会计英语作业

会计学英文版作业

a. Cash withdrawal by owner d. Cash g. Prepaid rentb. Office equipment e. Utilities expenses h. Unearned feesc. Accounts payable f. Office supplies i. Service fees earned1-6 The following are common categories on a classified balance sheet.A. Current assets D. Intangible assetsB. Long-term investments E. Current liabilitiesC. Plant assets F. Long-term liabilitiesFor each of the following items, select the letter that identifies the balance sheet category where the item typically would appear.______ 1. Land not currently used in operations ______ 5. Accounts payable______ 2. Notes payable (due in three years) ______ 6. Store equipment______ 3. Accounts receivable ______ 7. Wages payable______ 4. Trademarks ______ 8. Cash1-7 In the blank space beside each numbered balance sheet item, enter the letter of its balance sheet classification. If the item should not appear on the balance sheet, enter a Z in the blank.A. Current assets D. Intangible assets F. Long-term liabilitiesB. Long-term investments E. Current liabilities G. EquityC. Plant assets______ 1. Long-term investment in stock ______ 12. Accumulated depreciation—Trucks ______ 2. Depreciation expense—Building ______ 13. Cash______ 3. Prepaid rent______ 4. Interest receivable ______ 14. Buildings______ 5. Taxes payable ______ 15. Store supplies______ 6. Automobiles ______ 16. Office equipment______ 7. Notes payable (due in 3 years) ______ 17. Land (used in operations)______ 8. Accounts payable ______ 18. Repairs expense______ 9. Prepaid insurance ______ 19. Office supplies______ 10. Owner, Capital ______ 20. Current portion of long-term note payable ______ 11. Unearned services revenue1-8 In the blank space beside each numbered balance sheet item, enter the letter of its balance sheet classfication. If the item should not appear on the balance sheet, enter a Z in the blank.A. Current assets E. Current liabilitiesB. Long-term investments F. Long-term liabilitiesC. Plant assets G. Equity3-2 The adjusted trial balance for Chiara Company as of December 31, 2008, follows.Debit CreditCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,000Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . 52,000Interest receivable . . . . . . . . . . . . . . . . . . . . . . . . 18,000Notes receivable (due in 90 days) . . . . . . . . . . . . . 168,000Office supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,000Automobiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . 168,000Accumulated depreciation—Automobiles . . . . . . . $ 50,000Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138,000Accumulated depreciation—Equipment . . . . . . . . . 18,000Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78,000Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . 96,000Interest payable . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000Salaries payable . . . . . . . . . . . . . . . . . . . . . . . . . . 19,000Unearned fees . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,000Long-term notes payable . . . . . . . . . . . . . . . . . . . 138,000R.Chiara,Capital . . . . . . . . . . . . . . . . . . . . . . . . . 255,800R.Chiara,Withdrawals . . . . . . . . . . . . . . . 46,000Fees earned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 484,000Interest earned . . . . . . . . . . . . . . . . . . . . . . . . . . 24,000Depreciation expense—Automobiles . . . . . . . . . . 26,000Depreciation expense—Equipment . . . . . . . . . . . . 18,000Salaries expense . . . . . . . . . . . . . . . . . . . . . . . . . . 188,000Wages expense . . . . . . . . . . . . . . . . . . . . . . . . . . 40,000Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . 32,000Office supplies expense . . . . . . . . . . . . . . . . . . . . 34,000Advertising expense . . . . . . . . . . . . . . . . . . . . . . . 58,000Repairs expense—Automobiles . . . . . . . . . . . . . . 24,800Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,134,800 $1,134,800Required1. Use the information in the adjusted trial balance to prepare (a) the income statement for the year ended December 31,2008; (b) the statement of owner’s equity for the year ended December 31,2008;and (c) the balance sheet as of December 31, 2008.2. Calculate the profit margin for year 2008.3-3 On April 1, 2008, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company’s first month..April 1 Nozomi invested $30,000 cash and computer equipment worth $20,000 in the business.2 Rented furnished office space by paying $1,800 cash for the first month’s (April) rent.3 Purchased $1,000 of office supplies for cash.10 Paid $2,400 cash for the premium on a 12-month insurance policy. Coverage begins onApril 11.14 Paid $1,600 cash for two weeks’salaries earned by employees.24 Collected $8,000 cash on commissions from airlines on tickets obtained for customers.28 Paid another $1,600 cash for two weeks’salaries earned by employees.29 Paid $350 cash for minor rep airs to the company’s computer.30 Paid $750 cash for this month’s telephone bill.30 Nozomi withdrew $1,500 cash for personal use.The company’s chart of accounts follows:101 Cash 405 Commissions Earned106 Accounts Receivable 612 Depreciation Expense—Computer Equip.124 Office Supplies 622 Salaries Expense128 Prepaid Insurance 637 Insurance Expense167 Computer Equipment 640 Rent Expense168 Accumulated Depreciation—Computer Equip. 650 Office Supplies Expense209 Salaries Payable 684 Repairs Expense301 J.Nozomi,Capital 688 Telephone Expense302 J.Nozomi,Withdrawals 901 Income SummaryRequired:1. Use the balance column format to set up each ledger account listed in its chart of accounts.2. Prepare journal entries to record the transactions for April and post them to the ledger accounts. The company records prepaid and unearned items in balance sheet accounts.3. Prepare an unadjusted trial balance as of April 30.4. Use the following information to journalize and post adjusting entries for the month:a. Two-thirds of one month’s insurance coverage has expired.b. At the end of the month, $600 of office supplies are still available.c. This month’s depreciation on the computer equipment is $500.d. Employees earned $420 of unpaid and unrecorded salaries as of month-end.e. The company earned $1,750 of commissions that are not yet billed at month-end.5. Prepare the income statement and the statement of owner’s equity for the month of April a nd the balance sheet at April 30, 2008.6. Prepare journal entries to close the temporary accounts .7. Prepare a post-closing trial balance.。

