兹维博迪金融学第二版试题库5TB(1)

博迪《金融学》第2版名校考研真题[视频讲解](单选题)【圣才出品】

【圣才出品】](https://img.taocdn.com/s3/m/094c3ea002020740bf1e9b0a.png)

博迪《金融学》第2版名校考研真题【视频讲解】一、单选题1.以下货币制度中会发生劣币驱逐良币现象的是()。

[中央财大2011金融硕士] A.金银双本位B.金银平行本位C.金币本位D.金汇兑本位【答案】A【解析】金银双本位制下金、银两种金属同时被法律承认为货币金属,金、银铸币都可自由铸造,都有无限的法定支付能力。

当金银铸币各按其本身所包含的价值并行流通时,市场上的商品就出现了金银两重价格,而这两重价格随金银市场比价的不断变动而变动。

为了克服由此造成的紊乱,很多国家用法律规定了金币与银币的比价。

但金银市场比价并不会由于法定比例的确定而不再发生变化。

于是法定比价和市场比价之间可能会出现差异,价值被高估的货币渐渐被贮藏,而劣币充斥市场。

金银平行本位是金银两种本位币按其所含金属的实际价值流通,国家对两种货币的交换不加规定,而由市场上的金银的实际比价自由确定金币和银币比价的货币制度。

在金本位制下,每单位的货币价值等同于若干重量的黄金(即货币含金量);当不同国家使用金本位时,国家之间的汇率由它们各自货币的含金量之比——铸币平价(Mint Parity)来决定。

金汇兑本位制(Gold Exchange Standard)又称“虚金本位制”,该国货币一般与另一个实行金本位制或金块本位制国家的货币保持固定的比价,并在后者存放外汇或黄金作为平准基金,从而间接实行了金本位制。

实际上,它是一种带有附属性质的货币制度。

当然,无论金块本位制或金汇兑本位制,都是削弱了的金本位制,很不稳定。

而这种脆弱的制度经过1929年~1933年的世界经济危机,终于全部瓦解。

2.面值为100元的永久性债券票面利率是10%,当市场利率为8%时,该债券的理论市场价格应该是()元。

[中央财大2011金融硕士]A.100B.125C.110D.1375【答案】B 【解析】该债券的理论市场价格应该是(元)125%8%10100=⨯==m r C P 。

3.实际利率为3%,预期通货膨胀率为6%,则名义利率水平应该近似地等于()。

博迪《金融学》第2版课章节练习及详解(居民户的储蓄和投资决策)【圣才出品】

博迪《金融学》第2版课章节练习及详解第5章居民户的储蓄和投资决策一、概念题1.持久收入假说(武汉大学2002研;南开大学2008研)答:持久收入假说由美国经济学家米尔顿·弗里德曼(M.Friedman)提出,认为消费者的消费支出主要不是由他的现期收入决定,而是由他的永久收入决定。

所谓永久收入是指消费者可以预计到的长期收入。

永久收入大致可以根据观察到的若干年收入的数值之加权平均数计得,距现在的时间越近,权数越大;反之,则越小。

根据这种理论,政府想通过增减税收来影响总需求的政策是不能奏效的,因为人们减税而增加的收入,并不会立即用来增加消费。

与生命周期假说不同的是,持久收入假说偏重于个人如何预测自己未来收入问题。

持久收入假说认为:(1)消费不只同现期收入相联系,而是以一生或永久的收入作为消费决策的依据。

(2)一次性暂时收入变化引起的消费支出变动甚小,即其边际消费倾向很低,甚至近于零,但来自永久收入变动的消费倾向很大,甚至接近于1。

(3)当政府想用税收政策影响消费时,如果减税或增税只是临时性的,则消费者并不会受到很大影响,只有永久性税收变动,政策才会有明显效果。

2.跨期预算约束与最优消费选择费雪认为,人们在消费时会受到一些限制,这些约束包括:预算约束(即人们可以为自己进行消费所支出的数额大小)和跨期预算约束(即人们可以为自己在当前消费和未来消费所支付的数额大小)。

假定消费者的一生可以分为两个时期:第一个时期是青年时期,第二个时期是老年时期。

用1y 和1c 分别表示消费者在第一个时期的收入和消费,用2y 和2c 分别表示消费者在第二个时期的收入和消费。

再假定消费者有机会进行借贷或储蓄,因此他在任何一个时期的消费都可以大于或小于那一时期的收入。

第一个时期的储蓄或借贷:11s y c =-(0s >表示储蓄,0s <表示借贷),第二个时期的消费:()221c r s y =++,其中r 为实际利率。

博迪《金融学》第2版课后习题及详解(期权市场与或有索取权市场)【圣才出品】

博迪《金融学》第2版课后习题及详解第15章期权市场与或有索取权市场一、概念题1.或有索取权(contingent claim)答:或有索取权是一类范围广泛的资产或证券,这种资产未来的收益取决于其他资产或某些不确定事件的结果。

常见的或有索权权有债务和权益资本的或有索取权。

(1)债务资本的或有索取权:债务资本体现为借债的公司承诺在某一确定的时间支付给债权人一笔固定的金额。

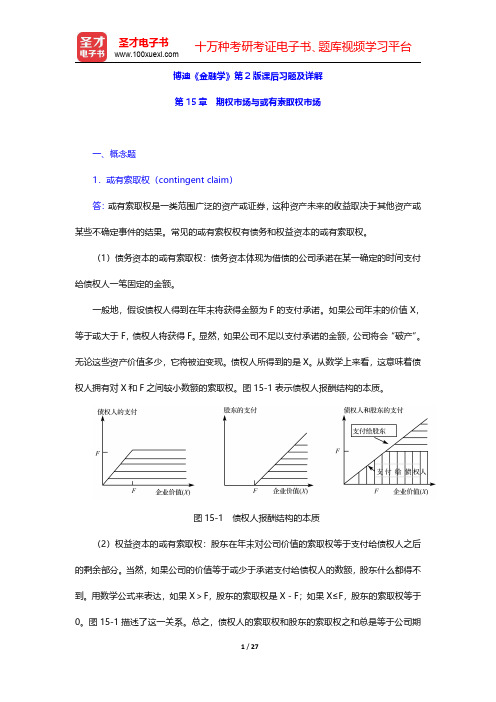

一般地,假设债权人得到在年末将获得金额为F的支付承诺。

如果公司年末的价值X,等于或大于F,债权人将获得F。

显然,如果公司不足以支付承诺的金额,公司将会“破产”。

无论这些资产价值多少,它将被迫变现。

债权人所得到的是X。

从数学上来看,这意味着债权人拥有对X和F之间较小数额的索取权。

图15-1表示债权人报酬结构的本质。

图15-1债权人报酬结构的本质(2)权益资本的或有索取权:股东在年末对公司价值的索取权等于支付给债权人之后的剩余部分。

当然,如果公司的价值等于或少于承诺支付给债权人的数额,股东什么都得不到。

用数学公式来表达,如果X>F,股东的索取权是X-F;如果X≤F,股东的索取权等于0。

图15-1描述了这一关系。

总之,债权人的索取权和股东的索取权之和总是等于公司期末的价值。

2.买入期权(call)答:买入期权又称“买方期权”、“看涨期权”、“多头期权”、“敲进”,是指期权买方在合约到期日或有效期内按照预先敲定的交割价格从期权卖方手中买入某种金融资产或商品的权利,是期权交易的种类之一。

购买这种期权以人们预测市场价格将有上涨趋势为前提。

投资者在支付一定的期权费取得该种期权后,在合约到期日或到期日之前的有效期限内,若市场价格超过协定价格与期权费之和的水平,则可通过行使期权以协定价格买入合约规定的一定数量的金融资产或商品,再以市场价格卖出,从而获利。

