2019年美联储FOMC会议纪要-精选word文档 (2页)

美联储货币政策会议纪要

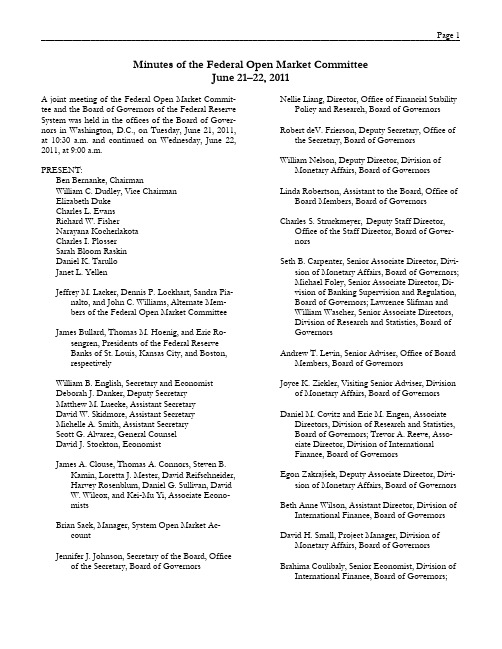

Minutes of the Federal Open Market CommitteeJune 21–22, 2011A joint meeting of the Federal Open Market Commit-tee and the Board of Governors of the Federal Reserve System was held in the offices of the Board of Gover-nors in Washington, D.C., on Tuesday, June 21, 2011, at 10:30 a.m. and continued on Wednesday, June 22, 2011, at 9:00 a.m.PRESENT:Ben Bernanke, ChairmanWilliam C. Dudley, Vice ChairmanElizabeth DukeCharles L. EvansRichard W. FisherNarayana KocherlakotaCharles I. PlosserSarah Bloom RaskinDaniel K. TarulloJanet L. YellenJeffrey M. Lacker, Dennis P. Lockhart, Sandra Pia-nalto, and John C. Williams, Alternate Mem-bers of the Federal Open Market Committee James Bullard, Thomas M. Hoenig, and Eric Ro-sengren, Presidents of the Federal ReserveBanks of St. Louis, Kansas City, and Boston,respectivelyWilliam B. English, Secretary and EconomistDeborah J. Danker, Deputy SecretaryMatthew M. Luecke, Assistant SecretaryDavid W. Skidmore, Assistant SecretaryMichelle A. Smith, Assistant SecretaryScott G. Alvarez, General CounselDavid J. Stockton, EconomistJames A. Clouse, Thomas A. Connors, Steven B.Kamin, Loretta J. Mester, David Reifschneider,Harvey Rosenblum, Daniel G. Sullivan, DavidW. Wilcox, and Kei-Mu Yi, Associate Econo-mistsBrian Sack, Manager, System Open Market Ac-countJennifer J. Johnson, Secretary of the Board, Office of the Secretary, Board of Governors Nellie Liang, Director, Office of Financial Stability Policy and Research, Board of GovernorsRobert deV. Frierson, Deputy Secretary, Office of the Secretary, Board of GovernorsWilliam Nelson, Deputy Director, Division of Monetary Affairs, Board of GovernorsLinda Robertson, Assistant to the Board, Office of Board Members, Board of Governors Charles S. Struckmeyer, Deputy Staff Director, Office of the Staff Director, Board of Gover-norsSeth B. Carpenter, Senior Associate Director, Divi-sion of Monetary Affairs, Board of Governors;Michael Foley, Senior Associate Director, Di-vision of Banking Supervision and Regulation, Board of Governors; Lawrence Slifman andWilliam Wascher, Senior Associate Directors,Division of Research and Statistics, Board ofGovernorsAndrew T. Levin, Senior Adviser, Office of Board Members, Board of GovernorsJoyce K. Zickler, Visiting Senior Adviser, Division of Monetary Affairs, Board of Governors Daniel M. Covitz and Eric M. Engen, Associate Directors, Division of Research and Statistics,Board of Governors; Trevor A. Reeve, Asso-ciate Director, Division of InternationalFinance, Board of GovernorsEgon Zakrajšek, Deputy Associate Director, Divi-sion of Monetary Affairs, Board of Governors Beth Anne Wilson, Assistant Director, Division of International Finance, Board of Governors David H. Small, Project Manager, Division of Monetary Affairs, Board of Governors Brahima Coulibaly, Senior Economist, Division of International Finance, Board of Governors;Louise Sheiner, Senior Economist, Division ofResearch and Statistics, Board of Governors Jean-Philippe Laforte,¹ Economist, Division of Re-search and Statistics, Board of Governors Penelope A. Beattie, Assistant to the Secretary, Of-fice of the Secretary, Board of Governors Randall A. Williams, Records Management Analyst, Division of Monetary Affairs, Board of Gov-ernorsJeff Fuhrer, Executive Vice President, Federal Re-serve Bank of BostonDavid Altig, Glenn D. Rudebusch, and Mark E.Schweitzer, Senior Vice Presidents, FederalReserve Banks of Atlanta, San Francisco, andCleveland, respectivelyMichael Dotsey,¹ William Gavin, Andreas L.Hornstein, and Edward S. Knotek II, VicePresidents, Federal Reserve Banks of Philadel-phia, St. Louis, Richmond, and Kansas City,respectivelyMarco Del Negro,¹ Joshua L. Frost, Deborah L.Leonard, and Jonathan P. McCarthy, AssistantVice Presidents, Federal Reserve Bank of NewYorkJeff Campbell,¹ Senior Economist, Federal Reserve Bank of Chicago_______________________¹ Attended the portion of the meeting relating todynamic stochastic general equilibrium models. Developments in Financial Markets and the Fed-eral Reserve’s Balance SheetThe manager of the System Open Market Account (SOMA) reported on developments in domestic and foreign financial markets during the period since the Federal Open Market Committee (FOMC) met on April 26–27, 2011. He also reported on System open market operations, including the continuing reinvest-ment into longer-term Treasury securities of principal payments received on the SOMA’s holdings of agency debt and agency-guaranteed mortgage-backed securi-ties, as well as the ongoing purchases of additional Treasury securities authorized at the November 2–3, 2010, FOMC meeting. Since November, purchases by the Open Market Desk of the Federal Reserve Bank of New York had increased the SOMA’s holdings by nearly the full $600 billion authorized.In light of ongoing strains in some foreign financial markets, the Committee considered a proposal to ex-tend its dollar liquidity swap arrangements with foreign central banks past August 1, 2011. Following their dis-cussion, members unanimously approved the following resolution:The Federal Open Market Committee directsthe Federal Reserve Bank of New York toextend the existing temporary reciprocal cur-rency arrangements (“swap arrangements”)for the System Open Market Account withthe Bank of Canada, the Bank of England,the European Central Bank, the Bank of Ja-pan, and the Swiss National Bank. The swaparrangements shall now terminate on Au-gust 1, 2012, unless further extended by theCommittee.Dynamic Stochastic General Equilibrium Models A staff presentation provided an overview of ongoing Federal Reserve research on dynamic stochastic general equilibrium (DSGE) models. DSGE models attempt to capture the dynamics of the overall economy in a way that is consistent both with the historical data and with optimizing behavior by forward-looking house-holds and firms. The presentation began by discussing the general features of DSGE models and considering their advantages and limitations relative to other ap-proaches of analyzing macroeconomic dynamics; with regard to the latter, the presentation noted that while the current generation of DSGE models is still some-what limited in the range of policy issues these models can address, further advances in modeling should in-crease the usefulness of DSGE models for forecasting and policy analysis. The presentation then reviewed some specific features of DSGE models that are cur-rently being studied at the Federal Reserve Board and the Federal Reserve Banks of New York, Philadelphia, and Chicago. This review included the four models’ characterizations of the forces affecting the economy in recent years and the models’ current forecasts for real economic activity, inflation, and short-term interest rates. In discussing the staff presentation, meeting par-ticipants expressed the view that DSGE models are a useful addition to the wide range of analytical ap-proaches traditionally used at the Federal Reserve, in part because they provide an internally consistent wayof exploring how the behavior of economic agents might change in response to systematic adjustments to policy. Some participants also expressed interest in seeing on a regular basis projections of key macroeco-nomic variables and other products from the DSGE models developed in the System. Finally, participants encouraged further staff work to improve these models by, for example, expanding the range of questions they can be used to address.Exit Strategy PrinciplesThe Committee discussed strategies for normalizing the stance and conduct of monetary policy, following up on its discussion of this topic at the April meeting. Participants stressed that the Committee’s discussions of this topic were undertaken as part of prudent plan-ning and did not imply that a move toward such nor-malization would necessarily begin sometime soon. For concreteness, the Committee considered a set of specific principles that would guide its strategy of nor-malizing the stance and conduct of monetary policy. Participants discussed several specific elements of the principles, including how they should characterize the monetary policy framework that the Committee would adopt after the conduct of policy returned to normal and whether the principles should encompass the pos-sible timing between the normalization steps. At the conclusion of the discussion, all but one of the partici-pants agreed on the following key elements of the strategy that they expect to follow when it becomes appropriate to begin normalizing the stance and con-duct of monetary policy:∙The Committee will determine the timing and pace of policy normalization to promote its statutory mandate of maximum employment and price sta-bility.