第五讲 习题一会计循环I 答案

会计循环试题及答案

会计循环试题及答案1. 选择题:(每题4分,共40分)1) 以下哪个不是会计循环的组成部分?A. 凭证记录B. 分类帐C. 试算平衡D. 利润表答案:D2) 会计循环的基本目的是什么?A. 监控经营业务B. 分析财务状况C. 对资金流动进行控制D. 实现税务要求答案:A3) 会计循环试算平衡指的是:A. 资产 = 负债 + 所有者权益B. 资产 - 负债 = 所有者权益C. 资产 + 负债 = 所有者权益D. 资产 - 所有者权益 = 负债答案:C4) 以下哪个不属于会计循环的步骤?A. 凭证记录B. 期末调整C. 资产负债表编制D. 利润表编制答案:B5) 会计循环中,凭证记录的目的是:A. 记录所有经济业务B. 查询和核对会计账目C. 汇总会计数据D. 提供给外部审计答案:A6) 以下哪个是会计循环的最后一步?A. 资产负债表编制B. 利润表编制C. 总账调整D. 凭证记录答案:B7) 会计循环的核心内容是:A. 分类帐B. 试算平衡C. 资产负债表D. 总账调整答案:A8) 会计循环的周期一般为:A. 日B. 月C. 季度D. 年答案:B9) 以下哪个是会计循环中的调整步骤?A. 凭证记录B. 资产负债表编制C. 总账调整D. 分类帐答案:C10) 会计循环试算平衡的目的是:A. 检查账目是否准确B. 获得收入和支出的明细C. 计算利润和损失D. 监控所有者权益答案:A2. 解答题:(每题10分,共30分)1) 简述会计循环的基本步骤。

答案:会计循环的基本步骤包括凭证记录、分类帐和试算平衡。

首先,通过凭证记录将经济业务明细记录下来,包括借方和贷方金额。

然后,将凭证记录的数据按照科目分类,形成分类帐,以便更好地掌握财务状况。

最后,通过试算平衡,检查资产、负债和所有者权益是否平衡,确保账目的准确性和一致性。

2) 请说明会计循环的重要性。

答案:会计循环是企业财务管理的基础,具有以下重要性:首先,会计循环可以监控经营业务,了解企业的经济状况和财务状况,为经营决策提供依据。

会计循环相关练习题

第五讲会计循环II:以制造业为例练习题1、名词解释(l)流动资产(2)固定资产(3)预付货款(4)固定资产折旧(5)长期负债(6)应收票据(7)应付账款(8)、预收账款(9)应付工资(10)长期借款(11)所有者权益(12)资本公积(13)实收资本(14)盈余公积(15)未分配利润(16)生产费用(17)生产成本(18)期间费用(19)管理费用(20)财务费用(21)制造费用(22)制造成本(23)收入(24)权责发生制(25)收付实现制(26)帐项调整(27)递延项目(28)待摊费用(29)应计项目(30)应计费用(31)产品销售成本(32)利润(33)营业利润(34)投资净收益(35)营业税金(36)营业外收入(37)营业外支出2、简答题(1)如何以权责发生制为时间基础来确定费用的归属期间?(2)工业企业生产经营过程的组成部分以及各个过程中资产的存在形态是什么?(3)企业的生产费用是什么?(4)在归集各材料的费用时,如何区分直接计入费用与间接计入费用?(5)原材料账户是什么性质的账户?它的借方发生额和余额分别表示什么?(6)“材料采购”账户是什么性质的账户?它的借方发生额和余额分别表示什么?(7)何为期间费用?期间费用包括哪些内容?(8)什么是直接费用?直接费用中的各个组成部分分别代表什么内容?(9)如何区分本期生产费用和非本期生产费用?(10)为归集生产费用,计算产品成本,企业应设置哪些账户?如何在这些账户反映生产费用的归集和产品成本的核算?(11)本期生产费用的归集包括什么过程?(12)如何确认期间费用?(13)从理论上讲,确认收入实现的原则包括哪些内容?(14)营业收入的实现随具体情况不同可采用哪些不同的标准确认?如何按这些标准确认?(15)如何按收现标志确认与计量营业收入?这种方法在什么情况下适用?(16)收入与费用的实际收支期与其应归属期的关系有哪几种情况?(17)按照权责发生制应如何确认和计量本期的收入和费用?(18)权责发生制与收付实现制有什么质的区别?(19)什么是账项调整?账项调整包括哪些内容?(20)简述费用成本的结转的步骤。

中级经济师经济基础知识第五部分 会计第二十九章 会计循环

中级经济师经济基础知识第五部分会计第二十九章会计循环分类:财会经济中级经济师主题:2022年中级经济师(人力资源管理+经济基础知识)考试题库科目:经济基础知识类型:章节练习一、单选题1、企业重新取得与其所拥有的某项资产相同或与其功能相当的资产需要支付的现金或现金等价物的金额,会计上称为()。

A.重置成本B.历史成本C.可变现净值D.公允价值【参考答案】:A【试题解析】:本题考查重置成本的概念。

重置成本,是指企业重新取得与其所拥有的某项资产相同或与其功能相当的资产需要支付的现金或现金等价物。

2、记账凭证账务处理程序的适用范围是()。

A.规模较小.经济业务量较少的单位B.采用单式记账的单位C.规模较大.经济业务量较多的单位D.会计基础工作薄弱的单位【参考答案】:A【试题解析】:本题考查账务处理程序。

