金融工程相关习题及答案

金融工程练习题及答案

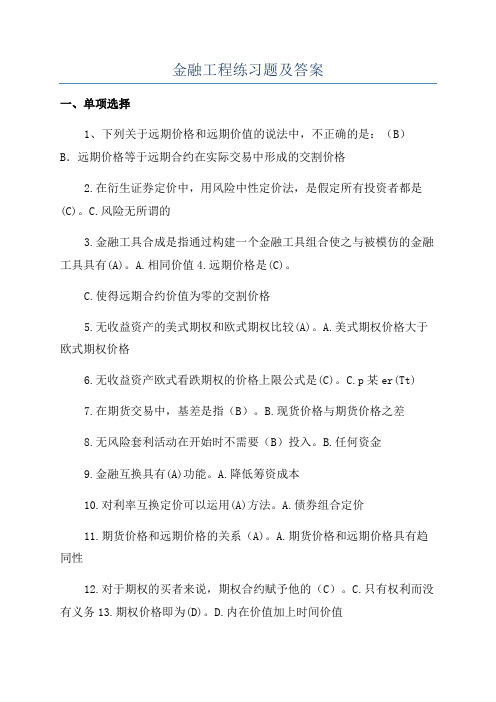

金融工程练习题及答案一、单项选择1、下列关于远期价格和远期价值的说法中,不正确的是:(B)B.远期价格等于远期合约在实际交易中形成的交割价格2.在衍生证券定价中,用风险中性定价法,是假定所有投资者都是(C)。

C.风险无所谓的3.金融工具合成是指通过构建一个金融工具组合使之与被模仿的金融工具具有(A)。

A.相同价值4.远期价格是(C)。

C.使得远期合约价值为零的交割价格5.无收益资产的美式期权和欧式期权比较(A)。

A.美式期权价格大于欧式期权价格6.无收益资产欧式看跌期权的价格上限公式是(C)。

C.p某er(Tt)7.在期货交易中,基差是指(B)。

B.现货价格与期货价格之差8.无风险套利活动在开始时不需要(B)投入。

B.任何资金9.金融互换具有(A)功能。

A.降低筹资成本10.对利率互换定价可以运用(A)方法。

A.债券组合定价11.期货价格和远期价格的关系(A)。

A.期货价格和远期价格具有趋同性12.对于期权的买者来说,期权合约赋予他的(C)。

C.只有权利而没有义务13.期权价格即为(D)。

D.内在价值加上时间价值14.下面哪一因素将直接影响股票期权价格(B)。

B.股票价格的波动率15.无收益资产的欧式看涨期权与看跌期权之间的平价关系为(A)。

A.c某er(Tt)p16、假设有两家公司A和B,资产性质完全一样,但资本结构不同,在MM条件下,它们每年创造的息税前收益都是1000万元。

A的资本全部由股本组成,共100万股(设公司不用缴税),预期收益率为10%。

B公司资本中有4000万企业债券,股本6000万,年利率为8%,则B公司的股票价格是(A)元A、10017、表示资金时间价值的利息率是(C)C、社会资金平均利润率18.金融工程的复制技术是(A)。

A.一组证券复制另一组证券19、金融互换的条件之一是(B)。

B.比较优势20、期权的内在价值加上时间价值即为(D)。

D.期权价值21、对于期权的卖者来说,期权合约赋予他的(D)。

金融工程的期末练习题附参考答案

⾦融⼯程的期末练习题附参考答案第⼆章⼀、判断题1、市场风险可以通过多样化来消除。

(F)2、与n个未来状态相对应,若市场存在n个收益线性⽆关得资产,则市场具有完全性。

(T)3、根据风险中性定价原理,某项资产当前时刻得价值等于根据其未来风险中性概率计算得期望值。

(F)4、如果套利组合含有衍⽣产品,则组合中通常包含对应得基础资产。

(T)5、在套期保值中,若保值⼯具与保值对象得价格负相关,则⼀般可利⽤相反得头⼨进⾏套期保值。

(F)⼆、单选题下列哪项不属于未来确定现⾦流与未来浮动现⾦流之间得现⾦流交换?()A、利率互换B、股票C、远期D、期货2、关于套利组合得特征,下列说法错误得就是( )。

A、套利组合中通常只包含风险资产B、套利组合中任何资产得购买都就是通过其她资产得卖空来融资C、若套利组合含有衍⽣产品,则组合通常包含对应得基础资产D.套利组合就是⽆风险得3、买⼊⼀单位远期,且买⼊⼀单位瞧跌期权(标得资产相同、到期⽇相同)等同于()A、卖出⼀单位瞧涨期权B、买⼊标得资产C、买⼊⼀单位瞧涨期权D、卖出标得资产4、假设⼀种不⽀付红利股票⽬前得市价为10元,我们知道在3个⽉后,该股票价格要么就是11元,要么就是9元。

假设现在得⽆风险年利率等于10%,该股票3个⽉期得欧式瞧涨期权协议价格为10、5元。

则( )A、⼀单位股票多头与4单位该瞧涨期权空头构成了⽆风险组合B、⼀单位该瞧涨期权空头与0、25单位股票多头构成了⽆风险组合C、当前市值为9得⽆风险证券多头与4单位该瞧涨期权多头复制了该股票多头D.以上说法都对三、名词解释1、套利答:套利就是在某项⾦融资产得交易过程中,交易者可以在不需要期初投资⽀出得条件下获取⽆风险报酬。

等价鞅测度答:资产价格就是⼀个随机过程,假定资产价格得实际概率分布为,若存在另⼀种概率分布使得以计算得未来期望风险价格经⽆风险利率贴现后得价格序列就是⼀个鞅,即,则称为得等价鞅测度。