会计英语练习题

会计英语练习题会计英语练习题在全球化的今天,学习外语已经成为了必不可少的技能。

对于会计专业的学生来说,掌握会计英语更是至关重要。

会计英语是会计学中的一门专业英语,它涵盖了会计的各个方面,包括财务报表、成本管理、税务等。

为了帮助大家更好地掌握会计英语,下面将提供一些练习题,希望能对大家的学习有所帮助。

1. What is the English term for "资产负债表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings2. Which of the following is not an expense?A. RentB. SalaryC. Accounts ReceivableD. Utilities3. What is the English term for "总账"?A. General LedgerB. Trial BalanceC. Income StatementD. Cash Flow Statement4. What is the English term for "应收账款"?A. Accounts PayableB. Accounts ReceivableC. InventoryD. Prepaid Expenses5. What is the English term for "固定资产"?A. Current AssetsB. Fixed AssetsC. Intangible AssetsD. Accounts Payable6. What is the English term for "净利润"?A. Gross ProfitB. Operating IncomeC. Net IncomeD. Retained Earnings7. What is the English term for "应付账款"?A. Accounts PayableB. Accounts ReceivableC. Accrued ExpensesD. Prepaid Expenses8. What is the English term for "现金流量表"?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Statement of Retained Earnings9. What is the English term for "财务报表分析"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting10. What is the English term for "税务"?A. Financial Statement AnalysisB. Cost AccountingC. TaxationD. Budgeting以上是一些关于会计英语的练习题,希望大家能够认真思考并给出正确答案。

会计专业英语试卷(推荐5篇)

A.withdrawalsB.accounts receivableC.interest payable 6.Which of the following is an assets account?

A.notes missionC.bonds payable 7.Which of the following is an owner’s equity account?

