japan’s terms of trade.e. A reduction in Japan’s tariff on raw materials will raise its internal relative price of manufactures.This price change will increase Japan’s RS and decrease Japan’s RD, which increases the worldRS and decreases the world RD (i.e., world RS shifts out and world RD shifts in). The worldrelative price of manufactures declines and Japan’s terms of trade deteriorate.6. The declining price of services relative to manufactured goods shifts the isovalue line clockwise sothat relatively fewer services and more manufactured goods are produced in the United States, thus reducing U.S. welfare.20 Krugman/Obstfeld •International Economics: Theory and Policy, Eighth Edition7. These results acknowledge the biased growth which occurs when there is an increase in one factor ofproduction. An increase in the capital stock of either country favors production of Good X, while an increase in the labor supply favors production of Good Y. Also, recognize the Heckscher-Ohlin result that an economy will export that good which uses intensively the factor which that economy has in relative abundance. Country A exports Good X to Country B and imports Good Y from Country B.The possibility of immiserizing growth makes the welfare effects of a terms of trade improvement due to export-biased growth ambiguous. Import-biased growth unambiguously improves welfare for the growing country.a. A’s terms of trade worsen, A’s welfare may increase or, less likely, decrease, and B’s welfareincreases.b. A’s terms of trade improve, A’s welfare increases and B’s welfare decreases.c. B’s terms of trade improve, B’s welfare increases and A’s welfare decreases.d. B’s terms of trade worsen, B’s welfare may increase or, less likely, decrease, and A’s welfareincreases.8. Immiserizing growth occurs when the welfare deteriorating effects of a worsening in an economy’sterms of trade swamp the welfare improving effects of growth. For this to occur, an economy must undergo very biased growth, and the economy must be a large enough actor in the world economy such that its actions spill over to adversely alter the terms of trade to a large degree. This combination of events is unlikely to occur in practice.9. India opening should be good for the U.S. if it reduces the relative price of goods that China sends tothe U.S. and hence increases the relative price of goods that the U.S. exports. Obviously, any sector in the U.S. hurt by trade with China would be hurt again by India, but on net, the U.S. wins. Note that here we are making different assumptions about what India produces and what is tradable than we are in Question #6. Here we are assuming India exports products the U.S. currently imports and China currently exports. China will lose by having the relative price of its export good driven down by the increased production in India.10. Aid which must be spent on exports increases the demand for those export goods and raises their pricerelative to other goods. There will be a terms of trade deterioration for the recipient country. This can be viewed as a polar case of the effect of a transfer on the terms of trade. Here, the marginal propensity to consume the export good by the recipient country is 1. The donor benefits from a terms of trade improvement. As with immiserizing growth, it is theoretically possible that a transfer actuallyworsens the welfare of the recipient.11. When a country subsidizes its exports, the world relative supply and relative demand schedules shiftsuch that the terms of trade for the country worsen. A countervailing import tariff in a second country exacerbates this effect, moving the terms of trade even further against the first country. The firstcountry is worse off both because of the deterioration of the terms of trade and the distortionsintroduced by the new internal relative prices. The second country definitely gains from the firstcountry’s export su bsidy, and may gain further from its own tariff. If the second country retaliated with an export subsidy, then this would offset the initial improvement in the terms of trade; the“retaliatory” export subsidy definitely helps the first country and hurts th e second.。

国际经济学 第五章 标准贸易模型

根据相对供给和相对需 求确定均衡相对价格(贸易 条件)。

PA/PB

RD’ RD

RS RS’

相对供给上升→贸易条 件恶化;

相对需求上升→贸易条 件改善。

(PA/PB)E

E” E

E’

(QA+Q*A) (QB+Q*B)

利利用用提提供供曲曲线线分分析析贸贸易易条条件件

➢ 相对价格变化,生产和需求改变,生产与需求之间差别通过贸易弥补。 如图所示,在原有的价格下,出口量为EF,进口量为CF;出口价格上 升后,出口量为E’F’,进口量为C’F’。

QB)之间的替代关系用生产可能性曲线表示。根据企业追求利润最大

化的原则,生产选择在生产可能性曲线上切线斜率的绝对值等于商品

相对价格(PA/PB)之处。(此时,在给定价格下,国内生产的名义总 产值也达到最大,请思考理由?)。QB

➢ A商品相对价格上升 →生产由点E转变为点E’ →A商品相对供给增加。

QB/Q

➢ 但如果对受援国提出必须采购本国产品的要求,本国对外国的援助所 引起的贸易条件恶化效应可以减少。

大国的关税和出口补贴同时影响供给和需求,对贸易条件形成影响。 关关税税

本国对进口产品征收关税→国内进口商品国内价格上升→进口商品相对供 给增加、相对需求减少→进口商品世界相对价格下降→本国贸易条件改善→ 有利于增加本国福利。

③ 出口产品相对价格较低时,提供曲线凸向出口商品

出口产品相对价格上升后, 一方面,在生产上,由于出口商品生产增加,增加生 产单位出口商品的成本上升, 进口商品国内生产的边际成本下降;另一方面, 在 需求上, 进口商品对于出口商品的边际替代率减少。 因此, 随着出口的增加,单 位出口要求交换的进口商品数量增加。

