亚太地区房地产信托基金(REIT)调查报告36页

房地产信托投资基金(REITs)双重课税问题研究

房地产 投资信托基金( Re a l E s t a t e I n v e s t me n t Tr u s t , 以下 为 。 简 称RE I T s ) 是一种 由投资 者将资金 交于专 业机构管 理 , 再 由机 ( 三) 双 重课 税 。针对REI T s 的双重 课税 , 主要表 现为 : 在设 构将 资金 投资 于出租性 房地 产进 而产生 稳定收 益 , 并将 收 益 以 立 阶 段 , 受 托人 需 要 缴 纳包 括 契税 、 印花税 等 在 内 的一 笔税

●

摘要 : E E I T s 是一种 由委托人 通过 发行 凭证 , 汇 集一 定数量 的资金 , 投 资管理 房地产 并将 所获 收益 返还投 资者 的投 资 基金 。P  ̄ E I T s 是 我 国未来房地产 融资 的重要 发展 方向 , 其在 国际上 已经成 为房地 产融 资的重要途 径。然 而, 按照我 国 现行 税收 法律体 系, 极 易导致对P  ̄ E I T s 的双重课 税 , 降低g E I T s 的经济 竞争 力。因此 , 研 究我 国R E I T s 双重课 税的产 生根 源, 探 索解 决路 径 , 就是E E I T s 不 可回避 的一 个课题 , 更是 推进 其早 日面世 的必 然要 求 关键词 : 房地 产信托投 资基金 ; , 但 双重 课税 问题却 是其 难 以真 正面 市 的 但 却存在多 次征税 的 问题 。

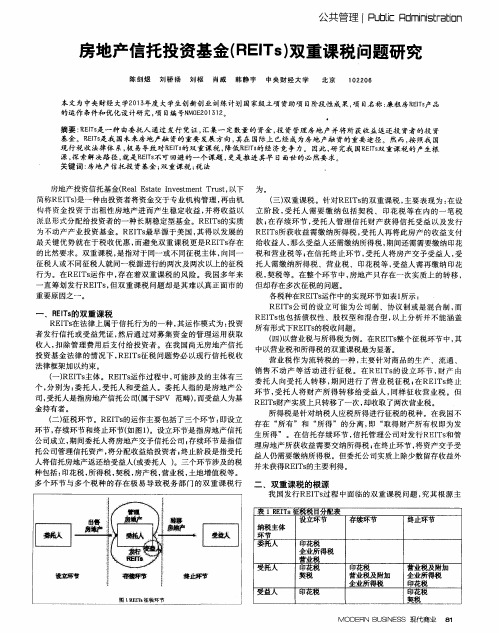

各税种在RE I T s 运作 中的实 现环 节如表 1 所示 :

重 要原因之一 。

一

RE I Ts 也包 括债 权性 、股权 型和 混合型 , 以上分析 并 不能涵 盖 RE I Ts 在法律 上属于 信托 行为的一 种 , 其运作 模式为 : 投资 所有形 式下RE I Ts 的税收 问题 。 者 发行信 托或受 益凭证 , 然后 通过对 募集 资金 的管理 运用 获取 ( 四) 以营 业税与所 得税为例 。在RE I T s 整 个征税环节 中, 其 收入 , 扣 除管 理费 用后支 付给 投资者 。在 我国 尚无房地 产信 托 中以营业税 和所得税 的双 重课税最为显著 。 投资基 金法 律 的情 况下 , RE I T s 征 税 问题 势必 以现 行信 托税 收 营 业税 作为 流转税 的一 种 , 主 要针对 商 品的生 产 、流通 、 法 律框架加 以约束。 销 售 不动 产 等 活 动进 行 征 税 。在 REI Ts 的设 立 环 节 , 财 产 由 ( 一) RE I T s 主 体。RE I Ts 运作过 程 中, 可能 涉及 的主体有三 委 托人 向受 托 人转 移 , 期 间进行 了营 业税 征税 , 在 RE I T s 终 止 个, 分别 为 : 委托人 , 受托 人和受 益人 。委托 人指 的是房 地产公 环节 , 受 托人 将财 产所 得 转移 给受 益人 , 同样 征 收营业 税 。但 司, 受托人 是指房地产信托 公司( 属于S P V 范畴) , 而受益人为基 R E I Ts 财 产实质上只转移 了一次 , 却收取了两次营业税 。 金持有者 。 所得税 是针对纳 税人应税 所得进 行征税 的税 种 。在 我国不 ( 二) 征税环 节 。RE I Ts 的运作 主要包括 了三个环 节 : 即设立 存在 “ 所有 ”和 “ 所得 ”的分 离 , 即 “ 取得 财产所有 权 即为发 环节 , 存续环节 和终止 环节 ( 如 图1 ) 。设立环 节是指 房地产 信托 生 所得 ” 。在信 托存 续环节 , 信托 管理公 司对 发行RE I T s 和 管 公司成 立 , 期间委托人 将房地产 交予信托 公司 , 存续环节 是指信 理房 地产所 获收益需要 交纳所得税 ; 在 终止环节 , 将资产 交予受 托公司 管理信托 资产 , 将分配收 益给投资者 ; 终 止阶段是 指受托 益 人仍需要 缴纳所得税 。但委 托公司实质上 除少数 留存 收益外 人将信托房地产 返还给受益人 ( 或委托人 ) 。三个环节涉 及的税 并未 获得R E I Ts 的主要利得 。 种包括 : 印花税 , 所得 税 , 契税 , 房产税 , 营业税 , 土地 增值税 等。