Passage 1

Many rule govern drivers on the streets and highways.The most common one is the speed limit.The speed limit controls how fast a car may go.On streets in the city, the speed limit is usually 25 or 35 miles per hour.On the highways between cities, the speed limit is usually 55 miles per hour.When people drive faster than the speed limit, a policeman can stop them.The policeman gives them pieces of paper which call traffic tickets.Traffic tickets tell the drivers how much they must pay.When drivers receive too many tickets, they probably cannot drive for a while.The rush hour is when people are going to or returning from work.At rush hour there are many cars on the streets and traffic moves very slowly.Nearly al big cities have rush hours and traffic jams.Drivers do not get tickets very often for speeding during the rush hour because they cannot drive fast.1.The most common rule to govern drivers on the streets and highways is _____.A.the traffic lightB.the traffic licenseC.the traffic jamD.th计专业英语试卷(推荐5篇)

会计英语作业 英语

会计英语作业英语Here's a sample of an accounting English assignmentthat meets the given requirements:Accounting, it's like a language of its own. You gotta know the right terms and figures to make sense of it all. Like, "assets" are the things that have value, like cash or equipment. And "liabilities" are what you owe, like loansor unpaid bills.In accounting, everything has to balance out. Like a scale, you have the debit side and the credit side. Whenyou make a sale, it goes on one side, and when you pay for something, it goes on the other. It's all about keepingtrack of where the money's coming from and where it's going.The financial statements are like the snapshots of a company's financial health. You can see how much money they made, how much they spent, and what they own. It's like looking at a person's bank account and credit cardstatements to get a sense of their financial situation.Audits are when someone comes in and checks your accounting books to make sure you're not cooking the books. They'll look at your receipts, invoices, and.。

会计学英语试题及答案

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

会计英语考试题目及答案

会计英语考试题目及答案一、选择题(每题2分,共20分)1. Which of the following is a basic accounting principle?A. The Going Concern PrincipleB. The Historical Cost PrincipleC. Both A and BD. Neither A nor BAnswer: C. Both A and B2. What is the term for the systematic arrangement of accounts in a specific order?A. JournalB. LedgerC. Trial BalanceD. Chart of AccountsAnswer: D. Chart of Accounts3. What does the term "Debit" mean in accounting?A. An increase in assetsB. A decrease in liabilitiesC. An increase in equityD. A decrease in expensesAnswer: A. An increase in assets4. Which of the following is not a type of financialstatement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D. Payroll Report5. What is the purpose of an adjusting entry?A. To update the financial recordsB. To prepare for the next accounting periodC. To correct errors in the accounting recordsD. All of the aboveAnswer: D. All of the above6. Which of the following is an example of a current asset?A. InventoryB. LandC. EquipmentD. Bonds PayableAnswer: A. Inventory7. What is the formula for calculating the return on investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Net Income / Investment) * 100D. (Total Assets / Net Income) * 100Answer: C. (Net Income / Investment) * 1008. What is the accounting equation?A. Assets = Liabilities + EquityB. Liabilities - Equity = AssetsC. Assets + Liabilities = EquityD. Equity + Assets = LiabilitiesAnswer: A. Assets = Liabilities + Equity9. What is the purpose of depreciation?A. To reduce the value of an asset over timeB. To increase the value of an asset over timeC. To calculate the cost of an assetD. To determine the net income of a companyAnswer: A. To reduce the value of an asset over time10. Which of the following is not a function of a general ledger?A. To record daily transactionsB. To summarize financial informationC. To provide a detailed account of each transactionD. To prepare financial statementsAnswer: A. To record daily transactions二、简答题(每题5分,共30分)1. Explain the difference between an asset and a liability. Answer: An asset is a resource owned by a business that hasfuture economic benefit, such as cash, inventory, or property.A liability is an obligation or debt that a business owes to others, such as loans, accounts payable, or salaries payable.2. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specificpoint in time, showing the company's assets, liabilities, and equity.3. Define the term "revenue."Answer: Revenue is the income generated from the normal business operations of a company, such as the sale of goodsor services.4. What is the difference between a journal and a ledger?Answer: A journal is a book that records financialtransactions in chronological order, while a ledger is a book that summarizes and organizes the financial transactions by accounts.5. Explain the concept of accrual accounting.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.6. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to ensure that the total debits equal the total credits in the general ledger, indicating that the accounting records are in balance.三、案例分析题(每题25分,共50分)1. A company purchased equipment for $50,000 on January 1, 2023, with a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: Using the straight-line method, the annual depreciation expense is calculated as follows:Depreciation Expense = (Cost of Equipment - Residual Value) / Useful LifeDepreciation Expense = ($50,000 - $0) / 5 = $10,000 per year2. A company has the following transactions for the month of March 2023:- Sold goods for $20,000 on credit.- Purchased inventory for $15,000 in cash.- Paid $2,000 in salaries.- Received $18,。