在市场价格上涨引起期权费上升的情况下,持有者也可在合约有效期限内以较高的期权费转售该种期权,从而获利。

博迪《金融学》第2版课章节练习及详解(投资组合机会和选择)【圣才出品】

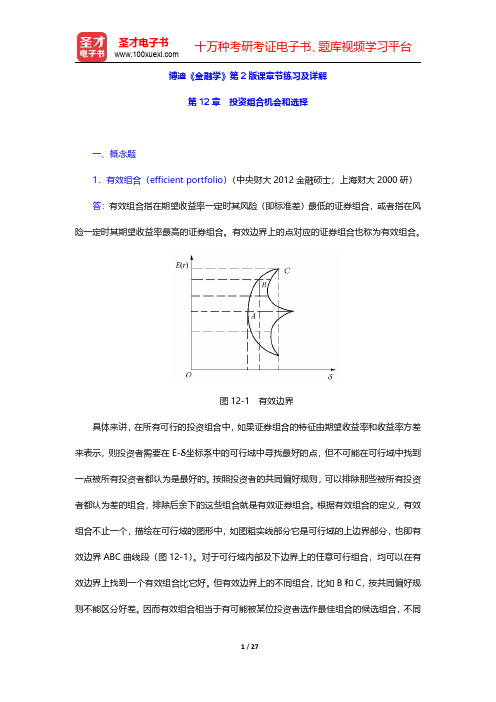

博迪《金融学》第2版课章节练习及详解第12章投资组合机会和选择一、概念题1.有效组合(efficient portfolio)(中央财大2012金融硕士;上海财大2000研)答:有效组合指在期望收益率一定时其风险(即标准差)最低的证券组合,或者指在风险一定时其期望收益率最高的证券组合。

有效边界上的点对应的证券组合也称为有效组合。

图12-1有效边界具体来讲,在所有可行的投资组合中,如果证券组合的特征由期望收益率和收益率方差来表示,则投资者需要在E-δ坐标系中的可行域中寻找最好的点,但不可能在可行域中找到一点被所有投资者都认为是最好的。

按照投资者的共同偏好规则,可以排除那些被所有投资者都认为差的组合,排除后余下的这些组合就是有效证券组合。

根据有效组合的定义,有效组合不止一个,描绘在可行域的图形中,如图粗实线部分它是可行域的上边界部分,也即有效边界ABC曲线段(图12-1)。

对于可行域内部及下边界上的任意可行组合,均可以在有效边界上找到一个有效组合比它好。

但有效边界上的不同组合,比如B和C,按共同偏好规则不能区分好差。

因而有效组合相当于有可能被某位投资者选作最佳组合的候选组合,不同投资者可以在有效边界上获得任一位置。

作为一个理性投资者,且厌恶风险,则他不会选择有效边界以外的点。

此外,A点是一个特殊的位置,它是上边界和下边界的交汇点,这一点所代表的组合在所有可行组合中方差最小,因而被称作最小方差组合。

2.市场证券组合(market portfolio)(上海财大2002研)答:市场证券组合指个人或机构投资者所持有的各种与整个资本市场的构成完全相同的有价证券组合的总称,通常包括各种类型的债券、股票及存款单等。

证券组合的分类通常以组合的投资目标为标准。

证券组合按不同标准可以分为避税型、收入型、增长型、收入和增长混合型、货币市场型、国际型及指数化型等。

投资者构建证券组合的原因主要有:①降低风险。

资产组合理论证明,证券组合的风险随着组合所包含证券数量的增加而降低,资产间关联性极低的多元化证券组合可以有效地降低非系统风险。

博迪《金融学》(第2版)笔记和课后习题详解修订版答案

博迪《金融学》(第2版)笔记和课后习题详解(修订版)完整版>精研学习䋞>无偿试用20%资料全国547所院校视频及题库全收集考研全套>视频资料>课后答案>往年真题>职称考试第1部分金融和金融体系第1章金融学1.1复习笔记1.2课后习题详解第2章金融市场和金融机构2.1复习笔记2.2课后习题详解第3章管理财务健康状况和业绩3.1复习笔记3.2课后习题详解第2部分时间与资源配置第4章跨期配置资源4.1复习笔记4.2课后习题详解第5章居民户的储蓄和投资决策5.1复习笔记5.2课后习题详解第6章投资项目分析6.1复习笔记6.2课后习题详解第3部分价值评估模型第7章市场估值原理7.1复习笔记7.2课后习题详解第8章已知现金流的价值评估:债券8.1复习笔记8.2课后习题详解第9章普通股的价值评估9.1复习笔记9.2课后习题详解第4部分风险管理与资产组合理论第10章风险管理的原理10.1复习笔记10.2课后习题详解第11章对冲、投保和分散化11.1复习笔记11.2课后习题详解第12章资产组合机会和选择12.1复习笔记12.2课后习题详解第5部分资产定价第13章资本市场均衡13.1复习笔记13.2课后习题详解第14章远期市场与期货市场14.1复习笔记14.2课后习题详解第15章期权市场与或有索取权市场15.1复习笔记15.2课后习题详解第6部分公司金融第16章企业的财务结构16.1复习笔记16.2课后习题详解第17章实物期权17.1复习笔记17.2课后习题详解。

博迪《金融学》第2版课后习题及详解(金融学)【圣才出品】

博迪《金融学》第2版课后习题及详解第1章金融学一、概念题1.金融学(finance)答:金融学是一项针对人们怎样跨期配置稀缺资源的研究。

其主要研究货币领域的理论及货币资本资源的配置与选择、货币与经济的关系及货币对经济的影响、现代银行体系的理论和经营活动的经济学科,是当代经济学的一个相对独立而又极为重要的分支。

金融学所涵盖的内容极为丰富,诸如货币原理、货币信用与利息原理、金融市场与银行体系、储蓄与投资、保险、信托、证券交易、货币理论、货币政策、汇率及国际金融等。

2.金融体系(financial system)答:金融体系是金融市场以及其他金融机构的集合,这些集合被用于金融合同的订立以及资产和风险的交换。

金融体系是由连接资金盈余者和资金短缺者的一系列金融中介机构和金融市场共同构成的一个有机体,包括股票、债券和其他金融工具的市场、金融中介(如银行和保险公司)、金融服务公司(如金融咨询公司)以及监控管理所有这些单位的管理机构等。

研究金融体系如何发展演变是金融学科的重要方面。

3.资产(assets)答:资产是指个人、公司或者组织拥有的具有商业或交换价值的任何物品,它能在未来产生经济利益,资产有三个非常重要的特征:①能在未来产生经济利益;②由实体控制;③由过去发生的事项或交易产生。

在国民账户体系中,资产是指经济资产,即所有者能对其行使所有权,并在持有或使用期间可以从中获得经济利益的资源或实体。

资产可分为金融资产和非金融资产两大类。

金融资产是指以价值形态或以金融工具形式存在的资产,它包括金融债权以及货币黄金和特别提款权。

非金融资产是指非金融性的资产,它包括生产资产和非生产资产。

在企业财务会计中,资产是指由过去的交易和事项所形成的,并由企业拥有或控制,预期会给企业带来经济利益的资源。

按流动性可分为流动资产和非流动资产两大类。

流动资产是指企业可以在一年或超过一年的一个营业周期内变现或者耗用的资产。

非流动资产是指不能在一年或者超过一年的一个营业周期内变现或耗用的资产。

博迪《金融学》第2版课后习题及详解(管理财务健康状况和业绩)【圣才出品】

博迪《金融学》第2版课后习题及详解第3章管理财务健康状况和业绩一、概念题1.账面价值(book values)答:账面价值是指会计账面所表现的资产价值,分为资产的账面价值和公司的账面价值。

资产的账面价值是指公司的资产在会计账簿上表现的价值,即原来购进资产的价值(资产的成本)减去折旧。

在固定资产购置当期,资产的账面价值等于当期市场价值加上运输、安装、调试等费用。

在固定资产正式投产营运后,每一会计期间都会对该资产计提折旧。

资产的账面价值会随着累计折旧的增加而减少,直到该资产报废时其账面价值仅剩残值,进而转销该资产。

公司的账面价值,是指公司资产负债表上所列示的资产总额减去负债、优先股之后的差额。

账面价值以历史成本为基础,它与一项资产或一个公司的市场价值关系不大。

2.无形资产(intangible assets)答:无形资产是指企业为生产商品、提供劳务、出租给他人,或为管理目的而持有的、没有实物形态的非货币性长期资产,如专利权、商标权、著作权、土地使用权、非专利技术、专营权、商誉等。