reit指数

reit指数REIT指数是指房地产证券化(REITs)所组成的指数,是投资者用来跟踪一定数量的REIT证券的指标。

REITs全部投资于房地产,是一种房地产资产的间接投资方式。

REIT指数包括全球REIT指数、亚洲REIT指数等。

本文将着重介绍REIT指数的定义、组成、特点和投资风险。

一、REIT指数概述房地产投资信托基金(REITs)被视为是一种非常成功的房地产证券化工具,它以房地产为基础来进行投资,以生产的租金作为回报。

房地产投资信托基金是由一系列权益证券组成的一种投资基金,这些权益所对应的房地产也被称作“资产组合”。

在买入某个REIT证券时,投资者实际上购买的是该证券所代表的物业的一部分所有权。

REIT市场的规模因国别、地域和资本市场环境因素而异。

REIT证券受当地政府监管,因此,投资者可以放心地进行投资而不必担心监管方面的问题。

REIT指数是根据REIT证券的组成、价格和市值计算出来的,每只基金重点关注某一特定地区和特定类型的房地产证券,由于REIT资产的性质,使得REIT指数通常被视作是收益稳定、资本增值低的投资。

二、REIT指数的组成REIT指数通常包括两种类别的证券:权益证券和负债证券。

权益证券是REIT的股票证券,负债证券包括债券和银行贷款等证券。

REIT证券的组成也有多种类型,如商业地产、酒店、办公楼、住宅和医疗设施等。

根据地理位置的不同,REIT证券也可以被归为国际、亚洲、日本和欧洲等类型。

三、REIT指数的特点1、稳定的收益REIT指数受到房地产价格的影响,通常具有比较稳定的现金流回报,因此收益较为稳定。

同时,REIT证券往往具有较低的风险系数,这使得它成为一种非常受欢迎的长期投资资产。

2、高的分配率REIT指数的另一特点是具有非常高的资本回报水平。

由于REIT证券的收益往往由租金、利润和其他收入构成,因此它可以为投资者提供高分红率。

具体到某些REIT指数,其分配率往往超过了5%。

房地产信托基金reits分类

房地产信托基金reits分类房地产信托基金(REITS)是一种被广泛使用的投资工具。

REITs 允许投资者通过购买REIT的股票来持有不动产投资组合,这使投资者能够轻松地在房地产市场中分散风险并获得收益。

根据不同的市场和国家,REITs可以基于不同的分类方法进行划分,下面将对REITs的分类进行详细解释。

第一类:按业务领域划分按业务领域划分,REITs可以分为不同的类型,如商业地产(如购物中心和办公楼)REIT,住房地产REIT和健康保险REIT等。

商业地产REITs在商业房地产领域内收益最高,同时也是REITs的主要来源。

住房地产REITs则投资于公寓,房屋和其它住宅类型。

健康保险REITs投资于医院和诊所的房产。

第二类:按地理位置划分REITs按其在特定地理位置上所投资的房产类别划分为区域性和全国性。

全国性REITs投资于全国范围内的不动产,而区域性REITs 则只投资于一个特定地区的不动产。

区域性REITs的优势在于,投资者可以获得更深入的了解该特定地区市场的信息。

第三类:按资本结构划分按资本结构划分,REITs有进一步的分支,包括股权REITs和抵押REITs两大类,分别重点关注于不同的投资策略。

股权REITs是指通过购买并持有房地产来产生收益。

抵押REIT在资本市场募集资金,然后通过购买抵押贷款来赚取收益。

第四类:按收益分配结构划分按照收益分配结构划分,REIT的分类方法包括传统的资本化收益(通过房地产租赁收益分配股利)和收益支付(除了股利,还有普通股)两种类型。

每种类型的REITs的利润来源略有不同,股息收益来自于租赁,而收益支付的主要来源是资本利得。

综上所述,REITS是一种非常重要的投资工具,在房地产市场中发挥着至关重要的作用。

根据不同的细节要求,REITs可以根据业务领域、地理位置、资本结构和收益分配结构等因素进行分类。

通过仔细研究和理解REIT的分类,投资者可以更好地了解他们的风险和收益特点,从而更好地制定投资策略并获得更高的回报。

房地产投资信托基金

房地产投资信托基金通过REITs融资的优势REITs国际运行模式的比较房地产投资信托进展意义我国引入房地产投资信托基金有着非常重要的作用。

再次,引入房地产投资信托基金有助于疏通房地产资金循环的梗阻。

房地产投资信托基金的引入,能够避免单一融通体系下银行有关政策对房地产市场的硬冲击,减缓某些特定目的的政策对整个市场的整体冲击力度,有助于缓解中国金融体系的错配矛盾。

房地产的固有特性决定了房地产投资信托基金具有保值增值的功能,因此房地产投资的收益相对比较稳固。

REITs与国内通常意义上的房地产信托有很大的差别第二,REITs对投资者的回报需要把收入的大部分分配给投资者,比如美国、香港要求把所得利润的95%分配给投资者;国内的房地产信托计划对投资者的回报为信托计划方案中的协议回报,目前通常在3%-9%左右。

第三,REITs的运作方式是:负责提供资金并组建资产管理公司或者经营团队进行投资运营;国内的房地产信托计划的运作方式是:提供资金,监管资金使用安全,或者部分或者局部参与项目公司运作获取回报。