记账凭证财务处理程序适用于规模较小.经济业务量较少的单位。

3、企业重新取得与其所拥有的某项资产相同或与其功能相当的资产需要支付的现金或现金等价物,称为()。

A.历史成本B.重置成本C.公允价值D.现值【参考答案】:B【试题解析】:本题考查重置成本的概念。

重置成本是指企业重新取得与其所拥有的某项资产相同或与其功能相当的资产需要支付的现金或现金等价物。

4、按提供信息的详细程度及其统驭关系分类,账户可以分为()。

A.总分类账户和明细分类账户B.一级账户和二级账户C.资产类账户和权益类账户D.基本账户和辅助账户【参考答案】:A【试题解析】:本题考查会计记录。

按提供信息的详细程度及其统驭关系分类,账户可以分为总分类账户和明细分类账户。

5、()是会计的核心问题,贯穿于会计从确认、记录到报告的全过程。

A.循环问题B.计量问题C.确认问题D.记录问题【参考答案】:B【试题解析】:本题考查会计计量。

计量问题是会计的核心问题,贯穿于会计从确认、记录到报告的全过程。

6、按照确认.计量.记录和报告为主要环节的会计基本程序及相应方法称为()。

会计学原理(会计凭证与账簿及会计循环)习题与答案

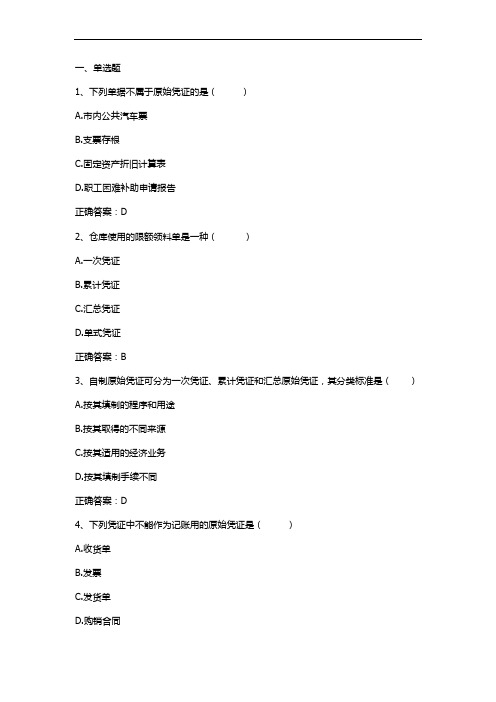

1、下列单据不属于原始凭证的是()A.市内公共汽车票B.支票存根C.固定资产折旧计算表D.职工困难补助申请报告正确答案:D2、仓库使用的限额领料单是一种()A.一次凭证B.累计凭证C.汇总凭证D.单式凭证正确答案:B3、自制原始凭证可分为一次凭证、累计凭证和汇总原始凭证,其分类标准是()A.按其填制的程序和用途B.按其取得的不同来源C.按其适用的经济业务D.按其填制手续不同正确答案:D4、下列凭证中不能作为记账用的原始凭证是()A.收货单B.发票C.发货单D.购销合同5、用转账支票支付前欠货款,应填制()A.转账凭证B.收款凭证C.付款凭证D.原始凭证正确答案:C6、某企业销售产品一批,部分货款收存银行,部分货款对方暂欠,该企业应编制()A.收款凭证和付款凭证B.收款凭证和转账凭证C.付款凭证和转账凭证D.两张转账凭证正确答案:B7、填制会计凭证是()的前提和依据。

A.成本计算B.编制会计报表C.登记账簿D.设置账户正确答案:C8、计提本期借款利息时应编制()A.收款凭证B.付款凭证C.转账凭证D.汇总凭证正确答案:C9、下列业务应编制转账凭证的是()A.预付购货款B.预收销货款C.领用生产产品用的材料D.支付材料采购运费正确答案:C10、会计凭证的传递是指( ),在本单位各有关部门和人员之间的传递程序和传递时间。

A.从取得原始凭证到编制成记账凭证时止B.从取得原始凭证到登记账簿时止C.从填制记账凭证到编制会计报表时止D.会计凭证从取得或填制时起到归档保管时止正确答案:D11、会计分录在会计实务中是填写在( )上的。