四、计算题每季度计⼀次复利得年利率为14%,请计算与之等价得每年计⼀次复利得年利率与连续复利年利率。

金融工程练习题及答案解析

金融工程练习题及答案解析金融工程练习题及答案解析1991年,下列关于远期价格和远期价值的说法是不正确的:(b)远期价格等于实际交易中远期合同形成的交货价格2。

在衍生证券的定价中,使用了风险中性定价方法。

假设所有投资者都是(风险无关紧要3。

金融工具组合是指构建一种金融工具组合,使其具有与模拟金融工具相同的价值(4。

远期价格为(使远期合同价值为零的交货价格为5)。

非盈利资产的美式期权与欧式期权的比较(美式期权的价格高于欧式期权6的价格)。

非盈利资产的欧洲看跌期权的价格上限公式是(p?Xe?r(T?T) 7。

在期货交易中,基差指的是(b)现货价格和期货价格之间的差额。

无风险套利一开始不需要(任何资本)投资。

9.金融互换具有(降低融资成本)的功能10。

(债券组合定价)方法可用于利率互换的定价11。

期货价格与远期价格的关系(期货价格与远期价格具有趋同性)12.对于期权买方来说,期权合同只赋予他权利而没有义务。

期权价格为(内在价值加时间价值14。

下列哪个因素会直接影响股票期权价格(股票价格波动15。

欧洲看涨期权和无回报看跌期权之间的平价关系是(C?Xe?r(T?t)?p?S 16。

假设有两家公司,资产完全相同,但资本结构不同。

在MM条件下,他们的税前年收入为1000万元。

a的资本完全由股本组成,共有100万股(公司不纳税),预期回报率为10%B公司有4000万企业债券和6000万股本,年利率为8%。

B公司股票价格为(1 00)元17,代表资金时间价值的利率为(社会基金平均利润率为18。

金融工程的复制技术是(一组证券复制另一组证券19,而金融互换的条件之一是(比较优势XXXX金融危机和金融衍生品(此类话题发生的概率很高)10、远期利率协议(本书第114页)远期利率协议是指交易双方现在同意在未来某一时间至未来另一时间结束期间,以约定利率(也称为约定利率)借入一定金额的资金,名义本金以特定货币表示的协议。

2.障碍期权(这两个是奇异期权中的相关概念)金融互换:根据双方同意的条款,合同P104看涨期权在规定时间内交换一系列现金流:合同P141看跌期权:合同P141期权价差交易,赋予买方在规定时间内以规定价格出售一定数量标的资产的权利。

金融工程习题及答案

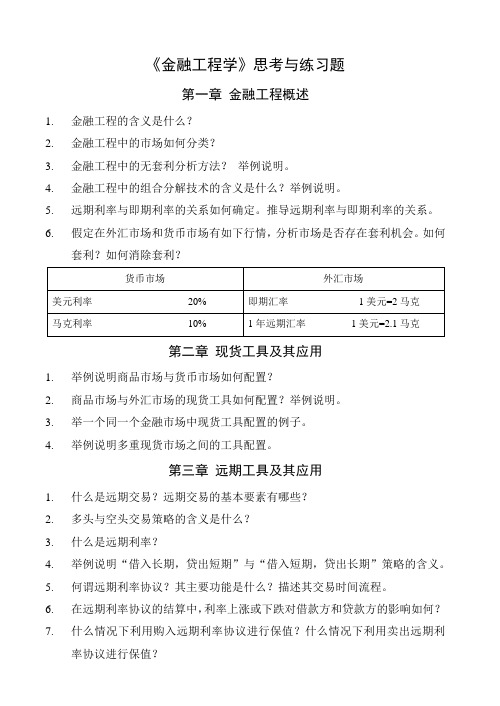

《金融工程学》思考与练习题第一章金融工程概述1.金融工程的含义是什么?2.金融工程中的市场如何分类?3.金融工程中的无套利分析方法?举例说明。

4.金融工程中的组合分解技术的含义是什么?举例说明。

5.远期利率与即期利率的关系如何确定。

推导远期利率与即期利率的关系。

6.假定在外汇市场和货币市场有如下行情,分析市场是否存在套利机会。

如何套利?如何消除套利?第二章现货工具及其应用1.举例说明商品市场与货币市场如何配置?2.商品市场与外汇市场的现货工具如何配置?举例说明。

3.举一个同一个金融市场中现货工具配置的例子。

4.举例说明多重现货市场之间的工具配置。

第三章远期工具及其应用1.什么是远期交易?远期交易的基本要素有哪些?2.多头与空头交易策略的含义是什么?3.什么是远期利率?4.举例说明“借入长期,贷出短期”与“借入短期,贷出长期”策略的含义。

5.何谓远期利率协议?其主要功能是什么?描述其交易时间流程。

6.在远期利率协议的结算中,利率上涨或下跌对借款方和贷款方的影响如何?7.什么情况下利用购入远期利率协议进行保值?什么情况下利用卖出远期利率协议进行保值?8.远期合约的价格与远期价格的含义是什么?如果远期价格偏高或偏低,市场会出现什么情况?9.远期价格和未来即期价格的关系是什么?10.在下列三种情况下如何计算远期价格?11.合约期间无现金流的投资类资产12.合约期间有固定现金流的投资类资产13.合约期间按固定收益率发生现金流的投资类资产14.一客户要求银行提供500万元的贷款,期限半年,并且从第6个月之后开始执行,该客户要求银行确定这笔贷款的固定利率,银行应如何操作?目前银行的4月期贷款利率为9.50%,12月期贷款利率为9.80%。