第六,国内的房地产信托概念较为宽泛,能够是REITs模式,也能够是贷款信托、优先购买权信托、财产权信托、受益权转让信托等等。

我国建立REITs的进展政策建议1、加快有关政策与法律法规制定2、加快房地产信托专门人才的培养4、建立信托企业信用制度房地产信托的定义房地产信托的进展房地产信托的性质房地产信托经营业务内容较为广泛,按其性质可分为:房地产信托的基本条件资金是房地产信托投资机构从事信托的基本条件。

房地产信托机构筹集资金的渠道与方式与银行不大一样,要紧来源有:房地产信托的种类根据资金投向的不一致,REIT可分为三类:房地产信托的运作流程房地产信托的运作流程基本上能够分为两种模式:一种是美国模式,另一种是日本模式。

这两种模式说到底就是资金信托与房地产资产信托的区别,由于各自的国情不一致,美国比较侧重于资金信托型REIT,而日本侧重于房地产资产信托型REIT。

不动产投资信托基金

运行模式

2003年7月,香港证券和期货事务监察委员会(香港证监会)颁布了《房地产投资信托基金守 则》,对REITs的设立条件、组织结构、从业人员资格,投资范围、利润分配等方面作出了明确 的规定。香港在很大程度上借鉴了美国REITs的结构,以信托计划(或房地产地产公司)为投资实 体,由房地产地产管理公司和信托管理人提供专业服务。

发展意义

发展意义

中国引入不动产投资信托基金有着非常重要的作用。 首先,引入不动产投资信托基金有利于完善中国房地产金融架构。房地产信托投资基金在国外既 参与房地产一级市场金融活动,也参与二级市场活动,是房地产金融发展的重要标志,也是促进 房地产金融二级市场的重要手段。房地产信托投资基金直接把市场资金融通到房地产行业,是对 以银行为手段的间接金融的极大补充。因此,推出不动产投资信托基金,将大大地提高房地产金 融的完备性,是房地产金融走向成熟的必然选择。 其次,引入不动产投资信托基金有助于分散与降低系统性风险,提高金融安全。从房地产金融的 角度来看,引进具有市场信用特征的房地产信托基金,将一定程度提高房地产金融当期的系统风 险化解能力,提高金融体系的安全性。 再次,引入不动产投资信托基金有助于疏通房地产资金循环的梗阻。

发展政策

1

法律体系

2

人才培养

3

道德风险

4

信用制度

5

披露制度

法律体系

房地产投资信托(REITs)作为一种新的房地产投资工具,是一个需要房地产业和金融业相结合的 市场配置资金的投资产品,需要建立完善的法律体系,保证和维持整个市场的公平、公正、公开 和透明,进而推进房地产投资信托业健康、理性地发展。要建立完善的法律体系,仅仅只颁布单 一的《信托法》、《投资基金法》是远远不够的。必须将法律制定工作细化、完备化,要达到此 目标还必须配备一些其他的相关法规。首先应进一步完善《公司法》或制定专门针对投资基金发 展的《投资公司法》、《投资顾问法》等法规。其次,还可制定一些不动产投资信托基金的专项 管理措施,如对投资渠道、投资比例的限制等等。使中国的不动产投资信托基金从一开始就以较 规范的形式发展。另外,还需对税法进行改革,避免双重征税问题,为其发展创造良好的税收环 境。

探究我国房地产信托投资基金(REITs)运营模式

探究我国房地产信托投资基金(REITs)运营模式师瑞斌(东万共创(平潭)投资管理有限公司,北京100026)摘要:房地产信托投资是当前国际上的一种主流房地产市场交易模式,其对于增强房地产市场资本流通,扩大市场交易规模具有重要意义。

在这一方面,我国的发展则相对较晚,但却给了我国更多时间去研究国外的发展情况。

本文对房地产信托投资基金以及概念厘定进行了分析,进而结合国际上的REITs模式对我国在这一方面的发展提出了相关措施。

关键词:房地产信托;信托投资;房地产市场中图分类号:F293.3;F832.49文献识别码:A文章编号:2096-3157(2020)27-0072-03—、弓I言房地产作为一个重要的经济产业,对社会整体经济发展有着极大带动作用。

我国是一个人口基数十分庞大的国家,在近年来城市化建设进程不断推进的情况下,城市人口数量激增,这就使我国拥有庞大的房地产市场需求。

因此,我国改革开放之后的房地产事业发展极为迅猛,房地产更成为我国多年来国民经济持续增长的重要支撑点。

但在房地产业不断发展的同时,我国房地产业的发展模式也亟待进行优化完善。

在国际房地产投资市场上,信托投资是一个十分先进的投资形式,且在许多国家中证实了其对房地产金融市场发展的积极促进作用。

对此,在我国房地产市场的发展中,将这一投资形式引入房地产行业中,可以进一步健全我国房地产市场上的金融运作模式,刺激房地产市场的更高层次演进。

因此,在我国房地产业蓬勃发展的当下,加强信托投资基金(REITs)运营模式的研究就显得尤为关键。

二、房地产信托投资基金(REITs)概述就房地产投资而言,其本身具有较低的流动性,这在市场化运行过程中明显无法形成旺盛的市场活力。

而房地产信托投资基金(REITs)则为房地产投资提供了一种证券化的手段。

具体而言,房地产信托投资实际上就是利用公开发行股票、受益凭证等来募集投资者的资金,再通过专业化房地产投资或房产抵押贷款投资信托来将房地产投资证券化,使得房地产投资可以直接进入资本市场,进行各种证券资产形式的金融交易。