A.原始凭证B.记账凭证C.总分类账D.明细分类账正确答案:B12、委托加工材料登记簿属于()A.序时账簿B.总分类账簿C.明细分类账簿D.备查账簿正确答案:D13、库存现金日记账和银行存款日记账应采用()A.订本式B.活页式C.三栏式D.卡片式正确答案:A14、从银行提取库存现金时,登记库存现金日记账的根据是()A.银行存款的付款凭证B.银行存款的收款凭证C.库存现金的付款凭证D.库存现金的收款凭证正确答案:A15、多栏式银行存款日记账属于()A.总分类账B.明细分类账C.序时账D.备查账正确答案:C16、库存商品明细分类账的格式一般采用()A.三栏式B.数量金额式C.多栏式D.横线登记式正确答案:B17、对于经营租入的固定资产,应在()中登记A.分类账B.备查账C.日记账D.日记总账正确答案:B18、会计人员在结账前发现,在根据记账凭证登记入账时,误将600元记成6 000元,而记账凭证无误,应采用()A.补充登记法B.划线更正法C.红字更正法D.蓝字登记法正确答案:B19、发现一记账凭证上的会计科目未错,但所记金额小于实际数,并据以登记入账,对此应采用()A.红字更正法B.划线更正法C.补充登记法D.挖补法正确答案:C20、汇总付款凭证是根据( )汇总编制而成的A.原始凭证B.汇总原始凭证C.付款凭证D.收款凭证正确答案:C21、科目汇总表账务处理程序()A.能清楚反映账户对应关系B.登记总账的工作量小C.登记总账的工作量大D.便于分析经济业务的来龙去脉正确答案:B22、根据记账凭证逐笔登记总账的账务处理程序是( )A.记账凭证账务处理程序B.汇总记账凭证账务处理程序C.科目汇总表账务处理程序D.多栏式日记账账务处理程序正确答案:A二、多选题1、下列单据中,可作为会计核算原始凭证的有()A.购销发票B.出差车票C.购销合同D.现金支票存根正确答案:A、B、D2、以下所列属于汇总原始凭证的有( )A.科目汇总表B.限额领料单C.工资结算汇总表D.收料凭证汇总表正确答案:C、D3、限额领料单同时属于( )A.原始凭证B.记账凭证C.累计凭证D.一次凭证正确答案:A、C4、付款凭证左上角的“贷方科目”可能登记的科目有()A.应付账款B.银行存款C.预付账款D.库存现金正确答案:B、D5、下列凭证中属于记账凭证的是()A.借款单B.支票C.转账凭证D.银行存款收款凭证正确答案:C、D6、收款凭证的贷方科目可能为下列()科目B.银行存款C.在途物资D.主营业务收入正确答案:A、D7、任何会计主体都必须设置的账簿有( )A.日记账B.辅助账簿C.总分类账簿D.备查账簿正确答案:A、C8、库存现金日记账的登记依据是()A.库存现金收款凭证B.库存现金付款凭证C.银行存款收款凭证D.银行存款付款凭证正确答案:A、B、D9、下列会计凭证中的()可以作为登记银行存款日记账的依据A.自制原始凭证B.外来原始凭证C.收款凭证D.付款凭证正确答案:C、D10、下列账户中,可以只按借方发生额来设置多栏式明细账页的有()B.生产成本C.管理费用D.本年利润正确答案:A、B、C11、登记明细账的根据可以是()A.原始凭证B.原始凭证汇总表C.记账凭证D.记账凭证汇总表正确答案:A、B、C12、数量金额式明细分类账的账页格式适用于( )A.库存商品B.制造费用C.管理费用D.原材料正确答案:A、D13、对()会计事项,企业月终应进行账项调整。

会计学(会计循环)习题与答案

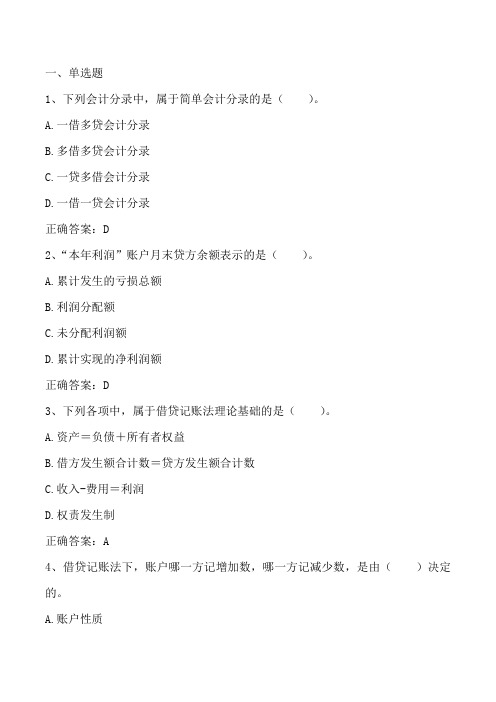

一、单选题1、下列会计分录中,属于简单会计分录的是()。

A.一借多贷会计分录B.多借多贷会计分录C.一贷多借会计分录D.一借一贷会计分录正确答案:D2、“本年利润”账户月末贷方余额表示的是()。

A.累计发生的亏损总额B.利润分配额C.未分配利润额D.累计实现的净利润额正确答案:D3、下列各项中,属于借贷记账法理论基础的是()。

A.资产=负债+所有者权益B.借方发生额合计数=贷方发生额合计数C.收入-费用=利润D.权责发生制正确答案:A4、借贷记账法下,账户哪一方记增加数,哪一方记减少数,是由()决定的。

A.账户性质B.账户格式C.记账方法D.账户结构正确答案:A5、下列账户中,通常期末没有余额的账户是()。

A.资产账户B.损益账户C.负债账户D.所有者权益账户正确答案:B6、()是标明某项经济业务中应借应贷账户及金额的记录。

A.原始凭证B.会计分录C.会计凭证D.会计账簿正确答案:B7、下列账户期末余额一般在贷方的是()账户。

A.待处理财产损溢B.应收账款C.制造费用D.累计折旧正确答案:D8、“短期借款”账户期初余额60 000元,本期借方发生额40 000元,本期贷方发生额30 000元,该账户的期末余额()元。