无形资产的特征有:①不具有实物形态;②可以在一个以上会计期间为企业提供经济利益;③有偿取得;④提供的未来经济利益具有很大的不确定性;⑤用于生产商品或提供劳务、出租给他人或为了行政管理目的而持有。

无形资产按形成来源不同可分为购入的、自创的、投资者投入的、接受捐赠的无形资产等;按能否辨认可分为可辨认无形资产和不可辨认无形资产。

无形资产只有在该资产产生的经济利益很可能流入企业、该资产的成本能够可靠地计量时,企业才能加以确认。

3.商誉(goodwill)答:商誉是指企业在经营活动中所具有的优越获利能力的潜在经济价值,是一种不可辨认的无形资产。

商誉由企业的良好信誉、产品的较高质量和市场占有率、可靠的销售网络、有效的内部管理、先进的技术、优越的地理位置等因素形成。

其特征是:①商誉与企业整体相关,不能单独存在;②形成商誉的因素无法单独计值;③商誉与形成商誉过程中所发生的成本无关,它是一种获得超额收益的能力。

博迪《金融学》第2版课后习题及详解(居民户的储蓄和投资决策)【圣才出品】

博迪《⾦融学》第2版课后习题及详解(居民户的储蓄和投资决策)【圣才出品】博迪《⾦融学》第2版课后习题及详解第5章居民户的储蓄和投资决策⼀、概念题1.⼈⼒资本(human capital)答:⼈⼒资本是指劳动者受到教育、培训、实践经验、迁移、保健等⽅⾯的投资⽽获得的知识和技能的积累,亦称“⾮物⼒资本”。

由于这种知识与技能可以为其所有者带来⼯资等收益,因⽽形成了⼀种特定的资本——⼈⼒资本。

任何使⼈⼒资本增值的活动都是⼈⼒资本投资,包括医疗和保健、在职⼈员培训、正规教育、成⼈教育与培训、迁移者⼯作搜寻等等。

⼈⼒资本投资的决策是⼀种收益与成本的权衡,其成本包括:实际的费⽤或直接的费⽤、放弃的⼯资报酬以及⼼理成本。

投资的预期收益可能是以各种形式表现出来的,⽐如较⾼的未来收⼊、终⾝⼯作满意程度的提⾼、对娱乐活动欣赏⽔平的提⾼以及欣赏兴趣的增长等。

2.永久性收⼊(permanent income)答:永久性收⼊是指消费者可以预期到的长期收⼊,即预期在较长时期中(3年以上)可以维持的稳定的收⼊流量。

永久性收⼊是弗⾥德曼持久收⼊假说中的重要概念,⼤致可以根据所观察到的若⼲年收⼊的数值的加权平均数来计算,估算持久收⼊的计算公式为:YP T=Y T-1+θ(Y T-Y T-1)=θY T-(1-θ)Y T-1(0<θ<1)式中,YP T为现期永久性收⼊,Y T为现期收⼊,Y T-1为前期收⼊,θ为加权数。

该公式说明,现期的永久性收⼊等于前期收⼊和两个时期收⼊变动的⼀定⽐率,或者说等于现期收⼊和前期收⼊的加权平均数。

加权数的⼤⼩取决于⼈们对未来收⼊的预期,这种预期要根据过去的经验进⾏修改,称为适应性预期。

如果⼈们认为前期和后期收⼊变动的时间较长,θ就⼤;反之,前期和后期收⼊变动的时间较短,θ就⼩。

3.跨期预算约束(inter-temporal budget constraint)答:跨期预算约束是指决定⼀⽣消费计划时⾯临的约束条件,即⼀⽣的消费开⽀和遗产的现值等于包括初始财产和未来劳动收⼊在内的⼀⽣资源的现值。

博迪《金融学》第2版课后习题及详解

博迪《金融学》第2版课后习题及详解博迪的《金融学》第2版是一本广泛使用的金融学教材,其中的课后习题对于学生理解和掌握金融学概念和理论具有重要意义。

本文将选取一些具有代表性的课后习题,并提供详细的解答和分析。

答:金融学是一项针对人们怎样跨期配置稀缺资源的研究。

它涉及货币、投资、证券、银行、保险、基金等领域,主要研究如何在不确定的环境下对资源进行跨时期分配,以实现最大化的收益或满足特定的目标。

金融体系(financial system)答:金融体系是金融市场以及其他金融机构的集合,这些集合被用于金融合同的订立以及资产和风险的交换。

它是由连接资金盈余者和资金短缺者的一系列金融中介机构和金融市场共同构成的一个有机体,包括股票、债券和其他金融工具的市场、金融中介(如银行和保险公司)、金融服务公司(如金融咨询公司)以及监控管理所有这些单位的管理机构等。

研究金融体系如何发展演变是金融学科的重要方面。

假设某个投资者在2022年购买了一张面值为1000元,年利率为5%的债券,并在2023年以1100元的价格卖出。

请问该投资者的年化收益率是多少?(1100 - 1000) / 1000 × 100% = 10%其中,分子部分为投资者获得的收益,分母部分为投资者的初始投资金额。

答:现代金融学的三个主要理论包括资本资产定价模型(CAPM)、有效市场假说(EMH)和现代投资组合理论(MPT)。

资本资产定价模型(CAPM)是一种用来决定资产合理预期收益的模型,它认为资产的预期收益与该资产的系统性风险有关。

在投资决策中,投资者可以通过比较不同资产的预期收益与其系统性风险来确定最优投资组合。

有效市场假说(EMH)认为市场是有效的,即市场上的价格反映了所有可用信息。

根据这个理论,投资者无法通过分析信息来获取超额收益。

然而,在实践中,许多研究表明市场并非完全有效,投资者可以通过分析和利用信息来获得超额收益。

现代投资组合理论(MPT)是由Harry Markowitz于20世纪50年代提出的,它认为投资者应该通过多元化投资来降低风险。

兹维博迪金融学第二版试题库3TB(1)