∙To begin the process of policy normalization, the Committee will likely first cease reinvesting some or all payments of principal on the securities hold-ings in the SOMA.∙At the same time or sometime thereafter, the Committee will modify its forward guidance on the path of the federal funds rate and will initiate tem-porary reserve-draining operations aimed at sup-porting the implementation of increases in the fed-eral funds rate when appropriate.∙When economic conditions warrant, the Commit-tee’s next step in the process of policy normaliza-tion will be to begin raising its target for the federal funds rate, and from that point on, changing thelevel or range of the federal funds rate target will be the primary means of adjusting the stance of monetary policy. During the normalization process, adjustments to the interest rate on excess reserves and to the level of reserves in the banking system will be used to bring the funds rate toward its target.∙Sales of agency securities from the SOMA will like-ly commence sometime after the first increase in the target for the federal funds rate. The timing and pace of sales will be communicated to the pub-lic in advance; that pace is anticipated to be rela-tively gradual and steady, but it could be adjusted up or down in response to material changes in theeconomic outlook or financial conditions.∙Once sales begin, the pace of sales is expected to be aimed at eliminating the SOMA’s holdings of agency securities over a period of three to five years, thereby minimizing the extent to which the SOMA portfolio might affect the allocation of credit across sectors of the economy. Sales at this pace would be expected to normalize the size of the SOMA securities portfolio over a period of twoto three years. In particular, the size of the securi-ties portfolio and the associated quantity of bank reserves are expected to be reduced to the smallest levels that would be consistent with the efficient implementation of monetary policy.∙The Committee is prepared to make adjustments to its exit strategy if necessary in light of economic and financial developments.Staff Review of the Economic SituationThe information reviewed at the June 21–22 meeting indicated that the pace of the economic recovery slowed in recent months and that conditions in the labor market had softened. Measures of inflation picked up this year, reflecting in part higher prices for some commodities and imported goods. Longer-run inflation expectations, however, remained stable.The expansion of private nonfarm payroll employment in May was markedly below the average pace of job gains in the previous months of this year. Initial claims for unemployment insurance rose, on net, between the first half of April and the first half of June. The unem-ployment rate moved up in April and then rose further to 9.1 percent in May, while the labor force participa-tion rate remained unchanged. Both long-duration un-employment and the share of workers employed part time for economic reasons continued to be elevated.Total industrial production expanded only a bit during April and May after rising at a solid pace in the first quarter. Shortages of specialized components imported from Japan contributed to a decline in the output of motor vehicles and parts. Manufacturing production outside of the motor vehicles sector increased mod-erately, on balance, during the past two months. The manufacturing capacity utilization rate remained close to its first-quarter level, but it was still well below its longer-run average. Forward-looking indicators of in-dustrial activity, such as the new orders diffusion in-dexes in the national and regional manufacturing sur-veys, weakened noticeably during the intermeeting pe-riod to levels consistent with only tepid gains in factory output in coming months. However, motor vehicle assemblies were scheduled to rise notably in the third quarter from their levels in recent months, as bottle-necks in parts supplies were anticipated to ease. Growth in consumer spending declined in recent months from the already modest pace in the first quar-ter. Total real personal consumption expenditures only edged up in April. Nominal retail sales, excluding pur-chases at motor vehicles and parts outlets, increased somewhat in May, but sales of new light motor vehicles declined markedly. Labor income rose moderately, as aggregate hours worked trended up, but total real dis-posable income remained flat in March and April, as increases in consumer prices offset gains in nominal income. In addition, consumer sentiment stayed rela-tively low through early June.Activity in the housing market remained depressed, as both weak demand and the sizable inventory of fore-closed or distressed properties continued to hold back new construction. Starts and permits of new single-family homes were essentially unchanged in April and May, and they stayed near the very low levels seen since the middle of last year. Sales of new and existing homes remained at subdued levels in recent months, while measures of home prices fell further.The available indicators suggested that real business investment in equipment and software was rising a bit more slowly in the second quarter than the solid pace seen in the first quarter. Nominal orders and ship-ments of nondefense capital goods declined in April. Business purchases of light motor vehicles edged up in April but dropped in May, while spending for medium and heavy trucks continued to increase in recent months. Survey measures of business conditions and sentiment weakened during the intermeeting period. Business expenditures for office and commercial build-ings remained depressed by elevated vacancy rates, low prices for commercial real estate, and tight credit condi-tions for construction loans. In contrast, outlays for drilling and mining structures continued to be lifted by high energy prices.Real nonfarm inventory investment rose moderately in the first quarter, but data for April suggested that the pace of inventory accumulation had slowed. Book-value inventory-to-sales ratios in April were similar to their pre-recession norms, and survey data also sug-gested that inventory positions generally remained in a comfortable range.The available data on government spending indicated that real federal purchases increased in recent months, led by a rebound in outlays for defense in April and May from unusually low levels in the first quarter. In contrast, real expenditures by state and local govern-ments appeared to have declined further, as outlays for construction projects fell in March and April, and state and local employment continued to contract in April and May.The U.S. international trade deficit widened slightly in March and then narrowed in April to a level below its average in the first quarter. Exports rose strongly in both months, with increases widespread across major categories in March, while the gains in April were con-centrated in industrial supplies and capital goods. Im-ports grew robustly in March, but they fell slightly in April, as the drop in automotive imports from Japan together with the decline in imports of petroleum products more than offset increases in other imported products.Headline consumer price inflation, which had risen in the first quarter, edged down a bit in April and May, as the prices of consumer food and