A.10 000B.130 000C.70 000D.50 000正确答案:D9、借贷记账法下的发生额平衡法的依据是()。

A.平行登记要点B.账户的结构C.“资产=权益”的会计等式D.“有借必有贷.有贷必相等”的规则正确答案:D10、原始凭证金额有错误的,应当()。

A.在原始凭证上更正B.由经办人更正C.由出具单位更正并且加盖公章D.由出具单位重开,不得在原始凭证上更正正确答案:D11、记账凭证的填制应该由()完成。

A.会计人员B.经办人员C.主管人员D.出纳人员正确答案:A12、会计机构和会计人员对不真实、不合法的原始凭证和违法收支,应当()。

A.予以退回B.予以纠正C.不予接受D.不予接受,并向单位负责人汇报正确答案:D13、一般情况下登记账簿的直接依据是()。

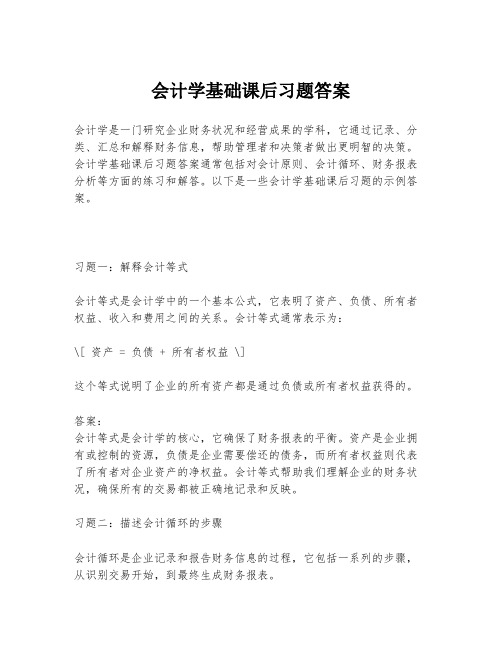

会计学基础课后习题答案

会计学基础课后习题答案会计学是一门研究企业财务状况和经营成果的学科,它通过记录、分类、汇总和解释财务信息,帮助管理者和决策者做出更明智的决策。

会计学基础课后习题答案通常包括对会计原则、会计循环、财务报表分析等方面的练习和解答。

以下是一些会计学基础课后习题的示例答案。

习题一:解释会计等式会计等式是会计学中的一个基本公式,它表明了资产、负债、所有者权益、收入和费用之间的关系。

会计等式通常表示为:\[ 资产 = 负债 + 所有者权益 \]这个等式说明了企业的所有资产都是通过负债或所有者权益获得的。

答案:会计等式是会计学的核心,它确保了财务报表的平衡。

资产是企业拥有或控制的资源,负债是企业需要偿还的债务,而所有者权益则代表了所有者对企业资产的净权益。

会计等式帮助我们理解企业的财务状况,确保所有的交易都被正确地记录和反映。

习题二:描述会计循环的步骤会计循环是企业记录和报告财务信息的过程,它包括一系列的步骤,从识别交易开始,到最终生成财务报表。

答案:会计循环通常包括以下步骤:1. 识别交易:确定影响企业财务状况的事件。

2. 记录初始条目:在日记账中记录交易的详细信息。

3. 过账:将日记账中的条目转移到分类账中。

4. 调整条目:在会计期末,对未记录的交易和调整进行处理。

5. 编制试算表:检查分类账的准确性。

6. 准备调整后的试算表:根据调整条目更新试算表。

7. 编制财务报表:根据调整后的试算表,准备资产负债表、利润表和现金流量表。

8. 结账:将本年度的余额转移到下一年的账簿中。

习题三:解释权责发生制和现金收付制会计核算有两种基础:权责发生制和现金收付制。

这两种方法决定了何时确认收入和费用。

答案:- 权责发生制:在权责发生制下,收入和费用在发生时即被确认,而不是在收到或支付现金时。

这种方法更注重经济活动的发生时间,而不是现金的实际流动。

- 现金收付制:现金收付制则在现金实际收到或支付时确认收入和费用。

这种方法更直观,但可能不反映企业的真实经营状况。

(word完整版)会计循环1习题精选含答案,推荐文档

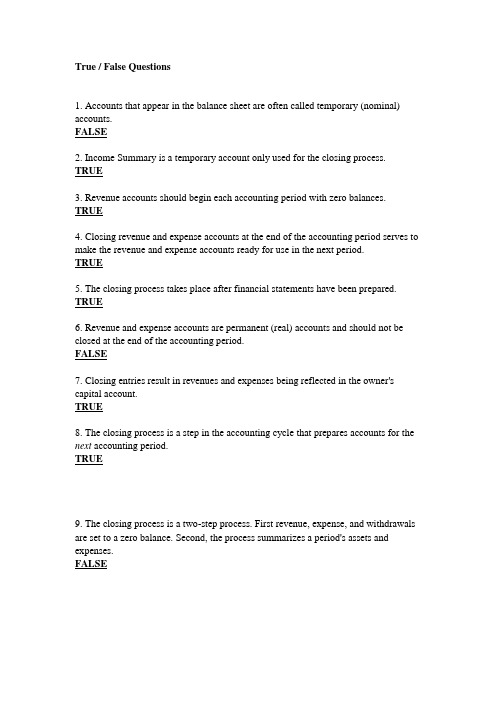

True / False Questions1. Accounts that appear in the balance sheet are often called temporary (nominal) accounts.FALSE2. Income Summary is a temporary account only used for the closing process. TRUE3. Revenue accounts should begin each accounting period with zero balances. TRUE4. Closing revenue and expense accounts at the end of the accounting period serves to make the revenue and expense accounts ready for use in the next period.TRUE5. The closing process takes place after financial statements have been prepared. TRUE6. Revenue and expense accounts are permanent (real) accounts and should not be closed at the end of the accounting period.FALSE7. Closing entries result in revenues and expenses being reflected in the owner's capital account.TRUE8. The closing process is a step in the accounting cycle that prepares accounts for the next accounting period.TRUE9. The closing process is a two-step process. First revenue, expense, and withdrawals are set to a zero balance. Second, the process summarizes a period's assets and expenses.FALSE10. Closing entries are required at the end of each accounting period to close all ledger accounts.FALSE11. Closing entries are designed to transfer the end-of-period balances in the revenue accounts, the expense accounts, and the withdrawals account to owner's capital. TRUE12. The Income Summary account is a permanent account that will be carried forward period after period.FALSE13. Closing entries are necessary so that owner's capital will begin each period with a zero balance.FALSE14. Permanent accounts carry their balances into the next accounting period. Moreover, asset, liability and revenue accounts are not closed as long as a company continues in business.FALSE15. The first step in the accounting cycle is to analyze transactions and events to prepare for journalizing.TRUE16. The accounting cycle refers to the sequence of steps in preparing the work sheet. FALSE17. The first five steps in the accounting cycle include analyzing transactions, journalizing, posting, preparing an unadjusted trial balance, and recording adjusting entries.TRUE18. The last four steps in the accounting cycle include preparing the adjusted trial balance, preparing financial statements and recording closing and adjusting entries. FALSE19. A classified balance sheet organizes assets and liabilities into important subgroups that provide more information to decision makers.TRUE20. An unclassified balance sheet provides more information to users than a classified balance sheet.FALSE21. Current assets and current liabilities are expected to be used up or come due within one year or the company's operating cycle whichever is longer.TRUE22. Intangible assets are long-term resources that benefit business operations that usually lack physical form and have uncertain benefits.TRUE23. Assets are often classified into current assets, long-term investments, plant assets, and intangible assets.TRUE24. Current liabilities are cash and other resources that are expected to be sold, collected or used within one year or the company's operating cycle whichever is longer.FALSE25. Long-term investments can include land held for future expansion.TRUE26. Plant assets and intangible assets are usually long-term assets used to produce or sell products and services.TRUE27. Current liabilities include accounts receivable, unearned revenues, and salaries payable.FALSE28. Cash and office supplies are both classified as current assets.TRUE29. Plant assets are also called fixed assets or property, plant, and equipment. TRUE30. The current ratio is used to help assess a company's ability to pay its debts in the near future.TRUEMultiple Choice Questions64. Another name for temporary accounts is:A. Real accounts.B. Contra accounts.C. Accrued accounts.D. Balance column accounts.E. Nominal accounts.65. When closing entries are made:A. All ledger accounts are closed to start the new accounting period.B. All temporary accounts are closed but not the permanent accounts.C. All real accounts are closed but not the nominal accounts.D. All permanent accounts are closed but not the nominal accounts.E. All balance sheet accounts are closed.66. Revenues, expenses, and