15.假设某投资者现在以20美元的现价购买某只股票,同时签订一个半年后出售该股票的远期合约,在该期间不分红利,试确定该远期合约的价格。

假定无风险利率为7.5%。

16.假设3个月期的即期年利率为5.25%,12月期的即期年利率为5.75%,问(3×12)远期利率是多少?如果市场的远期利率为6%,则市场是否存在套利机会?若存在,请构造一个套利组合。

金融工程试题及答案

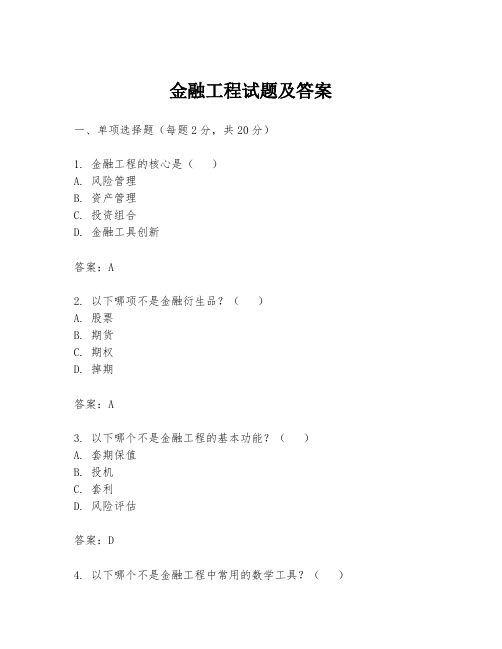

金融工程试题及答案一、单项选择题(每题2分,共20分)1. 金融工程的核心是()A. 风险管理B. 资产管理C. 投资组合D. 金融工具创新答案:A2. 以下哪项不是金融衍生品?()A. 股票B. 期货C. 期权D. 掉期答案:A3. 以下哪个不是金融工程的基本功能?()A. 套期保值B. 投机C. 套利D. 风险评估答案:D4. 以下哪个不是金融工程中常用的数学工具?()A. 概率论B. 统计学C. 微积分D. 线性代数答案:D5. 以下哪个不是金融工程中常用的金融工具?()A. 债券B. 股票C. 期权D. 掉期答案:B6. 以下哪个不是金融工程中的风险管理工具?()A. 期货合约B. 保险C. 期权D. 贷款答案:D7. 以下哪个不是金融工程中的风险度量方法?()A. 价值在险(VaR)B. 条件风险价值(CVaR)C. 标准差D. 收益率答案:D8. 以下哪个不是金融工程中的风险管理策略?()A. 资产组合分散化B. 风险转移C. 风险对冲D. 风险接受答案:D9. 以下哪个不是金融工程中常见的投资策略?()A. 套利B. 投机C. 套期保值D. 风险分散答案:D10. 以下哪个不是金融工程中的风险度量指标?()A. 夏普比率B. 索提诺比率C. 贝塔系数D. 阿尔法系数答案:D二、多项选择题(每题3分,共15分)1. 金融工程中常用的金融工具包括()A. 股票B. 期货C. 期权D. 掉期E. 债券答案:BCD2. 金融工程中的风险管理工具包括()A. 期货合约B. 保险C. 期权D. 贷款E. 掉期答案:ABC3. 金融工程中的风险度量方法包括()A. 价值在险(VaR)B. 条件风险价值(CVaR)C. 标准差D. 收益率E. 贝塔系数答案:ABC4. 金融工程中的风险管理策略包括()A. 资产组合分散化B. 风险转移C. 风险对冲D. 风险接受E. 风险评估答案:ABC5. 金融工程中常见的投资策略包括()A. 套利B. 投机C. 套期保值D. 风险分散E. 风险对冲答案:ABC三、判断题(每题2分,共10分)1. 金融工程的核心是资产管理。

(完整版)金融工程试题

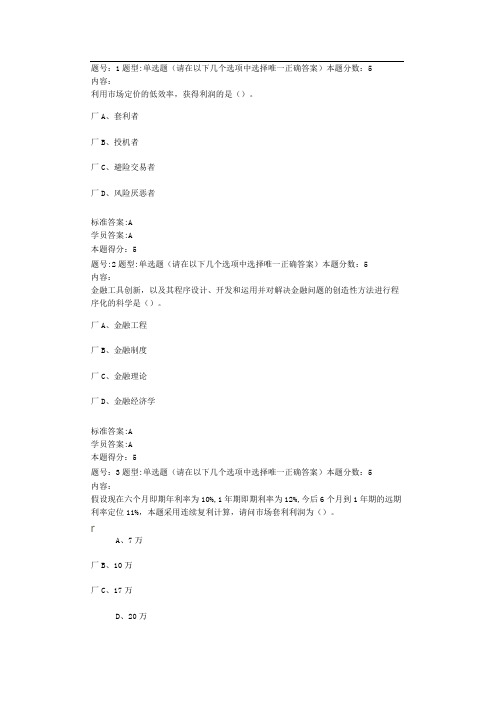

题号:1题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:利用市场定价的低效率,获得利润的是()。

厂A、套利者厂B、投机者厂C、避险交易者厂D、风险厌恶者标准答案:A学员答案:A本题得分:5题号:2题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:金融工具创新,以及其程序设计、开发和运用并对解决金融问题的创造性方法进行程序化的科学是()。

厂A、金融工程厂B、金融制度厂C、金融理论厂D、金融经济学标准答案:A学员答案:A本题得分:5题号:3题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:假设现在六个月即期年利率为10%,1年期即期利率为12%,今后6个月到1年期的远期利率定位11%,本题采用连续复利计算,请问市场套利利润为()。

rA、7万厂B、10万厂C、17万D、20万标准答案:c学员答案:c本题得分:5题号:4题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5 内容:追逐价格偏差,承担较高风险的是()。