energy decelerated from the pace seen in previous months. More recently, survey data through the middle of June pointed to de-clines in retail gasoline prices, and prices of food com-modities appeared to have decreased somewhat. Ex-cluding food and energy, core consumer price inflation picked up in April and May, pushing the 12-month change in the core consumer price index through May above its level of a year earlier. Upward pressures on core consumer prices appeared to reflect the elevated prices of commodities and other imports, along with notable increases in motor vehicle prices likely arising from the effects of recent supply chain disruptions and the resulting extremely low level of automobile inven-tories. However, near-term inflation expectations from the Thomson Reuters/University of Michigan Surveysof Consumers moved down a little in May and early June from the high level seen in April, and longer-term inflation expectations remained within the range that has generally prevailed over the preceding few years. Available measures of labor compensation showed that labor cost pressures were still subdued, as wage in-creases continued to be restrained by the large amount of slack in the labor market. In the first quarter, unit labor costs only edged up, as the modest rise in hourly compensation in the nonfarm business sector was mostly offset by further gains in productivity. More recently, average hourly earnings for all employees rose in April and May, but the average rate of increase over the preceding 12 months remained quite low.Global economic activity appeared to have increased more slowly in the second quarter than in the first quarter. The rate of growth in the emerging market economies stepped down from its rapid pace in the first quarter, although it remained generally solid. The Japanese economy contracted sharply following the earthquake in March, and the associated supply chain disruptions weighed on the economies of many of Ja-pan’s trading partners. The pace of economic growth in the euro area remained uneven, with Germany and France posting moderate gains in economic activity, while the peripheral European economies continued to struggle. Recent declines in the prices of oil and other commodities contributed to some easing of inflationary pressures abroad.Staff Review of the Financial SituationInvestors appeared to adopt a more cautious attitude toward risk, particularly later in the intermeeting period. The shift in investors’ sentiment likely reflected the weak tone of incoming economic data in the United States along with concerns about the outlook for global economic growth and about potential spillovers from a possible further deterioration of the situation in peri-pheral Europe.The decisions by the FOMC at its April meeting to continue its asset purchase program and to maintain the 0 to ¼ percent target range for the federal funds rate were generally in line with market expectations. The accompanying statement and subsequent press briefing by the Chairman prompted a modest decline in nominal yields, as market participants reportedly per-ceived a somewhat less optimistic tone in the Commit-tee’s economic outlook. Over the remainder of the intermeeting period, the expected path for the federal funds rate, along with yields on nominal Treasury se-curities, moved down appreciably further, as the bulk of the incoming economic data was more downbeat than market participants had apparently anticipated. Consistent with the weaker-than-expected economic data and the recent decline in the prices of oil and other commodities, measures of inflation compensation over the next 5 years and 5 to 10 years ahead based on nom-inal and inflation-protected Treasury securities de-creased considerably over the intermeeting period. Market quotes did not suggest expectations of signifi-cant movements in nominal Treasury yields following the anticipated completion of the asset purchase pro-gram by the Federal Reserve at the end of June. Al-though discussions about the federal debt ceiling at-tracted attention in financial markets, judging from Treasury yields and other asset prices, investors seemed to anticipate that the debt ceiling would be increased in time to avoid any significant market disruptions. Yields on corporate bonds stepped down modestly, on net, over the intermeeting period, but by less than the decline in yields on comparable-maturity Treasury se-curities, leaving credit risk spreads a little wider. In the secondary market for syndicated loans, conditions were little changed, with average bid prices for leveraged loans holding steady.Broad U.S. stock price indexes declined, on net, over the intermeeting period, apparently in response to the downbeat economic data. Stock prices of financial firms underperformed the broader market, reflecting the weaker economic outlook, potential credit rating downgrades, and heightened concerns about the antic-ipated capital surcharge for systemically important fi-nancial institutions. Option-adjusted volatility on the S&P 500 index rose somewhat on net.In the June 2011 Senior Credit Officer Opinion Survey on Dealer Financing Terms, dealers pointed to a con-tinued gradual easing over the previous three months in credit terms applicable to major classes of counterpar-ties across all types of transactions covered in the sur-vey. Dealers also reported that the demand for funding had increased over the same period for a broad range of securities, with the exception of equities. More re-cently, however, against a backdrop of disappointing economic data, heightened uncertainty about the situa-tion in Europe, and, possibly, concerns about the U.S. federal debt ceiling, market participants reported a gen-eral pullback from risk-taking and a decline in liquidity in a range of financial markets.Net debt financing by nonfinancial corporations was strong in April and May. Gross issuance of both in-vestment- and speculative-grade bonds by nonfinancial corporations hit a record high in May before slowing somewhat in June, and outstanding amounts of com-mercial and industrial (C&I) loans and nonfinancial commercial paper increased. Gross public equity is-suance by nonfinancial firms maintained a solid pace over the intermeeting period, and most indicators of business credit quality improved further. Commercial mortgage markets continued to show ten-tative signs of stabilization. In recent months, delin-quency rates for commercial real estate loans edged down from their previous peaks. However, commer-cial real estate markets remained weak. Property sales were tepid, and prices remained at depressed levels. Issuance of commercial mortgage-backed securities slowed somewhat in the second quarter.Conditions in residential mortgage markets were little changed overall but remained strained. Rates on con-forming fixed-rate residential mortgages declined about in line with 10-year Treasury yields over the intermeet-ing period. Mortgage refinancing activity picked up, on net, over the intermeeting period but was still relatively subdued. Outstanding residential mortgage debt con-tracted further in the first quarter. Rates of serious delinquency for subprime and prime mortgages were little changed at elevated levels. The rate of new delin-quencies on prime mortgages ticked up in April but remained well below the level of a few months ago. In March and April, delinquencies on mortgages backed by the Federal Housing Administration declined no-ticeably.The Federal Reserve continued its competitive sales of non-agency residential mortgage-backed securities held by Maiden Lane II LLC over the intermeeting period. Although the initial offerings of these securities were well received, investor demand at the most recent sales was not as strong, a development consistent with the declines in the prices of non-agency residential mort-gage-backed securities over the intermeeting period. Conditions in consumer credit markets continued to improve. Growth in total consumer credit picked up in April, as the gain in nonrevolving credit more than