withdrawals accounts, which are closed at the end of each accounting period are:A. Real accounts.B. Temporary accounts.C. Closing accounts.D. Permanent accounts.E. Balance sheet accounts.67. Which of the following statements is incorrect?A. Permanent accounts is another name for nominal accounts.B. Temporary accounts carry a zero balance at the beginning of each accounting period.C. The Income Summary account is a temporary account.D. Real accounts remain open as long as the asset, liability, or equity items recorded in the accounts continue in existence.E. The closing process applies only to temporary accounts.68. Assets, liabilities, and equity accounts are not closed; these accounts are called:A. Nominal accounts.B. Temporary accounts.C. Permanent accounts.D. Contra accounts.E. Accrued accounts.69. Closing the temporary accounts at the end of each accounting period:A. Serves to transfer the effects of these accounts to the owner's capital account on the balance sheet.B. Prepares the withdrawals account for use in the next period.C. Gives the revenue and expense accounts zero balances.D. Causes owner's capital to reflect increases from revenues and decreases from expenses and withdrawals.E. All of these.70. Journal entries recorded at the end of each accounting period to prepare the revenue, expense, and withdrawals accounts for the upcoming period and to update the owner's capital account for the events of the period just finished are referred to as:A. Adjusting entries.B. Closing entries.C. Final entries.D. Work sheet entries.E. Updating entries.71. The closing process is necessary in order to:A. calculate net income or net loss for an accounting period.B. ensure that all permanent accounts are closed to zero at the end of each accounting period.C. ensure that the company complies with state laws.D. ensure that net income or net loss and owner withdrawals for the period are closed into the owner's capital account.E. ensure that management is aware of how well the company is operating.72. Closing entries are required:A. if management has decided to cease operating the business.B. only if the company adheres to the accrual method of accounting.C. if a company's bookkeeper forgets to prepare reversing entries.D. if the temporary accounts are to reflect correct amounts for each accounting period.E. in order to satisfy the Internal Revenue Service.73. The recurring steps performed each reporting period, starting with analyzing and recording transactions in the journal and continuing through the post-closing trial balance, is referred to as the:A. Accounting period.B. Operating cycle.C. Accounting cycle.D. Closing cycle.E. Natural business year.74. Which of the following is the usual final step in the accounting cycle?A. Journalizing transactions.B. Preparing an adjusted trial balance.C. Preparing a post-closing trial balance.D. Preparing the financial statements.E. Preparing a work sheet.75. A classified balance sheet:A. Measures a company's ability to pay its bills on time.B. Organizes assets and liabilities into important subgroups.C. Presents revenues, expenses, and net income.D. Reports operating, investing, and financing activities.E. Reports the effect of profit and withdrawals on owner's capital.76. The assets section of a classified balance sheet usually includes:A. Current assets, long-term investments, plant assets, and intangible assets.B. Current assets, long-term assets, revenues, and intangible assets.C. Current assets, long-term investments, plant assets, and equity.D. Current liabilities, long-term investments, plant assets, and intangible assets.E. Current assets, liabilities, plant assets, and intangible assets.77. The usual order for the asset section of a classified balance sheet is:A. Current assets, prepaid expenses, long-term investments, intangible assets.B. Long-term investments, current assets, plant assets, intangible assets.C. Current assets, long-term investments, plant assets, intangible assets.D. Intangible assets, current assets, long-term investments, plant assets.E. Plant assets, intangible assets, long-term investments, current assets.78. A classified balance sheet differs from an unclassified balance sheet in thatA. a unclassified balance sheet is never used by large companies.B. a classified balance sheet normally includes only three subgroups.C. a classified balance sheet presents information in a manner that makes it easier to calculate a company's current ratio.D. a classified balance sheet will include more accounts than an unclassified balance sheet for the same company on the same date.E. a classified balance sheet cannot be provided to outside parties.79. Two common subgroups for liabilities on a classified balance sheet are:A. current liabilities and intangible liabilities.B. present liabilities and operating liabilities.C. general liabilities and specific liabilities.D. intangible liabilities and long-term liabilities.E. current liabilities and long-term liabilities.80. The current ratio:A. Is used to measure a company's profitability.B. Is used to measure the relation between assets and long-term debt.C. Measures the effect of operating income on profit.D. Is used to help evaluate a company's ability to pay its debts in the near future.E. Is calculated by dividing current assets by equity.81. The current ratio:A. Is calculated by dividing current assets by current liabilities.B. Helps to assess a company's ability to pay its debts in the near future.C. Can reveal problems in a company if it is less