四大会计师事务所 - 审计表 - 工作底稿. - 审计

四大审计师尽职调查的工作内容

四大审计师尽职调查的工作内容四大审计师尽职调查的工作内容审计的主要目的就是对客户的财务数据和信息发表自己的意见。

以下是店铺整理的四大审计师尽职调查的工作内容,想了解更多相关信息请持续关注我们店铺!四大的审计在创业和投资之前,我任职于安永会计师事务所,从事年报审计、上市前审计以及并购审计长达4年之久。

审计的主要目的就是对客户的财务数据和信息发表自己的意见。

审计报告只有一页纸,审计师的意见只有一句话,意思是:我们认为财务报告公允/不公允的反应真实情况。

审计师执业有国际通用的严格的审计准则指引,如何制定调研方案、如何取证、如何控制风险都应有尽有。

安永是国际四大会计师事务所之一,其不但遵循行业指引和审计准则,而且在此基础上还形成自己更为严格的全球通用审计方法(Global Audit Methodology)以及相应的培训体系。

四大在招聘新员工时,根本不需要考虑你是学什么专业,而只需考虑你是否足够聪明和有没有足够的领导力。

因为他们的业务流程和培训体系的标准化程度之高,足以让任何大学毕业生成为出色的审计师。

然而,风险投资行业,没有什么行业准则,甚少投资机构有自己的业务指引和培训体系。

也不存在一种叫“项目投资分析师”的资格认证,当然也就没有执业规范。

这个行业充其量也就只有一些行业惯例。

但是实际上怎么做尽职调查,投资经理的职责是什么,每一家机构都有不同诠释。

我希望通过本文在风险投资机构的实务层面进行探讨,分享一下我对风险投资机构决策机制以及投资经理尽职调查的认识。

我用的方法也许比较有趣,我把四大会计师事务所和风险投资机构对比来说。

对比完之后,你应该会发现,四大会计师的尽调极其值得风险投资机构借鉴。

调查的思想和方法都是通用的。

“尽职调查”是谁尽职?4年如8年的审计工作中,我做过无数的尽调。

尽调的思想、原则、方法,即使我离开这个职业已经9年,我仍然滚瓜烂熟。

什么叫尽职调查,Due Diligence?我曾经听有些投资经理说过尽职调查就是去看看项目的管理层有没有尽自己的责任把工作做好。

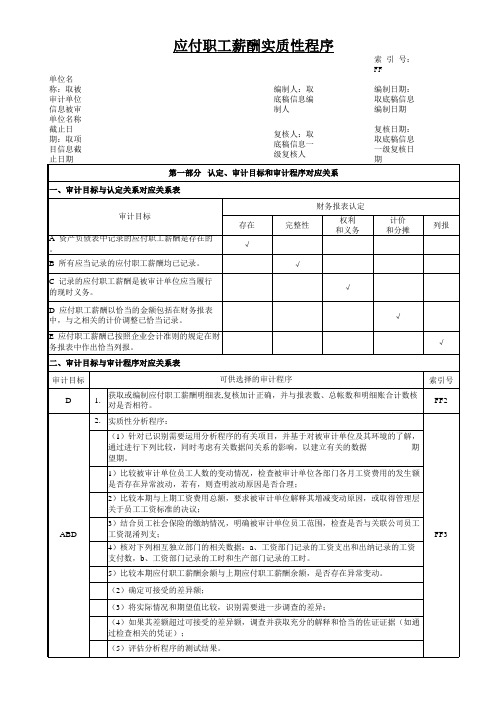

会计事务所全套审计工作底稿模板 F负债 FF应付职工薪酬

单位名称:取被审计单位信息被审单位名称编制人:取底稿信息编制人编制日期:取底稿信息编制日期截止日期:取项目信息截

复核人:取底稿信息一级复核人

复核日期:取底稿信息一级复核日

单位名称:取被审计单位信息被审单位名称编制人:取底稿信息编制人编制日期:取底稿信息编制日期截止日期:取项目信息截

复核人:取底稿信息一级复核人

复核日期:取底稿信息一级复核日

单位名称:取被审计单位信息被审单位名称编制人:取底稿信息编制人编制日期:取底稿信息编制日期截止日期:取项目信息截

复核人:取底稿信息一级复核人

复核日期:取底稿信息一级复核日。

审计工作底稿(模板)