off-set a further contraction in revolving credit. Delin-quency rates for consumer debt edged down further in recent months, with delinquency rates on some catego-ries moving back to pre-crisis levels. Issuance of con-sumer asset-backed securities remained robust over the intermeeting period. Bank credit was flat, on balance, in April and May. Core loans—the sum of C&I, real estate, and consumer loans—continued to contract modestly, pulled down by the ongoing decline in commercial and residential real estate loans. In contrast, C&I loans increased at a brisk pace in April and May. The most recent Survey of Terms of Business Lending conducted in May indicated that banks had eased some lending terms on C&I loans. The survey responses also suggested that the average size of loan commitments and their average maturity had trended up in recent quarters.M2 expanded at a robust pace in April and May. Liq-uid deposits, the largest component of M2, maintained a solid rate of expansion, likely reflecting the very low opportunity costs of holding such deposits. Currency continued to advance, supported by strong demand for U.S. bank notes from abroad.The broad nominal index of the U.S. dollar fluctuated over the intermeeting period in response to changes in investors’ assessment of the outlook for the U.S. econ-omy and the situation in the peripheral European economies. Since the April FOMC meeting, the dollar rose modestly, on net, after depreciating over the pre-ceding several months. Headline equity indexes abroad and foreign benchmark sovereign yields declined over the intermeeting period in apparent response to signs of a slowdown in the pace of global economic activity and reduced demand for risky assets. Concerns about the possibility of a restructuring of Greek government debt drove spreads of yields on the sovereign debts of Greece, Ireland, and Portugal to record highs relative to yields on German bunds.In the advanced foreign economies, most central banks left their policy rates unchanged, and the anticipated pace of monetary policy tightening indicated by money market futures quotes was pared back. However, cen-tral banks in several emerging market economies con-tinued to tighten policy, and the monetary authorities in China increased required reserve ratios further.Staff Economic OutlookWith the recent data on spending, income, production, and labor market conditions mostly weaker than the staff had anticipated at the time of the April FOMC meeting, the near-term projection for the rate of in-crease in real gross domestic product (GDP) was re-vised down. The effects of the disaster in Japan and of higher commodity prices on the rate of increase in real consumer spending were expected to hold down U.S. real GDP growth in the near term, but those effects were anticipated to be transitory. However, the staffalso read the incoming economic data as suggesting that the underlying pace of the recovery was softer than they had previously anticipated, and they marked down their outlook for economic growth over the medium term. Nevertheless, the staff still projected real GDP to increase at a moderate rate in the second half of 2011 and in 2012, with the ongoing recovery in activity receiving continued support from accommodative monetary policy, further increases in credit availability, and anticipated improvements in household and busi-ness confidence. The average pace of real GDP growth was expected to be sufficient to bring the un-employment rate down very slowly over the projection period, and the jobless rate was anticipated to remain elevated at the end of 2012.Although increases in consumer food and energy prices slowed a bit in recent months, the continued step-up in core consumer price inflation led the staff to raise slightly its projection for core inflation over the coming quarters. However, headline inflation was still expected to recede over the medium term, as increases in food and energy prices and in non-oil import prices were anticipated to ease further. As in previous forecasts, the staff continued to project that core consumer price inflation would remain relatively subdued over the pro-jection period, reflecting both stable long-term inflation expectations and persistent slack in labor and product markets.Participants’ Views on Current Conditions and the Economic OutlookIn conjunction with this FOMC meeting, all meeting participants—the five members of the Board of Gov-ernors and the presidents of the 12 Federal Reserve Banks—provided projections of output growth, the unemployment rate, and inflation for each year from 2011 through 2013 and over the longer run. Longer-run projections represent each participant’s assessment of the rate to which each variable would be expected to converge, over time, under appropriate monetary policy and in the absence of further shocks to the economy. Participants’ forecasts are described in the Summary of Economic Projections, which is attached as an adden-dum to these minutes.In their discussion of the economic situation and out-look, meeting participants agreed that the economic information received during the intermeeting period indicated that the economic recovery was continuing at a moderate pace, though somewhat more slowly than they had anticipated at the time of the April meeting. Participants noted several transitory factors that were restraining growth, including the global supply chain disruptions in the wake of the Japanese earthquake, the unusually severe weather in some parts of the United States, a drop in defense spending, and the effects of increases in oil and other commodity prices this year on household purchasing power and spending. Partici-pants expected that the expansion would gain strength as the influence of these temporary factors waned. Nonetheless, most participants judged that the pace of the economic recovery was likely to be somewhat slow-er over coming quarters than they had projected in April. This judgment reflected the persistent weakness in the housing market, the ongoing efforts by some households to reduce debt burdens, the recent sluggish growth of income and consumption, the fiscal contrac-tion at all levels of government, and the effects of un-certainty regarding the economic outlook and future tax and regulatory policies on the willingness of firms to hire and invest. Moreover, the recovery remained subject to some downside risks, such as the possibility of a more extended period of weak activity and declin-ing prices in the housing sector, the chance of a larger-than-expected near-term fiscal tightening, and potential financial and economic spillovers if the situation in pe-ripheral Europe were to deteriorate further. Partici-pants still projected that the unemployment rate would decline gradually toward levels they saw as consistent with the Committee’s dual mandate, but at a more gradual pace than they had forecast in April. While higher prices for energy and other commodities had boosted inflation this year, with commodity prices ex-pected to change little going forward and longer-term inflation expectations stable, most participants antic-ipated that inflation would subside to levels at or below those consistent with the Committee’s dual mandate. Activity in the business sector appeared to have slowed somewhat over the intermeeting period. Although the effects of the Japanese disaster on U.S. motor vehicle production accounted for much of the deceleration in industrial production since March, the most recent readings from various regional manufacturing surveys suggested a slowing in the pace of manufacturing activ-ity more broadly. However, business contacts in some sectors—most notably energy and high tech—reported that activity and business sentiment had strengthened further in recent months. Business investment in equipment and software generally remained robust, but growth in new orders for nondefense capital goods—though volatile from month to month—appeared to have slowed. While FOMC participants expected a rebound in investment in motor vehicles to boost capi-。