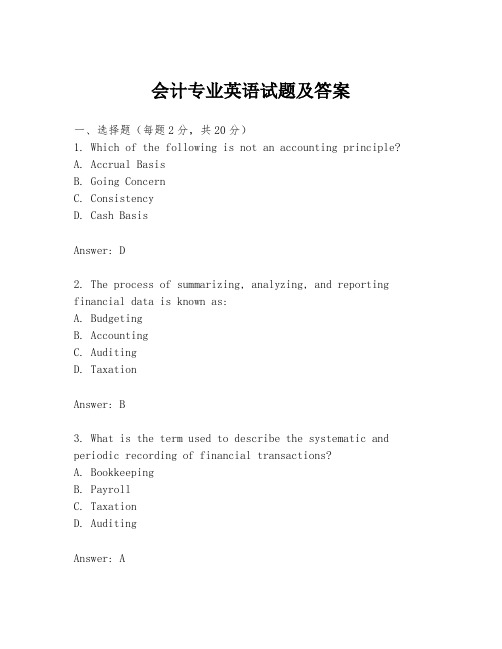

会计专业英语试题及答案

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

会计学英文版作业

a. Cash withdrawal by owner d. Cash g. Prepaid rentb. Office equipment e. Utilities expenses h. Unearned feesc. Accounts payable f. Office supplies i. Service fees earned1-6 The following are common categories on a classified balance sheet.A. Current assets D. Intangible assetsB. Long-term investments E. Current liabilitiesC. Plant assets F. Long-term liabilitiesFor each of the following items, select the letter that identifies the balance sheet category where the item typically would appear.______ 1. Land not currently used in operations ______ 5. Accounts payable______ 2. Notes payable (due in three years) ______ 6. Store equipment______ 3. Accounts receivable ______ 7. Wages payable______ 4. Trademarks ______ 8. Cash1-7 In the blank space beside each numbered balance sheet item, enter the letter of its balance sheet classification. If the item should not appear on the balance sheet, enter a Z in the blank.A. Current assets D. Intangible assets F. Long-term liabilitiesB. Long-term investments E. Current liabilities G. EquityC. Plant assets______ 1. Long-term investment in stock ______ 12. Accumulated depreciation—Trucks ______ 2. Depreciation expense—Building ______ 13. Cash______ 3. Prepaid rent______ 4. Interest receivable ______ 14. Buildings______ 5. Taxes payable ______ 15. Store supplies______ 6. Automobiles ______ 16. Office equipment______ 7. Notes payable (due in 3 years) ______ 17. Land (used in operations)______ 8. Accounts payable ______ 18. Repairs expense______ 9. Prepaid insurance ______ 19. Office supplies______ 10. Owner, Capital ______ 20. Current portion of long-term note payable ______ 11. Unearned services revenue1-8 In the blank space beside each numbered balance sheet item, enter the letter of its balance sheet classfication. If the item should not appear on the balance sheet, enter a Z in the blank.A. Current assets E. Current liabilitiesB. Long-term investments F. Long-term liabilitiesC. Plant assets G. Equity3-2 The adjusted trial balance for Chiara Company as of December 31, 2008, follows.Debit CreditCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,000Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . 52,000Interest receivable . . . . . . . . . . . . . . . . . . . . . . . . 18,000Notes receivable (due in 90 days) . . . . . . . . . . . . . 168,000Office supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,000Automobiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . 168,000Accumulated depreciation—Automobiles . . . . . . . $ 50,000Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138,000Accumulated depreciation—Equipment . . . . . . . . . 18,000Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78,000Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . 96,000Interest payable . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000Salaries payable . . . . . . . . . . . . . . . . . . . . . . . . . . 19,000Unearned fees . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,000Long-term notes payable . . . . . . . . . . . . . . . . . . . 138,000R.Chiara,Capital . . . . . . . . . . . . . . . . . . . . . . . . . 255,800R.Chiara,Withdrawals . . . . . . . . . . . . . . . 46,000Fees earned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 484,000Interest earned . . . . . . . . . . . . . . . . . . . . . . . . . . 24,000Depreciation expense—Automobiles . . . . . . . . . . 26,000Depreciation expense—Equipment . . . . . . . . . . . . 18,000Salaries expense . . . . . . . . . . . . . . . . . . . . . . . . . . 188,000Wages expense . . . . . . . . . . . . . . . . . . . . . . . . . . 40,000Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . 32,000Office supplies expense . . . . . . . . . . . . . . . . . . . . 34,000Advertising expense . . . . . . . . . . . . . . . . . . . . . . . 58,000Repairs expense—Automobiles . . . . . . . . . . . . . . 24,800Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,134,800 $1,134,800Required1. Use the information in the adjusted trial balance to prepare (a) the income statement for the year ended December 31,2008; (b) the statement of owner’s equity for the year ended December 31,2008;and (c) the balance sheet as of December 31, 2008.2. Calculate the profit margin for year 2008.3-3 On April 1, 2008, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company’s first month..April 1 Nozomi invested $30,000 cash and computer equipment worth $20,000 in the business.2 Rented furnish ed office space by paying $1,800 cash for the first month’s (April) rent.3 Purchased $1,000 of office supplies for cash.10 Paid $2,400 cash for the premium on a 12-month insurance policy. Coverage begins onApril 11.14 Paid $1,600 cash for two weeks’sal aries earned by employees.24 Collected $8,000 cash on commissions from airlines on tickets obtained for customers.28 Paid another $1,600 cash for two weeks’salaries earned by employees.29 Paid $350 cash for minor repairs to the company’s computer.30 Pa id $750 cash for this month’s telephone bill.30 Nozomi withdrew $1,500 cash for personal use.The company’s chart of accounts follows:101 Cash 405 Commissions Earned106 Accounts Receivable 612 Depreciation Expense—Computer Equip.124 Office Supplies 622 Salaries Expense128 Prepaid Insurance 637 Insurance Expense167 Computer Equipment 640 Rent Expense168 Accumulated Depreciation—Computer Equip. 650 Office Supplies Expense209 Salaries Payable 684 Repairs Expense301 J.Nozomi,Capital 688 Telephone Expense302 J.Nozomi,Withdrawals 901 Income SummaryRequired:1. Use the balance column format to set up each ledger account listed in its chart of accounts.2. Prepare journal entries to record the transactions for April and post them to the ledger accounts. The company records prepaid and unearned items in balance sheet accounts.3. Prepare an unadjusted trial balance as of April 30.4. Use the following information to journalize and post adjusting entries for the month:a. Two-thirds of one month’s insurance coverage has expired.b. At the end of the month, $600 of office supplies are still available.c. This month’s depreciation on the computer equipment is $500.d. Employees earned $420 of unpaid and unrecorded salaries as of month-end.e. The company earned $1,750 of commissions that are not yet billed at month-end.5. Prepare the income statement and the statement of owner’s equity for the month of April and the balance sheet at April 30, 2008.6. Prepare journal entries to close the temporary accounts .7. Prepare a post-closing trial balance.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Exercises for Unit TwoMultiple ChoicesA1. Which of the following users are not external users of accounting information?A. ManagersB. CreditorsC. InvestorsD. AnalystsD2. Which of the following is not an accounting standard-setting organization?A. FASBB. IASBC. MOFD. GAAPC3. The diversity of interested parties leads to a logical division in the discipline of accounting: financial accounting and _______.A. cost accountingB. financial managementC. managerial accountingD. tax accountingD4. CPAs provide services of the following except ________.A. auditB. consultingC. taxD. holding examination A5. Which of the following service involves providing an independent report on the appropriateness of financial statements?A. AuditB. TaxC. ConsultingD. BudgetingD6. Accountants employed by large corporations may work in the areas of the following except _______.A. product costing