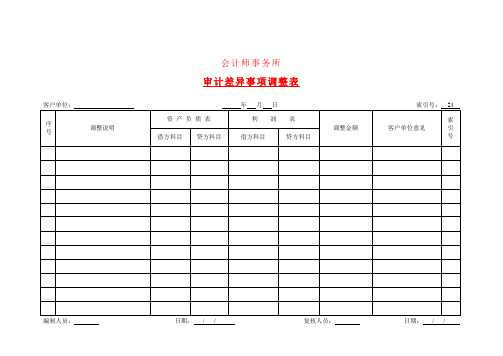

会计师事务所审计差异事项调整表编制人员:日期:/ / 复核人员:日期:/ /会计师事务所银行存款余额明细核对表编制人员:日期:/ / 复核人员:日期:/ /会计师事务所货币资金收入凭证抽查表编制人员:日期:/ / 复核人员:日期:/ /会计师事务所货币资金支出凭证抽查表编制人员:日期:/ / 复核人员:日期:/ /会计师事务所会计师事务所审计工作底稿目录(一)编制人员:日期:/ / ;复核人员:日期:/ /会计师事务所审计工作底稿目录(二)编制人员:日期:/ / ;复核人员:日期:/ /会计师事务所审计工作底稿目录(三)编制人员:日期:/ / ;复核人员:日期:/ /索引号Z20 会计师事务所业务报告签发处理单索引号Z21 会计师事务所客户提供相关资料情况表会计师事务所审计程序完成情况表(一)编制人员:日期:/ / ;复核人员:日期:/ /审计程序完成情况表(二)编制人员:日期:/ / ;复核人员:日期:/ /审计程序完成情况表(三)编制人员:日期:/ / 复核人员:日期:/ /业务约定书甲方:乙方:兹由甲方委托乙方进行下述业务范围的甲方年年度会计报表审计业务,经双方协商,达成以下约定:一、业务范围及目的乙方接受甲方委托:对甲方截止年月日的资产负债表以及截止该年度的损益表、现金流量表进行审计;乙方将根据《中国注册会计师独立审计准则》,对甲方的内部控制制度进行研究和评价,对会计记录进行必要的抽查,以及在当时情况下乙方认为必要的其他审计程序,并在此基础上对上述会计报表的合法性、公允性及会计处理方法的一贯性发表审计意见。