中国所有reits 表格-概述说明以及解释

中国所有reits 表格-范文模板及概述示例1:中国的REITs(房地产投资信托)市场在过去几年里迅速发展,提供了一种新的投资方式供投资者参与中国房地产市场。

REITs是一种基于房地产收益的证券品种,通过将不动产转换为可以交易的份额,为投资者提供了分散风险和流动性的机会。

它们对于想要投资房地产项目却没有足够资金或经验的个人投资者来说特别有吸引力。

REITs在中国的发展可以追溯到2014年,当时国家开始试点探索这一投资工具的可行性。

REITs的引入被视为一种提高房地产市场流动性、促进市场发展以及吸引更多资本投入的方式。

迄今为止,中国已经发展出多种类型的REITs,覆盖了不同的资产类别,包括商业地产、住宅、工业园区等。

下面是一些目前在中国市场上可用的REITs的列表:1. 金融街商业地产投资信托(FTREIT):成立于2015年,是中国目前最大的REITs之一。

它在中国资本市场上很受欢迎,提供了对北京金融街地区商业不动产的投资机会。

2. 中国金茂存量REITs:这个REITs由中国金茂集团于2019年发起,并在上海证券交易所挂牌交易。

它持有的资产包括商业地产、酒店以及其他不动产。

3. 龙湖存量REITs:随着龙湖地产于2019年推出的REITs,这个REITs 主要投资于龙湖地产持有的一些商业地产项目。

4. 恒大商业REITs:这是中国恒大地产集团于2020年设立的REITs,旨在为投资者提供对其持有的商业地产的投资机会。

5. 佳兆业商业地产信托(GLP J-REITs):这是一种由佳兆业物流地产公司设立的REITs,目前它在中国内地的物流园区有着广泛的投资。

这些只是中国市场上可用的一些REITs的例子。

它们提供了一种多样化的投资选择,允许投资者以较小的金额参与中国房地产市场,并受益于房地产收益的增长。

然而,投资者在购买REITs之前应该认真研究和评估每个REIT的回报风险特征以及市场前景。

总之,中国的REITs市场为投资者提供了多样化和流动性的投资选择。

24185628_2020_亚洲房地产投资信托基金(REITs)_研究报告

2020亚洲房地产投资信托基金(REITs)研究报告亚洲REITs市场发展迅速,在过去10年,除2020年外,年均保持20%的增幅,总市值达2814亿美元。

文 / 戴德梁行 中国房地产业协会戴德梁行与中国房地产业协会连续第五年发布《亚洲房地产投资信托基金(REITs)研究报告》。

本期报告介绍了2020年亚洲各地区REITs市场的最新发展情况及中国香港、新加坡持有内地资产分析,以及国内不动产资产证券化产品的市场表现,并且重点分析了海外基础设施REITs市场,以及新加坡丰树物流信托的案例。

本文就亚洲各地区REITs市场发展及表现情况进行解读。

亚洲REITs市场概览相比于美国,亚洲REITs市场起步较晚,直到2001年,日本首支REITs才正式发行上市。

但亚洲REITs市场发展迅速,在过去10年,除2020年外,年均保持20%的增幅。

根据戴德梁行统计,截至2020年12月31日,亚洲市场上共有185支REITs,总市值达2814亿美元,较2019年末市值下跌约5%。

目前,亚洲范围内已有近10个国家或地区发行有REITs产品,但仍主要集中于日本、新加坡、中国香港三地,合计占亚洲整体市场份额的89%。

其中78只是包含多种物业类型的综合型REITs。

其次为办公、工业/物流和零售物业REITs,分别为28、24和23只。

除此之外,酒店、公寓、医疗健康和数据中心领域的REITs则分别占18、9、4和1只。

受2020年新型冠状病毒(COVID-19)影响,全球金融市场经历较大波动,亚洲REITs市场也不例外,市场整体市值有所回落。

日本REITs市场受疫情和东京奥运会推迟的双重影响,2020年全年REITs股价整体下降9%,回升速度滞后于股票价格的回升,下半年随着一批J-REITs纳入富时全球股票指数,海外投资者成为J-REITs的净买入主力。

截至2020年12月31日,日本共有62只REITs,总市值约1,394亿美元,占据了亚洲REITs市场过半市值,为亚洲规模最大的REITs市场,亦是全球第二大REITs市场。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