兹维博迪⾦融学第⼆版试题库3TB(1)Chapter ThreeManaging Financial Health and PerformanceThis chapter contains 62multiple choice questions, 19 short problems and 9 longer problems. Multiple Choice1.For a corporation, net worth is called ________.(a) net income(b) assets(c) stockholder’s equity(d) retained earningsAnswer: (c)2.On a company’s published balance sheet, the value of assets, liabilities and net worth, are measured at ________.(a)expected market value(b)current book value(c)current market value(d)historical acquisition costsAnswer: (d)3.Any U.S. or non-U.S. company that wishes to list its shares on a U.S. exchange must regularly report its activities by filing financial statements with the ________.(a)SEC(b)NYSE(c)GAAP(d)AMEXAnswer: (a)4.Noncurrent assets typically consist of ________.(a)accounts payable(b)receivables and inventories(c)cash and marketable securities(d)property, plant, and equipmentAnswer: (d)5.The difference between a firm’s current assets and its current liabilities is called ________.(a)net worth(b)net working capital(c)net income(d)stockholder’s equityAnswer: (b)6.________ is the difference between revenues and cost of goods sold.(a)Operating income(b)Gross margin(c)Taxable income(d)Change in retained earningsAnswer: (b)7.________ is the difference between gross margin and GS&A expenses.(a)Operating income(b)Gross margin(c)Taxable income(d)Net incomeAnswer: (a)8.Although it differs from the income statement, the statement of cash flows is a useful supplement to the income statement because:(a)it focuses attention on what is happening to the firm’s cash position over time(b)it avoids the judgments about revenue and expense recognition that go into the income statement(c)it is influenced by accrual accounting decisions(d)(a) and (b)Answer: (d)9.On the statement of cash flows, the purchase of new plant and equipment represents a ________.(a)cash flow from operating activity(b)cash flow from investing activity(c)cash flow from financing activity(d)total cash flow from (a) + (b) +(c )Answer: (b)10.On the balance sheet, the value of assets, liabilities, and net worth are measured in accordance with ________.(a)generally accepted economic principles(b)generally accepted accounting principles(c)market value accreditation(d)generally adopted and accredited principlesAnswer: (b)11.________ is the official accounting value of assets and shareholder’s equity.(a)Market value(b)Historical market value(c)Book value(d)Economic value addedAnswer: (c)12.Building up a good reputation for quality and reliability, and building up a knowledge base as theresult of past research and development, are both examples of ________ that add to the firm’s________.(a)intangible assets, book value(b)tangible assets, market value(c)tangible assets, book value(d)intangible assets, market valueAnswer: (d)13.The value of goodwill is the difference between the ________ of the acquisition and its ________.(a)market price, book value(b)amortized value, market price(c)historical acquisition cost, book value(d)market price, after tax valueAnswer: (a)14.At the beginning of 19X7 Success Galore has a market price of $250 per share and at the end of theyear $225.50. Cash dividends for the year are $7.50 per share. Compute the total shareholder returns.(a)6.8%(b)–6.8%(c)12.8%(d)–12.8%Answer: (b)15.Success Galore had a market price of $178 per share at the beginning of 19X7 and at the end of theyear the price per share was $205.50. Cash dividends for the year were $7 per share. Calculate the total shareholder returns.(a)19.38%(b)–19.38%(c)16.79%(d)–16.79%Answer: (a)16.In 19X7, Kanga Inc. had a net income of $40.2 million, assets of $600 million, and shareholders’equity of $405 million. Calculate the return on equity.(a)4%(b)6.7%(c)9.93%(d)20.62%Answer: (c)17.Asset turnover ratios ________.(a)assess the firm’s profitability(b)assess the firm’s ability to use its assets productively in generating revenue(c)highlight the capital structure of the firm(d)measure the ability of the firm to meet its short-term obligationsAnswer: (b)Use the information below for BGB Manufacturing to answer Questions 18-22.18.Calculate the current ratio for BGB Manufacturing for 1998.(a)1.5 times(b)2.43 times(c)3.19 times(d)4.25 timesAnswer: (b)19.Calculate the quick ratio for BGB Manufacturing for 1997.(a)0.25 times(b)0.5 times(c)0.75 times(d)1.5 timesAnswer: (c)20.From the perspective of a bank loan officer from 1997 to the present, which of the followingstatements best summarizes the information revealed by the current ratio and quick ratio for BGB Manufacturing?(a)The ability of the firm to meet its long-term obligations has deteriorated.(b)The ability of the firm to meet its short-term obligations has improved.(c)The ability of the firm to meet its short-term obligations has deteriorated.(d)The ability of the firm to meet its long-term obligations has improved.Answer: (b)21.Calculate the debt ratio for BGB Manufacturing for 1999.(a)0.14%(b)0.24%(c)0.48%(d)0.82%Answer: (c)22.Calculate the times interest earned (TIE) ratio for BGB Manufacturing for 1998.(a)2.25 times(b)2.7 times(c)3.25 times(d)5.2 timesAnswer: (c)23. If a firm’s total asset turnover ratio is 3.0:(a)its average total assets are one-sixth of its annual sales(b)its average total assets are three times its annual sales(c)its annual sales are three times its average total assets(d)its annual sales are one-third of its total assetsAnswer: (c)24. A firm has a P/E of 9 and a market to book ratio of 2.5. If EPS are $3.50, what is the book value per share?(a) $8.75(b) $12.60(c) $31.50(d) $78.75Answer: (b)25. A firm has EBIT of $3 million, sales of $15 million, and average total assets of $30 million. Calculate its ROA.(a)6.67%(b)10%(c) 20%(d) 50%Answer: (b)26. If the average inventory for a firm is $17 million and inventory turnover is 0.9 times, what is its cost of goods sold?(a)$15.3 million(b)$18.89 million(c)$153 million(d)$188.9 millionAnswer: (a)27. If the average total assets for the Heartland Corporation are $660 million and EAT are $100 million, calculate its ROA. Assume a tax rate of 40% and interest of $3 million.(a) 15.15%(b) 15.6%(c) 25.15%(d) 25.71%Answer: (d)28. The beginning of year receivables for a firm are $40 million. If the receivables turnover for the firm is4.2 times and its sales are $220 million, calculate the firm’s end of year receivables.(a) $24.76 million(b) $52.38 million(c) $64.76 million(d) $168 millionAnswer: (c)29. In developing a financial plan, the first step is to:(a) distribute rewards and punishments to relevant parties(b) develop the firm’s strategic plan(c) establish specific performance targets for the firm and its suppliers(d) adjust targets based on the previous year’s dataAnswer: (b)30. The planning horizon is an important component of the financial planning process. Generally, the longer the horizon:(a) the less detailed the financial plan(b) the more detailed the financial plan(c) the more performance targets the financial plan will include(d) the less a financial plan is neededAnswer: (a)31. The “blueprints,” or the tangible outcomes of the financial planning process, are in the form of:(a) executive stock options(b) auditor’s recommendations(c) projected financial statements and budgets(d) tactical plans and budgetsAnswer: (c)32. Based on a consideration of the planning horizon, which of the following projects is most likely to consist of the most detailed financial plans?(a) a five-year financial plan(b) a one-year financial plan(c) a six-month financial plan(d) a one-month financial planAnswer: (d)33. Forecasting sales for the next year and assuming that most of the items on the income statement and balance sheet will maintain the same ratio to sales as in the previous year is called the_______________ method.(a) forecast ratio(b) percent-of-sales(c) planning horizon(d) financial predictorAnswer: (b)34. Using the percent-of-sales method, which of the following variables are typically assumed to increase proportionately with sales?(a) costs(b) EBIT(c) assets(d) all of the aboveAnswer: (d)35. Rupert’s Glassworks Ltd. has an inventory period of 50 days, a receivables period of 55 days, and a payables period of 40 days. Compute its cash cycle time.