二、甲方的责任与义务甲方的责任是:建立健全内部控制制度,保护资产的安全完整,保证会计资料的真实、合法、完整,保证会计报表充分披露有关的信息。

甲方的义务:1、及时为乙方的审计提供其所要求的全部会计资料和其他有关资料。

2、为乙方派出的有关人员提供必要的工作条件及合作,具体事项将由乙方审计工作人员于工作开始前提供清单。

四大会计事务所全套审计工作底稿模板

一、概述在企业经营活动中,会计事务所扮演着重要的角色,其提供的审计服务,对于企业的财务状况和经营活动具有至关重要的影响。

而会计事务所进行审计工作时,底稿模板的使用则显得格外重要。

四大会计事务所作为国际知名的会计服务机构,其审计底稿模板更是具有一定的标杆意义。

在这篇文章中,我们将从四大会计事务所的角度,为您提供一套全面的审计工作底稿模板。

二、四大会计事务所简介四大会计事务所是指国际知名的四家会计服务机构,包括普华永道、德勤、毕马威和安永,它们在全球范围内都有着广泛的业务覆盖和良好的口碑。

这四家会计事务所拥有丰富的审计经验和资深的审计专业人员,其审计底稿模板体现了世界级的审计标准和最佳实践。

三、审计工作底稿模板的组成(一)审计程序底稿审计程序底稿是审计工作中的核心内容,它包括了审计程序的设计、实施和结果评价等方面的内容。

审计程序底稿要求结构合理、条理清晰,以保证审计工作的全面性和有效性。

(二)风险评估底稿风险评估底稿是审计工作中不可或缺的一部分,它主要用于评估企业财务报表可能存在的风险,并制定相应的应对措施。

风险评估底稿要求全面考虑各种潜在的风险因素,以保障审计的客观性和可靠性。

(三)内部控制底稿内部控制底稿主要用于评价企业内部控制体系的有效性,从而为审计工作提供重要的依据。

内部控制底稿要求详细描述企业的内部控制流程,并进行合理的评价和建议。

(四)证据收集底稿证据收集底稿是审计工作中至关重要的一环,它要求审计人员以有效的方式收集、整理和分析审计证据,为审计意见的形成提供可靠的依据。

证据收集底稿要求审计人员具有丰富的经验和良好的分析能力,以保证审计工作的全面性和准确性。

(五)文档管理底稿文档管理底稿是审计工作中不可或缺的一部分,它要求审计人员对审计工作的各个环节进行详细的记录和管理,以保证审计工作的可追溯性和可审查性。

文档管理底稿要求审计人员严格按照规定的流程和要求进行文档的归档和管理,以保证审计工作的合规性和可靠性。

四大审计底稿

Audit Program31 December 2000Prepared byDate Reviewed byDate Approved byDateCLIENTYEAR ENDAUDIT PROGRAM FOR Cash & BankRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 1. Compare the listing of cash and bank accounts with those of priorperiods and investigate any unexpected changes (e.g., creditbalances, unusual large balances, new accounts, closed accounts) orthe absence of expected changes._____ 2. Review interest received in relation to the average cash and bankbalances.Cash balances_____ 3. (a) Obtain a copy of the list of balances of cash as at 31/12/1999 and31/12/2000.(b) Check casting and agree total with general ledger controlaccount._____ 4. Scan cash entries noting any unusual items and make furtherinvestigation where considered necessary.Bank Balances_____ 5. (a) Obtain a copy of the list of balances of bank as at the period enddate; and(b) Check casting and agree total with general ledger control account.6. Bank Confirmation request (Note 2)(a) Get a standard bank confirmation request form from thestationery cupboard.(b) Fill in the client name, our reference number and the period oryear end date (please specify) for the bank to confirm.(c) Give the partial completed form to the relevant client staff .(d) Request the client to perform the following tasks:·Stamp the form with the company chop;·Have the form signed by an authorized signatory;·Fill in the balances in the appropriate boxes;·For items which are not applicable for the company, fill in“N/A” in the corresponding boxes; and·Confirm to us whether the form can be sent to the bank by mailor if the client is required to take the confirmation to the bank.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Cash & Bank (Continued)Ref Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by Bank Balances (Continued)(e) Check the completed confirmation form to ensure thefollowing:·the balances agreed to the bank statements as at theconfirmation date;·the form is properly signed;·the client has filled in all security and guarantee related matterson the bank confirmation; and·Send the bank confirmation form to the bank by post.OrIf the client staff has to take the confirmation to the bank, arrange astaff to go with him/her. (Note 3)(f) Keep copies of the confirmation in the file until replies areobtained from the banks.(g) When replies are received, check the confirmations received toensure that:·the forms were stamped and signed by the bank on the lastpage; and·the individual balances and information are endorsed by thebank staff personal chop. (Note 4)_____ 7. Examine the client’s bank reconciliation as at 31/12/2000 asfollows:a) agree book balance to Cash Book and General Ledger;b)agree balance per bank statement to bank statement at theyear end and bank confirmation received;c) check casting of the bank reconciliation;d)vouch all lodgments / lodgments with amount greater thanRMB _____ * not clear to the cash book and bank statementin the following month ensuring all lodgments are cleared;(Note 5)e) vouch all outstanding cheques / outstanding cheques withamount greater than RMB _____ * to the cash book and to thebank statement in the following month & note down the datewhen they are cleared; (Note 5)f) obtain explanations from the client of all outstanding lodgments/ lodgment with amounts greater than RMB_____ *;g) investigate all stale cheques / stale cheques with amountgreater than RMB_____ * issued for more than five / ten days*, and make appropriate adjustments thereof in the cash bookand ledger; (Note 6)CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Cash & Bank (Continued)Ref Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by Bank Balances (Continued)h) investigate all payments / payments with amount greater thanRMB_____ * recorded by the bank but not recorded by theclient, and make appropriate adjustments thereof in the cashbook and ledger; (Note 6) andi) investigate all receipts / receipts with amount greater thanRMB_____ * recorded by the bank but not recorded by theclient, and make appropriate adjustments thereof in the cashbook and ledger. (Note 6)_____ 8. Review the bank book for any unusual items (greater than RMB_____) such as: a) non-trading receipts or payments andb) transfers in and out of the bank accounts._____ 9. Select receipts larger than RMB ______ and payments larger thanRMB ______ within ____weeks before and after the year end toensure that they have been properly accounted for.General_____ 10. Review the cash and bank accounts in the general ledger for unusualitems._____ 11. Review the cash disbursements and cash receipts registers forunusual items; investigate any such items observed._____ 12. Review bank confirmations, minutes, loan agreements and otherdocuments for evidence of restrictions on the use of cash, or ofliens, or security interests in, cash._____ 13. Consider the covenants and other narratives given in loan and othermaterial agreements and determine compliance with the agreementsand whether necessary disclosure have been made._____ 14. Consider the implications of client management practices that resultin recurring short term loan to finance working capital. Considerinquiry of client management and alert your senior / executiveshould such short term loans be encountered in the audit.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Cash & Bank (Continued)Ref Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by* Delete as appropriateNote 1i. The cash count should be performed by cashier with the presence of a staff that normally is not involved in the cashier function.ii. Cash certificate is acceptable only if the petty cash balance is considered as immaterial and / or the risk associated is low/ minimal.Note 2i. Bank confirmations are sent on an individual branch basis, i.e. one confirmation per branch.ii. Confirmation should also be sent to accounts closed during the year.iii. If either the bank or the client refuses to reply/send the confirmation, consider if there is a significantlimitation of our audit scope and its implications.Note 3When it is not feasible for an EYHM staff to go with the client, we must reconsider if the confirmation obtained provides sufficient and reliable audit evidence due to the lack of independence.Note 4Alternatively, the bank may issue its own bank certificate to confirm the deposits and loans balances and confirm that no other business transactions exiting.Note 5The extent of vouching work depends on our assessment of the likelihood of errors occurring.Note 6We have to consider the effect in aggregate regarding the unadjusted items which are below the amount stipulated in this procedure whenever one is set.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Accounts ReceivableRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by1. Obtain or prepare a listing of accounts receivable and investigateunusual balances. Credit balances, and accounts that may not beaccounts receivable, or may not be properly classified as accountsreceivable trade (e.g. consignment accounts, related-party oremployee accounts ).2. Trace the total in the customers’ ledger to the general ledger controlaccount: investigate reconciling items greater than ¥________ andunusual items.3. Compare current period’s receivables as a percentage of net sales withprior periods’ percentages. Compare discounts, returns, andallowances with prior periods (e.g. as 5 - 10% of sales).4. As of 31/12/2000, perform confirmation procedures for accounts asfollows:a. Select key items (accounts greater than ¥________ and accountswith the following characteristics: long aging, or involved in legalcase) for positive confirmation procedures.b. Using a MUS or Random technique, select a representative sampleor account (as determined through use of Audit Risk Table__________) for positive / negative confirmation procedures.c. Trace information (i.e.. balance and addresses) from individualrequests to the subsidiary records. Send requests and prepareconfirmation statistics.d. Trace confirmation replies to the trial balance and request theclient to reconcile differences. Investigate explanations for differencesgreater than ¥_______ and any unusual explanations.e. Send second requests for all unanswered positive confirmationrequests.f. Examine subsequent cash receipts, shipping records, salescontracts, and other evidence to substantiate the validity of accountsfor which no reply or an unsatisfactory reply was received.g. Summarize the results of the confirmation procedures.5. Test sales cut-off for service rendering greater than ¥ for theLast days before year end and the first ___days after year end.Determine that the sales were recorded in the proper period throughreview of shipping documents, billings, sales register and othersupporting documents.