美联储3月会议纪要全程回顾

美联储3月会议纪要全程回顾北京时间周四凌晨02:00,美国联邦公开市场委员会(FOMC)公布3月会议纪要。

美联储政策制定者在3月会议上就可能在4月上调联邦基金利率表达了“各种观点”。

许多政策制定者表示全球经济及金融形势仍给美国经前景构成显著下滑风险,而几位委员则表示其他央行的行动降低了全球经济前景风险。

同时,美联储会议纪要显示,4月加息将突出紧迫感,并非合适之举,这基本上浇灭了四月加息预期,暗示美联储并不急于在四月会议上行动。

此外,一些政策制定者暗示如果数据仍符合经济成长、就业和通胀目标,就可能有理由在4月加息,但其他委员认为不利因素仅会缓慢消除,多位政策制定者表示全球去通胀压力以及可能下降的通胀预期对通胀前景构成下滑风险,一些其他委员表示整体紧张的资源利用率可能将通胀推升至目标之上。

“美联储通讯社”John Hilsenrath点评此次会议纪要称,自上次会议以来,委员们受到美国喜忧参半数据所困扰,导致美联储本月在加息行动上有所犹豫;尽管经济稳定创造就业,但经济产量几乎没有增加;同时数位委员在3月会议上表达了对4月加息的担忧,可能会释放不适当的紧迫感。