than 1.D. Can affect a creditor's decision about whether to lend money to a company.E. All of these.AACSB: CommunicationsAICPA BB: IndustryAICPA FN: Risk AnalysisDifficulty: HardLearning Objective: A182. The Unadjusted Trial Balance columns of a company's work sheet show the balance in the Office Supplies account as $750. The Adjustments columns show that $425 of these supplies were used during the period. The amount shown as Office Supplies in the Balance Sheet columns of the work sheet is:A. $325 debit.B. $325 credit.C. $425 debit.D. $750 debit.E. $750 credit.83. A 10-column spreadsheet used to draft a company's unadjusted trial balance, adjusting entries, adjusted trial balance, and financial statements, and which is an optional tool in the accounting process is a(n) :A. Adjusted trial balance.B. Work sheet.C. Post-closing trial balance.D. Unadjusted trial balance.E. General ledger.84. Accumulated Depreciation, Accounts Receivable, and Service Fees Earned would be sorted to which respective columns in completing a work sheet?A. Balance Sheet or Statement of Owner's Equity-Credit; Balance Sheet or Statement of Owner's Equity Debit; and Income Statement-Credit.B. Balance Sheet or Statement of Owner's Equity-Debit; Balance Sheet or Statement of Owner's Equity-Credit; and Income Statement-Credit.C. Income Statement-Debit; Balance Sheet or Statement of Owner's Equity-Debit; and Income Statement-Credit.D. Income Statement-Debit; Income Statement-Debit; and Balance Sheet or Statement of Owner's Equity-Credit.E. Balance Sheet or Statement of Owner's Equity-Credit; Income Statement-Debit; and Income Statement-Credit.85. Which of the following statements is incorrect?A. Working papers are useful aids in the accounting process.B. On the work sheet, the effects of the accounting adjustments are shown on the account balances.C. After the work sheet is completed, it can be used to help prepare the financial statements.D. On the work sheet, the adjusted amounts are sorted into columns according to whether the accounts are used in preparing the unadjusted trial balance or the adjusted trial balance.E. A worksheet is not a substitute for financial statements86. A company shows a $600 balance in Prepaid Insurance in the Unadjusted Trial Balance columns of the work sheet. The Adjustments columns show expired insurance of $200. This adjusting entry results in:A. $200 decrease in net income.B. $200 increase in net income.C. $200 difference between the debit and credit columns of the Unadjusted Trial Balance.D. $200 of prepaid insurance.E. An error in the financial statements.87. Statements that show the effects of proposed transactions as if the transactions had already occurred are called:A. Pro forma statements.B. Professional statements.C. Simplified statements.D. Temporary statements.E. Interim statements.88. If in preparing a work sheet an adjusted trial balance amount is mistakenly sorted to the wrong work sheet column. The Balance Sheet columns will balance on completing the work sheet but with the wrong net income, if the amount sorted in error is:A. An expense amount placed in the Balance Sheet Credit column.B. A revenue amount placed in the Balance Sheet Debit column.C. A liability amount placed in the Income Statement Credit column.D. An asset amount placed in the Balance Sheet Credit column.E. A liability amount placed in the Balance Sheet Debit column.89. If the Balance Sheet and Statement of Owner's Equity columns of a work sheet fail to balance when the amount of the net income is added to the Balance Sheet and Statement of Owner's Equity Credit column, the cause could be:A. An expense amount entered in the Balance Sheet and Statement of Owner's Equity Debit column.B. A revenue amount entered in the Balance Sheet and Statement of Owner's Equity Credit column.C. An asset amount entered in the Income Statement and Statement of Owner's Equity Debit column.D. A liability amount entered in the Income Statement and Statement of Owner's Equity Credit column.E. An expense amount entered in the Balance Sheet and Statement of Owner's Equity Credit column.Problems129. In the table below, indicate with an "X" in the proper column whether the account is a (nominal) temporary account or a (real) permanent account.132. Based on the adjusted trial balance shown below, prepare a classified balance sheet for Focus Package Delivery.* $2,000 of the long-term note payable is due during the next year.135. Use the following partial work sheet from Matthews Lanes to prepare its income statement, statement of owner's equity and a balance sheet (Assume the owner did not make any investments in the business this year.)137. A partially completed work sheet is shown below. The unadjusted trial balance columns are complete. Complete the adjustments, adjusted trial balance, income statement, and balance sheet and statement of owner's equity columns.140. The adjusted trial balance of Sara's Web Services follows:(a) Prepare the closing entries for Sara's Web Services.(b) What is the balance of Sara's capital account after the closing entries are posted?Problems159. The unadjusted trial balance of Quick Delivery is entered on the partial work sheet below. Complete the work sheet using the following information:(a) Salaries earned by employees that are unpaid and unrecorded, $5,000.(b) An inventory of supplies showed $1,000 of unused supplies still on hand.(c) Depreciation on delivery vans, $24,000.(d) Services paid in advance by customers of $10,000 have now been provided tocustomers.。