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Accounts Receivable (Continued)Ref Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by6. Test for out-of-period credit memos by examining those greater than¥_____ issued for the period from the balance sheet dated to/ /2001. Inquire as to whether there are any unissued credits thatrelate to the period under audit.7. Test the aging of accounts receivable and unbilled contracts foramounts greater than ¥and accounts with the followingcharacteristics: opening receivable balance brought forward from // , to support the accuracy of the aged trial balance. Trace thedetails to and from the customer’s ledger accounts or supportingdocumentation.8. Compare aging, bad debt expanse, and write-offs with prior periods.Compar e the current period’s accounts receivable turnover and/ornumber of day’s sales outstanding with prior periods’ amounts.9. Evaluate the adequacy of the allowance for doubtful accounts and therelated provision as follows:a. From the aged trial balance as of 31/12/2000, select accounts withbalances greater than ¥ , accounts greater than ¥ thatare more than 180 days past due, and accounts with legalcontingencies.b. In addition to those accounts selected in a above, select anyadditional accounts that have a higher likelihood of error (e.g.. prioryear experience, industry concentration).c. For those accounts selected, discuss collectibles concerns with thecredit manager or other responsible individual and reviewcorrespondence files or other relevant data in support of the client’srepresentations.d. Review subsequent collections for those accounts selected forevaluation.e. Determine if any product related problems (e.g.. quality right ofreturn) are affecting collectibles and should be considered indetermining the adequacy of the allowance. These problems shouldalso be considered in determining the adequacy of the allowance forinventory obsolescence.f. Perform appropriate analytical review procedures.g. Conclude on the adequacy of the allowance.10. Review the accounts receivable and sales accounts in the generalledger and the sales and cash receipts registers for unusual items:investigate any such items observed.11. Determine whether any receivables are pledged as collateral orSubject to any liens; coordinate with work on debt payable.CLIENT .YEAR END 31 December 2000AUDIT PROGRAM FOR Prepayment & Construction in ProcessRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 1. Obtain or prepare an analysis for each significant classification ofprepaid expenses, deferred charges, other assets or intangibles.Include adequate descriptions of significant components and thefollowing:a. Balance at the beginning of the periodb. Additions at costc. Deductions charged to expense, and to other accountd. Balance at the end of the period._____ 2. Foot the analyses and trace totals to the general ledger: trace thebeginning balances to the prior period audit working papers._____ 3. Compare the account balances with those of prior periods andinvestigate any unexpected changes (or the absence of expectedchanges). For accounts greater than ¥and accounts that havechanged by the greater of ¥ or 5~10% from the prior period.Recomputed the ending balance (and examine supporting documentsfor significant charges as appropriate) and determine that thecarrying amount does not exceed amounts properly allocable tofuture periods._____ 4. Trace amounts amortized to expense during the period to the relatedgeneral ledger accounts._____ 5. Confirm deposits and assets held by others for those items greaterthan ¥and items related to construction of shelters andunipoles, or items related to operating expenses for sales centers._____ 6. Review the accounts under this classification and the related incomeand expense accounts in the general ledger for unusual items:investigate any such items noted._____ 7. Determine that there has been no permanent impairment of value fordeferred charges, intangible assets, etc._____ 8. Determine that balances are properly classified in the balance sheet(current versus non-current, etc.).____ 9. Identify any exceptional item (i.e. prepaid legal fee). Investigate itsnature and consider the recoverability of these items and whether anyprovision is needs.10. Perform reasonableness test on amortisation of deferred expenses._____ 11. Send and obtain confirmations from staff and sales centers to verifyexistence of assets._____ 12. Perform overall analytical review on total prepayment andconstruction in progress._____ 13. Obtain and review a movement of construction in progress, examinesupporting documents for material additions.14. Test the calculation of capitalised interest if appropriate.____ 15. Check Completion Verification to ensure that CIP is transferred tofixed assets at proper time.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR AffiliatesRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by ______ 1. Review other receivable and payables, and reclassify currentaccounts with ultimate holding company, subsidiaries, fellowsubsidiaries and associate company to the proper accounts.______ 2. Agree or reconcile all current accounts balance with relatedparty by sending confirmation. Agree the current accountbalance with subsidiaries’ books and records.CLIENT .YEAR END 31 December 2000AUDIT PROGRAM FOR Fixed Assets and Concession RightsRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by ______ 1. Obtain or prepare a summary of property, plant and equipment andrelated depreciation (by major classification) including thefollowing:a. Beginning and ending balances at cost.b. Asset additions at cost.c. Asset retirements and dispositions.d. Other changes (e.g. transfers).e. Beginning and ending balances of the allowances fordepreciation.f. Additions to the allowance for depreciation accompanied by ananalysis of amounts charged to expense, absorbed in inventory,and capitalized.g. Reductions of the allowance for depreciation for retirements anddispositions.______ 2. Obtain or prepare a schedule of asset additions during the period,including description, date acquired, estimated useful life, and cost,for all additions of ¥ or more, with those under that amountcombined so the total additions ties to the summary schedule byclassification. Compare the level of property acquisitions for theperiod with the prior period.______ 3. Obtain or prepare a schedule of retirements and dispositionincluding description, date of acquisition, date of retirement ordisposition, cost, accumulated depreciation, net carrying value,proceeds of disposition, and gain or loss on disposition.______ 4. Trace the beginning balances per the summary schedule to endingbalances per the prior p eriod’s audit working papers.______ 5. Trace amounts per the summary schedule to the general ledger, thedetailed asset records, and to the schedules of additions, andretirements and dispositions; test the footings and crossfootings ofthe schedules.______ 6. For asset additions greater than ¥and additions with thefollowing characteristics: capitalised interests, or capitalised legalfees, examine supporting documents (purchase contracts, paidchecks, vendors’ invoices) to verify record ed cost. Challenge theestimated useful lives assigned.