国际经济学第8版习题库

第三章:劳动生产率和比较优势——李嘉图模型多线选择题1.国家之间进行贸易是因为他们是(),也是由于()A.不同的,成本B.相似的,规模经济C.不同的,规模经济D.相似的,成本E.以上都不对答案:C2.如果满足下列哪个条件的话,这两个国家都会从贸易中得利。

A.每个国家出口自己有比较优势的产品B.每个国家都有优越的贸易条件C.每个国家对进口产品有更高的需求弹性D.每个国家对出口产品有更高的供给弹性E.C和D都对答案:A3李嘉图的比较优势理论认为,假如符合下列哪项,该国在小饰品产品上具有比较优势呢?A.该国每个小饰品工人的产量更高B.该国的汇率很低C.该国的工资率很高D.该国小饰品工人的生产率和该国其他产品的生产率之比高于国外E.B和C都对答案:D4.为了确定一个国家在一个特殊产品上的生产是否具有比较优势,我们至少需要知道几个单位产品劳动投入量的消息A.一个B.两个C.三个D.四个E.五个答案:D5.根据比较优势原理,一个国家进行国际贸易从中得到收益,是以为A.间接生产出口产品比直接生产更有效B.间接生产进口产品比国内生产更有效C.可以用更少的劳动力生产出口产品D.使用更少的劳动力间接生产出口产品E.以上都不对答案:B6.根据下面的信息:单位劳动力需求布料小饰品国内 10 20国外 60 30A.没有一个国家有比较优势B.国内在布料生产方面具有比较优势C.国外在布料生产方面具有比较优势D.国内在饰品生产方面具有比较优势E.国内在这两件产品上都具有比较优势答案:B7.假如国外使用犯人生产出口产品,那么国内应该A.出口布料B.出口小饰品C.两种产品都出口,而不进口D.不从事任何进口和出口E.上面都对答案:A8.假如国内经济遭受了大萧条,每种产品的单位劳动需求翻了四倍。

那么国内应该A.出口布料B.出口小饰品C.出口布料,不进口D.不做任何出口或进口E.以上都正确答案:A9.假如国内工资水平翻倍了,那么国内应该A.出口布料B.出口小饰品C.出口布料,不进口D.不做任何出口和进口E.以上都正确答案:A10.根据下面的信息一个单位劳动力生产的数量布料小饰品国内 10 20国外 60 30A.没有一个国家有比较优势国内在布料生产上有比较优势B.国外在布料生产上有比较优势国外在饰品生产上有比较优势C.国内在两种产品上都有比较优势答案:C11.假如国外使用犯人生产出口产品,国外生产布料的机会成本是小饰品的生产,那么国内应该A.出口布料B.出口小饰品C.两种产品都出口,不进口D.不进口,也不出口E.以上都正确答案:B12.假如国内工资翻倍了,国内应该A.出口布料B.出口小饰品C.两种产品都出口,不进口D.不出口也不进口E.以上都对答案:B14.假设只有两个国家进行贸易,这两个国家只生产两种产品,那么国际贸易会使什么增加A.假如两种产品的产量都增加了,消费者福利才会增加B.两种产品的生产量和两个国家的消费者福利都会增加C.两种产品的生产量都增加了,但不是两个国家的消费者福利都增加D.两个国家的消费者福利增加了,但不是两种产品的总生产量都增加了E.以上都不正确答案:B15.根据李嘉图模型,贸易的结果会带来哪个趋于专业化A.16.根据李嘉图模型,参加贸易的国家会发现他的消费束A.在生产边界线内部B.在生产边界线上C.在生产边界线外部D.在他贸易国生产边界线内部E.在他贸易国生产边界线上答案:C17.在李嘉图模型中,假如一个国家的贸易受到限制,下列哪项不会发生?A.有限的专业化和劳动分工B.贸易额和贸易所得都减少C.使国家在生产边界线内部进行生产D.可能导致一个国家生产一些不具有比较优势的产品E.以上都不是答案:C18.根据李嘉图模型,假如一个很小的国家和一个非常大的国家进行贸易,那么A.小国家的经济福利会下降B.大国际的经济福利会下降C.小国家将从贸易中获利D.大国家将从贸易中获利E.以上都不正确答案:C19.假如一个国家的世界相对价格在H国和F国的国内生产成本比率之间,那么A.H国将从贸易中获利,而不是F国B. F国和H国都将从贸易中获利C.H国和F国都不能从贸易中获利D.只有进行出口补贴的国家能从贸易中获利E.以上都不对答案:B20.假如F国的国内两种商品的相对价格等于世界贸易条件,那么A.H国将从贸易中获利,F国不能B.H国和F国都从贸易中获利C.H国和F国都不能从贸易中获利D.只有政府补贴出口的国家获利E.以上都不正确答案:A21.假如H国的国内两种商品的相对价格等于世界贸易条件,那么A.H国将从贸易中获利,F国不能B.H国和F国都从贸易中获利C.H国和F国都不能从贸易中获利D.只有政府补贴出口的国家获利E.以上都不正确答案:E22.假如生产可能性曲线凹向原点,那么下列哪种情况会进行生产A.机会成本不变B.机会成本递增C.机会成本递减D.机会成本无限E.以上都不正确答案:B23.假如两个国家有相同的生产可能性曲线,那么在下列哪种情况下他们之间的贸易不可能发生A.他们的供给曲线相同B.他们的成本函数相同C.他们的需求函数相同D.他们的收入相同E.以上都不正确答案:C24.比较优势原理最早是谁提出的?A.大卫。