会计循环习题答案--人大版

第二章会计循环习题答案《会计学》人大版11月11日借:银行存款 500 000贷:实收资本 500 00011月12日借:现金 10 000贷:银行存款 10 00011月14日借:预付帐款 30 000贷:银行存款 30 00011月16日借:固定资产 100 000贷:银行存款 80 000应付账款 20 00011月17日借:管理费用 800贷:现金 80011月20日借:库存商品 300 000贷:银行存款 200 000应付账款 100 00011月25日借:其他应收款 2 500贷:现金 2 50011月28日借:银行存款 150 000贷:主营业务收入 150 000借:主营业务成本 120 000贷:库存商品 120 00011月29日借:管理费用 2 200现金 300贷:其他应收款 2 50011月30日借:应付账款 20 000贷:银行存款 20 00011月30日借:管理费用 2 500贷:应付职工薪酬 2 50011月30日借:管理费用 5 000贷:预付帐款 5 0001(2)将分录登记至总分类账T型账户,为各账户结出余额。

其他应收款库存商品1(3)编制试算平衡表方华公司试算平衡表11月30日1(4) 编制11月份方华公司的利润表和11月31日的资产负债表。

方华公司利润表11月营业收入150 000减:营业成本120 000毛利30 000减: 管理费用 10 500利润19 500方华公司资产负债表11月30日资产负债货币资金317 000应付账款100,000其他应收款0应付职工薪酬 2 500预付帐款25,000负债合计102 500库存商品180,000所有者权益固定资产100,000实收资本500 000利润分配19 500所有者权益合计519 500资产合计622 000负债和所有者权益合计622 0002(1) 为方华公司12月份发生的业务编制会计分录12月1日借:银行存款 200 000贷:短期借款 200 00012月5日借:固定资产 40 000贷:银行存款 40 00012月6日借:库存商品 150 000贷:应付账款 150 00012月14日借:现金 8 000贷:银行存款 8 00012月15日借:应付职工薪酬 5000贷:现金 5 00012月16日借:银行存款 180000贷:主营业务收入 180000借:主营业务成本 144000贷:库存商品 14400012月18日借:现金 1 600贷:主营业务收入 1 60012月25日借:应付账款 150000贷:银行存款 15000012月31日借:应付账款 100 000贷:银行存款 100 00012月31日借:管理费用 2 500贷:应付职工薪酬 2 50012月31日借:管理费用 2 000贷:累计折旧 2 00012月31日借:管理费用 10 000贷:预付帐款 10 00012月31日借:财务费用 1 000贷:应付利息 1 000注:12月利息费用=200 000*6%/12=1 000 2(2)更新收入、成本及费用账户,并编制结账分录主营业务收入主营业务成本借: 主营业务收入 331600贷:本年利润 331600借:本年利润 290000贷:主营业务成本 264000管理费用 25000财务费用 1 000借:利润分配 36 100贷:本年利润 36 100库存现金银行存款应付职工薪酬应付账款实收资本短期借款200020001(4) 编制12 月份方华公司的利润表和12月31日的资产负债表。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第五讲会计循环I:以商业为例

3、计算分析题

(1)、练习掌握权责发生制下收入与费用的确定。

资料:(A)A公司20x1年1月1日至12月31日按收付实现制确定收入、费用及利润情况如下:

收入50 000元

费用31 400元

利润18 600元

(B)上述资料若以权责发生制为基础,则有关资料如下:

年初年末

预收收入 1 500元 1 800元

应收收入 1 000元900元

预付费用840元 1 130元

应计费用 1 870元 1 460元

要求:假设该公司年初的预收预付项目在年度内均已转为收入、费用,年初的应计项目也在年度中支出或收到现金。

试根据上列资料计算该公司20x1年度以权责发生制为基础的收入、费用和利润。

【答案】

A公司20x1年1月1日至12月31日按权责发生制确定的收入、费用及利润情况如下:(单位:元)

调整后收入=收入-预收收入增加额+应收收入增加额=50000-300-100=49600

调整后费用=费用-预付费用增加额+应计费用增加额=31400-290-410=30700

调增后利润=调整后收入-调整后费用=49600-30700=18900

(2)、练习掌握账项调整的会计处理。

[资料]20x3年8月31日青青批发公司结账后试算表如下:

现金200

银行存款50 100

应收账款18 000

坏账准备 2 000

应收股利230

预付账款7 000

长期股权投资10 000

库存商品17 900

固定资产30 000

累计折旧24 000

应付账款 3 800

应付职工薪酬 1 000

应付利息200

长期应付票据,利率12%20 000

普通股本50 000

未分配利润36 430

合计111 430

20x3年9月份该公司发生如下交易:

1)1日,收到上月应收股利现金230元;