______ 7. For asset retirements and dispositions with net carrying valuesgreater than ¥ , examine supporting documents (bills of sale,contracts, copies of checks) to verify proceeds and determine thatthe appropriate cost and accumulated depreciation were removedfrom the accounting records. Recomputed gain or loss.CLIENT .YEAR END 31 December 2000AUDIT PROGRAM FOR Fixed Assets and Concession Rights (Cont’d)Ref Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 8. Examine support for charges greater than ¥to repair andmaintenance expense accounts for potential items that should havebeen capitalized. Compare repair and maintenance expense accountbalances with the prior period and investigate any unexpectedchanges (or the absence of expected changes)._____ 9. Perform physical inspection of selected shelters in 3 major citiesand determine asset recoverability / realization._____ 10. Note down the depreciation policy under the Group’s instruction.Perform reasonableness test or detail recalculations to assessdepreciation / amortization expense and tie the total expense perthe property summary to the general ledger accounts._____ 11. Obtain or prepare schedules of lease and rental expense detail.Examine support for charges greater than ¥________ to determineproper classification. Determine that any new leases have beenproperly accounted for._____ 12. Test the calculation of capitalized interest, if appropriate._____ 13. Review the property, plant and equipment and related accounts inthe general ledger for unusual items; investigate such items noted._____ 14. Review minutes, agreements, UCC filings, and other documents(e.g., bank and loan confirmations) for evidence of liens, pledges,security interests, and restrictions on property, plant andequipment._____ 15. Determine the tax basis of accounting for property, plant andequipment transactions, and verify that any book-tax differenceshave been accounted for property.CLIENT .YEAR END 31 December 2000AUDIT PROGRAM FOR Accounts Payable, Accruals and Other LiabilitiesRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by ______ 1. Obtain or prepare a schedule of accounts payable details as of thebalance sheet date: foot the schedule and trace the total to theaccounts payable balance in the general ledger.______ 2. Compare the list of accounts payable with those of prior periodsand investigate any unexpected changes (e.g. changes in majorvendors, in the proportion of debit balances, in the aging of theaccounts, etc.) or the absence of expected changes.______ 3. Review the accounts payable account in the general ledger andsupporting detail for unusual items. Investigate debit balancesand , if significant, consider requesting positive confirmations andpropose reclassification of amounts.______ 4. Obtain or prepare a schedule of accrued liabilities and deferredincome. Examine the composition and the computation of thoseaccounts considered significant or whether the change / lack ofchange in lance from the prior period is unexpected.______ 5. Compare the account balances with those of prior periods andinvestigate any unexpected changes (or the absence of expectedchanges).______ 6. Ensure the provision of welfare fund and staff welfare expensesare properly accrued and accounted for.______ 7. Review construction contracts and related documents for anyunrecorded liabilities and make adjustments if necessary.______ 8. Circularise the payable accounts with material balances.______ 9. Agree payable accounts with material balance to suppliers’statements or vouch to customer receipts, if available.______ 10. Perform a search for unrecorded liabilities at the year end byreviewing disbursements voucher and unpaid invoices overRMB after year end.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Tax payableRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by ______ 1. For detailed procedures, please see PRC TAX PROVISIONAUDIT PROGRAMME.CLIENT .YEAR END 31 December 2000AUDIT PROGRAM FOR Short Term Bank LoansRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 1. Obtain or prepare a schedule and a movement of bank loan andrelated interest accounts by issue showing the following:Description (date of origin, type of debt, maturity, face amount,interest rate, timing and amount of payments): Activity in theprincipal and related interest accounts (beginning balance,additions, payments, ending balance)._____ 2. Test the clerical accuracy of the schedule in #1 above, and tracetotals to the general ledger. Compare the account balances withthose of prior periods and investigate any unexpected changes (orthe absence of expected changes)._____ 3. Confirm all debt account, including those paid off during theperiod, as of 31/12/2000. Information to be confirmed shouldinclude: principal and related interest due at end of period, terms,liens, security interests or assets pledged as collateral, andcompliance with covenants._____ 4. Test interest paid and accrued and tie expense to the trial balance.Perform an overall test of the reasonableness of interest expense bymultiplying the average interest rate by the average amount of debtoutstanding._____ 5. Vouch to supporting documents (bank-in slip etc.) to ensure thatrepayments have been made as expected and the year end balance iscorrect and correctly disclosed._____ 6. Obtain and review copies of all new debt agreements and anyexisting debt agreements for which we do not have a copy in ourfiles. Review to determine the terms, restrictions, and otherpertinent provisions of long-term debt._____ 7. Determine whether receivables, inventory, and / or property, plant,and equipment are pledged as collateral or subject to any liens._____ 8. Review short-term / long-term classification of debt for propriety.CLIENT .YEAR END 31 December 2000AUDIT PROGRAM FOR Share capitalRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 1. Obtain or prepare an analysis of all equity accounts progressingform the beginning of the period to the end of the period. Test theclerical accuracy of the analysis. Trace the beginning balances toprior period audit working papers and trace ending balances to thegeneral ledger._____ 2. Examine support for and determine the propriety of accounting forany changes in the equity accounts from the prior period._____ 3. Review minutes or other supporting documents for theauthorization for and the details of transactions that affected theequity accounts during the period._____ 4. If the company does not keep itsown stock record books:a.Obtain confirmation of shares outstanding from the registrarand transfer agent.b. Reconcile the schedule to the general ledger._____ 5. Analysis activity in the retained earnings account during the period;trace the beginning balance to the prior period audit wordingpapers; trace the ending balance to the general ledger; trace incometo the financial statements and support other changes asappropriate._____ 6. Obtain the calculation sheets of minority interests (MI) and reviewit. Ensure that all proposed adjustment related to retained earningsare also affect the results of MI.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Commitments and contingenciesRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 1. Review all contracts and agreements to determine the capitalcommitment._____ 2. Inquire management and check board minutes, bank confirmations,contracts, loan agreements, leases and correspondence withsolicitors for indications of other guarantees, commitments orcontingencies.CLIENT .YEAR END 31 December 2000AUDIT PROGRAM FOR RevenueRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 1. Obtain or prepare a comparative analysis of sales (by product line,division, etc.) and other income accounts for the current andpreceding period and investigate acoounts that changed by thegreater of ¥ or 10%._____ 2. Select 20-25 sales transactions from throughout the period andsupport proper recording by comparing sales invoice information toshipping documents and tracing the invoice through the accountingsystem to recording the general ledger._____ 3. See Accounts Receivable step #10._____ 4. Review the other non-current credit accounts in the general ledgerfor unusual items._____ 5. Perform additional analytical review procedures as follows:See Accounts Receivable step #3._____ 6. Refer to Accounts Receivable for the procedures relating to tests ofcut-off of sales invoices and credit memos._____ 7. Examine support for the charges to the other non-current creditaccounts during the period._____ 8. Account for and test the numerical sequence of sales invoice and /or photos that is for completeness.CLIENTYEAR END 31 December 2000AUDIT PROGRAM FOR Cost and ExpensesRef Audit Procedures - Nature, Timing and Extent W.P. Ref. Performed by _____ 1. Obtain or prepare a comparative analysis of expense accounts(grouped by income statement classification ) and investigateaccounts that fluctuated by the greater of ¥ or 10~20%. Alsocompare each classification of expenses as a percentage of net saleswith prior period percentages and investigate unexpected changes(or the absence of expected changes)._____ 2. Review the expense accounts in the general ledger and thepurchases journal for unusual items; investigate any such itemsobserved._____ 3. Perform monthly analysis of salries, and identify any sales bonus orcommission to assess reasonableness._____ 4. Perform reasonableness test on the following items:a.shelters’ rental, electricity and subcontractors expensesbased on the fluctuation of shelters quantity.b.rental expenses for head office and sales centres.c.interest income._____ 5. Test any irregular items in “others” obtain adequate supportingdocuments and perform analysis._____ 6. Consider any commitment arisen from those rental contracts forshelters in each city and from those lease contracts for premises.。