厂A、套利者厂B、投机者厂C、避险交易者厂D、风险厌恶者标准答案:B学员答案:B本题得分:5题号:5题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5 内容:下列哪项不属于未来确定现金流和未来浮动现金流之间的现金流交换()。

厂A、利率互换厂B、股票厂C、远期厂D、期货标准答案:B学员答案:B本题得分:5题号:6题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5 内容:保证金交易()。

厂A、每日结算厂B、隔日结算C、约定结算D、无具体要求标准答案:A学员答案:A本题得分:5题号:7题型:多选题(请在复选框中打勾,在以下几个选项中选择正确答案,答案可以是多个)本题分数:5内容:设立交易所有哪两种机制()。

」A 、公司制厂B 、会员制厂C 、合伙人厂D 、个体户标准答案:AB学员答案:AB本题得分:5题号:8题型:多选题(请在复选框中打勾,在以下几个选项中选择正确答案,答案可以是多个)本题分数:5内容:衍生金融工具包括()。

金融工程学试题及答案

金融工程学试题及答案一、选择题1. 金融工程学的主要目标是:A. 提高金融组织的效率B. 降低金融风险C. 实现金融创新D. 扩大金融市场规模答案:B. 降低金融风险2. 下列哪种金融衍生品属于利率类衍生品?A. 期权B. 期货C. 控股权D. 利率互换答案:D. 利率互换3. 金融工程学的核心理论是:A. 有效市场假说B. 平均趋势理论C. 期权定价理论D. 风险管理理论答案:C. 期权定价理论二、填空题1. 金融工程学是一门________学科,主要研究金融产品的创新与风险管理。

答案:交叉学科2. 金融工程学中,VaR代表________。

答案:价值-at-风险三、简答题1. 请简要解释金融工程学的基本原理和方法。

金融工程学的基本原理是通过应用数学、统计学和计算机科学等工具来创造新的金融产品,降低金融风险,并提高金融机构的效率和盈利能力。

主要方法包括:利用期权定价理论为金融衍生品定价,利用VaR(价值-at-风险)模型进行风险管理,利用数值方法进行金融模型的估计和计算,以及利用金融工程学模型进行投资组合优化等。

2. 请简述金融工程学在金融市场中的应用。

金融工程学在金融市场中广泛应用。

首先,通过金融工程学的方法,金融机构能够创造各种金融衍生品,如期权、期货、互换等,满足不同投资者的需求。

其次,金融工程学可以帮助金融机构进行风险管理,通过VaR模型等方法,量化和控制金融风险,提高机构的稳健性。

此外,金融工程学还可以应用于投资组合优化和资产定价,帮助投资者实现收益最大化。

四、计算题1. 根据以下数据,计算A公司的VaR(置信水平为95%):资产价格的均值:100资产价格的标准差:10答案:VaR = 均值 - 标准差 × Z值Z值 = 1.645(95%置信水平对应的Z值)VaR = 100 - 10 × 1.645 = 83.55结论:A公司的VaR为83.55。