asia-pacific reit survey J UNE 2010Results of a benchmark surveyof senior property professionalsto understand perceptions ofthe REIT markets in Asia-Pacific.2 | Asia-Pacific REIT Survey 2010welcome to the fourth edition of the Asia-Pacific REIT Survey.For the 2010 edition, The Trust company is delighted to partner with Asia-Pacific’s leading law firm, Baker & mckenzie. This year, Baker & mckenzie have provided the country analysis section withdescriptions of the regulatory and investment regime for REITs in each of the 13 markets.we would like to take this opportunity to thank all those who took the time to complete the survey. This year we had over 140 respondents, up 37% on last year. combined with the results of the previous years, their responses form the basis of the insights and trends that we share with you in this publication.In our last REIT Survey published in February 2009, we discussed the 3-R challenge; Refinancing, Recapitalisation and Revaluation. In the past 12 months, we certainly saw significant recapitalisation with over US$58.5bn 1 in global equity raised. In the Asia-Pacific, the largest REIT recapitalisations were in Australia (US$9.5bn 2) and Singapore (US$3.3bn). however, those REITs that were able to recapitalisetended to be the larger ones such as westfield (US$1.9bn), Stockland (US$1.4bn), capitaLand (US$1.2bn), gPT group (US$1.2bn) and goodman (US$0.9bn). Unfortunately, many smaller REITs remain mired in debt negotiations as we continue to move through the recovery phase.So what has happened to the Asia-Pacific REIT markets? There has been a dramatic change in the short-term outlook for REITs compared to a year ago. In the 2010 survey, 47% of respondents predictcompanies will increase the size of existing REITs compared to 27% last year and 20% of respondents expect additional REITs will belaunched which is a 17% increase on 2009. we have seen real evidence of this with the IPo of the cache REIT on the Singapore Exchange in April 2010, the first new REIT IPo since december 2007, and more innovative moves such as the dual listing of the Fortune REIT in Singapore and hong kong.After the lows of 2009, REIT markets across Asia-Pacific are starting to recover, although they remain a long way below the highs of the period between 2001 and mid-2008, where the size of the Asia-Pacific REIT market grew a multiple of 40 times.In terms of threats to REITs, it is interesting that each year a different threat has come out on top. This year, adverse taxation developments (71%) are rated as the biggest threat to the future of REITs ascompared to financial engineering (69%) in 2009. In our 2008 survey, low yields were seen as the biggest threat (63%).overall, the REIT sector can justifiably feel that the “worst may be over”. The reduction in REIT debt levels have created some breathing room, with rewards coming via higher share prices and improved levels of volatility compared to the broader market.however, we know that there is still some way to go before we can declare the recovery is complete. The next 12 months are likely to go a long way towards defining the future of the Asia-Pacific REIT market.wELcomE 3ABoUT US4BAckgRoUnd To SURvEy 5RESPondEnTS PRoFILE 6SURvEy RESULTS8coUnTRy SUmmARy And LEgAL UPdATE 20conTAcT US34WelcomecoNteNts1. Source: EPRA, nAREIT, RealPac & cohen & Steers2. Source: EPRA, nAREIT, RealPac & cohen & SteersThe Trust company and Baker & mckenzie | 3Milton Cheng PartnerAsia Pacific REITs Practice group Leader Baker & mckenzieJohn Atkinchief Executive officer The Trust company4 | Asia-Pacific REIT Survey 2010ABOUT THE TRUST COMPANYwhen it comes to corporate trustee services, it’s often difficult to know who to choose, or even where to start looking. That’s where we come in.we’re the only corporate trustee licenced to providecorporate trustee services in both Australia and Singapore. This allows us to build bespoke products, fashioned to suit the subtleties of businesses in each region – and your business in particular. granted we don’t know you (yet) but we’re sure to know someone in a position not dissimilar to yours. Someone who has already benefited from the experience, ingenuity and genuine local knowledge of our dedicated teams.we believe that there’s no substitute for experience. And with 125 years of financial expertise, which includes 55 years providing corporate trust services, we at The Trust company are one of the most experienced trustees in the Asia-Pacific. currently, we’re custodians of global assets totalling in excess of AUS$116 billion.we’ll be your:• T rustee for any type of collective investment scheme • C ustodian and cash administrator for wholesale, private or exempt property funds • Debenture/ bond trustee • Security trustee • Escrow agentabout usABOUT BAkER & MCkENziEBaker & mckenzie has provided sophisticated legal advice and services to many of the world’s most dynamic and global organisations for more than 60 years. we have the knowledge and resources to deliver the broad scope of quality legal services required to respond effectively to both international and local needs – consistently,confidently and with sensitivity for cultural, social and legal practice differences.As one of the first international law firms to recognise the importance of the Asia-Pacific, Baker & mckenzie has been assisting clients operating throughout the region for more than 40 years.we are one of the largest law firms in Asia, with more than 1,100 lawyers spanning 14 offices. As part ofBaker & mckenzie’s global network of 3,900 locally qualified, internationally experienced lawyers in 39 countries, each office and member firm provides a full spectrum of legal services to a range of clients. we areable to bring the right team of lawyers to best serve clients’ needs.our Asia-Pacific practice comprises full service offices located in Bangkok, Beijing, hanoi, ho chi minh city, hong kong, a correspondent firm in jakarta, kuala Lumpur,manila, melbourne, Shanghai, Singapore, Sydney, T aipei and T okyo. In India and South korea, we have longstanding relationships with respected firms and regularly engage them to provide full regional coverage to meet our clients’ needs.The Baker & mckenzie’s Asia-Pacific REITs group has been at the forefront of ground-breaking REIT transactions in Asia. The team has acted on almost all of the significant transactions to date involving REITs listed or with assets in hong kong and has also advised on other significant REIT-related deals across Asia-Pacific and Australia.bacKGrouNDIn order to develop a better understanding of the REIT market in Asia-Pacific and local