克鲁格曼国际经济学第八版上册课后答案

Chapter 4Resources, Comparative Advantage, and Income DistributionChapter OrganizationA Model of a Two-Factor EconomyPrices and ProductionChoosing the Mix of InputsFactor Prices and Goods PricesResources and OutputEffects of International Trade Between Two-Factor Economies Relative Prices and the Pattern of TradeTrade and the Distribution of IncomeFactor Price EqualizationTrade and Income Distribution in the Short RunCase Study: North-South Trade and Income InequalityThe Political Economy of Trade: A Preliminary ViewThe Gains from Trade, RevisitedOptimal Trade PolicyIncome Distribution and Trade PoliticsBox: Income Distribution and the Beginnings of Trade Theory Empirical Evidence on the Heckscher-Ohlin ModelTesting the Heckscher-Ohlin ModelImplications of the TestsSummaryAppendix: Factor Prices, Goods Prices, and Input Choices Choice of TechniqueGoods Prices and Factor PricesChapter OverviewIn Chapter 3, trade between nations was motivated by differences internationally in the relative productivity of workers when producing a range of products. In Chapter 4, this analysis goes a step further by introducing the Heckscher-Ohlin theory.The Heckscher-Ohlin theory considers the pattern of production and trade which will arise when countries have different endowments of factors of production, such as labor, capital, and land. The basic point is that countries tend to export goods that are intensive in the factors with which they are abundantly supplied. Trade has strong effects on the relative earnings of resources, and tends to lead to equalization across countries of prices of the factors of production. These theoretical results and related empirical findings are presented in this chapter.The chapter begins by developing a general equilibrium model of an economy with two goods which are each produced using two factors according to fixed coefficient production functions. The assumption of fixed coefficient production functions provides an unambiguous ranking of goods in terms of factor intensities. (The appendix develops the model when the production functions have variable coefficients.) Two important results are derived using this model. The first is known as the Rybczynski effect. Increasing the relative supply of one factor, holding relative goods prices constant, leads to a biased expansion of production possibilities favoring the relative supply of the good which uses that factor intensively.The second key result is known as the Stolper-Samuelson effect. Increasing the relative price of a good, holding factor supplies constant, increases the return to the factor used intensively in the production of that good by more than the price increase, while lowering the return to the other factor. This result has important income distribution implications.It can be quite instructive to think of the effects of demographic/labor force changes on the supply of different products. For example, how might the pattern of production during the productive years of the “Baby Boom” generation differ from the pattern of production for post Baby Boom generations? What does this imply for returns to factors and relative price behavior?The central message concerning trade patterns of the Heckscher-Ohlin theory is that countries tend to export goods whose production is intensive in factors with which they are relatively abundantly endowed. This is demonstrated by showing that, using the relative supply and relative demand analysis, the country relatively abundantly endowed with a certain factor will produce that factor more cheaply than the other country. International trade leads to a convergence of goods prices. Thus, the results from the Stolper-Samuelson effect demonstrate that owners of a country’s abundant factors gain from trade, but ownersof a country’s scarce factors lose. The extension of this result is the important Factor Price Equalization Theorem, which states that trade in (and thus price equalization of) goods leads to an equalization in the rewards to factors across countries. The political implications of factor price equalization should be interesting to students.The chapter also introduces some political economy considerations. First, it briefly notes that many of the results regarding trade and income distribution assume full and swift adjustment in the economy. In the short run, though, labor and capital that are currently in a particular industry may have sector-specific skills or knowledge and are being forced to move to another sector, and this involves costs. Thus, even if a shift in relative prices were to improve the lot of labor, for those laborers who must change jobs, there is a short run cost.The core of the political economy discussion focuses on the fact that when opening to trade, some may benefit and some may lose, but the expansion of economic opportunity should allow society to redistribute some of the gains towards those who lose, making sure everyone benefits on net. In practice, though, those who lose are often more concentrated and hence have more incentive to try to affect policy. Thus, trade policy is not always welfare maximizing, but may simply reflect the preferences of the loudest and best organized in society.Empirical results concerning the Heckscher-Ohlin theory, beginning with the Leontief paradox and extending to current research, do not support its predictions concerning resource endowments explaining overall patterns of trade, though some patterns do match the broad outlines of its theory (e.g., theUnited States imports more low-skill products from Bangladesh and more high-skill products from Germany). This observation has motivated many economists to consider motives for trade between nations that are not exclusively based on differences across countries. These concepts will be exploredin later chapters. Despite these shortcomings, important and relevant results concerning income distribution are obtained from the Heckscher-Ohlin theory.Answers to Textbook Problems1. The definition of cattle growing as land intensive depends on the ratio of land to labor used inproduction, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries as well if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. Comparisons between another country and the United States is less relevant for this purpose.2. a. The box diagram has 600 as the length of two sides (representing labor) and 60 as the lengthof the other two sides (representing land). There will be a ray from each of the two cornersrepresenting the origins. To find the slopes of these rays we use the information from the questionconcerning the ratios of the production coefficients. The question states that a LC/a TC= 20 anda LF/a TF= 5.Since a LC/a TC= (L C/Q C)/(T C/Q C) =L C/T C we have L C= 20T C. Using the same reasoning,a LF/a TF= (L F/Q F)/(T F/Q F) =L F/T F and since this ratio equals 5, we have L F= 5T F. We cansolve this algebraically since L=L C+ L F= 600 and T=T C+ T F= 60.The solution is L C= 400, T C= 20, L F= 200 and T F= 40.b. The dimensions of the box change with each increase in available labor, but the slopes of the raysfrom the origins remain the same. The solutions in the different cases are as follows.L= 800: T C= 33.33, L C= 666.67, T F= 26.67, L F= 133.33L= 1000: T C= 46.67, L C= 933.33, T F= 13.33, L F= 66.67L= 1200: T C= 60, L C= 1200, T F= 0, L F= 0. (complete specialization).c. At constant factor prices, some labor would be unused, so factor prices would have to change, orthere would be unemployment.3. This question is similar to an issue discussed in Chapter 3. What matters is not the absolute abundanceof factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries.4. In the Ricardian model, labor gains from trade through an increase in its purchasing power. Thisresult does not support labor union demands for limits on imports from less affluent countries. The Heckscher-Ohlin model directly addresses distribution by considering the effects of trade on theowners of factors of production. In the context of this model, unskilled U.S. labor loses fromtrade since this group represents the relatively scarce factors in this country. The results from theHeckscher-Ohlin model support labor union demands for import limits. In the short run, certainunskilled unions may gain or lose from trade depending on in which sector they work, but in theory, in the longer run, the conclusions of the Heckscher-Ohlin model will dominate.5. Specific programmers may face wage cuts due to the competition from India, but this is not inconsistentwith skilled labor wages rising. By making programming more efficient in general, this development may have increased wages for others in the software industry or lowered the prices of the goodsoverall. In the short run, though, it has clearly hurt those with sector specific skills who will facetransition costs. There are many reasons to not block the imports of computer programming services (or outsourcing of these jobs). First, by allowing programming to be done more cheaply, it expands the production possibilities frontier of the U.S., making the entire country better off on average.Necessary redistribution can be done, but we should not stop trade which is making the nation as a whole better off. In addition, no one trade policy action exists in a vacuum, and if the U.S. blocked the programming imports, it could lead to broader trade restrictions in other countries.6. The factor proportions theory states that countries export those goods whose production is intensivein factors with which they are abundantly endowed. One would expect the United States, whichhas a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods.Bowen, Leamer and Sveikauskas found for the world as a whole the correlation between factorendowment and trade patterns to be tenuous. The data do not support the predictions of the theory that countries’ e xports and imports reflect the relative endowments of factors.7. If the efficiency of the factors of production differs internationally, the lessons of the Heckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be moresuccessful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled workercould earn twice what lower-skilled workers do, and the price of one effective unit of labor would still be equalized.。