(a) 35 days(b) 45 days(c) 65 days(d) 105 daysAnswer: (c)Questions 36 through 45 refer to the following information:Income Statement data and Balance Sheet data is provided for the firm Neural Way Inc. for 19x7 and 19x8. Financial Statementsfor Neural Way Inc.19x719x8Income StatementSales$1,500,000$1,980,000Cost of Goods Sold$967,500$1,277,100Gross Margin$532,500$702,900Operating ExpensesAdvertising Expense$50,400$66,528Rent Expense$72,000$95,040Salesperson Commission Expense$48,000$63,360Utilities Expense$15,000$19,800EBIT$347,100$458,172Interest Expense$102,000$107,000Taxable Income$245,100$351,172Taxes (@35%)$85,785$122,910Net Income$159,315$228,262Dividends (40% payout)$63,726$91,305Change in Shareholders Equity$95,589$136,957Balance SheetAssetsCash and Equivalents$310,000$409,266Receivables$205,000$270,666Inventories$720,000$950,400Property, Plant and Equipment$1,956,000$2,571,306Total Assets$3,191,000$4,201,638LiabilitiesPayables$310,000$409,266Short Term Debt (10% interest)$510,000$1,088,535Long Term Debt (7% interest)$800,000$995,880Shareholders equityCommon Stock$1,150,000$1,150,000Retained earnings$421,000$557,957Total Liabilities and Equity$3,191,000$4,201,63836. From the financial data provided, which of the following items has maintained a fixed ratio to sales?(a) interest expense(b) net income(c) rent expense(d) taxes37.What is the ratio between sales and dividend payments in 19x8?(a) 3.22%(b) 4.25%(c) 4.61%(d) 6.09%Answer: (c)38.Calculate the rate of sales growth from 19x7 to 19x8.(a) 48%(b) 32%(c) 24.24%(d) 31.25%Answer: (b)39.What is the firm’s return on equity for 19x8?(a) 10.14%(b) 13.36%(c) 19.85%(d) 40.91%Answer: (b)40.What is the firm’s external financing funding requirement determined to be for 19x8?(a) $774,415(b) $873,681(c) $911,372(d) $972,947Answer: (a)41.If it is assumed that sales will grow by 17% for 19x9, then sales for 19x9 are forecast to be ________.(a) $1,755,000(b) $2,316,600(c) $2,613,600(d) $11,647,059Answer: (b)42.If sales growth is forecast to be 17% for 19x9, what is the forecast gross margin for 19x9?(a) $393, 822(b) $822,393(c) $873,300Answer: (b)43.How much additional funding will the firm need for 19x9?(a) $709,544(b) $639,979(c) $618,863(d) $549,288Answer: (d)44.In 19x7, taxable income is what proportion of sales?(a) 5.72%(b) 6.11%(c) 16.34%(d) 17.74%Answer: (c)45.In 19x8, common stock is what proportion of sales?(a) 28.18%(b) 58.08%(c) 76.67%(d) 86.26%Answer: (b)46.Which is the correct formula for calculating a firm’s sustainable growth rate?(a) sustainable growth rate = earnings retention rate x ROE(b) s ustainable growth rate = earnings retention rate x ROI(c) sustainable growth rate = (1 – dividend payout) x ROE x ROI(d) s ustainable growth rate = share repurchase rate x ROIAnswer: (a)47.Lucinda Inc. has the following fixed ratios:Asset Turnover = 0.6 Times per YearDebt/Equity Ratio = 1.5Dividend Payout Ratio = 0.53ROE = 25% per YearWhat is the sustainable growth rate for this firm?(a) 10%(b) 11.75%(c) 15%(d) 39.75%Answer: (b)48.Onegin Corporation has the following fixed ratios:Asset Turnover = 0.4 Times per YearDebt/Equity Ratio = 1.4Dividend Payout Ratio = 0.49ROE = 27% per YearWhat is the sustainable growth rate for this firm?(a) 13.77%(b) 14%(c) 16.2%(d) 18.25%Answer: (a)49. If a firm’s working capital need is permanent rather than seasonal, the firm ________.(a) will usually seek short-term financing for it(b) will not seek financing at all(c) will revise its strategic plan immediately(d) will usually seek long-term financing for itAnswer: (d)50. Which of the following is not part of a firm’s working capital?(a) inventories(b) accounts payable(c) plant and equipment(d) cashAnswer: (c)51. Working capital is defined to be ________.(a) the difference between current assets and current liabilities(b) the difference between accounts receivable and accounts payable(c) the difference between current assets and shareholders’ equity(d) the difference between total assets and total liabilitiesAnswer: (a)52. The cash cycle time begins with ________and ends with ________.(a) payment of cash to suppliers, liquidation of inventory(b) receipt of cash from customers, payment of cash to suppliers(c) payment of cash to suppliers, receipt of cash from customers(d) selling of purchase on credit, receipt of cash from customersAnswer: (c)53. Which of the following is the correct representation of the cash cycle time?(a) Cash cycle time = inventory period – payables period(b) Cash cycle time = inventory period – receivables period – payables period(c) Cash cycle time = receivables period – payables period(d) Cash cycle time = inventory period + receivables period – payables periodAnswer: (d)54. A firm’s required investment in working capital is ________ to the cash cycle length of time.(a) inversely proportional(b) directly related(c) indirectly related(d) not related at allAnswer: (b)Use the following data to answer Questions 55 - 59Prepare a multi-step income statement for Kangarucci Inc. (a retailer) for the year ending December 31, 1997. Use the information below:Interest Expense 18,799Beginning Inventory 422,550Depreciation 14,861General and Administrative Expenses 19,745Advertising 14,090Interest Income 5,087Ending Inventory 456,988Gross Sales 543,777Taxes 10,006Lease Payments 61,444Purchase of Materials 199,766Returns and Allowances 9,888R&D Expenditures 12,867Repairs and Maintenance 7,54255. The cost of goods sold is ________.(a)$34,438(b)$165,328(c)$199,766(d)234,204Answer: (b)56. The operating expenses for the period are ________.(a)$95,279(b)$110,140(c)$115,688(d)$130,549Answer: (d)57. The gross margin for the period is ________.(a)$353,700(b)$368,561(c)$378,449(d)$543,777Answer: (b)58. The operating income for the period is ________.(a)$238,012(b)$247,900(c)$273,282(d)$283,170Answer: (a)59. The net income is ________.(a)$214,294(b)$209,207(c)$204,120(d)$189,259Answer: (a)60. In the construction of a statement of cash flows, which of the following is considered a financing activity?(a)increase in accounts payable(b)repayment of long-term debt(c)reduction of accounts receivable(d)purchase of gross fixed assetsAnswer: (b)61. Assume you are given the following information for Flanders Company:Current Ratio: 2.5xQuick Ratio: 2.0xCurrent Liabilities: $200,000Current assets comprise cash, account receivables and inventory.Compute Inventory.(a)$500,000(b)$400,000(c)$100,000(d)$80,000Answer: (c)62. Assume you are given the following information for Flanders Company:Return on Assets (ROA): 11%Return on Equity (ROE): 20%Total Asset Turnover: 1.5xCalculate the ROS for Flanders Company.(a)7.33%(b)13.33%(c)13.64%(d)16.5%Answer: (a)Short Problems1.Explain why the market price of a company’s stock does not necessarily equal its book value.Answer:The book value does not include all of a firm’s assets and liabilities.The assets and liabilities included on a firm’s official balance sheet are (for the most part) valued at original acquisition cost less depreciation, rather than at current market values.2.Explain why it may be possible for two firms to have the same ROA.Answer: ROA = ROS x ATOFor example, a supermarket (low profit margin, high asset turnover) and a jewelry store (high profit margin, low asset turnover) – could have the same ROA.3.As a financial document, what purpose does the statement of cash flows serve? What is a benefit ofthe statement of cash flows?Answer: The statement of cash flows gives a summary of cash flows from operating, investing, and financing activities for a period of time. The statement of cash flows focuses attention on what is happening to the firm’s cash position over time and it also avoids judgements about revenue and expense recognition that go into the income statement. A benefit of the statement of cash flows is that it is not influenced by accrual accounting decisions.4.What are the three types of benchmarks?Answer:Financial ratios of other companies for the same period of time.Financial ratios of the company itself in previous time periods.Information extracted from financial markets such as asset prices or interest rates.5.You invest in a stock that costs $215.50. It pays a cash dividend during the year of $12.20 and you expect its price to be $229 at year’s end. What is the total shareholder return?Answer:Total Shareholder returns = Ending Price of a Share – Beginning Price of Share + Cash Dividend Beginning Price of Share= $229 - $215.50 + $12.20$215.50= 11.93%6.In 19X7, Slater Inc. had a net income of $30.3 million, assets of $560 million, and shareholders equity of $400 million. Calculate its return on equity.Answer: Return on equity = Net IncomeShareholders’ Equity= $30.3$400= 7.58%7.Grad Inc. has EBIT of $13 million, sales of $25 million, and average total assets of $50 million. Calculate its ROA.Answer: Return on assets = EBIT x SalesSales Assets= 13 x 252550= 26%8.If Profit Inc. has interest expenses of $16,000 per year, sales of $1,000,000, a tax rate of 40%, and a net profit margin of 7%, what is Success Inc.’s times interest earned ratio?Answer: EAT = Sales x Net Profit Margin= $1,000,000 x 0.07= $70,000EBT = EAT/(1-T)= $70,000/0.6= $116,667EBIT = EBT + I= $116,667 + $16,000= $132,667T.I.E = EBIT/ Interest Expense = $132,667/ $16,000= 8.29 times。