五、论述题金融工程学在现代金融市场中的应用举足轻重。

金融工程学》题库及答案

金融工程学》题库及答案1.证券投资收益最大化和风险最小化这两个目标大多数情况下可以同时实现。

2.金融工程中,通常用收益率的标准差来衡量风险。

3.β系数表示的是市场收益率的单位变化引起证券收益率的预期变化幅度。

4.下列哪个不是远期合约的特点:流动性好。

5.下列不属于金融期货:商品期货。

6.下列不属于资本资产定价模型的前提假设条件:资产能够被无限细分,拥有充分的流动性。

7.相对于基础证券,下列不属于金融衍生工具的特点是:对投资者的要求不高。

8.由于XXX予以税收、货币发行等特权,通常情况下,XXX证券不存在违约风险,因此,这一类证券被视为无风险证券。

9.债券价格受市场利率的影响,若市场利率上升,则债券价格下降。

10.在2007年以来发生的全球性金融危机中,导致大量金融机构陷入危机的最重要一类衍生金融产品的是信用违约互换。

11.某投资者投资元于一项期限为3年、年息8%的债券,按年计息,按复利计算该投资的终值为.12元。

12.股权类产品的衍生工具是指以股票或股票指数为基础的金融衍生工具。

2、金融市场中的风险管理是非常重要的,论述如何利用金融工具进行风险管理,并举例说明其应用。

3、股票市场的波动性对投资者来说是一种风险,论述如何利用期权进行股票市场波动性的风险管理,并分析其优缺点。

4、金融工程是一种创新的金融产品设计和交易的方式,论述金融工程的发展历程、应用领域及其对金融市场的影响。

5、CAPM模型是金融领域中的重要模型之一,论述CAPM模型的优缺点及其在实际中的应用。

6、期货和远期是金融市场中的两种重要交易方式,论述期货和远期的异同点,并分析其各自的优缺点。

7、债券是一种重要的金融工具,论述债券的基本特点及其在投资中的作用。

8、期权是一种金融衍生品,论述期权的基本特点及其在投资中的应用。

9、股指期货是金融市场中的重要交易品种,论述股指期货的基本特点、功能及其在投资中的应用。

10、金融市场中的交易方式多种多样,论述场外交易市场与交易所交易市场的异同点,并分析其各自的优缺点。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 1 Market Organization and Structure PRACTICE PROBLEMS FOR CHAPTER 11. Akihiko Takabe has designed a sophisticated forecasting model, which predicts the movements in the overall stock market, in the hope of earning a return in excess of a fair return for the risk involved. He uses the predictions of the model to decide whether to buy, hold, or sell the shares of an index fund that aims to replicate the movements of the stock market. Takabe would best be characterized as a (n):A. hedger.B. investor.C. information-motivated trader.2. James Beach is young and has substantial wealth. A significant proportion of his stock portfolio consists of emerging market stocks that offer relatively high expected returns at the cost of relatively high risk. Beach believes that investment in emerging market stocks is appropriate for him given his ability and willingness to take risk. Which of the following labels most appropriately describes Beach?A. Hedger.B. Investor.C. Information-motivated trader.3. Lisa Smith owns a manufacturing company in the United States. Her company has sold goods to a customer in Brazil and will be paid in Brazilian real (BRL) in three months. Smith is concerned about the possibility of the BRL depreciating more than expected against the U.S. dollar (USD). Therefore, she is planning to sell three-month futures contracts on the BRL. The seller of such contracts generally gains when the BRL depreciates against the USD. If Smith were to sell these future contracts, she would most appropriately be described as a (n):A. hedger.B. investor.C. information-motivated trader.4. Which of the following is not a function of the financial system?A. To regulate arbitrageurs’ profits (excess returns).B. To help the economy achieve allocational efficiency.C. To facilitate borrowing by businesses to fund current operations.5. An investor primarily invests in stocks of publicly traded companies. The investor wants to increase the diversification of his portfolio. A friend has recommended investing in real estate properties. The purchase ofreal estate would best be characterized as a transaction in the:A. derivative investment market.B. traditional investment market.C. alternative investment market.6. A hedge fund holds its excess cash in 90-day commercial paper and negotiable certificates of deposit. The cash management policy of the hedge fund is best described as using:A. capital market instruments.B. money market instruments.C. intermediate-term debt instruments.7. An oil and gas exploration and production company announces that it is offering 30 million shares to the public at $45.50 each. This transaction is most likely a sale in the:A. futures market.B. primary market.C. secondary market.8. Consider a mutual fund that invests primarily in fixed-income securities that have been determined to be appropriate given the fund’s investment goal. Which of the following is least likely to be a part of thisfund?A. Warrants.B. Commercial paper.C. Repurchase agreements.9. A friend has asked you to explain the differences between open-end and closed-end funds. Which of the following will you most likely include in your explanation?A. Closed-end funds are unavailable to new investors.B. When investors sell the shares of an open-end fund, they can receive a discount or a premium to the fund’s net asset value.C. When selling shares, investors in an open-end fund sell the shares back to the fund whereas investors in a closed-end fund sell the shares to others in the secondary market.10. The usefulness of a forward contract is limited by some problems. Which of the following is most likely one of those problems?A. Once you have entered into a forward contract, it is difficult to exit from the contract.B. Entering into a forward contract requires the long party to deposit an initial amount with the short party.C. If the price of the underlying asset moves adversely from theperspective of the long party, periodic payments must be made to the short party.11. Tony Harris is planning to start trading in commodities. He has heard about the use of futures contracts on commodities and is learning more about them. Which of the following is Harris least likely to find associated with a futures contract?A. Existence of counterparty risk.B. Standardized contractual terms.C. Payment of an initial margin to enter into a contract.12. A German company that exports machinery is expecting to receive $10 million in three months. The firm converts all its foreign currency receipts into euros. The chief financial officer of the company wishes to lock in a minimum fixed rate for converting the $10 million to euro but also wants to keep the flexibility to use the future spot rate if it is favorable. What hedging transaction is most likely to achieve this objective?A. Selling dollars forward.B. Buying put options on the dollar.C. Selling futures contracts on dollars.13. A book publisher requires substantial quantities of paper. The publisher and a paper producer have entered into an agreement for the publisher to buy and the producer to supply a given quantity of paper four months later at a price agreed upon today. This agreement is a:A. futures contract.B. forward contract.C. commodity swap.14. The Standard & Poor’s Depos itary Receipts (SPDRs) is an investment that tracks the S&P 500 stock market index. Purchases and sales of SPDRs during an average trading day are best described as:A. primary market transactions in a pooled investment.B. secondary market transactions in a pooled investment.C. secondary market transactions in an actively managed investment.15. The Standard & Poor’s Depositary Receipts (SPDRs) is an exchange-traded fund in the United States that is designed to track the S&P 500 stock market index. The current price of a share of SPDRs is $113.A trader has just bought call options on shares of SPDRs for a premium of $3 per share. The call options expire in