国际经济学第八版课后答案

国际经济学第八版课后答案国际经济学是当代世界上重要的一门学科,在全球经济不断发展的今天,在不同国家和地区间进行国际贸易和投资已成为一种常态,而这种现象的背后,正是国际经济学的基础理论支撑,因此学习国际经济学的重要性日益凸显。

而对于国际经济学这门学科来说,了解、掌握相关的知识点和要点,完成课后习题,是非常重要的。

国际经济学第八版通过对国际贸易、投资、汇率、国际收支等一系列问题进行系统讲述,对学生进行全方位的培养,涉及到的知识点也十分广泛,因此,在完成课后习题时,可能会遇到一定的问题,需要一定的帮助和指导才能完成。

因此,对于国际经济学第八版课后答案的研究也显得尤为重要。

在研究国际经济学第八版课后答案时,我们需要注意以下几点:1.仔细阅读教材,掌握理论基础课后习题的主要目的就是帮助学生巩固课堂上所学的知识点和理论基础,因此在完成课后习题时,学生需要仔细阅读教材,掌握理论基础。

只有对教材中所介绍的理论和分析方法有了充分的理解和把握,才能更好地完成课后习题,理解其中的思想和要点。

2.注重实践应用,锻炼思维能力国际经济学的学习需要注重实践应用,在完成课后习题时也应该如此,尤其是在解决实际问题的时候,需要更注重实践应用,并且要灵活运用学到的理论知识,通过对问题的分析、解答、讨论,锻炼自己的思维能力和创新意识。

3.积极参与交流讨论,锻炼合作能力课后习题的完成,不是个人的事情,而是需要学生之间相互交流、讨论、合作实现的,因此,在完成课后习题时,学生需要积极参与交流讨论,通过与同学之间的互动和交流,可以加深对问题的理解和认识,锻炼自己的合作能力。