会计师事务所基本工作内容-《资料清单及审计工作底稿》

会计师事务所基本工作内容-《资料清单及审计工作底稿》《会计师事务所基本工作》刚到会计师事务所时,需要学习收集相关资料和抽底稿。

具体程序:●弄清需要审计多少家公司●准备相应数量的税合同、审计合同、资料清单和审计工作底稿●根据记账凭证抽底稿●收集资料●盖章●整理一、复印件1、证照类:企业营业执照、工商变更登记备案表税务登记证(国税、地税)副本2、制度、报告类:财务会计制度验资报告上年度审计报告上年度所得税汇算清缴报告3、财务资料:科目余额表(到最明细账)(如用财务软件,可导出电子表格)期末各银行存款账户对账单及银行余额调节表复印件工资情况表、存货盘点表固定资产盘点表、大额固定资产购置发票往来款项账龄分析表投资合同、借款合同、抵押担保合同及重大经营合同大额销售发票、大额费用发票、工资表(2个月)全年增值税纳税申报表12月地税纳税申报表、年度企业所得税申报表税局核定文件二、原件(签字盖章)资产负债表、利润表、现金流量表现金盘点表会计制度调查表委托审计协议管理当局声明书银行存款询证函往来款项询证函三、企业认为有助于审计工作的资料一、复印件1、证照类:企业营业执照、工商变更登记备案表(变更名、地址)税务登记证(国税、地税)副本2、制度、报告类:财务会计制度验资报告(新开)上年度审计报告(上年由其他事务所负责的)上年度所得税汇算清缴报告(上年由其他事务所负责的)3、财务资料:科目余额表(到最明细账)(如用财务软件,可导出电子表格)(账簿)期末各银行存款账户对账单(12月最后发生一笔业务,一般放在期末凭证后面,最后余额与总账余额相对)及银行余额调节表复印件(余额相同,不需要;余额不同,则需要)工资情况表(即工资表)、存货盘点表(可从资产负债表中查看是否有变动)固定资产盘点表(不一定要,但需要折旧表)、大额固定资产购置发票(需要复印凭证附件)往来款项账龄分析表【一般不需要】投资合同、借款合同、抵押担保合同及重大经营合同(复印)大额销售发票、大额费用发票、工资表(2个月)(1月和12月)全年增值税纳税申报表(一般纳税人,1月到12月;小规模纳税人,12月)12月地税纳税申报表、年度企业所得税申报表(10至12月,第四季度)(外加个人所得税,12月)税局核定文件二、原件(签字盖章)资产负债表、利润表、现金流量表(12月)现金盘点表(要填)会计制度调查表委托审计协议管理当局声明书银行存款询证函往来款项询证函三、企业认为有助于审计工作的资料审计工作底稿外出审计,除收集以上资料之外,还需要抽凭证,做审计工作底稿。

四大审计底稿模板

四大审计底稿模板篇一:XX审计工作底稿模板审计署驻成都特派员办事处审计工作底稿索引号:第页(共页)附件:页[说明:审核人员提出2、3项审核意见的,审计人员应当将落实情况和结果作出书面说明,经审核人员认可并签字后,附于本底稿后。