five months and have an exercise price of $120 per share. On the expiration date, the trader will exercisethe call options (ignore any transaction costs) if and only if the shares of SPDRs are trading:A. below $120 per share.B. above $120 per share.C. above $123 per share.16. Which of the following statements about exchange-traded funds is most correct?A. Exchange-traded funds are not backed by any assets.B. The investment companies that create exchange-traded funds are financial intermediaries.C. The transaction costs of trading shares of exchange-traded funds are substantially greater than the combined costs of trading the underlying assets of the fund.17. Jason Schmidt works for a hedge fund and he specializes in finding profit opportunities that are the result of inefficiencies in the market for convertible bonds—bonds that can be converted into a predetermined amount of a company’s common stock. Schmidt tries to find convertibles that are priced inefficiently relative to the underlying stock. The trading strategy involves the simultaneous purchase of the convertible bond and the short sale of the underlyingcommon stock. The above process could best be described as:A. hedging.B. arbitrage.C. securitization.18. Pierre-Louis Robert just purchased a call option on shares of the Michelin Group. A few days ago he wrote a put option on Michelin shares. The call and put options have the same exercise price, expiration date, and number of shares underlying. Considering both positions, Robert’s exposure to the risk of the stock of the Michelin Group is:A. long.B. short.C. neutral.19. An online brokerage firm has set the minimum margin requirement at 55 percent. What is the maximum leverage ratio associated with a position financed by this minimum margin requirement?A. 1.55.B. 1.82.C. 2.22.20. A trader has purchased 200 shares of a non-dividend-paying firm on margin at a price of $50 per share. The leverage ratio is 2.5. Six months later, the trader sells these shares at $60 per share. Ignoring the interest paid on the borrowed amount and the transaction costs, what was the return to the trader during the six-month period?A. 20 percent.B. 33.33 percent.C. 50 percent.21. Jason Williams purchased 500 shares of a company at $32 per share. The stock was bought on 75 percent margin. One month later, Williams had to pay interest on the amount borrowed at a rate of 2 percent per month. At that time, Williams received a dividend of $0.50 per share. Immediately after that he sold the shares at $28 per share. He paid commissions of $10 on the purchase and $10 on the sale of the stock. What was the rate of return on this investment for the one-month period?A. −12.5 percent.B. –15.4 percent.C. –50.1 percent.22. Caroline Rogers believes the price of Gamma Corp. stock will godown in the near future. She has decided to sell short 200 shares of Gamma Corp. at the current market price of €47. The initial margin requirement is 40 percent. Which of the following is an appropriate statement regarding the margin requirement that Rogers is subject to on this short sale?A. She will need to c ontribute €3,760 as margin.B. She will need to contribute €5,640 as margin.C. She will only need to leave the proceeds from the short sale as deposit and does not need to contribute any additional funds.23. The current price of a stock is $25 per share. You have $10,000 to invest. You borrow an additional $10,000 from your broker and invest $20,000 in the stock. If the maintenance margin is 30 percent, at what price will a margin call first occur?A. $9.62.B. $17.86.C. $19.71.24. You have placed a sell market-on-open order—a market order that would automatically be submitted at the market’s open tomorrow and would fill at the market price. Your instruction, to sell the shares at the market open, is a(n):A. execution instruction.B. validity instruction.C. clearing instruction.25. A market has the following limit orders standing on its book for a particularstock. The bid and ask sizes are number of shares in hundreds.What is the market?A. 9.73 bid, offered at 10.14.B. 9.81 bid, offered at 10.10.C. 9.95 bid, offered at 10.02.26. Consider the following limit order book for a stock. The bid and ask sizes arenumber of shares in hundredsA new buy limit order is placed for 300 shares at ¥123.40. This limit order is said to:A. take the market.B. make the market.C. make a new market.27. Currently, the market in a stock is "$54.62 bid, offered at $54.71." A new selllimit order is placed at $54.62. This limit order is said to:A. take the market.B. make the market.C. make a new market.28. Jim White has sold short 100 shares of Super Stores at a price of$42 per share. He has also simultaneously placed a "good-till-cancelled, stop 50, limit 55 buy" order. Assume that if the stop condition specified by White is satisfied and the order becomes valid, it will get executed.Excluding transaction costs, what is the maximum possible loss that White can have?A. $800.B. $1,300.C. Unlimited.29. You own shares of a company that are currently trading at $30 a share. Yourtechnical analysis of the shares indicates a support level of $27.50. That is, if the price of the shares is going down, it is more likely to stay above this level rather than fall below it. If the price does fall below this level, however, you believe that the price may continue to decline. You have no immediate intent to sell the shares but are concerned about the possibility of a huge loss if the share price declines below the support level. Which of the following types of orders could you place to most appropriately address your concern?A. Short sell order.B. Good-till-cancelled stop sell order.C. Good-till-cancelled stop buy order.30. In an underwritten offering, the risk that the entire issue may not be sold to the public at the stipulated offering price is borne by the:A. issuer.B. investment bank.C. buyers of the part of the issue that is sold.31 . A British company listed on the Alternative Investment Market of the London Stock Exchange, announced the sale of 6,686,665 shares to a small group of qualified invest ors at £0.025 per share. Which of the following best describesthis sale?A. Shelf registration.B. Private placement.C. Initial public offering.32. A German publicly traded company, to raise new capital, gave its existing shareholders the opportunity to subscribe for new shares. The existing shareholders could purchase two new shares at a subscription price of €4.58 per share for every 15 shares held. This is an example of a(n):A. rights offering.B. private placement.C. initial public offering.33. Consider an order-driven system that allows hidden orders. The following four sell orders on a particular stock are currently in the system's limit order book. Based on the commonly used order precedence hierarchy, which of these orders will have precedence over others?A. Order I (time of