4.注意答案的准确性和合理性在完成课后习题时,需要注意答案的准确性和合理性,只有在确认自己所得出的答案是准确的、合理的,才能对所学到的内容有充分的理解和掌握。

综上所述,国际经济学第八版课后答案对于学生的学习来说具有非常重要的作用,同时也需要注意一些问题。

最后,我们希望广大学生能够通过认真学习、积极思考、有效交流,掌握好国际经济学的相关知识点,为将来更好地服务国家和世界经济发展做出自己的贡献。

国际经济学第8版第五章标准贸易模型中文答案

第五章 标准贸易模型1、答:如图,贸易后,两国原先的无差异曲线都移动到了更高的无差异曲线上,两国人民都更幸福,社会福利增加。

2、答:(a )如左图,假如过度捕鱼引起的鱼产量大幅度减少,则挪威的生产可能性边界发生变化,导致等价值线向下移动,相应的无差异曲线移动到了较低的水平上,导致福利下降。

(b )如右图,当过度捕鱼引起鱼的产量减少,在市场上鱼的供给减少,导致相对价格上升,上升到一定程度不仅可以弥补鱼的产量损失,甚至会带来福利的上升。

3、答:如图,以粮食和棉布为例,当生产可能性边界是直角时,贸易条件改善增进了本国福利。

生产点位于直角顶点,消费点是等价值线和无差异曲线的切点。

贸易条件的改善使得等价值线的截距增加,即等价值线直角顶点向外偏转(由于没有流动要素,生产点固定)。

经济体达鱼 车 鱼车瑞典 F C本国鱼 车 鱼车挪威 挪威挪威到获得了更高的无差异曲线,从直观上来看,产出并没有发生变化,经济体获益主要是通过相对于进口产品购买力的增加来实现的。

4、答:由于购买产品比例是固定的,所以无差异曲线是直角形状。

贸易条件的改善使该国达到了更高的无差异曲线。

无差异曲线沿着从原点出发的射线移动,其顶点始终在该射线上,射线的斜率为两种产品的比例,贸易条件的改善使无差异曲线远离原点。

5、答:日本贸易条件是制造品价格比去原材料价格的相对价格,贸易条件的变动由相对供给和相对需求的变动决定。

(a )中东石油供应的紧缺使得原材料的供给减少,这导致了制造品的相对供给增加,RS 曲线向右移动,制造品的相对价格下降,日本的贸易条件恶化。

(b )韩国扩展了汽车生产能力增加了世界汽车的总供给,使得世界汽车的相对供给增加了,RS 曲线向右移动,世界市场上汽车的相对价格下降了,日本的贸易条件恶化了。

(c )美国工程师以核反应堆代替石油燃料发电厂,减少了对石油,即原材料的需求,这导致了原材料相对价格的下降,RD 曲线向右移动,制造品的相对需求上升和相对价格上升,日本的贸易条件得以改善。

国际经济学(中文版) 克鲁格曼 第八版

4. Today, most trade is in manufactured goods, while historically agricultural and mineral products made up most of trade.