]篇二:四大审计底稿Audit Program 31 December XXPrepared byReviewed byApproved byDateDateDateCLIENTYEAR END_____ 1. Compare the listing of cash and bank accounts with those of priorperiods and investigate any unexpected changes (,credit balances, unusual large balances, new accounts, closed accounts) or the absence of expected changes._____ 2. Review interest received in relation to the average cash and bankbalances.Cash balances_____ 3. (a) Obtain a copy of the list of balances of cash as at 31/12/1999 and31/12/XX.(b) Check casting and agree total with general ledger control account._____ 4. Scan cash entries noting any unusual items and make furtherinvestigation where considered necessary.Bank Balances_____ 5. (a) Obtain a copy of the list of balances of bank as at the period enddate; and(b) Check casting and agree total with general ledger control account.6. Bank Confirmation request (Note 2) (a) Get a standard bank confirmation request form from thestationery cupboard.(b) Fill in the client name, our reference number and the period oryear end date (please specify) for the bank to confirm.(c) Give the partial completed form to the relevant client staff . (d) Request the client to perform the following tasks:· Stamp the form with the company chop; · Have the form signed by an authorized signatory; · Fill in the balances in the appropriate boxes; · For items which are not applicable for the company, fill in “N/A” in the corresponding boxes; and · Confirm to us whether the form can be sent to the bank by mail or if the client is required to take the confirmation to the bank.CLIENTYEAR ENDBank Balances (Continued)(e) Check the completed confirmation form to ensure thefollowing: · the balances agreed to the bankstatements as at theconfirmation date; ·the form is properly signed; · the client has filled in all security and guarantee related matterson the bank confirmation; and · Send the bank confirmation form to the bank by post. OrIf the client staff has to take the confirmation to the bank, arrange a staff to go with him/her. (Note3)(f) Keep copies of the confirmation in the file until replies areobtained from the banks.(g) When replies are received, check the confirmations received toensure that: · the forms were stamped and signed by the bank on the lastpage; and ·the individual balances and information are endorsed by thebank staff personal chop. (Note 4)_____ 7. Examine the client’s bank reconciliation as at 31/12/XX asfollows:a) agree book balance to Cash Book and General Ledger;b) agree balance per bank statement to bank statement at theyear end and bank confirmation received;c) check casting of the bank reconciliation; d) vouch all lodgments / lodgments with amount greater thanRMB _____ * not clear to the cash book and bank statement in the following month ensuring all lodgments are cleared; (Note 5)e) vouch all outstanding cheques / outstanding cheques withamount greater than RMB _____ *to the cash book and to the bank statement in the following month & note down the date when they are cleared; (Note 5)f) obtain explanations from the client of all outstanding lodgments/ lodgment with amounts greater than RMB_____ *;g) investigate all stale cheques / stale cheques with amountgreater than RMB_____ * issued for more than five / ten days *, and make appropriate adjustments thereofin the cash book and ledger; (Note 6)CLIENTYEAR ENDBank Balances (Continued)h) investigate all payments / payments with amount greater than RMB_____ * recorded by the bank but not recorded by the client, and make appropriate adjustments thereof in the cash book and ledger; (Note6) andi) investigate all receipts / receipts with amount greater than RMB_____ * recorded by the bank but not recorded by the client, and make appropriate adjustments thereof in the cash book and ledger. (Note 6)_____ 8. Review the bank book for any unusual items (greater than RMB _____) such as:a)non-trading receipts or payments and b) transfers in and out of the bank accounts._____ 9. Select receipts larger than RMB ______ and payments larger than RMB ______ within ____weeks before and after the year end to ensure that they have been properly accounted for.General _____ 10. Review the cash and bank accounts in the general ledger for unusual items._____ 11. Review the cash disbursements and cash receipts registers for unusual items; investigate any such items observed._____ 12. Review bank confirmations, minutes, loan agreements and other documents for evidence of restrictions on the use of cash, or of liens, or security interests in, cash._____ 13. Consider the covenants and other narratives given in loan and other material agreements and determine compliance with the agreements and whether necessary disclosure have been made._____ 14. Consider the implications of client management practices that result in recurring short term loan to finance working capital. Consider inquiry of client management and alert your senior / executive should such short term loans be encountered in the audit.CLIENTYEAR END* Delete as appropriateNote 1i. The cash count should be performed by cashier with the presence of a staff that normally is not involved in the cashier function.ii. Cash certificate is acceptable only if the petty cash balance is considered as immaterial and / or the risk associated is low/ minimal.Note 2i. Bank confirmations are sent on an individual branch basis, one confirmation per branch. ii. Confirmation should also be sent to accounts closed during the year.iii. If either the bank or the client refuses to reply/send the confirmation, consider if there is a significant limitation of our audit scope and its implications.Note 3When it is not feasible for an EYHM staff to go with the client, we must reconsider if the confirmation obtained provides sufficient and reliable audit evidence due to the lack of independence.Note 4Alternatively, the bank may issue its own bank certificate to confirm the deposits and loans balances and confirm that no other business transactions exiting.Note 5The extent of vouching work depends on our assessment of the likelihood of errors occurring.Note 6We have to consider the effect in aggregate regarding the unadjusted items which are below the amount stipulated in this procedure whenever one is set.篇三:审计工作底稿(模板)XXX会计师事务所审计差异事项调整表编制人员:日期:// 复核人员:日期://XXX会计师事务所银行存款余额明细核对表编制人员:日期:// 复核人员:日期://XXX会计师事务所货币资金收入凭证抽查表编制人员:日期:// 复核人员:日期://XXX会计师事务所货币资金支出凭证抽查表编制人员:日期:// 复核人员:日期:// XXX会计师事务所。