arrival of 9:52:01 ).B. Order II (time of arrival of 9:52:08).C. Order III (time of arrival of 9:53:04)34. Zhenhu Li has submitted an immediate-or-cancel buy order for 500 shares of a company at a limit price of CNY 74.25. There are two sell limit orders standing in that stock's order book at that time. One is for 300 shares at a limit price of CNY 74.30 and the other is for 400 shares at a limit price of CNY 74.35. How many shares in Li's order would get cancelled?A. None (the order would remain open but unfilled).B. 200 (300 shares would get filled).C. 500 (there would be no fill).35. A market has the following limit orders standing on its book for a particular stock:Ian submits a day order to sell 1,000 sha res, limit £19.83. Assuming thatno more buy orders are submitted on that day after Ian submits his order, what would be Ian's average trade price?A. £19.70.B. £19.92.C. £20.05.36. A financial analyst is examining whether a country's financial market is well functioning. She finds that the transaction costs in this market are low and trading volumes are high. She concludes that the market is quite liquid. In such a market:A. traders will find it hard to make use of their information.B. traders will find it easy to trade and their trading will make the marketless informationally efficient.C. traders will find it easy to trade and their trading will make the market more informationally efficient.37. The government of a country whose financial markets are in an early stage of development has hired you as a consultant on financial market regulation. Your first task is to prepare a list of the objectives of market regulation. Which of the following is least likely to be included in this list of objectives?A. Minimize agency problems in the financial markets.B. Ensure that financial markets are fair and orderly.C. Ensure that investors in the stock market achieve a rate of return that is atleast equal to the risk-free rate of return.Chapter 2 Portfolio Management: An Overview PRACTICE PROBLEMS FOR CHAPTER 21. Investors should use a portfolio approach to:A. reduce risk.B. monitor risk.C. eliminate risk.2. Which of the following is the best reason for an investor to be concerned with the composition of a portfolio?A. Risk reduction.B. Downside risk protection.C. Avoidance of investment disasters.3. With respect to the formation of portfolios, which of the following statements is most accurate?A. Portfolios affect risk less than returns.B. Portfolios affect risk more than returns.C. Portfolios affect risk and returns equally.4. Which of the following institutions will on average have the greatest need for liquidity?A. Banks.B. Investment companies.C. Non-life insurance companies.5. Which of the following institutional investors will most likely have the longest time horizon?A. Defined benefit plan.B. University endowment.C. Life insurance company.6. A defined benefit plan with a large number of retirees is likely to havea high need forA. income.B. liquidity.C. insurance.7. Which of the following institutional investors is most likely to manage investments in mutual funds?A. Insurance companies.B. Investment companies.C. University endowments.8. With respect to the portfolio management process, the asset allocation is determined in the:A. planning step.B. feedback step.C. execution step9. The planning step of the portfolio management process is least likely to include an assessment of the client'sA. securities.B. constraints.C. risk tolerance.10. With respect to the portfolio management process, the rebalancing of a portfolio's composition is most likely to occur in the:A. planning step.B. feedback step.C. execution step.11. An analyst gathers the following information for the asset allocations of three portfolios:Which of the portfolios is most likely appropriate for a client who has a high degree of risk tolerance?A. Portfolio 1.B. Portfolio 2.C. Portfolio 3.12. Which of the following investment products is most likely to trade attheir net asset value per share?A. Exchange traded funds.B. Open-end mutual funds.C. Closed-end mutual funds.13. Which of the following financial products is least likely to have a capital gain distribution?A. Exchange traded funds.B. Open-end mutual funds.C. Closed-end mutual funds.14. Which of the following forms of pooled investments is subject to the least amount of regulation?A. Hedge funds.B. Exchange traded funds.C. Closed-end mutual funds.15. Which of the following pooled investments is most likely characterized by a few large investments?A. Hedge funds.B. Buyout funds.C. Venture capital funds.Chapter 3 Portfolio Risk and Return: Part I PRACTICE PROBLEMS FOR CHAPTER 31. An investor purchased 100 shares of a stock for $34.50 per share at the beginning of the quarter. If the investor sold all of the shares for $30.50 per share after receiving a $51.55 dividend payment at the end of the quarter, the holding period return is closest to:A. - 13.0%.B. - 11.6%.C. - 10.1%.2. An analyst obtains the following annual rates of return for a mutual fund:The fund's holding period return over the three-year period is closest to:A. 0.18%.B. 0.55%.C. 0.67%.3. An analyst observes the following annual rates of return for a hedge fund:The hedge fund's annual geometric mean return is closest to:A. 0.52%.B. 1.02%.C. 2.67%.4. Which of the following return calculating methods is best for evaluating theannualized returns of a buy-and-hold strategy of an investor who has made annual deposits to an account for each of the last five years?A. Geometric mean return.B. Arithmetic mean return.C. Money-weighted return.5. An investor evaluating the returns of three recently formed exchange-traded funds gathers the following information:The ETF with the highest annualized rate of return is:A. ETF 1.B. ETF 2.C. ETF 3.6. With respect to capital market theory, which of the following asset characteristics is least likely to impact the variance of an investor's equally weighted portfolio?A. Return on the asset.B. Standard deviation of the asset.C. Covariances of the asset with the other assets in the portfolio.7. A portfolio manager creates the following portfolio:If the correlation of returns between the two securities is 0.40, the expected standard deviation of the portfolio is closest to:A. 10.7%.B. 11.3%.C. 12.1%.8. A portfolio manager creates the following portfolio:If the covariance of returns between the two securities is - 0.0240, the expected standard deviation of the portfolio is closest to:A. 2.4%.B. 7.5%.C. 9.2%.The following information relates to Questions 9-10A portfolio manager creates the following portfolio:9. If the standard deviation of the portfolio is 14.40%, the correlation between the two securities is equal to:A. - 1.0.B. 0.0.C. 1.0.10. If the standard deviation of the portfolio is 14.40%, the covariance between the two securities is equal to:A. 0.0006.B. 0.0240.C. 1.0000.The