彭博新闻社称,3月会议上美联储官员们讨论了4月加息的可能,不过目前看4月加息概率不大,这使得6月成为了可能的加息时点。

委员们对4月加息的讨论,表明他们认为不一定需要在有美联储主席耶伦新闻发布会的会议上加息。

彭博称,许多发达经济体都陷入增长缓慢、通胀低迷、政策利率近零甚至负利率的情形中。

尽管发达国家之间没有正式的政策合作,但美联储和其它央行在尽可能采取一致的步调,以提振经济。

美元指数在纪要公布后窄幅震荡,但跌势不减,最高触及94.54,最低触及94.32。

会议纪要整体来看依然偏向鸽派,加上联储内部分歧加大,加息进程恐遭推迟,美元下行压力仍难缓解。

美联储fomc会议纪要

美联储fomc会议纪要篇一:(:美联储fomc会议纪要)各大投行简评美联储会议纪要各大投行简评美联储会议纪要美联储(FEd)在周三(5月20日)发布4月份会议纪要,称许多与会者在4月份美国联邦公开市场委员会(Fomc)议息会议上称,他们认为美国经济不可能表明足以保证美联储在6月份议息会议上开始加息。

随后,各大投行迅速给出了评述。

道明证券(TdSecurities):美联储会议纪要表明加息意愿“非常高”,行动的门槛相当低,Fomc 成员们没有完全排除6月加息可能性“让人意外”,未来每次会议都有可能行动。

德意志银行(deutscheBank):我想美联储4月份会议纪要偏鸽派,纪要并未暗示Fomc将会很快加息。

加拿大帝国商业银行(ciBc)4月Fomc纪要表明,虽然4月决议下调对增长和就业市场趋势的评估,但称仅仅暂时性因素而已,意味着Fomc并非所有成员都对增速会在第二季度反弹感到乐观;对经济的预估恐怕要到9月份才能够得到验证,但仍然认为6月份开始加息的可能性仍然存在,哪怕这样的可能性降低,第一季度GdP数据乏善可陈之后的增长前景存在某种程度上的不确定性,这应当会限制市场对4月份会议纪要内容的反应程度。

“美联储通讯社”希尔森拉特(JohnHilseath)勿要对美联储会在加息行动之前给出警告心存幻想,美联储在4月份货币政策会议上一定程度地担心加息行动可能造成债券市场新一轮恐慌,官员们对隔夜逆回购操作等诸多退出工具感觉良好,美联储官员们在4月份货币政策会议上调经济增长预期,其依据是美元已经走软、且利率维持在低位水平的时间会长于先前预期。

第1页美国联邦基金利率期货继续押注美国联邦公开市场委员会(Fomc)将会在20XX年12月或者20XX年1月开始加息,届时有效利率料为37.5个基点,押注3/4月行动的有效利率为50个基点。

第2页篇二:美联储12月Fomc会议纪要美联储12月Fomc会议纪要:警惕海外经济4月前不太会加息来源:华尔街见闻周三,美联储12月会议纪要显示,4月前不大会加息;Fomc认为“耐心”指引可以提供更大的政策灵活性。

fomc会议纪要全文

fomc会议纪要全文篇一:Fomc会议纪要展望Fomc会议纪要展望文章转载自:会议纪要公布当天预计白银将会在6200~5900区间内运行,若上涨至6200压力位附近投资者可以考虑做空,若跌至5900支撑位附近投资者可以考虑做多,但是考虑到目前是空头趋势,投资者还是以做空为主较为适宜。

Fomc全称为美国联邦公开市场委员会,Fomc隶属于联邦储备系统,主要任务在决定美国货币政策,透过货币政策的调控,来达到经济成长及物价稳定两者间的平衡。

Fomc所决议出的货币政策主要由纽约联邦储备银行来执行,而所谓的公开市场操作,通常是指调整联邦基金利率。

1、各央行货币政策本周全球四大央行将会陆续发布会议纪要文件。

虽然会议纪要的重要性虽不及利率决议,但是会议纪要中往往会透露出更多的细节消息,并对未来的货币政策走向给出前瞻。

此前,G7和G20经济官员的会议上,各方已经排除了近期发生汇率战的可能,但各国央行的动向对市场的影响依旧深远。

澳洲联储2月19日公布2月5日利率决议的会议纪要,会议记录称:鉴于过去15个月大幅放松政策,货币政策已经很宽松,这持续在经济中产生作用,委员会认为本次会议维持利率不变是审慎的。

不过,本次会议评估的通胀前景,为在需要支持需求时进一步放松政策提供空间。

委员会成员在会议上简述了最新的预测,澳洲联储预期20XX 年经济增长幅度将约为2.5%,略低于其潜力水平,在随后一年中会小幅回升。

日本会议记录显示,在1月份会议上,日本央行上调通胀目标至2%,并承诺从明年开始无限量购买资产,这都是迫于首相安倍晋三采取更大胆行动抗击通缩的强大压力。

在随后的2月份会议上,日本央行保持货币政策不变,并上调对经济的评估,因日元持续贬值,且全球需求出现复苏迹象支撑了日本出口。

英国央行将于此后在周三(2月20日)发布本月初会议的纪要文件,这料将会引起各界的密切关注。

英国央行此前在上周三(2月13日)发布的季度通胀报告中,表示将下调经济预期并上调通胀预期,报告还具口头施压汇率的意味,称投资者认为英镑贬值的可能性大于升值的可能性。

2019年9月美联储议息会议点评:联储预期降息但内部分歧加大,贵金属继续多..