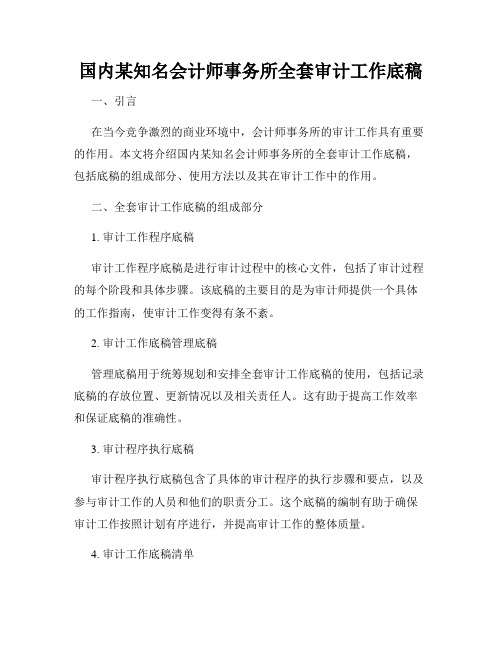

国内某知名会计师事务所全套审计工作底稿

国内某知名会计师事务所全套审计工作底稿一、引言在当今竞争激烈的商业环境中,会计师事务所的审计工作具有重要的作用。

本文将介绍国内某知名会计师事务所的全套审计工作底稿,包括底稿的组成部分、使用方法以及其在审计工作中的作用。

二、全套审计工作底稿的组成部分1. 审计工作程序底稿审计工作程序底稿是进行审计过程中的核心文件,包括了审计过程的每个阶段和具体步骤。

该底稿的主要目的是为审计师提供一个具体的工作指南,使审计工作变得有条不紊。

2. 审计工作底稿管理底稿管理底稿用于统筹规划和安排全套审计工作底稿的使用,包括记录底稿的存放位置、更新情况以及相关责任人。

这有助于提高工作效率和保证底稿的准确性。

3. 审计程序执行底稿审计程序执行底稿包含了具体的审计程序的执行步骤和要点,以及参与审计工作的人员和他们的职责分工。

这个底稿的编制有助于确保审计工作按照计划有序进行,并提高审计工作的整体质量。

4. 审计工作底稿清单审计工作底稿清单是一个列举了全套审计工作底稿的清单,用于确保底稿的完整性和正确性。

这一步骤是在整理和调整底稿时非常重要的一步,可以帮助审计师及时发现遗漏或错误,并进行及时修改。

三、全套审计工作底稿的使用方法1. 制定底稿使用规范为了确保全套审计工作底稿的正确使用,会计师事务所应制定相关的底稿使用规范。

这包括规定底稿填写格式、审计人员签名要求以及保密规定等内容,以提高底稿的可读性和可操作性。

2. 应用电子化工具管理底稿采用电子化工具管理全套审计工作底稿可以提高工作效率和准确性。

会计师事务所可以利用电子化软件,将底稿进行数字化存储和管理,实现底稿的快速检索和分享。

3. 审计工作底稿的修订和更新由于审计工作的特殊性,审计工作底稿需要定期进行修订和更新。

会计师事务所应及时根据审计准则的变化、事务所的实践经验和监管要求等因素进行底稿的修订和更新,确保底稿与实际工作相适应。

四、全套审计工作底稿在审计工作中的作用1. 提高审计工作的效率和准确性全套审计工作底稿为审计人员提供了一个有序的工作指南,能够帮助审计人员更好地组织和规划审计工作,提高工作效率和准确性。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第2页 (共2页)

注1:请将不适用的部分删去。

财务负责人姓名 ___________________________

财务负责人签名 ____________________________

制表日期 ______________________

第1页 (共2页)

资产负债表 (续) 续

其它有关单位背景的资料: 单位是否按中国法律成立的独立法人?如是请说明企业类型。 单位是否向中国地方及国家税务局以单位身份独立申报税金? (如问题一的答案是否定,此题则不适用),请列出下列有关单位的资料: 1. 2. 3. 4. 投资总额 注册资本 经营年限 所有投资者的名称及出资情况

表1

资产负债表

年 编制单位: 资产 序号 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 年初数 期末数 月 日 负债及所有者权益合计 流动负债 : 短期借款 应付票据 应付账款 预收账款 其它应付款 应付工资 应付福利费 未交税金 其它未交款 预提费用 一年内到期的长期负债 流动负债合计 长期负债: 长期借款 长期负债合计 递延税款: 递延税款贷项 负债合计 所有者权益: 实收资本 中方投资 (非人民币本期金额) 外方投资 (非人民币本期金额) 资本公积 盈余公积 其中: 储备基金 其中: 企业发展基金 未分配利润 所有者权益合计 负债及所有者权益合计 序号 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 年初数 货币单位:人民币元 期末数

流动资产: 货币资金 短期投资 应收账款 减:坏账准备 应收账款净额 预付账款 其它应收款 存货 其中:原材料 产成品 在产品及自制半成品 分期收款发出商品 侍摊费用 其它流动资产 流动资产合计 长期投资: 长期投资 固定资产: 固定资产 (原值) 减:累计折旧 固定资产净值 在建工程 待处理固定资产净损失 固定资产合计 无形资产及递延资产: 无形资产 长期待摊费用 无形资产及长期待摊费用合计 递延税款: 递延税款借项 资产合计