following information relates to Questions 11-14An analyst observes the following historic geometric returns:11 . The real rate of return for equities is closest to:A. 5.4%.B. 5.8%.C. 5.9%.12. The real rate of return for corporate bonds is closest to:A. 4.3%.B. 4.4%.C. 4.5%.13. The risk premium for equities is closest to:A. 5.4%.B. 5.5%.C. 5.6%.14. The risk premium for corporate bonds is closest to:A. 3.5%.B. 3.9%.C. 4.0%.15. With respect to trading costs, liquidity is least likely to impact the:A. stock price.B. bid-ask spreads.C. brokerage commissions.16. Evidence of risk aversion is best illustrated by a risk-return relationship that is:A. negative.B. neutral.C. positive.17. With respect to risk-averse investors, a risk-free asset will generate anumerical utility that is:A. the same for all individuals.B. positive for risk-averse investors.C. equal to zero for risk seeking investors18. With respect to utility theory, the most risk-averse investor will have an indifference curve with the:A. most convexity.B. smallest intercept value.C. greatest slope coefficient.19. With respect to an investor's utility function expressed as:21=E(r)- 2u A , which of the following values for the measure for risk aversion has the least amount of risk aversion?A. - 4.B. 0.C. 4.The following information relates to Questions 20-23A financial planner has created the following data to illustrate the application of utility theory to portfolio selection:20. A risk-neutral investor is most likely to choose:A. Investment 1.B. Investment 2.C. Investment 3.ExpectedStandard Deviation (% )28153021. If an investor's utility function is expressed as U = E(r) ~A& and the measure for risk aversion has a value of- 2, the risk-seeking investor is most likely to choose:A. Investment 2.B. Investment 3.C. Investment 4.22. If an investor's utility function is expressed as U = E(r) - ~A& and the measure for risk aversion has a value of2, the risk-averse investor is most likely to choose:A. Investment 1.B. Investment 2.C. Investment 3.23. If an investor's utility function is expressed as U =E(r) - ~A& and the measure for risk aversion has a value of4, the risk-averse investor is most likely to choose:A. Investment 1.B. Investment 2.C. Investment 3.24. With respect to the mean-variance portfolio theory, the capital allocation line, CAL, is the combination of the risk-free asset and a portfolio of all:A. risky assets.B. equity securities.C. feasible investments.25. Two individual investors with different levels of risk aversion will have optimalportfolios that are:A. below the capital allocation line.B. on the capital allocation line.C. above the capital allocation line.The following information relates to Questions 26-28A portfolio manager creates the following portfolio:26. If the portfolio of the two securities has an expected return of15%, the proportion invested in Security 1 is:A. 25%.B. 50%.C. 75%.27. If the correlation of returns between the two securities is - 0.15, the expected standard deviation of an equal-weighted portfolio is closest to:A. 13.04%.B. 13.60%.C. 13.87%.28. If the two securities are uncorrelated, the expected standard deviation of an equal-weighted portfolio is closest to:A. 14.00%.B. 14.14%.C. 20.00%.29. As the number of assets in an equally-weighted portfolio increases, the contribution of each individual asset's variance to the volatility of the portfolio:A. increases.B. decreases.C. remains the same.30. With respect to an equally-weighted portfolio made up of a large number of assets, which of the following contributes the most to the volatility of the portfolio?A. Average variance of the individual assets.B. Standard deviation of the individual assets.C. Average covariance between all pairs of assets.31. The correlation between assets in a two-asset portfolio increases during a market decline. If there is no change in the proportion of each asset held in the portfolio or the expected standard deviation of the individual assets, the volatility of the portfolio is most likely to:A. increase.B. decrease.C. remain the same.The following information relates to Questions 32-34An analyst has made the following return projections for each of three possible outcomes with an equal likelihood of occurrence:32. Which pair of assets is perfectly negatively correlated?A. Asset 1 and Asset 2.B. Asset 1 and Asset 3.C. Asset 2 and Asset 3.33. If the analyst constructs two-asset portfolios that areequally-weighted, which pair of assets has the lowest expectedstandard deviation?A. Asset 1 and Asset 2.B. Asset 1 and Asset 3.C. Asset 2 and Asset 3.34. If the analyst constructs two-asset portfolios that are equally weighted, which pair of assets provides the least amount of risk reduction?A. Asset 1 and Asset 2.B. Asset 1 and Asset 3.C. Asset 2 and Asset 3.35. Which of the following statements is least accurate? The efficient frontier is the set of all attainable risky assets with the:A. highest expected return for a given level of risk.B. lowest amount of risk for a given level of return.C. highest expected return relative to the risk-free rate.36. The portfolio on the minimum-variance frontier with the lowest standard deviation is:A. unattainable.B. the optimal risky portfolio.C. the global minimum-variance portfolio.37. The set of portfolios on the minimum-variance frontier that dominates all sets of portfolios below the global minimum-variance portfolio is the:A. capital allocation line.B. Markowitz efficient frontier.C. set of optimal risky portfolios.38. The dominant capital allocation line is the combination of therisk-free asset and the:A. optimal risky portfolio.B. levered portfolio of risky assets.C. global minimum-variance portfolio.39. Compared to the efficient frontier of risky assets, the dominant capital allocation line has higher rates of return for levels of risk greater than the optimal risky portfolio because of the investor's ability to:A. lend at the risk-free rate.B. borrow at the risk-free rate.C. purchase the risk-free asset.40. With respect to the mean-variance theory, the optimal portfolio is determined by each individual investor's:A. risk-free rate.B. borrowing rate.C. risk preference.Chapter 4 Portfolio Risk and Return: Part II PRACTICE PROBLEMS FOR CHAPTER 41. The line depicting the risk and return of portfolio combinations of a risk-free asset and any risky asset is the:A. security market line.B. capital allocation line.C. security characteristic line.2. The portfolio of a risk-free asset and a risky asset has a betterrisk-return tradeoff than investing in only one asset type because the correlation between the risk-free asset and the risky asset is equal to:A. - 1.0.B. 0.0.C. 1.0.3. With respect to capital market theory, an investor's optimal portfolio is the combination of a risk-free asset and a risky asset with the highest:A. expected return.B. indifference curve.C. capital allocation line slope.。