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter FiveHousehold Savings and Investment DecisionsThis chapter contains 28 multiple choice questions, 10 short problems, and 9 longer problems.Multiple Choice1.Getting a professional degree can be evaluated as ________.a) a social security decisionb)an investment in human capitalc)an investment in a consumer durabled) a tax exempt decisionAnswer: (b)2.Suppose you will face a tax rate of 20% before and after retirement. The interest rate is 8%.You are 30 years before your retirement date and invest $10,000 to a tax deferred retirement plan. If you choose to withdraw the total accumulated amount at retirement, what will you be left with after paying taxes?a)$51,445b)$64,000c)$80,501d)$100,627Answer: (c)3.Suppose you will face a tax rate of 20% before and after retirement. The interest rate is 8%.You are 30 years before your retirement date and have $10,000 to invest. If you invest this in an ordinary savings plan instead of a tax deferred retirement plan, what amount will you have accumulated at retirement?a)$51,445b)$64,000c)$80,501d)$100,627Answer: (a)4.When your tax rate remains unchanged, the benefit of tax deferral can be summarized in therule, “deferral earns you ________.”a)the after-tax rate of return before taxb)the pretax rate of return after taxc)the after-tax rate of return after taxd)the pretax rate of return before taxAnswer: (b)5.From an economic perspective, professional training should be undertaken if the ________exceeds the ________.a)future value of the benefit; present value of the costsb)present value of the benefits; future value of the costsc)future value of the benefits; future value of the costsd)present value of the benefits; future value of the costsAnswer: (d)6.Suppose you will face a tax rate of 30% before and after retirement. The interest rate is 6%.You are 35 years before your retirement date and $2,000 to a tax deferred retirement plan. If you choose to withdraw the total accumulated amount at retirement, what will you be left with after paying taxes?a)$7,532b)$10,760c)$12,298d)$15,372Answer: (b)7.Kecia is currently thirty years old and she plans to retire at age sixty. She is expected to liveto age eighty-five. Her labor income is $45,000 per year and she intends to maintain aconstant level of real consumption spending over the next fifty-five years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Kecia’s human capital?a)$31,797b)$35,196c)$778,141d)$994,888Answer: (c)8.Kecia is currently thirty years old and she plans to retire at age sixty. She is expected to liveto age eighty-five. Her labor income is $45,000 per year and she intends to maintain aconstant level of real consumption spending over the next fifty-five years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Kecia’s permanent income?a)$31,797b)$35,196c)$778,141d)$994,888Answer: (b)9.Oscar is currently thirty-five year old, plans to retire at age sixty-five, and to live to ageeighty-five. His labor income is $40,000 per year, and he intends to maintain a constant level of real consumption spending over the next fifty years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Oscar’s human capital?a)$884,344b)$691,681c)$39,999d)$32,198Answer: (b)10.Oscar is currently thirty-five year old, plans to retire at age sixty-five, and to live to ageeighty-five. His labor income is $40,000 per year, and he intends to maintain a constant level of real consumption spending over the next fifty years. Assuming a real interest rate of 4% per year, no taxes, and no growth in real labor income, what is the value of Oscar’spermanent income?a)$884,344b)$691,681c)$39,999d)$32,198Answer: (d)11.You are currently renting a house for $12,000 per year, and you also have an option to buy itfor $240,000. Maintenance and property taxes are estimated to be $4,320, and these costs are included in your rent. Property taxes ($2,880 of the $4,320) are deductible for income tax purposes. Your tax rate is 35%. You wish to provide yourself with housing at the lowest present value of cost. If the real after-tax rate is 2.52%, should you rent or buy?a)rent the house; the PV cost of renting is $476,190b)rent the house; the PV cost of renting is $309,524c)buy the house; the PV cost of owning is $442,198d)buy the house; the PV cost of owning is $371,429Answer: (d)12.You are currently renting a house for $12,000 per year and you also have an option to buy itfor $240,000. Maintenance and property taxes are estimated to be $4,320, and these costs are included in your rent. Property taxes ($2,880 of the $4,320) are deductible for income tax purposes. Your tax rate is 35%. You wish to provide yourself with housing at the lowest present value of cost. The real after-tax rate is 2.52%. What is the break-even rent?a)$6,048b)$9,360c)$10,128d)$12,302Answer: (b)13.As one gets older, the ________ declines, so ________ falls steadily until it reaches zero atage 65.a)future value of remaining labor income; human capitalb)future value of remaining labor income; initial wealthc)present value of remaining labor income; human capitald)present value of initial wealth; optimizationAnswer: (c)14.Any lifetime consumption spending plan that satisfies your budget constraint is:a)an optimal modelb) a feasible planc) a model benefitd) a target replacementAnswer: (b)15.There is an advantage to tax deferred retirement savings plans for those ________ when themoney is withdrawn.a)who will be in a lower tax bracketb)who will be in the same tax bracketc)both (a) and (b)d)neither (a) nor (b)Answer: (c)16.In the United States, individual retirement accounts (IRAs) are called ________ rather than________ because any amounts withdrawn from the plan are taxed at the time of withdrawal.a)tax advantaged; tax deferredb)tax deferred; tax exemptc)tax advantaged; tax loopholesd)tax exempt; tax deferredAnswer: (b)17.The present value of one’s future labor income is called ________ and the constant level ofcon sumption spending that has a present value equal to one’s human capital is called________.a)human income; taxable incomeb)human capital; permanent incomec)permanent capital; taxable incomed)permanent income; human capitalAnswer: (b)18.The ________ the interest rate, the ________ the value of human capital, but the higher thelevel of permanent income.a)lower; lowerb)higher; lowerc)higher; higherd)lower; higherAnswer: (b)19.The ________ states that the present value of one’s lifetime consumption spending andbequests equals the present value of one’s initial wealth and future labor income.a)consumption budget constraintb)spending constraintc)intertemporal budget constraintd)income and spending constraintAnswer: (c)20.According to the text, many experts recommend that in making a savings plan one should aimfor a replacement rate of ________ of pre-retirement income.a)100%b)25%c)50%d)75%Answer: (d)21.Economic costs that are said to be explicit costs include items such as ________.a)tuitionb)foregone rentc)foregone earningsd)all of the aboveAnswer: (a)22.Economic costs that are said to be implicit costs include items such as ________.a)tuitionb)administrative fees while undertaking a professional degreec)foregone earningsd)all of the aboveAnswer: (c)23.In making lifetime saving/consumption decisions it is considered simpler to do the analysis________.a)in nominal termsb)in inflationary termsc)in perpetual termsd)in real termsAnswer: (d)24.In terms of a lifetime saving/consumption decision such as buying or renting an apartment ora consumer durable, the alternative you should choose is ________.a)the one with the lower present value of benefitsb)the one with the lower present value of costsc)the one with the higher present value of costsd)the one with the lower present value of benefits and the higher present costsAnswer: (b)25.Among the approaches you can use for saving for your retirement is/are ________.a)aiming to maintain the same level of consumption spending before and afterretirementb)aiming for a target replacement rate of incomec)bypassing graduate school and continuing to consume at the same leveld)(a) and (b)Answer: (d)26.In the equation known as the intertemporal budget constraint, ________.a)the present value of lifetime consumption spending equals the present value ofbequestsb)the present value of lifetime consumption spending and bequests equals the presentvalue of lifetime resourcesc)the present value of lifetime consumption spending equals the future value of laborincomed)the future value of lifetime consumption spending equals the present value of laborincomeAnswer: (b)27.Salman is currently twenty-five years old and plans to live to age eighty. His labor income is$75,000 per year and he plans to maintain a constant level of real consumption spending over the next fifty-five years. Salman plans to retire at age 60. Assume the real