nuances in each country, The Trust company undertook an inaugural survey of key stakeholders in 2007. This is the fourth issue of theAsia-Pacific REIT Survey with the results comparedyear-to-year to highlight changes over time.This survey seeks to ascertain their views on the following specific areas:1. P roperty market growth: which countries offer the best prospects for growth?2. m arket growth: which markets offer the best prospects for growth of REITs?3. R EIT opportunities: which countries offer the best opportunity for REITs?4. o verall REIT potential: what is the overall rating for each country after combining the results of the 3 measures?5. R egulatory support: how supportive is the regulator to new REITs in each country?6. R EIT outlook: what is the greatest threat to REITs, and what does the future of REITs look like?The Trust company is delighted to be partnering with Baker & mckenzie for this year’s survey. Baker & mckenzie have provided the country summary and legal update. This is a succinct update of the current REIT legislation, along with their perspective on issues affecting that particular market.NEw SURvEY ENTRANTSThis year we have introduced Thailand and the Philippines into the Asia-Pacific REIT Survey. SURvEY METHOdOlOgYmembers of the property community were invited byemail to participate in the survey. This email contained aURL to an on-line survey tool, with an individual login and password for security and to protect individual respondent confidentiality.The on-line survey was undertaken by Latham consulting,a Sydney based performance management consultancy between 28 january and 8 march 2010.dATA iNTERPRETATiONThe survey questions used a 5-point rating scale where 1and 2 equal a negative rating, 3 equals a neutral rating and4 and5 equal a positive rating.For easy interpretation a colour code system has beenused in some graphics, where orange highlights a negative rating, purple highlights a neutral rating and blue highlightsa positive rating.In order to monitor changes in the REIT market outlookover time, we have compared the results year-on-year.For the purpose of the results the research in each yearwas taken at the following times:• 2007: 4 December 2006 and 19 January 2007• 2008: 20 November 2007 and 16 December 2007• 2009: 16 October and 10 November 2008Rating indexPositive neutral negativeThe Trust company and Baker & mckenzie | 56 | Asia-Pacific REIT Survey 2010respoNDeNtsOther 3%Malaysia 4%Philippines 3%A total of 140 respondents completed the survey which represents an increase of 37% compared to 2009.The quality of the final sample continues to improve year-on-year. This year’s sample represents 114 companies with 96% of the sample residing in or have resided in Asia. 69% of the respondents are professionals working in the property industry, with 60% working for international companies.The profile of the respondents is similar to previous years. key points regarding the sample are outlined below.Country of residenceTime in AsiaNationalityLess than a year 1%Do not work in Asia 4%American 3%Filipino 2%RolePropertyowner 8%The Trust company and Baker & mckenzie | 78 | Asia-Pacific REIT Survey 20101. wHiCH MARkET OffERS THE BEST PROSPECTS fOR gROwTH Of REiTs?Respondents were asked to rate each REIT market on their growth prospects.market growth prospects have improved across all sectors by 8% from a low of 46% in 2009.Infrastructure is still rated as the best prospect for growth with Retail rated as a close second (57%).Residential has shown the biggest increase in growthprospects, up 19% to 55%, its highest level since the survey began. hospitals have shown the biggest decline from number 2 in 2009 to number 5 this year.hotels are the least favoured sector of the REIT market at 48% with only 35% of respondents rating them positively.102030405060708090100HotelsIndustrial Hospitals Commercial OfficeResidentialRetail Infrastructure 2007 2008 2009 2010survey resultsThe Trust company and Baker & mckenzie | 92. wHiCH PROPERTY MARkETS OffER THE BEST PROSPECTS fOR gROwTH?Respondents were asked to rate each country on their property market growth prospects.Property market growth prospects have improved by 7% across the region to 50% from a low of 43% in 2009. These results demonstrate growth prospects are recovering to pre-gFc levels of 59%.china remains the best growth prospect with a rating of 68% and 81% of respondents rating it positively. Australia has demonstrated the biggest growth in the region with an increase of 20% on 2009 levels.new entrants Thailand and the Philippines, along with japan are seen as the least attractive markets for growth.2007 2008 2009 2010102030405060708090100JapanPhilippinesThailand Malaysia Indonesia Korea T aiwan Hong Kong Vietnam Singapore Australia IndiaChina10 | Asia-Pacific REIT Survey 20103. wHiCH COUNTRiES iN THE ASiA-PACifiC OffER THE BEST OPPORTUNiTY fOR REiTs?Respondents were asked to rate each country on how they felt it offered opportunity for REITs.REIT opportunity prospects have improved across the region by 6%. Although sentiment has not recovered to pre-gFc levels, indications are positive sentiment is increasing.Singapore retains its number 1 position (60%) in terms of REIT opportunity; however this is still down from itshistorical highs in 2007. Australia is a close number 2 (59%) with a massive 20% increase since 2009.new entrants Thailand and the Philippines, along with vietnam and Indonesia are the least attractive.102030405060708090100RegionalIndonesiaThailand Vietnam Philippines Japan T aiwanMalaysiaIndiaKoreaHong KongChina Australia Singapore 2007 2008 2009 20104. HOw SUPPORTivE iS THE REgUlATOR TO NEw REiTs iN EACH COUNTRY?Respondents were asked to rate the regulatory support of REITs in each country.Regulatory support ratings have improved across the region by 4% to 46%.Singapore retains its top ranking (70%), but there was a slight decrease of 3% from 2009.Australia has increased by 4%, and is moving closer to the number one ranking held by Singapore.The biggest increases were in vietnam (11%), china and Indonesia (10%). however vietnam and Indonesia have received the lowest ratings for regulatory support.102030405060708090100RegionalVietnam India T aiwan Korea Japan Australia 2007 2008 2009 20105. wHAT iS THE OvERAll REiTPOTENTiAl RATiNg fOR EACH COUNTRY?An overall REIT potential rating for each country is calculated by combining the three main measures of:1. Property market growth 2. REIT opportunities 3. Regulatory supportoverall “potential” ratings have improved across the region by 5%.Singapore retains its number 1 ranking at 62% and was rated positively by 66% of respondents.The greatest improvements were in Australia (15%), Indonesia (11%) and china and korea (10%).new entrants Thailand and the Philippines have below average ratings with Indonesia still seen as the countrywith the least potential.overall % +/- property% +/- REIT% +/- Regulatory % +/- Country Rating 20105.1COUNTRY SUMMARYAn overview of each country summary and accompanying comments from the respondents are outlined below.Comments • Strong interest in commercial investment properties from Asian investors. Local investors requiring debt are restricted by tight lending terms.