2019年9月美联储议息会议点评:联储预期降息但内部分歧加大贵金属继续多配思路未变研究发展中心宏观团队郭远爱吴昕岚2019年9月19日美联储年内第二次降息,但会议声明措辞鸽派不及预期美联储9月FOMC会议声明要点⚫降息25个基点。

美联储以7:3的投票比例通过本次利率决定宣布降息25个基点至1.75%-2%,为年内第二次降息,符合市场预期。

⚫下调超额准备金率30个基点。

美联储决定将超额准备金利率从2.1%下调至1.8%。

⚫美联储内部官员分歧很大。

本次议息会议中,三位美联储投了反对票。

James Bullard主张降息50个基点,Esther George和Eric Rosengren则倾向于保持基金利率稳定。

这也是近五年来美联储官员们对利率决议所出现的最大分歧。

⚫上调经济增长预期。

会议声明中美联储对经济的表述与7月并无大的出路,维持通胀温和、就业市场强劲的表述。

但是在预期文件中,美联储将2019年GDP增速的预期上调0.1pct至2.7%,同时也将2019年失业率上调0.1pct至3.7%。

⚫未提及流动性操作。

点阵图显示美联储官员对是否进一步降息分歧明显⚫美联储点阵图显示10名官员认为2019年不会再降息,只有7名官员认为2019年还将降息一次。

此外,点阵图显示2020年预期没有降息,2021年和2022年各有一次降息。

美联储6月议息会议点阵图美联储9月议息会议点阵图资料来源:美联储,信达期货研发中心鲍威尔新闻发布会仍对降息持开放态度美联储主席鲍威尔新闻发布会要点⚫关于美联储当前降息的看法:肯定降息的必要,降息可以保证经济增长强劲,降息为抵御风险提供保障。

⚫关于美国经济前景的看法:自去年以来全球经济增长前景有所走弱,指标显示投资持续疲软,制造业产出出现下滑;有一些额外的迹象表明海外经济疲软,美国国内通胀压力受抑,但仍预计通胀将升至2%;在就业方面,美联储预计劳动力市场将保持强劲。

此外,全球经济走弱和贸易均给经济带来很明显的风险,而地缘政治事件进一步增加了不确定性。

【推荐】12月FOMC会议纪要存在五大看点-精选word文档 (2页)

【推荐】12月FOMC会议纪要存在五大看点-精选word文档本文部分内容来自网络整理,本司不为其真实性负责,如有异议或侵权请及时联系,本司将立即删除!== 本文为word格式,下载后可方便编辑和修改! ==12月FOMC会议纪要存在五大看点美联储去年12月结束了长达7年的近零利率正式加息,结束了市场对首次加息时机的猜测。

周四(1月7日)凌晨03:00即将公布的会议纪要或将为之后的货币政策提供部分线索。

华尔街日报表示,此次FOMC会议纪要存在五大看点:1.渐近式加息意味着什么?美联储官员强调计划遵循“循序渐进的”加息路径。

这个词此前已经多次出现。

美联储官员的预估中值显示,美联储暗示201X年可能将累计加息一个百分点,但他们指出将于何时加息,每次加息的步伐有多大。

耶伦在记者的追问下只是表示,“逐步并不意味着机械、均匀、同样幅度的利率变化。

” 12会议纪要可能会在官员加息预期方面提供更多细节。

2.海外因素对美国经济的威胁耶伦12月3日在国会联合经济委员会上传出的消息显示,她密切关注动荡不安的国际形势,并确定其并未阻碍美国经济的发展。

她在12月美联储会议后重申,海外形势对经济的威胁自去年夏天以来已经有所减少。

会议记录可以为美联储对外国情况的分析提供更清晰的窗口,可以阐明美联储官员对来自国外威胁的看法。

3.如何看待自然利率处于低位?美联储联邦官员表示,自然利率在零附近徘徊,他们不指望其会迅速上升。

自上次会议以来,官员表示这是一个关键问题。

10月会议纪要表明,长期的低自然利率可能会限制决策者通过降息来刺激经济的能力,迫使他们依赖于其他方法。

此次纪要可能会就自然利率持续位于较低水平之际美联储的政策应对给出提示。

4.对于加息是否存在内部分歧?美联储12月一致投票通过首次加息,但这并不一定意味着所有美联储官员都意见统一。

毕竟,9月和10月会议投票计数表明美联储近乎达成一致,只有里奇蒙联储主席莱克持有异议。

12月纪要或将拉开内部辩论的帷幕。

美联储会议纪要范文(优秀6篇)