interest rate is 5% per year and there are no taxes and no growth in real labor income. What is the value ofSalman’s permanent income?a)$75,000b)$65,906c)$85,348d)$1,228,064Answer: (b)28.You are currently renting a house for $25,800 a year and you have an option to buy it for$350,000. Maintenance and property taxes are $6,150 per year and these costs are included in your rent. Property taxes ($4,150 of the $6,150) are deductible for income tax purposes. Your tax rate is 35%. The real after-tax rate is 3.5%. What is the break-even rent?a)$16,770.00b)$16,947.50c)$21,102.46d)$24,927.54Answer: (b)Short Problems1.You are currently renting a house for $17,000 a year and you also have an option to buy it for$300,000. Maintenance and property taxes are $5,040 per year and these costs are included in your rent. Property taxes ($3,360 of the $5,040) are deductible for income tax purposes.Your tax rate is 40%. You wish to provide yourself with housing at the lowest present value of cost. The real after-tax rate is 3.1% per year. Should you rent or buy? What is the break-even rent?Answer:After-tax outflow for property taxes each year is 0.6 x $3,360 = $2,016Cash outflow in year t = $1,680 + $2,016= $3,696PV cost of owning = $300,000 + $3,696/i= $300,000 + $3696/0.031= $419,226PV cost of renting = $17,000/i= $17,000/0.031= $548,387You would be better off buying the house.Break-even rent: X/0.031 = $300,000 +$3,696/0.031X = $12,996The break-even rent is $12,996.So if the rent is less than $12,996 per year, you would prefer to keep renting.2.You are currently renting a house for $16,000 a year and you also have an option to buy it for$250,000. Property taxes and maintenance care is $5,000 per year, and these costs areincluded in your rent. Property taxes ($3,200 of the $5,000) are deductible for income tax purposes. Your tax rate is 40%. You wish to provide yourself with housing at the lowest present value of cost. The real before-tax discount rate is 3.5% per year. Should you rent or buy? What is the break-even rate?Answer:Real after-tax rate = 0.6 x 0.035= 0.021After-tax cash outflow for property taxes each year is 0.6 x $3,200 = $1,920Cash outflow for year t = $1,800 + $1,920= $3,720PV cost of owning = $250,000 + $3,720/i= $250,000 + $3,720/0.021= $427,143PV cost of renting = $16,000/i= $16,000/0.021= $761,905You would be better off buying the house.To find the break-even rent:X/0.021 = $250,000 + $3,720/0.021X = $8,970So if the rent is less than $8,970 per year, you would be better off renting.3.Kieran is currently twenty-five years old, plans to retire at age sixty, and to live to age eighty.His labor income is $45,000 per year, and he intends to maintain a constant level of real consumption spending over the next fifty-five years. Assuming a real interest rate of 3%, no taxes, and no growth in real labor income, what is the val ue of Kieran’s human capital? What is the value of Kieran’s permanent income?Answer:n i PV FV PMT Result35 3 ? 0 45,000 PV = $966,925n i PV FV PMT Result55 3 $966,925 0 ? PMT = $36,114The value of Kieran’s human capital is $966,925.The value of Kieran’s permanent income is $36,114.4.Mariana is currently thirty years old, plans to retire at age seventy and to live to age ninety.Her labor income is $60,000 per year, and she intends to maintain a constant level of real consumption spending over the next sixty years. Assuming a real interest rate of 4% per year, no taxes and no growth in real labor income, what is the value of Mariana’s human capital?What is the value of Mariana’s permanent income?Answer:n i PV FV PMT Result40 4 ? 0 60,000 PV = $1,187,566n I PV FV PMT Result60 4 $1,187,566 0 ? PMT = $52,493The value of Mariana’s human capital is $1,187,566.The value of Mariana’s permanent income is $52,493.5.Your employer, Novocastrian Films, has agreed to make 60 quarterly payments of $1,000each into a trust account to fund your early retirement. The first payment will be made 3months from now. At the end of 15 years (60 payments), you will be paid 15 equal annual payments, with the first receipt to be made at the beginning of Year 16 (or the end of Year15). The funds will be invested at a nominal rate of 10.0%, quarterly compounding, duringboth the accumulation and the distribution periods. How large will each of your 15 receipts be?Answer:First determine the effective annual rate:EFF = (1 + 0.10/4)4–1= 10.38%Next, determine amount at end of year 15N I PMT Result_____________15 10.38 $4000 FV = $130,983.39At the end of year 15, there will be $130,983.39 in your retirement account.Since you will be making withdrawals at the beginning of each year, PV = $130,983/(1 +i), or $118,625.10.N I PV Result___________15 10.38 -$118,625.10 PMT = $15,935.89Each of the receipts will be $15,935.896.Mr. Palin has received a job offer from a large investment bank as an assistant to the vicepresident and Mr. Palin’s base salary will be $90,000. In addition, he will receive his first annual salary payment one year from the day he begins work. He will also get an immediate $45,000 bonus for joining the company and his salary will grow at 8 percent each year. Mr.Palin is expected to work for 20 years. What is the present value of the offer if the appropriate discount rate is 11 percent?Answer:Simplest approach is to set up a spreadsheet like:Year PMT PV@11%0 45,000 45,0001 90,000 81,081.082 97,200 78,889.70. . .. . .. . .19 359,641.75 49,514.6320 388,413.10 $48,176.39Total: $1,310,649.82The present value of the offer is $1,310,649.827.Natalia will face a tax rate of 25% before and after retirement. The interest rate is 9%. She is35 years from her retirement date and invests $5,000 to a tax deferred retirement plan. If shechooses to withdraw the total accumulated amount at retirement, what will she be left with after paying taxes?Answer:$5,000 x 1.0935 = $102,069After taxes this leaves $102,069 x 0.75 = $76,5528.Damian is currently twenty-five years old and plans to live to age eighty. His labor income is$80,000 per year, and he plans to maintain a constant level of real consumption spending over the next fifty-five years. Damian plans to retire at age 60. Assume the real interest rate is 5% per year and there are no taxes and no growth in real labor income. What is the value ofDamian’s human capital? What is the value of Damian’s permanent income?Answer:N I PV FV PMTResult_________35 5 ? 0 $80,000 PV =$1,309,936N I PV FV PMT Result________55 5 $1,309,936 0 ? PMT = $70,300Damian’s human capital is $1,309,936.Damian’s permanent income is $70,300.9.You are currently renting a house for $25,800 a year and you have an option to buy it for$350,000. Maintenance and property taxes are $6,150 per year, and these costs are included in your rent. Property taxes ($4,150 of the $6,150) are deductible for tax purposes. Your tax rate is 35%. The real after tax rate is 3.5%. What is the NPV of the investment in the house?Answer:After-tax outflow for property taxes each year is 0.65 x $4,150 = $2,697.50Cash outflow in year t = $2,697.50 + $2,000= $4,697.50PV cost of owning = $350,000 + $4,697/0.035= $350,000 + $134,214= $484,214PV cost of renting = $25,800/0.035= $737,143So the NPV of investing in the house instead of renting is $737,143 – $484,214 = $252,929.10.Carson will face a tax rate of 30% before and after retirement. The interest rate is 6%. He is32 years from his retirement date and invests $3,000 to a tax deferred retirement plan. If hechooses to withdraw the total accumulated amount at retirement, what will he be left with after paying taxes? Show how to find the answer using the rule, “Deferral earns you the pretax rate of return after tax.”Answer:If Carson paid the initial tax he would have $3,000 x 0.7 = $2,100 to invest.Investing $2,100 at the pretax rate of 6% would result in $2,100 x 1.0632 = $13,552Longer Problems1.Tamara is currently twenty-eight years old, plans to retire at age seventy and to live to ageninety. Her labor income is $50,000 per year, and she intends to maintain a constant level of real consumption spending over the next sixty-two years. Assume no taxes, no growth in real labor income and a real interest rate of 4% per year.(a)What is the value of Tamara’s human capital?(b)What is the value of Tamara’s permanent income?Answer:(a) N I PV FV PMT Result42 4 ? 