2)2日,用现金支付长期应付票据上月的利息200元;

3)3 日,赊购A 商品300 件,每件200 元,商品尚未入库;

4)5 日,以银行存款支付工资1 000 元;

5)6 日,出售存货40000 元,其中25000 元为赊销,余额为现销;

6)8 日,向客户收回应收账款13500 元;

7)9 日,以银行存款8000 元购入B 商品,商品已入库;

8)12 日,转销经确认不可收回的应收账款2000 元;

9)13 日,销售B 商品9000 元,并代客户支付运费300 元,货款未收;

10)15 日,以银行存款支付应付账款45000 元;

11)17 日,收到现销客户的退货,数额为200 元,并支付退货款;

12)19 日,计提销售人员的工资3200 元,行政部门管理人员的工资2400 元;13)20 日,用银行存款支付第四季度保险费4500 元;

14)23 日,用银行存款支付本期销售部门水电费1 000 元,管理部门水电费800 元;15)25 日,用银行存款支付下季度销售场地租金9000 元;

16)27 日,购入电脑一台,价值8000 元,款项已用银行存款支付;

17)30 日,盘点存货,A 商品短缺600 元,原因待查;

18)月末应调整账项:

a.本月应分摊保险费1 500 元,销售场地租金3000 元;

b.本月应计提固定资产折旧5000 元,其中销售部门3 000 台;管理部门2000元;c.本月按期末应收账款余额的4%,计提坏账准备;

d.结转本月产品销售成本2000 元;

e.计算结转本月销售收入、管理费用、销售费用、财务费用;

f.按本月利润总额的25%计缴所得税。

[要求]编制会计分录。

【答案】

1)借:库存现金230

贷:应收股利230

2)借:应付利息200

贷:库存现金200

3)借:材料采购——A 商品60 000

贷:应付账款60 000

4)借:应付职工薪酬1000

贷:银行存款1000

5)借:银行存款15 000

应收账款25 000

贷:主营业务收入40 000

6)借:银行存款13 500

贷:应收账款13 500

7)借:材料采购——B商品8000

贷:银行存款8000

借:库存商品——B商品8000

贷:材料采购——B商品8000

8)借:坏账准备2000

贷:应收账款2000

9)借:应收账款9300

贷:主营业务收入9000

库存现金300

10)借:应付账款45 000

贷:银行存款45 000

11)借:主营业务收入200

贷:银行存款200

12)借:销售费用3200

管理费用2400

贷:应付职工薪酬5600

13)借:预付账款-保险费4500

贷:银行存款4500

14)借:销售费用1000

管理费用800

贷:银行存款1800

15)借:预付账款—租金9000

贷:银行存款9000

16)借:固定资产8000

贷:银行存款8000

17)借:待处理财产损溢600

贷:库存商品——A商品 6 00

18)

a. 借:管理费用1500

销售费用3000

贷:预付账款4500

b. 借:销售费用3000

管理费用2000

贷:累计折旧5000

c. 借:资产减值损失1472

贷:坏账准备1472

d. 借:主营业务成本2000

贷:库存商品2000

e.

主营业务收入= 40000 + 9000 – 200 = 48800

管理费用= 2400 +800+1500+2000 =6700

销售费用= 3200+1000+3000+3000=10200

财务费用=长期应付票据,利率12%X 20 000/12 =200

资产减值损失=1472

结转收入:

借:主营业务收入48800

贷:本年利润48800

结转费用:

借:本年利润18572

贷:管理费用6700

销售费用10200

财务费用200

资产减值损失1472

利润=主营业务收入–管理费用–销售费用–财务费用-资产减值损失= 48800 –6700 –10200 –200-1472=30228

f.应交税费=利润×25%= 30228×25%=7557

借:所得税费用7557

贷:应交税费—应交所得税7557

(3)练习工作底稿与基本财务报表的编制

1、××商行20x5年12月31日调整前试算表资料如下:

现金 6 000

银行存款26 500

预付保险费800

库存商品7 000

固定资产220 000

应收账款 5 000

其他应收款700

累计折旧60 000

应付票据37 000

预收账款8 600

实收资本131 500

商品销售收入48 000

商品销售成本15 600

管理费用8 000

利息收入 4 500

合计289 600 元289 600元

2、12月31日应予调整的事项有:

1)本月应计提固定资产折旧为9 650元;

2)本年度的预付财产保险费余额全部由本月负担;

3)本月初将100平方米的空闲店面出租给多利公司,租期暂定3个月,每月租金5 400元,于第二个月中旬一次交付;

4)预收货款中的7 500元在本月已实现销售;

5)本月银行存款中应计利息为1 300元。

要求:1、试做出调整分录;

2、编制工作底稿;

3、编制利润表;

4、做结账分录;

5、编制资产负债表。

【答案】

1、调整分录

借:管理费用9650

贷:累计折旧9650 借:管理费用800

贷:预付账款800 借:其他应收款—多利公司5400

贷:其他业务收入——租金收入5400 借:预收账款7500

贷:主营业务收入7500 借:应收利息1300

贷:财务费用1300

3、利润表

XX商行利润表

20x5年

主营业务收入55500

其他业务收入5400

减:主营业务成本15600

管理费用18450

财务费用 5800

利润总额32650

4、结账分录

借:主营业务收入55500

其他业务收入5400

贷:本年利润60900

借:本年利润28250

财务费用5800

贷:主营业务成本15600

管理费用18450

借:本年利润32650

贷:利润分配——未分配利润32650

5、资产负债表

××商行资产负债表。