美联储会议纪要范文(优秀6篇)在日常学习、工作和生活中,我们在很多事务中使用会议纪要的情况与日俱增,会议纪要一般采用第三人称写法。

什么样的会议纪要才是有效的呢?为了帮助大家更好的写作美联储会议纪要,作者整理分享了6篇美联储会议纪要范文。

美联储会议纪要篇一北京时间周四(1月5日)03:00,美联储公布12月14日FOMC会议纪要,此次会议纪要内容对经济评估方面措辞是否会出现改变十分重要。

会议纪要显示绝大部分FOMC委员认为,在特朗普治下,经济增长预期存在上行风险,因为预计财政政策将更加宽松。

约半数FOMC委员将更大规模的财政刺激纳入了自己的预期考量范围。

鉴于长期失业率不及目标将导致通胀走高的风险上升,FOMC委员预计加息幅度可能比原先预期更快。

FOMC委员强调了未来财政及其他经济政策的实施时机、规模及构成上存在可观的不确定性。

绝大部分FOMC委员预计未来两年失业率将低于更长期限的正常水平。

不少FOMC委员称美元进一步走高可能将持续影响通胀。

FOMC委员基本同意将继续密切关注通胀、全球经济与金融走向。

纪要公布前,美国联邦基金利率显示,美联储3月加息概率为34.8%,6月加息概率为71.4%,9月加息概率为85.6%。

据CME消息,联邦基金利率期货在12月会议纪要公布后小幅上扬,但仍不足以表明美联储今年加息路径将出现调整,交易员仍预计美联储年内将加息2次。

虽然会议纪要表示,美联储官员认为目前来看渐进式加息路径是合适的;但联邦基金利率期货市场仍然消化了20xx年两次加息的预期,第二次大约在12月份。

20xx年7月合约隐含利率0.88基点,位于75-100基点目标区间内;12月合约隐含利率1.145%,接近100-125基点区间中点。

FOMC预测中值显示,联邦基金利率20xx年底料在1.375%,9月份时预估的是1.125%;对20xx年的两次预估分别是2.125%和1.875%。

彭博WIRP功能显示,20xx年6月份美联储加息的概率大约在71%。

美联储会议纪要重点

美联储会议纪要重点美联储会议纪要重点认真学习党的十七大精神是当前首要政治任务,要按照市委要求,结合我委工作实际,精心组织、科学安排。

邀请市委宣讲团作专题辅导,进一步加深对十七大精神的理解,并以此为契机,以更加饱满的政治热情、更加扎实有效的措施,把学习宣传十七大精神引向深入。

具体请徐卫球书记负责,组织人事科配合。

观点:日线虽然构成了反弹态势,但是回落的压力很重尤其是周线;等待趋势破位行情的出现。

盘中跌破1216美元可以继续看空。

北京时间10月29日凌晨02:00,美联储FOMC宣布利率决议并发表政策声明表示,至10月28日美联储维持0.25%的利率保持不变。

里奇蒙德联储主席莱克不赞成维持利率不变而主张加息25个基点,对利率决议投下反对票(9月同样是莱克对利率决策投下唯一反对票)。

会议指出,实施船舶人事制度改革是今后企业发展的必然趋势。

考虑到公司目前315KW型船舶技术状况、人员素质和年龄层次以及船舶运行劳动量等情况,在征求船员意见的基础上,先行选择一艘长水、一艘短途两艘拖轮,制定两套方案供船舶选定试点,待取得经验后,逐步扩大推广。

会议原则通过该试行方案,于8月底或9月初开始试运行。

美联储FOMC决议声明:维持0.25%的利率保持不变FOMC声明表示,美国经济温和增长,风险接近平衡,同时美联储关注全球局势。

就业增长趋缓,失业率保持稳定。

重申房地产市场进一步好转,出口仍较为疲软。

指出家庭开支和商业投资稳固上涨,劳动力市场疲软自年初以来减少。

FOMC声明指出,通胀率继续低于目标,重申预计通胀将在中期内升至2%。

同时强调基于调查的通胀前景指标依然较为稳定,重申加息时间取决于就业增长和通胀信心,重申评估内容包括了金融市场和国际的局势。

低通胀部分反映出能源、非能源进口价格下降。

基于市场的通胀补偿措施“小幅走低”,将继续维持再投资政策。

同时表示劳动力资源利用率不足的情况自2015年初以来减退。

纪要还显示,虽然3月15日会议上的货币政策决定是全体一致作出的,但在联邦公开市场委员会的10名轮值投票委员中,有几名委员认为经济复苏进程增强的证据、通胀率的上升以及通胀预期的增强“可能使得降低购买计划的步速或整体规模变得合适”。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2019年美联储FOMC会议纪要-精选word文档

本文部分内容来自网络,本司不为其真实性负责,如有异议或侵权请及时联系,本司将予以删除!

== 本文为word格式,下载后可随意编辑修改! ==

美联储FOMC会议纪要

本周,市场焦点集中在美国联邦公开市场委员会(fomc)4月货币政策会议纪要,同时日本央行本周将公布最新利率决议。

其他将公布的重要经济数据包括英欧美4月cpi、中国5月汇丰制造业pmi等,金融市场恐将再度迎来一场大幅波动。

接下来我们来一一细数影响本周市场的的重要经济数据及事件(如无特别说明,以下时间均为北京时间):

先来看美国方面。

近来美国系列经济数据均表现不佳,市场对美国经济稳步复苏的信心似乎有所动摇,从而引发对美联储年内是否升息的猜测。

美联储将于周四(5月21日)凌晨2:00公布4月28日-4月29日美联储fomc会议纪要,纪要将呈现美联储官员如何看待一季度美国经济走弱以及对二季度经济前景的预判。

此外,对于是否该在今年6月加息,美联储官员持何种态度,4月的会议纪要中也许能一见端倪。

对于4月的美联储fomc会议纪要,一些投行有自己的看法。

加拿大丰业银行(scotiabank)资本市场策略主管guy haselmann仍坚持认为,美联储最好尽快升息,美联储不应让市场面对有关首次升息时机的不确定性,因为等待的时间越长,届时引发的市场的反应可能会越大。

haselmann表认为6月份加息的概率为25%,7月份升息概率为70%。

然而相比而言,市场对这两次会议升息的预期分别仅为2.4%和10%的概率。

”

另一派观点而言,美联储主席格林斯潘(alan greenspan)日前则警告称,“美联储9年来首次升息将再次引发市场动荡。

上次qe缩减曾经引发市场动荡,升息也同样。

利率常态化不错,但道路不会平坦。

”

下周除了美联储会议纪要,美国还将公布包括4月cpi、4月新屋开工和4月nar季调后成屋销售等一大批重磅经济数据,金融市场恐将再度迎来一场大幅波动。

周二(5月19日)晚上20:30,美国4月新屋开工数将出炉,前值为92.6万,市场预测本次可能大涨到101.8万。