and pricingB. budgetingC. internal auditingD. product producingB7. ______ information is trusted by users. ______ information is helpful in contrasting organizations.A. RelevantB. ReliableC. ComparableD. SeparateA8. The ______ assumption assumes that a business will continue in the same lines of the business as those in which it is currently involved.A. Going-concernB. accounting periodC. accounting entityD. monetary unitB9. The ______ assumption assures that accounting information is reported at regular intervals.A. Going-concernB. accounting periodC. accounting entityD. monetary unitB10. The purpose of ______ principle is to allow meaningful inter-period comparison of an entity.A. matchingB. consistencyC. materialityD. conservatismTrue-FalseT 1. Accounting is a set of concepts and techniques that are used to measure and report financial information about an legal unit.T 2. Business managers need accounting information to make sound leadership decisions.F 3. Managerial accounting is primarily concerned with providing information to parties outside the firm.F 4. External users control the actual preparation of financial reports and do not rely on CPA’s opinion on financial reports.T 5. Investors and creditors place great reliance on financial statements in making their investment and credit decisions.F 6. Code of ethics can resolve all problems of accounting ethics.T 7. If a department in one store has its own accounting system and records transactions with other department, then it is an accounting entity.T8. Financial statements are presented in the currency of the country where an entity operates.T9. The value of money is constant over time.T10. The historical cost has an important advantage over other valuations: it is reliable. F11. Companies account for liabilities on a cost basis.T12. If accounting procedures are changed, the fact of the change and its effect on reported result are supposed to be disclosed in the financial statements.T13. In general, expenses are not recorded as soon as they become probable.After several months of planning, Jasmine Worthy started s haircutting business called Expressions. The following events (next page) occurred during its first month of business. Indicate the effect of each transaction on the accounting equation, using the following tabular headings.a. On August 1, Worthy invested $3,000 cash and $15,000 of equipment in Expressions.b. On August 2, Expressions paid $600 cash for furniture for the shop.c. On August 3, Expressions paid $500 cash to rent space in a strip mall for August.d. On August 4, it purchased $1,200 of equipment on credit for the shop (using a long-term note payable).e. On August 5, Expressions opened for business. Cash received from haircutting services in the first week and a half of business (ended August 15) was $825.f. On August 15, it provided $100 of haircutting services on account.g. On August 17, it received $100 check for services previously rendered on account.h. On August 17, it paid $125 cash to an assistant for hours worked during the grand opening.i. Cash received from services provided during the second half of August was $930.j. On August 31, it paid a $400 installment toward principal on the note payable entered into on August 4.k. On August 31, Worthy made a $900 cash withdrawal from the company for personal use.a.$3,000 $15,000 $18,000 investmentb.-$600 $600 expenses c,-$500 -$500 expenses d, $1,200 $1,200 expenses e,$825 $825 revenue f$100 $100 revenue g $100-$100 revenue h,-$125-$125 expenses i$930$930 revenue j-$400-$400 expenses k,-$900-$900 withdrawal $2330 + $0 + $600 + $16200 = $675 + $18455 Cash Furniture J. Worthy,+ == + Explanation of changein equity Equipment + + Note Payable Assets Liabilities Owner’ s Equit y。