➢ 用产品W(酒)来表示的产品C(奶酪) 的相对价格指的是交换一单位奶酪所需 要的酒的数量。

➢ 用 的 资美表 ,元示用价PwCC格奶表。酪示用的奶w美酪W元产表价业示格的酒,美产用元业P工的W资表美示元酒工

精选2021版课件

28

单一要素经济

单一要素经济是完全竞争的,因此没有利润存 在。奶酪部门的小时工资率等于工人每小时的 产值,即PC/aLC。而酒部门工人的小时工资率 则等于PW/aLW

比较优势建立在机会成本的比较之上。如果 一个国家生产某种产品的机会成本较低,则在 这种产品上具有比较优势

精选2021版课件

22

比较优势的概念

■如果每一个国家按照比较优势(较低的机会成 本)进行专业化(specialization)生产,然后 进行贸易,则这种贸易对双方都有好处。

■比较优势是如何决定的? 对这一问题的回答将帮助我们了解国家间的

精选2021版课件

19

第三章 劳动生产率和比较优势: 李嘉图模型

精选2021版课件

20

本章简介

■ 国家间进行国际贸易出于两个基本原因: 国家之间在气候、土地、资本、劳动以及技术

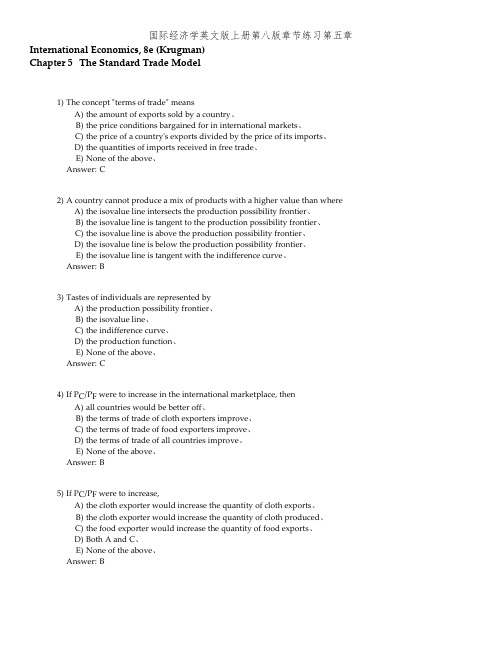

国际经济学英文版上册第八版章节练习第五章

International Economics, 8e (Krugman)Chapter 5 The Standard Trade Model1) The concept "terms of trade" meansA) the amount of exports sold by a country、B) the price conditions bargained for in international markets、C) the price of a country's exports divided by the price of its imports、D) the quantities of imports received in free trade、E) None of the above、Answer: C2) A country cannot produce a mix of products with a higher value than whereA) the isovalue line intersects the production possibility frontier、B) the isovalue line is tangent to the production possibility frontier、C) the isovalue line is above the production possibility frontier、D) the isovalue line is below the production possibility frontier、E) the isovalue line is tangent with the indifference curve、Answer: B3) Tastes of individuals are represented byA) the production possibility frontier、B) the isovalue line、C) the indifference curve、D) the production function、E) None of the above、Answer: C4) If P C/P F were to increase in the international marketplace, thenA) all countries would be better off、B) the terms of trade of cloth exporters improve、C) the terms of trade of food exporters improve、D) the terms of trade of all countries improve、E) None of the above、Answer: B5) If P C/P F were to increase,A) the cloth exporter would increase the quantity of cloth exports、B) the cloth exporter would increase the quantity of cloth produced、C) the food exporter would increase the quantity of food exports、D) Both A and C、E) None of the above、Answer: B6) If a small country were to levy a tariff on its imports then this wouldA) have no effect on that country's economic welfare、B) increase the country's economic welfare、C) decrease the country's economic welfare、D) change the terms of trade、E) None of the above、Answer: C7) Suppose now that Home experiences growth strongly biased toward its export, cloth,A) this will tend to worsen Home's terms of trade、B) this will tend to improve Home's terms of trade、C) this will tend to worsen Foreign's terms of trade、D) this will have no effect on Foreign's terms of trade、E) None of the above、Answer: A8) Suppose that Home is a "small country," and it experiences growth strongly biased toward its export, clothA) this will tend to worsen Home's terms of tradeB) this will tend to improve Home's terms of tradeC) this will tend to worsen Foreign's terms of tradeD) this will have no effect on Foreign's terms of tradeE) None of the aboveAnswer: D9) When the production possibility frontier shifts out relatively more in one direction, we haveA) biased growth、B) unbiased growth、C) immiserizing growth、D) balanced growth、E) imbalanced growth、Answer: D10) Export-biased growth in Country H willA) improve the terms of trade of Country H、B) trigger anti-bias regulations of the WTO、C) worsen the terms of trade of Country F (the trade partner)、D) improve the terms of trade of Country F、E) decrease economic welfare in Country H、Answer: D11) If the poor USAID recipient countries have a higher marginal propensity to consume each and every productthan does the United States, then such aid willA) worsen the U.S. terms of trade、B) improve the U.S. terms of trade、C) leave the world terms of trade unaffected、D) worsen the terms of trade of both donor and recipient countries、E) None of the above、Answer: B12) If, beginning from a free trade equilibrium, the (net barter) terms of trade improve for a country, then it willA) increase production of its import competing good、B) increase consumption of its export good、C) increase the quantity of its imports、D) experience an export-biased shift in its production possibility frontier、E) None of the above、Answer: C13) After WWI, Germany was forced to make large reparations-transfers of real income- to France、If themarginal propensity to consume was equal in both countries, and if France's demand was biased toward food (relative to Germany's demand pattern) then we would expect to findA) the world's relative price for food remains unchanged、B) the world's relative price for food increase、C) the world's relative price for food decrease、D) the world relative price for both food and non-food rise、E) None of the above、Answer: B14) During the 19th Century, economic growth of the major trading countries was biased toward manufacturesand away from food、The less developed countries of that time were net exporters of food、From this information, we would expect to have observedA) falling terms of trade for the less developed countries、B) improving (rising) terms of trade for the less developed countries、C) no change at all in the terms of trade of the less developed countries、D) a decrease in the relative price of food、E) None of the above、Answer: B15) Immiserizing growth could occur toA) a poor country experiencing export-biased economic growth、B) a poor country experiencing import-biased economic growth、C) a poor country experiencing growth in its non-traded sector、D) a poor country experiencing capital-intensive biased growth、E) None of the above、Answer: A16) A large country experiencing import-biased economic growth will tend to experienceA) positive terms of trade、B) deteriorating terms of trade、C) improving terms of trade、D) immiserizing terms of trade、E) None of the above、Answer: C17) If a there are no international loans or capital flows, then if a country's terms of trade improve, we wouldfind thatA) the value of its exports exceeds the value of its imports、B) the value of its exports becomes less than that of its imports、C) the value of its exports exactly equals that of its imports、D) the quantity of its