•mature market - IPos to be limited until market strengthens.Comments •north china e.g. Beijing and Shanghai are strongly engrossed in commercial and residential building and less affected by the world economic downturn. They are focussed on investment and legislative changes to attract foreign investment.•Strong opportunity in china but it will take a while before things happen as china’s legal and tax framework needs to be developed a lot more in order to make a REIT successful.Comments •market is somewhat overvalued.Comments • India has the potential to have excellent growth but its bureaucracy and poor corporate governance will hamper its ability to catch up with china.•complex legal framework and unfavourable tax regimes make it very difficult for REITs to grow in India.Comments •Transparency remains a concern.Comments •REIT market is already saturated and it is very difficult to set up a REIT in japan. Property players are better off setting up REITs with japanese properties overseas e.g. in Singapore where it is faster and cheaper, and may potentially have better tax outcomes for non-japanese investors.Comments• Positive yield provides high income yield as % of total return.Comments• The 2007 trust law is very helpful, but linking it to a REIT concept and the sluggish economy need to be addressed.Comments• Population growing, becoming more industrialised.6. OUTlOOk fOR REiTSRespondents were asked a number of questions on the future of, and threat to REITs, to determine the overall outlook for the future.6.1 fUTURE Of REiTsRespondents were asked which of these three statements best reflects their view of the future of REITs.In the short-term (1-2 years) and long-term (3-5 years) companies with existing REITs will:• Stay about the same size;• Increase the size of existing REITs;•Launch additional REITs.There has been a dramatic change in the short-term outlook for REITs compared to last year:• 47% of respondents predict companies will increase the size of existing REITs compared to 20% last year; • 33% of respondents believe REITs will stay the same size, compared to 77% last year;•20% of respondents expect additional REITs will be launched which is a 17% increase on 2009.Although the short-term outlook has not recovered to pre-gFc levels, positive sentiment is improving.1020304050607080901002009200820072010Short-term outlook for REITs - TrendsShort-term (1-2 years)Launch additional REIT’s Stay about the same sizeIncrease the size of existing REIT1020304050607080901002009200820072010Long-term outlook for REITs - TrendsLong-term (3-5 years)Launch additional REIT’s Stay about the same sizeIncrease the size of existing REIT The long-term outlook is far more optimistic and back to pre-gFc levels:•55% of respondents believe in the longer termcompanies will launch additional REITs, an increase of 13% on 2009;•43% of respondents predict companies will increase the size of existing REITs.Respondents were asked to rate six potential threats to REITs on a scale of 1 to 10.Respondents rated the biggest threat to the future of REITs as follows:•Adverse taxation developments are seen as thebiggest threat to the future of REITs at 71%, up from 62%;•The effects of financial engineering is rated as the second biggest threat at 69%, down from 74% last year;• Regulatory process (65%) has remained relatively constant over the years;• Low yields has increased 6% from 2009 and is back to the level of previous years;• Poor understanding (58%) has not changed since last year;•cost to market is seen as the lowest threat but is steadily increasing year-on-year.6.2 wHAT iS THE BiggEST THREAT fOR REiTs?1. AUSTRAliAWhen was the REIT regime introduced?In Australia, there is a long history of REITs as either listed property trusts (A-REITs) or unlisted property trusts.Is there a regulatory framework and, in particular, a separate regime for REITs apart from that for listed entities in general?There is no special REITs regime. The corporations Act 2001 (cth) (corporations Act) regulates widely held REITs in Australia. A-REITs are also required to comply with the Australian Securities Exchange (ASx) Listing Rules.Have there been recent deals and regulatory or other developments?The response of A-REITs to the global financial crisis wasto seek access to greater capital and explore simplification and consolidation. In addition, recent tax changes have given an impetus to foreign investors entering the market. Identify any significant factors that may/will impact upon the development of the REIT market in the jurisdiction, such as:Land ownership:• Are there any restrictions on foreign ownership?The Foreign Acquisition and T akeovers Act 1975 (cth) (FATA) requires that notice be given to the Foreign Investment Review Board (FIRB) whenever there is an acquisition of an interest in Australian urban land by a substantial foreign interest, and powers are conferred to restrict such investments.A substantial foreign interest is defined in section 9A of the FATA as where a single foreigner (and any associates) has 15% or more of the ownership or several foreigners (and any associates) have 40% or more in aggregate of the ownership of any corporation, business or trust.A limited range of exemptions apply to various persons, including US investors.Licensing/approval of the entity managing the REIT (the “Manager”):• Is the manager external or owned by the REIT? management may be either external or internal. where management is internal, the RE is generally owned by a company, the shares of which are stapled to a unit in the REIT.