0 $50,000 PV =$1,009,281(b) N I PV FV PMT Result62 4 $1,009,281 0 ? PMT =$44,261The value of Tamara’s human capital is $1,009,281The value of Tamara’s permanent income is $44,2612.You have just turned twenty-eight years of age and feel it is necessary to upgrade yourqualifications. After some consideration, you feel that undertaking full-time study for an MBA degree is one alternative. For the two years of full-time study, tuition and livingexpenses will be $25,000 per year. In addition, you will have to give up your current job witha salary of $35,000 per year. Assume all cash flows occur at the end of the year. Assume areal interest rate of 4% per year, ignoring taxes. Also assume that the salary increase is at a constant real amount that starts after you complete your degree (at the end of the yearfollowing graduation) and lasts until retirement at age sixty-five. In order to justify theinvestment, by how much does your salary have to increase as a result of getting the MBA degree?Answer:Find the FV of tuition and foregone salary at the end of two years:N i PV FV PMT Result________2 4 0 ? 60,000 FV = $122,400Find the increase in salary that has this amount as its PV:n i PV FV PMT Result_______35 4 $122,400 0 ? PMT = $6,5583.At the age of thirty Terry was earning $30,000 and decided to undertake an MBA to increasehis earning potential. Two years later Terry has his degree and has achieved a constant real increase of $5,898 in his annual salary that will last until he retires at age sixty. If Terry lives to the age of ninety, what will be the value of his human capital and permanent income?Assume a real interest rate of 2.52% per year, no taxes, and no growth in real labor income.Answer:New base salary = $30,000 + $5,898 = $35,898n i PV FV PMT Result________28 2.52 ? 0 $35,898 PV = $714,899n i PV FV PMT Result________58 2.52 $714,899 0 ? PMT = $23,584The value of Terry’s human capital is $714,899.The value of Terry’s permanent income is $23,584.4.Juliet currently rents an apartment but has the option to buy it for $185,000. Property taxesare $2,000 per year and are deductible for income tax purposes. Annual maintenance costs are $1,800 per year, but are not tax deductible. Juliet expects that the above taxes willincrease at the rate of inflation. Her income tax rate is 35%, and she can earn a before-tax real interest rate of 5% per year. If Juliet buys the apartment she plans to keep it forever. What is the “break-even” annual rent such that Juliet would buy the apartment if the rent exceeded this amount?Answer:Real after-tax rate = 0.65 x 0.05= 0.0325 (or 3.25%)After-tax annual outflow for property taxes each year is 0.65 x $2,000 = $1,300Break-even rent: X/0.035 = $185,000 + $3,100/0.0325X = 0.035($185,000) + $3,100X = $6,012.50 + $3,100X = $9,112.50So the break-even rent is $9,112.50.5.Anton’s retirement goal is to set aside an amount of money each year into a savings accountuntil he retires so that he can withdraw $80,000 each year during his retirement. He expects to retire in thirty years and expects to live for twenty years following his retirement. Anton expects to be able to earn 9 percent per year on his account balance. Calculate the deposit Anton must make for Plan 1 and the amount of the deposit Anton must make for Plan 2.Plan 1: Anton's first deposit will be one year from today and his last deposit will betwenty-nine years from today. He intends to make his first withdrawal thirty years from today.Plan 2: Anton's first deposit will be today and his last deposit will be thirty years fromtoday. He intends to make his first withdrawal thirty one years from today.Answer:Plan 1N I PMT Result__________20 9 $80,000 PV = $730,283.65N I FV Result__________29 9 $730,283.65 PMT = $5,882.96Under Plan 1, Anton must deposit $5, 882.96Plan 2N I PMT Result__________20 9 $80,000 PV = $730,283.65(set to Begin mode)N I FV Result_______31 9 $730,283.65 PMT = $4,479Under Plan 2, Anton must deposit $4,479.6.Your 68 year old mother plans to retire in 2 years, and she expects to live independently for 3years. She wants a retirement income that has, in the first year, the same purchasing power as $60,000 has today. However, her retirement income will be of a fixed amount, so her real income will decline over time. Her retirement income will start the day she retires (2 years from today), and she will receive a total of 3 retirement payments. Inflation is expected to be constant at 6%. Your mother has $100,000 in savings now, and she can earn 9% on savings now and in the future. How much must she save each year, starting today, to meet herretirement goals?Answer:First of all, your mother needs the following payments at age 70-72:Age 70: $67,416Age 71: $71,460.96Age 72: $75,748.62At age 68, the PV of these cash flows = $165,585.90Your mother has already set aside $100,000So to calculate what she has to save:Set calculator to Begin modePV N I/Y Result$65,585.90 2 9 PMT = $34,205.097. A relative of yours has just turned 45 years old and plans on retiring in 15 years on her 60thbirthday. She is saving money today for her retirement and is establishing a retirementaccount with your office. She would like to withdraw money from her retirement account on her birthday each year until she dies. She would ideally like to withdraw $60,000 on her 60th birthday, and increase her withdrawals 10% a year through her 69th birthday (i.e., she would like to withdraw $141,476.86 on her 69th birthday). She plans to die on her 70th birthday, at which time she would like to leave $400,000 to her descendants. Your relative currently has $100,000. You estimate that the money in the retirement account will earn 11% a year over the next 25 years. Calculate how much your relative should deposit each year (at the end of each year).Answer:Between ages 60-70, cash flows look like:Year CF Get the PV of these withdrawals.6060,0006166,006272,600. .. .. .69141,476.9070400,000At age 60, PV = $717,124.72At age 45, PV = $149,882.18Relative already has $100,000Solve:N I PV Result_________15 11 $49,882.18 PMT = $6,936.888.Consider the following retirement plan. Today is January 1 and your employer will make a$100 contribution to your retirement plan at the end of January and this amount will increase by $100 each month through December 31. Thus in February you get $200 and then up to a $1,200 contribution on December 31. Thus at the end of each January, you will alwaysreceive $100 and the end of each December you will always receive $1,200. The employer will continue this contribution pattern for the next 25 years. You expect to receive a 12% quoted yield, compounded monthly, on your investments. How much money will be in your account when you retire?Answer:Determine what the monthly deposits are worth on annual basis:CF0 = 0, CF1= 100, …, CF12 = $1,200NPV = $7,182.38 at start of each year.Determine EFF = 12.68%Set calculator to Begin mode:N I PMT Result_____________25 12.68 $7,182.38 F = $1,198,4879.Assume that you are planning for your financial future and you would like to fund all of yourfinancial needs by making monthly payments into an account that will pay 10 percent,compounded monthly. You plan to make these monthly payments for a total of 30 years with the first payment to be made one month from today. How much should your monthlypayments be?You need to use the following information:You have promised your partner that you will take a trip to Europe 3 years from today.a)You estimate that the trip will cost $10,000.b)You will retire in 30 years. If you could retire today you estimate that you wouldneed sufficient funds to purchase a 15 year fixed payment annuity that would pay$50,000 per year with the first payment to be received one year after you retire. Youassume that the price you will have to pay for the annuity will be based on an interestrate of 8.5 percent.Due to inflation, you estimate that the amount of the required annual annuitypayment will increase by 4 percent per year until the date you receive the firstpayment, but the annuity payment will remain fixed once you purchase the annuity.c)Your parents have promised to give you a piece of real estate in 5 years and today thereal estate is worth $12,000. You expect that the real estate will increase in value by9 percent per year. You plan to sell the real estate as soon as you receive it and toplace the proceeds in your account.d)You have already saved $15,000, which you will place in your account today.Answer:General strategy: get PV of each of the steps and then determine the monthly payment.Step a: N = 36I = 10/12 = 0.833FV = $10,000PV = $7,417.70Step b: Find FV of payment expected to increase:PV = $50,000, I/y = 4, N = 30, FV = $162,169.88PV at t = 30 of payments (annual compounding)PMT = $162,169.88, N = 15, I = 8.5PV = $1,346,697.05This is the lump sum need at t = 30 to buy the annuity.PV at t = 0 of the retirement annuity cost (monthly compounding)FV = $1,346,697.05, N = 360, I = 0.833PV = $67,886.77Step c: Value of land: FV = $18,463.49PV of land = ?FV = 18,463.49, N = 60, I = 0.833PV = ($11,222)Negative since it reduces the value neededFinally, SUM of all t = 0 present values:$7,417.40 + $67,886.77 + (11,222) + (15,000) = $49,082.17PV = $49,082.17n = 360I = 0.833CPT PMT = $430.73Monthly payment = $430.73。