exports equals that of its imports、E) None of the above、Answer: C18) If the U、S、Agency for International Development transfers funds to poor countries in Sub-Saharan Africa,the conventional assumption, following Keynes' analysis would presume that this would tend toA) worsen the U.S. terms of trade、B) improve the U.S. terms of trade、C) worsen the terms of trade of the African aid recipients、D) improve the terms of trade of the African aid recipients、E) None of the above、Answer: A19) If a country's growth is biased in favor of its import, this should unequivocally improve its terms of tradeand its economic welfare、Discuss、Answer: Suppose Japan experiences economic growth biased in favor of its import substitutes、For example, assume that Japan imports components and exports final goods, but that it experiences a major growthin its components manufacture sector、Since Japan is internationally a large country in these markets,this would tend to hurt its component supplier's terms of trade (and help Japan's)、However, such abias in economic growth may tend to lessen the volume of international trade、At an extreme, Japanmay become an exporter of components and an importer of final goods、If the result is a lessening ofspecialization and of the volume of trade, then this effect will lower Japan's welfare associated withgains from trade、If an actual change in the pattern of comparative advantage occurs (a possibility)this may cause dynamic dislocations whose harm overpowers static gains for a relatively long periodof time、20) At the conclusion of World War I, Germany, as a punishment, was obliged to make a large transfer to Francein the form of reparations、Is it possible that the actual reparations may have improved Germany'seconomic welfare?Answer: Such a result is not likely、However, theoretically, if France's income elasticity of demand for Germany's exports was higher than Germany's income elasticity of demand for its own exportable,then the real income transfer associated with these reparations may have improved Germany's termsof trade, and improved its balance of payments, thus helping Germany in manner unanticipated in theTreaty of Verssaille、Explain、21) If the U.S. (a large country) imposes a tariff on its imported good, this will tend toA) have no effect on terms of trade、B) improve the terms of trade of all countries、C) improve the terms of trade of the United States、D) cause a deterioration of U.S. terms of trade、E) raise the world price of the good imported by the United States、Answer: C22) If Slovenia is a small country in world trade terms, then if it imposes a large series of tariffs on many of itsimports, this wouldA) have no effect on its terms of trade、B) improve its terms of trade、C) deteriorate its terms of trade、D) decrease its marginal propensity to consume、E) None of the above、Answer: A23) If Slovenia were a large country in world trade, then if it instituted a large set of subsidies for its exports, thismustA) have no effect on its terms of trade、B) improve its terms of trade、C) deteriorate its terms of trade、D) decrease its marginal propensity to consume、E) None of the above、Answer: C24) If Slovenia were a large country in world trade, then if it instituted a large set of subsidies for its exports, thismustA) cause retaliation on the part of its trade partners、B) harm Slovenia's real income、C) improve Slovenia's real income、D) improve the real income of its trade partners、E) None of the above、Answer: D25) An export subsidy has the opposite effect on terms of trade to the effect of an import tariff、Domestically atariff will raise the price of the import good, deteriorating the domestic terms of trade、A productionsubsidy for the export product will lower the local price of the export good, lowering the domestic terms of trade for the country、Hence the export subsidy and the import tariff have the same effect、This analysis seems to contradict the first sentence in this paragraph、Discuss this paradox、Answer: While this (Lerner) equivalence may well occur domestically, internationally the tariff will improve a country's terms of trade、An export subsidy on the other hand will in fact lower the internationalprice of the (now readily available) export good, hence hurting a country's terms of trade、26) Suppose, as a result of various dynamic factors associated with exposure to international competition,Albania's economy grew, and is now represented by the rightmost production possibility frontier in the figure above、If its point of production with trade was point c, would you consider this growth to beexport-biased or import biased? If Albania were a large country with respect to the world trade of A and B, how would this growth affect Albania's terms of trade? Its real income?Answer: If point c is the production point with trade, then Albania has a comparative advantage in good B、Therefore, from the shape of the new production possibility frontier (as compared to the original one),this is clearly an export-biased growth、This ceteris paribus would tend to worsen Albania's terms oftrade、The terms of trade effect would, again ceteris paribus, worsen its real income、However, thegrowth itself acts in the opposite direction、27) Suppose, as a result of various dynamic factors associated with exposure to international competition,Albania's economy grew, and is now represented by the rightmost production possibility frontier in the figure above、If its point of production with trade was point b, would you consider this growth to beexport-biased or import biased? If Albania were a large country with respect to the world trade of A and B, how would this growth affect Albania's terms of trade? Its real income? What if Albania were a small country?Answer: If the production with trade point was point b, then the observed growth is a case of import-biased growth, and would improve Albania's terms of trade、If Albania were a small country, the world'sterms of trade would not change at all、In such a case, economic growth (with no induced change inincome distributions) would always increase its real income、。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第五章 标准贸易模型