• does the manager need to be licensed and what are the more significant criteria for the licence/approval? Section 601FA of the corporations Act requires the operator of a REIT which is registered to hold an Australian Financial Services Licence (AFSL). An AFSL will generally be granted if the applicant can demonstrate competency in the provision of the financial service (such as the operation of a scheme) and there is no reason to believe that the applicant will not fulfil the various obligations imposed by the AFSL, and has the requisite good fame and character, expertise and ability. The regulatory approval process involves both a review of the applicant and consideration of the kinds of financial services which the applicant proposes to provide.Foreign exchange control:• Are there any foreign exchange controls?no.Income/profit, tax etc:• Is there any tax exemption at the REIT level for the REIT’s income/profits?The REIT will not be taxed at the REIT level providedthat the unitholders (investors) of the trust are presently entitled to all of the net income and the trust is not taxed as a company.The trust will not be taxed as a company if the trust isnot widely held, or, where it is widely held, its business activities are limited to earning passive income, such as rent, and not operating a business. A-REITs can generally satisfy these requirements.• Is there any tax pass-through to the investors?where the taxable component of a distribution is lessthan the amount of its actual distribution, there arises what is commonly referred to as “tax deferred income”. generally speaking, this arises due to the availability of tax deductions, such as depreciation and capital allowances, which exceed those available for accounting purposes.T ax deferred income is not ordinarily included in an investor’s annual assessable income. however, tax deferred income will reduce an investor’s capital gains tax (cgT) cost base in the units, meaning that an investor will paytax on such reduced cost base at the time of disposal (although at the concessional capital gains tax rate).• Are there any other tax incentives for REITs?no specific tax concessions.• Is stamp duty applicable?Stamp duty is payable by REITs on the acquisition of properties, and usually on the acquisition or issue of equity in non-widely held REITs.• Is withholding tax applicable?withholding tax can be payable on distributions of Australian-sourced gains to non-residents at the top marginal rate of tax relevant to the non-resident.couNtry summary aND leGal upDateThe following section provides an update on the REIT legislation in each of the selected countries.2. CHiNAWhen was the REIT regime introduced?In december 2008 the chinese central government formally announced its support for pilot schemes of chinese REIT (c-REIT) products to be offered to the market. It has been reported that the chinese central government is reviewing the draft c-REIT legislation and the first batch of c-REIT products may hit the market in 2010.Is there a regulatory framework and, in particular, a separate regime for REITs apart from that for listed entities in general?Specific c-REIT legislation will be enacted and will be premised on the existing national legislation governing trust products, securities offerings, investment fund management and securitisation.It is expected that china will run two different pilot schemes of c-REIT products. one is essentially a scheme of securitisation of revenue streams from a pool of real estate assets that will be offered to institutional investors and traded on the inter-bank market. The other product will be offered to retail investors and will resemble the REIT products offered in hong kong and Singapore.Identify any significant factors that may/will impact upon the development of the REIT market in the jurisdiction, such as:Title system:• does the title system pose any difficulty for acquisition of property for investment by a REIT?with respect to the securitisation c-REIT product, there will be no transfer of real estate title. It has been reported that there will be a new system for registration of trust over real estate in support of this type of c-REIT product.with respect to the retail c-REIT product, the real estate title will be transferred to the trustee.Land ownership:• Are there any restrictions on foreign ownership?with effect from july 2006, foreign companies are no longer allowed to directly acquire and hold investment property in china. Acquisitions completed before july 2006 are grandfathered.Licensing/approval of the entity managing the REIT (the “Manager”):• Is the manager external or owned by the REIT?with respect to the securitisation c-REIT product, it is expected that legal title of the real estate assets will not be transferred and the existing owner will continue to retain operational control over the assets.with respect to the retail c-REIT products, legal title of the real estate assets will be transferred to the c-REIT trustee and the real estate assets will be operated by an external manager.• does the manager need to be licensed and what are the more significant criteria for the licence/approval?with respect to the securitisation c-REIT product, thec-REIT managers will be trust companies licensed by the china Banking Regulatory commission. The qualification requirements have not yet been announced.with respect to the retail c-REIT product, the c-REIT managers will be investment fund management companies licensed by the china Securities Regulatory commission.The qualification requirements have not yet been announced.Foreign investment:• Are there any restrictions on foreign investment in real estate?yes. china has strict exchange controls over all foreigndirect investment transactions. Foreign companies are not allowed to directly acquire and hold investment propertyin china. Foreign investment in china-incorporated real estate companies are also subject to many regulatory restrictions.Income/profit tax, etc:• Is there any tax exemption at the REIT level for the REIT’s income/profits?It is expected that the c-REIT regime will adopt the general principle of tax neutrality, i.e. there will be no specialincome/profits tax exemption for C-REIT products.• Is there any tax pass-through to the investors?It is expected that this will be permitted.• Are there any other tax incentives for REITs?It is expected there will be no special tax incentives forc-REIT products.• Is stamp duty applicable?Real estate transactions are subject to stamp duty andother indirect taxes. It is expected that there will be no special exemption for c-REITs.• Is withholding tax applicable?It is expected that there will be no special exemption forc-REITs.Identify any other factors that may/will impact on theREIT industry in the jurisdiction.The launch and the further growth of the c-REIT market needs the support of the chinese central government.It is possible that lobbying by dominant property industry players may impact the introduction and form of thec-REIT regime in china.The Trust company and Baker & mckenzie | 21。