1、

答:如图,贸易后,两国原先的无差异曲线都移动到了更高的无差异曲线上,两国人民都更幸福,社会福利增加。

2、

答:(a )如左图,假如过度捕鱼引起的鱼产量大幅度减少,则挪威的生产可能性边界发生变化,导致等价值线向下移动,相应的无差异曲线移动到了较低的水平上,导致福利下降。

(b )如右图,当过度捕鱼引起鱼的产量减少,在市场上鱼的供给减少,导致相对价格上升,上升到一定程度不仅可以弥补鱼的产量损失,甚至会带来福利的上升。

3、

答:如图,以粮食和棉布为例,当生产可能性边界是直角时,贸易条件改善增进了本国福利。

生产点位于直角顶点,消费点是等价值线和无差异曲线的切点。

贸易条件的改善使得等价值线的截距增加,即等价值线直角顶点向外偏转(由于没有流动要素,生产点固定)。

经济体达鱼 车 鱼

车

瑞典 F C

本国

鱼 车 鱼

车

挪威 挪威

挪威

到获得了更高的无差异曲线,从直观上来看,产出并没有发生变化,经济体获益主要是通过相对于进口产品购买力的增加来实现的。

4、

答:由于购买产品比例是固定的,所以无差异曲线是直角形状。

贸易条件的改善使该国达到了更高的无差异曲线。

无差异曲线沿着从原点出发的射线移动,其顶点始终在该射线上,射线的斜率为两种产品的比例,贸易条件的改善使无差异曲线远离原点。

5、答:日本贸易条件是制造品价格比去原材料价格的相对价格,贸易条件的变动由相对供给和相对需求的变动决定。

(a )中东石油供应的紧缺使得原材料的供给减少,这导致了制造品的相对供给增加,RS 曲线向右移动,制造品的相对价格下降,日本的贸易条件恶化。

(b )韩国扩展了汽车生产能力增加了世界汽车的总供给,使得世界汽车的相对供给增加了,RS 曲线向右移动,世界市场上汽车的相对价格下降了,日本的贸易条件恶化了。

(c )美国工程师以核反应堆代替石油燃料发电厂,减少了对石油,即原材料的需求,这导致了原材料相对价格的下降,RD 曲线向右移动,制造品的相对需求上升和相对价格上升,日本的贸易条件得以改善。

由于原材料的需求下降了,即使核反应堆没有建在日本,这种情况仍会发生。

(d )俄罗斯农业歉收减少了世界原材料的总供给,使得世界制造品的相对供给增加,RS 曲线向外移动;与此同时,俄罗斯对制造品的需求减少了,使得世界相对需求减少了,RD 曲线向内移动。

日本的贸易条件恶化了。

(e )降低关税是国内制造品相对价格上升了,增加了国内制造品的相对供给,减少了相对需求;与此同时,增加了世界制造品的相对供给并减少了世界相对需求。

世界RS 曲线向外移动,RD 曲线向内移动,制造品的世界相对价格下降了,日本的贸易条恶化了。

6、

s M USA

F C

答:如图,可出口性服务的相对价格下降导致等价值线顺时针旋转,导致美国将生产更少的服务和更多的制造品,所以无差异曲线移动到了较低的程度上,降低了福利。

7、答:当一种生产要素增加时,会发生偏向型增长。

资本存量的增加使X产品的产出相对增加,而劳动力的增加使Y产品的产出相对增加。

在赫克歇尔—俄林模型中,各国倾向于出口密集使用本国相对充裕要素的产品。

出口偏向型增长所带来的贸易条件恶化是否会成为福利恶化型增长,没有明确的结论。

进口偏向型增长带来的贸易条件的改善的确实会使得异国福利增加。

(a)A国的贸易条恶化,福利仍会改善,但在极端条件下可能恶化;B国的贸易条件及福利都改善了。

(b)A国的贸易条件及福利都改善了;B国的贸易条件和福利都恶化了。

(c)B国的贸易条件及福利都改善了;A国的贸易条件及福利都恶化了。

(d)B国的贸易条恶化,福利仍会改善,但在极端条件下可能恶化;A国的贸易条件及福利都改善了

8、答:福利恶化型增长的条件非常极端:RS和RD曲线必须非常陡峭,经济增长对出口产品的偏向非常强,该经济体在世界经济中的比重必须大到足以令其出口偏向型增长使其贸易条件大幅度恶化,以至于贸易条件的恶化足以抵消生产能力的提高所带来正面效应。

因此这种增长在现实中是不太可能存在的。

9.答:印度的开放有利于美国,如果它降低了中国出口到美国商品的相对价格,因此就提高了美国出口商品的相对价格。

虽然美国本土被与中国的贸易损害的部门会同样被与印度的贸易损害,但总体上来说,美国是获利的。

印度与中国出口的商品具有一定相似性,其加入与美贸易,会使得对美出口商品的总供给量增加,从而压低中国对美出口的商品的相对价格,导致中国福利损失。

10、答:这种援助条件对于收入转移问题的分析没有太大影响,从援助国角度来看该条件有一定现实意义。

必须购买援助国出口品的援助增加了援助国出口品的相对需求,使其相对价格上升,在该种情况下,受援国的贸易条件恶化了。

受援国福利条件恶化是转移支付的一种极端的情况,和福利恶化型增长一样,转移支付恶化受援国福利只是一种理论上的可能。

11、答:假设有两个国家,A国和B国,如果A国对出口产品进行补贴,那么其出口的相对供给就会上升,而相对需求就会下降,贸易条件就会恶化,B国针锋相对的关税加剧了A贸易条件的恶化。

A国遭受了贸易条件恶化及国内市场价格扭曲的双重损失;B国既享受了A 国的贸易补贴,又获得了关税收益,使其贸易条件得到了双重改善。

如果B国也进行出口补贴,那么这将会抵消A国贸易补贴给B国带来的贸易条件的改善,从而在一定程度上改善了A国原本恶化的贸易条件,恶化了B国原本改善的贸易条件。